Simplified VAT Filing Guidelines

Version 1 | July 2020

Contents

2. Who files VAT returns and when?

3. How do Taxpayers complete VAT return forms?

4. Where can Taxpayers refer to further information on VAT return filing?

Appendix - Simplified VAT Filing Scenarios

KSA Chemicals Manufacturer (1/2)

KSA Chemicals Manufacturer (2/2)

Change of VAT rate to 15% as of July 1, 2020

Upon the introduction of VAT in January 2018, the KSA applied a basic VAT rate of 5% to Taxable Supplies and Imports made in the Kingdom. The basic VAT rate was revised to 15% with effect from 1 July 2020 (the “Revised VAT Rate”).

Transitional rules have been introduced to clarify the VAT rate to be applied to long-term contracts for continuous supplies which span 1 July 2020, and for certain supplies where invoices are issued or contracts are concluded prior to 11 May 2020. These rules, and further detail surrounding the change to the VAT rate -including guidance in respect of specific types of supply- are detailed in a separate guideline on the Revised VAT Rate.

This Guideline was originally issued before the VAT rate was revised to 15%, and its content is based on the 5% rate in force at the time of its issue. Any references to the 5% VAT rate in this Guideline should be interpreted as 15% where applied to any Supplies or Imports made on or after 1 July 2020 and in accordance with the transitional rules. Monetary examples or calculations in this Guideline which include a 5% VAT rate should also be interpreted as if the 15% rate applied for all Supplies or Imports made on or after 1 July 2020 and in accordance with the transitional rules.

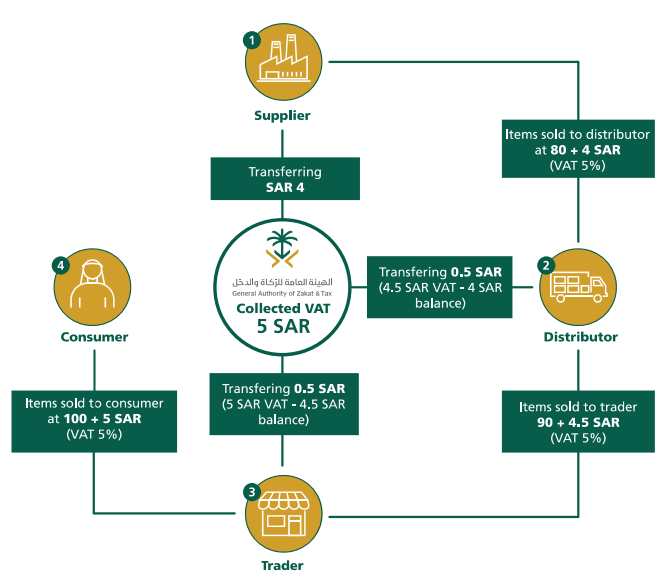

What is a VAT return?

VAT is collected throughout the value chain, where companies record the VAT revenue they collect via a VAT return form submitted to GAZT.

VAT Collection across the Supply Chain

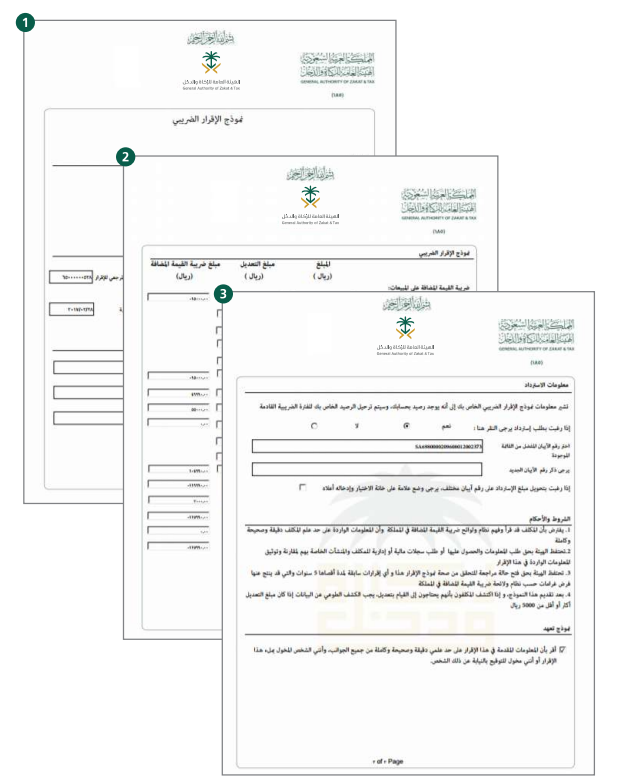

Completed VAT Return Forms

* For illustrative purposes only

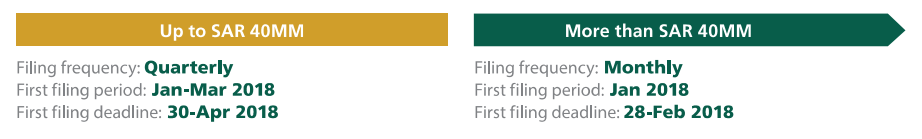

Who files VAT returns and when?

A business' volume of annual taxable supplies determines when it needs to start filing, as well as the frequency of its filing obligations.

Annual Taxable Supplies of VAT-Registered Businesses

How do Taxpayers complete VAT return forms?

Businesses file their VAT returns via the GAZT e-portal, which is designed to be as simple and user-friendly as possible.

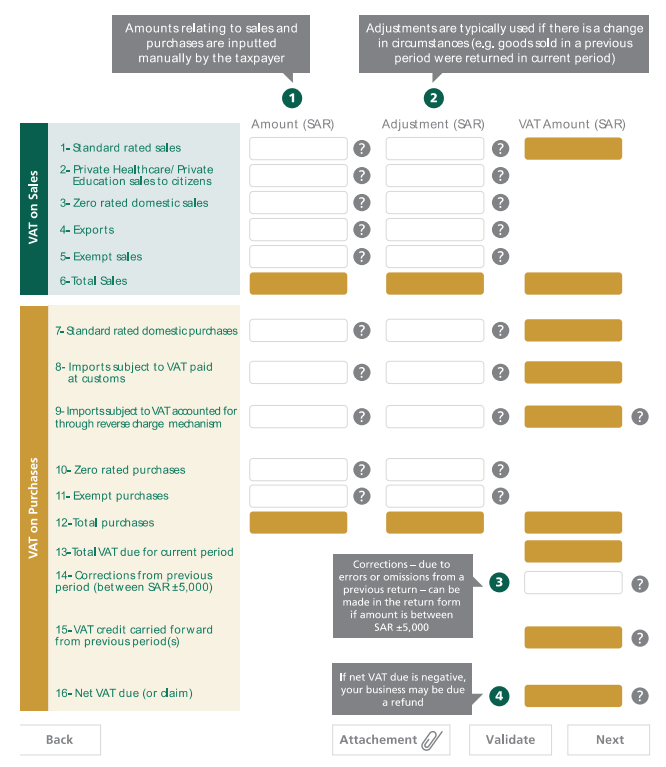

VAT Return Form Inputs

Where can Taxpayers refer to further information on VAT return filing?

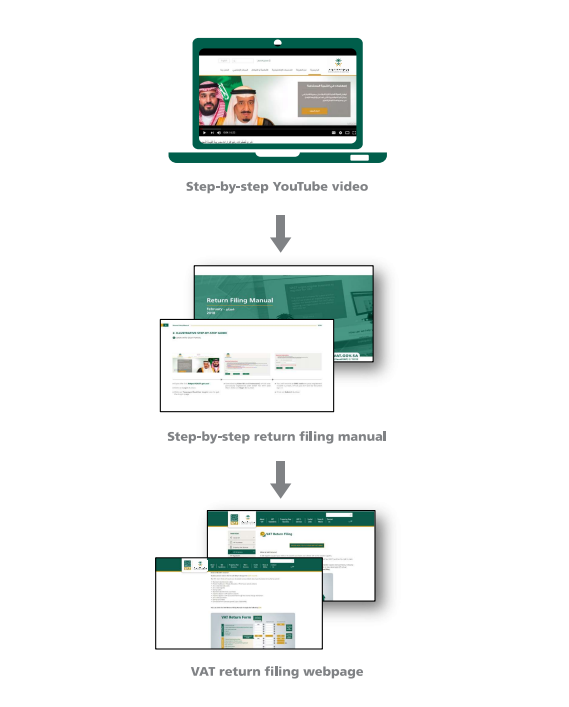

The GAZT VAT website offers a lot of resources to guide taxpayers through the filing process step-by-step.

VAT Return Filing Resources

Appendix - Simplified VAT Filing Scenarios

Simplified filing scenarios

3 independent filing examples are illustrated, spanning the wide range of potential filing scenarios.

KSA Shop (1/4)

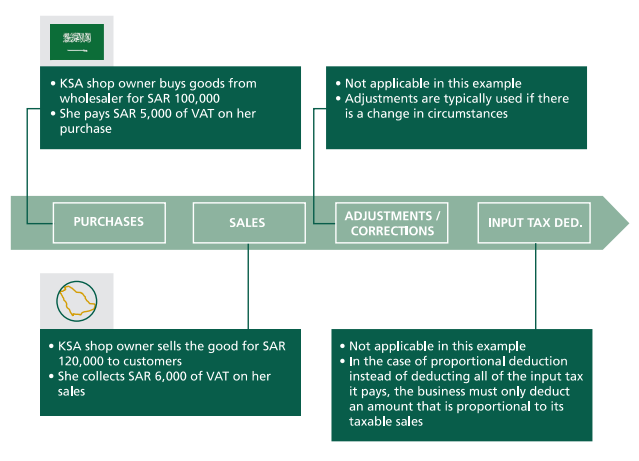

A KSA shop makes taxable supplies and purchases, submitting VAT returns on a quarterly basis.

KSA Shop (2/4)

In the Q1 reporting period, the retailer made supplies worth SAR 120k and purchases worth SAR 100k.

Retailer's supplies and purchases during Jan - Mar 2019

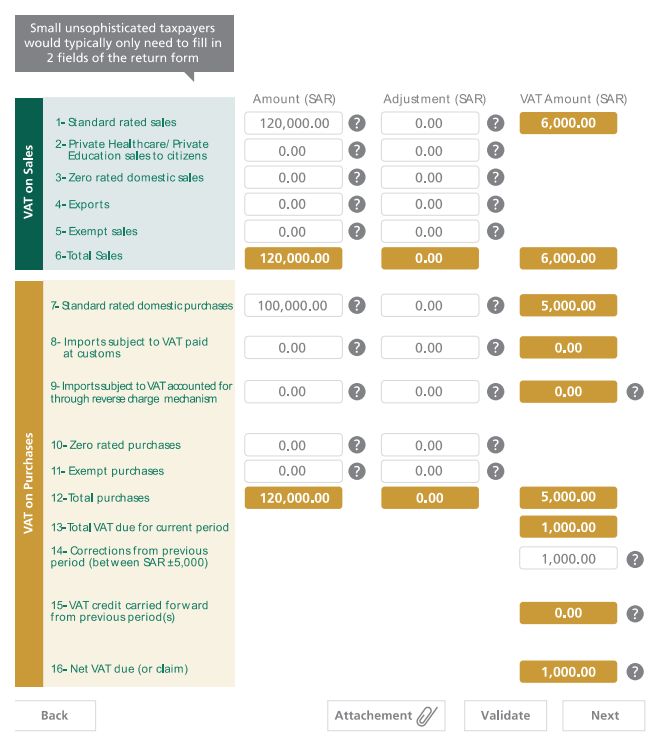

KSA Shop (3/4)

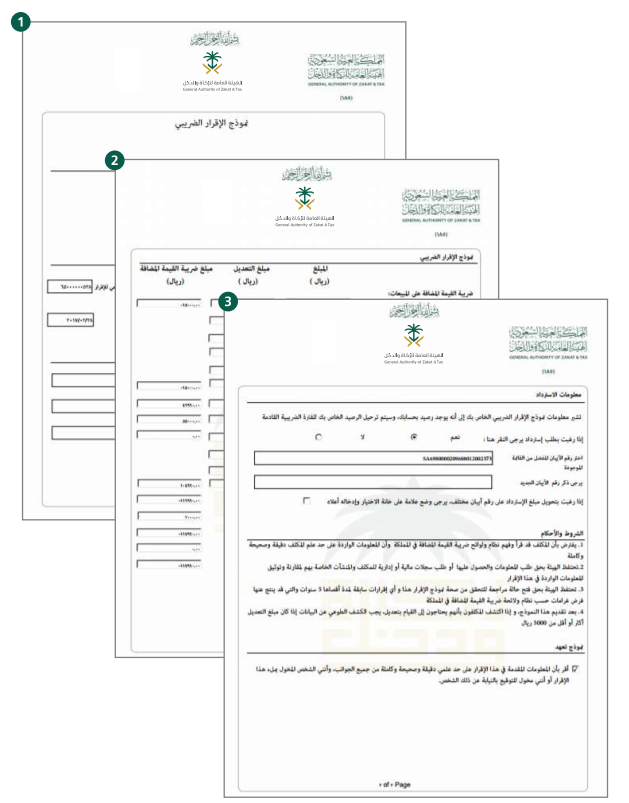

Taxpayer submitted her Q1 2018 VAT return on 23rd April.

VAT return form

KSA Shop (4/4)

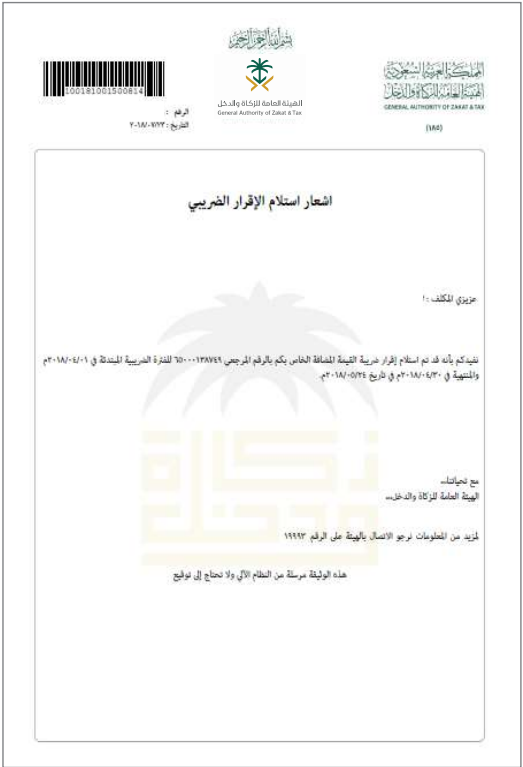

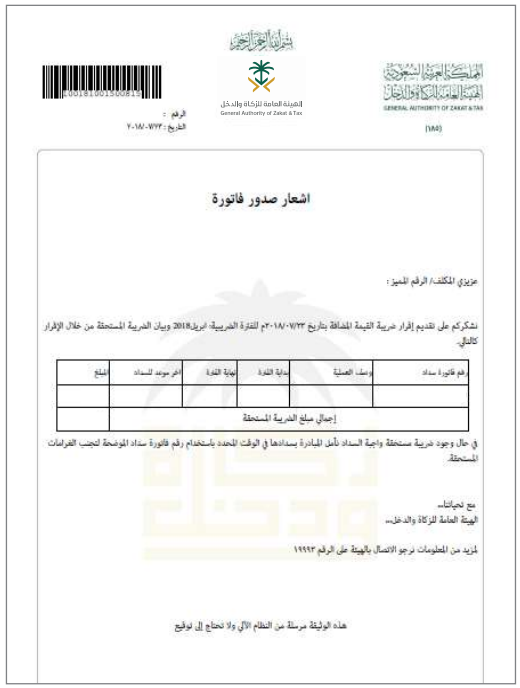

After submission, the taxpayer receives the following correspondences:

Return submission acknowledgement

* For illustrative purposes only

Submitted return form

* For illustrative purposes only

Billing notification

* For illustrative purposes only

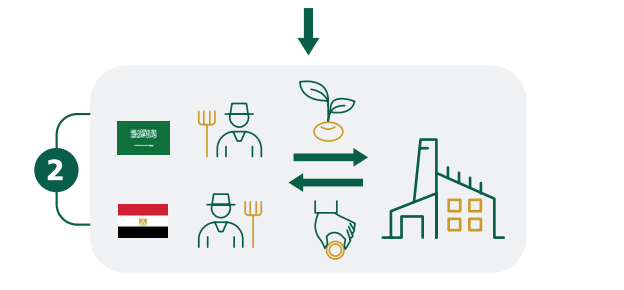

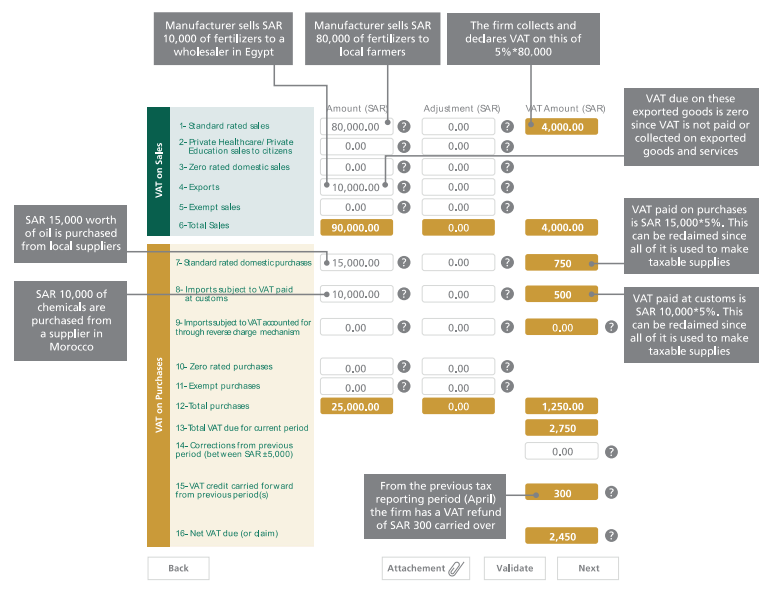

KSA Chemicals Manufacturer (1/2)

Domestic and exported sales, and domestic and imported inputs.

In the May tax period the chemicals manufacturer buys:

SAR 15,000 of oil from a local firm;

SAR 10,000 of phosphates from a supplier in Morocco, 500 SAR VAT has been paid on it at customs as per the factory imports customs statement.

In the same tax period the manufacturer sells SAR 80,000 of fertilizers to local farmers.

He also sells SAR 10,000 worth of fertilizers ('exports') to a wholesaler in Egypt as per the factory customs export data.

In June, the chemicals manufacturer submits the VAT return form for May and pays the tax due.

From the previous tax reporting period the firm has a VAT refund of SAR 300 carried over.

KSA Chemicals Manufacturer (2/2)

Domestic and exported sales, and domestic and imported inputs.

VAT Return Form

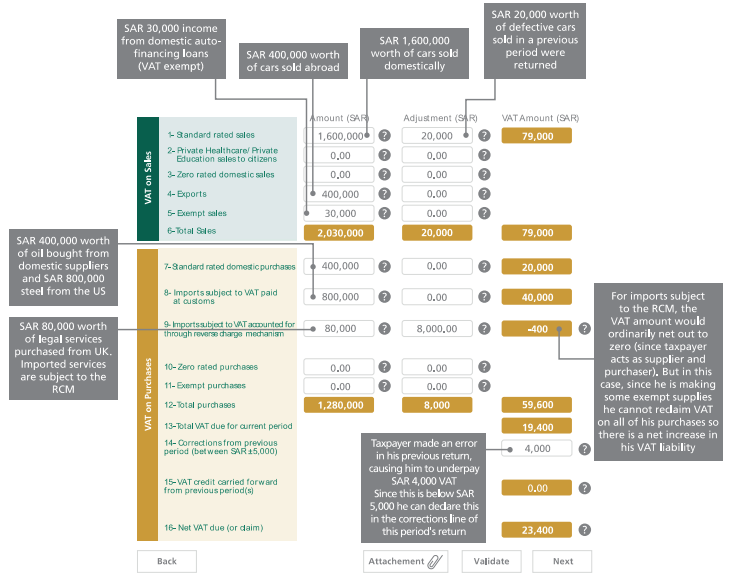

KSA Car Manufacturer and Finance Provider (1/2)

Reverse charge mechanism & default method of proportional deduction, adjustment and corrections.

During the tax period, KSA car manufacturer buys:

SAR 400,000 worth of oil from domestic suppliers used for taxable supplies;

SAR 800,000 worth of steel from a supplier in the US used for taxable supplies;

SAR 80,000 worth of legal services from the UK.

In the same period the car manufacturer sells:

80 cars at SAR 20,000 each for a total of SAR 1,600,000 to a local car dealer;

20 cars in Epypt at SAR 20,000 each for a total of SAR 400,000;

He also receives SAR 30,000 in lending fees from domestic auto-financing loans (VAT exempt).

However, the car manufacturer also has SAR 20,000 worth of cars (sold in a previous tax period) returned from a car dealer due to defects.

He also made an error in his previous tax return, causing him to under pay SAR 4,000 of VAT.

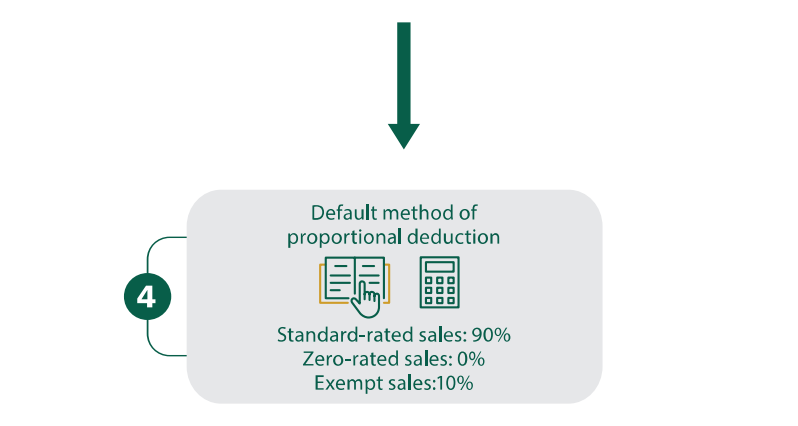

Applying the default method of proportional deduction based on last year's financials the car manufacturer calculates that:

90% of his purchases were used to produce cars (standard rated);

10% of his purchases were used to issue auto-financing loans (exempt).

Car manufacturer submits the VAT return and pays the tax due.

KSA Car Manufacturer and Finance Provider (2/2)

Reverse charge mechanism & default method of proportional deduction, adjustment and corrections.

VAT Return Form