FTA CLARIFIES CONDITIONS FOR UAE CORPORATE TAX PENALTY WAIVER

CTP-006 issued on July 2, 2025

Excerpt

The UAE FTA issued Clarification CTP006, waiving AED 10,000 late registration penalties if tax returns are filed within 7 months of the first tax period. It includes provisions for exempt persons and tax groups and automates the process via EmaraTax.

Executive Summary

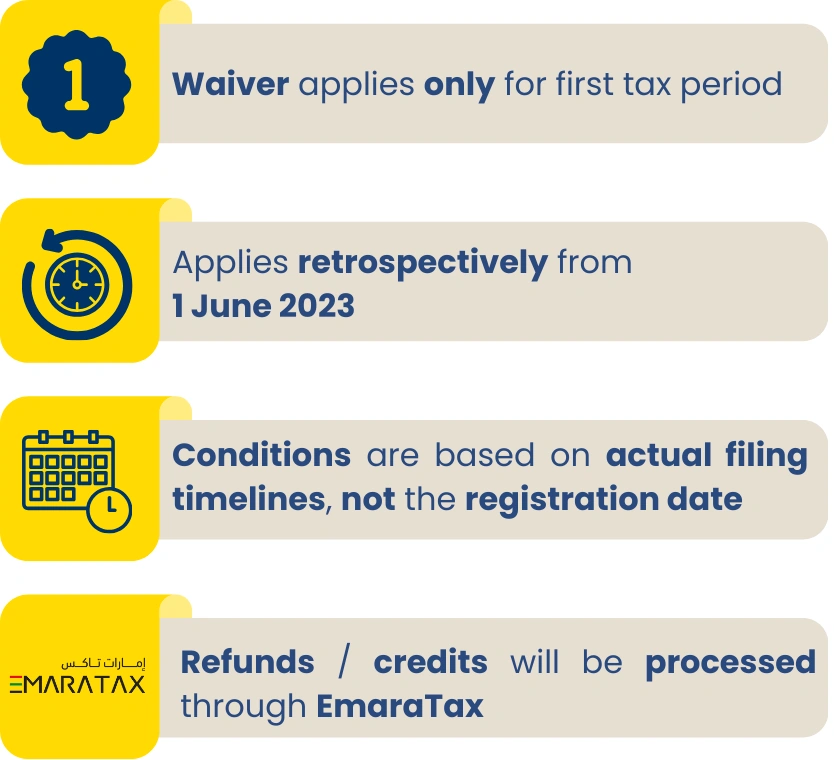

The UAE Federal Tax Authority has issued Public Clarification CTP006 providing detailed guidance on the AED 10,000 penalty waiver for late Corporate Tax registration. The waiver applies to taxpayers who file their tax return within 7 months from the end of their first tax period, effectively shortening the filing timeline from 9 months to 7 months for penalty relief purposes. The clarification covers automatic waivers, credit/refund processing, and special provisions for tax groups and exempt persons, offering relief that applies retrospectively from 1 June 2023.

Introduction

The AED 10,000 penalty for late Corporate Tax registration was introduced under Cabinet Decision No. 75 of 2023, affecting taxpayers who missed the registration deadline.

In April 2025, the UAE Cabinet approved a waiver mechanism, offering relief to certain taxpayers who missed the registration deadline - provided specific conditions were met.

With the release of Public Clarification CTP006, the Federal Tax Authority (“FTA”) has clarified the following:

Explanation

What CTP006 Confirms

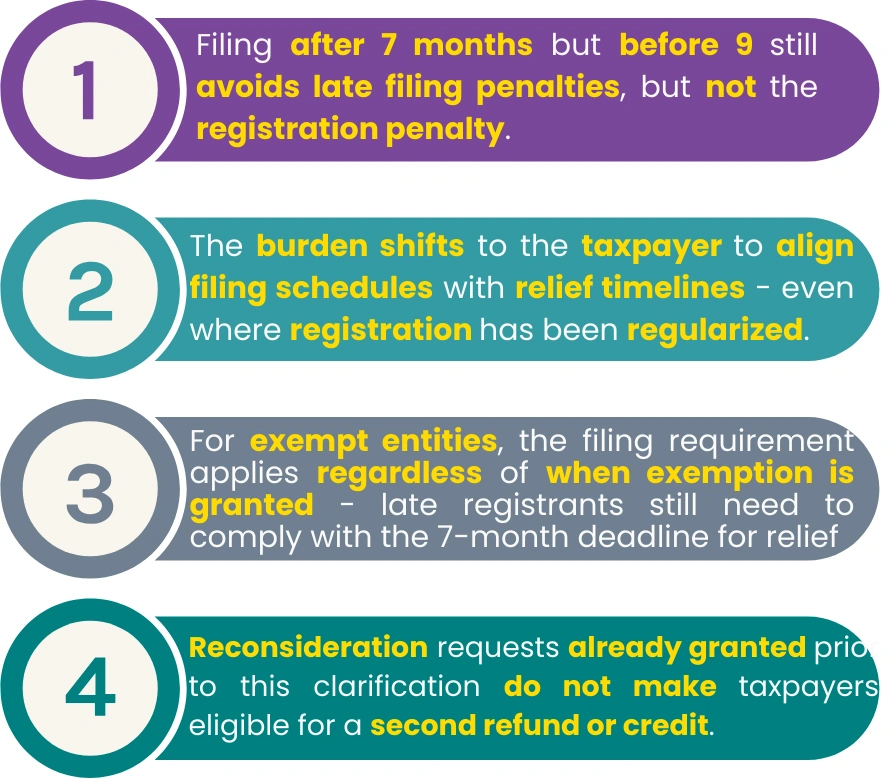

The 7 Month Threshold

To qualify for waiver or refund, the tax return must be filed within 7 months from the end of:

Practical Impact

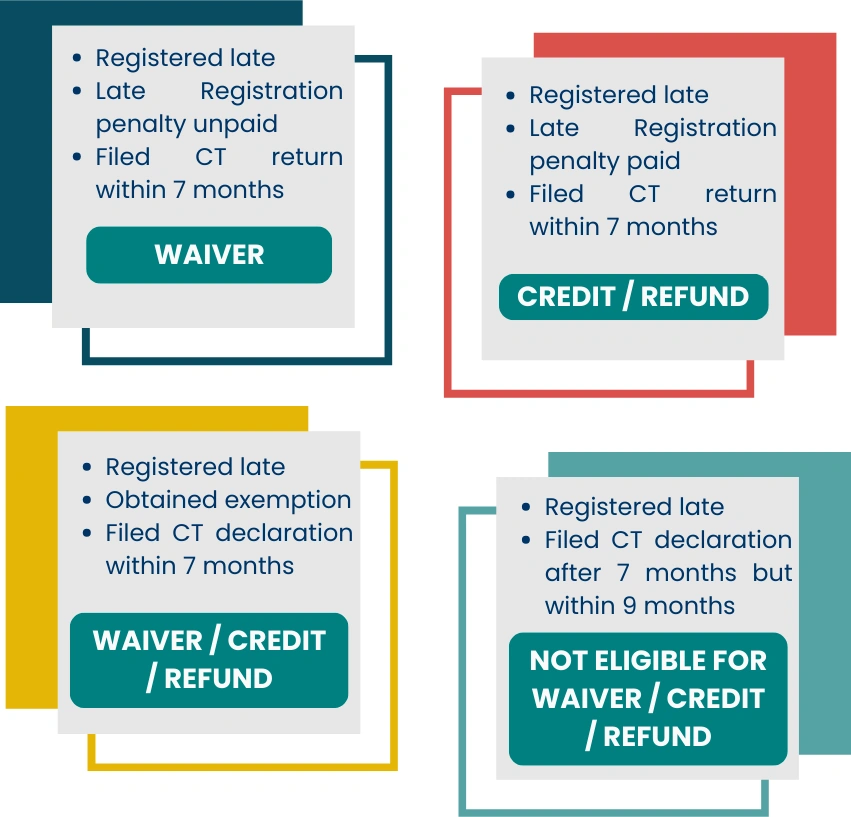

Key Covered Scenarios

Scenario Analysis

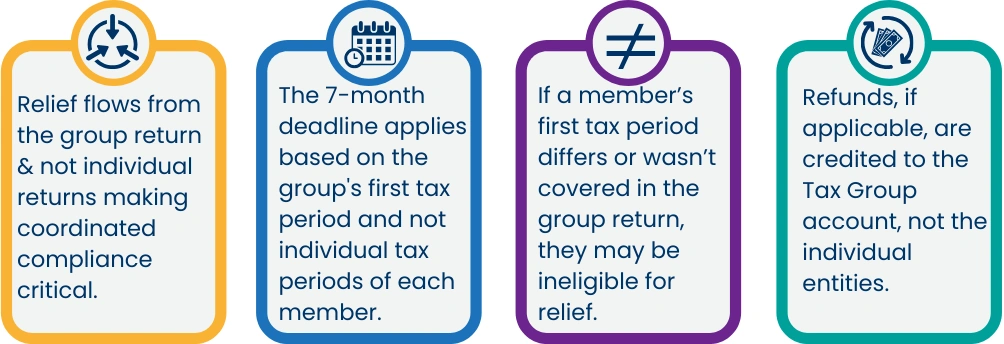

Tax Groups

If the group CT return is filed within 7 months from the end of the Group's first tax period, the AED 10,000 registration penalty imposed on each member for their individual late registration may be waived, provided the group return covers the first tax period of each member.

Key Points for Tax Groups

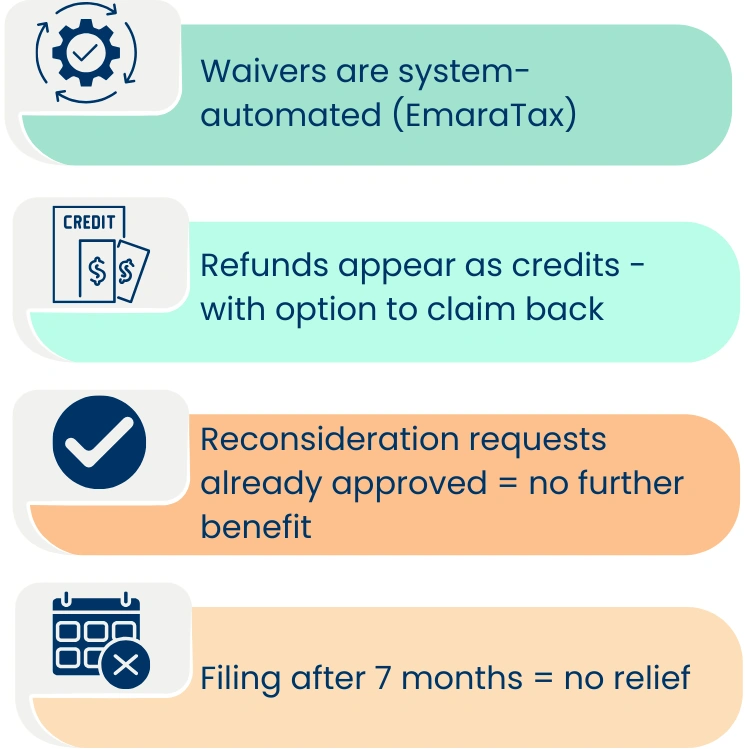

Other Key Matters

Important Clarification

Question: Where a reconsideration request was previously rejected by the FTA, does the taxpayer now qualify for a waiver or refund under CTP006?

Key Takeaways

Critical Success Factors

- 7-month deadline is critical - filing within this period is essential for penalty relief

- Relief is automatic through EmaraTax for qualifying taxpayers

- Tax groups benefit from coordinated filing but must ensure group return timing

- Previously rejected reconsideration requests may now qualify under new criteria

- Refunds are processed as credits with option to claim cash refund

Conclusion

CTP006 provides much-needed clarity on the UAE Corporate Tax penalty waiver mechanism, establishing clear timelines and processes for relief. The 7-month filing deadline represents a critical benchmark that taxpayers must meet to benefit from the waiver or refund provisions.

The automatic processing through EmaraTax and the retrospective application from June 2023 demonstrate the FTA's commitment to providing practical relief for taxpayers who faced registration challenges during the initial implementation period of UAE Corporate Tax.

Disclaimer: While every effort has been made to ensure accuracy and alignment with the original legislative text, users are advised to exercise discretion and consult official sources or seek professional legal/tax advice before relying on this content for decision-making or compliance purposes. This summary is based on Public Clarification CTP006 issued by the UAE Federal Tax Authority on July 2, 2025. Users should refer to the official clarification and seek professional guidance for specific situations.