Tax Resident and Tax Residency Certificate

Tax Procedures Guide | TPGTR1

October 2024

Contents

4. Resident Person under the Corporate Tax Law

4.1. Resident Person that is a juridical person

4.1.1. Juridical person incorporated or formed in the UAE

4.1.4. Effective management and control

4.1.5. Criteria for identifying person who make key management and commercial decisions

4.1.6. Where key management and commercial decisions are made

4.1.7. Income subject to Corporate Tax

4.1.8. Income from foreign sources received by a juridical Resident Person

5. Tax residency under UAE domestic law

5.1. Juridical person that is Tax Resident under UAE domestic law

5.1.1. Juridical person incorporated or otherwise formed or recognised in the UAE

5.1.2. Juridical persons otherwise considered a Tax Resident under other UAE Tax Laws

5.2. Natural person that is Tax Resident under UAE domestic law

6. Tax residency under Double Taxation Agreements

6.1. Juridical persons that are tax resident under Double Taxation Agreements

6.1.1. Tax residence of Government Entities under Double Taxation Agreements

6.1.2. Tax residence of Exempt Persons under Double Taxation Agreements

6.1.3. Double Taxation Agreements tie-breaker rules for juridical persons

6.2. Natural persons that are tax resident under Double Taxation Agreements

7. Obtaining a Tax Residency Certificate

7.1. Tax Residency Certificate

7.2. Periods covered by the Tax Residency Certificate

7.3. How to apply for a Tax Residency Certificate

7.4. Applying for a Tax Residency Certificate for the purposes of a Double Taxation Agreement

7.5.1. Documentation required to apply for purposes other than Double Taxation Agreement

7.5.2. Documentation required to apply for Double Taxation Agreement purposes

8. International form stamping

9. Appendix 1: Tax Resident Certificate sample

10. Appendix 2: Residency criteria of various legislative instruments

Glossary

AED | : | The United Arab Emirates dirham. |

Authority | : | Federal Tax Authority. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Connected Person | : | Any Person affiliated with a Taxable Person as determined in Clause 2 of Article 36 of the Corporate Tax Law. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Corporate Tax Payable | : | Corporate Tax that has or will become due for payment to the FTA in respect of one or more Tax Periods. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Extractive Business | : | The Business or Business Activity of exploring, extracting, removing, or otherwise producing and exploiting the Natural Resources of the UAE, or any interest therein as determined by the Minister. |

Financial Statements | : | A complete set of statements as specified under the Accounting Standards applied by the Taxable Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity and cash flow statement. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

Foreign Permanent Establishment | : | A place of Business or other form of presence outside the UAE of a Resident Person that is determined in accordance with the criteria prescribed in Article 14 of the Corporate Tax Law. |

Foreign Tax Credit | : | Tax paid under the laws of a foreign jurisdiction on income or profits that may be deducted from the Corporate Tax due, in accordance with the conditions of Article 47(2) of the Corporate Tax Law. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A juridical person incorporated, established or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

FTA | : | Federal Tax Authority, being the Authority responsible for the administration, collection and enforcement of federal taxes in the UAE. |

Government Controlled Entity | : | Any juridical person, directly or indirectly wholly owned and controlled by a Government Entity, as specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Government Entity | : | The Federal Government, Local Governments, ministries, government departments, government agencies, authorities and public institutions of the Federal Government or Local Governments. |

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Local Government | : | Any of the governments of the Member Emirates of the Federation. |

Mandated Activity | : | Any activity conducted by a Government Controlled Entity in accordance with the legal instrument establishing or regulating the entity, that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Minister | : | Minister of Finance. |

Mutual Agreement Procedure | : | A process that allows competent authorities of contracting states to resolve disputes regarding the application of Double Taxation Agreements. |

Natural Resources | : | Water, oil, gas, coal, naturally formed minerals, and other non-renewable, non-living natural resources that may be extracted from the UAE's Territory. |

Non-Extractive Natural Resource Business | : | The Business or Business Activity of separating, treating, refining, processing, storing, transporting, marketing or distributing the Natural Resources of the UAE. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

OECD | : | The Organisation for Economic Cooperation and Development. |

Participating Interest | : | An ownership interest in the shares or capital of a juridical person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Permanent Place of Residence | : | The place located in the UAE and available to the natural person at all times. |

Person | : | Any natural person or juridical person. |

Qualifying Investment Fund | : | Any entity whose principal activity is the issuing of investment interests to raise funds or pool investor funds or establish a joint investment fund with the aim of enabling the holder of such an investment interest to benefit from the profits or gains from the entity's acquisition, holding, management or disposal of investments, in accordance with the applicable legislation and when it meets the conditions set out in Article 10 of the Corporate Tax Law. |

Qualifying Public Benefit Entity | : | Any entity that meets the conditions set out in Article 9 of the Corporate Tax Law and that is listed in a decision issued by the Cabinet at the suggestion of the Minister. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Residence Permit | : | The permit or authorisation issued by the competent authorities in the UAE granting the natural person the right to reside or work within the territory of the UAE, and does not include any temporary permit to enter the UAE for a specified period for the purposes of temporary travel, tourism, sport, medical treatment or any other purpose. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

State | : | United Arab Emirates. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax | : | Every federal tax imposed under the Tax Law, that the FTA is mandated to administer, collect and enforce. |

Tax Law | : | Any federal law whereby Tax is imposed. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration Number | : | A unique number issued by the FTA to each Person who is registered for Corporate Tax purposes in the UAE. |

Tax Residency Certificate | : | A certificate issued by the FTA proving that the Person is a Tax Resident in the UAE. |

Tax Resident | : | The Person who is resident of the UAE as specified in Articles 3 and 4 of Cabinet Decision No. 85 of 2022. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Turnover | : | The gross amount of income derived during a Gregorian calendar year. |

UAE | : | United Arab Emirates. |

Withholding Tax | : | Corporate Tax to be withheld from State Sourced Income in accordance with Article 45 of the Corporate Tax Law. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments (“Corporate Tax Law”) was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates (“UAE”) on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits (“Corporate Tax”) in the UAE.

The provisions of the Corporate Tax Law shall apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance on Corporate Tax in the UAE and on tax residency rules. It provides readers with an overview of the following:

how a Person can determine whether they are a Resident Person for Corporate Tax purposes,

how a Person can determine whether they are a UAE Tax Resident under domestic law,

how a Person can determine whether they are a UAE Tax Resident under a Double Taxation Agreement (“DTA”), and

how a UAE Tax Resident can obtain a Tax Residency Certificate.

Who should read this guide?

This guide should be read by anyone that is responsible for tax matters, operating in the UAE, who wants to know more about the application of the domestic Tax Residency rules in the UAE, as well as their tax agents and advisers. It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further

guidance on some of the areas covered in this guide can be found in other topic-specific guides.

In some instances, examples are used to illustrate how key elements of the Corporate Tax Law apply to Resident Persons and the impact on the application to obtain a Tax Residency Certificate. The examples in the guide:

show how these elements operate in isolation and do not show the interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes, and

are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific Persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Law No. 5 of 1985 on Civil Transactions, and its amendments, is referred to as “Federal Law No. 5 of 1985”,

Federal Decree-Law No. 32 of 2021 on Commercial Companies is referred to as “Federal Decree-Law No. 32 of 2021”,

Federal Decree-Law No. 28 of 2022 on Tax Procedures is referred to as “Federal Decree-Law No. 28 of 2022”,

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as “Corporate Tax Law”,

Federal Decree-Law No. 31 of 2023 on Trusts is referred to as “Federal Decree-Law No. 31 of 2023”,

Cabinet Decision No. 65 of 2020 on Fees for the Services Provided by the Federal Tax Authority, and its amendments is referred to as “Cabinet Decision No. 65 of 2020”,

Cabinet Decision No. 85 of 2022 on Determination of Tax Residency is referred to as “Cabinet Decision No. 85 of 2022”,

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that are Subject to Corporate Tax is referred to as “Cabinet Decision No. 49 of 2023”,

Cabinet Decision No. 56 of 2023 on Determination of a Non-Resident Person's Nexus in the State for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Cabinet Decision No. 56 of 2023”,

Cabinet Decision No. 74 of 2023 on the Executive Regulation of Federal Decree-Law No. 28 of 2022 on Tax Procedures is referred to as “Cabinet Decision No. 74 of 2023”,

Ministerial Decision No. 27 of 2023 on Implementation of certain Provisions of Cabinet Decision No. 85 of 2022 on Determination of Tax Residency is referred to as “Ministerial Decision No. 27 of 2023”,

Ministerial Decision No. 116 of 2023 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 116 of 2023”,

Ministerial Decision No. 247 of 2023 on the Issuance of Tax Residency Certificate for the Purposes of International Agreements is referred to as “Ministerial Decision No. 247 of 2023”,

Foundations Regulations 2017 of the Abu Dhabi Global Market is referred to as “ADGM Foundations Regulations 2017”,

Dubai International Financial Centre Law No. 3 of 2018 is referred to as “DIFC Law No. 3 of 2018”, and

Ras Al Khaimah International Corporate Centre Regulations 2019 is referred to as “RAK ICC Foundations Regulations 2019”.

Status of this guide

This guidance is not a legally binding document but is intended to provide assistance in understanding the tax implications for Persons relating to the Corporate Tax regime in the UAE. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax in the UAE. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Concept of tax residence

The essential purpose of the concept of tax residence is to establish a connecting factor between a Person and a specific jurisdiction for tax purposes. A Person may be either a natural person (an individual) or a juridical person (a separate legal entity).

A Person may be liable to tax in any jurisdiction where the Person meets the criteria to be a tax resident. Each country has sovereignty to establish its own definition of tax residency and, therefore, it is possible for a Person with cross-border economic activities to be considered tax resident in more than one jurisdiction.

Where a Person is dual resident (that is, tax resident in two jurisdictions), the applicable DTA between the two jurisdictions generally determines the jurisdiction that is considered to be the residence state of the Person and how taxing rights should be allocated between the two jurisdictions. One jurisdiction may be considered the “residence state” while the other jurisdiction may be considered the “source state”.

Where there is a DTA, a Person that is tax resident in one jurisdiction but has been subject to tax in both jurisdictions should be able to claim relief from double taxation, such as applying a reduced withholding tax rate or requesting a withholding tax refund. To do this, a Person may be required to provide a Tax Residency Certificate (“TRC”) issued by a jurisdiction. A Person can apply to the FTA for a TRC (see Section 7). The FTA also provides an international form stamping service (see Section 8).

Tax residency is a different from other types of residency, such as for immigration purposes. Holding a Residence Permit or right to reside in the UAE based on the applicable immigration rules does not automatically mean that a natural person is also a Tax Resident in the UAE. Similarly, it is possible for a natural person to satisfy the criteria to be considered a Tax Resident of the UAE without holding a Residence Permit.

Being a “Resident Person” subject to Corporate Tax (see Section 4) is not the same as being a “Tax Resident” of the UAE (see Section 5) for the purposes of other taxes or being tax resident in the UAE for the purposes of a DTA entered into between the UAE and another jurisdiction.

Being a “Resident Person” for Corporate Tax purposes is also different from the concepts of residency used in subjects such as citizenship or when considering where a person is domiciled or habitually resides. These concepts are further detailed in Section 6.

Resident Person under the Corporate Tax Law

A Taxable Person is a Person subject to UAE Corporate Tax. Such a Person is either a “Resident Person” or a “Non-Resident Person”.[1]Furthermore, a Person is either a “juridical person“ or a ”natural person”. These classifications determine the scope of the Person's Corporate Tax obligations.

Resident Person

A juridical person that is a Resident Person is subject to Corporate Tax on its Taxable Income derived from inside and outside the UAE (worldwide income).[2]

A natural person that is a Resident Person is subject to Corporate Tax on his or her Taxable Income derived from in and outside the UAE, provided it relates to the Businesses or Business Activities conducted by the natural person in the UAE,[3]and the Turnover derived from such Businesses or Business Activities exceeds AED 1,000,000 within a Gregorian calendar year.[4]

For both a juridical person and a natural person who is a Resident Person, the Corporate Tax Law exempts certain income earned outside of the UAE, and allows a credit for taxes paid in a foreign country on income that is also subject to Corporate Tax in the UAE.

Non-Resident Person

A Non-Resident Person, whether a juridical person or natural person, is generally only subject to Corporate Tax on income sourced in the UAE, or attributable to a Permanent Establishment in the UAE.

A Non-Resident Person that is a juridical person may also be subject to Corporate Tax on income derived from a nexus in the UAE.[5]

Resident Person that is a juridical person

A juridical person refers to a legal entity that is incorporated, established or recognised under the relevant legislation. The relevant legislation includes the Federal, Emirate, Free Zone legislation and regulations, and appropriate laws of foreign jurisdictions. A

juridical person has a legal personality separate from its founders, owners and directors.

A juridical person is a Resident Person who is in scope for Corporate Tax purposes if:

it is incorporated or otherwise established or recognised under the applicable legislation of the UAE, irrespective of where its effective management and control is exercised,[6]or

it is incorporated or otherwise established or recognised under the applicable legislation outside the UAE but its effective management and control is exercised in the UAE[7](see Section 4.1.4).

Juridical person incorporated or formed in the UAE

A juridical person can be incorporated or established under different legal forms.

In the UAE, juridical persons include Limited Liability Companies (LLCs), Private Shareholding Companies (PSCs) with one single interest holder, Public or Private Joint Stock Companies (PJSCs), foundations or trusts that have been established under the UAE “mainland” legislation.

Civil companies incorporated or established in the UAE are also considered to be juridical persons.[8]

Furthermore, companies that are labelled as “offshore companies”, which are incorporated in the UAE are also considered to be juridical persons.

According to Federal Law No. 5 of 1985, a juridical person has:

a separate financial liability from any other person, and

legal capacity within the limits laid down by law or establishing document, and

the right to bring legal proceedings, and

a separate place of residence.[9]

However, whether a person is juridical will ultimately be assessed based on the establishment law of each entity.

Example 1: Juridical person legally formed under the UAE law

Company A is a media outlet that was established under Federal Decree-Law No. 32 of 2021 as an entity with separate legal personality. As a juridical person established under the laws of the UAE, Company A is a Resident Person for Corporate Tax purposes.

A UAE branch of a UAE juridical person is seen as an extension of its head office and, therefore, not considered a separate juridical person from its head office.[10]

Example 2: UAE branch of a juridical person incorporated in the UAE

Company B is an LLC that is incorporated in the UAE. Company B has a head office in Dubai, but mainly operates from branches in Ajman, Sharjah, and Abu Dhabi.

As a juridical person that is incorporated in the UAE, Company B is a Resident Person for Corporate Tax purposes.

Although Company B has separate offices and premises for its branches across the UAE, these branches are all considered an extension of Company B's head office. The head office and its branches are treated as one and the same, i.e. Company B and all of its UAE branches are considered as one juridical person that is a Resident Person.

Similarly, a UAE branch of a foreign juridical person is an extension of its parent or head office and is not considered a separate legal entity from the parent or head office. A UAE branch of a foreign company cannot be considered a Resident Person in its own right. Instead, the foreign company with a UAE branch has a UAE Permanent Establishment, and is considered as a Non-Resident Person for Corporate Tax purposes.[11]

Example 3: UAE branch of a foreign company

Company C is a company that is incorporated in Country C. It registers a branch in Al Ain, Abu Dhabi, for the purposes of facilitating loan arrangements for other companies in the same group.

Company C has no other connection to the UAE and is not considered a Resident Person under the Corporate Tax Law because it is not effectively managed and controlled in the UAE. Instead, because of its Abu Dhabi branch and assuming that the necessary conditions are met, Company C has a Permanent Establishment in the UAE and is considered a Non-Resident Person for Corporate Tax purposes.

Free Zones

Free Zones in the UAE have been set up to encourage investment and facilitate trade. These Free Zones offer businesses highly efficient infrastructure and distinct services that facilitate smooth workflows.

The Corporate Tax rules for a juridical person also apply to a Free Zone Person. Therefore, if a juridical person is incorporated or formed in a Free Zone in the UAE, the juridical person is also a Resident Person for Corporate Tax purposes.[12]

For the purposes of applying the Free Zone regime for Corporate Tax purposes, a branch of a foreign company established or registered in a Free Zone is considered the head office with the foreign parent being considered as a foreign branch. However, for tax residency purposes, where a branch of a foreign company (that is tax resident outside of the UAE) is established in a UAE Free Zone, the foreign company is considered to be a Non-Resident Person for Corporate Tax purposes.

Exempt Persons

An Exempt Person for Corporate Tax purposes is not considered a Resident Person subject to Corporate Tax, unless that Person conducts a Business or Business Activity that is outside the scope of their exempted activity.

This only applies to Government Entities,[13]Government Controlled Entities,[14]Persons engaged in an Extractive Business, [15]or a Non-Extractive Natural Resource Business.[16]

In these instances, the Business or Business Activity of the Exempt Person that is not its exempted activity is treated as an independent Business that is subject to Corporate Tax.[17]

Effective management and control

Determining residency for Corporate Tax purposes solely on the basis of place of incorporation does not always reflect the economic reality of where the business operates. Accordingly, for a juridical person incorporated or formed outside the UAE, the determination of residence for Corporate Tax purposes takes into account where the juridical person is effectively managed and controlled.[18]This is in line with many tax regimes in other countries that apply similar concepts such as “central management and control” or “place of effective management” rules to determine tax residency.

If a juridical person is not incorporated in the UAE but is effectively managed and controlled in the UAE, it is considered a Resident Person for Corporate Tax purposes.[19]This is assessed for each particular case based on its specific facts and circumstances.

The consequence of a non-UAE incorporated company being effectively managed and controlled in the UAE, and therefore a Resident Person, is that the company is subject to Corporate Tax on its profits sourced from both the UAE and from abroad, in the same way as a company that is incorporated under the laws of the UAE.[20]

The place of effective management and control is understood as the place where “key management and commercial decisions” that are necessary for the conduct of the juridical person's Business as a whole are, in substance, made.

The key management and commercial decisions that are necessary for the conduct of Business may include, but are not limited to, the following activities:

setting the general policies, for example, investment policies and operational policies,

determining the strategic direction of the company's operations,

deciding the type of transactions that the company can enter into, for example, mergers, acquisitions and purchase or sale of significant assets,

appointing c-suite and other senior executives and granting them authority to manage or carry out the day-to-day operations of the company,

directly or indirectly overseeing the persons appointed to manage or carry out the day-to-day business of the company, or

handling key finance matters such as the determination of how profits are used and declaration of dividends.

Broadly, effective management and control relates to where the strategic level of control (as opposed to day-to-day management) is conducted. This is in line with the commentary on the OECD Model Tax Convention (“OECD Commentary”).

The following are not considered to be key management and commercial decisions, and, therefore, do not constitute effective management and control:

formal finalisation or approval of decisions made by others,

mere implementation of decisions made by others,

day-to-day conduct and management of a company's activities and operations, or

legal and administration matters such as keeping a share register or undertaking minimum acts necessary to maintain a company's registration.

A juridical person can have multiple places of management, but only has one place of effective management and control at any one time. Therefore, if a juridical person's key management and commercial decisions affecting its Business as a whole are made in multiple locations, the place of effective management and control will be the location where those decisions are regularly and predominantly made.

The place of effective management and control test is one of substance over form and all relevant facts and circumstances must be examined on a case-by-case basis. This analysis can be broadly done in two steps:

Step 1: Identifying the persons who make the key management and commercial decisions.

Step 2: Determining the place where the key management and commercial decisions are in substance made.

Criteria for identifying person who make key management and commercial decisions

When determining who makes the key management and commercial decisions necessary for the conduct of a juridical person's Business, it is necessary to consider the Persons who substantially make those decisions and not those who merely formalise or approve the decisions made by others.

This analysis should consider the following key factors:

who has the legal power or authority to make the key management and commercial decisions of the juridical person?

do the persons with the legal power to make the key management and commercial decision in fact exercise this power?

if the persons with the legal power to make the key management and commercial decisions do not exercise this power, who does?

Three tests to identify the Person (or Persons) who make key management and commercial decisions are considered below:

the board of directors' test,

the delegation of authority test, and

the shareholders activity test.

Board of directors test

Although the effective management and control test ultimately depends on considering all the underlying facts and circumstances, it is necessary to review the relevant laws or other legal instruments that govern the status of the juridical person as a starting point to identify the Persons entrusted with the effective management and control of the juridical person according to its legal framework.

The applicable company laws and the instrument governing the management of the juridical person, for example, the memorandum or articles of association usually gives certain senior persons the legal power to manage and control a juridical person.

Typically, effective management and control is legally entrusted to the board of directors, although in some cases, this could be entrusted to a single individual such as a managing director. This may differ between jurisdictions, and between different types of juridical persons in each jurisdiction, and may depend on the instrument governing the management of the juridical person. For example, according to the Federal Decree-Law No. 32 of 2021, management of an LLC is entrusted to the board of directors or managers as determined by the memorandum of association or statute of the company.[21]

Where the board of directors have the legal power to make the key management and commercial decisions of a juridical person, it is necessary to consider whether the board of directors in fact make those decisions, or whether the decisions are in substance made by another person. A key factor is whether the board is able to come to a different conclusion to that reached by another person or whether the board merely “rubber stamps” the decisions made by another person.

Other factors include:

whether the directors are suitably qualified and experienced, and have sufficient knowledge of the juridical person and its Business, in order to make appropriate decisions,

whether the board of directors take instructions, and act on instructions, from another Person (or Persons),

the composition of the board of directors (both the executive and non-executive directors) and the role of different directors. For example, the executive directors

may be actively involved in decision-making while the non-executive directors do not have a decision-making role.

If key management and commercial decisions are not taken at board meetings by the board of directors, it is necessary to determine how and where those decisions are taken, and by whom.

Delegation of authority test

Mere legal power or authority to make the key management and commercial decisions of a juridical person is not sufficient to establish who exercises the effective management and control, and relevant consideration should be given to the persons who in fact develop and make the key management and commercial decisions.

In some cases, the Persons who have been granted the legal authority to exercise effective management and control may not, in reality, be actively involved in the decision-making process or governance of the juridical person, or may have delegated some or all of their powers to others, for example, to board executive committees or senior management.

In determining whether those with delegated authority indeed exercise effective management and control, it is important to consider the functions of the parties. If the board of directors, for example, evaluates the advice provided by senior management and chooses whether or not to follow such advice based on its suitability for the Business of the juridical person, then the board of directors would be considered to be the real decision makers exercising effective management and control. However, if the board of directors merely implements or approves decisions provided by the senior management without independent consideration, the senior management is likely to be considered to exercise effective management and control.

Given that the delegation of authority may be either formal or informal (based on the actual conduct), it is important to consider the underlying facts and circumstances.

The following factors may be examined:

Whether the board of directors has appointed other Persons (for example, senior management personnel) to conduct the company's day-to-day business.

Whether the appointed Persons implicitly control the juridical person by regularly overseeing the affairs and monitoring the performance of the juridical person, or formulating key strategies and policies, or making key commercial decisions, without the active intervention of the board of directors.

Whether the appointed Persons provide advice, recommendations or options relating to the key management and commercial decisions, which are merely approved or implemented by the board of directors.

Whether the board of directors actually considers whether or not to follow the advice or directions provided by the appointed Persons or others, based on the suitability of those recommendations for the overall Business of the juridical person.

Shareholders activity test

Depending on the level of actions taken by a shareholder, these can amount in practice to effective management and control.

Shareholders generally contribute to certain fundamental decisions such as the dissolution, liquidation or deregistration of the juridical person, the modification of the rights attaching to various share classes or issuance of new shares, appointment of those who control and direct the operations of the juridical person, etc. Such decisions are, generally, not relevant to the determination of the juridical person's place of effective management and control.

For a shareholder to be considered to be exercising effective management and control, the key decisions taken by that shareholder must go beyond decisions related to guidance or mere influence on the normal management and policy formulation of the juridical person's activities. For example, the decisions that a parent company of a multinational enterprises group would be expected to take for the strategic direction of the group as a whole or supervision of the operations of group members. In some cases, shareholders may limit the authority of, or provide guidelines for, the board and senior management of a juridical person.

These limitations and guidelines, together with all the other facts and circumstances, must be reviewed to determine whether the effect is that the shareholder is actually making the key decisions or whether the person receiving guidance is still making its own key decisions.

Undue influence on the board of directors or assumption of their powers by a shareholder may constitute effective management and control. This may be the case where the juridical person is wholly owned or controlled by a single person and its Related Parties or Connected Persons. In such cases, it is important to establish whether the board of directors of the juridical person independently makes its own decisions or merely implements the decisions or recommendations given by the shareholder without giving them any independent consideration of its own.

For the board of directors to exercise effective management and control, there should be a degree of autonomy or independence which those directors have in making the key decisions without reference to the shareholder. In instances where the majority of the members of the board of directors consist of specific shareholders, this should be

considered for the sake of determining whether the shareholders are exercising effective management and control over the board.

Where key management and commercial decisions are made

Once the person (or persons) who exercise effective management and control are identified, the next step is to identify the location of the person (or persons) when making the key management and commercial decisions. The place of domicile and/or residence of such persons may be taken into consideration but is not necessarily the determining factor. All relevant facts and circumstances must be evaluated on a case- by-case basis in determining the place of effective management and control of a juridical person.

The following factors should be considered:

The place where board meetings are physically held. This is a significant indication of the place of effective management and control only if the board of directors retains and exercises its authority to govern the juridical person and does, in substance, makes the key management and commercial decisions during board meetings. Otherwise, consideration should be given to the place where such decisions are made.

Board meetings may be held wholly virtually, or there may be a physical meeting location where some directors attend physically while others attend virtually. Consequently, the physical location of the board meeting may not be determinative of the place of effective management and control, but rather, the physical location where the directors with the overriding decision-making powers join from.

If the board of directors have other meetings outside the board meeting to make key management and commercial decisions, consideration should be given to such meetings, for example, who participates, what decisions are made during such meetings, and where such meetings take place.

In some cases, key management and commercial decisions are made via written resolutions or by email that are circulated on behalf of decision makers that are in different physical locations. The particular facts and circumstances of where the persons ultimately making the decisions are located may determine the place of effective management and control.

Minutes or other documents recording where the key management and commercial decisions are made, may be relevant. Board minutes can provide evidence of the decisions made, the persons who made the decisions and the place where the decisions were made. Certain details in the board minutes such as why the decisions were made and whether alternatives were considered or rejected can be valuable evidence of the exercise of effective management and control. Other evidence, however, may also be relied upon. This may include papers circulated to board members in advance of meetings, emails, statements

or other correspondence showing the board's deliberations and the role played by each director in the decision-making process.

If the effective management and control is exercised by Persons other than the board of directors, implicitly or by delegation of authority to, for example, shareholders, senior management, executive committees, etc., the place of effective management and control may be the location where those with delegated authority make the key management and commercial decisions.

The nature of the Business may determine where key management and commercial decisions are made in practice.

Generally, legal, administrative and operational factors such as the place of incorporation, the location of the registered office, the location where the shareholder register is kept, the place where accounting records are kept and the place where the day-to-day operations of the Business are carried out, do not have relevance in determining the place of effective management and control.

Additionally, even when the key management and commercial decisions are made in the UAE, a place of effective management and control may not be created where:

Key management and commercial decisions are made in the UAE on an occasional or one-off basis. This will depend on how significant the decisions are and whether there is a regular pattern of the key decisions being made in the UAE.

The presence of the Person (or Persons) making the key management and commercial decisions in the UAE is as a result of temporary and exceptional circumstances. This may include, but is not limited to, the following:

adoption of public health measures by competent authorities in the UAE, or in another relevant jurisdiction, or by the World Health Organisation,

imposition of travel restrictions by competent authorities in the UAE, or in another relevant jurisdiction,

imposition of legal sanctions on a person preventing them from leaving the UAE,

acts of war, or the occurrence of terrorist attacks,

natural disasters or force majeure beyond reasonable control, or

an emergency health condition affecting a person or their relatives (up to the fourth degree, including by way of adoption or guardianship).

In circumstances where a juridical person's key management and commercial decisions are made in more than one place, the relevant facts and circumstances should be examined to identify the place where effective management and control is made as a matter of substance.

If the factors listed above are inconclusive in determining the place of effective management and control, the place in which the juridical person has the strongest economic nexus may be considered. This is determined by examining various factors such as where the juridical person has most of its employees and assets, carries on most of its activities, derives most of its revenues or where the senior management functions are carried on.

Virtual Meetings

Business decisions may not necessarily occur in a single location. If the directors who make the key management and commercial decisions regularly attend board meetings virtually or from different locations, the following factors may be considered in determining the location of effective management and control:

the regularity of virtual and physical attendance of board meetings by the directors,

the physical location of the directors when they virtually attend board meetings, and whether that location changes,

the level of influence each director has in the overall decision-making process of the board, and

the number of directors that attend virtually compared to those who attend physically.

Example 4: Juridical person effectively managed and controlled in the UAE - “rubber stamping” decisions

Company D is established in Country D, and owns investment properties in Country D. Company D is owned by an individual (Mr U) who resides and is physically based in the UAE.

Company D's annual board meetings are held in Country D. These meetings are attended by directors physically based in Country D, whose involvement in the company is attending such meetings and the day-to-day management of Company D. Mr U does not attend the board meetings.

The directors in Country D do not receive information that would enable them to reasonably reach commercial decisions, and from the board minutes, it appears that the directors merely follow the directions of Mr U without question.

Based on these facts, Company D is likely to be effectively managed and controlled in the UAE, as the board in Country D appears to be merely “rubber stamping” decisions made in the UAE by Mr U.

Example 5: Juridical person effectively managed and controlled in the UAE board meetings

Company E is incorporated in Country E, and provides global logistics services. The board of directors make all the key management and commercial decisions. All the directors attend board meetings physically. Such meetings are held in Dubai, UAE, being a convenient location for all the directors to travel to.

On the basis that the key management and commercial decisions of Company E are made at the board meetings that are held in Dubai, Company E is effectively managed and controlled in the UAE.

Example 6: Juridical person not effectively managed and controlled in the UAE

Company F is incorporated in Country F, and manufactures and supplies medical equipment. The majority shareholder of Company F is another company, Company G, based in Country G.

The board of directors of Company F regularly hold their board meetings in Abu Dhabi, UAE, where many of the directors of Company F live. However, the board of directors typically acts at the directions of Company G, without independent consideration. Minutes of the board meetings of Company F suggests that all the key management and commercial decisions of Company F are in fact made by Company G's board of directors. Company G's board of directors always hold their board meetings in Country G.

Based on these facts, it is likely that Company F is effectively managed and controlled in Country G, rather than in Abu Dhabi, UAE. The board of directors of Company F are merely “rubber stamping” decisions made by Company G based in Country G.

The table below provides further guidance for determining the place of effective management and control for the purposes of the Corporate Tax Law for a juridical person that is incorporated outside the UAE.

Test | Factors likely to create a place of effective management and control in the UAE | Factors not likely to create a place of effective management and control in the UAE |

Board of directors' test, where key management and commercial decisions are made by the board of directors. |

|

|

Delegation test, where key management and commercial decisions are made by persons other than the board of directors (“delegated persons”). |

Senior management, being delegated persons, make decisions from an office located in the UAE. |

Senior management, being delegated persons, makes decisions from an office located outside the UAE. |

Shareholder activity test, where key management and commercial decisions are made by one or more shareholders (“delegated shareholder”), rather than by the board of directors. |

|

|

Income subject to Corporate Tax

A juridical person that is a Resident Person is subject to Corporate Tax on their Taxable Income, which can be derived from both within and from outside the UAE.[22]This means that a juridical person that is a Resident Person is taxed on all income earned, irrespective of whether the income is sourced in the UAE or a foreign country.

Income from foreign sources received by a juridical Resident Person

Where a juridical person that is a Resident Person has a Foreign Permanent Establishment, the juridical person can make an election to exclude the income and expenditure derived by the Foreign Permanent Establishment in calculating its Taxable Income, if certain conditions are satisfied.[23]

A Foreign Permanent Establishment refers to a fixed place of Business, such as an overseas branch, office or factory, or a dependent agent who habitually exercises an authority to conduct a Business or Business Activity on behalf of a Resident Person overseas.

Example 7: Foreign source income from Foreign Permanent Establishments

Company H is a hospitality and travel company incorporated in the UAE. It has Foreign Permanent Establishments in other countries in the form of sales offices.

As a UAE incorporated company, Company H is a juridical person that is a Resident Person for Corporate Tax purposes. Normally, this means that Company H is subject to Corporate Tax on its income earned in the UAE and the income earned by its Foreign Permanent Establishments.

However, Company H meets the necessary conditions that are required to be able to make a Foreign Permanent Establishment election. If Company H makes this election, it should not include the income and associated expenditure or losses from its Foreign Permanent Establishments when calculating its Taxable Income for the purposes of the Corporate Tax Law.

In addition, certain income received from foreign companies is exempt from Corporate Tax if the Resident Person holds a Participating Interest in the foreign company.[24]A Participating Interest is an interest in a juridical person that meets all the conditions of Article 23(2) of the Corporate Tax Law.

If the conditions for a Participating Interest are met, the following income will be exempt from Corporate Tax:

Dividends and other distributions derived from a Participating Interest in a foreign juridical person that is not a Resident Person,[25]

gains or losses on the transfer, sale, or other disposition of the whole or part of the Participating Interest,[26]

foreign exchange gains or losses in relation to a Participating Interest,[27]and

impairment gains or losses in relation to a Participating Interest.[28]

Furthermore, a Foreign Tax Credit may be available for tax paid in foreign jurisdictions on income that is also subject to UAE Corporate Tax.[29]The available Foreign Tax Credit reduces the Corporate Tax Payable in the UAE by the value of foreign taxes paid on the relevant income, up to the UAE Corporate Tax liability. This relief is unilateral and does not take into consideration any double taxation relief available under an applicable DTA or any other reciprocal relief from a foreign taxing jurisdiction.

Resident Person that is a natural person

Natural persons will only be treated as a Resident Person for Corporate Tax purposes if they conduct Business or Business Activity in the UAE, and the Turnover from such Business or Business Activity exceeds AED 1 million in a Gregorian calendar year.[30]

Natural persons can engage in a Business or Business Activity via, for example, a sole proprietorship. A sole proprietorship is a trading business owned and operated by a natural person, where the proprietor is not separate from the business. For Corporate Tax purposes, a sole proprietorship is treated as being one and the same as the natural person or natural persons owning them. This is because of the direct relationship and control of the natural person over the business and their unlimited liability for the business' debts and other obligations.

Natural persons will only be subject to Corporate Tax on the Taxable Income of their Business or Business Activity in the UAE. Any income earned outside the UAE is not subject to Corporate Tax unless it is in relation to the Business or Business Activity conducted in the UAE.[31]

Irrespective of where a natural person is domiciled or ordinarily resides, the natural person will be subject to Corporate Tax in the UAE on the income generated from a taxable Business or a Business Activity performed in the UAE, provided that the total Turnover from all the Business or Business Activities conducted in the UAE exceeds AED 1 million in a Gregorian calendar year.[32]

“Business” is defined as any activity that is conducted regularly, on an ongoing and independent basis by any Person and in any location.[33]For example, commercial activities, such as the selling of products, or the provision of services, are likely to constitute a Business. Similarly, a Person's trade or profession is also likely to constitute a Business.

The definition of a “Business Activity” is wider than that of a “Business”, and is defined as any transaction or activity, or series of transactions or activities, conducted by a Person in the course of its Business. For example, where a Person provides services, activities such as internal resourcing, marketing, and the actual delivery of the services, these would all constitute Business Activities. Similarly, where a Person manufactures a product, the manufacturing activities as well as the sales and marketing activities would constitute Business Activities.

Cabinet Decision No. 49 of 2023 specifies the conditions where a natural person is subject to Corporate Tax. It states that the following will not be considered Business or Business Activity and is, therefore, not be subject to Corporate Tax:[34]

Wage or salary, such as earnings from employment,

Personal investment income, where a Licence is not required, and

Real estate income, where a Licence is not required.

Example 8: Natural person who has income sourced from abroad

Ms J is a professor of history who teaches at a university in Sharjah, UAE, where she is an employee.

Once a month, Ms J travels to Country K where she and other experts in her field review examination material on Middle Eastern history. She is paid a fee by the university in Country K for this work. She does no additional work in relation to this work whilst she is in the UAE.

Ms J's additional income earned whilst in Country K does not relate to a Business she runs in the UAE. Furthermore, as the only income she receives in the UAE relates to employment income, Ms J is not a Resident Person for Corporate Tax purposes.

Tax residency under UAE domestic law

The criteria for UAE domestic tax residency are set out by Article 53 of Federal Decree- Law No. 28 of 2022, and Cabinet Decision No. 85 of 2022. Additional clarifications and implementation regulations with respect to natural persons are set out in Ministerial Decision No. 27 of 2023. Meeting the criteria of the UAE domestic tax residency will mean that the Person is Tax Resident and, upon a successful application to the FTA, this will be evidenced by the issuance of a Tax Residency Certificate.

For example, a Person may need to provide a Tax Residency Certificate to a bank to evidence their Tax Resident status.

Being Tax Resident under domestic law does not mean a Person is necessarily subject to Corporate Tax. The Person would still need to be a Taxable Person under the Corporate Tax Law in order to be liable to Corporate Tax (see Section 4).

Juridical person that is Tax Resident under UAE domestic law

As per Article 3 of Cabinet Decision No. 85 of 2022, a juridical person is considered to be a Tax Resident of the UAE if it is:

incorporated or otherwise formed or recognised in the UAE,[35]or

it is otherwise considered a Tax Resident of the UAE under other Tax Laws in the UAE (for example, the UAE Corporate Tax law).[36]

Juridical person incorporated or otherwise formed or recognised in the UAE

A juridical person can be established under different legal forms, such as:

companies such as Limited Liability Company, Private Shareholding Company, Public and Private Joint Stock Company,

civil companies,

foundations,[37]

trusts established under Federal Law No. 31 of 2023.[38]

The UAE tax residency rules for a juridical person equally apply to persons established and operating in Free Zones. Therefore, if a juridical person is incorporated or

otherwise formed in a Free Zone in the UAE, this juridical person is a UAE Tax Resident and able to apply for a Tax Residency Certificate.

Example 9: Juridical person incorporated in the UAE

Company L is an LLC incorporated in the UAE. Company L's head office is in Dubai, but Company L operates from branches in Ajman, Sharjah, and Abu Dhabi.

As a juridical person that is incorporated in the UAE, Company L is a UAE Tax Resident.

Although Company L has separate offices and premises for its branches across the UAE, these branches are all considered an extension of Company L's head office.

Example 10: Foreign company with UAE clients

Company M is a company incorporated in, and effectively managed and controlled in Country M. Company M does not have a physical presence or a dependent agent in the UAE but it has many customers in the UAE from whom it derives a significant portion of its worldwide revenue.

Company M is not a UAE Tax Resident even though it derives a significant amount of revenue from the UAE.

Juridical persons otherwise considered a Tax Resident under other UAE Tax Laws

A juridical person will be UAE Tax Resident if considered as a resident for tax purposes.[39] This includes the Corporate Tax Law.

Under the Corporate Tax Law, a juridical person that is not incorporated in the UAE may still be considered to be a Resident Person if it is effectively managed and controlled in the UAE.[40]

Example 11: Foreign company effectively managed and controlled in the UAE

Company N is a limited company incorporated in Country N. However, in 2024, Company N was effectively managed and controlled in the UAE and, therefore, considered a Resident Person for Corporate Tax purposes. As a consequence, the worldwide income of Company N was subject to Corporate Tax.

Tax residency of foreign companies with UAE branches

A UAE branch of a juridical person is an extension of its parent or head office and is not considered a separate legal entity in its own right. Therefore, a UAE branch of a foreign company (that is incorporated, and effectively managed and controlled, in a foreign jurisdiction) is not considered to be a Tax Resident Person.[41]Instead, the foreign company is considered to be a Non-Resident Person.

If, however, the foreign company (that is incorporated in a foreign jurisdiction) is effectively managed and controlled in the UAE, the foreign company (along with its branches) is considered to be a Resident Person for the purposes of the Corporate Tax Law[42]and, therefore, Tax Resident in the UAE.[43]

Tax residency of Exempt Persons

The tax residency status of an Exempt Person is determined by reference to the type of Exempt Person in question. Exempt Persons include four categories of persons:

Category 1: Automatically Exempt Persons

This applies to Government Entities.[44]The Business or Business Activity of this type of Exempt Person that is not its exempted activity is treated as an independent Business subject to Corporate Tax.[45]A Government Entity, despite being an Exempt Person, is established in the UAE and, therefore, considered as a Tax Resident.[46]

Category 2: Exempt if they notify the Ministry of Finance, and meet the relevant conditions

This applies to Persons engaged in an Extractive Business[47]or a Non-Extractive Natural Resource Business.[48]The Business or Business Activity of these Exempt Persons that are not based on exempted activity is treated as an independent Business subject to Corporate Tax. [49]This type of Exempt Person is either incorporated or otherwise formed or recognised in the UAE and, therefore, considered as a Tax Resident.[50]

Category 3: Exempt Persons if listed in a Cabinet Decision and subject to meeting relevant conditions

This applies to Government Controlled Entities [51]and Qualifying Public Benefit Entities.[52]They will be either incorporated or otherwise formed or recognised in the UAE and, therefore, considered as a Tax Resident.[53]

Category 4: Exempt Persons upon application to, and approval by, the FTA

This applies to public and private pensions and social security funds,[54]Qualifying Investment Funds,[55]and UAE incorporated juridical persons that are wholly owned and controlled by specific Exempt Persons.[56]These Exempt Persons will be either incorporated or otherwise formed or recognised in the UAE and, therefore, considered as a Tax Resident.[57]

Natural person that is Tax Resident under UAE domestic law

A natural person will be considered a Tax Resident in the UAE for domestic tax purposes if they meet at least one of the three conditions set out in Article 4 of Cabinet Decision No. 85 of 2022:

They were physically present in the UAE for 183 days or more, within the relevant 12 consecutive months.

They were physically present in the UAE for a period of 90 days or more, within the relevant 12 consecutive months, and:

they are a UAE or Gulf Cooperation Council (GCC) national, or hold a valid UAE Resident Permit, and

they have a Permanent Place of Residence in the UAE, or carry on an employment or Business in the UAE.

Their usual or primary place of residence and centre of financial and personal interests were in the UAE.[58]

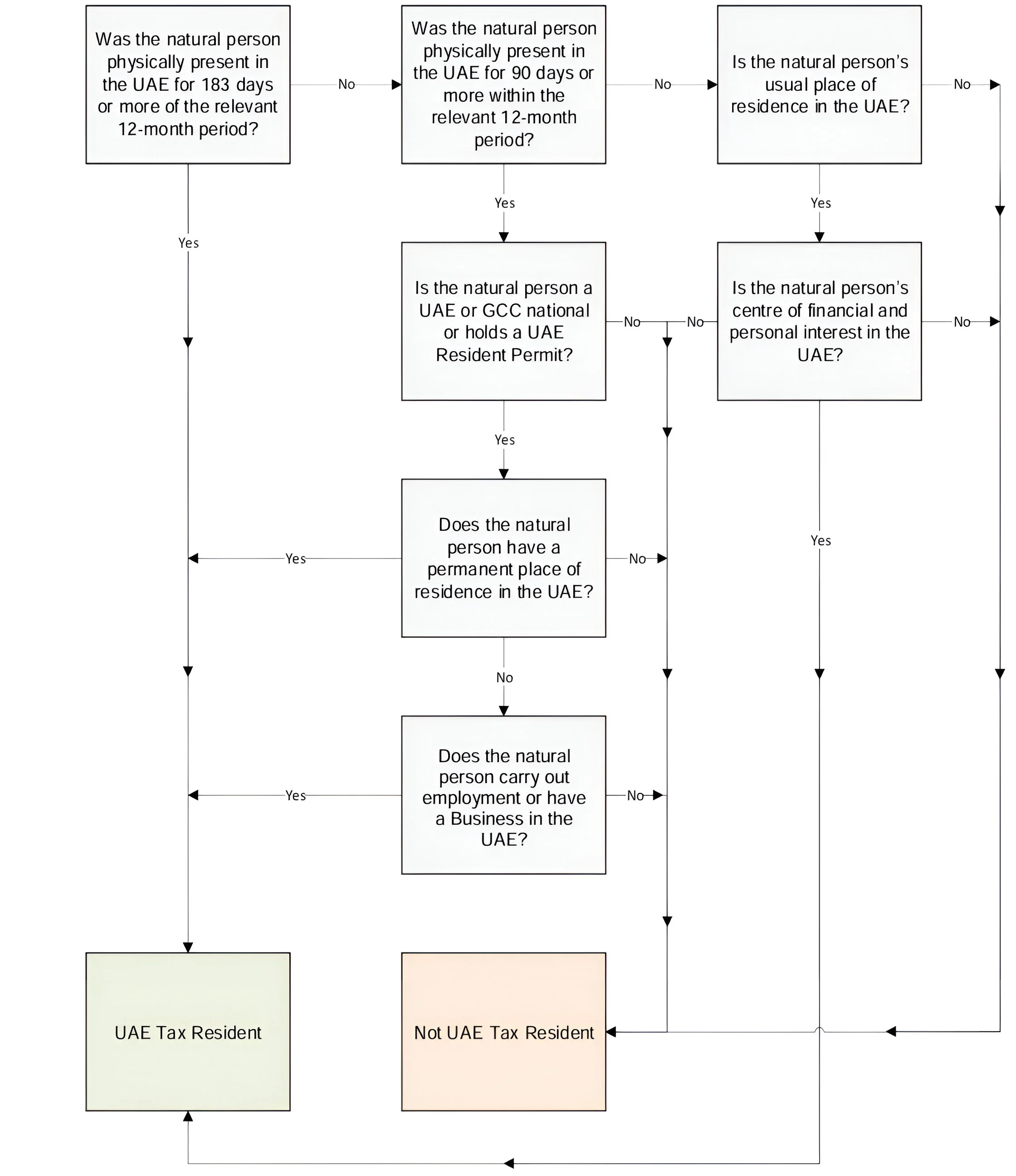

The following flowchart illustrates these conditions:

For the purposes of calculating whether the 183-day threshold has been met, any day or any part of a day, however brief, that a natural person was present in the UAE will be counted as a full day.[61]The days do not need to be consecutive.[62]If any of the days the natural person spent in the UAE were due to exceptional circumstances, these may be disregarded for the purposes of meeting the threshold.[63]For more information about exceptional circumstances, see Section 5.2.3.

183-days+ test

If a natural person was physically present in the UAE for 183 days or more in the relevant continuous 12-month period, they are considered a UAE Tax Resident for such a 12-month period.[59]It does not matter what activity, if any, is undertaken by the natural person during those 183 days.

The term “day” means a calendar day, and the term “month” means a calendar month for the purposes of meeting the physical presence test.[60]Being physically present refers to being within the state borders of the UAE.

Example 12: Days spent in the UAE

In 2025, Harry spends the following days in the UAE:

As any “part of day” is included when considering the “physically present test”, Harry should include the days of travel to and from the UAE when calculating his days of presence in the UAE.

Travel to the UAE | Travel from the UAE | Days in the UAE (inclusive of travel days) |

3 January | 6 March | 63 |

8 June | 9 August | 63 |

23 August | 6 September | 15 |

28 September | 11 November | 45 |

Total | 186 | |

As a result, in 2025, Harry has spent 186 days in the UAE. He can, therefore, be considered a UAE Tax Resident for the 12-month period from January to December 2025.

90-days+ test

If a natural person was physically present in the UAE for fewer than 183 days in the relevant continuous 12-month period, they may still be considered a UAE Tax Resident if they were present in the UAE for at least 90 days and also meet both of the following conditions:[64]

they have a legal right to reside in the UAE by virtue of being a national of the UAE or another GCC Member State, or holding a valid Residence Permit in the UAE, and

they also have a “Permanent Place of Residence” in the UAE or carry on employment or a Business in the UAE.

The meaning and determination of what constitutes a “day” for the purposes of the 90- day test is the same as in the 183-day test.

Permanent Place of Residence

A Permanent Place of Residence means a furnished house, apartment, room or other form of dwelling, which a natural person has arranged to have made continuously available to them.[65]This means that a Permanent Place of Residence does not need to be owned by the natural person to meet this test, but can be rented or otherwise occupied by the natural person as a dwelling,[66]provided it is available to them at all times continuously and on a regular basis, with some degree of permanency and stability, based on a right of occupation.[67]

A place will not be considered a Permanent Place of Residence if it is occupied by the natural person just occasionally or temporarily for the purposes of a stay which is for a short duration, for example, for the purposes of travel for business, leisure or education.[68]

There is a distinction between a Permanent Place of Residence for the purposes of Article 4(3) of Cabinet Decision No. 85 of 2022 and a usual or primary place of residence for the purposes of its Article 4(1) of Cabinet Decision No. 85 of 2022.

A usual or primary place of residence refers to the country where a natural person normally resides (see Section 5.2.4.1), whereas a Permanent Place of Residence refers to a form of dwelling that is continuously available to the natural person, regardless of whether they habitually reside there.

Example 13: 90+ days physically present and Permanent Place of Residence

During 2024, Fatima spent 95 days staying in a one-bedroom apartment in Dubai, UAE, which her sister, Nadia, owns but does not occupy. Nadia has given Fatima full access to the apartment, so Fatima can use it whenever she stays in the city. Fatima is a foreign national who holds a long-term UAE Residence Permit.

Fatima should be considered a UAE Tax Resident for the 12-month period from January to December 2024 because:

she has been physically present in the UAE for over 90 days in 2024, and

she has the legal right to reside in the UAE because she holds a UAE Residence Permit, and

she has a Permanent Place of Residence in the UAE given her ability to continuously access and stay in Nadia's apartment at any given time and for any duration.

Nadia's apartment still counts as a Permanent Place of Residence for Fatima, even though Fatima does not own it and she does not pay Nadia any rent for occupying the apartment.

Example 14: 90+ days physically present and no Permanent Place of Residence

Sulaiman, a non-UAE and non-GCC citizen, enjoys spending time in the UAE. During the 12 months of calendar year 2024, he spent 100 days in the UAE, entering the country under tourist visas. While in the UAE, Sulaiman stayed in a number of different hotels he booked online and he spent most of his time in the UAE doing leisure activities such as shopping and sightseeing. He does not conduct any Business in the UAE, nor carry out any employment in the UAE.

Sulaiman should not be considered a UAE Tax Resident for the 12 months ended 31 December 2024 because even though he has spent over 90 days in the relevant 12-month period in the UAE:

he does not have a legal right to permanently reside in the UAE and has always entered the UAE as a tourist, and

he does not have a Permanent Place of Residence in the UAE.

He also did not carry on employment or Business in the UAE, or hold a valid Residence Permit.

The hotels where Sulaiman has stayed do not count as a Permanent Place of Residence in the UAE for him as he stayed there only temporarily for leisure purposes. The hotel rooms were not continuously made available to him, he had to check the availability and make a booking each time prior to his arrival.

Employment

A natural person will be considered to be carrying on employment in the UAE, if:

they are party to a contract with an employer, which is incorporated or otherwise formed or recognised in the UAE, under which they serve the employer under the employer's administration or supervision for a promised remuneration by the employer,[69]

they are in a continuing relationship where all or substantially all of their income for their labour performed in the UAE is derived from one party,[70]and

it is not an engagement on a voluntary role.[71]

Employment status does not consider the nature of the employment contract, which can be limited or unlimited, on a full-time or part-time basis.[72]

Business

Business is defined as an activity conducted regularly, on an ongoing and independent basis by any Person, such as industrial, commercial, agricultural, professional, vocational, service or excavation activities or anything related to the use of tangible or intangible properties.[73]

Business should be interpreted broadly to include any activity such as the development, sale, production, manufacturing, exploitation, marketing or distribution of tangible and intangible properties.

The term “vocational” is to be interpreted as a skilled craft or trade, and “professional” is an occupation in which skill is applied to the affairs of others to meet their needs. Common examples of vocational and professional activities include accountancy, craftsmanship, consulting, teaching, architecture, medical and legal services.

Business can mean the carrying out of any economic activity, whether continuous or for a set period of time, by any Person; it does not necessarily need to generate a profit. Although a Business is typically carried on continuously and there is repetition of commercial activity, the definition allows for a short-term commercial activity to also be considered a Business.

Example 15: 90 days+ and employment in the UAE

Saleh is a GCC national. In the last 12 months, he was employed by Company O, a UAE incorporated company, to travel to different destinations in the UAE and promote their products. His employment lasted three months and he spent a total of 100 days in the UAE. Saleh held a UAE work visa during this time.

While in the UAE, Saleh stayed in various hotel rooms booked and paid for by Company O. As such, he did not have a Permanent Place of Residence in the UAE. Still, Saleh was a UAE Tax Resident for the 12-month period because:

he was physically present in the UAE for over 90 days in the year, and

he has the legal right to reside in the UAE because he is a GCC national, and

he had employment in the UAE by virtue of his employment contract with a company incorporated in the UAE.

Even though Saleh is considered a Tax Resident in the UAE, he is not a Resident Person for Corporate Tax purposes because he does not conduct any Business in the UAE.

Exceptional circumstances leading to a physical presence

There are occasions in which natural persons will be physically present in the UAE for reasons beyond their control. An exceptional circumstance is an event occurring while the natural person is already in the UAE, which prevents them from leaving the UAE as originally planned. The exceptional circumstance must be an event beyond the natural person's control that they could not reasonably have predicted or prevented.[74]

Examples of exceptional circumstances may include, but are not limited to:

local or national emergencies, for example, natural disasters, closing of borders, war or civil unrest,

personal emergencies, for example, a sudden or critical illness or injury to the natural person.

As a result, a natural person may inadvertently be a UAE Tax Resident. When calculating the number of days that a natural person has spent in the UAE, the days they stayed in the UAE due to exceptional circumstances shall be disregarded.[75]

Example 16: Exceptional circumstances

Nicholas spent 180 days in the UAE during 2025. He visited the UAE on tourist visas and has no employment or business connections to the UAE.

On the day before he was due to fly back to his home country, Nicholas suddenly fell critically ill. He was required to spend an additional week in the UAE so that he could have emergency surgery. He flew home on his 187th day in the UAE.

Normally, the fact that Nicholas spent over 183 days in the UAE would result in him being considered a Tax Resident in the UAE. However, as his extended stay was the result of a medical emergency that he could not control and could not have reasonably predicted or prevented, the additional days he spent in the UAE should be excluded when calculating his total number of days in the UAE.

This means that, despite being physically present in the UAE for over 183 days, Nicholas may not necessarily be considered a Tax Resident for the relevant 12-month period under the days count test as he has no employment or other significant connections to the UAE.

Example 17: Non-exceptional circumstances

Sam spent 175 days in the UAE during 2024. He is a non-UAE and non-GCC national with a UAE tourist visa, with no permanent home in the UAE.

Instead of flying home, Sam decided to stay in the UAE for a few additional days in order to have an elective medical procedure in a hospital in Dubai.

As a result of his extended stay, Sam spent a total of 190 days in the UAE during 2024. As he made the conscious decision to schedule the elective medical procedure knowing it would require recovery time in the UAE, the additional days spent in the UAE beyond 180 days were within Sam's control and will not be classed as exceptional circumstances.

Therefore, Sam is considered to be UAE Tax Resident under the physical presence test.

Usual or primary place of residence and centre of financial and personal interests test

A natural person will be considered a Tax Resident in the UAE if both their usual or primary place of residence and the centre of their financial and personal interests are in the UAE.[76]Both of these conditions must be simultaneously satisfied in order for a natural person to be considered a UAE Tax Resident.

Usual or primary place of residence

A “usual or primary place of residence” refers to the country where a natural person habitually or normally lives as a part of their settled routine and where they spend most of their time as compared to any other place.[77]

This is the country in which a natural person is customarily or usually present, which depends on the frequency, duration and regularity of stays that are part of a person's life over a sufficient length of time.

The concept of “usual or primary place of residence”[78]is distinct from a “Permanent Place of Residence”[79](or permanent home). A usual or primary place of residence refers to the country where a natural person normally resides, whereas a Permanent Place of Residence refers to a form of dwelling that is continuously available to the natural person, regardless of whether they habitually reside there.

Centre of their financial and personal interests

The “centre of financial and personal interests” condition considers factors such as the place of employment, place of business, and where the financial and other investments are located and managed.[80]It also considers other factors such as family and social connections, memberships of clubs and associations and any cultural and other activities the natural person takes part in.

Having one's centre of financial and personal interests in the UAE does not mean that the natural person cannot have interests outside the UAE. However, the UAE must be the place where these interests are the closest or of the greatest significance to the natural person.[81]

It is not only the number of connections but also the depths and importance of those connections that is considered. For example, the location of close family members or a business in the UAE has a more significant weight than holding a membership of a sports club in another country.

Example 18: Usual or primary place of residence and centre of financial and personal interests' criteria

Laila is a UAE national, who owns an apartment in Sharjah, UAE. However, she spends most of her time in Country P, where she has lived with her husband and children in a house owned by her parents for the past 10 years. Laila has a full-time job in Country P as a teacher and she is an integral part of the local community.

Every year, Laila spends a few weeks outside of Country P when she travels to the UAE to see her extended family and friends, during which time she stays in her apartment in Sharjah. She intends to use the apartment as her main home at some point in the future. In the last 12 months, she spent a total of 30 days in the UAE.

Based on these facts, Laila's usual or primary place of residence is in Country P because this is where she habitually lives and spends more time as compared to the UAE and any other country. The fact that her employment, close family members and social ties are also all in Country P indicates that her centre of financial and personal interests is also in Country P. Therefore, for the last 12 months, based on the “usual or primary place of residence and centre of financial and personal interests” test, Laila is not considered a UAE Tax Resident.

Example 19: Usual or primary place of residence's criteria

Caleb was born in Country Q but has moved to the UAE, where he is a full-time university student. He lives in an apartment in the UAE, which he rents on an annual basis, and he travels back to Country Q for one month each summer.