Small Business Relief

Corporate Tax Guide | CTGSBR1

August 2023

Contents

3. What is Small Business Relief?

3.1. Who is not eligible for Small Business Relief?

4. Eligibility conditions for Small Business Relief

4.1. Restriction to Tax Periods ending on or before 31 December 2026

5. Impact of the Small Business Relief on other Corporate Tax rules

6. Compliance obligations, record keeping requirements, and administration for Small Business Relief

6.1. Requirement to self-assess, register and make an election

6.2. Requirement to file Tax Returns

Glossary

Accounting Income | : | The accounting net profit or loss for the relevant Tax Period as per the financial statements prepared in accordance with the provisions of Article 20 of the Corporate Tax Law. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or activities, conducted by a Person in the course of its Business. |

Business Restructuring Relief | : | Business Restructuring Relief is a Corporate Tax relief that allows eligible Taxable Persons to transfer their entire Business, or an independent part of their Business (such as for example certain mergers and demergers), at no gain or loss to another Taxable Person in exchange for shares or other ownership interests. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on Juridical Persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses. |

Country-by-Country Reporting | : | An obligation to submit a Country-by-Country Report as introduced by Action 13 of the Base Erosion and Profit Shifting (“BEPS”) initiative led by the Organisation for Economic Co-operation and Development (“OECD”) and the Group of Twenty (“G20”) industrialised nations. This is enforced in the UAE via Cabinet Decision No. 44 of 2020 on Organizing Reports submitted by Multinational Companies. |

Country-by-Country Report | : | A report that declares annually the details of each tax jurisdiction in which a Multinational Enterprise Group (“MNE”) does business. This includes the amount of revenue, profit before income tax and income tax paid and accrued. It also requires MNEs to report their number of employees, stated capital, retained earnings and tangible assets in each tax jurisdiction. Finally, it requires MNEs to identify each entity within the group doing business in a particular tax jurisdiction and to provide an indication of the business activities each entity engages in. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Exempt Income | : | Any income exempt from Corporate Tax under the Corporate Tax Law. |

Foreign Permanent Establishment | : | A place of Business or other form of presence outside the UAE of a Resident Person that is determined in accordance with the criteria prescribed in Article 14 of the Corporate Tax Law. |

FTA | : | Federal Tax Authority, being the Authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A Juridical Person incorporated, established, or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

Interest | : | Any amount accrued or paid for the use of money or credit, including discounts, premiums and profit paid in respect of an Islamic financial instrument and other payments economically equivalent to Interest, and any other amounts incurred in connection with the raising of finance, excluding payments of the principal amount. |

Juridical Person | : | An entity established or otherwise recognised under the laws and regulations of the UAE, or under the laws of a foreign jurisdiction, that has a legal personality separate from its founders, owners and directors. |

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Licensing Authority | : | The competent authority concerned with licensing or authorising a Business or Business Activity in the UAE. |

Natural Person | : | Individual human being (distinct from a Juridical Person). |

Net Interest Expenditure | : | The Interest expenditure amount that is in excess of the Interest income amount as determined in accordance with the provisions of the Corporate Tax Law. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Participating Interest | : | An ownership interest in the shares or capital of a Juridical Person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Permanent Establishment (PE) | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any Natural Person or Juridical Person. |

Personal Investment | : | Investment activity that a Natural Person conducts for their personal account that is neither conducted through a Licence or requiring a Licence from a Licensing Authority in the UAE, nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022 on Issuing the Commercial Transactions Law. |

Qualifying Free Zone Person | : | A Free Zone Person that meets the conditions of Article 18of the Corporate Tax Law and is subject to Corporate Tax under Article 3(2) of the Corporate Tax Law. |

Qualifying Income | : | Any income derived by a Qualifying Free Zone Person that is subject to Corporate Tax at the rate specified in Article 3(2)(a) of the Corporate Tax Law. |

Real Estate Investment | : | Any investment activity conducted by a Natural Person related to, directly or indirectly, the sale, leasing, sub-leasing, and renting of land or real estate property in the UAE that is not conducted, or does not require to be conducted through a Licence from a Licensing Authority. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023 on Small Business Relief. |

Tax Loss | : | Any negative Taxable Income as calculated under the Corporate Tax Law for a given Tax Period. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration Number (“TRN”) | : | A unique number issued by the FTA to each Person who is registered for Corporate Tax purposes in the UAE. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is liable to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Turnover | : | The gross amount of income derived during a Gregorian calendar year. |

UAE | : | United Arab Emirates. |

Wage | : | The wage that is given to the employee in consideration of their services under the employment contract, whether in cash or in kind, payable annually, monthly, weekly, daily, hourly, or by piece-meal, and includes all allowances, and bonuses in addition to any other benefits provided for, in the employment contract or in accordance with the applicable legislation in the UAE. |

Introduction

Overview

Short brief

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (“Corporate Tax Law”) was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates (“UAE”) on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits (“Corporate Tax”) in the UAE.

The provisions of the Corporate Tax Law shall apply to Tax Periods commencing on or after 1 June 2023. The Corporate Tax Law includes a specific relief for small Businesses.

Purpose of the guide

This guide is designed to provide general guidance on the Small Business Relief for Corporate Tax in the UAE. It provides you with and overview of:

What the Small Business Relief is;

Who is eligible for it;

How it works;

How long it is available for; and

Related compliance requirements.

Any Person carrying on a Business in the UAE should review the relevant sections of this guide and consider if the Small Business Relief is applicable to them.

Who should read this guide?

Any Person carrying on a Business in the UAE and consider that they may qualify for the Small Business Relief provided for in the Corporate Tax Law should read this guide to determine if they qualify for Small Business Relief.

How to use this guide

The relevant articles of the Corporate Tax Law are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, simple examples are used to illustrate how key elements of Small Business Relief function. The examples in the guide:

Show how these aspects operate in isolation and do not show the interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used and all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes; and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural person.

This guide is intended to be read in conjunction with other relevant guidance published by the FTA.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as the “Corporate Tax Law”;

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that Are Subject to Corporate Tax is referred to as “Cabinet Decision No. 49 of 2023”;

Cabinet Decision No. 55 of 2023 on Qualifying Income for the Qualifying Free Zone Person for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Cabinet Decision No. 55 of 2023”;

Cabinet Resolution No. 44 of 2020 on Organising Reports Submitted by Multinational Companies is referred to as “Cabinet Resolution No. 44 of 2020”;

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 73 of 2023”;

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 114 of 2023”;

Ministerial Decision No. 116 of 2023 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 116 of 2023”;

Ministerial Decision No. 126 of 2023 on the General Interest Deduction Limitation Rule for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 126 of 2023”;

Ministerial Decision No. 132 of 2023 on Transfers Within a Qualifying Group for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 132 of 2023”; and

Ministerial Decision No. 139 of 2023 Regarding Qualifying Activities and Excluded Activities for the Purposes of Federal Decree Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 139 of 2023”.

Status of this guide

This guidance is not a legally binding document, but is intended to provide assistance in understanding the provisions relating to Small Business Relief. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of the Small Business Relief. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

What is Small Business Relief?

Small Business Relief is provided to small Businesses resident for Corporate Tax purposes in the UAE to ease their implementation of the Corporate Tax regime. Small Business Relief reduces the compliance obligations faced by small Businesses in the early stages of the Corporate Tax regime, primarily by alleviating the burden of having to calculate and pay Corporate Tax.

Any eligible Taxable Person (being a Resident Taxable Person - either a Natural Person or a Juridical Person) with Revenue below or equal to AED 3,000,000 [1] in a relevant Tax Period and all previous Tax Periods that end on or before 31 December 2026 [2] can elect to be treated as having no Taxable Income in that period, and will not be obliged to calculate its Taxable Income or complete a full Tax Return.

This will mean that these eligible Taxable Persons that have elected for the Small Business Relief will benefit from both:

Administrative relief: they will not be required to calculate their Taxable Income and will benefit from simplified tax return filing and record keeping requirements, including the ability to prepare their Financial Statements using the cash basis of accounting; [3] and

Tax relief: they are not required to pay any Corporate Tax on income earned in the Tax Period.

Eligible Taxable Persons can elect for Small Business Relief in their Tax Return. Once the election has been made, they will be able to complete a simplified Tax Return and benefit from the relief.

Table 1: Overview of the Small Business Relief

| If election for Small Business Relief is made | If no election for Small Business Relief is made | |

|---|---|---|

Required to register for Corporate Tax | ✓ | ✓ |

Required to file a full Tax Return | ✗ | ✓ |

Can file a simplified Tax Return | ✓ | ✗ |

Required to calculate Taxable Income | ✗ | ✓ |

No Corporate Tax to pay | ✓ | Depends on the level of Taxable Income |

Subject to meeting necessary conditions: | ||

– Can accrue and utilise Tax Losses for the relevant Tax Period | ✗ | ✓ |

– Can accrue and utilise Excess Interest Expenditure for the relevant Tax Period | ✗ | ✓ |

– Can carry forward Tax Losses and Excess Interest Expenditure from previous Tax Periods | ✓ | ✓ |

– Can apply reliefs for transfers within a Qualifying Group or for Business restructuring transactions | ✗ | ✓ |

– Must comply with transfer pricing documentation requirements | ✗ | ✓ |

– Must comply with the Arm's Length Principle | ✓ | ✓ |

As Table 1 demonstrates, Businesses that elect for Small Business Relief enjoy significant tax and administrative benefits, while remaining subject to a number of compliance requirements.

Revenue threshold

In order to elect for Small Business Relief, an eligible Taxable Person's Revenue must be below or equal to AED 3,000,000 for the relevant Tax Period and all previous Tax Periods [4] . Where a Taxable Person's Revenue exceeds AED 3,000,000 in a Tax Period, the Taxable Person will no longer be able to elect for Small Business Relief, even if its Revenue is equal to or falls below the AED 3,000,000 threshold in subsequent Tax Periods. [5]

The Revenue for the purpose of this Article shall be determined in accordance with the applicable accounting standards accepted in the UAE. [6]

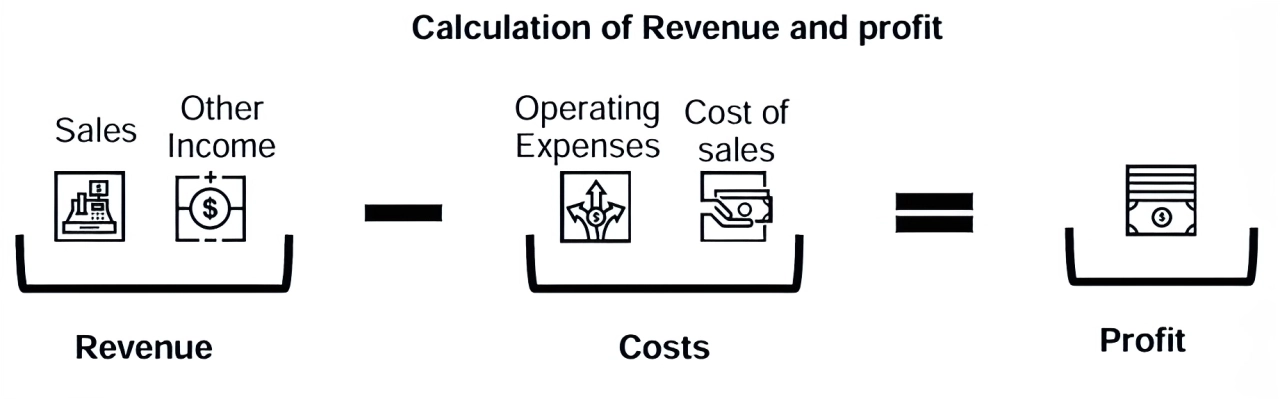

Revenue is defined in the Corporate Tax Law as 'the gross amount of income derived during a Tax Period'. This includes, for example, income from all of the sales a business makes, as well as any other gross income it receives, such as income from the sale of an asset. Revenue is therefore different from profit, which is the difference between a business' Revenue and its costs. The amount of profit a business makes does not have an impact on its eligibility for Small Business Relief. Revenue should be determined based on the arm's length principle.

When determining the Revenue, the income from all Business Activities undertaken by a particular juridical person must be taken into account, and certain defined Business Activities in the case of a natural person.

Who is not eligible for Small Business Relief?

Small Business Relief will be available to UAE Resident Persons whose Revenue does not exceed AED 3,000,000 for the relevant Tax Period and all previous Tax Periods. However, there are two key exceptions to this criterion:

Where the business is a member of a Multinational Enterprise Group (MNE); [7]

Where the business is a Qualifying Free Zone Person. [8]

Members of an MNE

Small Business Relief will not be available to a business that is a constituent company of an MNE. MNEs are groups of companies that operate in more than one country and that have a total consolidated group revenue of more than AED 3.15 billion and are required to prepare a Country-by-Country Report under the UAE's Country-by-Country Reporting legislation. [9]

A constituent company means:

Any separate business unit of an MNE that is included in the consolidated financial statements of the MNE for the purposes of preparing the financial reports;

Any business unit that is excluded from the MNE's consolidated financial statements solely on size or materiality grounds; or

Any PE of a separate business unit of the MNE if the business unit prepares separate financial statements for the PE.

Even if a UAE constituent company of an MNE has Revenue equal to or below AED 3,000,000 for the relevant Tax Period and all previous Tax Periods, the UAE constituent company will still not be able to elect for Small Business Relief.

Qualifying Free Zone Persons

Small Business Relief will not be available to Qualifying Free Zone Persons. Qualifying Free Zone Persons already benefit from a 0% Corporate Tax rate on their Qualifying Income. [10]A Qualifying Free Zone Person is a Free Zone Person that: [11]

Maintains adequate substance in the UAE;

Derives Qualifying Income as specified in the relevant Cabinet Decision; [12]

Has not elected to be subject to Corporate Tax;

Complies with the requirements under the Arm's Length Principle and transfer pricing documentation; and

Meets the following other conditions prescribed by the Minister; [13]

The non-qualifying Revenue derived by the Qualifying Free Zone Person in a Tax Period does not exceed 5% (five percent) of the total Revenue of the Qualifying Free Zone Person in that Tax Period or AED 5,000,000 (five million dirhams), whichever is lower; [14]and

Prepares audited financial statements.

Artificial separation

Small Business Relief will also not be available where a Person artificially separates their Business into more than one entity in order to ensure that the Revenue of each entity is below the threshold for Small Business Relief. [15]Where the FTA establishes that artificial separation has taken place, the Person will have to repay any unpaid Corporate Tax and any penalties that may be charged. [16]

How does Small Business Relief work?

Small Business Relief allows eligible Resident Persons to elect to be treated as having no Taxable Income in a Tax Period where they have Revenue of less than or equal to

AED 3,000,000 in a relevant Tax Period and all previous Tax Periods ending on or before 31 December 2026. As a result of this treatment, they will pay no Corporate Tax. The amount of Corporate Tax liability that is not payable based on the relief will depend on the profitability of the Business. This is because Corporate Tax would be paid at the rate of 0% on Taxable Income up to AED 375,000 and 9% on Taxable Income above AED 375,000 had the Small Business Relief not been elected for. This means that the amount of Corporate Tax relief enjoyed by Businesses that are able to elect for Small Business Relief is relative to their profitability, as shown in Table 2 below.

Table 2: Small Business Relief and relative profitability

Business 1 | Business 2 | Business 3 | |

|---|---|---|---|

Revenue (AED) | 2,800,000 | 2,800,000 | 2,800,000 |

Eligible for Small Business Relief? | ✓ | ✓ | ✓ |

Costs (AED) | 2,000,000 | 1,800,000 | 1,300,000 |

Profits (AED) | 800,000 | 1,000,000 | 1,500,000 |

Corporate Tax Payable calculation (AED) | 375,000 @ 0% 425,000 @ 9% | 375,000 @ 0% 625,000 @ 9% | 375,000 @ 0% 1,125,000 @ 9% |

Corporate Tax due (AED) | 38,250 | 56,250 | 101,250 |

Small Business Relief is an optional relief, and Resident Persons that wish to benefit from this advantage must elect for this relief within their Tax Return. Once the Tax Return for the relevant Tax Period has been submitted with no election to benefit from the Small Business Relief, there would be no possibility to claim this benefit at a later stage.

As the election must be made in a Tax Return, an eligible Taxable Person seeking to claim Small Business Relief will first need to register with the FTA for Corporate Tax and obtain a TRN in order to be able to make the election. Additionally, they will need to keep information to demonstrate their eligibility for the relief. This includes keeping records of their Revenue. More details on the compliance obligations that apply to Businesses that elect for Small Business Relief can be found in Section 6.

What does it mean to have no Taxable Income?

Ordinarily, businesses would calculate their Taxable Income by calculating their Accounting Income and making adjustments for the Corporate Tax treatment of certain income and expenditure. This includes excluding Exempt Income, such as dividends, and adding back non-deductible expenditure, such as fines. Businesses may also be eligible for other reliefs, such as for transfers within a Qualifying Group, which would be applied when calculating Taxable Income. Businesses then have to calculate the amount of Corporate Tax they must pay based on their Taxable Income.

By contrast, Small Business Relief treats eligible Taxable Persons as having no Taxable Income for the relevant Tax Period. This means that they will not have to calculate their Taxable Income, and that they do not need to identify the relevant expenses that they would otherwise be required to in order to deduct or apply any other reliefs.

As Corporate Tax is only charged on Taxable Income, Taxable Persons electing for Small Business Relief for that Tax Period do not need to pay Corporate Tax.

Businesses who elect for Small Business Relief will complete a simplified Tax Return. Electing for Small Business Relief means that certain other provisions of the Corporate Tax Law that are relevant to the calculation of Taxable Income will not apply. Additionally, Businesses that elect for Small Business Relief will not be required to maintain Transfer Pricing documentation. [17]These exclusions are intended to further reduce the compliance burden. See Section 5 for detailed information on each of these provisions.

Tax Losses

If an eligible Resident Person elects for Small Business Relief for a Tax Period, it will not be able to apply the provisions of the Corporate Tax Law relating to Tax Losses in that Tax Period. [18]This means that they cannot accrue, utilise or transfer any Tax Losses.

If the Resident Person has unutilised Tax Losses brought forward from prior Tax Periods at the beginning of a Tax Period in which it elects for Small Business Relief, such Tax Losses will continue to be carried forward and can be used in the next Tax Period in which the Resident Person has Taxable Income and has not elected for Small Business Relief, subject to meeting the conditions of carrying forward and utilising available Tax Losses. [19]

More information on the treatment of Tax Losses when electing for Small Business Relief can be found in Section 5.1.

General Interest Deduction Limitation Rule

If an eligible Resident Person elects for Small Business Relief for a Tax Period, the General Interest Deduction Limitation Rule will not apply in that Tax Period. [20]This means that they cannot accrue or utilise any Net Interest Expenditure in that Tax Period, nor carry it forward to any subsequent Tax Periods. [21]

If the Resident Person has carried forward Net Interest Expenditure incurred in previous Tax Periods where an election for Small Business Relief was not made, at the beginning of a Tax Period in which it elects for Small Business Relief, such Net Interest Expenditure will be carried forward and can be used in the next Tax Period in which it has Taxable Income and has not elected for Small Business Relief, subject to the relevant provisions of the General Interest Deduction Limitation Rule. [22]

More information on the application of the General Interest Deduction Limitation Rule when electing for Small Business Relief can be found in Section 5.2.

Other reliefs

In addition to the Tax Loss Rules and General Interest Deduction Limitation Rule, there are a number of other reliefs that do not apply where a Resident Person has elected for Small Business Relief. [23]This includes being able to transfer assets at net book value within a Qualifying Group and Business Restructuring Relief.

More information on the treatment of these reliefs can be found in Section 5.4.

Exempt Income

Certain types of income, known as Exempt Income, are not taxable. However, this distinction is only relevant for businesses that need to calculate their Taxable Income.

The rules on Exempt Income therefore do not apply to businesses that elect for Small Business Relief. [24]

More information on the treatment of Exempt Income when electing for Small Business Relief can be found in Section 5.3.

How to elect for Small Business Relief

Eligible Taxable Persons that meet the conditions for Small Business Relief and wishing to benefit from Small Business Relief must first register for Corporate Tax. Then they must make an election in their Tax Return in order to benefit from the relief. This election must be made for each Tax Period that a Tax Return is filed in order for the relief to apply for that Tax Period.

More information on Tax Returns and broader compliance requirements when electing for Small Business Relief can be found in Section 6.

Eligibility conditions for Small Business Relief

In order to be able to elect for Small Business Relief, a Person must be a Resident Person for Corporate Tax purposes and have Revenue of less than or equal to AED 3,000,000 in the relevant Tax Period and any previous Tax Periods.

There are no additional requirements. The only exception is that members of MNEs and Qualifying Free Zone Persons are not eligible for Small Business Relief. See Section 3.1 for more details on MNEs and Qualifying Free Zone Persons.

Restriction to Tax Periods ending on or before 31 December 2026

Small Business Relief will be available for Tax Periods that begin on or after 1 June 2023. Small Business Relief will be available for Tax Periods that end before or on 31 December 2026 in which the Revenue in the relevant Tax Period and all previous Tax Periods was less than or equal to AED 3,000,000.

Illustrative examples

Example 1: Electing for Small Business Relief

Mr X operates a Business in Abu Dhabi. He is a Resident Person for Corporate Tax purposes. He started trading on 1 January 2025 and his Tax Period ends on 31 December. In the most recent Tax Period ending 31 December 2025, Mr X derived Revenue of AED 2,000,000.

Mr X is eligible to benefit from Small Business Relief because he is a Natural Person with a Business or Business Activity generating Revenue in excess of AED 1,000,000 and less than AED 3,000,000 for the 31 December 2025 Tax Period.

Mr. X has not breached the Revenue threshold from previous periods given that the 2025 Tax Period is his first year of operation.

If he wishes to benefit from Small Business Relief, he must make an election in his Tax Return.

Example 2: Non-Resident Persons

ABC Ltd is a USA-incorporated company that has an office in Dubai from which it assists its UAE-based clients. ABC Ltd is a Non-Resident Person for Corporate Tax purposes. In its most recent Tax Period ending 31 December 2024, ABC Ltd derived Revenue of AED 2,500,000, with AED 1,000,000 of this Revenue attributable to its office in Dubai.

ABC Ltd is not eligible for Small Business Relief as it is a Non-Resident Person, regardless of its Revenue or having an office in Dubai.

Example 3: Revenue in previous Tax Periods

Ms Y operates a Business in Sharjah. She is a Resident Person for Corporate Tax purposes. Her Tax Period ends on 31 December each year.

In the most recent Tax Period ending 31 December 2026, Ms Y derived Revenue of AED 1,900,000. In the previous Tax Period ending 31 December 2025, she had Revenue of AED 4,300,000.

Ms Y is not eligible to benefit from Small Business Relief for the Tax Period ending 31 December 2026 as her Revenue has exceeded the threshold of AED 3,000,000 in a prior Tax Period.

What is a Resident Person?

There are specific rules within the Corporate Tax Law for determining whether a Person is a Resident Person, and these differ from many other international residence rules that look to where someone lives or resides. The rules are also different for Natural Persons (i.e. individuals) and Juridical Persons (e.g. companies).

A short explanation of how the Corporate Tax residence rules work is provided below.

Natural Persons

Natural Persons are individuals and will be considered as Resident Persons for Corporate Tax purposes if they conduct a taxable Business or a Business Activity in the UAE generating Turnover above a set threshold determined in a Cabinet Decision. In this regard, Cabinet Decision No. 49 of 2023specifies that the threshold is AED 1,000,000 of Turnover derived within the Gregorian calendar year. [25]

However, income derived by a Natural Person from the following three sources shall not be regarded as being derived from Businesses or Business Activities that are subject to Corporate Tax, regardless of the amount of income derived from such sources:

Wages;

Personal Investment income; and

Real Estate Investment income. [26]

Where a Natural Person receives income from any of these three sources, such income will not be subject to Corporate Tax, and are excluded from the AED 1,000,000 Turnover threshold. [27]

Where a Natural Person derives income from Businesses or Business Activities above the AED 1,000,000 threshold during a Gregorian calendar year, he will be subject to Corporate Tax and will be required to register for Corporate Tax. In this instance, he may be able to claim Small Business Relief if they meet the requirements of the Small Business Relief.

Juridical Persons

Juridical Persons are entities that have a separate legal personality from their owners. Common examples include Limited Liability Companies (LLCs), Private Shareholding Companies (PSCs) and Public Joint Stock Companies (PJSCs).

A Juridical Person will be a Resident Person if it is incorporated or otherwise established or recognised under the applicable legislation in the UAE, [28]or incorporated otherwise established or recognised under the applicable legislation outside the UAE but 'effectively managed and controlled' in the UAE. [29]

Whether a foreign legal entity is effectively managed and controlled in the UAE depends on the facts and circumstances specific to that entity. However, a business is generally considered to be effectively managed and controlled where key management and commercial decisions concerned with broader strategic and policy matters are made. This is distinct from day to day operational management.

Free Zone Persons are Juridical Persons that are incorporated, established or otherwise registered in a Free Zone, and are Resident Persons for Corporate Tax purposes. This means that Free Zone Persons may be eligible for Small Business Relief, subject to having Revenue that is equal to or below AED 3,000,000. [30]However, Qualifying Free Zone Persons are not eligible for Small Business Relief. A Qualifying Free Zone Person is a Free Zone Person that meets certain criteria. These are set out at Section 3.1.2.

Example 4: Residence of Juridical Persons

ABC LLC was incorporated in the UAE. ABC LLC is a Resident Person for Corporate Tax purposes.

Example 5: Residence of Juridical Persons

DEF LLC was incorporated in a foreign country. It is effectively managed and controlled in the UAE. DEF LLC is a Resident Person for Corporate Tax purposes.

Example 6: Residence of Juridical Persons

XYZ LLC was incorporated in a foreign country. It conducts Business in the UAE without any fixed place of business in the UAE. XYZ LLC is not a Resident Person for Corporate Tax purposes.

Exclusion of members of MNEs

Constituent companies of MNEs will not be eligible for Small Business Relief, even if they are Resident Persons. [31]

An MNE is any group that is made up of two or more companies that operate in separate countries, or includes a single company that is resident in one country and subject to tax in another, and has total consolidated group revenue of at least AED 3.15 billion. [32]

A constituent company means any separate business unit of an MNE that is included in the consolidated financial statements of the MNE for the purposes of preparing the financial reports, or any business unit that is excluded from the MNE's consolidated financial statements solely on size or materiality grounds. In addition, any PE of a separate business unit of the MNE will be considered a constituent company if the business unit prepares separate financial statements for the PE.

The definition of a 'constituent company' is based on Cabinet Resolution No. 44 of 2020 on Organising Reports Submitted by Multinational Companies. Therefore, any changes that are made to this definition in future will potentially affect a Taxable Person's eligibility for Small Business Relief.

Exclusion of Qualifying Free Zone Persons

Qualifying Free Zone Persons will not be eligible for Small Business Relief, even if they are Resident Persons and have Revenue that is equal to or less than AED 3,000,000 in the relevant Tax Period and all previous Tax Periods. [33]

Free Zone Persons that are not Qualifying Free Zone Persons are eligible for Small Business Relief and can elect for Small Business Relief if they are a Resident Person and their Revenue does not exceed AED 3,000,000 in the relevant Tax Period and all previous Tax Periods.

Qualifying Free Zone Persons that elect to be subject to Corporate Tax under Article 19 of the Corporate Tax Law for a specific Tax Period are then considered as Free Zone Persons and can elect for Small Business Relief if they meet the requirements for Small Business Relief.

Permanent Establishments of Non-Resident Persons

In general, PEs in the UAE of Non-Resident Persons would not be eligible for the Small Business Relief as they are not considered as Resident Persons. However, if the Non- Resident Person is based in a country which has a Double Taxation Agreement in force with the UAE and if that Agreement includes a provision dealing with non- discrimination of a Permanent Establishment based on the OECD Model Tax Convention or the UN Model Double Tax Convention, [34]its UAE PE would be eligible for the Small Business Relief if the required conditions to apply the relief are met.

UAE sourced income and foreign income

Many businesses will earn income from within and outside of the UAE. Both of these sources of income must be considered when calculating Revenue. This is because Revenue is based on gross income and includes all of the income that a Business earns.

Juridical Persons must include all of their foreign and UAE income when calculating their Revenue for Small Business Relief purposes. However, Natural Persons should only take into account foreign income that is related to their taxable Business or Business Activity in the UAE (in addition to their domestic income). This is aligned to the rules for Taxable Income.

Accounting standards for Revenue calculation

Accounting standards are sets of rules and principles that are managed by regulatory bodies, and that govern how businesses report their financial activities. Some of the rules and principles differ between regulatory bodies and, as a result, the choice of accounting standard will determine and may impact the amount of Revenue a business is determined to have earned in a Tax Period.

Businesses that elect for Small Business Relief will be able to prepare financial statements based on the cash basis of accounting, if their revenue does not exceed AED 3,000,000. [35]

Revenue is the gross amount of income derived during a Tax Period calculated according to applicable accounting standards. According to Ministerial Decision No. 114 of 2023, the applicable accounting standard is International Financial Reporting Standards ('IFRS') or IFRS for SME's. [36]However, a Person may prepare Financial Statements using the Cash Basis of Accounting, where the Person derives Revenue that does not exceed AED 3,000,000. [37]Thus, a business may apply either IFRS (or IFRS for SME's), or a Cash Basis of Accounting in order to calculate their Revenue for the purposes of determining if they are eligible to elect the Small Business Relief. However, the FTA has the right to challenge this choice if the outcome is unreasonable.

It is important to note that Revenue is not restricted to the sale of goods or services by a business. It includes all income earned in the period. For example, if a business sells an asset like a vehicle, or a part of its business, the proceeds of these sales must be included in its Revenue calculation. Non-cash receipts (e.g. goods received in terms of a barter transaction) should be included in Revenue at the market value.

As Figure 1 above demonstrates, Revenue is not the same as profit. Businesses do not take into account their expenses or costs when calculating their Revenue.

Example 7: Calculation of Revenue

ABC LLC is a UAE Resident Person. During its most recent Tax Period, ABC LLC made sales of AED 1,500,000 and received AED 1,000,000 of dividends from UAE companies. It had operating expenses of AED 2,000,000.

ABC LLC therefore has Revenue of AED 2,500,000, costs of AED 2,000,000 and a profit of AED 500,000. However, the costs and profit are not relevant for the purposes of assessing whether ABC LLC is eligible for Small Business Relief. ABC LLC will be eligible because its Revenue is below the threshold of AED 3,000,000.

Implications for Resident Persons that are VAT registered

Businesses that are registered for VAT are required to charge VAT on certain products or services that they sell. The VAT charged should not be included in the calculation of Revenue. This is because the VAT collected must be transferred to the FTA and does not belong to the Business.

Small Business Relief is a Corporate Tax relief. It does not change the Resident Person's compliance requirements for VAT or any other purpose in any way. This means that while some Taxable Persons can benefit from Small Business Relief for Corporate Tax purposes and therefore have simplified Corporate Tax compliance requirements, their VAT compliance requirements will continue as before.

Illustrative examples

Example 8: Sale of Business asset during a Tax Period

Mr X is a Resident Person for Corporate Tax purposes. He has conducted a Business for many years and his Revenue has never exceeded AED 3,000,000. In the Tax Period ending on 31 December 2024, his Revenue was AED 1,850,000 and he elected for Small Business Relief.

During the Tax Period ending 31 December 2025, Mr X agreed to sell his shop to a friend for AED 1,200,000. Mr X's Revenue for the Tax Period, including the proceeds from the sale of the shop, totalled AED 4,150,000.

Mr X is not eligible for Small Business Relief for the Tax Period ending 31 December 2025. The fact that Mr X's Revenue has exceeded the Revenue threshold as a result of a one-off event is not relevant. Because Mr X's Revenue exceeded AED 3,000,000, he will not be able to elect for Small Business Relief again, even if his Revenue in the Tax Period ending 31 December 2026 is less than AED 3,000,000.

Example 9: Resident Person anticipates exceeding the Revenue threshold

ABC LLC is a Resident Person for Corporate Tax purposes. ABC LLC has been conducting Business for a number of years but has never generated Revenue of more than AED 2,000,000. ABC LLC elected for Small Business Relief for the Tax Period ending 31 December 2024.

At the beginning of 2025, one of ABC LLC's competitors ceased trading suddenly and ABC LLC experienced a huge increase in sales as a result. ABC LLC now forecasts that for the Tax Period ending on 31 December 2025, it will have Revenue of more than AED 5,000,000.

ABC LLC does not need to do anything different immediately. However, if its Revenue for the 31 December 2025 Tax Period does exceed AED 3,000,000, it will no longer be eligible for Small Business Relief. It will have to calculate and pay Corporate Tax on its Taxable Income.

In this regard, ABC LLC will need to consider all the relevant provisions of the Corporate Tax Law, including any reliefs which might be applicable.

Impact of the Small Business Relief on other Corporate Tax rules

Businesses that elect for Small Business Relief are excluded from applying certain other Corporate Tax reliefs and rules. This is because these reliefs are relevant for the calculation of Taxable Income, and Small Business Relief treats eligible Taxable Persons as having no Taxable Income for the relevant Tax Period. However, they will still need to comply with the filing obligations set out in the Corporate Tax Law.

Eligible Taxable Persons that elect for Small Business Relief are also exempt from the requirement to maintain transfer pricing documentation. This measure is intended to further reduce the compliance burden on small Businesses.

Tax Losses

If a Taxable Person has negative Taxable Profit, known as a Tax Loss, it can offset its Tax Loss against its Taxable Income in later Tax Periods. If the Taxable Person is a Juridical Person, it will also be able to transfer Tax Losses to other Juridical Persons, subject to certain conditions being met. [38]

Implications of election for Small Business Relief on Tax Losses

When an eligible Taxable Person elects for Small Business Relief, the rules on Tax Losses will not apply in that Tax Period. [39]This means that in the Tax Period where an eligible Taxable Person elects for Small Business Relief, the Taxable Person will not be able to accrue, utilise or transfer Tax Losses.

If a Taxable Person has unutilised Tax Losses from a previous Tax Period where an election to apply the Small Business Relief was not made, these will be carried forward to future Tax Periods, and can be offset against Taxable Income in the future when they do not elect for Small Business Relief, subject to the conditions set out in the Corporate Tax Law. [40]

Illustrative examples

Example 10: Carried forward unutilised Tax Losses

Mr X is a Resident Person. In the Tax Period ending 31 December 2024, his Revenue was AED 2,500,000. Mr X did not elect for Small Business Relief and had a Tax Loss of AED 400,000 to carry forward.

In the Tax Period ending 31 December 2025, Mr X's Revenue was AED 1,700,000.

Mr X elects for Small Business Relief for the Tax Period ending 31 December 2025. His carried forward Tax Losses of AED 400,000 cannot be used in this Tax Period, but will be carried forward and can be used in future Tax Periods (provided the relevant conditions are met).

Example 11: Tax Losses

ABC LLC is a Resident Person that started trading on 1 January 2025. In the Tax Period ending 31 December 2025, ABC LLC had Revenue of AED 2,500,000 and expenses and costs of AED 3,500,000. This resulted in ABC LLC having a negative Taxable Income (i.e. a Tax Loss) of AED 1,000,000 for the 31 December 2025 Tax Period.

As a Resident Person whose Revenue does not exceed AED 3,000,000, ABC LLC is eligible to elect for Small Business Relief.

If ABC LLC elects for Small Business Relief, it will be treated as having no Taxable Income and benefit from simplified compliance requirements. Electing for Small Business Relief means that the Tax Loss incurred will not be declared to the FTA and cannot be carried forward to future Tax Periods.

If ABC LLC chooses not to elect for Small Business Relief, it will be able to declare its Tax Loss to the FTA and the Tax Loss can be carried forward to be utilised in future Tax Periods. However, in order to do this, ABC LLC would have to comply with ordinary Corporate Tax compliance requirements, including calculating Taxable Income and completing a full Tax Return.

Example 12: Transfer of Tax Losses

ABC LLC and DEF LLC are Resident Persons that are both wholly-owned by XYZ LLC and meet all the required conditions to transfer Tax Losses to each other.

In the Tax Period ending 31 December 2026, ABC LLC had Revenue of AED 2,500,000 and Taxable Income of AED 500,000. At the beginning of this Tax Period, ABC LLC had carried forward unutilised Tax Losses of AED 700,000. ABC LLC has not had Revenue exceeding AED 3,000,000 in any previous Tax Period and is eligible for Small Business Relief.

In the same Tax Period, DEF LLC had Revenue of AED 7,500,000 and Taxable Income of AED 3,100,000.

If ABC LLC elects for Small Business Relief, it will be treated as not having any Taxable Income and will not pay any Corporate Tax. However, this also means that ABC LLC will be unable to transfer any of its unutilised Tax Losses to DEF LLC.

If ABC LLC does not elect for Small Business Relief, it will be required to pay Corporate Tax on its Taxable Income. Furthermore, it will be able to both reduce its Taxable Income using its Tax Losses and transfer its remaining Tax Losses to DEF LLC, subject to meeting all the required conditions of transferring Tax Losses and provided ABC and DEF do not form a tax group.

General Interest deduction limitation rules

The amount of Interest expenditure that Businesses can deduct in each Tax Period when calculating their Taxable Income may be limited. [41]Businesses can deduct their Net Interest Expenditure up to 30% of their accounting earnings before the deduction of interest, tax, depreciation and amortisation (EBITDA) in that Tax Period - this is known as the general Interest deduction limitation rule. These rules only apply to Businesses whose Net Interest Expenditure is greater than a set threshold.

The limitation on the deductible Net Interest Expenditure shall not apply where the Net Interest Expenditure for the relevant Tax Period does not exceed AED 12,000,000. [42]

Net Interest Expenditure which exceeds 30% of the Business's EBITDA cannot be deducted due to this limitation in the Tax Period it is incurred, and instead can be carried forward for ten Tax Periods from the period in which the Net Interest Expenditure was disallowed. [43]In addition to the amount being limited, there are rules that limit the circumstances in which a deduction can be made for Interest expenditure incurred on a loan obtained, directly or indirectly, from a Related Party. [44]

Implications of election for Small Business Relief on General Interest Deduction Limitation Rule

The limitations on the deduction of Interest expenditure do not apply to Businesses in the Tax Periods that they have elected for Small Business Relief. [45]This also means that Businesses will not be able to accrue Net Interest Expenditure that can be carried forward to later years or use Interest expenditure from previous years. [46]

If a Business has Net Interest Expenditure carried forward from a previous Tax Period, this will be carried forward to future Tax Periods, and can be utilised in future Tax Periods in which the Business does not elect for Small Business Relief. [47]However, the Tax Periods in which Businesses elect for Small Business Relief will continue to be counted for the purposes of limiting the carry forward to ten subsequent Tax Periods from the Tax Period in which the Net Interest Expenditure was disallowed.

Example 13: Carry forward of Net Interest Expenditure

ABC LLC is a Resident Person for Corporate Tax purposes. In the Tax Period ending 31 December 2024, ABC LLC had Revenue of AED 2,000,000 but it did not elect for Small Business Relief. During the same Tax Period, ABC LLC has excess Interest expenditure of AED 400,000, which is carried forward to be used in subsequent Tax Periods.

In the Tax Period ending 31 December 2025, ABC LLC had Revenue of AED 2,000,000. ABC LLC elected for Small Business Relief for that Tax Period. As a result, it was unable to utilise any of its carried forward Net Interest Expenditure. This also means that any Net Interest Expenditure incurred in that Tax Period cannot be carried forward to later years. Accordingly, the Net Interest Expenditure of AED 400,000 will be carried forward to the next Tax Period, unless ABC LLC would elect again for the Small Business Relief for that Tax Period if the required conditions are met.

Given ABC LLC is eligible for and elects the Small Business Relief, they would not be required to calculate their Net Interest Expenditure for the Tax Period ending 31 December 2025.

Exempt Income

Certain types of income are not taxable. These are known as Exempt Income, and when calculating Taxable Income, Businesses must exclude these items. Exempt Income includes:

Dividends and other profit distributions received from Juridical Persons resident in the UAE;

Other income and gains from a Participating Interest in a Juridical Person resident in the UAE;

Dividends and other profit distributions received from a Participating Interest in a foreign Juridical Person; and

Income of a Foreign Permanent Establishment, subject to meeting certain conditions. [48]

Interaction between Exempt Income and Small Business Relief

The rules on Exempt Income do not apply to Businesses that have elected for Small Business Relief. [49]This means that all income, even if it would not be taxable, must be included when a Resident Person calculates its Revenue for Small Business Relief Purposes.

Example 14: Exempt Income - Dividends from UAE companies

ABC LLC is a Resident Person for Corporate Tax purposes. During its Tax Period ending 31 December 2024, it made sales of AED 2,500,000. ABC LLC also received dividends of AED 1,000,000 from DEF LLC, a Resident Person. The income from the dividends are Exempt Income and would not be included when calculating ABC LLC's Taxable Income.

As the provisions of the Corporate Tax Law relating to Exempt Income do not apply when a Business is seeking to benefit from Small Business Relief, the dividend income should be included in the calculation of ABC LLC's Revenue. ABC LLC's Revenue for the Tax Period is therefore AED 3,500,000 (AED 2,500,000 + AED 1,000,000), and ABC LLC is not eligible to elect for Small Business Relief for the Tax Period ending 31 December 2024.

Other Reliefs

Businesses can benefit from relief where assets or liabilities are transferred within a Qualifying Group, and for certain Business restructuring transactions. Where certain conditions are met, both parties in these types of transactions are able to record the transaction as taking place at net book value. This means that there will be no gain or loss attributed to either party for Corporate Tax purposes.

As Business Restructuring Relief and relief for transfers within a Qualifying Group impact both parties in the transaction, businesses will need to consider the impact of their choice on the other party to the transfer or business restructuring transactions they are involved in.

Implications of election for Small Business Relief on other reliefs

These reliefs are not available to Businesses in the Tax Periods for which they elect for Small Business Relief. [50]Small Business Relief works by treating Businesses as if they had no Taxable Income. Therefore, the amount for which a transaction is treated as having taken place will have no impact on the Business tax position.

Example 15: Transfer within a Qualifying Group

ABC LLC and DEF LLC are each wholly-owned by XYZ LLC. All three companies are Resident Persons for Corporate Tax purposes, and ABC LLC and DEF LLC meet the conditions to be considered a Qualifying Group. Accordingly, transfers of assets and liabilities between them can benefit from the relevant relief. [51]

During their Tax Period ending 30 June 2024, ABC LLC had Revenue of AED 2,200,000 and DEF LLC had Revenue of AED 4,500,000. During the same Tax Period, DEF LLC sold a vehicle to ABC LLC. The vehicle had a net book value of AED 100,000 and ABC LLC paid AED 200,000 for it, resulting in a gain of AED 100,000 for DEF LLC.

ABC LLC is eligible to elect for Small Business Relief due to having Revenue below AED 3,000,000. The transfer of the vehicle is eligible for relief due to being transferred between members of the same Qualifying Group.

If ABC LLC elects for Small Business Relief, ABC LLC will be treated as having no Taxable Income and DEF LLC will be unable to apply the transfer within the Qualifying Group relief for the sale of the vehicle. This means that DEF LLC will have to recognise, and pay Corporate Tax on, the gain of AED 100,000 from the vehicle sale.

If ABC LLC does not elect for Small Business Relief, ABC LLC and DEF LLC can benefit from intra-group relief on the sale of the vehicle provided that DEF LLC made an election to apply the transfers within a Qualifying Group relief. [52]This means that the sale will be treated as having taken place at net book value and no gain or loss will arise for either ABC LLC or DEF LLC. However, by not electing for Small Business Relief, ABC LLC would have to calculate and pay Corporate Tax on its Taxable Income by filing a Tax Return.

Deductions

Certain expenditures are disallowed or limited for Corporate Tax purposes. As these rules differ from ordinary accounting rules, this means that, when calculating their Taxable Income, Businesses must exclude or adjust some deductions.

Deductible expenditure rules do not apply to those who elect for Small Business Relief

The rules on deductions do not apply to Businesses in Tax Periods for which they have elected for Small Business Relief. [53]Small Business Relief is based on Revenue alone and, as it works by treating Businesses as if they had no Taxable Income, there will be no requirement to consider deductions. This means that any expenditure, even if it would not ordinarily be allowable for Corporate Tax purposes, will not impact a Business that has elected for Small Business Relief.

Example 16: Deductible expenditure

Mr X is a Resident Person who conducts Business in Dubai. During his Tax Period ending 30 September 2024, Mr X's Revenue was AED 1,850,000. During the same Tax Period, he makes a donation of AED 100,000 to a local charity that is not a Qualifying Public Benefit Entity.

Donations made to entities that are not Qualifying Public Benefit Entities are not allowed to be deductible for Corporate Tax purposes. However, as the provisions of the Corporate Tax Law relating to deductions do not apply when a Business is seeking to benefit from Small Business Relief, the donation made and the fact that the amount is non-deductible for Corporate Tax purposes has no impact on Mr X's eligibility for Small Business Relief.

Transfer pricing documentation

Transfer pricing is an internationally recognised approach used to determine the price that should be charged by a taxable person when conducting transactions with related parties or connected persons. Transfer pricing is applied on cross-border transactions to prevent base erosion and profits shifting between taxable entities and non or low- taxed entities.

The FTA can require a Business to file its transfer pricing disclosure and other supporting documentation together with its Tax Return, or within 30 days of being requested to provide it by the FTA. [54]

Transfer pricing documentation requirements for those who elect for Small Business Relief

Transfer pricing documentation rules do not apply to Businesses in the Tax Period for which they elect for Small Business Relief. [55]

It is important to note that this provision relates to the requirement to provide a disclosure at the same time as its Tax Return, or within 30 days of it being requested by the FTA, and the requirement to maintain a master and local file. It does not prevent the FTA from enquiring into the Resident Person's Corporate Tax affairs, or reviewing its transactions, including those with its Related Parties. The Resident Person must also ensure that they have considered and complied with the Arm's Length Principle.

Example 17: Transfer Pricing Documentation

ABC LLC is a Resident Person for Corporate Tax purposes. During its Tax Period ending 31 May 2025, it had Revenue of AED 2,800,000. This was made up entirely of sales made to DEF Ltd, a foreign company that is a Related Party.

ABC LLC elects for Small Business Relief. The FTA would not require ABC LLC to file a disclosure containing information regarding its transactions and arrangements with its Related Party along with its Tax Return, nor request any transfer pricing documentation.

However, ABC LLC is still required to ensure that its transactions with DEF Ltd are consistent with the Arm's Length Principle.

Participation Exemption for owners of UAE Juridical Persons that elect for Small Business Relief

Dividends from companies resident in the UAE are exempt from Corporate Tax. In addition, other income and gains from UAE resident companies may also be exempt if the relevant conditions under the Participation Exemption are met. [56]

A Participating Interest is a long-term ownership interest in a Juridical Person that provides the basis for the exercise of some level of control or influence over the activities of the Participation. There are a number of conditions which must be satisfied for a Participating Interest to exist. [57]One of these conditions is that the Juridical Person is subject to Corporate Tax at a rate of at least 9%. [58]

Although Businesses that elect for Small Business Relief will effectively not have a Corporate Tax liability, they are still considered to be subject to Corporate Tax.

As a result, Persons that hold a Participating Interest in a Business that elects for Small Business Relief should be able to benefit from the Participation Exemption relief, subject to meeting the relevant conditions. This also applies in the case of Persons with capital gains and the other income. [59]

Any dividends received by a Taxable Person electing for Small Business Relief from UAE resident companies are exempt and are not subject to the Participation Exemption conditions.

Tax Groups and Small Business Relief

Companies under common ownership (and meeting other relevant conditions) are able to form a Tax Group. [60]This allows these companies to be treated as a single Taxable Person, reducing the compliance burden on individual companies by consolidating accounts and eliminating intra-group transactions, and increasing flexibility in the utilisation of Tax Losses.

A Tax Group is able to elect for Small Business Relief if its Revenue is equal to or below AED 3,000,000. As a single Taxable Person, the Revenue threshold for Small Business Relief will apply to the Tax Group as a whole, rather than to each member of the Tax Group. Irrespective of how many companies make up the Tax Group, the Revenue threshold of AED 3,000,000 will apply to the Tax Group as a whole.

Example 18: Tax Groups and Small Business Relief

ABC LLC is the Parent Company of a Tax Group, which also includes its wholly- owned subsidiaries XYZ LLC and DEF LLC. During its Tax Period ending 31 July 2024, ABC LLC itself had Revenue of AED 1,300,000, XYZ LLC had Revenue of AED 900,000 and DEF LLC had Revenue of AED 1,000,000. None of the Revenues of ABC LLC, XYZ LLC and DEF LLC are earned from each other.

The total consolidated Revenue for the Tax Group (after netting of intra-group transactions) was therefore AED 3,200,000 (AED 1,300,000 + AED 900,000 + AED 1,000,000).

Although each of the companies has Revenue below the threshold for Small Business Relief, the Tax Group will not be eligible for Small Business Relief. This is because the Tax Group is treated as a single Taxable Person, and the Tax Group's overall consolidated Revenue of AED 3,200,000 is above the Small Business Relief threshold of AED 3,000,000.

Compliance obligations, record keeping requirements and administration for Small Business Relief

Requirement to self-assess, register and make an election

In order to claim Small Business Relief, the eligible Taxable Person must first be registered for Corporate Tax. It then can elect for the relief through the filing of a Tax Return. An election must be made in each Taxable Period.

An eligible Taxable Person that has elected for Small Business Relief remains a Taxable Person for the purposes of the Corporate Tax Law. This means that it will continue to be required to meet its Corporate Tax compliance obligations in each Tax Period. This includes the obligation to register for Corporate Tax, file a simplified Tax Return and retain all relevant documents and records to support their Corporate Tax filings.

Requirement to file Tax Returns

Businesses will be required to make the election for Small Business Relief in their Tax Return. Therefore, the requirement to file Tax Returns is not impacted by the eligibility for the Small Business Relief.

Businesses that elect for the Small Business Relief will however benefit from a simplified Tax Return, reducing the amount of information they need to provide, and the amount of time needed to complete the Tax Return.

Records required to be kept to demonstrate Revenue

The Corporate Tax Law includes a number of record-keeping requirements. These are in addition to the requirements already imposed on Businesses and their agents by the Tax Procedures Law.

Under the Corporate Tax Law, all Businesses are required to maintain records and documentation that:

Support the information provided in a Tax Return or in any other document to be submitted to the FTA; [61]and

Enable the Taxable Person's Taxable Income to be readily ascertained by the FTA. [62]

Small Business Relief works by treating eligible Resident Persons as having no Taxable Income if their Revenue is equal to or below AED 3,000,000 for the relevant Tax Period and all previous Tax Periods. Therefore, in order to demonstrate that they have no Taxable Income, the eligible Resident Persons must be able to provide evidence to the FTA that their Revenue did not exceed the Small Business Relief threshold for all relevant Tax Periods.

As every Business is different, there is no prescribed list of documentation or records that should be maintained. However, examples of documents which need to be kept include but is not limited to:

Bank statements;

Sales ledgers;

Invoices or other records of daily earnings, such as till rolls;

Order records and delivery notes; and

Other relevant Business correspondence.

There is no requirement that documents are maintained in their original format and it may be possible to keep them in an alternative format. For example, paper receipts could be scanned and stored electronically. Whatever storage medium is chosen, the records need to be readable and available to the FTA on request.

Businesses are responsible for the storage of their own records and documentation. Taxable Persons must provide the FTA with any information, documents or records reasonably required by the FTA when requested to do so. The records must, therefore, be easily accessible if the FTA requests them.

Record keeping period

All Businesses must keep records and documents for seven years following the end of the Tax Period to which they relate. [63]

This requirement applies to the Tax Period to which the documents relate, and not the Tax Period in which they were created. For example, if a Taxable Person uses the cash basis accounting method, they may have invoices which were raised in the Tax Period before the one in which they were paid. In this instance the seven-year period starts from the end of the Tax Period in which the invoices were paid, and not the date that they were created.

Example 19: Record keeping

Mr X is a Resident Person for Corporate Tax purposes. In the Tax Period ending 31 December 2026, he had Revenue of AED 2,050,000 and elected for Small Business Relief.

Mr X must retain records and documents capable of evidencing his Revenue in the Tax Period until 31 December 2033. After this date, Mr X will no longer have a duty to maintain the records relating to the Tax Period ending 31 December 2026.

Artificial separation

Artificial separation occurs when a Business fragments its activity into different parts to operate under the Small Business Relief threshold.

FTA's powers to address artificial separation

The FTA has the power to counteract transactions or arrangements which have been entered into to gain a Corporate Tax advantage. Engaging in artificial separation to benefit from Small Business Relief is considered a Corporate Tax advantage under the General Anti-Abuse Rule of the Corporate Tax Law. [64]

If the FTA determines that a Business has artificially separated its activities, and its overall Revenue exceeds AED 3,000,000 for the relevant Tax Period, it will not be eligible for Small Business Relief. The Business will have to repay any Corporate Tax which it would have owed if the Business had not been artificially separated in order for the separate entities to elect for Small Business Relief. A penalty may also be imposed on the Business.

Types of artificial separation

Artificial separation can take a range of forms but generally fall into one of three categories:

Functional separation: This involves artificially separating the different functions of a Business, for example, separating drinks and foods sales in a restaurant;

Geographical separation: This involves artificially separating the different locations of a Business where the same activity is carried on at each location, for example, a chain of cafes; and

Temporal separation: This involves artificially separating a Business such that different Persons operate it at different times. This can be, for example, a succession of different legal entities that operate for a short period of time but cease operation when their Revenue reaches the Small Business Relief threshold. It may also occur where different companies claim to only operate at certain times, for example, on set days of the week.

Purpose of artificial separation test

There are legitimate circumstances in which a Business may separate its activities or choose to operate through separate entities. For example, someone may wish to operate their Business using more than one limited company in order to limit their legal liability. Therefore, the fact alone that a Business operates through more than one entity is not sufficient to demonstrate that the Business has been artificially separated.

In order to determine whether a Business has been artificially separated, the FTA will undertake an artificial separation test. The FTA will review the activity that has been separated to determine:

Whether the separation was undertaken for a valid and genuine commercial purpose; and

Whether substantially the same Business or Business Activity is being conducted.

In order for the FTA to conclude that a Business has been artificially separated, both elements must be considered. [65]

Factors taken into account when determining whether a Business has been artificially separated

When considering whether a Business has been artificially separated the FTA will consider the individual facts and circumstances of the Business being reviewed, including the financial, economic and organisational links between the separate entities.

Financial links

Financial links between entities can be an indicator of artificial separation. Key questions to consider include:

Does one entity financially support another?

Is one entity financially viable without the support of the other?

Ordinarily, one Business would not expect to be financially supported by another. Support in this context can mean one entity lending or giving money to another. It is important to note that this is distinct from an ordinary commercial relationship in which an entity charges market interest or a fee to lend money to another entity.

Economic links

Economic links between entities can also indicate that a Business has been artificially separated. Key questions to consider include:

Do the activities of the entities mutually benefit each other?

Do the entities have the same group of customers?

If the activities of two or more entities mutually benefit each other this can be an indicator that they are in Business together. Having the same group of customers is an additional example of economic links that can indicate artificial separation.

Organisational and structural links

Organisational and structural links can be important indicators that artificial separation has taken place. Organisational links show how closely related the operations of two entities are. Key questions to consider include:

Do the entities conduct Business from the same premises or using the same equipment?

Does one or several managers oversee the activities of both entities or would the entities have the same directors or board members?

Do the same employees work for both entities?

Do the entities jointly advertise or market their Businesses?

Would a customer know that they were dealing with two separate Business entities?

There are genuine circumstances in which two Businesses operate from the same premises. In addition, employees are generally free to work for more than one employer if they wish. Therefore, these questions need to be considered in the context of the Business being reviewed.

Illustrative examples

Example 20: Functional artificial separation

Mr X owns a hotel in Ras Al Khaimah. In the Tax Period ending on 31 December 2024, Mr X's Revenue was AED 3,100,000. Mr X was therefore not eligible for Small Business Relief.

On the ground floor of the hotel there is a restaurant where hotel guests can have breakfast. Breakfast is not included in the price of the hotel room but when guests check in, they are asked if they would like breakfast and pay for it at the hotel reception. The restaurant also prepares meals for hotel guests who request room service. The restaurant is not open to the public.

Mr X employs a general manager, Mr Y, who manages both the hotel and the restaurant. Other employees work in both the hotel and the restaurant.

On 1 January 2025, Mr X created a limited company, ABC LLC, to operate the restaurant. Mr X wholly owns and controls ABC LLC.

ABC LLC does not pay rent to Mr X for the use of the ground floor of the hotel. Guests continue to pay for breakfast at the hotel reception and the restaurant continues to be closed to the public. Mr Y is still the manager of both the hotel and the restaurant, and Mr X's other employees continue to work in both the hotel and restaurant. ABC LLC has a separate bank account and at the end of each month Mr X pays ABC LLC the amounts that hotel guests have made for breakfast or room service in the past month.

At the end of the Tax Period ending on 31 December 2025, Mr X's Revenue was AED 1,850,000 and ABC LLC's Revenue was AED 1,300,000. Mr X cannot elect for Small Business Relief as his Revenue previously exceeded AED 3,000,000. ABC LLC elected for Small Business Relief.

This is functional artificial separation, as Mr X and ABC LLC are operating substantially the same Business. This is on the basis that Mr X and ABC LLC are closely economically linked. As the restaurant is not open to the public, ABC LLC has the exact same group of customers as Mr X. The financial links between Mr X and ABC LLC are also strong. Mr X is ABC LLC's sole income stream and it is not clear how ABC LLC could be sustained without receiving hotel guests. Mr X and ABC LLC are also organisationally close. The hotel and restaurant have shared management and staff and, given that the restaurant is in the hotel and payment for restaurant meals is made to the hotel, it is not clear that a hotel guest would understand that they are dealing with two separate entities.

Example 21: Business separated for a valid commercial purpose

ABC LLC operates a cafe in Abu Dhabi. On 1 January 2026 DEF LLC entered into a franchise agreement with ABC LLC. This allowed DEF LLC to open a cafe of the same name in Dubai.

Under the franchise agreement DEF LLC is allowed to use the same branding as ABC LLC. ABC LLC will carry out all marketing and advertising activity. The agreement requires DEF LLC to purchase all of its ingredients and packaging from ABC LLC. Customers would not be aware that the Businesses are separately owned.

In this case, it appears that the Businesses have not been artificially separated. This is an example of a Business being separated for a valid commercial purpose. Franchise agreements are genuine arrangements which Business owners use to expand their income without undertaking the additional activity themselves. The requirement for the franchise owner to carry out all marketing and provide all ingredients are common clauses in franchise agreements to ensure consistent standards across all franchisees.

Example 22: Temporal artificial separation

Mr X wholly owned ABC LLC, a company which he incorporated in the UAE on 1 January 2025. Mr X was the sole employee of ABC LLC and the company's clients understood that by contracting ABC LLC they were paying for Mr X's services.

On 1 March 2025 ABC LLC had made sales of AED 2,800,000. On 2 March 2025 ABC LLC deregistered for Corporate Tax and in its final return declared Revenue of AED 2,800,000 and elected for Small Business Relief.

On the same day, 2 March 2025, Mr X incorporated DEF LLC. DEF LLC provided the same services to the same clients that ABC LLC had, with Mr X as the sole employee of the company. On 6 September 2025 DEF LLC had made sales of AED 2,750,000. On 6 September 2025 DEF LLC deregistered for Corporate Tax and in its final return declared Revenue of AED 2,750,000 and elected for Small Business Relief.

On the same day, 6 September 2025, Mr X incorporated XYZ LLC. Mr X is XYZ's sole employee and XYZ LLC offers the same services to the same clients that DEF LLC and ABC LLC had previously.

This is temporal artificial separation. Mr X is operating substantially the same Business through different entities by incorporating companies through which he offers his services, and deregistering them for Corporate Tax when their sales get close to the Small Business Relief threshold. Each successive entity works with the same clients and each client appears to understand that they will receive Mr X's services. Hence, the structuring of Mr X's Business was to gain a Corporate Tax advantage and the artificially separated entities would not be able to elect for Small Business Relief.

Example 23: Geographical artificial separation

ABC LLC is a Resident Person that is wholly owned by Mr X. ABC LLC owns and operates a laundrette in Dubai, which services customers exclusively in the area of Downtown Dubai. In the Tax Period ending 31 December 2025, ABC LLC had Revenue of AED 2,400,000.