Tax Groups

Corporate Tax Guide | CTGTGR1

January 2024

Contents

4. Conditions to form a Tax Group

4.1. Juridical persons condition

4.2. Resident Persons condition

4.2.1. Resident Person under the Corporate Tax Law and under Double Taxation Agreements

4.3. Share capital ownership condition

4.3.2. Ownership of share capital

4.3.3. Determining the 95% share capital ownership threshold

4.5. Profits and net assets condition

4.5.2. Entitlement to at least 95% of the Subsidiary’s net assets

4.5.3. Impact of different share classes

4.6. Exempt Person condition and Qualifying Free Zone Person condition

5. Forming a Tax Group and tax compliance obligations

5.1. Application to FTA to form a Tax Group

5.2. Responsibilities of the Parent Company of a Tax Group

5.3. Liability for Corporate Tax Payable

5.4. Tax Registration of the Tax Group and members of the Tax Group

5.5. Tax Deregistration of the Tax Group and members of the Tax Group

6. Change in members of a Tax Group

8. Taxable Income of a Tax Group

8.1. Determining the Taxable Income of a Tax Group

8.2. Consequence of leaving a Tax Group or cessation of Tax Group on transfers within the Tax Group

8.3. Application of the provisions of the Corporate Tax Law to Tax Groups

8.3.1. Application of reduced Corporate Tax rate and Small Business Relief

8.3.2. Application of ownership conditions at the level of Tax Group

8.3.3. Application of Qualifying Group Relief

8.3.4. Application of limitation of Tax Losses carried forward

8.3.5. Application of election for realisation basis

8.4. Treatment of Subsidiaries which have shareholders outside the Tax Group

9. Attribution of Taxable Income between members of a Tax Group

9.1. Situations in which attribution is required

9.2. Principles of attribution of Taxable Income

10.1. Tax Losses applicable to Tax Groups

10.2. Order of utilisation of Tax Losses

10.2.2. Order of utilisation where there are several Tax Losses

10.3. Impact of changes in the members of a Tax Group on Tax Losses

11. Interest Deduction Limitation Rule

11.1. Application of General Interest Deduction Limitation Rule to Tax Groups

11.2. Impact of changes in the members of a Tax Group on unutilised Net Interest Expenditure

11.3. Impact of a Tax Group that includes Banks and Insurance Providers

12. Foreign Tax Credits and Foreign Permanent Establishment

Glossary

Accounting Standards | : | The accounting standards specified in Ministerial Decision No. 114 of 2023. |

Accrual Basis of Accounting | : | An accounting method under which the Taxable Person recognises income when earned and expenditure when incurred. |

Administrative Penalties | : | Amounts imposed and collected under the Corporate Tax Law or the Tax Procedures Law. |

Bank | : | A Person licensed in the UAE as a bank or finance institution or an equivalent licensed activity that allows the taking of deposits and the granting of credits as defined in the applicable legislation of the UAE. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, professional, vocational, service or excavation activities or anything related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Business Restructuring Relief | : | A relief from Corporate Tax for business restructuring transactions, available under Article 27 of the Corporate Tax Law and as specified under Ministerial Decision No. 133 of 2023. |

Cash Basis of Accounting | : | An accounting method under which the Taxable Person recognises income and expenditure when cash payments are received and paid. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses. |

Corporate Tax Payable | : | Corporate Tax that has or will become due for payment to the FTA in respect of one or more Tax Periods. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return on capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Double Taxation Agreement | : | An International Agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Financial Asset | : | Financial asset as defined in the Accounting Standards applied by the Taxable Person. |

Financial Liability | : | Financial liability as defined in the Accounting Standards applied by the Taxable Person. |

Financial Statements | : | A complete set of statements as specified under the Accounting Standards applied by the Taxable Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity and cash flow statement. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

Foreign Permanent Establishment | : | A place of Business or other form of presence outside the UAE of a Resident Person that is determined in accordance with the criteria prescribed in Article 14 of the Corporate Tax Law. |

Foreign Tax Credit | : | Tax paid under the laws of a foreign jurisdiction on income or profits that may be deducted from the Corporate Tax due, in accordance with the conditions of Article 47(2) of the Corporate Tax Law. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A juridical person incorporated, established or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

FTA | : | Federal Tax Authority, being the Authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

General Interest Deduction Limitation Rule | : | The limitation provided under Article 30 of the Corporate Tax Law. |

IFRS | : | International Financial Reporting Standards. |

IFRS for SMEs | : | International Financial Reporting Standard for small and medium-sized entities. |

Immovable Property | : | Means any of the following:

|

Insurance Provider | : | A Person licensed in the UAE as an insurance provider that accepts risks by entering into or carrying out contracts of insurance, in both the life and non-life sectors, including contracts of reinsurance and captive insurance, as defined in the applicable legislation of the UAE. |

Intangible Asset | : | An intangible asset as defined in the Accounting Standards applied by the Taxable Person. |

International Agreement | : | Any bilateral or multilateral agreement, or any other agreement to which the UAE is a party, that has been ratified by the parties. |

Interest | : | Any amount accrued or paid for the use of money or credit, including discounts, premiums and profit paid in respect of an Islamic financial instrument and other payments economically equivalent to interest, and any other amounts incurred in connection with the raising of finance, excluding payments of the principal amount. |

Market Value | : | The price which could be agreed in an arm's-length free market transaction between Persons who are not Related Parties or Connected Persons in similar circumstances. |

Membership or Partnership Capital | : | The capital paid to a juridical person where the paid capital is divided into membership or partnership interests by a Person in order to be a member or partner and have the rights of membership or partnership in that juridical person. |

Net Interest Expenditure | : | The Interest expenditure amount that is in excess of the Interest income amount as determined in accordance with the provisions of the Corporate Tax Law. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Ordinary Shares | : | The category of capital stock or equivalent ownership interest, which gives its owner, on a share-by-share basis, equal entitlement to voting rights, profits, and liquidation proceeds. |

Parent Company | : | A Resident Person that can make an application to the FTA to form a Tax Group with one or more Subsidiaries in accordance with Article 40(1) of the Corporate Tax Law. |

Participating Interest | : | An ownership interest in the shares or capital of a juridical person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Participation | : | The juridical person in which the Participating Interest is held. |

Participation Exemption | : | An exemption from Corporate Tax for income from a Participating Interest, available under Article 23 of the Corporate Tax Law and as specified under Ministerial Decision No. 116 of 2023. |

Person | : | Any natural person or juridical person. |

Preferred Shares | : | The category of capital stock or equity interest which gives its owner priority entitlement to profits and liquidation proceeds ahead of owners of Ordinary Shares. |

Qualifying Free Zone Person | : | A Free Zone Person that meets the conditions of Article 18 of the Corporate Tax Law and is subject to Corporate Tax under Article 3(2) of the Corporate Tax Law. |

Qualifying Group | : | Two or more Taxable Persons that meet the conditions of Article 26(2) of the Corporate Tax Law. |

Qualifying Group Relief | : | A relief from Corporate Tax for transfers within a Qualifying Group, available under Article 26 of the Corporate Tax Law and as specified under Ministerial Decision No. 132 of 2023. |

Redeemable Shares | : | The category of capital stock or equity interest which the juridical person issuing this instrument has agreed to redeem or buy back from the owner of this instrument at a future date or after a specific event, for a predetermined amount or with reference to a predetermined amount. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023. |

Specific Interest Deduction Limitation Rule | : | The limitation provided under Article 31 of the Corporate Tax Law. |

State | : | United Arab Emirates. |

Subsidiary | : | A Resident Person that can make an application to the FTA to form a Tax Group with a Parent Company in accordance with Article 40(1) of the Corporate Tax Law. |

Tax Deregistration | : | A procedure under which a Person is deregistered for Corporate Tax purposes with the FTA. |

Tax Group | : | Two or more Taxable Persons treated as a single Taxable Person according to the conditions of Article 40 of the Corporate Tax Law. |

Tax Loss | : | Any negative Taxable Income as calculated under the Corporate Tax Law for a given Tax Period. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration | : | A procedure under which a Person registers for Corporate Tax purposes with the FTA. |

Tax Registration Number | : | A unique number issued by the FTA to each Person who is registered for Corporate Tax purposes in the UAE. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the State under the Corporate Tax Law. |

UAE | : | United Arab Emirates. |

Unincorporated Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (“Corporate Tax Law”) was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates (“UAE”) on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits (“Corporate Tax”) in the UAE.

The provisions of the Corporate Tax Law shall apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance to Taxable Persons, helping them to understand the taxation of two or more juridical Resident Persons that form a Tax Group.

Once a Tax Group is formed, the juridical Resident Persons that are part of the Tax Group are treated as a single Taxable Person and, therefore, Taxable Income needs to be calculated on a consolidated basis for the entire Tax Group. As a result, only one Tax Return for the Tax Group needs to be submitted to the FTA.

This guide provides readers with an overview of:

What is a Tax Group;

Who is eligible to form or be a member of a Tax Group;

When a Tax Group can be formed and when it ceases to exist;

How the Taxable Income of a Tax Group is determined; and

Related compliance requirements.

Tax Groups are an optional regime, and a Tax Group is only formed if juridical Resident Persons, who meet the relevant conditions, apply to form one and it is approved by the FTA. Therefore, the concept of a Tax Group will not apply to every Taxable Person.

This guide does not cover the concept of a Qualifying Group for the purposes of Article 26 of the Corporate Tax Law (under which assets and liabilities may be transferred between members of a Qualifying Group on a no gain or loss basis for Corporate Tax purposes), except insofar as this provision interacts with the rules related to Tax Groups.

Who should read this guide?

This guide should be read by any juridical Resident Person that thinks it may qualify to form a Tax Group (with a Parent Company and at least one Subsidiary) or join an existing Tax Group as per the Corporate Tax Law, and that wants to enjoy the benefits of the Tax Group regime (for example consolidated Taxable Income, reduced compliance burden, etc.).

It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant Articles of the Corporate Tax Law and the implementing decisions are indicated in each Section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides (such as Participation Exemption, foreign tax credit).

In some instances, simple examples are used to illustrate how the key Corporate Tax rules for Tax Groups apply. The examples in this guide:

Show how these elements operate in isolation and do not show the interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes; and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 28 of 2022 on Tax Procedures is referred to as “Tax Procedures Law”;

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as the “Corporate Tax Law”;

Cabinet Resolution No. 44 of 2020 on Organising Reports Submitted by Multinational Companies is referred to as “Cabinet Resolution No. 44 of 2020”;

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as the “Ministerial Decision No. 73 of 2023”;

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 114 of 2023”;

Ministerial Decision No. 116 of 2023 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 116 of 2023”;

Ministerial Decision No. 120 of 2023 on the Adjustments Under the Transitional Rules for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 120 of 2023”;

Ministerial Decision No. 125 of 2023 on Tax Group for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 125 of 2023”;

Ministerial Decision No. 126 of 2023 on the General Interest Deduction Limitation Rule for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 126 of 2023”;

Ministerial Decision No. 134 of 2023 on the General Rules for Determining Taxable Income for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 134 of 2023”;

Federal Tax Authority Decision No. 5 of 2023 on the Conditions for Change in Tax Period for the Purposes of the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “FTA Decision No. 5 of 2023”;

Federal Tax Authority Decision No. 6 of 2023 on Tax Deregistration Timeline for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “FTA Decision No. 6 of 2023”; and

Federal Tax Authority Decision No. 12 of 2023 on Conditions for Forming the Tax Group by Subsidiaries of a Government Entity for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “FTA Decision No. 12 of 2023”.

Status of this guide

This guidance is not a legally binding document but is intended to provide assistance in understanding the tax implications for Tax Groups relating to the Corporate Tax regime in the UAE. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

What is a Tax Group?

The Corporate Tax Law defines a Tax Group as two or more Taxable Persons treated as a single Taxable Person according to the conditions of Article 40 of the Corporate Tax Law. [1]Only Resident Persons can be part of a Tax Group. [2]A Tax Group for Corporate Tax purposes is distinct from a tax group for value added tax purposes.

If the relevant conditions are met, [3] a joint application can be made to the FTA by the Parent Company and each Subsidiary seeking to form or become a member of a Tax Group. [4]A member of a Tax Group may refer to either a Parent Company or a Subsidiary included in the relevant Tax Group.

A Subsidiary can only be a member of a Tax Group if all conditions outlined in Article 40(1) of the Corporate Tax Law are met.

There are several benefits of forming a Tax Group, which include the ability for the Parent Company to file a single Tax Return on behalf of all members of the Tax Group. [5]Forming a Tax Group also allows for the income and losses of the members of the Tax Group to be offset against each other. Also, generally the transfer of assets and liabilities and other transactions and arrangements between members of the Tax Group are to be disregarded when determining the Taxable Income of the Tax Group.

Conditions to form a Tax Group

A Parent Company and one or more Subsidiaries can make an application to the FTA to form a Tax Group where all of the following conditions are satisfied:

The Parent Company and each Subsidiary are juridical persons (the “juridical persons condition”); [6]

The Parent Company and each Subsidiary are Resident Persons (the “Resident Persons condition”); [7]

The Parent Company owns at least 95% of the share capital of each Subsidiary, either directly or indirectly through one or more Subsidiaries (the “share capital ownership condition”); [8]

The Parent Company owns at least 95% of the voting rights of each Subsidiary, either directly or indirectly through one or more Subsidiaries (the “voting rights condition”); [9]

The Parent Company is entitled to at least 95% of each Subsidiary's profits and net assets, either directly or indirectly through one or more Subsidiaries (the “profits and net assets condition”); [10]

Neither the Parent Company nor the Subsidiaries are an Exempt Person (the “Exempt Person condition”); [11]

Neither the Parent Company nor the Subsidiaries are a Qualifying Free Zone Person (the “Qualifying Free Zone Person condition”); [12]

The Parent Company and each Subsidiary must have the same Financial Year (the “Financial Year condition”); [13]and

The Parent Company and each Subsidiary must prepare their Financial Statements using the same Accounting Standards (the “Accounting Standards condition”). [14]

The share capital ownership condition, the voting rights condition and the profits and net assets condition can be met if the Parent Company holds such rights directly and/or through one or more Subsidiaries. This means indirect ownership is only considered if it is through one or more intermediate Subsidiaries of the Parent Company.

For a Tax Group to be formed, the Parent Company and the Subsidiary must continuously meet all of the above-mentioned conditions throughout the relevant Tax Period during which the Tax Group rules are applied. [15]This means that if both or either of the Parent Company and the Subsidiaries meet the conditions only for part of a Tax Period, it is not possible to form a Tax Group in that Tax Period.

For the Tax Group to continue to exist, the Parent Company and all Subsidiaries must meet all the above-mentioned conditions continuously throughout the relevant Tax Period. [16]. If the Parent Company and all Subsidiaries meet the conditions only for part of a Tax Period, it is not possible for the Tax Group to continue to exist in that Tax Period, except in cases where a Parent Company is replaced by another Parent Company without discontinuation of the Tax Group (see Section 6.4). [17]Similarly, if any Subsidiary does not meet the conditions continuously throughout the relevant Tax Period, the subsidiary will no longer be a member of the Tax Group. [18]

A Tax Group that existed in a Tax Period will continue to exist in the following Tax Period, provided the Parent Company and all the Subsidiaries continue to meet all the conditions throughout that next Tax Period. Where the Parent Company and all the Subsidiaries do not continuously meet all the conditions during a subsequent Tax Period, the Tax Group will cease to exist from the beginning of that subsequent Tax Period, [19]except in cases where a Parent Company is replaced by another Parent Company without discontinuation of the Tax Group, [20]or where a member of the Tax Group ceases to exist as a result of transfer of a Business within the same Tax Group. [21]

It may be possible to form a Tax Group again after it ceases to exist or to readmit a Subsidiary that left the Tax Group if the relevant conditions are met in a later Tax Period by submitting an application to the FTA.

There is no limit to the number of members of a Tax Group. However, a juridical person can only be a member of one Tax Group at any given time. Further, if a Parent Company forms a Tax Group with one or more Subsidiaries, these are regarded as a single Tax Group. Thus, it is not possible for a Parent Company to form multiple Tax Groups with different Subsidiaries.

There is no requirement for any connection or relation between the Business or Business Activities of the members of the Tax Group.

Each of the conditions listed in Article 40(1) of the Corporate Tax Law are considered below.

Juridical persons condition

The Parent Company and each Subsidiary of a Tax Group must be a juridical person, i.e. have a separate legal personality from its founders, owners and directors. Examples of juridical persons include companies (such as private or public joint stock companies or limited liability companies) and certain incorporated partnerships which have separate legal personality. [22]

Natural persons, carrying on Business as a sole establishment, are not juridical persons and, therefore, cannot qualify to be a member of a Tax Group.

Unincorporated Partnerships are a contractual relationship between two or more persons that generally do not have distinct legal personality separate from their partners / members. Given that Unincorporated Partnerships are not juridical persons in their own right, they cannot be part of a Tax Group (either as a Parent Company or as a Subsidiary). This applies even if an Unincorporated Partnership is treated as a Taxable Person on the basis of an approved application by its partners under Article 16(8) of the Corporate Tax Law, as this does not change the legal form of an Unincorporated Partnership. A juridical person which is a partner in a fiscally transparent Unincorporated Partnership, can be a member of a Tax Group as said partner is a juridical person.

Resident Persons condition

Resident Person under the Corporate Tax Law and under Double Taxation Agreements

The Parent Company and each Subsidiary of a Tax Group must be a Resident Person. [23]Under the Corporate Tax Law, a juridical person is a Resident Person where:

It is incorporated or otherwise established or recognised under the applicable legislation of the UAE; [24]or

It is incorporated or otherwise established or recognised under the applicable legislation of a foreign jurisdiction but is effectively managed and controlled in the UAE. [25]

In addition, juridical persons can be members of a Tax Group only if they are regarded both as a Resident Person under the Corporate Tax Law as well as a tax resident of the UAE for the purposes of an applicable Double Taxation Agreement. [26]In other words, a juridical person cannot be a member of a Tax Group if they are considered tax resident in a foreign jurisdiction under a Double Taxation Agreement in force in the UAE.

Double Taxation Agreements are bilateral agreements between the UAE and another jurisdiction for the elimination of double taxation with respect to taxes on income and capital and the prevention of tax evasion and avoidance. Such agreements aim, inter alia, at resolving double taxation in instances where a person is a dual resident in the UAE and in another jurisdiction. For this purpose, Double Taxation Agreements generally provide rules for determining in which jurisdiction a Person is regarded as tax resident for the purposes of the agreement (see Section 4.2.2.1 in relation to the “tie-breaker rule”).

Dual resident persons

If a Resident Person is also liable to an income tax or any other tax that is similar to Corporate Tax in a foreign jurisdiction by virtue of residence, place of management or any other criterion of a similar nature, the Resident Person is considered a dual resident person. Whether a dual resident person can be a member of a Tax Group will depend on the relevant facts and circumstances, as explained below.

The Double Taxation Agreement includes a tie-breaker rule

In general, Double Taxation Agreements will outline a clear procedure to determine the sole jurisdiction in which a dual resident person is considered tax resident for the purposes of that agreement (a “tie-breaker rule”).

If the dual resident person is regarded as a tax resident of only the UAE under the tie-breaker rule of an applicable Double Taxation Agreement with another jurisdiction, then that Resident Person is not considered a tax resident of that foreign jurisdiction. As a result, the dual resident person can be a member of a Tax Group.

However, if a dual resident person is regarded as a tax resident of a foreign jurisdiction under the tie-breaker rule of an applicable Double Taxation Agreement, then that Resident Person cannot form or be a member of a Tax Group. [27]

If a dual resident person qualified as a member of a Tax Group in earlier Tax Periods, but subsequently is treated as a tax resident of a foreign jurisdiction under the tie-breaker rule of an applicable Double Taxation Agreement, then that member ceases to be a member of the Tax Group from the beginning of the Tax Period in which the member became a tax resident of the foreign jurisdiction. [28]

The reason for this condition is that where a dual resident person is regarded as a tax resident of a foreign jurisdiction under an applicable Double Taxation Agreement, the restrictions under the Double Taxation Agreement would usually mean it is not effectively taxed in a manner similar to other Resident Persons for UAE Corporate Tax purposes as the UAE's taxing rights on that person will generally be limited to specific instances.

The Double Taxation Agreement has the mutual agreement procedure as a tie breaker rule

Certain Double Taxation Agreements do not provide a conclusive tie-breaker rule for dual resident persons. Instead, tax residence is determined through mutual agreement of the competent authorities of both countries. In this case, until the competent authorities come to a conclusion, the person is treated as a tax resident of both countries. [29]

For Tax Group purposes, a Resident Person should not be resident for tax purposes in another jurisdiction under a Double Taxation Agreement. [30] This requirement is not met until the mutual agreement procedure is complete. As a result, the Resident Person is not eligible to join or form a Tax Group in such cases, even though the UAE is not restricted from exercising a taxing right on the income of the dual resident person.

After the mutual agreement procedure is concluded and the tax residence is allocated to one specific jurisdiction, a dual resident person can join a Tax Group only if the Resident Person is regarded as being tax resident only in the UAE by the competent authorities under the relevant Double Taxation Agreement.

No Double Taxation Agreement between UAE and another foreign jurisdiction

It is possible that a Resident Person is also a tax resident under the domestic tax law of a foreign jurisdiction with which the UAE does not have an in force Double Taxation Agreement. In such cases, the requirement under Article 3(1) of Ministerial Decision No. 125 of 2023 does not apply, as this provision only applies if there is an applicable Double Taxation Agreement. Thus, the Resident Person would still be eligible to join a Tax Group.

Documentation to prove tax residence

For Tax Group purposes, the following Resident Persons are required to maintain the requisite documentation to support that they are not tax resident in a foreign jurisdiction in which they are incorporated or effectively managed and controlled: [31]

Juridical persons incorporated or otherwise established or recognised under the applicable legislation of a foreign jurisdiction but that are effectively managed and controlled in the UAE; and

Juridical persons incorporated or otherwise established or recognised under applicable legislation of UAE but that are effectively managed and controlled in a foreign jurisdiction.

The documentation to be maintained includes either of the following:

A confirmation issued by the relevant tax authority of that foreign jurisdiction to support that they are not tax resident under domestic law of that foreign jurisdiction. [32]

A confirmation issued by the relevant competent authorities for the purposes of the application of the relevant Double Taxation Agreement. [33]

Failure of a dual resident person to maintain documentation can mean that the Resident Person is unable to prove it is not tax resident in a foreign jurisdiction. In those circumstances, the FTA may treat the dual resident as if the conditions for being part of a Tax Group were not met for Tax Periods for which insufficient documentation is available.

Parent Company held by a non-resident person

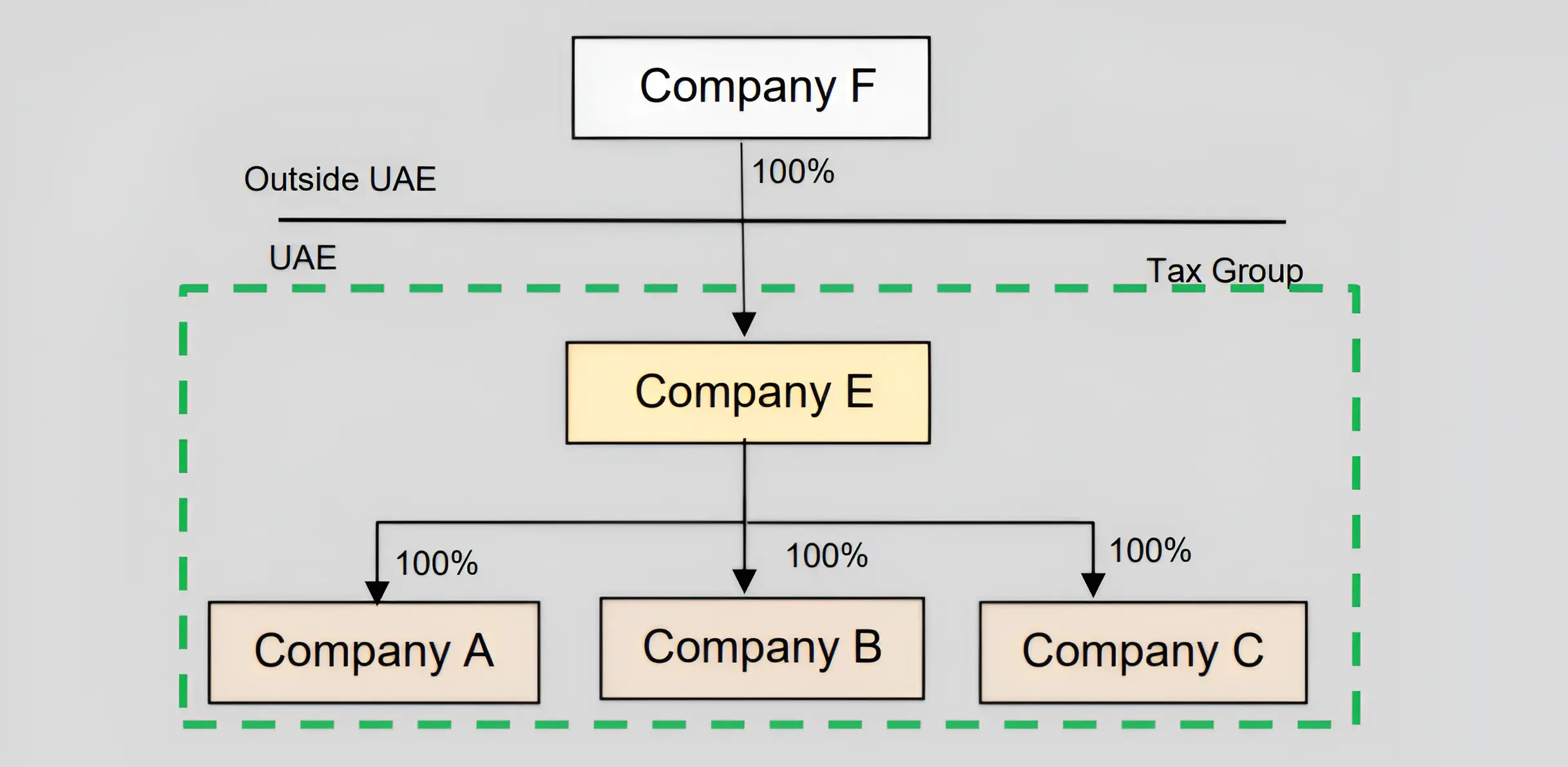

A foreign company, that is not a Resident Person, cannot qualify to be a member of a Tax Group. However, it is possible that a foreign company directly or indirectly holds shares or interests of several juridical Resident Persons including a Parent Company. In such a case, the juridical Resident Persons (Subsidiaries of the foreign company) can form a Tax Group provided that such companies are held by a Parent Company which is a juridical Resident Person and meets all of the conditions under Article 40(1) of the Corporate Tax Law such that it qualifies as the Parent Company of the Tax Group.

Company F (incorporated in and tax resident of a foreign country) holds 100% of the share capital of Company E, which in turn holds 100% of the share capital of Company A, Company B and Company C. Company A, Company B, Company C and Company E are all incorporated and resident in the UAE for Corporate Tax purposes.

Assuming all other conditions to form a Tax Group are met, Company E, as a Parent Company, can make an application together with Company A, Company B and Company C to the FTA to form a Tax Group.

Share capital ownership condition

To form a Tax Group, the Parent Company must own at least 95% of the share capital in each of the Subsidiaries, either directly or indirectly through one or more Subsidiaries. [34]The 95% threshold allows companies to form or join a Tax Group when there is a minority interest holder. This can be the case, for example, if an applicable law requires at least two shareholders for the incorporation of a juridical person.

What is share capital?

Share capital is defined as the nominal issued and paid-up share capital, or Membership or Partnership Capital, as applicable. [35]

The term “share” refers to a unit of ownership in a company which entitles the holder to a number of rights. These may include the right to vote, the right to participate in distributions of company profits, and the right to a return on the company's capital. The particular rights attached to a share will depend on the constitutional documents of the company. The term includes all types of shares issued by a company which carry a right to participate in the company's profits and liquidation proceeds, such as Ordinary Shares, Preferred Shares, Redeemable Shares etc. The term should be interpreted consistently with the term “shares or capital” and other usage of the term “share capital” in the Corporate Tax Law [36]and implementing decisions. [37]Any related guidance on those terms can also be applied. For instance, an ownership interest shall qualify as “share or capital” if it is classified as an equity interest under the Accounting Standards as applied by the Person holding the ownership interest. [38]

Share capital consists of share capital that has been issued and paid-up and does not include share capital that has been authorised but not yet issued and/or paid up. Rights of shareholders (such as voting rights and rights to receive profit distributions) are usually determined by reference to the nominal or par value (for example the “unit value”) of the shares, in which case the share capital condition requires the Parent Company to own at least 95% of the nominal value of the share capital. Usually, the nominal value is determined separately from any share premium (i.e. amounts contributed on shares in excess of their nominal value).

If the share capital of a company does not have nominal value, the rights of shareholders would usually be determined by reference to a different metric, such as a capital account allocated to a shareholder. In such a case, the share capital condition requires the Parent Company to own at least 95% of such a metric.

Share capital also includes capital invested in other forms of juridical persons (other than companies) such as Membership or Partnership Capital (which is the total amount of capital held by such juridical person that can be allocated to specific owners). Capital in an incorporated partnership or units of a trust also qualify as share capital where such entities are treated as juridical persons according to the law under which they are incorporated.

A Parent Company must hold at least 95% of voting rights and entitlement to profits and net assets in the capital of the Subsidiaries i.e. the “voting rights condition” and the “profits and net assets condition” (see Sections 4.4 and 4.5). [39]

Ownership of share capital

The share capital ownership condition under Article 40(1)(b) of the Corporate Tax Law refers to the legal owner of the shares, that is the Person who holds the legal title to the shares or interest. Where the shares do not have a legal title, this will be the Person who is otherwise recognised as the owner of the share capital from a legal perspective.

Where the Parent Company legally owns directly or indirectly at least 95% of the share capital of the Subsidiary, the share capital ownership condition should be met. However, whether this is the case should be determined based on the particular facts and circumstances on a case-by-case basis and after considering the specific legal arrangements that are in place.

The share capital ownership is not met if a Person transfers the legal title in shares or ownership interest to another Person while retaining the voting rights and entitlement to other benefits from such shares or interest.

Further, even if the share capital ownership condition is met, it should be assessed separately whether the voting rights condition and the profits and asset condition are also met (see Sections 4.4 and 4.5).

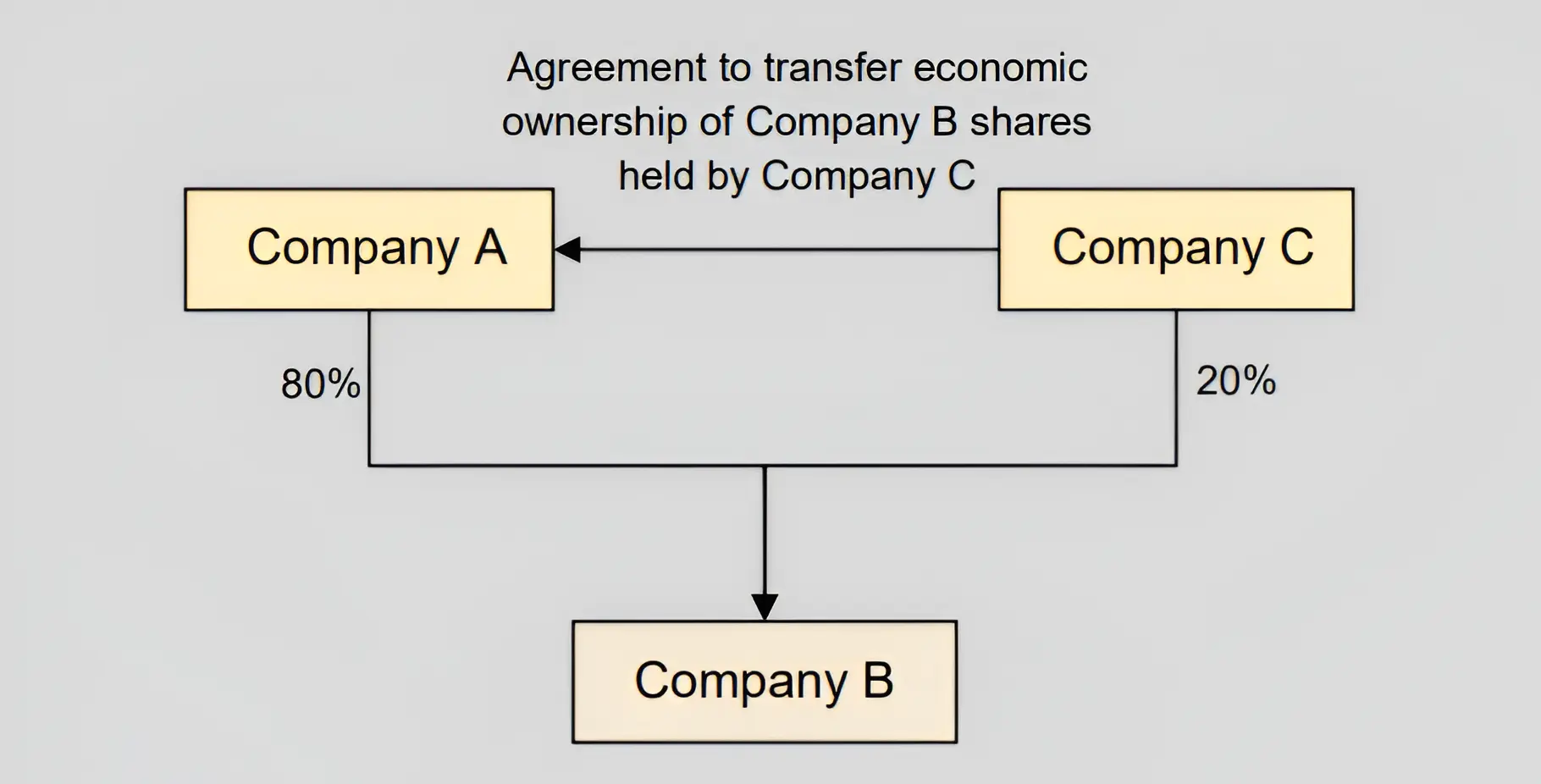

Example 2: Legal ownership of shares

Company A owns 80% of the shares in Company B. Company C holds the remaining 20% of the shares in Company B. Company A, Company B and Company C are incorporated and tax resident in the UAE.

Company C and Company A enter into an agreement for the transfer of economic ownership under which Company C will continue to legally own 20% of the shares in Company B but will do so on behalf of Company A.

Company C will transfer all rights relating to the 20% to Company A and grant Company A the right to request the transfer of legal title to the 20% at any time. In return for the transfer of economic ownership, Company A pays a consideration equal to the Market Value of the 20% of shares held in Company B to Company C.

After the transfer, Company A owns 80% of the shares in Company B outright and 20% as an economic owner. However, the share capital ownership condition is determined based on legal ownership of the shares and not based on effective ownership. As Company A legally only owns 80% of the shares in Company B, the share capital ownership condition is not met. Therefore, Company A and Company B cannot form a Tax Group.

Determining the 95% share capital ownership threshold

Whether the condition to hold at least 95% of share capital is met should be assessed by reference to the nominal issued or paid-up share capital. [40]. As explained in Section 4.3.1, the nominal issued or paid-up share capital represents the metric used by the juridical person to determine the proportionate rights of shareholders.

This is computed as: XY * 100% where,

X is the portion of nominal issued and paid-up share capital of the Subsidiary that is owned by the Parent Company directly or indirectly through one or more Subsidiaries.

Y is the total nominal issued and paid-up share capital of the Subsidiary.

It is possible that the Subsidiary issues shares with different nominal values through the use of different share classes. In such a case, testing the 95% ownership condition only on the basis of the number of shares held can lead to an inaccurate representation. Instead, the number of shares should be weighted by the nominal value of each share when computing X and Y to provide an accurate representation of the shareholding.

Example 3: Shares with different nominal values

Company A (incorporated in and tax resident of the UAE) has issued 2 classes of shares to its shareholders:

Class of share | Number of shares issued | Nominal value per share (AED) | Total capital (AED) |

Class 1 | 100 | 10 | 1,000 |

Class 2 | 1 | 1,000 | 1,000 |

Total | 101 | - | 2,000 |

Company B holds 100% of Class 1 shares of Company A.

Applying the formula above to Class 1 shares leads to the following result: (1,000 / 2,000) × 100% = 50%.

As the number of shares held in Company A is weighted by reference to their nominal value, the share capital ownership condition is not met by Company B even though Company B holds 100% of the Class 1 shares and 99% of the total number of shares.

As rights relating to the shares (such as voting rights and profit rights) are usually determined by reference to the nominal value, this provides a more realistic picture of the ownership stake in Company A.

It is also possible that the share capital of a Subsidiary consists of different types of shares, for example Ordinary Shares, Preferred Shares, etc. All types of shares held by the Parent Company in the Subsidiary directly or indirectly should be considered when computing X and Y.

Any instruments issued that are not share capital (such as convertible loans, warrants, options over shares that have not been issued) should not be considered in determining whether the share capital ownership condition has been met.

Certain juridical persons do not have capital divided into shares with a nominal value, but instead determine the entitlement of their owners by reference to Membership or Partnership Capital. In such cases, the share capital condition should be tested by reference to such Membership or Partnership Capital. This means capital paid to a partnership or trust (that is a juridical person) by a Parent Company (directly or indirectly) or capital held in a capital account for the benefit of the Parent Company should be considered as X and the total capital account of the partnership or trust should be considered as Y.

Indirect ownership

The Parent Company must own at least 95% of the share capital in the Subsidiaries, either directly or indirectly through one or more intermediate Subsidiaries of the Parent Company. The condition is also met if the combination of direct and indirect ownership adds up to at least 95%. [41]

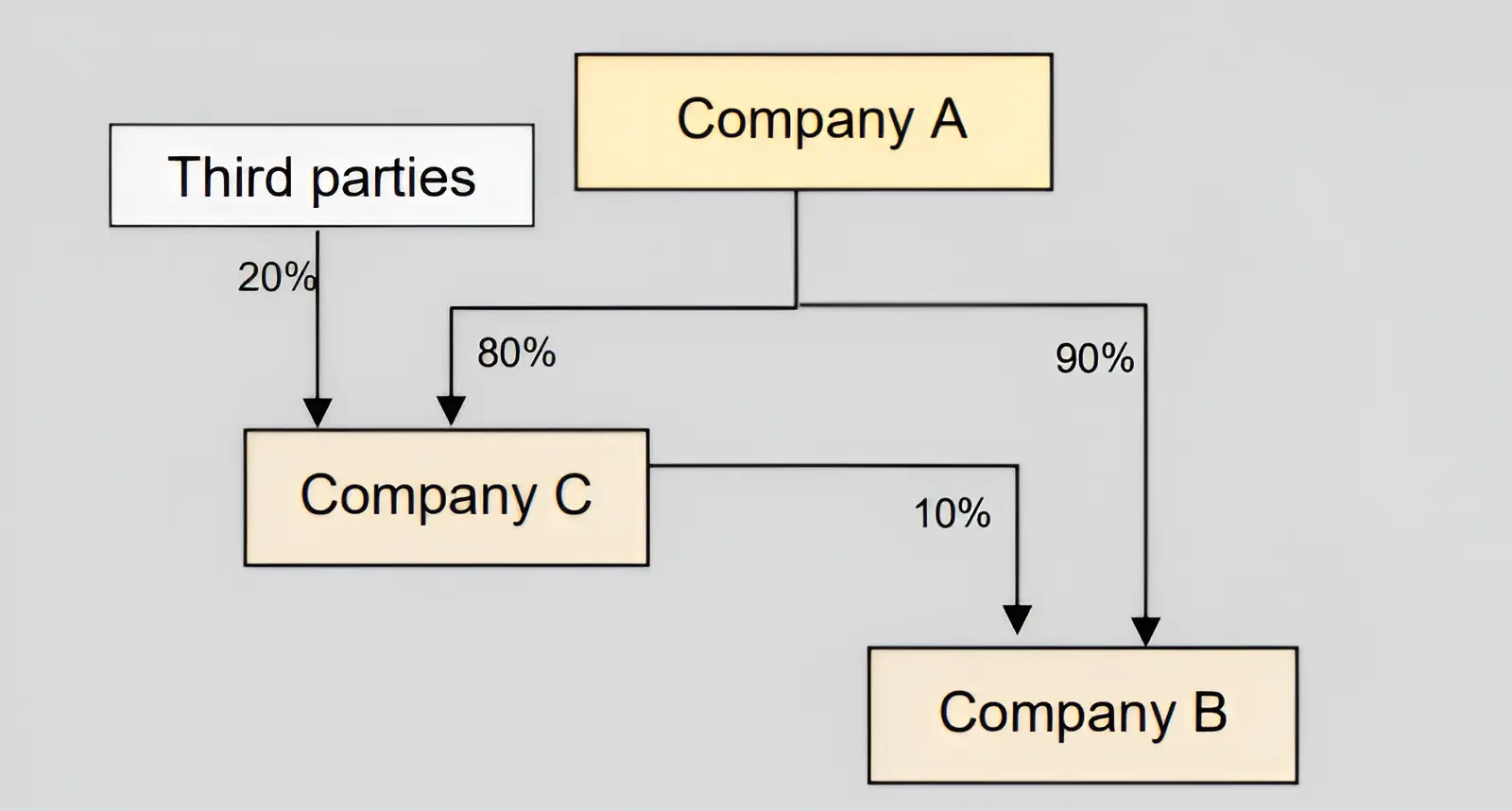

Example 4: Indirect ownership

Company A, Company B and Company C are all juridical Resident Persons. Company A owns 90% of the share capital of Company B and 80% of the share capital of Company C. The remaining 10% of the share capital of Company B is owned by Company C. The remaining 20% of the share capital of Company C is owned by third parties.

As Company A owns less than 95% of the share capital in Company C, Company A does not meet the share capital condition in respect of Company C. Therefore, Company C is not a Subsidiary of Company A, and the two cannot form a Tax Group.

Company A directly owns 90% of the share capital in Company B. The indirect ownership of share capital in Company B can only be considered if held through one or more Subsidiaries. As Company C is not a Subsidiary of Company A, the shares owned by Company C cannot be considered in determining whether the share capital condition is met by Company A in relation to Company B. Therefore, the condition is not met in case of Company B as well. Company A cannot form a Tax Group with either Company C or Company B.

If a Parent Company indirectly owns the share capital of a juridical Resident Person through non-wholly owned Subsidiaries, the holding of the Parent Company in that juridical Resident Person should be counted proportionately i.e. in proportion to the Parent Company's holding in the intermediate non-wholly owned Subsidiary.

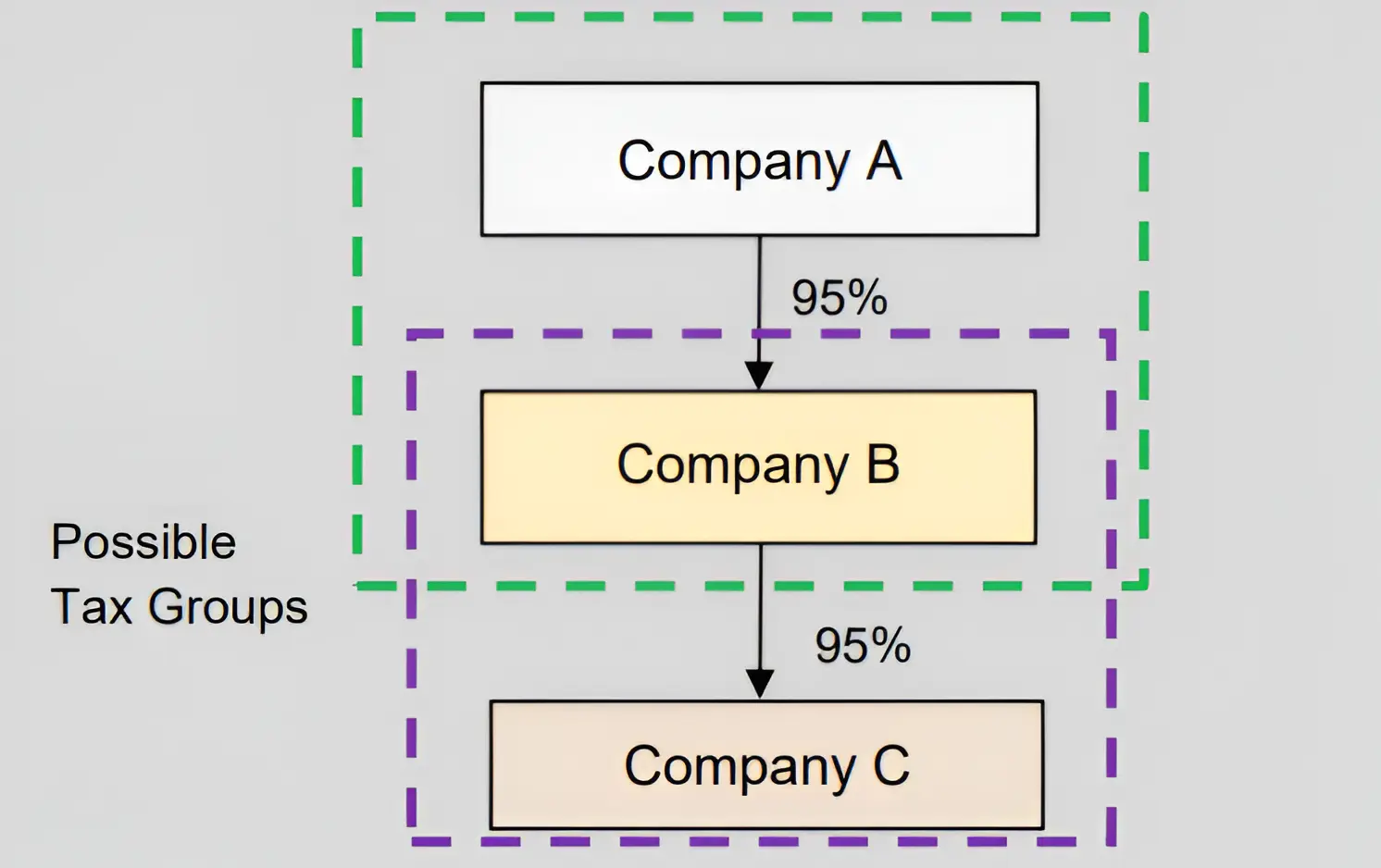

Example 5: Entities held through non-wholly owned Subsidiaries

Company A, Company B and Company C are all juridical Resident Persons. Company A holds 95% of the shares in Company B and Company B holds 95% of the shares in Company C.

Assuming all other conditions of Article 40(1) of the Corporate Tax Law are met, Company A can form a Tax Group with Company B. However, Company C cannot be a member of this Tax Group since Company A's indirect shareholding in Company C is less than 95% (i.e. 95% × 95% = 90.25%).

Alternatively, Company B holds 95% of shares in Company C. Assuming the other conditions of Article 40(1) are met, Company B can form a Tax Group with Company C.

However, a juridical Resident Person can only be part of one Tax Group at any given time. Hence, during any Tax Period, Company B can only be part of one Tax Group and not both the Tax Groups, i.e. Tax Group with Company A or Tax Group with Company C.

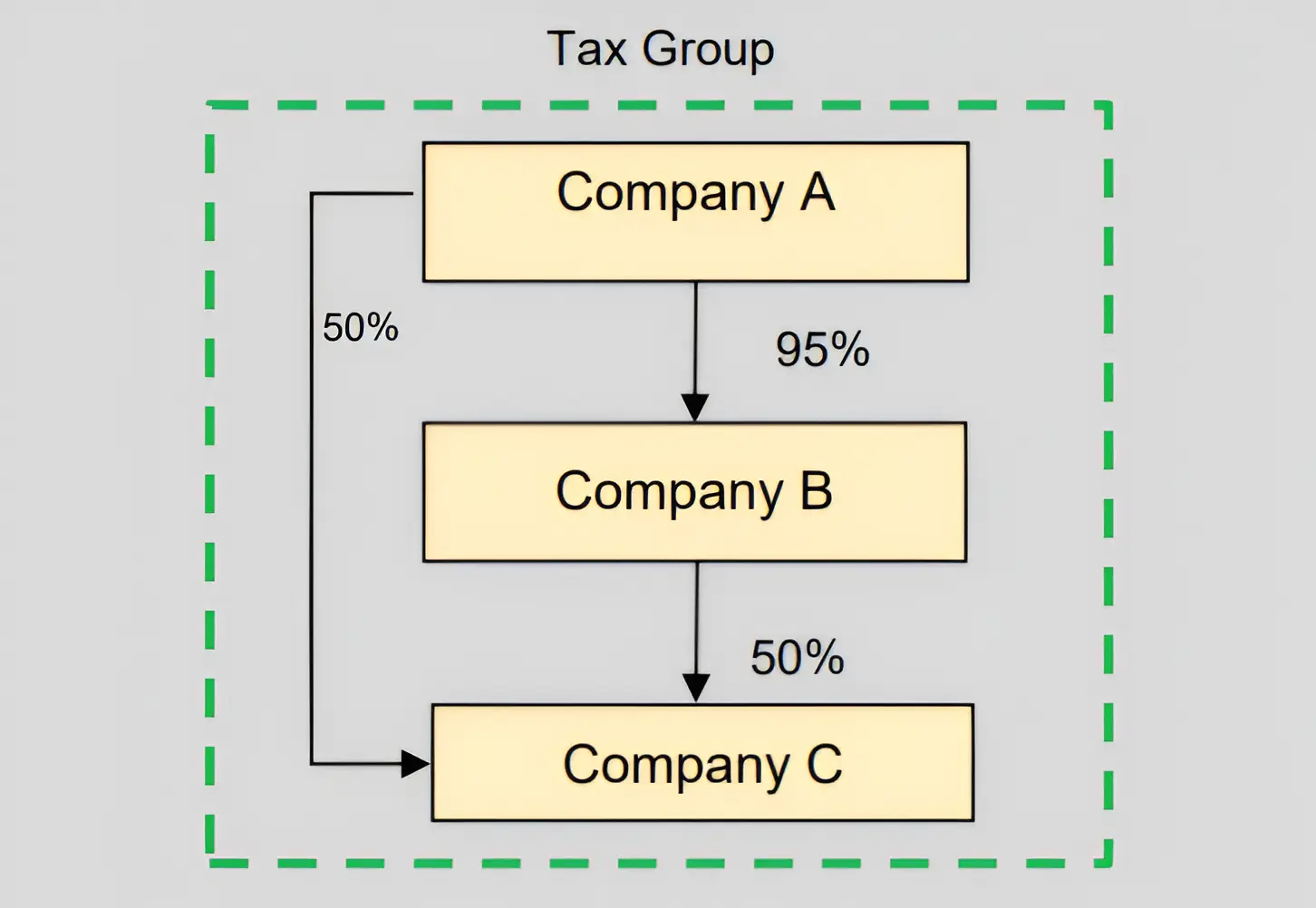

To determine the share capital ownership threshold, a direct ownership held by the Parent Company can be combined with any indirect shareholding or equivalent ownership interest held by a Subsidiary. The share capital ownership condition is met if total ownership (i.e. direct and indirect ownership) is 95% or more.

Example 6: Direct and indirect shareholding in a Subsidiary

Company A, Company B and Company C are all juridical Resident Persons. Company A wishes to form a Tax Group with Company B and Company C.

Company A holds 95% shares in Company B. Assuming all other conditions of Article 40(1) of the Corporate Tax Law are met, Company B qualifies as a Subsidiary. Company A can form a Tax Group with Company B.

Company A holds a 50% direct stake in Company C. The remaining 50% is held by Company B. Accordingly, Company A holds 47.5% (i.e. 95% of 50%) of the share capital of Company C indirectly through Company B (which is considered a Subsidiary of Company A). As a result, the total of Company A's direct (50%) and indirect (47.5%) ownership of the share capital of Company C is 97.5%. This means Company A meets the share capital ownership condition in respect of Company C. Assuming all other conditions of Article 40(1) of the Corporate Tax Law are met, Company C can also be a member of the Tax Group with Company A and Company B.

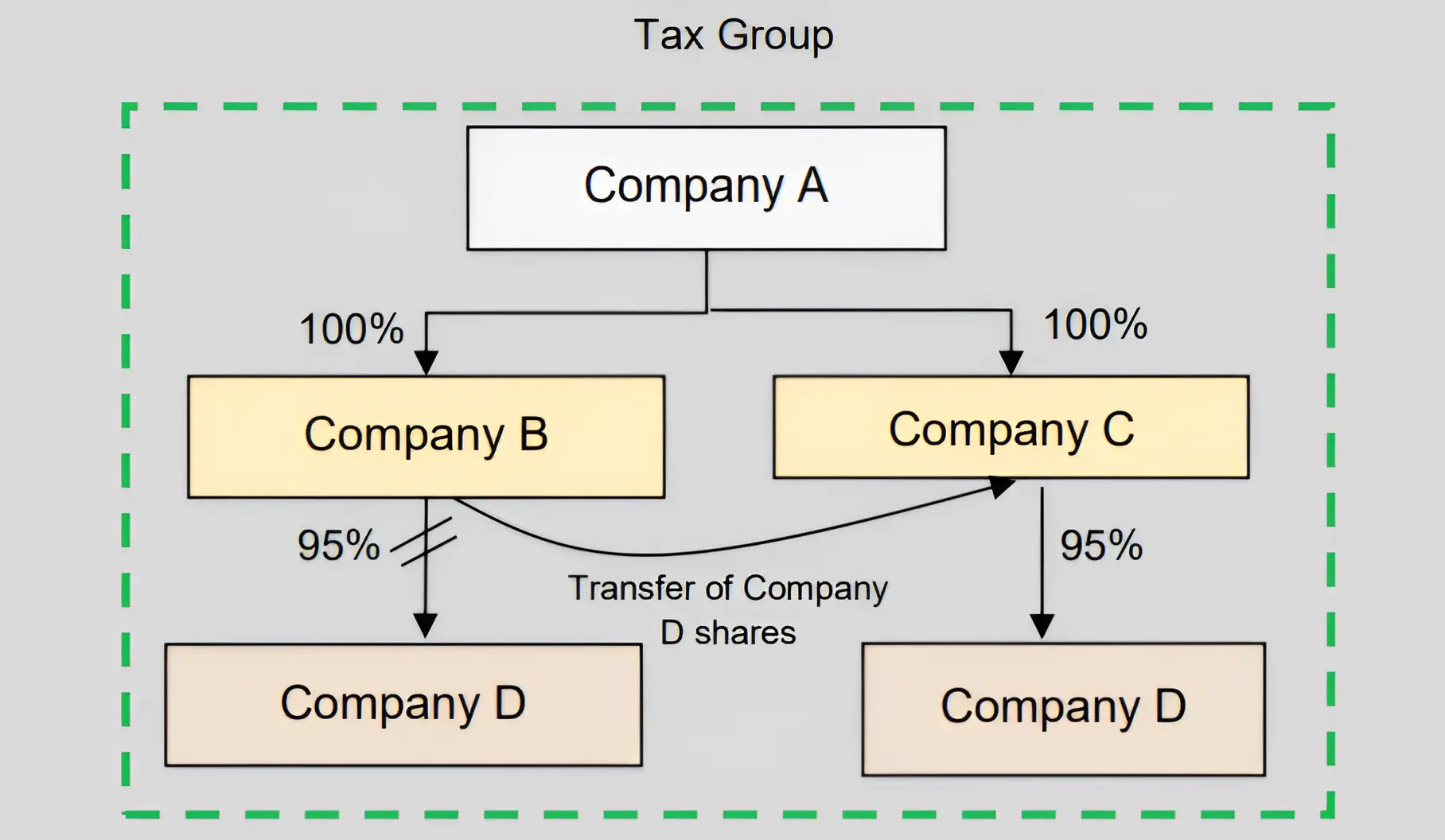

Transfer of shares between members of a Tax Group

The transfer of shares of a Subsidiary held by one member of a Tax Group to another member of the same Tax Group will not impact the share capital ownership condition provided the Parent Company continues to hold at least 95% share capital of that Subsidiary directly or indirectly through one or more Subsidiaries.

Example 7: Transfer of shares between members of a Tax Group

Company A, Company B, Company C and Company D are all juridical Resident Persons. Company A holds 100% of the shares in Company B and 100% of the shares in Company C. Company B holds 95% of the shares in Company D. All four companies have formed a Tax Group for the Tax Period beginning 1 January 2024.

On 1 December 2024, Company B transfers its 95% shares in Company D to Company C.

The share capital ownership condition requires that Company A continuously holds at least 95% of the share capital of Company D, either directly or indirectly. Company A's direct or indirect shareholding of Company D during the Tax Period beginning 1 January 2024 is as follows:

Before the transfer, Company A's indirect ownership of Company D was 95% (i.e. 100% of 95%).

After the transfer on 1 December 2024, Company A's indirect ownership remains at 95% (i.e. 100% of 95%).

As Company A has held an indirect ownership of at least 95% in Company D at all times throughout 2024, the share capital ownership condition has been met continuously for 2024. This means it is possible for Company D to remain a member of the Tax Group, provided all the other conditions continue to be met as well.

Transfer of shares outside the Tax Group

Transactions for the sale of shares between independent parties can be subject to a long negotiation process, usually resulting in the parties entering into a share purchase agreement (“signing”) and a transfer of the shares (“closing”). Signing and closing can occur on the same date or there can be a time gap between signing and closing.

In the case of a time gap, questions can arise on whether the buyer or seller of the shares can continuously meet the share capital ownership condition between signing and closing of a share purchase agreement. As discussed in Section 4.3.2, the owner for the purposes of the share capital ownership condition is the legal owner of the share capital. Whether the legal ownership is transferred from buyer to seller depends on the specifics of the share purchase agreement. As a principle, until such time as the legal title in the shares is transferred to the buyer, the seller should be considered as the legal owner of the shares. As a result, it is possible for the seller to meet the share capital ownership condition after signing. Once the legal title of shares is transferred to the buyer, the buyer will be the legal owner of the shares. After that date, it is possible for the buyer to meet the share capital ownership condition.

If a sale of all the shares in a Subsidiary happens within a Tax Period, neither the seller nor the purchaser of the shares can meet the share capital ownership condition for the entire Tax Period, except in a scenario where a new Parent Company can make an application to replace the existing Parent Company without a discontinuation of the Tax Group. [42]

Therefore, the Subsidiary is considered to leave the Tax Group as of the start of the Tax Period in which the share capital ownership condition was no longer met. [43]In addition, the purchaser would not be able to form a Tax Group for that Tax Period, as it has not met the share capital ownership condition continuously for the entire Tax Period.

If the other conditions are met, the purchaser may form a Tax Group with the Subsidiary from the next Tax Period.

Voting rights condition

General

The voting rights condition requires the Parent Company to hold at least 95% of the voting rights in the Subsidiary, either directly or indirectly through one or more Subsidiaries. [44] The condition is also met if the combination of direct and indirect entitlement to voting rights adds up to at least 95%. An indirect entitlement to voting rights is only considered if held through one or more intermediate Subsidiaries of the Parent Company.

Although the voting rights condition will often be met if the share capital ownership condition is met, voting rights need to be assessed independently and can produce different results if there are restrictions on voting rights or if voting rights do not fully align with nominal share capital ownership.

To determine this, voting rights on matters that require shareholder approval are relevant. Voting rights on matters that only require board approval are not relevant. What qualifies as a matter requiring shareholder approval would usually depend on the constitutive documents of the entity and any shareholder's agreement that sets out the rights, responsibilities, and obligations of the shareholders of the entity. Usually, matters such as appointment of directors, Dividends and the decision to wind up a juridical person require shareholder approval.

The voting rights condition is determined by whether the Parent Company and/or a relevant intermediary Subsidiary legally holds voting rights on shareholder matters.

A contractual agreement to vote in a certain way would not generally limit the legal right of a shareholder to vote. Similarly, appointing another person to vote on behalf of the shareholder through a proxy arrangement does not generally result in the shareholder losing its right to vote, as the proxyholder exercises the voting right on behalf of the shareholder. It is irrelevant for the voting rights condition whether the Parent Company and/or a relevant intermediary Subsidiary has exercised or regularly exercises its voting rights attached to the shares of the Subsidiary it owns.

Generally, voting rights are tied to the nominal value of share capital. Therefore, the voting rights condition will usually be met if the share capital ownership condition is met. However, some shares may not carry voting rights (non-voting shares) or carry extraordinary voting rights (see Section 4.4.2).

Where a Subsidiary has issued shares with voting rights as well as shares without voting rights, the latter should be excluded when determining whether the voting right condition has been met. This means that it is possible that the share capital ownership condition is met but the voting rights condition is not met.

Alternatively, where the Parent Company or a relevant intermediary Subsidiary transfers legal title to the shares in or interest to another Person while retaining the voting rights and entitlement to other benefits from such shares or interest, those voting rights would still count for the purposes of the voting right condition (even though the shares would not be counted for the share capital ownership condition (see Section 4.3.2)).

Extraordinary voting rights

Sometimes a juridical person issues shares which carry extraordinary voting rights to significant shareholders such as founders as compared to other shareholders. For instance, holders of these shares can have the right to appoint one board member or the right to veto certain important business decisions such as mergers, significant acquisitions and disposals or liquidation of the company.

If such shares are held by a minority shareholder holding a small stake of 5% or less, such shares do not automatically prevent the formation of a Tax Group. For instance, the right of a minority shareholder to appoint a board member does not jeopardise the voting rights condition, provided that the Parent Company and/or a relevant intermediary Subsidiary still has the ability to appoint a majority of the board members.

In addition, veto rights attached to certain shares do not prevent meeting the voting rights condition, provided that the Parent Company and/or a relevant intermediary Subsidiary continues to hold 95% of the voting rights on shareholder decisions. In other words, different classes of shares with different voting rights should generally not affect the voting right condition if the Parent Company can demonstrate that it directly or indirectly holds 95% or more of the total/overall statutory voting rights of the Subsidiary.

However, the above would need to be considered on a case-by-case basis depending on all the facts and circumstances.

Indirect holding of voting rights

The same principle as discussed above in relation to share capital ownership applies to determine the percentage of voting rights held directly or indirectly. In this regard, see Section 4.3.3 for situations where the Parent Company holds voting rights indirectly through Subsidiaries and how to determine the percentage of voting rights held by the Parent Company.

Profits and net assets condition

A Tax Group requires the Parent Company to have, either directly or indirectly, an entitlement to at least: [45]

95% of the Subsidiary's profits (herein referred to as the “profits condition”); and

95% of the Subsidiary's net assets (herein referred to as the “net assets condition”).

This means the condition is only met if both conditions are satisfied. Both conditions need to be assessed on the basis of the effective entitlement. Although the profits and net assets condition will often be met if the share capital ownership condition is met, the profits and net assets rights need to be assessed independently and can produce different results if contractual arrangements limit the rights to profits and net assets, or if the rights to profits and net assets do not fully align with nominal share capital ownership.

Profits condition

The profits condition requires that the Parent Company is, directly or indirectly, entitled to receive at least 95% of profits from the Subsidiary. This consists of distributable profits and profits that are not distributable. Distributable profits of a juridical person are determined by the corporate law and applicable legislation of the UAE or a foreign jurisdiction which governs the formation or existence of the Subsidiary.

Often distributable profits will be the accumulated realised net profits based on the applicable Accounting Standards. If certain profits are not available for distribution, such as those allocated to a (non-distributable) legal reserve, the shareholders can generally be considered to hold a right to such profits and the profits condition can be met if the Parent Company (whether directly, or indirectly through one or more Subsidiaries) holds at least 95% of the rights to such profits if they were to be distributed.

Any portion of share capital that is not held by the Parent Company or a relevant intermediary Subsidiary should be taken into account when assessing who would have the right to receive profit distributions.

Profit allocation can be determined by various factors, such as shareholder agreements, company bylaws, or specific arrangements made among the shareholders. Moreover, different classes of shares with different economic entitlement (e.g. Preferred Shares) may impact the actual entitlement of the Parent Company and/or a relevant intermediary Subsidiary. These factors can allow for different profit-sharing ratios from the shareholding/ownership percentages. Irrespective of the percentage of the legal ownership interest held by the Parent Company (whether directly, or indirectly through one or more Subsidiaries), the profits condition requires that the Parent Company is directly or indirectly entitled to at least 95% of the profits of the Subsidiary.

If a juridical person contractually agrees to share a portion of operational results with a third party, this would not necessarily reduce a shareholder's right to the profits, provided that the contractual entitlement is not an equity relationship. However, this would need to be determined based on the facts and circumstances in each case.

Entitlement to at least 95% of the Subsidiary's net assets

The net assets condition is tested as the direct or indirect entitlement to at least 95% of the net assets of the Subsidiary upon winding-up of the Subsidiary. [46]The net assets are defined by the value of the Subsidiary's total assets minus its total liabilities. In other words, the net assets of the Subsidiary upon liquidation after all creditors have been settled. The total amount of net assets equals the equity of the shareholders in the Subsidiary.

Impact of different share classes

If a company has several share classes with different economic entitlements, situations can occur where meeting the profits and net assets condition is not immediately obvious. This is illustrated in the example below.

Example 8: Profit distribution only to holders of Preferred Shares

Company C is incorporated in and tax resident of the UAE. The share capital of Company C is as follows:

Class of share | Number of shares issued | Nominal value per share (AED) | Total capital (AED) |

Ordinary Shares | 100 | 10 | 1,000 |

Preferred Shares | 1 | 50 | 50 |

Total | 101 | 1,050 |

All the Ordinary Shares are held by Company A and all Preferred Shares are held by Company B. Since Company B holds Preferred Shares, it enjoys priority in terms of entitlement to profits and liquidation proceeds ahead of owners of Ordinary Shares. Company C uses the Gregorian calendar year as its Financial Year.

In 2024, Company C reports profits of AED 3 million, which if distributed would be distributed AED 2.86 million (3 million*1000/1050) to Company A and AED 0.14 million (3 million*50/1050) to Company B. Company C distributes the full profits for 2024 on 1 March 2025.

In 2025, Company C makes AED 0.1 million profits which if distributed would be distributed fully to Company B since it holds Preferred Shares and hence enjoy priority over Company A during distribution of profit. No distribution is made during 2025.

In 2024, Company A meets the share capital ownership condition and profits condition. Company A would also meet the net assets condition, provided it would be entitled to at least 95% of the proceeds if Company C were to be liquidated.

Assuming all of the other conditions are also met, Company A can form a Tax Group with Company C as of 1 January 2024. The theoretical possibility that the 95% profits condition may not be met at a future point in time does not prevent the formation of a Tax Group for 2024.

However, in 2025, the profits condition is not met. Therefore, if a Tax Group was formed in 2024, it would cease to exist in 2025, effective from the beginning of the Tax Period in which the profits condition was not met, [47]i.e. from 1 January 2025.

The Tax Group shall notify the FTA within 20 business days of the date from which the conditions are no longer met. [48]As the entitlement of shareholders to profits can only be assessed at the end of the Financial Year, the Tax Group is required to notify the FTA within 20 business days of the end of the 2025 Financial Year.

Transfer of shares outside the Tax Group

In circumstances where a shareholder has entered into an agreement to sell its shares, it depends on the specifics of the share purchase agreement whether the economic entitlement is transferred from seller to buyer and from which date such a transfer is effective. As a general principle, the buyer will be considered entitled to the profits and net assets relating to the shares once the share purchase agreement has become unconditional. As of that moment, the buyer can meet the profits and net assets condition (assuming the shares transferred represent at least 95% entitlement to profits and net assets). That also means the seller no longer meets the profits and net assets condition as of that moment.

However, depending on the relevant facts and circumstances, if there are material conditions to be met that are not within the control of the buyer (for example, a regulatory approval or other approval by third parties), the buyer may not be effectively entitled to the profits and net assets relating to the shares transferred until such time that the material conditions are met. In each case, this will depend on the particular facts and circumstances.

Indirect holding of rights to profits or net assets

The same principles as discussed above in relation to share capital ownership and voting rights apply to determine the percentage of rights to profits and net assets held directly or indirectly. In this regard, see Section Error! Reference source not found. for situations where the Parent Company holds rights to profits or net assets indirectly through Subsidiaries and how to determine the percentage of rights to profits or net assets held directly or indirectly by the Parent Company.

Exempt Person condition and Qualifying Free Zone Person condition

General

A Tax Group is intended to allow for the grouping of entities which are subject to Corporate Tax in the same manner. In line with this principle, an Exempt Person or a Qualifying Free Zone Person cannot form or join a Tax Group. [49]

By contrast, a juridical Resident Person that is a Free Zone Person but not a Qualifying Free Zone Person can be a member of a Tax Group, whether as a Parent Company or as a Subsidiary, if the other conditions for forming or joining a Tax Group are met. The mere fact that a juridical person is incorporated or established in a Free Zone is not, in itself, a barrier to being a member of a Tax Group.

A branch of a Non-Resident Person could also fall within the definition of a Free Zone Person, if it is registered in a Free Zone. [50]However, a branch of a Non-Resident Person registered in a Free Zone cannot be a member of a Tax Group since it would not meet the juridical person condition, as the branch does not have a separate legal personality from its head office. The Non-Resident Person of which the branch is a part would also not meet the Resident Person condition. [51]

Where a member of a Tax Group becomes an Exempt Person during the relevant Tax Period, or is a Qualifying Free Zone Person for a Tax Period and does not elect to be subject to tax under Article 19 of the Corporate Tax Law, the Exempt Person condition or Qualifying Free Zone Person condition will no longer be met. As a result, the relevant member of the Tax Group shall be treated as leaving the Tax Group from the beginning of the Tax Period in which the event took place. [52]

In case the Parent Company becomes an Exempt Person, the Tax Group ceases to exist from the beginning of the Tax Period in which it becomes an Exempt Person, [53]and all members of the Tax Group will be subject to Corporate Tax on a standalone basis (also see Section 7), unless the Parent Company is replaced by another Parent Company that meets the conditions to form a Tax Group (see Section 6.4). [54]

Exception for Government Entities

There are scenarios where a Government Entity, is the shareholder of juridical Resident Persons. Because Government Entities are Exempt Persons, they cannot form or join a Tax Group as per the Exempt Person condition under the Tax Group regime.

However, taxable Subsidiaries of a Government Entity can form or join a Tax Group without the Government Entity, subject to meeting certain conditions. [55]

Small Business Relief

A Resident Person with Revenue below or equal to AED 3 million in a relevant Tax Period and all previous Tax Periods can elect for Small Business Relief. [56]As a Tax Group will be treated as a single Taxable Person, Small Business Relief applies to the Tax Group rather than to the individual members of the Tax Group. This means the Revenue threshold for Small Business Relief applies to the consolidated Revenue of the Tax Group, and not to each member individually.

If a juridical Resident Person that is eligible for Small Business Relief during the relevant Tax Period joins a Tax Group, it will no longer be eligible for Small Business Relief on a standalone basis as the Tax Group is treated as a single Taxable Person. The Small Business Relief would be applicable at the level of that single Taxable Person (i.e. the Tax Group) if the relevant conditions are met. Therefore, the Tax Group can only benefit from the Small Business Relief if on a consolidated basis:

The Tax Group has a Revenue below or equal to AED 3 million in a relevant Tax Period and all previous Tax Periods; [57]and

None of the members of the Tax Group is a Constituent Company of a Multinational Enterprises Group that is required to prepare a Country-by-Country Report under the UAE's Country-by-Country Reporting legislation. [58]

Example 9: Tax Group applies Small Business Relief

In the current Tax Period, Company A, Company B and Company C form a Tax Group with Company A as the Parent Company, assuming that all other conditions are met. All three entities were formed in the current Tax Period.

The Revenue of the members of the Tax Group in the current Tax Period, after eliminating Revenues earned from member of Tax Group, is as follows:

Company A: AED 1 million

Company B: AED 2 million

Company C: AED 0.5 million

The Revenue of each member of the Tax Group on a standalone basis does not exceed AED 3 million in the relevant Tax Period or previous Tax Periods. However, the Small Business Relief is not available to the Tax Group since the total Revenue of the Tax Group (AED 1 million + AED 2 million + AED 0.5 million=AED 3.5 million) exceeds the AED 3 million threshold.

Financial Year condition

General

A key aim of the Tax Groups regime is to reduce the number and overall burden of tax filings. For example, Taxable Persons might have different Financial Years which would require the apportionment of results and thus add a layer of complexity. Therefore, a Tax Group requires all members to have the same Financial Year [59]and have the same Tax Period. [60]

In the UAE Corporate Tax Law, the Financial Year is defined as either the Gregorian calendar year (beginning on 1 January and ending on 31 December) or a 12-month period for which Financial Statements according to the applicable Accounting Standards are prepared. [61]

If the Parent Company of a Tax Group wants to change its Financial Year, all members of the Tax Group would need to change their Financial Year simultaneously as well for the Tax Group to continue existing. If some but not all of the Tax Group members change their Financial Year, the Financial Year condition will no longer be met in relation to those members that have a different Financial Year from the Parent Company. Accordingly, the members will leave the Tax Group.

Newly established juridical person joining a Tax Group

A newly established juridical person can join an existing Tax Group from the date of incorporation if the conditions of Article 40(1) of the Corporate Tax Law are met from the date of incorporation onwards. [62]The Financial Year condition can be met provided the end date of the Financial Year of the newly established juridical person joining the Tax Group is aligned with that of the existing members of the Tax Group. This means that if the other conditions are met, a newly established juridical person can join a Tax Group from the date of its incorporation, and it does not have to wait until the start of the Tax Group's next Tax Period. However, if the Financial Year of the newly incorporated juridical person differs from the Financial Year of the Tax Group upon incorporation, it cannot join the Tax Group as of the date of incorporation. It will need to first change its Financial Year to align with the existing Tax Group members.

Change of Tax Period in order to form or join a Tax Group

If a juridical Resident Person meets all the conditions for forming or joining a Tax Group except for the Financial Year condition, that person can make an application to the FTA to change the start and end date of its Tax Period, or use a different Tax Period [63]and align their Financial Year (i.e. the start and end date of a financial reporting period) so that a Tax Group can then be formed or that person can join an existing Tax Group.

The FTA shall allow that Person to change its Tax Period to align Financial Years for the purpose of forming a Tax Group or joining an existing Tax Group [64] provided the Tax Period is not extended to more than 18 months or reduced to less than 6 months. [65]However, Taxable Persons cannot change their Tax Period end date to a date that none of the intended Tax Group members apply, if forming a Tax Group is the sole purpose for the change in Tax Period. For instance, if the conditions for forming a Tax Group are first met on 1 March of a given year, and the entities have a Financial Year ending on 31 December each year, it will ordinarily not be possible to form a Tax Group until 1 January of the following year as the conditions were not met continuously throughout the relevant Tax Period. Unless there are valid commercial, economic or legal reasons to change the Tax Period, the companies involved cannot change their Financial Year to start a new Tax Period as per an earlier date.

Example 10: Change of Tax Period to form a Tax Group

Company A has a Gregorian calendar year end (31 December). Company B has a Financial Year that ends on 31 August. On 3 May 2024, Company A buys all the shares in Company B.

Company A could change its Financial Year end to 31 August and consequently change its Tax Period with the approval of the FTA to allow formation of a Tax Group with Company B effective from 1 September 2025.

Alternatively, after 3 May 2024, Company B could change its Financial Year to Gregorian calendar year with the approval of the FTA to allow Company B to form a Tax Group with Company A effective from 1 January 2025.

Company A and Company B can form a Tax Group, with approval from the FTA, when both companies have the same Financial Year.

Accounting Standards condition

Under this condition, all members of the Tax Group must prepare their Financial Statements using the same Accounting Standards. [66] For the purposes of the UAE Corporate Tax Law, a Taxable Person is required to prepare Financial Statements based on IFRS. Where the Revenue of the Taxable Person does not exceed AED 50 million, they may choose to apply IFRS for SMEs instead. [67]

Tax Groups are required to prepare consolidated Financial Statements using the above Accounting Standards for the purpose of determining the Taxable Income of a Tax Group. [68]For this purpose, the standalone Financial Statements of the Parent Company and each Subsidiary that is a member of the Tax Group must be consolidated by way of aggregation, generally eliminating any transactions between the members of the Tax Group. [69] If the consolidated Revenue of the Tax Group exceeds AED 50 million during the relevant Tax Period, such Financial Statements of the Tax Group are required to be audited. [70]However, the Corporate Tax Law does not require the separate Financial Statements of the Parent Company and Subsidiary members to be audited, even when a member's Revenue exceeds AED 50 million.

All members of the Tax Group must use the same Accounting Standards for the relevant Tax Period in which the Tax Group is formed. This condition would not be met if one juridical Resident Person uses IFRS and another juridical Resident Person uses IFRS for SMEs. If one juridical Resident Person preparing its Financial Statements based on IFRS for SMEs wants to join a Tax Group whose members are preparing Financial Statement based on IFRS, that juridical person would need to prepare its Financial Statement based on IFRS in order to be able to join the Tax Group.

The Accounting Standards condition does not explicitly require all the members to follow the same accounting policy in the standalone Financial Statements. However, for the purposes of preparing the Financial Statements of the Tax Group, a single accounting policy consistent with the applicable Accounting Standard will need to be applied by all members of the Tax Group.

Although a Tax Group may have consolidated Financial Statements that are already available for financial reporting purposes, the consolidated Financial Statements used for the purposes of determining the Taxable Income of the Tax Group for Corporate Tax purposes should cover, and be accompanied by, a statement that aggregates the standalone Financial Statements of all entities included in the Tax Group and no other entities.

Forming a Tax Group and tax compliance obligations

Application to FTA to form a Tax Group

Once the relevant conditions are met, the Parent Company can form a Tax Group with its Subsidiaries. In such a case, the Parent Company and each Subsidiary seeking to become members of the Tax Group shall jointly make an application to the FTA. [71]This application should also specify the first intended Tax Period of the Tax Group. A request should be filed before the end of the Tax Period for which the formation of the Tax Group is requested. [72]In principle, the Tax Group will be formed from the beginning of the Tax Period specified in the application, but the FTA has the right to determine the Tax Period from which a Tax Group may be formed, even if this differs from the date requested in the application. [73]