Agents

VAT Guideline | Version One

July 2020

Contents

2. Definitions of the main terms used

3. Economic Activity and Registration

5. VAT treatment where Agent acts on behalf of Principal

6. VAT treatment where Agent acts in his own name

13. Applying for the issue of rulings (interpretative decisions)

The Zakat, Tax and Customs Authority ('ZATCA', 'Authority') has issued this Guide for the purpose of clarifying certain tax treatments concerning the implementation of the statutory provisions in force as of the Guide's issue date. The content of this Guide shall not be considered as an amendment to any of the provisions of the Laws and Regulations applicable in the Kingdom.

Furthermore, the Authority would like to highlight that the clarifications and indicative tax treatments prescribed in this Guide, where applicable, shall be implemented by the Authority in light of the relevant statutory texts. Where any Clarification, interpretation or content provided in this Guide is modified - in relation to unchanged statutory text - the updated indicative tax treatment shall then be applicable prospectively, in respect of transactions made after the publication date of the updated version of the Guide on the Authority's website.

Introduction

Implementing a Value Added Tax (VAT) system in the Kingdom of Saudi Arabia (KSA)

The Unified VAT Agreement for the Cooperation Council for the Unified Arab States of the Gulf (the 'VAT Agreement') was approved by KSA by a Royal Decree No. M/51, dated 3-5-1438H. Pursuant to the provisions of the Unified VAT Agreement, the KSA issued the VAT Law under Royal Decree No. M/113 dated 21-11-1438 ('the VAT Law') and its corresponding Implementing Regulations were subsequently issued by the Board of Directors of the Zakat, Tax and Customs Authority (ZATCA) by Resolution No. 3839 dated 4-12-1438 ('the Implementing Regulations').

Zakat, Tax and Customs Authority (ZATCA)

ZATCA also referred to as 'the Authority' herein, is the authority in charge of the implementation and administration of VAT (which may be referred to hereinafter as 'the tax') in KSA. In addition to the registration and deregistration of taxable persons for VAT, the administration of VAT return filing and VAT refunds; and undertaking audits and field visits, ZATCA also has the power to levy penalties for non-compliance with legal provisions relating to VAT.

What is Value Added Tax?

VAT is an indirect tax, which is imposed on the importation and supply of goods and services throughout the supply chain, with certain limited exceptions. VAT is imposed in more than 160 countries around the world.

VAT is a tax on consumption that is paid and collected at every stage of the supply chain, starting from the point when a manufacturer purchases raw materials until a retailer sells the end-product to a consumer. Unlike other taxes, persons registered for VAT will both:

Collect VAT from their customers equal to a specified percentage of each eligible sale;

Pay VAT to their suppliers equal to a specified percentage of each eligible purchase.

When taxable persons sell a good or provide a service, a 15% VAT charge - assuming a standard case - is assessed and added to the sales price. The taxable persons will account for that 15% that they have collected or due for collection from all eligible sales separately from its revenue in order to later remit a portion of it to the Authority. The VAT taxable persons collect on their sales is called Output VAT.

That same will apply to purchase transactions, in that VAT will be added at the rate of 15% to purchases of goods or services from other taxable persons (on the assumption that the basic rate applies to those supplies). The VAT a business pays to its suppliers is called Input VAT.

Further information about VAT can be found in the KSA VAT Manual or at zatca.gov.sa.

This Guideline

The purpose of this guideline is to provide further clarification to taxpayers regarding the VAT implications on transactions involving agents, or other situations where a person acts on behalf of another person.

This guideline represents ZATCA's views on the application and fair treatment of the Unified VAT Agreement, the VAT Law and the Implementing Regulations to the sector as of the date of this guideline.

For further advice on specific transactions you may apply for a ruling, or visit the official VAT website at (zatca.gov.sa), which contains a wide range of tools and information that has been established as a reference to support persons subject to VAT, as well as visual guidance materials, all relevant information, and FAQs.

Definitions of the main terms used

Agent | : | Agent is not a defined term for VAT purposes. In this guideline, an Agent is described as a person who is authorised to act for, or in place, of a person and to create legal obligations for that person. See Section 4 for more details. |

Principal | : | A Principal is not a defined term for VAT purposes. In this guideline, a Principal is described as a person who authorises another Person to act on his or her behalf as an Agent. |

Agent acting in Principal's name | : | An Agent acting for a Principal in cases where the agency relationship is disclosed to the third party. The Agent in this case may also be referred to as a 'disclosed agent'. |

Agent acting in his own name | : | The VAT Law sets out specific rules concerning situations where an Agent acts in his own name. This involves an Agent acting for a Principal in cases where it does not disclose to the third party that it is acting on a Principal's behalf. An Agent acting in his own name is often referred to as an 'undisclosed agent' or a 'commissionaire'. |

Supplier | : | In respect of any individual supply, the Supplier is defined as the 'Person who supplies Goods or Services.'[1] |

Customer | : | In respect of any individual supply, the Customer is defined as the 'Person who receives Goods or Services.'[2] |

Underlying supply (of goods or services) | : | This is not a defined term for VAT purposes, but is used in this guideline for clarity, to refer to the goods or services supplied by a Seller (Supplier) and ultimately received by the End Customer. |

Seller | : | In this guideline, the term 'Seller' is used to clarify the person who makes the underlying supply of goods or services. |

End Customer (for underlying goods or services) | : | In this guideline, the term 'End Customer' is used to clarify the person who receives the underlying supply of goods or services regardless of whether the 'End Customer' also consumes or benefits from the goods or services. |

Importer | : | Importer is defined for VAT purposes as the person liable for paying VAT on the Import of Goods, 'pursuant to the Common Customs Law'[3]. |

Import VAT | : | Import VAT is not a defined term for VAT purposes. It is used to describe the VAT paid or payable upon the importation of goods. [4] |

Disbursement | : | Disbursement is not a defined term for VAT purposes. In this guideline, it is used to refer to an Agent seeking payment for costs incurred in the name of its Principal, and the Principal pays back those costs to the Agent. |

Reimbursement | : | Reimbursement is not a defined term for VAT purposes. In this guideline, it is used to describe costs incurred by an Agent acting in its own name, and charged on to the Principal which pays back those costs to the Agent. |

Economic Activity and Registration

Who carries out an Economic Activity?

An Economic Activity may be carried out by natural persons or legal persons.

It will be presumed that a legal person that has a regular activity making supplies carries on an Economic Activity.

Natural persons may perform certain transactions as part of their Economic Activity, or as part of their private activities. There are therefore specific rules to determine whether a natural person falls within the scope of VAT or not.

Natural persons and legal persons who carry on an Economic Activity must register for the purposes of VAT if so required, and such persons must collect the VAT applicable to their activities, and pay the tax collected to the Authority.

Mandatory registration

Registration is mandatory for all persons who carry out an Economic Activity on a regular basis and whose annual taxable supplies exceed a certain threshold. If the total value of a person's taxable supplies during any 12 months exceeds SAR 375,000, (the 'mandatory VAT registration threshold'), that person must register for VAT[5] on the supplies made, subject to the transitional provisions provided for in the Implementing Regulations.

Taxable supplies do not include:

Exempt supplies- such as exempt financial services or residential rental which qualifies for VAT exemption.

Supplies taking place outside the scope of VAT in any GCC state.

Revenues on sales of capital assets - a capital asset is defined as a material and immaterial asset that form part of a business' assets and allocated for long-term use as a business instrument or means of investment.[6]

In certain circumstances, other tests will apply for mandatory registration:

Persons who are not resident in the Kingdom of Saudi Arabia are required to collect or pay the VAT in respect of supplies made or received by them in the Kingdom of Saudi Arabia and to register for VAT irrespective of the value of the supplies for which they are obliged to collect and pay the VAT.[7]

During a transitional period up to 1 January 2019, businesses will only be required to register for VAT purposes where annual taxable supplies exceed SAR 1,000,000, and an application for registration must be submitted no later than 20 December 2017[8]. Starting from 2019, the mandatory registration shall be required when annual turnover exceeds SAR 375,000 as required in the Unified VAT Agreement, and an application for registration must be submitted no later than 20 December 2018.

More information on mandatory registration for VAT is contained at zatca.gov.sa

Optional VAT registration

Any Resident person in the Kingdom of Saudi Arabia who has taxable supplies or taxable expenses exceeding the 'Optional VAT registration threshold' of SAR 187,500 in a twelve month period may register for VAT on a voluntary basis.[9]

Optional VAT registration may be desirable where a business wishes to claim VAT charged to it on its supplies received before invoices are raised or the occurrence of an onward supply.

More information on voluntary registration for VAT is contained at Zatca.gov.sa.

Agency

Concept of Agency for VAT purposes

The Unified VAT Agreement imposes VAT on a taxable supply of goods or services made by a Supplier to a Customer. It does not expressly determine how VAT applies in circumstances where an Agent acts on behalf of a Supplier or Customer in respect of such a supply.

For the purpose of this guideline, ZATCA considers an agency relationship exists in any circumstance where a Principal authorises an Agent to:

Act on the Principal's behalf.

Take actions that create legal obligations for the Principal (to legally 'bind' the Principal).

An Agent can act on behalf of a Supplier of goods or services, or can act on behalf of a Customer with goods or services. The Agent will only bind the Principal in cases where it acts within the Principal's authority (or the Principal subsequently authorises the Agent's action).

An Agent acts on behalf of a Principal in supplying goods and services, or receiving a supply of goods and services.

In this guideline, that supply of goods or services is referred to as the underlying supply of goods or services.

The Agent performs a service for its Principal in acting on its behalf for the underlying supply of goods and services. The Agent may also agree to carry out other tasks, such as storing and transporting goods. The fees paid to the Agent for these services are often called the 'commission', and might be calculated as a percentage of the underlying supply of goods or services.

Example 1:

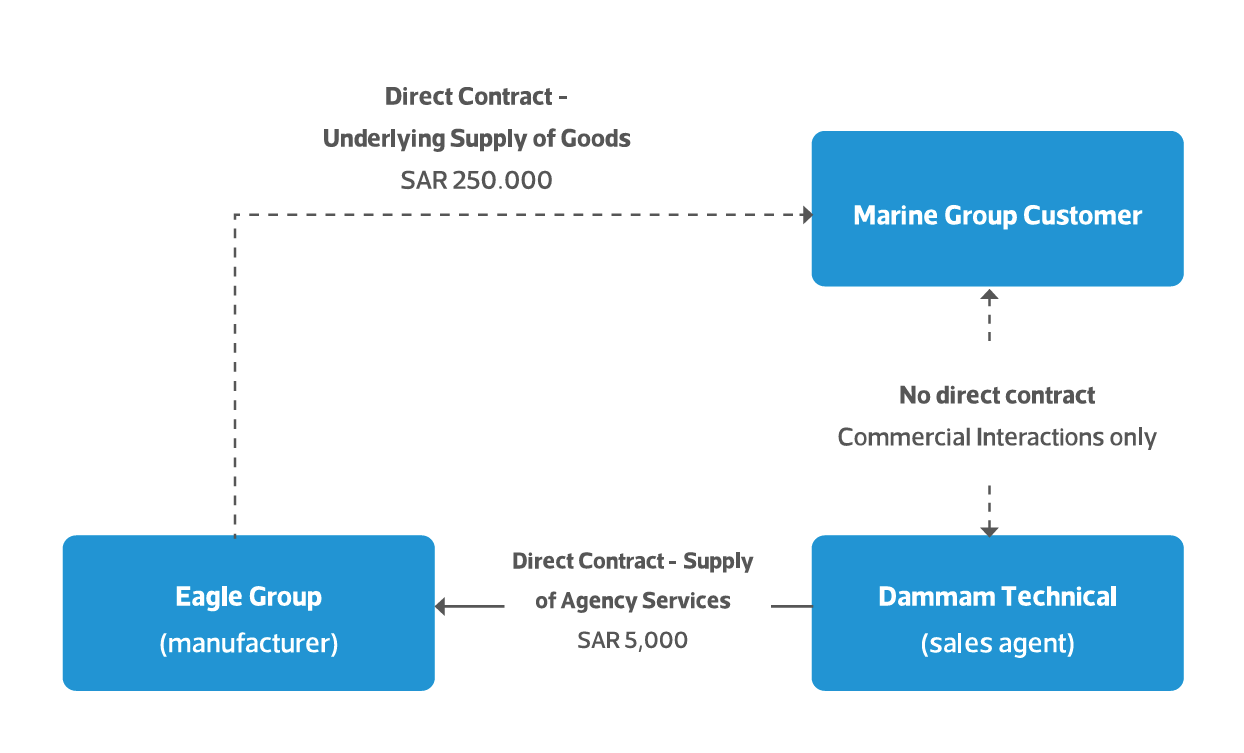

Eagle Group is a KSA resident company, which produces specialist machinery for the local market. It wishes to sell its machinery to the oil and gas sector in the Eastern Province, and engages Dammam Technical Co. to promote its products in the region, and to arrange for sales and distribution to Customers. It agrees to pay an annual fee plus a 2% commission of any sales made.

Dammam Technical Co. carries out a number of demonstrations, and secures a contract to sell machinery valued at SAR 250,000 to Marine Group. The contract is reviewed and signed directly between Eagle Group and Marine Group. Dammam Technical Co. arranges for the goods to be transported to the Marine Group facilities, and is paid a commission of SAR 5,000.

The relationship between the three parties is depicted below. In this case, the Agent acts for the Supplier (Eagle Group) and assists to make the supply of underlying goods for the account of the Supplier to a third party End Customer (Marine Group).

For VAT purposes, these two supplies can be classified as follows:

| Underlying Supply of Goods | Supply of Agency Services | |

|---|---|---|

| Supplier | Eagle Group | Dammam Technical |

| Customer | Marine Group | Eagle Group |

| Agent (person acting on behalf of a Principal) | Dammam Technical (acting on behalf of Eagle Group.) | N/A |

The KSA VAT Law expressly sets out special rules affecting how VAT is applied in some circumstances where an Agent supplies or receives goods on behalf of its Principal.[10] These rules are discussed in Sections 5 and 6 of this guideline.

In some cases, a person may be commercially described as an 'agent', but will in practice make supplies of goods or services on its own account. For VAT purposes, this person acts as a Principal in respect of those supplies.

Example 2:

Gulf Arabian Group is the 'exclusive agent' for a particular European vehicle manufacturer in the KSA. Gulf Arabian Group has an agreement with the vehicle manufacturer to promote and sell the vehicles in the KSA. The agreement specifies that Gulf Arabian Group will purchase and import the vehicles into the KSA, and then sell these directly to Saudi consumers. In this case, Gulf Arabian Group is described as an 'agent' but acts as a Principal in receiving a supply of the vehicles from the manufacturer, and subsequently making supplies of the vehicles to the consumers in the KSA.

Commercial Agencies Law

The Law of Commercial Agencies[11] regulates cases in which Agents act for non-Saudi companies or their representatives. The ambit of this law is different from the concept of an 'agent' for VAT purposes as set out by this guideline.

The law applies to 'Anyone who contracts with a manufacturer or his representative in his country for commercial activities, whether as agent or distributor in any form of agency or distribution for profit, commission or facilities of any nature, including agencies for maritime transport, air, or land and any other agencies that would be decided by the Minister of Commerce and Industry'[12].

Whether a person falls under the definition within the Law of Commercial Agencies does not influence whether that person acts as Principal or Agent for VAT purposes.

For example, a 'commercial agent' under the Law of Commercial Agencies can be a distributor or a franchisee for a non-resident manufacturer. A distributor or franchisee does not generally enter into legal transactions on behalf of their non-resident Principal (such as signing contracts with customers in the name of the manufacturer) - they instead act as a Principal in making supplies of goods and services in their own right.

A 'commercial agent' acting in this way does not make or receive supplies of goods and services on behalf of a Principal. In these cases, the 'commercial agent' would therefore not be considered an Agent for VAT purposes.

Conversely, it may be possible that a person is not subject to the Law of Commercial Agencies[13], but will be viewed as an Agent for VAT purposes if he acts on behalf of the KSA resident Principal in making or receiving supplies of goods or services.

Principal or Agent?

A person involved in effecting an underlying supply from a Seller to an End Customer may, in respect of that transaction, either:

act as Agent for an underlying supply of goods or services on behalf of a Principal.

act as a Principal in receiving the supply of goods or services on his own behalf from the Seller, and making an onwards supply of those goods or services to the End Customer.

A person may act as Agent in respect of certain supplies, and separately as a Principal in respect of other supplies.

The distinction between a person acting as Principal or as Agent will not always be clear for each transaction. The correct position should be based on an analysis of the agreements between the persons, and the commercial reality of the relationship between those persons, based on all of the relevant factors.

Common features of an Agent are:

The Agent enters into a contractual agreement to arrange transactions on behalf of his Principal, for the account of and for the benefit of that Principal.

The Agent acts based on instructions from a Principal. This may be direct instructions, an agreed upfront authorization for certain acts, or the Principal providing subsequent ratification of the act carried out.

The Agent does not own the underlying goods, nor does it have the right to receive any underlying services in its own name.

The Agent is not able to determine the price or other attributes of supply without the approval or ratification of his Principal.

Common features of a Principal are:

The Principal enters into transactions directly with a Seller or an End Customer for the Principal's own account and its own benefit.

It is possible that the Principal might not take possession of the goods, or be directly involved in the provision of the service.

The Principal may agree with a Seller or End Customer to carry on activities in a certain way, or to meet certain standards, but generally retains the ability to make business decisions without authorization.

The Principal generally assumes business risks such as for payment and for inventory.

The remuneration structure agreed between the persons should not be viewed as definitive in whether a Person is acting as an Agent or Principal. An Agent may earn a payment of 'commission', and the word 'commission' is often associated with intermediary services. However, a Principal can also agree to earn a commission (which can be a fixed amount, a percentage of the final sale, or a 'markup' on the original sale).

Applying VAT to transactions made by Agent as Principal

A Principal will be treated in its own right as a Supplier (in respect of a sale transaction), and a Customer (in respect of a purchase transaction).

Often, one commercial arrangement can result in the Principal being both a Customer and a Supplier.

For example, the Principal makes a purchase of goods or services from one person, and a corresponding sale of the same goods or services to another person, without materially altering the goods or services. However, both the purchase and the sale transactions are viewed as separate supplies, which can be subject to VAT.

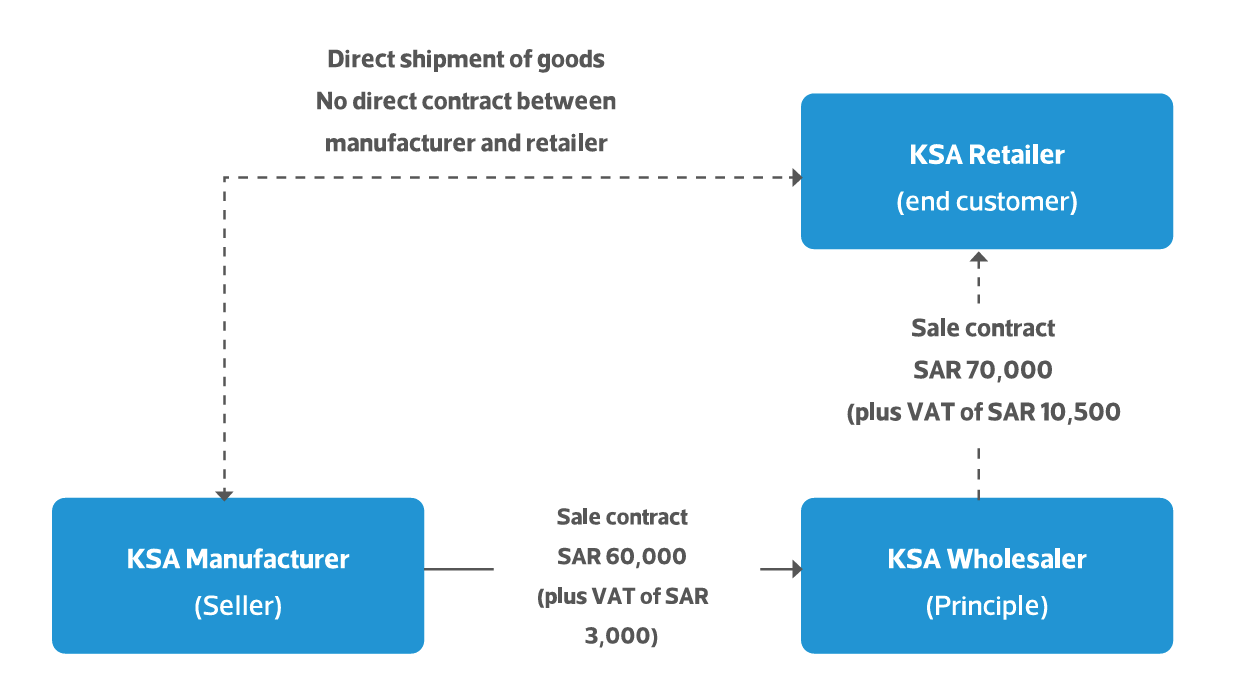

Example 3:

A KSA Wholesaler agrees to purchase a stock of consumer goods from a KSA manufacturer for SAR 60,000 (plus SAR 9,000 of VAT). On the same day, the wholesaler agrees to sell those goods to a retailer for SAR 70,000 (plus SAR 10,500 of VAT). The wholesaler instructs the manufacturer to deliver the goods directly to the KSA retailer (the retailer will stock the goods in its shops for individual sales to consumers).

In this case, there is one delivery of goods but there are two supplies of the same goods: firstly from the KSA Manufacturer to the KSA Wholesaler, and secondly from the KSA Wholesaler to the KSA Retailer. KSA Wholesaler acts as a Customer in respect of the first supply, and as the Supplier for the second supply. KSA Manufacturer physically delivers the goods to KSA Retailer, but does not make a supply to KSA Retailer.

Usually, a Principal seeks to earn revenue by applying an additional markup to the sales price. However, a Principal may also request consideration for services provided to the Seller or the End Customer, separate to the underlying supply. In such a case, VAT will also be applicable to any separate supply of services.

VAT treatment where Agent acts on behalf of Principal

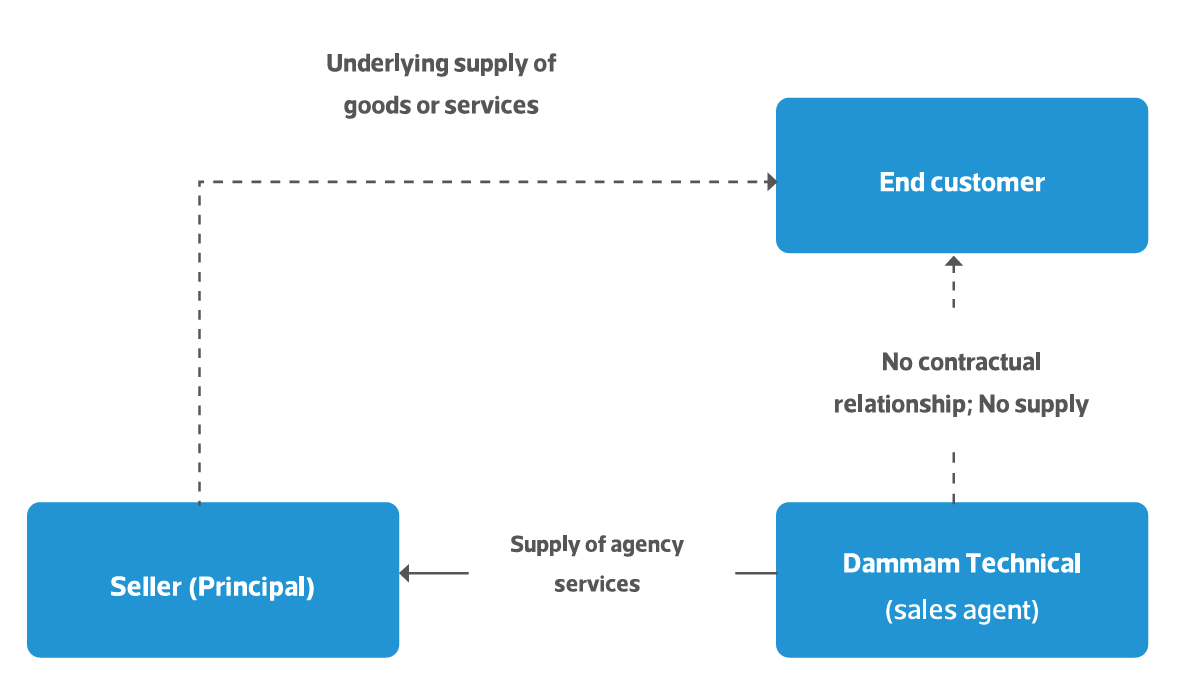

In the case of a disclosed Agent, the underlying supply is made directly from Seller to End Customer, and the Agent may charge consideration to the Principal he acts for.

The diagram below depicts the supplies taking place for VAT purposes where an Agent acting on behalf of a Seller as Principal in respect of an underlying supply of goods or services.

Underlying supply made directly from Seller to End Customer

The underlying supply of goods and services is subject to VAT following the standard rules for a direct supply from a Supplier to a Customer.

The Principal makes the supply and remains liable for charging output VAT and issuing a Tax Invoice (even if an Agent assists with the invoicing or payment collection procedures on his behalf). An Agent may issue a Tax Invoice on behalf of a Principal who is a Taxable Person; provided certain criteria are met[14], (refer to Section 11 of this guideline, and the Invoicing and Records Keeping guideline). In such cases, the Principal is liable for the accuracy of the information shown on the Tax Invoice and for reporting Output Tax on the supply.

The End Customer directly receives the supply from the Principal and is eligible to claim deduction provided that the supply is incurred as part of its Economic Activity in the course of making Taxable Supplies. (Refer to Section 10 of this guideline for more information on input VAT deduction).

The Agent may carry out certain tasks to facilitate the sale, such as delivery of goods, raising of an invoice or collecting payment. Provided that the Agent is acting in the name of the Principal (and this is disclosed to the third party), the completion of these tasks by an Agent does not affect the VAT treatment.

Supply of agency services made by Agent to Principal

An Agent may agree to act for (and on behalf of) either a Seller, or an End Customer.

It will receive a commission or other remuneration for carrying out these services. This is a supply of services, which is separate to the underlying supply it arranges on behalf of the Principal. For this supply, the Agent acts as a Supplier, and the Principal as a Customer.Example 4:

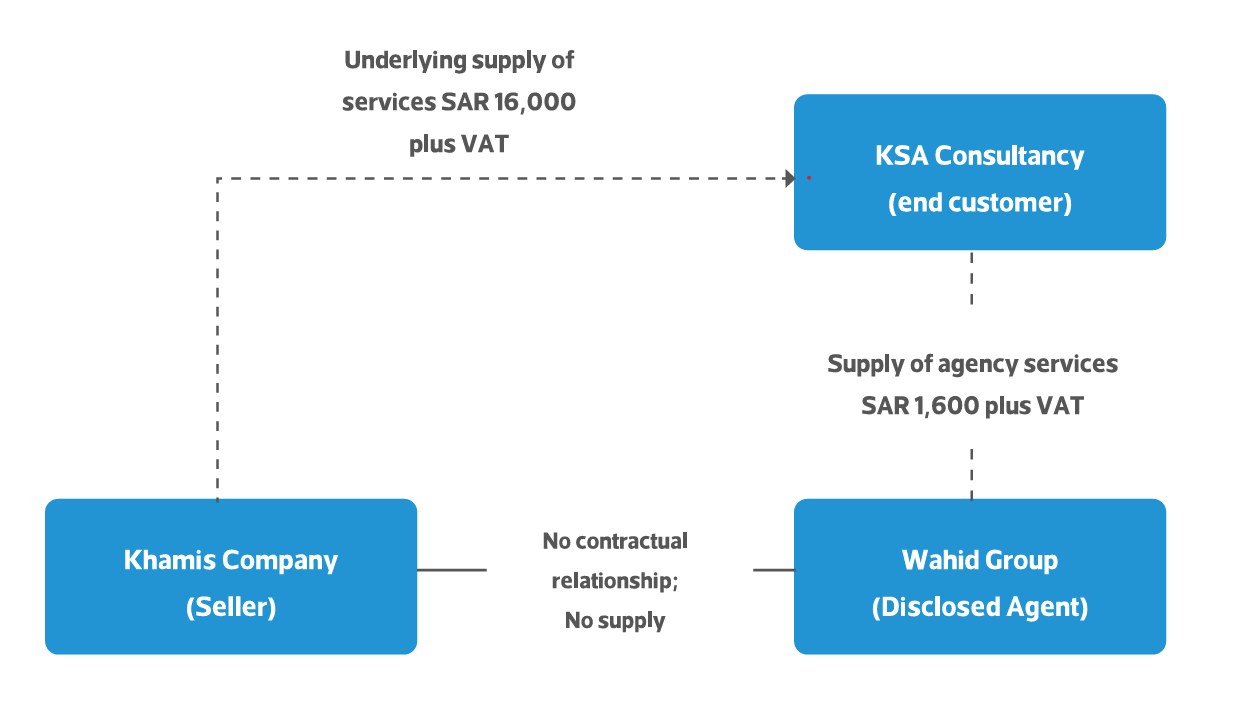

A KSA consultancy firm needs to engage a subject matter expert in Islamic Finance on an ad-hoc basis to complete a project. It asks Wahid Group, a specialist agency, to find an appropriate local firm. Wahid Group recommends Khamis Company to carry out the work, and arranges a quote for their services for SAR 16,000 (plus VAT of SAR 1,600). Wahid Group charges an additional commission of 10% for the introduction.

Khamis Company (the Seller in this case) signs a contract directly with the KSA consultancy firm (the End Customer), and provides the underlying supply of services directly. Wahid Group charges SAR 1,600 (plus VAT of SAR 240) as its commission, separately to the supply of the underlying consultancy services.

In rare cases, it may be possible that an Agent agrees to act for, and charges a consideration to, both parties. In these cases, the Agent will make two separate supplies of services.

In all cases, the supply of agency services to a KSA resident Principal should be subject to the standard 15% rate of VAT; regardless of whether the underlying supply of goods and services is subject to VAT. Section 9 of this guideline discusses agency fees in respect of arranging exempt financial services, and arranging zero-rated international transport.

Commission charged to non-KSA Principals

An Agent acting for a non-KSA resident Principal must determine whether its supply may qualify for the zero-rate.

The Implementing Regulations allow zero-rating for services provided to a non-KSA resident Customer, provided that each of the conditions is met:

the Supply of those services does not take place in any Member State under the Special Cases listed in Articles 17 to 21 (17, 18, 19, 20, 21) of the Agreement,

the Taxable Person has no evidence that the Customer has any residence in any Member State and has evidence that the Customer is resident outside of Council Territory,

the benefit of the services is not received by the Customer or any other Person when that Person is situated in a Member State,

the services are not related to any tangible Goods or property located within a Member State during the Supply,

the Taxable Person intends that the services are consumed by the Customer outside of Council Territory,

the Taxable Person has no evidence that the benefit of the services will be enjoyed within Council Territory.[15]

The potential application of the zero-rate will depend on the actual services being provided by the Agent. Please note the following points with particular relevance to agency services:

If the Agent makes a charge to the Principal for the storage or handling of physical goods in the KSA, this is not eligible for zero-rating (as it relates to tangible goods or property located in the KSA during the supply).

ZATCA interprets the phrase 'the benefit of the services' in this Article to mean the direct and predominant benefit of the services. In general, it is acknowledged that services provided directly to one recipient may have a secondary or ancillary benefit to other third parties. In cases where the direct benefit of the services is received by a Principal outside the KSA, but another person in the KSA receives or enjoys a secondary or ancillary benefit, the secondary or ancillary benefit should not affect the ability of the Supplier to apply the zero-rate specified in Article 33 of the Implementing Regulations.

Example 5:

Petra Company is established in Jordan and provides remote computing services for companies around the Middle East. Petra has no establishment of any sort in the KSA, but has a number of business Customers who are Taxable Persons in the KSA. It engages a Saudi e-Payment agent to establish a portal allowing collection of payments from Petra's Customers and transfer to Petra's USD bank account in Jordan. The e-Payment agent does not take on any obligations towards Petra's Customers.

In this case, the e-Payment agent is providing a service where Petra in Jordan receives the predominant benefit. Petra's Customers in KSA do not receive or enjoy the predominant benefit of the service. The e-Payment agent should apply the zero-rate to its services.

VAT treatment where Agent acts in his own name

When does an Agent act in his own name?

An Agent acts in his own name in cases where the agency relationship is not disclosed to the third party. Therefore, the third party will believe he is engaging with a Principal acting in his own name.

Example 6:

A distributor is authorized by a KSA manufacturer to sell specific computer equipment to the local market in Jeddah. The distributor's contract with the manufacturer sets a fixed selling price, and requires the distributor to remit all sale proceeds to the manufacturer (less a 5% commission). The distributor is therefore selling for the account of the undisclosed Principal, but third parties are unaware of this. For VAT purposes, the distributor is treated as acting in his own name in respect of the sales to third parties.

Example 7:

Nova Group is a vehicle distributor in KSA with an excess stock of all-terrain vehicles during 2020. Yasar Rental, a retail car rental firm, agrees to offer the excess stock for rental to the public, for a commission of 10% of total rental revenues earned. Nova Group retains ownership of the vehicles and is an undisclosed Principal. Yasar is acting in its own name in respect of the rentals.

Agent Is treated as a Principal for VAT purposes

The VAT law prescribes a special rule to apply VAT to an Agent acting in his own name:

'A Taxable Person, acting in his name, supplying or receiving Goods or Services on behalf of any other Person shall be deemed, for the purposes of the Law and the Regulations, as supplying or receiving such Goods or Services for himself.'[16]

This means that where an Agent acts in his own name, he is treated in the same way as a Principal for VAT purposes:

The Agent receives a supply of the goods or services from the Seller (the Agent is deemed to act as a Customer in respect of the purchase).

The Agent makes a subsequent supply of the goods or services to the End Customer (the Agent is deemed to act as a Supplier for the onwards sale).

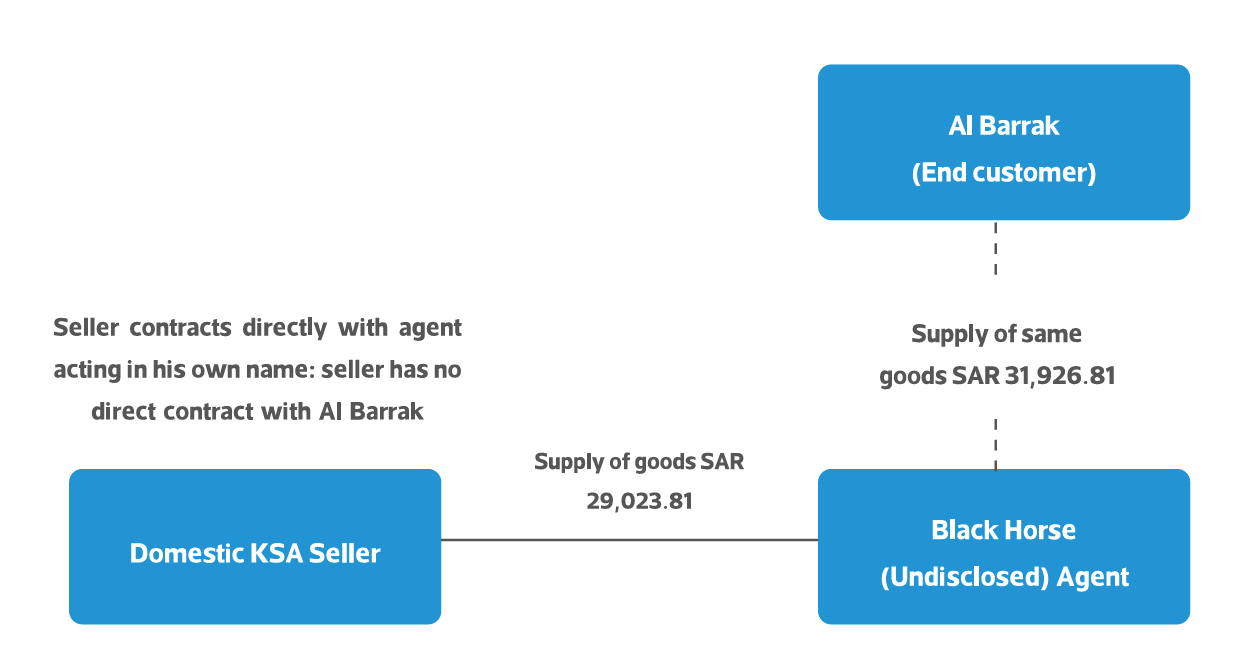

Example 8:

Al Barrak wishes to purchase goods for its business and appoints Black Horse Company, a purchasing Agent, to obtain specific goods at a good quality and price from the domestic market. Black Horse approaches Suppliers in the province to obtain quotations, without disclosing that it is working on behalf of a Principal. Under the agreement with Al Barrak, Black Horse must obtain approval from the Principal before proceeding with the best quotation, and is required to transport the goods to Al Barrak's premises. Al Barrak agrees to pay the cost of the goods (SAR 2,023.81 including VAT) plus a 10% markup to cover Black Horse's intermediary and transportation services. However, Black Horse enters into the purchase agreement directly with the Supplier.

In this situation, Black Horse is treated as receiving a supply of goods from the KSA Seller, and making a supply of the same goods to Al Barrak for the higher price of 29,150. There is no separate supply of services from Black Horse to Al Barrak.

Black Horse can deduct Input VAT (SAR 3,785.71, being the VAT component of the purchase for SAR 29,023.81) on the purchase and must report Output VAT in respect of the full value of the sale (SAR 4,164.285, being the VAT component of SAR 31,926.18).The corresponding entries in the relevant fields of Black Horse's VAT return for these transactions are:

| Amount (SAR) | Adjustment (SAR) | VAT Amount (SAR) | |

| (1) Standard rated sales | 27,761.90 | 4,164.285 | |

| (7) Standard rated domestic purchases | 25,238.10 | 3,785.71 | |

| (13) Total VAT due for current tax period | 378.51 |

VAT liability on supplies

Where the Agent acts in his own name, VAT is applied to each individual supply based on the nature of each supply. Usually, this will result in the same VAT rate applying to both supplies, but this must be confirmed for each supply as the facts may require a different treatment. For example, if an Agent purchases goods locally on behalf of a non-resident Principal and exports these to the Principal's office outside the GCC, the initial purchase (with VAT at 5%) will be treated separately to the subsequent export (with VAT at 0%).

In cases where the Agent acts in his own name, it is not usual for the Agent to provide a separate supply of agency services. In most cases, the Agent's remuneration is reflected in the markup or price difference between the purchase and onwards supply of the goods or services. However, it is possible that the Agent and Principal agree for distinct services to be provided (separate to and in addition to the underlying supplies of services).

Example 9:

Al Yarmouk Limited, an office products distributor engages The White Book Co., a licensed sales Agent who is registered for VAT, to promote and distribute its products to businesses in the Asir province. The agreement provides that The White Book Co. will sign contracts in his own name but must pass all revenues earned to Al Yarmouk Limited, less a 15% commission. The White Book Co. is also paid a fixed monthly fee of SAR 10,000 for its services (regardless of whether any sales are made). The fixed monthly fee is a supply of services, which is separate to the underlying supplies of goods.

Agent acting as Importer

Liability for import VAT

Saudi Customs apply VAT to any imports of goods entering the KSA from another territory[17], as part of the formal customs declaration process.

Importer is defined for VAT purposes as the person liable for paying VAT on the Import of Goods, 'pursuant to the Common Customs Law[18]'. The Common Customs Law defines Importer to mean 'the natural or legal person importing the goods'.

For Customs purposes, a person wishing to enter goods into the KSA commercially must be licensed in order to carry out an import and will be named on the import declaration as the Importer. The procedure for lodging the customs declaration can be carried out by the owner of the goods or an authorised representative, or by a customs broker.[19] The representative or broker performs these acts on behalf of, and for the account of, the Importer - and does not act as Importer.

Conversely, if a person acts as an Importer, even if on the instruction of another Person, that person will still be liable for payment of VAT.

Example 10:

Galaxy Education is a KSA company licensed to import and distribute learning materials in the KSA. A KSA university requests Galaxy to source textbooks from various Suppliers in Europe and deliver these to the university campus in Riyadh. The terms of the contract agree that Galaxy will import and deliver the materials (using a Delivered Duty Paid trade term), and that the university will pay approved purchase prices (SAR 100,000), a 15% commission of the purchase price, and any applicable VAT.

Whilst Galaxy Education is acting upon instruction from the university, it is importing the textbooks on its own account (since it is licensed for importation) and should ensure the customs declaration is completed showing Galaxy as the Importer. When Galaxy delivers the textbooks to the university, this is a domestic supply of goods - for the full consideration (including mark-up) of SAR 115,000. VAT of SAR 17,250 should be applied in addition to the sale. Galaxy is entitled to deduct the VAT paid upon import (as the goods were supplied onwards in a taxable sale).

Deduction of import VAT

Deduction of import VAT is only applicable for the person who acts as Importer of the goods into the KSA. To be eligible for input tax deduction, the Importer must use the imported goods for the purpose of carrying on its Economic Activity, which constitutes making taxable supplies[20].

As a condition of input VAT deduction, a taxable person must hold:

'The customs documents proving that he imported the Goods in accordance with the Common Customs Law.[21]'

If a taxable person does not act as Importer, it is not eligible to deduct VAT on the import of goods.

The Importer is the person eligible to deduct input tax charged on imports. In some cases, the Importer may vary according to the records of the person who owns the goods at the time of importation (for example when a broker imports the goods, see below). In all cases, the person eligible to deduct/recover VAT is the Importer where the goods are to be used in the course of taxable activities.

A customs broker is able to carry out non-commercial imports in respect of a natural Person/individual. In these cases, the broker acts on behalf of the individual in entering the goods. The import VAT cannot be deducted by the broker in these cases.

Example 11:

A KSA resident individual appoints a customs broker to carry out import formalities for an expensive vehicle, using the broker's licence. The broker pays the VAT on import and passes this to the KSA resident as a disbursement, together with the fee for his brokerage services. The imported vehicle is not used by the broker as part of its Economic Activities. The individual does not carry out any Economic Activity. In this case, neither the individual nor the broker are able to deduct the input VAT.

Example 12:

A US resident business sells equipment to a KSA resident business, Refinery Co. Refinery Co is developing a new refinery facility in the Eastern Province, and it has engaged Focus Construction, a third party construction company in KSA, to install the equipment. The goods are shipped from the US to KSA, and Focus Construction is appointed to act as an 'import agent' for entering the goods in KSA. As the Importer, it pays the import VAT due. Although it is referred to commercially as an 'import agent' for the equipment, the construction company acts as Importer in its own name and on its own account. Focus Construction does not own or make an onward supply of the equipment to Refinery Co, and does not use the goods as part of its own Economic Activities. Therefore, Focus Construction is not able to deduct the VAT paid on import as input VAT.

If Refinery Co were to act as the importer in this situation, the VAT paid would be deductible in principle.

Charges of costs by Agents

An Agent may agree with its Principal to recover costs borne when acting on behalf of a Principal. The application of VAT will depend on whose name in which the costs are incurred.

Expenses incurred in name of Principal 'Disbursement'

In cases where an Agent arranges for a supply to be received from a third party in the name of his Principal, this supply takes place directly from the third party to the Principal as Customer.

Typically, an Agent will make physical payment to the Supplier and recover the amount paid from the Principal. In these cases, the recovery of the money from the Principal is not consideration for a supply made by the Agent. This situation is often referred to as a 'disbursement'.

Care should be taken as the term 'disbursement' can be used differently in practice. ZATCA accepts that an Agent does not need to charge VAT on a 'disbursement' provided the following criteria are met:

The Principal actually receives the goods or services (whether directly or via the Agent);

The Principal is the person responsible to pay;

The Principal is aware of a supply by third party Supplier and gives (either general or specific) authority to the Agent to make payment on his behalf;

The Agent claims the exact amount from the Principal, without markup; and

The disbursed cost is clearly evidenced in commercial documentation to be separate and additional to the supplies the Agent makes to the Principal.

Example 12:

A KSA design firm is completing an office design for its client, Century Bank. Once the design phase is complete, Century Bank authorizes the design firm to pay a fee of SAR 15,000 to the municipal authority to obtain certification to carry out necessary construction works. The permission is in the name of Century Bank.

The design firm is carrying out the design work on its own account as Principal, but acts as Agent in obtaining certification from the municipal authority. If the design firm seeks the SAR 15,000 as an individual amount (separate to the design fees), this will be a disbursement and not subject to VAT.

However, if the design firm charges an inclusive price for the design, including costs to obtain the municipal certification, then this will be a single supply of services, which is subject to VAT in full.

A disbursement is not a taxable supply made by the Agent, so the Agent is not subject to specific tax invoicing requirements in law and regulations for that disbursement. However, ZATCA recommends that if a disbursement is charged by an Agent who is a Taxable Person to the Principal, the Agent issues a Tax Invoice which clearly evidences that the charge is a disbursement (and therefore not subject to VAT).

If clear documentation of the disbursement is not issued, it may indicate that the Agent has itself made a taxable supply in respect of the consideration received.

Expenses incurred in Agent's own name 'Reimbursement'

If an Agent incurs expenses in its own name, and agrees a charge to the Principal for these expenses, this is consideration for a supply made by the Agent to the Principal. To distinguish from a 'disbursement', costs charged in this way are often referred to as a 'reimbursement'.

Note however that the VAT treatment will depend on what capacity the Agent acts in (whether his Principal's name or his own name), rather than the description given to the charge.

In the case of a reimbursement, VAT may be applied as an onwards supply of that same good or service, or - if applicable - as additional consideration for a larger 'dominant' supply made by the Agent.

An onwards supply will have the appropriate VAT rate and treatment for that good or service, when supplied from the Agent to the Principal (with exception to the cases where the supply is exempted or outside the scope). Usually this will match the VAT rate applied to the original charge, but this may differ depending on the status of the parties.

Example 13:

Golden Auto Company arranges repair and maintenance services for commercial car fleets. One of its Customers, United Foods, has a vehicle needing an uncommon part for repair. Golden Auto finds the part from a small auto wrecker who is not registered for VAT. It purchases the part in its own name for SAR 800 and charges United Foods for reimbursement of the cost incurred.

Whilst Golden Auto was not charged VAT on the purchase, the onward supply of that good is a taxable supply made as part of its own Economic Activity. Golden Auto must include VAT at 15% on the reimbursement amount.

If a cost being reimbursed forms part of a larger dominant supply, then the reimbursement of that cost will be viewed as additional consideration for the dominant supply. Therefore, VAT will apply at the same rate as that supply.

Example 14:

Element Consulting, a KSA consulting firm, is completing a large project with a Saudi Ministry. To complete the project, it needs to fly in a small number of experts from other countries and therefore, it agrees to reimburse the exact travel air costs of its staff in addition to the prescribed fees.

The reimbursement of airfares is not a separate service provided to the Ministry - it instead forms an inseparable part of delivering the project. The airfares incurred are subject to VAT at 0%, but, the reimbursement of those costs should be charged as additional consideration for the project fees (and therefore subject to VAT at 15%).

Special cases

This section outlines considerations relevant to agency within particular sectors.

Travel Agency

'Travel agents' may commercially act in different capacities. For example, a travel agent can act:

as Principal, purchasing the rights to travel, accommodation and related goods and services and making an onwards supply of these to the traveller.

as Agent, creating a directly enforceable contract between the traveller and Supplier and charging a separate commission for its services.

The application of VAT will depend on the individual circumstances and in which capacity the travel agent acts.

A charge made by a transport Supplier, or a travel agent acting as Principal, for international passenger transport is zero-rated[22].

A separate fee charged by a travel agent as commission for zero-rated international travel is a distinct service to the transportation provided by the transport Supplier. The commission cannot be zero-rated.

Land transportation services and ride sourcing applications

Individual passengers wishing to take land transportation services (by way of a taxi or similar vehicle) may find an individual driver directly (for example, by flagging down a taxi on a street), or may ask another person to arrange the trip (such as a local business or mobile ride sourcing application). The business will then arrange for an individual driver to carry out that trip.

In cases where:

an individual traveller or company holds an account with a business offering taxi or similar land transportation services (including a business operating a mobile ride sourcing application);

requests for transport are made through the business; and

payment is collected by the business.

The business acts as Principal in performing the transportation service. Individual drivers provide their services to the business.

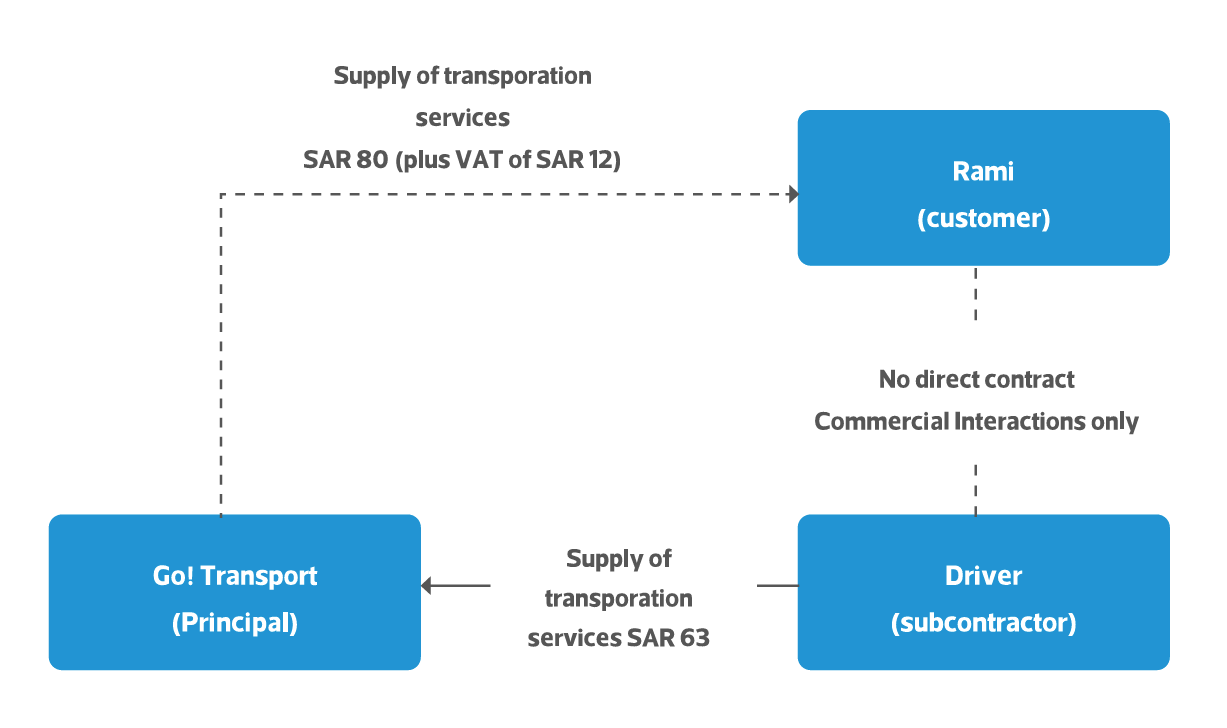

Example 15:

Rami holds an account with Go! Transport, which is licensed to offer transportation in the KSA. Rami wishes to travel from central Riyadh to King Khaled International Airport, and obtains a quoted fare of SAR84 (including VAT) from Go! Transport through their mobile application. Rami will authorize payment once the trip is completed.

Go! Transport finds a driver with a vehicle to perform the trip, and agrees to pass on the fare less a commission of 25%. In this case, Go! Transport has received the request for transport and has the obligation to the Customer for fulfilling it as it is the party contracting with the Customer. Then, Go! Transport provides the transportation service through independent drivers, who are providing the service to Go! Transport. Therefore, Go! Transport acts as Principal. The driver acts as a subcontractor, performing the transportation service for Go! Transport for a fee of SAR 63 (75% of the amount collected from the Customer).

Go! Transport must charge VAT of SAR 4, calculated on the full value of the supply made to Rami. If the driver is registered for VAT, it must report VAT of SAR 9 as part of the total consideration for the trip, and arrange for a tax invoice to be issued to Go! Transport.

Financial intermediary

Financial intermediaries act as an Agent in connecting a Principal to another person wishing to enter into a financial transaction. The intermediary charges a commission (or other consideration) to reflect the introductory service. This may also include other related services (such as processing contracts or performing necessary regulatory checks).

An explicit fee (whether calculated as a fixed price, percentage of value, or other method) is in all cases taxable in nature, even if the underlying financial service or product is VAT exempt.[23]

Example 16:

A stockbroker arranges for a KSA investor to find an appropriate portfolio of domestic securities listed on Tadawul for investment purposes. The stockbroker initiates contact with the exchange and executes the trades based on a standing authority from the investor, and charges a percentage of the value as a commission.

The supply of the equity security is an exempt supply of financial services. However, the stockbroker's services are not the supply of an equity security, and are charged on an explicit fee basis. For this reason, the stockbroker must include VAT on the commission charged to the investor.

It is possible for a financial service provider to earn commissions on an implicit margin or spread basis between supply and demand prices. In these cases, the 'intermediary' is trading on own its account, and is acting as Principal. 'Commissions charged on an implicit margin or spread between supply and demand prices for brokerage services, or under a 'Mudaraba' or 'Wakala' contract[24]' are exempt from VAT as a financial service provided on the Supplier's own account as a Principal.

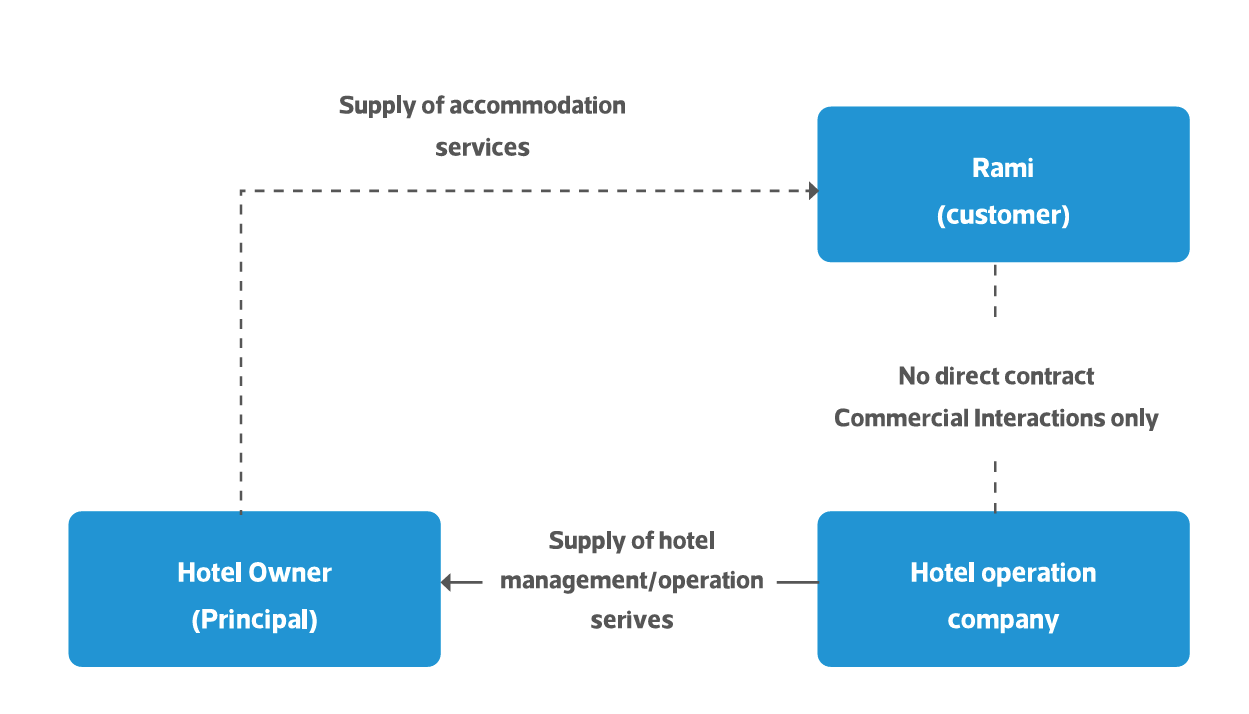

Hotel operators

Owners of hotels and similar accommodation commonly engage with a third party company to operate the facilities. In these cases, the standard principles for determining which party makes the supply to the Customer or hotel guest should be applied to determine the appropriate VAT treatment:

If the operator acts as principal, or acts in his own name towards hotel guests, the operator is required to charge VAT on the supply of accommodation. This is regardless of whether the operator treats the consideration as its revenue, or is required to pass this on to the owner.

If the hotel guest enters into a contract with the hotel owner, or enters into a contract which shows the name of the hotel owner as the supplier, the hotel owner is required to charge VAT on the supply of accommodation.

The application of VAT will depend on the exact facts in the case. Relevant facts to consider include:

When the hotel guest signs to accept terms and conditions (for example upon check-in), do the terms and conditions refer to the hotel owner? If not, this may indicate that the hotel operator acts as principal or in his own name.

Is the hotel owner or hotel operator liable to the guest for contractual performance (for example, which entity is required to find alternative accommodation or pay damages if the hotel becomes fully booked)? If the hotel operator is liable, this indicates the hotel operator acts as principal or in his own name.

Is the hotel owner mentioned on invoices issued to the guests? If not, this indicates that the hotel operator acts as principal or in his own name.

Therefore, it is advisable that hotel operators and hotel owners make it clear (from the contractual and other documentation issued to the customer) in whose name the supply of accommodation is being made to the hotel guest.

Hotel operator acts as principal

A hotel operator acts as principal if he operates the hotel on his own account. In these cases, the hotel operator must report VAT on the supplies made.

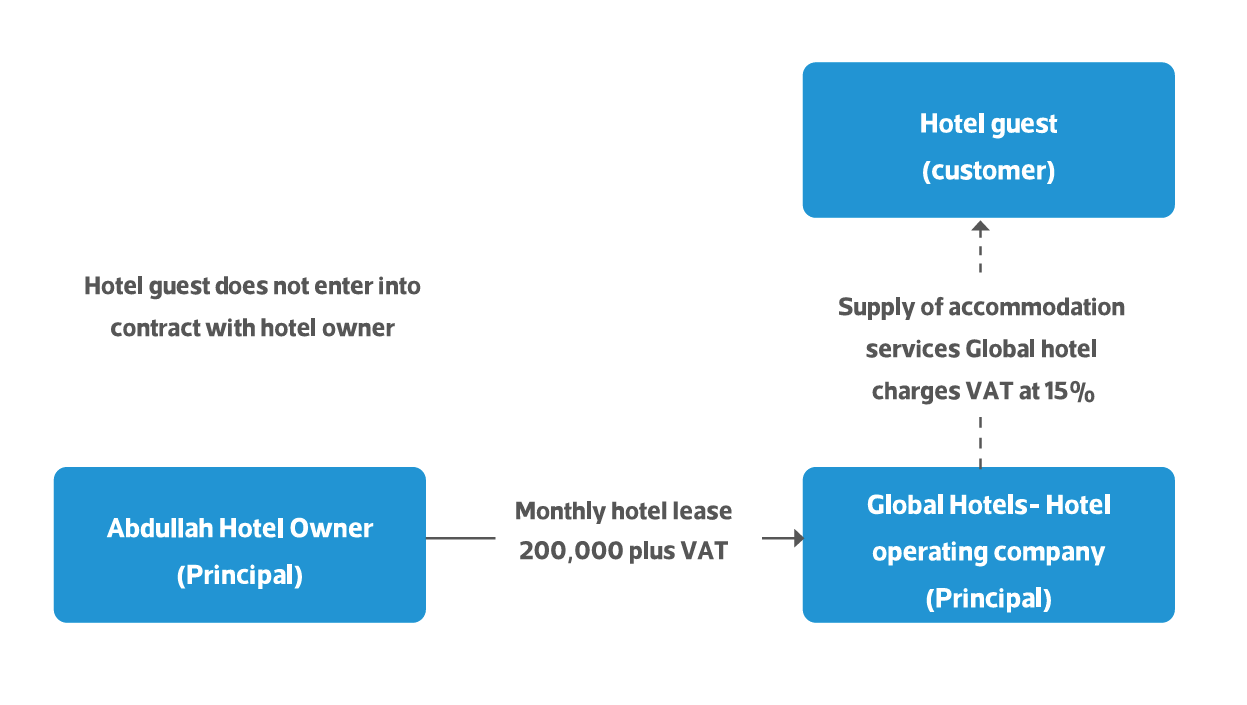

Example 17:

Abdullah owns a hotel facility in Riyadh. He leases this to an international hotel company, Global Hotels, for a monthly fee of SAR 200,000 plus VAT. Global Hotels does not own the hotel building but enters into all contracts with hotel guests in its own name and in its own account. It incurs costs from third party suppliers directly.

Global Hotels must charge VAT on supplies of accommodation and other revenues to hotel guests.

Hotel operator acts as Agent but in its own name

If the hotel operator acts on the instruction of (and for the account of) the hotel owner, this indicates that the operator acts on behalf of the owner.

However, if the hotel operator acts in its own name, and the hotel guest is not aware that the operator is acting on behalf of a principal, the hotel operator is treated as the person making the supply of accommodation and similar services for VAT purposes. The hotel operator must collect VAT on these supplies.

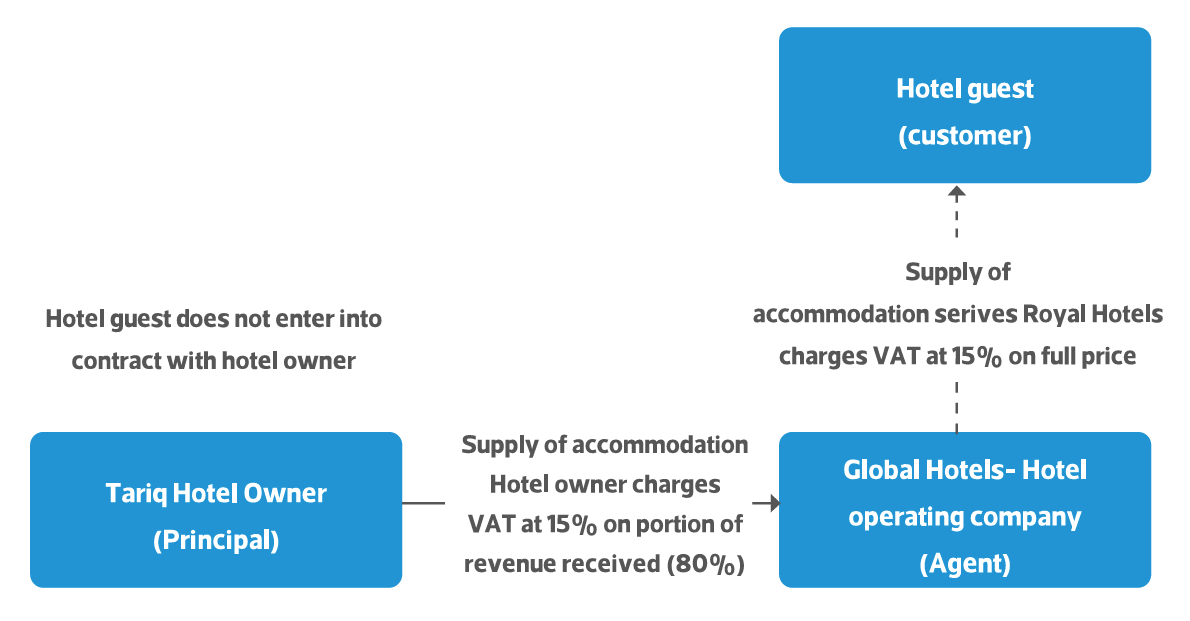

Example 18:

Tariq owns a hotel in Riyadh. He enters into a contract with Royal Hotels whereby Royal Hotels operates the hotel on his behalf. Royal Hotels must operate the hotel in accordance with the agreed instructions, and is obligated to provide 80% of all revenues (less approved expenditures) to Tariq on a monthly basis. Royal Hotels does not record revenues or expenditures in its own account, other than the 20% it is entitled to retain under the contract with Tariq.

A small sign in the hotel entrance states that Tariq is the hotel owner, and that Royal Hotels is the operator. However, all contracts with guests and third party suppliers are signed in the name of Royal Hotels. Guests and suppliers are not aware that Royal Hotels acts on behalf of Tariq. The diagram below shows how VAT is recorded on supplies of accommodation.

Hotel guest enters into a contract with the hotel owner

In cases where the hotel guest books the accommodation where the name of the hotel owner or its group is shown as a supplier, or accepts terms and conditions issued in the name of that hotel owner, the guest generally would not have any separate contractual relationship with the operating company in respect of that supply.

In these cases, the hotel owner is making the supply of accommodation to the guest as a Principal, and the hotel operator does not supply accommodation for VAT purposes (it instead provides services to the hotel owner).

The hotel owner has to issue Tax Invoices to the guests in its own name and report the VAT on the supplies. The hotel operating company acts as a Supplier based on the instructions of the hotel owner to operate the hotel, but does not act in it's own name in making supplies of accommodation to Customers. It will report VAT on the supplies made to the hotel owner.

Input VAT Deduction

General Provisions

A VAT registered person may deduct Input VAT charged on goods and services it purchases or receives in the course of carrying on its Economic Activity. Input VAT may be deducted on:

VAT charged by a VAT-registered Supplier in the KSA.

VAT self-accounted by the VAT-registered person under the Reverse Charge Mechanism.

Import VAT paid to Saudi Customs on imports of goods into the Kingdom.

As a general rule, input VAT, which is related to the taxpayer's VAT exempted activities, is not deductible as input VAT.

In addition, input VAT may not be deducted on any costs incurred that do not relate to the Economic Activity of the taxable person (including some blocked expenditure types such as entertainment, sporting or cultural services, catering service, and restricted motor vehicles)[25], or on any costs which relate to making exempt supplies. This input VAT is a credit entered on the VAT return which is offset against the VAT charged on supplies (output VAT) made during that period.

Input VAT may only be deducted where the Taxable Person holds a tax invoice, or customs documents showing the amount of tax due, or any other document showing the amount of input tax paid or due, subject to the approval of the Authority.[26]

Input VAT incurred by Agents

An Agent acting in his own name in receiving supplies of goods or services on behalf of a Principal is treated as if he had received those goods or services for himself[27]. Therefore, an Agent acting in his own name is entitled to deduct input tax on such supplies, provided he holds a Tax Invoice issued in his name and the other criteria for deduction are met.

An Agent acting in the name of his Principal is not entitled to deduct input tax on supplies received in the name of the Principal.

For imports of goods, VAT paid to Saudi Customs is only deductible by the person acting as Importer, where the Importer uses those goods as part of his own taxable activity. See Section 7.2 of this guideline for further details.

Proportional deduction relating to input VAT

VAT incurred, which relates to a taxpayer's VAT exempt activities, such as exempt financial services or residential rental, is not deductible as Input VAT. A person making both taxable and exempted supplies can only deduct the Input VAT related to the taxable supplies. If a taxable person incurs general costs or expenses (overheads) in the making of taxable supplies, and others that are exempt from VAT, he must in that event split the costs and expenses precisely to specify those costs that relate to the taxable supplies. The input tax will be determined in accordance with the following rules[28]:

Input VAT directly attributed to taxpayer's taxable sales | Deduct in full. |

Input VAT directly attributed to taxpayer's exempt sales | No deduction. |

Overheads and all other input VAT that cannot be directly attributed | Partial deduction based on apportionment. |

The overhead costs/expenses incurred by the Taxable Person for making both taxable and exempted supplies must be apportioned to most accurately reflect the use of those costs in the taxable portion of the taxpayer's activities.

A prescribed default method of proportional deduction is calculated on the values of supplies made in the year, using of the following fraction:

The value of Taxable Supplies made by the Taxable Person in the last calendar yearThe total value of Taxable Supplies and Exempt Supplies made by the Taxable Person during the last calendar year

The fraction for the default method does not include supplies of Capital Assets made by the taxpayer, as these distort the use of input VAT. Alternative attribution methods, using other calculation approaches than the value of supplies, may be approved with ZATCA in cases where these had better reflect the actual use of VAT incurred.

Further information about deduction of VAT and proportional VAT recovery is provided in the Input Tax deduction and Partial Exemption guideline.

VAT Obligations of the Taxable Person

In your capacity as a taxable person, you must evaluate your tax obligation and comply with the conditions and obligations relating to VAT. This includes registering for VAT as necessary, and exactly calculating the net amount of VAT payable, and paying the tax at the time due, as well as keeping all necessary records, and cooperating with officials of the Authority on demand.

If you are not sure of your obligations, you must contact the Authority through its website at vat.gov.sa or by other means of communication, and you may seek external consultation through a qualified consultant. There follows below a review of the most important tax obligations provided for in the Law and the Implementing Regulations.

Issuing tax invoices

A Supplier must issue a tax invoice for each taxable supply made to any VAT-registered person or to any other legal person, or issue a simplified invoice in the event that the value of the supply is less than SAR 1,000, or for supplies made to the end consumer, by no later than fifteen days following the end of the month in which the supply is made.

The tax invoice must clearly detail information such as the invoice date, Supplier's tax identification number, taxable amount, tax rate applied, and the amount of VAT charged[29]. If different rates have been applied to supplies, the value of each supply at each rate must be separately specified, as well as the VAT applicable to each rate. A tax invoice may be issued in the form of a commercial document, provided that document contains all of the requirements for the issuing of tax invoices as set out in the Implementing Regulations to the Law[30].

Third party billing

A third party may issue Tax Invoices for Taxable Supplies provided when the following conditions are met:

A Taxable Supplier should provide the Taxable supplies to their Customer. In this case, the third party issues the invoice on behalf of the Taxable Supplier.

The details of the Supplier, including the Tax Identification Number, must be disclosed on the invoice, and it should be clear that that Supplier issues the Tax Invoice in respect of a supply. The third party must not include its Tax Identification Number on the invoice (and is not required to disclose any of its details on the invoice).

The Taxable Supplier must not issue a Tax Invoice for a supply if a third party has issued a Tax Invoice on its behalf for the same supply.

Obtaining the approval of the concerned Tax authority and provided that all the obligations provided for in the Unified VAT Agreement and the Local Law are fulfilled[31]. For supplies made in the KSA, ZATCA approves the use of billing by third parties provided that the conditions in this notice are met unless it rejects the notification provided to it by the Supplier and third party.

The Supplier shall be responsible for the accuracy of the information shown on the Tax Invoice and for reporting Output Tax on the supply[32].

Both the Supplier and the third party (if registered for VAT purposes) must notify ZATCA with their agreement through the procedure as specified by ZATCA and subject to any further conditions as ZATCA may determine. If ZATCA rejects this notification, the third party must not issue tax invoices on behalf of that Supplier.

Further information on the requirements for tax invoicing can be found in the Taxpayer guideline on Invoicing and Records.

Filing VAT Returns

Each VAT registered person, or the person authorised to act on his behalf, must file a VAT return with ZATCA for each monthly or quarterly tax period. The VAT return is considered the taxable person's self-assessment of tax due for that period.

Monthly VAT periods are mandatory for taxable persons with annual revenues exceeding SAR 40 million. For all other VAT registered persons, the standard tax period is three months.

The VAT return must be filed, and the corresponding payment of net tax due made, no later than the last day of the month following the end of the tax period to which the VAT return relates.

More information on filing of VAT returns is provided in a separate guideline.

If the VAT return results in VAT due to the taxpayer, or if the taxpayer has a credit balance for any reason a request for a refund of this VAT may be made after the filing of the VAT return, or at any later time during the next five years by filing a request for a refund to the Authority. ZATCA will review these requests and will pay the amount due on refund requests that have been approved, directly to the taxpayer.[33]

Keeping records

All taxpayers are required by law to keep appropriate VAT records relating to their calculation of VAT for audit purposes. This includes any documents used to determine the VAT payable on a transaction and in a VAT return. This will generally include:

tax invoices issued and received;

books and accounting documents;

contracts or agreements for large sales and purchases;

bank statements and other financial records;

import, export and shipment documents; and

other records relating to the calculation of VAT.

Records may be kept in physical copy or in some cases electronically - but must be made available to ZATCA on request.

All records must be kept for at least the standard retention period of 6 years. That minimum period for retention is extended to 11 years in connection with invoices and records relating to movable capital assets, and 15 years in connection with invoices and records relating to non-movable capital assets.[34]

The Taxable Person may appoint an Agent or other third party to comply with its record storage requirements. The Taxable Person in all cases remains directly responsible for such compliance.[35]

Certificate of registration within the VAT System

A resident person who is subject to VAT and registered with the Authority in the VAT system must display a certificate to the effect that he has been registered in the VAT system in a place visible to the public at his main place of business and at all his branches.

In the event of a contravention, the person in breach will be liable to the penalties provided for in the Law.

Correcting past errors

If a taxable person becomes aware of an error or an incorrect amount in a filed VAT Return, or of any other non-compliance with the VAT obligation, he should notify ZATCA and correct the error by amending VAT the tax return. Errors resulting in a net understatement of VAT (exceeding SAR 5,000) must be made known to ZATCA within twenty (20) days of detecting the error or incorrect amount, and the previous return must be amended. In connection with minor errors resulting in a difference of less than SAR 5,000 the error may be corrected by amending the net tax in the subsequent tax return[36].

Further information on correcting errors can be found through Zatca.gov.sa.

Penalties

The Authority may impose penalties or fines on taxpayers for violations of VAT requirements set out by the Law or Implementing Regulations[37].

| Description of offence | Associated fine |

|---|---|

| Submitting false documents with the intent of evading the payment of the VAT due or to reducing its value. |

|

| Moving goods in or out of the Kingdom without paying the VAT due. |

|

| Failure to register for the VAT in the allotted timeframe. | SAR 10,000 |

| Filing incorrect tax return, amend a tax return after submission or filing any VAT document with the Authority resulting in a lower amount due. | Equal to 50% of the value of the difference between the calculated Tax and Tax due. |

| Failure to file VAT return in time. | 5%-25% of the VAT in respect of which the return should have been filed. |

| Failure to pay the VAT in time. | 5% of the VAT due for each month or part thereof. |

| Collecting VAT without being registered. | Up to SAR 100,000. |

| Failure to maintain books and records as stipulated in the regulations. | Up to SAR 50,000. |

| Preventing ZATCA employees from performing their duties. | Up to SAR 50,000. |

| Violating of any other provision of the VAT regulations or the VAT law. | Up to SAR 50,000. |

In all cases, if a violation is repeated within three years from the date of issuing the final decision of the penalty, the Authority may double fine for the second offense.

The level of the penalty or fine imposed is set by ZATCA with regard to the taxpayer's behaviour and compliance record (including taxpayers meeting their requirements to notify ZATCA of any errors and provide co-operation to rectify mistakes).

Applying for the issue of rulings (interpretative decisions)

In the event that you are not sure about the manner of application of VAT to a particular activity or particular transaction that you are doing or intend to do, after referring to the relevant provisions and the relevant guideline, you may submit an application to the Authority to obtain a ruling. The application should set out the full facts relating to the particular activity or particular transaction on which you are asking the Authority to express its view.

A reply to a request for a ruling may be either:

Public, in which event the Authority will publish details of the ruling, but without referring to any private particulars relating to the individual taxpayer, or

Private, in which case the Authority will not publish the ruling.

The ruling may contain all of the information relating to the activity or the transaction in respect of which the ruling is requested, in addition to an explanation concerning the particular area of doubt or uncertainty in the law or the guide that you have looked at. You may choose to describe the alternatives and what you consider to be the correct treatment.

The Authority is not obliged to respond to all requests for rulings, and it may review all requests and specify priorities based on certain elements, including:

The level of information submitted by the taxpayer in the request, The potential benefit to taxpayers as a whole on the issuing of a general ruling concerning,

Some transaction or activity,

Whether there is an existing law or guide dealing with this request.

Neither a public nor a private ruling issued by the Authority will be treated as binding on it or upon the taxpayer in connection with any transaction that he performs, and it shall not be possible to rely on it in any manner.

Contact Us

For more information about VAT treatment, kindly visit our website: (zatca.gov.sa); or contact us on the following number: 19993.

Frequently Asked Questions

(1) Can an Agent issue Tax Invoices on behalf of the Principal?

If the Agent acts in his own name, he is deemed to make a supply himself and must issue a Tax Invoice showing the Agent's name and Tax Identification Number.

If the Agent acts in his Principal's name, the tax invoice must show the Principal's name and Tax Identification Number. The Agent is able to issue tax invoices on behalf of the Principal provided the criteria for third party billing are met.

(2) Is an Agent liable for the VAT obligations of the Principal?

If the Agent acts in the name of the Principal and within the authorization or instruction provided by the Principal, the Principal will have the primary liability for all VAT obligations arising as a part of his Economic Activity.

Note that in some cases, including where the Agent participates in the Principal violating his obligations under the Agreement and local law, the Agent can be held jointly liable for the VAT and penalties due.

(3) A VAT registered 'travel agent' sells an international air travel ticket with a price shown in the system of SAR 1,100. The travel agent sells to the Customer for SAR 1,000 plus a separate commission of SAR 100. Will the commission be subject to VAT?

The VAT treatment of the ticket sale and commission depends on whether the travel agent acts in the capacity of an Agent or Principal under the commercial arrangements that governs the transaction.

The case described, with a separately disclosed commission amount, suggests a person acting as an Agent, and acting in the name of the airline makes international air ticket sale. In this case, whilst the underlying ticket is eligible to be zero-rated, the commission amount charged by the travel agent will be subject to VAT at 15%.

(4) A property management company has an agreement with the owners of a commercial property. Under this agreement, the management company is authorized to lease the property to tenants; and is required to carry out supervision, control, operate and maintenance of the property. The management company signs the lease contract with the third party lessee, using its own name as the lessor. How is VAT applied in this case?

The property management company acts in its own name in making supplies to third party lessors. It acts as undisclosed Agent on behalf of the property owners. The property management company must charge VAT on the lease.

(5) A trader sells produce at the market on behalf of local farmers. It passes proceeds back to the farmers less an agreed commission. Is the trader required to issue a Tax Invoice in his name for the supply?

If the trader acts in his own name in making the sales at the local market, he will be presumed to be making the supply for himself. The trader should issue Tax Invoices for the full amount collected from the Customer, and report VAT on the sale.

In this case, the individual farmers will be viewed as making supply of the produce sold (valued at the net amount received from the trader). The farmers must charge VAT on their own supplies if they are Taxable Persons.