Investment Funds and Investment Managers

Corporate Tax Guide | CTGIFM1

May 2024

Contents

3. What are investment funds and investment managers?

4. Investment Funds and the Corporate Tax Law

4.1. Corporate Tax treatment of investment funds

4.1.1. Treatment of investment fund entities that are Resident Persons

4.1.2. Treatment of investment fund entities that are Unincorporated Partnerships

4.2. Treatment for investment managers

4.3. Overview of Qualifying Investment Fund status

4.4. Treatment of investors in a Qualifying Investment Fund

4.4.1. Inclusion of the fund’s net income in the income of investors

4.4.3. Time apportionment of income

4.4.4. Treatment of distributions

4.4.5. Application of other Corporate Tax provisions

4.4.6. Treatment of Exempt Persons held by Qualifying Investment Funds

4.4.7. Impact of ceasing to be part of a Qualifying Group

4.4.8. Impact of leaving a Tax Group or causing a Tax Group to cease to exist

5. Conditions for being a Qualifying Investment Fund

5.1.1. Persons eligible for Qualifying Investment Fund status

5.1.2. Impact of not meeting the conditions in later Tax Periods

5.2. Regulatory oversight condition

5.5. Investment Business condition

5.5.1. Meaning of Investment Business

5.5.2. Distinction between Business of the Investment Manager and the Investment Business

5.5.3. Examples of other activities treated as Investment Business

5.6. Diversity of ownership condition

5.6.2. Application of condition on indirect ownership

5.6.3. Application to feeder funds

5.6.4. Application to parallel funds

5.6.5. Application during the first years of an investment fund

5.7. Investment Manager condition

5.9. Additional conditions applicable to REITs

5.9.1. REIT minimum real estate asset value condition

5.9.2. REIT ownership condition: Recognised Stock Exchange and Institutional Investor

5.10. Conditions for Exempt Person status for entity held by a Qualifying Investment Fund

5.10.2. Juridical person incorporated in the UAE

5.10.3. Wholly owned and controlled by Qualifying Investment Funds

6. Corporate Tax compliance requirements

Glossary

AED | : | The United Arab Emirates Dirham. |

Authority | : | Federal Tax Authority. |

Bank | : | A Person licensed in the UAE as a bank or finance institution or an equivalent licensed activity that allows the taking of deposits and the granting of credits as defined in the applicable legislation of the UAE. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or activities, conducted by a Person in the course of its Business. |

Business Restructuring Relief | : | A relief from Corporate Tax for Business restructuring transactions, available under Article 27 of the Corporate Tax Law and as specified under Ministerial Decision No. 133 of 2023. |

Control | : | The direction and influence over one Person by another Person in accordance with the conditions of Article 35(2) of the Corporate Tax Law. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return on capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Federal Government | : | The government of the UAE. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

Foreign Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the laws of a foreign jurisdiction. |

Foreign Permanent Establishment | : | A place of Business or other form of presence outside the UAE of a Resident Person that is determined in accordance with the criteria prescribed in Article 14 of the Corporate Tax Law. |

Foreign Tax Credit | : | Tax paid under the laws of a foreign jurisdiction on income or profits that may be deducted from the Corporate Tax due, in accordance with the conditions of Article 47(2) of the Corporate Tax Law. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A juridical person incorporated, established, or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

FTA | : | Federal Tax Authority, being the Authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

Government Controlled Entity | : | Any juridical person, directly or indirectly wholly owned and controlled by a Government Entity, as specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Government Entity | : | The Federal Government, Local Governments, ministries, government departments, government agencies, authorities and public institutions of the Federal Government or Local Governments. |

Immovable Property | : | Means any of the following:

|

Insurance Provider | : | A Person licensed in the UAE as an insurance provider that accepts risks by entering into or carrying out contracts of insurance, in both the life and non-life sectors, including contracts of reinsurance and captive insurance, as defined in the applicable legislation of the UAE. |

Interest | : | Any amount accrued or paid for the use of money or credit, including discounts, premiums and profit paid in respect of an Islamic financial instrument and other payments economically equivalent to interest, and any other amounts incurred in connection with the raising of finance, excluding payments of the principal amount. |

International Agreement | : | Any bilateral or multilateral agreement, or any other agreement to which the UAE is a party, that has been ratified by the parties. |

Investment Business | : | The issuing of investment interests to raise funds or pool investor funds or establish a joint investment fund with the aim of enabling the holder of such an investment interest to benefit from the profits or gains resulting from the entity's acquisition, holding, management or disposal of investments, in accordance with the applicable legislation of the UAE. |

Investment Manager | : | A Person who provides brokerage or investment management services that is subject to the regulatory oversight of the competent authority in the UAE. |

Investment Manager Exemption | : | The treatment of an Investment Manager as an independent agent of a Non-Resident Person, available under Article 15 of the Corporate Tax Law. |

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Licensing Authority | : | The competent authority concerned with licensing or authorising a Business or Business Activity in the UAE. |

Local Government | : | Any of the governments of the Member Emirates of the Federation. |

Market Value | : | The price which could be agreed in an arm's-length free market transaction between Persons who are not Related Parties or Connected Persons in similar circumstances. |

Net Interest Expenditure | : | The Interest expenditure amount that is in excess of the Interest income amount as determined in accordance with the provisions of Article 30 of the Corporate Tax Law. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Parent Company | : | A Resident Person that can make an application to the FTA to form a Tax Group with one or more Subsidiaries in accordance with Article 40(1) of the Corporate Tax Law. |

Participating Interest | : | An ownership interest in the shares or capital of a juridical person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Participation | : | The juridical person in which the Participating Interest is held. |

Participation Exemption | : | An exemption from Corporate Tax for income from a Participating Interest, available under Article 23 of the Corporate Tax Law and as specified under Ministerial Decision No. 116 of 2023. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Personal Investment | : | Investment activity that a natural person conducts for their personal account that is neither conducted through a Licence or requiring a Licence from a Licensing Authority in the UAE, nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022. |

Qualifying Free Zone Person | : | Free Zone Person that meets the conditions of Article 18 of the Corporate Tax Law and is subject to Corporate Tax under Article 3(2) of the Corporate Tax Law. |

Qualifying Group | : | Two or more Taxable Persons that meet the conditions of Article 26(2) of the Corporate Tax Law. |

Qualifying Group Relief | : | A relief from Corporate Tax for transfers within a Qualifying Group, available under Article 26 of the Corporate Tax Law and as specified under Ministerial Decision No. 132 of 2023. |

Qualifying Investment Fund | : | Any entity whose principal activity is the issuing of investment interests to raise funds or pool investor funds or establish a joint investment fund with the aim of enabling the holder of such an investment interest to benefit from the profits or gains from the entity's acquisition, holding, management or disposal of investments, in accordance with the applicable legislation and when it meets the conditions set out in Article 10 of the Corporate Tax Law. |

Real Estate Asset Percentage | : | The portion of the Real Estate Income generating assets as a percentage of the total value of the assets of the investment fund. |

Real Estate Gains | : | Gains derived from the sale or disposal of land or real estate. |

Real Estate Income | : | Income derived from renting of land or real estate, excluding Real Estate Gains. |

Real Estate Investment Trust ('REIT') | : | A real estate fund as defined in the applicable legislation of the UAE. |

Recognised Stock Exchange | : | Any stock exchange established in the UAE that is licensed and regulated by the relevant competent authority, or any stock exchange established outside the UAE of equal standing. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

State | : | United Arab Emirates. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax Group | : | Two or more Taxable Persons treated as a single Taxable Person according to the conditions of Article 40 of the Corporate Tax Law. |

Tax Loss | : | Any negative Taxable Income as calculated under the Corporate Tax Law for a given Tax Period. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

UAE | : | United Arab Emirates. |

Unincorporated Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE. |

Withholding Tax | : | Corporate Tax to be withheld from State Sourced Income in accordance with Article 45 of the Corporate Tax Law. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses ('Corporate Tax Law') was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ('UAE') on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits ('Corporate Tax') in the UAE.

The provisions of the Corporate Tax Law apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance to help persons understand the UAE Corporate Tax treatment for investment funds, investors, and investments with the assistance of Investment Managers. This guide explains some of the terms and conditions in the Corporate Tax Law, and sets out the following:

An overview of the meaning of Qualifying Investment Fund and Investment Manager,

Conditions for a Qualifying Investment Fund to be exempt from Corporate Tax,

Conditions for a Real Estate Investment Trust ('REIT') to be exempt from Corporate Tax,

Tax implications for an investor investing in a Qualifying Investment Fund,

Conditions for a foreign person to benefit from the Investment Manager Exemption as specified under Article 15 of the Corporate Tax Law, and

Relevant Corporate Tax compliance requirements for the above.

Who should read this guide?

Any Person seeking to apply either the exemption for Qualifying Investment Funds or the Investment Manager Exemption. This guide will be useful for investors, financial advisors, tax professionals, and individuals involved in managing or advising investment funds and provides insights into tax implications, exemptions, and regulations relevant to these entities.

How to use this guide

The relevant Articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, simple examples are used to illustrate how key elements of the Corporate Tax Law apply to Qualifying Investment Funds and Investment Managers. The examples in the guide:

Show how these elements operate in isolation and do not show all the possible interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes, and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as the 'Corporate Tax Law',

Federal Decree-Law No. 50 of 2022 Issuing the Commercial Transactions Law is referred to as 'Commercial Transactions Law',

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that are Subject to Corporate Tax is referred to as "Cabinet Decision No. 49 of 2023",

Cabinet Decision No. 56 of 2023 on Determination of a Non-Resident Person's Nexus in the State for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Cabinet Decision No. 56 of 2023",

Cabinet Decision No. 81 of 2023 on Conditions for Qualifying Investment Funds for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Cabinet Decision No. 81 of 2023",

Ministerial Decision No. 105 of 2023 on the Determination of the Conditions under which a Person may Continue to be Deemed as an Exempt Person, or Cease to be Deemed as an Exempt Person from a Different Date for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as 'Ministerial Decision No. 105 of 2023',

Ministerial Decision No. 116 of 2023 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 116 of 2023",

Ministerial Decision No. 120 of 2023 on the Adjustments Under the Transitional Rules for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 120 of 2023",

Ministerial Decision No. 126 of 2023 on the General Interest Deduction Limitation Rule for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 126 of 2023",

Ministerial Decision No. 127 of 2023 on Unincorporated Partnership, Foreign Partnership and Family Foundation for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 127 of 2023",

Ministerial Decision No. 132 of 2023 on Transfers Within a Qualifying Group for the purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 132 of 2023",

Ministerial Decision No. 134 of 2023 on the General Rules for Determining Taxable Income for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 134 of 2023",

Federal Tax Authority Decision No. 7 of 2023 Provisions of Exemption from Corporate Tax for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "FTA Decision No. 7 of 2023", and

Federal Tax Authority Decision No. 11 of 2023 Provisions of Exemption from Corporate Tax for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "FTA Decision No. 11 of 2023".

Status of this guide

This guidance is not a legally binding statement but is intended to provide assistance in understanding the provisions of the Corporate Tax Law. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stands when the guide is published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of the Qualifying Investment Fund and Investment Manager Exemption rules. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

What are investment funds and investment managers?

In broad terms, investment funds invest funds received from investors on a collective basis in accordance with a defined investment policy. In return, investors share in the profits of the investment fund.

An investment fund can consist of one or several entities. Any group of entities that aim to pool funds from investors to invest on a collective basis can be referred to as an 'investment fund'. An investment fund can use the same type of corporate entities that are available to Businesses more generally, including joint liability companies, limited partnership companies, limited liability companies, public joint stock companies and private joint stock companies. Similarly, an investment fund could also use unincorporated partnerships or investment trusts. If an investment fund is incorporated in a Free Zone, it can similarly use the corporate entity types that are available in a Free Zone. In addition, an investment fund could include entities incorporated outside the UAE.

Investment funds commonly include marketable security funds, mutual funds, exchange-traded funds, money-market funds, hedge funds, private equity funds, and real estate funds. Investment funds may also be referred to as alternative investment funds that primarily invest in the specialist 'non-traditional' asset classes.

Generally, an investor in an investment fund provides capital or assets to the fund with the aim of a return on investment. The investment fund uses this capital to make investments, undertake Business Activities, and generate profits or returns. Investors in an investment fund can include any range of persons, such as pension funds, sovereign wealth funds, endowment plans, family offices, natural persons, foundations, insurance companies and any other persons.

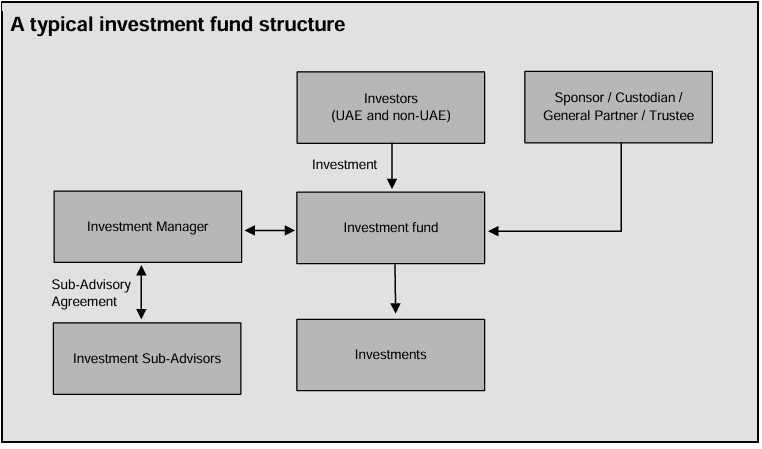

An investment fund may appoint an investment manager who will make investment decisions on behalf of the investment fund, in line with a pre-agreed investment policy and applicable investment procedures. Sometimes, all or a portion of those activities will be carried out by an investment advisor or a general partner. An investment manager or an investment advisor may also subcontract a portion of their activities to other group entities, usually called 'investment subadvisors'. Similarly, some funds may also appoint a custodian, general partner or trustee, who holds certain assets on behalf of the fund or the investors or performs certain administrative tasks. In addition, an investment fund could have a dedicated sponsor which could be responsible for establishing and overseeing the fund.

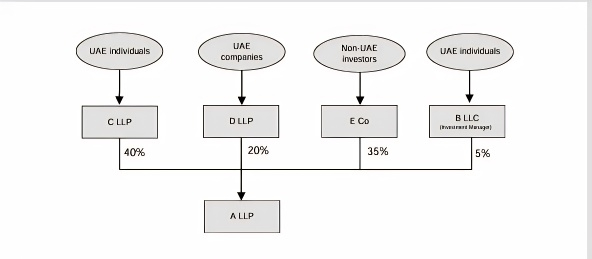

If there is a main investment fund entity, investors will directly or indirectly hold a stake in the main investment fund entity. It is possible that investors hold their stake through one or several other entities, either wholly owned by them or as pooling vehicles with

other investors. If these holding vehicles are managed by the investment manager of the main investment fund entity, these vehicles could be regarded as feeder funds (or sometimes feeder entities) and would normally be regarded as investment fund entities.

The investment manager can receive income from its investment management activities through charging a pre-agreed management fee (for example, equivalent to a percentage of capital committed, capital invested or assets under management), a performance fee (for example, a portion of excess returns), or a co-investment (such as a carried interest investment).

Investment funds landscape in the UAE

Investment funds activity in the UAE reflects the broad range of financial investment products consistent with similar products available in global markets. UAE funds generally include:

Public funds, which are available to the general public at large.

Private funds, which are not accessible to the wider public. Private funds are only offered to professional investors.

Investment funds can be open-ended or close-ended. Open-ended investment funds have variable capital that increases according to the new issued units and decreases by the redemption of existing units. Close-ended investment funds have fixed capital whose units are redeemed only on the expiry of the fund, unless the relevant regulatory authority approves an increase of its capital by new subscriptions or reduction of its capital by the existing units redeemed.

In addition, investment funds can be based on specific investment themes, specific underlying asset classes, or specific sectors. Private equity funds, venture capital funds, private credit funds, infrastructure funds, real estate funds, umbrella funds, money market funds, exchange traded funds, funds investing in crypto tokens, feeder funds, real estate investment trusts and debt funds are terms that usually refer to the type of assets the fund invests in the UAE. Hedge funds usually refer to funds with a specific type of trading strategy. Islamic funds usually refer to a joint pool wherein the investors contribute their surplus money for the purpose of its investment to earn halal profits in strict conformity with the precepts of Islamic Sharia.

In the investment fund industry, these and many other terms are used to refer to different types of investment funds. These terms may sometimes have a narrow technical meaning, but sometimes they do not have a fixed meaning and are used loosely. In the context of the Corporate Tax Law, the provisions of the Qualifying Investment Fund exemption and the Investment Manager Exemption are not restricted to a specific investment fund or strategy and can apply to any investment fund, where the relevant conditions are met.

Rationale for exempting Qualifying Investment Funds

Investment funds generally allow investors of various sizes to benefit from investment opportunities that would otherwise only be available for investors with a certain scale, network or expertise, thereby creating a more even playing field for investors, which can stimulate economic growth and development.

The Corporate Tax Law seeks to ensure neutrality such that investors of an investment fund are in a similar Corporate Tax position as if they had invested directly in the underlying assets of the fund. It is internationally common for a tax system to provide for neutrality between direct investments and investment through collective investment vehicles by not subjecting the income of such entities to taxation or burdensome compliance obligations.

In line with this, investment funds that are structured as Unincorporated Partnerships will be treated as transparent for Corporate Tax purposes which generally achieves an outcome similar to one where the ultimate investor had invested directly. For investment funds that are not structured as Unincorporated Partnerships, a similar outcome can be achieved by exempting the investment fund from Corporate Tax as a Qualifying Investment Fund. This will prevent tax at the level of the investment fund and only the investors would be taxed on the investment returns.

In addition, investment funds play a crucial role in providing liquidity to financial markets by pooling funds from multiple investors and investing in a diversified portfolio of assets. A tax exemption can facilitate more efficient capital allocation and trading activities within financial markets, thereby enhancing overall market liquidity. It can also encourage innovation in financial products and services, as investment managers have more flexibility to structure investment vehicles that meet the diverse needs of investors. This can lead to the development of new investment strategies, products, and markets, fostering financial innovation and competitiveness.

Investment Funds and the Corporate Tax Law

Corporate Tax treatment of investment funds

Treatment of investment fund entities that are Resident Persons

In line with Article 11(3) of the Corporate Tax Law, any entity that forms part of a fund structure and that is a juridical person will be regarded as a Resident Person if it is incorporated in the UAE or incorporated outside the UAE and effectively managed and controlled in the UAE.

An investment fund entity that is considered a Resident Person will be subject to Corporate Tax in the UAE. However, an investment fund entity can apply to the FTA for exemption from Corporate Tax as a Qualifying Investment Fund provided that the relevant conditions are met (as discussed in Section 5 ). [1]An investment fund entity can only apply for the exemption after it has been registered with the FTA as a Taxable Person.

Where an application is approved, the Qualifying Investment Fund will be an Exempt Person and will not be subject to Corporate Tax. However, each investor in the Qualifying Investment Fund that is a Taxable Person will include their proportional part of the Qualifying Investment Fund's net income available for distribution as reflected in the financial statements of the Qualifying Investment Fund in their own income, in accordance with Article 20 of the Corporate Tax Law, as explained further in Section 4.3. [2]

Treatment of investment fund entities that are Unincorporated Partnerships

An investment fund established as an Unincorporated Partnership in accordance with the Corporate Tax Law is not considered a juridical person and will not be treated as a Taxable Person in its own right (i.e. the fund is transparent for Corporate Tax purposes). Income derived by such an Unincorporated Partnership would be treated as earned by the investors (partners) for Corporate Tax Purposes. [3]

A Foreign Partnership, established in accordance with the laws of a foreign jurisdiction, is treated as an Unincorporated Partnership provided that it meets the requirements of Article 16(7) of the Corporate Tax Law and Article 4 of Ministerial Decision No. 127 of 2023.

The investors (partners) in an Unincorporated Partnership may apply to the FTA for the Unincorporated Partnership to be treated as a separate Taxable Person (fiscally opaque), provided that the relevant conditions are met. [4]If the FTA approves the application:

The investors in the fiscally opaque Unincorporated Partnership will not include the income and expenditure of the Unincorporated Partnership in their own income for Corporate Tax purposes, [5]unless that Unincorporated Partnership becomes a Qualifying Investment Fund. [6]

The fiscally opaque Unincorporated Partnership can apply to be exempt from Corporate Tax as a Qualifying Investment Fund if the relevant conditions are met. [7]

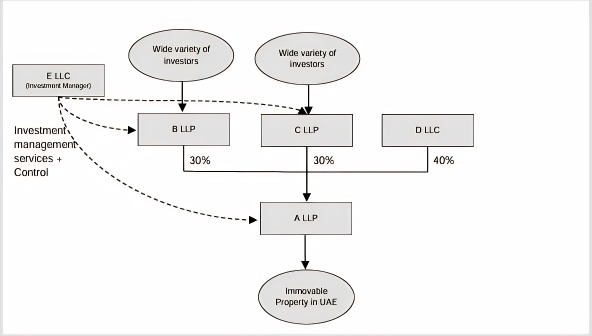

Treatment of non-resident investment funds

An investment fund entity that is established as a juridical person outside of the UAE will not be a Resident Person, provided that the entity is not effectively managed and controlled in the UAE. [8] However, such a non-resident investment fund entity would be subject to Corporate Tax in the UAE if it has: [9]

A Permanent Establishment in the UAE (typically no Permanent Establishment should exist in cases where the conditions of the Investment Manager Exemption are met),

State Sourced Income, or

A nexus in the UAE as specified in Cabinet Decision No. 56 of 2023.

A Non-Resident Person with a Permanent Establishment in the UAE will be subject to Corporate Tax on income that is attributable to that Permanent Establishment.[10]

State Sourced Income derived by a Non-Resident Person, that is not attributable to a Permanent Establishment, may be subject to Withholding Tax. However, Withholding Tax is currently set at the rate of 0%. [11]

The concept of nexus is applicable only to a Non-Resident Person that is a juridical person. Such a Non-Resident Person will have a nexus in the UAE if they earn income from Immovable Property in the UAE. [12]

Treatment for investment managers

Investment managers usually earn a fee for the provision of brokerage or investment management services. If an investment manager is a Resident Person, such a fee is within the scope of UAE Corporate Tax. Fees earned from a Qualifying Investment Fund would be included in the investment manager's Taxable Income, similar to any other income from the investment manager's Business Activities.

If the investment manager is a Non-Resident Person, it may also be subject to Corporate Tax if it meets any of the conditions mentioned in Section 4.1.3 above. [13] If the investment manager has a Permanent Establishment in the UAE, the fees earned by the investment manager would be subject to Corporate Tax if they can be attributed to the Permanent Establishment. [14] If the investment manager receives its income as State Sourced Income, it may be subject to Withholding Tax on the State Sourced Income. However, the current Withholding Tax rate on State Sourced Income is 0%. [15]

Overview of Qualifying Investment Fund status

Impact of Qualifying Investment Fund status

A Qualifying Investment Fund is exempt from UAE Corporate Tax and is an Exempt Person. This means:

The Qualifying Investment Fund will not be a Taxable Person. [16]

The Qualifying Investment Fund cannot form part of a Qualifying Group for the purposes of Qualifying Group Relief. [17]

The Qualifying Investment Fund is not entitled to benefit from Business Restructuring Relief for transfers of an entire Business or an independent part of a Business. [18]

The Qualifying Investment Fund is not entitled to benefit from the provisions for the transfer of Tax Losses. [19]

The Qualifying Investment Fund cannot form part of a Tax Group. [20]

The Qualifying Investment Fund must maintain all records to enable its status to be readily ascertained by the FTA for a minimum period of 7 years. [21] The FTA requires the Qualifying Investment Fund to file an annual declaration confirming that it continues to meet the exemption conditions. [22]

As a Qualifying Investment Fund remains within the scope of Corporate Tax, it is considered liable to tax.

Treatment of investors in a Qualifying Investment Fund

Inclusion of the fund's net income in the income of investors

If an investor in a Qualifying Investment Fund is a Taxable Person, they are required to include in their income, their proportional share of the amount reflected as net income available for distribution in the financial statements of the Qualifying Investment Fund. [23] For these purposes, net income available for distribution of the Qualifying Investment Fund is allocated between Exempt Income, Interest income, income from Immovable Property in the UAE and other income (as explained further below).

Resident Persons

For a Resident Person investor that is a juridical person and that holds an ownership interest in a Qualifying Investment Fund, any net income available for distribution that is not Exempt Income will be treated as Taxable Income.[24]

For a Resident Person investor that is a natural person and that holds an ownership interest in a Qualifying Investment Fund, any net income available for distribution that is not Exempt Income will be treated as Taxable Income if the natural person holds the ownership interests in the Qualifying Investment Fund as part of a Business or Business Activity conducted by the natural person.[25]This could be the case if a natural person undertakes investment activities that require a Licence from a Licensing Authority, or is considered part of a commercial business in accordance with the Commercial Transactions Law.

However, if the natural person holds the ownership interest as a Personal Investment, the net income of the Qualifying Investment Fund will not be treated as Taxable Income of the natural person. [26]

Example 1: A natural person investing in a Qualifying Investment Fund

A natural person based in the UAE invests (using personal savings) in a Qualifying Investment Fund where he earns income from his investment. He does not require a Licence to make such an investment.

The income derived by the natural person is Personal Investment income and accordingly is not subject to Corporate Tax.

Non-Resident Persons

For a Non-Resident Person that holds an ownership interest in a Qualifying Investment Fund, any net income that is not Exempt Income will be taken into account for Corporate Tax purposes if it is attributable to a Permanent Establishment of the Non- Resident Person in the UAE.

An investor that is a Non-Resident Person and a juridical person that holds an ownership interest in a Qualifying Investment Fund which earns income from Immovable Property in the UAE, is earning income from that Immovable Property and, therefore, has a nexus in the UAE, as specified in Cabinet Decision No. 56 of 2023. [27]The proportional part of net income from Immovable Property in the UAE shall be treated as Taxable Income of that investor.

A Non-Resident Person that holds an ownership interest in a Qualifying Investment Fund may derive State Sourced Income, however, the current Withholding Tax rate on State Sourced Income is 0%. [28]

Exempt Persons

If an Exempt Person holds an ownership interest in a Qualifying Investment Fund, it will not be subject to Corporate Tax on the net income from the Qualifying Investment Fund. However, if an Exempt Person is treated as a Taxable Person in relation to certain Business or Business Activities under Article 4(2) of the Corporate Tax Law, such an Exempt Person shall treat any net income from a Qualifying Investment Fund (that is not Exempt Income) as Taxable Income only to the extent that it holds an ownership interest in a Qualifying Investment Fund as part of its taxable Business or Business Activity.

If a Qualifying Investment Fund ('Fund 1') holds an ownership interest in another Qualifying Investment Fund ('Fund 2'), any net income of Fund 2 that is available for distribution will be proportionally included in the net income of Fund 1 that is available for distribution, allocated between net Exempt Income, net Interest income, net income from Immovable Property in the UAE and other net income and, therefore, ultimately included in the income of any investors in Fund 1 that are Taxable Persons.

Allocation of income between Exempt Income, Interest income, income from Immovable Property in the UAE, and other income

At the Qualifying Investment Fund level

The Qualifying Investment Fund shall allocate the amount reflected as net income available for distribution in its financial statements into four categories:

Exempt Income,

Interest income,

Income from Immovable Property in the UAE, and

Other income.

Exempt income

Exempt Income includes Dividend income from Resident Persons, [29] Dividend income from a Participating Interest in a foreign juridical person which meets the conditions of the Participation Exemption, [30] and capital gains, foreign exchange gains or losses and impairment gains or losses in relation to a Participating Interest which meets the conditions of the Participation Exemption. [31]

An ownership interest in a juridical person should be a Participating Interest held by the Qualifying Investment Fund, if the following conditions are met: [32]

The Qualifying Investment Fund has held, or has the intention to hold, the Participating Interest for an uninterrupted period of at least 12 months,

The Participation is subject to Corporate Tax or any other tax imposed under the applicable legislation of the country or territory in which the juridical person is resident which is of a similar character to Corporate Tax at a rate not less than the rate specified in Article 3(1)(b) of the Corporate Tax Law (i.e. 9%),

The ownership interest in the Participation entitles the Qualifying Investment Fund to receive not less than 5% of the profits available for distribution by the Participation, and not less than 5% of the liquidation proceeds on cessation of the Participation,

Not more than 50% of the direct and indirect assets of the Participation consist of ownership interests or entitlements that would not have qualified for the Participation Exemption if held directly by the Qualifying Investment Fund, subject to any conditions that may be prescribed under Article 23(2)(e) of the Corporate Tax Law, and

All other conditions in relation to the Participation Exemption have been met. [33]

Exempt Income does not include Dividends from:

Exempt Persons, and

Ownership interests in a foreign Person, if such ownership interests are not Participating Interests.

The question of whether shares or other ownership interests qualify as Participating Interests held by the Qualifying Investment Fund should be assessed at the level of the Qualifying Investment Fund. This applies, for instance, to the requirement to hold an ownership interest of at least 5%. [34]This requirement shall be met if the Qualifying Investment Fund holds an ownership interest of at least 5%, even if the investor's proportional stake in the underlying Participation amounts to less than 5%. This similarly applies to the requirement to hold the Participation for at least 12 months. [35] This requirement shall be met if the Qualifying Investment Fund held the Participation for at least 12 months, even if the investor held their stake in the fund for a shorter period.

Interest income

Interest income refers to the amount accrued or paid for the use of money or credit, including discounts, premiums and profit paid in respect of an Islamic Financial Instrument and other payments economically equivalent to interest, and any other amounts incurred in connection with the raising of finance, excluding payments of the principal amount.[36]

Interest also includes, but is not limited to, the interest component on any of the following: [37]

Performing and non-performing debt instruments,

Interests held in collective investment schemes that primarily invest in cash and cash equivalents,

Collateralised asset backed debt securities and similar instruments,

Agreements for the sale and subsequent repurchase of the same security at a future date at an agreed upon price,

Stock lending and similar agreements for the disposal of a security subject to an obligation or right to reacquire the same or a similar designated security,

Securitisations and similar transactions involving the transfer of assets in exchange for the issuance of securities that entitle the holder to proceeds generated from these assets,

Lease or hire purchase arrangements where all the risks and rewards incidental to the ownership of the underlying asset have been substantially transferred to the lessee, and

Factoring and similar accounts receivable purchase transactions.

In addition, Interest includes: [38]

Certain amounts incurred in connection with raising finance,

The interest equivalent component on Islamic Financial Instruments,

The finance element of finance lease payments as documented in the accounts of a Taxable Person,

Foreign exchange gains and losses accruing from Interest shall be considered Interest, and

Certain income or expenditure on capitalised interest.

Income from Immovable Property in the UAE

The Qualifying Investment Fund should also recognise the net income available for distribution from Immovable Property in the UAE, separately. [39]Immovable Property means any of the following:

Any area of land over which rights or interests or services can be created,

Any building, structure or engineering work attached to the land permanently or attached to the seabed, or

Any fixture or equipment which makes up a permanent part of the land or is permanently attached to the building, structure or engineering work or attached to the seabed.

Other income

Any net income available for distribution that is not categorised as Exempt Income, Interest income or income from Immovable Property in the UAE, should be allocated to other income.

At the investor level

Any investor in a Qualifying Investment Fund that is a Taxable Person shall include in their income their proportional share of the amount reflected as net income available for distribution in the financial statements of the Qualifying Investment Fund.

To the extent the net income relates to net Exempt Income, this should also be treated as Exempt Income for the investor that is a Taxable Person.

Any proportional amount of net Interest income shall be treated as Interest income for any investor that is a Taxable Person.

Under Article 30(1) of the Corporate Tax Law, a Taxable Person's Net Interest Expenditure shall be deductible up to 30% of the Taxable Person's adjusted accounting earnings before the deduction of Interest, tax, depreciation and amortisation, or AED 12 million, whichever is higher. [40] Net Interest Expenditure is determined as the amount by which Interest expenditure exceeds the taxable Interest income. [41]

If the net income of a Qualifying Investment Fund includes net Interest income, a proportional part of the income included shall be treated as Interest income for the Taxable Person who is an investor for the purposes of Article 30 of the Corporate Tax Law. Interest income would reduce the Net Interest Expenditure of the investor.

The net income from Immovable Property in the UAE can create a nexus for an investor that is a Non-Resident juridical person, as explained above.[42]

All other income shall be included in the Taxable Income of the investor where relevant.

Furthermore, where an investor that is a Taxable Person realises a capital gain on the disposal of their ownership interest in a Qualifying Investment Fund, the resulting gain could be Exempt Income, if the ownership interest in the Qualifying Investment Fund qualifies as a Participating Interest. [43]In this respect, a Participation in a Qualifying Investment Fund is considered to meet the subject to Corporate Tax condition under Article 23(2)(b) of the Corporate Tax Law.

Example 2: Taxation of investor income

A Qualifying Investment Fund has 15 investors and has allocated the net income available for distribution in the relevant financial year as follows:

| Particulars | Amounts (in AED million) |

|---|---|

| Net Exempt Income | 22.5 |

| Net Interest income | 5 |

| Net income from Immovable Property in the UAE | 15 |

| All other net income | 7.5 |

| Total net income available for distribution | 50 |

The investors in the Qualifying Investment Fund are as follows:

Thirteen investors are natural persons, each holding their investment as a Personal Investment and who collectively hold a 20% ownership interest in the fund.

One investor is a UAE incorporated juridical person who is a Resident Person (Investor 1) and holds a 40% ownership interest in the fund.

One investor is a foreign juridical person (Investor 2) who holds a 40% ownership interest in the fund and who does not have a Permanent Establishment in the UAE or State Sourced Income as a result of any of their other activities.

The net income of the natural persons will not be treated as Taxable Income as they hold their stake as a Personal Investment.

Investor 1 and Investor 2 will include the relevant portion of net income available for distribution of the fund in their income. For the relevant financial year, the net income of the Qualifying Investment Fund to be included by investors will be calculated as follows:

Particulars | Net Exempt Income | Net Interest income | Net income from Immovable Property in the UAE | All other net income |

|---|---|---|---|---|

(Amounts in AED million) | ||||

Net income per income category | 22.5 | 5 | 15 | 7.5 |

Inclusion of net income by Investor 1 (40%) in its income | 9 | 2 | 6 | 3 |

Inclusion of net income by Investor 2 (40%) in its income | n/a | n/a | 6 | n/a |

For Investor 1, the Exempt Income of AED 9 million will not be treated as Taxable Income, as it remains Exempt Income. The remaining net income of AED 11 million (i.e. net Interest income, net income from Immovable Property, and other net income) will be treated as Taxable Income.

For Investor 2, as a foreign juridical person, it will be regarded as having a nexus only to the extent that it receives income from Immovable Property in the UAE. [44] In this example, net Exempt Income, net Interest income and all other net income, is not included in Investor 2's income, as it is not attributable to its nexus in the UAE. Therefore, only the income from Immovable Property in the UAE of AED 6 million will be treated as Taxable Income for Investor 2.

The requirement to allocate net income applies equally to Qualifying Investment Funds that are REITs.

Example 3: Taxation of investor income in case of a REIT

A Qualifying Investment Fund which is a REIT has 15 investors and derives the following net income available for distribution in a financial year:

Particulars | Amounts (in AED million) |

|---|---|

Net Exempt Income | 0 |

Net Interest income | 2.5 |

Net income from Immovable Property in the UAE | 47.5 |

All other net income | 0 |

Total net income available for distribution | 50 |

The investors in the REIT are as follows:

Thirteen investors are natural persons, each holding their investment as a Personal Investment and who collectively hold a 20% ownership interest in the fund.

One investor is a UAE incorporated juridical person who is a Resident Person (Investor 1) and holds a 40% ownership interest in the fund.

One investor is a foreign juridical person (Investor 2) who holds a 40% ownership interest in the fund and who does not have a Permanent Establishment in the UAE or State Sourced Income as a result of any of their other activities.

The net income of the natural persons will not be treated as Taxable Income as they hold their stake as a Personal Investment.

Investor 1 and Investor 2 will include the relevant portion of net income available for distribution of the fund in their income. For the relevant financial year, the net income of the REIT to be included by investors will be calculated as follows:

Particulars | Net Exempt Income | Net Interest income | Net income from Immovable Property in the UAE | All net other income |

|---|---|---|---|---|

(Amounts in AED million) | ||||

Net income per income category | 0 | 2.5 | 47.5 | 0 |

Inclusion of net income by Investor 1 (40%) in its income | 0 | 1 | 19 | 0 |

Inclusion of net income by Investor 2 (40%) in its income | n/a | n/a | 19 | n/a |

For Investor 1, all of the net income totalling AED 20 million will be treated as Taxable Income.

For Investor 2, as a foreign juridical person, it will be regarded as having a nexus to the extent it receives income from Immovable Property in the UAE. [45]In this example, net Exempt Income, net Interest income and all other net income, is not included in Investor 2's income, as it is not attributable to its nexus in the UAE. Therefore, only the net income from Immovable Property in the UAE of AED 19 million will be treated as Taxable Income for Investor 2.

Time apportionment of income

The requirement to include the net income and expenditure of a Qualifying Investment Fund only applies to the extent the net income and expenditure has been reflected as net income available for distribution in the financial statements of the Qualifying Investment Fund. [46] Therefore, the net income and expenditure for a particular financial year of the Qualifying Investment Fund will be the amount reflected in the financial statements of the Qualifying Investment Fund as at its year end.

If the financial year of the Qualifying Investment Fund differs from the Tax Period of an investor that is a Taxable Person, the investor must include the net income available for distribution in the Tax Period in which the year end of the Qualifying Investment Fund occurs.

If a Taxable Person held a stake for only part of the financial year of the Qualifying Investment Fund, the net income is also required to be apportioned by the Qualifying Investment Fund. As a result, it is possible that a Taxable Person is required to include the net income from the Qualifying Investment Fund that was earned in a Tax Period when it no longer holds the investment in the Qualifying Investment Fund.

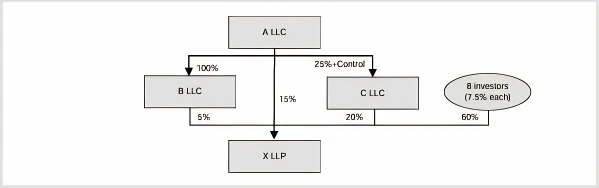

Example 4: Inclusion of net income for investor in a Tax Period that includes the closing date of the financial year of the Qualifying Investment Fund

X LLP is a Qualifying Investment Fund. X LLP uses the Gregorian calendar year (31 December) as its financial year end.

A LLC is a Resident Person that acquires a 10% ownership interest in X LLP on 26 May 2025 for AED 100 million. A LLC sells its ownership interest on 14 March 2027 for AED 120 million. A LLC's Financial Year end is 31 March.

As a result, A LLC shall include the relevant net income available for distribution in its income, for the Tax Periods ending on 31 March 2026 and 31 March 2027 respectively.

In the Tax Period ending 31 March 2028, the requirement to include net income applies despite A LLC having sold its stake before the Tax Period started. As a result, A LLC shall include the relevant net income available for distribution in its Taxable Income for the Tax Period ending on 31 March 2028.

If A LLC realised a capital gain on the sale of the ownership interest in X LLP and if the ownership interest in X LLP qualified as a Participating Interest, the capital gain realised on the sale would be Exempt Income and, therefore, not included in the Taxable Income of A LLC (in this regard, refer to Section 4.4.4 below).

Treatment of distributions

Any distributions made by a Qualifying Investment Fund should not be included in the income of an investor who is a Taxable Person, to the extent that net income available for distribution was already previously included in the income of that investor (as outlined in the previous section). [47]

Whether net income available for distribution was previously included by the investor in its income should be determined on a combined basis for all Tax Periods up to and including the Tax Period in which the distribution was made.

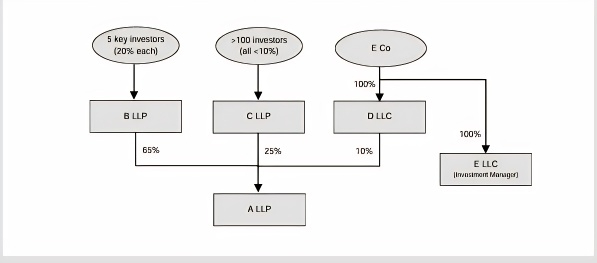

Example 5: Inclusion of distributions in income

X LLP is a Qualifying Investment Fund. A LLC is a Resident Person that acquires a 10% ownership interest in X LLP. X LLP and A LLC use the Gregorian calendar year (31 December) as their financial year end.

All of the income of X LLP is other net income. Over a three-year period, X LLP realises the following net income available for distribution:

| Particulars | Financial year ending 31 December 2024 | Financial year ending 31 December 2025 | Financial year ending 31 December 2026 |

|---|---|---|---|

| (Amounts in AED million) | |||

| Total net income available for distribution | 60 | 10 | 100 |

| Net income included by A LLC (10% of total net income) | 6 | 1 | 10 |

| Total distributions made by X LLP | - | 50 | 80 |

| Distributions made by X LLP to A LLC (10% of total distributions made) | - | 5 | 8 |

A LLC should not include the distributions in its income to the extent that it has previously included net income available for distribution.

In the financial year ending 31 December 2025, A LLC receives a distribution of AED 5 million, which is less than the AED 7 million it has included in its income (i.e. AED 6 million in the 2024 Tax Period and AED 1 million in the 2025 Tax Period). Therefore, A LLC shall not include the distribution by X LLP in its income.

In the financial year ending 31 December 2026, it receives a distribution of AED 8 million. Together with the distribution received in the prior years, A LLC has received AED 13 million of distributions from X LLP (i.e. AED 5 million in the 2025 Tax Period and AED 8 million in the 2026 tax period), which is less than the AED 17 million it has included in its income (i.e. AED 6 million in the 2024 Tax Period, AED 1 million in the 2025 Tax Period and AED 10 million in the 2026 Tax Period). Therefore, A LLC shall not include the distribution by X LLP in its income.

The net income previously included by an investor includes net Exempt Income, net Interest income, net income from Immovable Property in the UAE and other net income. In other words, if a Qualifying Investment Fund realises Exempt Income, investors that are Taxable Persons would also take into account such income for the purpose of Article 4(2) of Cabinet Decision No. 81 of 2023.

If a distribution by a Qualifying Investment Fund to a particular investor exceeds the amount of net income that has already been taken into account as part of the investor's income, only the excess amount of the distribution should be treated as income for the investor.

A distribution by a Qualifying Investment Fund incorporated in the UAE would not qualify as Exempt Income for the investor, as the Qualifying Investment Fund is not a Resident Person (because it is an Exempt Person). [48]Therefore, a distribution that exceeds the net income included for a Taxable Person would be Taxable Income.

By contrast, if an investor that is a Taxable Person realises a capital gain on the disposal of their ownership interest in a Qualifying Investment Fund, the resulting gain could be Exempt Income, if the ownership interest in the Qualifying Investment Fund qualifies as a Participating Interest. [49]

Application of other Corporate Tax provisions

As a Qualifying Investment Fund is not a Taxable Person and is not subject to Corporate Tax, the net income of a Qualifying Investment Fund that is available for distribution should not be adjusted under the provisions of the Corporate Tax Law that apply only to Taxable Persons, for instance Article 20(2), Article 20(3), Article 20(5), Article 24, Article 26, Article 27, Article 28, Article 29, Article 30, Article 31, Article 32, Article 33 or Article 34 of the Corporate Tax Law.

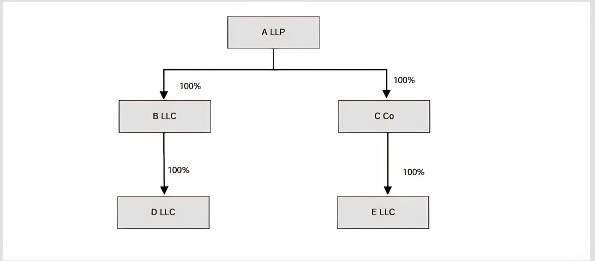

Treatment of Exempt Persons held by Qualifying Investment Funds

A juridical person incorporated in the UAE that is wholly owned by a Qualifying Investment Fund can also apply to be an Exempt Person, if the conditions in Article 4(1)(h) of the Corporate Tax Law are met (as explained in Section 5.10). This treatment is not automatic and requires an application, following the same procedures and time limits as a Qualifying Investment Fund.

When determining the net income of a Qualifying Investment Fund that is available for distribution and to be included in the income of the investors, the net income of the Qualifying Investment Fund should include the net income of any Exempt Persons who are wholly owned by that Qualifying Investment Fund and derive their Exempt Person status from Article 4(1)(h) of the Corporate Tax Law.

If the Qualifying Investment Fund prepares consolidated financial statements that include the results of such Exempt Persons and do not include the results of any other Persons, the determination of the net income included by investors can be based on such consolidated financial statements.

If no such consolidated financial statements are available, in determining the net income available for distribution to investors, the net income of the Qualifying Investment Fund and the net income of any subsidiaries that are treated as Exempt Persons under Article 4(1)(h) of the Corporate Tax Law shall be aggregated in a manner similar to consolidation, eliminating:

Any Dividends paid by the Exempt Persons, and

Any other transactions between the Exempt Persons and the Qualifying Investment Fund.

Impact of ceasing to be part of a Qualifying Group

If the Taxable Persons involved in a transfer under Article 26 of the Corporate Tax Law cease to be members of the same Qualifying Group within two years, the transfer of the asset shall be treated as having taken place at Market Value at the date of the transfer for the purposes of determining the Taxable Income of both Taxable Persons for the relevant Tax Period. [50]If an entity obtains Qualifying Investment Fund status, it will become an Exempt Person and will cease to form part of any Qualifying Group. Therefore, obtaining Qualifying Investment Fund status could trigger a clawback, if this occurs within two years of a transfer of assets or liabilities within a Qualifying Group. [51]

Example 6: Corporate Tax arising from ceasing to be part of Qualifying Group

A LLP and B LLC are part of a Qualifying Group and resident in the UAE. A LLP holds a 90% direct ownership interest in B LLC. Their Tax Periods end on 31 December.

On 1 March 2025, A LLP transfers certain assets to B LLC on which the no gain or loss treatment is applied in accordance with Article 26(3) of the Corporate Tax Law. The book value of the assets at the time of transfer is AED 30 million, but their Market Value is AED 35 million.

On 1 January 2026, A LLP becomes a Qualifying Investment Fund and, therefore, an Exempt Person. As a result, A LLP will cease to be a member of the Qualifying Group with B LLC which is within two years of transferring the assets to B LLC.

As A LLP and B LLC cease to be members of the same Qualifying Group within two years of the transfer within the Qualifying Group, the transfer of the asset shall be treated as having taken place at Market Value at the date of the transfer for the purposes of determining the Taxable Income of both Taxable Persons for the current Tax Period. The resulting gain should, in principle, be included in the Taxable Income of the transferor, but as the transferor ceases to be a Taxable Person as a result of the Qualifying Investment Fund status, the gain would be included in the Taxable Income of the transferee instead. [52]As a result, a gain of AED 5 million will be included in the Taxable Income of B LLC in the Tax Period ending 31 December 2026.

Impact of leaving a Tax Group or causing a Tax Group to cease to exist

A Qualifying Investment Fund is an Exempt Person and, therefore, cannot be part of a Tax Group under Article 40 of the Corporate Tax Law. [53]As a result, if an investment fund that is part of a Tax Group obtains Qualifying Investment Fund status, it will automatically leave the Tax Group. The investment fund entity will be treated as having left the Tax Group from the beginning of the Tax Period in which it ceases to meet the conditions to form part of the Tax Group. [54]

If the Qualifying Investment Fund was the Parent Company of the Tax Group, the Tax Group would also cease to exist as per the start of that Tax Period, unless the Qualifying Investment Fund is replaced by another Parent Company. [55]

If any asset or liability was transferred to or from an investment fund within the Tax Group in the two-year period before it became a Qualifying Investment Fund (and, therefore, applied to be an Exempt Person), the associated gain or loss on the transfer may need to be taken into account by the relevant transferor or transferee. [56]

Impact on relief for Tax Losses

If an investment fund has existing Tax Losses or unutilised Net Interest Expenditure prior to obtaining Qualifying Investment Fund status, those Tax Losses and unutilised Net Interest Expenditure cannot be utilised while it has Qualifying Investment Fund status. [57]

However, if it loses the Exempt Person status in a later Tax Period, it can utilise the Tax Losses or unutilised Net Interest Expenditure from that Tax Period onwards, provided that the conditions for utilisation are met. [58]For the purposes of carrying forward those Tax Losses, obtaining Qualifying Investment Fund status is not considered a change of ownership under Article 39 of the Corporate Tax Law if the ownership of the investors in the investment fund does not change.

A Taxable Person cannot claim Tax Loss relief for losses incurred before a Person becomes a Taxable Person under the Corporate Tax Law, nor for losses incurred from an asset or activity the income of which is exempt, or otherwise not taken into account, under the Corporate Tax Law. [59] This means that any losses which arose in the hands of an investment fund at the time it was a Qualifying Investment Fund are not Tax Losses and cannot be carried forward to any subsequent Tax Periods or utilised by a fund if it ceases to be a Qualifying Investment Fund.

Conditions for being a Qualifying Investment Fund

Overview

An investment fund may apply to the FTA to be exempt from Corporate Tax as a Qualifying Investment Fund provided the conditions prescribed in Article 10(1) of the Corporate Tax Law and Cabinet Decision No. 81 of 2023 are met. The conditions set out in Article 10(1) of the Corporate Tax Law are as follows: [60]

The investment fund or the investment fund's manager is subject to the regulatory oversight of a competent authority in the UAE, or a foreign competent authority recognised for the purposes of Article 10 of the Corporate Tax Law (the 'regulatory oversight condition'),

Interests in the investment fund are traded on a Recognised Stock Exchange or are marketed and made available sufficiently widely to investors (the 'fund ownership condition'), and

The main or principal purpose of the investment fund is not to avoid Corporate Tax (the 'main purpose condition').

The main Business or Business Activities conducted by the investment fund are Investment Business activities, and any other Business or Business Activities conducted by the investment fund are ancillary or incidental (the 'Investment Business condition'),

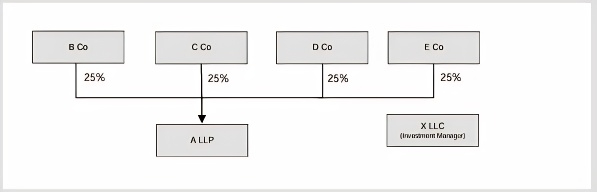

A single investor and its Related Parties do not own:

More than 30% of the ownership interests in the investment fund, where the investment fund has less than ten investors; or

More than 50% of the ownership interests in the investment fund, where the investment fund has ten or more investors (the 'diversity of ownership condition'),

The investment fund is managed or advised by an Investment Manager that has a minimum of three investment professionals (the 'Investment Manager condition'), and

The investors shall not have control over the day-to-day management of the investment fund (the 'independence condition').

The value of real estate assets, excluding land, under the management or ownership of the REIT exceeds AED 100 million (the 'REIT minimum real estate asset value condition').

At least 20% of the REIT share capital is floated on a Recognised Stock Exchange, or it is directly wholly owned by two or more institutional investors specified in Article 5 of Cabinet Decision No. 81 of 2023, provided that at least two of those institutional investors are not Related Parties (the 'REIT ownership condition').

The REIT has an average Real Estate Asset Percentage of at least 70% during the relevant Gregorian calendar year or the relevant 12-month period for which the financial statements are prepared (the 'REIT real estate percentage condition').

It fails to meet the conditions as a result of its liquidation or termination, or

The failure to meet the conditions is of a temporary nature and will be promptly rectified, and appropriate procedures are in place to monitor compliance with the relevant conditions. [69]

The failure to meet the conditions is due to a situation or an event beyond the Qualifying Investment Fund's control which it could not reasonably have predicted or prevented.

The Qualifying Investment Fund has made an application to the FTA to continue to be treated as an Exempt Person within 20 business days from the date it fails to meet the conditions of a Qualifying Investment Fund. The FTA shall review the application and notify its decision within 20 business days of the submission of the application or, if the FTA has notified the Qualifying Investment Fund, such other time period required to review the application.

It is reasonably expected to rectify the failure to meet the conditions within 20 business days from the submission of such application. This period may be extended upon request (and subject to approval by the FTA) for another 20 business days if the failure to rectify is beyond the Qualifying Investment Fund's reasonable control. [73]

Upon request by the FTA, the Qualifying Investment Fund provides evidence to support putting in place the appropriate procedures to monitor the compliance with the relevant conditions of the Corporate Tax Law, within 20 business days from the date of the request by the FTA, or any other period as may be determined by the FTA.

It will no longer be an Exempt Person and, as a result, will be subject to Corporate Tax as a Taxable Person from the start of the Tax Period in which the conditions were not met. [74] If the Taxable Person does not realise the conditions are not met, it is possible it mistakenly does not file Tax Returns for one or more Tax Periods. In such a case, it would be liable for penalties for its failure to file a Tax Return.

Any entities wholly owned and controlled by such an investment fund will no longer be an Exempt Person under Article 4(1)(h) of the Corporate Tax Law. Such entities will cease to be an Exempt Person for any of their Tax Periods, where they are no longer continuously wholly owned and controlled by a Qualifying Investment Fund.

Investors in such an investment fund that are Taxable Persons should no longer include the relevant net income in their income as of that date.[75]

Any feeder funds investing in such an investment fund should no longer count a proportional part of the Revenue of the investment fund for the purpose of the Investment Business condition (as explained in Section 5.5)

If such an investment fund invests in a second investment fund, the second investment fund should no longer look through the first investment fund for the purpose of the diversity of ownership condition (as explained in Section 5.6).

The following additional conditions for investment funds (other than Real Estate Investment Trusts 'REITs') are set out in Cabinet Decision No. 81 of 2023, as follows: [61]

The above additional conditions do not apply to REITs. Instead, Cabinet Decision No. 81 of 2023 has set out the following additional conditions for REITs. [62]These additional conditions are in addition to the conditions under Article 10(1) of the Corporate Tax Law:

A failure to meet the conditions would not immediately cause a Qualifying Investment Fund to lose its status, if the conditions of Article 4(6) of the Corporate Tax Law and Ministerial Decision No. 105 of 2023 are met (as explained in Section 5.1.2). [63]However, in other cases, each of the conditions outlined above must be met continuously during the relevant Tax Period by the Qualifying Investment Fund or the REIT, as the case may be, in order to be treated as an Exempt Person during such Tax Period.

Each of these conditions is discussed in detail in this section. In addition, this section will discuss the conditions for entities wholly owned and controlled by a Qualifying Investment Fund to be treated as an Exempt Person. [64]

Persons eligible for Qualifying Investment Fund status

A Qualifying Investment Fund is an Exempt Person, which means it is a Person exempt from Corporate Tax. [65]Natural persons and juridical persons are regarded as Persons.[66]A natural person cannot be a Qualifying Investment Fund. Thus, subject to the exception referred to below, only a juridical person can be a Qualifying Investment Fund.

If an election has been made to treat an Unincorporated Partnership as a Taxable Person in its own right (i.e. as fiscally opaque), [67]it can make an application to be a Qualifying Investment Fund, provided the relevant conditions are met.

If a foreign incorporated investment fund entity is subject to Corporate Tax as either a Resident Person (for example, due to effective management and control in the UAE) or as a Non-Resident Person (for example, due to a Permanent Establishment or other nexus in the UAE), it can apply to be exempt from Corporate Tax as a Qualifying Investment Fund, if it meets the relevant conditions.

A Free Zone Person may apply to the FTA to be exempt from Corporate Tax as a Qualifying Investment Fund if the relevant conditions are met.

Impact of not meeting the conditions in later Tax Periods

Once any of the conditions for a Qualifying Investment Fund are no longer met at any particular time during a Tax Period, the Qualifying Investment Fund will cease to be an Exempt Person from the start of the Tax Period during which it ceased to meet the relevant condition. [68]

However, a Qualifying Investment Fund would not lose its status from the start of the Tax Period if:

In respect of (1), the Qualifying Investment Fund must notify the FTA within 20 business days from the date of the beginning of the liquidation or termination procedures. [70]In such a case, the Qualifying Investment Fund shall cease to be an Exempt Person on the day following the date of the completion of the liquidation or termination procedure. [71]

In respect of (2), the Qualifying Investment Fund shall continue to be an Exempt Person if all of the following conditions are met: [72]

If the failure to meet the conditions is not of a temporary nature, an investment fund entity will cease to be a Qualifying Investment Fund. If so, this will mean:

Regulatory oversight condition

Regulatory oversight generally provides a legal framework for the promotion and distribution of investment opportunities to UAE investors and for ensuring appropriate risk management, investor rights protection and communication to investors about investment risks.

The regulatory oversight condition requires that the investment fund or the investment fund's manager must be subject to the regulatory oversight of a competent authority in the UAE, or a recognised foreign competent authority. [76]

There are three different competent authorities responsible for the authorisation and supervision of UAE financial institutions which includes investment funds and investment managers. These are:

The Securities and Commodities Authority ('SCA') which regulates markets, listed companies and securities brokers within the UAE (other than those resident in DIFC and ADGM),

The Dubai Financial Services Authority ('DFSA'), which is the regulator of the Dubai International Financial Centre ('DIFC'), and

The Financial Services Regulatory Authority ('FSRA'), which is the regulator of the Abu Dhabi Global Market ('ADGM').

Whilst, in practice, it may be difficult for a non-resident fund manager of a UAE investment fund to carry on all its activities without requiring a Licence or registration in the UAE, the Qualifying Investment Fund status could also be available if the fund manager of a UAE managed fund is subject to regulatory oversight by a foreign authority that is recognised as competent to regulate fund management activities. The inclusion of foreign competent authorities is also relevant to cover non-UAE incorporated investment funds that are not Resident Persons, but are Taxable Persons due to having a Permanent Establishment in the UAE or a nexus in the UAE as specified in Cabinet Decision No. 56 of 2023 and wish to apply for the Qualifying Investment Fund exemption.

A foreign authority will generally be considered a 'foreign competent authority' if it subjects an investment fund or its manager to regulatory oversight with the aim of protecting matters such as financial stability, interests of investors in collective investment schemes and preventing disproportionate financial risks and fraudulent activities by investment managers.

Fund ownership condition

To be a Qualifying Investment Fund, interests in the investment fund need to be either:[77]

Traded on a Recognised Stock Exchange, or

Marketed and made available sufficiently widely to investors.

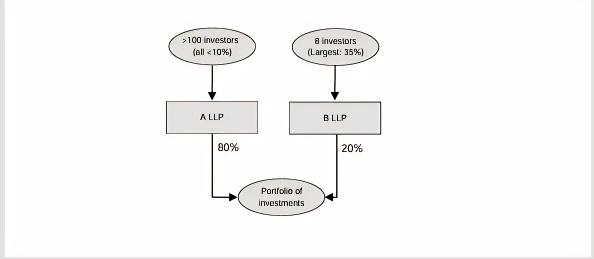

A Recognised Stock Exchange includes a stock exchange established in the UAE that is licensed and regulated by the relevant competent authority (such as the Abu Dhabi Securities Exchange ('ADX'), Dubai Financial Market ('DFM'), and Nasdaq Dubai), or a foreign stock exchange that is licensed and regulated by the relevant foreign competent authority and has an equal standing to that of a UAE stock exchange. Whether a stock exchange established outside the UAE has equal standing is dependent on whether that stock exchange that is recognised as such for the purpose of its local legislation.

The fund ownership condition can also be met if a fund is considered marketed and made available sufficiently widely to investors. This means that the fund needs to demonstrate it has attempted to achieve a diversity of ownership. However, if a fund (other than a REIT) has achieved a diversity of ownership in line with the diversity of ownership condition described in Section 5.6 below, it would be reasonable to conclude that the fund has been marketed and made available sufficiently widely and, as a result, the fund ownership condition would be met.

Main purpose condition

Qualifying Investment Fund status is not available for funds when the main or principal purpose of the fund is to avoid UAE Corporate Tax. The main or principal purpose condition refers specifically to UAE Corporate Tax and does not extend to foreign taxes.