THE TWO-PILLAR TAX REFORM: PART II

A BEGINNER'S GUIDE TO PILLAR I & II

Excerpt

Pillar II introduces a global minimum tax to prevent profit shifting by MNEs. It applies a 15% Effective Tax Rate per jurisdiction. Key components include the Globe rules, QDMTT, IIR, and UTPR. Countries will adopt these rules through domestic legislation between 2024 and 2025.

Executive Summary

Pillar II introduces a coordinated 15% global minimum corporate tax rate through the GloBE (Global Anti-Base Erosion) rules. Developed by the OECD Inclusive Framework during 2019-2020, it applies to multinational enterprises with annual revenues of €750 million or more. The framework operates through multiple rules including the Income Inclusion Rule (IIR), Undertaxed Profits Rule (UTPR), and optional Qualified Domestic Minimum Top-Up Tax (QDMTT). With 136 countries agreeing to implement this regime, Pillar II aims to prevent profit shifting to low-tax jurisdictions and ensure multinationals pay their fair share of tax globally.

Introduction

Pillar II focuses on tackling the remaining issue of profit shifting to low-tax jurisdictions. Its objective is to introduce a 15% global minimum corporate tax rate, ensuring that large MNEs pay at least a minimum level of tax, no matter where they operate, discouraging the shifting of profits in a manner that results in low-tax outcomes or to low tax jurisdictions and tax havens.

It was developed alongside Pillar I by the OECD Inclusive Framework during 2019-2020, starting out as a set of anti-base erosion proposals.

By setting a global minimum, Pillar II helps prevent a race to the bottom on corporate tax rates, safeguarding countries' tax bases. In October 2021, a total of 136 countries agreed to implement this global minimum tax regime - signalling broad support for the principle that multinationals should pay their fair share of tax in every country they operate.

Explanation

Pillar II: Key Features

Pillar II introduces a coordinated global minimum tax framework, known as the GloBE (Global Anti-Base Erosion) rules.

It applies to:

- MNE groups with annual consolidated revenues of at least €750 million (same threshold as Country-by-Country Reporting)

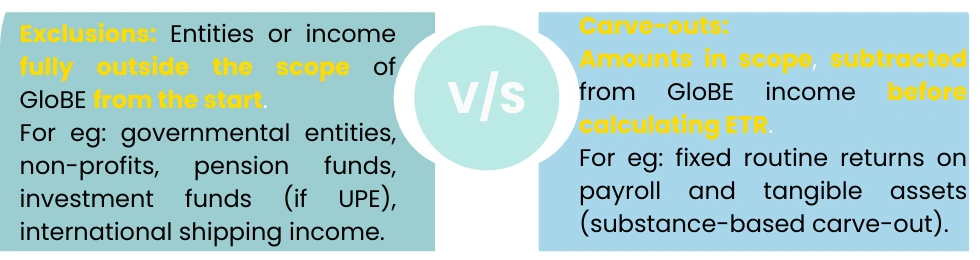

Exclusions:

Governmental entities, Non-profits, Pension funds, Investment funds (if UPE), International shipping income.

The core of Pillar II is a minimum Effective Tax Rate ('ETR') of 15%, calculated separately for each jurisdiction where the group operates.

If an MNE's income in a particular country is taxed at less than 15%, a top-up tax is applied to bring the overall tax paid in that country up to the minimum level.

Importantly, the GloBE ETR is calculated per country and not as a global average: meaning low-tax profits in one country cannot be adjusted by higher-tax profits in another.

Understanding ETR (Effective Tax Rate)

ETR under Pillar II is the core metric used to determine if a jurisdiction's profits are taxed at least at the 15% minimum rate.

ETR Formula:

ETR is calculated separately for each jurisdiction where the MNE operates.

- If the ETR is below 15%, a top-up tax applies.

- If it meets or exceeds 15%, no additional tax is required.

Why not statutory rate?

Because the ETR reflects actual taxes paid relative to income, after adjusting for local incentives, deductions, and exemptions providing a real-world view of tax levels.

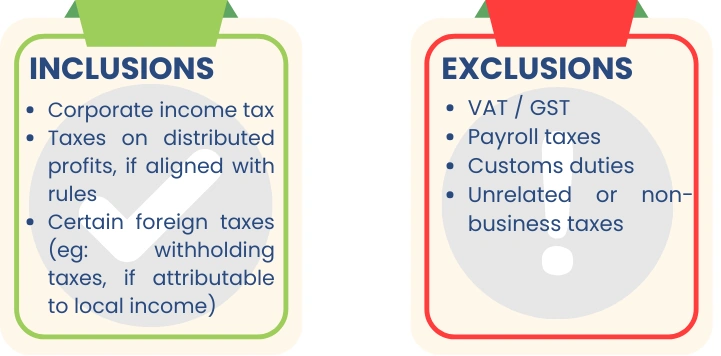

Special Considerations(Not exhaustive)

- Deferred tax expenses may be included in covered taxes, but only if measured at or above the 15% minimum rate. This helps avoid penalizing companies just because some taxes are delayed due to timing differences (like accelerated depreciation).

- Certain foreign withholding taxes may count if they are tied to local profits. For example, withholding taxes on royalties or interest may be included if they directly reduce local income.

- Tax refunds or credits can adjust covered taxes depending on OECD rules. Refundable tax credits reduce covered taxes, but non-refundable credits may still be counted if they reduce the final tax liability.

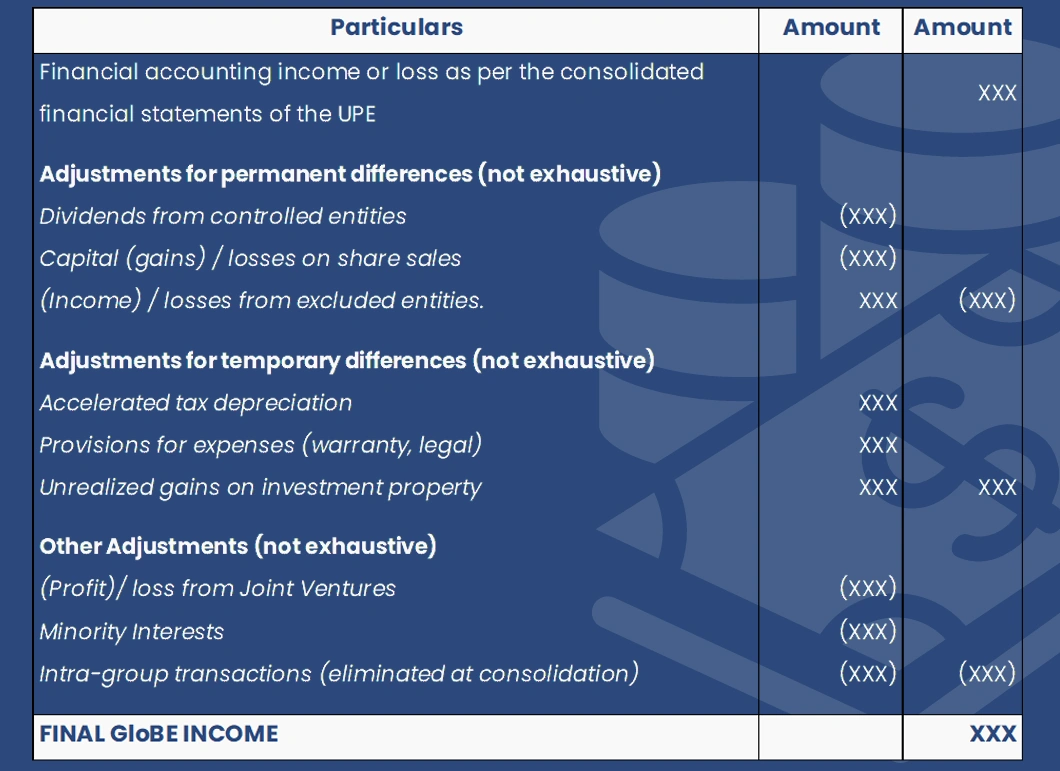

Decoding Pillar II - GloBE Income

GloBE income is the income base used to calculate the ETR under the OECD Pillar II GloBE rules.

GloBE income DOES NOT equal taxable income under local tax law. It is based on the group's financial accounting (book) income, with specific adjustments defined by the OECD Model Rules

Why not just use taxable income?

Because:

- Taxable income varies widely between countries due to local rules.

- Financial accounting income (especially from audited consolidated statements) offers a standardized, comparable base across jurisdictions.

- It ensures uniformity and avoids local manipulation.

In summary, GloBE income = standardized, adjusted financial accounting income, used as the base to calculate the ETR under Pillar II. It is the "common ground" number that makes the top-up tax system work globally.

Determination Of Globe Income

Pillar II: Key Concepts

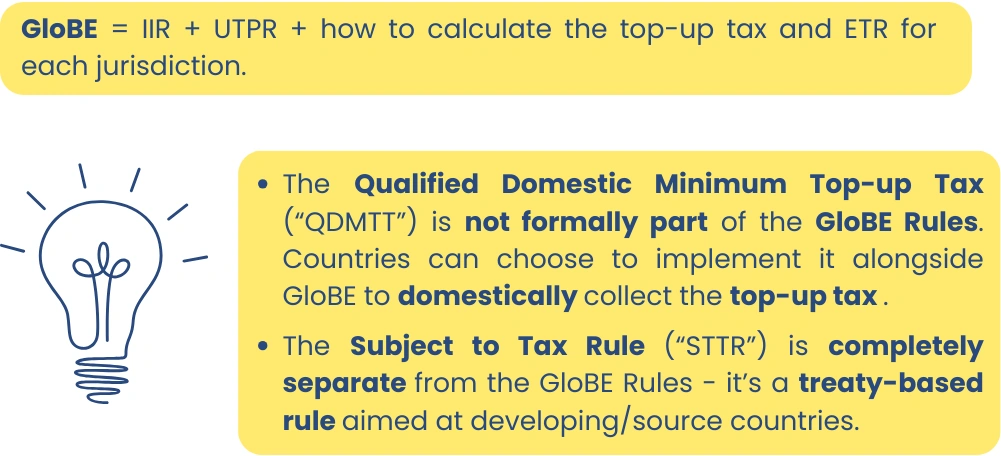

The "GloBE Rules" refer to:

- The Income Inclusion Rule ('IIR')

- The Undertaxed Payments Rule ('UTPR')

- Related definitions, computations, and mechanisms under the OECD Model Rules

Substance Based Carve-Outs

Under the OECD GloBE rules, the substance-based income exclusion (often called the "substance carve-out") reduces the amount of profit subject to top-up tax based on the idea that MNEs should not pay top-up tax on routine profits from genuine economic activities - like having employees and assets - even if the jurisdiction's ETR is below 15%.

Fixed Percentage Returns:

The GloBE rules provide a fixed percentage return on:

- Eligible payroll costs: Initially 10% (decreasing to 5% over 10 years)

- Eligible tangible assets: Initially 8% (decreasing to 5% over 10 years)

This "routine return" is carved out from GloBE income before testing for top-up tax.

Under the GloBE rules, the fixed percentages of 10% (payroll) and 8% (assets) gradually decrease over a ten-year period to 5% each, as prescribed by the OECD rules, reducing the amount of income subject to top-up tax.

Substance Based Carve-Outs

WHY DOES IT MATTER?

Without the carve-out, even low-taxed income from real, on-the-ground business (like factories, warehouses, employees) would face top-up tax. The carve-out ensures the 15% minimum tax applies only to excess profits, not routine economic returns.

EXAMPLE: Say an MNE in Country A earns €100 million profit (GloBE income), incurs €30 million in eligible payroll expenses and owns eligible tangible assets to the tune of €50 million.

Calculation:

- Payroll carve-out → 10% × €30m = €3m

- Asset carve-out → 8% × €50m = €4m

- Total carve-out → €3m + €4m = €7m

Adjusted GloBE income: €100m – €7m = €93 million

This €93 million is the amount tested against the 15% ETR. If the ETR on €93m is below 15%, a top-up tax applies. The carve-out reduces the income base, not the ETR or tax directly. This design protects normal business profits from top-up tax, focusing the 15% minimum tax only on residual profits - that is, profits exceeding a routine, normal return.

Pillar II Implementation & Development Timeline

Pillar II is being implemented through domestic legislation in each jurisdiction, following the OECD's agreed GloBE rules; it takes effect as countries enact local laws applying the 15% minimum tax, with many already effective from 2024 and others following in 2025.

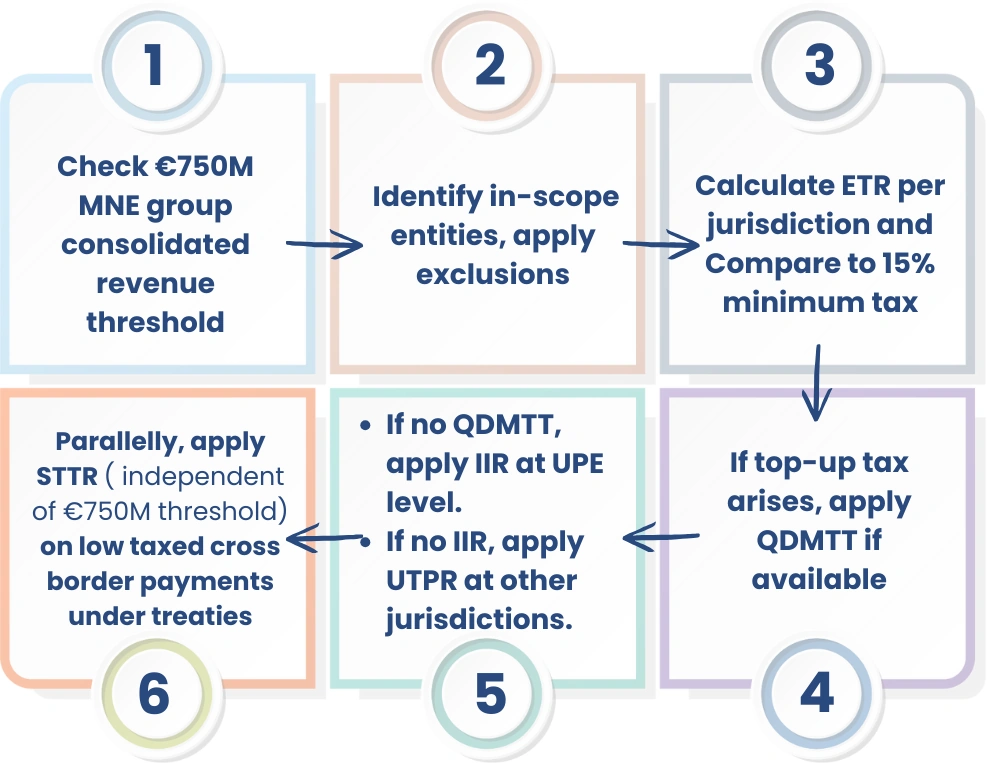

Decoding Pillar II - IIR

Income Inclusion Rule is also known as the Top-Down Rule.

What does it mean?

If an MNE group has subsidiaries in jurisdictions where the ETR is below 15%, the UPE jurisdiction applies a top-up tax on those low-taxed profits ensuring that the group's ETR in each jurisdiction meets the 15% minimum standard under the GloBE rules.

Importantly, the country where the low-taxed profits arise does not change its own tax liability unless it has implemented a QDMTT.

IIR prevents profits from escaping the 15% minimum tax, ensuring the parent country collects the shortfall when the source country does not.

IIR applies before the UTPR, following a top-down approach. Simply put, if a subsidiary's profits are taxed below 15%, the top-up tax is first collected at the UPE level under IIR. Only if the parent jurisdiction doesn't apply IIR, or if a shortfall remains do other countries apply UTPR to collect the balance.

Decoding Pillar II - UTPR

Undertaxed Profits Rule (UTPR) is also known as the Backstop Rule.

What does it mean?

If an MNE group has low-taxed profits (ETR < 15%) and the UPE jurisdiction does not apply an IIR, then the UTPR lets other countries where the MNE operates step-in. These countries can apply proportionate adjustments to collect the remaining top-up tax needed to reach the 15% global minimum.

How does the other country apply proportionate adjustments?

Through measures such as:

- Denying tax deductions (e.g., for intra-group payments).

- Imposing equivalent taxes or adjustments on local entities.

Countries apply UTPR proportionally, based on:

- The number of employees , or

- The value of tangible assets located in their jurisdiction.

This avoids giving all the collection power to a single country and ensures a fair allocation

Decoding Pillar II - QDMTT

Qualified Domestic Minimum Top-Up Tax is often referred to as the Domestic Top-Up Tax.

What does it mean?

If an MNE group has a subsidiary in Country X with a low ETR (<15%), Country X can apply its own Qualified Domestic Minimum Top-up Tax (QDMTT) to collect the top-up tax within Country X itself. This ensures that the profits earned locally are taxed up to the 15% minimum, before any foreign parent country (via IIR) or other group countries (via UTPR) can step in.

QDMTT gives the local country first claim on the top-up tax, allowing the local country to collect the top-up tax directly, rather than the tax flowing to foreign governments.

How does it work?

QDMTT is calculated using the same Pillar II principles as the GloBE rules:

- It applies the 15% minimum rate,

- On the same GloBE income,

- With the same covered taxes and adjustments.

Decoding Pillar II - STTR

Subject to Tax Rule (STTR) is a treaty-based rule designed to protect source countries (countries where the income is earned/accrued), especially developing economies. It is separate from the GloBE rules (IIR, UTPR), operates alongside them and is not automatic.

What does it mean?

STTR allows the source country to apply a withholding tax on certain cross-border intra-group payments if those payments are taxed below 9% in the recipient's country. This applies to defined payments such as:

- Interest payments

- Royalties

- Franchise fees

- Other similar payments

When does it apply and how does it work?

STTR applies only when two countries have agreed to include it in their tax treaty. When an MNE makes qualifying payments to a related entity abroad, and the recipient country taxes that income below the agreed nominal rate (usually 9%), the source country can levy a withholding tax up to the agreed STTR rate on the gross payment amount.

Broad Steps for Pillar II

Implementation Steps

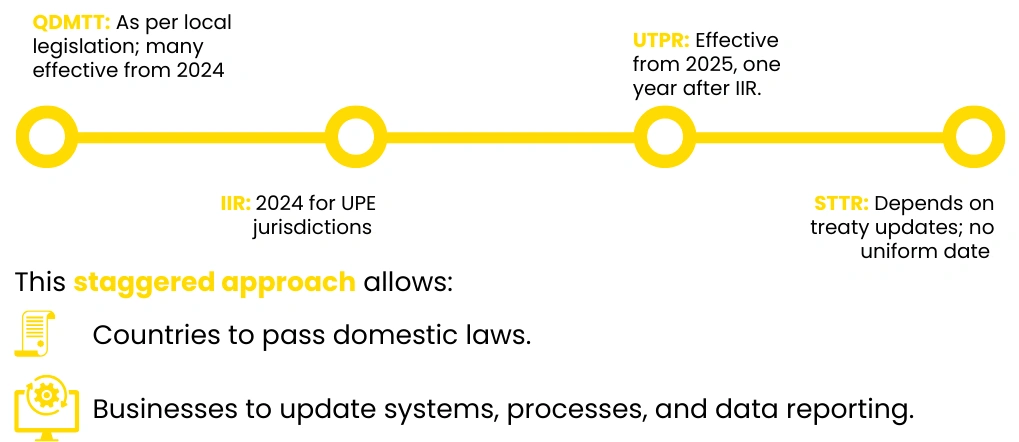

Effective Dates and Phased Introduction

The OECD's global minimum tax rules come into force in a phased manner, giving MNEs and tax authorities time to prepare.

Implementation Timeline:

Note: Timelines and milestones are based on OECD Model Rules (Dec 2021), Commentary (Mar 2022), and EU Minimum Tax Directive (Dec 2022) and are baseline recommendations, with actual application depending on local adoption between 2024–2025.

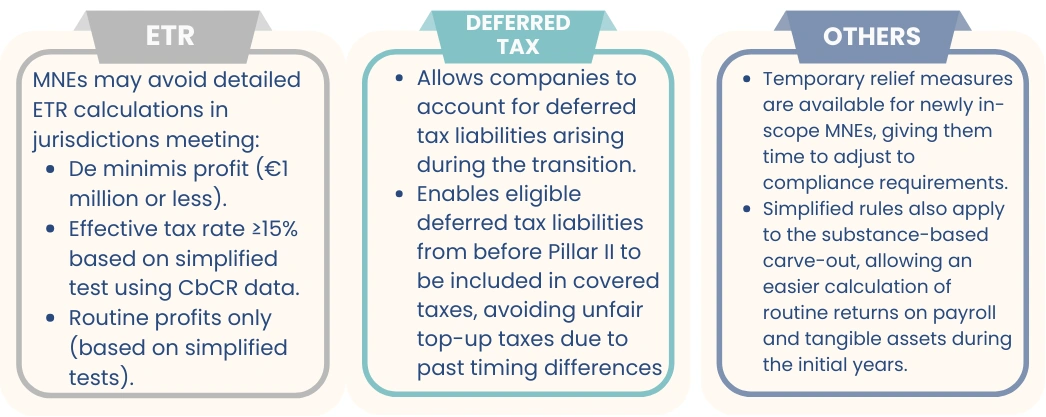

Transitional Measures and Safe Harbours

What transitional reliefs apply?

These measures ease initial compliance and reduce risk of penalties, giving companies time to adjust to the complex rules and build necessary systems and processes.

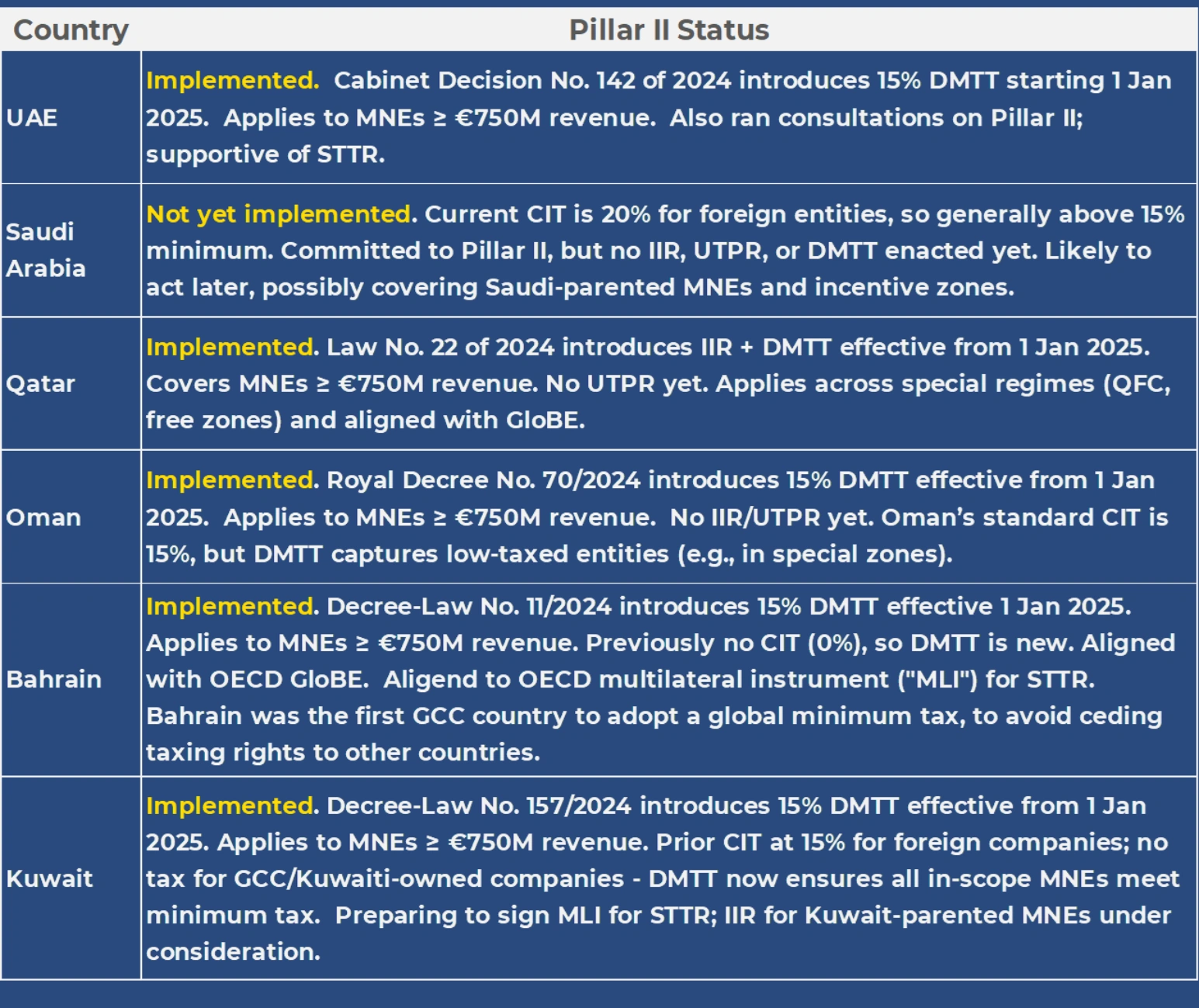

Gcc Implementation Status: Pillar II

Conclusion

Pillar II represents the most significant development in international corporate taxation in decades. By establishing a global minimum tax rate of 15%, it fundamentally changes the tax planning landscape for large multinational enterprises and helps restore fairness to the international tax system.

The coordinated implementation through domestic legislation ensures that the benefits of the minimum tax accrue to the countries where profits are earned, while the substance-based carve-outs recognize the importance of real economic activity. With over 136 countries committed to implementation, Pillar II marks the beginning of a new era in international tax cooperation.

Disclaimer: This material has been prepared solely for informational and general educational purposes. It provides a factual summary of the OECD Pillar II framework as of mid-2025. While all reasonable care has been taken to ensure accuracy, this material does not constitute legal, tax, financial, or investment advice. The international tax landscape remains fluid and subject to change. Users are responsible for staying informed of ongoing developments and should seek professional advice for specific situations.