KUWAIT IMPLEMENTS GLOBAL MINIMUM TAX

A Guide to Law No. 157 of 2024 & Executive Regulations No. 55 of 2025

Excerpt

The Gulf Cooperation Council continues its ambitious journey toward VAT harmonization. This analysis examines implementation status, cross-border transaction rules, and the challenges of standardizing VAT policies in 2024-2025.

Executive Summary

Kuwait has formally enacted a Global Minimum Tax regime in line with the OECD's Pillar Two framework. Law No. 157 of 2024 was signed on December 26, 2024, with Executive Regulations issued via Ministerial Resolution No. 55 of 2025. The law applies to fiscal years beginning on or after 1 January 2025, targeting Multinational Enterprise Groups with consolidated revenue ≥ EUR 750 million and at least one Constituent Entity in Kuwait.

Introduction

In line with the OECD's Pillar Two framework, Kuwait has formally enacted a Global Minimum Tax regime. This landmark legislation represents Kuwait's commitment to international tax coordination and base erosion prevention.

Law No. 157 of 2024 was signed on December 26, 2024 and published in the Official Gazette No. 1672 dated 30 December 2024.

Executive Regulations were issued via Ministerial Resolution No. 55 of 2025, published in Official Gazette No. 1685 dated 9 June 2025.

Effective Date: The law applies to fiscal years beginning on or after 1 January 2025.

Explanation

Who Is Covered?

Implementation Timeline

The Law and Executive Regulations apply to:

- Fiscal years starting on or after 1 January 2025

First GloBE Return Filing Deadlines

- 15 months after year-end (i.e., by 31 March 2027 if FY ends 31 Dec 2025)

- 18 months for the first reporting year (i.e., 30 June 2027)

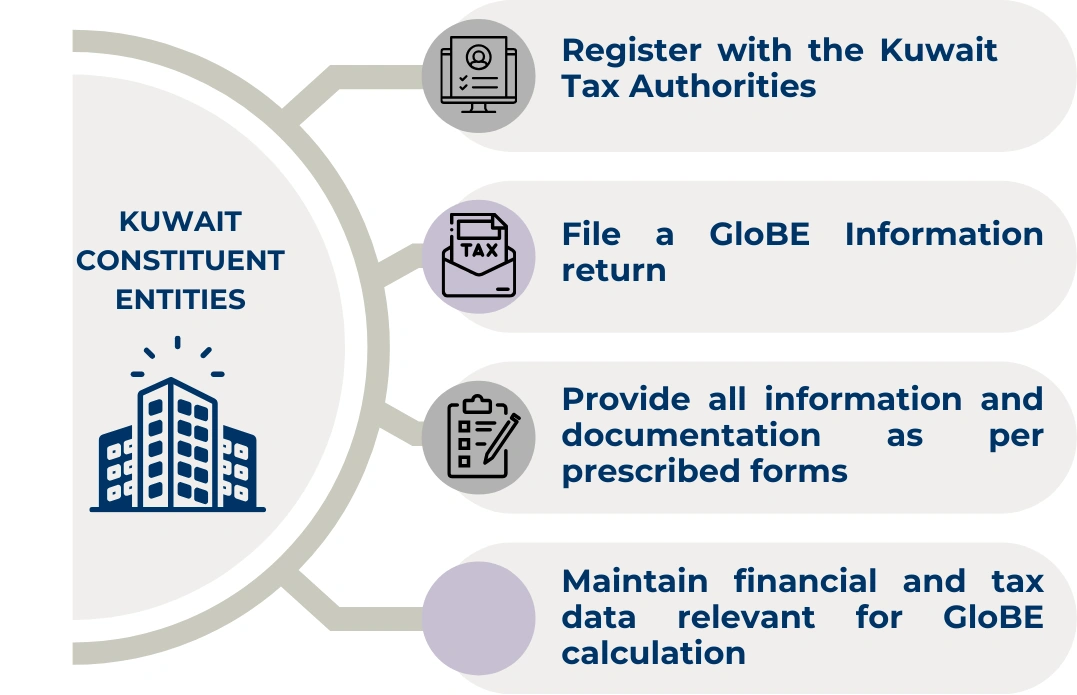

Every Kuwait-based Constituent Entity must Register with the Kuwait Tax Authorities upon becoming subject to the Law (no specific statutory deadline prescribed).

Key Requirements

In-scope Kuwait Constituent Entities must:

Top-Up Tax Framework

If jurisdictional Effective Tax Rate (ETR) < 15%:

- A Top-Up Tax applies

ETR Formula:

Key Definitions

Covered Taxes:"Taxes on income or profits, including taxes on distributed profits, and any other taxes as determined by the Minister."

GloBE Income or Loss:"The income or loss determined for each Constituent Entity in accordance with the GloBE Rules, before any elimination of intra-group transactions or consolidation adjustments, and after making the necessary adjustments as prescribed under the GloBE Rules and the Minister's decisions."

Filing Requirements

Who Files?

The following may file the GloBE Information Return:

- The Ultimate Parent Entity ("UPE"); Or

- A Designated Filing Entity under qualified exchange agreements

What Is Filed?

GloBE Information Return must include:

- Identity and role of each Constituent Entity

- GloBE Income, Covered Taxes, ETR

- Jurisdictional Top-Up Tax calculation

- Other disclosures and reconciliations (as prescribed)

Definitions Clarified in Regulations

Regulatory Clarifications

- GloBE Income/Loss

- Covered Taxes

- Qualified Domestic Minimum Top-Up Tax (QDMTT)

- Investment Entities / Pension Service Entities

- Permanent Establishment

- Hybrid and Transparent Entities

- Role classification (e.g., UPE, Intermediate, etc.)

Penalties for Non-Compliance

Violations include:

- Failure to register

- Failure to file or filing inaccurate data

- Not maintaining required documentation

Penalty Cap: Up to 1% of the violating Kuwait entity's total revenues per fiscal year

Conclusion

Kuwait's implementation of the Global Minimum Tax regime represents a significant step in international tax coordination. With the law effective from 1 January 2025, multinational enterprises operating in Kuwait must prepare for compliance with the new GloBE rules, registration requirements, and filing obligations.

The comprehensive framework established through Law No. 157 of 2024 and its Executive Regulations ensures Kuwait's alignment with OECD Pillar Two standards while providing clear guidance for affected taxpayers.

Disclaimer: The information presented in this post is based on unofficial English translations of Law No. 157 of 2024 and Executive Regulations No. 55 of 2025, as published in the Kuwaiti Official Gazette (in Arabic). While every effort has been made to ensure accuracy and alignment with the original legislative text, users are advised to exercise discretion and consult official Arabic sources or seek professional legal/tax advice before relying on this content for decision-making or compliance purposes.