Registration of Juridical Persons

Corporate Tax Guide | CTGRJP1

August 2023

Contents

4. Overview of the Corporate Tax Registration process

4.1. Who can register for Corporate Tax?

4.1.1. Persons already registered for VAT and Excise Tax

4.1.2. Tax Agents for Corporate Tax registering on behalf of another Person

4.3. Key documentation requirements for Corporate Tax Registration purposes

5. Taxable Persons and Exempt Persons

6.1. LLCs, public / private joint stock companies incorporated in the UAE

6.2. Foreign entities that are effectively managed and controlled in the UAE

6.3. Branches of UAE companies

6.4. Resident juridical persons eligible for small business relief

7. FTA power to register a Person for Corporate Tax

Glossary

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Extractive Business | : | The Business or Business Activity of exploring, extracting, removing, or otherwise producing and exploiting the Natural Resources of the UAE, or any interest therein as determined by the Minister. |

FTA | : | Federal Tax Authority, being the Authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

Foreign Permanent Establishment | : | A place of Business or other form of presence outside the UAE of a Resident Person that is determined in accordance with the criteria prescribed in Article 14 of the Corporate Tax Law. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A juridical person incorporated, established, or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

Government Controlled Entity | : | Any juridical person, directly or indirectly wholly owned and controlled by a Government Entity, as specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Government Entity | : | The Federal Government, Local Governments, ministries, government departments, government agencies, authorities and public institutions of the Federal Government or Local Governments. |

Immovable Property | : | Means any of the following:

|

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Licensing Authority | : | The competent authority concerned with licensing or authorising a Business or Business Activity in the UAE. |

Local Government | : | Any of the governments of the Member Emirates of the Federation. |

Mandated Activity | : | Any activity conducted by a Government Controlled Entity in accordance with the legal instrument establishing or regulating the entity, that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Ministry | : | Ministry of Finance. |

Non-Extractive Natural Resource Business | : | The Business or Business Activity of separating, treating, refining, processing, storing, transporting, marketing or distributing the Natural Resources of the UAE. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Participating Interest | : | A significant ownership interest in the shares of the juridical person that meets the conditions of Article 23 of the Corporate Tax Law. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural or juridical person. |

Qualifying Investment Fund | : | Any entity whose principal activity is the issuing of investment interests to raise funds or pool investor funds or establish a joint investment fund with the aim of enabling the holder of such an investment interest to benefit from the profits or gains from the entity's acquisition, holding, management or disposal of investments, in accordance with the applicable legislation and when it meets the conditions set out in Article 10 of the Corporate Tax Law. |

Qualifying Public Benefit Entity | : | Any entity that meets the conditions set out in Article 9 of the Corporate Tax Law and that is listed in a decision issued by the Cabinet at the suggestion of the Minister. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

State | : | United Arab Emirates. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax Agent | : | Any Person registered with the FTA who is appointed on behalf of another Person to represent him before the FTA and assist them in the fulfilment of his Tax obligations and the exercise of their associated Tax rights. |

Tax Deregistration | : | A procedure under which a Person is deregistered for Corporate Tax purposes with the FTA. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration | : | A procedure under which a Person registers for Corporate Tax purposes with the FTA. |

Tax Registration Number ("TRN") | : | A unique number issued by the FTA to each Person who is registered for Corporate Tax purposes in the UAE. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person liable to Corporate Tax in the UAE under the Corporate Tax Law. |

UAE | : | United Arab Emirates. |

Introduction

Overview

Short Brief

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses ("Corporate Tax Law") was signed on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ("UAE") on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits ("Corporate Tax") in the UAE.

The provisions of the Corporate Tax Law shall apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance on registration for Corporate Tax in the UAE for juridical persons. It provides readers with an overview of:

The Corporate Tax Registration rules;

How a Person can determine whether they need to register for Corporate Tax; and

The Corporate Tax Deregistration process.

Who should read this guide?

Any juridical person carrying on a Business or Business Activity in the UAE should read this guide. This includes any non-resident person who has a Permanent Establishment in the UAE.

How to use this guide

The relevant articles of the Corporate Tax Law are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, simple examples are used to illustrate how the Corporate Tax registration requirements function. The examples in the guide:

Show how these requirements operate in isolation and do not show the interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used and all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes; and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural person.

This guide is intended to be read in conjunction with other relevant guidance published by the FTA.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as the “Corporate Tax Law”;

Cabinet Decision No. 37 of 2023 Regarding the Qualifying Public Benefit Entities for the Purposes of the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Cabinet Decision No. 37 of 2023";

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that Are Subject to Corporate Tax is referred to as "Cabinet Decision No. 49 of 2023";

Cabinet Decision No. 56 of 2023 on Determination of a Non-Resident's Persons Nexus for the purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Cabinet Decision No. 56 of 2023";

Cabinet Decision No. 74 of 2023 on the Executive Regulation of Federal Decree-Law No. 28 of 2022 on Tax Procedures is referred to as "Cabinet Decision No. 74 of 2023";

Ministerial Decision No. 43 of 2023 Concerning Exception from Tax Registration for the Purpose of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 43 of 2023";

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 73 of 2023";

Ministerial Decision No. 115 of 2023 on Private Pension Funds and Private Social Security Funds for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 115 of 2023";

Federal Tax Authority Decision No. 6 of 2023 on Tax Deregistration Timeline for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "FTA Decision No. 6 of 2023"; and

Federal Tax Authority Decision No. 7 of 2023 on Provisions of Exemption from Corporate Tax for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "FTA Decision No. 7 of 2023".

Status of this guide

This guidance is not a legally binding document, but is intended to provide assistance in understanding the provisions relating to the registration of Juridical persons. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of the Corporate Tax Registration rules for juridical persons. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Corporate Tax Registration

Corporate Tax is a self-assessment regime. This means that a Person is responsible for assessing whether they are in scope of Corporate Tax, and whether they will need to fulfil any Corporate Tax obligations.

Generally, Persons who determine they are within the scope of Corporate Tax is required to register for Corporate Tax. This will allow them to fulfil their Corporate Tax obligations, such as submitting a Corporate Tax Return and paying any Corporate Tax due.

Broadly, Corporate Tax applies to the following "Taxable Persons":

UAE companies and other juridical persons that are incorporated or effectively managed and controlled in the UAE;

Natural persons (individuals) who conduct a taxable Business or Business Activity in the UAE as specified in Cabinet Decision No. 49 of 2023;

Non-resident juridical persons (foreign legal entities) that have a Permanent Establishment in the UAE;

Non-resident juridical persons (foreign legal entities) that have a nexus in the UAE arising from earning income from any Immovable Property in the UAE as specified in Cabinet Decision No. 56 of 2023;

Juridical persons established in a UAE Free Zone (if meeting the conditions to be considered a Qualifying Free Zone Person, they may benefit from a Corporate Tax rate of 0% on their Qualifying Income);

Non-resident persons that do not have a Permanent Establishment in the UAE and earn State Sourced Income; and

Non-resident persons that have a Permanent Establishment in the UAE and earn State Sourced Income that is not related to their Permanent Establishment.

Certain categories of Persons will not be required to register for Corporate Tax if they are specifically excluded in the relevant decision. [1]The requirement to register and provide the relevant supporting documentation depends on whether the Person is a natural person (i.e. an individual) or a juridical person (i.e. a legal entity), and whether they are considered a Taxable Person (i.e. a Resident Person or a Non-Resident Person), or an Exempt Person for Corporate Tax.

The table below sets out who will be required to register for Corporate Tax. More details on each of these categories are included in the sections below.

Once a Person is registered, the Federal Tax Authority (FTA) will issue them with a Tax Registration Number (TRN). This will be their Corporate Tax reference number and should be used when corresponding with the FTA regarding their Corporate Tax affairs.

Table 1: Overview of the Corporate Tax Registration requirements

Overview of who is required to register for Corporate Tax | |

Taxable Person | |

Resident juridical person | ✓ |

Non-resident juridical person with a Permanent Establishment in the UAE | ✓ |

Non-resident juridical person with a nexus in the UAE | ✓ |

Natural person subject to certain conditions | ✓ |

Exempt Person | |

Government Entity | Are not required to register unless they conduct a Business or Business Activity under a Licence issued by a Licensing Authority |

Government Controlled Entity | Are not required to register unless they conduct a Business or Business Activity which is not their Mandated Activity |

Extractive Business | Are not required to register unless they conduct a Business which is within the scope of Corporate Tax |

Non-Extractive Natural Resource Business | Are not required to register unless they conduct a Business which is within the scope of Corporate Tax |

Qualifying Public Benefit Entity | ✓ |

Qualifying Investment Fund | ✓ |

Pension and Social Security Fund | ✓ |

Juridical Persons wholly Owned and Controlled by certain other Exempt Persons | ✓ |

Overview of the Corporate Tax Registration process

Who can register for Corporate Tax?

Most Taxable Persons will be required to register. There is however an exception to this for Non-Resident Persons that derive only State Sourced Income without having a Permanent Establishment in the UAE. [2]These Persons will not have to register.

However, where a non-resident juridical person has a nexus in the UAE arising from earning income from any Immovable Property in the UAE, they would be required to register for Corporate Tax. [3]

An Exempt Person is not ordinarily subject to Corporate Tax provided certain conditions are met. However, some types of Exempt Persons will still be required to register.[4]

As Corporate Tax is a self-assessment regime, a Person within the scope of the Corporate Tax regime will be responsible for registering themselves for Corporate Tax.

Persons already registered for VAT and Excise Tax

A Person who is already registered for Value Added Tax (VAT) and / or Excise Tax will still be required to register for Corporate Tax if they are within the scope of the Corporate Tax regime. Once registered, they will be issued with a separate TRN for Corporate Tax purposes. The Corporate Tax TRN will be similar to their existing TRN for VAT and / or Excise Tax, but the last digit will be different from their VAT and / or Excise TRN.

Tax Agents for Corporate Tax registering on behalf of another Person

Many Persons will have Tax Agents who will act on their behalf and help them to meet their Corporate Tax obligations, subject to meeting certain conditions. These Tax Agents might already act on their behalf for VAT and Excise Tax and will be able to do so for Corporate Tax, if they are listed with the FTA as Tax Agents for Corporate Tax purposes.

Persons not registered for VAT and Excise Tax

Taxable Persons who are not subject to VAT or Excise Tax but are within the scope of the Corporate Tax will be required to register for Corporate Tax purposes.

How to register

An application to register for Corporate Tax can be made on the EmaraTax portal. A Person who is already registered for VAT or Excise Tax can use their existing login details. A Person that has not previously registered with the FTA will be required to create new login credentials the first time they access the EmaraTax portal.

A step by step user guide on the Corporate Tax Registration process is available on the FTA Website, and additional support can be accessed by contacting the FTA helpline on 80082923 during working hours.

The Corporate Tax Registration process

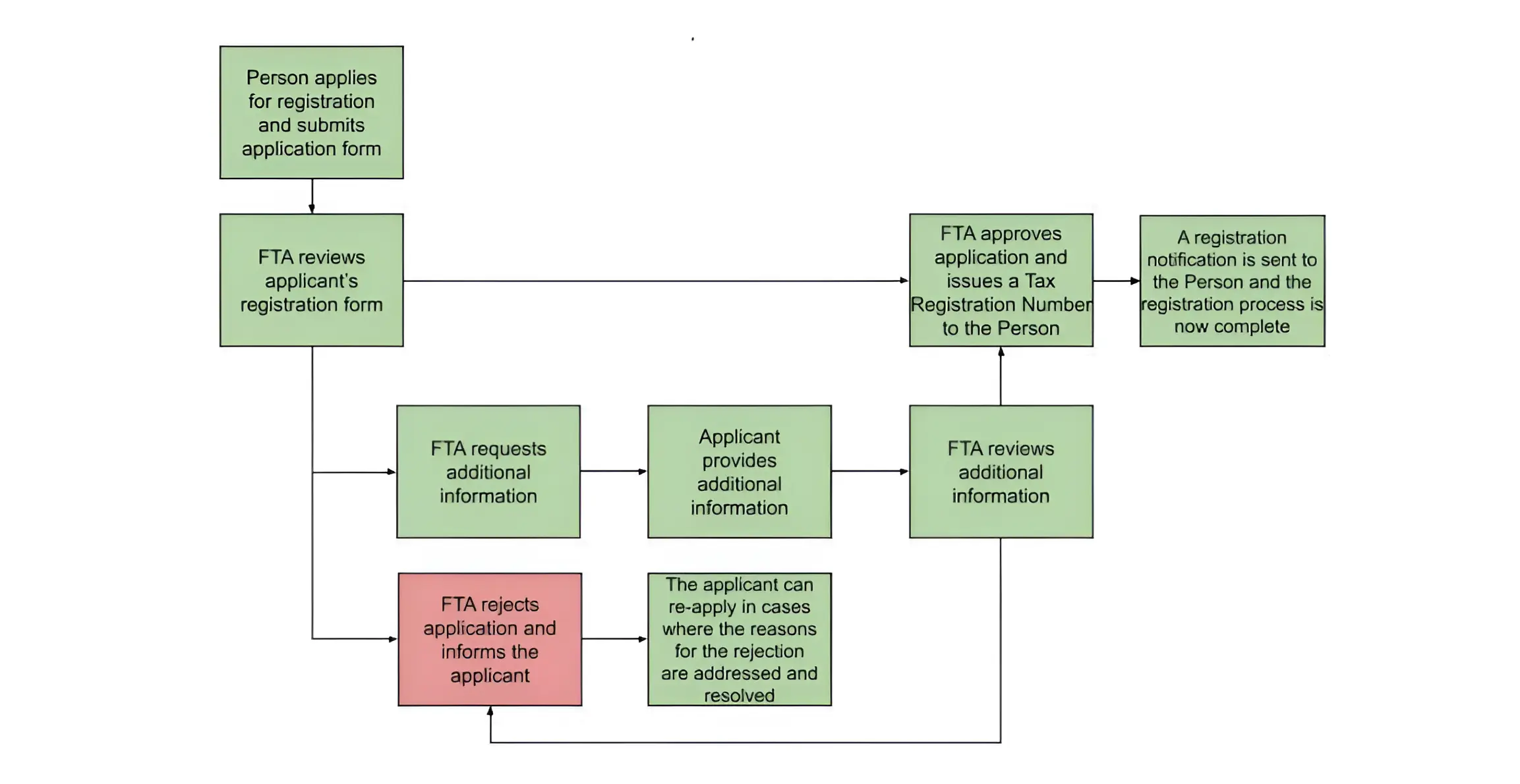

A Person who wishes to register for Corporate Tax must submit a registration application along with the relevant supporting documentation to the FTA. The FTA will review each application and approve or reject it. Once an application is approved, the FTA will issue the Person with a TRN.

Figure 1: Overview of the Corporate Tax Registration process

Tax Registration application processing time

The FTA aims to review the registration application form and respond within 20 business days from the date on which the completed registration application is received.

Where additional information has been requested by the FTA, the FTA will aim to respond to the applicant within 20 business days of receiving the additional information. If the additional information is not submitted within the timeframe specified by the FTA, the application shall be rejected and a new application will need to be submitted.

Key documentation requirements for Corporate Tax Registration purposes

The Corporate Tax Registration process has been designed to be simple and easy to complete for applicants. The information required to complete the registration application should be information that the applicant will already have, or is expected to have.

Applicants should ensure that they have the documentation specified in Table 2 ready before starting the Corporate Tax Registration process.

Table 2: Key documentation requirement for the Corporate Tax Registration process for resident juridical persons

Documentation | Requirement |

|---|---|

Trade Licence / Business Licence details (a copy to be uploaded) | Mandatory |

Passport of the immediate owner who directly owns at least 25% of the shares of the juridical or Exempt Person (a copy of the photo page to be uploaded) | Mandatory if the owner is an individual |

Emirates ID of the immediate owner who directly owns at least 25% of the shares of the juridical person (a copy of the front and back of the Emirates ID to be uploaded) | Mandatory if the owner is an individual and a UAE resident |

Passport of authorised signatory (a copy of the photo page to be uploaded) | Mandatory |

Emirates ID of authorised signatory (a copy of the front and back of the Emirates ID to be uploaded) | Mandatory if authorised signatory is a UAE resident |

Proof of authorisation for the authorised signatory (either a copy of the power of attorney or memorandum of association to be uploaded) | Mandatory |

In addition to the documentation requirements outlined above, the FTA can request other information that it believes are necessary to approve or reject the application.

If additional information is required, the FTA will contact the applicant through the EmaraTax portal. An email and / or a SMS notification will be sent to the applicant, and the status of their application will be changed to “Awaiting Information”. The applicant must provide the information requested within the timeframe specified by the FTA in order for the FTA to continue processing their application.

Obligations once registered

Once a Person has registered for Corporate Tax, they will be subject to a number of administrative Corporate Tax obligations. These include:

Filing a Corporate Tax Return and paying any Corporate Tax due within 9 months of the end of their Tax Period; [5]

Retaining all records and documents which support their tax position for a period of 7 years following the end of the Tax Period to which they relate; [6]and

Ensuring that all of their registration details are up to date and informing the FTA of any changes within 20 business days, in order for administrative penalties not to be imposed. [7]

Taxable Persons and Exempt Persons

Who is a Taxable Person?

Under the Corporate Tax Law, a Taxable Person is either a Resident Person or a Non- Resident Person. Whether a Person is a Resident or Non-Resident determines the scope of their tax obligations.

A Resident Person can be:

A juridical person incorporated or otherwise established or recognised under the applicable legislation in the UAE (including a Person incorporated, established or otherwise registered in a Free Zone); [8]

A juridical person incorporated or otherwise established or recognised under the applicable legislation outside the UAE but “effectively managed and controlled” in the UAE; [9]or

A natural person that conducts a taxable Business or Business Activity in the UAE in accordance with the provisions of Cabinet Decision No. 49 of 2023. [10]

A Resident juridical person must register for Corporate Tax. Further guidance on Natural Persons will be issued in the near future.

Example 1: Juridical person incorporated in the UAE

Company A is a limited liability company incorporated in the UAE. As a company incorporated in the UAE, the company would be considered a Resident Person under the Corporate Tax Law and will be required to register for Corporate Tax.

Who is an Exempt Person?

Certain Persons, referred to as Exempt Persons, will be exempt from Corporate Tax. Exempt Persons fall into one of four categories:

Automatically Exempt Persons;

Exempt if they notify the Ministry of Finance, and meet relevant conditions;

Exempt if listed in a Cabinet Decision and meet relevant conditions; and

Exempt upon application to, and approval by, the FTA.

In addition, if a juridical person incorporated, established or recognised under the applicable legislation in the UAE only derives Exempt Income, [11]this does not exempt the Person from registering for Corporate Tax. The juridical person will still be considered as a Taxable Person and will be required to register for Corporate Tax purposes. Please refer to section 5.3 for further information on Exempt Income.

Automatically Exempt Persons

Government Entities

A Government Entity includes the Federal Government, Local Governments, ministries, government departments, government agencies, authorities and public institutions of the Federal Government or Local Governments. [12]

Government Entities are automatically exempt from Corporate Tax. [13]However, a Government Entity shall be subject to Corporate Tax if it conducts a Business or Business Activity under a Licence issued by a Licensing Authority. Any Business or Business Activity conducted by a Government Entity under a Licence issued by a Licensing Authority shall be treated as an independent Business, the entity will be subject to Corporate Tax in relation to that licensed Business or Business Activity and will be required to register for Corporate Tax. [14]

Example 2: A Government Entity established in the UAE

Ministry "M" is a Government Entity in the UAE and is part of the Federal Government. Ministry M does not undertake a business under a Licence.

A Government Entity will automatically be exempt from Corporate Tax as long as it does not conduct a business under a Licence. As Ministry M is part of the Federal Government, it will not be required to register for Corporate Tax.

Exempt Persons if they notify the Ministry, and meet relevant conditions

Extractive Businesses and Non-Extractive Natural Resource Businesses that meet the relevant conditions

Both Extractive Businesses and Non-Extractive Natural Resource Businesses that meet the relevant conditions will be exempt from Corporate Tax. [15]Where an Extractive Business or Non- Extractive Natural Resource Business conducts an independent Business that is not ancillary to its ordinary business and this Business accounts for more than 5% of their total Revenue, it will be required to register with the FTA for Corporate Tax. [16]

Example 3: Extractive and Non-Extractive Natural Resource Businesses that meet the requirements to be exempt from Corporate Tax

Company T is an Extractive Business and Company U is a Non-Extractive Natural Resource Business. Both entities meet the requirements to be exempt from Corporate Tax.

Neither Company T or Company U will be required to register for Corporate Tax as they will be treated as Exempt Persons.

Example 4: Extractive and Non-Extractive Natural Resource Business that do not meet the conditions set out in Article 7 or Article 8 of the Corporate Tax Law

Company V is engaged in the extraction of oil but does not meet the conditions to be exempt from Corporate Tax.

As Company V does not meet the conditions to be an Exempt Person, it is a Taxable Person and must register for Corporate Tax.

Example 5: Extractive Business engaged in ancillary activities that regularly exceeds 5% of total Revenues

Company W is an Extractive Business established, registered and effectively subject to tax in Ajman. On an annual basis, Company W engages in ancillary activities that represent 15% of the company's total Revenue.

As Company W engages in ancillary activities that make up more than 5% of its total Revenues, the Company will be required to register for Corporate Tax and report the ancillary business Revenue and expenses in its Corporate Tax Return.

Exempt Persons if listed in a Cabinet Decision and meet relevant conditions

Government Controlled Entities

A Government Controlled Entity is any juridical person, directly or indirectly wholly owned and controlled by a Government Entity, as specified in a decision issued by the Cabinet at the suggestion of the Minister. [17]

Government Controlled Entities that conduct Mandated Activities and are listed in a Cabinet Decision will be exempt from Corporate Tax. [18]However, a Government Controlled Entity that conducts Business that is not its Mandated Activity will be subject to Corporate Tax in relation to that activity and must register for Corporate Tax. [19]

Example 6: A Government Controlled Entity that undertakes Mandated Activities

Company R is incorporated in Abu Dhabi, and is wholly owned and controlled by Abu Dhabi's Department “D”. Company R is listed in a Cabinet Decision as a Government Controlled Entity along with its Mandated Activities. Company R does not conduct any other Business Activities.

As Company R and all of its activities are listed in a Cabinet Decision, the entity will be exempt from Corporate Tax and will not be required to register for Corporate Tax.

Example 7: A Government Controlled Entity that undertakes both Mandated Activities and non-Mandated Activities

Company S is an entity wholly owned and controlled by the Department “D” in Sharjah. The entity conducts Mandated Activities and is listed in a Cabinet Decision as a Government Controlled Entity. Company S also conducts non-Mandated Activities.

As Company S conducts non-Mandated Activities, these Business Activities will be taxable. Company S will be required to register for Corporate Tax. Any income earned and relevant expenses incurred for the Mandated Activities will be exempt from Corporate Tax.

Qualifying Public Benefit Entity

A Qualifying Public Benefit Entity is an organisation formed by private individuals, government or non-governmental bodies for carrying out religious, charitable, scientific, artistic, cultural, athletic, educational, healthcare, environmental, humanitarian, animal protection without the motive of making profit for distribution to private persons. [20]

In this regard, Cabinet Decision No. 37 of 2023 has been issued which specifies the Qualifying Public Benefit Entities for Corporate Tax purposes. Qualifying Public Benefit Entities listed in this Cabinet Decision must still register for Corporate Tax purposes and obtain a Corporate Tax TRN. [21]The application to register for Corporate Tax purposes for Qualifying Public Benefit Entities will be available as of 1 October 2023. [22]

A Public Benefit Entity that is not listed in the Cabinet Decision as a Qualifying Public Benefit Entity will not be considered as an Exempt Person, and will be a Taxable Person. As a result, it should register for Corporate Tax according to its relevant entity type, for example as a resident juridical person.

Example 8: A charity is established in the UAE

Charity A is a licensed animal charity in Ras Al Khaimah. The charity meets all of the conditions set out in Article 9 of the Corporate Tax Law and would like to be considered as a Qualifying Public Benefit Entity and be exempt from Corporate Tax.

Charity A is listed in Cabinet Decision No. 37 of 2023, and therefore, will be required to register for Corporate Tax in order to be eligible to be considered as a Qualifying Public Benefit Entity and exempt from Corporate Tax.

Exempt Persons upon application to the FTA

Certain Persons may be exempt from Corporate Tax if they meet specific conditions. These Persons must make an application to the FTA to be exempt from Corporate Tax. [23]The entities which may be exempt if an application is approved by the FTA are:

Public and private pension or social security funds;

Qualifying Investment Funds;

Juridical persons incorporated in the UAE that are wholly owned and controlled by certain Exempt Persons; and

Any other Person as may be determined in a decision issued by the Cabinet at the suggestion of the Minister.

Before making an application to be exempt from Corporate Tax, these entities must register for Corporate Tax and obtain a TRN. [24]The possibility to submit a Corporate Tax Registration application for the four categories of Persons listed above will be available as of 1 June 2024. [25]

Once an application to be exempt is approved by the FTA, the entity will still be required to submit a declaration. [26]If the entity ceases to be exempt, it will be required to comply with ordinary Corporate Tax obligations.

Pension and social security fund

Public pensions and social security funds [27]are typically initiated, sponsored and governed by a Federal or Local Government Entity. However, as the entitlement to receive the benefits from these funds and any surplus assets of the fund normally rests with the beneficiaries, they are not typically considered to be wholly owned and controlled by the Government Entity which oversees them.

Public and private pension and social security funds will be required to register for Corporate Tax as they will be considered to be a Taxable Person. [28]Once registered, the funds can make an application to the FTA to be treated as an Exempt Person, provided all the relevant conditions are met. [29]

A private social security fund may apply to the Authority to be exempt from Corporate Tax where all of the following conditions are met:

The fund comprises a pool of assets which have been assigned by law or contract as fund assets or the acquisition of these assets has been financed by or with the use of contributions to the fund for the exclusive purpose of financing the End of Service Benefit.

The income of the fund solely comprises income as specified in the relevant decision.

The fund must have an Auditor. [30]

A private pension fund may apply to the Authority to be exempt from Corporate Tax Law where all of the following conditions are met:

The fund comprises a pool of assets which have been assigned by law or contract as pension plan assets or the acquisition of these assets has been financed by or with the use of contributions to a pension plan for the exclusive purpose of financing the pension plan benefits.

The fund grants pension plan members or beneficiaries a right or other contractual claim or entitlement, against its assets or earnings.

The income of the fund solely comprises income as specified in the relevant decision.

The fund must have an Auditor. [31]

Example 9: A Pension Fund established in the UAE

Company Y is a private pension fund established in Umm Al Quwain that meets the conditions to be exempt from Corporate Tax. The fund would like to make an application to the FTA to be treated as an Exempt Person.

Company Y will be required to register for Corporate Tax as the fund will be considered a Taxable Person for Corporate Tax purposes until such time the application to be exempt for Corporate Tax is approved by the FTA. Once Company Y is registered for Corporate Tax, it can make an application to the FTA to be treated as an Exempt Person provided all the relevant conditions are met.

Qualifying Investment Funds

Whilst there are various structures that collective investment funds may take, the term investment fund refers to a contractual arrangement or juridical person whose primary purpose is to pool investor funds and invest such funds in accordance with a defined investment policy.

Regardless of the type of investment fund, the Corporate Tax Law seeks to ensure the tax neutrality of investment funds so that investors, whether domestic or foreign, are in the same or a similar tax position as if they had invested directly in the underlying assets of the fund.

In recognition of the neutrality principle, an investment fund can make an application to the FTA for exemption from Corporate Tax as a Qualifying Investment Fund where it meets the relevant conditions. [32]However, the investment fund must register for Corporate Tax before doing so. [33]

Example 10: A Qualifying Investment Fund established in the UAE

Fund X is an investment fund established in Fujairah. The investment fund meets all of the conditions to be considered as a Qualifying Investment Fund in the UAE. The fund would like to make an application to the FTA to become a Qualifying Investment Fund and be exempt from Corporate Tax.

Fund X will be required to register for Corporate Tax before making an application to the FTA to be considered as a Qualifying Investment Fund. If the application is approved after registration, Fund X will be exempt from Corporate Tax.

Wholly owned subsidiaries of certain Exempt Persons

A juridical person that is incorporated in the UAE and is wholly owned by a Government Entity, Government Controlled Entity, Qualifying Investment Fund or a public / private pension or social security fund will be exempt from Corporate Tax where certain conditions are met. [34]

In order to qualify for the exemption, the juridical person must undertake part or whole of the activity of the Exempt Person, be engaged exclusively in holding assets or investing funds for the benefit of the Exempt Person or only carry out activities that are ancillary to those carried out by the Exempt Person. If one of these conditions is met, the juridical person will be required to register for Corporate Tax first and then can make an application to the FTA to be exempt from Corporate Tax. [35]

Example 11: A subsidiary of a certain type of Exempt Person

Company Z is a holding company wholly owned by Fund A, a Qualifying Investment Fund operating in Abu Dhabi. Company Z is engaged exclusively in investing funds for the benefit of Fund A, an Exempt Person.

Company Z will be required to register for Corporate Tax as the company will be considered a Taxable Person despite being wholly owned by a Qualifying Investment Fund. Once Company Z is registered, it can apply to the FTA to be treated as an Exempt Person.

Example 12: An entity wholly owned by a Government Entity that does not conduct Mandated Activities

The Department “D” in Fujairah is a part of the Emirate's Government. Department “D” wholly owns Company Q, a company engaging in Business Activities that are not related to Department D's government duties. Company Q is not listed in a Cabinet Decision as a Government Controlled Entity.

Although Company Q is wholly owned by Department D (a Government Entity), as Company Q is not listed in a Cabinet Decision as a Government Controlled Entity conducting Mandated Activities, Company Q will be required to register for Corporate Tax.

What is Exempt Income?

Under the Corporate Tax Law, there are a number of types of income that are not subject to Corporate Tax. These are known as Exempt Income. [36]If a Person only receives Exempt Income in a Tax Period, they will not have a Corporate Tax liability as the income they receive is not taxable. However, the Person is not exempted from Corporate Tax obligations. A Taxable Person that only receives Exempt Income would still be considered as a Taxable Person and is required to register for Corporate Tax and meet its Corporate Tax obligations.

The types of income, and related expenditure, which are exempt from Corporate Tax include:

Dividends and other profit distributions received from UAE resident juridical persons; [37]

Dividends and other profit distributions received from a Participating Interest in a foreign juridical person; [38]

Other income from a Participating Interest as specified in Article 23 of the Corporate Tax Law; [39]

Income received from a Foreign Permanent Establishment where the election has been made to not take into account its income from Corporate Tax; [40]and

Income earned by a Non-Resident Person from operating aircrafts or ships used in international transportation, where certain conditions are met. [41]

Resident juridical persons

A juridical person is an entity established or otherwise recognised under the laws and regulations of the UAE, or under the laws of a foreign jurisdiction, that has a legal personality separate from its founders, owners and directors. A juridical person can take a number of forms, which are set out below.

LLCs, public / private joint stock companies incorporated in the UAE

Examples of juridical persons “incorporated or otherwise established or recognised in the UAE” include, but are not limited to, Limited Liability Companies (LLCs), Private Shareholding Companies (PSCs) and Public Joint Stock Companies (PJSCs).

Example 13: UAE Public Joint Stock Company

Company D is a public joint stock company incorporated in Dubai.

As Company D is a company incorporated in the UAE, the company will be considered a Resident Person and will be required to register for Corporate Tax.

Foreign entities that are effectively managed and controlled in the UAE

A foreign juridical person that is effectively managed and controlled in the UAE will be considered a Resident Person for Corporate Tax purposes.

For a juridical person to be considered effectively managed and controlled in the UAE, it is not necessary for its board members (or equivalent) to be domiciled or resident in the UAE. Effective management and control is not determined by where the decisions made by the ultimate decision makers are implemented or managed on a day-to-day basis. A juridical person could have multiple places of management in different jurisdictions, but generally will have only one place of effective management and control. This is where the key management or commercial decisions are regularly and predominantly made throughout the relevant Tax Period.

Example 14: Juridical person effectively managed and controlled in the UAE

Company E is a limited company registered in Country L. All of the key management and commercial decisions for Company E are made in the Umm Al Quwain.

As the key management and commercial decisions are made in the UAE, Company E will be considered a Resident Person and will be required to register for Corporate Tax in the UAE.

Branches of UAE companies

A UAE branch of a Resident Person shall be treated as one and the same Taxable Person.[42]In fact, a UAE branch of a domestic juridical person is regarded as an extension of its head office and, therefore, is not considered a separate juridical person. As a result, a branch of a UAE company will not be able to register for Corporate Tax individually. The head office must register for Corporate Tax on behalf of all of the UAE branches. This is also applicable for Free Zone branches of mainland UAE juridical persons and also for mainland branches of Free Zones Persons.

Example 15: Branches of UAE companies

Company F is a UAE incorporated logistics company that has a number of branches in the different Emirates of the UAE.

Branches of UAE companies are regarded as an extension of their head office and, therefore, they may not register them separately. Therefore, Company F would register for Corporate Tax and be required to list all of the UAE branches it has on the Corporate Tax Registration application form.

Resident juridical persons eligible for small business relief

Small business relief will be available to businesses that meet the required conditions.[43]Specifically, an eligible Taxable Person can claim small business relief if their Revenue is below or equal to AED 3,000,000 (three million dirhams) in the relevant Tax Period and all previous Tax Periods commencing 1 June 2023. [44]

Where the small business relief election is made, the business will be treated as having no Taxable Income during the relevant Tax Period. This means that they will have no Corporate Tax liability. However, meeting the conditions to elect for small business relief does not exempt that Taxable Person from meeting their Corporate Tax compliance obligations such as filing a Tax Return. Appropriate records need to be maintained to support the eligibility for the election being made.

As the election must be made in the Corporate Tax Return, the Taxable Person electing for small business relief must register for Corporate Tax before they can make the election.

Example 16: Small business relief

Company L is incorporated in Sharjah and earns Revenues of AED 2,500,000 in the Tax Period 1 January 2024 to 31 December 2024, and would like to claim small business relief.

Even though Company L's Revenue for a Tax Period remains under AED 3,000,000, meeting the conditions to be eligible for small business relief does not affect the Corporate Tax compliance obligations that Company L has as a Resident Person. Therefore, Company L will be required to register for Corporate Tax.

FTA power to register a Person for Corporate Tax

If the FTA believes that a Person is a Taxable Person and should have registered for Corporate Tax but has failed to do so, the FTA can, at its discretion and based on information available to the FTA, register a Person for Corporate Tax. [45]

A Person has the right to appeal against a tax assessment issued following a registration initiated by the FTA if they disagree with such a decision.

Example 17: The FTA registering a Person for Corporate Tax

Company ABC is a UAE resident company that was incorporated in Dubai in 2014. It is not VAT registered, and as a result the company did not receive automated communications about registering for Corporate Tax from the FTA.

In 2026, the company still had not registered for Corporate Tax despite the fact that it should have applied to be registered as the company had met the definition of a Taxable Person for Corporate Tax purposes.

The FTA has the power to register Company ABC for Corporate Tax effective from the date it should have registered from, as the company is within the scope of the Corporate Tax Law from that date.

Corporate Tax Deregistration

If a juridical person is no longer subject to Corporate Tax, they should deregister. This will most commonly occur when a Business or Business Activity ceases, but could also occur due to dissolution or liquidation or other circumstances.

In order to deregister from Corporate Tax, a juridical person must make an application to the FTA. [46]Once approved, the date of deregistration will be the date the Business or Business Activity ceased, unless the FTA determines that another date should be used. [47]

In order to be deregistered, a Taxable Person must meet all of their tax compliance obligations such as filing all of the relevant Tax Returns and paying all Corporate Tax liabilities and administrative penalties due. [48]

A juridical person is required to file a Tax Deregistration application within 3 months of the date the entity ceases to exist, cessation of the Business, dissolution, liquidation or otherwise. [49]

Example 18: Deregistration

Company ABC is a UAE resident company. The company's Tax Period runs from 1 January to 31 December. Company ABC ceased trading on 31 December 2025. On 3 January 2026, the company made an application to the FTA to be deregistered for Corporate Tax purposes. The last Corporate Tax Return filed by Company ABC was for the Tax Period 1 January 2024 to 31 December 2024.

As Company ABC has not filed its Corporate Tax Return for the Tax Period 1 January to 31 December 2025, this return must be filed and any tax due paid before the FTA approves the deregistration of the company.

Example 19: Deregistration

Company DD is a UAE resident company. The company's Tax Period runs from 1 June to 31 May. The company was liquidated on 31 May 2025. Before being liquidated, Company DD filed all required Corporate Tax Returns up to the Tax Period ending on 31 May 2025 and has no outstanding Corporate Tax liabilities. The company applied to be de-registered on 1 June 2025.

As Company DD has filed all relevant Corporate Tax Returns and paid all Corporate Tax liabilities up to the year ending 31 May 2025, the FTA would approve Company DD's request to be deregistered for Corporate Tax Purposes.

Updates and Amendments

Date of amendment | Amendments made |

|---|---|

August 2023 |

|