Taxation of Family Foundations

Corporate Tax Guide | CTGFF1

May 2025

Contents

3. What is a Family Foundation?

5. Conditions to be a Family Foundation

7.5. Payment to beneficiaries for services provided to a Family Foundation

7.7. Distribution by a Family Foundation to its beneficiaries

Glossary

AED | : | The United Arab Emirates dirham. |

Authority | : | Federal Tax Authority. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Connected Person | : | Any Person affiliated with a Taxable Person as determined in Article 36(2) of the Corporate Tax Law. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return of capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Family Foundation | : | Any foundation, trust or similar entity that meets the conditions of Article 17 of the Corporate Tax Law. |

Foreign Tax Credit | : | Tax paid under the laws of a foreign jurisdiction on income or profits that may be deducted from the Corporate Tax due, in accordance with the conditions of Article 47(2) of the Corporate Tax Law. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

FTA | : | Federal Tax Authority, being the Authority responsible for the administration, collection and enforcement of federal taxes in the UAE. |

Immovable Property | : | Means any of the following:

|

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Licensing Authority | : | The competent authority concerned with licensing or authorising a Business or Business Activity in the UAE. |

Minister | : | Minister of Finance. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Participation | : | The juridical person in which the Participating Interest is held. |

Participating Interest | : | An ownership interest in the shares or capital of a juridical person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Participation Exemption | : | An exemption from Corporate Tax for income from a Participating Interest, available under Article 23 of the Corporate Tax Law and as specified under Ministerial Decision No. 302 of 2024. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Personal Investment | : | Investment activity that a natural person conducts for their personal account that is neither conducted through a Licence or requiring a Licence from a Licensing Authority in the UAE, nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022. |

Qualifying Public Benefit Entity | : | Any entity that meets the conditions set out in Article 9 of the Corporate Tax Law and that is listed in a decision issued by the Cabinet at the suggestion of the Minister. |

Real Estate Investment | : | Any investment activity conducted by a natural person related to, directly or indirectly, the sale, leasing, sub-leasing, and renting of land or real estate property in the UAE that is not conducted, or does not require to be conducted through a Licence from a Licensing Authority. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

State | : | United Arab Emirates. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Subsidiary | : | A Resident Person in which the share capital or Membership or Partnership Capital, as applicable, is held by a Parent Company, in accordance with Article 40(1) of the Corporate Tax Law. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration | : | A procedure under which a Person registers for Corporate Tax purposes with the FTA. |

Tax Registration Number | : | A unique number issued by the FTA to each Person who is registered for Corporate Tax purposes in the UAE. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Turnover | : | The gross amount of income derived during a Gregorian calendar year. |

UAE | : | United Arab Emirates. |

Unincorporated Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE. |

Wage | : | The wage that is given to the employee in consideration of their services under the employment contract, whether in cash or in kind, payable annually, monthly, weekly, daily, hourly, or by piece-meal, and includes all allowances, and bonuses in addition to any other benefits provided for, in the employment contract or in accordance with the applicable legislation in the UAE. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ("UAE") on 10 October 2022. This Decree-Law together with its amendments is referred to as the "Corporate Tax Law".

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits ("Corporate Tax") in the UAE.

The provisions of the Corporate Tax Law shall apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance on the taxation of Family Foundations. It provides readers with an overview of:

The requirements to qualify as a fiscally transparent Family Foundation,

A general understanding of how the Corporate Tax Law treats Family Foundations,

Information about how the Corporate Tax Law applies to Family Foundations and their beneficiaries, and

Information regarding the registration, compliance and other Corporate Tax obligations related to Family Foundations and their beneficiaries.

Who should read this guide?

The guide should be read by Persons involved in the establishment or management of Family Foundations, as well as their beneficiaries. It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, simple examples are used to illustrate how key elements of the Corporate Tax Law apply to Family Foundations. The examples in the guide:

Show how these elements operate in isolation and do not show all the possible interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes, and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Law No. 5 of 2018 on WAQF (Endowment), is referred to as "Federal Law No. 5 of 2018",

Federal Decree-Law No. 32 of 2021 on Commercial Companies, is referred to as "Federal Decree-Law No. 32 of 2021",

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as "Corporate Tax Law",

Federal Decree-Law No. 50 of 2022 issuing the Commercial Transactions Law, is referred to as "Federal Decree-Law No. 50 of 2022",

Federal Decree-Law No. 31 of 2023 Concerning Trust, is referred to as "Federal Decree-Law No. 31 of 2023",

Cabinet Decision No. 37 of 2023 on the Qualifying Public Benefit Entities for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, is referred to as "Cabinet Decision No. 37 of 2023",

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that are Subject to Corporate Tax, is referred to as "Cabinet Decision No. 49 of 2023",

Ministerial Decision No. 261 of 2024 on Unincorporated Partnership, Foreign Partnership and Family Foundation for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, is referred to as "Ministerial Decision No. 261 of 2024",

Ministerial Decision No. 301 of 2024 on Tax Group for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, is referred to as "Ministerial Decision No. 301 of 2024",

Ministerial Decision No. 302 of 2024 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, is referred to as "Ministerial Decision No. 302 of 2024",

Federal Tax Authority Decision No. 7 of 2023 on Provisions of Exemption from Corporate Tax for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, is referred to as "FTA Decision No. 7 of 2023",

Federal Tax Authority Decision No. 16 of 2023 on Determining the Requirements for the Registration of the Unincorporated Partnership and Determining the Distributive Shares of Partners in an Unincorporated Partnership for the purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments, is referred to as "FTA Decision No. 16 of 2023",

Federal Tax Authority Decision No. 3 of 2024 on the Timeline specified for Registration of Taxable Persons for Corporate Tax for the purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments, is referred as "FTA Decision No. 3 of 2024",

Federal Tax Authority Decision No. 5 of 2025 on Determining the Tax Compliance Requirements for Unincorporated Partnerships and Foreign Partnerships and Family Foundations for the purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments is referred to as "FTA Decision No. 5 of 2025",

ADGM Foundations Regulations 2017 (Consolidated Version January 2025) is referred to as "ADGM Foundations Regulations 2017",

Foundations Law DIFC Law No. 3 of 2018 (Consolidated Version March 2024) is referred to as "DIFC Law No. 3 of 2018",

Operating Law – DIFC Law No. 7 of 2018 (Consolidated Version March 2024) is referred to as "DIFC Law No. 7 of 2018", and

RAK ICC Foundations Regulations 2019 is referred to as "RAK ICC Foundations Regulations 2019".

Status of this guide

This guidance is not a legally binding document, but is intended to provide assistance in understanding the tax implications of the Corporate Tax regime for Family Foundations. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax in the UAE. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

What is a Family Foundation?

Overview

The term "Family Foundation", as understood within the context of the Corporate Tax Law, is not an entity type that is recognised explicitly in the general legal framework of the UAE. A Family Foundation is a concept for Corporate Tax purposes and is best understood as an entity that families may use for managing and preserving wealth across generations. A Family Foundation is defined in the Corporate Tax Law as any foundation, trust or similar entity that meets the conditions of Article 17(1) of the Corporate Tax Law.[1] Thus, there are two criteria to consider:

First, being a foundation, trust or similar entity, and

Second, meeting the conditions of Article 17(1) of the Corporate Tax Law (see Section 5).

The first criterion, i.e. being a foundation, a trust or a similar entity, relies on the relevant (non-tax) legislation (see Sections 3.2 and 3.3), while the second criterion is determined by the Corporate Tax Law.[2] As a result, the determination of Family Foundation status requires consideration of other relevant legislation as well as the Corporate Tax Law.

There is no requirement for a Family Foundation to be an entity formed in the UAE. Hence, it is possible for a foreign (i.e. non-UAE) entity to meet the conditions to be a Family Foundation, as set out in Article 17(1) of the Corporate Tax Law.

A number of different structures are used to manage personal wealth and investments for asset protection, succession, philanthropic and other reasons. These include, for example, a contractual trust, or a foundation. Some common entities are considered below. The instances in Sections 3.2 to 3.5 are drawn from the UAE, but note that this does not preclude a foreign entity from being a foundation, trust or similar entity.

Where the entity has a separate legal personality (i.e. distinct from its beneficiaries), it will be a juridical person and so it would, in the first instance, be subject to Corporate Tax in its own right (see Section 4). However, an application to be treated as fiscally transparent may be made to the FTA where the relevant conditions are met (see Section 5).[3]

Where an entity does not have a separate legal personality, it is, by default, treated for Corporate Tax purposes as an Unincorporated Partnership, that is fiscally transparent, without the need to make an application.

Foundations

The expression "foundation" can be found in various pieces of legislation in the UAE. For example (a non-exhaustive list), foundations can be established under the legislation of Free Zones such as Dubai International Finance Centre ("DIFC"),[4] Abu Dhabi Global Market ("ADGM"),[5] or RAK International Corporate Centre ("RAK ICC").[6] They may be used, for example, to benefit persons by name, category or class,[7] or to manage and distribute the foundation assets and income in accordance with its charter.[8]

Foundations formed outside the UAE that operate in Free Zones and which have satisfied the necessary requirements of the Free Zones may also be recognised as foundations in the respective Free Zones. For example, where such a foundation operates in the DIFC, the relevant Free Zone legislation applies to it as if it had been established under the Free Zone legislation.[9]

Foundations typically may not carry out any commercial activities, except those necessary for, and ancillary or incidental to, the objectives of the foundation consistent with the legislation under which they are formed.

Generally, foundations do not hold commercial licences because, as mentioned above, they may not carry out commercial activities. For example, a foundation registered in DIFC, in accordance with DIFC Law No. 3 of 2018, is issued an operating licence as per DIFC Law No. 7 of 2018.[10] This licence is defined in the DIFC Operating Regulations as "a licence issued by the registrar to a registered person which does not carry out or propose to carry out commercial activities in or from DIFC". The existence of such a licence would not cause a foundation to fail the principal activity condition (see Section 5.2) or the no Business Activity condition (see Section 5.3).

Where a Family Foundation has a separate legal personality, it is a juridical person for Corporate Tax purposes, and so, in the first instance, would be subject to Corporate Tax in its own right. Therefore, an application can be made to the FTA for the entity be treated as fiscally transparent (see Section 8.2) where the relevant conditions are met (see Section 5).

Trusts

A trust is a legal arrangement where a settlor, who may be a natural person or a juridical person, transfers assets to either the trust or to a trustee, for the benefit of the beneficiaries. The trustee manages the assets for the benefit of the beneficiaries, for which the trustee may receive a fee. A trust deed normally governs the trust's terms, beneficiaries, trustee's powers, and other details.

Unincorporated trusts

In the UAE, trust structures and arrangements which do not have a separate legal personality are unincorporated trusts. Examples include trusts established in the DIFC and/or ADGM which are a contractual relationship between two or more Persons (such as the beneficiary, settlor, and trustee).

Unincorporated trusts are by default considered Unincorporated Partnerships and, therefore, fiscally transparent for Corporate Tax purposes.[11] Accordingly, the income of an unincorporated trust would be attributed to the beneficiaries. Therefore, unincorporated trusts do not need to submit an application under Article 17(1) of the Corporate Tax Law to be treated as fiscally transparent. However, they would only have the status of a Family Foundation if they meet the conditions of that Article (see Section 5). Having the status of a Family Foundation is relevant when a juridical person held by an unincorporated trust wishes to apply to be treated as an Unincorporated Partnership (see Section 3.5 and Section 6).

Incorporated trusts

Incorporated trusts are those that have a separate legal personality. Examples of incorporated trusts include trusts established under Federal Decree-Law No. 31 of 2023 or a Waqf (plural Awaqf, i.e. Islamic charitable endowments), generally established in the mainland.[12] Trusts established under the Federal Trust Law must receive approval from, and be registered with, the competent authority of the relevant Emirate.[13]

For Corporate Tax purposes, incorporated trusts are treated the same as any other juridical person, and will be subject to Corporate Tax. However, where a Waqf is a Qualifying Public Benefit Entity it would be exempt from Corporate Tax. (For more information about the conditions to be a Qualifying Public Benefit Entity see the Corporate Tax Guide on Exempt Persons: Public Benefit Entities, Pension Funds and Social Security Funds.) An incorporated trust that is subject to Corporate Tax can make an application to the FTA to be treated as fiscally transparent, i.e. not subject to Corporate Tax in its own right, as an Unincorporated Partnership, where the relevant conditions are met (see Section 5).[14]

Similar entities

The definition of Family Foundation includes a "similar entity" to foundations or trusts. A similar entity is one that is intended to be used for the administration of family wealth and that is not a commercial company. Such an entity may wish to make an application to the FTA to be treated as fiscally transparent where the entity meets the relevant conditions (see Section 5).

Entities wholly owned and controlled by a Family Foundation

A Family Foundation may hold ownership of one or more juridical persons. A juridical person which is not a foundation, trust or similar entity (i.e. under the definition of Family Foundation under Article 1 of the Corporate Law) may nonetheless apply to be treated as fiscally transparent under the Corporate Tax Law if it is wholly owned and controlled by a Family Foundation that is treated as an Unincorporated Partnership and meets other conditions (see Section 6).[15] Examples of such juridical persons include limited liability companies (LLCs) and other types of special purpose vehicles (SPVs) established under the Commercial Companies Law, and other relevant UAE legislation.

Entities wholly owned and controlled by a Family Foundation cannot apply to be treated as fiscally transparent if they conduct commercial activities (see Section 5.3).

Overview of Corporate Tax

This section provides a brief overview of the Corporate Tax Law and its treatment of Persons for Corporate Tax purposes.

Persons subject to Corporate Tax

In the UAE, a Taxable Person is either a Resident Person or a Non-Resident Person.[16] A Resident Person or Non-Resident Person may be either a juridical person or a natural person.

A juridical person is a Resident Person if it is incorporated or otherwise established under the applicable legislation of the UAE, including in a Free Zone, or if it is incorporated/established in a foreign jurisdiction but effectively managed and controlled in the UAE.[17]

A juridical person is a Non-Resident Person if it is not a Resident Person and:[18]

Has a Permanent Establishment in the UAE, or

Derives State Sourced Income, or

Has a nexus in the UAE

A natural person is a Resident Person if he or she conducts a Business or a Business Activity in the UAE with a total Turnover exceeding AED 1 million in a Gregorian calendar year. Turnover derived from Wages, Personal Investment income and Real Estate Investment income is not considered to be derived from a Business or Business Activity for natural persons (see Section 4.3). [19] A natural person may conduct a Business or a Business Activity through a sole establishment or an Unincorporated Partnership which is fiscally transparent for Corporate Tax purposes.[20]

A natural person is a Non-Resident Person if he or she has a Permanent Establishment in the UAE or if he or she derives State Sourced Income.[21]

Distinguishing between a juridical person and a natural person, and between a Resident Person and a Non-Resident Person, is relevant to the way the Corporate Tax Law operates.

Exempt Persons

The Corporate Tax Law exempts particular Persons from Corporate Tax. The categories of Exempt Persons are listed in Article 4 of the Corporate Tax Law and include, among others, a Qualifying Public Benefit Entity.[22]

The relevance for a Family Foundation situation is that where a beneficiary is a Qualifying Public Benefit Entity, the beneficiary, as an Exempt Person, is not subject to Corporate Tax on any income from the Family Foundation.[23]

Certain income of natural persons not subject to Corporate Tax

As mentioned in Section 4.1, for natural persons, Turnover derived from Wages, Personal Investment income and Real Estate Investment income is not considered to be derived from a Business or Business Activity and, therefore, does not fall within the scope of Corporate Tax.[24]

Wage refers to cash or payment in kind given to an employee in consideration of their services under an employment contract.[25]

Personal Investment income arises from an investment activity that a natural person conducts for their personal account that is neither conducted through a Licence, or requiring a Licence from a Licensing Authority, nor considered as a commercial business in accordance with the Commercial Transactions Law.[26]

Real Estate Investment income arises from an investment activity conducted by a natural person related to, directly or indirectly, the sale, leasing, sub-leasing, and renting of land or real estate property in the UAE that is not conducted, or does not require to be conducted, through a Licence from a Licensing Authority.[27]

Where a natural person conducts a Business or Business Activity in the UAE that falls within the scope of Corporate Tax, that natural person will only have to register for Corporate Tax if his or her total Turnover from such Business or Business Activity exceeds AED 1 million in a Gregorian calendar year.[28]

Family Foundations under the Corporate Tax Law

A foundation, a trust or similar entity that is a juridical person may be subject to Corporate Tax in its own right like any other juridical person. If, however, the entity meets the conditions specified in Article 17(1) of the Corporate Tax Law, it will be a Family Foundation. It can then apply to the FTA to be treated as an Unincorporated Partnership for Corporate Tax purposes.[29] If the application is approved, the Family Foundation will be treated as a fiscally transparent Unincorporated Partnership. In that case, it will not be subject to Corporate Tax in its own right and will be treated as transparent for Corporate Tax purposes. However, the compliance requirements or relevant applications available for Unincorporated Partnerships under Article 16 of the Corporate Tax Law on a standalone basis will not apply to such Family Foundations (for example, applying to be a Taxable Person or registering as an Unincorporated Partnership).[30]

A trust or similar association of Persons that is established by contract but is not incorporated is treated as an Unincorporated Partnership (according to Article 1 of the Corporate Tax Law). As such, it is treated as fiscally transparent by default and, therefore, an application to the FTA to be treated as an Unincorporated Partnership is not required. If a fiscally transparent entity meets the conditions in Article 17(1) of the Corporate Tax Law, it will automatically be regarded as a Family Foundation (i.e. there are no administrative requirements to confirm its status and an application for a fiscally transparent status is not needed). The Family Foundation status is relevant to the ability of juridical persons under the entity in a multi-tier structure to be treated as fiscally transparent (see Section 6).

Conditions to be a Family Foundation

Article 17 of the Corporate Tax Law provides that a Family Foundation can make an application to the FTA to be treated as an Unincorporated Partnership, i.e. fiscally transparent for Corporate Tax purposes, where all of the following conditions are met:[31]

The Family Foundation was established for the benefit of identified or identifiable natural persons, or for the benefit of a public benefit entity, or both ("beneficiary condition"),[32]

The principal activity of the Family Foundation is to receive, hold, invest, disburse, or otherwise manage assets or funds associated with savings or investment ("principal activity condition"),[33]

The Family Foundation does not conduct any activity that would have constituted a Business or Business Activity had the activity been undertaken, or its assets been held, directly by a natural person who is its founder, settlor, or any of its beneficiaries ("no Business Activity condition"),[34]

The main or principal purpose of the Family Foundation is not the avoidance of Corporate Tax ("no tax avoidance condition"),[35] and

The Family Foundation meets one of the distribution conditions where any of the beneficiaries are public benefit entities ("distribution condition").[36]

Each of the above conditions is considered below from Section 5.1 to Section 5.5.

Beneficiary condition

Beneficiaries of the foundation, trust or similar entity can be:

Identified or identifiable natural persons, and/or

A public benefit entity. [37]

Beneficiaries are not only the direct/immediate beneficiaries of the foundation, trust or similar entity, but also indirect beneficiaries, that is to say through one or more other entities which are fiscally transparent for Corporate Tax purposes.

An "identified" natural person is someone who is a named beneficiary in the charter, by-laws or any other official documentation of the foundation, trust or similar entity.

An "identifiable" natural person is someone who is not specifically named but who is included in a class of natural person beneficiaries, for example, a child or grandchild of the settlor. Such persons may be unborn at the time the foundation, trust or similar entity is established.

A "public benefit entity" is not specifically defined and, therefore, takes its ordinary meaning. It does not need to be a Qualifying Public Benefit Entity under the Corporate Tax Law. A Qualifying Public Benefit Entity would, however, be a public benefit entity. A public benefit entity is typically established for the welfare of the public and society, promoting philanthropy, community services or corporate and social responsibility. For example, a not-for-profit or charitable organisation, established either in the UAE or another jurisdiction, is likely to be a public benefit entity.

There is no minimum or maximum number of beneficiaries for a Family Foundation prescribed by the Corporate Tax Law. Furthermore, there are no requirements or restrictions regarding the relationship of the beneficiaries, for instance, the natural person beneficiaries are not required to be from the same family.

Principal activity condition

To meet this condition, the principal activity of the foundation, trust or similar entity must be to receive, hold, invest, disburse, or otherwise manage assets or funds associated with savings and investments.[38] This may include purchasing and selling stocks, bonds, real estate, or other assets, intended to grow the value of the assets and/or generate an income stream for the beneficiaries.

The foundation, trust or similar entity may also disburse funds for specific purposes, such as supporting beneficiaries, funding charitable activities, or covering operational expenses in accordance with the objectives and legal obligations. For example, fees may be paid to an investment manager or a family office that manages the assets of the foundation, trust or similar entity.

No Business Activity condition

The foundation, trust or similar entity must not conduct an activity that would have constituted a Business or Business Activity if undertaken by a natural person.[39] This is to ensure that a foundation, trust or similar entity is used for its intended purpose of managing investments and not to conduct a Business or Business Activity on a commercial basis.

As mentioned in Section 4.3, in respect of a natural person, Turnover derived from Wages, Personal Investment income and Real Estate Investment income is not considered to be derived from a Business or Business Activity. The foundation, trust or similar entity may, therefore, undertake an activity that would be considered Personal Investment and/or Real Estate Investment had it been undertaken by the natural person beneficiaries directly (see Section 4.3 for the definition of Personal Investment and Real Estate Investment activity.)

Example 1: Foundation conducting activity that would have constituted a Business or Business Activity for a natural person

The J Foundation holds and manages real estate properties which consist of several residential units in the UAE that are leased to tenants and a motel building that the J Foundation operates.

Mr J and Mrs J each have a 50% beneficial interest in the J Foundation.

The residential units are rented out without any existing or required Licence. Hence, in respect of these properties, the "no Business Activity" condition is met.

The operation of the motel would have required a Licence if the motel was being operated by Mr J and Mrs J directly. Thus, in such case the activity would have constituted a Business or Business Activity (i.e. it would not have been a Real Estate Investment activity) and, therefore, the "no Business Activity" condition is not met.

The J Foundation does not meet all the conditions to be a Family Foundation and, therefore, cannot apply to be treated as an Unincorporated Partnership.

No tax avoidance condition

The main or principal purpose of a Family Foundation should not be for the avoidance of Corporate Tax.[40]

This condition will be met where a Family Foundation is used for the purposes envisaged by the Corporate Tax Law, namely to receive, hold, invest, disburse or/and manage assets for the benefit of individuals or charitable organisations.

Making an application to be treated as an Unincorporated Partnership and thereby permitting income to be excluded from Corporate Tax (as set out in Section 7) would not in itself be seen as a tax avoidance purpose.

Distribution condition where beneficiaries include public benefit entities

Where one or more of the beneficiaries of the foundation, trust or similar entity are public benefit entities, the foundation, trust or similar entity must meet any of the following additional conditions:[41]

Such beneficiaries are not deriving income (through the Family Foundation) that would be considered as Taxable Income had they derived it directly in their own right, or

The income that would be considered as Taxable Income is distributed to the relevant beneficiaries within 6 months from the end of the relevant Tax Period.

Condition (a) above would be met where either:

All the income derived by a beneficiary that is a public benefit entity is Exempt Income, or

The public benefit entity is a Qualifying Public Benefit Entity.

Exempt Income is defined in Article 22 of the Corporate Tax Law and includes, for example, Dividends from a juridical person that is a Resident Person, and income from a Participating Interest in a foreign juridical person.

A Qualifying Public Benefit Entity is an entity that meets the conditions set out in Article 9 of the Corporate Tax Law and is listed in Cabinet Decision No. 37 of 2023.

Where condition (a) above is not met, condition (b) above must be met in order for the foundation, trust or similar entity to be treated as an Unincorporated Partnership.

Example 2: Family Foundation receiving Taxable Income

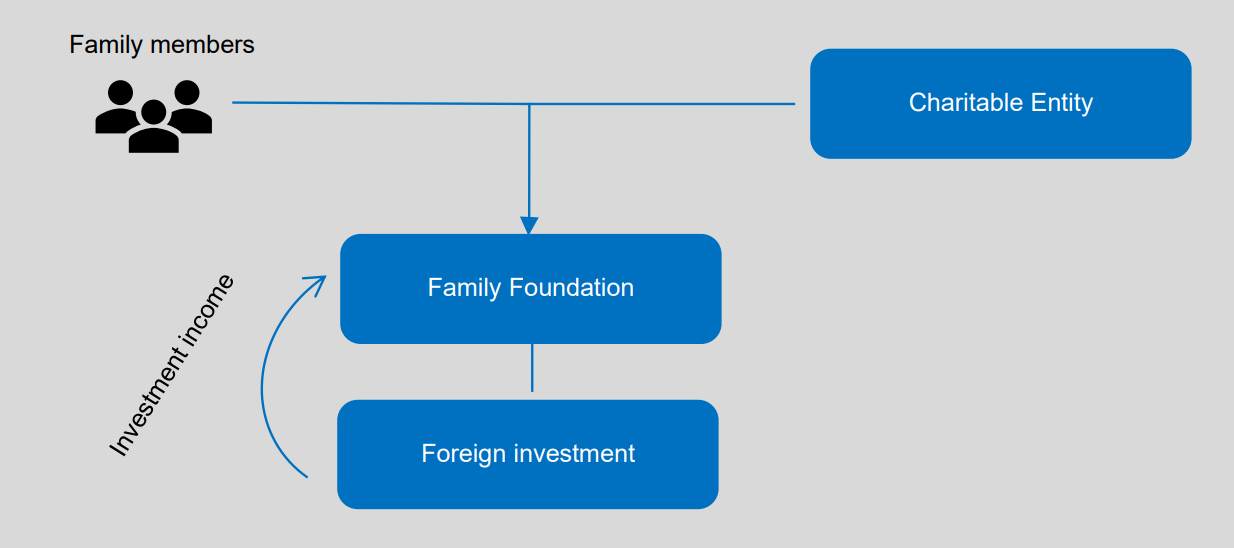

A Family Foundation meets the conditions of Article 17(1) of the Corporate Tax Law and is recognised as an Unincorporated Partnership, which means it is treated as fiscally transparent for Corporate Tax purposes. It follows the Gregorian calendar year as its Tax Period and has two types of beneficiaries: family members (i.e. natural persons) and a charitable entity that is a public benefit entity (which is not a Qualifying Public Benefit Entity).

In February 2025, the Family Foundation buys a 10% shareholding of a foreign company. In October 2025, the Family Foundation sells a 7% shareholding of the foreign company, at a gain. As the shares were not held for an uninterrupted period of 12 months, the Participation Exemption would not apply to the realised gain (for more information see the Corporate Tax Guide on Exempt Income: Dividends and Participation Exemption). The income received would, therefore, be Taxable Income if derived directly by the charitable entity. Accordingly, the first distribution condition (under Article 5(1)(a) of Ministerial Decision No. 261 of 2024 ) is not met.

To meet the second distribution condition (under Article 5(1)(b) of Ministerial Decision No. 261 of 2024), the Family Foundation is required to distribute the proportion of the income derived from the sale of the 7% shareholding of the foreign company that belongs to the charitable entity by 30 June 2026, i.e. within 6 months from the end of its Tax Period i.e. 31 December 2025. There is no requirement for the Family Foundation to distribute the proportion of the income that belongs to the family members to those members.

Foreign entities and Family Foundations

It is possible for a foreign entity that is a foundation, trust or similar entity to be a Family Foundation as long as all the conditions of Article 17(1) of the Corporate Tax Law are satisfied.

The following examples consider different scenarios involving foreign entities.

Example 3: Foreign entity that has a nexus in the UAE

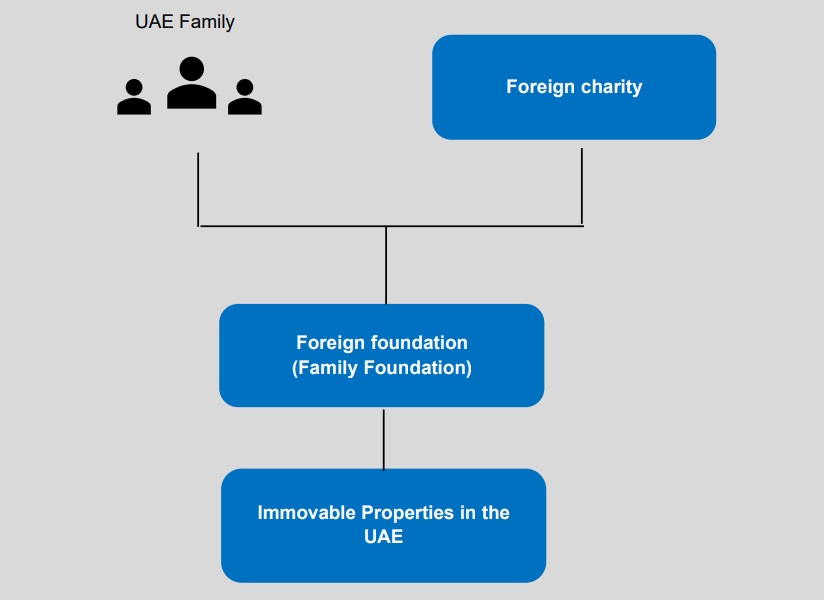

A foreign foundation, a juridical person, is established outside the UAE to hold and manage the UAE real estate assets of a UAE family. The beneficiaries are the members of the UAE family and the foreign charity.

The foreign foundation has a nexus in the UAE and is considered a Taxable Person in its own right (i.e. a Non-Resident Person with a nexus in the UAE) and is required to register for Corporate Tax.[42]

If the foreign foundation meets all the conditions of Article 17(1) of the Corporate Tax Law, it can be considered a Family Foundation and can, therefore, apply to be treated as a fiscally transparent Unincorporated Partnership for Corporate Tax purposes. If the application is approved by the FTA, the Corporate Tax position will be as follows:

The foreign foundation, as a fiscally transparent Unincorporated Partnership, will not be a Taxable Person in its own right.

The UAE family members will not be subject to Corporate Tax on the income generated by the Family Foundation as the income will meet the definition of Real Estate Investment income.

The foreign charity will be considered a Non-Resident Person with a nexus in the UAE (as it derives income from Immovable Property), and will, therefore, be subject to Corporate Tax on its distributive share of the income from the Immovable Properties in the UAE.

Example 4: Foreign foundation that has a nexus in the UAE

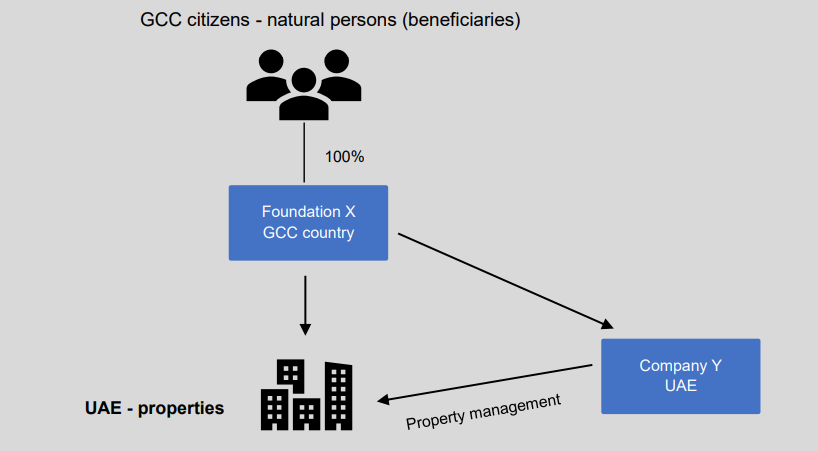

Family X resides in a Gulf Cooperation Council ("GCC") country outside the UAE. The family establishes a foundation, Foundation X, in that GCC country to hold and manage UAE Immovable Property for Family X as beneficiaries. Foundation X earns rental income from the UAE properties. No Licence from the relevant UAE Licensing Authority is required to rent out the Immovable Property.

Foundation X does not maintain any physical presence such as employees or office space in the UAE. Instead, it hires an unrelated Company Y, a real estate management company in the UAE, to source tenants, register tenancy contracts and collect the rent from tenants for a fee.

Foundation X is considered to have a nexus in the UAE by virtue of deriving income from Immovable Property in the UAE. It will be subject to Corporate Tax as a Non- Resident Person on this income and so is required to register with the FTA for Corporate Tax purposes. However, if it meets all the conditions of Article 17(1) of the Corporate Tax Law, it may apply to be treated as an Unincorporated Partnership. If the FTA approves the application, the Corporate Tax position will be as follows:

Foundation X will be treated as fiscally transparent. As a result, it will no longer be subject to Corporate Tax in its own right. Instead, the Corporate Tax liability will be assessed at the level of the beneficiaries.

The members of Family X will not be subject to Corporate Tax in respect of the rental income derived by Foundation X as the income will meet the definition of Real Estate Investment income (see Section 4.3).

The family members will not be subject to Corporate Tax on any distributions received from the Family Foundation.

The Corporate Tax treatment of Company Y is unchanged.

Multi-tier structures

A juridical person that meets the following conditions may apply to be treated as an Unincorporated Partnership. The eligibility of juridical persons in a multi-tier structure to be treated as Unincorporated Partnerships must be determined for each entity separately. To be able to make an application to be treated as fiscally transparent, a juridical person in the structure must:

Be wholly owned and controlled by a Family Foundation, either directly or indirectly. Where ownership and control are indirect, these must be through an uninterrupted chain of other entities which are themselves all fiscally transparent under the Corporate Tax Law,[43] and

Meet the conditions specified in Article 17(1) of the Corporate Tax Law and, where applicable, Ministerial Decision No. 261 of 2024 (see Section 5).[44]

Where a Family Foundation is automatically treated as an Unincorporated Partnership without need to make an application to the FTA (such as an unincorporated trust, see Section 3.3.1) and wholly owns and controls a juridical person, and that juridical person meets the conditions of Article 17(1) of the Corporate Tax Law, the first condition above is considered to be satisfied notwithstanding legal ownership of the trust assets may vest in the trustee(s).

Both conditions should be met continuously throughout the relevant Tax Period of the juridical person. Where the conditions are not met continuously through the relevant Tax Period, the relevant juridical person (and juridical persons wholly owned and controlled by that juridical person) will no longer be treated as an Unincorporated Partnership from the beginning of that Tax Period. There is no requirement for juridical persons within the uninterrupted chain to have the same Financial Year.

Example 5: Juridical persons held by a Family Foundation

Company X and Company Y are two entities within an uninterrupted chain ultimately owned and controlled by a Family Foundation that is treated as a fiscally transparent Unincorporated Partnership.

Company X wholly owns and controls Company Y. Company X has a Financial Year that ends on 31 December. Company Y has a Financial Year that ends on 31 March.

For Company Y to be treated as an Unincorporated Partnership for its Tax Period ending 31 March 2025, Company X must also be treated as an Unincorporated Partnership for the whole of Company Y's Tax Period, i.e. Company X's Tax Periods ending 31 December 2024 and 31 December 2025.

Any entities in a multi-tier structure which are not fiscally transparent, for instance, a juridical person which has not made an application under Article 17(1) of the Corporate Tax Law, or does not meet the conditions of Article 17(1) of the Corporate Tax Law, will represent an interruption in the chain. Any juridical persons which these fiscally opaque entities hold will consequently also not be eligible to be treated as fiscally transparent under the Family Foundation provisions.

Where the entities in a multi-tier Family Foundation structure meet the conditions and obtain approval from the FTA to be treated as fiscally transparent (where not already transparent), they will not be subject to Corporate Tax in their own right, and the income, expenditure, assets and liabilities will be deemed to arise to the ultimate beneficiaries.

The examples below consider the Corporate Tax treatment of a multi-tier Family Foundation structure.

Example 6: Simple multi-tier structure

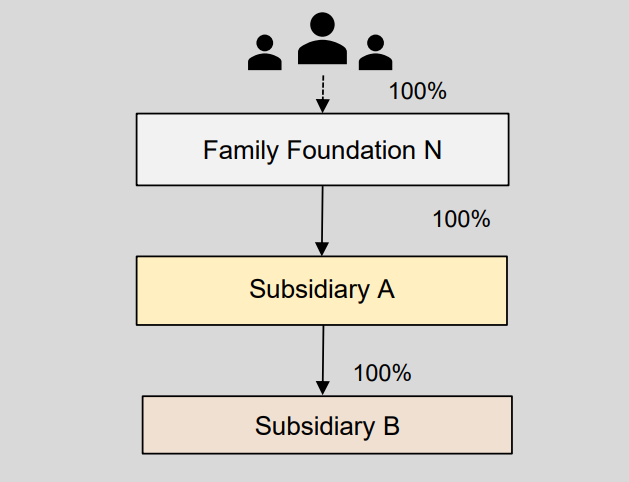

Family Foundation N is an ADGM foundation set up to hold the assets of the members of Family N. It is a juridical person.

Family Foundation N established two subsidiaries, Subsidiary A and Subsidiary B. Both subsidiaries are UAE-incorporated LLCs that only hold real estate properties for the members of Family N. If the properties were held directly by the family members, the income would be Real Estate Investment income (see Section 4.3).

Subsidiary A is wholly owned and controlled by Family Foundation N. Subsidiary B is wholly owned and controlled by Subsidiary A.

Corporate Tax treatment for Family Foundation N:Family Foundation N is set up solely to manage the family wealth for the benefit of the identified beneficiaries. As a Family Foundation meeting the conditions of Article 17(1) of the Corporate Tax Law, it has made an application to the FTA to be treated as an Unincorporated Partnership, i.e. fiscally transparent. The application was approved by the FTA and, therefore, for Corporate Tax purposes the income, expenditure, assets and liabilities of Family Foundation N, are treated as the income, expenditure, assets and liabilities of the beneficiaries, in accordance with their respective distributive shares.

Corporate Tax treatment for Subsidiary A:Subsidiary A, a juridical person, is wholly owned and controlled directly by Family Foundation N. It thereby satisfies the condition of Article 5(2)(a) of Ministerial Decision No.261 of 2024. It also fulfils the requirements of Article 17(1) of the Corporate Tax Law, and as a result, it meets the condition, specified in Article 5(2)(b) of the same Ministerial Decision.

Subsidiary A has made an application to be treated as an Unincorporated Partnership, i.e. a fiscally transparent entity. The application was approved by the FTA. Given that Family Foundation N is also fiscally transparent, the income, expenditure, assets and liabilities of Subsidiary A will be deemed to be the income, expenditure, assets and liabilities of the members of Family N who are the ultimate beneficiaries.[45]

Corporate Tax treatment for Subsidiary B:Subsidiary B is wholly owned and controlled indirectly by Family Foundation N through Subsidiary A.

Given that Subsidiary A is treated as an Unincorporated Partnership and Subsidiary B satisfies the conditions of Article 17(1) of the Corporate Tax Law, Subsidiary B is eligible to make an application to the FTA to also be treated as an Unincorporated Partnership. If the application is approved by the FTA, the income, expenditure, assets and liabilities of Subsidiary B will be deemed to be the income, expenditure, assets and liabilities of the members of Family N who are the ultimate beneficiaries. The application mechanism is covered in Section 8.

The income deemed to be the income of the family members via the Family Foundation will not be subject to Corporate Tax as it is Real Estate Investment income. See Section 7for further details.

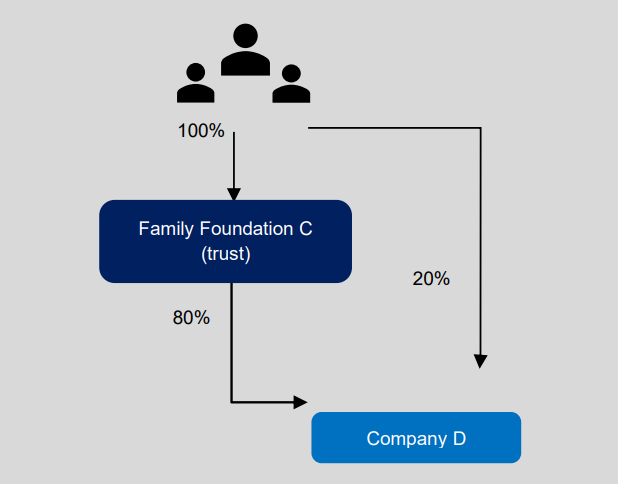

Example 7: Multi-tier structure - Ownership condition not met

Family Foundation C is a trust in the UAE mainland established under the Federal Decree-Law No. 31 of 2023.[46] It is a juridical person and is subject to Corporate Tax. Its purpose is holding and managing assets for a family.

Company D, an LLC in the UAE, was incorporated to hold investments. 80% of Company D is held directly by the Family Foundation and the remaining 20% is held directly by one of the ultimate beneficiaries, i.e. the family members, who is also the settlor of the trust. If the investments were held directly by the family members, the income would be Personal Investment income (see Section 4.3).

Corporate Tax treatment for Family Foundation CFamily Foundation C, i.e. the trust itself, is set up solely to hold the family wealth for the benefit of the identified beneficiaries. As a Family Foundation meeting the conditions of Article 17(1) of the Corporate Tax Law, it can make an application to the FTA to be treated as a fiscally transparent Unincorporated Partnership. If the application is approved by the FTA, the trust will not be subject to Corporate Tax on its income on the basis that it will be fiscally transparent.

Company D, a juridical person, is not wholly owned and controlled by the Family Foundation and, therefore, Company D is not eligible to be treated as fiscally transparent and will be subject to Corporate Tax.[47]

Corporate Tax treatment for the family members who are beneficiariesThe income deemed to arise in the hands of family members via the Family Foundation will be considered Personal Investment income since it relates to the holding of the investment in Company D, and will not be subject to Corporate Tax. Likewise, Dividends or other profit distributions received by the family member directly from Company D by way of the 20% shareholding could also be considered Personal Investment income. See Section 7for further details.

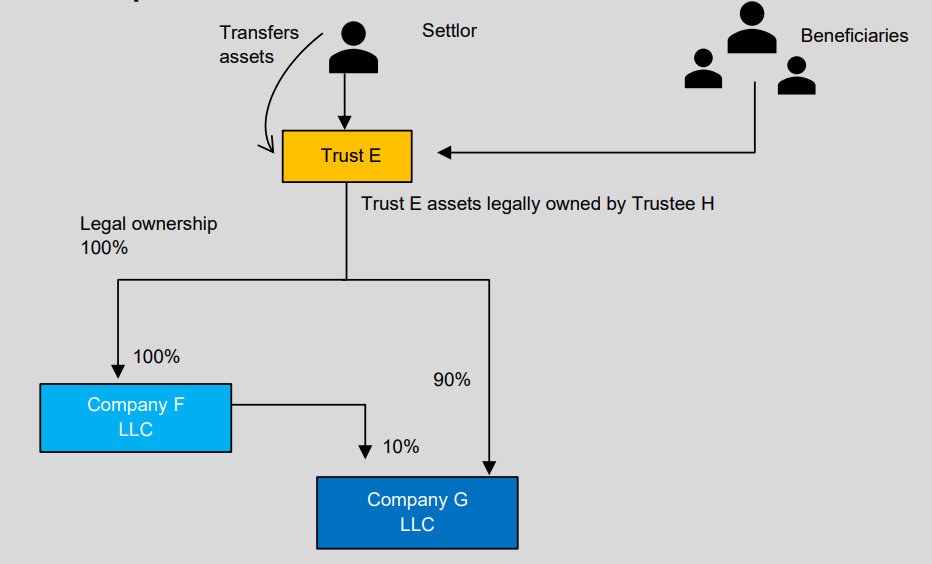

Example 8: Transparent trust-led multi-tier structure

Trust E is a Free Zone trust which is set up as a structure solely to manage a family's wealth. Trust E is an unincorporated trust.

Trustee H is a UAE juridical person appointed as the custodian trustee to hold and invest the trust assets.

The beneficiaries of Trust E are 3 members of Family E.

The Trust E structure includes two limited liability companies for the benefit of the 3 members of Family E:

Company F is 100% legally owned by Trustee H. It holds and manages Company G (10% ownership) and the beneficiaries' properties. If the properties were held directly by the family members, the income would be Real Estate Investment income (see Section 4.3).

Company G is 90% legally owned by Trustee H and 10% by Company F. It holds other assets ultimately for the benefit of the settlor of the trust or its beneficiaries, i.e. the natural persons. If the assets were held directly by these natural persons, the income would be Personal Investment income (see Section 4.3).

Corporate Tax treatment for Trust EUnder the specific Free Zone legislation, Trust E is not considered a juridical person and is, therefore, transparent by default for Corporate Tax purposes. If Trust E meets the conditions of Article 17(1) of the Corporate Tax Law, it would have the status of a Family Foundation. Given it is by default a fiscally transparent entity, there is no need for it to make an application under Article 17(1) of the Corporate Tax Law. However, Trust E can submit an application (see Section 8.2.2) on behalf of Companies G and F, where these entities meet all the conditions specified in Article 17(1) of the Corporate Tax Law and wish to be treated as Unincorporated Partnerships, i.e. fiscally transparent.

Corporate Tax treatment for Company FCompany F is directly wholly owned and controlled by Trust E, a Family Foundation treated as an Unincorporated Partnership by default, Company F may apply to be treated as an Unincorporated Partnership. If the application is approved by the FTA, the income, expenditure, assets and liabilities of Company F will be deemed to be arising to the family members who are the ultimate beneficiaries. Company F holds properties for the family. The family members will not be subject to Corporate Tax on the income from the properties as it is Real Estate Investment income.

Corporate Tax Treatment for Company GCompany G is wholly owned and controlled by Trust E (90% directly and 10% indirectly through Company F) which is a Family Foundation treated as an Unincorporated Partnership. Company F also meets the conditions in Article 17(1) of the Corporate Tax Law, so Company G can be treated as an Unincorporated Partnership, on the basis that Company F is also treated as an Unincorporated Partnership. Company G holds and manages the family's other assets. The family members will not be subject to Corporate Tax on the income from the assets as it is Personal Investment income.

If Company F did not meet the conditions in Article 17(1) of the Corporate Tax Law, or met the conditions but chose not to apply to the FTA to be treated as an Unincorporated Partnership, then Company G would not be eligible to submit an application to be treated as an Unincorporated Partnership because the ownership and control through an uninterrupted chain requirement would not be met due to Company F's ownership.

Corporate Tax treatment of the family members who are beneficiariesThe income deemed to arise in the hands of the family members due to the trust and its subsidiaries being fiscally transparent will be considered a combination of Real Estate Investment (derived through Company F) and Personal Investment income (derived through Company G), and will not be subject to Corporate Tax. See Section 7for further details.

Corporate Tax treatment for Trustee HOn the basis that Trustee H holds the bare legal title of Company F and Company G, (and is not a beneficiary of the income and assets), it will not be considered as the beneficial owner of these 2 companies or of any income generated from them. Consequently, it will not be subject to Corporate Tax in respect of these assets and associated income. However, Trustee H will be required to include in its Taxable Income the fees earned for its role as a trustee.

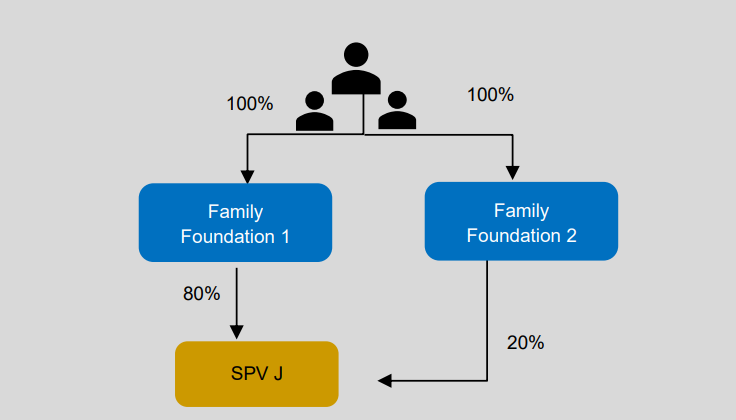

Example 9: Multi-tier structure (entity not wholly owned)

Family Foundation 1 and Family Foundation 2 are juridical persons treated as Unincorporated Partnerships, pursuant to separate applications under Article 17(1) of the Corporate Tax Law approved by the FTA.

The Family Foundations have jointly incorporated a real estate investment SPV J in ADGM to hold and manage properties contributed by both Family Foundations. Family Foundation 1 holds an 80% ownership interest in SPV J, and Family Foundation 2 holds the remaining 20%.

If the assets of Family Foundation 1 and Family Foundation 2 were held directly by the beneficiaries, the income would be Personal Investment income. If the properties of SPV J were held directly by the beneficiaries, the income would be Real Estate Investment income (see Section 4.3).

Corporate Tax treatment for SPV JSPV J is not wholly owned and controlled by one Family Foundation and, therefore, SPV J is not eligible to make an application under Article 17(1) of the Corporate Tax Law to be treated as fiscally transparent.[48] The income SPV J derives will be subject to Corporate Tax.

Corporate Tax treatment of the family members who are beneficiariesThe income attributed to the family members in respect of Family Foundation 1 and Family Foundation 2 (including Dividends from SPV J) will not be subject to Corporate Tax as it is Personal Investment income. See Section 7for further details.

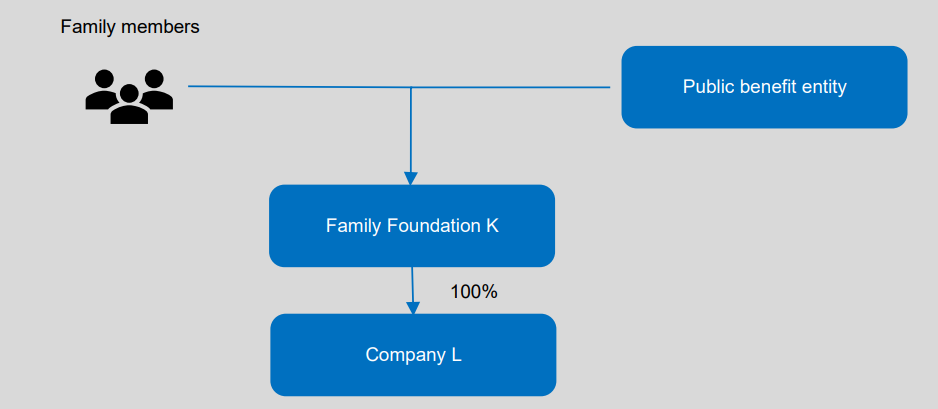

Example 10: Family Foundation receiving Taxable Income - Multi-tier structure

Family Foundation K is a juridical person with two types of beneficiaries: family members (natural persons) and a public benefit entity (which is not a Qualifying Public Benefit Entity).

Family Foundation K wholly owns and controls a limited liability company, Company L. Company L is a foreign company which is not a Participation for the purposes of the Participation Exemption (for more information see the Corporate Tax Guide on Exempt Income: Dividends and Participation Exemption). Company L pays Dividends annually.

Family Foundation K and Company L both meet the relevant conditions to be treated as Unincorporated Partnerships (see Section 5.6for the conditions related to Company L). Following the submission of the necessary application(s) and receiving approval(s) from the FTA, both Family Foundation K and Company L are treated as Unincorporated Partnerships. Therefore, the income generated not only by Family Foundation K but also by Company L is deemed to arise to the family members and to the public benefit entity.

Both entities follow the Gregorian calendar year as their Tax Period.

Where a beneficiary of a Family Foundation is a public benefit entity, the income it derives must not be Taxable Income if it had derived it in its own right. As the Participation Exemption does not apply in respect of Company L and the public benefit entity is not a Qualifying Public Benefit Entity, the Dividends from Company L would be Taxable Income if derived directly by the public benefit entity. Accordingly, the first distribution condition is not met (see Section 5.5).

Family Foundation K, therefore, needs to determine if it meets the second distribution condition. This requires a Family Foundation to distribute to a public benefit entity its share of income within 6 months of the end of its Tax Period (see also Section 5.5). Thus, for a Dividend paid by Company L to Family Foundation K in the Tax Period ending on 31 December 2027, Family Foundation K would need to pay to the public benefit entity its share by 30 June 2028. Failure to do so would result in both Family Foundation K and Company L ceasing to be treated as Unincorporated Partnerships.

Corporate Tax implications for a Family Foundation that is treated as an Unincorporated Partnership

This section deals with the Corporate Tax treatment of Family Foundations that are treated as (fiscally transparent) Unincorporated Partnerships, whether that is by virtue of an application approved by the FTA (in the case of a juridical person) or because they are an Unincorporated Partnership by default (e.g. an unincorporated trust).

Family Foundations and juridical persons wholly owned and controlled by the Family Foundation that do not meet the conditions of Article 17(1) of the Corporate Tax Law, or do not submit an application to be treated as Unincorporated Partnerships, or do not receive an approval from the FTA, will continue to be subject to Corporate Tax in their own right.

Family Foundation

Where a Family Foundation is treated as an Unincorporated Partnership, it is considered fiscally transparent and hence not subject to Corporate Tax in its own right. Therefore, the beneficiaries will be deemed to be partners in an Unincorporated Partnership and, for Corporate Tax purposes, each beneficiary is treated as:[49]

Conducting the activity of the Family Foundation,[50]

Having the status, intention and purpose of the Family Foundation,

Holding assets that the Family Foundation holds, and

Being party to any arrangement to which the Family Foundation is a party.

For Corporate Tax purposes, the assets, liabilities, income and expenditure of the Family Foundation will be allocated to each beneficiary in proportion to their distributive share (i.e. the beneficial interest) for each relevant Tax Period. This applies even if a trustee has legal ownership of the trust assets, for instance, in an unincorporated trust. The Corporate Tax treatment will then be assessed at the level of each beneficiary, in accordance with the general rules for determining Taxable Income under the Corporate Tax Law. Accordingly, the relevant entities in such structures should provide each beneficiary with sufficient information in relation to their Corporate Tax obligations for each relevant Tax Period.

For practical purposes, this allocation is only required where any of the beneficiaries will be subject to Corporate Tax on the income generated by the Family Foundation, such as public benefit entities which are not exempt from Corporate Tax as Qualifying Public Benefit Entities.

Natural person beneficiary

Any beneficiary who is a natural person will not be subject to Corporate Tax on their distributive share of income from the Family Foundation on the basis that such income would either be considered Personal Investment income or Real Estate Investment income (see Section 4.3).

Public benefit entity beneficiary

Where the beneficiary is, and remains, a Qualifying Public Benefit Entity, it will not be subject to Corporate Tax as it is an Exempt Person.

However, any beneficiary that is a public benefit entity which is, or becomes, a Taxable Person will include its distributive share of the Family Foundation's income and expenditure in its Taxable Income. A beneficiary that is a foreign public benefit entity which was not already a Taxable Person may become subject to Corporate Tax as a Non-Resident Person as a result of the Family Foundation being fiscally transparent, for example, by virtue of having a nexus in the UAE (see Section 5.6).

The public benefit entity beneficiaries that are subject to Corporate Tax must assess the Corporate Tax treatment of the relevant income and expenditure following the general rules as per Article 20 of the Corporate Tax Law. Examples of the applicable Corporate Tax treatment of certain types of income and expenditure are provided in the subsequent sections.

Income attributable to a public benefit entity

Where a beneficiary of a Family Foundation is a public benefit entity, it becomes relevant to assess whether any income generated from investment in shares and other ownership interests, such as Dividends or other profit distributions and capital gains or losses, is exempt from Corporate Tax. This is achieved as follows:

Income in the nature of Dividends will be exempt from Corporate Tax in the hands of the beneficiary if:

It is received from a juridical person that is a Resident Person, for example, a UAE-incorporated company (without any further conditions),[51] or

It is received from a Participating Interest in a foreign juridical person, where the relevant conditions for the Participation Exemption are met.[52] These conditions will be assessed at the level of the beneficiary and not at the level of the Family Foundation.

Income in the nature of gains or losses on the transfer, sale or disposal of shares of a UAE or foreign juridical person as well as foreign exchange gains/losses and impairment gains/losses will be exempt from Corporate Tax if they arise from a Participating Interest and the relevant conditions for the Participation Exemption are met.[53] These conditions will be assessed at the level of the beneficiary and not at the level of the Family Foundation.

Deductible expenditure

The Taxable Income, if any, of the beneficiaries must take into account their distributive share of expenditure incurred by the Family Foundation in relation to that income. There are specific rules that restrict or disallow the deductibility of certain types of expenditure for Corporate Tax purposes.[54]

In some cases, the Family Foundation may incur expenses on behalf of the beneficiary. Such expenses may then be reimbursed in whole or in part by the beneficiary. If any expenses have been reimbursed, the cost incurred would be set off against the reimbursement income received and no adjustments will be required for Corporate Tax purposes. Equally the beneficiary may incur expenses on behalf of the Family Foundation, and if these are reimbursed in line with the above, there will be no adjustments required for Corporate Tax purposes. For further information on the reimbursement of expenditure and the implications for partners, i.e. beneficiaries, see the Corporate Tax Guide on the Taxation of Partnerships.

Payment to beneficiaries for services provided to a Family Foundation

If a beneficiary renders services to the Family Foundation not in their capacity as a beneficiary (or employee), but as a service provider, where such services are wholly and exclusively conducted for the purposes of the Family Foundation's activities, and the payment for such services is at arm's length, the payment for services will be deductible while determining the Taxable Income of the taxable beneficiaries to the extent of their distributive share.

The Corporate Tax treatment of any income received by a beneficiary for the services rendered to the Family Foundation will be assessed separately by the relevant beneficiary and is not covered in this guide.

Foreign Tax Credit

A fiscally transparent Family Foundation may receive foreign source income which is subject to tax in that foreign jurisdiction. Where the income passes through to the beneficiaries that are subject to Corporate Tax on such income, the beneficiary may be able to claim a Foreign Tax Credit in proportion to its distributive share of income in the Family Foundation.

Distribution by a Family Foundation to its beneficiaries

For Corporate Tax purposes, the Family Foundation is required to distribute the income to any beneficiary that is a public benefit entity within 6 months of the end of the Tax Period in which the income was derived by the Family Foundation, if the income is not Exempt Income or the public benefit entity is not an exempt Qualifying Public Benefit Entity (see Section 5.5).[55]

A distribution by a Family Foundation is disregarded for Corporate Tax purposes when the underlying income has been included in the beneficiary's Taxable Income, where relevant.

Example 11: Application of the Participation Exemption at the beneficiary level and the treatment of distributions

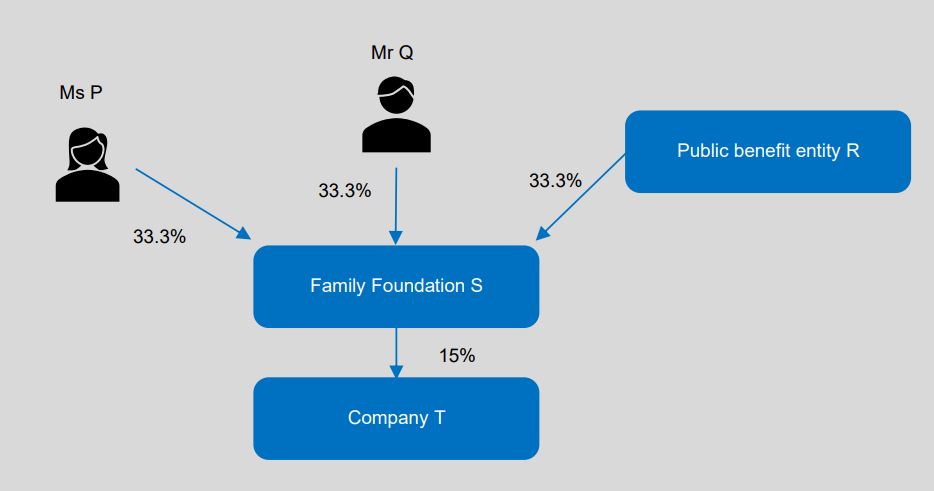

Ms P, Mr Q, and public benefit entity R, are beneficiaries of Foundation S, a juridical person that is a Family Foundation which has made an application and received approval from the FTA to be treated as an Unincorporated Partnership (i.e. to be treated as fiscally transparent). The foundation's primary objective is to hold assets.

All three beneficiaries have an equal beneficial interest in Foundation S.

Foundation S holds a 15% stake in Company T (a company incorporated in and a tax resident of Country T) on behalf of the beneficiaries. After holding the shares for more than 12 months, Foundation S receives Dividends from Company T. One year later, it sells the shares in Company T at a gain. If the shares in Company T were held directly by Ms P and Mr Q, the income would be Personal Investment income (see Section 4.3).

For Corporate Tax purposes, Foundation S should allocate its income and expenditure to the beneficiaries in proportion to their distributive share.

Distribution condition for Foundation SThe public benefit entity, assuming it is not an Exempt Person, has one-third (⅓) of the income, expenditure, assets and liabilities of the Family Foundation allocated to it. As Foundation S holds 15% of Company T, the public benefit entity is treated as holding 5% of Company T, thus meeting one of the requirements for the Participation Exemption. If the other relevant Participation Exemption conditions are met, public benefit entity R can exclude its share of Dividends and capital gains in respect of Company T from its Taxable Income. For more information see the Corporate Tax Guide on Exempt Income: Dividends and Participation Exemption.

If the other conditions of the Participation Exemption are not met, those Dividends and capital gains will be Taxable Income. In such a case, Foundation S should distribute to public benefit entity R its share of the income within 6 months from the end of the relevant Tax Period, otherwise the distribution condition is not met, and Foundation S will cease to be treated as an Unincorporated Partnership (see Section 8.3).

Corporate Tax treatment for Ms P and Mr QIf the distribution condition is met and Foundation S continues to be treated as an Unincorporated Partnership, Ms P and Mr Q will not be subject to Corporate Tax on their share of the Dividends and capital gains because the income is Personal Investment income which is excluded from Corporate Tax for natural persons.

If the distribution condition is not met and Foundation S is no longer treated as an Unincorporated Partnership, Foundation S will be subject to Corporate Tax in its own right. Amongst other matters, Foundation S would need to determine whether the Participation Exemption applied to its income. Regardless, for Ms P and Mr Q the income from Foundation S, i.e. Dividends, would be excluded from Corporate Tax as Personal Investment income.

Tax compliance

Registration for Corporate Tax purposes

A juridical person that is a Family Foundation or is wholly owned and controlled by a Family Foundation and that wishes to apply to be treated as an Unincorporated Partnership, i.e. fiscally transparent, will first need to register for Corporate Tax purposes. Each juridical person in a multi-tier structure (see Section 6) should be registered separately for Corporate Tax before it applies to be treated as fiscally transparent. For more information see the Corporate Tax Guide on Registration of Juridical Persons.

Where an application to be treated as a fiscally transparent Unincorporated Partnership is approved by the FTA, the entity will not be subject to Corporate Tax in its own right.

A Family Foundation that is by default treated as an Unincorporated Partnership is also required to register for Corporate Tax purposes. For more information see the Corporate Tax Guide on the Taxation of Partnerships.

Natural persons that are beneficiaries of a Family Foundation that is fiscally transparent are not required to register for Corporate Tax, unless they conduct a separate Business or Business Activities in the UAE and the total Turnover for those activities exceeds AED 1 million in a Gregorian Calendar year.

Beneficiaries of a Family Foundation that are public benefit entities are required to register for Corporate Tax if they are considered Taxable Persons, regardless of their interest in a Family Foundation. This includes Qualifying Public Benefit Entities.[56] For more information see the Corporate Tax Guide on Registration of Juridical Persons.

Application to be treated as an Unincorporated Partnership

Where all the conditions set out in Section 5 are met, a juridical person which is a Family Foundation may make an application to the FTA to be treated as an Unincorporated Partnership. It must make the application to the FTA before the end of the relevant Tax Period. For applications made on or before 31 December 2025, the application can be effective from the commencement of any Tax Periods ending on or before 31 December 2025 as stipulated in the application.[57]

As part of the application, the Family Foundation should provide the relevant information including details of the beneficiaries and confirmation that the Family Foundation meets the relevant conditions.

The Family Foundation must indicate the relevant Tax Period for which the application is made. This can be one of the following:[58]

The current Tax Period during which the application is submitted.

The next Tax Period following the Tax Period during which the application is submitted.

If the application is approved, the Family Foundation will be treated as a tax transparent Unincorporated Partnership and the beneficiaries would be seen as directly owning or benefiting from the activities and assets of the Family Foundation effective from the commencement of the Tax Period specified in the application or any other date determined by the FTA.[59]

Foreign entities

Where a foreign entity that is a foundation, trust, or similar entity has a presence in the UAE, for example a nexus, and meets the relevant conditions (which includes being a juridical person), it may make an application to the FTA to be treated as an Unincorporated Partnership (fiscally transparent entity) for Corporate Tax purposes.[60] The same application timelines apply as those set out in section 8.2 above.

It should be able to provide, if requested by the FTA, the relevant information and documentation from the jurisdiction where it is incorporated to show that it meets the conditions of Article 17(1).[61] This would include, for example, demonstrating that it is a foundation, trust or similar entity under the legislation of the foreign jurisdiction or demonstrating that the beneficiaries are natural persons and/or public benefit entities.

Where an application made by the foreign entity under Article 17 of the Corporate Tax Law is approved by the FTA, the Family Foundation would be treated as an Unincorporated Partnership for UAE Corporate Tax purposes, in the same way as a Family Foundation formed in the UAE (subject to meeting the relevant conditions).

Multi-tier structures

The same application timelines apply to a juridical person(s) wholly owned and controlled by a Family Foundation (or an Unincorporated Partnership that is tax transparent) as those set out in section 8.2 above. If any juridical person in the structure does not have a Tax Registration Number (for example, a juridical person has been newly incorporated), it will first have to apply for a Tax Registration Number before applying to be treated as an Unincorporated Partnership.

Where a foundation, trust or similar entity is an Unincorporated Partnership and, therefore, a tax transparent entity by default, there is no need for it to make an application under Article 17(1). However, the Unincorporated Partnership can submit an application on behalf of the juridical person(s) wholly owned and controlled by the Unincorporated Partnership that has the status of a Family Foundation, where the entity meets all the conditions specified in Article 17(1) of the Corporate Tax Law and wishes to be treated as an Unincorporated Partnership, i.e. fiscally transparent.

The application can be submitted by the Unincorporated Partnership, for and on behalf of the juridical person(s) wholly owned and controlled by the Family Foundation. Each juridical person(s) in the multi-tier structure would need to authorise the application made by the Unincorporated Partnership. Alternatively, the application can be made by each entity, subject to approval by the FTA of the tier above the relevant entity.

Annual Confirmation of the Family Foundation

For the purposes of monitoring the continued compliance by a Family Foundation with the conditions of Article 17(1) of the Corporate Tax Law, the FTA requires the Family Foundation (or a juridical person wholly owned and controlled by a Family Foundation) which has made an application to be treated as an Unincorporated Partnership, to file an annual confirmation within 9 months from the end of the relevant Tax Period.[62] The deadline to file an annual confirmation shall be 31 December 2025 for any Tax Periods that ended on or before 31 March 2025.[63]

Annual Confirmation by a Family Foundation

In a multi-tier scenario, the annual confirmation can be submitted by the Family Foundation, for the Family Foundation itself and any juridical person(s) wholly owned and controlled by the Family Foundation. Alternatively, the confirmation can be made by each entity.

Annual Confirmation by an Unincorporated Partnership

In a multi-tier scenario, the annual confirmation can be submitted by the Unincorporated Partnership (to confirm that it continues to meet the conditions of a Family Foundation), for the Unincorporated Partnership itself and any juridical person(s) wholly owned and controlled by the Unincorporated Partnership. Alternatively, the confirmation can be made by the Unincorporated Partnership and each entity separately.

Failure to continue meeting the conditions

If a Family Foundation has applied to be treated as an Unincorporated Partnership and such application has been approved by the FTA, however, subsequently the Family Foundation fails to meet any of the conditions under Article 17(1) of the Corporate Tax Law, then it will lose its fiscally transparent status and revert to being a Taxable Person for Corporate Tax purposes from the beginning of the Tax Period in which such failure occurred.

Where an entity in a multi-tier structure (see Section 6) ceases to meet the conditions, any entities it holds directly or indirectly will also cease to be eligible to be treated as fiscally transparent under the Family Foundation provisions.

Updates and Amendments

Date of amendment | Amendments made |

|---|---|

May 2025 |

|