Real Estate Investment for Natural Persons

Corporate Tax Guide | CTGREI1

October 2024

Contents

3. Natural persons and income excluded from Corporate Tax

4.1. Definition of Real Estate Investment

4.2. Criteria for Real Estate Investment exclusion

4.3. Corporate Tax implications of Real Estate Investment

4.4. Distinguishing between taxable Business and excluded Real Estate Investment

Glossary

Accounting Standards | : | The accounting standards specified in Ministerial Decision No. 114 of 2023. |

AED | : | The United Arab Emirates dirham. |

Authority | : | Federal Tax Authority. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or activities, conducted by a Person in the course of its Business. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Control | : | The direction and influence over one Person by another Person in accordance with Article 35(2) of the Corporate Tax Law. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Dividend | : | Any payments or distributions that are declared or paid on or in respect of shares or other rights participating in the profits of the issuer of such shares or rights which do not constitute a return on capital or a return on debt claims, whether such payments or distributions are in cash, securities, or other properties, and whether payable out of profits or retained earnings or from any account or legal reserve or from capital reserve or revenue. This will include any payment or benefit which in substance or effect constitutes a distribution of profits made in connection with the acquisition or redemption or cancellation of shares or termination of other ownership interests or rights or any transaction or arrangement with a Related Party or Connected Person which does not comply with Article 34 of the Corporate Tax Law. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Financial Statements | : | A complete set of statements as specified under the Accounting Standards applied by the Taxable Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity and cash flow statement. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

FTA | : | Federal Tax Authority, being the Authority responsible for the administration, collection and enforcement of federal taxes in the UAE. |

IFRS | : | International Financial Reporting Standards. |

Licence | : | A document issued by a Licensing Authority under which a Business or Business Activity is conducted in the UAE. |

Licensing Authority | : | The competent authority concerned with licensing or authorising a Business or Business Activity in the UAE. |

Minister | : | Minister of Finance. |

Non-Resident Person | : | The Taxable Person specified in Article 11(4) of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Personal Investment | : | Investment activity that a natural person conducts for their personal account that is neither conducted through a Licence or requiring a Licence from a Licensing Authority in the UAE, nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022 Issuing the Commercial Transactions Law. |

Real Estate Investment | : | Any investment activity conducted by a natural person related to, directly or indirectly, the sale, leasing, sub-leasing, and renting of land or real estate property in the UAE that is not conducted, or does not require to be conducted, through a Licence from a Licensing Authority. |

Related Party | : | Any Person associated with a Taxable Person as determined in Article 35(1) of the Corporate Tax Law. |

Resident Person | : | The Taxable Person specified in Article 11(3) of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

Small Business Relief | : | A Corporate Tax relief that allows eligible Taxable Persons to be treated as having no Taxable Income for the relevant Tax Period in accordance with Article 21 of the Corporate Tax Law and Ministerial Decision No. 73 of 2023. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Tax Return | : | Information filed with the FTA for Corporate Tax purposes in the form and manner as prescribed by the FTA, including any schedule or attachment thereto, and any amendment thereof. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE under the Corporate Tax Law. |

Turnover | : | The gross amount of income derived during a Gregorian calendar year. |

UAE | : | United Arab Emirates. |

Wage | : | The wage that is given to the employee in consideration of their services under the employment contract, whether in cash or in kind, payable annually, monthly, weekly, daily, hourly, or by piece-meal, and includes all allowances, and bonuses in addition to any other benefits provided for, in the employment contract or in accordance with the applicable legislation in the UAE. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments ("Corporate Tax Law") was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ("UAE") on 10 October 2022.

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits ("Corporate Tax") in the UAE.

The provisions of the Corporate Tax Law apply to Tax Periods commencing on or after 1 June 2023.

Purpose of this guide

This guide is designed to provide general guidance to natural persons that derive Real Estate Investment income. It focuses specifically on the application of Cabinet Decision No. 49 of 2023 which excludes from Corporate Tax the Real Estate Investment income derived by a natural person where the specified conditions are met.

Who should read this guide?

The guide should be read by any natural person that derives income from real estate.

It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use this guide

The relevant articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide is read in its entirety to provide a complete understanding of the definitions and interactions of the different rules. Further guidance on some of the areas covered in this guide can be found in other topic-specific guides.

In some instances, examples have been used to illustrate how key elements of the Corporate Tax Law apply to natural persons that derive income from real estate. The examples in the guide:

Show how these elements operate in isolation and do not show the possible interactions with other provisions of the Corporate Tax Law that may occur. They do not, and are not intended to, cover the full facts of the hypothetical scenarios used nor all aspects of the Corporate Tax regime, and should not be relied upon for legal or tax advice purposes; and

Are only meant for providing the readers with general information on the subject matter of this guide. They are exclusively intended to explain the rules related to the subject matter of this guide and do not relate at all to the tax or legal position of any specific juridical or natural persons.

Legislative references

In this guide, the following legislation will be referred to as follows:

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as "Corporate Tax Law",

Cabinet Decision No. 49 of 2023 on Specifying the Categories of Businesses or Business Activities Conducted by a Resident or Non-Resident Natural Person that are Subject to Corporate Tax is referred to as "Cabinet Decision No. 49 of 2023",

Ministerial Decision No. 73 of 2023 on Small Business Relief for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 73 of 2023", and

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses is referred to as "Ministerial Decision No. 114 of 2023".

Status of this guide

This guidance is not a legally binding document, but is intended to provide assistance in understanding the tax implications for a natural person in relation to Real Estate Investment and the income derived from it as per the provisions of the Corporate Tax Law. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax for natural persons. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Natural persons and income excluded from Corporate Tax

Natural persons subject to Corporate Tax in the UAE are Taxable Persons. They can be either Resident Persons or Non-Resident Persons.[1]

According to the UAE Corporate Tax Law, natural persons conducting Business or Business Activities in the UAE are classified as Resident Persons, regardless of their actual place of residence. Note that international agreements, such as Double Taxation Agreements, override any provisions of the UAE Corporate Tax Law that may conflict with such agreements, when determining the tax residence of natural persons.

However, natural persons will only be subject to Corporate Tax, and required to register for Corporate Tax, if the total Turnover they derive from Business or Business Activities conducted in the UAE exceeds AED 1 million within a Gregorian calendar year.[2]

Further, for a natural person, income from the following categories is not considered as arising from a Business or Business Activity, and is disregarded when determining Turnover, i.e. it is not subject to Corporate Tax regardless of the amount:[3]

Wage,

Personal Investment income, and

Real Estate Investment income.

This guide addresses the tax implications for natural persons under Article 2(2)(c) of Cabinet Decision No. 49 of 2023 in relation to Real Estate Investment and the income derived from it.

Real Estate Investment

Definition of Real Estate Investment

Business or Business Activities, conducted by a natural person, shall be subject to Corporate Tax only where the total Turnover derived from such Business or Business Activities exceeds AED 1 million within a Gregorian calendar year.[4]

As mentioned in Section 3, for Corporate Tax purposes, Turnover from Real Estate Investment is excluded from Business or Business Activities conducted by a natural person.

Cabinet Decision No. 49 of 2023 defines Real Estate Investment as any investment activity conducted by a natural person related directly or indirectly to the sale, leasing, sub-leasing, and renting of land or real estate property in the UAE that is not conducted, or does not require to be conducted, through a Licence from a Licensing Authority. [5]

Therefore, the gross amount of income, and related expenditure, derived by a natural person from Real Estate Investment is excluded from Corporate Tax (see Section 4.4.1 for more information on expenditure).

Criteria for Real Estate Investment exclusion

Investment activity

Investment activity for the purposes of the Real Estate Investment exclusion consists of the following activities that are related to land or real estate property investment:

Selling,

Leasing/renting, or

Sub-leasing.

The list of activities stated above is exhaustive and, unless directly or indirectly related to these activities (see Section 4.2.3), no other activities constitute Real Estate Investment. Moreover, an investment activity will involve earning income from utilising the land or real estate property itself, rather than from services rendered in relation to the land or real estate property (for instance, property management services).

However, if the investment activity itself is conducted (or is required to be conducted) through a Licence issued by a Licensing Authority, it will not be considered as an investment activity within the scope of Real Estate Investment exclusion and so would be within the scope of Corporate Tax.

Scope of land or real estate property

The definition of Real Estate Investment specifies that the investment activities must be conducted in relation to land or real estate property (see Section 4.2.1).

Real estate means any of the following:

Any area of land over which rights or interests or services can be created.

Any building, structure or engineering work attached to the land permanently or attached to the seabed.

Any fixture or equipment which makes up a permanent part of the land or is permanently attached to the building, structure or engineering work or attached to the seabed.

Real estate property can include residential property, furnished holiday homes, commercial property, showrooms, warehouses and storage rooms, parking lots and garages, etc. It may also include structures, fixtures or similar equipment that are permanently attached to the property.

Land can include agricultural land, industrial land, residential land, etc. It may also include structures, fixtures or similar equipment that are permanently attached to the land.

When determining whether Real Estate Investment activities are being performed, it is irrelevant whether the third-party occupant(s)/lessee(s) use(s) the land or real estate property for Business or non-Business purposes. Real Estate Investment activity can include income from commercial or residential use of the land or real estate property, or a mixture of both.

Regardless of the size, quantity or value of land or real estate property owned and the amount of income derived, such income would not be subject to Corporate Tax as long as it satisfies the definition of Real Estate Investment.

Location of land or real estate property

The exclusion from Corporate Tax applies to investment activities conducted in the UAE, which is in relation to land or real estate property located in the UAE and/or outside of the UAE.

Licensing Authority

The term 'Licensing Authority' refers to an authority in the UAE that is responsible for, and authorised to, license the conduct of a Business or Business Activity in the UAE (including Free Zones).

Some examples of Licensing Authorities in relation to land or real estate property are the Departments of Economic Development in each Emirate, Abu Dhabi Department of Culture and Tourism, Abu Dhabi Department of Municipalities and Transport, Dubai Department of Economy and Tourism, Dubai Land Department, and Sharjah Real Estate Registration Department.

Licence

The term "Licence" applies to any type of document issued by a Licensing Authority (regardless of the duration of its validity) which authorises or permits a Business or Business Activity to be conducted in the UAE.

For example, a document issued by the Dubai Department of Economy and Tourism to permit a natural person to engage in leasing holiday homes would constitute a relevant Licence in this context. However, the issuance of a tenancy contract information registration certificate or termination of tenancy contract through the relevant systems of each Emirate (for example, Ejari for Dubai, Tawtheeq for Abu Dhabi, etc.) are administrative records rather than permission to conduct Business, and so would not constitute a Licence for this purpose.

The Corporate Tax Law and its implementing decisions do not create a requirement for natural persons to obtain a Licence to conduct a Business or Business Activity. Rather, this is mandated by the relevant Licensing Authority and the relevant legislation through which it operates.

Not required to be conducted through a Licence

The phrase 'required to be conducted' in relation to the definition of Real Estate Investment is to be understood as covering the situation where a Licence is required but it has not been obtained. In this scenario, the lack of a valid Licence does not result in the investment activity being outside the scope of Corporate Tax. Such activity would be considered a Business or Business Activity and the income derived from it would be subject to Corporate Tax (subject to meeting the relevant Turnover threshold) even if the natural person does not have the required Licence.

Example 1: Investment activity not conducted or required to be conducted through a Licence

A natural person owns two properties (one located in the UAE and one outside the UAE), which the natural person leases to tenants and earns rental income.

The natural person does not have, nor requires, a Licence to earn rental income from these properties. Such income is Real Estate Investment income and shall be excluded from the scope of Corporate Tax.

Example 2: Fixed sum rental income from a real estate property

A natural person owns a real estate property in the UAE that is leased to a third-party commercial company. The natural person is entitled to an annual rental payment in a fixed sum from the third-party commercial company.

The natural person does not have a Licence nor is required to have a Licence for its leasing activity.

As such, the rental income received by the natural person is considered Real Estate Investment income, and hence shall be excluded from the scope of Corporate Tax.

Example 3: Rental income linked to the performance of a tenant's Business

A natural person owns a real estate property in the UAE that is leased to a third-party commercial company.

The natural person agrees with the company to receive an annual rent calculated as the sum of a fixed amount of AED 50,000 and 7% of the company's annual Revenue.

The natural person does not have a Licence nor are they required to have a Licence for this activity. Although they receive variable rental income that is connected to the tenant company's Revenue, they are not involved in any of the company's activities.

As such, the rental income received by the natural person is considered Real Estate Investment income, and hence shall be excluded from the scope of Corporate Tax.

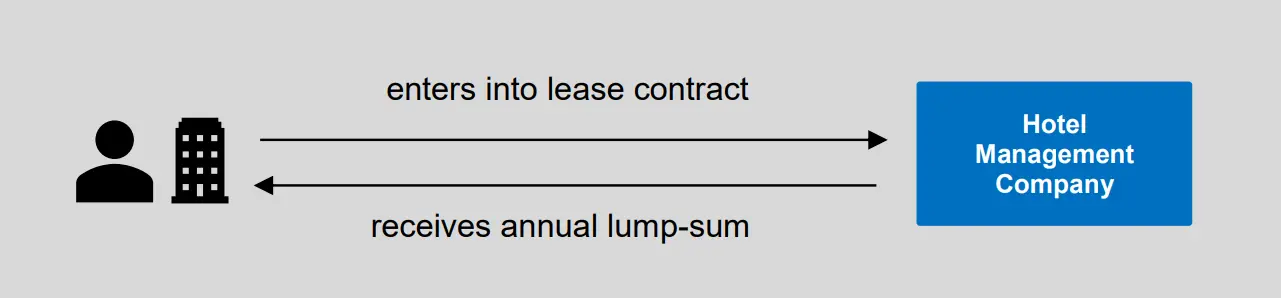

Example 4a: Income from lease of property to a hotel management company

A natural person owns a building in the Emirate of Dubai. As per the relevant legislation, in order for the building to be used as a hotel establishment, it must have a manager or enter into a contract with a hotel management company licensed by the Department of Tourism and Commerce Marketing to manage its operations.

The natural person decides to enter into a contract with a licensed hotel management company.

The natural person and the hotel management company agree that the natural person will lease the hotel building (an activity for which the natural person does not have, nor is required to have, a Licence) to the hotel management company and in return will receive an annual lump-sum amount.

The natural person is not involved in the operation of the hotel, rather it is carried out by the hotel management company. In this case, the income received by the natural person from the hotel management company is in relation to Real Estate Investment and it shall be excluded from the scope of Corporate Tax by the natural person.

Example 4b: Variation on Example 4a

If, alternatively, the natural person was carrying out the management of the hotel business which required a Licence, then by virtue of conducting a Business with (or requiring) a Licence, the Real Estate Investment exclusion would not be applicable, and the income received by the natural person would be within the scope of Corporate Tax.

"Directly or indirectly"

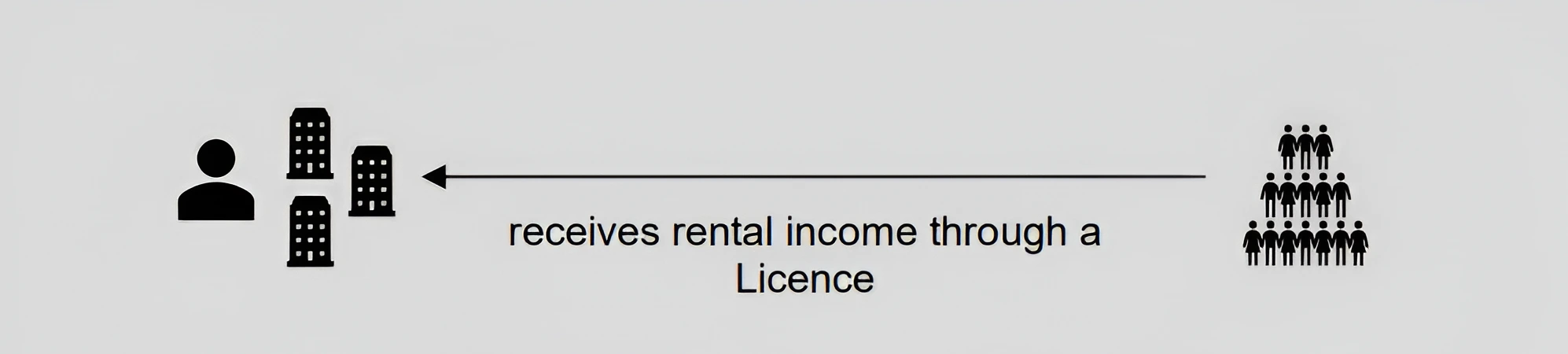

Investment activities can be conducted directly by the natural person, or indirectly through an intermediary.

With reference to the term 'indirectly', the income received by a natural person through an intermediary can qualify for the Real Estate Investment exclusion, depending on the exact facts and circumstances. An intermediary may be an agent or property management company.

For example, if the natural person engages a third-party agent to manage the renting of their apartment and collect rent on their behalf, the engagement of the agent and the rent received by the natural person is still considered as part of a Real Estate Investment activity. In this situation, it is not relevant to the natural person that the third-party agent has a Licence to conduct its Business.

Income derived by a natural person from other activities that relate to Real Estate Investment activity will similarly only be excluded from Corporate Tax if the activities are not conducted (or not required to be conducted) through a Licence from a Licensing Authority.

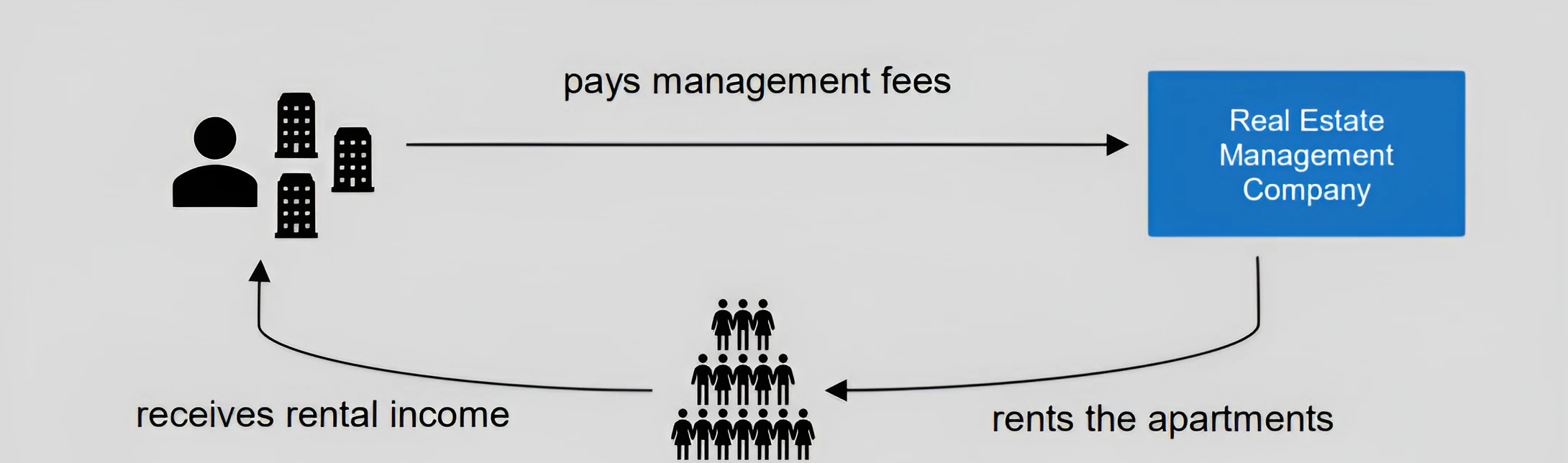

Example 5: Investment activity conducted indirectly by a natural person

A natural person who is an owner of apartments receives rental income through a third-party real estate management company that manages the apartments on behalf of the natural person. The rental agreements show the natural person as the, landlord, owner or lessor.

The real estate management company possesses the appropriate Licence for property management and is a Taxable Person.

Among other services, such as sourcing tenants, tenancy contract registration, advertising properties, etc., the real estate management company also collects the rent from the tenants and then transfers it to the natural person (owner).

In return for the services it provides, the real estate management company is entitled to management fees.

The use of an agent does not alter the nature of the income or to whom it belongs.

Therefore, the rental income received by the natural person (via the real estate management company), relates to a Real Estate Investment activity, that is the leasing of real estate by a natural person for which the natural person does not have nor is required to have a Licence. Hence, the income shall be excluded from the scope of Corporate Tax by the natural person.

Sole establishments and sole proprietorships

A sole establishment or sole proprietorship is a Business which is owned and conducted by a natural person on his/her own account and in their own name, as the case may be. In such situations, the natural person and the sole establishment/sole proprietorship are the same Person, which is distinguishable from a single owner company which has its own legal personality where the owner and the company are separate Persons.

The sole establishment or sole proprietorship and the natural person are one and the same because of their direct relationship and Control over the Business and their unlimited liability for the debts and other obligations of the Business. For Corporate Tax purposes, the Taxable Person is the natural person conducting the Business and not the sole establishment or sole proprietorship.

Example 6: Natural person with sole establishment

A natural person owns several real estate properties in both Abu Dhabi and Dubai and conducts no other Business. The natural person created a sole establishment in February 2024 which has a Licence to manage self-owned properties.

The sole establishment is not considered to have a separate legal personality from the natural person. As the natural person, through the sole establishment, holds a Licence to manage his real estate, the rental income will not be classified as Real Estate Investment income, and will be subject to Corporate Tax (if the AED 1 million turnover threshold is exceeded within the 2024 Gregorian calendar year).

Corporate Tax implications of Real Estate Investment

If income from Real Estate Investment is excluded from the scope of Corporate Tax, then expenditure that relates directly or indirectly to Real Estate Investment income is not deductible for Corporate Tax purposes. Consequently, any profits will not be included in the calculation of any Taxable Income, and any loss will not be eligible for any Corporate Tax relief.

Impact on registration for Corporate Tax

Natural persons conducting Businesses or Business Activities in the UAE that are subject to Corporate Tax are only required to register for Corporate Tax purposes once the total Turnover derived from such Businesses or Business Activities exceeds AED 1 million within a Gregorian calendar year. [6]This is applicable as of the 2024 Gregorian calendar year.

Income derived from Real Estate Investment that benefits from the exclusion is outside the scope of Corporate Tax and shall not be included in the natural person's Turnover (see Section 3).

Transactions at arm's length

Transactions between Related Parties, including a transaction between a natural person and another Person that is a Related Party, must meet the arm's length standard for Corporate Tax purposes.[7]Such transactions would include, but not be limited to, lease agreements between a natural person and its Related Parties, and property management agreements between a natural person and its Related Parties.

Distinguishing between taxable Business and excluded Real Estate Investment

Real Estate Investment income is disregarded when determining Turnover and so is not subject to Corporate Tax, regardless of the amount.[8]

The exclusion from Corporate Tax does not apply to land or a real estate property that is owned as part of a Business or Business Activity conducted by the natural person through a Licence.

A natural person may own land or real estate property in a non-Business capacity and also operate a Business or Business Activity requiring a Licence. In this situation the question arises as to whether any income earned in relation to land or real estate property is outside the scope of Corporate Tax, (i.e. derived from a Real Estate Investment activity). It is necessary to consider whether the income may be Taxable Income derived from the use of the real estate for the purposes of the natural person's Business, and thus, would not benefit from the Real Estate Investment exclusion for Corporate Tax purposes.

Under the self-assessment principles of Corporate Tax, a natural person should be able to clearly demonstrate the basis for separating real estate income earned in a non-Business capacity from their other Business or Business Activities to benefit from the exclusion. The real estate income earned in a non-Business capacity can benefit from the Real Estate Investment exclusion. An example of a transaction covered by the Real Estate Investment exclusion could be a natural person with a Business in relation to real estate, who sells their personal residence in a non-business capacity.

Example 7: A natural person selling personal residence (non-Business)

Mr Y (based in the UAE) bought a personal residence in 2023 for AED 3,000,000. In 2024, Mr Y sells his personal residence to a third-party for AED 3,400,000. Because Mr Y's personal residence increased in value, he realised a profit of AED 400,000.

Mr Y did not have a Licence nor was required to have a Licence to execute the sale of his house.

As such, the realised income by Mr Y from the sale of his personal residence is considered Real Estate Investment income and, hence, shall be excluded from the scope of Corporate Tax.

If a person has (or requires) a Licence for a Business or Business Activity, and those activities can clearly be distinguished from the Real Estate Investment activities, then the Real Estate Investment exclusion may still be available in relation to those Real Estate Investment activities.

Example 8: Rental income received by a natural person that also carries on a Business or Business Activity (unrelated to real estate) through a Licence

A natural person carries on a bakery Business through a sole establishment and has a Licence to conduct that Business. In addition, the natural person owns and leases two apartments.

The natural person does not have (or require) a Licence to lease the apartments and earn rental income from them.

In such circumstances, the income from the leasing of the apartments would not be considered as connected to the bakery Licence.

As such the rental income shall qualify as Real Estate Investment income and thus would be outside the scope of Corporate Tax.

On the other hand, if based on the facts, the land or the real estate property or any related income from it, forms part of the Business or Business Activity, and this is conducted or is required to be conducted through a Licence, then any income would fall outside the definition of Real Estate Investment and, therefore, be within the scope of Corporate Tax.

Example 9: Rental income received by a sole establishment which has a Business Licence relating to real estate

A natural person who is the owner of apartments receives rental income through their real estate management sole establishment. The real estate management sole establishment does not have a separate legal personality from the natural person (owner).

The sole establishment possesses the appropriate Licence for property management and leasing.

Among other services such as sourcing tenants, tenancy contract registration, advertising properties, etc., the real estate management sole establishment also collects the rent from the tenants.

As the property management sole establishment carries on the Business of leasing, or otherwise dealing in real estate through a Licence, the natural person would be considered as operating through a Licence and would not be entitled to apply the Real Estate Investment exclusion.

As a result, the rental income would need to be taken into account in the calculation of their Turnover by the natural person for Corporate Tax purposes.

Apportionment of expenditure

Expenditures related to Real Estate Investment may be shared between activities falling within the Real Estate Investment exclusion and activities falling within other Business or Business Activities.

Expenditure directly linked to specific activities is straightforward to allocate. Shared costs, such as general overheads must be allocated indirectly using a fair and consistent apportionment method to ensure each activity accurately reflects its share of expenses.

Apportionment methods are criteria used to determine how expenses can be assigned or distributed across different activities. These methods can be applied to factors such as headcount, floor space, usage, time spent, or any other measurable and reasonable basis. The primary goal is a realistic determination of the net income from each activity.

The appropriate apportionment method will depend on the nature of the expense and the contribution that it makes to each income component. The apportionment method chosen must be logical and must fairly represent the benefit that the expense generates for each income component. The apportionment method should be used consistently from one Tax Period to the next, unless there is a change in fact pattern which justifies a change in apportionment or methodology.

The approach chosen should accurately reflect the underlying activity, and should not be unnecessarily burdensome and complex.

Example 10: Splitting income and expenditure

Miss M owns 16 apartments in the Emirate of Dubai, out of which:

14 apartments are rented as holiday homes, for which she obtains holiday home permits from the Department of Economy and Tourism in Dubai.

This is considered a Business or Business Activity conducted through a Licence and the income derived from it is within the scope of Corporate Tax, i.e. Revenue.

2 apartments are rented to tenants as residential apartments, with registered certificates of tenancy contract (i.e. registered Ejari) issued by the Dubai Land Department. These contracts do not require a Licence (they are not covered by the holiday home permits). Therefore, renting these apartments would not be considered a Business or Business Activity and so the income derived is out of scope of Corporate Tax, i.e. it is Real Estate Investment income.

Miss M incurs direct costs and common costs in respect of the holiday homes Business and the residential apartments. Miss M is registered with the FTA for Corporate Tax and pays Corporate Tax.

In relation to the common costs, Miss M applies an apportionment method based on the value of the properties. Thus, Miss M's Taxable Income in relation to real estate would be the income from the holiday homes, less direct costs incurred for the holiday homes and the common costs apportioned to the 14 holiday homes.

The income derived from the 2 apartments, less the direct costs incurred for the 2 apartments and common costs apportioned to the 2 apartments would fall under the Real Estate Investment exclusion.

Jointly owned land or real estate property

In the case of co-ownership of land or real estate property by multiple persons, the income derived from Real Estate Investment activity must be allocated to each owner. All facts and circumstances must be assessed on a case-by-case basis to determine the appropriate allocation of income between joint owners.

Where the owner is a natural person, their allocated income will be out of scope of Corporate Tax if they do not conduct the Real Estate Investment activity through a Licence (or require a Licence to do so). Each joint owner should individually assess whether their income is from Real Estate Investment based on their individual facts and circumstances.

Example 11: Rental income from jointly owned real estate property

Mr F owns apartments in Ras Al Khaimah that are rented as holiday homes under a licensed real estate sole establishment. Mr F has registered for Corporate Tax, was not eligible for Small Business Relief due to his Turnover exceeding AED 3,000,000 during a Gregorian calendar year, and pays Corporate Tax on the Taxable Income of the Business.

In addition, Mr F and his brother, Mr G, inherit 25 villas in Ras Al Khaimah, with each brother holding a 50% ownership interest in each villa. They decide that 22 villas will be rented as holiday homes, and this activity requires a Licence. As such, the holiday homes are rented under Mr F's sole establishment. Each brother will be allocated their share of income in respect of their ownership interest, i.e. 50% each.

The remaining 3 villas are rented as residential properties by the two brothers, jointly without the requirement for a Licence, to tenants with registered tenancy contracts issued by the Ras Al Khaimah Municipality, and independently of the sole establishment.

Corporate Tax Implications

Mr F:

Mr F's income from the non-inherited Ras Al Khaimah apartments remains taxable.

Mr F's share of the income from the inherited 22 villas rented as holiday homes would not be considered as Real Estate Investment income on the basis that the lease of such villas requires a Licence. The income and associated costs would be included in the calculation of Taxable Income and subject to Corporate Tax for Mr F.

The share of rental income from the 3 villas would not be subject to Corporate Tax for Mr F. This activity qualifies as a Real Estate Investment because it is not conducted through a Licence. This income, and any related expenditure, shall not be included in the calculation of Taxable Income of Mr F.

Mr G:

Mr G's share of the income and associated costs from the 22 villas rented as holiday homes would not be considered as Real Estate Investment income on the basis that renting holiday homes requires a Licence. The net income may be subject to Corporate Tax where his Turnover exceeds the AED 1 million threshold in a Gregorian calendar year (unless Mr G elects for the Small Business Relief, subject to meeting the relevant conditions).[9]

The share of rental income from the 3 villas (let as residential properties) would not be subject to Corporate Tax for Mr G. This activity qualifies as Real Estate Investment because it is not conducted through a Licence. This income, and any related expenditure, shall not be included in the calculation of Taxable Income (if any) of Mr G.

Accounting Standards

The Corporate Tax treatment of land and real estate property transactions and related activities will follow how these transactions and activities are accounted for under the applicable Accounting Standards where relevant.

In determining whether income falls within the Real Estate Investment exclusion, a natural person must consider the way in which the land and real estate property, and related income, is accounted for under the applicable Accounting Standards. This would include considering the treatment in the Financial Statements of Related Parties or third-parties that are involved in the transactions and activities.

Example 12: Rental income received from a wholly owned UAE company

A natural person owns a commercial building. The natural person also wholly owns Company X, a limited liability company incorporated in the UAE.

Company X enters into agreements with tenants in respect of the commercial building owned by the natural person, collects rents from the building, and holds a Licence to operate a Business of property management.

The Corporate Tax treatment will depend on the arrangements between the natural person and Company X.

If Company X is the principal in relation to the tenancy agreements (i.e. there are arrangements in place, such as a lease agreement, that provide Company X with the right to use or sublease the commercial building), Company X would receive rental income for its own account and would reflect this as income in its Financial Statements.

However, if there are no arrangements in place to provide Company X with rights over the commercial property, the rental income would arise for the account of the natural person as owner of the commercial building and all associated property rights.

The income derived by Company X would be the amount of commission that the natural person pays to Company X for its property management services.

Where the natural person does not have, nor require, a Licence to earn rental income from the commercial building, such income will be considered Real Estate Investment income and shall be excluded from the scope of Corporate Tax. Alternatively, where a Licence is held or required to be held, the natural person would reflect the income in their Financial Statements and consequently in their Tax Return (unless their Turnover does not exceed AED 1,000,000 in a Gregorian calendar year or the natural person has elected for the Small Business Relief subject to meeting the relevant conditions).

As the natural person and Company are Related Parties, any arrangements between them should comply with the arm's length principle for Corporate Tax purposes.

Example 13: Income from a wholly owned UAE company which owns Real Estate

A company established in the UAE, which is wholly owned by a natural person, owns a commercial building.

The UAE company collects rents from tenants (as the lessor in its own right, under tenancy agreements) in respect of the commercial building and holds a Licence for this activity. The natural person does not have, nor is required to have a Licence, to own shares in the company.

Whilst wholly owned by the natural person, the UAE company is considered a separate Person from the natural person under the Corporate Tax Law.

The rental income is accounted for (under IFRS) in the accounts of the UAE company.

To the extent the UAE company distributes profits as a Dividend to its shareholder, (i.e. the natural person), such Dividend would typically be considered Personal Investment income (and not Real Estate Investment income). However, it would similarly be excluded from the scope of Corporate Tax.

General Anti-abuse Rule

The General Anti-abuse Rule allows the FTA to counteract or adjust any transaction or arrangement (or any part thereof) which lacks commercial substance or does not reflect economic reality and is undertaken for the main purpose of, or where one of the main purposes is, obtaining a Corporate Tax advantage that is not consistent with the intention of the Corporate Tax Law. [10]

Thus, if a real estate transaction or arrangement is entered into with a main purpose of obtaining a Corporate Tax advantage, such as the Real Estate Investment exclusion, and this lacks commercial substance as well as being inconsistent with the intention of the Corporate Tax Law, the FTA can, for instance, require the relevant income to be treated as Taxable Income.

Updates and Amendments

Date of amendment | Amendments made |

|---|---|

October 2024 |

|