VAT Deregistration - Oct 2022

VAT Deregistration User Manual

Date: Oct 2022

Version 1.0.0.0

Contents

1. Document Control Information

2. Annexure - List of other user manuals that can be referred to

3. Navigating through EmaraTax

4. Introduction

6. VAT Tile

8. Guidelines and Instructions

9. De-Registration information

12. Post Application Submission

13. Correspondences

Document Control Information

Document Version Control

Version No. | Date | Prepared/Reviewed by | Comments |

1.0 | 01-Oct-22 | Federal Tax Authority | User Manual for EmaraTax Portal |

Annexure - List of other user manuals that can be referred to

The below are the list of User manuals that you can refer to

S. No | User Manual Name | Description |

1 | Register as Online User | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website and create an EmaraTax account with the FTA. |

2 | Manage online user profile | This manual is prepared to provide you an understanding on Login process, user types, forgot password and modify online user profile functionalities. |

3 | User Authorisation | This manual is prepared to provide you an understanding on Account Admin, Online User, and Taxable Person account definitions and functionalities. |

4 | Taxable person dashboard | This manual is prepared to help the following ‘Taxable person‘ users to navigate through their dashboard in the Federal Tax Authority (FTA) EmaraTax Portal:

|

5 | Link TRN to email address | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website to Link TRN to New Email Address. |

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process

Button | Description |

In the Portal | |

| This is used to toggle between various personas within the user profile such as Taxable Person, Tax Agent, Tax Agency, Legal Representative etc |

| This is used to enable the Text to Speech feature of the portal |

| This is used to toggle between the English and Arabic versions of the portal |

| This is used to decrease, reset, and increase the screen resolution of the user interface of the portal |

| This is used to manage the user profile details such as the Name, Registered Email Address, Registered Mobile Number, and Password |

| This is used to log off from the portal |

In the Business Process application | |

| This is used to go the Previous section of the Input Form |

| This is used to go the Next section of the Input Form |

| This is used to save the application as draft, so that it can be completed later |

| This menu on the top gives an overview of the various sections within the form. All the sections need to be completed in order to submit the application for review. The current section is highlighted in Blue and the completed sections are highlighted in green with a check |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for taxpayers to benefit from these services in the best and simplest ways. To get more information on these services Click Here

Introduction

This manual is prepared to help a taxpayer navigate through the Federal Tax Authority EmaraTax portal and submit their VAT deregistration application. A taxpayer is eligible or is required to apply to the FTA to deregister from VAT based on the following criteria:

Business no longer making taxable supplies.

Business making taxable supplies, but below the Voluntary Registration Threshold.

Business making taxable supplies, above the Voluntary Registration but below the Mandatory Registration Threshold.

OR Other (reasons, which needs to be specified).

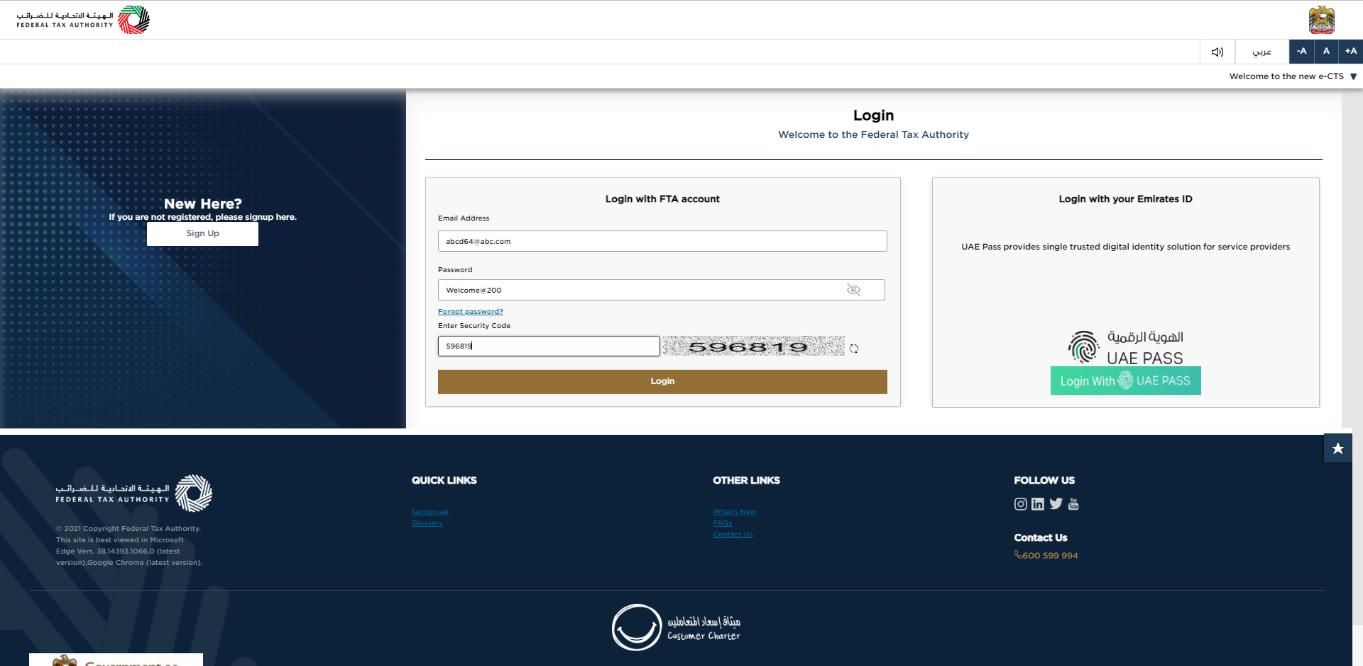

Login to EmaraTax

|

|

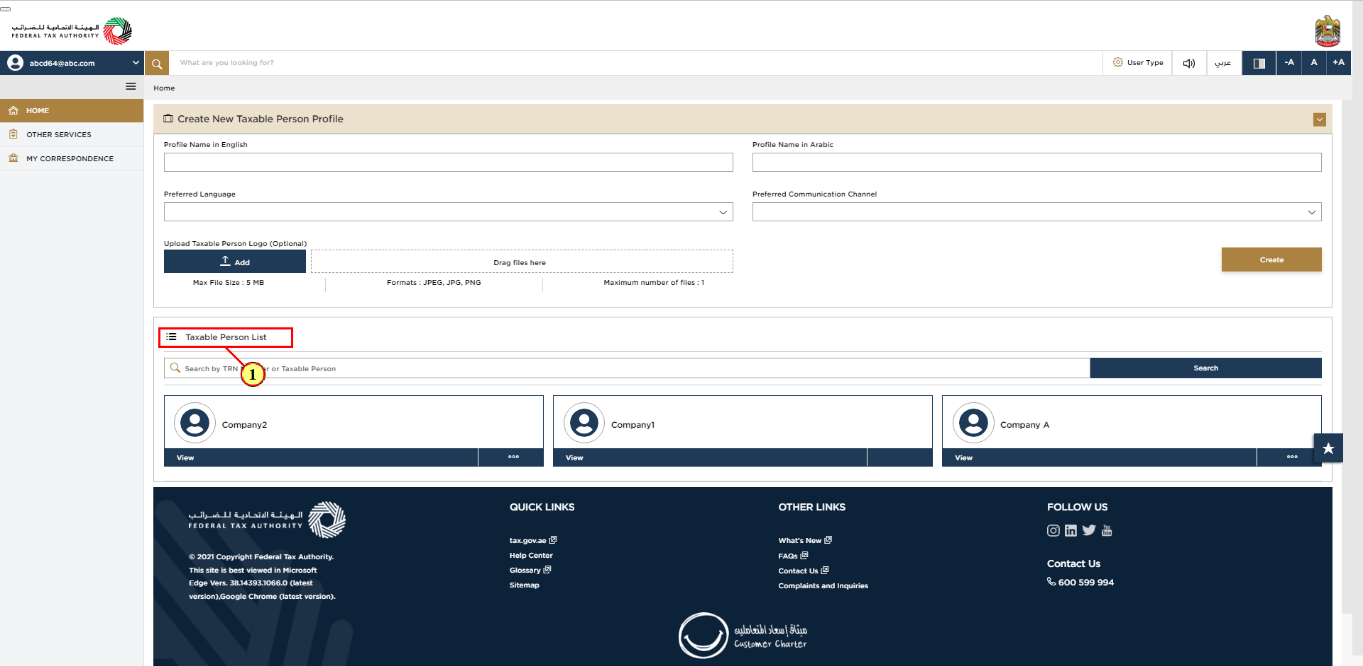

Step | Action |

(1) | On successful login, the Taxable Person list screen is displayed. It displays the list of the Taxable Person linked to your EmaraTax user profile. If there are no Taxable Person linked to your user profile, this list will be empty and you would need to create a Taxable Person. |

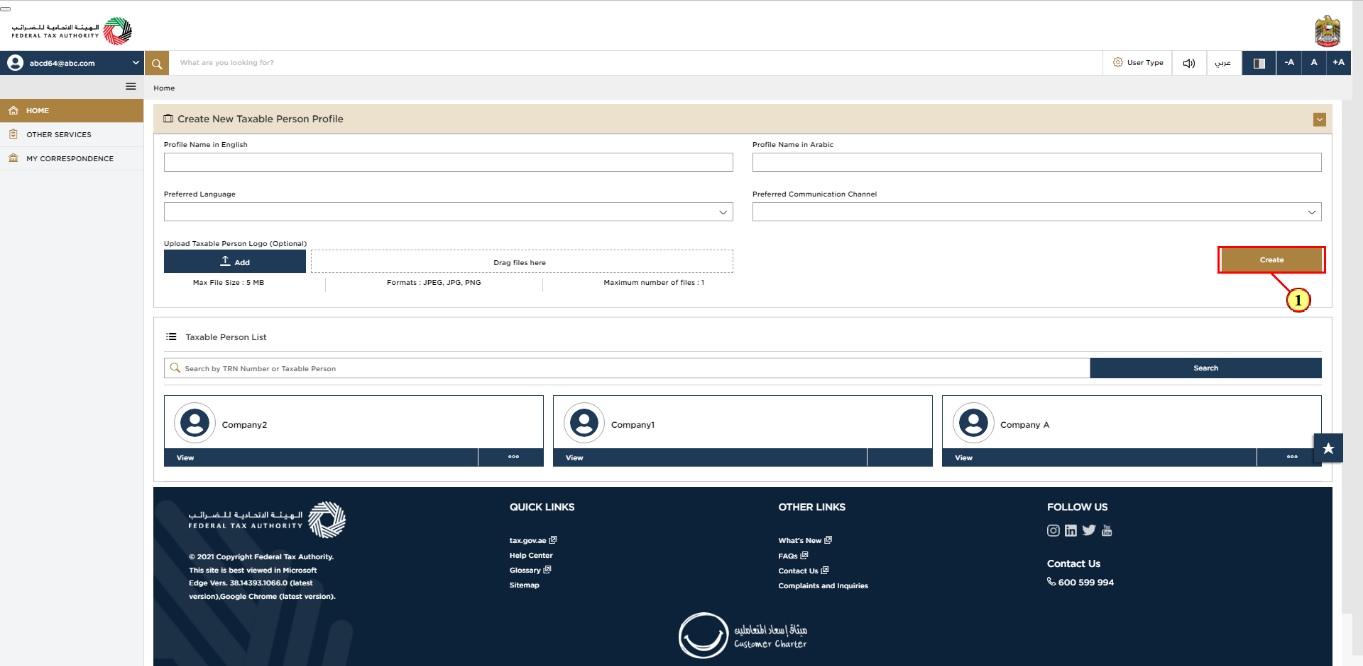

Step | Action |

(1) | To create a new Taxable Person, enter the mandatory details and click 'Create'. The new Taxable Person will be displayed in the list. |

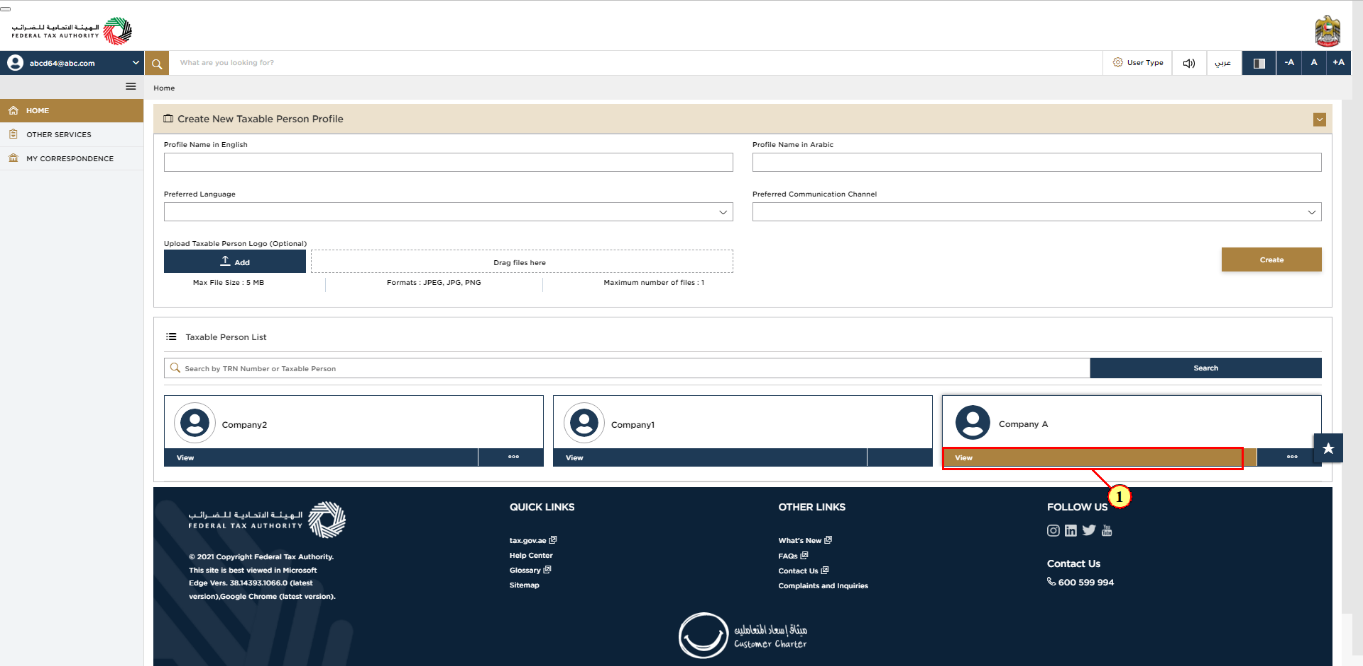

Step | Action |

(1) | Select the Taxable Person from the list and click 'View' to open the dashboard. |

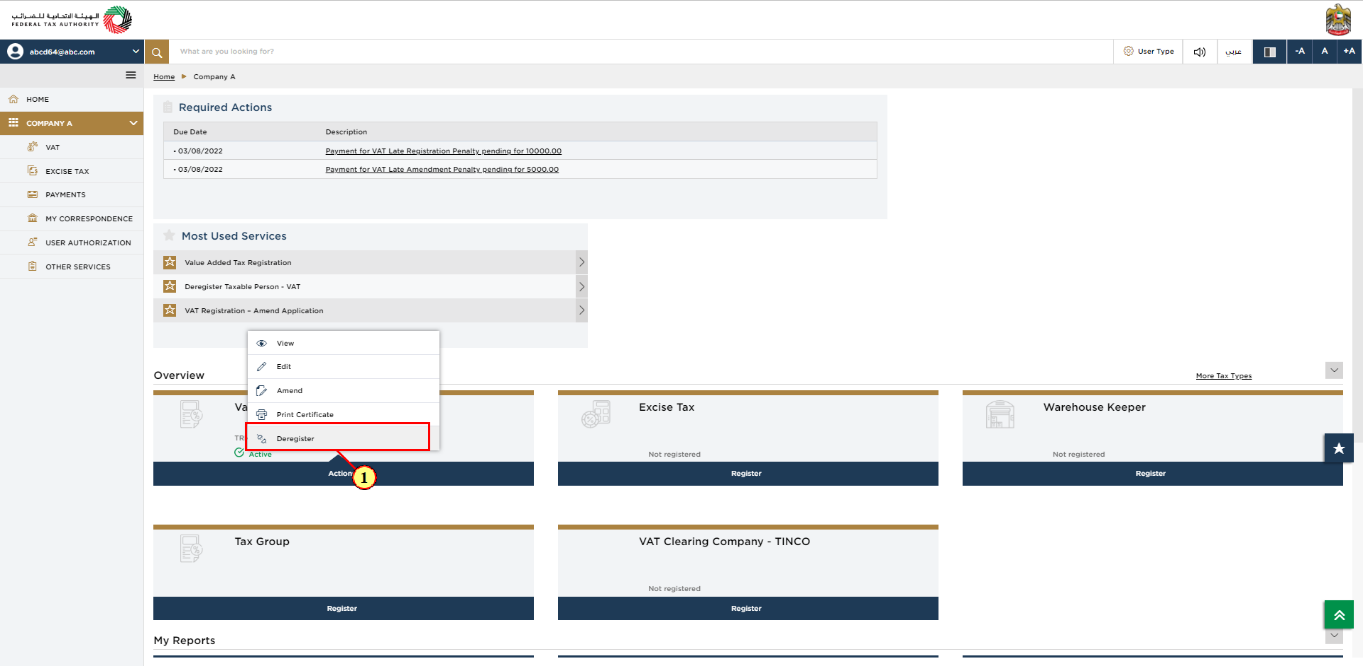

VAT Tile

Step | Action |

(1) | To initiate the VAT Deregistration application click 'Actions' on the VAT tile and select 'Deregister'. |

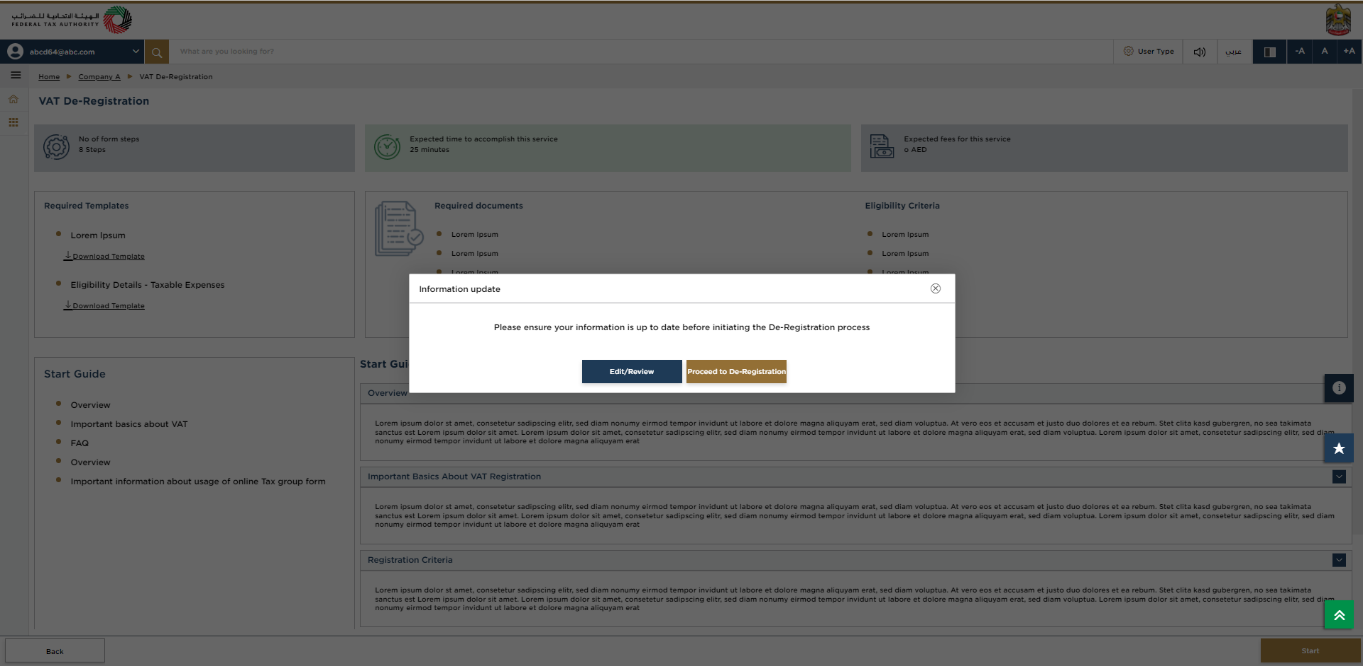

Information update

|

|

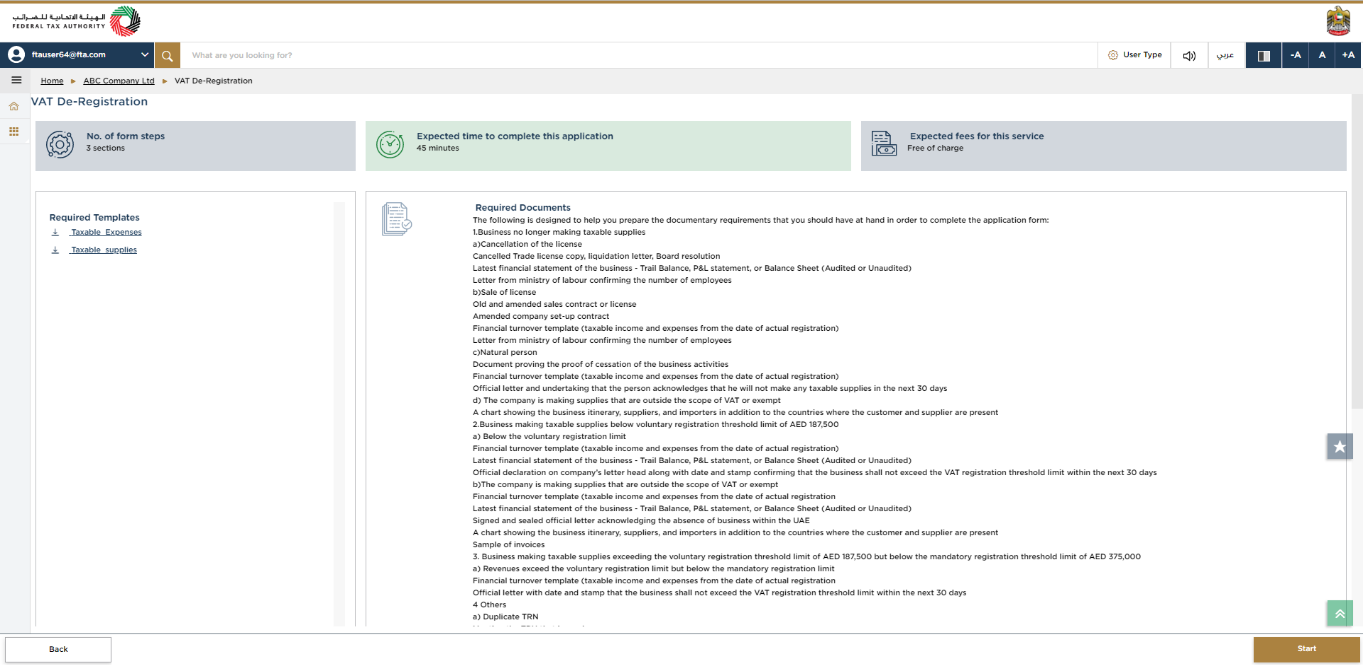

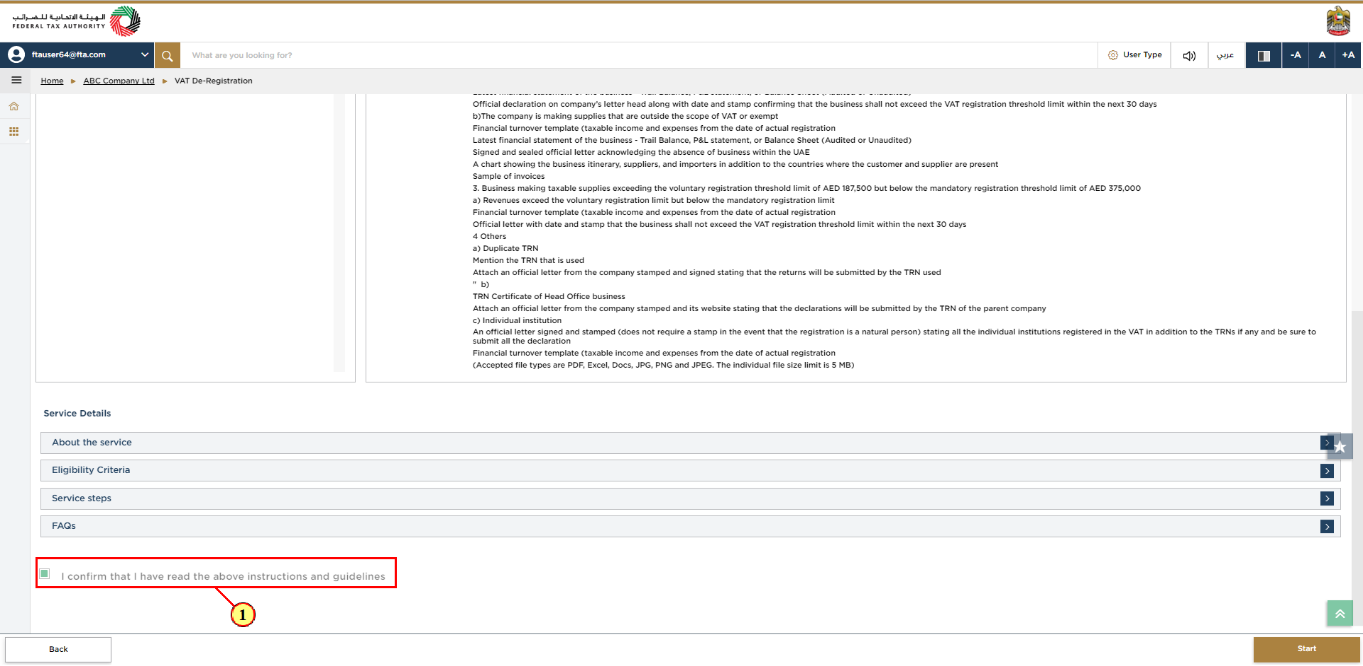

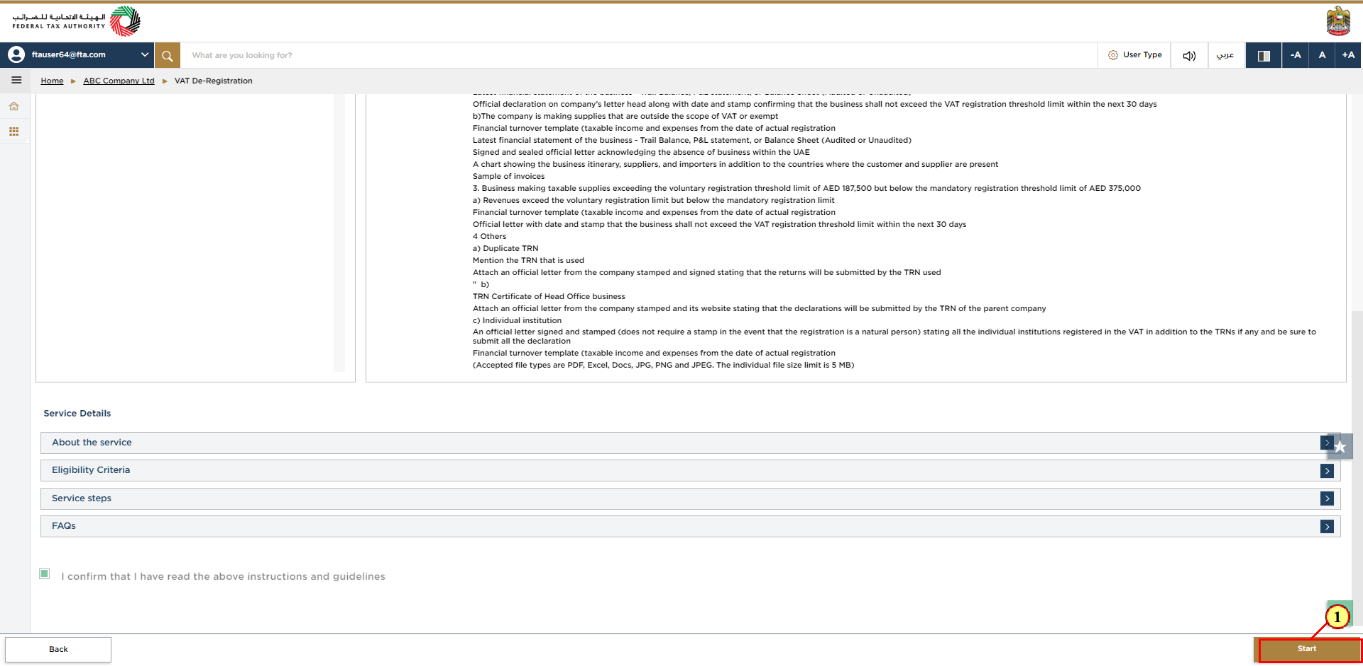

Guidelines and Instructions

| The 'guidelines and instructions' page is designed to help you understand certain important requirements relating to VAT De-Registration in the UAE. It also provides guidance on what information you should have in hand when you are completing the VAT De-Registration application. |

Step | Action |

(1) |

|

Step | Action |

(1) | Click 'Start' to initiate the VAT Deregistration application. |

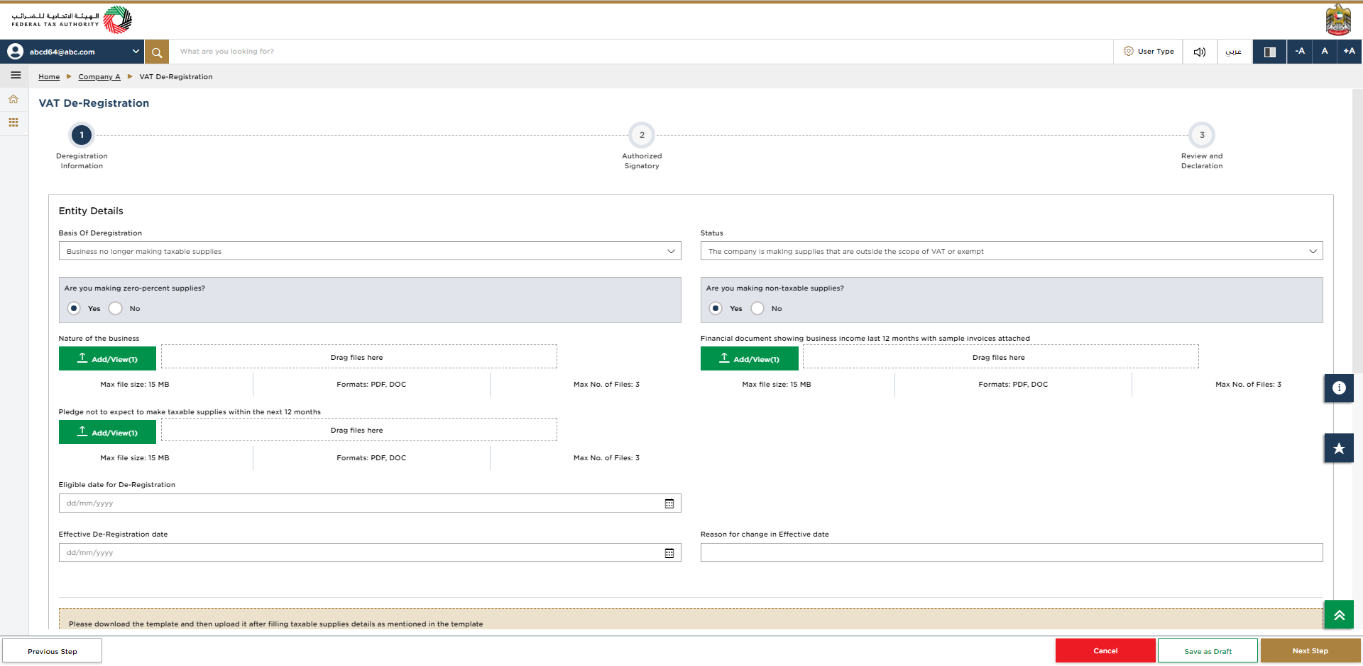

De-Registration information

|

|

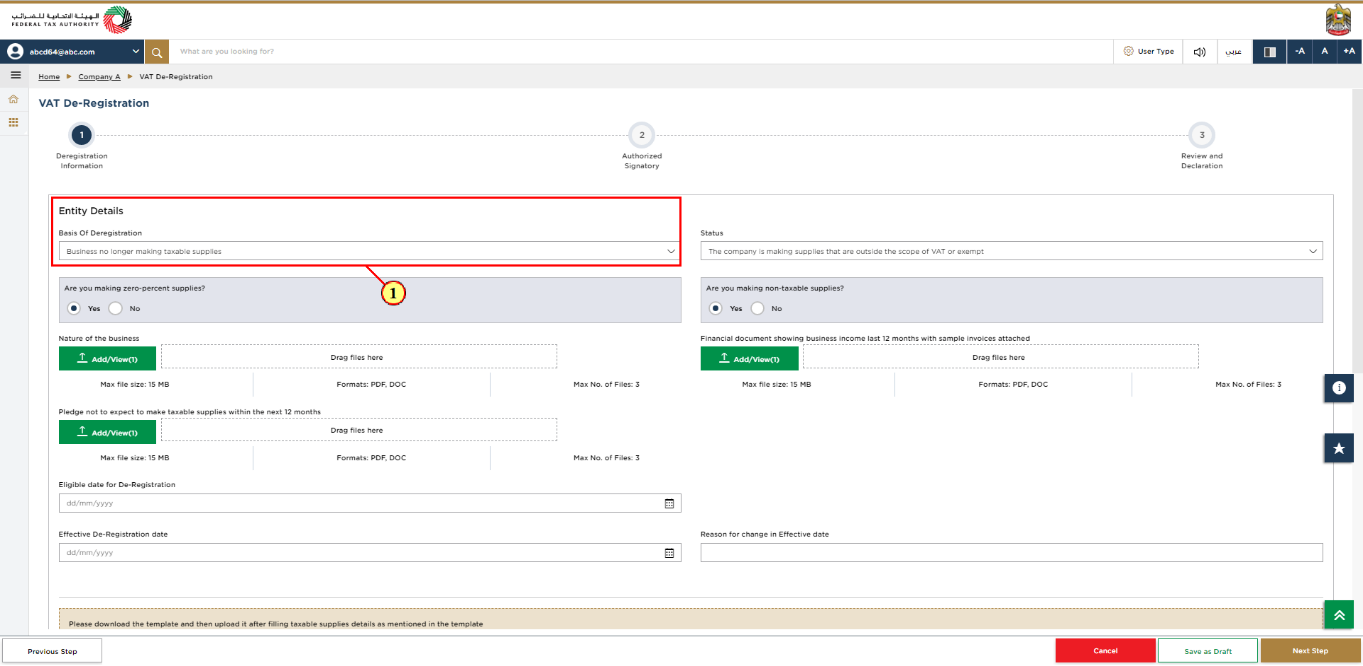

Step | Action |

(1) |

|

Step | Action |

(1) |

|

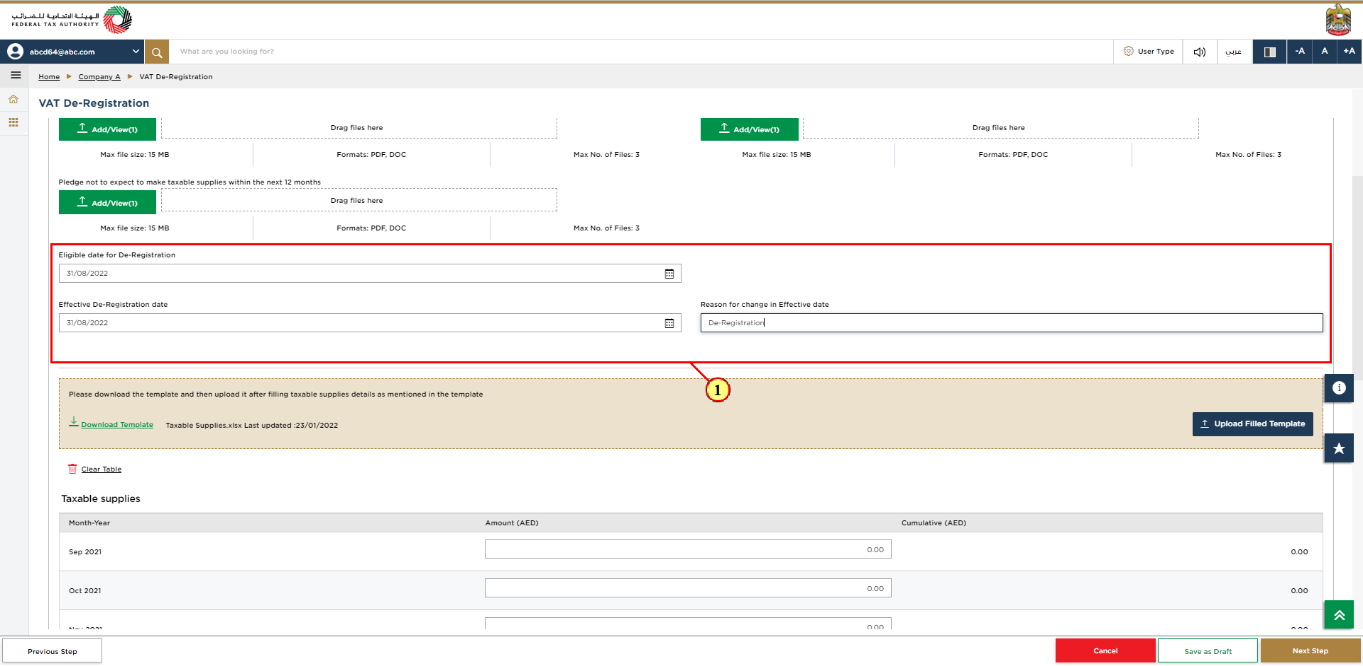

Step | Action |

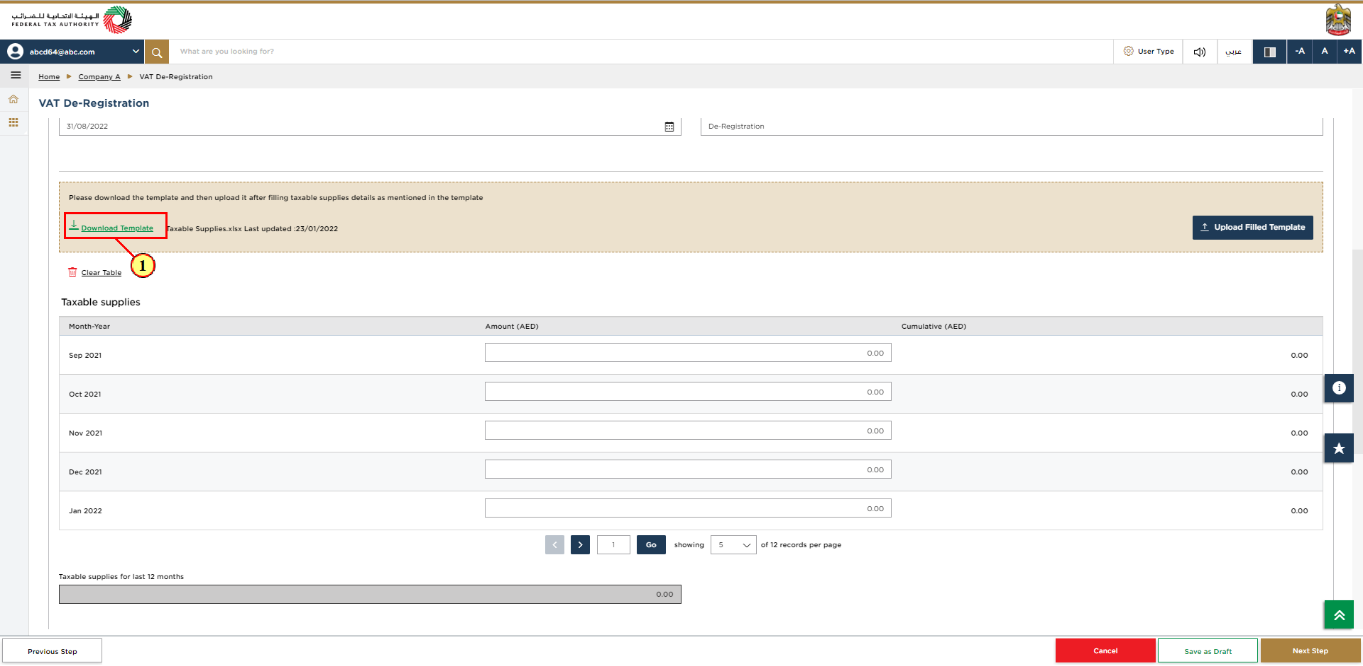

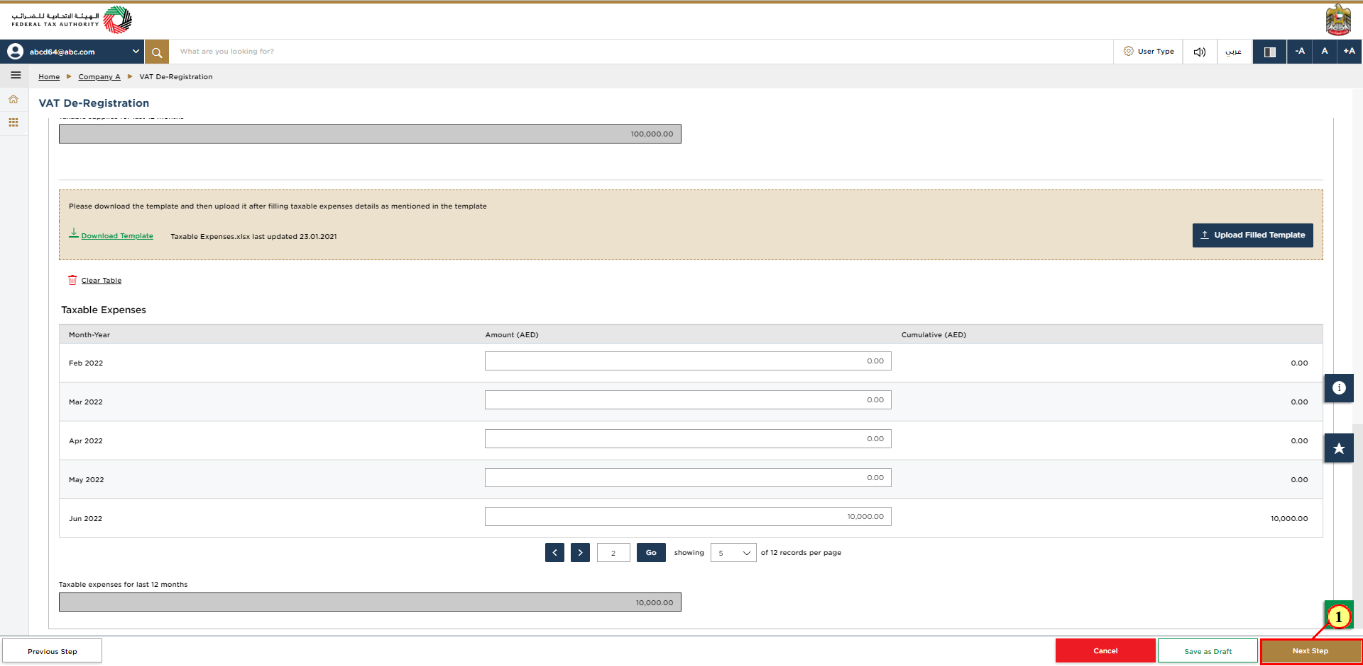

(1) | You are required to submit your Taxable supplies and expenses to support your deregistration application.

|

Step | Action |

(1) | Click 'Next Step' to save and proceed to 'authorized signatory' section. |

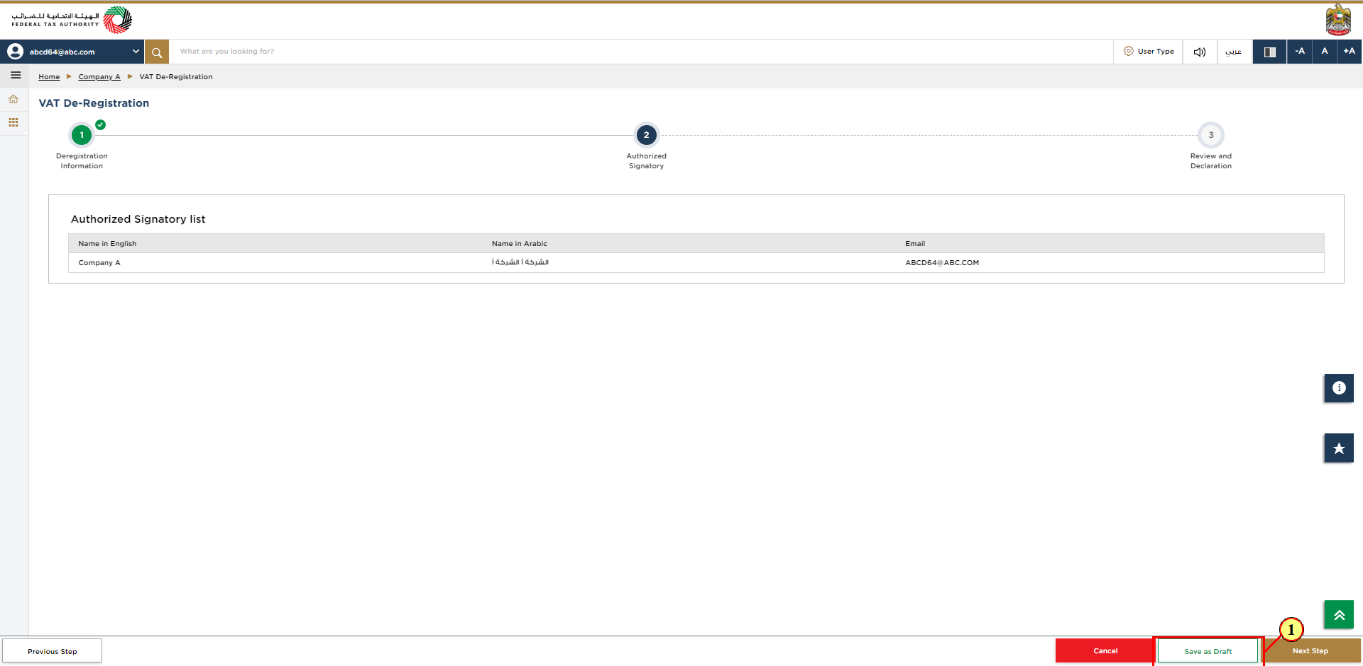

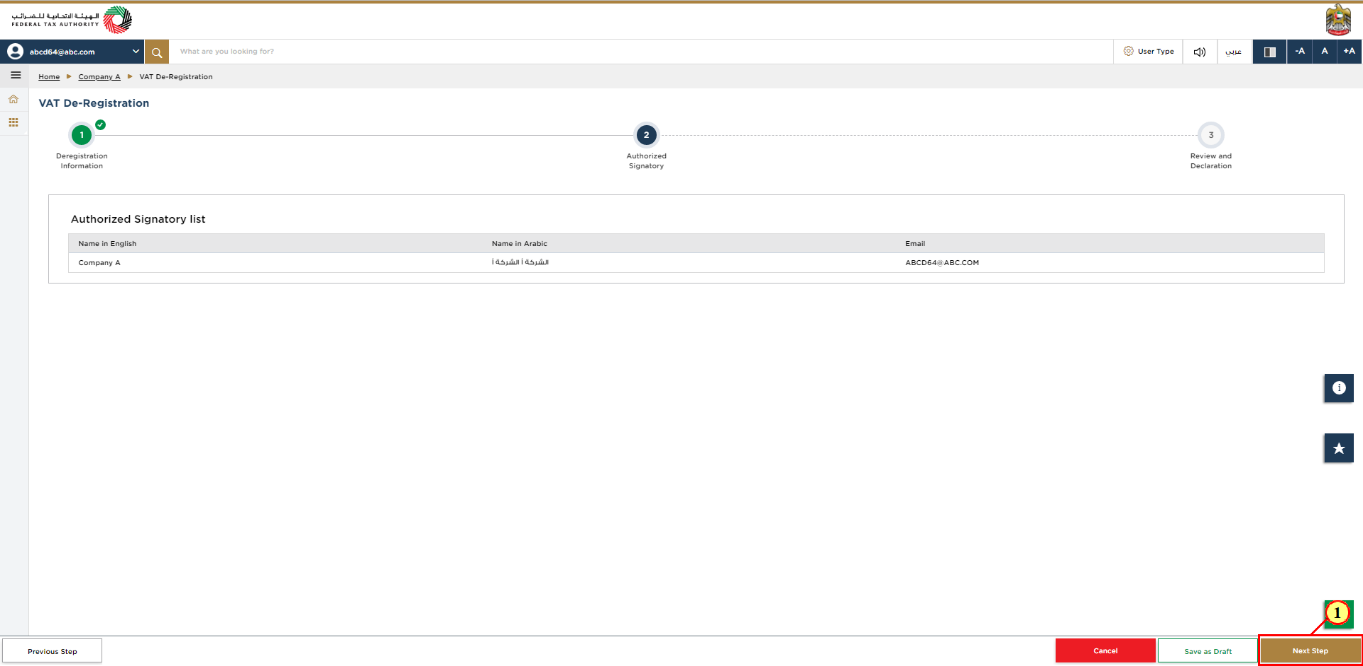

Authorized Signatory

Step | Action |

(1) | Click 'Save as draft' to save your application and return to continue working on your application later. |

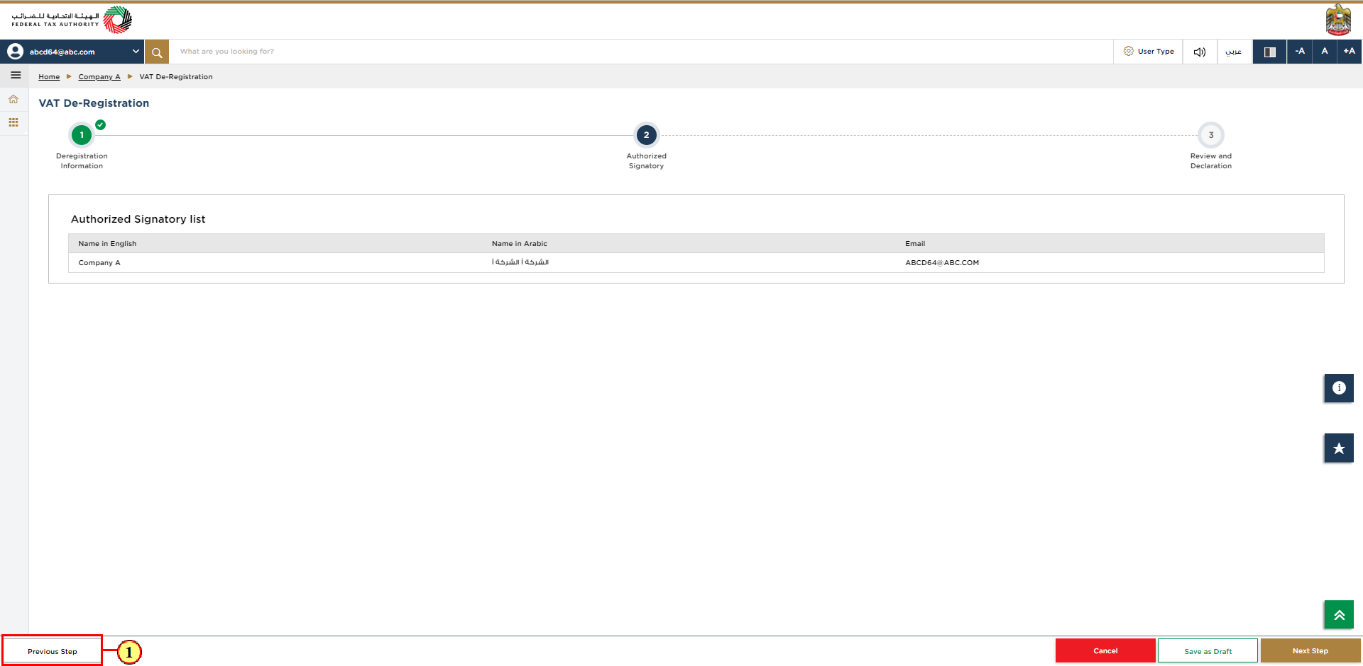

Step | Action |

(1) | Click 'Previous Step' to go back to the previous section. |

Step | Action |

(1) | Review the authorized signatory details and click 'Next Step' to save and proceed to next section. |

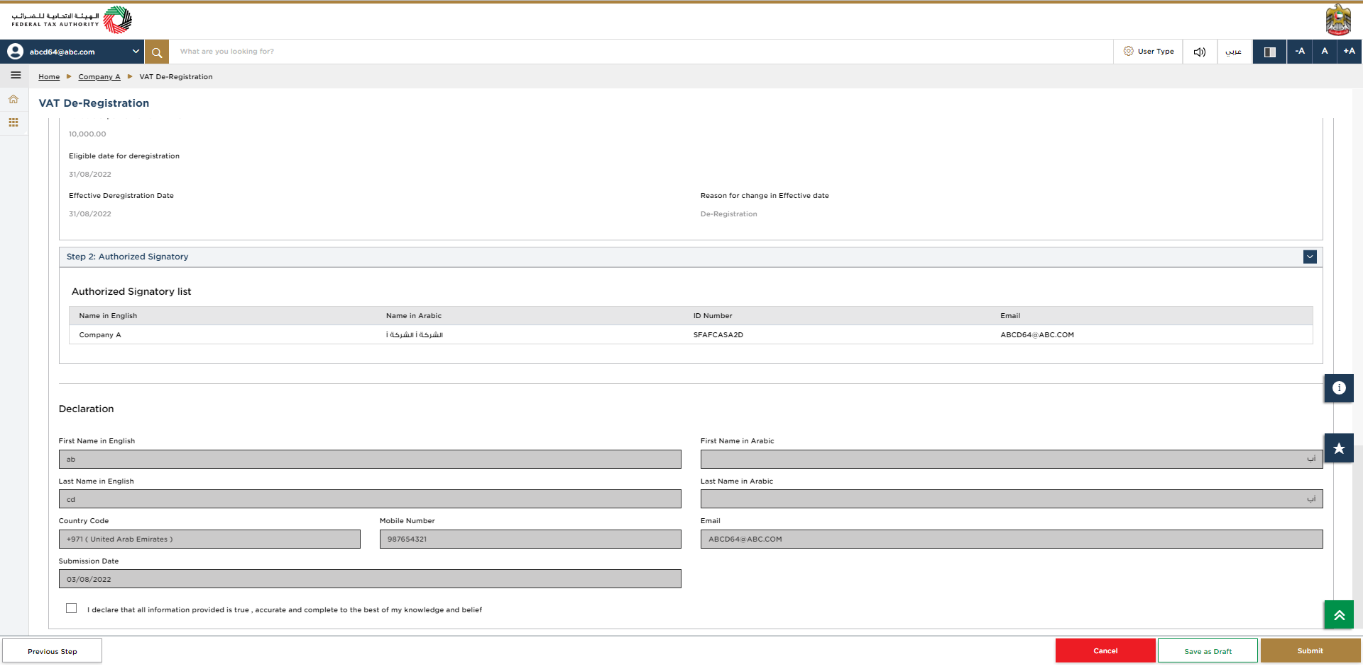

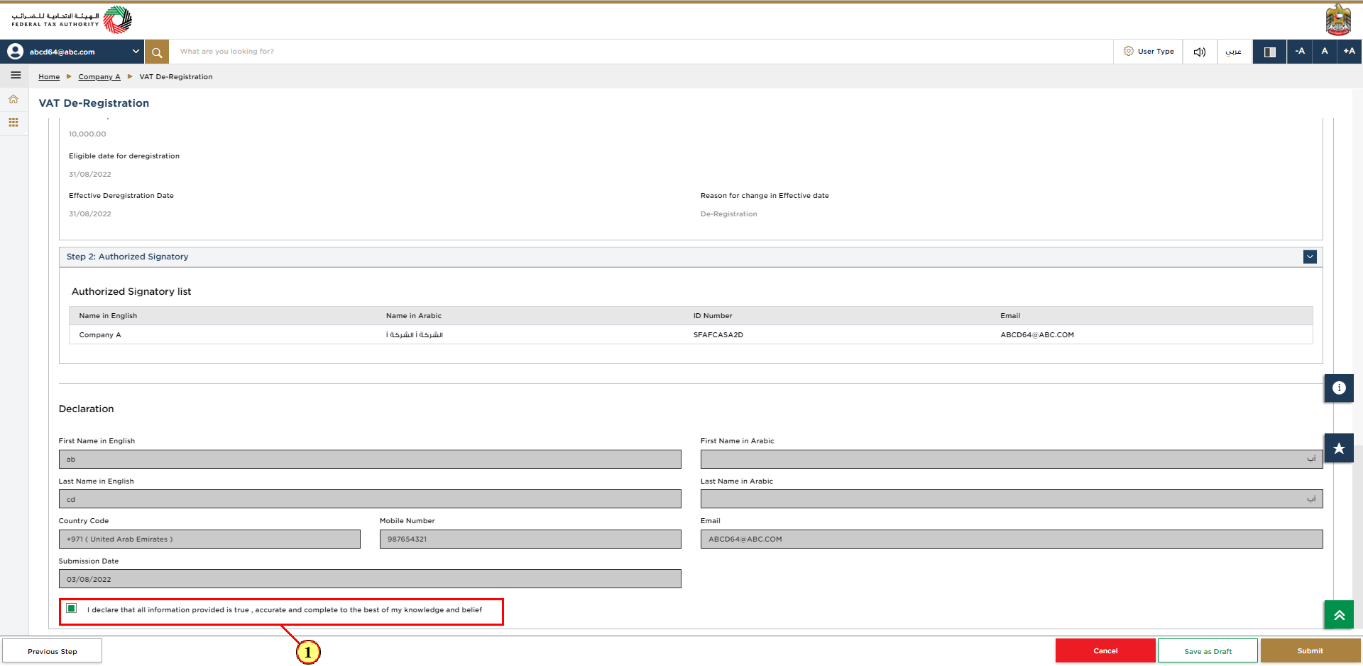

Review and Declaration

| This section highlights all the details entered by you across the application. You are requested to review and submit the application formally. |

Step | Action |

(1) | After carefully reviewing all of the information entered on the application, mark the checkbox to declare the correctness of the information provided in the application. |

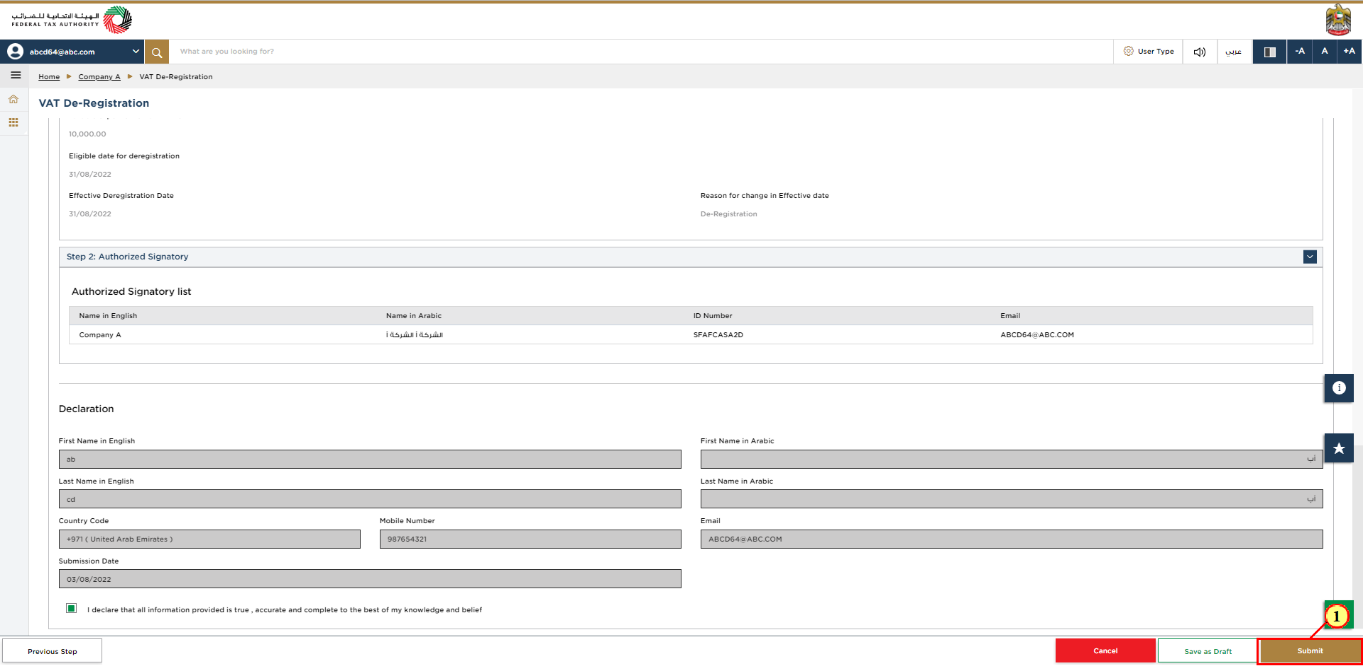

Step | Action |

(1) | Click 'Submit' to submit the VAT De-Registration application. |

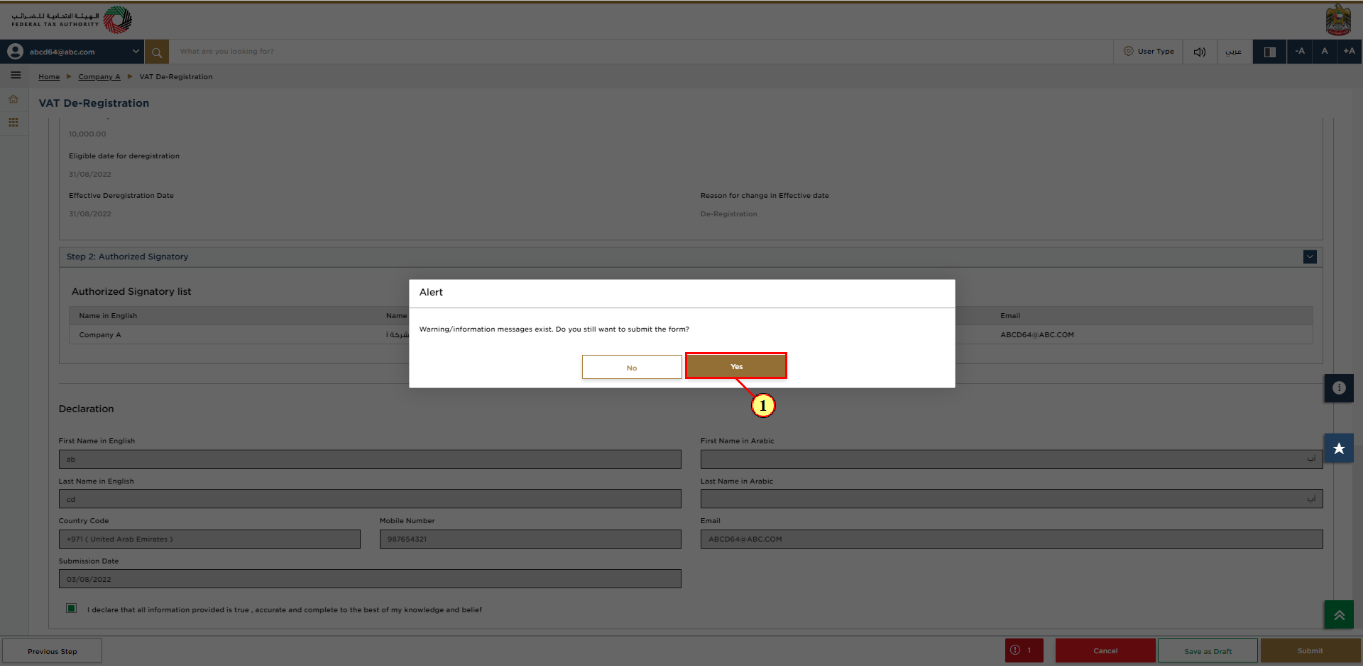

Step | Action |

(1) | Click 'Yes' to continue. |

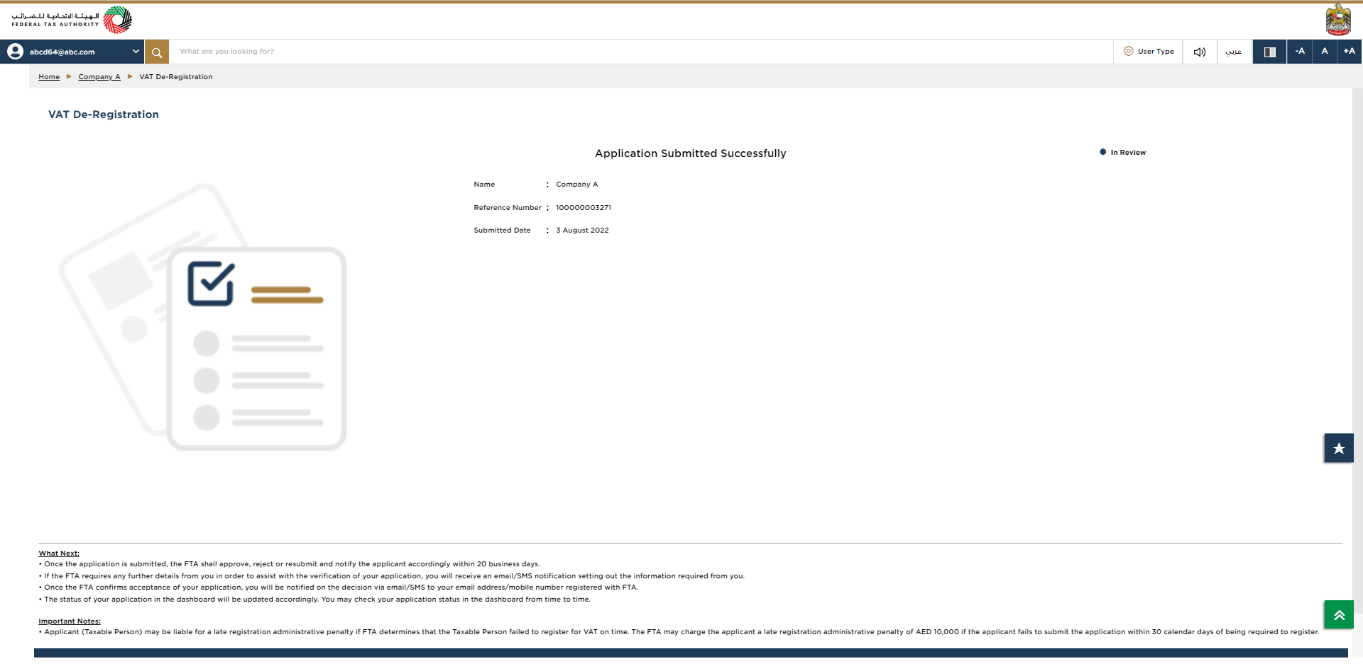

Post Application Submission

| After your application is submitted successfully, a Reference Number is generated for your submitted application. Note this reference number for future communication with FTA. What's next?

|

Correspondences

After submission, Taxpayer receives the following correspondences:

Application submission acknowledgment.

Additional information notification (only if FTA requires more information to assist with their review of your application).

Application pre-approval or rejection notification.