THE INTERPRETATION OF INTERNATIONAL TAX TREATIES

A CONCEPTUAL FOUNDATION

Excerpt

This article outlines the conceptual and legal framework for interpreting international tax treaties. It emphasizes the importance of mutual intent, context, and purpose, referencing Articles 31-33 of the Vienna Convention. Key principles include textual meaning, object and purpose, and supplemen...

Executive Summary

International tax treaties require principled interpretation that goes beyond linguistic analysis to ascertain the mutual intentions of contracting states. This document explores the conceptual foundations, legal principles, and practical challenges in tax treaty interpretation, examining frameworks from the Vienna Convention on the Law of Treaties (VCLT) to modern developments like the Multilateral Instrument (MLI).

Introduction

The Imperative of Interpretation in International Tax Law

International tax treaties are pivotal in a globalized economy, enabling cross-border investment, shaping the basis of taxing rights, and preventing double taxation.

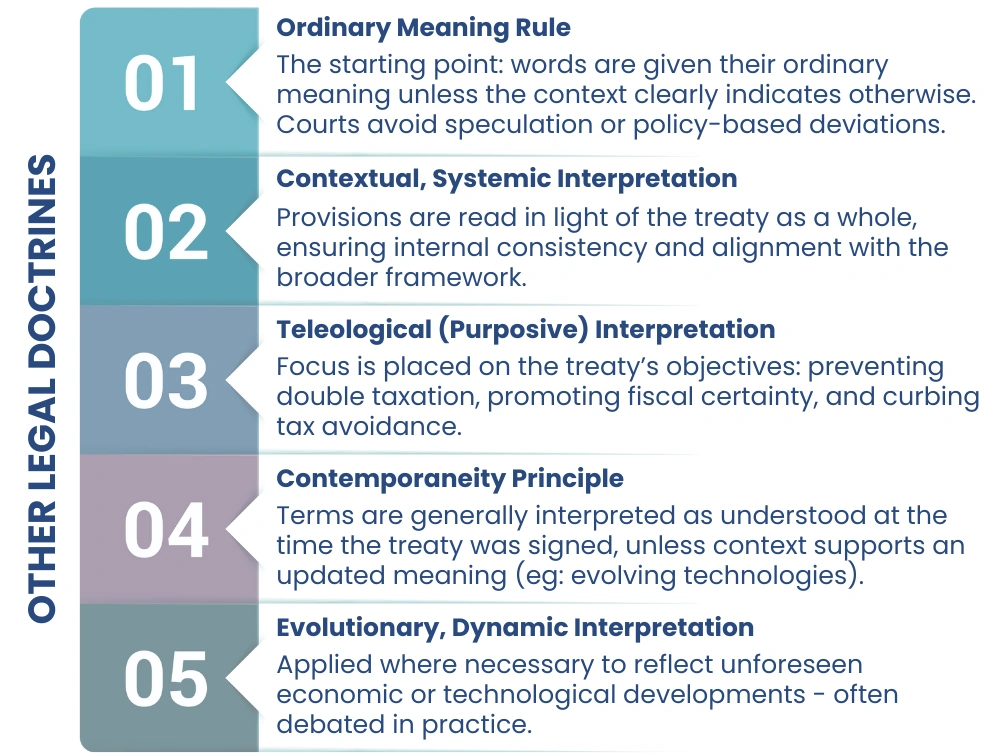

Interpretation of tax treaties is not a mere linguistic or semantic exercise; rather, it is a principled process aimed at ascertaining the meaning, intent, and balance of the treaty as shaped by negotiation between states with diverse legal systems.

Courts and academic commentators consistently emphasize that treaty interpretation requires drawing upon the text, the context, the purpose, and above all the mutual intention of the contracting states.

The United Nations ("UN") also highlights this point: Tax treaties, as products of diplomatic negotiation, must be interpreted with purpose, giving due regard to the common objectives and intentions agreed upon by the parties.

In the context of international tax, interpretation is the intellectual bridge that brings a negotiated agreement between countries to life, translating it into practical effect by aligning different legal systems into a coherent and balanced framework.

Conceptual Foundations of Tax Treaty Interpretation

What is Interpretation?

In legal theory, interpretation is the process by which the meaning of a legal text (statute, treaty or contract) is established and applied to real-life situations.

Key Challenges That Arise From the Nature of Treaties

Bilateral Nature of Tax Treaties and Its Implications

Tax treaties are predominantly bilateral. Each party seeks to safeguard its revenue base, policy goals, and domestic law traditions, resulting in agreement text that embodies compromise.

Interpretation must reflect principles of mutuality:

- The views and expectations of both Contracting States

- Negotiating history and diplomatic exchanges (travaux préparatoires)

- Practices after the treaty's conclusion if both parties concur

Courts may use post-treaty conduct (mutual administrative practice) to deduce intent [Article 31(3)(b) of the VCLT].

Legal Principles and Doctrines Governing Treaty Interpretation

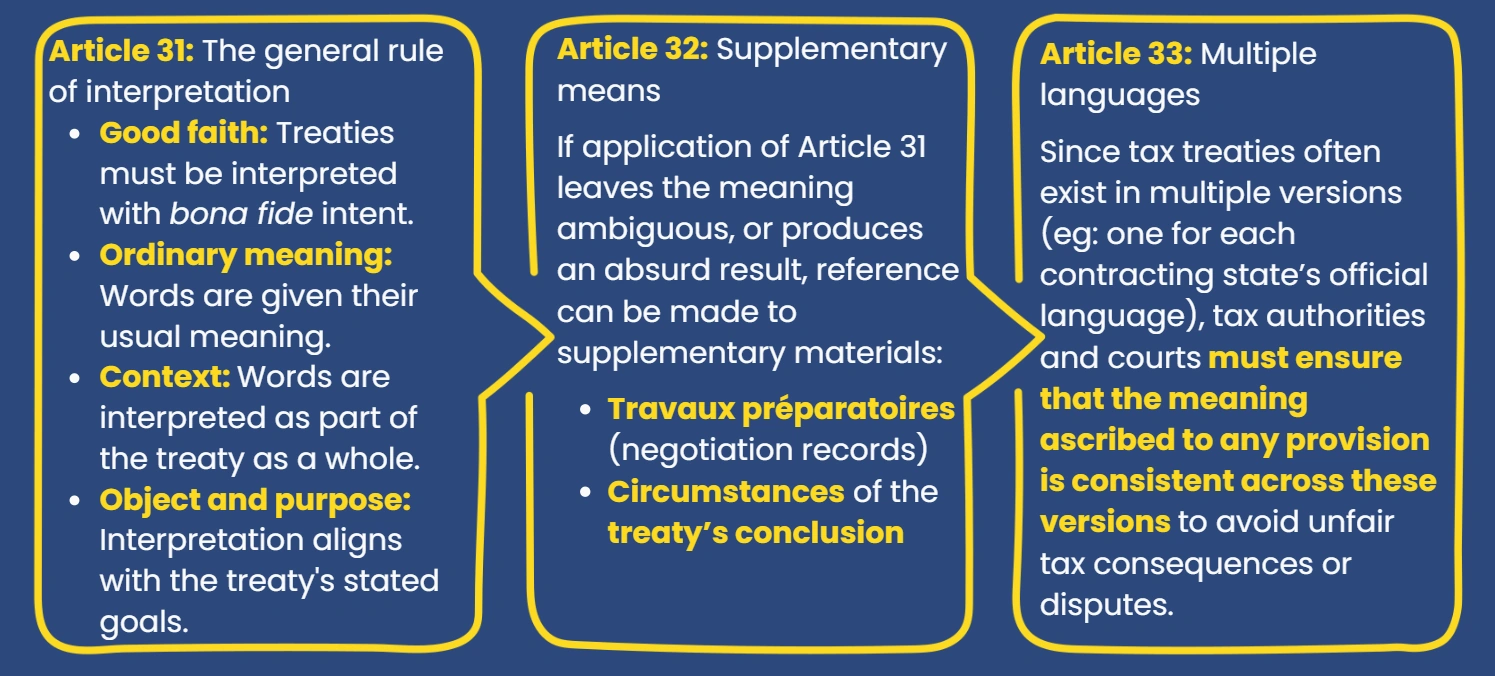

The Vienna Convention on the Law of Treaties ("VCLT") is the internationally recognized framework for interpreting treaties, widely applied to tax treaties. While not every signatory is a formal party to the VCLT, its interpretive methodology is accepted as customary international law. Domestic courts and tax authorities worldwide (whether in Europe, Asia, Africa, or the Americas) invoke Articles 31-33 of the VCLT when construing tax treaties.

Principle of Effectiveness (Ut res magis valeat quam pereat)

A treaty should be interpreted in a way that gives meaning and effect to all its provisions, avoiding interpretations that render clauses redundant or meaningless.

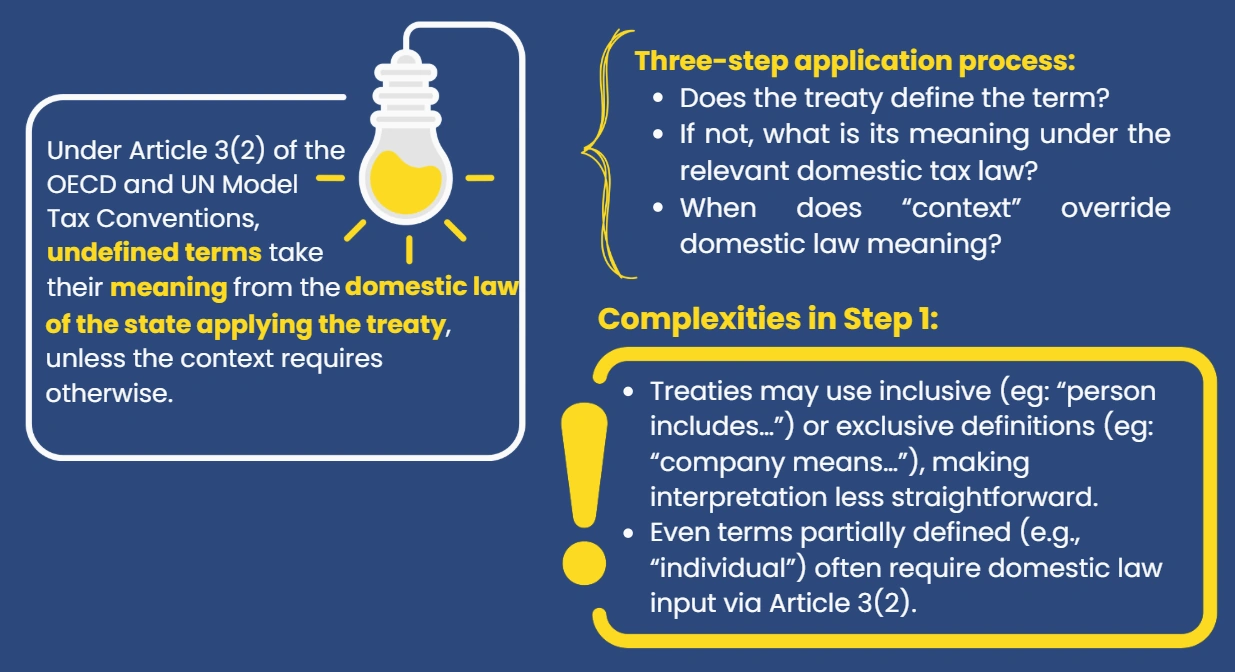

Alongside the Vienna Convention, tax treaties based on the Organisation for Economic Co-operation & Development ("OECD") & UN Model Conventions include their own internal rule of interpretation.

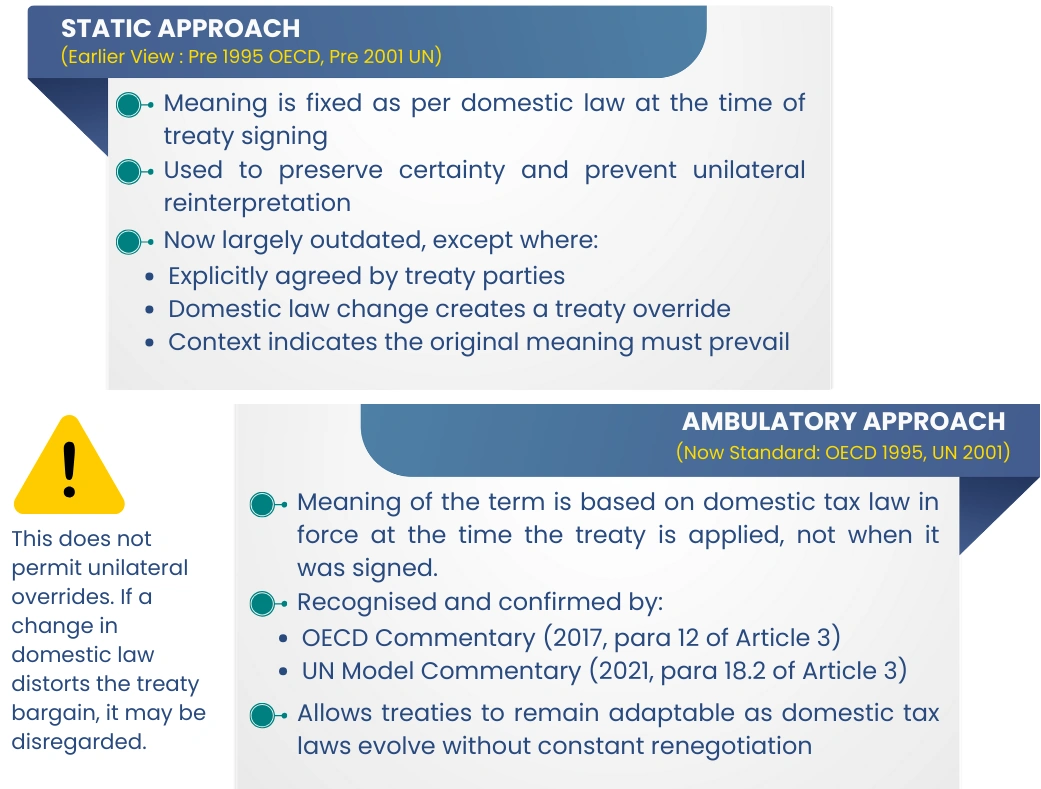

Static vs Ambulatory Interpretation Under Article 3(2)

Interaction with Domestic Tax Law

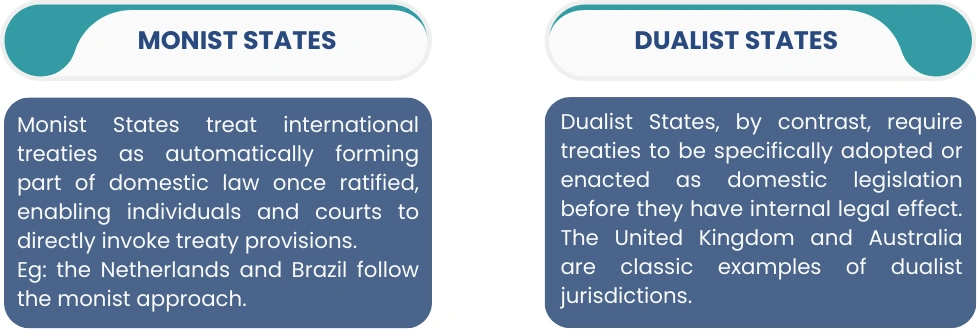

The interaction between tax treaties and domestic law is one of the most critical and complex areas in international tax. A treaty's practical effect depends not just on the agreed language, but on how it's implemented, interpreted, and challenged within each country's legal system. Countries differ in how they incorporate treaties into their domestic legal systems. This divergence is captured in the concepts of Monist and Dualist states:

Though the monist-dualist distinction captures the main theoretical models, many countries follow hybrid or nuanced practices. In reality, the interaction between treaty and domestic law may not fit neatly into either category, but these two frameworks remain the dominant reference points in comparative international law.

Interaction with Domestic Tax Law

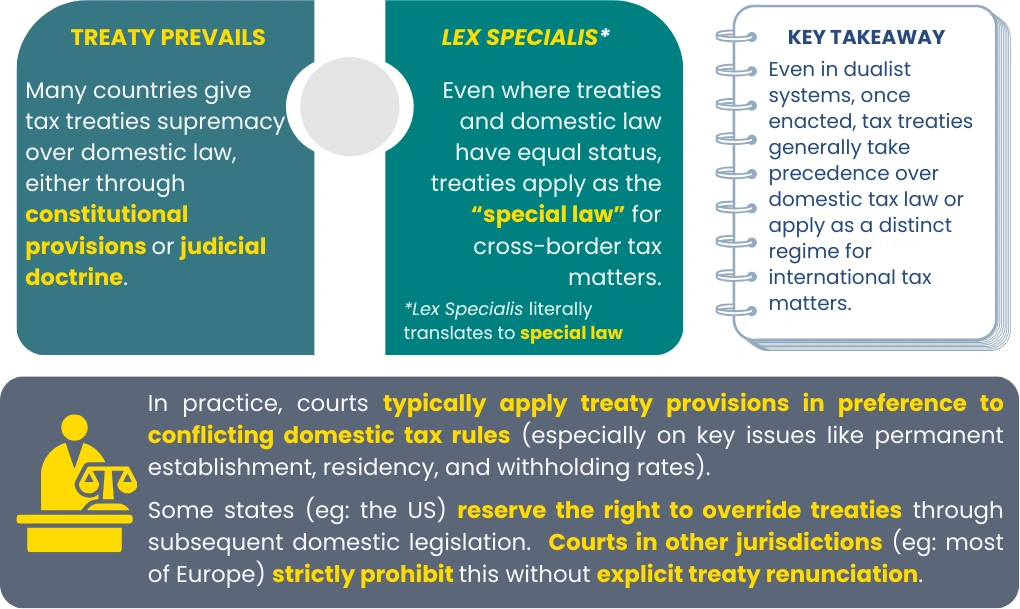

Once a tax treaty is validly incorporated into domestic law, the next question is: What happens if it conflicts with local tax law?

Most jurisdictions follow one of two approaches:

GCC Approach to Tax Treaty Enforcement

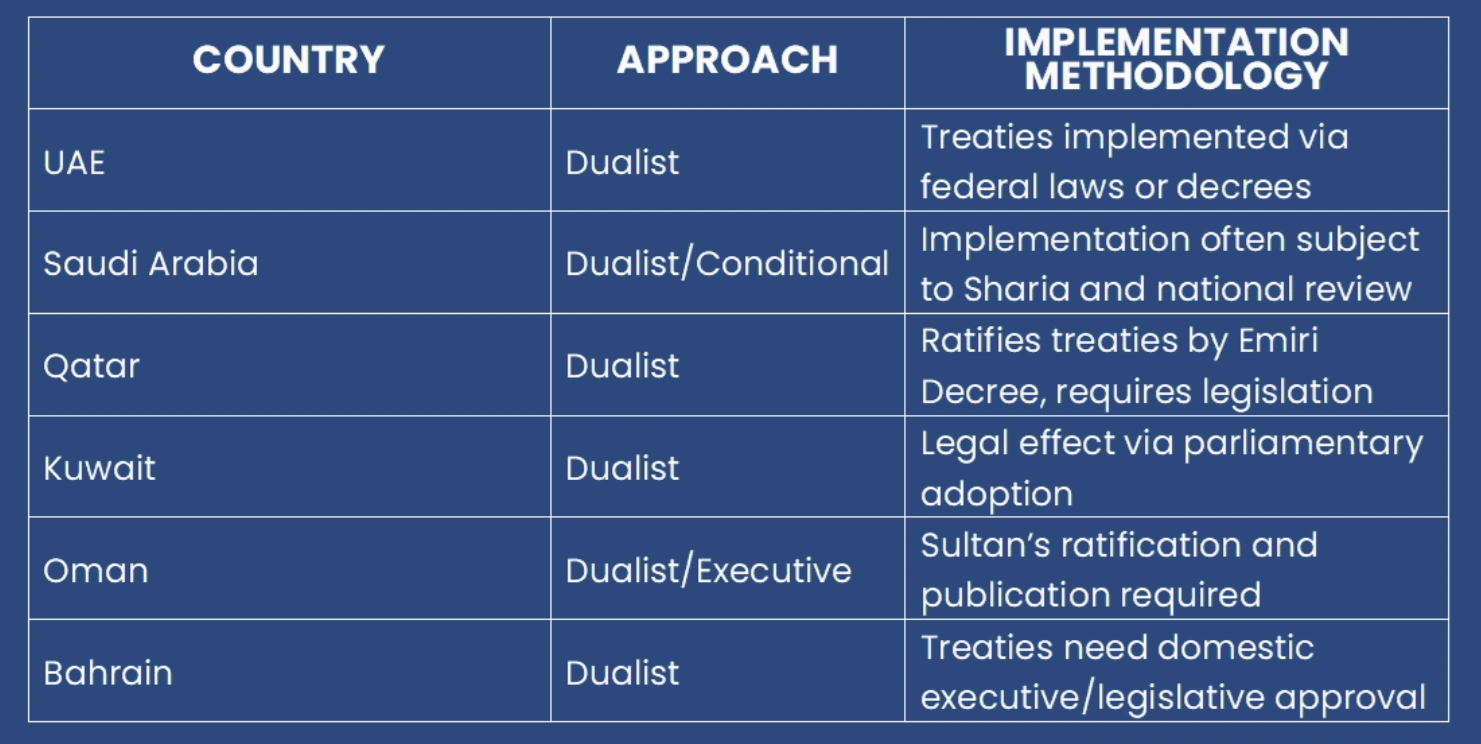

The GCC states are fundamentally dualist in their approach to international and tax treaties. International treaties, once signed or ratified, do not automatically take effect domestically without a specific process of local implementation or legislative adoption.

Role of OECD and UN Model Commentaries in Treaty Interpretation

The OECD and UN Model Tax Convention Commentaries ("MTCC") are widely used as tools to interpret bilateral tax treaties.

While not legally binding, they serve as persuasive aids for courts, tax authorities, and practitioners in understanding the intended meaning and application of treaty provisions, especially where treaty text is ambiguous or undefined.

Their legal basis is rooted in Articles 31(2) and 32 of the VCLT, which allow supplementary materials (like MTCC) to be used to confirm or clarify meaning in light of its object and purpose.

However, the legal weight assigned to MTCC varies across jurisdictions. In many common law systems, such as India, the OECD MTCC is treated as persuasive but not binding.

The Supreme Court of India, in Union of India v. Azadi Bachao Andolan, (2003) [10 SCC 1], explicitly acknowledged the use of OECD MTC in interpreting undefined terms and emphasized that tax treaties should be interpreted with a purposive approach and not a narrow domestic lens.

However, in the case of CIT v. P.V.A.L. Kulandagan Chettiar (1995) [216 ITR 221], the Supreme Court rejected the reliance on OECD MTCC, affirming that Commentary alone cannot alter the clear terms of a treaty or domestic statute. The Court emphasized that treaties must be interpreted based on their text and context, and that Commentary is not binding unless expressly incorporated through bilateral agreement.

The Dutch Supreme Court, taking a restrictive approach in its decision in ECLI:NL:HR:2022:1103, ruled that OECD MTCC issued after the conclusion of a tax treaty (in this case, the 2010 Commentary on "employer" under a 1959 Netherlands-Germany treaty) can only be used if they clarify, but do not reinterpret, the original intent of the contracting states. [Example of the static approach of interpretation discussed earlier].

In contrast, courts in civil law jurisdictions like France have shown greater deference to OECD Commentary, even when it postdates the treaty. In Conseil d'État, Decision No. 420174 (2020), the French Supreme Court relied heavily on the OECD MTCC to conclude that a French subsidiary constituted a dependent agent PE for its Irish parent. Although the treaty was based on the 1968 France-Ireland convention, the court treated the MTCC as reflective of evolving international consensus and justified its use under a purposive and teleological interpretative approach. [Example of the ambulatory approach of interpretation discussed earlier].

Conversely, in South Africa, courts have been skeptical of OECD MTCC where it conflicts with domestic law. In Krok v. Commissioner for the South African Revenue Service, Case No. 864/12, [2014] ZASCA 107 (SCA), the Court rejected OECD guidance when interpreting "resident" under the Australia- South Africa treaty, holding that domestic definitions prevail in the absence of treaty-specific language, and cautioning against post- signature reinterpretations by the OECD.

US tax courts adopt a self-contained approach, rarely citing OECD or UN Commentary. The US MTC diverges from the OECD MTC in key areas, with courts relying on domestic law and statutory interpretation. In Taisei Fire & Marine Insurance Co. Ltd. v. Commissioner, 104 T.C. 535 (1995), the U.S. Tax Court ignored OECD materials, focusing instead on treaty text and technical explanations issued at ratification. US Treasury Technical Explanations serve as an internal equivalent of Commentary in the US.

While the OECD and UN MTCCs are influential interpretative tools, their legal authority is not uniform across jurisdictions. Courts are more open to using these Commentaries, especially when they clarify existing terms. However, where the Commentary appears to alter the meaning or where domestic law offers a contrary definition, courts often disregard or limit its use. As such, the MTCC serves best as a contextual aid but not as a source of binding law.

Multilateral Instrument: A New Layer of Treaty Interpretation

The Multilateral Instrument ("MLI"), born from the OECD's BEPS Action Plan, revolutionized international tax treaty interpretation. Instead of renegotiating thousands of treaties bilaterally, the MLI overlays existing tax treaties with new anti-abuse provisions, notably:

- Principal Purpose Test ("PPT")

- Expanded PE rules

- Improved dispute resolution (MAP and arbitration)

- New tie-breaker rules for dual-resident entities

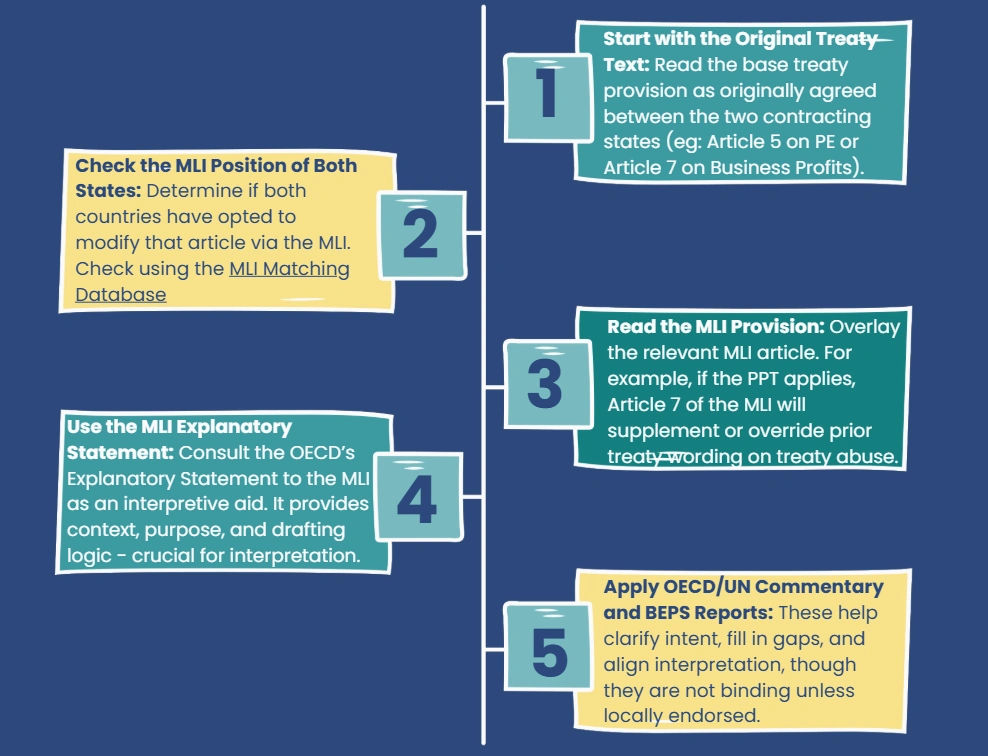

Interpretation after the MLI cannot rely solely on the original treaty text or prior Commentaries. Instead, taxpayers, tax authorities and courts will now assess:

- Whether the MLI has modified a given article of the treaty (eg Article 5 on PE)?

- The reservation and notification positions of both contracting states under the MLI

- The text of the MLI itself, which may introduce new standards, such as the PPT

- The Explanatory Statement to the MLI, which serves as a supplementary interpretative aid akin to OECD Commentary (see VCLT Article 32)

For example, the new PPT introduced by Article 7 of the MLI overrides prior treaty language on limitation of benefits ("LOB"), and courts must interpret treaty abuse through the lens of purpose-based reasoning and substance over form logic embedded in the MLI framework.

Interpreting MLI-Modified Tax Treaties

Treaty interpretation post-MLI is no longer linear, it's layered:

Caveat

This document does not provide an exhaustive analysis of all interpretative aids or doctrines relevant to tax treaty interpretation. The examples and references have been selectively included to illustrate key issues for a general and professional audience.

The content is intended solely for informational and academic discussion. While it draws on publicly available guidance, legal interpretations, and authoritative source, particularly from the OECD, UN, and global court rulings, it does not constitute legal, tax, or professional advice.

Tax treaty interpretation is a complex and evolving field. Judicial reasoning, administrative positions, and the weight given to OECD Commentaries, the MLI, and Explanatory Statements vary across jurisdictions based on local law and treaty context.

Readers should consult the full treaty text, official rulings, and local guidance-and seek professional advice-before applying any principles outlined here to specific facts. No assurance is given as to the current applicability or accuracy of the positions described.

Conclusion

The interpretation of international tax treaties represents a sophisticated legal discipline that balances textual analysis, contextual understanding, and purposive reasoning. As demonstrated throughout this analysis, effective treaty interpretation requires practitioners and courts to navigate multiple layers of legal authority, from the foundational Vienna Convention principles to modern innovations like the Multilateral Instrument.

The evolution from static to ambulatory interpretation approaches, the varying treatment of OECD and UN Commentaries across jurisdictions, and the complex interplay between domestic law and treaty provisions all underscore the dynamic nature of this field. The MLI has added further complexity, requiring a layered interpretive approach that considers original treaty text alongside modern anti-abuse provisions.

Understanding these interpretive frameworks is essential for tax professionals, as proper treaty interpretation directly impacts cross-border tax outcomes, dispute resolution, and international tax compliance strategies.