CTP008

Corporate Tax Public Clarification

Corporate Tax treatment of family wealth management structures

Issue

Article 17 of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments ("Corporate Tax Law")[1] and Article 5 of Ministerial Decision No. 261 of 2024,[2] provide for the treatment of family wealth management structures for Corporate Tax purposes.

The purpose of this Public Clarification is to provide clarity on the Corporate Tax implications of family wealth management structures, including a Single Family Office ("SFO") or a Multi Family Office ("MFO").

Summary

A family wealth management structure typically includes the following entities:

a Family Foundation,

a holding company,

a Special Purpose Vehicle ("SPV"),

a SFO or MFO, and

family members.

The Corporate Tax treatment of these entities and the family members is considered in turn below, after which four examples of typical structures are set out.

Detailed Analysis

Family Foundation

A Family Foundation means any foundation, trust or similar entity, whether domestic or foreign, that meets the conditions of Article 17(1) of the Corporate Tax Law.[1] For the avoidance of doubt, "similar entity" means an entity that has a similar legal structure or character to a foundation or trust, and would, therefore, exclude a limited liability company.

A Family Foundation or any family wealth management vehicle that does not have a separate legal personality is automatically considered tax transparent (i.e. not considered a Taxable Person in its own right).[3] Examples include a trust established under Abu Dhabi Global Market ("ADGM") or Dubai International Financial Centre ("DIFC") trust laws.

A Family Foundation that has a separate legal personality can make an application to the FTA to be tax transparent if it meets the conditions of Article 17(1) of the Corporate Tax Law.[1] Examples include foundations established under the ADGM or DIFC foundations laws or trusts established under the UAE Federal Trust Law.[4]

A family wealth management vehicle that has a separate legal personality and does not meet the definition of a Family Foundation or the conditions of Article 17(1) of the Corporate Tax Law is a Taxable Person in its own right.[1],[3] Where such a vehicle is a Free Zone Person ("FZP"), it may benefit from a 0% Corporate Tax rate[5] on Qualifying Income from Qualifying Activities,[6] for example, the holding of shares and other securities for investment purposes.[7]

A family wealth management vehicle that has a separate legal personality may also benefit from an exemption for domestic dividends or the participation exemption for foreign dividends and capital gains, where the relevant conditions are met.[8],[9],[10],[11]

Holding vehicles or SPVs

Any holding vehicles or SPVs that are wholly owned and controlled by a tax transparent Family Foundation, either directly or indirectly through an uninterrupted chain of other tax transparent entities, may make an application to the FTA to be tax transparent if they meet the conditions of Article 17(1) of the Corporate Tax Law. [1],[2]

SFO or MFO

Where an SFO or MFO is a juridical person that does not meet the conditions of Article 17 of the Corporate Tax Law, it is a Taxable Person, and is subject to Corporate Tax on all its income, including management fees and any other income it receives.[12] The SFO or MFO must be remunerated at arm's length for any services provided to its Related Parties and Connected Persons.[13],[14]

Where the SFO or MFO is an FZP, it may benefit from a 0% Corporate Tax rate on Qualifying Income from Qualifying Activities,[5],[6] for example, wealth and investment management services,[15] or fund management services,[16] that are subject to the regulatory oversight of the Competent Authority in the UAE.[17],[18] The Competent Authorities are the UAE Central Bank, the Dubai Financial Services Authority ("DFSA") and the Financial Services Regulatory Authority ("FSRA").

If the SFO or MFO only holds a licence without the regulatory oversight of the Competent Authority, these services would not be considered Qualifying Activities.

The family members

The family members in a Family Foundation will not be subject to Corporate Tax on any income earned from the following entities on the basis that such income would either be considered Personal Investment income or Real Estate Investment income:[19]

Income from any family wealth management vehicle that is a Taxable Person.

Income from a tax transparent trust, foundation or similar entity that meets the conditions of Article 17(1) of the Corporate Tax Law, whether automatically tax transparent or by application to the FTA.[1]

Income from a tax transparent wealth management vehicle that does not meet the conditions of Article 17(1) of the Corporate Tax Law, will not be taxed in the hands of family members where it qualifies as Personal Investment or Real Estate Investment income [19]

The family members may be subject to Corporate Tax on any income from commercial Business or Business Activities of the vehicle if their share of that income exceeds AED 1 million in a Gregorian calendar year.[20]

Examples of family wealth management structures

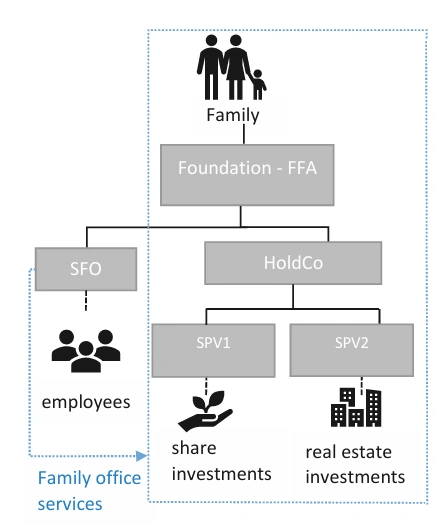

Example 1: An SFO held directly by the Family Foundation

Family members are beneficiaries of FFA, a foundation with separate legal personality established in DIFC.

FFA wholly owns both the SFO and the holding company, HoldCo. Both are juridical persons established in DIFC.

The SFO holds a licence but is not regulated by DFSA.

HoldCo wholly owns two SPVs established in DIFC: SPV1 and SPV2.

SPV1 holds share investments.

SPV2 holds real estate investments.

Scenario 1: Tax transparency

If the FFA meets the conditions of Article 17(1) of the Corporate Tax Law, it can apply to the FTA to be tax transparent.[1]

If the FFA is tax transparent, HoldCo can apply to the FTA to be tax transparent if it meets the conditions of Article 17(1) of the Corporate Tax Law.[1]

If both the FFA and HoldCo are tax transparent, SPV1 and SPV2 can also apply to the FTA to be tax transparent if they meet the conditions of Article 17(1) of the Corporate Tax Law.[1]

If FFA, HoldCo, SPV1 and SPV2 are tax transparent vehicles, none would be subject to Corporate Tax on their income.

The SFO is a Taxable Person and is subject to Corporate Tax on all its income, subject to the arm's length principle. Even if the SFO is a FZP, it cannot benefit from a 0% Corporate Tax rate on income from fund management[16] or wealth and investment management services[15] because these services are not subject to the regulatory oversight of DFSA.[17],[18]

The family members are not subject to Corporate Tax on the income earned from the structure as this income would be considered Personal Investment Income or Real Estate Investment Income.[19]

Scenario 2: No tax transparency

Where the conditions of Article 17(1) of the Corporate Tax Law are not met, or an application is not made to the FTA, FFA would be considered a Taxable Person.[1]

If FFA is not tax transparent, HoldCo, SPV1 and SPV2 cannot apply for tax transparency and would be considered as Taxable Persons.

If FFA, HoldCo and SPV1 are Taxable Persons, they would be subject to Corporate Tax on their income.

If, however, FFA, HoldCo and SPV1 are FZPs, they may benefit from a 0% Corporate Tax rate on Qualifying Income from Qualifying Activities,[5],[6] such as the holding of shares and other securities for investment purposes.[7]

Alternatively, FFA, HoldCo and SPV1 may benefit from an exemption on domestic dividends, or the participation exemption may apply on foreign dividends and capital gains where the relevant conditions are met.[8],[9],[10],[11]

Since SPV2 is not tax transparent and is considered a Taxable Person, it would be subject to Corporate Tax on income derived from its real estate investments.

The tax treatment of the SFO is similar to scenario 1 above.

The family members are not subject to Corporate Tax on the income earned from the structure as this income would be considered Personal Investment Income.[19]

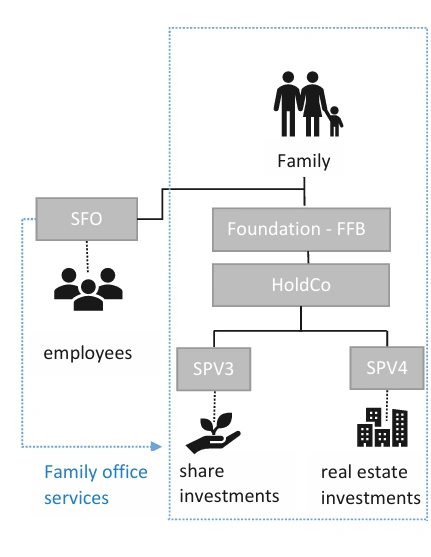

Example 2: The SFO is held directly by the family members

The Family members are beneficiaries of FFB, a foundation with separate legal personality established in ADGM.

The family members hold the SFO directly. The SFO is established in ADGM and it holds a licence but is not regulated by the FSRA.

The FFB wholly owns a holding company, HoldCo, established in ADGM.

HoldCo wholly owns two SPVs established in ADGM: SPV3 and SPV4.

SPV3 holds share investments.

SPV4 holds real estate investments.

Scenario 1: Tax transparency

The same tax treatment in scenario 1 of example 1 applies to the entities in this structure and to the family members. The direct ownership of the SFO by the family members does not impact its tax treatment or that of the other entities within the structure.

Scenario 2: No tax transparency

The same treatment in scenario 2 of example 1 applies to the entities in this structure, and the family members. The direct ownership of the SFO by the family members does not impact its tax treatment or that of the other entities within the structure.

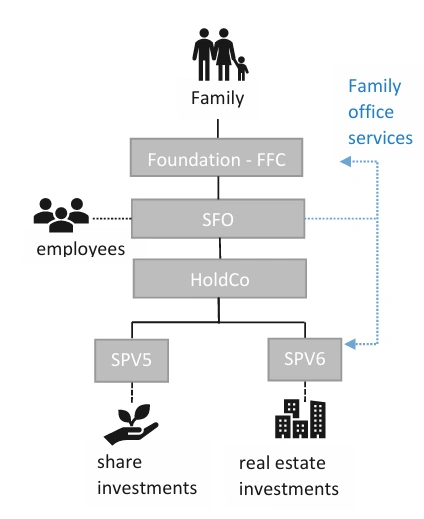

Example 3: The SFO holds the underlying investments

The Family members are beneficiaries of FFC, a foundation with separate legal personality established in DIFC.

FFC wholly owns the SFO. The SFO is established in DIFC and holds a licence but is not regulated by DFSA.

The SFO wholly owns a holding company, HoldCo, established in DIFC.

HoldCo wholly owns two SPVs established in DIFC: SPV5 and SPV6.

SPV5 holds share investments.

SPV6 holds real estate investments.

If FFC meets the conditions of Article 17(1) of the Corporate Tax Law, it can apply to the FTA to be tax transparent.[1]

The SFO is a Taxable Person and is subject to Corporate Tax on all its income, subject to the arm's length principle.

Even if the SFO is an FZP, it cannot benefit from a 0% Corporate Tax rate on the income from fund management[16] or wealth and investment management services[15] because these services are not subject to the regulatory oversight of DFSA.[17],[18]

As the SFO is not tax transparent, HoldCo, SPV5 and SPV6 cannot apply for tax transparency and would each be considered Taxable Persons subject to Corporate Tax on their income.

- However, if HoldCo and SPV5 are FZPs, they may benefit from a 0% Corporate Tax rate[5] on Qualifying Income from Qualifying Activities[6] such as the holding of shares and other securities for investment purposes.[7] Alternatively, they may benefit from an exemption on domestic dividends or the participation exemption may apply on foreign dividends and capital gains where the relevant conditions are met.[8],[9],[10],[11]

Since SPV6 is not tax transparent and considered a Taxable Person, it would be subject to Corporate Tax on income derived from its real estate investments.

The family members are not subject to Corporate Tax on the income earned from the structure as this income would be considered Personal Investment Income.[19]

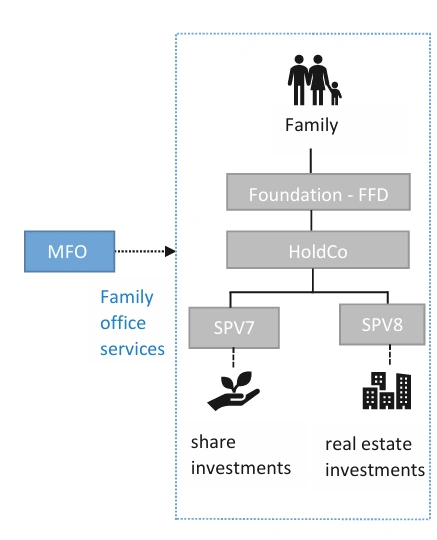

Example 4: Using a regulated MFO instead of an unregulated SFO

The Family members are beneficiaries of FFD, a foundation with separate legal personality established in DIFC.

FFD wholly owns a holding company, HoldCo, a juridical person established in DIFC.

HoldCo wholly owns two SPVs established in DIFC: SPV7 and SPV8.

SPV7 holds share investments.

SPV8 holds real estate investments.

A DIFC MFO provides family office services, including financial activities. The MFO was set up to service more than one family, and has obtained relevant authorisations from the DFSA.

Scenario 1: Tax transparency

The same treatment in scenario 1 of example 1 applies to the family members and entities in this structure, except for the MFO.

Assuming the MFO is a juridical person, it is a Taxable Person and is subject to Corporate Tax on its income, subject to the arm's length principle.

If the MFO is an FZP, it may benefit from a 0% Corporate Tax rate on income from fund management[16] or wealth and investment management services[15] where these services are subject to the regulatory oversight of DFSA or another Competent Authority.[17],[18]

Scenario 2: No tax transparency

The same treatment in scenario 2 of example 1 applies to the family members and the entities in this structure, except for the MFO.

The tax treatment of the MFO is similar to scenario 1 of example 4 above.

This Public Clarification issued by the FTA is meant to clarify certain aspects related to the implementation of the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Business, and its amendments, and its implementing decisions.

This Public Clarification states the position of the FTA and neither amends nor seeks to amend any provision of the aforementioned legislation. Therefore, it is effective as of the date of implementation of the relevant legislation, unless stated otherwise.

Legislative References:

In this clarification, Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Business and its amendments is referred to as "Corporate Tax Law", Federal Decree-Law No. 31 of 2023 on Trust is referred to as "UAE Federal Trust Law", Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that are Subject to Corporate Tax is referred to as "Cabinet Decision No. 49 of 2023 ", Cabinet Decision No. 100 of 2023 on Determining Qualifying Income for the Qualifying Free Zone Person for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Cabinet Decision No. 100 of 2023 ", Ministerial Decision No. 261 of 2024 on Unincorporated Partnership, Foreign Partnership and Family Foundation for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 261 of 2024", and Ministerial Decision No. 229 of 2025 Regarding Qualifying Activities and Excluded Activities for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 229 of 2025".

Article 1 of Corporate Tax Law defines the following terms as:

"Business" – Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties.

"Business Activity" – Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business.

"Family Foundation" – Any foundation, trust or similar entity that meets the conditions of Article 17 of the Corporate Tax Law.

"Free Zone" – A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister.

"Free Zone Person" – A juridical person incorporated, established or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone.

"Market Value" – The price which could be agreed in an arm's-length free market transaction between Persons who are not Related Parties or Connected Persons in similar circumstances

"Non-Resident Person" – The Taxable Person Specified in Article 11(4) of the Corporate Tax Law.

"Person" – Any natural person or juridical person.

"Qualifying Free Zone Person" – A Free Zone Person that meets the conditions of Article 18 of the Corporate Tax Law and is subject to Corporate Tax under Article 3(1) of the Corporate Tax Law.

"Qualifying Income" – Any income derived by a Qualifying Free Zone Person that is subject to Corporate Tax at the rate specified in Article 3(2)(a) of the Corporate Tax Law.

"Resident Person" – the Taxable Person specified in Article 11(3) of the Corporate Tax Law.

"Tax Period" – The period for which a Tax Return is required to be filed.

"Taxable Income" – The income that is subject to Corporate Tax under the Corporate Tax Law.

"Taxable Person" – A Person subject to Corporate Tax in the UAE under the Corporate Tax Law.

"Unincorporated Partnership" – A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE.

Article 1 of Cabinet Decision No. 49 of 2023 defines the following terms as:

"Personal Investment" – Investment activity that a natural person conducts for their personal account that is neither conducted through a Licence or requiring a Licence from a Licensing Authority in the UAE, nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022 .

"Real Estate Investment" - Any investment activity conducted by a natural person related to, directly or indirectly, the sale, leasing, sub-leasing, and renting of land or real estate property in the State that is not conducted, or does not require to be conducted through a Licence from a Licensing Authority.

"Turnover" – The gross amount of income derived during a Gregorian calendar year.