Registration of Natural Persons

Corporate Tax Guide | CTGRNP1

December 2023

Contents

3. Tax Registration obligations

4. The Tax Registration process for Corporate Tax

4.2. The Tax Registration process

4.3. Key information and documentation requirements for Tax Registration purposes

Glossary

Accounting Income | : | The accounting net profit or loss for the relevant Tax Period as per the Financial Statements prepared in accordance with the provisions of Article 20 of the Corporate Tax Law. |

Accrual Basis of Accounting | : | An accounting method under which the Taxable Person recognises income when earned and expenditure when incurred. |

Administrative Penalties | : | Amounts imposed and collected under the Corporate Tax Law or the Tax Procedures Law. |

AED | : | The United Arab Emirates dirham. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Cash Basis of Accounting | : | An accounting method under which the Taxable Person recognises income and expenditure when cash payments are received and paid. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Corporate Tax Payable | : | Corporate Tax that has or will become due for payment to the FTA in respect of one or more Tax Periods. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return on capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Financial Year | : | The Gregorian calendar year, or the twelve-month period for which the Taxable Person prepares Financial Statements. |

FTA | : | Federal Tax Authority, being the authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

Legal Representative | : | The guardian or custodian of an incapacitated person or minor, or the bankruptcy trustee appointed by the court for a company that is in bankruptcy, or any other Person legally appointed to represent another Person. |

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Licensing Authority | : | The competent authority concerned with licensing or authorising a Business or Business Activity in the UAE. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Permanent Establishment | : | A place of Business or other form of presence in the UAE of a Non-Resident Person in accordance with Article 14 of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Personal Investment | : | Investment activity that a natural person conducts for their personal account that is neither conducted through a Licence or requiring a Licence from a Licensing Authority in the UAE, nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022. |

Real Estate Investment | : | Any investment activity conducted by a natural person related to, directly or indirectly, the sale, leasing, sub-leasing, and renting of land or real estate property in the UAE that is not conducted, or does not require to be conducted through a Licence from a Licensing Authority. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023. |

State | : | United Arab Emirates. |

State Sourced Income | : | Income accruing in, or derived from, the UAE as specified in Article 13 of the Corporate Tax Law. |

Tax Agent | : | Any Person registered with the FTA who is appointed on behalf of another Person to represent him before the FTA and assist him in the fulfilment of his Tax obligations and the exercise of his associated Tax rights, under the Tax Procedures Law. |

Tax Deregistration | : | A procedure under which a Person is deregistered for Corporate Tax purposes with the FTA. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Registration | : | A procedure under which a Person registers for Corporate Tax purposes with the FTA. |

Tax Registration Number | : | A unique number issued by the FTA to each Person who is registered for Corporate Tax purposes in the UAE. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Turnover | : | The gross amount of income derived during a Gregorian calendar year. |

UAE | : | United Arab Emirates. |

Unincorporated Partnership | : | A relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the applicable legislation of the UAE. |

Wage | : | The Wage that is given to the employee in consideration of their services under the employment contract, whether in cash or in-kind, payable annually, monthly, weekly, daily, hourly, or by piece-meal, and includes all allowances, and bonuses in addition to any other benefits provided for, in the employment contract or in accordance with the applicable legislation in the UAE. |

Withholding Tax | : | Corporate Tax to be withheld from State Sourced Income in accordance with Article 45 of the Corporate Tax Law. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses ("Corporate Tax Law") was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ("UAE") on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits ("Corporate Tax") in the UAE.

The provisions of the Corporate Tax Law shall apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance on registration of natural persons in the UAE for Corporate Tax purposes. It provides readers with an overview in relation to Corporate Tax, of:

The Tax Registration rules for a natural person;

How a natural person can determine whether they need to register for Corporate Tax; and

The Tax Deregistration process.

Who should read this guide?

This guide should be read by any natural person that is conducting a Business or Business Activity in the UAE, to help them understand whether they need to register for Corporate Tax. It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic- specific guides.

In some instances, simple examples are used to illustrate how key elements of the Corporate Tax Law apply to natural persons. The examples in the guide:

Show how these elements operate in isolation and do not show the interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes; and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 28 of 2022 on Tax Procedures is referred to as "Tax Procedures Law";

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as "Corporate Tax Law";

Federal Decree-Law No. 50 of 2022 issuing the Commercial Transactions Law is referred to as "Commercial Transactions Law";

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that are Subject to Corporate Tax is referred to as "Cabinet Decision No. 49 of 2023";

Cabinet Decision No. 74 of 2023 on the Executive Regulation of Federal Decree- Law No. 28 of 2022 on Tax Procedures is referred to as "Cabinet Decision No. 74 of 2023";

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 73 of 2023";

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 114 of 2023"; and

Federal Tax Authority Decision No. 6 of 2023 on Tax Deregistration Timeline for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "FTA Decision No. 6 of 2023".

Status of this guide

This guidance is not a legally binding statement, but is intended to provide assistance in understanding the provisions relating to Tax Registration for Corporate Tax for natural persons. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Tax Registration obligations

The UAE Corporate Tax regime is a self-assessment regime. This means that a natural person is responsible for assessing whether they are within the scope of Corporate Tax, and whether they will need to fulfil any Corporate Tax obligations.

Generally, natural persons who are within the scope of Corporate Tax are required to register for Corporate Tax purposes. This will allow them to fulfil their Corporate Tax obligations, such as submitting a Corporate Tax Return and paying any Corporate Tax due.

A natural person will fall within the scope of Corporate Tax and thus be required to register for Corporate Tax purposes, where:

He/she is a Resident Person;

He/she is a Non-Resident Person with a Permanent Establishment in the UAE;

He/she carries on a Business or Business Activity in respect of which he/she derives a total Turnover in excess of AED 1 million; and

The Turnover is not derived from:

Wage,

Personal Investment, or

Real Estate Investment.

Each of the above listed concepts and requirements is explained in Section 3.2.5.

Who is a Taxable Person?

A Taxable Person could either be a natural person or a juridical person. Most Taxable Persons will be required to register for Corporate Tax purposes, with the exception of Non-Resident Persons that derive only State Sourced Income without having a Permanent Establishment in the UAE.

The circumstances under which a natural person will be treated as a Taxable Person who is required to register for Corporate Tax are set out below.

Who is a natural person?

The term natural person takes its ordinary meaning, and refers to a living human person of any age, whether resident in the UAE or elsewhere. A natural person would only be subject to Corporate Tax insofar as he/she conducts a Business or Business Activity in the UAE. This includes sole establishments and individual partners in Unincorporated Partnerships that conduct a Business or Business Activity in the UAE.

A sole establishment is a trading Business owned by a natural person, where the proprietor is not separate from the Business. This is because of the direct relationship and control of the natural person(s) over the Business and his/her unlimited liability for the Business's debts and other obligations. In such circumstances, the natural person carries on the Business in his/her own name, as opposed to owning an interest in a separate legal entity which carries on the Business.

A natural person can be either a Resident Person or a Non-Resident Person. See Section 3.2.1 and 3.2.2 below.

For minors or incapacitated individuals, the natural person's Corporate Tax obligations shall be fulfilled by their Legal Representative. [1]

Resident natural person

Residence for Corporate Tax purposes is not determined by physical residence in the UAE, whether by virtue of citizenship or a residency visa. For determining whether a natural person is considered a Resident Person for Corporate Tax purposes, or whether his/her income is taxable, the approach is as follows:

When a natural person resides in the UAE and he/she conducts Business or Business Activities in the UAE, he/she is considered to be a Resident Person and, therefore, a Taxable Person for Corporate Tax purposes, subject to the key considerations covered in Section 3.2.4 and 3.2.5.

When a natural person resides outside the UAE (for example, having his/her home in another country), he/she becomes a Resident Person for Corporate Tax purposes if he/she conducts Business or Business Activities in the UAE, as shall be covered in Section 3.2.3, 3.2.4 and 3.2.5.

Accordingly, under the UAE Corporate Tax Law, and if the natural person has not invoked the application of a Double Taxation Agreement, any natural person conducting Business or Business Activities in the UAE will be a Resident Person for purposes of the Corporate Tax Law.

This approach means that natural persons conducting Business or Business Activities in the UAE are Resident Persons for Corporate Tax irrespective of their nationality, whether they hold a residency visa in the UAE, whether their income is sourced in the UAE or from abroad, or how much time they may physically spend in the UAE.

By implication, in the absence of a Double Taxation Agreement, a natural person who has a Permanent Establishment in the UAE by virtue of a fixed place through which he/she carries on Business in the UAE, will be treated as a Resident Person for UAE Corporate Tax purposes.

Non-resident natural person

Where a natural person resides in a country that has an applicable Double Taxation Agreement with the UAE, and as a result of the application of that Double Taxation Agreement the natural person is not resident in the UAE but has a Permanent Establishment in the UAE, he/she will be a Non-Resident Person and taxable in the UAE in relation to his/her Permanent Establishment.

Under the UAE Corporate Tax Law, where no Double Taxation Agreement is applicable to the position of the natural person, a natural person cannot be a Non- Resident with a Permanent Establishment in the UAE. Instead, he/she would be considered as a Resident Person, as explained in Section 3.2.1.

Since the position may be different if a Double Taxation Agreement is applicable, each non-resident natural person should assess their UAE Corporate Tax status based on their particular circumstances.

A natural person residing outside the UAE may also be a Non-Resident Person, if they derive State Sourced Income, [2] which is income that accrues in, or is derived from, the UAE, as long as that income is not from a Business or Business Activity conducted by the natural person in the UAE. [3]

State Sourced Income derived by a natural person who is a Non-Resident Person may be subject to Withholding Tax (currently the rate is 0%), [4] and would not require a natural person to register with the FTA.

Thus, in summary, if the natural person is a Resident Person (or is Non-Resident Person with a Permanent Establishment in the UAE), their related income would be subject to Corporate Tax at the applicable rate (rather than Withholding Tax), if such natural person's total Turnover exceeds AED 1 million during the Gregorian calendar year, as explained below. This would require them to register for Corporate Tax purposes with the FTA.

What is a Business and a Business Activity?

The Corporate Tax Law provides the definitions of Business and Business Activity that fall under the scope of Corporate Tax in the UAE. [5]

Business Activity has a very comprehensive definition and includes any transaction or activity, or series of transactions or activities, conducted by a Person in the course of its Business.

Business is defined as any activity conducted regularly, on an ongoing and independent basis. The definition provides the following examples for activities constituting a Business: "industrial, commercial, agricultural, vocational, professional, service or excavation activities". The definition also mentions that any other activity related to the use of tangible or intangible properties constitutes a Business.

Nevertheless, "ongoing" should not be interpreted in such a way so as to exclude short-term activities. As such, short-term activities can be within the scope of Corporate Tax on the basis that they constitute a "transaction or activity, or series of transactions or series of activities" as prescribed in the definition. The definition allows for a short-term commercial activity to be considered a Business for Corporate Tax purposes. This is why the Corporate Tax Law refers to the "conduct" of a Business rather than the "carrying on" of a Business.

Examples of activities conducted by a natural person that are not typically considered a Business or a Business Activity would include participation in a lottery or game show resulting in winnings or prizes.

However, whether or not a Business is conducted on an ongoing basis will be evaluated on a case-by-case basis.

If a natural person conducts Business or Business Activity while being present in the UAE, their Taxable Income (if any) will include income derived from sources (for example, clients) located in the UAE and outside of the UAE, as long as the income relates to the Business or Business Activities they are conducting in the UAE.

For the purpose of determining whether the income is related to the Business or Business Activity conducted in the UAE, it would be relevant to consider (among others), the following elements:

Whether persons who contributed to producing or selling the goods or services are managed in, working from, or are residents of the UAE;

Whether contracting or Business development related to selling the goods or providing services was conducted from the UAE; or

Whether the assets that contributed to the production of the goods or rendering of the services are located in the UAE.

On the other hand, in general terms, where a natural person is considered a Non- Resident Person, such natural person would only be subject to tax from their Business or Business Activities conducted within the UAE.

Business or Business Activities of a natural person that are subject to Corporate Tax

Business or Business Activities conducted by a natural person in the UAE are subject to Corporate Tax if the total Turnover from such Business or Business Activities exceeds AED 1 million within a Gregorian calendar year. [6] Where the Business or Business Activity is subject to Corporate Tax, the natural person is required to register for Corporate Tax purposes.

The term Turnover is defined as the gross amount of income derived during a Gregorian calendar year. [7] This means that the total Turnover is the sum of all the income before any costs are deducted. See Section 3.3 below regarding the calculation of the total Turnover of a natural person.

When is a natural person not subject to Corporate Tax and thus not required to register for Corporate Tax?

For a natural person, income from the following categories is not considered as arising from Business or Business Activity, and is disregarded when determining the total Turnover and not subject to Corporate Tax, regardless of the amount: [8]

Wage;

Personal Investment income; and

Real Estate Investment income.

If a natural person conducts an activity that generates any of the above incomes and does not conduct any Business or Business Activities in the UAE, they will not need to register for Corporate Tax purposes.

Wage

Wage, including any compensation or benefit received, whether in cash or in-kind, by any employee from his/her employer is not subject to Corporate Tax. Thus, a salary or other form of remuneration received by a natural person as an employee from his/her employer would not fall within the scope of Corporate Tax.

Personal Investment income

Personal Investment income is not subject to Corporate Tax when derived by a natural person from investment activity conducted in his/her personal capacity that is neither conducted through a Licence or requiring a Licence from a Licensing Authority, nor considered as a commercial business in accordance with the Commercial Transactions Law. [9]

Real Estate Investment income

Real Estate Investment income is not subject to Corporate Tax when derived by a natural person if it is related, directly or indirectly, to the selling, leasing, sub-leasing, and renting of land or real estate property in the UAE that is not conducted through a Licence nor requiring a Licence from a Licensing Authority. [10]

Whether or not a natural person's activities which give rise to investment income or income from the selling, leasing, sub-leasing, and renting of land or real estate property in the UAE, is conducted through a Licence or required to be conducted through a Licence, is a question of fact to be determined by each natural person based on his/her own facts and circumstances.

Natural person not exceeding the AED 1 million threshold

If a natural person conducts a Business or Business Activity in the UAE and his/her total Turnover does not exceed AED 1 million in a Gregorian calendar year, he/she will not be subject to Corporate Tax, hence the natural person would not need to register for Corporate Tax.

For further details on taxable Business or Business Activities for natural persons, readers are advised to consult Cabinet Decision No. 49 of 2023.

Example 1: Tax Registration for natural persons

Case 1: A natural person is a shareholder in a UAE joint stock company and does not conduct Business independently from the company.

The income from being a shareholder will be classed as Personal Investment income so the natural person will not be required to register for Corporate Tax.

Case 2: A natural person develops accounting software in her home in Sharjah and starts selling licences to companies. The total sales in a Gregorian calendar year are AED 1.2 million.

The natural person is required to register as she is conducting a Business in the UAE and her total Turnover in the Gregorian calendar year exceeds AED 1 million.

Case 3: A natural person is a shareholder of a UAE joint stock company and opens an independent car rental agency operated from his home in Abu Dhabi that generates a monthly income of AED 1.5 million.

The income from being a shareholder will be classed as Personal Investment income so will not be subject to Corporate Tax. However, the natural person is required to register as he is conducting a Business in the UAE (i.e. the car rental agency Business) and his total Turnover in the Gregorian calendar year exceeds AED 1 million.

Case 4: A natural person employed by a UAE limited liability company sells her two personal cars for more than AED 550,000 each.

The natural person is not required to register on the basis that the selling of her personal cars is not a Business Activity, and her Wage is also not subject to Corporate Tax.

Case 5: A natural person derives rental income of AED 1.5 million from two apartments he owns in the UAE that he bought as a Real Estate Investment.

The natural person is not required to register as the rental income will be classed as Real Estate Investment income, which is not subject to Corporate Tax for natural persons.

Calculation of Turnover

Definition of Turnover

For the purposes of calculating the total Turnover of a natural person, gross income derived during a Gregorian calendar year from all the categories of Businesses or Business Activities that he/she conducts in the UAE should be taken into consideration. For example, income derived from a sole proprietorship or his/her share of income from a fiscally transparent Unincorporated Partnership would need to be combined.

Income derived from Wages, Personal Investments, or Real Estate Investments is excluded when determining the total Turnover.

For the purpose of determining whether the natural person's total Turnover exceeds the threshold of AED 1 million, the total Turnover is that of the Gregorian calendar year in question. [11] The total Turnover should be measured on an Accrual Basis of Accounting except where the natural person applies the Cash Basis of Accounting, in which case it must be determined using the Cash Basis of Accounting. [12]

Eligibility for Small Business Relief does not affect a Person's registration obligations to register for Corporate Tax purposes. A natural person's registration obligations for Corporate Tax start as soon as his/her total Turnover exceeds the AED 1 million threshold. The natural person can subsequently elect to apply Small Business Relief in the relevant Tax Period, where the relevant conditions are met. [13]

Tax Period

The Tax Period of a natural person who conducts a Business or Business Activity that is subject to Corporate Tax, shall be the Gregorian calendar year. The Gregorian calendar year runs from 1 January until 31 December.

The first potential Tax Period for a natural person is the 2024 Gregorian calendar year. For example, a natural person starting their Business or Business Activity on 1 October 2024 would need to assess whether he/she exceeds the AED 1 million threshold by 31 December 2024. If this is the case, he/she would need to register for Corporate Tax purposes and his/her first Tax Period would be the Gregorian calendar year commencing on 1 January 2024 and ending on 31 December 2024. He/she would need to file his/her Tax Return before the end of September 2025.

Example 2: A natural person receiving Wages and Personal Investment income

A natural person residing in the UAE is employed by Company A, a UAE incorporated company. The natural person receives a monthly salary from Company A.

Additionally, the natural person has made an investment in Company B, also incorporated in the UAE. In return, the natural person receives Dividends, which are classified as Personal Investment income.

Given these circumstances, the natural person is not required to register for Corporate Tax. This is because she only earns income from being employed by Company A and in relation to a Personal Investment, and so does not engage in any Business or Business Activity subject to Corporate Tax.

The Wage received from Company A and any Dividends received from Company B are not included in the calculation of the natural person's total Turnover.

Example 3: Dividends from investments

A natural person operates a small bakery in the UAE and decided to buy shares in Company C, using the Business account. Company C is a flour production company that supplies flour to the bakery.

During the Gregorian calendar year 2025, the natural person receives AED 500,000 in Dividends from Company C. The Turnover for the bakery for the Gregorian calendar year is AED 900,000. Therefore, the natural person's total Turnover for that year is AED 1.4 million.

The Dividends received from Company C will be included as part of that Tax Period's total Turnover, since the Dividends were received in the course of a Business Activity as part of the Business from the bakery's Business account, not the natural person's personal account, i.e. not as a Personal Investment. This will be calculated as follows:

Income from bakery: AED 900,000

Dividends from Company C: AED 500,000

Total Turnover: AED 1.4 million

The natural person is considered in this case to meet the AED 1 million threshold.

The Tax Registration process for Corporate Tax

How to register

An application to register for Corporate Tax can be made on the EmaraTax portal. A natural person who is already registered for Value Added Tax or Excise Tax can use his/her existing login details. A natural person that has not previously registered with the FTA will be required to create new login credentials the first time he/she accesses the EmaraTax portal.

A step-by-step user guide on the Tax Registration process is available on the FTA website, and additional support can be accessed by contacting the FTA helpline on 80082923 during working hours.

The Tax Registration process

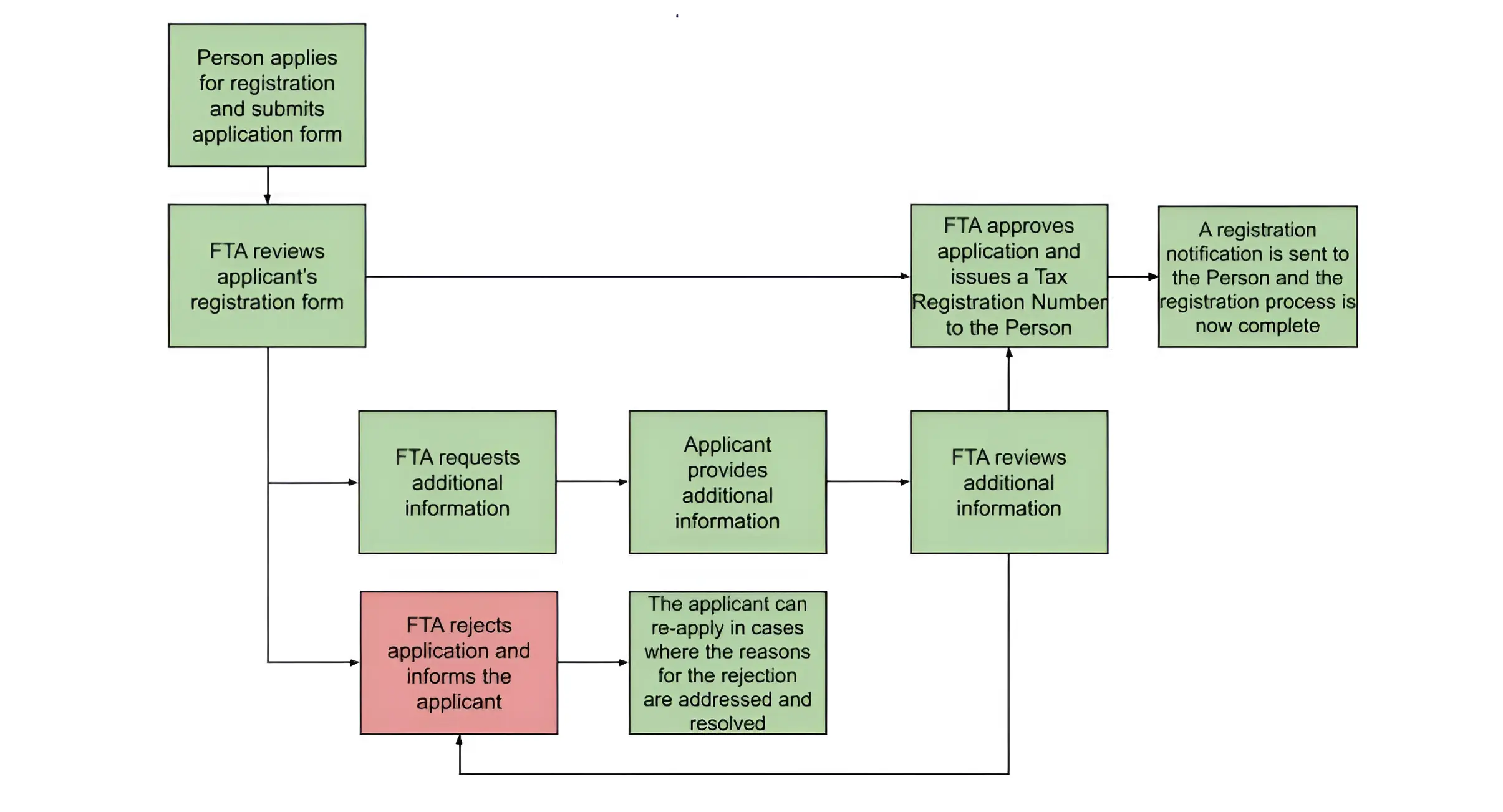

A natural person who is required to register for Corporate Tax must submit a registration application along with the relevant supporting documentation to the FTA. [14] The FTA will review each application and either approve or reject it. Once the application is approved, the FTA will issue the natural person with a Tax Registration Number.

Figure 1: Overview of the Tax Registration process

The Tax Registration processing timeline

The FTA will aim to review the registration application form and respond within 20 business days from the date on which the completed registration application is received.

Where additional information has been requested by the FTA, the FTA will aim to respond to the applicant within 20 business days of receiving the additional information. If the additional information is not submitted within the timeframe specified by the FTA, the application shall be rejected and a new application will need to be submitted.

Key information and documentation requirements for Tax Registration purposes

The Tax Registration process has been designed to be simple and easy to complete for applicants. The information required to complete the registration application should be information that the applicant will already have, or is expected to have.

Applicants should ensure that they have the information and documentation specified in Table 1 available before starting the Tax Registration process.

Table 1: Overview of Tax Registration information and documentation requirements

Information and documentation for a natural person | Requirement |

|---|---|

Contact details: telephone number, physical address and email address | Mandatory |

Passport (a copy of the photo page to be uploaded with the application) | Mandatory |

Emirates ID (a copy of the front and back of the Emirates ID to be uploaded with the application) | Mandatory (if applicable) |

Sole establishment details and Licence details in relation to the Business and Business Activities conducted, if any (a copy of each to be uploaded with the application) | Not mandatory |

Value Added Tax, or Excise Tax registration details (with an attachment, if any) | Not mandatory |

Bank account details | Not mandatory |

Other procedural aspects

Persons already registered for Value Added Tax and Excise Tax

A natural person who is already registered for Value Added Tax and/or Excise Tax will still be required to register for Corporate Tax if he/she is within the scope of the Corporate Tax regime. Once registered, he/she will be issued with a separate Tax Registration Number for Corporate Tax purposes. This Tax Registration Number will be similar to their existing Tax Registration Number for Value Added Tax and/or Excise Tax, but the last digit will be different from their Tax Registration Number(s) for Value Added Tax and/or Excise Tax.

Tax Agents for Corporate Tax registering on behalf of another Person

Many natural persons will have Tax Agents who will act on their behalf and help them to meet their Corporate Tax obligations, subject to meeting certain conditions. These Tax Agents might already act on their behalf for Value Added Tax and/or Excise Tax, and will be able to do so for Corporate Tax purposes, if they are listed with the FTA as Tax Agents for Corporate Tax purposes.

Persons not registered for Value Added Tax and Excise Tax

Natural persons who are not subject to Value Added Tax or Excise Tax but are within the scope of the Corporate Tax will be required to register for Corporate Tax purposes.

Obligations once registered

Once a natural person has registered for Corporate Tax, he/she will be subject to a number of administrative Corporate Tax obligations. These include:

Filing a Tax Return and paying any Corporate Tax due within 9 months of the end of their Tax Period; [15]

Retaining all records and documents which support his/her tax position for a period of 7 years following the end of the Tax Period to which they relate; [16] and

Ensuring that all of his/her registration details are up to date and informing the FTA of any changes within 20 business days, otherwise penalties may arise. [17]

FTA power to register a Person for Corporate Tax

If the FTA believes that a natural person is a Taxable Person and should have registered for Corporate Tax but has failed to do so, the FTA can, at its discretion and based on information available to the FTA, register that natural person for Corporate Tax, effective from the date they should have registered from. [18]

A natural person has the right to appeal against a tax assessment issued following a registration initiated by the FTA if they disagree with such a decision.

Example 4: The FTA registering a natural person for Corporate Tax

Mr Y is a UAE resident natural person that has conducted Business in Dubai since 2014.

In the Gregorian calendar year 2025, Mr Y's total Turnover exceeded AED 1 million. Therefore, Mr Y's Business should have applied to register for Corporate Tax for the 2025 Tax Period. However, he failed to do so.

In this case, the FTA has the authority to register Mr Y for Corporate Tax for the 2025 Tax Period, and issue a tax assessment.

Deregistration

Cessation of Business or Business Activity

Generally, if a natural person is no longer subject to Corporate Tax, he/she should deregister. This will most commonly occur when his/her Business or Business Activity ceases. [19]

A natural person will only have one Tax Registration Number for Corporate Tax for all his/her Business and Business Activities. A natural person should only deregister for Corporate Tax if he/she has ceased conducting all Business or Business Activities. [20]

In case of cessation of his/her Business or Business Activity, a natural person or, in certain cases, his/her Legal Representative must make a Tax Deregistration application to the FTA. This application must be made within 3 months of the date of cessation of the Business or Business Activity. [21] The date of deregistration will be the date the Business or Business Activity ceased, unless the FTA determines otherwise. [22]

A natural person who is already registered for Corporate Tax with the FTA should not file a Tax Deregistration application if any of the natural person's Business or Business Activities are still active or being conducted, even if the natural person's total Turnover falls under the AED 1 million threshold within a Gregorian calendar year. Instead, he/she will retain his/her Tax Registration status. However, a natural person who remains registered whilst his/her total Turnover is under the AED 1 million threshold will only be required to file a 'nil' tax return.

The Tax Deregistration will not be approved if the natural person has not filed all the required Tax Returns and paid all due Corporate Tax and Administrative Penalties, including the Tax Return for the Tax Period up to and including the date of cessation. [23]

In the event that a natural person submitted an application for deregistration and then in the same Tax Period commenced a new Business or Business Activity following submission, the Tax Deregistration application would no longer be valid and the natural person would continue to be registered for Corporate Tax. [24]

Example 5: Deregistration obligations

Mr A is a UAE resident operating a Business in the UAE. His Tax Period runs from 1 January to 31 December. Mr A ceased trading on 31 December 2025. On 3 January 2026, Mr A made an application to the FTA to be deregistered for Corporate Tax purposes. The last Tax Return filed by Mr A was for the Tax Period 1 January 2024 to 31 December 2024.

As Mr A has not filed his Tax Return for the Tax Period 1 January to 31 December 2025, this Tax Return must be filed and any Corporate Tax due must be paid before the FTA approves the deregistration of Mr A.

Example 6: Conducting multiple Businesses

Mrs F is a natural person conducting two Businesses in the UAE, with a Tax Period from 1 January to 31 December. Mrs F decided to cease one of her Businesses on 31 December 2025. Mrs F filed all required Tax Returns up to the Tax Period ending on 31 December 2025 and has no outstanding Corporate Tax liabilities.

Even though Mrs F has filed all relevant Tax Returns and paid all Corporate Tax liabilities up to the year ending 31 December 2025, Mrs F should not apply to deregister for Corporate Tax purposes, since she is still conducting her other Business.

Death of a natural person

When a natural person dies, he/she ceases to be a Taxable Person. The settlement of any outstanding Corporate Tax liabilities due from the natural person prior to the date of death, shall be made in accordance with the provisions of Article 42(1) of the Tax Procedures Law. These apply as follows:

For Corporate Tax Payable due prior to the date of death, settlement shall be made from the value of the elements of the estate or income arising thereof prior to distribution among the heirs or legatees.

If it transpires after the distribution of the estate that there is Corporate Tax Payable still outstanding, recourse shall be had against the heirs and legatees for settlement of such outstanding tax each to the extent of their share in the estate, unless a clearance certificate has been obtained from the FTA for the estate representative or any of the heirs.

Updates and Amendments

Date of amendment | Amendments made |

|---|---|

December 2023 |

|