Recreation and Entertainment

VAT Guide | Version 1

July 2020

Contents

3. Economic Activity and Registration

6. Cultural, Artistic, Sport and Entertainment Services - Specific Issues

7. Hotel, Restaurant and Catering Services

9. VAT Obligations of the Taxable Person

11. Applying for the Issue of Rulings (Interpretative Decisions)

The Zakat, Tax and Customs Authority ('ZATCA', 'Authority') has issued this Guide for the purpose of clarifying certain tax treatments concerning the implementation of the statutory provisions in force as of the Guide's issue date. The content of this Guide shall not be considered as an amendment to any of the provisions of the Laws and Regulations applicable in the Kingdom.

Furthermore, the Authority would like to highlight that the clarifications and indicative tax treatments prescribed in this Guide, where applicable, shall be implemented by the Authority in light of the relevant statutory texts. Where any clarification, interpretation or content provided in this Guide is modified - in relation to unchanged statutory text - the updated indicative tax treatment shall then be applicable prospectively, in respect of transactions made after the publication date of the updated version of the Guide on the Authority's website.

Introduction

Implementing a Value Added Tax ('VAT') System in the Kingdom of Saudi Arabia ('KSA')

The Unified VAT Agreement for the Cooperation Council for the Unified Arab States of the Gulf (the 'VAT Agreement') was approved by KSA by a Royal Decree No. M/51, dated 3 / 5 / 1438H. Pursuant to the provisions of the Unified VAT Agreement, the Kingdom of Saudi Arabia issued the VAT Law under Royal Decree No. M/113 dated 2 / 11/ 1438H ('the VAT Law') and its corresponding Implementing Regulations were subsequently issued by the Board of Directors of Zakat, Tax and Customs Authority ('ZATCA') by Resolution No. 3839 dated 14 / 12 / 1438H ('the Implementing Regulations').

Zakat, Tax and Customs Authority

ZATCA, also referred to as 'the Authority' herein, is the authority in charge of the implementation and administration of VAT (which may be referred to hereinafter as 'the tax') in KSA. In addition to the registration and deregistration of Taxable Persons for VAT; the administration of VAT return filing and VAT refunds, and undertaking audits and field visits, ZATCA also has the power to levy penalties for non-compliance with legal provisions relating to VAT.

What is Value Added Tax?

VAT is an indirect tax which is imposed on the importation and supply of goods and services throughout the supply chain, with certain limited exceptions. VAT is imposed in more than 160 countries around the world.

VAT is a tax on consumption that is paid and collected at every stage of the supply chain, starting from when a manufacturer purchases raw materials until a retailer sells the end-product to a consumer. Unlike other taxes, persons registered for VAT will both:

Collect VAT from their Customers equal to a specified percentage of each eligible sale.

Pay VAT to their Suppliers equal to a specified percentage of each eligible purchase.

When Taxable Persons sell a good or provide a service, a 15% VAT charge - assuming a standard case - is assessed and added to the sales Price. The Taxable Persons will account for that 15% that they have collected from all eligible sales separately from its revenue in order to later remit a portion of it to the Authority. The VAT Taxable Persons collect on their sales is called Output VAT.

That same will apply to purchase transactions, in that VAT will be added at the rate of 15% to purchases of goods or services from other Taxable Persons (on the assumption that the basic rate applies to those supplies). The VAT a business pays to its Suppliers is called Input VAT.

Further general information about VAT can be found in the KSA VAT Manual or at Zatca.gov.sa

This Guideline

The purpose of this guideline is to provide further clarification to Taxpayers regarding the VAT implications of common activities carried out by Taxable Persons in the Entertainment and Recreation sectors. Additionally, this guideline provides additional information about the VAT treatment for specific topics such as catering services.

This guideline represents ZATCA's views on the application and fair treatment of the Unified VAT Agreement, the VAT Law and the Implementing Regulations to the sector as of the date of this guideline.

For further advice on specific transactions you may apply for a ruling, or visit the official VAT website at Zatca.gov.sa, which contains a wide range of tools and information that has been established as a reference to support persons subject to VAT, as well as visual guidance materials, all relevant information, and FAQs.

Definitions of key terms

Economic Activity | : | is defined for VAT purposes as: 'an activity that is conducted in an ongoing and regular manner including commercial, industrial, agricultural, or professional activities or Services or any use of material or immaterial property and any other similar activity.'[1] |

Taxable Person | : | is a defined term for VAT purposes. In the KSA, this includes all Persons who are registered or obliged to register for VAT in the KSA (see section 3 for more details on registration). |

Taxable Supplier | : | is a Taxable Person acting in the capacity of a Supplier, and a Taxable Customer is a Taxable Person acting in the capacity of a Customer. |

Taxable Supply | : | is a defined term for VAT purposes: 'Supplies on which Tax is charged in accordance with the provisions of the Agreement, whether at the standard rate or zero-rate and for which associated Input Tax is deducted in accordance with the provisions of the Agreement.'[3] |

Private Use | : | is not a defined term for VAT purposes. ZATCA considers the private use to be any use, consumption or enjoyment of goods or services by a natural or legal Person or group of Persons, where such use does not take part in the course of an Economic Activity by those Persons. |

Catering Services | : | is a term referred to in the Unified VAT Agreement and Implementing Regulations, but is not a defined term in those laws for VAT purposes. |

Consideration | : | is defined as: |

Resident | : | is a term defining a natural or legal person who has a place of residence in the KSA for VAT purposes, and a Non-Resident is a person with no such place of residence in the KSA.[6] |

Principal | : | is not a defined term for VAT purposes. For the purposes of this guide, a principal is a person who has an agent acting on behalf of him legally. |

Agent acting on behalf of the principal and in the principal's name | : | is the agent who acts on behalf of the principal's name in cases where the attorney is disclosed to a third party. |

Agent acting in his name | : | Who is the undercover agent, the agent acts on his behalf in cases where the agency is not visible to third parties or cases in which the identity of the principal is not disclosed. The VAT law provides for specific rules concerning cases in which the agent acts in his own name. The hidden agent is sometimes referred to as the undeclared agent or commission agent. |

Economic Activity and Registration

Who carries out an Economic Activity?

An Economic Activity may be carried out equally by natural Persons or legal Persons.

It will be presumed that a legal person that has a regular activity making supplies carries on an Economic Activity. It should be stated that natural persons may perform certain transactions as part of their Economic Activity, or as part of their private activities. There are therefore specific rules to determine whether or not a natural person falls within the scope of VAT.

Natural persons and legal persons who carry on an Economic Activity must register for the purposes of VAT if so required, and such persons must collect the VAT applicable to their activities, and pay the tax collected to the Authority.

Mandatory registration

Registration is mandatory for all persons whose annual turnover exceeds a certain threshold. If the total value of a person's Taxable Supplies during any 12 months exceeds SAR 375,000, (the 'mandatory VAT registration threshold'), that person must register for VAT[7] on the supplies made, subject to the transitional provisions provided for in the Implementing Regulations.

Taxable Supplies do not include:

Exempt supplies - such as exempt financial services or residential rental which qualifies for VAT exemption.

Supplies taking place outside the scope of VAT in any GCC state.

Revenues on sales of capital assets - a capital asset is defined as an asset allocated for long-term business use[8].

In certain circumstances, other tests will apply for mandatory registration:

Persons who are not Resident in the Kingdom of Saudi Arabia are required to pay the VAT in respect of supplies made or received by them in the Kingdom of Saudi Arabia and to register for VAT irrespective of the value of the supplies for which they are obliged to collect and pay the VAT[9].

During a transitional period up to 1 January 2019, businesses will only be required to register where annual turnover exceeds SAR 1,000,000, and an application for registration must be submitted no later than 20 December 2018[10].

More information on mandatory registration for VAT is contained at Zatca.gov.sa

Optional VAT Registration

Any Resident person in the Kingdom of Saudi Arabia who has Taxable Supplies or taxable expenses exceeding the 'Optional VAT registration threshold' of SAR 187,500 in a twelve-month period may register for VAT on a voluntary basis[11].

Optional VAT registration may be desirable where a business wishes to claim VAT charged to it on their costs before invoices are raised or the occurrence of an onward supply.

More information on voluntary registration for VAT is contained at Zatca.gov.sa

Place of Supply

Place of Supply - General Principles

VAT is applicable on any supply of goods or services which is made in the KSA for VAT purposes - that is, in cases where the place of supply is in Saudi Arabia.

KSA VAT is only chargeable on services which take place in the KSA under the place of supply rules within the Unified VAT Agreement. By default, all supplies of services made by a KSA Resident fall within the scope of KSA VAT:

'The place of supply for Services provided by a Taxable Supplier shall be the Place of Residence of the Supplier.[12]'

In addition to this, a supply made by a Non-Resident can take place in the KSA e.g. due to the Customer's residence. Supplies made to a Taxable Customer in KSA are, by default, also subject to KSA VAT[13]. Section 4.3 discusses supplies by Non-Residents in more detail.

Special rules apply to specific categories of services (Special Cases).

Place of supply - special cases

As an exception to the general rules of the place of supplies for goods and services, the Unified VAT Agreement sets out special rules for the place of supply of 'Other services' as follows:

'The place of supply for the following Services shall be where they are actually offered:

Restaurant, hotel and catering Services.

Cultural, artistic, sport, educational and entertainment Services...'[14]

By way of example, ZATCA considers that these categories include the following Services:

Cultural, artistic, sports and entertainment services | Cultural events |

Adventure activities (e.g. safari trips) | |

Sports clubs | |

Museums | |

Galleries | |

Fashion and modelling events | |

Cinemas | |

Musical, dramatic and other artistic theatres | |

Other similar events | |

Hotel, restaurant, and catering | Accommodation for hotel guests |

Hire of hotel and conference rooms for commercial events | |

Other hotel facilities, such as a spa or health centre | |

Hotel restaurants and in-room dining | |

Restaurants and cafes | |

Food courts | |

Food and beverages trucks | |

Food served on planes or other forms of transportation intended for consumption during the journey | |

Food served at events or as part of other social entertainment activities |

The place where services are 'actually offered' in the context of the Agreement means the physical location at which these services are provided to the Customer. Generally, this will be same place as where those services are consumed by the Customer. The concept of the physical location is set out in the Implementing Regulations:

'Cultural, artistic, sport, educational and entertainment services include the admission to any event taking place in a physical location or the provision of educational services where these are provided in a physical location. The physical location is the place in which the services are offered.'[15]

Therefore, the place of supply will always be determined based on where the actual services are provided to the Customer, regardless of the place where the Supplier or Customer are Resident. The sale of a ticket in advance does not affect the place where the services are actually offered.

Example (1)

A registered Museum in the KSA sells tickets to enter the Museum. The place of supply for the cultural service takes place in the KSA (the physical location of the Museum where the services are offered), and VAT must be charged on admission, regardless of the residence or VAT status of the customer.

Example (2)

A registered Travel Agency in the KSA sells tickets for a Museum in Spain as part of their traveling package. As the physical location of the Museum where the services are offered is outside KSA, the place of supply for the tour service is not in the KSA, and the admission fee is not subject to KSA VAT, despite the fact that in this case the Supplier of the ticket (the travel agency) is a KSA Resident.

However, any additional commission or fees charged by the travel agent to the Customer for the booking or reservation should be subject to KSA VAT.

Supplies by Non-Resident performers

The place of supply for the recreation and entertainment services falling within the table in section 4.2 will always be determined by the location where those services are actually offered. In principle, KSA VAT will always be chargeable on services offered in the KSA.

However, the mechanism for charging VAT may differ in cases where the supplier is Non-Resident.

See the table below.

| (a) NON-RESIDENT SUPPLIER IS OBLIGED TO CHARGE KSA VAT | |

|---|---|

If a Non-Resident Supplier makes a supply to a KSA Resident Customer who is not a Taxable Person (e.g. an individual), and the place of supply is in the KSA: | The Non-Resident Supplier must charge KSA VAT to the Customer. The Non-Resident Supplier must register for KSA VAT, if not already registered. |

If a Non-Resident Supplier makes a supply to a Customer who is not a KSA Resident, and the place of supply is in the KSA: | The Non-Resident Supplier must charge KSA VAT to the Non-Resident Customer. The Non-Resident Supplier must register for KSA VAT, if not already registered. |

| (b) TAXABLE CUSTOMER SELF-ACCOUNTS FOR KSA VAT | |

If a Non-Resident supplier makes a supply to a KSA Resident customer who is a Taxable Person, and the place of supply is in the KSA: | The Taxable Customer is obliged to self account for the VAT using the Reverse Charge Mechanism. The Non-Resident Supplier must not charge KSA VAT. |

| (c) NO KSA VAT IS DUE | |

If a Non-Resident Supplier makes a supply to a Customer and the place of supply is outside the KSA: | The supply is not subject to KSA VAT. |

If the Non-Resident Supplier is obliged to charge VAT, it must be registered regardless of its turnover[16]. However, once it is registered, a Non-Resident is only obliged to collect and pay tax in respect of supplies in Category (a) above. It should not charge VAT on supplies made to Taxable KSA-Resident Customers.

A practical example in the entertainment sector where Non-Residents may be required to register is for supplies of performance services made directly to KSA consumers (involving sales of tickets for admission).

Example (3)

Giancarlo SPA, a European design company, is given a licence to hold a one-off design event in Riyadh, and to sell tickets for admission to the general public. Giancarlo SPA does not have a KSA establishment, so is considered a Non-Resident Supplier for VAT purposes. It charges a fee of SAR 150 to Saudi-Resident individuals (these individuals attend in a private capacity and are not registered for VAT), and derives total ticket revenues of SAR 285,000 from the event. Giancarlo SPA is required to register for VAT, and to charge VAT on the supplies of services to the KSA consumers, regardless of the fact that its turnover does not exceed the 'Mandatory Registration Threshold' applying to KSA Resident persons.

A separate example illustrates how the VAT reporting differs ifa Non-Resident supplies through a KSA Resident company:

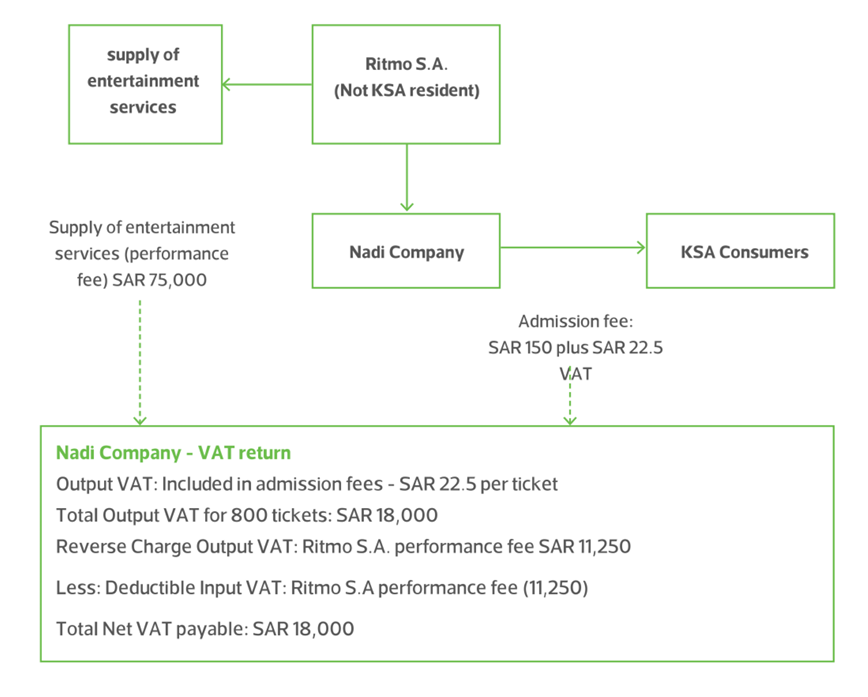

Example (4)

Nadi Company is a KSA Resident company, licensed to organise and promote events in the KSA. It arranges for the visit ofa Brazilian musical group to perform for the public. Nadi Company sells 800 tickets directly to attendees for SAR 150 each (excluding VAT), and pays a fee of SAR 75,000 to the Brazilian group's company (Ritmo SA) for the group's services.

Both Nadi Company and Ritmo SA are supplying cultural / entertainment services. KSA VAT is collected on the supplies under different methods:

Ritmo SA makes a supply of services actually offered in the KSA, so the place of supply is in the KSA. Its Customer is Nadi Company, who is a Taxable Customer and Resident in the KSA. Nadi Company reports for VAT due (15%x SAR 75,000) in its VAT return under the Reverse Charge Mechanism. It claims full deduction for this VAT, so makes no net payment to the Authority in respect of this Supply.

Nadi Company makes supplies of services directly to KSA Customers for admission to the event. The place of supply is the KSA. It includes VAT on the admission price, reports this on its VAT return and pays the VAT to the Authority.

Admission fees

ZATCA considers that the essential characteristics of admission fees are the granting of the right of admission to an event or multiple events in exchange for a ticket or payment, including payment in the form of a subscription, a season ticket or a periodic fee.

When the event or events take place in the KSA, the admission fees are considered as Taxable Supplies in nature, and should be taxable at the standard rate of five percent (15%)

The Supplier is the person who enters into the contract with the Customer to allow admission to the event, and is contractually responsible for provision of the services. Depending on the commercial arrangements, the Supplier charging the admission fee could therefore be the Person physically performing the cultural, artistic, sporting or entertainment service and allowing admission directly to the public (similar to example 3), or could be an event organiser (similar to example 4).

Date of supply

VAT becomes due on the earlier of the following dates:

The date the performance of the service was completed.

The date of issuance of the tax invoice.

The date of partial or full receipt of the Consideration, to the extent of the amount paid[17].

For admission fees, the performance of the service is completed when the event is completed. However, if the admission fee is paid in advance of the event (e.g. if a ticket is purchased before the event takes place), VAT becomes payable when the admission fee is paid (or upon the issue of a tax invoice, if earlier).

ZATCA considers that the supply of a ticket for an event is not the issue or supply of a 'voucher' falling within the special VAT rules for vouchers[18]. VAT becomes due at any time when Consideration is received to attend a future event.

Booking fees

A booking fee is an additional amount to the admission fee. The booking fee enables the Customer to secure the right to attend an event in advance, and may in some cases include rights to reserving a particular seat.

If the booking fee is charged by the same Person who acts as Supplier charging an admission fee to an event taking place in the KSA, ZATCA will presume that the booking fee is treated in an identical manner to the admission fee - therefore it is also subject to KSA VAT, regardless of the residence of the Supplier or Customer.

A booking fee charged by a third party intermediary, who does not act as Supplier of the underlying admission, is viewed as a separate supply of services. The intermediary must apply VAT to the booking fee as appropriate.

VAT consequences of cancellation

The right of admission to an event can be cancelled by the Supplier (for example, in case the event cannot take place), or by the Customer (if the Customer has purchased admission in advance but wishes to forfeit his right to attend, such as in the case where he or she is no longer able to attend).

If the Customer forfeits his right to attend, and is not entitled to any refund of the admission fee, the Supplier is still required to charge VAT on the supply made to Customer. In such a case, the Customer pays Consideration for the right to attend an event, whether he or she attends the event or not.

Adjustment to Consideration

If the admission fee paid upfront is refunded either partially or fully to the Customer, this results in:

a change to the Consideration payable (in the case or a partial refund).

a cancellation of the Supply (where a full refund is provided).

In these cases, the Taxable Supplier must provide the Customer with a credit note to reflect the change to the (VAT-inclusive) Consideration[19] paid for the admission fee. The credit note should be issued within fifteen days following the end of the month in which the cancellation took place. The Output VAT amount should be adjusted in the equivalent Tax Return[20]:

| 1 | If the credit note is issued in the same Tax Period in which the original supply (of the ticket) was made, or before the Tax Return for that original supply has been filed: | By adjusting the Output Tax (downwards) for the Tax Period in which the original supply took place. |

| 2 | If a credit note is issued after the Tax Return for that original supply (of the ticket) has been filed: | By adjusting the Output Tax (downwards) for the Tax Period in which the Credit note is issued, or the circumstance giving rise to the adjustment took place, whichever is later. |

The non-refundable portion is Consideration for the right to attend the event (even in cases where that has been cancelled). VAT should be calculated as the VAT fraction (5105/)[G1] of the retained Consideration.

Example (5)

On 30 March 2019, a VAT-registered musical theatre sold a ticket to Ahmed for SAR 200, plus VAT of SAR 10 for a musical show taking place on 18 May 2019. It also charges a 10% booking fee (SAR 21, including VAT). The Customer pays on the date of sale, meaning that the musical theatre must include SAR 11 of Output Tax in its VAT return for the quarterly Tax Period ending 31 March.

The terms and conditions on the refund of the ticket state that the Customer is able to return the ticket up to 7 days before the show and receive a full refund. The refund amount will be 50% of the original price if the ticket is returned during the 7 days before the show.

Scenario (a): On 10 May, Ahmed requests cancellation (8 days before the show); the musical theatre approves the refund of the full amount but retains the booking fee. The theatre issues a credit note for SAR 210, and adjusts Output VAT for SAR 10 in the quarterly Tax Period ending 30 June, being the VAT fraction of the refunded amount. No adjustment is made to Output VAT for the retained booking fee.

Scenario (b): On 16 May, Ahmed requests cancellation (2 days before the show); the musical theatre approves refund of half of the ticket price. The theatre issues a credit note for SAR 105, and makes an adjustment to Output VAT for SAR 5 in the quarterly Tax Period ending 30 June, being the VAT fraction of the refunded amount.

Cultural, Artistic, Sport and Entertainment Services - Specific Issues

Sports clubs

Membership and admission fees

Section 5 on admission fees outlines the application of VAT to Supply of sales of tickets to attend sports events or competitions by Taxable Persons in the KSA.

Club memberships with additional benefits (such as participation in sport or training, provision of coaching, or to use the facilities or equipment) are also considered as Taxable Supplies of services, and will be subject to VAT at the standard rate of 15%. These are usually provided on a continuing basis across a set period of time.

VAT will also apply at 15% to any one-off fees charged to participants to use club facilities or to enter individual competitions.

Contract agreements

The VAT treatment of the sport club members and management differs depending on the arrangement and the Supply received. Services provided by an individual under an employment contract are not considered to be part of the individual's Economic Activity, and therefore fall outside the scope of KSA VAT[21].

Example (6)

Majid, a natural Person who is Resident in the KSA, has signed an agreement with a Basketball Club for an annual salary of (SAR 500,000) to become an official tournament player during a two-year contract period.

Majid is considered as an employee who provides professional sports services to the Basketball Club. The annual salary received for providing these services is not subject to KSA VAT.

Alternatively, external professional sportspersons may make charges for professional sports services such as appearance fees or coaching. These are considered as Taxable Supplies of services in the KSA.

Example (7)

Mohamed, a former professional sportsperson, has signed an agreement with a Basketball Club for an annual fee of (SAR 1,000,000) to become an external advisor for the team during a two-year contract period.

Mohamed provides professional sports services to the Basketball Club, but is not considered as an employee of the Club. The annual fees received for providing these services are considered as Taxable Supplies, subject to VAT at the standard rate of 15%.

As a Resident natural Person with annual turnover exceeding the Mandatory registration threshold (SAR 375,000), Mohamed is required to register for VAT, and issue Tax Invoices charging VAT on the Supply of services he provides in the KSA.

Section 4.3 of this guide considers the implication of Non-Resident contractors making supplies of sporting services to Customers in the KSA.

Advertisement and sponsorships

In cases where a Taxable Person derives revenue through advertising services, such as the display of an advertisement, this is viewed as Consideration for a Taxable Supply of services.

In the recreation and entertainment sector, organizations often enter into 'sponsorship' agreements - in which a sponsor pays monetary or non-monetary Consideration and receives certain benefits in return. Examples of benefits provided to sponsors include:

Display of advertisements or the sponsor's name at the premises, on the clothing of performers, or in published material such as newsletters or programmes.

Provision of naming rights to an event or venue.

Promotion of the sponsor's goods or services.

Providing rights to attend events or use facilities.

The sponsorship received is Consideration for the supply of advertising or other benefits.

Example (8)

Arabian Gulf Bank LLC is a Taxable Person, and is Resident in the KSA. It enters into an official sponsorship agreement with one of Saudi Premier League Basketball clubs. Under the terms of the sponsorship agreement, Arabian Gulf Bank LLC will pay an annual sponsorship amount of SAR 2 million, and in return the Basketball Club is required to use Arabian Gulf Bank's logo on the playing court and on the team uniforms.

In this case, the sponsorship fee paid by the bank is Consideration for the provision of advertising services, which is subject to VAT at 15%.

Donations

A 'true' donation given to a club or organization, without any benefit being provided in return, is not Consideration for a supply and is not subject to VAT.

Care must be taken to identify cases in which a donation is Consideration for some kind of benefit provided to the donor. It is presumed that in most commercial arrangements, a person providing a sum of money as a donation will be doing so for some form of benefit. However, ZATCA accepts that in a case where a donation is made in a non-commercial context and some small benefit of trivial value is provided to the donor, this will not constitute a supply by the recipient of the donation.

Competitions: appearance fees and prize monies

A person may derive income from entering sporting or other competitions, such as an appearance fee agreed in advance, or prize monies awarded for winning or achieving a certain result. Such fees may often be seen in motorsport or racing animal events.

The VAT treatment of such income must be analysed on the specific circumstances in each case. ZATCA considers that an appearance fee will in all cases be Consideration for a supply of services. If the Person deriving the appearance fee does so as part of a regular Economic Activity, the appearance fee will be subject to VAT.

Leisure activities may constitute an Economic Activity where they are carried out on a regular basis and meet the tests to be considered as an Economic Activity. The ownership of a racing animal (such as a horse or camel) can be an investment and a means of deriving income on a regular basis. However, ZATCA will require a Person to clearly evidence an intention to derive regular income in order to register for VAT and to deduct Input VAT incurred. The taxpayer guideline on Economic Activity provides further detail and examples.

Often, the award of prize money at an event is not clearly linked to any services provided by the recipient. In cases where money or goods are awarded as a true prize to a participant, and are not a means of compensating the participant for appearance, advertising or other services, ZATCA accepts that the prize money or goods will not be subject to VAT (i.e. not seen as Consideration for a Supply by the Person winning the prize).

Temporary importation for events

A Person wishing to participate in events or competitions held in the KSA may be required to import equipment into the Kingdom in order to enter the event. For example:

Non-Residents who wish to enter a racing horse, racing camel, or sports car into the KSA to compete in a one-off event.

Equipment required to hold a conference or event.

The Common Customs Law allows for temporary importation of goods into the Kingdom in specific cases[22].

The temporary importation involves the release of goods or equipment to free circulation under conditions specified and administered by Saudi Customs, for a set period after which the goods are re-exported from the country. For VAT purposes, temporary importation qualifies as a 'customs duty suspension situation'. Provided that the goods are under a valid temporary admission arrangement, VAT does not become due on their import[23].

It is important that any goods or equipment intended for temporary entry must be entered under the requisite conditions specified by Saudi Customs in order for VAT to be suspended.

Private jets, boats, and similar transportation

Means of transport such as aeroplanes, boats or luxury vehicles are sometimes used to provide entertainment services or to carry out excursions.

Any means of transport which is designed, adapted, or intended for recreation or private use[24], including a private jet or boat, is not considered a qualifying means of transport. Therefore, charges for the lease or use of such a vehicle - or the international transport of passengers on these vehicles - do not qualify for zero-rating, and will be subject to VAT at 15%.

The taxpayer guideline on Transportation provides more detail on cases when zero-rating does apply to international transport.

Hotel, restaurant and catering services

Hotels and serviced accommodation

The provision of accommodation or lodging in any hotel, motel, guesthouse, serviced accommodation or similar establishment is subject to VAT at 15%. Such facilities are not intended as the guest's primary residence, and as such, the accommodation in these facilities does not qualify for VAT exemption as a residential rental[25].

The taxpayer guideline on Real Estate gives further detail on the cases where VAT exemption applies to residential rental.

The table below considers the application of VAT to some common charges made for hotels or serviced accommodation. For hotels or serviced accommodation situated in the KSA, VAT will apply at 15% to accommodation and related charges, regardless of the place of residence or the tax registration status of the Customer.

| Accommodation | Provision of accommodation is subject to VAT at 15%. |

| Early Check-in or Late Checkout Fee | Additional Consideration charged to the guest for the supply of accommodation. Subject to VAT at 15%. |

| Municipality Tax | Additional Consideration charged to the guest for the supply of accommodation. VAT must be charged at 15% on the total Consideration payable (including municipality tax or other local fees). |

| Service Charges | Charges for services ancillary to the accommodation: such as cleaning, laundry services, security, use of electricity, etc. Subject to VAT at 15%. |

| Use of Business Facilities | Hire of rooms or facilities for meetings and events, use of business centre facilities. Subject to VAT at 15%. |

| Use of Other Hotel Facilities | For example – charges for use of health centre, or for specific treatments at a hotel spa. Subject to VAT at 15%. |

| Telecommunications Services | Including charges for phone calls, internet, television, and similar services provided at the hotel. Subject to VAT at 15%. |

| Restaurant, catering or in-room dining | Subject to VAT at 15%. See catering section below. |

| Hotel transfers within the KSA | Transportation between the hotel and a KSA airport or other similar location will be subject to VAT at 15%. |

| Discretionary Tips | Not subject to VAT, if provided freely / without obligation by the guest. Any service charge added or required is subject to VAT at 15%. |

Hotel operating companies

Owners of hotels and similar accommodation commonly engage with a third party company to operate the facilities. In these cases, the standard principles for determining which party makes the supply to the Customer or hotel guest should be applied to determine the appropriate VAT treatment:

If the operator acts as principal, or acts in his own name towards hotel guests, the operator is required to charge VAT on the supply of accommodation. This is regardless of whether the operator treats the Consideration as its revenue, or is required to pass this on to the owner.

If the hotel guest enters into a contract with the hotel owner, or in the name of the hotel owner, the hotel owner is required to charge VAT on the supply of accommodation.

The application of VAT will depend on the exact facts in the case. Relevant facts to consider include:

When the hotel guest signs to accept terms and conditions (for example upon check-in), do the terms and conditions refer to the hotel owner? If not, this indicates the hotel operator acts as principal or in his own name.

Is the hotel owner or hotel operator liable to the guest for contractual performance (for example, which entity is required to find alternative accommodation or pay damages if the hotel becomes fully booked)? If the hotel operator is liable, this indicates the hotel operator acts as principal or in his own name.

Is the hotel owner mentioned on invoices issued to the guests? If not, this indicates that the hotel operator acts as principal or in his own name.

As follows from the above, it is advisable that hotel operators and hotel owners make it clear (from the contractual and other documentation issued to the Customer) in whose name the supply of accommodation is being made to the hotel guest.

Hotel operator acts as principal

A hotel operator acts as principal if he operates the hotel on his own account. In these cases the hotel operator must report VAT on the supplies made.

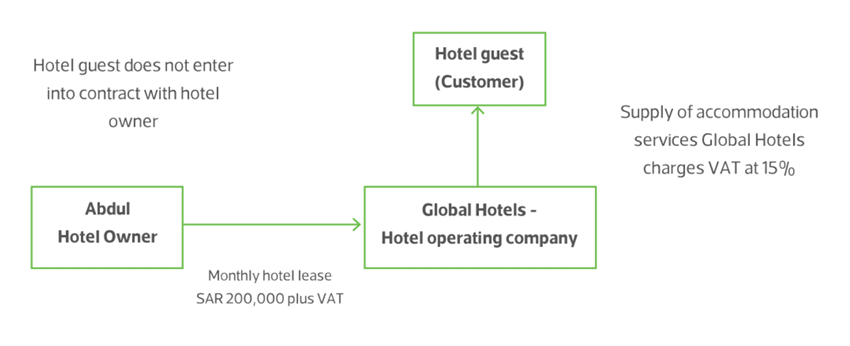

Example (9)

Abdul owns a hotel facility in Riyadh. He leases this to an international hotel company, Global Hotels, for a monthly fee of SAR 200,000 plus VAT. Global Hotels does not own the hotel building but enters into all contracts with hotel guests in its own name and in its own account. It incurs costs from third party Suppliers directly.

Global Hotels must charge VAT on supplies of accommodation and other revenues to hotel guests. Abdul, the hotel owner, charges VAT on the monthly lease fee, which is a separate supply for VAT purposes.

Hotel operator acts as agent, but in its own name

If the hotel operator acts on the instruction of (and for the account of) the hotel owner, this indicates that the operator acts on behalf of the owner as a principal.

However, if the hotel operator acts in its own name, and the hotel guest is not aware that the operator is acting on behalf of a principal, the hotel operator is treated as the person making the supply of accommodation and similar services for VAT purposes. The hotel operator must collect VAT on these supplies.

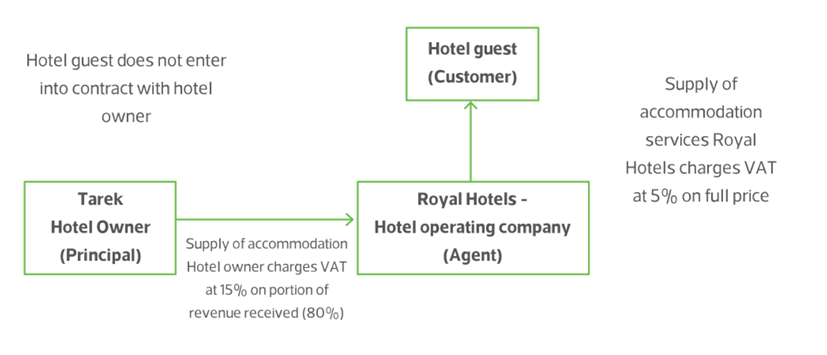

Example (10)

Tariq owns a hotel in Riyadh. He enters into a contract with Royal Hotels whereby Royal Hotels operates the hotel on his behalf. Royal Hotels must operate the hotel in accordance with the agreed instructions, and is obligated to provide 80% of all revenues (less approved expenditures) to Tariq on a monthly basis. Royal Hotels does not record revenues or expenditures in its own account, other than the 20% it is entitled to retain under the contract with Tariq.

A small sign in the hotel entrance states that Tariq is the hotel owner, and that Royal Hotels is the operator. However, all contracts with guests and third party Suppliers are signed in the name of Royal Hotels. Guests and suppliers are not aware that Royal Hotels acts on behalf of Tariq. The diagram below shows how VAT is recorded on Supplies of accommodation.

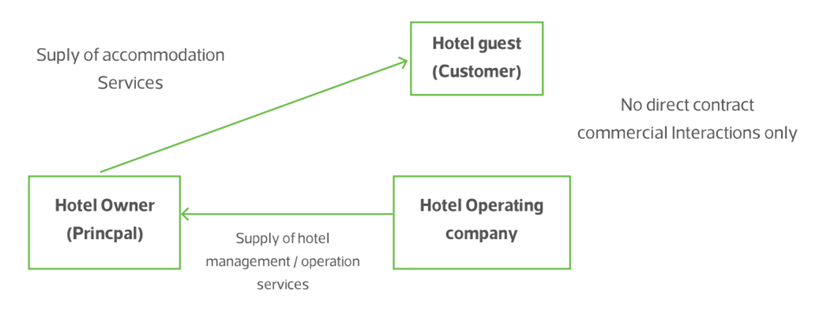

Hotel guest enters into a contract with the hotel owner

In cases where the hotel guest books the accommodation in the name of the hotel owner or its group, or accepts terms and conditions issued in the name of that hotel owner, the guest generally would not have any separate contractual relationship with the operating company in respect of that supply.

In these cases, the hotel owner is making the supply of accommodation to the guest as Principal, and the hotel operator does not supply accommodation for VAT purposes (it instead provides services to the hotel owner).

The hotel owner should issue Tax Invoices to the guests in its own name and report the VAT on the supplies. The hotel operating company acts a Supplier on the instruction of the hotel owner to operate the hotel, but does not act in it is own name in making supplies of accommodation to Customers. It will report VAT on the supplies made to the hotel owner.

In cases where the hotel owner contracts directly with the hotel guests, it is possible that one of the hotel operating company's tasks is to physically issue Tax Invoices to the guests.

The hotel operating company can issue invoices in the name of the hotel owner through the concept of 'third party billing', as described in example 11 below of this guideline. In such cases the Tax invoices must only mention the name of the hotel owner and his Tax Identification Number. It will be the hotel owner that remains responsible for issuing the correct Tax Invoices and paying the VAT to the Authority.

Example (11)

ABC Hotels LLC owns a number of hotels throughout the KSA. It engages with Al Salem Hospitality, a company registered for VAT, to provide management and operational services in its hotels.

The sale of the hotel accommodation takes place directly from ABC Hotels LLC to the Customer, with VAT charged on the invoice issued from ABC Hotels LLC to hotel guest for the accommodation price. As the hotel operator, Al Salem is authorised to issue tax invoices on behalf of ABC Hotels LLC. It arranges for a tax invoice to be issued to the guest, showing ABC Hotels LLC's name and Tax Identification Number.

At the end of each month, Al Salem Hospitality issues a separate invoice to ABC Hotels LLC for its operational fee, being SAR 50,000 plus 20% of accommodation revenues during the month. Al Salem Hospitality's fees is a separate Taxable Supply.

The VAT invoices should indicate the following:

Invoice issued from ABC Hotels LLC to hotel guest for the sale of hotel accommodation service (one night's standard accommodation at a room rate of SAR 1,000).

Supplier: ABC Hotels LLC TIN: 30000 44144 00003 Customer: Hotel Guest Date: 28 October 2019 Check in 27.10.2019

Check out 28.10.2019

Accommodation

1,000 (Value of the supply) VAT at 5% 50 (VAT = Value x 5%) Total due 1,050 (Total Consideration payable) Monthly tax invoice issued from Al Salem Hospitality to ABC LLC

Supplier: Al Salem Hospitality TIN: 30000 70563 00003 Customer: ABC Hotels LLC Date: 31 October 2019 Monthly operation fee - October 2019 50,000 Additional commission: 20% x SAR 1,000 200 Total fees October 2019 50,200 (Value of the supply) VAT at 5% 2,510 (VAT = Value x 5%) Total due 52,710 (Total Consideration payable)

Restaurant and Catering Services

The provision of food or beverages at a restaurant or café, and indeed in all cases where the food and beverages are intended for consumption on the premises, is a supply of catering services.

This includes, for example, food or refreshments provided together with a meeting or conference room, and any food and beverages consumed in a hotel room (either in-room dining or consumption from a hotel mini-bar). Section 8 of this guideline discusses Input Tax deduction in respect of catering services.

Catering services provided at any restaurant, café, hotel or other KSA location by a Taxable Person must be subject to VAT at the standard rate of 15%. The total Consideration for the Taxable Supply of catering services includes any service charges added to the price.

Example (12)

The International Restaurant in La Coruna Hotel sells a hamburger meal for consumption in the restaurant for SAR 53. It also offers an after-hours service, where hotel guests can request meals to be cooked upon request between midnight and 6am and delivered to their rooms, for a fixed surcharge of SAR 10. The restaurant clearly marks that published prices include 5% VAT.

If a Customer requests a hamburger meal to be delivered after midnight, the value of the catering service is SAR 63, including the Service Charge. VAT of SAR 3.00 must be included within Consideration charged and shown on the Tax Invoice.

Discretionary Tips

The Taxable Supplier or his employee may receive an additional Consideration for the services provided, which are known as 'tips'. A 'tip' is a discretionary amount provided by the Customer, intended to reward the employee or employees for good service. It may take the form of money provided directly to an employee, or may be added to a bill.

ZATCA accepts that in the instances where a Customer gives a truly discretionary additional amount (that is, the Customer is under no obligation to provide a tip and has not been provided any 'suggested' tip amount), such a tip is not Consideration for the services, and is outside the scope of VAT. If the tip is collected through a hotel room invoice or card payment, the amount of the discretionary tip must be clearly marked on the invoice.

In cases where ZATCA believes that tips are being collected by a Taxable Person as required additional Consideration for services, it reserves the right to determine that VAT is due on the full amount received.

Example (13)

Metro Café is situated in Riyadh and is registered for VAT. It places a 'tips box' on the counter allowing Customers to give monetary tips to reflect high quality service. At the end of each day, the money in the tips box is shared between the employees working that day.

The money placed in the tips box is clearly a discretionary amount provided by Customers, and is not additional Consideration for the supply of catering services. Metro Café is not required to account for VAT on the tip money collected.

Example (14)

Delicious Restaurant in Jubail issues a summary document to the Customer at the end of each meal. The document allows the Customer to enter an amount of a discretionary tip and increase the amount paid electronically. Tips collected via electronic payment are shared between employees, together with any cash tips paid. A finalised receipt and tax invoice is provided upon the Customer payment.

Delicious Restaurant charges one family group for a meal, with a total price for the food ordered and service charge of SAR 420, including VAT. The Customer chooses to pay a total Consideration of SAR 470. The final Tax Invoice issued to the Customer clearly states that the total VAT inclusive price is SAR 420, but that an additional SAR 50 is paid as a discretionary tip. Delicious Restaurant is not required to report VAT on the additional SAR 50.

Input VAT Deduction

General Provisions

A VAT-registered person may deduct Input VAT charged on goods and services it purchases or receives in the course of carrying on its Economic Activity. Input VAT may be deducted on:

VAT charged by a VAT-registered Supplier in the KSA.

VAT self-accounted by the VAT-registered person under the Reverse Charge Mechanism.

Import VAT paid to Saudi Customs on imports of goods into the Kingdom.

As a general rule, Input VAT which is related to the Taxpayer's VAT exempted activities is not deductible as Input VAT.

In addition, Input VAT may not be deducted on any costs incurred that do not relate to the Economic Activity of the Taxable Person (see section 8.3 for further detail).

Deductible Input VAT is a credit entered on the VAT return which is offset against the VAT charged on supplies (Output VAT) made during that period.

Input VAT may only be deducted where the Taxable Person holds a Tax Invoice, or customs documents showing the amount of tax due, or any other document showing the amount of Input Tax paid or due, subject to the approval of the Authority.[26]

Proportional deduction relating to input VAT

VAT incurred which relates to a Taxpayer's VAT exempt activities, such as exempt financial services or residential rental, is not deductible as Input VAT. A person making both Taxable Supplies and exempted supplies can only deduct the Input VAT related to the Taxable Supplies. If a Taxable Person incurs general costs or expenses (overheads) in the making of Taxable Supplies, and others that are exempt from VAT, he must in that event split the costs and expenses precisely so as to specify those costs that relate to the Taxable Supplies. The Input VAT will be determined in accordance with the following rules[27]:

| Input VAT directly attributed to Taxpayer’s Taxable Supplies | Deduct in full |

| Input VAT directly attributed to Taxpayer’s exempt supplies | No deduction |

| Overheads and all other Input VAT that cannot be directly attributed | Partial deduction based on apportionment |

The overhead costs/expenses incurred by the Taxable Person for making both taxable and exempted supplies must be apportioned to most accurately reflect the use of those costs in the taxable portion of the Taxpayer's activities.

A prescribed default method of proportional deduction is calculated on the Values of supplies made in the year, using of the following fraction:

The Value of Taxable Supplies made by the Taxable Person in the last calendar yearThe total Value of Taxable Supplies and Exempt Supplies made by the Taxable Person during the last calendar year

The fraction for the default method does not include supplies of Capital Assets made by the Taxpayer, as these distort the use of Input VAT.

Alternative attribution methods, using other calculation approaches than the Value of supplies, may be approved with the Authority in cases where these better reflect the actual use of VAT incurred. Further information about deduction of VAT and proportional VAT recovery is provided in the Input Tax deduction and Partial Exemption guideline.

Restrictions to input VAT deduction

Input tax deduction is intended for goods used within an Economic Activity. The Implementing Regulations consider certain types of expenditure as falling outside the Economic Activity, meaning that VAT is not deductible when expenditures of these types are incurred by a Taxable Person.

'Expenditure relating to the following Goods or services is not considered to be incurred by the Taxable Person in the course of carrying on his Economic Activity, and consequently the Taxable Person will not be permitted to deduct the Input Tax relating to such expenditure, save where the Goods or services are to be directly supplied onwards as a Taxable Supply by the Taxable Person:

Any form of entertainment, sporting or cultural services.

Catering services in hotels, restaurants and similar venues.

The purchase or lease of Restricted Motor Vehicles, as defined in the second paragraph of this Article.

Repair, alteration, maintenance or similar services on Restricted Motor Vehicles.

Fuel used in Restricted Motor Vehicles.

Any other Goods and services used for a private or non-business purpose.[28]

Entertainment, sporting, cultural or catering services

A Taxable Person, who does not supply entertainment, sporting, cultural or catering services as part of his Economic Activity, is unable to deduct Input VAT incurred on these costs as part of his business. Despite the fact that these costs may be incurred for a specific business purpose by a Taxable Person who is ordinarily able to deduct VAT in full, the costs are specifically blocked from VAT deduction.

Example (15)

Al Fahad Engineering, a Saudi Company registered for VAT, takes all employees on an external activity to visit the National Museum as a 'team-building' event. Al Fahad Engineering purchases 40 tickets with the price of SAR 105 per ticket (including VAT). The National Museum charges VAT (of SAR 200) to Al Fahad Engineering. As Al Fahad Engineering is deemed not to purchase these services in the course of its Economic Activity, it is not eligible to deduct this VAT as Input Tax.

Example (16)

The management of Shaikh Company, a VAT registered company in the KSA, travel to Jeddah to meet with a prospective client. They hold the meeting in a local restaurant, and eat a meal whilst they discuss potential business opportunities. Whilst the cost of the meal is related to Shaikh Company's business, the deduction of Input VAT on the cost is prohibited.

Goods or services purchased for onwards supply

Notwithstanding the restrictions for Input VAT deduction on specific categories of goods or services, a Taxable Person who purchases any goods or services within the listed restricted categories but uses these for a direct onwards supply of those same goods and services is able to deduct the VAT incurred.

Catering during an event

Educational or training events, under which employees receive instruction or training relevant to their work duties, will not be considered as entertainment or cultural events, and will in principle be eligible for VAT deduction. If a Taxable Person pays a fee to attend an educational or training event which includes the provision of light refreshments, and the value of those refreshments is clearly immaterial in the context of the overall event and attendance fee, ZATCA accepts that Input VAT can be deducted by the Taxable Person in respect of the event.

Example (17)

A KSA technology consulting company provides a full day educational seminar about the latest technology developments in the KSA, charging delegates a fee of SAR 1,000 (plus VAT of SAR 50). The seminar fee relates mainly to the training material and speeches from industry specialists. Food and beverages made available to participants are coffee, tea, water with a light working lunch made available during the seminar break.

In this case, the catering component is clearly immaterial to the provision of training. The Taxable Customer may be able to deduct the full amount of Input VAT (SAR 50) as it directly relates to their Economic Activity, without making a restriction for any portion of the fee relating to catering services.

Catering provided by employers

ZATCA considers that a staff canteen or cafe which serves meals falls within the scope of a 'similar location' to a hotel or restaurant as prescribed in the Implementing Regulations.

In normal circumstances, where Employers provide catering services to their employees or other guests at a staff canteen or cafe for no Consideration, Input Tax incurred in respect of these catering services is not deductible. Incidental expenditures (such as the cost of cutlery or cooking equipment) relating to the provision of catering for no Consideration are also non-deductible.

If employees are charged for food consumed, then Input VAT may be deducted on the related goods and services incurred for the catering services as these are directly supplied onwards as a Taxable Supply of catering by the Employer. Note that if Consideration is charged for catering services, transactions between a Taxable Person and an Employee must be valued at fair market value for VAT purposes.

If a staff canteen or cafe is used to provide both free meals to employees and to provide catering for Consideration, the portion of the Input VAT that relates to the catering provided for Consideration is deductible. The Employer should keep evidence of the method of apportionment with its business records.

ZATCA considers that a facility at an Employer's premises which does not provide meals - but offers hot or cold drinks, reheating facilities, and similar equipment - will not in itself be considered a venue which is similar to a hotel or restaurant. Input VAT relating to such facilities should be deductible in accordance with standard deduction principles.

Fulfilment of legal obligations by employers

Any costs incurred by Employers in the fulfilment of legal obligations (as a consequence of Labour Law or other KSA law) to Employees are deemed to be carried on for the purpose of their Economic Activity. Whilst the Employees also derive a benefit from these obligations being fulfilled, this is a necessary cost of business and will not be considered private expenditure. ZATCA considers that this includes any situations where catering services are required to be provided to employees working on remote sites.

Input VAT deduction is permitted on the same basis as any other overheads or non-attributable expenditure, depending on whether the Employer's Economic Activity constitutes making Taxable or exempt supplies.

VAT obligations of the Taxable Person

In your capacity as a Taxable Person, you must evaluate your tax obligation and also comply with the conditions and obligations relating to VAT. This includes registering for VAT as necessary, and exactly calculating the net amount of VAT payable, and paying the tax at the time due, as well as keeping all necessary records and cooperating with officials of the Authority on demand.

If you are not sure of your obligations, you must contact the Authority through its website at vat.gov.sa or by other means of communication, and you may also seek external consultation through a qualified consultant. There follows below a review of the most important tax obligations provided for in the Law and the Implementing Regulations.

Issuing tax invoices

A Supplier must issue a tax invoice for each Taxable Supply made to any VAT-registered person or to any other legal person, or issue a simplified invoice in the event that the Value of the supply is less than SAR 1,000, or for supplies made to the end consumer, by no later than fifteen days following the end of the month in which the supply is made.

The tax invoice must clearly detail information such as the invoice date, supplier's tax identification number, taxable amount, tax rate applied, and the amount of VAT charged[29]. If different rates have been applied to supplies, the Value of each supply at each rate must be separately specified, as well as the VAT applicable to each rate. A tax invoice may be issued in the form of a commercial document, provided that document contains all of the requirements for the issuing of tax invoices as set out in the Implementing Regulations to the Law[30].

Note that a Tax Invoice for a Nominal Supply (for example, resulting from the provision of goods or services for no Consideration) must be kept with the person's business records, but must not be issued to the recipient of the goods or services.

Further information on the requirements for tax invoicing are set out in the Taxpayer guideline on Invoicing and Records.

Filing VAT Returns

Each VAT-registered person, or the person authorised to act on his behalf, must file a VAT return with the Authority for each monthly or quarterly tax period. The VAT return is considered the Taxable Person's self-assessment of tax due for that period.

Monthly VAT periods are mandatory for Taxable Persons with annual revenues exceeding SAR 40 million. For all other VAT registered persons, the standard tax period is three months.

The VAT return must be filed, and the corresponding payment of net tax due made, no later than the last day of the month following the end of the tax period to which the VAT return relates.

More information on filing of VAT returns is provided in a separate guideline.

If the VAT return results in VAT due to the Taxpayer, or if the Taxpayer has a credit balance for any reason a request for a refund of this VAT may be made after the filing of the VAT return, or at any later time during the next five years by filing a request for a refund to the Authority. ZATCA will review these requests and will pay the amount due on refund requests that have been approved, directly to the Taxpayer[31].

Keeping records

All Taxpayers are required by law to keep appropriate VAT records relating to their calculation of VAT for audit purposes. This includes any documents used to determine the VAT payable on a transaction and in a VAT return. This will generally include:

tax invoices issued and received.

books and accounting documents.

contracts or agreements for large sales and purchases.

bank statements and other financial records.

import, export and shipment documents.

other records relating to the calculation of VAT.

Records may be kept in physical copy, or electronically provided the relevant criteria are met - but in all cases must be made available to the Authority on request.

All records must be kept for at least the standard retention period of 6 years. That minimum period for retention is extended to 11 years in connection with invoices and records relating to movable capital assets, and 15 years in connection with invoices and records relating to non-movable capital assets[32].

Certificate of registration within the VAT system

A Resident person who is subject to VAT and registered with the Authority in the VAT system must display a certificate to the effect that he has been registered in the VAT system in a place visible to the public at his main place of business and at all his branches.

In the event of a contravention, the person in breach will be liable to the penalties provided for in the Law.

Correcting past errors

If a Taxable Person becomes aware of an error or an incorrect amount in a filed VAT Return, or of any other non-compliance with the VAT obligation, he should notify the Authority and correct the error by amending VAT the tax return. Errors resulting in a net understatement of VAT (exceeding SAR 5,000) must be made known to the Authority within twenty (20) days of detecting the error or incorrect amount, and the previous return must be amended. In connection with minor errors resulting in a difference of less than SAR 5,000, the error may be corrected by amending the net tax in the subsequent tax return[33].

Penalties

The Authority may impose penalties or fines on Taxpayers for violations of VAT requirements set out by the Law or Implementing Regulations[34].

| Description of offence | Associated fine |

|---|---|

Submitting false documents with the intent of evading the payment of the VAT due or to reducing its value | • At least the amount of the VAT due • Up to three times the value of the goods or services |

Moving goods in or out of the Kingdom without paying the VAT due | • At least the amount of the VAT due • Up to three times the value of the goods or service |

Failure to register for the VAT in the allotted timeframe | SAR 10,000 |

Filing incorrect tax return, amend a tax return after submission or filing any VAT document with the Authority resulting in a lower amount due | Equal to 50% of the value of the difference between the calculated Tax and Tax due |

Failure to file VAT return in time | 5%-25% of the VAT in respect of which the return should have been filed |

Failure to pay the VAT in time | 5% of the VAT due for each month or part thereof |

Collecting VAT without being registered | Up to SAR 100,000 |

Failure to maintain books and records as stipulated in the regulations | Up to SAR 50,000 |

Preventing ZATCA employees from performing their duties | Up to SAR 50,000 |

Violating of any other provision of the VAT regulations or the VAT law | Up to SAR 50,000 |

In all cases, if a violation is repeated within three years from the date of issuing the final decision of the penalty, the Authority may double fine for the second offense.

The level of the penalty or fine imposed is set by the Authority with regard to the Taxpayer's behaviour and compliance record (including Taxpayers meeting their requirements to notify the Authority of any errors, and to provide co-operation to rectify mistakes).

Applying for the issue of rulings (interpretative decisions)

In the event that you are not sure about the manner of application of VAT to a particular activity or particular transaction that you are doing or intend to do, after referring to the relevant provisions and the relevant guideline, you may submit an application to the Authority to obtain a ruling. The application should set out the full facts relating to the particular activity or particular transaction on which you are asking the Authority to express its view.

A reply to a request for a ruling may be either:

Public, in which event the Authority will publish details of the ruling, but without referring to any private particulars relating to the individual Taxpayer.

Private, in which case the Authority will not publish the ruling.

Neither a public nor a private ruling issued by the Authority will be treated as binding on it or upon the Taxpayer in connection with any transaction that he performs, and it shall not be possible to rely on it in any manner.

The Authority is not obliged to respond to all requests for rulings, and it may review all requests and specify priorities on the basis of certain elements, including:

The level of information submitted by the Taxpayer in the request.

The potential benefit to Taxpayers as a whole on the issuing of a general ruling concerning some transaction or activity.

Whether there is an existing law or guide dealing with this request.

Contacting Us

For more information about VAT treatment, Kindly visit our website: zatca.gov.sa; or contact us on the following number: 19993.

Questions and answers

Are Non-Resident visiting musicians, sportspersons or entertainers liable to register for VAT in respect of performances in the KSA?

The supply of entertainment or similar services is made in the country where the performance takes place, so will be subject to KSA VAT. However, a Non-Resident is only required to register for VAT in cases where he is obligated to collect VAT on a Taxable Supply. Provided the Non-Resident musician, sportsperson or entertainer charges a fee to a Taxable Customer in the KSA - and that Taxable Customer can self-account for VAT using the Reverse Charge - the Non-Resident is not required to register for KSA VAT.

At what time is a Taxable Person liable to account for VAT on an admission fee to an event?

VAT becomes due at the earlier of the completion of the services (completion of the event), the collection of payment or the issue of a Tax invoice in respect of the supply. If a Customer purchases a ticket in advance for an event, VAT becomes due in the tax period in which upfront payment occurs.

If the attendee purchases a ticket to an event but does not attend, is VAT still due on the Consideration received?

Yes. The attendee purchases the right to attend an event, which is a Taxable Supply of services. If the Taxable Person hosting the event retains all or some of the Consideration, VAT should be due on the relevant VAT fraction (15/115) of the Consideration received.

How does VAT apply to Sponsorship payments received by a sports club?

The receipt of sponsorship payment by a person carrying out an Economic Activity is presumed by ZATCA to be the Consideration for a supply of services by that person. If the sports club is a Taxable Person and carries on an Economic Activity, it must account for VAT on the sponsorship received.

Can a VAT-registered Company deduct or refund Input Tax on entertainment for employees?

No, expenditures related to entertainment for the employees (the supply of goods and services mentioned in Article 50 of the Implementing Regulations) are not considered to be incurred in the course of the Taxable Person's Economic Activity. The VAT paid on such supplies is not eligible for deduction or refund.

Can the Company claim the VAT paid by the Company on the cost of food in employees'/workers' housing as Input VAT?

No. Catering services for staff in restaurants or similar venues is not eligible for deduction, regardless of whether this is incurred as a part of carrying out the employment duties or not. Note that deduction may be permitted in specific cases where catering is provided in remote areas as a requirement of the employer fulfilling its obligations under Labour Law.

Employees of the Company stay in hotels in different cities in KSA or within GCC as a requirement of their work duties, for business or training purposes. The employees incur the costs directly, and the Company agrees to reimburse such payments including VAT paid. Can the amount of VAT be claimed as Input tax?

The VAT on the invoice can be deducted in accordance with the general VAT deduction rules, provided the Company acting as Employer can clearly evidence that:

The Employee has received a supply of goods or services as a required part of his employment duties.

The Employer has actually incurred the cost paid by the Employee (including VAT as appropriate).

Such expenses were incurred in course of practising the Economic Activities of the Taxable Person and on behalf of the Employer (shown for example by receiving tax invoices with the name of the employee and referring to the company name).

The VAT due on the accommodation itself should in principle be deductible, however VAT on catering services incurred during the stay is not deductible.

Any VAT charged in a country outside the KSA (from hotels located outside the KSA) cannot be deducted via the KSA VAT return of the company.