Guideline for Regional Headquarters in KSA

Guideline to Clarify the Tax and Zakat Provisions

Applicable to the Activities of Regional Headquarters

Contents

2. Overview of the Regional Headquarters Program

3. Economic Substance Requirements (ESR)

4. Taxes and Tax Incentives Applied in KSA to the Activities of Regional Headquarters

5. International Tax Aspects and Application of DTAA

6. Tax Procedures applied to Regional Headquarters

6.2. Tax/Zakat Base, Submission of Returns and Payment of Tax/Zakat

6.6. Penalties Imposed for Non-Compliance with Economic Substance Requirements

6.7. Penalties Imposed for Non-Compliance with Tax Regulations

Table 1 - Type of Violation: Failure to Submit the Required Tax Return or Disclosure

Table 2 - Type of Violation: Failure to Pay Tax

Table 3 - Type of Violation: Other Violations of the Tax Law and International Agreements

Table 4 - Type of Violation: Tax Evasion and Penalties

Annexure: Guidelines and Publications Relevant to Regional Headquarters

The Zakat, Tax and Customs Authority (“ZATCA, Authority”) has issued this Guideline for the purpose of clarifying certain tax treatments concerning the implementation of the statutory provisions in force as of the Guideline’s issue date. The content of this Guideline shall not be considered as an amendment to any of the provisions of the Laws and Regulations applicable in the Kingdom.

Furthermore, the Authority would like to highlight that the clarifications and indicative tax treatments prescribed in this Guideline, where applicable, shall be implemented by the Authority in light of the relevant statutory texts. Where any clarification, interpretation or content provided in this Guideline is modified -in relation to unchanged statutory text- the updated indicative tax treatment shall then be applicable prospectively, in respect of transactions made after the publication date of the updated version of the Guideline on the Authority’s website.

Glossary

KSA | : | Kingdom of Saudi Arabia. |

ZATCA | : | Zakat, Tax and Customs Authority. |

Governing Body | : | Ministry of Investment in the Kingdom of Saudi Arabia (MISA). |

Territory | : | Middle East and North Africa region. |

Tax Rules | : | Regional Headquarters Tax Rules Issued by resolution of the Board of Directors of the Zakat, Tax and Customs Authority No. (24-1-9) dated 23/07/1445H corresponding to 04/02/2024, and any amendments or replacements thereto. |

Income Tax Law | : | Income Tax Law in the Kingdom of Saudi Arabia issued by Royal Decree No. (M/1) dated 15/01/1425 AH, and any amendments or replacements thereto. |

Income Tax Law Implementing Regulations | : | Income Tax Law Implementing Regulations issued by Ministerial Resolution No. (1535) dated 11/6/1425 AH, and any amendments or replacements thereto. |

Value Added Tax Law | : | Value Added Tax Law issued by Royal Decree No. (M/113) dated 2/11/1438 AH, and any amendments or replacements thereto. |

Value Added Tax Law Implementing Regulations | : | Value Added Tax Law Implementing Regulations Issued by resolution of the Board of Directors of the Zakat, Tax and Customs Authority No. (3839) dated 14/12/1438 AH, and any amendments or replacements thereto. |

Zakat Collection Implementing Regulations | : | Zakat Collection Implementing Regulations issued by Ministerial Resolution No. (2216) dated 1440 AH, and any amendments or replacements thereto. |

Transfer Pricing By-Laws | : | Transfer Pricing By-Laws Issued by resolution of the Board of Directors of the Zakat, Tax and Customs Authority No. (19-1-6) dated 25/05/1440 AH, and any amendments or replacements thereto. |

Resident | : | Every person who is considered as resident in accordance with the provisions of the Income Tax Law. |

Non-Resident | : | Every person who is not considered as resident in accordance with the provisions of the Income Tax Law.[1] |

Person | : | Any natural or legal person.[2] |

Taxable Person | : | Person registered or obligated to register for VAT purposes, in accordance with the provisions of the Value Added Tax Law and its Implementing Regulations. |

Taxpayer | : | The person subject to tax under the Income Tax Law.[3] |

Tax | : | Income tax, withholding tax, value added tax, or excise tax. |

Person Obligated to Withhold Tax | : | Any person - whether taxpayer or non-taxpayer - and any permanent establishment of a non-resident in KSA that is obligated to withhold tax from an amount paid to the non-resident. |

Regional Headquarters | : | Regional headquarters or legal entity of a group of multinational companies that is established in accordance with the Laws in force in KSA and the concept of regional headquarters activity for international companies shall apply thereto according to the National Classification of Economic Activities No. (701011). |

Entity | : | A foreign multinational company or group that has at least two affiliated legal entities or branches around the world other than KSA and the country of incorporation (headquarters). |

Regional Headquarters License | : | License issued by the Governing Body that grants the licensed entity the authority to carry out the legally specified activities specified in the license and to qualify for incentives approved in accordance with the Laws and Decisions related to these incentives. |

Related Company | : | It has the meaning stipulated in the Income Tax Law and the Transfer Pricing Bylaws issued in accordance with the decision of ZATCA's Board of Directors. |

Tax Incentives | : | It means the tax incentives and exemptions provided to the regional headquarters by Royal Decree No. (M/62) dated 28/04/1445 AH corresponding to 12/11/2023 AD. |

Economic Substance Requirements (ESR) | : | Requirements that must be met by the regional headquarters to verify the presence of actual economic activities in KSA, which are stipulated within the Regional Headquarters Tax Rules. |

Eligible Activities | : | Main activities carried out by the regional headquarters which aim to enhance the group's image in the territory, provide strategic supervision and administrative guidance, and support the internal work of the company, its branches and related companies in the territory in accordance with the National Classification of Economic Activities No. (701011). |

Eligible Income | : | Income from eligible activities generated by the regional headquarters. |

Non-Eligible Activities | : | Activities other than eligible activities that may be undertaken by the regional headquarters. |

Introduction

ZATCA is pleased to provide this Guideline with the aim of providing the necessary clarifications and guidance regarding the tax provisions and rules related to regional headquarters in KSA. This Guideline aims to reduce to the minimum possible any ambiguity facing the regional headquarters in KSA. Moreover, this Guideline represents the details and controls of tax and zakat treatment in accordance with the tax and zakat laws and regulations applied in KSA. ZATCA is keen to cooperate with all persons, but this does not prevent differences in viewpoints from occurring between ZATCA and taxpayers, and this Guideline does not affect ZATCA's right to conduct audits and assessments, as well as impose fines and penalties on persons who have violated tax provisions.

To obtain more information regarding the application of Laws and Regulations in a specific case related to regional headquarters, you can contact ZATCA through official channels to obtain additional information or further clarification. You can also submit a request to issue a ruling[4]. ZATCA will do its best to provide you with the information required for the case in question.

The information provided in this Guideline is for informational purposes only, and the reader must refer to the provisions referred to in the Laws and Regulations in force in KSA regarding zakat, tax, and customs.

Overview of the Regional Headquarters Program

Overview

The Regional Headquarters Program in KSA was created for multinational companies that wish to establish their regional headquarters in KSA as an entity established in accordance with the Laws in force in KSA, for the purpose of supporting, managing and providing strategic direction to its branches, subsidiaries and related companies operating in a specific territory.

On the other hand, multinational companies that establish their regional headquarters in KSA in accordance with the licensing requirements and qualification standards for regional headquarters are eligible to benefit from a package of incentives, including benefiting from a set of tax incentives.

This Guideline aims to clarify the tax provisions and rules related to licensed regional headquarters in KSA, in addition to providing additional clarifications regarding the following axes:

Standards for qualifying regional headquarters, including mandatory and optional activities that are permitted to be practiced.

Regional headquarters registration mechanism.

Current application of taxes in KSA to regional headquarters.

Tax incentives available to regional headquarters in KSA.

International tax aspects and application of double taxation avoidance agreements ("DTAAs").

Tax and zakat procedures applied to regional headquarters.

Regional Headquarters Qualification Standards

The Company is eligible to benefit from the regional headquarters program when it meets all of the following criteria issued by the Governing Body:

The entity must own at least two subsidiaries or branches of the entity around the world other than the headquarter country and KSA.

The entity applying for the license must have a commercial register in the country of headquarters.

The entity applying for the license must have at least two commercial records from two different countries for entities affiliated with the company (not including KSA and the applicant company's register).

Submitting audited financial statements for the last fiscal year of the foreign company in the country of location.

Registering the regional headquarters according to the Laws in force in KSA as a foreign company (limited liability company) or a branch in KSA.

The regional headquarters in KSA must be an independent entity from other company entities in KSA.

Mandatory Activities of the Regional Headquarters

The regional headquarters must carry out the following activities for the benefit of its affiliated entities:

Strategic Direction Activities | Management Function Activities |

|

|

Optional Activities of the Regional Headquarters

The regional headquarters must carry out at least three (3) of the following optional activities for the branches, subsidiaries and/or companies related with the multinational group, at least within one year from the date of granting the license:

Supporting sales and marketing

Managing human resources and employees

Providing training services

Providing financial management, foreign exchange, and treasury center services

Monitoring compliance and conducting internal monitoring

Providing accounting services

Providing legal services

Providing audit services

Providing research and analysis services

Providing consulting services

Monitoring operations

Providing logistics and supply chain management services

Providing international trade services

Providing technical support services or engineering assistance

Conducting operations related to IT systems networks.

Providing research and development services.

Managing intellectual property rights.

Managing production.

Sourcing raw materials and spare parts.

Tax Incentives Available to Regional Headquarters

Regional headquarters that meet the qualification criteria issued by the Governing Body and the Economic Substance Requirements referred to in this Guideline will be granted the following tax incentives for a period of thirty (30) years, subject to renewal:

Zero percent (0%) income tax on eligible income from eligible activities.

Zero percent (0%) withholding tax on payments made by the regional headquarters to non-residents, according to the following:

Dividends.

Payments to related persons.

Payments to unrelated persons for services necessary for the activity of the regional headquarters.

Every international obligation to which KSA is a party applies to regional headquarters.

Registration Mechanism

Companies wishing to register as regional headquarters in KSA and benefit from the benefits of the regional headquarters program must register through the electronic services portal of the Ministry of Investment. Interested applicants and investors can access the electronic services website (https://investsaudi.sa/ar/login), create an account, and apply for a "new investment license". In addition, the user may then fill out the license form and submit all the required details and documents, including details regarding the company and its shareholders. These details and documents include, but are not limited to, information related to the entity, the type of license required and its validity period, basic information about the new company, business activities, shareholder information, etc. For the purposes of obtaining the license for the regional headquarters, specific documents must be submitted including all of the following:

Copy of the commercial register of the applicant establishment certified by the Saudi Embassy.

Copies of at least two commercial records or two commercial licenses for a multinational company in two different countries (other than KSA and the country in which the multinational group's headquarters are located) attested by the Saudi embassy in the countries concerned.

Copy of the financial statements for the last fiscal year of the foreign company requesting a license, attested by the Saudi embassy in the country concerned.

Upon completing the form, the user shall send the request to the Licensing Department for review purposes.

For more information in this regard, the Ministry of Investment has issued the following user guides with the aim of assisting and guiding interested investors in the licensing process, which also include a list of application submission requirements and required documents.

Economic Substance Requirements (ESR)

Economic Substance Requirements (ESR)

Notwithstanding the eligibility criteria required by The Governing Body, Regional Headquarters must satisfy all of the following Economic Substance Requirements contained in the tax rules[5] in order to benefit from the tax incentives contained within Paragraph (2.3) of this Guideline:

1. The Regional Headquarters must hold a valid license issued by The Governing Body and shall only carry out activities that are within the scope of such license.

2. The Regional Headquarters must have appropriate assets, including adequate premises in KSA that are suitable for its business activities.

The regional headquarters must have a physical office in KSA, which may be either owned or leased by the regional headquarters.

The office space at the disposal of the regional headquarters must be proportional to the activities it carries out.

3. The activities of the Regional Headquarters shall be directed and managed in KSA, which include holding board meetings for the Regional Headquarters where strategic decisions shall be made. The Board of Directors meeting must also be held frequently based on the activity, the number of subsidiaries, and the nature of transactions between the regional headquarters and its subsidiaries.

Board of Directors meetings must be held physically in KSA, during which actual and strategic decisions are taken and recorded in the minutes of the meeting, in accordance with eligible activities, provided that a quorum is met for the attendance of Board members to these meetings.

If the regional headquarters has one director, the regional headquarters must prove that the written decisions were issued by that director when he was physically present in KSA.

Although the Regional Headquarters may have one director initially, according to the Regional Headquarters licensing criteria, the Regional Headquarters must have at least three (3) employees at the level of Executive Director or Vice President as a minimum requirement, and these three employees are expected to make key decisions for the regional headquarters.

All minutes and records of the regional headquarters must be kept in KSA, and the records of the regional headquarters must include records that must be kept in line with the Companies Law in force in KSA.

The minutes of the Board of Directors meeting held in KSA must include all documents supporting those meetings, in addition to other main documents required by the Board of Directors to make its decisions.

The original/signed copies must be kept in KSA, but in cases where records are kept electronically, it is sufficient to keep these records and be able to view them in KSA, without there being a need for the relevant data center to be in KSA.

4. The Regional Headquarters must incur operational expenditures in KSA, which shall be commensurate with the activities of the regional headquarters.

Operating expenses generally include rental fees (if applicable), salaries, marketing expenses, equipment and other expenses related to regional headquarters activities.

Operating expenses must be documented with the necessary supporting documents which can be kept available.

The level of operational spending by the regional headquarters must be proportional to the activities it carries out.

5. The Regional Headquarters must generate revenues from the eligible activities in KSA.

6. The Regional Headquarters must have at least one director that is resident in KSA.

Residence must be statutory and not just through applying the relevant provisions in local income tax laws.

7. The Regional Headquarters must employ an adequate number of full-time employees, during a tax year, in proportion to the level of activity carried out by the Regional Headquarters.

An employee who worked for a specific part of the fiscal year in question is counted among the total number of employees working, in proportion to the period of time he worked during the fiscal year.

The part-time employee is counted within the total number of working employees, in proportion to the period of time he worked during the fiscal year compared to the full-time employee of a similar grade.

In cases where an employee spends only part of his time on work related to the relevant eligible activity and part of his time on work related to other activities, he will be treated as a part-time employee, in relation to the period of time spent engaging in the relevant activity.

An employee residing in KSA may be treated as if he is physically present in KSA throughout the period of his work, regardless of the necessity of performing part of his duties outside KSA.

An employee who is not resident in KSA may not be treated as if he is physically present in KSA at any time, regardless of the possibility of performing part of his duties within KSA.

The employee is treated as a resident of KSA if he spends most of his working hours in KSA.

An individual contractor who works entirely or almost entirely for the Regional Headquarters is considered an employee.

8. The Regional Headquarters' employees must have the requisite qualifications and skills necessary to execute their duties and fulfil their responsibilities. These qualifications should include the level of experience, educational background, and other qualifications relevant to a particular position and its seniority. The Board of Directors must unanimously have the knowledge and experience necessary to perform their duties as Board members, and the majority of employees must have relevant experience to carry out the activities of the regional headquarters.

It should be noted that the term "adequate" is used to describe what is adequate for a specific need or purpose, while the term "appropriate" means correct or most appropriate for a particular situation. These definitions are applied based on the nature of the regional headquarters and its eligible activity, and therefore regional headquarters must take these factors into account and maintain records showing their compliance with tax rules.

Also, standards may vary depending on the size of the business, which means that resources that are appropriate for smaller entities may not be adequate/appropriate for larger entities.

Procedures for Submitting a Declaration that Economic Substance Requirements have been Met

The regional headquarters must submit an annual report using the form prepared by ZATCA in accordance with the procedures specified thereby, in order to verify that the Economic Substance Requirements are met.

Taxes and Tax Incentives Applied in KSA to the Activities of Regional Headquarters

Income Tax

Income that regional headquarters receive from practicing the mandatory and optional activities mentioned above shall be subject to income tax at a rate of zero percent (0%) for a renewable period of thirty (30) years (this period shall be calculated from the date of issuance of the regional headquarters license in KSA).

In order to ensure the benefit of applying the tax at a rate of zero percent (0%), regional headquarters must not engage in any commercial activities (i.e. activities that aim to generate revenues) - other than the activities that the regional headquarters are licensed to practice -. Moreover, all commercial activities must be carried out by related companies that hold the necessary commercial licenses, and compliance with the Economic Substance Requirements (ESR) issued by ZATCA and contained in this Guideline is required.

In the event that the regional headquarters engages in commercial activities, other than the activities it is licensed to practice, the tax treatment applied to the regional headquarters' income from ineligible activities will be determined in accordance with the relevant tax laws in KSA.

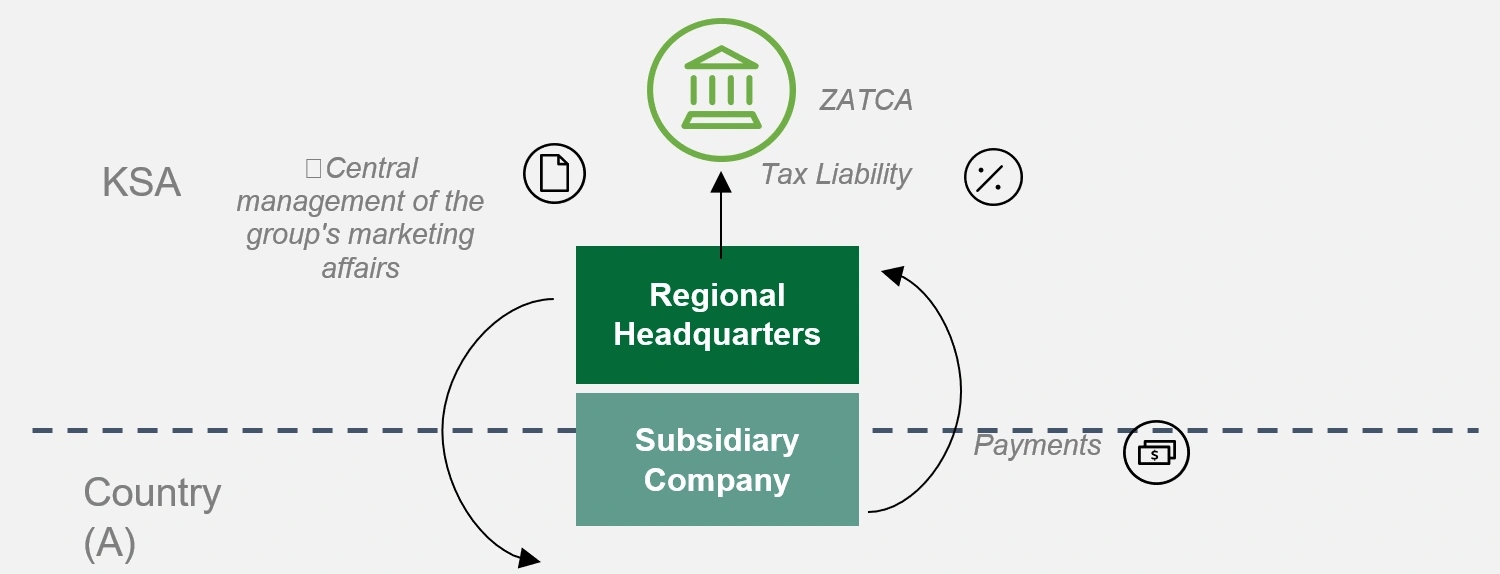

Example (1) - The taxable income of the regional headquarters in KSA and the activities it is licensed to practice.

The regional headquarters in KSA provides central management services for the group's marketing affairs to one of the group's subsidiaries, and in return, the regional headquarters receives payments from the subsidiary.

The regional headquarters carries out activities that it is licensed to practice in KSA.

Tax Treatment of the Regional Headquarters: The regional headquarters is considered to have carried out an activity within the activities it is licensed to practice in KSA in its capacity as a regional headquarters. Accordingly, the income received by the regional headquarters will be subject to income tax in KSA at a rate of zero percent (0%).

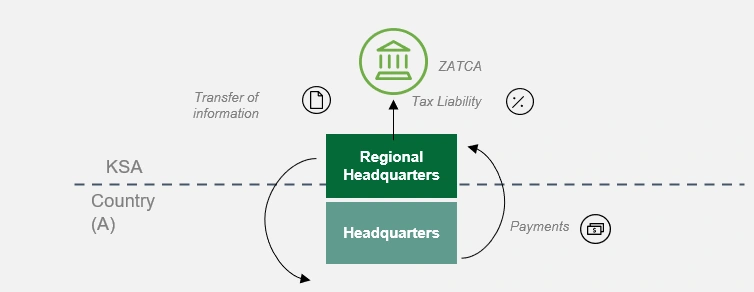

Example (2) - The taxable income of the regional headquarters in KSA and the activities it is licensed to practice.

The Regional Headquarters in KSA transfer information to the Headquarters (such information includes, but is not limited to, offers, invitations to bid, prices, and terms and conditions of sale). In return, the Regional Headquarters receives payments from the Headquarters.

The regional headquarters carries out activities that it is licensed to practice in KSA.

Tax Treatment of the Regional Headquarters: The regional headquarters is considered to have carried out an activity within the activities it is licensed to practice in KSA in its capacity as a regional headquarters. Accordingly, the income received by the regional headquarters will be subject to income tax in KSA at a rate of zero percent (0%).

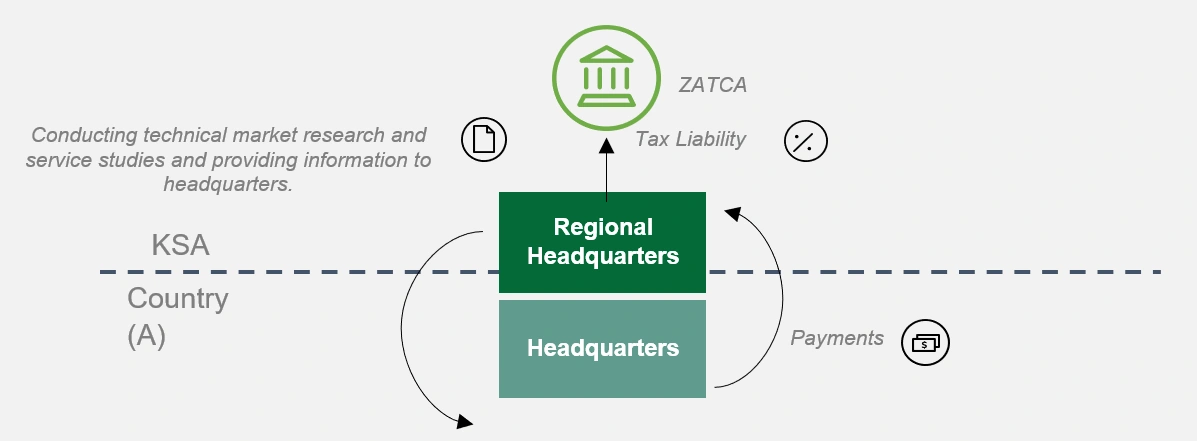

Example (3) - The taxable income of the regional headquarters in KSA and the activities it is licensed to practice

The regional headquarters in KSA conducts technical market research and service studies and provides information to the headquarters and its affiliates, and in return, the regional headquarters receives payments from the headquarters and its affiliates.

The regional headquarters carries out activities that it is licensed to practice in KSA.

Tax Treatment of the Regional Headquarters: The regional headquarters is considered to have carried out an activity within the activities it is licensed to practice in KSA in its capacity as a regional headquarters. Accordingly, the income received by the regional headquarters will be subject to income tax in KSA at a rate of zero percent (0%).

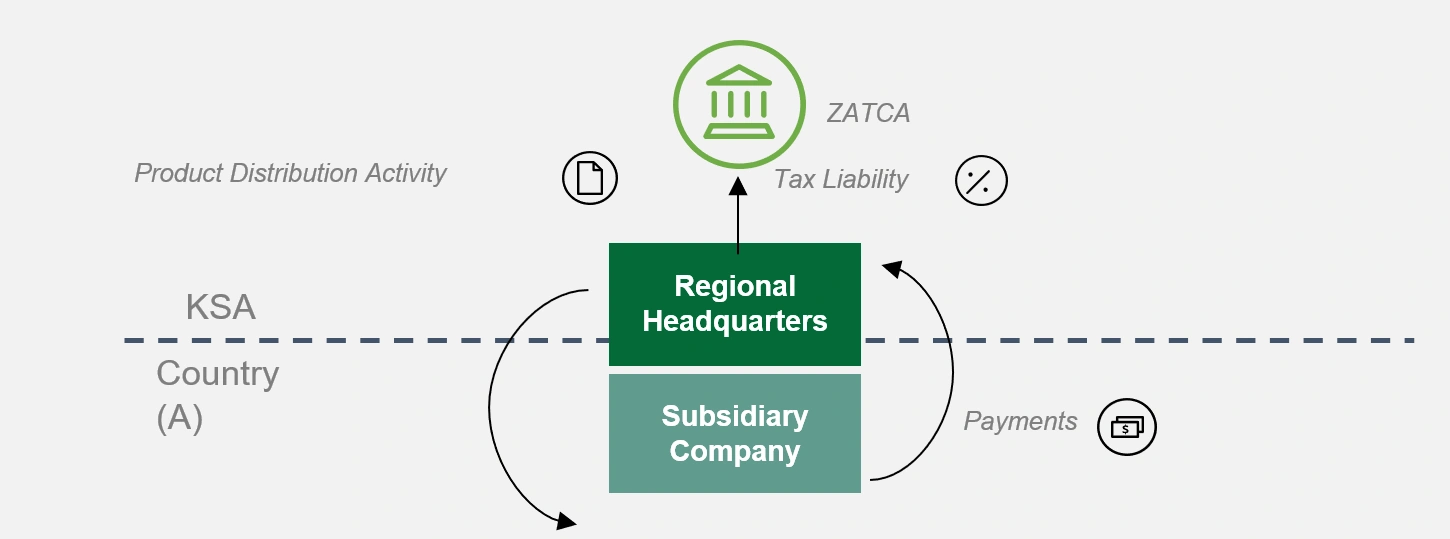

Example (4) - The regional headquarters engages in activities that it is not licensed to practice

The regional headquarters in KSA engages in distribution of products in KSA on behalf of its affiliate entity.

The regional headquarters carries out activities that it is not licensed to practice in KSA.

Tax Treatment of the Regional Headquarters: The regional headquarters is considered to have engaged in an activity outside of the activities it is licensed to practice in KSA in its capacity as a regional headquarters, and this may result in violating the provisions of the tax rules. Moreover, income generated from practicing ineligible activities does not benefit from tax incentives and is subject to tax in KSA in accordance with the provisions of the Income Tax Law.

Tax Residency

Tax Residency Status - Regional Headquarters

Article 3 of the Income Tax Law defines the concept of "Residency" based on two criteria:

Establishment in KSA

The location of the central management. If the regional headquarters meets the conditions resulting from one of the two criteria, it shall be considered a resident in KSA for tax purposes.

Establishment Criterion

This criterion is clear. If the regional headquarters is established in accordance with the Saudi Companies Law, it is considered a resident of KSA. It is worth noting that one of the requirements of the Regional Headquarters Program is that the regional headquarters must be established in KSA.

Headquarters Program is that the regional headquarters must be established in KSA.

Location of the Central Management Criterion

The regional headquarters shall be treated as residing in KSA if its central management is located in KSA.

In accordance with Ministerial Resolution No. (2194) dated 12/07/1432 AH, which stipulates that the Central Management is the place where senior policies are mainly drafted and the main administrative and commercial decisions necessary to carry out the Company's business in general are taken. The location of the Central Management shall be considered in KSA when at least two of the following conditions are met:

Holding regular meetings of the Board of Directors, which are held on a regular basis, during which the main policies and decisions related to the company's management and the conduct of its business in KSA are taken.

Making important executive decisions related to managing the company's functions, such as the decisions of the CEO and his deputies in KSA.

Most of the company's business, from which most of its revenues are generated, shall be conducted in KSA.

Tax Residency - Companies Affiliated with the Regional Headquarters Group

A company that is established outside KSA shall not be treated as resident in KSA by the virtue of eligible activities of the regional headquarters.

The regional headquarters of the group's subsidiaries in the territory operates based on the general principles of the group's global policy defined by the headquarters. The regional headquarters shall be responsible for performing the strategic direction, management function and comprehensive support activities in the territory that are not limited to any entity of the Group but are implemented for the benefit of all subsidiaries of the Group.

Example (5) - Tax Residency of the Group Subsidiary

A multinational company has a regional headquarters in KSA, and the Multinational operates in KSA, Bahrain and Oman. The Bahraini company obtained an important project in KSA, and the project's revenue amounts to 80% of the Bahraini company's income. In view of the importance of the project, the Managing Director and CEO of the Bahraini company decided to move to KSA to carry-on the commercial activities of the Company in KSA. In this case, is the Bahraini company considered a tax resident in KSA?

The Bahraini company has met the criterion related to the location of central management, considering that:

KSA is the place where its managing director and CEO have moved and are engaged in commercial activities including the senior executive decision making for the operations and management of the entity.

KSA is the place where most of the revenues generated from the vast majority of the businesses carried out by the company are generated (80% of its income).

Therefore, the Bahraini company is considered a tax resident in KSA and will be subject to tax in KSA.

It should be noted, however, that the activities carried out by the regional headquarters in KSA do not affect the eligibility of the Bahraini company to be a tax resident in KSA, it is the project management and execution in KSA that create tax residency for the Bahraini company.

If the main management conditions are not met, such as in the aforementioned example that the project's revenues represent 20% of the Bahraini company's income, then in this case, the Bahraini company is not considered a resident in KSA for income tax purposes according to the conditions stipulated in Ministerial Resolution No. (2194) dated 12/07/1432 AH.

Permanent Establishment of a Non-Resident Company Affiliated with the Group

A non-resident company affiliated with the Group is not considered a resident company in KSA simply because the regional headquarters carries out its operations within the mandatory activities in KSA, but it may fall within the scope of tax in KSA if the non-resident company carries out actual activities in KSA or generates income from a source in KSA.

According to the Income Tax Law, a non-resident in KSA is subject to income tax on its profits when it carries out its activities through a permanent establishment in KSA.

Article 4 of the Income Tax Law defines a "Permanent Establishment (PE)" as a permanent place of a non-resident's activity through which it carries out business, in full or in part, including business carried out through its agent.

Therefore, the extent to which a non-resident company affiliated with the Group has a permanent establishment in KSA depends on the specific facts and circumstances of its activities in KSA.

Permanent Establishment of a Non-Resident Company Affiliated with the Group - Proof of Income

Example (6) - Income attributable to a PE in KSA

Can the presence of the regional headquarters in KSA lead to income generated outside KSA from the global operations of the regional headquarters being subject to tax in the Kingdom in accordance with Paragraph (10) of Article 5 of the Income Tax Law[6]?

If the regional headquarters takes the form of a capital company, then paragraph (10) of Article 5 of the Income Tax Law must not apply to that regional headquarters in KSA, as this paragraph applies only to the permanent establishment of a non-resident in KSA.

In addition, if the regional headquarters takes the form of a branch (PE), then according to the nature of the activities carried out by the regional headquarters in KSA, and since for the purposes of obtaining a license for the regional headquarters, the applicant must prove, in addition to other matters, that the regional headquarters will not participate in commercial activities. In this case, there is no need to apply this paragraph, as the activities provided by the regional headquarters to the group companies will not be the same or similar to the activities carried out by the group companies in KSA (as commercial activities).

However, in cases where the regional headquarters takes the form of a branch in KSA and carries out business or activities or sells goods similar to those sold by its headquarters (although they are not compatible with the license), then the income generated as a result of this falls within the scope of tax in KSA, regardless of whether the income is directly attributable to the regional headquarters or is facilitated by it (taking into account that if there is a Double Taxation Avoidance Agreement in effect between KSA and the country in which the headquarters resides, then in that case the provisions of the aforementioned agreement will be applied).

Withholding Tax

The following payments related to mandatory and optional activities made by the regional headquarters to non-resident entities in KSA are subject to withholding tax at the rate of zero percent (0%), for a period of thirty (30) years, subject to renewal. This period is calculated from the date of issuance of the regional headquarters license in KSA:

Dividends.

Payments to related persons.

Payments to unrelated persons for services necessary for the activity of the regional headquarters.

Exemption from withholding tax does not apply in the following cases[7]:

If the amount paid by the regional headquarters relates to ineligible activities.

Cases of tax avoidance mentioned in paragraph (6.5) of this guideline.

In order to obtain these incentives, compliance with the Economic Substance Requirements (ESR) issued by ZATCA is required

KSA does not impose withholding tax on payments that are made between taxpayers residing in KSA or that are made to a permanent establishment of a non-resident in KSA (i.e. payments made from a resident in KSA to another resident in KSA or to a permanent establishment of a non-resident in KSA) as these payments fall within the scope of income tax or Zakat. Accordingly, regional headquarters that pay or receive amounts from/to their branches, subsidiaries, or associated companies residing in KSA are not subject to tax withholding.

Value Added Tax (VAT)

Value added tax is an indirect tax imposed on the import and supply of taxable goods and services at every stage of the supply chain from production to final sale to the final consumer, with the taxable person registered with ZATCA having the right to refund the tax incurred on his taxable purchases as deductible input tax.

A taxable person including the regional headquarters registered for VAT purposes must charge and pay tax on all taxable supplies and services made. The VAT collected by the taxable person including the regional headquarters from the customer or the recipient of services is known as Output Tax. Likewise, The VAT collected by the taxable person from the customer is known as Output Tax. Likewise, the VAT paid by the taxable person for purchasing goods or services from suppliers registered for VAT purposes is called Input Tax.

The supply of goods and services in KSA may also be subject to tax at the standard rate of (15%) or at the zero percent rate (0%), and the supply of goods and services may also be exempt from VAT in some specific cases in accordance with the provisions of the Value-Added Tax Law and its Implementing Regulations.

Registration for VAT Purposes

All persons, including regional headquarters residing in KSA, must register for VAT purposes if the value of their taxable supplies exceeds the Mandatory Registration Threshold of three hundred and seventy-five thousand (375,000) Saudi riyals in the previous twelve (12) month period[8], or if the value of the taxable supplies is expected to exceed three hundred and seventy- five thousand (375,000) Saudi riyals in the next twelve (12) month period[9].

If the regional headquarters does not qualify for the purposes of the Mandatory Registration Threshold (i.e. the annual value of taxable supplies is less than the mandatory threshold of SAR 375,000), it can apply for registration voluntarily provided that the Voluntary Registration Threshold which consists of making taxable supplies or incurring taxable expenses of at least SAR 187,500 in a twelve (12) month period[10]. It is worth noting that voluntary registration allows a person, including the regional headquarters, to deduct Input Tax on his taxable expenses as of the effective date of tax registration, also may deduct Input Tax incurred on supplies before the date of registration under the conditions Stipulated in the VAT Implementing Regulations.

If the regional headquarters exceeds the Mandatory Registration Threshold and only makes taxable supplies at zero percent (0%) rate, the regional headquarters will not be required to register mandatorily for VAT purposes and may apply for registration voluntarily. In this case, the notification of ZATCA of the same would not be required, but the regional headquarters must maintain sufficient evidence to prove that the revenues are inherently subject to the full zero percent (0%) rate.

Registration for VAT purposes can be made on the website, and taxpayers must apply for registration through the portal available on ZATCA's website. Once the tax registration is approved, ZATCA issues a Tax Registration Certificate to the regional headquarters, and the certificate must be displayed in a clearly visible place in the main workplace of the regional headquarters and all its branches.

If the regional headquarters has multiple branches within the same legal entity, all branches of that entity (including the regional headquarters) will be considered as one taxable person for VAT purposes, and only one tax account number will be issued.

Registration of Tax Group

Two or more legal persons residing in KSA who meet all the conditions[11] required to form a tax group may be treated as a single taxable person for VAT purposes.

For the purpose of forming a Tax Group, the following is required:

All members of the Tax Group must engage in an economic activity.

All members of the Tax Group must be legal persons residing in KSA.

All potential members of the Tax Group must be under common control, which means that the same entity or person owns fifty percent (50%) or more of the stocks or shares of the Group members, and the joint owner does not necessarily have to be a member of the Tax Group.

At least one member of the Group must be subject to tax.

The regional headquarters can apply to form a Tax Group (with related parties located within KSA) when the required conditions are met for the purposes of forming a Tax Group. If ZATCA approves the registration of the Tax Group, all supplies made within the Tax Group will be considered as outside the scope of VAT. In addition, a unified/joint tax return will be submitted by the Tax Group that collects all supplies and purchases made for and by the members of the Group by taxable suppliers and by them to their customers.

Supply of Goods and Services

VAT is applied at the relevant rates to all economic activities carried out by the taxable person, including regional headquarters, and is due on supplies made by the regional headquarters in accordance with the place of supply[12] and the date of supply rules[13].

Since there are no special tax rules for regional headquarters licensed in KSA in terms of VAT, the rules currently in effect for VAT are applied to all supplies made by regional headquarters (including back charge costs) in accordance with the VAT Law and its Implementing Regulations. However, it should be noted that VAT does not apply in cases where the supply is made to a member of the Tax Group. In addition, VAT does not apply in relation to supplies made by the regional headquarters to its branch and from the branch to the regional headquarters. In cases where the regional headquarters operates as a branch of the parent company in KSA, VAT is not applied with respect to supplies made between the branch and the parent company, because the regional headquarters and its branches are considered a single legal person and a single person is not considered to have made a supply for himself for VAT purposes.

If the regional headquarters operates as a branch of the parent company in KSA, the regional headquarters must commit to applying VAT on supplies made by the regional headquarters whose place of supply is within KSA, in addition to supplies made by the parent company to customers in KSA whose place of supply is in KSA.

Import of Goods and Services

Regardless of the taxable supply of goods and services, the regional headquarters registered with ZATCA for VAT purposes shall be responsible for calculating VAT on services received by it and supplied to it by a non-resident person in KSA in cases where the Reverse Charge Mechanism applies. In addition, it is the responsibility of the regional headquarters whether registered or not registered with ZATCA for VAT purposes to charge VAT on the import of taxable goods that is carried out into KSA in its name, regardless of the value of the import.

The Reverse Charge Mechanism is applied in cases where the taxable person receives a supply of services in KSA under the rules of the place of supply from a non-resident supplier. In this case, the taxable customer (i.e. the regional headquarters that receives the supply from the non-resident supplier) is considered to be making a supply for himself[14], and is obligated to report the VAT due on behalf of the non-resident supplier (Output Tax) under the Reverse Charge Mechanism. In case the regional headquarters is eligible to deduct the full amount of VAT on imported services, the Output Tax and Input Tax are declared equally in the tax return under the Reverse Charge Mechanism, without any net tax payable[15].

As for the import of goods, VAT is due when the goods enter KSA from outside the Gulf Cooperation Council countries (and as a transitional measure, from any place outside KSA, until the full implementation of the electronic service system between Member States regarding VAT for the purposes of intra-GCC Trade) and must be paid to ZATCA upon the entry of goods into KSA[16], in addition to customs duties and other fees imposed, unless the regional headquarters is eligible to postpone payment of the tax due upon import to customs and declare it through VAT returns[17]. The regional headquarters is eligible for the same if it is registered for VAT purposes and the imported goods are related to its taxable activity in KSA.

The VAT paid in connection with the import of goods into KSA can be refunded according to the regular deduction rules that will be discussed in the following sections.

VAT Deduction

Input tax is deducted through VAT returns, and tax returns are submitted on a monthly basis (for taxable persons whose annual revenues exceed SAR 40 million) or quarterly basis (for all other taxable persons).

Regional headquarters may deduct the Input Tax imposed on goods and services to the extent that they are purchased in the course of carrying out an economic activity for the purpose of making taxable supplies (at the standard rate or zero percent (0%) rate) or on supplies that would have been subject to tax had they been made in KSA. In addition to the VAT charged by registered suppliers for VAT purposes in KSA, there are two other categories of Input Tax eligible for deduction:

Self-accounted VAT under the Reverse Charge Mechanism on the supply of services from a non-resident supplier in KSA, provided that the Output Tax associated with the services received and to which that mechanism applies is reported.

VAT paid to ZATCA upon import, or postponed payment through the VAT return on imports of goods.

It should be noted that in cases of supplies between the regional headquarters that takes the form of a branch and the parent company, the Input Tax related to those supplies shall not be deducted, and the Input Tax related to the supplies of a taxable person that are exempt from VAT shall not be deducted as well, such as exempt financial services or exempt residential rent. If the supplies of the taxable person include supplies subject to VAT and others exempt from VAT, that person may deduct the Input Tax related to the part subject to VAT, and if the taxable person incurs general expenses or costs in exchange for making supplies subject to VAT and others exempt from tax, then he must, in this case, accurately divide the expenses and costs to determine the costs related to the part subject to VAT. The Input Tax is determined according to the following table[18]:

Input Tax directly Related to Supplies subject to VAT | Full deduction |

Input Tax directly Related to Supplies exempt from VAT | Full deduction is not permissible |

Input Tax related to supplies subject to VAT and supplies exempt from VAT which cannot be directly attributable to either of them | Partial or proportional deduction |

Deduction of Input Tax is subject to certain conditions and controls as stipulated in the VAT Implementing Regulations, and therefore regional headquarters must ensure that these conditions are met before deducting any Input Tax[19].

The regional headquarters may be eligible to deduct the Input Tax paid on purchases made before the actual VAT registration date, and the VAT deduction before tax registration is subject to the conditions and standards[20] stipulated in this regard.

Tax Invoices

Regional headquarters must issue a tax invoice for each taxable supply of goods or services, but a simplified tax invoice may be issued if the supply is made to a non-taxable natural person (individual), or in relation to low value supplies (supplies whose value is less than SAR 1,000). In addition, all tax invoices, whether regular or simplified, must be issued in accordance with the requirements stipulated in the VAT Implementing Regulations[21], as well as the e-invoicing regulations and the rules and controls related thereto.

Deregistration

The regional headquarters must submit a request to cancel its tax registration on a mandatory basis in accordance with the Unified VAT Agreement for the Cooperation Council for the Arab States of the Gulf[22], in the following cases:

Cessation of carrying out the economic activity.

Cessation of making taxable supplies.

The value of the Taxable supplies falls below the Voluntary Registration Threshold of SAR 187,500.

Regarding the application of point (C) in KSA, the VAT Implementing Regulations have specified three tests to describe the value of supplies as less than the registration threshold, based on the revenues of the taxable person during the previous two years and the revenues expected to be generated in the coming year.

The taxable regional headquarters registered with ZATCA must also submit a request to ZATCA to cancel its registration within thirty (30) days from the date of the occurrence of any of the aforementioned cases[23].

The below examples are cases related to local supply of services to the regional headquarters and export of services by the regional headquarters.

Example (7) - Local Supply of Services by the Regional Headquarters

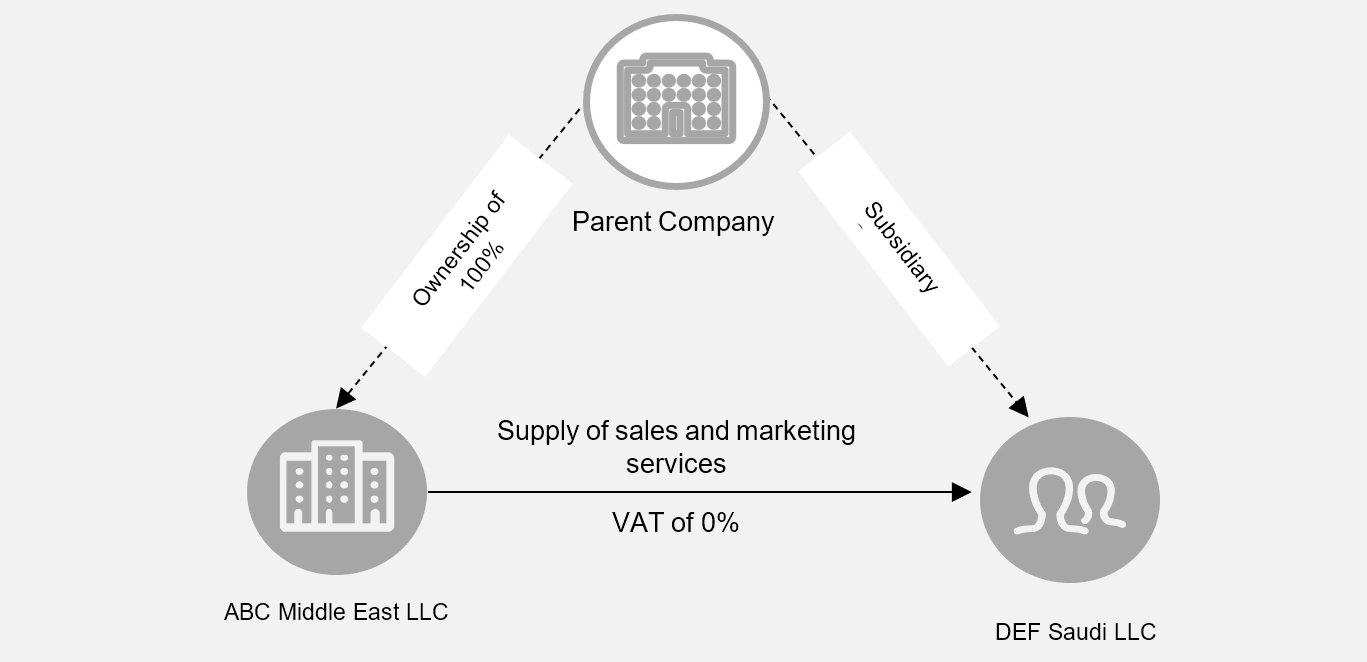

ABC Middle East LLC ("the Company") is a licensed regional headquarters in KSA. As the regional headquarters of a multinational group, the Company provides sales and marketing support services to one of the resident subsidiaries in KSA (DEF Saudi LLC) of its multinational group abroad. ABC Middle East LLC and DEF Saudi LLC have the same primary parent company but are registered separately for VAT purposes in KSA (i.e., the entities are not included within a Tax Group for VAT purposes).

The agreement concluded between the companies allows ABC Middle East LLC. to impose annual fees of SAR 500,000 (including VAT) on the sales and marketing support services provided to DEF Saudi LLC and issue an invoice for the fees imposed every three months for SAR 125,000 (excluding VAT).

ABC Middle East LLC is a company registered for VAT purposes and supplies taxable services of sales and marketing support to another company resident in KSA, so ABC Middle East LLC must charge a VAT of 15% on the supply of these services.

Therefore, ABC Middle East LLC must issue a tax invoice of SAR 143,750 including tax (value of services of SAR 125,000 plus 15% VAT amounting to SAR 18,750) on a quarterly basis.

DEF Saudi LLC utilizes sales and marketing support services in carrying out its economic activity in KSA for the purpose of making taxable supplies. Therefore, it is eligible to deduct the VAT imposed on it as Input Tax in its tax returns.

Example (8) - Export of Services by the Regional Headquarters

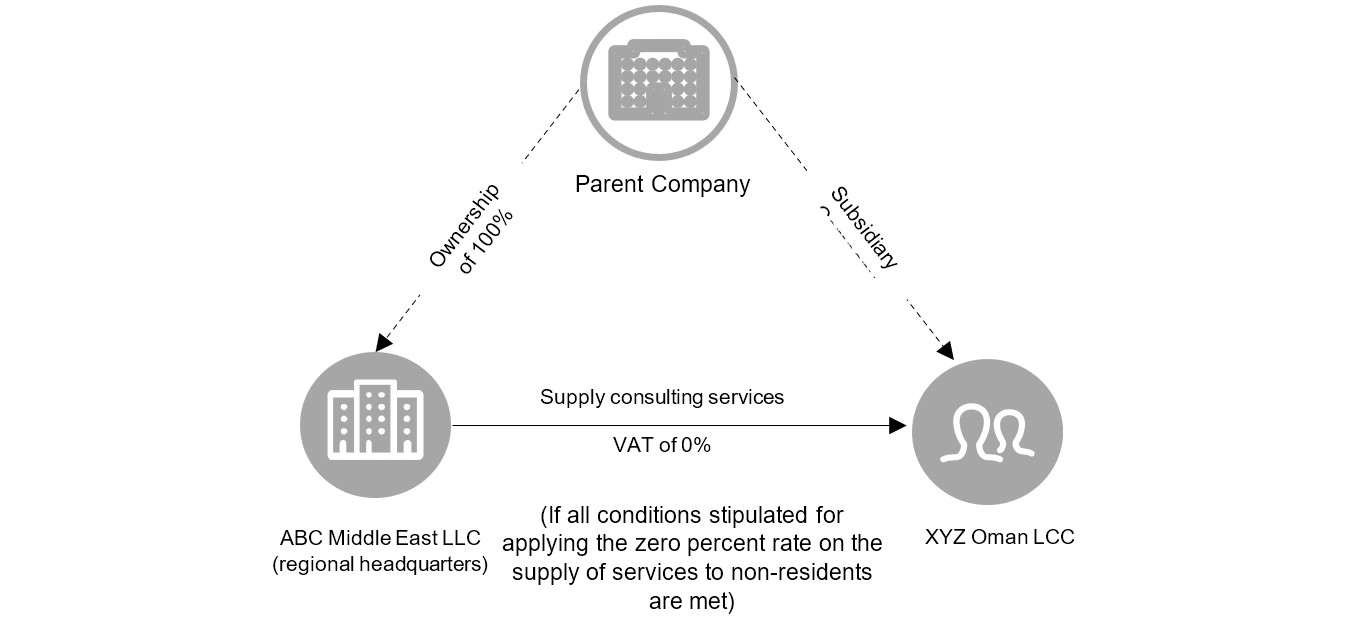

ABC Middle East LLC is a regional headquarters registered for VAT purposes and established in KSA. It provides consulting services to all the subsidiaries of its parent company abroad located in the Middle East region, including XYZ Oman LLC established in Oman.

Assuming that all conditions stipulated for applying the zero percent (0%) rate on the supply of services to a non-resident person have been met in accordance with the provisions of Article 33 of the VAT Implementing Regulations, then ABC Middle East LLC will be able to apply the zero percent (0%) rate on the supply of these consulting services.

Zakat

Regional headquarters licensed in KSA may be subject to Zakat based on the shares owned by a person subject to Zakat. According to Zakat Collection Implementing Regulations, Zakat is applied to companies residing in KSA on the shares of Saudi partners, those who are treated as citizens of the GCC countries, and anyone who practices the activity based on a license issued by a competent governmental or administrative authority in accordance with the controls set by ZATCA[24].

The Zakat base is determined in accordance with Chapter (2) of Zakat Collection Implementing Regulations, and Zakat is imposed at a rate of 2.5% of the Zakat base for the Hijri year[25].

Transfer Pricing

Regional headquarters that are a party to transactions with related persons must apply the provisions stipulated in the Transfer Pricing Bylaws issued by ZATCA to ensure that all transactions between related parties are conducted on the basis of the Arm's Length Principle, and that all relevant documents are kept and submitted to ZATCA, including the Master File, the local file, and the report of each country in accordance with the provisions of the Transfer Pricing Bylaws[26].

Regional headquarters can refer to the guideline published by ZATCA regarding Transfer Pricing to view all information and details related to regulating transfer pricing, including but not limited to interpretation, execution and application of these instructions.

Real Estate Transaction Tax (RETT)

When carrying out any real estate transaction that transfers the ownership or possession of the property for the purpose of possessing it or possessing its usufruct in accordance with the RETT Implementing Regulations issued pursuant to Ministerial Resolution No. (712) dated 15/02/1442 AH and its amendments, regional headquarters must disclose these transactions according to the agreed-upon value, or the value of the property, provided that the disclosed value is not less than the fair market value of the property at the time of the transaction. The RETT must be paid at a rate of (5%) of the value of the real estate transaction on the specified dates in accordance with the provisions of the RETT Implementing Regulations. In addition, certain real estate transactions are excluded from the application of the tax, according to paragraph (A) of Article 3 of the RETT Implementing Regulations.

International Tax Aspects and Application of Double Taxation Avoidance Agreements

Licensed regional headquarters in KSA are expected to conduct commercial or financial transactions with its branches, subsidiaries, or affiliated companies in the region or other entities. These transactions, if concluded between the regional headquarters in KSA and subsidiaries and other parties in other countries, are considered cross-border transactions. Therefore, they may be subject to the provisions of the Double Tax Avoidance Agreement (DTA) between KSA and the other country that is a party to the agreement (if any), in addition to the Income Tax Law in KSA, in order to determine the tax treatment of the type of income in relation thereto, as well as the allocation of taxation rights (between KSA and the other country).

KSA has concluded a number of DTAAs, and in the event of a conflict between such DTAAs and the local law, the tax treatment stipulated in the DTAAs shall be applied first, with the exception of the provisions related to Anti Tax Avoidance procedures stipulated in Article 63 of the Income Tax Law, in accordance with the provisions of Article 35 of the Income Tax Law. Therefore, the taxpayer may be able to benefit from the tax exemption or reduced tax rates available under the applicable DTAA, taking into account the evaluation of the benefits granted in the enforceable double taxation agreement for each case and circumstance separately.

For more information about the mechanism and procedures for implementing Double Taxation Agreements, please refer to the guidelines and tax publications available on ZATCA's website Zatca.gov.sa.

Tax Procedures applied to Regional Headquarters

Registration

Regional headquarters must register with ZATCA for tax purposes. This is done automatically when the regional headquarters is registered, and a license is issued from the Ministry of Investment. Entities become registered for tax and Zakat purposes as soon as they receive the commercial register, provided that this registration occurs before the end of the taxpayer's first fiscal year.

Regional headquarters registered with ZATCA as licensed entities obtain a separate tax identification number.

In addition, the regional headquarters may be required to register for VAT purposes, as clarified in Section 3.3 of this guideline.

Tax/Zakat Base, Submission of Returns and Payment of Tax/Zakat

Licensed regional headquarters in KSA must comply with the obligations related to submitting tax, Zakat, or mix returns and paying any amounts due on the statutory deadlines specified in accordance with tax legislation and Zakat Collection Implementing Regulations. As for all types of taxes, statements, tax returns, and any accompanying annexures must be submitted to ZATCA in Arabic language.

Income Tax

An income is considered realized from a source in KSA and is subject to tax in any of the cases mentioned in Article 5 of the Income Tax Law.

Taking into account the incentives granted to regional headquarters, licensed entities in KSA are subject to tax on non-qualified income at a rate of twenty percent (20%) of the Tax base, with the exception of companies operating in the production of oil and hydrocarbons. The tax is determined in accordance with the provisions stipulated in the Income Tax Law and its Implementing Regulations.

Submission of Returns and Tax Payment

Regional headquarters must submit an annual tax return as specified in the provisions of the Income Tax Law. The income tax return must be submitted within one hundred and twenty (120) days from the end of the taxable year for which the return is submitted. The taxpayer must also list all the income he earned during the reporting period[27]. In addition, expenses must be related to the activity and pertain to the taxable period in order to be deductible. Regardless of whether the company's accounts are consolidated with another person's accounts for accounting purposes, filing consolidated tax returns (i.e. one tax return on behalf of the entire group) is not permitted for income tax purposes.

In addition to the aforementioned, the amount of tax due -if any- must be paid (with respect to commercial activities that fall outside the scope of activities licensed to be practiced by the regional headquarters) according to the tax return within one hundred and twenty (120) days from the end of the taxpayer's taxable year[28]. The provisions for advance payments may also be applied in accordance with the Income Tax Law and its Implementing Regulations[29].

Delay fines are imposed on the tax which payment is delayed or approved to be settled in installments, from the maturity date until the date of payment at a rate of one percent (1%) of the unpaid tax for every thirty (30) day delay.

If the tax is overpaid and is not disputed, taxpayers may submit a request to refund the overpaid amount and obtain compensation at the rate of one percent (1%) for every thirty (30) days, starting after thirty (30) days from the date of requesting a refund and continuing until the amount is received[30].

Withholding Tax

Taking into account the incentives granted to regional headquarters, according to the Tax Laws and Regulations in force in KSA, withholding tax is due when a resident in KSA or a permanent establishment of a non-resident entity makes a payment to a non-resident from a source in KSA[31].

Submitting Withholding Tax and Tax Payment Forms

The Income Tax Law and its Implementing Regulations stipulate the obligations incurred with regard to submitting the forms and paying withholding tax, and the person who pays an amount subject to withholding tax must comply with the relevant requirements regarding submitting the form and paying the tax in accordance with the Income Tax Law and its Implementing Regulations[32].

The person obligated to withhold the tax must register with ZATCA and submit a monthly withholding form that includes any paid amounts subject to withholding tax in the relevant month. If there are no paid amounts subject to withholding tax, there will be no need to submit the monthly withholding form, and the person obligated to withhold the tax must submit the form and pay the withheld amount -if any- within the first ten days of the month following the month in which the payment was made to the beneficiary.

In addition to submitting the monthly form and paying the tax, the person obligated to withhold the tax must submit an annual form, provided that this is done no later than one hundred and twenty (120) days from the end of the fiscal year of the person obligated to withhold the tax. The annual form for the withholding tax can be considered a summary of all monthly withholding forms submitted during the year, and therefore there should not be any additional withholding amounts payable when submitting the annual withholding form. In this regard, it should be noted that unlike the monthly form, which can be made whenever there are payments to a non-resident that are subject to withholding tax, submitting an annual withholding form is mandatory, even if there is no tax to be declared throughout the fiscal year[33].

Value Added Tax (VAT)

Regional headquarters registered in KSA must submit VAT returns on a quarterly or monthly basis[34].

Monthly VAT returns are mandatory for taxable persons whose annual supplies exceed forty (40) million Saudi riyals. As for all other persons registered for VAT purposes, the tax period is limited to three (3) months.

As an exception to the above-mentioned rule, the regional headquarters whose annual taxable supplies are less than (40) million Saudi riyals may submit a request to ZATCA and request to follow the monthly tax period. In addition, if the regional headquarters follows the monthly tax period for two years, it may submit a request to ZATCA to follow a quarterly tax period provided that the value of its annual taxable supplies is less than (40) million Saudi riyals during the last twelve (12) months at the time of submitting the request.

Submitting Tax Returns and Paying the Tax

All regional headquarters registered for VAT purposes can submit their tax returns by logging into ZATCA's electronic portal. They must also submit a VAT return and pay the tax due no later than the last day of the month following the end of the tax period to which the tax return relates[35] The total VAT due or tax liability is calculated by reducing the total input tax from the total output tax for the relevant tax period, and the net difference collected must be paid to ZATCA on or before the due date mentioned above, through a bank transfer to ZATCA's designated account, by using "SADAD" payment system. It is worth noting that the "SADAD" payment system is a payment portal in KSA that aims to facilitate payment transactions for individuals, banks, businesses, and the government sector.

If the input VAT to be recovered is greater than the output VAT payable, the regional headquarters is in a recoverable position and the refund request can be applied for through the VAT return related to the refund period, or within five (5) years from the end of the calendar year to which the credit balance relates, or through an independent refund request. ZATCA reviews this request and pays the amount due on the approved refund requests directly to the details of the International Bank Account Number (IBAN) specified by the taxpayer. In return, the regional headquarters may choose to carry forward the excess tax that will be refunded and use it against any future tax liabilities[36].

In the event that the regional headquarters becomes aware of an error or an incorrect amount included in the submitted tax return, which has led to the tax payable being declared less than its actual amount, ZATCA must be notified of this within twenty (20) days from the date of its knowledge, and this is done by correcting the tax return through the electronic portal, if the taxable person found that there is an error or inaccuracy in his tax return that results in an excess in the amount of tax due, previously reported to ZATCA, he may, at any time, correct this error in any tax return subsequent to the date of realizing this error, taking into account what was stated in Paragraph Four (4) of Article 69 of the Implementing Regulations of the Value Added Tax Law, and despite the above, it should be noted that when the net tax due and declared in decrease is less than fifteen thousand (15,000) Saudi Riyals, the correction can be made by amending the net tax in the next tax return.

Zakat

Entities licensed as regional headquarters may be subject to zakat based on the ownership of shares in them, and according to the Implementing Regulations for Zakat Collection, zakat is applied to resident companies in relation to the shares of Saudi shareholders and those treated as citizens of the GCC countries, and everyone who carries out the activity based on a license issued from a competent governmental or administrative authority in accordance with the controls set by ZATCA. The zakat base is calculated based on Chapter Two of the Implementing Regulations for Zakat Collection. In general, zakat is applied at a rate of (2.5%) of the zakat base for the Hijri year, if the taxpayer's fiscal year differs from the Hijri year, then zakat is calculated in days, by dividing two and a half percent (2.5%) by the number of days in the Hijri year multiplied by the number of actual days of the taxpayer's zakat year, except for the net adjusted profit, which is subject to a rate of two and a half percent (2.5%) for any financial period. On this basis, zakat for the Gregorian, long or short financial period is calculated at the beginning of the activity, when the financial year is modified, or when ownership of the individual establishment is transferred.

Submitting Returns and Paying Zakat

Taxpayers subject to zakat must submit the zakat return and its attachments and pay the zakat within a period not exceeding one hundred and twenty (120) days from the end of the zakat year[37]. In the case of zakat assessment, the taxpayer must pay the full zakat due on him within sixty (60) days from the date of ZATCA's assessment, in the event that there is no objection to the zakat assessment within the statutory period[38]. Taxpayers may request payment of the amounts due from them in installments in accordance with the controls stipulated in Article 27 of the Implementing Regulations for Zakat Collection. It is also allowed to submit consolidated zakat returns that include wholly owned subsidiaries.

Transfer Pricing

Licensed regional headquarters in KSA must submit transfer pricing documents, when applicable, and this includes both the master file, the local file, and the country-by-country reporting. In this regard, it should be noted that the master file includes information about the global operations of the business and the transfer pricing policies of the MNE group, while the local file includes detailed information on all transactions of the taxable person and subject to control, and as for the country by country reporting[39], it is a report submitted by MNE groups about their operations in each country, and taxpayers are obligated to submit the country by country reporting, based on Article 18 of the Transfer Pricing Bylaws, in addition to submitting the Disclosure Form for Controlled Transactions, which is considered part of the tax return and zakat return, within one hundred and twenty (120) days from the end of the fiscal year, in addition to maintaining transfer pricing documents and submit the documents if requested by ZATCA within a period of no less than thirty (30) days from the date of the request.

Record Keeping and Maintaining Requirements

Licensed regional headquarters must prepare and maintain accounts, including audited financial statements, for each tax year throughout the term of the regional headquarters license, including the partial tax year that begins from the date of obtaining a regional headquarters license and ends on the last day of the tax year for that entity, in accordance with the Tax Laws and the Implementing Regulations for Zakat Collection.

For the purposes of complying with tax requirements related to keeping books, records and tax invoices, regional headquarters must apply the provisions included in the Tax and Zakat Laws and Regulations in force in KSA and should refer to them directly to determine the obligations arising therefrom[40].

In accordance with applicable laws and regulations, at least the following documents must be kept: The journal, general ledger/account book, inventory book, invoices, and other accounting records and documents necessary to determine tax liability. Taxpayers must also retain supporting documents, data, and explanatory notes. ZATCA may request additional records for the purposes of registration, examination, and assessment/valuation procedures.

For the purposes of withholding tax, the person obligated to withhold tax must provide ZATCA at the end of the tax year with the name, address, and registration number of the beneficiary, within the limits of the information available to the person obligated to withhold tax, and ZATCA may request further information in this regard.

In addition to the above, the person obligated to withhold the tax must maintain records proving his compliance with the provisions of the Income Tax Law and the validity of the withheld tax, and these records must include at least the name and address of the beneficiary and the type of amount paid (i.e. the amount of payment for services, royalties, loan fees, dividends, etc.), the payment amount and the withheld amount.

It is allowed to keep books and records via computer, subject to certain conditions as stipulated in the Implementing Regulations of the Income Tax Law and the Implementing Regulations for Value-Added Tax[41].

If the regional headquarters engages in non-qualifying activities at any time during the tax year, the regional headquarters must maintain separate accounts for the non-qualifying activities and income must be allocated to the qualifying activities as if they were independent of other activities of the regional headquarters.

Examination, Assessment, and Objection Procedures

Tax Examination and Assessment/Valuation

Entities licensed as regional headquarters are subject to tax examination and assessment by ZATCA, in accordance with the tax laws and regulations in force in KSA.

Entities licensed as regional headquarters must apply the provisions of the Tax Laws and Regulations in force in KSA and refer to them directly to learn about the tax examination and assessment procedures. This section provides a brief overview of the tax examination and assessment procedures in accordance with the tax legislation applied in KSA.

As a general overview, ZATCA has the right to conduct an examination and tax assessment on taxpayers who fail to submit their tax returns. ZATCA may also make an additional assessment on the taxpayer and make any amendments if it is found that the previously submitted tax return is incorrect. The taxpayer will be notified of the tax assessment or re-assessment of due tax by notification by any other acceptable means.

It is worth noting that the statutory period for tax assessment is five (5) years of the deadline specified for filing the tax return for the taxable year, or at any time with the written consent from the taxpayer.

In addition, ZATCA may make or amend an assessment within ten (10) years of the deadline specified for filing the tax return for the taxable year if a taxpayer does not file its tax return within the statutory period, or it is found that the return is incomplete or incorrect with the intention of tax evasion.

With regard to VAT, ZATCA may issue or amend the assessment within five (5) years from the end of the calendar year in which the tax period falls. If any transaction is carried out with the intention of tax evasion or if a person fails to register for VAT purposes, an assessment may be issued or amended until a period of twenty (20) years from the end of the calendar year in which the tax period falls[42].

The taxpayer may request a refund of any amounts paid in excess at any time within five (5) years from the end of the tax year for which the excess tax was paid.

ZATCA may also conduct field examinations, and the taxpayer is obligated under the Law to provide information as required by ZATCA. ZATCA has the right to conduct a field examination of all books, records, and documents of the taxpayer without prior notice. Field examinations may be conducted at the taxpayer's headquarters or at ZATCA's offices pursuant to an official notification from ZATCA.

ZATCA shall notify the taxpayer of any additional obligations it determines in relation to the taxes and penalties imposed on him, in addition to his right to object to them. Tax returns shall be deemed accepted by ZATCA if five (5) years have passed since they were submitted without receiving any notification from ZATCA regarding them.

ZATCA may correct the error resulting from incorrect application of the law, within five (5) years from the lapse of the specified deadline for submitting the tax return for the taxable year. The correction may be made upon a request from the taxpayer, or if the error is found by ZATCA.

In cases where the taxpayer fails to cooperate fully with ZATCA's employees regarding providing the required information, ZATCA's employees may take additional measures to obtain invoices, books, records, accounting documents, and other relevant documents that provide this information, and they may confiscate these documents temporarily if they have reason to believe that the taxable person concealed it, destroyed it, or tampered with its contents.

Objection/Appeal Procedures[43]

The tax legislation in KSA, the Implementing Regulations for Zakat Collection, and the Work Rules of the Zakat, Tax and Customs Committees, issued by Royal Order No. (25711) dated 08/04/1445 AH stipulate procedures for objection and appeal against ZATCA's decisions. The following paragraphs provide a brief overview of this topic, and taxpayers must refer to the Work Rules of the Zakat, Tax and Customs Committees. and Guidelines referred to above.

Taxpayers may object to assessment or re-assessment decisions within the statutory period specified of sixty (60) days from the date of notification of the assessment or re-assessment letter. Objections must be submitted in the form of a memorandum that includes a detailed explanation of the reasons for the objection and is directed to the authority that issued the notice. In the event of no objection during this statutory period, the payables included in the assessment or re-assessment become final and payable.

ZATCA will consider the objection, and if the reasons stated in the memorandum and documents submitted are acceptable and convincing, ZATCA may accept the objection in whole or in part and notify the taxpayer of the results within ninety (90) days from the date of the objection, and the taxpayer may within thirty (30) days from the date of receiving ZATCA's response to the objection or the lapse of the ninety (90) day period without receiving a response from ZATCA appeal before the Zakat, Tax and Customs committees.

Taxpayers must also pay any amounts due for any unobjectionable items, and for disputes related to VAT, ZATCA may request a cash or bank guarantee for the disputed amounts.

Tax Avoidance

The regional headquarters must adhere to all provisions related to tax avoidance and evasion stipulated in the relevant tax laws. ZATCA, in coordination with the Governing Body may revoke the Tax Incentives for the Regional Headquarters in any of the following cases[44]:

The Regional Headquarters intentionally submitted false or misleading information or declarations to ZATCA.

The Regional Headquarters has intentionally misapplied the Tax Rules or misused Tax Incentives to take advantage or assist others take advantage from the Tax Incentives in relation to non-eligible activities, and activities not licensed by the Governing Body.

The Regional Headquarters provided payments to non-residents on behalf of persons that do not qualify for Tax Incentives.

In the event that the Tax Incentives are revoked in accordance with the above cases, ZATCA shall issue the tax assessment and apply the applicable penalties in accordance with the Tax Laws in relation to the tax years in which the cases mentioned above are fulfilled.

Penalties Imposed for Non-Compliance with Economic Substance Requirements

Notwithstanding any penalties stipulated in the Tax laws, in the event that the Regional Headquarter does not fulfil any of the Economic Substance Requirements during the duration of its license, ZATCA shall notify the Regional Headquarters of the violation attributed thereto and grant it a corrective period of ninety (90) days from the notice date and in the event of failure to remedy, the following shall apply[45]:

Impose a SAR 100,000 fine provided that the violation is remedied within ninety (90) days from the date of imposing the fine.

In the event of failure to remedy the violation within ninety (90) days from imposing the fine specified in paragraph (1) above, or in the event that the Regional Headquarter repeats the same violation for which the fine in paragraph (1) above within (3) years from the date from imposing the fine, a SAR 400,000 fine is imposed provided that the violation is remedied within ninety (90) days from the date of imposing the fine.

In the event that the violation persists after the fine prescribed in paragraph (2) have been imposed, ZATCA in coordination with The Governing Body may consider suspension of Tax Incentives.

Penalties Imposed for Non-Compliance with Tax Regulations

Failure to comply with the Tax Laws and Regulations applicable in KSA may result in the imposition of penalties according to the following:

| Table 1 - Type of Violation: Failure to Submit the Required Tax Return or Disclosure | |

|---|---|

Summary of the Imposed Penalty | Law Reference |

| Article 76 of the Income Tax Law. |

| Article 42 of Value Added Tax Law. |

| Table 2 - Type of Violation: Failure to Pay Tax | |

|---|---|

Summary of the Imposed Penalty | Law Reference |

| Article 68 of the Implementing Regulations of the Income Tax Law. |

| Article 43 of Value Added Tax Law. |

| Table 3 - Type of Violation: Other Violations of the Tax Laws and International Agreements | |

|---|---|

Summary of the Imposed Penalty | Law Reference |

| Article 58 of Implementing Regulations of the Income Tax Law. |

| Article 44 of Value Added Tax Law. |

| Article 45 of Value Added Tax Law. |

| Table 4 - Type of Violation: Tax Evasion and Penalties | |

|---|---|

Summary of the Imposed Penalty | Law Reference |

| Article 77 of the Income Tax Law. |

| Article 69 of Implementing Regulations of the Income Tax Law. |

| Article 39 and 40 of Value Added Tax Law. |

| Article 48 of Value Added Tax Law. |

Annexure: Guidelines and Publications Relevant to Regional Headquarters

Regional headquarters can view the Tax Guidelines and Bulletins published on ZATCA’s website, including:

| Income Tax and Withholding tax | |

|---|---|

1 | The Income Tax Guideline regarding the Controls on whether Expenses can be Deducted or not for the Purpose of Determining the Tax Base |

2 | Income Tax Simplified Guideline |

3 | Tax-Exempt Income Guideline |

4 | Clarifying the provisions for withholding tax for some types of income |

5 | Guideline for Applying the Provisions included in the Income Tax Law regarding Withholding Tax |

6 | Withholding Tax Simplified Guideline |

| Zakat | |

1 | General Manual of Zakat |

2 | Zakat Simplified Guideline for Zakat Treatment of the Most Common Disputed Zakatable Items |

3 | Manual of Transition to the International Financial Reporting Standards: IAS 16 - 'Lease Contracts' |

4 | Manual of Transition to the International Financial Reporting Standards: Manual of Transition to the International Financial Reporting Standards IAS 1 "Presentation of Financial Statements" and IAS 37 "Provisions, contingent liabilities and contingent assets" |