THE TWO-PILLAR TAX REFORM: PART I

A BEGINNER'S GUIDE TO PILLAR I & II

Excerpt

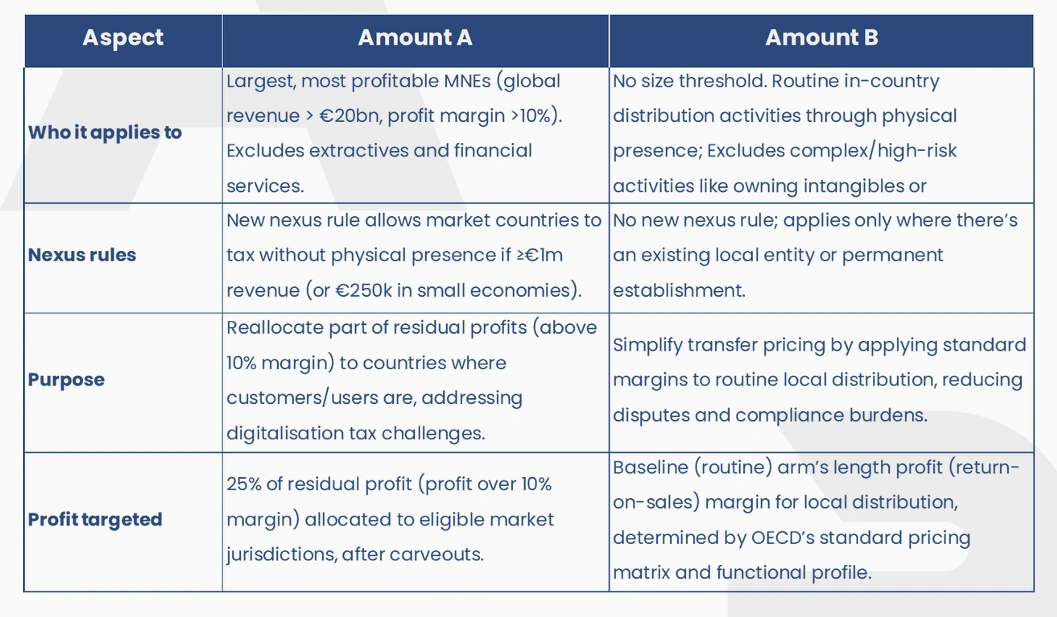

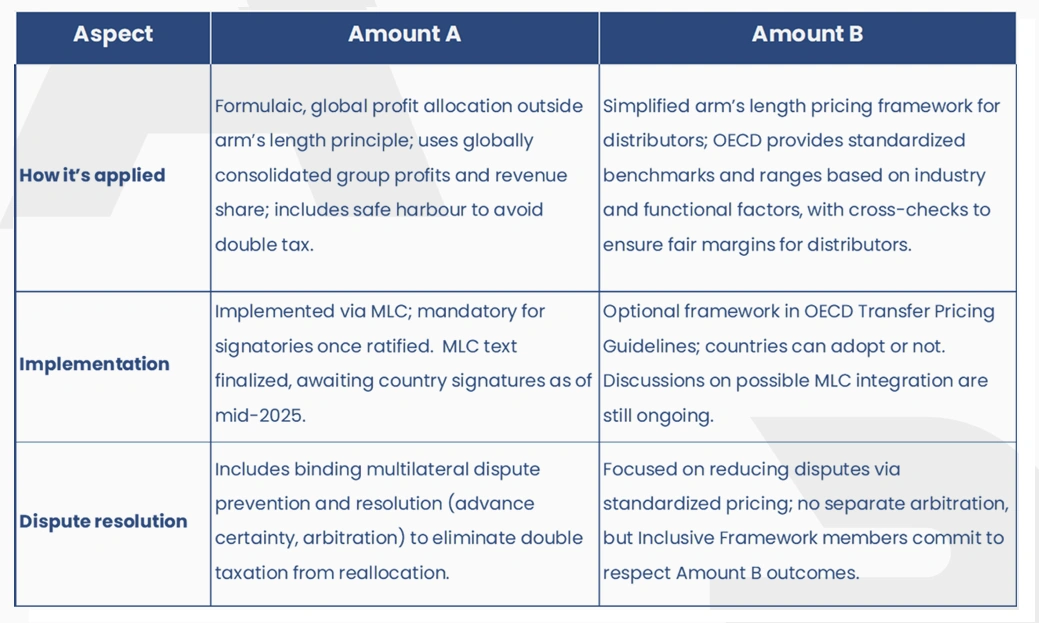

Pillar I reallocates taxing rights to countries where customers are located, even if businesses have no physical presence. It targets MNEs with global revenues over €20B and includes Amount A (residual profit allocation) and Amount B (routine distribution income).

Executive Summary

Pillar I is a groundbreaking international tax reform designed to reallocate taxing rights from residence countries to market jurisdictions where customers and users are located. Developed by the OECD/G20 BEPS initiative, it targets the largest multinational enterprises with annual global revenues over €20 billion and profitability above 10%. The framework includes two components: Amount A (reallocating 25% of residual profits to market jurisdictions) and Amount B (simplifying taxation of routine distribution activities). All six GCC countries have agreed in principle to Pillar I as part of the OECD/G20 Inclusive Framework, alongside over 130 jurisdictions globally. However, no country has yet implemented Pillar I, as the Multilateral Convention is still pending critical mass of ratifications.

Introduction

Why Did Pillar I and II Emerge?

Pillar I: Origin and Purpose

Pillar I was developed under the OECD/G20 BEPS initiative as one part of a broader "Two-Pillar" solution aimed at tackling the tax challenges of digital economy.

Its main objective is to update the rules around profit allocation and nexus so that large multinational enterprises ("MNEs") are required to pay tax in countries where their customers or users are located, even if the business has no physical presence there.

This approach was driven by concerns that highly digital companies were able to shift profits to low-tax jurisdictions, despite generating substantial revenues in market countries. Pillar I is designed to support a fairer sharing of taxing rights in today's digital economy.

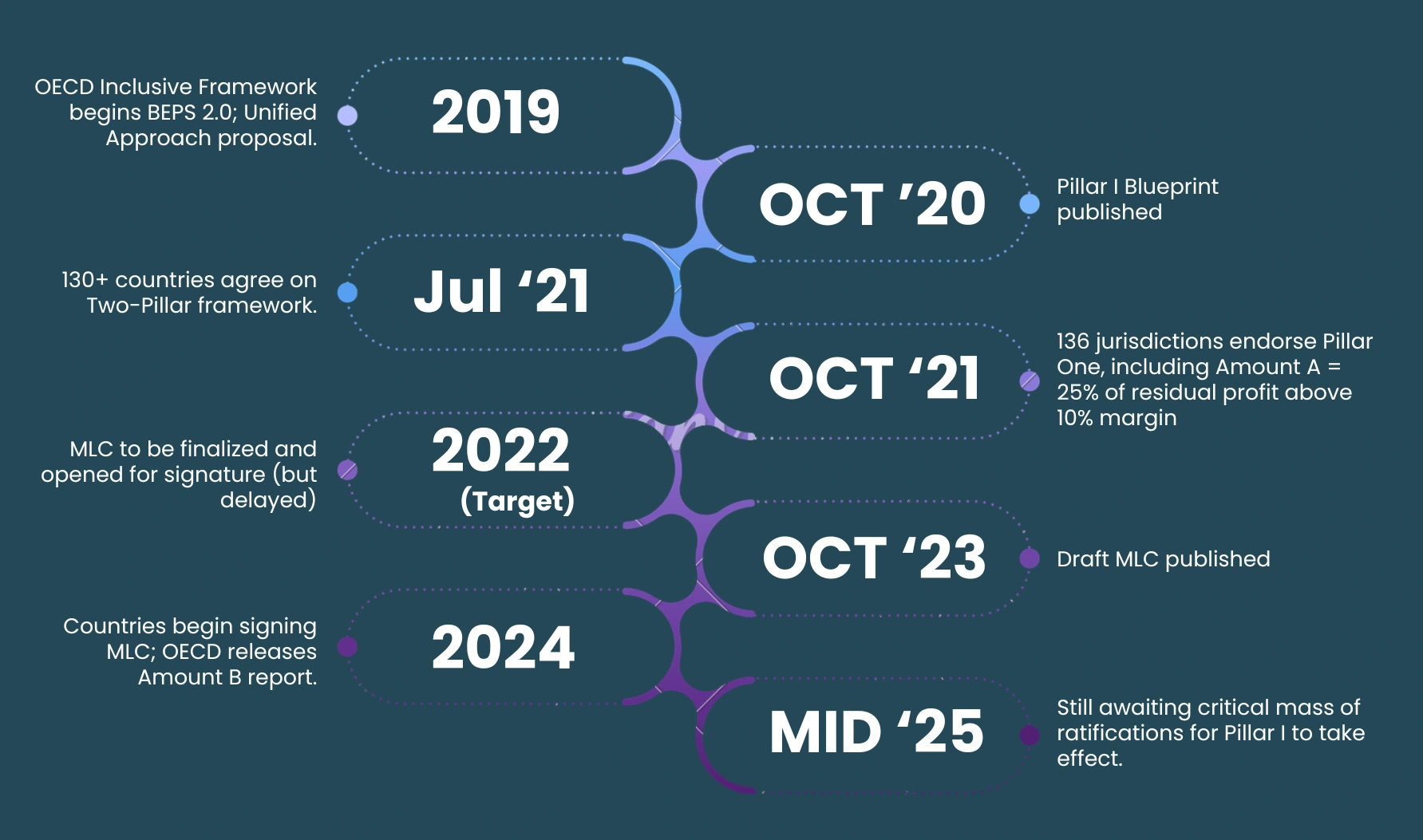

All six GCC countries have in principle agreed to Pillar I as part of the OECD/G20 Inclusive Framework, alongside over 130 jurisdictions globally. However, no country in the world has yet implemented Pillar I, as the Multilateral Convention ("MLC") is still pending a critical mass of ratifications to become effective.

Explanation

Pillar I Implementation & Development Timeline

Pillar I will be implemented through a MLC, which reassigns taxing rights to market jurisdictions; it will take effect only once a critical mass of jurisdictions signs and ratifies the agreement.

Pillar I: Key Features

Pillar I is designed to apply only to the largest and most profitable MNE groups with significant presence in any jurisdiction. Under the agreement reached in October 2021, it targets MNEs with:

- Annual global revenues over €20 billion, and

- Profitability above 10%, measured as profit before tax divided by revenue

At country level, revenue threshold: €1 million (€250k for smaller economies)

Extractive industries and regulated financial services are excluded entirely. If ≥75% of a segment's revenue is from excluded activities, the whole segment is carved out.

Pillar I is made up of two components: Amount A & Amount B

Amount A includes a mandatory, binding multilateral dispute prevention and resolution mechanism specifically designed for all issues related to Amount A, including profit allocation and relief from double taxation.

Amount A: Demystified

How "Amount A" works:

- First, calculate the MNE's residual profit: this is the amount of profit above a 10% margin. For example: say, global level margin is 17%, then 7% is considered the MNE's residual profit.

- Then, 25% of that residual profit is allocated to countries where the company earns significant revenue (market jurisdictions).

Amount A is determined once at the global level by calculating the MNE's residual profit above a 10% margin. 25% of that profit is reallocated to market jurisdictions based on the revenue it contributes relative to other qualifying countries.

How do you determine in which country the revenues arise?

- Goods: Customer's delivery location

- Services: Place of use of service

- Advertising: Where the audience is located

Qualifying Thresholds

A sales-based nexus rule determines which countries get a share:

- A country qualifies for Amount A if the MNE has at least €1 million in revenue there, or

- If the MNE has a revenue of €250,000 for smaller countries with a GDP under €40 billion.

- No impact on revenues below €250,000 in any country

Once the global Amount A (i.e., 25% of residual profit) is calculated, it is allocated across eligible market jurisdictions using the following method:

Each market jurisdiction, then taxes its share of Amount A at its own corporate income tax rate. To avoid double taxation, the jurisdiction in which the Ultimate Parent Entity ("UPE") is a tax resident is required to provide tax relief - by exempting or crediting the share of residual profit reallocated to market countries under Amount A.

Pillar I – Marketing & Distribution Safe Harbour

Once Amount A is calculated and allocated, there's an important question:

What if a market jurisdiction is already taxing some of those profits?

For example, a local distributor might already earn a high profit margin under transfer pricing rules, covering part of the residual profit.

Without adjustment, Amount A would add an extra layer of tax on top - possibly resulting in double taxation.

To manage this, Pillar I includes a special rule to avoid double taxation: Marketing & Distribution Profits Safe Harbour ("MDSH").

How does MDSH work?

Where a market jurisdiction already taxes residual profits, its Amount A allocation is capped or reduced. This ensures that local profits aren't taxed twice, and Amount A only tops up what's missing, not more.

Safe Harbour Example:

- Global residual profit (profit above 10%) of MNE = €1 billion

- Amount A (25% of residual) = €250 million to allocate among market jurisdictions of which Country X qualifies for €20 million

- MNE's local distributor earns a 15% profit margin:

- First 10% = routine profit (under TP)

- Next 5% = residual profit (already taxed locally)

However, under MDSH, because Country X is already taxing some of the residual profits locally, its €20 million Amount A allocation is reduced or capped depending on how much of that amount overlaps with profits already taxed under local rules.

The exact formula to apply this cap is still being finalized by the OECD Inclusive Framework, but the goal is clear: avoid taxing the same profit twice.

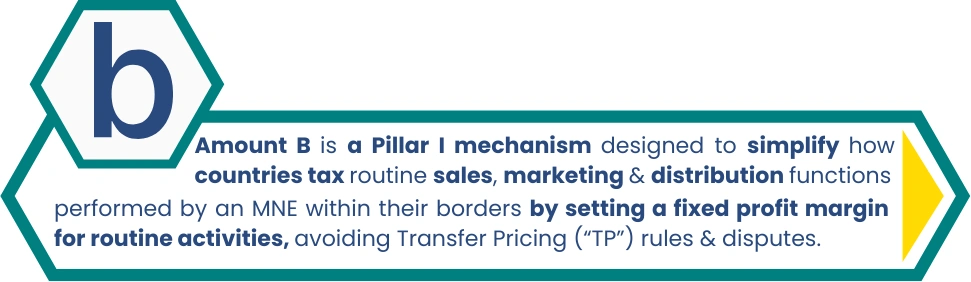

Amount B: Simplified Returns, Fewer Disputes

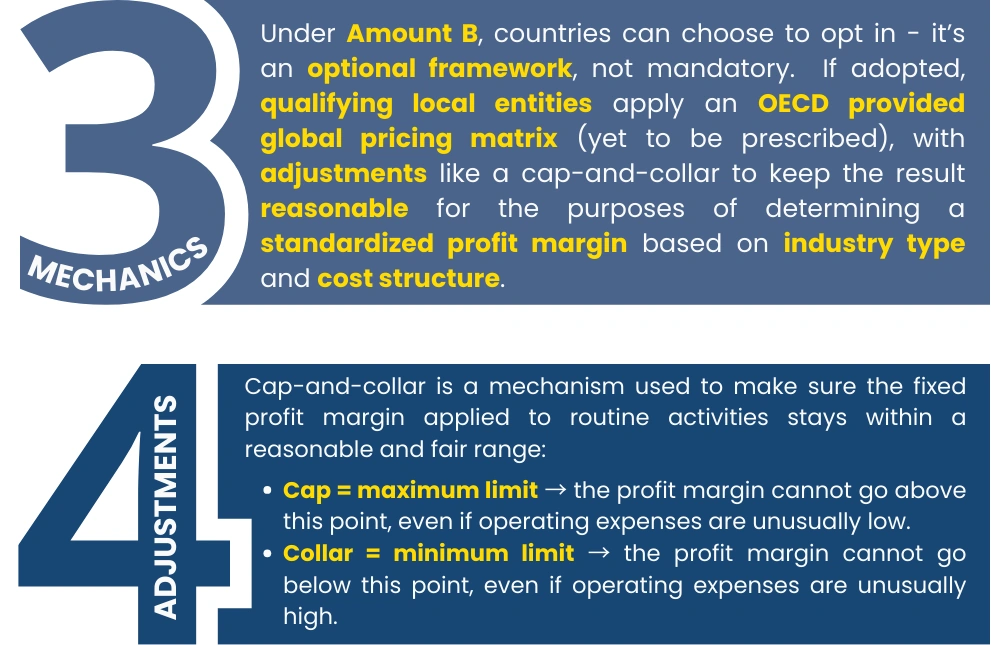

How "Amount B" works:

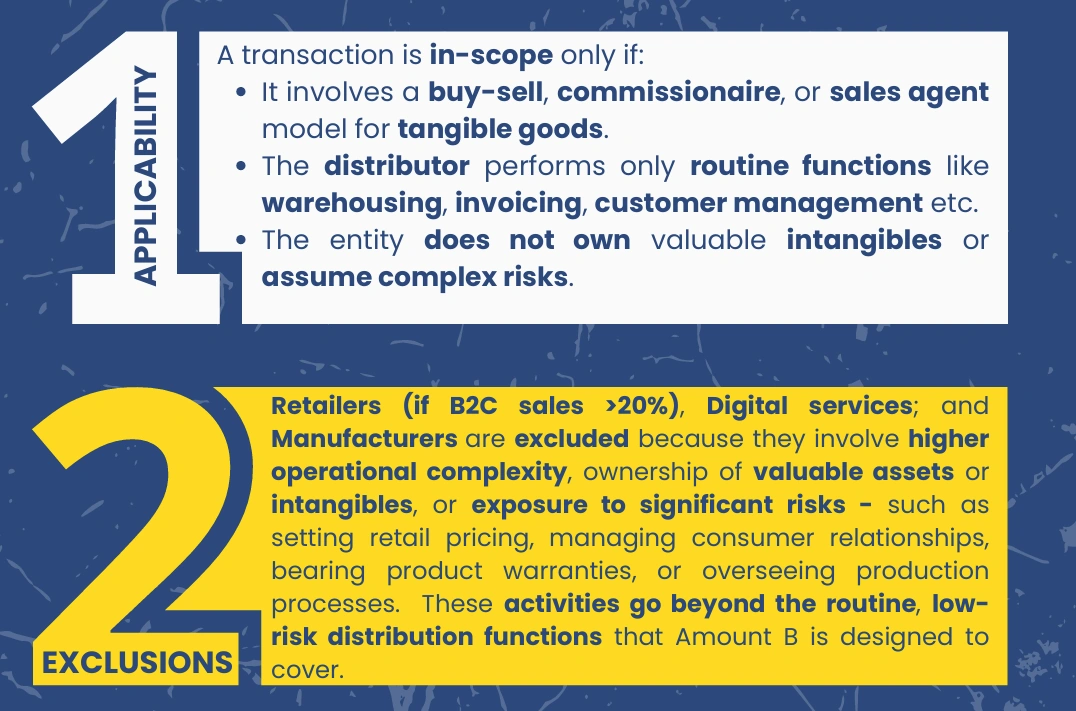

- It applies only when an MNE has a physical presence (either by way of a subsidiary or a permanent establishment) & performs qualifying marketing/distribution activities in a country.

- The country gets to tax those activities at a standardized profit level, regardless of internal benchmarking or comparables.

- This gives certainty to tax authorities and taxpayers, especially in smaller or low-capacity jurisdictions ("LCJ").

Amount B does not reallocate global profits. Instead, it applies where a local entity performs qualifying activities (such as sales, marketing & distribution), giving market jurisdictions a clear, simplified taxing right - without going through a full-blown TP analysis.

Amount B Explained

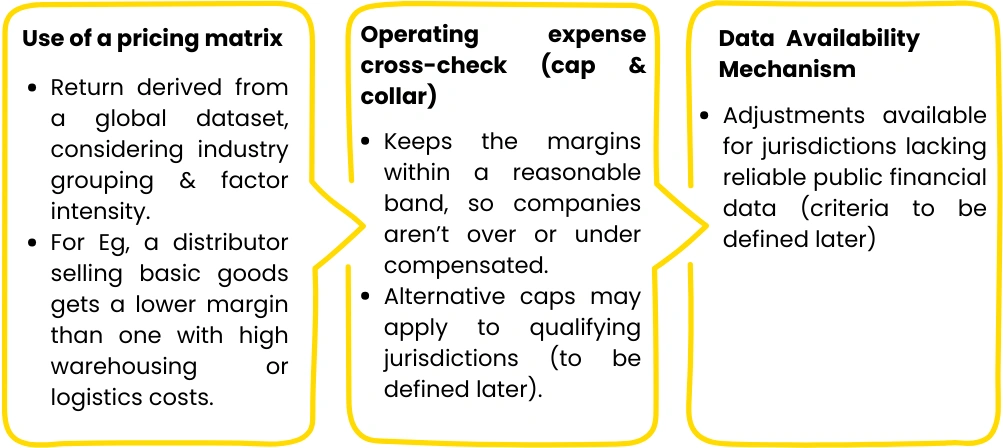

The Simplified Pricing Framework

Key Features of Amount B Framework:

- Many GCC jurisdictions act as regional hubs or sales locations for MNEs.

- Amount B may directly impact how these routine distribution functions are taxed.

Amount A vs Amount B - Summary

Conclusion

This material has been prepared solely for informational and general educational purposes. It provides a factual summary of the OECD Pillar I framework and the publicly reported implementation status across Gulf Cooperation Council ("GCC") countries as of mid-2025.

While all reasonable care has been taken to ensure accuracy and completeness, no representation or warranty, express or implied, is made as to the accuracy, reliability, or completeness of the information provided.

This material does not constitute legal, tax, financial, or investment advice, nor should it be relied upon as a substitute for obtaining professional advice tailored to your specific situation.

The international tax landscape, including the implementation of the OECD's Two-Pillar Solution, remains fluid and subject to change. Users are responsible for staying informed of ongoing developments.