Free Zone Persons

Corporate Tax Guide | CTGFZP1

May 2024

Contents

3. Free Zone Corporate Tax rules: At a glance

3.1. Scope of the Free Zone Corporate Tax rules

3.2.1. The regime is applicable to a Free Zone Person

3.2.2. The Free Zone Person must maintain adequate substance in a Free Zone

3.2.3. The Free Zone Person must derive Qualifying Income

3.2.5. The Free Zone Person must comply with the arm’s length principle

3.2.6. The Free Zone Person must maintain Transfer Pricing documentation

3.2.7. The Free Zone Person must maintain audited Financial Statements

3.2.8. The non-qualifying Revenue must meet the de minimis requirements

4.3. Scope of the Free Zone Corporate Tax rules

4.5. Other criteria to be a QFZP

5. Calculating Corporate Tax for a Free Zone Person

5.1. Corporate Tax rate for a QFZP

5.3. Taxable Income that is not Qualifying Income

6. Maintaining adequate substance

7. Foreign Permanent Establishment or Domestic Permanent Establishment

9.3. Income must be derived from intellectual property

9.4. Qualifying Intellectual Property

9.5. Qualifying Income from Qualifying Intellectual Property

10.2. Scope of Qualifying Activity and associated ancillary activities

10.2.1. Necessary for the performance of the main activity

10.2.2. Minor contribution and closely related to the main activity

10.3. Manufacturing of goods or materials

10.4. Processing of goods or materials

10.5. Trading of Qualifying Commodities

10.6. Holding of shares and other securities for investment purposes

10.7. Ownership, management, and operation of Ships

10.9. Fund management services

10.10. Wealth and investment management services

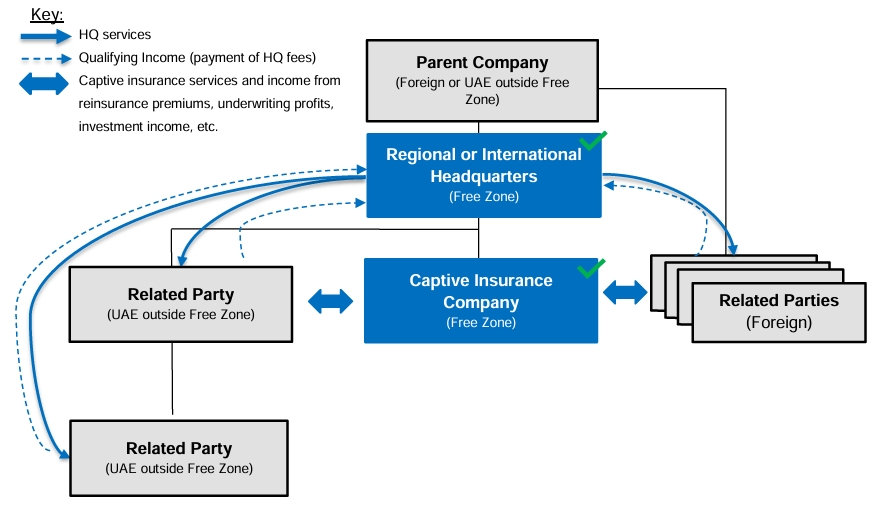

10.11. Headquarter services to Related Parties

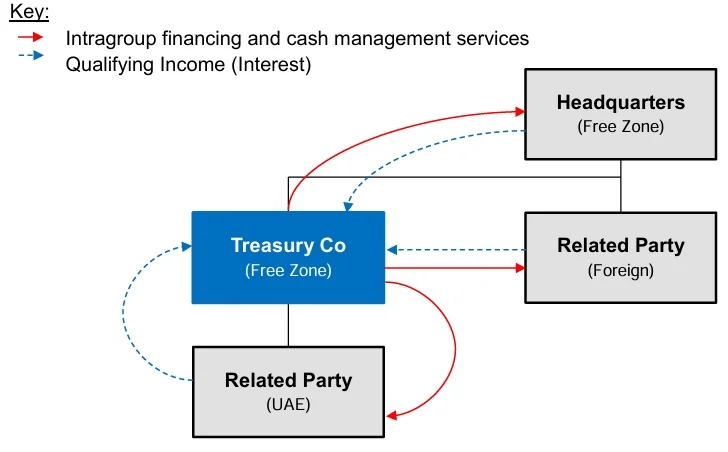

10.12. Treasury and financing services to Related Parties

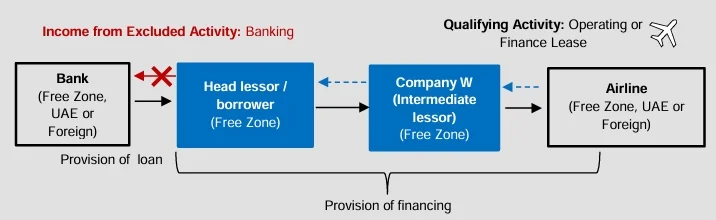

10.13. Financing and leasing of Aircraft

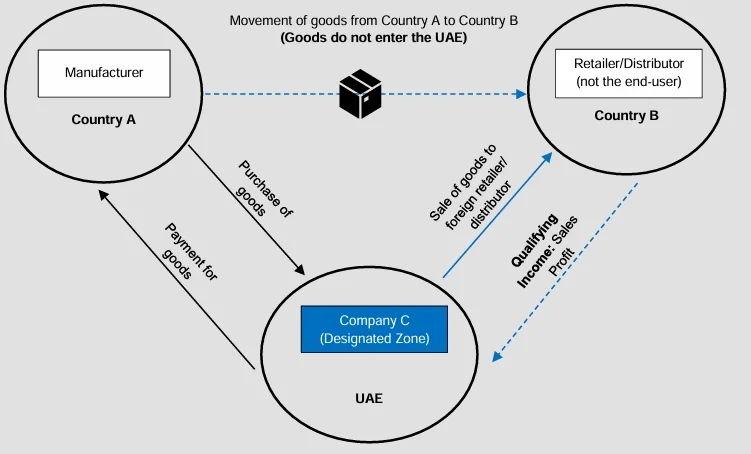

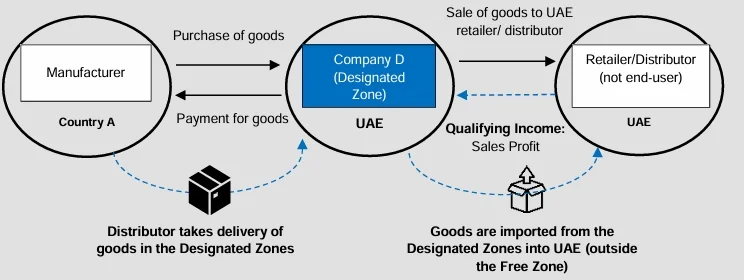

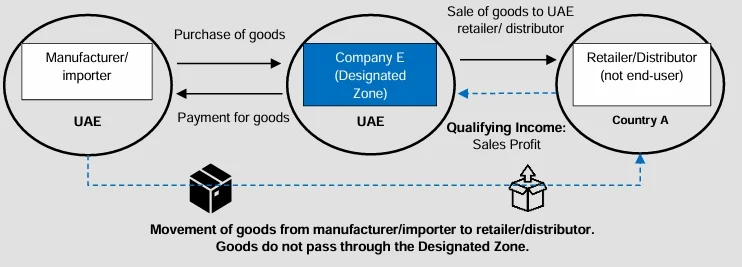

10.14. Distribution of goods or materials in or from a Designated Zone

Glossary

Accounting Standards | : | The accounting standards specified in Ministerial Decision No. 114 of 2023. |

Administrative Penalties | : | Amounts imposed and collected under the Corporate Tax Law or the Tax Procedures Law. |

AED | : | The United Arab Emirates dirham. |

Aircraft | : | Any machine that can derive support in the atmosphere from the reactions of the air other than the reactions of the air against the surface of the earth. |

Beneficial Recipient | : | For the purposes of Article 3 of Cabinet Decision No. 100 of 2023 in relation to determining if income is derived from transactions with a Free Zone Person, it shall mean a Person who has the right to use and enjoy the service or the Good and does not have a contractual or legal obligation to supply such service or Good to another person. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Business Restructuring Relief | : | A relief from Corporate Tax for Business restructuring transactions, available under Article 27 of the Corporate Tax Law and as specified under Ministerial Decision No. 133 of 2023. |

Cash Basis of Accounting | : | An accounting method under which the Taxable Person recognises income and expenditure when cash payments are received and paid. |

Commercial Property | : | Immovable Property or part thereof used exclusively for a Business or Business Activity and not used as a place of residence or accommodation including hotels, motels, bed and breakfast establishments, serviced apartments and the like. |

Competent Authority | : | The Central Bank of the United Arab Emirates, the Dubai Financial Services Authority of the Dubai International Financial Centre ("DFSA"), the Financial Services Regulatory Authority of the Abu Dhabi Global Market ("FSRA"), and the Securities and Commodities Authority ("SCA") as applicable. |

Connected Person | : | Any Person affiliated with a Taxable Person as determined in Article 36(2) of the Corporate Tax Law. |

Controlled Transactions | : | Transactions or arrangements between two parties that are Related Parties or Connected Persons. |

Copyrighted Software | : | Any copyright subsisting in software granted under the law regulating copyrights in the UAE or granted under the relevant law of a foreign jurisdiction. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Designated Zone | : | A designated zone according to what is stated in Federal Decree-Law No. 8 of 2017, and which has been included as a Free Zone in accordance with the Corporate Tax Law. Reference to Free Zone comprises Designated Zone, as the context may require. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return on capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Domestic Permanent Establishment | : | A place of Business or other form of presence of a Qualifying Free Zone Person outside the Free Zone in the UAE. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

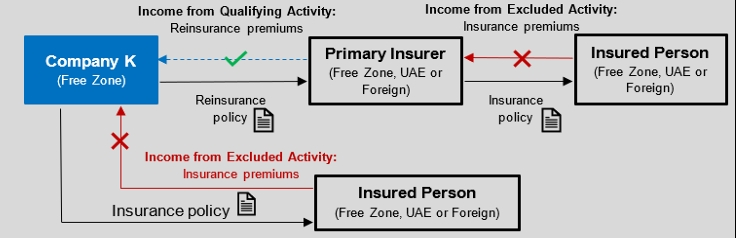

Excluded Activities | : | Any activities determined in accordance with Article 2 of Ministerial Decision No. 265 of 2023 and conducted by a Qualifying Free Zone Person from which non-Qualifying Income is derived. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Extractive Business | : | The Business or Business Activity of exploring, extracting, removing, or otherwise producing and exploiting the Natural Resources of the UAE, or any interest therein as determined by the relevant law. |

Financial Statements | : | A complete set of statements as specified under the Article Accounting Standards applied by the Taxable Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity and cash flow statement. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

Foreign Permanent Establishment | : | A place of Business or other form of presence outside the UAE of a Resident Person that is determined in accordance with the criteria prescribed in Article 14 of the Corporate Tax Law. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A juridical person incorporated, established or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

FTA | : | Federal Tax Authority, being the Authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

General Interest Deduction Limitation Rule | : | The limitation provided under Article 30 of the Corporate Tax Law. |

Good | : | For the purposes of assessing the Beneficial Recipient, it shall mean tangible or intangible property that has economic value in dealing including moveable and Immovable Property. |

Government Controlled Entity | : | Any juridical person, directly or indirectly wholly owned and controlled by a Government Entity, as specified in a decision issued by the Cabinet at the suggestion of the Minister. |

IFRS | : | International Financial Reporting Standards. |

IFRS for SMEs | : | International Financial Reporting Standard for small and medium-sized entities. |

Immovable Property | : | Means any of the following:

|

Interest | : | Any amount accrued or paid for the use of money or credit, including discounts, premiums and profit paid in respect of an Islamic Financial Instrument and other payments economically equivalent to interest, and any other amounts incurred in connection with the raising of finance, excluding payments of the principal amount. |

Non-Free Zone Person | : | Any Person who is not a Free Zone Person. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Overall Expenditures | : | For the purposes of Article 4(1) of Ministerial Decision No. 265 of 2023, means total expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property, including acquisition costs of the Qualifying Intellectual Property. |

Overall Income | : | For the purposes of Article 4(1) of Ministerial Decision No. 265 of 2023, means royalties or any other income derived from Qualifying Intellectual Property as determined according to the provisions of the Corporate Tax Law, including embedded intellectual property income derived from the sale of products and the use of processes directly related to the Qualifying Intellectual Property as determined in accordance with the arm's length principle under Article 34 of the Corporate Tax Law. |

Patents | : | Any patent granted under the law regulating patents in the UAE or granted under the relevant law of a foreign jurisdiction. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Qualifying Activities | : | Any activities determined in accordance with Article 2 of Ministerial Decision No. 265 of 2023 and conducted by a Qualifying Free Zone Person from which Qualifying Income is derived. |

Qualifying Commodities | : | Metals, minerals, energy and agriculture commodities that are traded on a Recognised Commodities Exchange Market in raw form. |

Qualifying Expenditures | : | For the purposes of Article 4(1) of Ministerial Decision No. 265 of 2023, means expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person in the UAE or any Person outside the UAE that is not a Related Party, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property. |

Qualifying Free Zone Person ("QFZP") | : | A Free Zone Person that meets the conditions of Article 18 of the Corporate Tax Law and is subject to Corporate Tax under Article 3(2) of the Corporate Tax Law. |

Qualifying Group | : | Two or more Taxable Persons that meet the conditions of Article 26(2) of the Corporate Tax Law. |

Qualifying Group Relief | : | A relief from Corporate Tax for transfers within a Qualifying Group, available under Article 26 of the Corporate Tax Law and as specified under Ministerial Decision No. 132 of 2023. |

Qualifying Income | : | Any income derived by a Qualifying Free Zone Person that is subject to Corporate Tax at the rate specified in Article 3(2)(a) of the Corporate Tax Law. |

Qualifying Intellectual Property | : | Patents, Copyrighted Software and any right functionally equivalent to a Patent that is both legally protected and subject to a similar approval and registration process to a Patent, such as utility models, intellectual property assets that grant protection to plants and genetic material, orphan drug designations, and extensions of Patent protection, but not including any marketing-related intellectual property assets, such as trademarks. |

Recognised Commodities Exchange Market | : | Any commodities exchange market established in the UAE that is licensed and regulated by the relevant Competent Authority, or any commodities exchange market established and recognised outside the UAE of equal standing. |

Recognised Stock Exchange | : | Any stock exchange established in the UAE that is licensed and regulated by the relevant competent authority, or any stock exchange established outside the UAE of equal standing. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

Ship | : | Any structure normally operating, or set for operating in maritime navigation regardless of its power and tonnage. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023. |

State | : | United Arab Emirates. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax Group | : | Two or more Taxable Persons treated as a single Taxable Person according to the conditions of Article 40 of the Corporate Tax Law. |

Tax Loss | : | Any negative Taxable Income as calculated under the Corporate Tax Law for a given Tax Period. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration | : | A procedure under which a Person registers for Corporate Tax purposes with the FTA. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Transfer Pricing | : | Rules on setting of arm's length prices for Controlled Transactions, including but not limited to the provision or receipt of goods, services, loans and intangibles. |

UAE | : | United Arab Emirates. |

Unincorporated Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE. |

Uplift Expenditures | : | For the purposes of Article 4(1) of Ministerial Decision No. 265 of 2023, means the Qualifying Expenditures increased by 30%, but only to the extent that Qualifying Expenditures, after being uplifted, is less than or equal to Overall Expenditures. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (“Corporate Tax Law”) was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates (“UAE”) on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits (“Corporate Tax”) in the UAE.

The provisions of the Corporate Tax Law apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance on the application of the Corporate Tax Law to Free Zones and Free Zone Persons. It provides readers with an overview of:

The conditions required to be met for a Free Zone Person to be a Qualifying Free Zone Person (“QZFP”) and benefit from the 0% Corporate Tax rate, and

The activities that are considered Qualifying Activities and Excluded Activities for a QFZP.

Who should read this guide?

This guide should be read by any Person that is carrying on a Business in a Free Zone in the UAE. It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, examples have been used to illustrate how key elements of the Corporate Tax Law apply to Free Zone Persons. The examples in the guide:

Show how these elements operate in isolation and do not show all the possible interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes, and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Law No. 5 of 1985 on the Civil Transactions Law of the United Arab Emirates, and its amendments, is referred to as “Federal Law No. 5 of 1985”,

Federal Law No. 6 of 2007 on the Organisation of Insurance Operations, and its amendments, is referred to as “Federal Law No. 6 of 2007”,

Federal Decree-Law No. 8 of 2017 on Value Added Tax, and its amendments, is referred to as “Federal Decree-Law No. 8 of 2017”,

Federal Decree-Law No. 14 of 2018 Regarding the Central Bank and Organisation of Financial Institutions and Activities, and its amendments, is referred to as “Federal Decree-Law No. 14 of 2018”,

Federal Decree-Law No. 28 of 2022 on Tax Procedures is referred to as “Tax Procedures Law”,

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as “Corporate Tax Law”,

Cabinet Decision No. 59 of 2017 on Designated Zones for the Purposes of the Federal Decree-Law No. 8 of 2017 on Value Added Tax, and its amendments, is referred to as “Cabinet Decision No. 59 of 2017”,

Cabinet Decision No. 56 of 2023 on Determination of a Non-Resident Person's Nexus in the State for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Cabinet Decision No. 56 of 2023”,

Cabinet Decision No. 75 of 2023 on the Administrative Penalties for Violations Related to the Application of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as “Cabinet Decision No. 75 of 2023”,

Cabinet Decision No. 100 of 2023 on Determining Qualifying Income for the Qualifying Free Zone Person for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Cabinet Decision No. 100 of 2023”,

Ministerial Decision No. 43 of 2023 Concerning Exception from Tax Registration for the Purpose of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 43 of 2023”,

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, is referred to as “Ministerial Decision No. 73 of 2023”,

Ministerial Decision No. 82 of 2023 on the Determination of Categories of Taxable Persons Required to Prepare and Maintain Audited Financial Statements for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 82 of 2023”,

Ministerial Decision No. 97 of 2023 on Requirements for Maintaining Transfer Pricing Documentation for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 97 of 2023”,

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 114 of 2023”,

Ministerial Decision No. 132 of 2023 on Transfers Within a Qualifying Group for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 132 of 2023”,

Ministerial Decision No. 133 of 2023 on Business Restructuring Relief for the Purposes of Federal Decree Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 133 of 2023”,

Ministerial Decision No. 265 of 2023 Regarding Qualifying Activities and Excluded Activities for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 265 of 2023”, and

Federal Tax Authority Decision No. 3 of 2024 on The Timeline specified for Registration of Taxable Persons for Corporate Tax for the purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments, is referred to as “FTA Decision No. 3 of 2024”.

Status of this guide

This guidance is not a legally binding document, but is intended to provide assistance in understanding the tax implications of the Corporate Tax regime for Free Zone Persons. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax in the UAE. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Free Zone Corporate Tax rules: At a glance

Scope of the Free Zone Corporate Tax rules

Free Zones are an integral part of the UAE economy and play a critical role in driving economic growth and transformation both in the UAE and internationally. Free Zones offer Businesses various benefits such as relaxed foreign ownership restrictions, streamlined administrative procedures, modern and sophisticated infrastructure, developed Business communities and the availability of additional legal entity forms and commercial activities.

To recognise the continued importance of Free Zones, the UAE Corporate Tax rules enable Free Zone companies and branches that meet certain conditions to benefit from a 0% Corporate Tax rate on certain Qualifying Activities and transactions.

Generally, the Corporate Tax rules for Free Zones are intended to provide a 0% Corporate Tax rate on Qualifying Income from:

Transactions between QFZPs and Free Zone Persons (where the Free Zone Person is the Beneficial Recipient of these transactions), and

Certain activities performed from within the prescribed geographical areas of a Free Zone (or a Designated Zone for distribution activities).

The list of Designated Zones for VAT purposes is provided by Cabinet Decision No. 59 of 2017. All taxpayers should check with their respective Free Zone Authority to confirm if they operate in a Free Zone or Designated Zone for Corporate Tax purposes.

Conditions to be a QFZP

To be a QFZP, the Free Zone Person must meet all of the conditions required in the Corporate Tax Law and the implementing decisions, as set out in Sections 3.2.1 to 3.2.8. If a Free Zone Person does not meet all of the conditions, it will no longer be a QFZP and its income will be subject to the standard Corporate Tax rules and rates.

A Free Zone Person will be deemed to be a QFZP unless one of the conditions to be a QFZP is not met, or if the QFZP makes an election to be subject to tax.

The regime is applicable to a Free Zone Person

A Free Zone Person is defined as a juridical person incorporated, established, or otherwise registered in a Free Zone including a branch of a Non-Resident Person or a UAE juridical person that is registered in a Free Zone. For clarity, this includes the relevant Free Zone authorities and other Government Controlled Entities that are established in a Free Zone.

The term “Free Zone Person” refers to the juridical person as a whole. This means that a Free Zone Person may:

Have its head office in a Free Zone and have a branch outside the Free Zone, or

Have a head office in the UAE (outside a Free Zone) or another country and have a branch within a Free Zone. In this situation the head office would be generally considered a Domestic Permanent Establishment or a Foreign Permanent Establishment, respectively.

In either scenario, the 0% Corporate Tax rate on Qualifying Income applies only to its Free Zone Business, (i.e. the portion of the Business that is registered in the Free Zone). For example, in the second scenario above, the head office (Domestic Permanent Establishment or Foreign Permanent Establishment) would not be eligible for the 0% Corporate Tax rate, but the branch in the Free Zone would. To reflect this, the term “Free Zone parent” is used in the guide to refer to the operations that a Free Zone Person has within a Free Zone, and when it has a taxable presence outside of the Free Zone the term “Domestic Permanent Establishment” or “Foreign Permanent Establishment” is used to reflect its non-Free Zone Business.

The Free Zone Person must maintain adequate substance in a Free Zone

The Free Zone Person must undertake its core income-generating activities relating to transactions and activities benefiting from the 0% Corporate Tax rate on Qualifying Income in a Free Zone (for distribution activities, this needs to be a Designated Zone). The Free Zone Person must have adequate assets, full-time employees, and incur an adequate amount of operating expenditures in the Free Zone (or Designated Zone for distribution activities) to perform its core income-generating activities. The core income-generating activities are the essential and value-adding activities that a Free Zone Person performs to generate Revenue from its Free Zone Business.

A Free Zone Person may outsource its core income-generating activities to other Persons located in a Free Zone (or Designated Zone for distribution activities), provided it has adequate supervision of the outsourced activities. For research and development (R&D) relating to the development of Qualifying Intellectual Property, a Free Zone Person may also outsource its core income-generating activities to any Persons in the UAE or non-Related Parties outside the UAE, provided it has adequate supervision of the outsourced activities.

The Free Zone Person must derive Qualifying Income

The Free Zone Person must derive Qualifying Income from one or more of the following sources:

Transactions with other Free Zone Persons, provided those Free Zone Persons are the Beneficial Recipient of the transactions and the transactions do not relate to Excluded Activities,

Transactions relating to Qualifying Activities that are not Excluded Activities,

Income derived from the ownership or exploitation of Qualifying Intellectual Property, or

Other income, provided the Free Zone Person meets the de minimis requirements (see Section 3.2.8).

However, income from the following sources (even if within the list above) will not give rise to Qualifying Income and will be taken into account in determining the Taxable Income that is subject to the 9% Corporate Tax rate (unless the income is exempt from Corporate Tax under another provision):

Income attributable to a Foreign Permanent Establishment,

Income attributable to a Domestic Permanent Establishment,

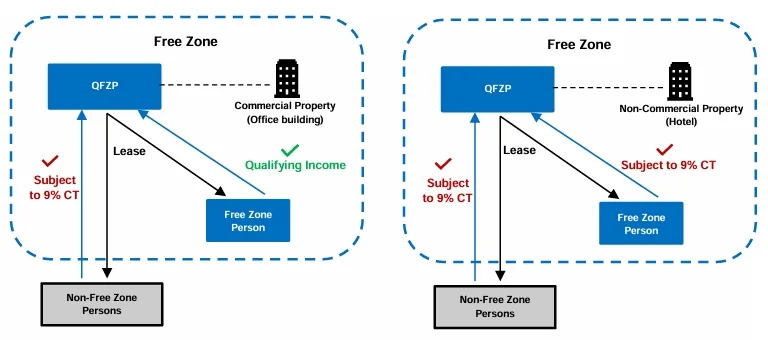

Income from Immovable Property (other than Commercial Property located in a Free Zone when the income arises from a transaction with a Free Zone Person), and

Income from the ownership or exploitation of intellectual property (other than Qualifying Income from Qualifying Intellectual Property).

The Free Zone Person must not have elected to be subject to the standard Corporate Tax rules and rates

A Free Zone Person must not have made an election under Article 19 of the Corporate Tax Law to be subject to the standard Corporate Tax rules and rates.

The Free Zone Person must comply with the arm's length principle

The Free Zone Person must comply with the arm's length principle for transactions with Related Parties and for arrangements between the Free Zone parent and its Foreign Permanent Establishments or Domestic Permanent Establishments. This means that the Free Zone parent must earn and record operating profits or losses at arm's length, determined in accordance with internationally accepted profit attribution methods such as the separate entity approach, taking into account the functions performed, assets used and risks assumed through the Free Zone parent and through its Foreign Permanent Establishments or Domestic Permanent Establishments.

The Free Zone Person must maintain Transfer Pricing documentation

The Free Zone Person must comply with the Transfer Pricing documentation requirements relating to transactions or arrangements with its Related Parties and Connected Persons. This requires the maintenance of documentation to demonstrate the arm's length nature of the relevant transactions and the preparation of a master file, local file, and disclosure form for the Free Zone Person as a whole if the relevant Transfer Pricing compliance thresholds are met.

In addition, where the Free Zone Person has income that is subject to the 9% Corporate Tax rate (for example, income attributable to its Foreign Permanent Establishment or Domestic Permanent Establishment), it should be able to demonstrate how the profits attributed to its Free Zone parent are commensurate with the functions performed, assets used, and risks assumed by the Free Zone parent and reflects an arm's length share of its overall operating profits.

The Free Zone Person must maintain audited Financial Statements

The Free Zone Person must prepare and maintain audited Financial Statements, regardless of the amount of Revenue it earns.

The non-qualifying Revenue must meet the de minimis requirements

The de minimis requirements are met if the Free Zone Person's non-qualifying Revenue does not exceed the lower of:

AED 5,000,000, or

5% of its total Revenue.

The Free Zone Person's non-qualifying Revenue in a Tax Period is Revenue derived from:

Excluded Activities,

Activities that are not Qualifying Activities where the other party to the transaction is a Non-Free Zone Person, and

Transactions with a Free Zone Person where such Free Zone Person is not the Beneficial Recipient of the relevant services or Goods.

When the Free Zone Person undertakes the de minimis calculation, Revenue from certain sources (as mentioned under Section 3.2.3) that do not give rise to Qualifying Income is not taken into consideration as part of total Revenue or non-qualifying Revenue. For example:

If the Free Zone Person derives Revenue of AED 10,000,000 of which AED 2,000,000 is attributable to a Domestic Permanent Establishment, its total Revenue for the purposes of de minimis calculation will be AED 8,000,000 and the AED 2,000,000 will not be considered as non-qualifying Revenue.

If the Free Zone Person derives AED 5,000,000 from Excluded Activities (which normally gives rise to non-qualifying Revenue) but this Revenue is attributable to a Domestic Permanent Establishment (giving rise to income that is subject to the 9% rate of Corporate Tax per Section 3.2.3), its non-qualifying Revenue for the purposes of the de minimis calculation would be zero.

Taxation of a QFZP

If the Free Zone Person meets all the conditions (including the de minimis requirements) to be a QFZP, it will be subject to Corporate Tax at the following rates:

0% on its Qualifying Income, and

9% on its Taxable Income that is not Qualifying Income.

A QFZP is not eligible to benefit from the 0% standard Corporate Tax rate applicable on Taxable Income up to the AED 375,000 threshold, and is subject to 9% on its Taxable Income that is not Qualifying Income.

To determine its Taxable Income that is not Qualifying Income, the Free Zone Person should apply the standard Corporate Tax rules in Article 20 of the Corporate Tax Law (for example, the Foreign Permanent Establishment exemption) to any income sources that do not give rise to Qualifying Income, but without the benefit of Small Business Relief, Qualifying Group Relief, Business Restructuring Relief, transfer of Tax Losses, or the Tax Group regime.

Losing status of a QFZP

A QFZP that elects to be subject to the standard Corporate Tax rules and rates or that fails to meet the criteria to be a QFZP for a certain Tax Period will cease to be a QFZP from the beginning of the Tax Period for which it elects to be subject to Corporate Tax or in which it fails to meet the criteria to be a QFZP, and the four subsequent Tax Periods.

Requirements to be a QFZP

Introduction

The Corporate Tax Law applies a 0% Corporate Tax rate to the Qualifying Income of a QFZP from transactions with Free Zone Persons and certain activities performed from within a Free Zone.[1]

Each Free Zone is regulated by a Free Zone authority and has its own local regulations. The Free Zone authority regulates the establishment of various businesses, including legal entities and branches within the Free Zone and the issuance and monitoring of trade licences for activities conducted in or from within the Free Zone.

The 0% Corporate Tax rate applies for the remainder of the tax incentive period stipulated in the legislation of the Free Zone in which the QFZP is registered.[2]

Being a Free Zone Person

A Free Zone Person is a juridical person that is incorporated, established, or otherwise registered in a Free Zone.[3] This also includes the relevant Free Zone authorities and other Government Controlled Entities that are established in a Free Zone.

A foreign juridical person's registered branch in a Free Zone will be considered a Free Zone Person (with the foreign parent being considered as a Foreign Permanent Establishment). A UAE juridical person that has a branch that is registered in a Free Zone will be a Free Zone Person (with the UAE juridical person becoming a Domestic Permanent Establishment) for the purposes of the Corporate Tax Law.

A Person that is not a juridical person (i.e. an entity without a separate legal personality that is distinct from its owners or founders), such as an Unincorporated Partnership or a natural person, cannot be a Free Zone Person. A juridical person incorporated or established outside of a Free Zone also cannot be a Free Zone Person solely because the place of effective management and control of that juridical person is situated in a Free Zone.

A Free Zone Person will be deemed to be a QFZP unless one of the conditions to be a QFZP is not met, or if the QFZP makes an election to be subject to tax (see Sections 4.4 to 4.6).

Scope of the Free Zone Corporate Tax rules

The 0% Corporate Tax rate under the Free Zone regime applies to transactions and activities performed from within the prescribed geographical areas of Free Zones (including Designated Zones) and is intended to benefit Qualifying Income derived from the following sources:

Transactions with another Free Zone Person who is the Beneficial Recipient of the transaction, unless the transaction relates to:

Excluded Activities (see Section 11),

Immovable Property located outside a Free Zone, or

non-Commercial Property located in a Free Zone.

Transactions relating to Qualifying Activities (see Section 10) that are not Excluded Activities.

Income from Qualifying Intellectual Property that a Free Zone Person has developed (see Section 9).

Any other income where the de minimis requirements are met.

Example 1: Transactions with a Free Zone Person

Company A (a Free Zone Person) performs legal services solely for Free Zone Persons who are the Beneficial Recipients of those services.

Transactions between Free Zone Persons are not required to be within the scope of Qualifying Activities to benefit from the 0% Corporate Tax rate on Qualifying Income. Consequently, income from Company A's transactions will constitute Qualifying Income as long as it does not arise from Excluded Activities (for example, transactions with natural persons are normally Excluded Activities).

As legal services are not Excluded Activities, Company A may still derive Qualifying Income from the services provided to juridical persons (who are Free Zone Persons and Beneficial Recipients of these services) and benefit from the 0% Corporate Tax rate on that income, even though legal services are not a Qualifying Activity.

Beneficial Recipient

The 0% Corporate Tax rate on Qualifying Income is intended to apply to transactions between Free Zone Persons, provided the transactions do not relate to an Excluded Activity. However, to preserve the integrity of the rules, the 0% Corporate Tax rate only applies to those transactions if the recipient (i.e. the Free Zone Person) is the Beneficial Recipient of the relevant services or Goods.[4]

A Free Zone Person is considered to be the Beneficial Recipient of services or Goods if the Free Zone Person has the right to use and enjoy the services or Goods and is not bound by a contractual or legal obligation to supply such services or Goods to another person.[5] To be considered as the Beneficial Recipient, the services or Goods must be for use by the Free Zone parent and not by a Foreign Permanent Establishment or Domestic Permanent Establishment.

Where the recipient is acting as a conduit or intermediary (for example, an agent or nominee) for a third party (including a Related Party or group entity), the Beneficial Recipient of that transaction is the third party and not the conduit or intermediary.

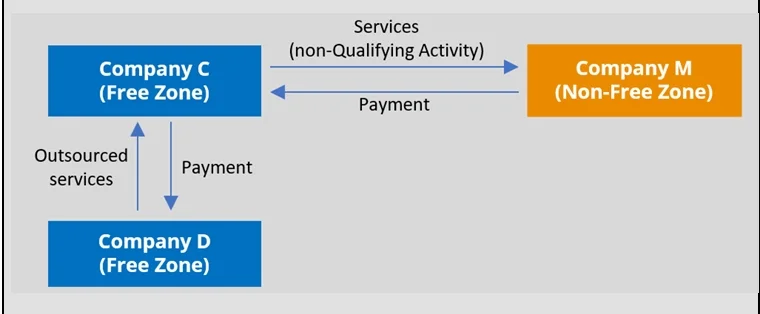

Example 2: Beneficial Recipient rule

Company C (a Free Zone Person) is engaged in the Business of providing legal services (i.e. not a Qualifying Activity). Company C enters into a contract with Company M (a Non-Free Zone Person) to provide legal advice in Mandarin to Company M. While Company C performs the legal analysis, Company C outsources the Mandarin and other translation work to Company D (a Free Zone Person). The arrangements are illustrated in the diagram below.

For Company D, Company C would be the Beneficial Recipient of its services. Although Company C provides the translation directly to Company M to meet its commitments to Company M, Company C has the right to use and enjoy the services as Company C does not have a contractual or legal obligation to supply the specific services from Company D to Company M (i.e. the services Company D is performing are not specific deliverables for Company M but are an input for Company C and this is not an instance where Company M could have contracted directly with Company D in order to obtain the legal services). Accordingly, subject to meeting all the other relevant requirements, the income Company D derives from Company C will be considered to be derived from a transaction with a Free Zone Person that is the Beneficial Recipient of the services.

For Company C, the payment from Company M would be considered non-Qualifying Income as Company C is engaged in rendering non-Qualifying Activity to a Non-Free Zone Person (Company M).

When a Free Zone Person sells services or Goods to another Free Zone Person, it is required, in order to determine its own status as a QFZP, to consider if the purchaser is the Beneficial Recipient of such services or Goods. The seller or service provider may rely on a written statement or undertaking from the purchaser (for example, a contractual stipulation) confirming that the purchaser is the Beneficial Recipient and will use the services or Goods for its Free Zone Business, unless the seller has reason to believe that such representation may be incorrect (for example, because the Goods are to be delivered to a third party).

De minimis requirements

To preserve the integrity of the 0% Corporate Tax rate on Qualifying Income, where a Free Zone Person derives income that is outside the intended scope of the rules (see Section 4.3), it will lose its status as a QFZP unless it satisfies the de minimis requirements.[6]

When assessing the de minimis requirements, Revenue derived from the following sources is not taken into consideration and will not affect a Free Zone Person's status as a QFZP:[7]

Revenue attributable to a Foreign Permanent Establishment,

Revenue attributable to a Domestic Permanent Establishment,

Revenue from Immovable Property located in a Free Zone (other than Commercial Property located in a Free Zone when the income arises from a transaction with a Free Zone Person), and

Revenue from the ownership or exploitation of intellectual property (other than Qualifying Income from Qualifying Intellectual Property).

The income that arises from these Revenue sources will be subject to a 9% Corporate Tax rate (unless the income is Exempt Income) as applicable under the Corporate Tax Law.[8]

For other Revenue sources, the de minimis requirements allow a Free Zone Person to derive an immaterial amount of income from Excluded Activities and non-qualifying sources without affecting its ability to be a QFZP provided the de minimis requirements are satisfied.[9]

Applying the de minimis requirements

The de minimis requirements are satisfied where the non-qualifying Revenue derived by the QFZP in a Tax Period does not exceed the lower of:[10]

5% of the total Revenue of the QFZP in that Tax Period, or

AED 5,000,000.

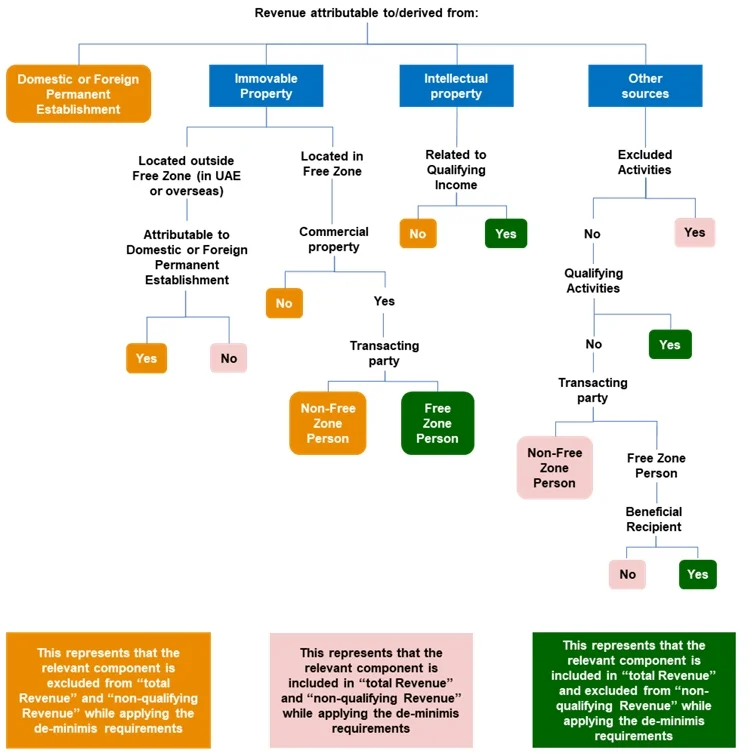

To determine the non-qualifying Revenue and total Revenue to apply the de minimis requirements, the Revenue of a Free Zone Person must be segregated into its components:

Total Revenue is all the Revenue that a Free Zone Person derives in Tax Period, less the amount of Revenue that is:[11]

Attributable to a Foreign Permanent Establishment (see Section 7.2).

Attributable to a Domestic Permanent Establishment (see Section 7.3).

Derived from Immovable Property located in a Free Zone, other than Commercial Property transactions with Free Zone Persons (see Section 8 for more information on Immovable Property located in a Free Zone), and

Derived from the ownership or exploitation of intellectual property, other than Revenue relating to Qualifying Income from Qualifying Intellectual Property (see Section 9 for information on Qualifying Intellectual Property).

Non-qualifying Revenue is the Free Zone Person's Revenue from the following activities/transactions once adjusted for the above exclusions:[12]

Excluded Activities.

Activities that are not Qualifying Activities where the other party to the transaction is a Non-Free Zone Person.

Transactions with a Free Zone Person where such Free Zone Person is not the Beneficial Recipient of the relevant services or Goods.

The Revenue that is attributable to a Foreign Permanent Establishment or Domestic Permanent Establishment is determined by applying the arm's length principle.

Example 3: Revenue attributable to a Domestic Permanent Establishment

Company B (a Free Zone Person) manufactures goods in a Free Zone and transfers those goods to its Domestic Permanent Establishment, which then sells those goods for AED 100,000. The arm's length price of the goods when they are transferred to the Domestic Permanent Establishment is AED 70,000.

The Revenue attributable to Company B's Domestic Permanent Establishment will be AED 30,000, which is the difference between the price for which the goods were sold and the arm's length price of the goods when they were transferred to the Domestic Permanent Establishment.

Example 4: Revenue attributable to a Domestic Permanent Establishment

Company D (a Free Zone Person) conducts part of its Business through a Domestic Permanent Establishment and conducts Qualifying Activities through its Free Zone parent. Company D performs routine administrative activities (for example, payroll administration) for the whole entity through its Domestic Permanent Establishment. The arm's length value of the services that are received by the Free Zone parent is AED 100,000.

The arm's length value of those services will constitute Revenue attributable to the Domestic Permanent Establishment and will be excluded for the purposes of the de minimis requirement. The income attributable to those activities would also be taken into consideration when determining the Taxable Income of the Domestic Permanent Establishment.

The segregation of Revenue to determine what is considered “non-Qualifying Revenue” is illustrated in the flow chart below.

Determining 'total Revenue' and 'non-qualifying Revenue'

Income that an Exempt Person derives in its capacity as an Exempt Person (for example, income from an Extractive Business) is also excluded from the above calculations/steps on the basis that the provisions of the Corporate Tax Law do not apply to that Business.[13]

If the de minimis requirements are not met, the Free Zone Person will not be a QFZP and will be subject to the standard Corporate Tax rules and rates from the beginning of the relevant Tax Period and for the subsequent four Tax Periods.[14]

Example 5: De minimis requirements to be treated as QFZP

Company E (a Free Zone Person) derives the following Revenue:

| Revenue | Amounts in AED |

|---|---|

| From a Domestic Permanent Establishment | 10,000,000 |

| From rental of Immovable Property located in a Free Zone to Non-Free Zone Persons | 2,500,000 |

| From transactions with other Free Zone Persons (who are the Beneficial Recipients), of which AED 200,000 relates to Excluded Activities | 5,000,000 |

| From transactions with Non-Free Zone Persons, all of which arises from Qualifying Activities that are not Excluded Activities | 2,000,000 |

| From other transactions with Non-Free Zone Persons (that are not Qualifying Activities) | 300,000 |

The Revenue from the Domestic Permanent Establishment (AED 10,000,000) and Immovable Property located in the Free Zone (AED 2,500,000) is disregarded in determining whether Company E has met the de minimis requirements to be considered as a QFZP.

Company E has non-qualifying Revenue of AED 500,000, arising from:

AED 200,000 of Revenue from Excluded Activities from transactions with Free Zone Persons, and

AED 300,000 of Revenue from other transactions with Non-Free Zone Persons (that are not Qualifying Activities).

For purposes of the de minimis requirement, the total Revenue of Company E is AED 7,300,000 arising from:

AED 5,000,000 from transactions with other Free Zone Persons (who are the Beneficial Recipients). This includes the AED 200,000 that relates to Excluded Activities,

AED 2,000,000 from transactions with Non-Free Zone Persons, all of which arises from Qualifying Activities that are not Excluded Activities, and

AED 300,000 from other transactions with Non-Free Zone Persons (that are not Qualifying Activities).

As Company E's non-qualifying Revenue is 6.85% (500,000/7,300,000) of total Revenue, which exceeds the 5% de minimis threshold, Company E does not meet the requirements to be a QFZP and would, therefore, be subject to the standard Corporate Tax rules and rates on the entirety of its Taxable Income.

Example 6: De minimis requirements to be treated as QFZP

The facts are the same as in Example 5, except that the AED 300,000 from other transactions with Non-Free Zone Persons is attributable to Company E's Domestic Permanent Establishment.

Company E has non-qualifying Revenue of AED 200,000 arising from Revenue from Excluded Activities from transactions with Free Zone Persons. For purposes of the de minimis requirement, the total Revenue of Company E is AED 7,000,000. As the non-qualifying Revenue is 2.86% (200,000/7,000,000) of total Revenue, which is within the 5% de minimis threshold, and does not exceed the AED 5,000,000 de minimis threshold, Company E meets the de minimis requirements to be a QFZP and may be able to benefit from the 0% Corporate Tax rate for QFZPs on its Qualifying Income, provided it meets the other relevant conditions.

Other criteria to be a QFZP

In addition to meeting the de minimis requirements, a Free Zone Person must meet all the following criteria to be a QFZP in a Tax Period:

The Free Zone Person must have adequate substance (see Section 6).[15] This means that it must undertake, in a Free Zone, all of its core income-generating activities relating to transactions and activities that generate Qualifying Income (for distribution activities, these core income-generating activities need to be undertaken within a Designated Zone). It is also required that the Free Zone Person maintains adequate assets, full-time employees, and operating expenditures in the Free Zone (or Designated Zone) to perform the core income-generating activities. The only exception to this requirement is in relation to Qualifying Intellectual Property where R&D activities may be outsourced to certain Persons outside the Free Zone.

The Free Zone Person must derive Qualifying Income (see Section 5.2).[16] A Free Zone Person that does not earn any Qualifying Income in a Tax Period because it has not started to derive Revenue would be considered to meet this requirement (see Section 4.5.1).

The Free Zone Person must not have elected to be subject to the standard Corporate Tax rules and rates (see Section 4.6).[17]

The Free Zone Person must comply with the arm's length principle for transactions with Related Parties (see Section 4.5.2) and maintain appropriate Transfer Pricing documentation for its overall UAE operations (see Section 4.5.3).[18]

The Free Zone Person must prepare and maintain audited Financial Statements for the purposes of the Corporate Tax Law, regardless of the amount of Revenue that it earns (see Section 12.4).[19]

Deriving Qualifying Income

A Free Zone Person that does not earn any Qualifying Income in a Tax Period because it has not started to derive Revenue will not be disqualified from being a QFZP, provided it does not derive any non-qualifying Revenue and complies with all other requirements prescribed by the Corporate Tax Law. An example of this would be a Free Zone Person that conducts activities in a Free Zone that may give rise to Qualifying Income but is yet to derive Revenue from those activities.

Example 7: Free Zone Person with no Revenue in start-up phase

Company F (a QFZP) is incorporated on 1 January 2024 in a Free Zone to manufacture environmentally friendly products (a Qualifying Activity). It follows the Gregorian calendar year as its Tax Period.

Throughout the 2024 and 2025 Tax Periods, Company F remains in the preparatory phase, purchasing equipment, hiring staff, and finalising its product development. The company does not earn any Qualifying Income as its Qualifying Activity of manufacturing is not yet fully operational. No Revenue arises during the 2024 and 2025 Tax Periods, even though the company has incurred expenditure.

In this case, having no Qualifying Income for the 2024 and 2025 Tax Periods will not automatically disqualify Company F from being a QFZP as there is no Revenue and Business operations have not commenced.

Therefore, Company F can retain its QFZP status for the 2024 and 2025 Tax Periods, anticipating its potential to generate Qualifying Income in the successive periods when its Qualifying Activity of manufacturing begins and it generates Revenue. In this case, Company F can file its Tax Returns as a QFZP for the 2024 and 2025 Tax Periods. However, there will be no Qualifying Income to benefit from the 0% Corporate Tax rate.

Example 8: Free Zone Person with Interest income in start-up phase

The facts are the same as in Example 7, except that Company F deposits its working capital in an Interest-bearing bank account and derives AED 100 of Interest income in the 2024 Tax Period.

The investment of surplus funds cannot be considered as an ancillary activity (see Section 10.2.3). However, such Interest income can be treated as arising from the Qualifying Activity of treasury and financing services to Related Parties (see Section 10.12). The relevant core income-generating activities for treasury and financing services and associated level of substance for this activity will still need to be met.

For the purpose of assessing whether Company F has adequate employees, it will need to be ensured that there is no double counting of employees (i.e. the employee that oversees the treasury activity cannot also be counted for the purpose of the manufacturing activity substance test).

Example 9: Free Zone Person with non-qualifying Revenue in start-up phase

The facts are the same as in Example 7, except that Company F sells an office chair to an employee for AED 100 in the 2024 Tax Period.

The sale of the office chair to the employee is an Excluded Activity (transactions with natural persons) and would be treated as non-qualifying Revenue. As the non- qualifying Revenue (i.e. AED 100) exceeds 5% of the total Revenue (i.e. AED 100), Company F will not meet the de minimis requirements in 2024 and will not qualify to be a QFZP for the 2024 Tax Period and the four subsequent Tax Periods.

Arm's length principle

One of the conditions to be a QFZP is that a Free Zone Person must comply with the arm's length principle.[20] When determining Taxable Income, income and expenses relating to transactions and arrangements between Related Parties must be consistent with the results that would have been realised if Persons who were not Related Parties had engaged in similar transactions or arrangements under similar circumstances.[21]

In other words, the Related Parties must earn arm's length income and record operating profits or losses in line with their respective functions, assets, and risks and contributions to the value chain across the group.

Section 5.4 discusses the practical application of the arm's length principle to the attribution of profits of a Free Zone Person between the Free Zone parent and its Foreign Permanent Establishments or Domestic Permanent Establishments.

Transfer Pricing documentation

Another condition to be a QFZP is that a Free Zone Person must comply with the Transfer Pricing documentation requirements relating to transactions and arrangements with its Related Parties and Connected Persons.[22] This would require the maintenance of documentation to demonstrate the arm's length nature of the relevant transactions and the preparation of a master file, local file, and other Transfer Pricing documentation requirements for the Free Zone Person as a whole if the relevant Transfer Pricing compliance thresholds are met.[23]

In addition, a QFZP should maintain sufficient documentation to be able to demonstrate how the profits attributed to the Free Zone parent and its Foreign Permanent Establishments or Domestic Permanent Establishments are commensurate with their relative functions performed, assets deployed, and risks assumed.

Election not to be a QFZP

Being a beneficiary to the 0% Corporate Tax rate, a QFZP will not be eligible for some of the standard features of the Corporate Tax regime. For instance, a QFZP does not qualify for the 0% Corporate Tax rate on Taxable Income up to AED 375,000 that is available to a Person that is not a QFZP. A QFZP also does not qualify for Tax Grouping and specific relief provisions available under the Corporate Tax Law such as Small Business Relief, Qualifying Group Relief, Business Restructuring Relief and transfer of Tax Losses.

The Corporate Tax regime does, however, provide flexibility to allow a Free Zone Person to elect not to be treated as a QFZP, and to be subject to Corporate Tax in the same manner as other Taxable Persons in general.[24] A Free Zone Person would, in those instances, be able to qualify for the specific provisions listed above, subject to meeting the necessary conditions.

The Free Zone Person has the option to make the election effective from either of:[25]

The commencement of the Tax Period in which the election is made, or

The commencement of the Tax Period following the Tax Period in which the election was made.

The above election can be made by the Free Zone Person in relation to the relevant Tax Period at any time during such Tax Period and after the end of such Tax Period in the related Tax Return. The election cannot be made after the due date for filing the relevant Tax Return has lapsed.

Example 10: Election not to be a QFZP

Company G (a Free Zone Person) has determined that it does not want to be a QFZP for the Tax Period 1 January 2024 to 31 December 2024.

For the election to apply to the Tax Period ending 31 December 2024, Company G would need to make this election up to the due date of filing of the Tax Return for 2024. Where such an election has been made by 30 September 2025 (i.e. within 9 months from the end of the Tax Period ending 31 December 2024), it would mean that Company G is not a QFZP for the Tax Period ending 31 December 2024 and the four subsequent Tax Periods.

Effect of an election to be subject to standard Corporate Tax rules and rates

An election not to be a QFZP will apply for the Tax Period from which it is effective and for the following four Tax Periods. After that, it would need to make a new election to not be treated as a QFZP (i.e. to be subject to standard Corporate Tax rules and rates), unless it otherwise fails to meet the criteria to be a QFZP for that Tax Period.[26]

Losing status as a QFZP

If a QFZP fails to meet the criteria to be a QFZP for a Tax Period, the QFZP will cease to be a QFZP from the beginning of that Tax Period and for the four subsequent Tax Periods.[27]

Example 11: Not meeting criteria to be a QFZP

Company H (a QFZP) consistently follows the Gregorian calendar year as its Tax Period. During the 2024 Tax Period, if Company H fails to meet the de minimis requirements it would be treated as a QFZP that has failed to meet the criteria to be a QFZP. Accordingly, Company H would cease to be treated as a QFZP from 1 January 2024, and for the four subsequent Tax Periods. As it consistently follows the Gregorian calendar year as its Tax Period, it would not be eligible to be treated as a QFZP until the end of the 2028 Tax Period (31 December 2028).

Example 12: Failing to qualify as a QFZP in the previous five Tax Periods

Company I (a QFZP) consistently follows the Gregorian calendar year as its Tax Period. During the 2024 Tax Period, if Company I elects not to be a QFZP, or if it fails to meet the de minimis requirements then Company I would fail to meet the criteria to be a QFZP. Accordingly, Company I would not be a QFZP for the 2024 Tax Period and the four subsequent Tax Periods, even if the conditions to be a QFZP during any of these four subsequent years are met. As it consistently follows the Gregorian calendar year as its Tax Period, it would not be eligible to be treated as a QFZP until the end of the 2028 Tax Period (31 December 2028).

However, non-compliance with the rules during these five Tax Periods does not affect the future eligibility beyond the end of those Tax Periods.

For the 2029 Tax Period starting on 1 January 2029, Company I would test again whether it qualifies to be a QFZP. If Company I fails to meet the criteria to be a QFZP, it would not be a QFZP for the 2029 Tax Period and the four subsequent Tax Periods through to the end of the 2033 Tax Period, and it would review its status again for the 2034 Tax Period.

Calculating Corporate Tax for a Free Zone Person

Corporate Tax rate for a QFZP

If a Free Zone Person meets all the conditions (including the de minimis requirements) to be a QFZP, it will be subject to:[28]

0% Corporate Tax rate on its Qualifying Income, and

9% Corporate Tax rate on its Taxable Income that is not Qualifying Income.

A QFZP is not entitled to a 0% Corporate Tax rate on its first AED 375,000 of Taxable Income.

Qualifying Income

Qualifying Income is defined in relation to the following categories of income:[29]

Transactions with a Free Zone Person who is the Beneficial Recipient of the transaction (except Revenue from Excluded Activities),

Transactions in respect of Qualifying Activities (except Revenue from Excluded Activities),

Qualifying Income from Qualifying Intellectual Property, and

Other sources (including Revenue from Excluded Activities) if the QFZP satisfies the de minimis requirements.

However, Revenue from the following sources will not give rise to Qualifying Income, even if it falls within the items listed above:[30]

Revenue attributable to a Foreign Permanent Establishment,

Revenue attributable to a Domestic Permanent Establishment,

Revenue in respect of Immovable Property (other than Commercial Property located in a Free Zone when the income arises from a transaction with a Free Zone Person), and

Revenue from the ownership or exploitation of intellectual property (other than Qualifying Income from Qualifying Intellectual Property).

Taxable Income that is not Qualifying Income

To determine the amount of Taxable Income that is not Qualifying Income, which will be subject to the 9% Corporate Tax rate, a QFZP will need to:

separate the Revenue in its Financial Statements into Revenue pertaining to the Qualifying Income component and to the Taxable Income component,

allocate the expenses in its Financial Statements against those components in a reasonable manner, consistent with the arm's length principle (see Section 5.4), and

apply Article 20 of the Corporate Tax Law (i.e. the general rules for determining Taxable Income) to determine the Taxable Income that is not Qualifying Income (see Section 5.5).

Example 13: Corporate Tax on QFZP with a Domestic Permanent Establishment

Company J (a QFZP) derives the following Revenue for the Tax Period ending 31 December 2024:

AED 1,000,000 attributable to Qualifying Activities that are not Excluded Activities performed in a Free Zone.

AED 2,000,000 attributable to activities conducted through a Domestic Permanent Establishment.

Company J incurs the following operating expenses during the Tax Period:

AED 600,000 by the Free Zone parent.

AED 1,400,000 by its Domestic Permanent Establishment.

AED 300,000 in the Domestic Permanent Establishment relating to HR administrative activities that support both the Free Zone parent and Domestic Permanent Establishment. Applying an appropriate allocation key (for example, relative headcount), Company J determines that 50% of these expenses should be attributed to its Free Zone parent.

Based on the arm's length principle, Company J determines that the Revenue and expenses in its Financial Statements for the Tax Period ending 31 December 2024 can be allocated between Qualifying Income and Taxable Income, as follows (amounts in AED):

| Items | Total | Domestic Permanent Establishment (Taxable Income) | Free Zone Parent (Qualifying Income) |

|---|---|---|---|

| Revenue | 3,000,000 | 2,000,000 | 1,000,000 |

| Less: Direct expenses | 2,000,000 | 1,400,000 | 600,000 |

| Less: Allocated expenses | 300,000 | 150,000 | 150,000 |

| Profit | 700,000 | 450,000 | 250,000 |

Company J will be subject to Corporate Tax on its Qualifying Income (of AED 250,000) at 0%. Company J will be subject to Corporate Tax of AED 40,500 (i.e. 9% Corporate Tax rate on the AED 450,000 profit attributable to its Domestic Permanent Establishment). This is based on the assumption that there are no further adjustments as per Article 20 of the Corporate Tax Law.

Allocating expenses

Where a QFZP derives both Qualifying Income and Taxable Income that is not Qualifying Income, it will need to allocate its expenses between the two components to determine the Taxable Income component. This should be done by applying the arm's length principle.[31] For income attributable to a Foreign Permanent Establishment or Domestic Permanent Establishment, this requires the Foreign Permanent Establishment or Domestic Permanent Establishment to be treated as if it were a separate and independent Person transacting at arm's length (“separate entity approach”). In relation to income that is not connected with a Foreign Permanent Establishment or Domestic Permanent Establishment, the Free Zone Person should make a reasonable allocation between the components to determine the arm's length value of profits attributable to each activity.

To attribute the profit between a Free Zone parent and its Foreign Permanent Establishment or Domestic Permanent Establishment, a two-step approach is required:

Step one: Conduct a functional analysis to identify the functions performed by the Foreign Permanent Establishment or Domestic Permanent Establishment on one side, and the Free Zone parent on the other side, treating each as separate to the other. This analysis should also take into account the assets used and the risks assumed by the Foreign Permanent Establishment or Domestic Permanent Establishment and the Free Zone parent.

Step two: Determine the compensation relating to arrangements or dealings between the Foreign Permanent Establishment or Domestic Permanent Establishment and the Free Zone parent, commensurate with their respective functions performed, assets deployed, and risks assumed.

For further information on the two-step approach, see the FTA Corporate Tax Guide on Transfer Pricing. Free Zone Persons can also refer to the 2010 report[32] and the 2018 report[33] on the attribution of profits to permanent establishments issued by the OECD for further guidance.

The approach adopted should be pragmatic, taking into consideration cost-benefit considerations and should be fact and circumstance specific.

Where expenses are incurred specifically for a determined income component, those expenses should be allocated directly to that category of income. However, if the QFZP incurs deductible expenses that cannot be directly attributed to the Qualifying Income or Taxable Income component (for example, Interest, centralised general and administration expenses), the QFZP will need to allocate those expenses between the Qualifying Income and Taxable Income components on an arm's length basis using appropriate allocation keys. This allocation should be consistent with the arm's length principle.

Allocation keys are criteria used to determine how costs can be assigned or distributed across different departments, products, services, or divisions within a Business. These keys can be applied to factors such as headcount, floor space, usage, time spent, or any other measurable and reasonable basis. The primary goal of allocation keys is to provide a fair and accurate distribution of costs, allowing for more accurate determination of the income arising from each income component.

The appropriate allocation key will depend on the nature of the expense and the contribution that it makes to each income component. In many cases, an allocation that pro rates expenses based on Revenue will be considered as a reasonable allocation. However, this will not always be the case and the following principles should be considered to determine whether Revenue or some other basis would be appropriate to allocate each expense item. For example:

Cause and effect: An allocation should be consistent with identifiable cause-and- effect relationships (for example, machinery running hours may be an appropriate allocation key to allocate maintenance costs).

Benefits derived: An allocation should be commensurate with the benefits received.

The allocation key chosen must be logical and must fairly represent the benefit that the expense generates for each income component. The allocation key should also be used consistently for each Tax Period unless there is a change in fact pattern which may justify a change in allocation or methodology.

Example 14: Allocation key for independent operations

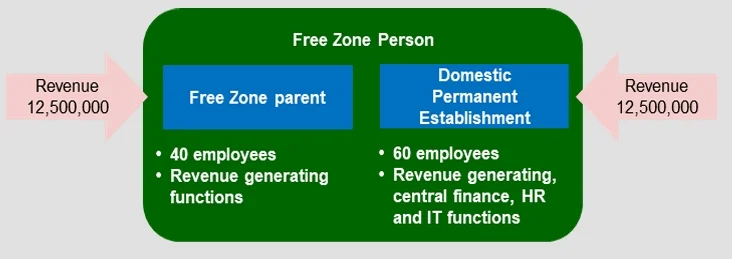

Company K (a QFZP) has a Free Zone parent and a Domestic Permanent Establishment, each of which performs an independent Business and derives

Revenue from sales to third parties. There is no flow of goods between the Free Zone parent and the Domestic Permanent Establishment. However, Company K's HR, finance, and IT departments in the Domestic Permanent Establishment support both the Free Zone parent and the Domestic Permanent Establishment.

Company K has 60 employees in its Domestic Permanent Establishment and 40 employees in its Free Zone parent. Company K generates AED 25,000,000 in Revenue for the Tax Period ending 31 December 2024, of which AED 12,500,000 relates to sales by the Free Zone parent and AED 12,500,000 relates to sales by the Domestic Permanent Establishment. The structure is reflected in the following diagram.

Company K derives 50% of its Revenue from its Qualifying Income component. However, based on an analysis of the benefits derived by the Free Zone parent and the Domestic Permanent Establishment:

It may be more reasonable for Company K to allocate 40% of the costs of its HR and finance department to its Qualifying Income component based on headcount and Revenue respectively, as the cost of those functions tends to be correlated to the number of employees and Revenue (this would be subject to a full Transfer Pricing analysis).

It may be appropriate to allocate IT costs based on the number of IT support tickets raised by the Free Zone parent and the Domestic Permanent Establishment, as this may provide a reasonable indication of the intensity of IT related activity for each income component (this would be subject to a full Transfer Pricing analysis).

Other allocation keys may also be appropriate depending on the facts and circumstances and suitable Transfer Pricing analysis. Company K should adopt an allocation key for each expense that fairly represents the benefit that the expense generates for each income component.

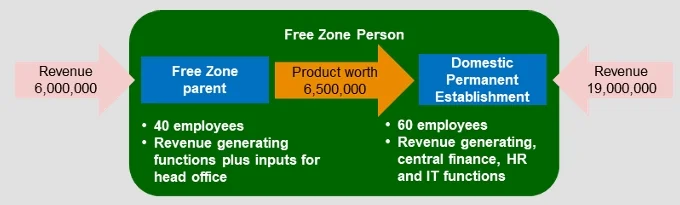

Example 15: Allocation key for interdependent operations

The facts are the same as in Example 14, except that the Domestic Permanent Establishment and Free Zone parent are integrated and interdependent. The market value of the output of the Free Zone parent is AED 12,500,000, of which AED 6,000,000 is realised through sales to third party and AED 6,500,000 represents the arm's length value of output transferred to the Domestic Permanent Establishment. The Domestic Permanent Establishment further processes and sells the output from the Free Zone parent, and this forms part of the AED 19,000,000 of Revenue that the Domestic Permanent Establishment receives from sales to third parties. The structure is reflected in the following diagram.

Company K would allocate indirect costs between its Free Zone parent and Domestic Permanent Establishment applying similar principles to Example 14.

Taxable Income subject to the 9% rate of Corporate Tax

To determine the amount of Taxable Income that is not Qualifying Income and is subject to the 9% rate of Corporate Tax, the QFZP should start from the income and expenses that do not pertain to Qualifying Income. Then the QFZP should determine its Taxable Income under the standard rules of the Corporate Tax Law, subject to the removal of Exempt Income, and the unavailability of reliefs under the Corporate Tax Law that a QFZP is not eligible to benefit from. A QFZP will not be able to benefit from:

Small Business Relief,[34]

Qualifying Group Relief,[35]

Business Restructuring Relief,[36]

The ability to transfer or receive a Tax Loss,[37] or

The ability to be a member of a Tax Group.[38]

Example 16: Application of Corporate Tax rate

Company L (a QFZP) conducts Business through its Free Zone parent and multiple Foreign Permanent Establishments and Domestic Permanent Establishments and derives income (after arm's length expense allocations) as follows:

| Source | Amount | Observation |

|---|---|---|

Free Zone parent | AED 1,000,000 | All Qualifying Income |

Domestic Permanent Establishments | AED 500,000 | |

Foreign Permanent Establishments | AED 5,000,000 |

Company L elects not to take into account the income and associated expenditure of its Foreign Permanent Establishments,[39] so the income of the Foreign Permanent Establishments is Exempt Income.[40]

Company L derives Qualifying Income of AED 1,000,000 in relation to its Free Zone parent and Taxable Income of AED 500,000 through its Domestic Permanent Establishments. Company L will be subject to Corporate Tax as follows:

0% rate on the AED 1,000,000 of Qualifying Income, and

9% rate on the AED 500,000 of Taxable Income that is not Qualifying Income, amounting to AED 45,000 of Corporate Tax due. This is because the 375,000 AED threshold (subject to 0%) does not apply to a QFZP.

Example 17: Non-deductible Interest expense

Company M (a QFZP) conducts Business through its Free Zone parent and through a Domestic Permanent Establishment. Company M derives no Interest income and incurs Interest expense of AED 36,000,000. The Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA), and the Net Interest Expenditure attributable to its Taxable Income and Qualifying Income components are reflected in the table below.

Note that the adjusted EBITDA in relation to Qualifying Income is provided for illustrative purposes only.

Items | Total | Domestic Permanent Establishment (Taxable Income) | Free Zone Parent (Qualifying Income) |

Adjusted EBITDA | 72,000,000 | 42,000,000 | 30,000,000 |

Net Interest Expenditure | 36,000,000 | 27,000,000 | 9,000,000 |

Thus, Company M's Interest deduction under the General Interest Deduction Limitation Rule is restricted to the greater of:

30% of adjusted EBITDA related to Taxable Income (i.e. AED 42,000,000 x 30% = AED 12,600,000), or

AED 12,000,000.[41]

Company M may deduct the Net Interest Expenditure of AED 12,600,000 in determining its Taxable Income that is not Qualifying Income. In applying this test, income and expenses relating to Qualifying Income are disregarded.

Example 18: Non-deductible Interest expense

The facts are the same as in Example 17, except that the adjusted EBITDA and Net Interest Expenditure attributable to Company M's Taxable Income and Qualifying Income components are reflected in the table below. Note that the adjusted EBITDA in relation to Qualifying Income is provided for illustrative purposes only.

Items | Total | Domestic Permanent Establishment (Taxable Income) | Free Zone Parent (Qualifying Income) |

Adjusted EBITDA | 36,000,000 | 20,000,000 | 16,000,000 |

Net Interest Expenditure | 18,000,000 | 9,000,000 | 9,000,000 |

As the Net Interest Expenditure attributable to Taxable Income is less than the AED 12,000,000 threshold, the General Interest Deduction Limitation Rule will not be applicable. Company M may deduct the Net Interest Expenditure of AED 9,000,000 in determining its Taxable Income that is not Qualifying Income.

Tax Losses

If a QFZP incurs Tax Losses on the Taxable Income component after applying Article 20 of the Corporate Tax Law, those Tax Losses may be carried forward and offset against the QFZP's Taxable Income in subsequent Tax Periods except for income from intellectual property (i.e. other than Qualifying Income from Qualifying Intellectual Property), provided the conditions in relation to Tax Loss relief and carry forward of Tax Losses are met.[42] Income from intellectual property (i.e. other than Qualifying Income from Qualifying Intellectual Property) can only be offset against Tax Losses from such intellectual property.

A QFZP cannot utilise any losses incurred prior to the commencement of Corporate Tax or prior to becoming a Taxable Person.[43]

If a QFZP incurs losses in relation to the Qualifying Income component of its income, those losses may not be applied against the QFZP's Taxable Income, transferred, or carried forward. A QFZP cannot transfer Tax Losses to, or receive Tax Losses from, another Taxable Person.[44]

Example 19: Tax Loss incurred by QFZP

Company N (a QFZP) has a Free Zone parent and a Domestic Permanent Establishment.

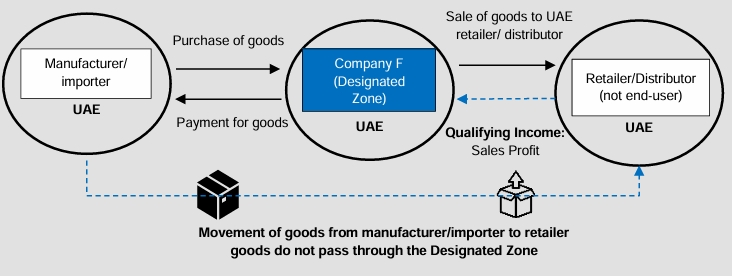

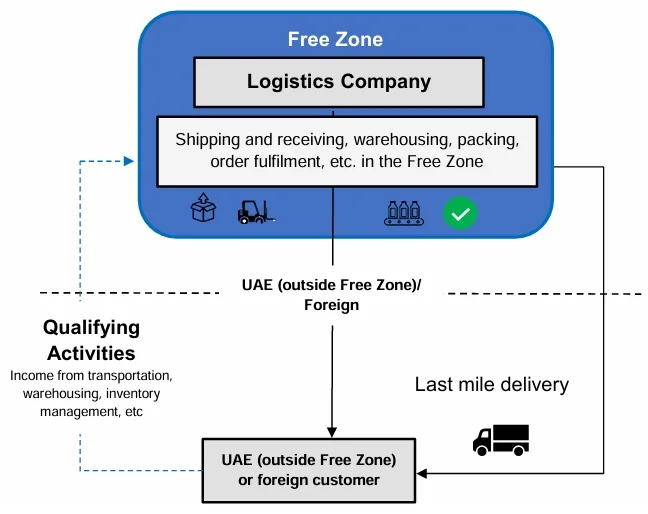

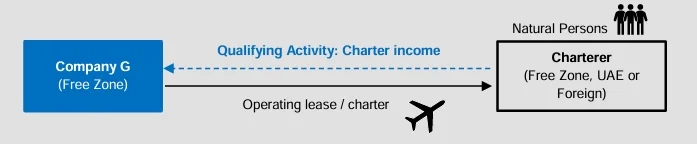

Company N renders contract manufacturing services (a Qualifying Activity) through its Free Zone parent that generates Qualifying Income. Company N also renders tech consulting services from its Domestic Permanent Establishment that generates Taxable Income that is not Qualifying Income.