UAE ENTITY, INDIA EXPOSURE

HYATT'S STRATEGIC ROLE TRIGGERS PERMANENT ESTABLISHMENT, SAYS SUPREME COURT

Excerpt

The article details the Supreme Court ruling on whether Hyatt's Dubai-based entity (HISWA) constituted a Permanent Establishment (PE) in India. It examines the Strategic Oversight Service Agreement (SOSA) with Indian hotels, which granted HISWA control over operations, HR, procurement, and b...

Executive Summary

The Supreme Court of India ruled that Hyatt International Southwest Asia Ltd (HISWA), a UAE entity, had established a Permanent Establishment (PE) in India through its Strategic Oversight Service Agreement with Indian hotel operators. Despite being UAE tax-resident, HISWA's substantial operational control over Hyatt hotels-including appointing key personnel, setting policies, and performance-linked compensation-created a Fixed Place PE under the India-UAE DTAA. The Court emphasized that legal ownership of premises isn't required for PE; sustained business operations with sufficient permanence suffices. The 20-year agreement granted HISWA contractual authority over strategic planning, brand standards, HR, pricing, and financial controls, transcending advisory services to constitute direct operational management. Significantly, the Court rejected that global losses preclude profit attribution to the Indian PE, affirming that taxability flows from the PE's existence and activities regardless of overall financial position.

Introduction

In a Nutshell

Key Takeaways

Facts Explained

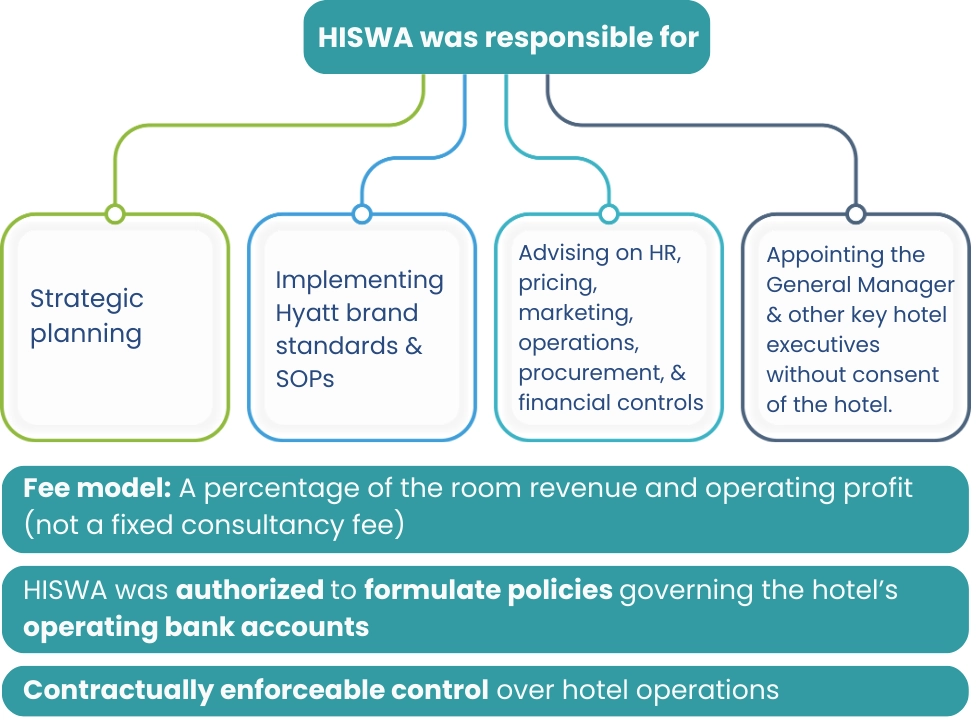

Taxpayer: Hyatt International Southwest Asia Ltd ("HISWA"), a company incorporated under DIFC Law No. 3 of 2006 in Dubai, United Arab Emirates ("UAE").

Tax residence: UAE under Article 4 of the India-UAE Double Taxation Avoidance Agreement ("DTAA").

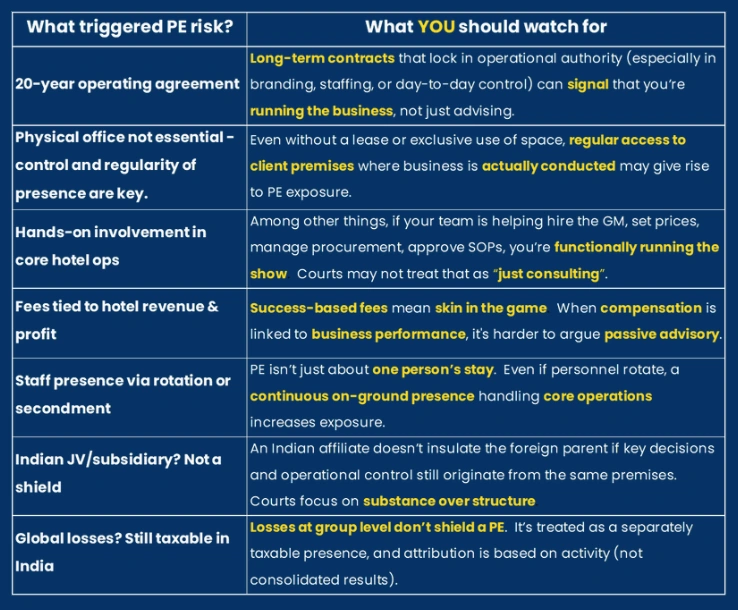

Contract period: Initial term of 20 years, extendable by another 10 years by mutual agreement.

As per the SOSA, HISWA had the right to assign its own or affiliate employees to AHL [later reorganized, with Asian Hotels (North) Ltd continuing the hotel ownership], including those who would serve full-time in executive roles.

Terms of the SOSA

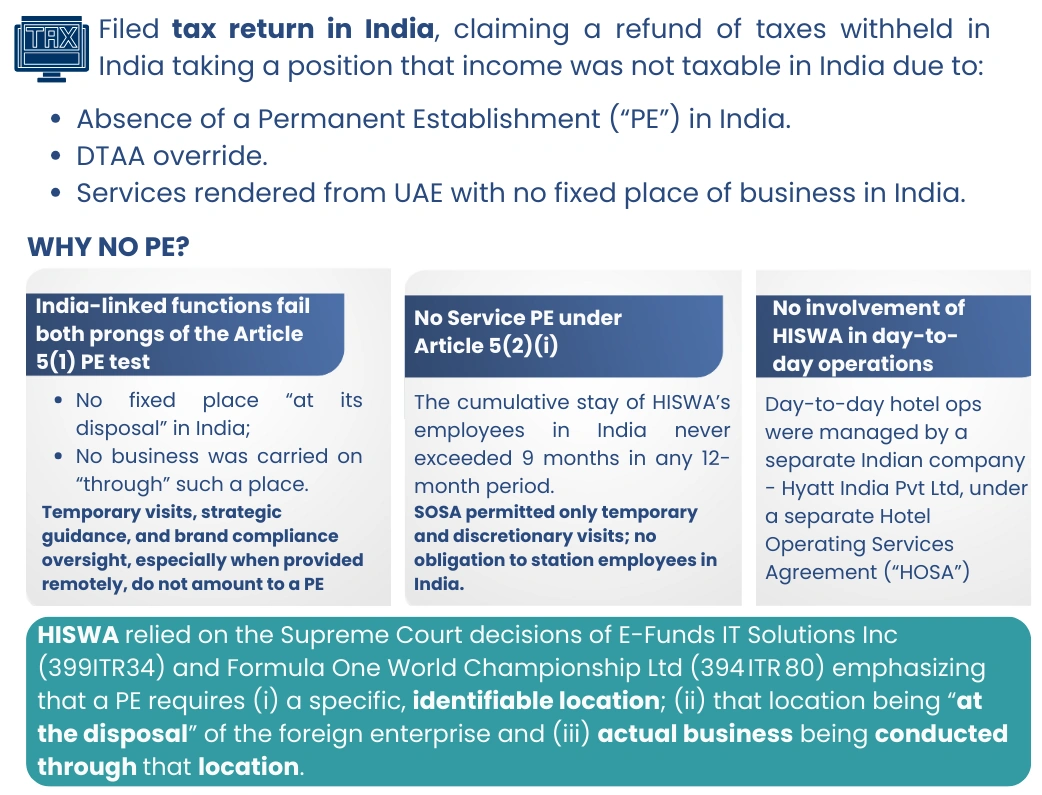

HISWA's India Tax Position

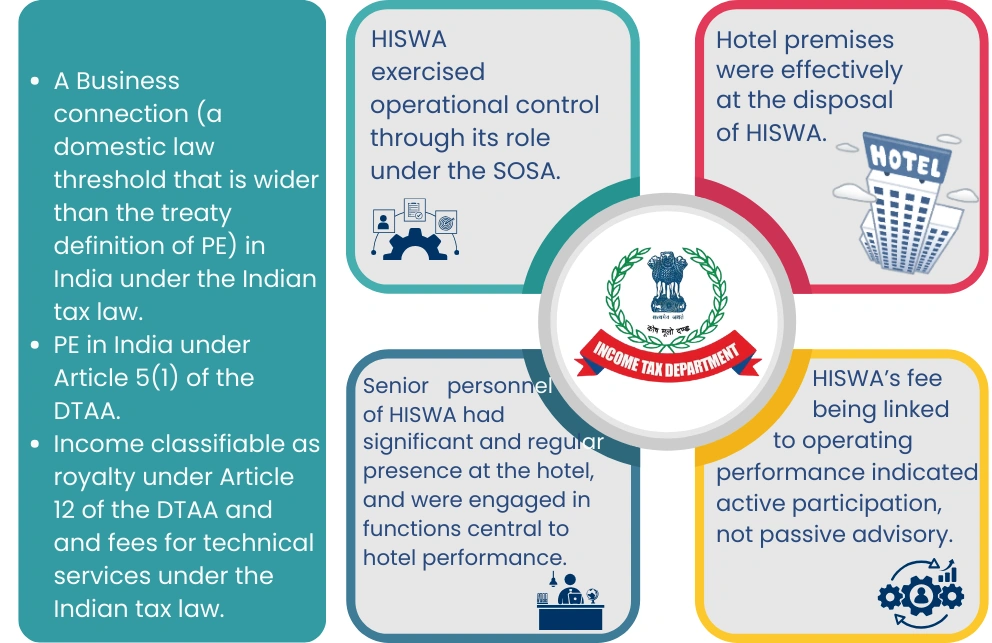

India Tax Authority Position

HISWA's facts confirm the existence of a fixed placePE in India under Article 5(1) of the DTAA.

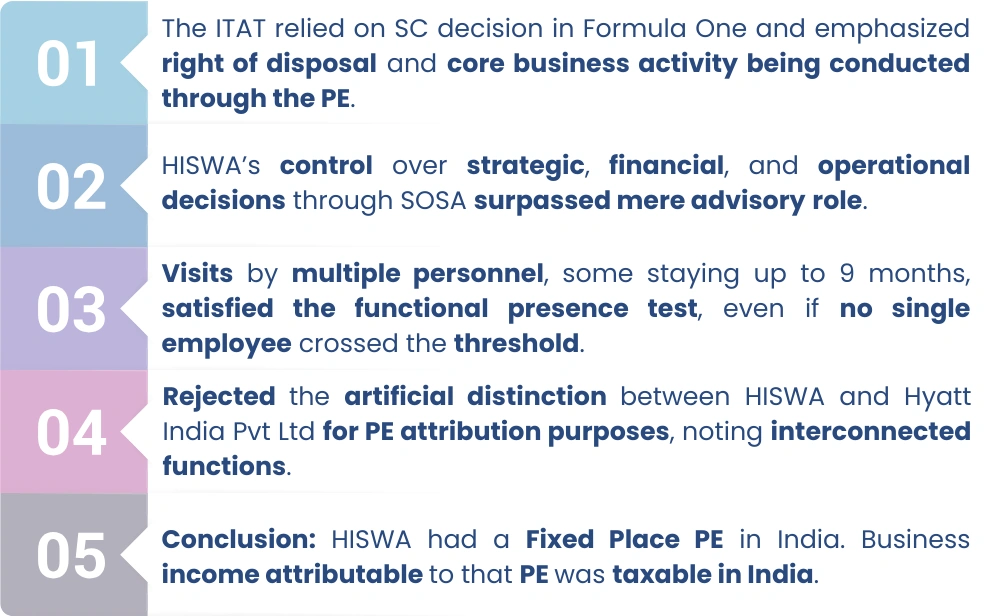

ITAT Observations and Ruling

The Income Tax Appellate Tribunal ("ITAT") is the second appellate authority for direct tax matters in India (below the State High Courts) and is the final fact-finding authority.

High Court Observations and Ruling

The Supreme Court Judgment

Substantial question of law: Whether HISWA had a Fixed Place PE in India under Article 5(1) of the India-UAE DTAA?

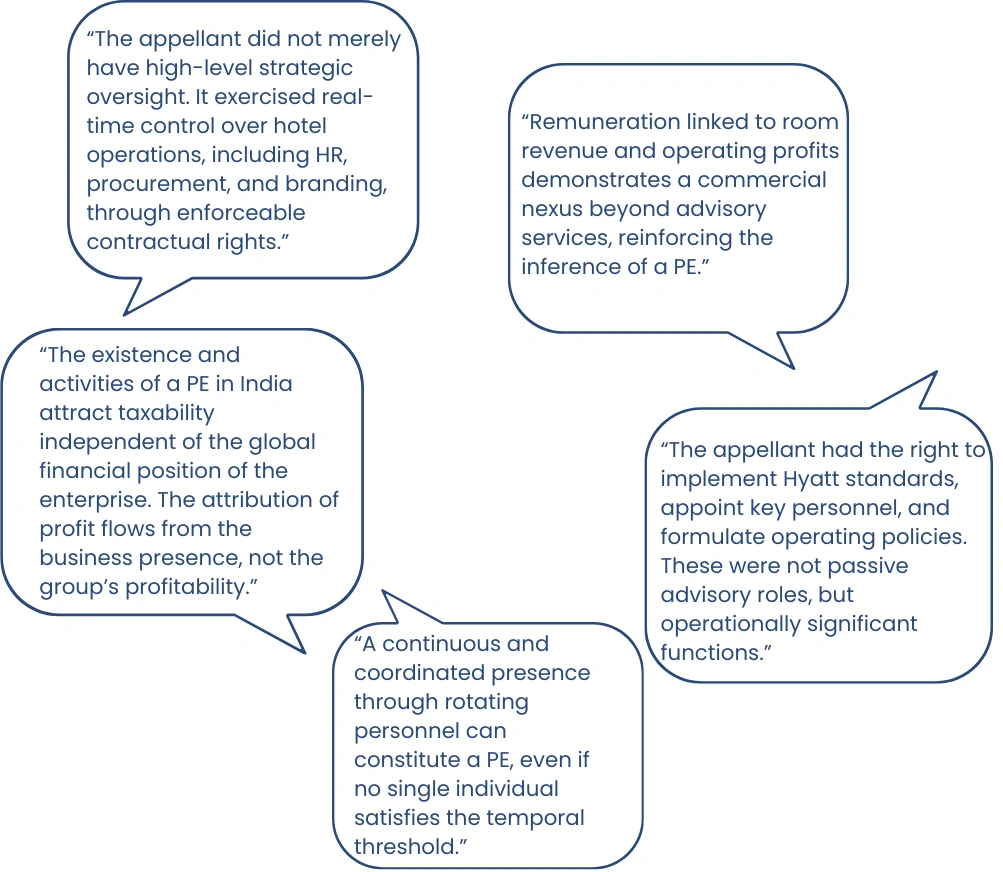

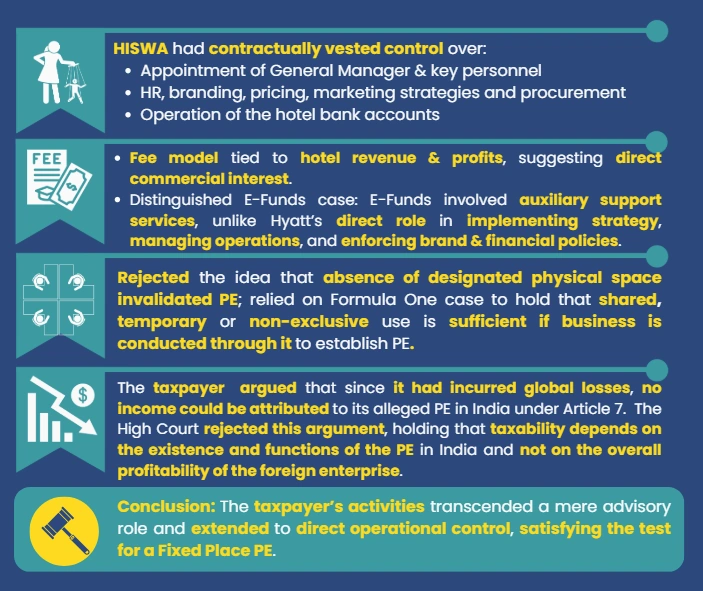

OBSERVATIONS ON THE SOSA AGREEMENT

The SOSA was a long-term contract (20 years, extendable by 10) that granted HISWA substantive operational authority.

The agreement conferred HISWA with rights to:

Appoint and supervise key hotel personnel, including the General Manager;

Formulate and enforce policies on HR, procurement, branding, pricing, guest experience, and bank account operations;

Deploy personnel (including affiliate employees) at its discretion, without requiring consent from the hotel owner.

The consideration was linked to the hotel's financial performance (room revenue and gross operating profit) rather than a fixed fee, This underscored a commercially participative role.

OBSERVATIONS ON CONCEPT OF PE

The Court reaffirmed the principles laid down in Formula One case that a Fixed Place PE exists where a place is:

At the disposal of the foreign enterprise, and

Such place is used to carry on its business (wholly or partly).

The Supreme Court reiterated that the existence of a Fixed Place PE under Article 5(1) must be assessed using three key criteria:

Stability: A sustained and continuous arrangement for conducting business from a particular location;

Productivity: Performance of revenue-generating functions at that location;

Dependence: A business presence that is functionally reliant on the use of the premises.

The fact that no single employee stayed in India beyond the 9 month threshold under Article 5(2)(i) was not decisive.

The Court observed that continuity of business operations (even via multiple personnel in rotation) was sufficient to support the existence of a PE.

ON THE MATTER OF ATTRIBUTION OF PROFITS DESPITE GLOBAL LOSSES

The Court rejected the argument that no attribution of profits could be made because the entity incurred global losses.

Citing the High Court's ruling (larger bench) on the same matter, the Supreme Court affirmed that taxability in India arises from the existence and activity of the PE, not from group-level profitability.

The PE is treated as a separately taxable presence in a foreign jurisdiction, and profits attributable to it can be taxed in India regardless of the foreign entity's overall financial position.

Conclusion

The Supreme Court held that HISWA had a Fixed Place PE in India under Article 5(1) of the India-UAE DTAA, based on its sustained operational control over key hotel functions through a long-term agreement. It clarified that legal ownership or exclusive possession of premises is not necessary - what matters is the right to access and use the premises in the course of business with a sufficient degree of permanence. The Court also rejected the plea that global losses preclude attribution, affirming that taxability flows from the existence and activities of the PE itself.

CAVEAT

This post is a summary of key legal findings from the Supreme Court's decision in the Hyatt HISWA case. While care has been taken to ensure accuracy, the content is intended solely for educational and informational purposes. It does not represent legal or tax advice, nor does it substitute a full reading of the judgment or professional consultation based on specific facts.