Business Restructuring Relief

Corporate Tax Guide | CTGBRR1

April 2024

Contents

3. Business Restructuring Relief: General Aspects

3.1. Overview of transactions covered in scope of Business Restructuring Relief

3.3. Examples of transactions covered under Article 27(1)(b) of the Corporate Tax Law

3.4. Examples of transactions not covered under Business Restructuring Relief

4. Conditions to qualify for Business Restructuring Relief

4.1. Legally compliant condition

4.2. Taxable Persons condition

4.3. Exempt Person condition and Qualifying Free Zone Person condition

5. Consequences of electing for Business Restructuring Relief

5.1. Transfer of assets and liabilities at net book value

5.2. Value of shares or ownership interest received

5.4. Consequences of not meeting requirements or not electing for Business Restructuring Relief

6. Clawback of Business Restructuring Relief

6.1. Transfer of shares in the Transferor or Transferee

8. Interaction of Business Restructuring Relief with other parts of Corporate Tax Law

Glossary

Accounting Income | : | The accounting net profit or loss for the relevant Tax Period as per the Financial Statements prepared in accordance with the provisions of Article 20 of the Corporate Tax Law. |

Accounting Standards | : | The accounting standards specified in Ministerial Decision No. 114 of 2023. |

AED | : | The United Arab Emirates dirham. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or activities, conducted by a Person in the course of its Business. |

Business Restructuring Relief | : | A relief from Corporate Tax for Business restructuring transactions, available under Article 27 of the Corporate Tax Law and as specified under Ministerial Decision No. 133 of 2023. |

Connected Person | : | Any Person affiliated with a Taxable Person as determined in Article 36(2) of the Corporate Tax Law. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Exempt Person | : | A Person exempt from Corporate Tax under Article 4 of the Corporate Tax Law. |

Financial Asset | : | Financial asset as defined in the Accounting Standards applied by the Taxable Person. |

Financial Liability | : | Financial liability as defined in the Accounting Standards applied by the Taxable Person. |

Financial Statements | : | A complete set of statements as specified under the Accounting Standards applied by the Taxable Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity and cash flow statement. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A juridical person incorporated, established, or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

FTA | : | Federal Tax Authority, being the Authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

IFRS | : | International Financial Reporting Standards. |

IFRS for SMEs | : | International Financial Reporting Standard for small and medium-sized entities. |

Immovable Property | : | Means any of the following:

|

Intangible Asset | : | An intangible asset as defined in the Accounting Standards applied by the Taxable Person. |

Islamic Financial Instrument | : | A financial instrument which is in compliance with Sharia principles and is economically equivalent to any instrument provided for under Article 2(2) of Ministerial Decision No. 126 of 2023, or a combination thereof. |

Market Value | : | The price which could be agreed in an arm's-length free market transaction between Persons who are not Related Parties or Connected Persons in similar circumstances. |

Membership and Partner Interests | : | The equity interests owned by a member or a partner in the juridical person, which entitles the member or the partner to a share of the profits, determined with reference to the member's or the partner's capital contribution, and which may be transferred to others. |

Net Interest Expenditure | : | The Interest expenditure amount that is in excess of the Interest income amount as determined in accordance with the provisions of the Corporate Tax Law. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Ordinary Shares | : | The category of capital stock or equivalent ownership interest, which gives its owner, on a share-by-share basis, equal entitlement to voting rights, profits, and liquidation proceeds. |

Participating Interest | : | An ownership interest in the shares or capital of a juridical person that meets the conditions referred to in Article 23 of the Corporate Tax Law. |

Participation Exemption | : | An exemption from Corporate Tax for income from a Participating Interest, available under Article 23 of the Corporate Tax Law and as specified under Ministerial Decision No. 116 of 2023. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Preferred Shares | : | The category of capital stock or equity interest which gives its owner priority entitlement to profits and liquidation proceeds ahead of owners of Ordinary Shares. |

Qualifying Free Zone Person | : | A Free Zone Person that meets the conditions of Article 18 of the Corporate Tax Law and is subject to Corporate Tax under Article 3(2) of the Corporate Tax Law. |

Qualifying Group | : | Two or more Taxable Persons that meet the conditions of Article 26(2) of the Corporate Tax Law. |

Qualifying Group Relief | : | A relief from Corporate Tax for transfers within a Qualifying Group, available under Article 26 of the Corporate Tax Law and as specified under Ministerial Decision No. 132 of 2023. |

Redeemable Shares | : | The category of capital stock or equity interest, which the juridical person issuing this instrument has agreed to redeem or buy back from the owner of this instrument at a future date or after a specific event, for a predetermined amount or with reference to a predetermined amount. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax Loss | : | Any negative Taxable Income as calculated under the Corporate Tax Law for a given Tax Period. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Transferee | : | A Taxable Person to which the entire Business or an independent part of the Business of the Transferor is transferred under Article 27 of the Corporate Tax Law. |

Transferor | : | A Taxable Person that transfers its entire Business or an independent part of its Business to another Taxable Person under Article 27 of the Corporate Tax Law. |

UAE | : | United Arab Emirates. |

Unincorporated Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses ('Corporate Tax Law') was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ('UAE') on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits ('Corporate Tax') in the UAE.

The provisions of the Corporate Tax Law apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance on the Business Restructuring Relief available under Article 27 of the UAE Corporate Tax Law.

The guide provides the readers with an overview of the following in respect of the Business Restructuring Relief:

Transactions covered within scope of the relief,

Conditions to be eligible for the relief,

Consequences of electing for the relief,

Circumstances when the relief will be clawed back and consequences of clawback of the relief,

Compliance requirements, and

Interaction with other provisions of the UAE Corporate Tax Law.

Who should read this guide?

The guide should be read by any Taxable Person intending to transfer its entire Business or part of an independent Business to another Taxable Person or who will become a Taxable Person as a result of the transfer.

It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, simple examples are used to illustrate how key elements of the Corporate Tax Law apply to Business Restructuring Relief. The examples in the guide:

Show how these elements operate in isolation and do not show all the possible interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes, and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 32 of 2021 on Commercial Companies, is referred to as 'Commercial Companies Law',

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as 'Corporate Tax Law',

Cabinet Decision No. 56 of 2023 on Determination of a Non-Resident Person's Nexus in the State for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Cabinet Decision No. 56 of 2023”,

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 114 of 2023”,

Ministerial Decision No. 116 of 2023 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 116 of 2023”,

Ministerial Decision No. 120 of 2023 on the Adjustments Under the Transitional Rules for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 120 of 2023”,

Ministerial Decision No. 132 of 2023 on Transfers Within a Qualifying Group for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 132 of 2023”,

Ministerial Decision No. 133 of 2023 on Business Restructuring Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 133 of 2023”,

Ministerial Decision No. 134 of 2023 on the General Rules for Determining Taxable Income for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “Ministerial Decision No. 134 of 2023”, and

Federal Tax Authority Decision No. 5 of 2023 on Conditions for Change in Tax Period for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as “FTA Decision No. 5 of 2023”.

Status of this guide

This guidance is not a legally binding document but is intended to provide assistance in understanding the tax implications for Business Restructuring Relief relating to the Corporate Tax Law. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Business Restructuring Relief: general aspects

The Corporate Tax Law eliminates the Corporate Tax impact of certain transactions undertaken as part of the restructuring or reorganisation of a Business.[1]Ordinarily, Business restructuring transactions such as mergers or demergers could result in a taxable gain or loss, even where the ultimate ownership of the Business or Taxable Person does not change, or the original owners of the Business or Taxable Person retain an ownership in the restructured Business. In order not to hamper restructuring transactions undertaken for valid commercial or other non-fiscal reasons, the Business Restructuring Relief in Article 27 of the Corporate Tax Law allows certain types of restructuring transactions to take place in a tax neutral manner.

Business Restructuring Relief is available only if the relevant conditions are met (see Section 4) and the Transferor has elected for the relief to apply (see Section 7.1).

Further, the relief would be clawed back if, within two years, the Transferee ultimately disposes of the transferred Business, or the ownership of the Transferor or Transferee changes (see Section 6).

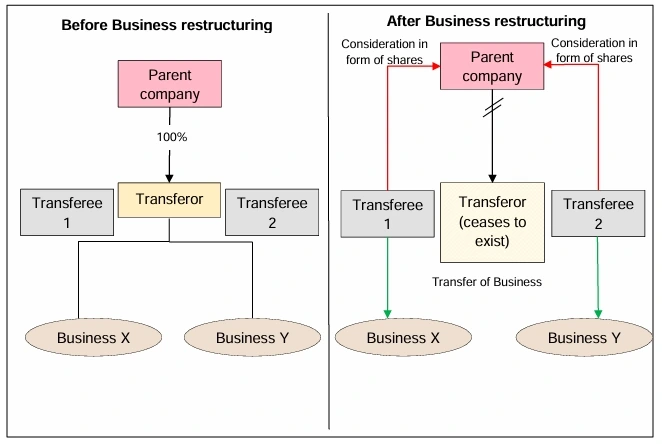

Overview of transactions covered in scope of Business Restructuring Relief

Business Restructuring Relief applies to two categories of transactions. The first category is where there is a transfer of an entire Business or an independent part of the Business from one Taxable Person to another. This is covered by Article 27(1)(a) of the Corporate Tax Law. The second category is where there is a transfer of an entire Business from one or more Taxable Persons to another, and the Transferor then ceases to exist. This is covered by Article 27(1)(b) of the Corporate Tax Law. An overview of the two categories is given in the table below. As each category has specific conditions attached, they are discussed separately in this guide.

| Topic | Restructuring transactions in scope of Article 27(1)(a) | Restructuring transactions in scope of Article 27(1)(b) |

|---|---|---|

| Transferor (Refer Section 4) | A Taxable Person | One or more Taxable Persons who cease to exist as a result of the transfer. |

| Transferee (Refer Section 4) | Another Taxable Person or a Person who will become a Taxable Person as a result of the transfer | |

| Item of transfer (Refer Section 3.5) | Entire Business or an independent part of its Business | Entire Business |

| Types of consideration for the transfer (Refer Section 3.6) |

| |

Examples of Business restructuring transactions covered under Article 27(1)(a) of the Corporate Tax Law

The following transactions can fall within the scope of Article 27(1)(a) of the Corporate Tax Law, provided the relevant conditions are met:[5]

A natural person converts their sole proprietorship Business into an incorporated entity and that natural person holds shares or interests of the incorporated entity (for example a single owner Limited Liability Company (LLC)).

An Unincorporated Partnership applies to the FTA to become a Taxable Person in its own right under Article 16(8) of the Corporate Tax Law, in which case the partners in the Unincorporated Partnership will be considered as having transferred their ownership of the Businesses to a separate Taxable Person.[6]See Section 3.6.4.

A transaction in terms of which the Transferor transfers its Business to a third-party Transferee, which already holds another Business, in exchange for the issue of shares by the Transferee to the Transferor.

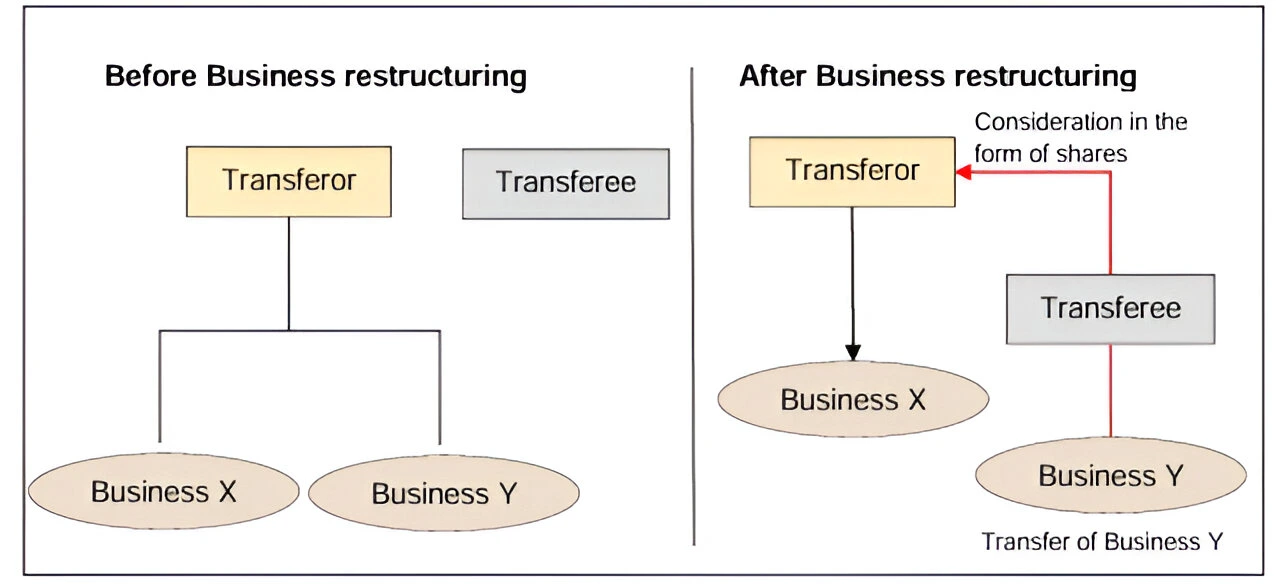

A legal demerger where the Transferor transfers an independent part of its Business under universal title to another Taxable Person (i.e. the Transferee) in consideration for shares of the Transferee. The Transferor continues to exist after the demerger. Shareholders of the Transferor also become shareholders of the Transferee following the demerger. This is illustrated below where the Transferee is a third party prior to the demerger.

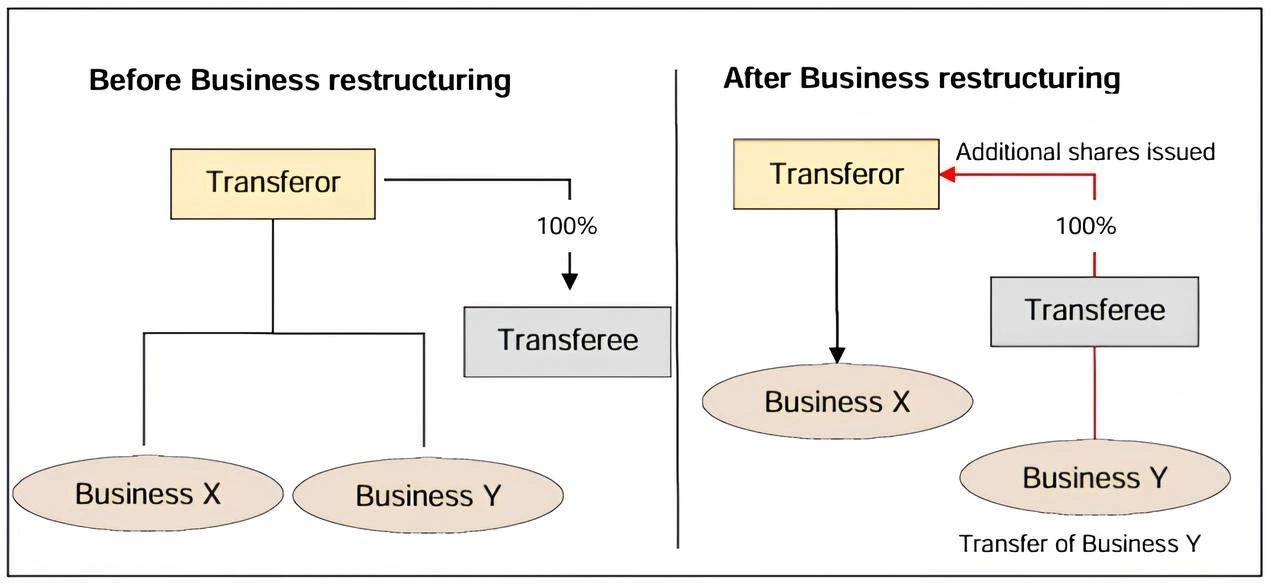

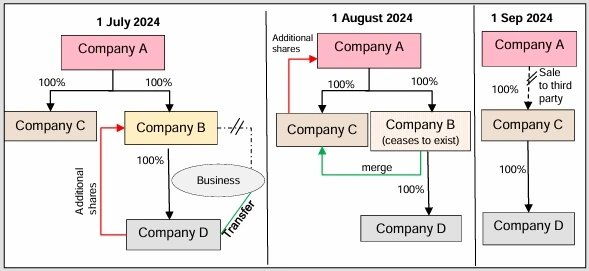

A hive down transaction where the Transferor entity transfers its Business or an independent part of its Business into its subsidiary (Transferee) and receives additional shares of the subsidiary as consideration, as shown below. This scenario would be the same if the subsidiary was a newly incorporated entity established by the Transferor to acquire the Business.

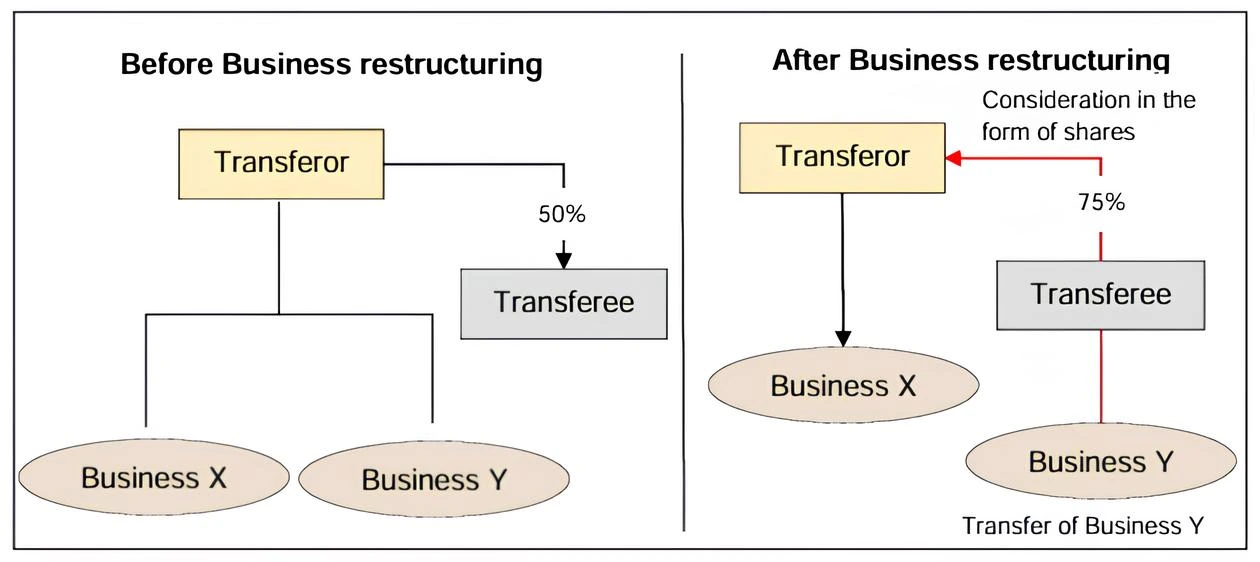

A Business merger where the Transferor transfers its Business or an independent part of its Business into a non-wholly owned entity (Transferee) and receives shares of the subsidiary as consideration, which would dilute the other shareholder(s) of the Transferee.

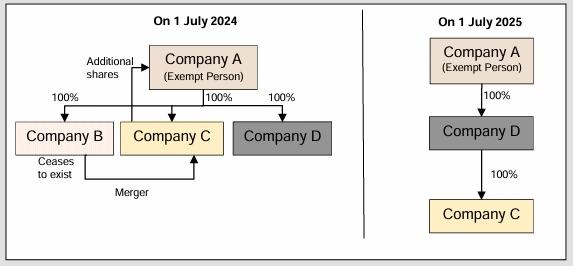

Examples of transactions covered under Article 27(1)(b) of the Corporate Tax Law

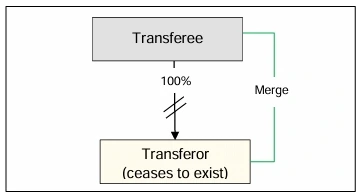

The following transactions can fall within the scope of Article 27(1)(b) of the Corporate Tax Law, provided the relevant conditions are met:[7]

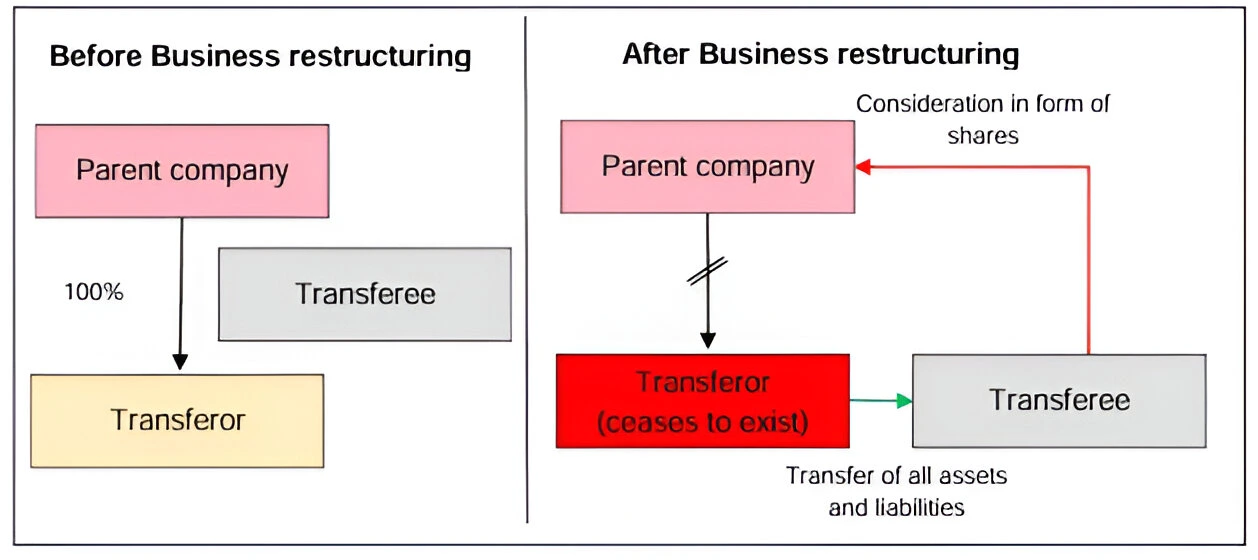

A legal merger where the Transferor transfers its entire Business to the Transferee under universal title, after which:

The Transferor is dissolved, or ceases to exist under law, without going into liquidation, and the shares or ownership interests of the Transferor are cancelled by law, and

The owner(s) of the Transferor become the owner(s) of the Transferee, for example, the Transferee issues new shares to the owner(s) of the Transferor in exchange for the transfer.

- A full legal demerger where the Transferor transfers its entire Business under universal title to at least two or more persons, after which the Transferor entity is dissolved without going into liquidation, and shares of the Transferor entity are cancelled by law. Shareholders of the Transferor entity become shareholders of the Transferee entity.

Examples of transactions not covered under Business Restructuring Relief

The following transactions are examples of transactions that are not covered under the Business Restructuring Relief:

Where a Taxable Person liquidates (ceases to have legal existence)[8]and assets or liabilities of that Taxable Person are transferred to another Taxable Person as a result of liquidation, such a transaction is not covered under the Business Restructuring Relief.[9]

Where a subsidiary merges into its parent company after which the subsidiary dissolves under law, without going into liquidation and its shares are cancelled by law. In this case, there will be no consideration on transfer since the Transferor ceases to exist and the Transferee is the parent company of the Transferor and cannot issue shares to itself.

Where a company transfers its Business or an independent part of its Business to a wholly owned subsidiary without issuing shares or other ownership interests. As no consideration is paid in shares or other ownership interests, the conditions are not met. However, it is possible that Qualifying Group Relief may be available.[10]

Where an independent part of a Business is transferred by a wholly owned subsidiary to its parent without issuing shares or other ownership interests. As no consideration is paid in shares or other ownership interests, the conditions are not met. However, it is possible that Qualifying Group Relief may be available.[11]

Meaning of Business or independent part of a Business

The definition of Business covers any activity conducted regularly on an ongoing and independent basis.[12]It includes activities such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties.

If the Transferor transfers only part of its assets and liabilities to the Transferee, it should be assessed whether the assets and liabilities transferred can be considered as an “independent part of a Business” in order to qualify as Business restructuring covered under Article 27(1)(a) of the Corporate Tax Law. An independent part of a Business refers to a part of the Business that may be operated independently and separately from the other Business of the Taxable Person. In this regard, some indicative factors may be as follows:

Assets and liabilities transferred must be capable of being operated independently as a separate and distinct Business. Individual assets or liabilities cannot be considered as an independent part of a Business if they require ongoing support from the other assets and liabilities to be operated. However, an integrated pool of assets and liabilities could meet this condition. For example, if a real estate investment company transfers pieces of real estate to individual holding companies, this can be an independent part of a Business if the piece(s) transferred are capable of being operated independently and are not intertwined with the rest of the real estate.

Part of a Business is transferred on a going concern basis as per applicable Accounting Standards.

The fact that some form of operational support is required (whether from a Related Party or from a third party) does not imply that the transfer is not a transfer of an independent part of a Business. For example, a transfer can qualify as an independent part of a Business even if certain functions stay behind, for example accounts department, information technology support, human resources etc. Whether an activity is mere operational support depends on the specific facts and circumstances. Activities such as information technology cannot be considered as a support function if that function is key to ensuring continued operation as a Business.

Consideration for transfer

Recipient of consideration

One of the conditions for Business Restructuring Relief on the transfer of a Business or an independent part of a Business is that the consideration for the transfer is to be received by the Transferor.[13]As an exception, a transfer will still be considered to meet the conditions for the Business Restructuring Relief if the consideration is received by a Person that has a direct or indirect ownership interest of at least 50% in the Transferor.[14]Thus, the consideration for a transferred Business or an independent part of a Business can be received by the Transferor, or a shareholder of the Transferor who holds at least 50% of ownership interests, directly or indirectly, in the Transferor. Alternatively, consideration for the transfer can also be split between the Transferor, and its direct or indirect shareholder(s) who meets the 50% holding condition.

The shareholder of the Transferor who can receive the consideration for a transfer within the framework of Business Restructuring Relief can be a juridical person or a natural person and is not required to be a Taxable Person. Thus, the condition is met even if the consideration for the transfer is received by a shareholder of the Transferor who is:

A natural person who is not engaged in any Business or Business Activities;

A foreign company incorporated and managed outside the UAE and who does not have a Permanent Establishment in the UAE.

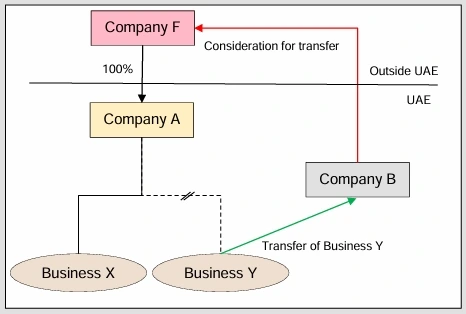

Example 1: Recipient of consideration

Company A transfers one of its Businesses (Business Y) to a third party, Company B. Company A and Company B are both incorporated and resident in the UAE.

Company B pays consideration for the transfer in the form of its shares but the shares are issued to the parent company of Company A, that is Company F, which is a company incorporated and managed outside the UAE.

Although the consideration is not received by the Transferor (Company A), the Business restructuring transaction may be covered under Article 27(1)(a) since the shares are issued to a Person (Company F) who holds more than 50% shares in the Transferor.[15]

Payer or issuer of consideration

As a general rule, for Business Restructuring Relief, the consideration for a transfer is in the form of shares or other ownership interests of the Transferee.[16]As an exception, a transfer will still be considered to meet the conditions for the Business Restructuring Relief, if the consideration is in the form of shares or other ownership interests issued or granted by a Person that has a direct or indirect ownership interest of at least 50% in the Transferee.[17]Thus, the consideration can be in the form of shares or other ownership interests of the Transferee, or shareholder of the Transferee who holds at least 50% of ownership interests, directly or indirectly, in the Transferee. It is also possible that the consideration for a transfer is a mixture of shares or other ownership interests in the Transferee and its direct or indirect shareholder(s) who meet the 50% holding condition.

It is possible to meet the conditions of Article 27 of the Corporate Tax Law if the shareholder(s) of the Transferee issuing or granting the consideration is(are) not a Taxable Person. However, as the consideration must be in the form of shares or ownership interests in a Person, such a person must be capable of issuing or granting shares or ownership interests, as applicable.

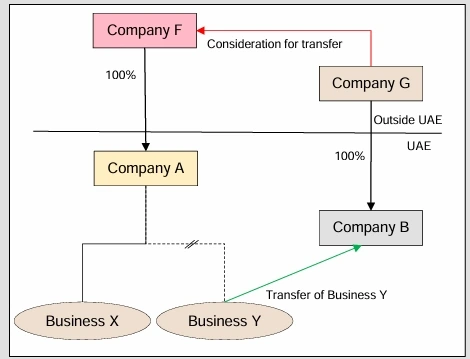

Example 2: Payer of consideration

Company A transfers one of its Businesses (Business Y) to a third party, Company B. Company A and Company B are incorporated and resident in the UAE.

The consideration for the transfer is not paid by Company B (that is, the Transferee). Instead, the consideration is issued by the parent company of Company B, that is Company G, a company incorporated and managed outside the UAE.

Though the consideration is not issued by the Transferee, the Business restructuring transaction may be covered under Article 27(1)(a) since the shares are issued by a Person (Company G) who holds more than 50% shares in the Transferee.[18]

Form of consideration

In order to qualify for Business Restructuring Relief, the consideration for transfer of a Business or an independent part of a Business should be in the form of shares or other ownership interests.[19]

What is an ownership interest?

The term “ownership interest” should be applied consistently with how it is applied in other parts of the Corporate Tax Law.[20]Any other guidance relating to this term when used in other parts of the Corporate Tax Law should similarly apply in the context of Business Restructuring Relief under Article 27 of the Corporate Tax Law as well.

An ownership interest can be understood as any equity or similar interest (for example, a partnership interest) that carries rights to the profits and liquidation proceeds of the entity whose shares are issued.

An ownership interest shall only be treated as such if it is classified as equity interest under the Accounting Standards applied by the Taxable Person holding the ownership interest.[21]This ensures that the mere legal ownership of shares or other ownership interests is not sufficient, in case the Accounting Standards do not treat the ownership interest as an equity interest.

An ownership interest can include, but is not limited to, holdings in any one or a combination of the following instruments:[22]

Type of instrument | Description |

|---|---|

| Ordinary Shares | Category of capital stock or equivalent ownership interest, which gives its owner, on a share-by-share basis, equal entitlement to voting rights, profits, and liquidation proceeds. |

| Preferred Shares | Category of capital stock or equity interest which gives its owner priority entitlement to profits and liquidation proceeds ahead of owners of Ordinary Shares. |

| Redeemable Shares | Category of capital stock or equity interest which the juridical person issuing this instrument has agreed to redeem or buy back from the owner of this instrument at a future date or after a specific event, for a predetermined amount or with reference to a predetermined amount. |

| Membership and Partner Interests | Equity interests owned by a member or a partner in the juridical person, which entitles the member or the partner to a share of the profits, determined with reference to the member's or the partner's capital contribution, and which may be transferred to others. |

| Islamic Financial Instrument or a combination of arrangements that form part of the same Islamic Financial Instrument | A financial instrument which is compliant with Sharia principles. |

The above list of ownership instruments is illustrative. Other types of instruments which grant rights to the profits and liquidation proceeds of the entity whose shares or ownership interest are transferred (i.e. Transferee or a Person that has a direct or indirect ownership interest of at least 50% in the Transferee) and are classified as an equity interest under the applicable Accounting Standards may also qualify as ownership interest.[23]For example, the definition of Ordinary Shares refers to capital stock which gives its owner equal entitlement to voting rights, profits, and liquidation proceeds. However, shares that do not carry voting rights but have rights to profits and liquidation proceeds can also qualify as an ownership interest, if classified as equity interest under the applicable Accounting Standards of the Person who is holding the shares or ownership interests which are issued as consideration of the transfer.[24]

Ordinarily debt instruments do not qualify as an ownership interest. However, a debt instrument (including one convertible into equity) is treated as an ownership interest if it is classified as an equity interest under the Accounting Standards applied by the Person who is holding shares or ownership interests which are issued as a consideration of transfer.[25]

Holder of ownership interest

A Taxable Person shall be treated as holding an ownership interest where the following two conditions are met:[26]

The ownership interest is controlled by that Taxable Person under the Accounting Standards applied by the Taxable Person, and

That Taxable Person has the right to the economic benefits produced by the ownership interest under the Accounting Standards as applied by the Taxable Person.

With respect to the first condition, the meaning of “control” is to be determined in accordance with the applicable Accounting Standards. On the basis of Accounting Standards[27], a Taxable Person shall be considered to be controlling the ownership interest of a juridical person (i.e. the investee) if and only if it has all of the following:

Power over the investee,

Exposure, or rights, to variable returns from its involvement with the investee, and

The ability to use its power over the investee to affect the amount of the investor's returns.

With respect to the second condition, the Taxable Person holding the ownership interests in another juridical person must be the economic owner of the ownership interests. A Taxable Person is the economic owner of an ownership interest where they have (or are entitled to) the benefits and burdens of ownership, including rights to profits, liquidation proceeds, or voting in respect of the ownership interests held, and they have not renounced or transferred such rights under another arrangement. Accordingly, if a Taxable Person holds the ownership interest in the capacity of an agent, nominee, fiduciary or administrator, so that they are simply a conduit for another Person who in fact is entitled to the benefits and burdens of ownership, the former is not the economic owner of the ownership interest.

Other form of consideration

In addition to shares or other ownership interests, if any other form of consideration is paid such as cash, a transfer will still be considered to meet the conditions of the Business Restructuring Relief if the Market Value of the other form of consideration does not exceed the lower of:[28]

The net book value of the assets and liabilities transferred,

10% of the nominal value of the ownership interest issued.

Example 3: Consideration other than shares

Company A and Company B are companies incorporated and resident in the UAE and who use the Gregorian calendar year as their Financial Year and Tax Period.

On 1 July 2024, Company A transfers all of its Business to Company B in exchange for shares in Company B with a nominal value of AED 6 million, and a cash payment of AED 0.5 million. The net book value of the assets and liabilities transferred was AED 6.5 million. Company A elects to apply Business Restructuring Relief on the transfer.

Although the consideration for the transfer of the Business did not fully consist of shares or other ownership interests, the transfer can still benefit from Business Restructuring Relief if the cash consideration does not exceed the lower of:

The net book value of the assets and liabilities transferred (which is AED 6.5 million in this case), and

10% of the nominal value of the ownership interests issued (which is AED 0.6 million in this case).[29]

As the cash consideration of AED 0.5 million is less than AED 0.6 million, Business Restructuring Relief is permitted in this case, assuming all the other conditions are met.

Situations where no consideration is required

In order to qualify for Business Restructuring Relief, the transfer of a Business or an independent part of the Business is required to be for a consideration.[30]In other words, if consideration is not paid or issued as part of the transaction, the transaction cannot be covered under Business Restructuring Relief. For examples on this, see Section 3.4.

An exception to this condition is made when the partners of an Unincorporated Partnership apply to treat the Unincorporated Partnership as a Taxable Person under Article 16(8) of the Corporate Tax Law, and the application is approved by the FTA. In such a case, the application results in the Unincorporated Partnership becoming a Taxable Person, which is treated for Corporate Tax purposes as the relevant partners transferring their portion of the Unincorporated Partnership's assets and liabilities to the Unincorporated Partnership. However, the application does not legally trigger a transfer of assets and liabilities. In such circumstances, the no gain or loss treatment under Article 27 of the Corporate Tax Law can be available, even if the Unincorporated Partnership does not legally issue any consideration. In addition, the no gain or loss treatment will be available even if the Transferor(s) (i.e. partners of the Unincorporated Partnership) are not Taxable Persons.[31]

After an Unincorporated Partnership is treated as a Taxable Person, it can also be involved in other restructurings to which Article 27 of the Corporate Tax Law applies. The exceptions under Article 27(4)(c) of the Corporate Tax Law only apply to a restructuring in which an Unincorporated Partnership applies to be treated as a Taxable Person and not to any other restructuring in which the Unincorporated Partnership is involved.[32]

Conditions to qualify for Business Restructuring Relief

In order for Business Restructuring Relief to apply, all of the following conditions need to be met:

The transfer is undertaken in accordance with, and meets all the conditions imposed by, the applicable legislation of the UAE (the “legally compliant condition”),[33]

The Transferor and the Transferee are Resident Persons, or Non-Resident Persons that have a Permanent Establishment in the UAE (the “Taxable Persons condition”),[34]

Neither the Transferor nor the Transferee is an Exempt Person (the “Exempt Person condition”),[35]

Neither the Transferor nor the Transferee is a Qualifying Free Zone Person (the “Qualifying Free Zone Person condition”),[36]

The Financial Year of Transferor and Transferee ends on the same date (the “Financial Year condition”),[37]

The Transferor and Transferee prepare their Financial Statements using the same Accounting Standards (the “Accounting Standards condition”),[38] and

The transfer is undertaken for valid commercial or other non-fiscal reasons which reflect economic reality (the “valid commercial reasons condition”).[39]

There is no condition in respect of the ownership of the Transferor or the Transferee. Thus, the relief covers Business restructuring transactions where a Business is transferred from one Related Party to another and also where the Business restructuring is between third parties.

Legally compliant condition

The Corporate Tax Law itself does not provide the legal basis for restructuring. Hence this condition requires that the Business restructuring transaction complies with all applicable other legislation in the UAE, that is any UAE Federal and/or Emirate laws and regulations, in order to benefit from Business Restructuring Relief. By way of example, where the Business Restructuring Relief is applied in relation to a merger, all the requirements for a valid merger in terms of Articles 285 to 293 of the Commercial Companies Law must be met.

Business Restructuring Relief can also apply on a transfer that is completed under a foreign law. The legally compliant condition would be met as long as the transaction also complies with UAE law, i.e. does not conflict with any legislation in force in the UAE. If the transaction is not permissible under the applicable UAE law, then the relief would not be available.

Taxable Persons condition

For Business Restructuring Relief, the Transferor must be a Taxable Person.[40]The Transferee must also be a Taxable Person or become a Taxable Person as a result of the Business restructuring transaction.[41]This condition ensures that any gain or loss that benefits from the Business Restructuring Relief remains within the scope of Corporate Tax.

To qualify for Business Restructuring Relief, both the Transferor and Transferee must be a Taxable Person that is:

A Resident Person, or

A Non-Resident Person that has a Permanent Establishment in the UAE.[42]

If a Non-Resident Person with a Permanent Establishment in the UAE transfers or is transferred assets or liabilities attributable to its Permanent Establishment to or from another Taxable Person in exchange for shares, this transfer could benefit from Business Restructuring Relief if all the other relevant conditions are met. This applies even if the Non-Resident Person transfers all assets and liabilities attributable to the Permanent Establishment and ceases to be a Taxable Person as a result of the Business restructuring transaction.[43]Whilst the entity continues to exist in the foreign jurisdiction, its Permanent Establishment in the UAE ceases to exist, and so, the restructuring transaction cannot qualify for Business Restructuring Relief under Article 27(1)(b) of the Corporate Tax Law,[44]but it could qualify for Business Restructuring Relief if the relevant conditions under Article 27(1)(a) of the Corporate Tax Law are met.[45]

Business Restructuring Relief can also apply if assets or liabilities are transferred from one Permanent Establishment in the UAE to another Permanent Establishment in the UAE, if the relevant conditions are met.[46]In addition, Business Restructuring Relief can also apply if a Person becomes a Taxable Person for the first time as a result of the transfer, because the Business or an independent part of a Business that is transferred qualifies as a Permanent Establishment in the UAE for the Transferee.[47]

However, Business Restructuring Relief is not available for transfers between a Permanent Establishment in the UAE and the head office since a Permanent Establishment and its head office are the same Person and Business Restructuring Relief can apply only to the transfer of a Business from one Taxable Person to another Taxable Person. Similarly, Business Restructuring Relief is not available if a Non- Resident Person transfers or is transferred a Business or an independent part of a Business which is not attributable to a Permanent Establishment in the UAE.[48]

The Transferor can be a natural person or a juridical person, provided it is a Taxable Person.[49]Accordingly, an Unincorporated Partnership, that has applied and obtained approval from the FTA to be treated as a Taxable Person can also qualify as a Transferor which transfers its Business or an independent part of its Business in a Business restructuring transaction.

As the consideration is required to be in the form of shares or other ownership interests in the Transferee or its shareholder(s), the Transferee cannot be a natural person.[50]The Transferee can be a juridical person and an Unincorporated Partnership treated as a Taxable Person under Article 16(9) of the Corporate Tax Law. [51]

Example 4: Transfer of Business by a natural person

Mr A, who conducts a Business in the UAE, is a Resident Person under the Corporate Tax Law. Mr A converts his sole proprietorship Business into a company (Company A) incorporated in the UAE. Mr A holds all the shares of Company A.

This transaction meets the condition of Article 27(2)(b) since the Transferor (Mr A) and Transferee (Company A) are Resident Persons under the Corporate Tax Law.

Exempt Person condition and Qualifying Free Zone Person condition

To qualify for Business Restructuring Relief, neither the Transferor or the Transferee can be an Exempt Person according to Article 4 of the Corporate Tax Law nor a Qualifying Free Zone Person according to Article 18 of the Corporate Tax Law.[52]A Transferor or Transferee that is a Free Zone Person but not a Qualifying Free Zone Person may satisfy the condition of Article 27(2)(d) of the Corporate Tax Law. Thus, the mere fact that a Taxable Person is incorporated or established in a Free Zone is not a barrier itself.

The conditions of Business Restructuring Relief are to be evaluated in respect of each Business restructuring transaction. Hence, the conditions should be tested in the Tax Period in which the Business restructuring transaction takes place. Accordingly, if the Transferor or Transferee becomes an Exempt Person or a Qualifying Free Zone Person in a subsequent Tax Period (i.e. the Tax Period after the Business restructuring transaction), the conditions of Article 27(2)(c) and 27(2)(d) are still met when the restructuring transaction took place. Thus, merely becoming an Exempt Person or Qualifying Free Zone Person in a subsequent Tax Period does not trigger a clawback of the Business Restructuring Relief claimed in an earlier Tax Period.

Where a Resident Person elects for Small Business Relief, it is not entitled to apply the provisions of Article 27 of the Corporate Tax Law.[53]

Financial Year condition

Business Restructuring Relief requires the Transferor and Transferee to have their Financial Years ending on the same date.[54]This will result in the Transferor and Transferee having their Tax Period ending on the same date.[55]

Under the Corporate Tax Law, the Financial Year is defined as either the Gregorian calendar year (beginning on 1 January and ending on 31 December) or a 12-month period for which Financial Statements according to the applicable Accounting Standards are prepared.[56]

If the Transferor and Transferee meet all the conditions for Business Restructuring Relief except for the Financial Year condition, they may choose to change the end date of their Financial Year to align with each other. This could be done by one or both of them making an application to the FTA, subject to the following conditions:[57]

The Taxable Person has not yet filed the Tax Return for the Tax Period it is applying to change,[58]

The Tax Period is neither extended to last more than 18 months nor reduced to last less than 6 months,[59]

Where the Taxable Person filed an application to shorten a Tax Period, the application is not in respect of a prior or current Tax Period,[60]and

The application is made before the lapse of 6 months from the end of the original Tax Period.[61]

The Financial Year condition requires the Financial Year of the Transferor and Transferee to end on the same date.[62]This does not necessarily require them to have the same Financial Year/Tax Period. For example, if the Transferor has a longer or shorter Financial Year as compared to the Transferee, the Financial Year condition is met so long as the reorganisation transaction on which Business Restructuring Relief is claimed takes place in a Financial Year that has the same end date of the Financial Year for both parties.

Accounting Standards condition

Business Restructuring Relief requires the Transferor and Transferee to prepare their Financial Statements using the same Accounting Standards.[63]For the purposes of the UAE Corporate Tax Law, a Taxable Person is required to prepare Financial Statements based on IFRS.[64]Where the Revenue of the Taxable Person does not exceed AED 50 million, they may choose to apply IFRS for SMEs instead.[65]This condition would not be met if one Taxable Person uses IFRS and another Taxable Person uses IFRS for SMEs.

It is possible that the Transferor and Transferee meet all the conditions for Business Restructuring Relief except the Accounting Standards condition because one Taxable Person prepares its Financial Statements under IFRS for SMEs whereas the other applies IFRS. In such a case, the Taxable Person may choose to prepare its Financial Statements under IFRS to align with the other Person.[66]This does not require any application to the FTA.

Further, the Accounting Standards condition is not a requirement to follow the same accounting policies in the standalone Financial Statements. Thus, even if Transferor and Transferee follow the same Accounting Standards, they may follow different accounting policies, provided that such policies are permitted under the relevant Accounting Standards.

Valid commercial reasons condition

Business Restructuring Relief is only available to transfers undertaken for valid commercial or other non-fiscal reasons which reflect economic reality.[67]The reason for the Business restructuring is to be understood after having full regard to all relevant facts and circumstances. The Transferor and Transferee must maintain appropriate documentation which can show that the Business restructuring transaction was for valid commercial reasons or other non-fiscal reasons which reflect economic reality. See Section 7.2.

Consequences of electing for Business Restructuring Relief

Transfer of assets and liabilities at net book value

Where a Business or an independent part of a Business is transferred on a no gain or loss basis under Article 27(1) of the Corporate Tax Law, the assets or liabilities transferred will be treated as transferred at their net book value at the date when the transfer takes place.[68]Accordingly, for the Transferor, there will be no taxable gain or loss on transferring the assets and liabilities.

Example 5: Transfer of assets and liabilities at net book value

Company F (a company resident and incorporated in the UAE) sells agricultural machinery. Company Z (a company resident and incorporated in the UAE) operates an agricultural machinery repair business.

During a Tax Period, Company Z bought Company F's Business in return for 20% of the shares in Company Z. The net book value of Company F's Business at the time of transfer was AED 2.3 million. The Market Value of the shares received by Company F was AED 2.7 million, which equals the Market Value of the Business. Company Z measures its assets and liabilities at fair value and, therefore, recognised the assets and liabilities of the transferred Business at a net book value of AED 2.7 million for accounting purposes.

For Corporate Tax purposes, the Business of Company F will be treated as having been transferred to Company Z at its net book value, AED 2.3 million. This means that when calculating their Taxable Income, Company F will be treated as having received a consideration of AED 2.3 million and Company Z will be treated as having paid AED 2.3 million for the Business. As a result, no gain or loss accrues to Company F for Corporate Tax purposes.

| Description | Amounts in AED |

|---|---|

| Amount of consideration deemed to have been received for Corporate Tax purposes | 2.3 million |

| Less: Net book value of the Business | 2.3 million |

| Gain/loss arising for Corporate Tax purposes on the transfer of the Business | 0 |

Determining net book value of assets and liabilities transferred

The net book value of an asset or liability is generally the cost of the asset or liability after deducting any accumulated depreciation, amortisation and any other value adjustments that have been processed in the Financial Statements.

Thus, if the Financial Statements of the Transferor recognise depreciation or amortisation up to the date of transfer which occurred during the relevant Tax Period, the depreciation or amortisation will reduce the net book value of the assets and liabilities transferred by the Transferor. As a result, the depreciation and amortisation can reduce the Taxable Income of the Transferor for the period up to the transfer of the Business, even if the transfer itself does not trigger a gain or loss.

Adjustments to be made by the Transferee

Where Business Restructuring Relief applies, the assets and liabilities transferred are treated as being transferred at their net book value at the time of transfer so that neither a gain nor loss arises in the hands of the Transferor for Corporate Tax purposes.[69]However, it is possible that commercially the assets and liabilities of the Business are acquired at Market Value and the Financial Statements of the Transferee reflect this Market Value. In line with this, the depreciation, amortisation or other change in the value of the transferred assets and liabilities in the Financial Statements of the Transferee would be based on the Market Value. If Business Restructuring Relief applies, the Transferee shall make the following adjustments in the calculation of its Taxable Income:

In cases other than upon realisation: to exclude depreciation, amortisation or other change in the value of the transferred assets and liabilities to the extent that they relate to the gain or loss that arose to the Transferor and were not recognised as a result of the Business Restructuring Relief being applied. [70]

Upon realisation of the assets and liabilities: to include any amount of depreciation, amortisation or other change in the value of the transferred assets and liabilities that has not been recognised for Corporate Tax purposes under the application of Article 27 of the Corporate Tax Law. [71]For these purposes, realisation includes the sale, disposal, transfer, settlement and complete worthlessness of any asset and the settlement, assignment, transfer and forgiveness of any liability, but does not apply to no gain or loss transfers under Article 26 or 27 of the Corporate Tax Law. [72]

The gain or loss not recognised as a result of Business Restructuring Relief will usually relate to various assets and liabilities. The requirement to exclude depreciation, amortisation or other changes applies in relation to the assets and liabilities that were subject to the Business Restructuring Relief and applies only to the extent a gain or loss was not recognised in respect of that transferred asset or liability. Similarly, the requirement to include an amount upon realisation only applies to the extent a gain or loss was not recognised in respect of that transferred asset or liability.

Example 6: Adjustments to the Taxable Income of the Transferee

Company A and Company B are companies incorporated and resident in the UAE and both use the Gregorian calendar year (i.e. year ending 31 December) as their Financial Year and Tax Period.

Company A conducts Business in the UAE and has assets with a net book value of AED 20 million, of which AED 10 million relates to an Immovable Property with a net book value of AED 10 million. On 31 December 2024, Company A transfers its Business to Company B at Market Value of AED 30 million in exchange for shares issued by Company B. The Market Value of the Immovable Property at that date was AED 12 million. For Corporate Tax purposes, Company A elects to apply the Business Restructuring Relief. Accordingly, Company A is treated as transferring the assets at AED 20 million for Corporate Tax purposes and so will not include the gain of AED 10 million (i.e. 30 million – 20 million) in its Taxable Income for the Tax Period ending 31 December 2024.

In the Financial Statements of Company B, the Immovable Property is recorded as follows:

| Tax Period | Opening Net Book Value (in AED) | Depreciation (using straight line method over 10 years, in AED) | Closing Net Book Value (after depreciation, in AED) |

|---|---|---|---|

| 2025 | 12 million | 1.2 million | 10.8 million |

| 2026 | 10.8 million | 1.2 million | 9.6 million |

| 2027 | 9.6 million | 1.2 million | 8.4 million |

Since the transfer is on a no gain or loss basis for Corporate Tax purposes, Company B is deemed to acquire the Immovable Property at its net book value. Accordingly, Company B must exclude any depreciation on the asset to the extent it relates to the gain that arose to Company A but was not taxed due to the application of Business Restructuring Relief.[73]

Thus, for Corporate Tax purposes, the tax treatment of depreciation recorded in the Financial Statements of Company B shall be as follows:

| Tax Period | Depreciation as per Financial Statements | Depreciation not deductible for Corporate Tax purposes | Depreciation allowed for Corporate Tax purposes |

|---|---|---|---|

| 2025 | 1.2 million | 1.2 million | Nil |

| 2026 | 1.2 million | 0.8 million | 0.4 million |

| 2027 | 1.2 million | Nil | 1.2 million |

If, in the 2027 Tax Period, Company B sells the Immovable Property to a third party, for the purposes of calculating its Taxable Income, Company B will include the gain of AED 2 million that arose to Company A on the transfer to Company B that has not been recognised previously for Corporate Tax purposes. It will also be entitled to a deduction for the depreciation adjustments of AED 1.2 million previously made in the Tax Period ending 31 December 2025 and AED 0.8 million made in the Tax Period ending 31 December 2026.[74]

Company B will need to make similar adjustments for all other assets and liabilities it has received as part of the transaction on which Business Restructuring Relief applied.

If there have been several transfers on a no gain or loss basis under Article 27, all the gains and losses in relation to those transfers would need to be included upon realisation, unless these amounts were already adjusted or included in the Taxable Income as a result of being clawed back.[75]In addition, if depreciation, amortisation or other changes in the value of the transferred assets and liabilities were earlier excluded from the Taxable Income of the Transferee, such depreciation, amortisation or other changes in the value are included in the Taxable Income upon realisation.[76]

If a clawback under Article 27(6) of the Corporate Tax Law is triggered in relation to a no gain or loss transfer, this is treated as a realisation of the asset or liability and the resulting gain or loss should be included in the Taxable Income of the Transferor of the transaction for which the clawback was triggered in the Tax Period when the clawback is triggered.[77]See Section 6 for consequences on clawback of Business Restructuring Relief.

If there has been a previous transfer on a no gain or loss basis under Article 27(1) of the Corporate Tax Law, it is possible that a disposal will trigger a gain or loss that was previously not taken into account. In such cases, the net book value should be adjusted to such an amount that results in no gain or loss.[78]

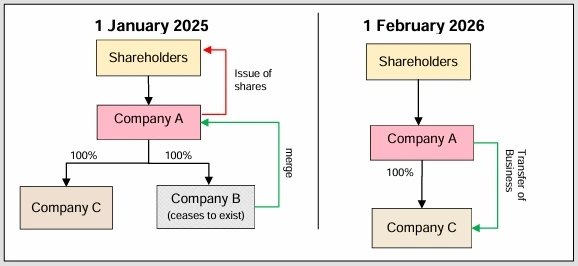

Example 7: Effect of several transfers on a no gain or loss basis

Company A, Company B, Company C and Company D are companies incorporated and resident in the UAE and who all use the Gregorian calendar year (i.e. year ending 31 December) as their Financial Year and Tax Period.

Company A owns a Business which is transferred to Company B on 1 January 2025 in exchange for shares in a transaction on which Business Restructuring Relief is applied. On 1 January 2026, Company B transfers the Business to Company C in exchange for shares in a transaction on which Business Restructuring Relief is applied. Thereafter, on 1 January 2028, Company C sells the Business to a third party. Consequently, assets of the Business are also transferred multiple times.

Company A and Company B elect to apply Business Restructuring Relief in respect of transfers of the Business made by them (i.e. as Transferors). In their Financial Statements, Company B and Company C depreciate and amortise part of the assets received as part of the transactions on which Business Restructuring Relief applied. However, Company C does not elect to apply Business Restructuring Relief on the transfer of the Business to the third party.

| Tax Period | Impact in hands of Transferor | Impact in hands of Transferee |

|---|---|---|

| 2025 | On the transfer of the Business to Company B, Company A will be considered to have transferred the assets at net book value meaning that the gain or loss on transfer of the Business will not be included in the Taxable Income of Company A.[79] | Company B will exclude the depreciation and amortisation, to the extent it relates to gains or losses that were not taken into account on the transfer of the Business.[80] |

| 2026 | On the transfer of the Business from Company B to Company C, Company B will be considered to have transferred the assets at net book value meaning that the gain or loss on transfer of the Business will not be included in the Taxable Income of Company B.[81]Further, Company A will also not include the gain or loss on the transfer of the Business that was not previously taken into account, because the subsequent transfer on which Business Restructuring Relief applies is not treated as a realisation.[82]The amount of gain or loss not taken into account is determined as the difference between the consideration included in the Financial Statements and the net book value of the assets and liabilities (after applicable depreciation and amortisation). | Company C will exclude the depreciation and amortisation, to the extent it relates to the gain that was not taken into account on the transfers.[83] |

| 2027 | N/A | Company C will exclude the depreciation and amortisation, to the extent it relates to the remaining gain that was not taken into account on the transfers.[84] |

| 2028 | The transfer of the Business by Company C to the third party does not trigger a clawback on the transfers that took place on 1 January 2025 and 1 January 2026 as this is not within two years of either Business Restructuring Relief. However, this is a realisation event, meaning that any gain or loss not previously taken into account is included in Company C's Taxable Income for 2028.[85]The amount to be included in Taxable Income upon transfer shall be calculated as the income on the disposal in the Financial Statements (disposal proceeds, reduced by the net book value in the Financial Statements); adjusted for the gains or losses not previously taken into account due to Business Restructuring Relief; and a depreciation and amortisation adjustment for amounts previously disallowed. [86] | The third party will recognise the assets and liabilities at Market Value as on the date of transfer. |

Value of shares or ownership interest received

Where a Business or independent part of a Business is transferred on a no gain or loss basis under Article 27(1)(a) of the Corporate Tax Law, the Transferor or shareholder(s) of the Transferor who hold at least 50% of the ownership interests directly or indirectly in the Transferor[87]shall treat the shares or other ownership interests received as having a value not exceeding the net book value of the assets transferred and any liabilities assumed, less the value of any other form of consideration received for Corporate Tax purposes.[88]This means that for Corporate Tax purposes, the total value of the consideration received by the Transferor shall be treated as not exceeding the net book value of the Business or independent part of the Business being transferred. In addition, this value should be used to calculate any taxable gain or loss upon the sale of those received shares or ownership interests.

Example 8: Value of shares received by Transferor

Company A and Company B are companies incorporated and resident in the UAE and use the Gregorian calendar year as their Financial Year and Tax Period.

On 1 July 2024, Company A transfers all of its Business to Company B in exchange for shares in Company B with a nominal value of AED 6 million and cash payment of AED 0.5 million. The net book value of the assets and liabilities transferred was AED 6.5 million. The Market Value of the assets and liabilities was AED 10 million. Thus, the cash consideration did not exceed the lower of (i) the net book value of the assets and liabilities transferred, or (ii) 10% of the nominal value of the shares issued.

Company A elects to apply Business Restructuring Relief on the transfer.

Company A is required to record the shares in Company B for a value not exceeding the net book value of the assets and liabilities transferred, minus any other form of consideration received.[89]The net book value of assets and liabilities was AED 6.5 million. Company A also received a cash payment of AED 0.5 million. As a result, Company A shall treat the shares as being received for a value of AED 6 million for Corporate Tax purposes, even if they are recorded at a different value in its Financial Statements.

If Business Restructuring Relief is applied on a transaction where the Taxable Person or Persons that are the Transferor cease to exist as contemplated in Article 27(1)(b) (for instance as a result of a legal merger), any Person surrendering shares or other ownership interests in exchange for new shares or other ownership interests shall treat the new shares or other ownership interests as having a value not exceeding the net book value of the shares or ownership interests surrendered, less the value of any other form of consideration received.[90]

Transfer of Tax Losses

Where a Business or independent part of a Business is transferred on a no gain or loss basis under Article 27(1) of the Corporate Tax Law, unutilised Tax Losses incurred by the Transferor in Tax Periods before the restructuring transaction, can be carried forward and are considered as Tax Losses of the Transferee,[91]provided the Transferee continues to conduct the same or a similar Business or Business Activity as the Transferor conducted before the restructuring transaction.[92]

This similarity is determined based on factors such as:[93]

The Transferee uses some or all of the same assets that the Transferor used before the transfer.

The Transferee does not make significant changes to the core identity or operations of the Business post-transfer.

Any changes that have occurred should result from the development or exploitation of assets, services, processes, products, or methods that existed before the transfer.

This condition aims to ensure that Tax Losses incurred by the Transferor can only be carried forward if the Transferee genuinely continues the same or similar Business conducted by the Transferor prior to the transfer of the Business to the Transferee,[94]rather than changing the nature of the Business immediately after the Business restructuring transaction. If the Business restructuring transaction is a transfer of an independent part of the Business, the similarity should be tested by reference to the independent part of the Business that was transferred.[95]

Unlike Tax Losses, Article 27 of the Corporate Tax Law does not provide that unutilised Net Interest Expenditure can be transferred to the Transferee where Business Restructuring Relief applies.

Consequences of not meeting requirements or not electing for Business Restructuring Relief

Article 27(1) of the Corporate Tax Law does not apply to all transfers of a Business between two Taxable Persons. If the conditions for a no gain or loss transfer are not met (see Section 4) or if the Transferor has not elected for the application of Article 27 of the Corporate Tax Law (see Section 7.1), the transfer would be outside the scope of Article 27 of the Corporate Tax Law. If such a transfer is between Related Parties, the transfer is a transaction that should meet the arm's length standard.[96]This means the gain or loss resulting from the transfer should be determined based on the arm's length value of the assets or liabilities being transferred as part of the Business being transferred.

If a transfer of assets or liabilities is not between Related Parties, the arm's length standard does not apply as it is assumed that a transaction between two unrelated parties would be at arm's length. In such a case, the gain or loss on the transfer should be determined based on the standalone Financial Statements prepared for financial reporting purposes in accordance with the applicable Accounting Standards.[97]

Clawback of Business Restructuring Relief

Business Restructuring Relief shall not apply if any of the following circumstances occur within two years from the date of transfer:[98]

- The shares or other ownership interests in the Transferor or the Transferee are sold, transferred or otherwise disposed of, wholly or partially to a Person that is not a member of the Qualifying Group to which the relevant Taxable Persons belong.

- There is a subsequent transfer or disposal of the Business or the independent part of the Businesses transferred under Article 27(1) of the Corporate Tax Law.

In such cases, Business Restructuring Relief will be clawed back and the transfer of the Business or the independent part of the Business shall be treated as having taken place at Market Value on the date of the transfer.[99]The resulting gain or loss shall be included in the Taxable Income of the Transferor in the Tax Period in which either of the above circumstances arise.[100]

The following sections provide further detail on the circumstances that trigger the clawback and the consequences of the clawback.

Transfer of shares in the Transferor or Transferee

Business Restructuring Relief is clawed back if the shares or other ownership interests in the Transferor or Transferee are wholly or partially transferred within two years to a Person that is not in a Qualifying Group with the relevant Taxable Persons.[101]This clawback applies only in respect of those shares or ownership interests that were issued by the Transferor or the Transferee as part of Business Restructuring Relief. In a Business restructuring transaction, it is uncommon for a Transferor to issue any shares or ownership interest, so it is expected to be uncommon that a transfer of shares or ownership interests in the Transferor would trigger the clawback. In case of a transfer of shares or ownership interests in the Transferee, the clawback would be triggered only if that transfer included shares or ownership interests in the Transferee that were issued as part of Business Restructuring Relief.

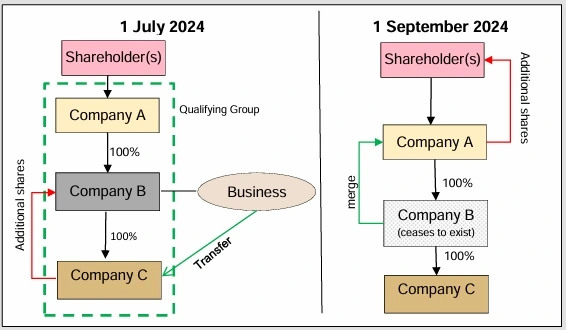

Example 9: Clawback on transfer of shares in the Transferee

Company A, Company B and Company C are companies incorporated and resident in the UAE and who use the Gregorian calendar year as their Financial Year and Tax Period. Company B holds 100% of the shares in Company C.

On 1 July 2024, Company A transfers all of its Business to Company C in exchange for shares representing an ownership interest of 20% in Company C. The remaining 80% of the shares in Company C continue to be held by Company B. Company A elects to apply Business Restructuring Relief on the transfer.

On 1 July 2025, Company B transfers all of the shares it owns in Company C to a third party.

Business Restructuring Relief would be clawed back if the shares in the Transferee that were issued as part of Business Restructuring Relief are wholly or partially transferred within two years to a Person that is not in a Qualifying Group with the relevant Taxable Persons.[102]In this case, Company B transfers its shares in the Transferee to a third party. However, these shares were not issued as part of the Business Restructuring Relief. As a result, the clawback under Article 27(6)(a) of the Corporate Tax Law does not apply.

Situations where transfer of shares will trigger clawback of relief

The clawback can apply if the shares or other ownership interests in the Transferor or Transferee which are issued as part of Business Restructuring Relief are “sold, transferred or otherwise disposed of” within the relevant two-year period to a Person which does not form part of the Qualifying Group with the Person transferring shares or other ownership interests of the Transferor or Transferee, as the case may be.[103]Examples where the clawback could be triggered include the following cases:

Sale of all shares in the Transferee to a party not part of a Qualifying Group with the selling shareholder(s),

Transfers as part of a liquidation or winding up where the Transferee ceases to exist,

Transfers as part of another transaction on which Business Restructuring Relief applies, if this involves a transfer between members who are not part of the same Qualifying Group.

The clawback applies on a transfer “in whole or part”. Any transfer of shares in the Transferee which were issued as part of Business Restructuring Relief can be considered a transfer of either the whole or part of the shares. This means the transfer of a single share which was earlier issued as part of Business Restructuring Relief could trigger the clawback, even if the owners of the other shares in the Transferee remain unchanged.

It is possible that a shareholder in the Transferee also holds shares or other ownership interests in the Transferee which were not issued in consideration for a restructuring transaction to which a Business Restructuring Relief is applied. In such a case, the shareholder of the Transferee holds shares or other ownership interests in the Transferee both (a) as a consideration for a Business Restructuring Relief transaction and (b) unconnected to the Business Restructuring Relief transaction.

If the shares are identifiable (for example, by serial numbers included in the share register), the clawback would trigger when the shares transferred are identified as the shares which were issued as part of Business Restructuring Relief.

However, where it is not practically possible to identify which shares are transferred by the shareholder, the shareholder is deemed to have transferred or sold the shares it held the longest first (a “first in first out” approach).

This also applies to transfers of shares or other ownership interests issued by another Person other than the Transferee as a result of Article 27(4)(b) of the Corporate Tax Law.

It is possible that the Transferor or Transferee will have shareholders who do not meet the conditions to be part of any Qualifying Group. This can be the case if the shareholder is an individual, an Exempt Person, a Qualifying Free Zone Person or a company incorporated and managed outside the UAE without a Permanent Establishment in the UAE. [104]It can also apply to shareholders with a different Financial Year end or who apply a different Accounting Standard.[105]In such cases, any transfer of the shares they hold in the Transferor or Transferee, which were issued as part of Business Restructuring Relief, can trigger the clawback, if done in the two years after a transaction on which Business Restructuring Relief was applied. This is because it is not possible for those shareholders to transfer shares between members of a Qualifying Group.

Example 10: Clawback on transfer of shares by an Exempt Person

Company A, Company B, Company C and Company D are companies incorporated and resident in the UAE and who all use the Gregorian calendar year as their Financial Year and Tax Period. Company A is an Exempt Person as a Government Controlled Entity. Before 1 July 2024, Company A held 100% of the shares in Company B, Company C and Company D.

Company A, Company B, Company C and Company D are companies incorporated and resident in the UAE and who all use the Gregorian calendar year as their Financial Year and Tax Period. Company A is an Exempt Person as a Government Controlled Entity. Before 1 July 2024, Company A held 100% of the shares in Company B, Company C and Company D.On 1 July 2024, Company B enters into a legal merger in which it transfers all of its Business to Company C, Company C issues additional shares to Company A and Company B ceases to exist. Company B elects to apply Business Restructuring Relief on the merger.

On 1 July 2025, Company A transfers 100% of its shares in Company C to Company D.

Business Restructuring Relief would be clawed back if the shares in the Transferee which were issued as part of Business Restructuring Relief are wholly or partially transferred within two years to a Person that is not in a Qualifying Group with the Person who is transferring the Transferee's shares.[106]

In this case, Company A transfers the shares in the Transferee to Company D. Although Company A holds 100% of the shares in Company D, Company A is not in a Qualifying Group with Company D, as it is an Exempt Person. As a result, the clawback under Article 27(6)(a) of the Corporate Tax Law is triggered on 1 July 2025.

Business Restructuring Relief can also be applied where consideration for transfer of the Business or an independent part of the Business is issued or granted by a shareholder of the Transferee who directly or indirectly holds at least 50% of the shares of the Transferee.[107]In such cases, the provisions of Article 27 of the Corporate Tax Law apply on such shares as well, which means the clawback also applies on such shares.[108]

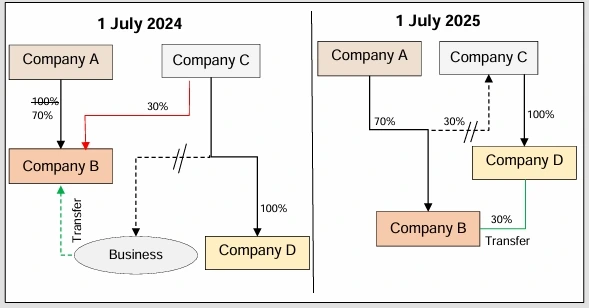

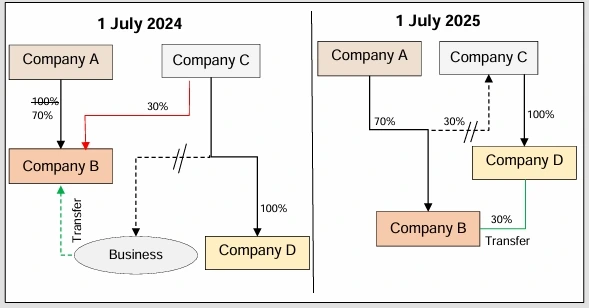

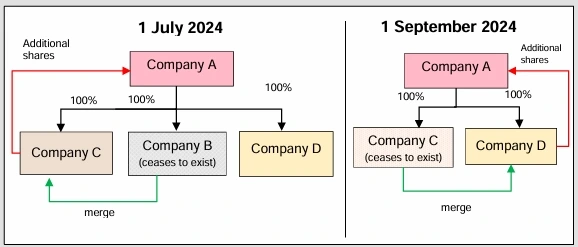

Example 11: Clawback where shares are issued by shareholder of the Transferee

Company A, Company B, Company C and Company D are companies incorporated and resident in the UAE and who all use the Gregorian calendar year as their Financial Year and Tax Period. Before 1 July 2024, Company A holds 100% of the shares in Company B and Company C holds 100% of the shares in Company D.

On 1 July 2024, Company B enters into a legal merger under which it transfers all of its Business to Company D, Company C (as shareholder of Company D) issues shares to Company A and Company B ceases to exist. Company B elects to apply Business Restructuring Relief on the merger.

On 1 July 2025, Company A sells all shares it held in Company C to a third party.

Business Restructuring Relief would be clawed back if the shares in the Transferee are wholly or partially transferred within two years to a Person that is not in a Qualifying Group with the relevant Taxable Persons.[109]

In this case, the shares in consideration for the merger were issued by a Person other than the Transferee. As a result, the provisions of Article 27 of the Corporate Tax Law shall also apply to the shares issued by Company C, even though Company C is not the Transferee. [110]This means the clawback applies if the shares issued by Company C (in place of the Transferee) to Company A as part of the Business restructuring are transferred to a Person that is not in a Qualifying Group with Company A. As Company A is not in a Qualifying Group with the third party that buys the shares in Company C, the clawback under Article 27(6)(a) of the Corporate Tax Law applies.

Clawback in the context of the transfer of shares