Advance Pricing Agreements

Corporate Tax Guide | CTGAPA1

December 2025

Contents

3. Introduction to APA programme

Glossary

AED | : | The United Arab Emirates Dirham. |

Authority | : | Federal Tax Authority. |

Advance Pricing Agreement ("APA") | : | An APA is an agreement by the Authority with a Person, which sets the criteria to determine the Arm's Length Price in relation to Controlled Transactions entered or to be entered by that Person with its Related Party/Parties, over a fixed period of time. |

Annual Declaration | : | A declaration submitted to the Authority by the Person for each Tax Period covered under an APA to demonstrate the Person's compliance with the terms and conditions of the APA. |

Arm's Length Principle | : | The international standard that the Organisation for Economic Co-operation and Development member countries and many other jurisdictions have agreed to use for determining transfer prices for tax purposes. The principle is set forth in Article 9 of the Organisation for Economic Co-operation and Development ("OECD") Model Tax Convention as follows: Where conditions are made or imposed between the two enterprises in their commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which would, but for those conditions, have accrued to one of the enterprises, but, by reason of those conditions, have not so accrued, may be included in the profits of that enterprise and taxed accordingly. |

Arm's Length Price | : | The price determined for a specific business transaction in accordance with the Arm's Length Principle. |

Business | : | Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties. |

Business Activity | : | Any transaction or activity, or series of transactions or series of activities conducted by a Person in the course of its Business. |

Business Day | : | Any day of the week, except weekends and official holidays of the Federal Government. |

Competent Authority | : | Ministry of Finance of the UAE or its representative. |

Corporate Tax | : | The tax imposed by the Corporate Tax Law on juridical persons and Business income. |

Corporate Tax Law | : | Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments. |

Controlled Transactions | : | Transactions or arrangements between two parties that are Related Parties or Connected Persons. |

Double Taxation Agreement | : | An international agreement signed by two or more countries for the avoidance of double taxation and the prevention of fiscal evasion on income and capital. |

Extractive Business | : | The Business or Business Activity of exploring, extracting, removing, or otherwise producing and exploiting the Natural Resources of the State or any interest therein as determined by the Minister. |

Federal Tax Authority ("FTA") | : | The authority in charge of administration, collection and enforcement of federal taxes in the UAE. |

Financial Statements | : | A complete set of statements as specified under the Accounting Standards applied by the Person, which includes, but is not limited to, statement of income, statement of other comprehensive income, balance sheet, statement of changes in equity and cash flow statement. |

Free Zone | : | A designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Free Zone Person | : | A juridical person incorporated, established or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone. |

Government Controlled Entity | : | Any juridical person, directly or indirectly wholly owned and controlled by a Government Entity, as specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Government Entity | : | The Federal Government, Local Governments, ministries, government departments, government agencies, authorities and public institutions of the Federal Government or Local Governments. |

Legal Representative | : | The guardian or custodian of an incapacitated Person or minor, or the bankruptcy trustee appointed by the court for a company that is in bankruptcy, or any other Person legally appointed to represent another Person. |

Mandated Activities | : | Any activity conducted by a Government Controlled Entity in accordance with the legal instrument establishing or regulating the entity, that is specified in a decision issued by the Cabinet at the suggestion of the Minister. |

Minister | : | Minister of Finance. |

Mutual Agreement Procedure ("MAP") | : | A process by which the UAE and other contracting states in Double Taxation Agreements ("DTAs") seek to resolve international tax disputes, which result, or will result in taxation, that is not in accordance with the DTA. A MAP may also be sought where there is an issue of interpretation or application of the relevant DTA and where double taxation arises for cases not provided for in the relevant DTA. |

Non-Extractive Natural Resource Business | : | The Business or Business Activity of separating, treating, refining, processing, storing, transporting, marketing or distributing the Natural Resources of the State. |

Parent Company | : | A Resident Person that can make an application to the FTA to form a Tax Group with one or more Subsidiaries in accordance with Article 40(1) of the Corporate Tax Law. |

Person | : | Any natural person or juridical person. |

Qualifying Free Zone Person | : | A Free Zone Person that meets the conditions of Article 18 of the Corporate Tax Law and is subject to Corporate Tax under Article 3(2) of the Corporate Tax Law. |

Related Party | : | Any Person associated with a Person as determined in Article 35 of the Corporate Tax Law. |

Revenue | : | The gross amount of income derived during a Tax Period. |

State | : | United Arab Emirates ("UAE"). |

Tax | : | Every federal tax imposed under the Tax Law, that the Authority is mandated to administer, collect and enforce. |

Tax Agent | : | Any Person registered with the FTA who is appointed on behalf of another Person to represent him before the FTA and assist him in the fulfilment of his obligations and the exercise of his associated Tax rights. |

Tax Law | : | Any federal law whereby the Tax is imposed. |

Tax Group | : | Two or more Taxable Persons treated as a single Taxable Person according to the conditions of Article 40 of the Corporate Tax Law. |

Taxable Income | : | The income that is subject to Corporate Tax under the Corporate Tax Law. |

Tax Period | : | The period for which a Tax Return is required to be filed. |

Taxable Person | : | A Person subject to Corporate Tax in the UAE as mentioned in Article 11 of the Corporate Tax Law. |

Transfer Pricing ("TP") | : | The setting of arm's length prices for Controlled Transactions, including but not limited to the provision or receipt of goods, services, loans and intangibles. |

Tax Return | : | Information filed with the Authority for Corporate Tax purposes in the form and manner as prescribed by the Authority, including any schedule or attachment thereto, and any amendment thereof. |

Introduction

Overview

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses was issued on 3 October 2022 and was published in Issue #737 of the Official Gazette of the United Arab Emirates ("UAE") on 10 October 2022. This Decree-Law together with its amendments is referred to as the "Corporate Tax Law".

The Corporate Tax Law provides the legislative basis for imposing a federal tax on corporations and Business profits in the UAE.

Purpose of the guide

This guide is aimed at providing guidance on procedural aspects of an Advance Pricing Agreement ("APA"), a mechanism available under the Corporate Tax Law and covers:

Overview of the APA programme,

APA procedures, and

APA monitoring and review.

Who should read the guide?

This guide should be read by anyone responsible for the tax affairs of any Person, who seeks to obtain tax certainty by entering into an APA covering Controlled Transactions. It is intended to be read in conjunction with the Corporate Tax Law, the implementing decisions and other relevant guidance published by the FTA.

How to use the guide

The relevant Articles of the Corporate Tax Law and the implementing decisions are indicated in each section of the guide.

It is recommended that the guide be read in its entirety to provide a complete understanding of the definitions and interactions of the different rules.

Legislative references

In this guide, the following legislation shall be referred to as follows:

Federal Decree-Law No. 28 of 2022 on Tax Procedures, and its amendments, is referred to as "Tax Procedures Law",

Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as "Corporate Tax Law",

Cabinet Resolution No. 44 of 2020 on Organising Reports Submitted by Multinational Companies, is referred to as "Cabinet Resolution No. 44 of 2020",

Cabinet Decision No. 75 of 2023 on the Administrative Penalties for Violations Related to the Application of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments, is referred to as "Cabinet Decision No. 75 of 2023",

Cabinet Decision No. 65 of 2020 on Fees for the Services Provided by the Federal Tax Authority, and its amendments, is referred to as "Cabinet Decision No. 65 of 2020", and

Federal Tax Authority Decision No. 5 of 2021 on Issuing Clarifications and Directives, and its amendments, is referred to as "FTA Decision No. 5 of 2021".

Status of the guide

This guide is not a legally binding document, but is intended to provide assistance in understanding the APA programme under the Corporate Tax regime in the UAE. The information provided in this guide should not be interpreted as legal or tax advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. It is based on the legislation as it stood when the guide was published. Each Person's own specific circumstances should be considered.

The Corporate Tax Law, the implementing decisions and the guidance materials referred to in this document will set out the principles and rules that govern the application of Corporate Tax in the UAE. Nothing in this publication modifies or is intended to modify the requirements of any legislation.

This document is subject to change without notice.

Introduction to APA programme

Transfer Pricing ("TP") provisions were introduced in the UAE along with the Corporate Tax Law. Article 34 of the Corporate Tax Law requires that transactions or arrangements between Related Parties must meet the arm's length standard.

Article 59 of the Corporate Tax Law permits the submission of an application for an Advance Pricing Agreement ("APA") in the determination of the Arm's Length Price with respect to Controlled Transactions or arrangements proposed or entered into by the Person.

Overview of APAs

The APA programme offers a voluntary mechanism for a Person to enter into an agreement for determining the Arm's Length Price of Controlled Transactions over a period of time and preventing the risk of TP disputes and litigation.

The FTA encourages the adoption of the APA programme between the FTA and the Person. Key benefits of an APA include:

Enhanced predictability: Enhances predictability regarding the tax treatment of Controlled Transactions for Tax Periods.

Facilitated collaboration: Provides an opportunity to engage with the FTA in a cooperative environment.

Prevention from risk of TP disputes: Reduces the need for time-consuming examinations of complex TP issues and mitigates the risk of tax litigations.

Prevention of double taxation: Reduces or effectively eliminates double taxation through bilateral APAs.

Streamlined compliance: Simplifies record-keeping by clearly outlining the required documentation to ensure compliance with the APA.

Types of APAs

An APA can be of the following types:

Unilateral APA ("UAPA"): A UAPA is an agreement between a Person and the FTA for domestic and cross border Controlled Transactions. A UAPA between a Person and the FTA will provide the Person with an assurance on key criteria and assumptions to be followed for establishing the Arm's Length Price for the Controlled Transactions during the period covered under the APA.

The UAPA shall be binding only on the FTA, and the Person that is a party to the UAPA, to provide tax certainty exclusively from a UAE Corporate Tax Law perspective. The UAPA is not binding on any foreign taxpayer or foreign tax administration that may be the counterparty to the Controlled Transactions covered by the UAPA. Accordingly, the terms and conditions agreed under the UAPA shall not be construed as enforceable or applicable beyond the jurisdiction of the UAE and shall not be binding on the foreign tax administration. For a domestic UAPA, counterparty to the covered Controlled Transactions should comply with the Arm's Length Price and other terms agreed in the UAPA. Further, during an audit of the counterparty, if any, the FTA will take into consideration the position agreed in the UAPA, unless additional facts are identified during the audit that are inconsistent with the understanding on which the UAPA was based.

A Person may suffer double taxation if the foreign tax administration disagrees with the UAPA concluded with the FTA and makes adjustments to the transfer prices. The Person will then have to rely on other remedies to resolve the double taxation such as a Bilateral/Multilateral Advance Pricing Agreement ("BAPA/MAPA") or Mutual Agreement Procedure ("MAP").

The UAPAs for cross border Controlled Transactions shall be exchanged with foreign tax administrations of the jurisdiction of ultimate parent entity, immediate parent entity and counterparty of Controlled Transactions. Where a Person obtains an APA from a foreign tax administration regarding the same Controlled Transactions, it is obliged to notify the FTA of the same.

For domestic Controlled Transactions, the FTA shall accept the application for UAPAs from December 2025 and for cross-border Controlled Transactions, the commencement date will be announced in 2026.

BAPA: A BAPA is an agreement between competent authorities of two jurisdictions reached through a MAP. A BAPA provides tax certainty in relation to Controlled Transactions in the UAE and the relevant foreign jurisdiction.

MAPA: A MAPA is a set of agreements between competent authorities of more than two jurisdictions reached through a MAP. MAPAs offer significant tax certainty as compared to traditional BAPAs in situations involving more than two jurisdictions.

The FTA is introducing its APA programme in a phased manner, initially through UAPAs.

While the initial focus is on UAPAs, covering both domestic and cross-border Controlled Transactions, the FTA, along with the Competent Authority, is committed to further enhancing the programme by gradually expanding to BAPAs/MAPAs. This phased approach will ensure a strong foundation is laid through practical experience, stakeholder engagement, and capacity building, for effective and efficient mutual agreement for BAPAs/MAPAs with treaty partners.

Additional guidance will be issued upon implementation of BAPAs/MAPAs. The date of receiving APA applications other than UAPAs shall be announced in the future.

Scope of an APA

An APA will set out the criteria for determining the Arm's Length Price in relation to Controlled Transactions entered or to be entered by that Person, over a fixed period of time. The manner in which an Arm's Length Price is determined in an APA may include application of one or combination of the TP methods[1] under the Corporate Tax Law, along with such adjustments or variations, as may be necessary to do so. At the initial stage, UAPAs shall only cover prospective periods.

An APA may among other elements, include:

Parties to the APA,

Controlled Transactions covered by the agreement,

Tax Periods covered by the agreement,

Agreed TP criteria for determining Arm's Length Price including the definition of any relevant terms to be used in the agreement,

Critical assumptions, and

Documentation and implementation mechanism.

An APA entered into shall be binding on:

the Person in whose case and in respect of the Controlled Transactions in relation to which, the agreement has been entered into, and

the FTA subject to conditions prescribed in Section 5.

Eligibility for an APA

A Person who has proposed or entered into domestic and/or cross-border Controlled Transactions is eligible to enter into an APA under the APA programme. However, such Controlled Transactions shall meet the materiality threshold prescribed in Section 3.5 to apply for an APA.

A Person may apply for an APA if there are significant uncertainties in determining the appropriate criteria for establishing the Arm's Length Price of proposed or existing Controlled Transactions. This could include cases involving complex Business operations or Controlled Transactions, or where such Controlled Transactions have been historically subject to audit. Controlled Transactions that fall under safe harbour provisions, including low value-adding intra-group services, shall not be taken into consideration for APAs.

Domestic Controlled Transactions may be covered under an UAPA if the Person and its domestic Related Party are subject to different tax rates or are eligible for any tax incentives under the Corporate Tax Law.

Domestic Controlled Transactions that may be covered under a UAPA include, but are not limited to, the following Controlled Transactions undertaken:

by a Qualifying Free Zone Person with a Person based in mainland or vice versa,

by a Business or Business Activity of a Government Entity,

by a Business or Business Activity of a Government Controlled Entity that is not its Mandated Activities,

between an Extractive Business and another Business of such Person, or

between a Non-Extractive Natural Resource Business and another Business of such Person.

Materiality threshold to apply for an APA

A Person can apply for an APA with respect to domestic or cross-border Controlled Transactions, where the total/expected value of all the Controlled Transactions proposed to be covered under the APA is at least AED 100 million per Tax Period.

In determining the threshold of AED 100 million the Controlled Transactions of a Person must be at arm's length[2] as calculated and proposed by the Person through its own analysis at the time of submitting the APA application.

The FTA will consider only the Controlled Transactions proposed for inclusion in the APA when assessing whether the threshold is met, unless the FTA specifically excludes certain transactions. For example, Controlled Transactions covered under safe harbour provisions shall be excluded from both the scope of the APA and the threshold calculation.

For a Tax Group, the threshold of AED 100 million shall apply at the level of the Tax Group. The value of all Controlled Transactions between the Tax Group and Related Parties outside the Tax Group shall be aggregated for the purpose of determining whether the threshold is met. Controlled Transactions between members of the Tax Group are generally eliminated when computing the Taxable Income of the Tax Group and shall not be considered for the threshold calculation. However, if any Controlled Transactions are required to be recognised for specific purposes under the Corporate Tax Law, such as for tax incentives, where applicable, they must be priced at arm's length, as calculated and proposed by the Person, and will be eligible for inclusion under both the scope of the APA and the threshold calculation.

However, meeting the materiality threshold is not the sole criterion for acceptance or rejection of an APA application. The FTA shall evaluate each request based on its specific facts and circumstances, including the complexity of the Controlled Transactions, the potential for tax risk, and the overall benefit of entering into an APA. This means that an application may still be rejected even if the threshold is met, or accepted even if the threshold is not met. The threshold is intended as an indicator of materiality, not an absolute requirement. If the value of the Person's Controlled Transactions is less than the threshold limit, they should provide a robust justification for why an APA would help ensure compliance and certainty in such cases.

Filing a pre-filing consultation and APA application

Subject to satisfaction of the eligibility criteria, a pre-filing consultation and APA application (collectively referred to as "APA Request") must be filed by a Person, its Tax Agent or Legal Representative on behalf of the Person.

Note that only a Tax Agent registered for Corporate Tax purposes with the FTA may submit the APA Request on behalf of the Person in the prescribed form.

In the case of a Tax Group, only the Parent Company of that Tax Group is permitted to submit the APA Request on behalf of the Tax Group or its members.

An APA Request submitted by any Person other than those mentioned above shall not be accepted.

Pre-filing consultation, APA application, or any other information required during the APA process can be submitted from 30 December 2025 by email to APA@tax.gov.ae, or via EmaraTax (from the date that shall be announced).

Critical assumptions underlying an APA

An APA sets out certain critical assumptions crucial for its validity, including aspects related to the Person applying for the APA, its Related Party, industry conditions, general economic factors.

Any changes to or breaches of these critical assumptions could render the APA ineffective. Appendix 1 contains a list of potential critical assumptions.

A Person must notify the FTA of any modifications or violations of the critical assumptions within 20 Business Days of the occurrence of such events, accompanied by a sufficient and reasonable justification for such modification or violation. The FTA shall then review the circumstances and engage with the Person to determine the appropriate course of action, which may include the revision, cancellation, or revocation of the APA.

Period of an APA

An APA shall be applied for a minimum of three Tax Periods and maximum of five Tax Periods. At the initial stage, UAPAs shall only cover prospective periods.

APA fees

An APA application shall be accompanied with a non-refundable fee of AED 30,000 at the time of filing the APA application. This fee is inclusive of any revisions/amendments (see Section 5.4) to the APA application.

In case of renewal of an APA (see Section 5.6), a Person is required to pay a non-refundable fee of AED 15,000.

Timeline of an APA application

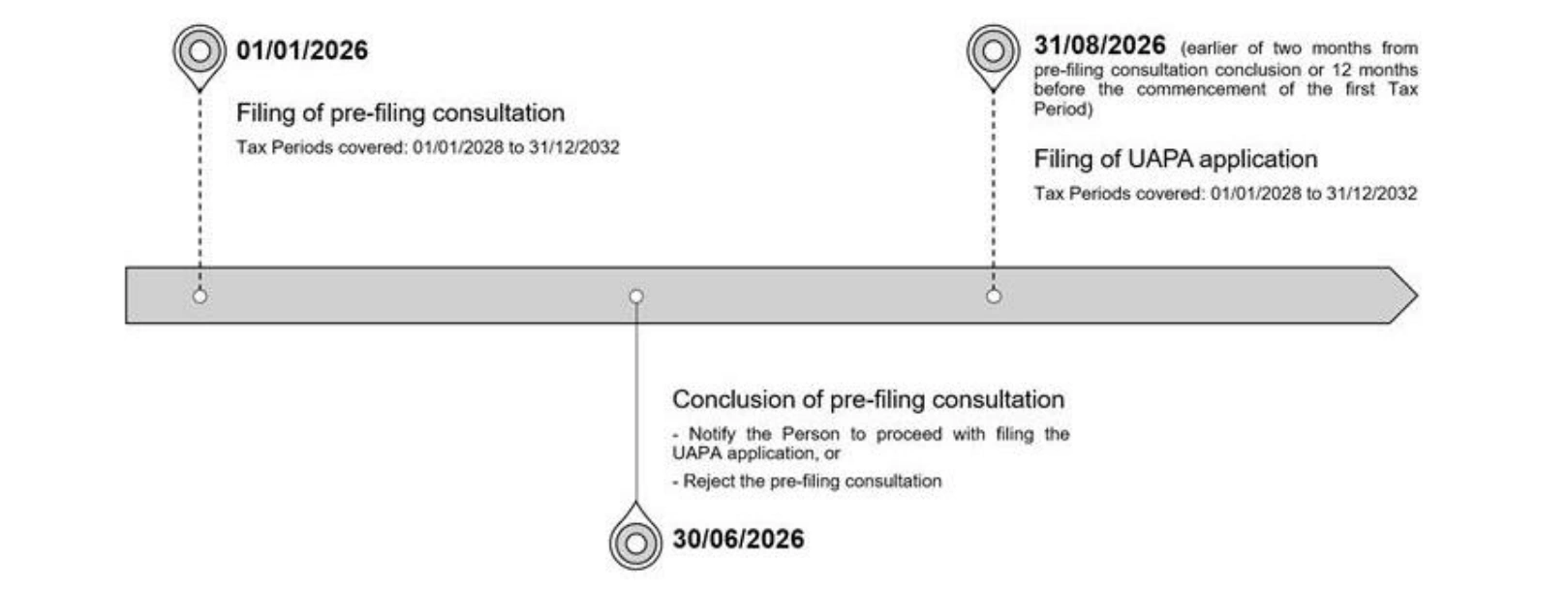

A Person must submit the UAPA application within two months from the date of approval notification of pre-filing consultation by the Authority, or at least twelve months prior to the commencement of the first Tax Period to be covered under the UAPA, whichever is earlier.

The FTA shall endeavour to conclude an APA as soon as possible and within the best practice timelines prescribed by the OECD, subject to the timely submission of required information from the Person. Where the FTA requests the Person to submit further information or documentation, the Person is expected to submit such information or documentation within 40 Business Days from the date requested. The FTA will aim to request only the relevant information necessary for determining and concluding the APA. However, such information may also include details relating to other group entities or the wider group. The FTA shall use the information gathered during the APA process only for the purposes of the evaluation and conclusion of APA.

Stages of an APA

The stages of an APA process typically include the following:

Stage 1 – Pre-filing consultation (see Section 4.1)

Stage 2 – Filing of an APA application (see Section 4.2)

Stage 3 – Evaluation and negotiation of the APA (see Section 4.3)

Stage 4 – Concluding an APA and implementation (see Section 4.4)

APA procedures

Stage 1 – Pre-filing consultation

A Person proposing to enter into an APA must make a request to the FTA for a pre-filing consultation. This request should be made as per the prescribed form in Appendix 2.

A pre-filing consultation shall, inter-alia, address:

scope of the APA, including proposed Controlled Transactions and period of APA,

details of other Controlled Transactions not proposed to be covered,

identification of the potential TP issues/ complexity,

evaluation of suitability of proposed TP methodology and other terms proposed by the Person,

any prior APAs in foreign jurisdictions covering the same Controlled Transactions or litigation history, and

other relevant information.

A pre-filing consultation does not bind the FTA to enter into an APA, nor construe that the Person has applied for an APA.

Review of the APA pre-filing consultation request

The FTA will endeavor to conclude the pre-filing consultation within six to nine months from receipt of the pre-filing request. This indicative timeline assumes full co-operation by the Person in responding to any request(s) for further information and documents raised by the FTA in a timely manner. The Person is expected to submit the required information within 40 Business Days, for each request by the FTA.

The FTA will conduct a review of the pre-filing request along with any supporting documentation. If the request is found to be incomplete, the FTA shall notify the Person of the additional information and documents required before scheduling a pre-filing meeting, if required.

Pre-filing meeting

The purpose of a pre-filing meeting is to enable the FTA and the Person to assess the possibility of entering into an APA.

The FTA shall schedule a pre-filing meeting (virtually or face-to-face) as mutually agreed upon with the Person or their representative.

Depending on the complexity of the Controlled Transactions proposed to be covered under an APA, more than one pre-filing meeting may be required. The purpose of the pre-filing meeting is to enable the FTA to gather sufficient information to make a decision on the possibility of entering into an APA. The pre-filing consultation is to assess suitability of the Person to enter into the APA and not a way to provide certainty on TP positions and any views exchanged cannot be relied upon by the Person.

The Person shall be notified of the understanding reached on TP issues in the pre-filing consultation stage within 60 Business Days of pre-filing consultation meeting, if no further information is required. If, based on the outcome of the pre-filing consultation, the FTA decides to proceed with the APA process, the Person must submit the UAPA application within 40 Business Days from the date of notification by the FTA, or at least twelve months prior to the commencement of the first Tax Period to be covered under the UAPA, whichever is earlier.

Rejection of request

The FTA may reject a Person's request, for any of the following reasons:

the Controlled Transactions proposed under the APA indicates a tax avoidance strategy,

the Controlled Transactions are based on a scenario that is superficial or not completely thought through,

where it appears inefficient to the FTA to pursue an APA due to the limited scope,

where the Arm's Length Principle can be reliably applied beyond significant doubt,

significant restructurings forecasted within the Business for the Tax Periods covered under the APA, thereby potentially rendering the outcomes of the proposed APA irrelevant,

the Person's Business at the time of the request is unpredictable or undergoing significant fluctuations,

the Person's decision to include or exclude certain Controlled Transactions in the APA without a satisfactory rationale, or

where insufficient historical records restrict reliable projections or there are discrepancies in the selection of most appropriate method or benchmarking analysis.

Stage 2 – Filing of an APA application

A Person may proceed to submit an APA application upon receiving the notification to proceed with APA filing. The Person shall file the APA Application within two months from the date of notification by the FTA, or at least 12 months prior to the commencement of the first Tax Period to be covered under the APA, whichever is earlier. The APA application should include the following information:

Controlled Transactions proposed to be covered,

the Tax Period covered under the APA,

the proposed TP method, proposed price and relevant analysis including industry analysis, functional and economic analysis, and

the critical assumptions on which the Transfer Pricing methodology is based, etc.

The APA must be filed in the format specified by the FTA in Appendix 3.

Upon acceptance of an APA application, the FTA and the Person shall agree a project plan outlining the timelines for each stage of the process from commencement to conclusion of the APA.

Submission of an APA application

All documents submitted with the APA application must be in English or Arabic. The FTA may issue a request for additional information or documents at any stage throughout the APA process.

Merely filing of an APA shall not influence any ongoing Tax Audit of the Person.

Review of application

The process for reviewing an APA application generally includes:

Reviewing all the information and documents provided by the Person.

Request for further information/clarification for processing APA application.

Conducting site visits or interviews or meetings with the key business personnel. The FTA shall conduct site visits or interviews or meetings in the business premises of the Person or the FTA or through video conference. All interviews shall be conducted in English. The interviews may be conducted in Arabic, if requested by the Person. The FTA reserves the right to take minutes of meeting during these meetings, but is not obliged to share such minutes. Further, the FTA may also request the Person to provide signed minutes of the meeting, duly acknowledged by the relevant attendees.

Engagement of industry or functional experts, if required.

The FTA shall not use any information and documents gathered during the APA process for audit purposes.

Rejection of application

The FTA may reject an APA application under the following circumstances, but not limited to the following:

the materiality threshold set out in Section 3.5 is not met,

the APA application does not address all of the concerns raised during the pre-filing consultation,

there are significant discrepancies between legal contracts and the actual conduct of Persons' Business,

the Business conditions, facts and circumstances of the Person have changed significantly since the outcome of the pre-filing consultation or during the processing of APA application,

an inadequate and unreliable economic analysis,

requests for information and documents have not been responded to in a timely manner,

the application includes information that is incorrect, incomplete or misleading, or

the Person has not kept sufficient records to demonstrate that assumptions made in forecasts are accurate.

The FTA may also decide to reject the APA application based on the reasons set forth in Section 4.1.3.

Stage 3 – Evaluation and negotiation

Once site visits, interviews, meetings, and the collection of all required information and documents are complete, the FTA will commence its evaluation and analysis.

Evaluation and analysis

The FTA will evaluate and analyse the APA application, along with facts and information obtained during site visits, interviews, and meetings, and shall prepare a TP analysis that addresses the following:

the manner of determining the Arm's Length Price, (selection of most appropriate method, acceptable filters, etc.),

key criteria for determining the Arm's Length Price over the Tax Periods covered under an APA, and

any other terms and conditions (including critical assumptions).

The FTA shall provide its TP analysis to the Person and engage in discussions, as outlined in the negotiation process (see Section 4.3.2).

Negotiation process

The Person shall confirm in writing its feedback on the FTA's TP analysis within 30 Business Days from the date of receipt of such analysis. The FTA may provide an opportunity to the Person to discuss the TP analysis, upon the Person's request.

If after the negotiation process, the FTA and Person are not able to reach a mutually agreeable position, the APA application may be closed without concluding the APA. In this situation, there would be no refund of any fees paid.

Stage 4 – Concluding an APA and implementation

Final version of an APA

The FTA shall discuss the implementation of the agreement with the Person. The FTA and the Person shall sign the APA agreement based on terms mutually agreed.

Withdrawal of APA application

A Person may withdraw their APA application at any point prior to the conclusion of the APA agreement. However, withdrawal, particularly at an advanced stage of the process and without valid justification, is discouraged due to the significant resource expenditure such actions entail. There shall be no refund of any fees paid.

Legal effect

An APA is binding on signatories to the APA with respect to the Controlled Transactions for the Tax Periods covered under an APA.

If the Person who entered into an APA complies with all terms and conditions of the APA, the FTA shall not contest the Arm's Length Price or the transfer pricing method applied to the Controlled Transactions covered under the APA for the Tax Periods specified in the APA. However, an APA does not establish a precedent for any other Tax Periods of the Person, nor for any other Person that is not covered under the APA.

Indicative UAPA timeline

APA monitoring and review

Filing of an APA Annual Declaration

Any Person who has entered into an APA with the FTA is required to file an APA Annual Declaration for each Tax Period covered under the APA in the prescribed form provided in Appendix 4. This declaration should cover all aspects outlined in the APA including any terms and conditions specified therein.

The APA Annual Declaration shall be filed within 90 Business Days from the date of the signed APA or by the due date of filing each relevant Tax Return, whichever is later.

Review of APA Annual Declaration

The FTA may review the APA Annual Declaration to assess adherence to the terms and conditions agreed upon in the APA. Any review will primarily focus on verifying compliance with the APA's terms, conditions, facts, and circumstances, and will specifically examine whether:

material representations in the APA application, the related documents, and the APA Annual Declaration remain valid and accurately describe the Person's operations and those of the Related Parties for the Tax Period under review,

the agreed-upon most appropriate method has been consistently and accurately applied for the Tax Period being reviewed in accordance with the terms and conditions of the APA,

supporting data and calculations used in applying the agreed-upon most appropriate method for the Tax Period is correct in all material respects, and

critical assumptions underlying the APA remain valid and relevant.

Findings from the review of the APA Annual Declarations

The FTA shall notify the Person of any issues arising from the review. Depending on the nature of these issues the outcome may vary, i.e. no changes may be required to the APA, or it may result in a revision, subject to mutual agreement between the FTA and the Person. In cases where matters cannot be resolved, the APA may be cancelled. Additionally, revocation may occur, in case of the FTA's observation of any conditions outlined in Section 5.5.

Revision or cancellation of an APA

The FTA may revise an APA if there is:

any change in law affecting the UAE Corporate Tax treatment of the Controlled Transactions covered under an APA,

any change in Business, economic or any other relevant conditions, for example, entry or exit of Resident Persons from a Tax Group, which may necessitate an assessment of or modifications to the critical assumptions of the existing APA, and/or

any other exceptional circumstances notified by the Person.

A Person must self-assess the need to revise an APA and furnish notification to the FTA within 20 Business Days from occurrence of such event.

The Authority may, at its discretion and based on information available, initiate revision of an APA upon becoming aware of any of the above circumstances that may impact the terms of the APA.

Based on its review of the Person's operations, the FTA may request further information and documents from the Person. Depending on the impact of changes, the FTA shall assess if any revision is required to the terms and conditions of the APA. If both parties, the FTA and the Person, agree to proceed with revisions of an APA, the new effective date shall be stated in the revised APA.

However, if the FTA determines that, due to the impact of the change, a revision is not feasible, or a revision is possible but the FTA and the Person are unable to reach a mutual agreement, the APA may be cancelled prospectively from the Tax Period in which the event occurred, while remaining effective for prior Tax Periods covered under the APA.

Revocation or cancellation of an APA

The FTA shall revoke or cancel an APA in any of the following cases:

The Person made a material misrepresentation attributable to neglect, carelessness, or wilful default in the APA application or the APA Annual Declaration.

The Person failed to comply with one or more material terms and conditions of the APA.

The Person has breached one or more critical assumptions.

When the FTA revokes an APA:

The revocation shall take effect from the first Tax Period covered under the APA.

After the revocation becomes effective, the Controlled Transactions previously governed by the APA shall be subject to the provisions set forth in the Corporate Tax Law and Tax Procedures Law.

Depending on the severity of any breach or non-compliance, if the FTA decides to cancel the APA, it shall be cancelled prospectively from the Tax Period in which the breach or non-compliance occurred, as well as for all subsequent Tax Periods.

Renewal of an APA

A Person may opt for a renewal of an APA if there are no material changes in the Business operations and facts relating to the Controlled Transactions and if the critical assumptions remain valid. The Person shall file an APA renewal request with the required supporting documentation, including updated documents, analyses, and other relevant information, at least three months before the expiry of the existing APA.

The renewal request shall follow the same forms and procedures as the initial APA application, with the exception that a pre-filing consultation is not required and, therefore, the reduced fee applicable for renewal of APA shall apply.

Appendices

Appendix 1: List of potential critical assumptions

Critical assumptions: the use of critical assumptions in the following areas identified below will depend on the facts and circumstances of each APA case. The areas below are not intended to be exhaustive, but merely identify key areas where critical assumptions may be required.

Operational and economic critical assumptions: these critical assumptions are predominately related to how the Person undertakes their operations to limit material changes, where those changes may affect the underlying profitability of the Person, and may include:

how the Person defines, computes, allocates, and apportions costs and expenses,

limits on the amount and manner by which expenses and costs can vary,

limits on sales mixes, maximum sales amounts, projections of sales, and permissible sales trends and variations,

how new or disposed of related entities are treated, to what extent inventories can fluctuate, or to what extent covered purchases can be imported finished products

specific items to remain substantially the same, including customers, products, risks, functions, Business methods, assets, pricing policies, Business structure, presence and effect of a cost sharing agreement, functional currency, operating assets, presence or absence of intangible assets, intangible asset ownership, licensee agreements, specific personnel, location of specific personnel, presence or absence of commissions, and royalty amounts and percentages,

consistent exchange rates, interest rates, credit ratings and capital structure, and

no significant changes in market conditions, technology, product liability, product design, process design, and market share.

Legal critical assumptions: these critical assumptions are predominantly related to ensure consistent legal and regulatory conditions and may include:

ensuring consistent external conditions relating to supervisory rights, customs duties, import and export restrictions, government regulatory requirements and maintenance of agreements in place (for example, distribution agreements),

maintaining current related and non-Related Party agreements, such as guarantees, warranties, product liability and debt obligations, and

keeping consistent shareholding ratios.

Financial and tax related critical assumptions: these critical assumptions are predominantly related to ensure consistent financial and tax conditions and may include:

no substantial changes to the tax circumstances prevailing in either country, including significant tax reform,

limiting changes to the Person's estimated tax liability, period of limitation on assessment, tax effect of specified expenses, sourcing of income, permanent establishment, Foreign Tax Credit limitation; the ability to change a specified tax election or undertake tax consolidation (or fiscal unity), and, the ability to file for a refund,

limitations on system loss, intangible profit projections, buy-in payments, lack of currency risk, and valid business reasons for debt,

assumptions regarding the use of generally accepted accounting principles, such as favourable certified opinions, market to market accounting, consistency of accounting computations for all related parties, methods of accounting for foreign currency gains and losses, and unchanged methods for both financial and accounting, and

corrections to transfer prices by a third-party country not involved in the APA which influence the APA.

Other assumptions: these are critical assumptions that generally, will be reflected in every APA, these may include:

the Business Activities, functions performed, assets employed and risks assumed, financial and accounting methods and classifications (including estimates) of a Person in relation to the Controlled Transactions covered under the APA, will remain materially the same as described or used in the APA application,

the organisational structure of the Person and the Related Parties remain substantially the same, as described in their APA application,

the accounting policies, procedures, and practices of the Person and its Related Parties remain substantially the same as those described in the APA application,

the working capital levels (such as accounts receivable, accounts payable and inventory) of the Person and Related Parties do not vary significantly from those levels existing when the transfer pricing method for the Controlled Transactions were established,

the Person and Related Parties have no exposure to extraordinary items or the sharing of losses arising in other entities, other than that exposure arising from its own decision-making and activities, and

neither the Person nor its Related Parties have intangible property that either directly or indirectly affects the Controlled Transactions that are covered under the APA.

Appendix 2: APA pre-filing Form

About the Person

Particulars | Description |

Person’s name (in English or Arabic) | Input the full name of the Person |

Tax Registration Number (TRN) for Corporate Tax | Input the TRN, if available |

Address details | Input address line, city, country code, landline number, mobile number, email ID and P.O. Box. |

Primary business | Input a brief description about the Person’s business |

APA details

Particulars | Description (Please input the details in the relevant fields or include PDF, image, excel, word or power point attachment) |

Application type

| |

Group structure including the Ultimate Parent Entity of the Person. | |

Type of APA requested

| |

Organisation or management structure of the Person and the group. | |

Overview of the industry in which the Person and its group operates. | |

Overview of the Person and its group’s business operations. | |

Tax Periods proposed to be covered under the APA. | |

Particulars of Controlled Transactions proposed to be covered in the APA for each Tax Period. | |

Transaction 1 (provide details of the all-proposed transactions): | |

a. Description of Controlled Transactions. | |

b. Value or expected value of each Controlled Transaction. | |

c. Functional currency of the Person. | |

d. Proposed Transfer Pricing method for each Controlled Transaction. | |

e. Proposed Arm’s Length Price for each Controlled Transaction with high level economic analysis. | |

Corporate Tax litigation history and present status of appeals / reconsiderations (if any) in the UAE and in foreign jurisdictions. | |

Details of APA (in progress or otherwise) in other tax jurisdictions that are relevant to Controlled Transactions proposed to be covered under the APA. | |

Proposed critical assumptions. | |

Additional information relating to the APA or any further information that you would like to submit for consideration. | |

Any other attachments. |

Details of the Person’s authorised signatory

Particulars | Description |

Name (in English or Arabic) | The signatory must be authorised to lodge application of behalf of the applicant |

Designation | Input the designation of the authorised signatory |

Contact details of authorised signatory | Input phone number and email address |

Contact details of other Persons with whom correspondence should be made | Input phone number and email address |

Copy of Power of Attorney | Provide signed and attested Power of Attorney |

Review and Declaration

I confirm that I have been granted full authority to complete this form on behalf of the relevant Person.

I confirm that the information provided in this form, including any attachments, is to the best of my knowledge complete and accurate at the date of submission.

Signature:Date:

Note:

All relevant documents/analyses/agreements should be enclosed with this request form at the time of submission.

Appendix 3: APA Application Form

About the Person

Particulars | Description |

Person’s name (in English or Arabic) | Input the full name of the Person |

Tax Registration Number (TRN) for Corporate Tax | Input the TRN, if available |

Address details | Input address line, city, country code, landline number, mobile number, email ID and P.O. Box. |

Primary business | Input a brief description about the Person’s business |

APA details

Particulars | Description (Please input the details in the relevant fields or include PDF, image, excel, word or power point attachment) |

Details of the Person’s business | |

a. Group structure including the Ultimate Parent Entity of the Person. | |

b. Description of Business Activities of the Person. | |

c. Description of key products and/or services of the Person. | |

d. Description of supply chain of the Person. | |

e. Details of the Person’s key suppliers. | |

f. Description of the management structure of the Person, a local organisation chart, and a description of the individuals to whom local management reports and the country(ies) in which such individuals maintain their principal offices. | |

g. Key value drivers of the Person’s business | |

h. Business strategies, budget statements, projections and business plans for future Tax Periods covered in the APA. | |

Details of Related Party(ies) with whom the APA is requested for | |

a. Name of Related Party. | |

b. Name of the country in which the Related Party is located. | |

c. Tax Registration Number / any unique number used for identification of the Related Party by the government of that country / specified territory. | |

d. Description of Business, including details of key products or services of the Related Party. | |

Details of APA request | |

Tax Periods proposed to be covered under the APA. | |

Details of Controlled Transaction(s) proposed to be covered in the APA for each Tax Period | |

a. Description of Controlled Transaction. | |

b. Value or expected value of each Controlled Transaction. | |

c. Functional currency of the Person. | |

d. Proposed pricing mechanism for each Controlled Transaction. | |

e. Proposed Transfer Pricing method for each Controlled Transaction. | |

f. Copies of all relevant inter-company agreements and any other supporting documents (if available) | |

Proposed terms and conditions, and critical assumptions for the APA. | |

Details of market and industry of the Person and its Related Parties specified above | |

a. Comprehensive description of the industry in which the Person and its group is involved. | |

b. Description of generally accepted and prevailing commercial practices in the industry. | |

c. Identification and profile of key competitors of the Person, including respective market shares. | |

d. Key value drivers of the industry. | |

e. Detailed analysis of the markets for all countries involved. | |

Details of Transfer Pricing methodology proposed in accordance with the UAE Corporate Tax Law for each Controlled Transaction | |

a. Detailed Function, Asset and Risk analysis | |

b. Detailed analysis and explanations on the evaluation and selection of the proposed Transfer Pricing method(s). | |

c. Detailed analysis and explanations on the application of the proposed Transfer Pricing method(s) to each Controlled Transaction. | |

d. Benchmarking analysis report including accept-reject matrix of internal or external comparables. | |

e. Details of secondary Transfer Pricing method(s) applied (if any) on a corroborative basis. | |

Details of financial and operating information | |

a. Standalone Financial Statements, audited if available, of the Person and its Related Parties specified above for the prior two Financial Years. | |

b. Annual Report or Consolidated Financial Statements, audited if available, of the Person's group for the prior two Financial Years. | |

c. Operating data (gross and net) segmented by division / unit, and geographic region of the Person for the prior two Financial Years. | |

d. Accounting standards followed by the Person and its Related Parties specified above. | |

Historic Transfer Pricing background of the Person and its Related Parties specified above | |

a. Transfer Pricing methodologies, policies, and practices for the Controlled Transactions proposed to be covered under the APA during the prior two Financial Years (if applicable) | |

b. Relevant rulings, any APAs, MAPs, and other similar arrangements entered into with foreign tax administrations, related to the Controlled Transactions covered under the APA. | |

c. Ongoing or concluded Corporate Tax litigation history, appeals / reconsiderations of the Person (if any) in the UAE and in foreign jurisdiction up to two prior Tax Periods related to the Controlled Transactions covered under the APA. | |

d. Relevant ongoing or concluded foreign Corporate Tax audit, appeals, and judicial history up to two prior Tax Periods, related to the Controlled Transactions covered under the APA. | |

Spontaneous Exchange of Information (Note 1) | |

a. In relation to the ultimate parent company of the Person, please provide: | |

- Name | |

- Country of residence | |

- Address | |

- TIN or other tax reference number, where available | |

b. In relation to the immediate parent company of the Person, please provide: | |

- Name | |

- Country of residence | |

- Address | |

- TIN or other tax reference number, where available | |

c. In relation to all Related Parties with which the Person enters into a transaction that is covered by the APA, please provide: | |

- Name | |

- Country of residence | |

- Address | |

- TIN or other tax reference number, where available | |

Other information | |

Group Master File (if any). | |

Local File of the Person for the previous Tax Period (if applicable). | |

Any other information or documents that may be relevant for the APA. |

Note 1 – Cross border UAPAs are subject to Exchange of Information in accordance with the Organisation for Economic Cooperation and Development Base Erosion and Profit Shifting Action Five, and the Competent Authority is required to exchange a summary of the APA with foreign tax administrations of relevant countries, based on international requirements. Accordingly, please provide the relevant information requested in the 'Spontaneous Exchange of Information' section.

Details of the Person's authorised signatory

Particulars | Description |

Name (in English or Arabic) | The signatory must be authorised to lodge application of behalf of the applicant |

Designation | Input the designation of the authorised signatory |

Contact details of authorised signatory | Input phone number and email address |

Contact details of other Persons with whom correspondence should be made | Input phone number and email address |

Copy of Power of Attorney | Provide signed and attested Power of Attorney |

Review and Declaration

I confirm that I have been granted full authority to complete this form on behalf of the relevant Person.

I confirm that the information provided in this form, including any attachments, is to the best of my knowledge complete and accurate at the date of submission.

Signature:Date:

Note:

All relevant documents/analyses/agreements should be enclosed with this request form at the time of submission.

Appendix 4: APA Annual Declaration Form

I am submitting herewith Annual APA Declaration for the period beginning from dd/mm/yyyy to dd/mm/yyyy for the Advance Pricing Agreement entered into between (Name of the Person) and the Federal Tax Authority vide APA Reference No. ............................ dated ……………. In this regard, I provide below the necessary information.

About the Person

Particulars | Description |

Person’s name (in English or Arabic) | Input the full name of the Person |

Tax Registration Number (TRN) for Corporate Tax | Input the TRN, if available |

Address details | Input address line, city, country code, landline number, mobile number, email ID and P.O. Box. |

Primary business | Input a brief description about the Person’s business |

Content of the declaration:

Description | Please add “Yes”, “No”, or “N/A” | Please input the details in the relevant fields or include PDF, image, excel, word or power point attachment |

Are Controlled Transactions (covered under the APA) undertaken with Related Parties as per the terms agreed in the APA? | ||

Has the Person complied with all the terms and critical assumptions agreed in the APA? | ||

Has the Transfer Pricing methodology agreed in the APA been complied with in respect of each Controlled Transaction covered under the APA? | ||

Has the Person applied the agreed Profit Level Indicator(s)? | ||

Has the Person prepared the audited Financial Statements considering the agreed Arm's Length Price? | ||

If answer to Sr.no 5 is 'No', please specify where the APA adjustment is reflected in the Tax Return (specify in comments section) | ||

Has the Person complied with the record-keeping requirements pertaining to the Controlled Transactions? |

Details of the Person's authorised signatory

Particulars | Description |

Name (in English or Arabic) | The signatory must be authorised to lodge application of behalf of the applicant |

Designation | Input the designation of the authorised signatory |

Contact details of authorised signatory | Input phone number and email address |

Contact details of other Persons with whom correspondence should be made | Input phone number and email address |

Copy of Power of Attorney | Provide signed and attested Power of Attorney |

Review and Declaration

I confirm that I have been granted full authority to complete this form on behalf of the relevant Person.

I confirm that the information provided in this form, including any attachments, is to the best of my knowledge complete and accurate at the date of submission.

Signature:Date:

Note:

All relevant documents/analyses/agreements should be enclosed with this request form at the time of submission.

APA Annual Declaration checklist for attachments:

All appropriate information and computations that clearly show how the selected Transfer Pricing methods were applied.

Audited Financial Statements for the relevant Tax Period.

Reconciliation statement of all adjustments made between the net income in the audited Financial Statements and the taxable income disclosed in the Tax Return (if applicable).

Any other appropriate document or information necessary to validate if agreed APA terms have been complied with.

Updates and Amendments

Date of amendment | Amendments made |

December 2025 |

|