Determination of Taxable Income

Corporate Tax Guide | CTGDTI1

July 2024

Contents

3. Determination of Taxable Income and calculation of Corporate Tax Payable – An Overview

4. Determination of Taxable Income and calculation of Corporate Tax Payable – Key concepts

4.1. Starting point for determination of Taxable Income

4.3. Unrealised gains and losses

4.5. Deductible and non-deductible expenditure

4.5.1. Expenditure incurred wholly and exclusively for the Business

4.5.2. Employment related expenditure

4.5.3. Expenditure incurred in deriving Exempt Income

4.5.4. Expenditure incurred for more than one purpose

4.5.5. Non-arm's length expenditure

4.5.7. Pre-incorporation or pre-trade expenses

4.5.8. Creation & reversal of provisions (bad debts, write-off and recovery)

4.6. General Interest Deduction Limitation Rule

4.6.2. Application of the General Interest Deduction Limitation Rule

4.6.3. Calculation of Net Interest Expenditure

4.6.4. Calculation of 30% of adjusted EBITDA

4.6.5. Exceptions to the General Interest Deduction Limitation Rule

5. Case Study 1: Deductible and non-deductible expenditure

5.2. Determining Taxable Income and calculating Corporate Tax Payable

5.3.1. Expenditure incurred wholly and exclusively for the purpose of the Business

5.3.2. Capital vs revenue expenditure

5.3.3. Expenditure not incurred for the purpose of Business

5.3.4. Expenditure incurred for more than one purpose

5.3.5. Entertainment expenditure

5.3.7. Fines, penalties and compensation

5.3.8. Bribes, illicit payments

5.3.9. Payments to Connected Persons

5.3.11. Contributions to a private pension fund

6. Case Study 2: Interest expenditure

7. Case Study 3: Tax Loss relief

8. Case Study 4: Interest expenditure and Tax Loss relief

9. Case Study 5: Transfer of Tax Loss and limitation on Tax Loss carried forward

10. Case Study 6: Cash Basis of Accounting

10.2. Determining Taxable Income and calculating Corporate Tax Payable

11. Case Study 7a: Unrealised gains and losses, Exempt Income

12. Case Study 7b: Foreign Permanent Establishment

13. Case Study 8: Non-Resident Person conducting Business in the UAE

Glossary

Accounting Income | : | The accounting net profit or loss for the relevant Tax Period as per the Financial Statements prepared in accordance with the provisions of Article 20 of the Corporate Tax Law. |

Accounting Standards | : | The accounting standards specified in Ministerial Decision No. 114 of 2023. |

Accrual Basis of Accounting | : | An accounting method under which the Taxable Person recognises income when earned and expenditure when incurred. |

AED | : | The United Arab Emirates dirham. |

Authority | : | Federal Tax Authority. |

Bank | : | A Person licensed in the UAE as a bank or finance institution or an equivalent licensed activity that allows the taking of deposits and the granting of credits as defined in the applicable legislation of the UAE. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Business Restructuring Relief | : | A relief from Corporate Tax for Business restructuring transactions, available under Article 27 of the Corporate Tax Law and as specified under Ministerial Decision No. 133 of 2023. |

Cash Basis of Accounting | : | An accounting method under which the Taxable Person recognises income and expenditure when cash payments are received and paid. |

Connected Person | : | Any Person affiliated with a Taxable Person as determined in Article 36(2) of the Corporate Tax Law. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Corporate Tax Payable | : | Corporate Tax that has or will become due for payment to the FTA in respect of one or more Tax Periods. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return on capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Financial Statements | : | A complete set of statements as specified under the Accounting Standards applied by the Taxable Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity, and cash flow statement. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

Foreign Permanent Establishment | : | A place of Business or other form of presence outside the UAE of a Resident Person that is determined in accordance with the criteria prescribed in Article 14 of the Corporate Tax Law. |

Foreign Tax Credit | : | Tax paid under the laws of a foreign jurisdiction on income or profits that may be deducted from the Corporate Tax due, in accordance with the conditions of Article 47(2) of the Corporate Tax Law. |

Free Zone Person | : | A juridical person incorporated, established, or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

FTA | : | Federal Tax Authority, being the Authority responsible for the administration, collection, and enforcement of federal taxes in the UAE. |

Functional Analysis | : | The analysis aimed at identifying the economically significant activities and responsibilities (functions) undertaken, assets used or contributed, and risks assumed by the parties to the transactions. |

General Interest Deduction Limitation Rule | : | The limitation provided under Article 30 of the Corporate Tax Law. |

IFRS | : | International Financial Reporting Standards. |

IFRS for SMEs | : | International Financial Reporting Standard for small and medium-sized entities. |

Immovable Property | : | Means any of the following:

|

Insurance Provider | : | A Person licensed in the UAE as an insurance provider that accepts risks by entering into or carrying out contracts of insurance, in both the life and non-life sectors, including contracts of reinsurance and captive insurance, as defined in the applicable legislation of the UAE. |

Interest | : | Any amount accrued or paid for the use of money or credit, including discounts, premiums and profit paid in respect of an Islamic Financial Instrument and other payments economically equivalent to interest, and any other amounts incurred in connection with the raising of finance, excluding payments of the principal amount. |

Islamic Financial Instrument | : | A financial instrument which is in compliance with Sharia principles and is economically equivalent to any instrument provided for under Article 2(2) of Ministerial Decision No. 126 of 2023, or a combination thereof. |

Market Value | : | The price which could be agreed in an arm's-length free market transaction between Persons who are not Related Parties or Connected Persons in similar circumstances. |

Minister | : | Minister of Finance. |

Net Interest Expenditure | : | The Interest expenditure amount that is in excess of the Interest income amount as determined in accordance with the provisions of the Corporate Tax Law. |

Non-Free Zone Person | : | Any Person who is not a Free Zone Person. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Participating Interest | : | An ownership interest in the shares or capital of a juridical person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Participation | : | The juridical person in which the Participating Interest is held. |

Participation Exemption | : | An exemption from Corporate Tax for income from a Participating Interest, available under Article 23 of the Corporate Tax Law and as specified under Ministerial Decision No. 116 of 2023. |

Pension Plan | : | A contract having an explicit objective of providing benefits upon a defined retirement age in the UAE, prior to which the benefits cannot be paid without incurring a significant contractual penalty. It may also provide benefits in cases of disability and death. |

Pension Plan Member | : | A natural person who is making contributions, or on behalf of whom contributions are being made, to a private pension fund and is accumulating assets or entitlements in the private pension fund. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Qualifying Free Zone Person | : | A Free Zone Person that meets the conditions of Article 18 of the Corporate Tax Law and is subject to Corporate Tax under Article 3(2) of the Corporate Tax Law. |

Qualifying Group | : | Two or more Taxable Persons that meet the conditions of Article 26(2) of the Corporate Tax Law. |

Qualifying Group Relief | : | A relief from Corporate Tax for transfers within a Qualifying Group, available under Article 26 of the Corporate Tax Law and as specified under Ministerial Decision No. 132 of 2023. |

Qualifying Income | : | Any income derived by a Qualifying Free Zone Person that is subject to Corporate Tax at the rate specified in Article 3(2)(a) of the Corporate Tax Law. |

Qualifying Infrastructure Project | : | A project that meets the conditions of Article 14 of Ministerial Decision No. 126 of 2023. |

Qualifying Infrastructure Project Person | : | A Resident Person that meets the conditions of Article 14(2) of Ministerial Decision No. 126 of 2023. |

Qualifying Public Benefit Entity | : | Any entity that meets the conditions set out in Article 9 of the Corporate Tax Law and that is listed in a decision issued by the Cabinet at the suggestion of the Minister. |

Recognised Stock Exchange | : | Any stock exchange established in the UAE that is licensed and regulated by the relevant competent authority, or any stock exchange established outside the UAE of equal standing. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023. |

Specific Interest Deduction Limitation Rule | : | The limitation provided under Article 31 of the Corporate Tax Law. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax Loss | : | Any negative Taxable Income as calculated under the Corporate Tax Law for a given Tax Period. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Transfer Pricing | : | Rules on setting of arm's length prices for controlled transactions, including but not limited to the provision or receipt of goods, services, loans, and intangibles. |

Turnover | : | The gross amount of income derived during a Gregorian calendar year. |

UAE | : | United Arab Emirates. |

Unincorporated Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE. |

Withholding Tax | : | Corporate Tax to be withheld from State Sourced Income in accordance with Article 45 of the Corporate Tax Law. |

Withholding Tax Credit | : | The Corporate Tax amount that can be deducted from the Corporate Tax due in accordance with the conditions of Article 46 of the Corporate Tax Law. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments ('Corporate Tax Law') was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ('UAE') on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits ('Corporate Tax') in the UAE.

The provisions of the Corporate Tax Law apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance to Taxable Persons for determining their Taxable Income and calculating their Corporate Tax Payable under the Corporate Tax Law. It provides readers with an overview of:

The adjustments required to be made to the Accounting Income for determining the Taxable Income under the Corporate Tax Law, and

The adjustments required to be made to the Taxable Income for calculating the Corporate Tax Payable under the Corporate Tax Law.

Specific aspects of the Corporate Tax Law, which are covered in detail in other guides, are not covered here. The FTA has published a number of subject-specific Corporate Tax guides including on Tax Groups, Unincorporated Partnerships, Small Business Relief, Free Zone Persons, Extractive Business and Non-Extractive Natural Resource Business, Qualifying Group Relief, Business Restructuring Relief, and Transfer Pricing.

Who should read this guide?

The guide should be read by any Person who wants to know how to determine Taxable Income and calculate the Corporate Tax Payable. It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, examples have been used to illustrate how key elements of the Corporate Tax Law apply to a Taxable Person for determining their Taxable Income and calculating their Corporate Tax Payable. The examples in the guide:

Show how these elements operate in isolation and do not show all the possible interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes, and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 8 of 2017 on Value Added Tax and its amendments is referred to as “Federal Decree-Law No. 8 of 2017”,

Federal Decree-Law No. 32 of 2021 on Commercial Companies is referred to as “Federal Decree-Law No. 32 of 2021”,

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as “Corporate Tax Law”,

Federal Law No. 41 of 2023 on the Regulation of the Auditing Profession is referred to as “Federal Law No. 41 of 2023”,

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that are Subject to Corporate Tax is referred to as “Cabinet Decision No. 49 of 2023”,

Cabinet Decision No. 56 of 2023 on Determination of a Non-Resident Person's Nexus in the State for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Cabinet Decision No. 56 of 2023”,

Ministerial Resolution No. 403 of 2015 Concerning the International Standards of the Auditing Profession is referred to as “Ministerial Resolution No. 403 of 2015”,

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 73 of 2023”,

Ministerial Decision No. 82 of 2023 on the Determination of Categories of Taxable Persons Required to Prepare and Maintain Audited Financial Statements for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 82 of 2023”,

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 114 of 2023”,

Ministerial Decision No. 115 of 2023 on Private Pension Funds and Private Social Security Funds for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 115 of 2023”,

Ministerial Decision No. 116 of 2023 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 116 of 2023”,

Ministerial Decision No. 120 of 2023 on the Adjustments Under the Transitional Rules for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 120 of 2023”,

Ministerial Decision No. 126 of 2023 on the General Interest Deduction Limitation Rule for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 126 of 2023”,

Ministerial Decision No. 132 of 2023 on Transfers Within a Qualifying Group for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 132 of 2023”,

Ministerial Decision No. 133 of 2023 on Business Restructuring Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 133 of 2023”,

Ministerial Decision No. 134 of 2023 on the General Rules for Determining Taxable Income for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 134 of 2023”, and

Federal Tax Authority Decision No. 5 of 2023 on Conditions for Change in Tax Period for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “FTA Decision No. 5 of 2023”.

Status of this guide

This guidance is not a legally binding document, but is intended to provide assistance in understanding the tax implications of the Corporate Tax regime in the UAE. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax in the UAE. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Determination of Taxable Income and calculation of Corporate Tax Payable – An Overview

Introduction

Under the UAE Corporate Tax Law, the starting point for determining Taxable Income is the Accounting Income. This is the accounting net profit or loss for a relevant Tax Period, based on the Financial Statements prepared in accordance with IFRS, or IFRS for small and medium-sized entities (IFRS for SMEs) or as per the income and expenditure statement maintained by Taxable Persons that follow the Cash Basis of Accounting.

The Accounting Income is subject to adjustments, which are set out in Article 20(2) of the Corporate Tax Law, in order to determine the Taxable Income for Corporate Tax purposes.

Determining Taxable Income

An illustrative list of the adjustments that may be relevant in determining Taxable Income is as follows:

Adjust | Item | Amount (AED) | Legal Reference [1] |

Accounting Income of the Taxable Person | xxx | ||

+/- | Unrealised gain or loss (if election made) | ... | 20(2)(a) |

+/- | Exempt Income (and exempt losses): | ... | 20(2)(b) |

| |||

| |||

| |||

+/- | Reliefs: | 20(2)(c) | |

| ... | ||

| ... | ||

+ | Non-deductible expenditure: | ... | 20(2)(d) |

| |||

| |||

| |||

| |||

| |||

| |||

+/- | Adjustments for Related Party transactions not at arm's length | ... | 20(2)(e) |

- | Incentives/special reliefs (none at present) | ... | 20(2)(g) |

+/- | Adjustments specified in a Ministerial Decision[2] | ... | 20(2)(i) |

Taxable Income before Tax Loss relief | xxx/(xxx) | ||

- | Tax Loss relief set-off (see table below) | (xx) | 20(2)(f) |

Taxable Income subject to Corporate Tax | xxx/(xxx) | ||

Calculation of Tax Loss relief | |||

Adjust | Item | Amount (AED) | Legal Reference |

- | Tax Loss brought forward | xxx | 20(2)(f) |

+ | Tax loss transferred to another Taxable Person (if applicable) | xxx | |

- | Tax Loss received from another Taxable Person (if applicable) | xxx | |

Subtotal: Tax Losses | xxx | ||

Tax Loss available to set-off, subject to 75% of the Taxable Income before Tax Loss relief | xxx | ||

The above list is not exhaustive, and further adjustments may be required according to the Taxable Person's specific circumstances.

Calculation of Corporate Tax Payable

Once the Taxable Income for the relevant Tax Period has been determined, it is subject to Corporate Tax at the following rates:[3]

0% on the portion of the Taxable Income not exceeding AED 375,000.

9% on the portion of the Taxable Income exceeding AED 375,000.

A Qualifying Free Zone Person is subject to Corporate Tax at the following rates:[4]

0% on the Qualifying Income.

9% on the Taxable Income that is not Qualifying Income.

This guide will be relevant to a Qualifying Free Zone Person to the extent it has Taxable Income that is not Qualifying Income.

The Corporate Tax liability is first reduced by any Withholding Tax Credit,[5]followed by Foreign Tax Credit,[6]in order to calculate the Corporate Tax Payable or refundable.[7]

The current Withholding Tax rate applicable in the UAE is 0%. However, until the categories of income that are subject to Withholding Tax are specified in a Cabinet Decision, which is not yet issued, Withholding Tax is not applicable in the UAE.

The following table illustrates this:

Adjust | Item | Amount (AED) | Legal Reference[8] |

Taxable Income subject to Corporate Tax | xxx/(xxx) | ||

0% up to AED 375,000 | 0 | 3(1) | |

9% above AED 375,000 | xxx/0 | ||

Corporate Tax liability | xxx/(xxx) | ||

- | Withholding Tax Credit | ... | 44 |

- | Foreign Tax Credit (under Article 47 of the Corporate Tax Law, or under the relevant Double Taxation Agreement) | (xxx) | |

Corporate Tax Payable/(refundable) | xxx/(xxx) | ||

Overview of case studies

This guide covers key concepts for the determination of Taxable Income along with 9 case studies in Chapters 5 to 13 to further illustrate some of these concepts. Each case study provides an illustrative extract of financial information from the Financial Statements for the purposes of demonstrating the principles of the Corporate Tax Law. The extracts are not intended to represent the complete Financial Statements or the FTA's view on the application of Accounting Standards.

The guide is not intended to provide a detailed discussion on concepts or topics already covered in other guides.

The case studies in this guide cover the following concepts.

Case Study 1: | Deductible and non-deductible expenditure This case study covers the adjustments to be made to Accounting Income relating to deductible and non-deductible expenditure (excluding Interest deduction limitation rules). |

Case Study 2: | Interest expenditure This case study covers the adjustments to be made to Accounting Income relating to Interest expenditure. It covers the applicability of the General and Specific Interest Deduction Limitation Rules (i.e. deductible and non-deductible Interest expenditure and the treatment of disallowed/unutilised Net Interest Expenditure). |

Case Study 3: | Tax Loss relief This case study covers the adjustments to be made to Accounting Income relating to Tax Loss relief and the treatment of unutilised Tax Losses. |

Case Study 4: | Interest expenditure and Tax Loss relief This case study covers the adjustments to be made to Accounting Income in a situation where there is both unutilised/carried forward Net Interest Expenditure and Tax Losses. |

Case Study 5: | Transfer of Tax Loss and limitation on Tax Loss carried forward This case study covers the application of provisions relating to the transfer of a Tax Loss and the limitation on the use of Tax Loss carried forward. |

Case Study 6: | Cash Basis of Accounting This case study covers the determination of Taxable Income and calculation of Corporate Tax Payable in the case of a Taxable Person having Revenue equal to or less than AED 3 million and applying the Cash Basis of Accounting. |

Case Study 7a: | Unrealised gains and losses, Exempt Income This case study covers the adjustments to be made to Accounting Income for unrealised gains or losses, and for Exempt Income (such as Dividends, income from Participating Interests) including expenditure incurred in earning Exempt Income. |

Case Study 7b: | Foreign Permanent Establishment This case study covers the adjustments to be made to Taxable Income in relation to the Foreign Permanent Establishment exemption. |

Case Study 8: | Non-Resident Person conducting Business in the UAE through a Permanent Establishment This case study covers the determination of Taxable Income and calculation of Corporate Tax Payable in the case of a Non-Resident Person operating in the UAE through a Permanent Establishment. |

Determination of Taxable Income and calculation of Corporate Tax Payable – Key concepts

This section provides a broad overview of the most common concepts under the Corporate Tax Law which are relevant for determination of Taxable Income and calculation of Corporate Tax Payable. The practical application of these concepts is discussed from Section 5 onwards in various case studies.

The selected topics are not exhaustive. Therefore, Taxable Persons are advised to read this guide along with the General Guide on Corporate Tax and/or other subject-specific guides which may be applicable depending on the Taxable Person's facts and circumstances.

Starting point for determination of Taxable Income

Financial Statements are a set of documents that record the activities and financial performance of a Business and are a key element of the Taxable Income calculation. A Taxable Person's Accounting Income (accounting net profit or loss) as stated in the Financial Statements is used as the starting point for determining Taxable Income.

Taxable Persons that earn Revenue that does not exceed AED 3 million in a Tax Period may use the Cash Basis of Accounting.[9]Once a Taxable Person's Revenue exceeds AED 3 million in a Tax Period, they must prepare Financial Statements using the Accrual Basis of Accounting, except under exceptional circumstances and following the FTA's approval.[10]The Revenue amount (of AED 3 million) must be considered in line with the arm's length standard.

Taxable Persons must prepare Financial Statements in accordance with IFRS. However, Taxable Persons that earn Revenue that does not exceed AED 50 million may apply IFRS for SMEs. [11]The Revenue amount (of AED 50 million) must be considered in line with the arm's length standard.

Additionally, Taxable Persons deriving Revenue exceeding AED 50 million during the relevant Tax Period are required to maintain audited Financial Statements.[12]

For companies incorporated in the UAE, (or operating in the UAE through a Permanent Establishment situated in the UAE), the audit must be performed by a UAE-registered auditor, pursuant to Federal Law No. 41 of 2023 on the Regulation of the Auditing Profession and its amendments, read together with Ministerial Resolution No. 403 of 2015 concerning the International Standards for the Auditing Profession, or any other applicable legislation.

Tax Period

The Tax Period for a Taxable Person (other than a natural person) is their Financial Year, or part thereof, for which a Tax Return is required to be filed. This usually means the 12-month period for which they prepare their Financial Statements.

Where a Taxable Person (other than a natural person) applies to the FTA to change its Tax Period, the first Tax Period resulting from such change, may not be shorter than six months or longer than 18 months.

The Tax Period of a Taxable Person that is a natural person is always the Gregorian calendar year, i.e. 1 January to 31 December. Regardless of when a natural person commences Business during a particular year, their Tax Period will be the Gregorian calendar year (i.e. the 12-month period from 1 January to 31 December) in which they (i) commenced Business and (ii) their Turnover exceeds AED 1 million.

The first Tax Period for natural persons is the 12-month period starting from 1 January 2024 to 31 December 2024.

Unrealised gains and losses

It is common for assets or liabilities held by a Business to change in value for accounting purposes, even where no transactions have taken place. For example, assets on the balance sheet may be revalued, or holdings of foreign currencies or loan liabilities denominated in a foreign currency may fluctuate with exchange rates.

As the value of an asset or liability changes, gains or losses could arise even where there has been no actual disposal or transfer (i.e. 'realisation') of the asset or liability. Taxable Persons are required to include any realised and unrealised gains and losses reported in the Financial Statements in the determination of their Taxable Income. This is unless the election to use the realisation basis is made, in which case only the realised gains and losses are considered in the determination of Taxable Income.

In addition, any realised or unrealised gains and losses that are reported in the Financial Statements, insofar as they would not be subsequently recognised in the statement of income, must also be taken into account in the determination of Taxable Income.[13]By way of example, if an amount of income is not recognised in the income statement, but is reflected in the statement of comprehensive income in the Financial Statements, then such income may need to be taken into account in the determination of Taxable Income.

Election to use the realisation basis

For the purpose of determining Taxable Income, Businesses that prepare Financial Statements using the Accrual Basis of Accounting may elect to take into account gains and losses on a realisation basis.[14]Broadly, this election can be made either in relation to all assets and liabilities that are subject to fair value or impairment accounting under the applicable Accounting Standards (i.e. IFRS or IFRS for SMEs), or only for assets that are held on capital account.[15]

An election to apply the realisation basis must be made by the Taxable Person during the first Tax Period. The election is irrevocable except under exceptional circumstances, pursuant to approval by the FTA.[16]If the Taxable Person does not make the election to apply the realisation basis in their first Tax Period, then this will be considered an irrevocable election in itself.

Refer to Section 11 (Case Study 7a) for details on the treatment of unrealised gains or losses while determining Taxable Income.

Exempt Income

Several income exemptions are provided for within the Corporate Tax regime.[17]The purpose of these exemptions is to either:

Exempt the income arising from ownership interests in another juridical person or a Foreign Permanent Establishment on the basis that it has already been taxed, or

Align the UAE Corporate Tax treatment with international standards, and in particular, in relation to the taxation of international transportation.

Generally, in the absence of a specific provision to the contrary, these exemptions are symmetrical. This means that, typically, expenditure incurred in deriving Exempt Income cannot be deducted for Corporate Tax purposes.[18]

Domestic Dividends

Dividends, and other profit distributions, received from a juridical person that is a Resident Person are exempt from Corporate Tax.[19]There are no additional conditions that a Taxable Person has to meet in order to benefit from this exemption.

Participation Exemption

Dividends and other profit distributions from foreign juridical persons

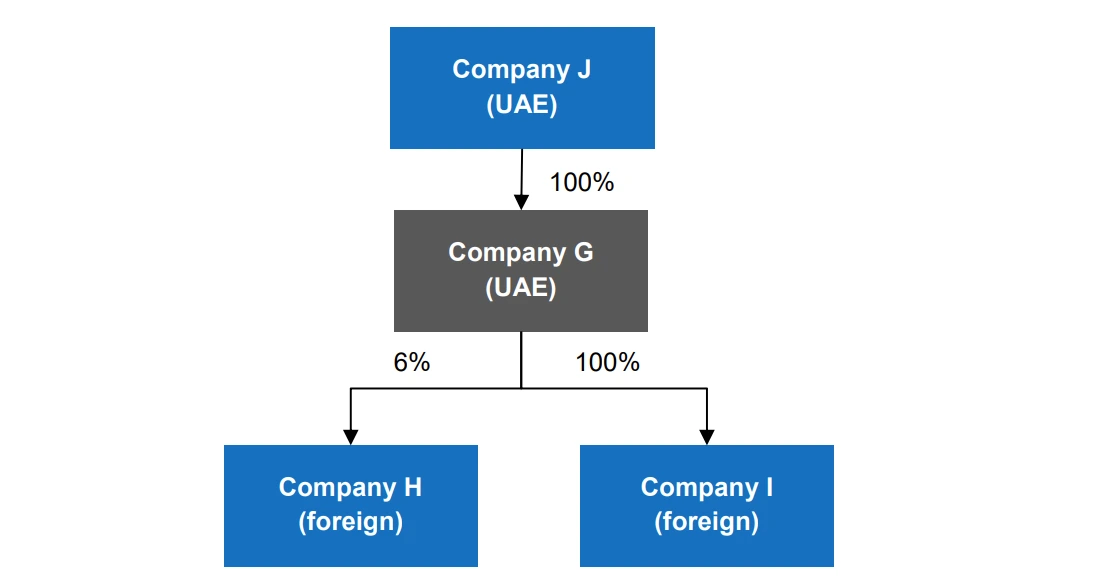

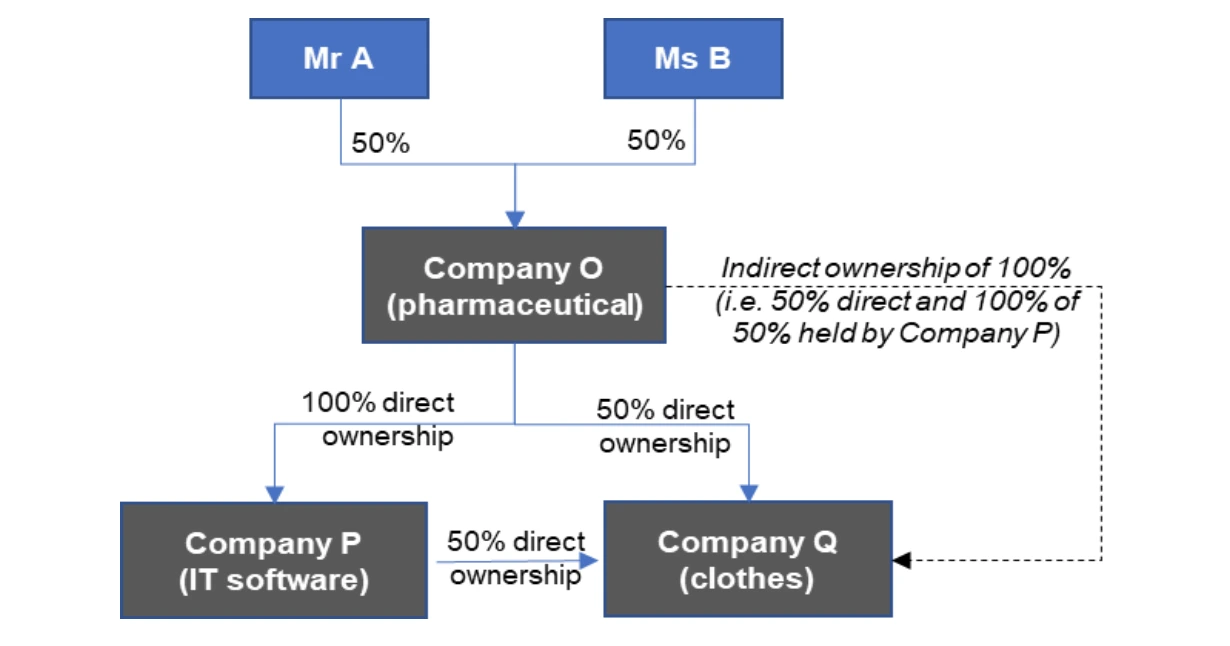

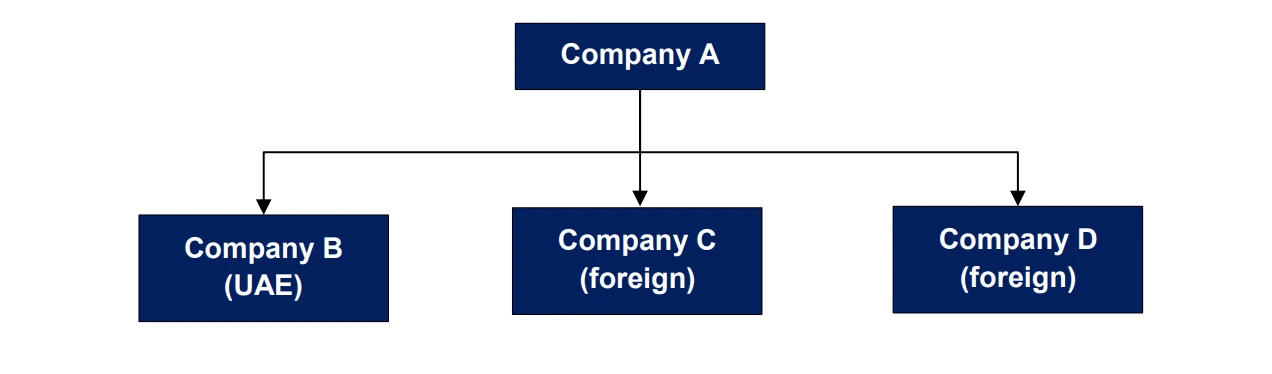

Dividends and other profit distributions received from foreign juridical persons are exempt from Corporate Tax if the recipient has a Participating Interest in a foreign juridical person.[20]A Participating Interest is a 5% or more ownership interest in the shares or capital of a juridical person (the 'Participation') subject to the conditions below.

A Participating Interest exists where all of the following conditions are met:[21]

The Taxable Person has an ownership interest of 5% or more in the shares or capital of the Participation. As an alternative to the requirement to have a 5% or more ownership interest, a Taxable Person will be treated as having a Participating Interest in a Participation where the aggregate acquisition cost of ownership in that juridical person is AED 4 million or more.

The Participation has been held, or is intended to be held, for an uninterrupted period of at least 12 months.

The Taxable Person is entitled to at least 5% of profits available for distribution by the Participation and at least 5% of the liquidation proceeds of the Participation.

Not more than 50% of the Participation's direct and indirect assets consist of ownership interests that would not have qualified for the Participation Exemption if they were held directly by the Taxable Person.

The Participation is resident for tax purposes throughout a given Tax Period in another country that levies a tax that is applied on a similar basis to Corporate Tax and at a headline statutory tax rate of at least 9% (i.e. the 'subject to tax' requirement). The subject to tax requirement is also considered to have been met if it can be demonstrated that the Participation is subject to a tax on income, equity or net worth at an effective rate of at least 9% on profits.

Participation Exemption for other income and gains

Other income and gains may also be exempt if they are derived from a Participating Interest. The requirements for both a domestic and a foreign Participating Interest are the same, save that a Participating Interest in a Qualifying Free Zone Person or an Exempt Person is considered to meet the subject to tax requirement.[22]

If a Taxable Person holds a Participating Interest and the relevant conditions continue to be met, it will be exempt from Corporate Tax on:

Gains or losses on the transfer, sale, or other disposition of the whole or part of the Participating Interest,[23]

Foreign exchange gains or losses in relation to the Participating Interest,[24]and

Impairment gains or losses in relation to the Participating Interest.[25]

Expenditure incurred in relation to the acquisition, transfer, sale, or other disposition of the whole or part of the Participating Interest will not be deductible while determining Taxable Income.[26]This includes professional fees, due diligence costs, litigation costs, commissions and brokerage fees, and other associated costs. [27]Instead, this expenditure should be capitalised as part of the acquisition cost of the Participating Interest.[28]

Only income received by the Taxable Person in their capacity as a shareholder (i.e. as an owner of the ownership interest) can be exempt. Other income earned from the Participation from other relationships, such as that of a debtor-creditor (for example, Interest income received) or service provider (for example, service fee received), will remain subject to Corporate Tax unless exempt under other applicable provisions.[29]

Refer to Section 11 (Case Study 7a) for details on the treatment of domestic Dividends, income from a Participating Interest and expenditure incurred in relation to Exempt Income while determining Taxable Income.

Foreign Permanent Establishment exemption

To eliminate potential international double taxation, a Resident Person can make an election to have the income and associated expenditure derived from Foreign Permanent Establishments exempted from Corporate Tax in the UAE where the relevant conditions are met.[30]

Where such an election is made, the Resident Person shall not include the following items in the determination of Taxable Income:

Losses in any of its eligible Foreign Permanent Establishments,[31]and

Income, and associated expenditure, in any of its eligible Foreign Permanent Establishments.[32]

In addition, any Foreign Tax Credit otherwise available as a reduction in the Corporate Tax Payable, will not be available to be used by the Resident Person if an election is made.[33]

In determining the income, expense or loss of each Foreign Permanent Establishment that is treated as exempt, a Resident Person and its Foreign Permanent Establishments must be treated as separate and independent Businesses in accordance with internationally accepted profit attribution methods, such as the separate entity approach, and any transactions which take place between them must be treated as having taken place at Market Value.[34]

Where a Resident Person elects to exclude the income, expenses and losses of the Foreign Permanent Establishments from the calculation of its Taxable Income, the election will apply to all the Resident Person's Foreign Permanent Establishments which are subject to Corporate Tax, or a tax of a similar character to Corporate Tax, in the relevant foreign country at a rate of not less than 9% (i.e. the 'subject to tax requirement').[35]

Additionally, if a Resident Person has utilised a Tax Loss incurred in their Foreign Permanent Establishment, that Tax Loss must be fully offset by the Taxable Income from the Foreign Permanent Establishment in a subsequent Tax Period or Tax Periods before the Resident Person can elect to apply the Foreign Permanent Establishment exemption.[36]

Refer to Section 12 (Case Study 7b) for details of the Foreign Permanent Establishment exemption while determining Taxable Income.

Deductible and non-deductible expenditure

Accounting Income is calculated by deducting a Business's normal day-to-day expenditure i.e. revenue expenditure, incurred during the course of regular Business operations, from the Revenue earned in the same Tax Period. However, not all expenditure recognised under the general accounting rules is deductible for Corporate Tax purposes. Non-deductible expenditure will need to be added back to Accounting Income when determining Taxable Income.

In general terms, to be deductible, expenditure must be incurred wholly and exclusively for the purposes of the Taxable Person's Business and must not be capital in nature. These aspects are briefly discussed in Sections 4.5.1 to 4.5.7 below. The 'wholly and exclusively' condition is applicable to all expenditures claimed as a deductible expense for Corporate Tax purposes.

Expenditure is deductible in the Tax Period in which it is incurred, subject to the provisions of the Corporate Tax Law.

No deduction is allowed in relation to the following:

Expenditure not incurred for the purposes of the Taxable Person's Business,

Expenditure incurred in deriving Exempt Income, and

Losses not connected with or arising out of the Taxable Person's Business.

Expenditure incurred wholly and exclusively for the Business

The general rule is that expenditure must be incurred wholly and exclusively for the purposes of the Taxable Person's Business and must not be capital in nature for the expenditure to be deductible for Corporate Tax purposes.[37]

Additional specific deduction rules are applicable for specific categories of expenditure, for example, entertainment expenditure (see Section 4.5.10) and Interest expenditure (see Sections 4.6 and 4.7).

It is necessary to consider the purpose for incurring the expenditure to assess whether it can be deducted for Corporate Tax purposes. For it to be fully deductible, the expenditure needs to be incurred 'wholly and exclusively' for Business purposes. If expenditure is incurred for more than one purpose, the proportion of the expenditure that is incurred for non-Business purposes is not deductible for Corporate Tax purposes and must be added back when determining Taxable Income.[38]

Employment related expenditure

Employee costs are generally considered to be wholly and exclusively incurred for Business purposes provided that they are not excessive (and subject to the requirement to meet the arm's length standard where employees are Related Parties or Connected Persons).

As such, it is not relevant whether an employee is paid wholly in cash or also receives other benefits, such as a car for personal use. In this situation, the personal use should be viewed in the same way as the employee spending their cash salary on items for their personal benefit. The same applies to other benefits, such as medical insurance or a flight allowance (for spouse and children). In other words, the cost is wholly and exclusively for Business purposes as rewarding employees is wholly a Business purpose. The same principle applies in relation to costs incurred for entertainment of employees, for example, for team building at a seasonal function, or to reward performance.

This should be distinguished from entertainment expenditure incurred to entertain business partners or customers as discussed in more detail in Section 4.5.10 below.

Refer to Section 5 (Case Study 1) for the treatment of expenditure incurred wholly and exclusively for the purposes of the Business while determining Taxable Income.

Expenditure incurred in deriving Exempt Income

Expenditure incurred in relation to deriving Exempt Income is not deductible when determining Taxable Income.[39]

Expenditure incurred for more than one purpose

If expenditure is incurred for more than one purpose, the portion of the expenditure which can be deducted must be determined as follows:[40]

Any identifiable part or proportion of the expenditure incurred wholly and exclusively for the purposes of deriving Taxable Income, is deductible, and

An appropriate proportion of any unidentifiable part or proportion of the expenditure incurred for the purposes of deriving Taxable Income that has been determined on a fair and reasonable basis, having regard to the relevant facts and circumstances of the Taxable Person's Business, is deductible.

Based on the above, if expenditure is incurred partly for Business purposes and partly for some other purpose, the amount must be apportioned so that only the part relating to deriving Taxable Income will be allowed as a deduction. This includes any identifiable part or proportion of any unidentifiable expenditure incurred wholly and exclusively for the purposes of deriving Taxable Income that has been determined on a fair and reasonable basis. [41]What is fair and reasonable will depend on the circumstances and facts of each case. In many cases, there will be more than one method of apportioning expenses which is fair and reasonable to use.

Allocation keys are criteria used to determine how expenses can be assigned or distributed across different departments, products, services, or divisions within a Business. These keys can be applied to factors such as headcount, floor space, usage, time spent, or any other measurable and reasonable basis. The primary goal of allocation keys is to provide a fair and accurate distribution of expenses, allowing for a more accurate determination of the income arising from each income component.

The appropriate allocation key will depend on the nature of the expense and the contribution that it makes to each income component. In many cases, an allocation that prorates expenses based on Revenue will be considered as a reasonable allocation. However, this will not always be the case and the following principles should be considered to determine whether Revenue or some other basis will be appropriate to allocate each expense item. For example:

Cause and effect: An allocation should be consistent with identifiable cause-and- effect relationships (for example, machinery running hours may be an appropriate allocation key to allocate maintenance costs)

Benefits derived: An allocation should be commensurate with the benefits received.

The allocation key chosen must be logical and must fairly represent the benefit that the expense generates for each income component. The allocation key should also be used consistently for each Tax Period, unless there is a change in fact pattern which may justify a change in allocation or methodology.

The fair and reasonable approach chosen should accurately reflect the underlying activity, should not be unnecessarily burdensome and complex for the Taxable Person to determine and justify, or for the FTA to understand and review.

If the expenditure incurred for more than one purpose cannot be apportioned on a fair and reasonable basis, it will not be allowed as a deduction for Corporate Tax purposes.

Refer to Section 5 (Case Study 1) for the treatment of expenditure incurred for more than one purposes while determining Taxable Income.

Non-arm's length expenditure

Payments or benefits provided by a Taxable Person to its Related Parties and/or Connected Persons would be deductible only to the extent that the payment or benefit corresponds with the Market Value of the service or benefit provided by the Related Parties and/or Connected Person, and where the payment or benefit is incurred wholly and exclusively for the purposes of the Taxable Person's Business.[42]

For example, the salary or bonus paid to directors or officers of a company or an owner of the Taxable Person would be deductible when determining Taxable Income, but only insofar as this salary corresponds with the Market Value rates for such services rendered. In order to determine if the value of a service or benefit provided matches its Market Value, the arm's length standard should be applied.[43]

Capital expenditure

Capital expenditure is not deductible when determining Taxable Income. Capital expenditure is any expenditure that creates an enduring benefit to a Business. This is in contrast to revenue expenditure, which supports the day-to-day operations of the Business. For example, purchasing a long-term asset like machinery would be a capital expense, but paying for routine maintenance to keep the machinery running would be a revenue expense. The question of whether expenditure is of a capital or revenue nature will depend on the particular facts and circumstances and will need to be determined on a case-by-case basis, in line with the Accounting Standards applied by the Taxable Person.

In relation to capital expenditure, the following principles are laid out in Article 7 of Ministerial Decision No. 134 of 2023 :

No deduction shall be allowed for depreciation, amortisation or other change related to capitalised expenditure, where such expenditure would not have been deductible had it been an expenditure that is not capital in nature.

Expenditures that are capital in nature that have not been deducted for the purpose of calculating the Taxable Income, other than those under the above bullet point, shall be deductible in the calculation of gains or losses upon the realisation of the asset or liability.

In this respect, expenditures that are capital in nature shall be those treated as such under the Accounting Standards applied by the Taxable Person.

While capital expenditure is not deductible, when determining Taxable Income, the depreciation of the cost of capital assets is a deductible expense for Corporate Tax purposes. Depreciation is an accounting concept which allows for the cost of an asset to be spread over the life of the asset (representing the reduction of the asset's value).

In certain cases, a Taxable Person may have an accounting policy to not capitalise low value capital items that do not meet the recognition criteria, as per the relevant Accounting Standard. Such expenditure is directly expensed in the income statement. In such circumstances, the accounting treatment should be followed and the expense will be fully deductible in the Tax Period in which it is incurred, provided that it is not otherwise non-deductible.

In accordance with the relevant Accounting Standard, the Taxable Person may capitalise the directly attributable costs or costs initially incurred to acquire or construct an asset. In certain cases, a part of these costs, if debited to the income statement, would not have been allowed as a deduction while determining Taxable Income.

Article 7 of Ministerial Decision No. 134 of 2023 states that the depreciation/ amortisation charge which relates to such non-deductible expenditure will also not be allowed as a deduction for the purpose of determining Taxable Income. Examples of such expenditure that could be capitalised include fees paid to Related Parties/Connected Persons which do not meet the arm's length standard (see Section 4.5.5) or, fines and penalties levied by a statutory body/government on the acquisition or construction of the asset (see Section 4.5.9) etc. Since these expenses are generally not deductible while determining Taxable Income, the corresponding depreciation charge will also not be deductible.

Example 1: Non-deductible capitalised expenditure

A company incurs a fine of AED 50,000 due to non-compliance with environmental regulations while building an environmental control system. This amount is not deductible while calculating the Taxable Income as it is considered a punitive expense rather than an ordinary Business expense.

If the company capitalises this fine as part of the cost base of the environmental control system (an asset), with the intention to depreciate the amount over a 10- year period (assumed life of the asset), the Corporate Tax treatment will differ from the accounting treatment. Based on Article 7 of Ministerial Decision No. 134, no depreciation deduction is allowed for an expense that, if not capitalised, would not be deductible (i.e. AED 50,000 in this case).

Therefore, even though the fine is capitalised and included in the cost of the asset, the company will not be permitted to claim the annual depreciation of AED 5,000 (i.e. AED 50,000/10 years) as a deduction.

The treatment of capital expenditure when determining Taxable Income is covered in Section 5 (Case Study 1) and Section 11 (Case Study 7a) for a Taxable Person following the Accrual Basis of Accounting and in Section 10 (Case Study 6) for a Taxable Person following the Cash Basis of Accounting.

Pre-incorporation or pre-trade expenses

Certain expenditure may be incurred before the Business is officially incorporated (for example, in the case of a company), which are typically associated with the process of setting up a Business. Examples include feasibility studies, registration fees, legal and professional fees in relation to incorporation documents, etc.

As a general rule, unless specified otherwise, any such expenditure incurred wholly and exclusively for the Business that is not capital in nature would be allowed as a deduction in the Tax Period in which it is incurred.[44]'Incurred' means the time at which it is required to be recorded in the Financial Statements based on IFRS or IFRS for SMEs, where a Taxable Person uses the Accrual Basis of Accounting.

Similarly, in the case of the Cash Basis of Accounting, the pre-incorporation expenses will be allowed in the first Tax Period to the extent recorded in the income and expenditure statement.

Thus, pre-incorporation expenditure, (though incurred before the Business is officially incorporated or set-up), will be allowed as a deduction to the extent to which it is recorded in the income statement once the company is incorporated (or the Business is set up), in line with the relevant Accounting Standards, subject to meeting the general deduction criteria under the Corporate Tax Law[45]and provided that it has not been claimed as deductible expenditure by another Taxable Person.

A Taxable Person may also incur pre-trading expenses i.e. expenditure incurred after a Business is incorporated or set-up, but before it starts generating revenue or conducting its normal trading operations. These expenses typically occur during the pre-launch phase, when a Business is preparing to commence its commercial activities. Examples include costs associated with product development, marketing and advertising expenses, office setup costs, utilities, office equipment, expenses for hiring and training employees before the commencement of operations, etc.

Where such pre-trading expenditure is recorded as an expense in the Financial Statements, it will be allowed as a deduction in the Tax Period when it is incurred, subject to meeting the general deduction criteria under the Corporate Tax Law,[46]even if the Business has not started generating Revenue in the Tax Period in which the expense is incurred.

Refer to Section 5 (Case Study 1) for the treatment of expenditure incurred prior to commencement of Business when determining Taxable Income.

Creation & reversal of provisions (bad debts, write-off and recovery)

A provision is typically recognised when a past event has created a legal or constructive obligation, an outflow of resources is probable, and the amount of the obligation can be estimated reliably. The amount recognised is the best estimate of the settlement amount at the end of the Financial Year.

Considering the above, if a Taxable Person records a provision in its Financial Statements in accordance with the relevant Accounting Standards (i.e. IFRS or IFRS for SMEs), the provision will be allowed as a deduction, as long as it satisfies the requirements for deductibility of expenditure under the Corporate Tax Law (so for instance it is not in respect of an illegal payment - see Section 4.5.9).

If such a provision is released or reversed in a subsequent Tax Period, there are no specific adjustments required to be made to the release or reversal. Therefore, the relevant credit to the Financial Statements (i.e. income) will be treated as Taxable Income for Corporate Tax purposes.

In instances where a provision was recorded before a Taxable Person's first Tax Period and then reversed after the Person becomes subject to Corporate Tax, the reversal is taxable when the credit is recorded in the Financial Statements.

Bad debts, write-off and recovery

A bad debt is a receivable that is determined to be uncollectable. This may result in a provision, but it can also lead to a Business writing off the receivable, i.e. no longer recognising it. In either case, there would normally be an expense in the income statement.

If a balance is written off as a bad debt and this is in accordance with the relevant Accounting Standards (i.e. IFRS or IFRS for SMEs), the bad debt expense will be deductible when determining Taxable Income, as long as it satisfies the requirements for deductibility of expenditure in the Corporate Tax Law. Further, if a balance which was written off in a prior Tax Period is subsequently recovered, the credit to the income statement will be taxable in the Tax Period in which it is recognised in accordance with the requirements of IFRS or IFRS for SMEs, as applicable.

Refer to Section 5 (Case Study 1) for the treatment of provisions when determining Taxable Income.

Non-deductible expenses

Aside from the circumstances discussed above, deductions are also specifically disallowed for:

A donation, grant or gift made to an organisation that is not a Qualifying Public Benefit Entity (see Section 5, i.e. Case Study 1 for details).[47]Any amounts paid by Taxable Persons in relation to Zakat will only be deductible if it is paid to a Qualifying Public Benefit Entity,

Any fines and penalties, other than amounts awarded as compensation for damages or breach of contract (see Section 5, i.e. Case Study 1 for details),[48]

Bribes or other illicit payments (see Section 5, i.e. Case Study 1 for details),[49]

Dividends, profit distributions or benefits of a similar nature paid to an owner of the Taxable Person (see Section 5, i.e. Case Study 1 for details),[50]

Amounts withdrawn from the Business by a natural person who is a Taxable Person or a partner in an Unincorporated Partnership,[51]

Corporate Tax,[52]

Recoverable input Value Added Tax (see Section 5, i.e. Case Study 1 for details),[53]

Tax on income imposed outside the UAE (however, tax relief may be available as a Foreign Tax Credit),[54]and

Contributions made by employers to a private pension fund in respect of its employees which are not paid in the Tax Period, or are in excess of 15% of the employee's total remuneration in the relevant Tax Period (see Section 5, i.e. Case Study 1 for details).[55]

Local taxes that are not in the nature of Corporate Tax, such as municipal and property taxes, will be deductible.

However, a tax under an Emirate Law, such as that paid by branches of foreign banks in the UAE is not allowed as a deduction from Taxable Income under the Corporate Tax Law. The availability or not, of a credit against a tax under Emirate Law in respect of Corporate Tax, such as under Dubai Law No. 1 of 2024 on Taxation of Foreign Banks Operating in the Emirate of Dubai, does not alter this.

Entertainment expenditure

Entertainment is considered as hospitality of any kind and entertainment expenditure is the expense of providing entertainment. It is common to incur such costs for the entertainment, amusement or recreation of customers, shareholders, suppliers, or other business partners, such as hospitality at restaurants, cultural events, sporting events, hotel stays and similar trips. Entertainment expenditure usually serves to build relationships and promote the Business in a more informal or social setting. Entertainment expenditure includes expenditure in connection with meals (food and beverages), accommodation, transportation, admission fees, as well as facilities and equipment used in connection with such entertainment.[56]

However, this type of expenditure often contains a private element that is provided for the enjoyment or hospitality of the recipients/guests that would prevent the expenditure from being wholly and exclusively incurred for Business purposes. Thus, a 50% deduction for entertainment expenditure is allowed for Corporate Tax purposes.[57]

For Corporate Tax purposes, the accounting classification of a particular expense is not relevant when considering whether such an expense is entertainment expenditure.

Entertainment for employees

Entertainment expenditure should be distinguished from expenditure incurred in relation to employees. Employment related expenditure will not fall under the ambit of entertainment expenditure and should be fully deductible, provided that it is incurred wholly and exclusively for the Taxable Person's Business.

Based on the above, expenditure reported in the Financial Statements that is incurred for employee/staff entertainment, such as staff parties, off-site events/away-days or rewards for meeting performance targets, are employee related expenses as opposed to entertainment expenses and can be fully deducted for Corporate Tax purposes. However, if an expense is incurred for an event which is private in nature, such as a wedding for family members who happen to also be staff, it will not be deductible for Corporate Tax purposes.

Where a Taxable Person organises conferences and/or business events for employees, their spouses and children (such as team building events or seasonal events), for which it incurs expenditure on catering, this expenditure will be deductible since it relates to the Business of the Taxable Person and is not meant for the entertainment of non-employees, provided that the expenditure is not excessive.

Incidental expenses

Any expense incurred which is incidental to a Business purpose (for example, food or drink provided during a Business meeting) shall not be considered as entertainment expenditure. Food and refreshments in an office setting would generally be considered as incidental and in connection with the Business and, hence, would be fully deductible. A further example of an incidental expense which would not be considered as entertainment expenditure would be where a retailer provides complimentary refreshments to prospective customers.

Expenditure incurred for Business purposes (other than for employees) on food and beverages at a venue such as a restaurant, whether or not accompanied by any other form of entertainment (for example, a live band) cannot be considered as incidental, and so would be entertainment expenditure subject to the 50% deduction rule.

Commercial hospitality

Where a Taxable Person provides commercial hospitality as part of their Business or Business Activity, such expenditure would not be considered as entertainment expenditure. For example, where an airline provides a washbag or in-flight entertainment, or where hotels provide packaged or mid-week promotions, such expenditure would be considered as ordinary Business expenditure and not entertainment expenditure. However, where benefits are provided to clients and business partners that are not considered commercial hospitality or promotions, then such expenditure incurred would be considered as entertainment expenditure and would be subject to the 50% restriction (e.g. providing business partners with complimentary stays at hotels).

Marketing or advertising expenditure

The 50% deduction rule does not apply to other marketing expenditure, such as advertising, online promotion, attending trade shows or direct marketing campaigns, which is deductible in line with the general principles of the Corporate Tax Law, subject to being wholly and exclusively incurred for Business purposes.

Whether an item of expenditure can be considered as marketing expenditure or entertainment expenditure, will largely depend on the industry in which the Taxable Person operates. Where marketing involves expenditure on the promotion of a Taxable Person's goods or services, for example, demonstrating a car at a racetrack, the necessary costs of doing so will not be subject to the 50% restriction.

However, (typically discretionary) costs of providing hospitality at the event such as meals, a musical performance or accommodation will be subject to the 50% restriction for entertainment expenditure.

Expenditure would not be subject to the 50% deduction rule, where it involves a Business advertising its own services or products by making them available to the general public at a reduced price or for free. This will also be the case where only certain individuals can benefit because they will generate publicity for the Business, such as a restaurant giving a free meal to a food critic, a spa providing free entry to an influencer, a trial run of hotel facilities provided to a potential bulk buyer of the product, etc.

As another example, a Taxable Person taking a group of clients to a sporting event and providing them with tickets, meals and drinks in a corporate box will be treated as entertainment expenditure. Hence, only 50% would be treated as deductible for Corporate Tax purposes, whereas a Taxable Person purchasing a booth at a trade show to display the company's new product line would be treated as sales/marketing expenditure for running the Business and, hence, deductible for Corporate Tax purposes.

Sponsorship costs (for example, sponsoring an event) will be deductible where such costs are incurred for marketing purposes. However, to the extent that benefits are received as part of that sponsorship (for example, tickets to a sporting event) and the benefits are used to entertain business partners and/or customers, then the value of these benefits will be considered as entertainment expenditure and will be subject to the 50% deduction.

Refer to Section 5 (Case Study 1) for the treatment of entertainment expenditure while determining Taxable Income.

General Interest Deduction Limitation Rule

Meaning of Interest

Businesses regularly borrow money and take out loans for a wide variety of reasons, for example, to purchase Business assets, to meet costs, or increase working capital. As a result, Interest is a common Business expense.

Interest expenditure can be deducted when determining Taxable Income for the Tax Period in which it is incurred, subject to the general rules for deductibility.[58]In addition, such expenditure is subject to the General Interest Deduction Limitation Rule (refer Section 4.6 for details).[59]

For the purposes of the General Interest Deduction Limitation Rule, Interest means any amount that is accrued or paid for the use of money or credit, including discounts, premiums, profit paid in respect of an Islamic Financial Instrument, other payments economically equivalent to interest, and any other amounts incurred in connection with the raising of finance, but does not include payments of the principal amount.[60]These categories are elaborated on below.

Interest component on financial assets and liabilities

The Interest component (or other payments that are economically equivalent to Interest) that is included in the financial returns on a financial asset or liability is considered as Interest expenditure or income for the purposes of the General Interest Deduction Limitation Rule, regardless of the classification and treatment of such amounts under the applicable Accounting Standards (i.e. IFRS or IFRS for SMEs).[61]

Interest shall include, but not be limited to, the Interest component on the following:[62]

Performing and non-performing debt instruments,

Interests held in collective investment schemes that primarily invest in cash and cash equivalents,

Collateralised asset backed debt securities and similar instruments,

Agreements for the sale and subsequent repurchase of the same security at a future date at an agreed upon price,

Stock lending and similar agreements for the disposal of a security subject to an obligation or right to reacquire the same or a similar designated security,

Securitisations and similar transactions involving the transfer of assets in exchange for the issuance of securities that entitle the holder to proceeds generated from these assets,

Lease or hire purchase arrangements where all the risks and rewards incidental to the ownership of the underlying asset have been substantially transferred to the lessee, and

Factoring and similar accounts receivable purchase transactions.

Amounts incurred in connection with raising finances

Any amount incurred in connection with the raising of finance shall be considered as Interest expenditure or income for the purposes of the General Interest Deduction Limitation Rule.[63]This includes, but is not limited to, the following:[64]

Fees such as guarantee fees, arrangement fees, commitment fees, etc. and

Interest component on financial derivative instruments such as forward contracts, futures contracts, options, interest rate and foreign exchange swap agreements, any financial derivative instrument used to hedge risks directly connected with raising finance.

Islamic Financial Instruments

Islamic Financial Instruments are financial instruments that follow Sharia principles and are economically equivalent to any instrument mentioned in Section 4.6.1.1 above. The equivalent Interest component on such instruments shall be treated as Interest expenditure or income for the purposes of the General Interest Deduction Limitation Rule.[65]

Finance and non-finance lease

The finance element of finance lease and non-finance lease payments shall be considered as Interest for the purposes of the General Interest Deduction Limitation Rule, and this includes both expenditure in relation to the finance cost element and income received therefrom.[66]

For the purposes of finance lease payments, the finance element as recorded in the accounts of a Taxable Person prepared in accordance with the applicable Accounting Standards (i.e. IFRS or IFRS for SMEs) shall be considered as Interest.

For the purposes of non-finance lease payments, the finance element is the share of any lease payment that is in proportion to the share of the total cost of the lease as attributable to the total finance element.

Foreign exchange movements

All foreign exchange gains and losses accruing from Interest shall also be considered as Interest for the purposes of the General Interest Deduction Limitation Rule.[67]

Capitalised Interest

Where an amount that is deemed to be Interest is capitalised in the accounts of the Taxable Person in accordance with the applicable Accounting Standards (i.e. IFRS or IFRS for SMEs), the income and expenditure attributable to such capitalised Interest amount shall be subject to the General Interest Deduction Limitation Rule.[68]

Application of the General Interest Deduction Limitation Rule

A Taxable Person's Net Interest Expenditure is subject to the General Interest Deduction Limitation Rule. The Net Interest Expenditure is the difference between the amount of Interest expenditure incurred (including any carried forward Net Interest Expenditure) and the Interest income derived during a Tax Period.[69]

Where the Net Interest Expenditure exceeds AED 12 million in a Tax Period, the amount of deductible Net Interest Expenditure is the greater of:

30% of adjusted EBITDA (earnings before the deduction of Interest, tax, depreciation and amortisation) for a Tax Period, calculated as the Taxable Income for the Tax Period with adjustments for:[70]

Net Interest Expenditure for the relevant Tax Period,

Depreciation and amortisation expenditure taken into account in determining the Taxable Income for the relevant Tax Period,

Any Interest expenditure (minus Interest income) relating to historical financial assets or liabilities held prior to 9 December 2022, and

Any Interest expenditure (minus Interest income) relating to Qualifying Infrastructure Projects.

Or the de minimis threshold of AED 12 million.[71]

This is known as the General Interest Deduction Limitation Rule.

If the Net Interest Expenditure is below the de minimis threshold of AED 12 million for a Tax Period, the General Interest Deduction Limitation Rule does not apply.[72]This means that, subject to the Specific Interest Deduction Limitation Rule, [73]the full amount of Interest expenditure incurred in a Tax Period can be deducted.

The de minimis threshold of AED 12 million is adjusted in proportion to the length of the Tax Period, if the relevant Tax Period is more than or less than 12 months.[74]

Where the Net Interest Expenditure is less than the higher of 30% of adjusted EBITDA (see Section 4.6.4) and AED 12 million (as adjusted for a Tax Period of more than or less than 12 months), no adjustment is required under the General Interest Deduction Limitation Rule. The Net Interest Expenditure for the relevant Tax Period will be deductible.

Any Net Interest Expenditure disallowed in a Tax Period by the General Interest Deduction Limitation Rule can be carried forward and utilised in the subsequent 10 Tax Periods in the order in which the amount was incurred, subject to the same conditions as the General Interest Deduction Limitation Rule.[75]

To determine the deductible and non-deductible Net Interest Expenditure, the following components need to be calculated:

Net Interest Expenditure, and

30% of adjusted EBITDA.

Calculation of Net Interest Expenditure

As noted above, Net Interest Expenditure is the difference between the amount of Interest expenditure incurred (including any carried forward Net Interest Expenditure) and the Interest income accrued. Net Interest Expenditure will include all Interest components discussed in Section 4.6.1.

However, the following will not be considered while calculating the Net Interest Expenditure for the purposes of the General Interest Deduction Limitation Rule:

Interest expenditure that is disallowed under any other provisions of the Corporate Tax Law,[76]for example, the Specific Interest Deduction Limitation Rule [77](see Section 4.7) or non-arm's length amounts,[78]

Interest income or Interest expenditure related to grandfathered debts (i.e. prior to 9 December 2022),[79]and

Interest income and Interest expenditure in relation to Qualifying Infrastructure Projects.[80]

An illustrative list of the adjustments that may be relevant in calculating the Net Interest Expenditure is as follows:

Adjust | Calculation of Net Interest Expenditure | Amount (AED) |

Net Interest Expenditure based on the Financial Statements (i.e. Interest expenditure less Interest income) | xxx | |

Less: | Interest expenditure that is disallowed under any other provisions of the Corporate Tax Law[81] | (xxx) |

Less: | Net Interest Expenditure related to grandfathered debts[82] | (xxx) |

Less: | Net Interest Expenditure related to Qualifying Infrastructure Projects[83] | (xxx) |

Add: | Net Interest Expenditure carried forward from previous 10 Tax Periods[84] | xxx |

Total Net Interest Expenditure for the relevant Tax Period | xxx |

Calculation of 30% of adjusted EBITDA

For the purposes of the General Interest Deduction Limitation Rule, EBITDA for a Tax Period is the Taxable Income calculated in accordance with the general rules for determining Taxable Income[85](i.e. all adjustments are required to be made except for adjustments in relation to the General Interest Deduction Limitation Rule and Tax Loss relief provisions). Such Taxable Income (even if negative) before the General Interest Deduction Limitation Rule and Tax Loss relief is required to be increased by the following, to arrive at the 'adjusted EBITDA' for the purposes of the General Interest Deduction Limitation Rule:[86]

Net Interest Expenditure for the relevant Tax Period (see Section 4.6.3),

Depreciation and amortisation expenditure taken into account in determining the Taxable Income for the relevant Tax Period,

Any Interest income or expenditure relating to historical financial assets or liabilities held prior to 9 December 2022, and

Any Interest income or Interest expenditure in relation to Qualifying Infrastructure Projects.

If the adjusted EBITDA as per the above results is a negative amount, then the adjusted EBITDA will be considered to be AED 0.[87]

An illustrative list of the adjustments that may be relevant in calculating the adjusted EBITDA is as follows:

Adjust | Calculation of adjusted EBITDA | Amount (AED) |

Accounting Income/(loss) | xxx/(xxx) | |

+/- | All adjustments as per Article 20 of the Corporate Tax Law, except General Interest Deduction Limitation Rule and Tax Loss provisions | xxx/(xxx) |