Administrative Exceptions

VAT Guide | VATGEX1

December 2025

Glossary

Applicant | : | Person applying for a VAT administrative exception. |

Business Day | : | Any day of the week, except weekends and official holidays of the Federal Government. |

Commercial Evidence | : | The document issued by sea, air or land transport companies and agents, which proves the transfer and departure of the Goods from the UAE to outside the UAE, and includes any of the following documents:

|

Concerned Services | : | Services that have been imported, where the place of supply is considered to be in the UAE, and would not be exempt if supplied in the UAE. |

Electronic Credit Note | : | A credit note issued, transmitted, and received in a structured electronic format, that enables automatic and electronic processing, in accordance with the Electronic Invoicing System. |

Electronic Invoice | : | An invoice issued, transmitted, and received in a structured electronic format that enables automatic and electronic processing, in accordance with the Electronic Invoicing System. |

Electronic Invoicing System | : | An electronic system designated for the issuance, transmission, exchange and sharing of invoice and credit note data, in accordance with legislation governing tax procedures. |

Export | : | Goods departing the UAE, or the provision of Services to a Person whose Place of Establishment or Fixed Establishment is outside the UAE. |

Legal Representative | : | The guardian or custodian of an incapacitated Person or minor, or the bankruptcy trustee appointed by the court for a company that is in bankruptcy, or any other Person legally appointed to represent another Person. |

Official Evidence | : | The export certificate issued by the customs departments in the UAE or a clearance certificate issued by these departments or the competent authorities in the UAE regarding the Goods leaving the UAE after verifying their departure from the UAE, or a document or clearance certificate certified by the competent authorities in the country of destination stating the entry of the Goods into the country. |

Person | : | A natural or legal person. |

Registrant | : | The Taxable Person who has been issued with a Tax Registration Number. |

Shipping Certificate | : | A certificate issued by sea, air or land transport companies and agents as an equivalent of a Commercial Evidence where it is not available. |

Tax | : | Value Added Tax ("VAT"). |

Taxable Person | : | Any Person registered or obligated to register for Tax purposes under the VAT Law. |

Taxable Supply | : | A supply of Goods or Services for Consideration during the course of Business by any Person in the UAE, and does not include Exempt Supply. |

Tax Agent | : | Any Person registered with the FTA who is appointed on behalf of another Person to represent him before the FTA and assist him in the fulfilment of his obligations and the exercise of his associated Tax rights. |

Tax Credit Note | : | A written or electronic document in which any amendment to reduce or cancel a Taxable Supply and its details are recorded, including an Electronic Credit Note, as the case may be. |

Tax Group | : | Two or more Persons registered with the FTA for Tax purposes as a single Taxable Person in accordance with the provisions of the VAT Law. |

Tax Invoice | : | A written or electronic document in which any Taxable Supply and its details are recorded, including an Electronic Invoice, as the case may be. |

Introduction

A VAT administrative exception is a mechanism which provides Registrants with concessions/exceptions allowed by the VAT Law and the Executive Regulation.

The purpose of this Guide is to provide more information on the relevant criteria for being eligible to apply for a VAT administrative exception.

Scope

The scope of this Guide is limited to the following VAT administrative exceptions provided for in the Executive Regulation:

Issuance and details reflected on a Tax Invoice,[1]

Issuance and details reflected on a Tax Credit Note,[2]

Alternative evidence to prove the Export of Goods,[3] and

Extension of the period to export Goods.[4]

Kindly note that, since Registrants can amend their VAT stagger and length of their Tax Period via EmaraTax, administrative exceptions are no longer provided for these instances.

The scope of administrative exceptions does not include other requirements relating to the imposition of VAT, [5] VAT refunds, [6] exception from VAT registration, [7] waiver of Administrative Penalties[8] or any other VAT technical matters.

Legal framework

In this Guide,

Federal Decree-Law No. 8 of 2017 on Value Added Tax and its amendments is referred to as the "VAT Law".

Federal Decree-Law No. 28 of 2022 on Tax Procedures and its amendments is referred to as "Tax Procedures Law".

Cabinet Decision No. 52 of 2017 on the Executive Regulation of the Federal Decree-Law No. 8 of 2017 on Value Added Tax , and its amendments, is referred to as the "Executive Regulation".

Cabinet Decision No. 74 of 2023 on the Executive Regulation of Federal Decree-Law No. 28 of 2022 on Tax Procedures is referred to as "Tax Procedures Executive Regulation".

Federal Tax Authority Decision No. 2 of 2025 on the Authority's Policy on Issuing Clarifications and Directives is referred to as "FTA Decision No. 2".

Status of the document

This Guide is not a legally binding document and is intended to provide assistance in understanding and applying the VAT legislation with regards to administrative exceptions.

The information provided in this Guide should not be interpreted as legal or Tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the Guide was published. Each Person's own specific circumstances should be considered.

This document is subject to change without notice.

Eligibility criteria

Introduction

VAT administrative exceptions may only be granted in respect of the specific cases provided for in the VAT legislation. These relate to:

Tax Invoices,[9]

Tax Credit Notes,[10]

Alternative evidence to prove the Export of Goods,[11] and

The time period for exporting Goods.[12]

NOTE: VAT registration exceptions are not covered under this process but fall under the normal VAT registration process. For more information on this process, please refer to the relevant EmaraTax Guide.

The FTA will reject requests for any administrative exception that is outside the scope of the mandate granted to the FTA under the Tax legislation.[13]

Eligible Persons

Only Registrants are eligible to apply for an administrative exception, i.e. a Taxable Person who has been issued with a VAT TRN.

The request must be submitted by any of the following Persons:

the authorised signatory of the Registrant, or the Registrant himself in the case of a natural Person,

the Tax Agent appointed by the Registrant, or

the Legal Representative appointed by the court.

Note that only a Tax Agent listed as a Tax Agent for indirect taxes may submit requests relating to administrative exception on behalf of other Persons. Hence, a Tax Agent listed for direct tax (CT), is not allowed to represent clients for indirect tax purposes, unless the Tax Agent is listed for both direct taxes and indirect taxes and fulfilled all the requirements and conditions to be listed as such, including completing the required structured continuous professional development hours related to these tax types.[14]

In the case of a Tax Group, the request must be submitted by the authorised signatory of the representative member of the Tax Group or the Tax Group's appointed Tax Agent. Applications from any other Person (e.g. tax consultant who is not a Tax Agent or a natural Person submitting a request on behalf of a legal Person) will not be accepted.

Eligible cases

Registrants may submit VAT administrative exception requests in respect of the specific categories provided for in the Executive Regulation. The table below reflects the cases and scenarios, references in the legislation, and conditions that the Applicant must meet in order for the FTA to consider the application:

Category | Case/scenario | Conditions |

Tax Invoices Article 59(7) of the Executive Regulation. |

|

|

Tax Credit Notes Article 60(2) of the Executive Regulation. |

|

|

Evidence to prove the Export of Goods Article 30(6) of the Executive Regulation. | A Registrant requests to allow the use of an alternative form of evidence to prove that an Export of Goods has taken place. The FTA may specify an alternative form of evidence based on the nature of the Export or nature of the Goods being exported. | A Registrant must provide:

|

Time to export Goods Article 30(7) of the Executive Regulation. | A Registrant requests an extension of the 90-day period to export the Goods from the UAE. | A Registrant must provide:

|

Concerned Goods and Concerned Services

Taxable Persons are not required to issue Tax Invoices to themselves in respect of the receipt of Concerned Services[15] where the conditions set out in VATP044 on Concerned Services – Accounting for Output Tax, issuing Tax Invoices, and Input Tax recovery, are met.

Documentary evidence to prove the Export of Goods

Kindly note that the documentary evidence required to prove the Export of Goods was amended with effect from 15 November 2024. Before this date, Registrants were required to obtain and retain both Official Evidence (i.e. exit certificate) and Commercial Evidence to support zero-rating under Article 30 of the Executive Regulation. Note that the amendment does not apply retroactively, i.e. for Exports completed before 15 November 2024, Registrants are required to retain both Official Evidence and Commercial Evidence to prove the Export of Goods.

From 15 November 2024, Registrants are required to obtain and retain any of the following combinations of documents to prove that the relevant Goods were exported:

a customs declaration, and Commercial Evidence[16] that proves the Export of Goods,

a Shipping Certificate[17] and Official Evidence[18] that prove the Export of Goods, or

a customs declaration that proves the suspension arrangement of customs duties, in case the Goods are put into customs suspension.

If the Registrant is unable to obtain any of the above combinations, the eligible Person may apply for an administrative exception via EmaraTax.

Administrative exception process

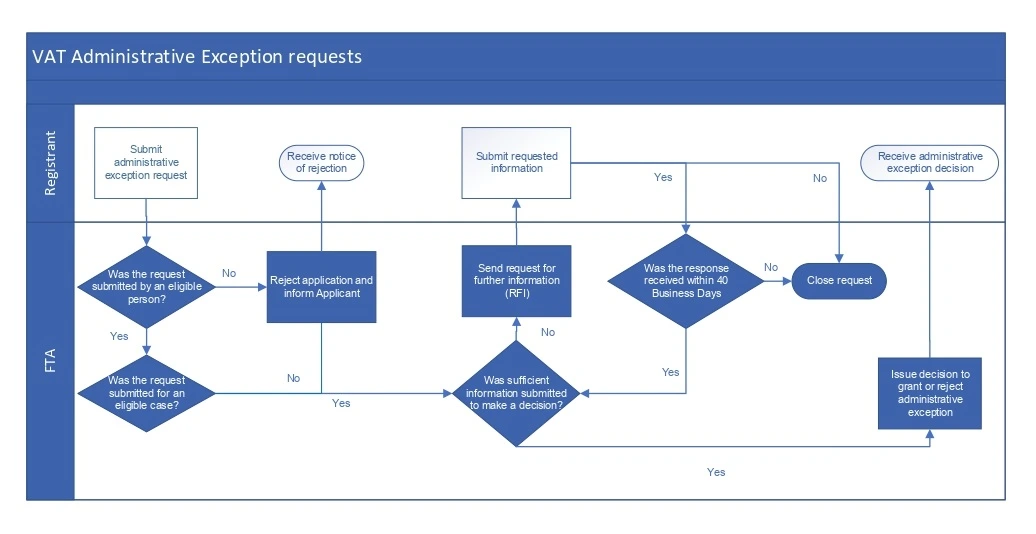

The administrative exception process starts with the Applicant submitting the request (including the relevant supporting documents) via EmaraTax and ends when the request is rejected or a decision is issued by the FTA. These processes are addressed in more detail below.

Submission of the administrative exception request

The following steps should be followed in EmaraTax to submit a VAT administrative exception request:[19]

Access the EmaraTax account dashboard.

Click on "View" to access the "Taxable Person Account".

Click on "VAT" from the list available on the right side of the panel and then choose "Other Services".

Click on "View" under "VAT Administrative Exceptions".

Click on "New Request" and then click on "Proceed".

Complete the application process.

If the Applicant initiates an administrative exception request in EmaraTax but it is not submitted to the FTA, the FTA will send an automated email to remind the Applicant to complete the draft request within 20 Business Days, and to finalise the request within 40 Business Days from the date of starting the request. If the request is not submitted within 40 Business Days from the date of starting the request, the FTA shall close the request.

Required supporting documents

Registrants are required to upload sufficient supporting evidence as part of the application for a VAT administrative exception, including:

A formal letter printed on the Registrant's letterhead that is signed by the authorised signatory. This letter must include the following:

Background of the Registrant's Business operations, including whether the Business operates in the mainland or a Designated Zone.

Details of the specific category of VAT administrative exception the Registrant is applying for. (See Section 3.3)

Explanation why the Registrant is unable to meet the legal and/or administrative obligation in accordance with the VAT Law and Executive Regulation. Please note that this must include the circumstances that make it impractical or impossible to meet these obligations.

A declaration that the information provided is correct and accurate.

The date from which the Applicant requires the administrative exception, if granted, to be valid from.

Documentary evidence proving that the Registrant is not able to meet the specific legal and/or administrative obligations.

Alternative documents that are intended to be used as supporting evidence instead of the documents that are required.

Accepted file types are PDF, DOC, XLS, XLSX, JPG, PNG and JPEG. The total file size limit is 15 MB.

Review of the administrative exception request

Once the FTA receives the request for an administrative exception, the FTA will consider the request and take one of the following actions:[20]

Accept the application

The FTA will accept the application and proceed to draft the decision to either approve or reject the request for the VAT administrative exception. If the administrative exception is approved, the decision will stipulate the conditions (if applicable) and effective date of the approval. The decision shall be effective from the date of its issuance unless otherwise stated.

If the request for a VAT administrative exception is rejected, the Applicant will be notified of the reasons why the administrative exception request was rejected, e.g. if the proposed alternative documents do not contain sufficient information to prove the Export of Goods from the UAE.

Request further information

If the FTA requests further information, the Applicant would be required to submit such information within 40 Business Days. Requests for further information are, generally, sent through EmaraTax. If the FTA does not receive all the requested information within this period, the request will be closed.

NOTE: Applicants are required to submit responses to further information requests within 40 Business Days otherwise the request will be closed.

Reject the application

The FTA will reject the application if it relates to any case other than the cases referred to in Section 3.3 of this Guide, for example a request to waive Administrative Penalties or an exception from VAT registration.

Decision by the FTA

Following the submission of the request, the FTA will, generally, respond to the request within:

25 Business Days for VAT administrative exceptions relating to the extension of the time period to export the Goods due to the urgent nature of such requests and the potential impact on international trade, or

45 Business Days for all other VAT administrative exception categories.[21]

NOTE: If the application is incomplete, or additional information is required, the FTA will request the required/additional documentation. After re-submitting the complete application, it may take the FTA a further 25/45 Business Days to respond to the updated request.

If issuance of the administrative exception decision is likely to take more than 25/45 Business Days, the FTA shall inform the Applicant that the period within which the decision will be communicated shall be extended.

The approval or rejection of each administrative exception is based on the facts and documents provided by the Applicant at the time the VAT administrative exception application is submitted as well as further information provided in response to information requests.

The final response to the VAT administrative exception request will be in a decision format which will be reflected in the Applicant's EmaraTax dashboard, and/or be sent via email to the Applicant's registered e-mail address. It is the Applicant's responsibility to ensure that all contact details (including e-mail address) are correctly reflected in their Taxpayer profile on EmaraTax.

Validity period

Generally, VAT administrative exception decisions are valid for three years from the decision date reflected on the issued administrative exception. [22] An Applicant may request an earlier effective date of up to five years prior to the application.

Depending on the nature of the Export and the nature of the Goods, the FTA may specify a shorter validity period of the administrative exception decision. In the event that the provisions of the legislation which are the subject of the decision are repealed or amended, the decision shall cease on the effective date of the repeal or amendment made to the provisions of the relevant Tax legislation.

The administrative exception decision does not aim to provide any explicit or implicit clarification regarding the correct Tax treatment but only addresses the specific matter in respect of which the decision is issued.

A Registrant may request to renew an administrative exception by submitting a new administrative exception request containing all the necessary documents, as well as referring to the administrative exception decision that the Applicant wishes to renew. Such application should be submitted before the expiry of the previously issued administrative exception decision to continue to use the administrative exception.

NOTE: VAT administrative exception decisions are, generally, valid for three years from the decision date reflected on the issued administrative exception.

Administrative exception decisions related to Tax Invoices and Tax Credit Notes

Kindly note that all administrative exception decisions relating to content or obligation to issue Tax Invoices [23] and/or Tax Credit Notes [24] will expire when e-Invoicing is implemented, and the Taxable Person becomes required to issue Electronic Invoices via the Electronic Invoicing System.

Common errors

Based on the VAT administrative exception applications received from Applicants, the FTA has identified common errors. When submitting a VAT administrative exception application, Registrants may refer to the checklist below to avoid submitting incomplete or incorrect applications and supporting documents:

Submitting an application under an incorrect category. For example, requesting an exception to use alternative documents to prove an Export of Goods under the Tax Invoice/Tax Credit Note category.

Submitting an application requesting a waiver from an administrative and/or legal requirement in instances other than the eligible cases referred to in Section 3.3.

Requesting a VAT refund as part of the VAT administrative exception application. Please note that VAT refund requests are processed as part of a VAT refund application. Therefore, a VAT administrative exception application requesting a VAT refund will be rejected.

Failure of the Applicant to provide a cover letter with sufficient background information and supporting evidence when requesting a VAT administrative exception.

Submitting an application related to the issuance of Tax Invoices for an Export of Services under Article 59(3) of the Executive Regulation.

Submitting an application related to VAT registration exceptions. Persons who intend to submit an application for an exception from registering for VAT must submit their request as part of the VAT registration or amendment of registration process.

A natural Person applying for a VAT administrative exception relating to a legal Person.

A member other than the representative member of a Tax Group applying for an administrative exception.

A tax advisor or Tax Agent only listed for direct tax (CT) purposes submitting the request for an administrative exception on behalf of another Person.

A request submitted by (or on behalf of) a Person who is not registered for VAT in the UAE.

Submitting a request to waive the requirement to issue Tax Invoices in the case of Concerned Services, where such instances are already covered under the VAT Public Clarification on Concerned Services – Accounting for Output Tax, issuing Tax Invoices, and Input Tax recovery ("VATP044").

Updates and amendments

Date of amendment | Amendments made |

May 2019 | Guide published on the FTA's website. |

July 2019 | Updated the previously issued guide. |

March 2020 |

|

June 2023 |

|

December 2025 |

|

Annexure

Application checklist

Before submitting a request for a VAT Administrative Exception, please use the following checklist:

The Applicant is registered for VAT.

The application is submitted by an eligible person. (See Section 3.2)

The application is in respect of an eligible case. (See Section 3.3)

Uploaded a formal letter containing all the details referred to in Section 4.2, printed on the Registrant's letterhead and signed by the authorised signatory.

Uploaded documentary evidence proving that the Registrant is not able to meet the specific legal and/or administrative obligations.

Uploaded alternative documents that are intended to be used as supporting evidence instead of the documents that are required.

Confirmed that the document types are PDF, DOC, XLS, XLSX, JPG, PNG and JPEG.

Ensured that the total file size is less than 15 MB.

In the case of a response to a request for further information, the response is being submitted within 40 Business Days.