Interest Deduction Limitation Rules

Corporate Tax Guide | CTGIDL1

April 2025

Contents

Glossary

Accounting Income | : | The accounting net profit or loss for the relevant Tax Period as per the Financial Statements prepared in accordance with the provisions of Article 20 of the Corporate Tax Law. |

Accounting Standards | : | The accounting standards specified in Ministerial Decision No. 114 of 2023. |

Accrual Basis of Accounting | : | An accounting method under which the Taxable Person recognises income when earned and expenditure when incurred. |

AED | : | The United Arab Emirates dirham. |

Authority | : | Federal Tax Authority. |

Bank | : | A Person licensed in the UAE as a bank or finance institution or an equivalent licensed activity that allows the taking of deposits and the granting of credits as defined in the applicable legislation of the UAE. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Business Restructuring Relief | : | A relief from Corporate Tax for business restructuring transactions, available under Article 27 of the Corporate Tax Law and as specified under Ministerial Decision No. 133 of 2023. |

Cash Basis of Accounting | : | An accounting method under which the Taxable Person recognises income and expenditure when cash payments are received and paid. |

Connected Person | : | Any Person affiliated with a Taxable Person as determined in Article 36(2) of the Corporate Tax Law. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Corporate Tax Payable | : | Corporate Tax that has or will become due for payment to the FTA in respect of one or more Tax Periods. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return of capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Extractive Business | : | The Business or Business Activity of exploring, extracting, removing, or otherwise producing and exploiting the Natural Resources of the UAE, or any interest therein as determined by the Minister. |

Financial Statements | : | A complete set of statements as specified under the Accounting Standards applied by the Taxable Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity and cash flow statement. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

Foreign Tax Credit | : | Tax paid under the laws of a foreign jurisdiction on income or profits that may be deducted from the Corporate Tax due, in accordance with the conditions of Article 47(2) of the Corporate Tax Law. |

FTA | : | Federal Tax Authority, being the Authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

General Interest Deduction Limitation Rule | : | The limitation provided under Article 30 of the Corporate Tax Law. |

Government Controlled Entity | : | Any juridical person, directly or indirectly wholly owned and controlled by a Government Entity, as specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Government Entity | : | The Federal Government, Local Governments, ministries, government departments, government agencies, authorities and public institutions of the Federal Government or Local Governments. |

IFRS | : | International Financial Reporting Standards. |

IFRS for SMEs | : | International Financial Reporting Standard for small and medium-sized entities. |

Immovable Property | : | Means any of the following:

|

Insurance Provider | : | A Person licensed in the UAE as an insurance provider that accepts risks by entering into or carrying out contracts of insurance, in both the life and non-life sectors, including contracts of reinsurance and captive insurance, as defined in the applicable legislation of the UAE. |

Interest | : | Any amount accrued or paid for the use of money or credit, including discounts, premiums and profit paid in respect of an Islamic financial instrument and other payments economically equivalent to interest, and any other amounts incurred in connection with the raising of finance, excluding payments of the principal amount. |

Islamic Financial Instrument | : | A financial instrument which is in compliance with Sharia principles and is economically equivalent to any instrument provided for under Article 2(2) of Ministerial Decision No. 126 of 2023, or a combination thereof. |

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Licensing Authority | : | The competent authority concerned with licensing or authorising a Business or Business Activity in the UAE. |

Market Value | : | The price which could be agreed in an arm’s-length free market transaction between Persons who are not Related Parties or Connected Persons in similar circumstances. |

Net Interest Expenditure | : | The Interest expenditure amount that is in excess of the Interest income amount as determined in accordance with the provisions of the Corporate Tax Law. |

Non-Extractive Natural Resource Business | : | The Business or Business Activity of separating, treating, refining, processing, storing, transporting, marketing or distributing the Natural Resources of the UAE. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Participating Interest | : | An ownership interest in the shares or capital of a juridical person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Participation | : | The juridical person in which the Participating Interest is held. |

Participation Exemption | : | An exemption from Corporate Tax for income from a Participating Interest, available under Article 23 of the Corporate Tax Law and as specified under Ministerial Decision No. 302 of 2024. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Personal Investment | : | Investment activity that a natural person conducts for their personal account that is neither conducted through a Licence or requiring a Licence from a Licensing Authority in the UAE, nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022. |

Qualifying Investment Fund | : | Any entity whose principal activity is the issuing of investment interests to raise funds or pool investor funds or establish a joint investment fund with the aim of enabling the holder of such an investment interest to benefit from the profits or gains from the entity’s acquisition, holding, management or disposal of investments, in accordance with the applicable legislation and when it meets the conditions set out in Article 10 of the Corporate Tax Law. |

Qualifying Infrastructure Project | : | A project that meets the conditions of Article 14 of Ministerial Decision No. 126 of 2023. |

Qualifying Infrastructure Project Person | : | A Resident Person that meets the conditions of Article 14(2) of Ministerial Decision No. 126 of 2023. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023. |

Specific Interest Deduction Limitation Rule | : | The limitation provided under Article 31 of the Corporate Tax Law. |

State | : | United Arab Emirates. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax Group | : | Two or more Taxable Persons treated as a single Taxable Person according to the conditions of Article 40 of the Corporate Tax Law. |

Tax Loss | : | Any negative Taxable Income as calculated under the Corporate Tax Law for a given Tax Period. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration | : | A procedure under which a Person registers for Corporate Tax purposes with the FTA. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Transfer Pricing | : | Rules on setting of arm’s length prices for Controlled Transactions, including but not limited to the provision or receipt of goods, services, loans and intangibles. |

Turnover | : | The gross amount of income derived during a Gregorian calendar year. |

UAE | : | United Arab Emirates. |

Withholding Tax | : | Corporate Tax to be withheld from State Sourced Income in accordance with Article 45 of the Corporate Tax Law. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates (“UAE”) on 10 October 2022. This Decree-Law together with its amendments is referred to as the “Corporate Tax Law”.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits (“Corporate Tax”) in the UAE.

The provisions of the Corporate Tax Law shall apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance on the deductibility of Interest expenditure while calculating the Taxable Income of a Taxable Person. The guide elaborates on the following aspects:

Meaning of Interest under the Corporate Tax Law,

Application of the General Interest Deduction Limitation Rule and Specific Interest Deduction Limitation Rule,

Carry forward and utilisation of disallowed Net Interest Expenditure, and

Interaction of the Interest limitation rules with other provisions of the UAE Corporate Tax Law.

Who should read this guide?

The guide should be read by any Taxable Person that conducts Business in the UAE and incurs Interest expenditure. This guide explains the deductibility of Interest expenditure while calculating the Taxable Income of a Taxable Person who is not part of a Tax Group[1]. It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, simple examples are used to illustrate how key elements of the Corporate Tax Law apply to deductibility of Interest. The examples in the guide:

Show how these elements operate in isolation and do not show the interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes; and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as “Corporate Tax Law”,

Cabinet Decision No. 56 of 2023 on Determination of a Non-Resident Person’s Nexus in the State for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Cabinet Decision No. 56 of 2023”,

Ministerial Decision No. 43 of 2023 Concerning Exception from Tax Registration for the Purpose of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 43 of 2023”,

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, is referred to as “Ministerial Decision No. 73 of 2023”,

Ministerial Decision No. 126 of 2023 on the General Interest Deduction Limitation Rule for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 126 of 2023”, and

Ministerial Decision No. 134 of 2023 on the General Rules for Determining Taxable Income for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 134 of 2023”.

Status of this guide

This guidance is not a legally binding document but is intended to provide assistance in understanding the tax implications for Interest expenditure under the Corporate Tax regime in the UAE. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person’s own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Meaning of Interest

Overview

Interest, a common Business expenditure, is generally allowed as a deduction while calculating a Taxable Person’s Taxable Income for a Tax Period. However, the deductibility of interest for Corporate Tax purposes is not without limits. It includes interest income and interest expenditure that typically represents amounts paid for use of money or credit, and other associated costs. This is subject to various Corporate Tax provisions, applied in the following order:

General principles of deductibility of expenditure (Section 4.1),

Arm’s Length Principle (Section 4.3),

Specific Interest Deduction Limitation Rule (Section 5), and

General Interest Deduction Limitation Rule (Section 6).

The purpose of the Specific Interest Deduction Limitation Rule and General Interest Deduction Limitation Rule (together referred as “Interest limitation rules”) is to ensure that the tax deduction for Interest expenditure does not result in the erosion of the UAE’s tax base and shifting of profits away from the UAE.

The General Interest Deduction Limitation Rule does not apply to certain categories of persons, including Banks, Insurance Providers and natural persons doing business in the UAE (see Section 7).

What is “Interest”?

The Corporate Tax Law defines the term “Interest” broadly to reflect the fact that there is considerable flexibility in how financing arrangements may be structured, which may be different from the interest recorded for accounting purposes following the applicable Accounting Standards (i.e. IFRS or IFRS for SMEs). Taxable Persons will, therefore, be required to identify what constitutes “Interest” based on the definition provided under the Corporate Tax Law[2] rather than what constitutes interest under IFRS (or IFRS for SMEs).

The definition of Interest under the Corporate Tax Law covers the following elements:

Any amount accrued or paid for the use of money or credit (see Section 3.2),

Discounts and premiums (see Section 3.3),

Profit paid in respect of an Islamic financial instrument (see Section 3.4),

Other payments economically equivalent to Interest (see Section 3.5), and

Any other amounts incurred in connection with the raising of finance (see Section 3.10).

Interest does not include repayments of the principal loan or debt amount.[3]

Timing of recognition

The recognition of income or expenditure for Corporate Tax purposes follows the accounting method adopted by the Business, which can be either the Accrual Basis of Accounting or the Cash Basis of Accounting.

Under the Accrual Basis of Accounting, income or expenditure is generally recognised when it is earned or incurred, regardless of when the payment is made.

In the case of a Cash Basis of Accounting (allowed only where Taxable Person’s Revenue is below AED 3 million or by way of specific application the FTA)[4], income or expenditure is accounted only when the payment is actually made.

Any income or expenditure that is treated as Interest will adopt the accounting method followed by the Business, except for capitalised interest (see Section 3.7) only where Accrual Basis of Accounting is followed.

Amount accrued or paid for use of money or credit

Interest may be charged as a result of borrowing funds or receiving credit. It is the additional amount that a borrower pays to a lender on top of the repayment of principal (the underlying amount borrowed/owed).

Any amounts which are accrued or paid for the use of money or credit are economically equivalent to Interest, and will be considered to be Interest (see Section 3.5).

Example 1: Use of money

A company takes out a bank loan of AED 500,000 at an interest rate of 6% per annum to finance the expansion of its operations. The annual expense of AED 30,000 is the charge for the use of the money and is treated as Interest expenditure.

Example 2: Use of overdraft facility

A company uses an overdraft facility with an annual interest rate of 20% to make purchases. During the year, it utilises the overdraft facility to the extent of AED 2 million, and is charged AED 33,333 (AED 2 million * 20% / 12 months) per month for the use of the overdraft facility. That charge is treated as Interest expenditure.

Discounts and premiums

Discounts and premiums are treated as Interest when they are related to the borrowing of money or the issuance of debt instruments because they represent the cost of borrowing or return on lending.

When a bond or debt instrument is issued at a price lower than its face value, the difference between the issue price and the face value is known as a “discount”. This may occur where the bond pays no interest (zero coupon) or the interest rate is below the market rate. This discount (which may be amortised over the term of the debt instrument) is treated as Interest. For example, a company issues a bond with a face value of AED 10,000 at a price of AED 9,500. The discount of AED 500 (which may be amortised over the term of the debt instrument) is considered to be Interest income for the lender (the holder) and Interest expenditure for the borrower (the issuer).

When a bond or debt instrument is issued for more than its face value, the excess amount is referred to as a “premium”. This may occur where the bond pays a rate of Interest higher than the prevailing market rate. This premium (which may be amortised over the term of the debt instrument) is considered to represent the lender’s reward for the loan of money and is, therefore, treated as Interest.

For example, a bond with a face value of AED 10,000 is subscribed at a market price of AED 10,200. The issuer (the borrower) must pay back AED 10,000 to the holder (the lender) being the face value of the bond. For the holder (the lender), the AED 200 premium is typically amortised and recognised in the income statement over the term of the bond, which will be treated as Interest expenditure whereas for the issuer (the borrower), the AED 200 is amortised over the term of the bond as a reduction to its Interest expenditure (i.e. it is considered as Interest income).

Discounts provided as sales incentives or for early payment are not considered Interest, as they are not related to the financing or borrowing of money. Other examples of discounts and premium that are not considered to be Interest include:

Trade discounts: reductions from the list price of goods or services offered by sellers, for instance to preferred customers.

Volume discounts: offered to customers for purchasing in large quantities.

Sales promotions and rebates: reductions in the selling price of goods or services as part of promotional campaigns or as retrospective discounts.

Premium or discount on issuance of equity instruments: arising when equity instruments are issued at a price above or below their face value.

Loyalty Points or Rewards: discounts or benefits given to reward customer loyalty.

Payments made in respect of Islamic Financial Instruments

Islamic Financial Instruments[5] are designed to facilitate financial transactions, while adhering to Sharia principles, which prohibit Interest. Common examples of Islamic financing structures used to offer sharia-compliant products are Mudarabah, Murabaha, Ijara, Sukuk, etc.

Such instruments typically contain an element (such as “profit” or “mark-up”) that is considered to be economically equivalent to Interest, regardless of the classification and treatment of the element under IFRS (or IFRS for SMEs).[6]

An Islamic Financial Instrument (or a combination of arrangements that form part of the same Islamic Financial Instrument) that is classified as an ownership interest under the Accounting Standards issued by the Accounting and Auditing Organisation for Islamic Financial Institutions (“AAOIFI”) is not considered to have an Interest element.

Accordingly, in order to determine how these Islamic Financial Instruments should be treated for Corporate Tax purposes, it is necessary to understand how these instruments have been treated as per IFRS. For example, if the instrument is recognised as a debt instrument in accordance with IFRS, the corresponding profit distribution should be considered as equivalent to Interest for the purposes of the Interest limitation rules. Conversely, if the instrument is not classified as a debt instrument under IFRS, there would be no Interest equivalent element. For example, a profit distribution in respect of an instrument that is recognised as a debt in accordance with IFRS, such profit distribution should be considered as equivalent to Interest for the purposes of the Interest limitation rules.

Below are examples of Islamic Financial Instruments and the corresponding Interest equivalent element (assuming they are classified as a debt instrument under IFRS).

A Mudarabah is a contractual relationship executed between two parties, one supplying the capital and the other supplying the labour and skill as an agent or manager, for investment purposes. Each party is granted a ratio of any earnings, determined at the time of making the investment. Such earnings would be typically treated as Interest equivalent for Corporate Tax purposes.

In a Murabaha cost-plus financing structure, a bank purchases an asset and sells it to the borrower at an agreed price (including an agreed upon mark-up) on a deferred payment basis. The payments (which consist of principal plus mark-up) are paid by the borrower in instalments or a lump sum on an agreed future date or dates. The mark-up charged by the bank may be considered as Interest for Corporate Tax purposes.

Ijara or Islamic leasing, is a Shariah-compliant financial structure where the lessor (financier) leases an asset to the lessee (borrower) for a specified period in exchange for rental payments. The ownership of the asset remains with the lessor, who also bears the risks associated with ownership, such as maintenance and insurance. Generally, in asset-based financing, the ownership of the asset is eventually transferred to the lessee at the end of the lease term, often for a nominal or minimal payment. The rental payments made by the lessee to the lessor can be fixed or variable, often linked to a benchmark rate, allowing for flexibility in adjusting payments over time. The rental payments include both a profit and principal element. The profit element may be considered as akin to Interest for Corporate Tax purposes (after adjustment for implied maintenance charges for the asset (if any)).

As an alternative to conventional bonds, investors in a Sukuk (for example, a typical Murabaha-based Sukuk) may receive periodic distributions of profits as per the agreed mark-up. The mark-up element is typically considered as akin to Interest. In other structures, instead of fixed distribution payments, investors may receive income from a “right of use” asset, which may be considered to be equivalent to an Interest-like element.

Sukuk can also be issued under other Islamic structures such as Ijara. The specific structure and its terms need to be assessed to determine if there is an element that can be considered as akin to Interest for Corporate Tax purposes.

In a Istisna the financer or investor (typically a Bank) enters into a contract to facilitate in the construction of an asset. They agree to deliver the asset at a future date for a pre-agreed price, which can be paid in instalments or as a lump sum upon completion that includes a margin or mark-up. The profit margin or mark-up included in the price may be considered as Interest for Corporate Tax purposes.

A Salam contract is in the nature of a forward contract that includes goods or products (typically agricultural products) where delivery is at a later date and with a pre-agreed mark-up. The profit margin or mark-up included in the price may be considered as Interest for Corporate Tax purposes.

Payments economically equivalent to Interest

The concept of "payments economically equivalent to Interest" encompasses a wide array of financial charges that, although not explicitly labelled as Interest, fulfil a similar economic role. These payments may occur within transactions or arrangements where the term 'Interest' has not been used but the economic substance of the transactions or arrangements are similar to a loan on which Interest should be charged.

When determining whether a payment is economically equivalent to Interest, it is essential to consider whether the economic substance provides financial returns that are akin to debt or equity. This substance may not necessarily follow the treatment under applicable Accounting Standards.

Performing and non-performing debt instruments[7]

A debt instrument is a contract where a person (the lender) provides money (the principal amount) to another person (the borrower) for a period of time, and the borrower agrees to pay back the principal amount along with interest to the lender at specified intervals or upon maturity.

A performing debt instrument is where the borrower is making payments of interest and/or repayments of the principal amount on the previously agreed dates. The interest that is paid is treated as Interest expenditure for the borrower and Interest income for the lender.

On the other hand, a non-performing debt instrument is where the borrower is not making the previously agreed payments. For the borrower, any penalties or higher interest charges resulting from the default is treated as Interest expenditure as well as the "standard" interest that it owes. For the lender, any amount receivable from the borrower that is not in respect of a repayment of the principal amount, is treated as Interest income.

A provision or write-off amount in respect of a loan is not considered to be Interest but depending on the accounting treatment, the amount could be a deductible expense for the lender (who has made a loss on the loan) subject to general principles of deductibility and other provisions of the Corporate Tax Law. The borrower (who no longer has a loan liability) would have corresponding Taxable Income where the liability (loan) is written back.

Interest held in collective investment schemes that primarily invest in cash and cash equivalents[8]

A collective investment scheme is an arrangement that enables investors to effectively "pool" their respective assets within a fund scheme and typically have these professionally managed.

Collective investment schemes that invest "primarily" in cash and cash equivalents shall mean collective investment schemes investing more than 50% (fifty percent) of their portfolio in cash and cash equivalents. Whether or not a collective investment scheme primarily invests in cash and cash equivalents needs to be assessed on an ongoing basis.

Any returns from interests held in a collective investment scheme that does not primarily invest in cash and cash equivalents is not considered to be Interest but instead considered to be Dividends or other profit distributions.[9] However, where a collective investment scheme primarily invests in cash and cash equivalents, such as money markets or ultra short-term bonds, this is akin to lending money. For example, instead of directly providing a loan and receiving Interest income (which may be taxable), the lender could indirectly lend money via a collective investment scheme in order to receive a return that is a Dividend (which may be Exempt Income). To prevent this situation, where a Person invests in a collective investment scheme that primarily invests in cash and cash equivalents, any return receivable by the Person from that collective investment scheme is treated as Interest income.

Separate rules apply to a collective investment scheme that is a Qualifying Investment Fund – see the Corporate Tax Guide on Investment Funds and Investment Managers for more information.

Example 3: Receipts from collective investment schemes

Company A (incorporated and tax resident in the UAE) is a manufacturer but also invests in a collective investment scheme. The collective investment scheme has the following portfolio: 75% cash equivalent investments and 25% equity investments.

Company A's income and expenses during the calendar year 2025 include:

Income receivable from the collective investment scheme arising from its investment in short-dated government bonds: AED 25,000

Income receivable from the collective investment scheme arising from its investment in equities: AED 30,000

Interest payable on working capital borrowings: AED 150,000

All the income receivable from the collective investment scheme, regardless of its source, is considered to be Interest income because the collective investment scheme primarily invests in cash and cash equivalents. Therefore, the income receivable that is derived from the investment in equities is not considered to be a profit distribution / dividend income. It does not matter that the income receivable in respect of the investment in equities is more than the investment in respect of cash or cash equivalents in a given Tax Period.

Accordingly, for Tax Period 2025, AED 55,000 will be considered as part of Interest income while computing Net Interest Expenditure, and the same amount will be adjusted while computing adjusted EBITDA.

Collateralised asset-backed debt securities[10]

Collateralised asset-backed debt securities refer to financial products that are secured/backed by a pool of assets that generate cash flow, such as rental property.

Example 4: Mortgage-backed securities

Company B (incorporated and tax resident in the UAE) has invested in a mortgage-backed security whereby the underlying assets are a pool of residential mortgage loans. The borrowers (the homeowners) make repayments of the principal amount of the loans as well as interest payments.

As a holder of the mortgage-backed security, Company B received a total of AED 600,000 in its Tax Period for the year ended 31 December 2024. Of that amount, AED 350,000 was derived from repayments of the principal amount of the loans while AED 250,000 was in respect of interest payments made by the borrowers.

For the purposes of the Corporate Tax, Company B is treated as having Interest income of AED 250,000 in its 2024 Tax Period.

Sale and subsequent repurchase agreement (repo)[11]

An agreement for the sale and subsequent re-purchase of the same security (or securities) is commonly known as a “repo”. Under a repo, the seller (borrower) sells a security to a buyer (lender) with a promise to buy back the same security at a future date for a predetermined, agreed-upon price.

The agreed repurchase price is typically higher than the original price, and the difference represents the cost of borrowing or financing. The element that represents the cost of borrowing or financing is treated as Interest income for the lender and Interest expense for the borrower.

Example 5: Tri-party repo

Company C (incorporated and tax resident in the UAE) specialises in developing software solutions. It needs short-term financing to manage its cash flows.

Company C owns government bonds worth AED 10 million. Via an agent, it enters into a repo agreement with a bank whereby Company C sells the government bonds to the bank for AED 9,500,000 and will repurchase the government bonds after 30 days for AED 9,531,667. The difference of AED 31,667 equates to an annual interest rate of 4%. In addition, Company C pays AED 20,000 to the agent.

Company C has Interest expenditure of AED 51,667. This is made up of the difference in price of AED 31,667 in respect of the repo agreement, and AED 20,000 which is an amount incurred in connection with the raising of finance (see Section 3.10).

Stock lending agreement [12]

Stock lending agreements, also known as securities lending agreements, are arrangements in which one party (the lender) temporarily transfers securities to another party (the borrower), typically in exchange for collateral, with the agreement that the borrower will return the equivalent securities at a later date. The borrower normally pays a fee to the lender for the use of the securities.

The fee paid by the borrower to the lender is compensation for the temporary use of the securities, akin to interest paid on a cash loan. Hence, the return or profit on a stock lending transaction is treated as Interest.

Example 6: Securities lending agreements, where Dividend is paid to the lender

Company D (incorporated and tax resident in the UAE) owns a portfolio of securities, including blue-chip equities.

Company X (incorporated and tax resident in the UAE), a trading company with fixed assets, expects that the market value of those blue-chip equities is going to fall. It, therefore, wants to short sell those equities, that is, sell the equities and then buy them back at a lower price, in order to make a profit.

Company D and Company X enter into an agreement whereby Company D lends to Company X its blue-chip equities which are worth AED 20 million at that time, for a period of 90 days. Under the agreement, Company D will charge Company X a fee of AED 98,630, which is the equivalent of an annualised lending fee of 2% (20,000,000 * 2% * 90/365). Since Company X intends to short sell the equities and there is no guarantee that it will be able to repurchase those equities to return to Company D, it places some fixed assets as collateral with Company D.

During the 90-day lending period, Company X, as the legal holder of the equities, receives a Dividend of AED 500,000 in respect of the equities. Under the agreement, Company X should forward any Dividend income to Company D (that is, the amount of Dividend received is not part of or factored into pricing of the arrangement).

At the end of the 90 days, Company X returns the equities it borrowed to Company D and Company D returns the collateral to Company X. In addition, Company X pays AED 598,630 to Company D. This amount is in respect of the lending fee of AED 98,630 and the AED 500,000 Dividend receipt.

For Company D (the lender), the fee of AED 98,630 is considered to be Interest income. Where the Dividend receipt of AED 500,000 retains its characteristic as Dividend income for Company D (following applicable accounting standards IFRS or IFRS for SMEs), this may be considered as Exempt Income (if all conditions are met) for Corporate Tax Purposes.

For Company X (the borrower), the fee of AED 98,630 is considered to be Interest expenditure. Although it received a Dividend of AED 500,000, this is not subject to tax for Company X because it passes this income to Company D. However, any profit or loss made from the short selling of the equities is subject to tax in accordance with the accounting treatment and the Corporate Tax rules.

Accordingly, the Dividend shall not be considered as a part of the Interest component.

Example 7: Securities lending agreements, where Dividend is retained by the borrower

Taking the same facts as in Example 6 above, except that Company X retains the Dividend of AED 500,000. In this case, Company X would be taxable on the Dividend income rather than Company D in accordance with the normal Corporate Tax rules. In certain situations, the Dividend may be exempt. [13]

Securitisation involving transfer of assets in exchange for securities[14]

Securitisation is the process of taking an asset or a group of assets and transforming those assets into an investable security. The process typically involves a special purpose vehicle (SPV) issuing securities to investors in exchange for cash. The SPV uses that cash to purchase assets that generate cash flows, for example, loans or receivables, such as mortgages, credit card receivables, auto (car) loans, or other types of debt. The cash flows typically include an interest component and, therefore, the economic substance of a securitisation transaction is similar to that of a loan arrangement between the investor and ultimate borrower.

The securities that are issued to the investors represent claims on the cash flows produced by the underlying assets, so although an investor may be receiving a return on a security, the investor is treated as receiving Interest income (rather than a Dividend), to the extent that the return is derived from a cash flow with an interest component. For the SPV that has issued the securities, the return on the underlying assets (excluding capital repayment) as well as the payment to investors represents compensation for the use of funds (a financing arrangement) and is treated as Interest expense.

Example 8: Securitisation of auto loans

A Bank wishes to dispose of a portfolio of auto (car) loans that it holds. The ultimate borrowers (who have purchased the cars) make monthly payments of interest as well as principal repayments.

The Bank sets up a special purpose vehicle (SPV). Neither the Bank nor the SPV is an Exempt Person for Corporate Tax purposes.

The SPV purchases the auto loans from Bank and then issues securities to investors. The monthly payments made by the ultimate borrowers are paid to the investors via the SPV.

The payments made to the investors that represent a return on their investment (payment of interest by the borrowers to the bank which is ultimately paid to the SPV) is considered to be Interest.

Hire purchase and finance leases[15]

There are different types of contracts whereby one party (the lessor) conveys an asset to another (the lessee) for a specified time, usually in return for a periodic payment.

Three such contracts are considered below: hire purchase, finance lease, and non- finance lease (also known as operating lease). Further, a “sale and leaseback” transaction could be either a finance lease or non-finance lease (see section 3.5.8), depending on the contractual terms.

Under a hire purchase contract, the lessee has the option to purchase the asset at the end of the contract term. Ownership of the asset is transferred from the lessor to the lessee after all payments have been made. Such payments include those related to purchasing the asset at the end of the hire purchase period.

Under a finance lease contract, legal title of the asset remains with the lessor but the lease term usually covers a significant portion of the asset's useful life. The lessee typically assumes most of the risks and rewards of ownership of the asset, and is, for example, responsible for maintenance, insurance and other costs associated with the asset. The finance lease payments are typically structured to cover the full cost of the asset plus a financing charge over the lease term, which is similar to a loan repayment schedule.

For both hire purchase and finance lease contracts, the lessee typically makes regular payments that cover both the cost of the leased asset and financing charge (associated with the lease liability) over the contract term. The lessee may be required under IFRS (or IFRS for SMEs) to record its “right of use” as an asset. If an asset is recorded, the financing charge is Interest expenditure.[16] If IFRS (or IFRS for SMEs) requires the lessor to record a finance element in respect of the contract, that finance element is Interest income.

Example 9: Hire purchase of a car

Company E (incorporated and tax resident in the UAE) is a leasing company which has provided a car under hire purchase to Company G (incorporated and tax resident in the UAE) on 1 January 2025. Both companies follow the Gregorian calendar year as their Financial Year and Tax Period.

The detail of the hire purchase is given below:

Cost of the car for Company G: AED 200,000

Useful life: 4 years

Hire purchase term: 4 years (with the option to purchase the car once all payments have been made)

Annual lease payments: AED 53,717 due at the start of each year

Implicit interest rate in the lease (as accounted for under IFRS): 5% per annum calculated as the opening balance minus annual lease payment, multiplied by 5%.

The amortisation of the lease is as follows:

| Year | Opening balance | Payments | Implicit interest (as per IFRS) | Closing balance |

|---|---|---|---|---|

1 – 2025 | 200,000 | (53,717) | 7,315 | 153,598 |

2 – 2026 | 153,598 | (53,717) | 4,994 | 104,875 |

3 – 2027 | 104,875 | (53,717) | 2,559 | 53,717 |

4 – 2028 | 53,717 | (53,717) | 0 | 0 |

The implicit interest component is treated as Interest for the relevant Tax Periods. For example, in the 2025 Tax Period, Company G should include AED 7,315 as Interest expenditure.

Any cancellation charges incurred due to the early termination of a hire purchase contract is not considered to be Interest.

Non-finance leases[17]

A non-finance lease, commonly referred to as an operating lease, is an arrangement where the lessor allows the lessee to use an asset for a specific period in exchange for rental payments. Unlike a finance lease, an operating lease does not provide the lessee with all the benefits and risks typically associated with ownership of the asset.

A non-finance lease is still considered to have a finance element that represents the cost of funding, and that finance element is treated as Interest.[18]

For the lessee, where there is a right-of-use asset, there should be a finance element for accounting purposes, and this finance element is considered to be Interest.

For the lessor, there would be no finance element for accounting purposes, and therefore, the finance element, which is considered to be Interest, should be calculated as follows:[19]

Finance element of non-finance lease payment = Lease payment * Total finance element of the leaseTotal cost of the lease

where:

Lease payment = specific instalment paid by the lessee to the lessor.

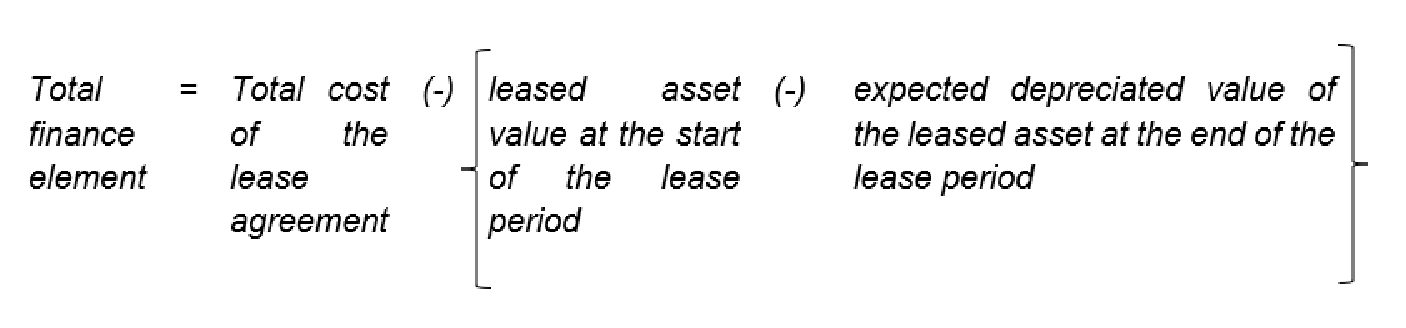

Total finance element = the total financing cost over the lease term calculated as follows:

Total cost of the lease = the sum of all lease instalments over the lease term.

Example 10: Non-Finance lease of machinery

Both Company K and Company L are incorporated and tax resident in the UAE. Company K provided machinery under a non-finance lease contract to Company L on 1 January 2025.

The details of the non-finance lease are as follows:

Initial value of the machinery: AED 100,000

Lease term: 5 years

Annual lease payment: AED 26,000 [Present value of lease: AED 118,195]

Expected depreciated value of the machinery at the end of the lease period (residual value): AED 20,000

Implicit interest rate (as accounted for under IFRS by lessee): 5% per annum calculated as the opening balance minus annual lease payment, multiplied by 5%.

The impact for 2025 Tax Period is as follows:

For Company L (lessee):

The lessee calculates implicit interest as AED 4,610 [(AED 118,195 less AED 26,000) * 5%] as per the relevant Accounting Standards followed by the Taxable Person which is considered as Interest.

For Company K (lessor):

If Company K accounts for this lease as a non-finance lease, with no implicit interest recorded. The calculation of Interest income is as under:

Finance element of non-finance lease payment = Lease payment * Total finance element of the leaseTotal cost of the lease

Lease payment is AED 26,000.

The total finance element of the lease is the total cost of the lease less the difference between the initial value of the leased asset and the expected depreciated value at the end of the lease period.

Total cost of the lease is AED 26,000 * 5 = AED 130,000 (annual lease payment multiplied by the lease term)

Initial value of the leased asset = AED 100,000

Expected depreciated value at the end of the lease period = AED 20,000 Total finance element of the lease = 130,000 – (100,000 – 20,000) = AED 50,000

For the 2025 Tax Period, the finance element is therefore: 26,000 * (50,000 / 130,000) = AED 10,000. This represents Company K’s annual Interest income in respect of the non-finance lease unless the terms of the lease change.[20]

Factoring and similar transactions[21]

A business may sell goods or services to customers on credit such that customers need only pay later. Those customers may be referred to as “debtors” and the amounts they owe may be referred to as “accounts receivable”. The business might want or need immediate payment for cash flow or working capital purposes. Instead of taking out a loan to cover the period before the debtors make their payments, the business could sell the accounts receivable.

Factoring is where a business sells its accounts receivable to another party, known as a “factor”, usually at a discount or “factoring fee”. The factor then assumes the responsibility for collecting the payments from the business's customers (the debtors). There are two types of factoring arrangements:

In a “recourse” factoring arrangement, the business retains the risk of non- payment by its debtors. So, if the debtor fails to pay, the factor can demand repayment from the seller. In this situation, the seller will suffer a bad debt expense, which may be a deductible expense (under the general principles of deductibility for Corporate Tax purposes).

In a “non-recourse” factoring arrangement, the credit risk of non-payment is assumed by the factor. So, if the debtor fails to pay, the factor cannot seek repayment from the business. In this situation, the factor will suffer the bad debt expense, which may be deductible expense (under the general principles of deductibility for Corporate Tax purposes).

Given the differences in risks, the factoring fee is typically higher for non-recourse factoring compared to recourse factoring arrangements. Factoring is effectively a financing transaction and, therefore, the factoring fee, i.e. discount or any other Interest-like component, is treated as Interest at the time it is recognised under IFRS (or IFRS for SMEs).

Example 11: Recourse factoring of accounts receivable

Company M (incorporated and tax resident in the UAE) develops residential and commercial properties in the UAE. It decides to use non-recourse factoring to improve its cash flow.

Company M sells its accounts receivable with a face value of AED 1 million to a factor in exchange for AED 960,000 in cash. The discount of 4%, that is, AED 40,000, is the cost of the factoring and treated as Interest expenditure for Company M.

Foreign exchange movements

Foreign exchange movement refers to the change in the value of one currency relative to another. These movements can result in gains or losses when a Business has assets, liabilities, income, or expenses denominated in a foreign currency.

Any foreign exchange gains or losses that are related to Interest or other payments economically equivalent to interest are considered to be Interest.[22] However, foreign exchange gains or losses arising from the principal portion of the loan (as distinct from interest on the loan) is not considered to be Interest. Similarly, foreign exchange gains and losses on other Business arrangements or transactions that are not related to Interest, for example, on the sale of finished products or the purchase of raw materials, should not be considered as Interest.

Example 12: Foreign exchange gain on Interest in relation to foreign currency loan

Company P (incorporated and tax resident in the UAE) has a Financial Year end of 30 June. It takes out a loan of 1 million Singapore Dollars (SGD) on 1 January 2024. The annual interest rate on the loan is 5%.

The interest of SGD 50,000 is due to be paid on 1 June 2024 but Company P actually pays the interest on 30 September 2024.

On 30 June 2024, the exchange rate is AED 2.60 : SGD 1

On 30 September 2024, the exchange rate is AED 2.65 : SGD 1

Thus, on 30 June 2024, an accrual is created for the interest payable of AED 130,000 (SGD 50,000 * 2.60) while on 30 September 2024, Company P actually pays interest of AED 132,500 (SGD 50,000 * 2.65).

The Interest expenditure for the Tax Period ending on 30 June 2024 is AED 130,000. For the Tax Period ending on 30 June 2025, the Interest expenditure includes the exchange movement of AED 2,500 (AED 132,500 less AED 130,000).

The foreign exchange movement on the principal portion of the loan is also taken into account for Corporate Tax purposes, but not as Interest income or expenditure.

Capitalised Interest

Generally, borrowing costs that are directly attributable to the acquisition, construction or production of an asset are capitalised based on IFRS (or IFRS for SMEs). Where capitalisation is appropriate, interest, processing fees and any other costs incurred in obtaining a loan to construct a long-term asset is added to the cost base of the asset rather than being immediately expensed in the income statement under IFRS (or IFRS for SMEs).

Capitalised interest is not deductible in the Tax Period in which it is incurred because it is capital in nature.[23] Instead, it should be treated as part of the cost of the related asset and, therefore, increases the cost base of that asset for depreciation purposes.

Income and expenditure attributable to the capitalised interest amount is subject to the General Interest Deduction Limitation Rule.[24] Any amount of income and expenditure attributable to capitalised interest in accordance with the Accounting Standards followed by the Taxable Person (i.e. IFRS or IFRS for SMEs) should be treated as part of Net Interest Expenditure in the Tax Period in which the capitalised interest is amortised over the useful life of the related asset, and not in the Tax Period in which the interest is incurred and capitalised.[25]

Accordingly, where the Taxable Person has capitalised interest in accordance with IFRS (or IFRS for SMEs), the Taxable Person must make the following adjustments when calculating Net Interest Expenditure and adjusted EBITDA:

Net Interest Expenditure - the capitalised interest should be spread on a straight- line basis over the useful life of the underlying asset, and the relevant portion for each Tax Period should be included in Net Interest Expenditure.

Adjusted EBITDA - to avoid double-counting, the amount of depreciation that is added back when calculating adjusted EBITDA should be reduced by the amount included in Net Interest Expenditure under (a) above because that amount is re- characterised from being depreciation to being Interest in that Tax Period.

If the related asset is disposed of in a Tax Period before the capitalised interest has been fully included in Net Interest Expenditure, the balance of the capitalised interest should be treated as part of Net Interest Expenditure in the Tax Period in which the asset is disposed of.

Example 13: Calculating Net Interest Expenditure and adjusted EBITDA where Interest is capitalised

Company Q (incorporated and tax resident in the UAE) follows the Gregorian calendar year as its Financial Year and Tax Period. It decided to build a machine in the UAE to manufacture drinks. To fund the machine, Company Q obtained a bank loan in its 2025 Tax Period of AED 10 million for a period of 1 year at an annual interest rate of 10% with an agreement that the principal will be repaid at the start of year 2. Company Q also paid the bank AED 200,000 in loan processing fees.

Based on the applicable Accounting Standards followed by Company Q, the following amounts were capitalised in the year ended 31 December 2025:

AED 10 million spent on constructing the machine (assuming that the machine meets the asset recognition test as per IFRS or IFRS for SMEs),

AED 1 million interest payable in 2025 (AED 10 million * 10%), and

AED 200,000 loan processing fees.

The cost of the machine recorded in the Financial Statements at 31 December 2025 is AED 11.2 million. The machine was brought into use on 1 January 2026.

The useful life of the machine was estimated to be 10 years. However, Company Q decides to apply a rate of 15% applying the diminishing value approach for depreciation. Accordingly, during the 2026 Tax Period, a depreciation charge of AED 1,680,000 (15%*11.2 million) is recorded in the income statement.

During the 2026 Tax Period, AED 1.2 million (i.e. capitalised interest in Year 1 of AED 1 million and loan processing fees of AED 200,000) is amortised on a straight-line basis over the useful life of the asset of 10 years, being AED 120,000 per annum.

Accordingly, for Tax Period 2026, AED 120,000 is treated to be Interest while computing Net Interest Expenditure, and the same amount is excluded from depreciation while computing adjusted EBITDA.

Example 14: Capitalised Interest on an investment property valued at fair value (where election is made for realisation basis).

The facts are the same as for Example 13. However, during the 2026 Tax Period, the machine is fair valued at AED 12 million and the company records the fair value gain of AED 800,000 (AED 12 million less AED 11.2 million being the cost of the machine) in its income statement and elects for realisation basis.[26] This does not affect the calculation of Net Interest Expenditure and adjusted EBITDA.

The AED 1.2 million (the capitalised interest and loan processing fees) is still amortised on a straight-line basis over the useful life of the asset of 10 years, being AED 120,000 per annum. Accordingly, for the 2026 Tax Period, as per example 13 above, AED 120,000 is considered to be Interest when computing Net Interest Expenditure, and the same amount is excluded from depreciation while computing adjusted EBITDA.

Example 15: Disposal of asset

Continuing Example 13, Company Q sold the machine to a third party for AED 9 million at the end of year 4 (of its useful life of 10 years), in the 2029 Tax Period. The net book value on 31 December 2029 is AED 5,846,470.

| Tax Period | Opening cost of asset (AED) | Depreciation @15% (AED) | Closing WDV (AED) |

|---|---|---|---|

2026 | 11,200,000 | 1,680,000 | 9,520,000 |

2027 | 9,520,000 | 1,428,000 | 8,092,000 |

2028 | 8,092,000 | 1,213,800 | 6,878,200 |

2029 | 6,878,200 | 1,031,730 | 5,846,470 |

Accordingly, Company Q records a gain on sale of the machine in its income statement amounting to AED 3,153,530 (AED 9 million less AED 5,846,470). Capitalised interest of AED 120,000 has been claimed for each of the years 2026, 2027 and 2028 (totalling AED 360,000). In the 2029 Tax Period, the unamortised amount of capitalised Interest of AED 840,000 (AED 1.2 million - AED 360,000), is considered to be Interest while computing Net Interest Expenditure, and the same amount is excluded from depreciation while computing adjusted EBITDA.

Hybrid instruments

Hybrid instruments are financial products that combine features of both debt and equity. Hybrid instruments can take various forms. For instance, convertible debentures or bonds are debt instruments that can be converted into equity of the issuing company.

To the extent a hybrid instrument is not converted to equity and not classified as equity under IFRS (or IFRS for SMEs), the income and expenditure in relation to it will be considered as Interest.[27]

However, if a hybrid instrument is classified as an equity interest under IFRS (or IFRS for SMEs), any income and expenditure in relation to the instrument will not be considered as Interest but instead considered to be a Dividend or other profit distribution.[28]

For example, profit participating loans or preference shares may be difficult to classify because they can be akin to debt or equity depending on their terms. Where they are classified as a financial liability for accounting purposes, the payments made by the issuer to the holder is considered to be Interest. Where they are classified as an equity instrument for accounting purposes, the payments made by the issuer to the holder is considered to be a Dividend.

Late payments

In relation to statutory dues

Late payment (or non-payment) of statutory dues, such as taxes, customs duties, or other government-imposed fees, typically incurs penalties or interest charges for the delay.

Regardless of how they are calculated, any charges in respect of a breach of law are considered to be fines or penalties and are not deductible expenditure for Corporate Tax purposes[29]. Any interest element will also not be considered as Interest.

In relation to commercial dues

Late payment of commercial or Business dues, such as invoices from suppliers or service providers, can result in additional charges, which can take the form of late payment fees or interest charges.

Unless the charges are specified as a fine or penalty in a relevant contract, such charges should be considered to be compensation to the creditor for the delayed use of funds that were due to them. Accordingly, these charges should be treated as Interest.

For example, if a company has agreed to payment terms with a supplier that include a charge at a rate of 1% per month on overdue invoice balances, and the company fails to pay an invoice on time, the additional amount charged should be treated as Interest. On the other hand, if the charge on overdue invoice balances is a one-off fixed penalty amount of say AED 10,000 regardless of when the overdue invoice is paid, the AED 10,000 would not be considered Interest.

Amounts incurred in connection with the raising of finance

The term "amounts incurred in connection with raising finance" refers to the various costs that a Business may incur when obtaining capital through borrowing or other financial instruments (other than equity instruments). These costs are considered to be Interest.[30]

Even if the amounts are capitalised as part of the cost of the asset under IFRS (or IFRS for SMEs), the capitalised amounts would still be treated as Interest (see Section 3.7).

The broad definition ensures that all forms of compensation to creditors or costs related to financing are captured, regardless of how they are structured or named. This includes but is not limited to:[31]

Guarantee fees:When a company seeks a loan, it might require a Related Party or third-party guarantee to assure the lender of repayment. A fee charged by a guarantor for this would be considered an amount incurred in raising finance.[32] Where a Related Party does not charge a guarantee fee but a fee would be charged on an arm’s length basis (i.e. under transfer pricing rules), such a deemed fee would also be considered as Interest. For example, if a company borrows AED 10 million and the Bank requires a guarantee from a guarantor, a guarantee fee of 1% would be AED 100,000. This fee will be treated as Interest expenditure for the borrowing company and Interest income for the Related Party guarantor.

Arrangement fees: These are fees charged by financial institutions for setting up a loan or credit facility.[33] For example, if a company arranges an AED 50 million credit line with a bank, and the bank charges a 0.5% arrangement fee, the company incurs an AED 250,000 fee. This fee is treated as Interest expenditure for the company.

Commitment fees: These fees are charged by lenders for agreeing to provide a loan or credit facility, even if the borrower does not draw down the loan.[34] For example, if a company has an undrawn credit facility of AED 20 million with a commitment fee of 0.25% per annum, it will incur an AED 50,000 annual fee, which is treated as Interest expenditure.

Any other fees that are similar in nature to the above-mentioned fees should also be treated as “amounts incurred in connection with raising finance” and, hence, Interest.[35] Examples include:

Underwriting fees: When a company issues bonds or other debt securities, it may use an underwriter to guarantee a certain price for the securities to investors. The underwriter may charge a fee for this service, which is an amount incurred in connection with raising finance. For example, if a company issues bonds (a debt instrument) worth AED 50 million and the underwriting fee is 2%, the company would incur an AED 1 million fee which should be treated as Interest expenditure.

Legal and professional fees: The costs of legal advice, accounting services, and other professional fees directly related to the structuring and negotiation of financing are also considered amounts incurred in connection with raising finance. For example, if a company incurs AED 200,000 in legal fees to document and close a syndicated loan transaction, these fees should be treated as Interest expenditure.

Early or pre-payment of loan: Pre-payment charges, pre-payment penalties or break costs are fees that lenders charge to compensate for the loss of expected income due to a loan being paid off before its maturity date. The penalty is directly related to the cost of borrowing and arises from the financing agreement between the borrower and the lender and hence is an amount incurred in connection with raising finance. Such pre-payment charges, if incurred by a company, should be treated as Interest expenditure.

Derivative contracts

Derivative contracts are not specifically defined but include financial contracts between two or more parties that derive their value from one or more underlying asset. They include forward contracts, futures contract, options, and swap agreements. These contracts may be used as a way of raising finance but they are more typically used to hedge risks connected with the raising of finance. For example, a company that has taken a variable interest rate loan could effectively fix the interest rate through an interest rate swap agreement.

Any interest component of a derivative contract is considered to be Interest. [36] The “interest component” would follow the interest or other financing amount or gain or loss taken to the income statement under IFRS (or IFRS for SMEs).

Costs directly related to entering into derivative contracts, such as fees, are also treated as Interest expenditure.

Disposal, sale or transfer

Where a debt instrument is disposed, sold or transferred, it may result in a gain or loss. Such gain or loss is considered as Interest to the extent it is treated as interest or other financing amount under IFRS (or IFRS for SMEs).

For example, a company that has invested in interest-bearing corporate bonds decides to sell these bonds before they mature. It realises a loss and records all of this as a loss on disposal of financial assets (not interest expense). Accordingly, no element of this loss is treated as Interest. However, that loss is included in Accounting Income and, therefore, brought into the Taxable Income calculation.[37]

Another example would be where a real estate company sells a property for an agreed sale price of AED 1 million. Instead of the buyer paying for the property in one lump sum, however, the company agrees that the buyer can pay for the property in six instalment payments of AED 200,000 over two years. The total amount received is, therefore, AED 1.2 million. The additional AED 200,000 over the sale price is recorded as Interest income for the real estate company. Each instalment payment would have an Interest element of AED 33,333 (being AED 200,000 / 6).

Deductible Interest expenditure

Overview

As stated above in Section 3.1, deductibility of Interest is subject to various Corporate Tax rules. These Corporate Tax rules should be applied in the following order:

General principles of deductibility of expenditure (Section 4.2),

Arm’s Length Principle (Section 4.3),

Specific Interest Deduction Limitation Rule (Section 5), and

General Interest Deduction Limitation Rule (Section 6).

The General Interest Deduction Limitation Rule must be applied after all the Corporate Tax rules, apart from the Tax Loss Provisions.[38]

Where adjustments are made to accounting or tax figures, for example, due to the General Anti-abuse Rule[39] applying or following a Tax Audit,[40] the calculations in respect of the General Interest Deduction Limitation Rule may need to be revised.

General principles of deductibility of expenditure

In general, Business expenditure is allowed as a deduction while calculating the Taxable Income of a Taxable Person if it is incurred wholly and exclusively for the purposes of the Taxable Person's Business and is not capital in nature. Such expenses are deductible in the Tax Period in which they are incurred. What constitutes “expenditure” generally follows the accounting classification and measurement per the Financial Statements that have been prepared in accordance with IFRS (or IFRS for SMEs) and, therefore, the Accounting Income figure within the income statement is the starting point when calculating Taxable Income.[41]

However, for Corporate Tax purposes, additional rules apply such that expenditure that is recognised as such for accounting purposes may not be deductible when calculating Taxable Income (see Section 4.2.1). Such rules also apply to Interest expenditure.

There are specific adjustments to be made items of expenditure in line with the following rules:[42]

Expenditure not incurred for the purposes of the Taxable Person’s Business (see Section 4.2.1),

Expenditure incurred in deriving Exempt Income, other than certain Interest expenditure (see Section 4.2.1), and

Losses that are not connected with or arising out of the Taxable Person’s Business.

Expenditure not incurred for the purposes of the Taxable Person’s Business

Business expenditure must be incurred “wholly and exclusively” for the purposes of the Taxable Person's Business. Therefore, regardless of the accounting, if the expenditure is not wholly and exclusively for the purposes of the Taxable Person's Business or is incurred for more than one purpose, all or part of the expenditure must be added back to the Accounting Income figure when calculating Taxable Income.[43]

For instance, if a company takes out a loan and the money is used to buy a private residential property that is used by a director and his family, and the property is not used for Business purposes, any Interest related to that loan is not deductible as Interest, even though it may be included in the income statement of the company.

If expenditure is incurred for more than one purpose, the portion of the expenditure that can be deducted must be determined as follows:[44]

Any identifiable part or proportion of the expenditure incurred wholly and exclusively for the purposes of deriving Taxable Income is deductible, and

An appropriate proportion of any un-identifiable part or proportion of the expenditure incurred for the purposes of deriving Taxable Income should be deductible.

Any proportion should be determined on a fair and reasonable basis, having regard to the relevant facts and circumstances of the Taxable Person’s Business. What is “fair and reasonable” will depend on the specific circumstances and facts, and there may be more than one method of apportioning expenses which is fair and reasonable.

Expenditure that is capital in nature

The Business expenditure must also not be “capital in nature”.[45] What is “capital” generally follows the accounting classification in the Financial Statements (that have been prepared in accordance with IFRS or IFRS for SMEs).

For example, purchasing a long-term asset like machinery would be a capital expense, but paying for routine maintenance to keep the machinery running would be a revenue expense.

Interest expenditure related to deriving Exempt Income

The general rule is that expenditure associated with deriving Exempt Income is not deductible.[46] However, there is an exception for Interest expenditure, which may still be deductible if it meets the criteria set by the General and Specific Interest Deduction Limitation Rules.[47] This exception applies specifically to Interest expenditure incurred in deriving any Exempt Income from Dividends and other profit distributions received from a juridical person that is a Resident Person or from a Participating Interest in a foreign juridical person, other income from a Participating Interest, income of a Foreign Permanent Establishment, and income derived by a Non-Resident Person from operating aircraft or ships in international transportation.[48] The tax deductibility of this Interest expenditure remains conditional upon the Interest expenditure meeting the criteria set by the General and Specific Interest Deduction Limitation Rules.[49]

For example, a company that borrows money to invest in a venture that generates Exempt Income from Dividends and other profit distributions would be entitled to deduct the Interest expenditure on those borrowings, subject to the General Interest Deduction Limitation Rule.

Interest expenditure incurred in relation to the acquisition and subsequent holding of a Participating Interest (that can result in Exempt Income) is allowed as a deduction subject to the General and Specific Interest Deduction Limitation Rules.[50]

If the loan used to finance the acquisition and subsequent holding of a Participating Interest is from a Related Party, it may be subject to the Specific Interest Deduction Limitation Rule in certain circumstances that could lead to a full disallowance of the Interest expenditure[51] (see Section 5).

Interest expenditure due to Connected Persons and/or Related Parties

Any expenditure incurred in relation to transactions or arrangements with Connected Persons is deductible only to the extent that the payment or benefit corresponds with the Market Value of the service or benefit provided by the Connected Persons, and where the payment or benefit is incurred wholly and exclusively for the purposes of the Taxable Person’s Business.[52] Similarly, transactions or arrangements with Related Parties must adhere to the arm's length standard.[53]

Where the Interest payable to a Related Party or Connected Person is adjusted to meet the arm's length / Market Value requirement, the amount of Interest after the adjustment is taken into account for the purposes of the Interest limitation rules (unless the Interest is already disallowable under another provision of the Corporate Tax Law).[54]

Example 16: Interest rate more than Market Value

Company T borrows AED 1 million from Ms U, who is a shareholder and director of Company T and, therefore, a Connected Person. Both Company T and Ms U are tax residents of the UAE.

Ms U charges Company T an interest rate of 8% on the loan even though the market interest rate for similar loans is 5%.

Interest paid at 8%: AED 1 million x 8% = AED 80,000

Arm's length Interest at 5%: AED 1 million x 5% = AED 50,000

Adjustment: AED 50,000 - AED 80,000 = AED 30,000

Even though the Financial Statements of Company T will account for Interest expense of AED 80,000, non-arm’s length Interest of AED 30,000 shall be disallowed. The balance of Interest of AED 50,000 shall be deductible subject to the General Interest Deduction Limitation Rule.[55]

Specific Interest Deduction Limitation Rule

Overview

The Specific Interest Deduction Limitation Rule is a targeted provision designed to prevent the erosion of the Corporate Tax base. This could be achieved through the use of certain financial transactions between Taxable Persons and their Related Parties. For example, transactions could be carried out for the sole or main purpose of creating deductible Interest expenditure, while the Interest income derived may not be subject to tax.[56]

This Specific Interest Deduction Limitation Rule applies after the application of the general principles of deductibility for Interest expenditure (see Section Error! Reference source not found.[G1]), including the application of the Arm’s Length Principle[57] but before the General Interest Deduction Limitation Rule (see Section 6).

Non-deductibility of Interest expenditure

The Specific Interest Deduction Limitation Rule disallows Interest expenditure incurred on a loan obtained, directly or indirectly, from a Related Party in respect of any of the following transactions:[58]

Dividend or profit distribution to a Related Party,

Redemption, repurchase, reduction or return of share capital to a Related Party,

Capital contribution to a Related Party, and

Acquisition of ownership interest in a Person who is or becomes a Related Party after the acquisition.

The reference to “Interest expenditure incurred on a loan” is interpreted widely to include any kind of borrowings, line of credit, bonds or transactions akin to a loan.

However, this is subject to a “main purpose test”.

Main purpose test

The Specific Interest Deduction Limitation Rule is not applicable if the main purpose of obtaining the loan and carrying out one of the transactions listed at Section 5.2 is not to obtain a Corporate Tax advantage.[59]

A “Corporate Tax advantage” is defined as including, but is not limited to the following:

A refund or an increased refund of Corporate Tax,

Avoidance or reduction of Corporate Tax Payable,

Deferral of a payment of Corporate Tax or advancement of a refund of Corporate Tax, or

Avoidance of an obligation to deduct or account for Corporate Tax.[60]

Whether or not the main purpose of a obtaining a loan and carrying out a transaction referred to under Section 5.2 is to gain a Corporate Tax advantage is based on the specific facts and circumstances. The onus is on the Taxable Person to demonstrate that the main purpose is not to gain a Corporate Tax advantage.

Example 17: Interest subject to Specific Interest Deduction Limitation Rule

Company M (incorporated and tax resident in the UAE) is wholly owned by its parent company, Company O, incorporated and tax resident in a foreign country that does not have a Corporate Tax regime.

Company M borrows AED 10 million at an arm’s length interest rate of 5% from Company O. It uses the funds to repurchase some of its shares from Company O, returning some of its share capital.

The annual interest rate on the loan is 5%, resulting in an annual Interest expense of AED 500,000 for Company M.