VAT 201 Final Return for e-commerce reporting - User Manual - July 2023

Final VAT 201 Return for e-commerce reporting - User Manual

Date: July 2023 | Version: 1.0.0.0

Contents

1. Document Control Information

2. Annexure - List of other user manuals that can be referred to

3. Navigating through EmaraTax

4. Introduction

9. Instructions and Guidelines

11. Final VAT Return

13. Correspondences

1. Document Control Information

Document Version Control

| Version No. | Date | Prepared/Reviewed by | Comments |

|---|---|---|---|

| 1.0 | 11-July-23 | Federal Tax Authority | User Manual for EmaraTax Portal |

2. Annexure - List of other user manuals that can be referred to

The below are the list of User manuals that you can refer to

| S. No | User Manual Name | Description |

|---|---|---|

| 1 | Register as Online User | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website and create an EmaraTax account with the FTA. |

| 2 | Manage online user profile | This manual is prepared to provide you an understanding on Login process, user types, forgot password and modify online user profile functionalities. |

| 3 | User Authorisation | This manual is prepared to provide you an understanding on Account Admin, Online User, and Taxable Person account definitions and functionalities. |

| 4 | Taxable person dashboard | This manual is prepared to help the following 'Taxable person' users to navigate through their dashboard in the Federal Tax Authority (FTA) EmaraTax Portal:

|

| 5 | Link TRN to email address | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website to Link TRN to New Email Address. |

4. Introduction

This user manual provides detailed guidance on how to process and submit your Final VAT Return for e-commerce reporting through the EmaraTax portal.

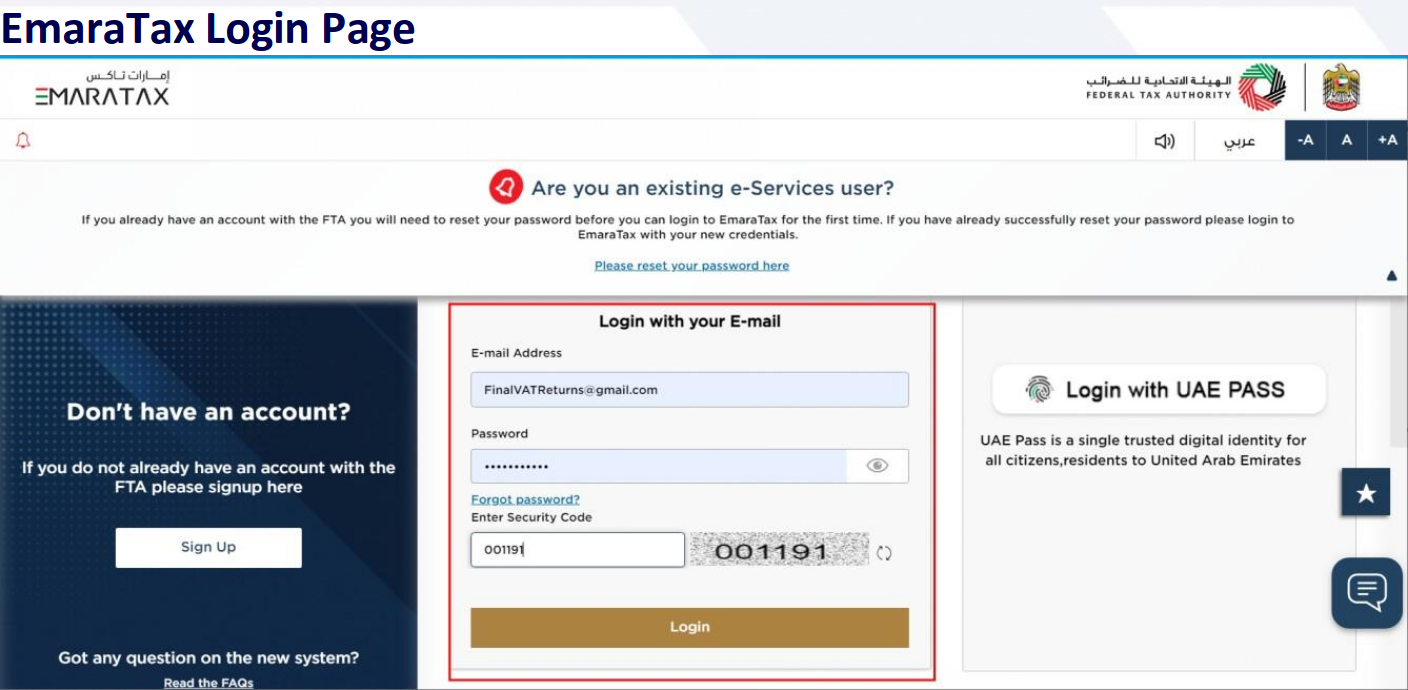

5. EmaraTax Login Page

|

|

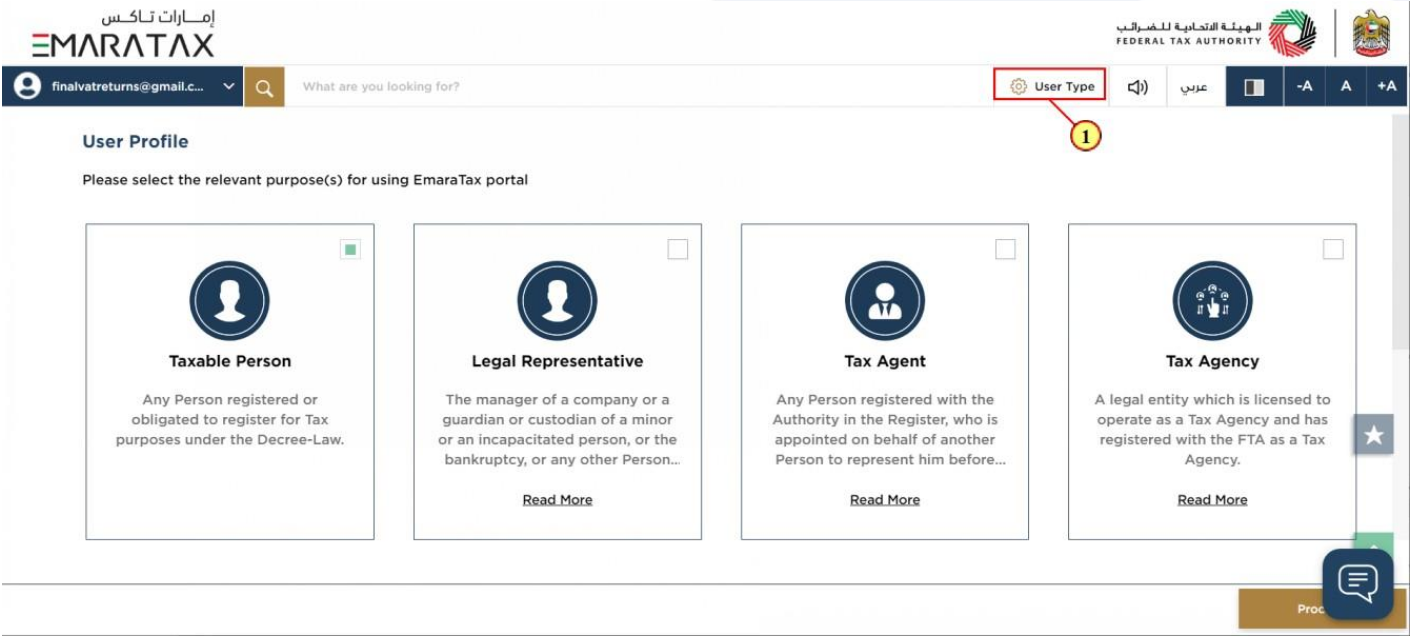

6. User type Selection

| Step | Action |

|---|---|

| (1) | Click here to select the user type |

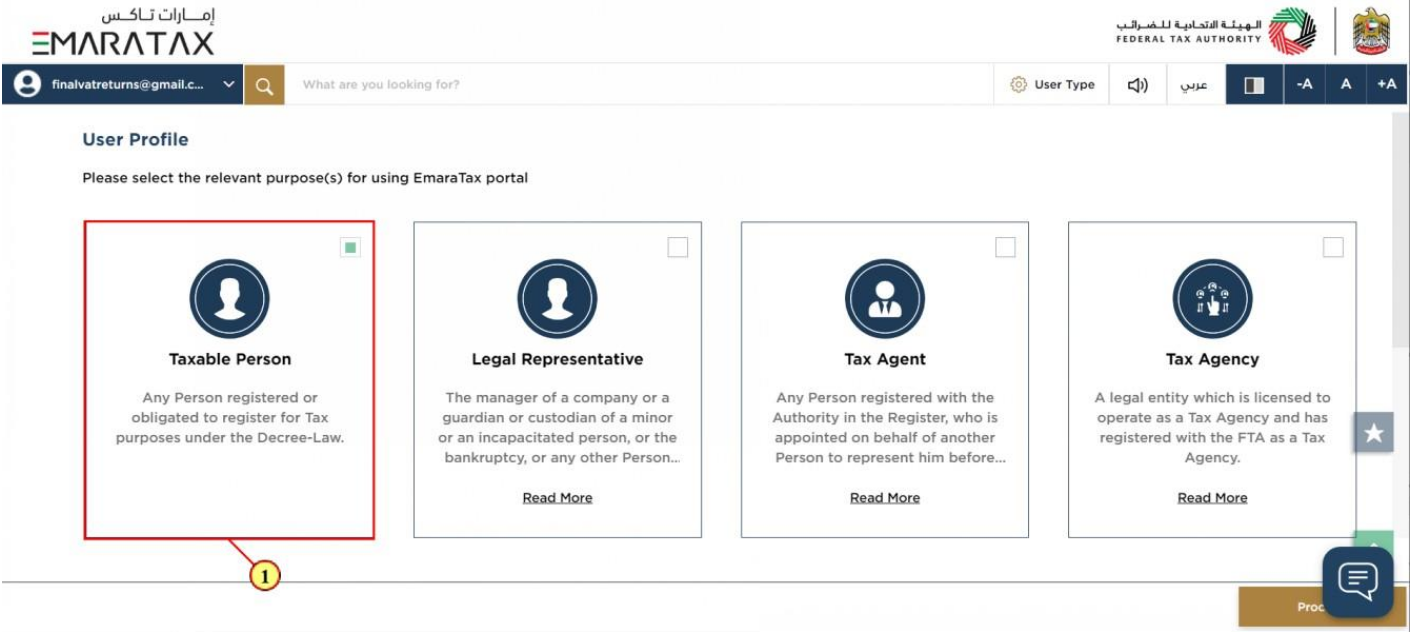

| Step | Action |

|---|---|

| (1) | Select the Taxable Person tile |

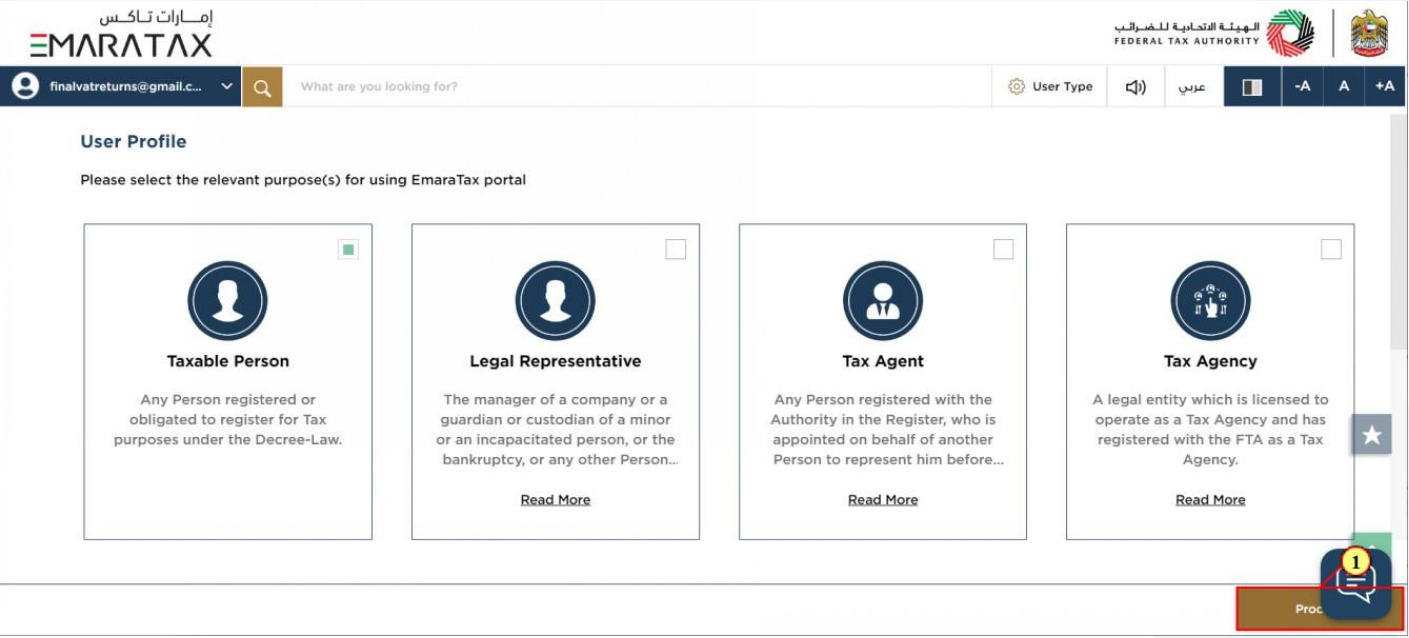

| Step | Action |

|---|---|

| (1) | Click on 'Proceed' to proceed to the Taxable Person |

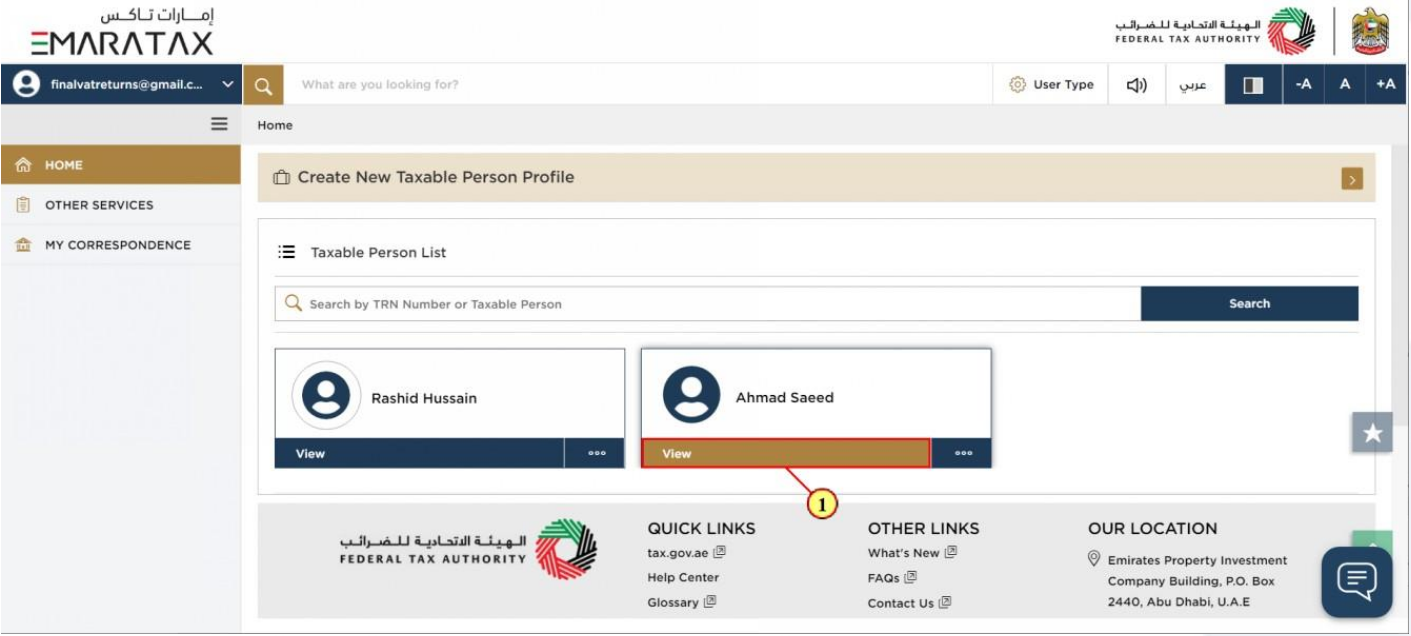

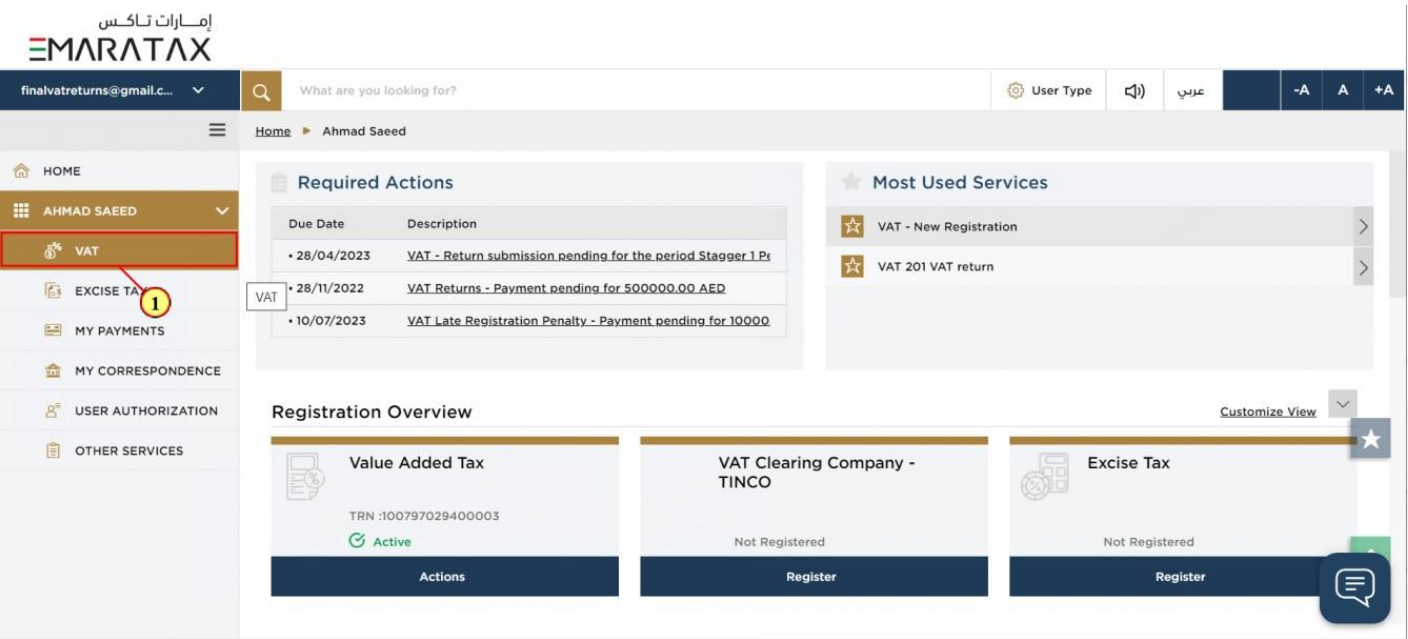

7. Taxable Person Home Page

| Step | Action |

|---|---|

| (1) | Click here to view the Taxable Person dashboard |

| Step | Action |

|---|---|

| (1) | Click here to access the VAT module |

| Step | Action |

|---|---|

| (1) | Click here to view all your VAT Returns |

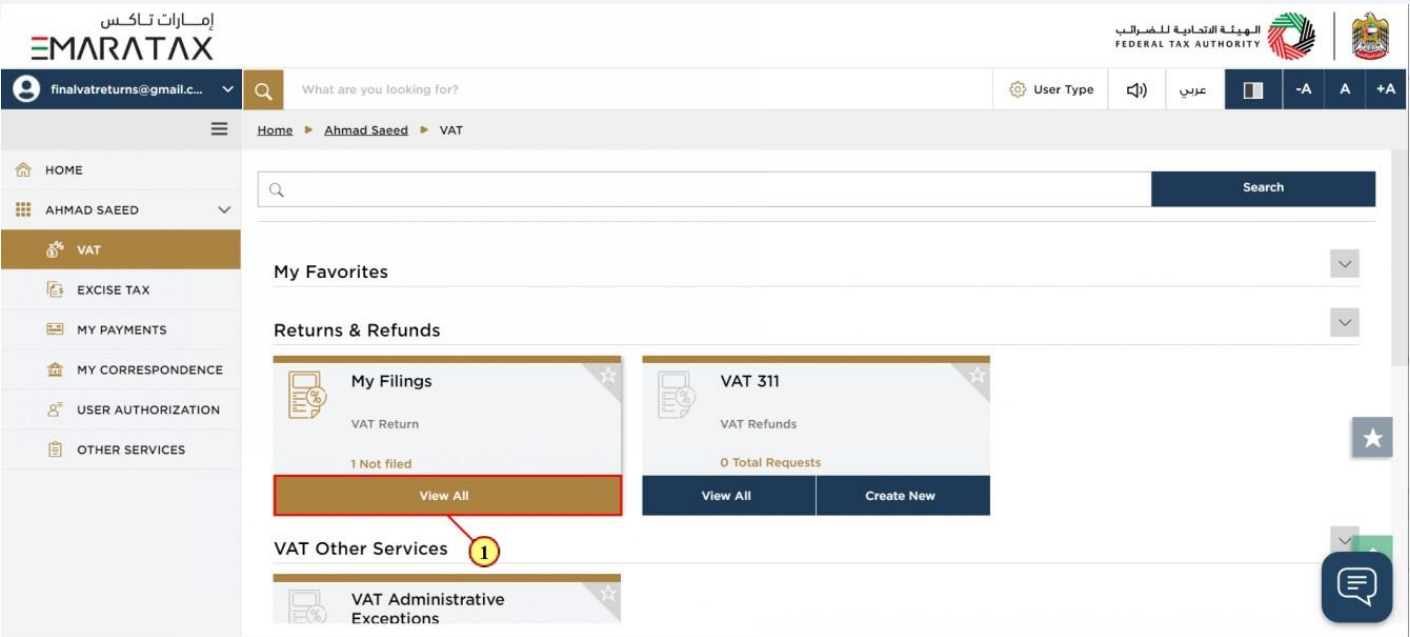

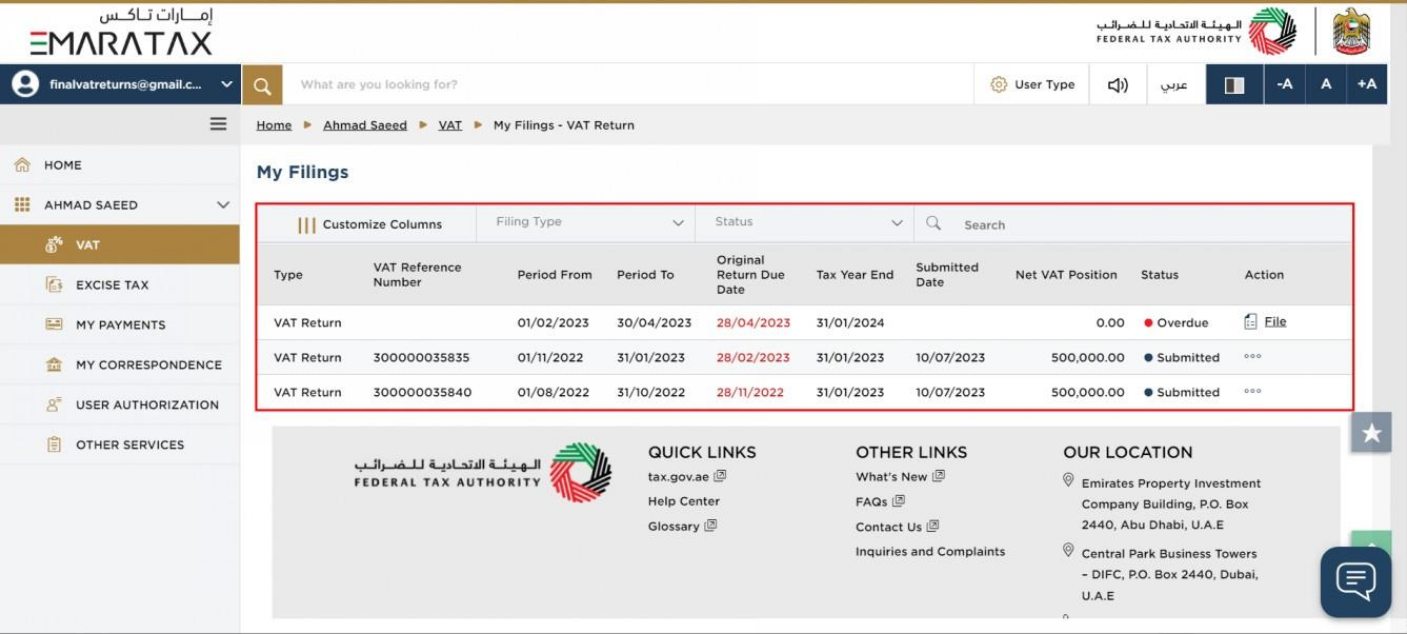

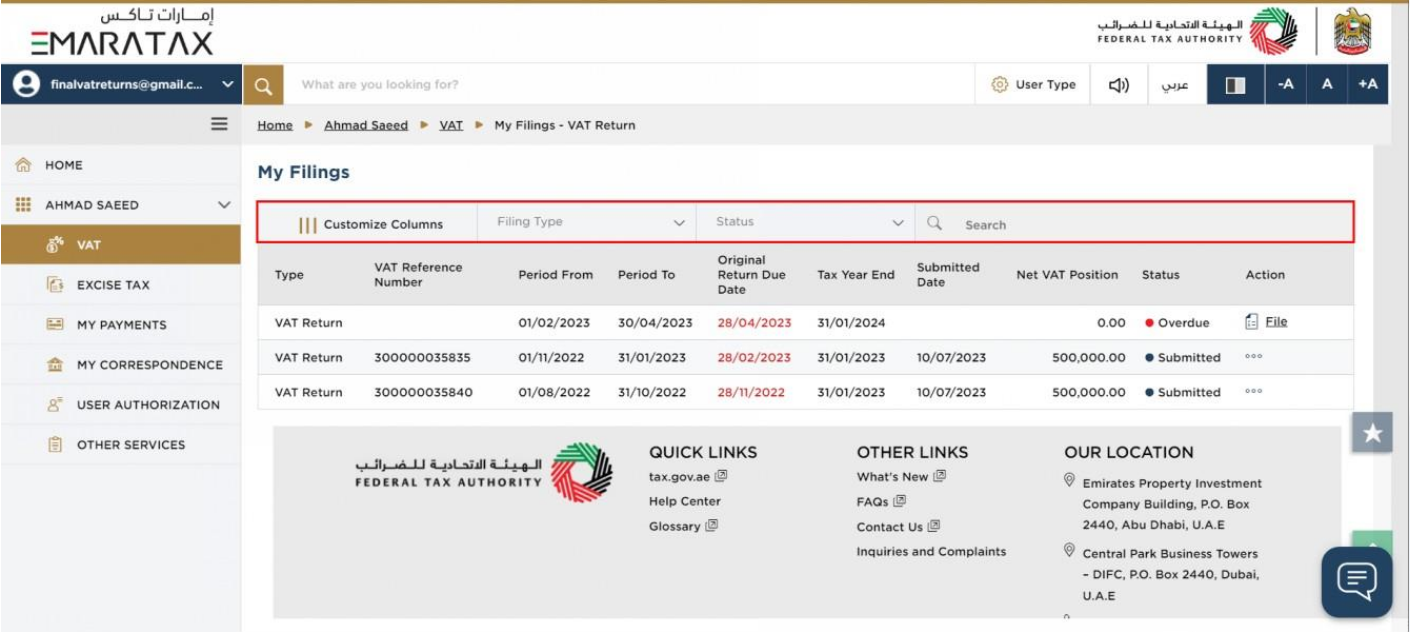

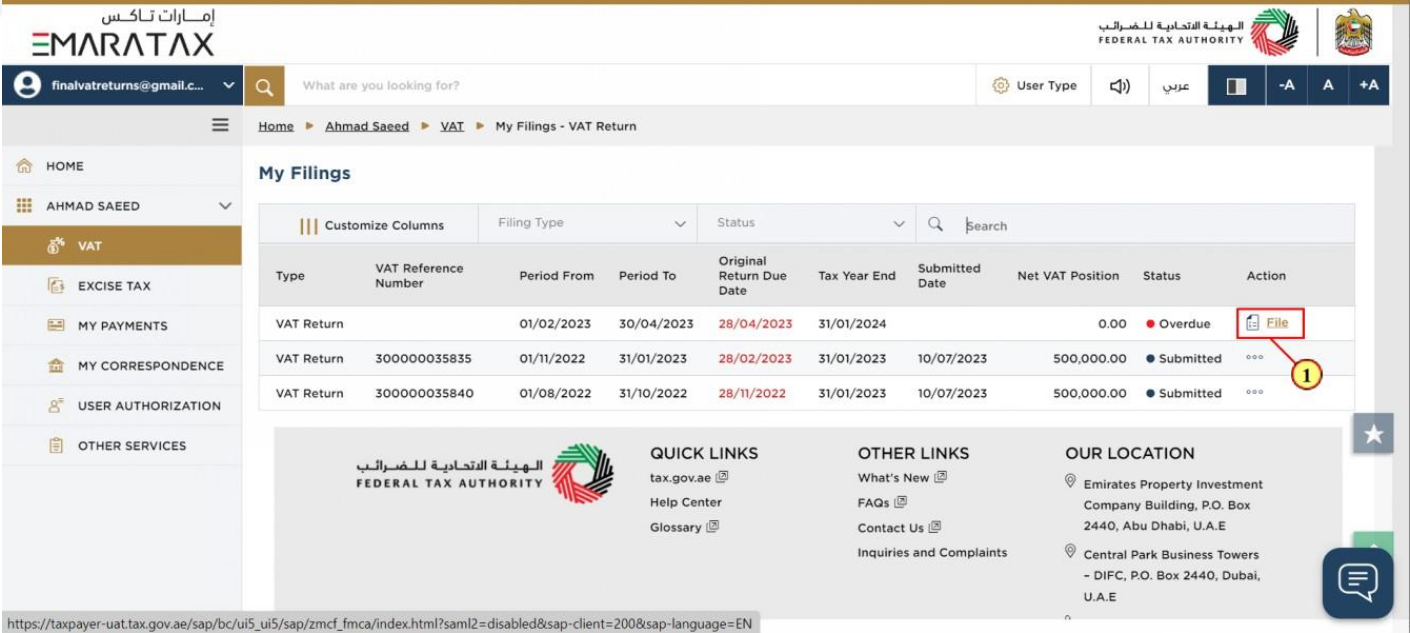

8. VAT 201 Return Dashboard

| This dashboard displays information related to your VAT Returns. |

| You can add a new column to the table or filter the filings by its Return type and status. You can also search for VAT Return by reference number. |

| Step | Action |

|---|---|

| (1) | Click here to start filing a new VAT Return for the selected period. |

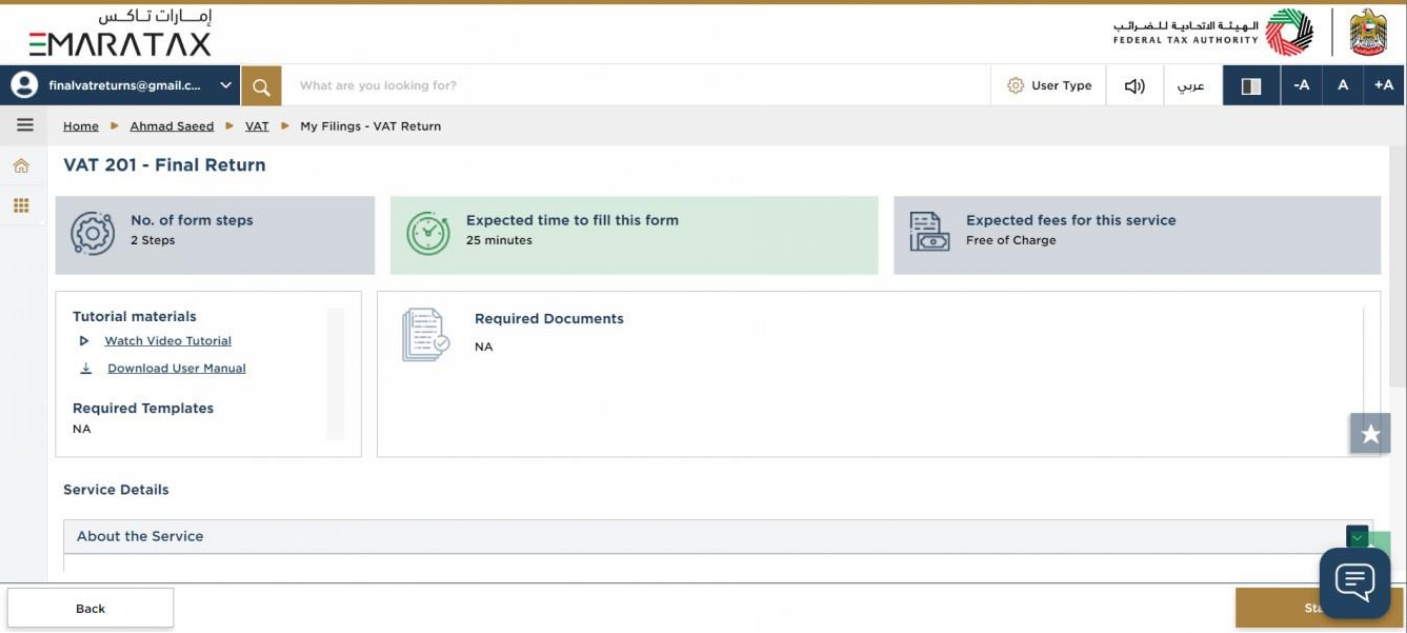

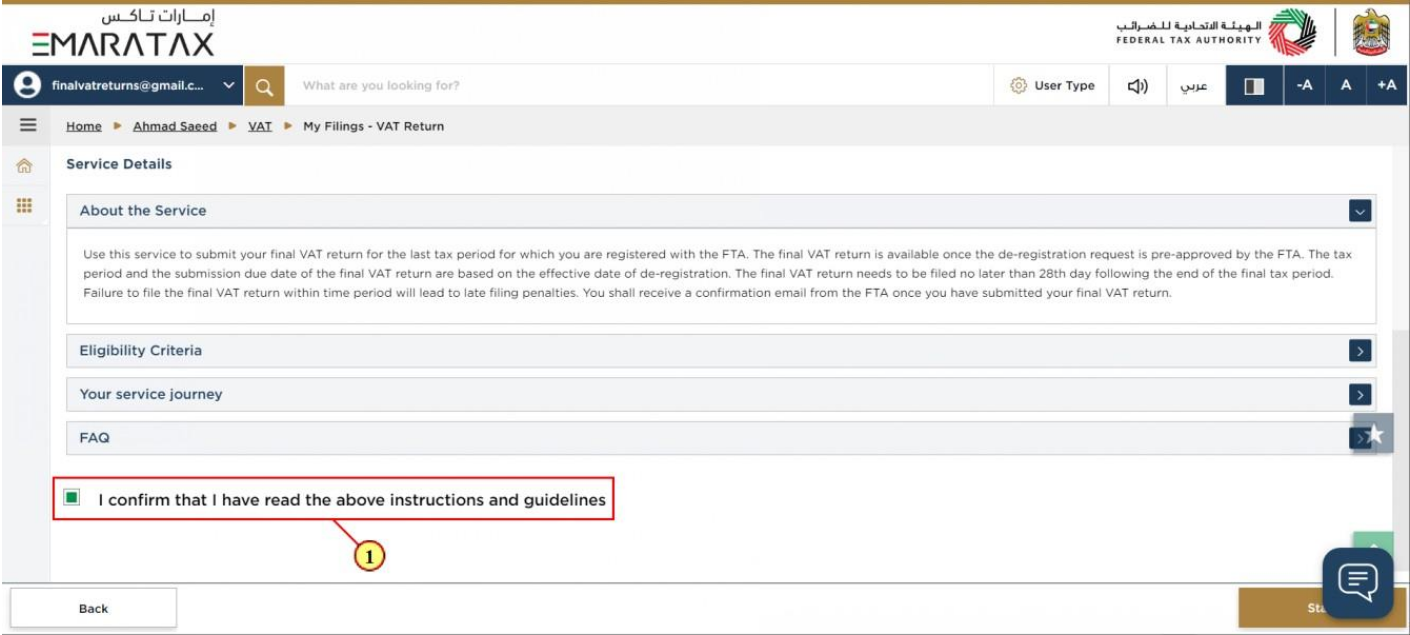

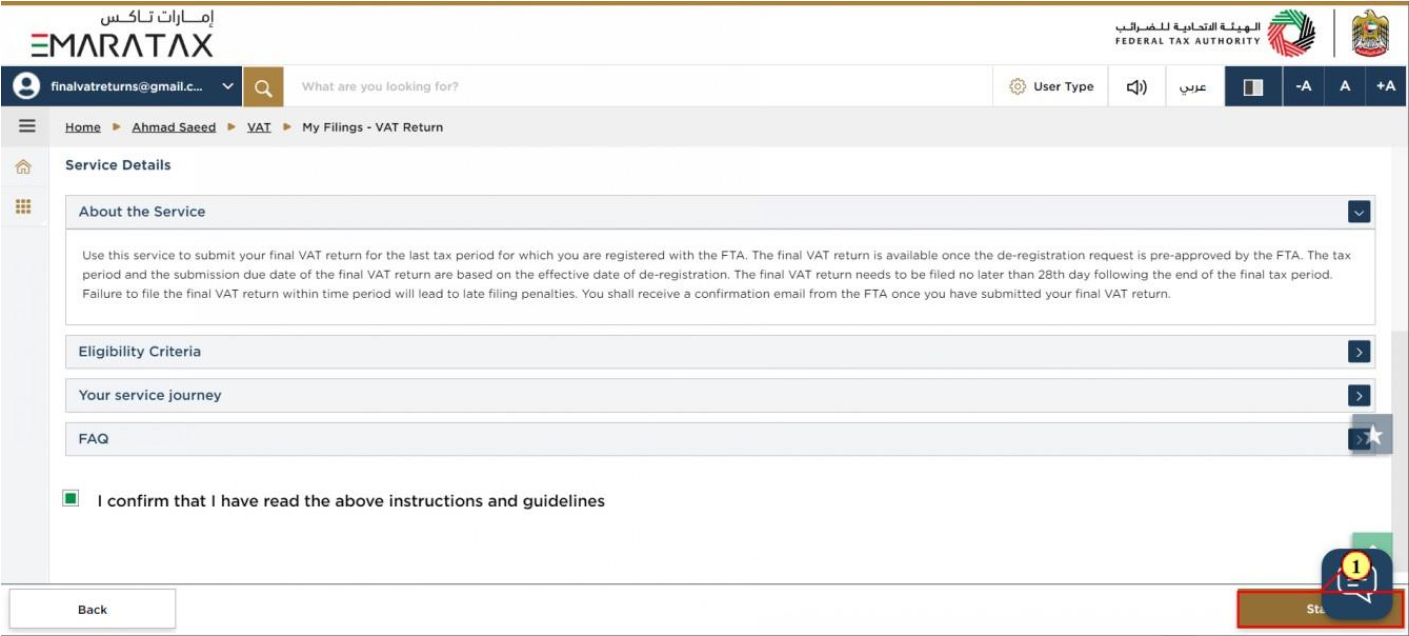

9. Instructions and Guidelines

| These are the instructions and guidelines which detail key information such as required templates, supporting documentation, eligibility criteria and the expected time to complete this return. |

| Step | Action |

|---|---|

| (1) | Mark the checkbox to confirm that you have read and understood the instructions and guidelines. |

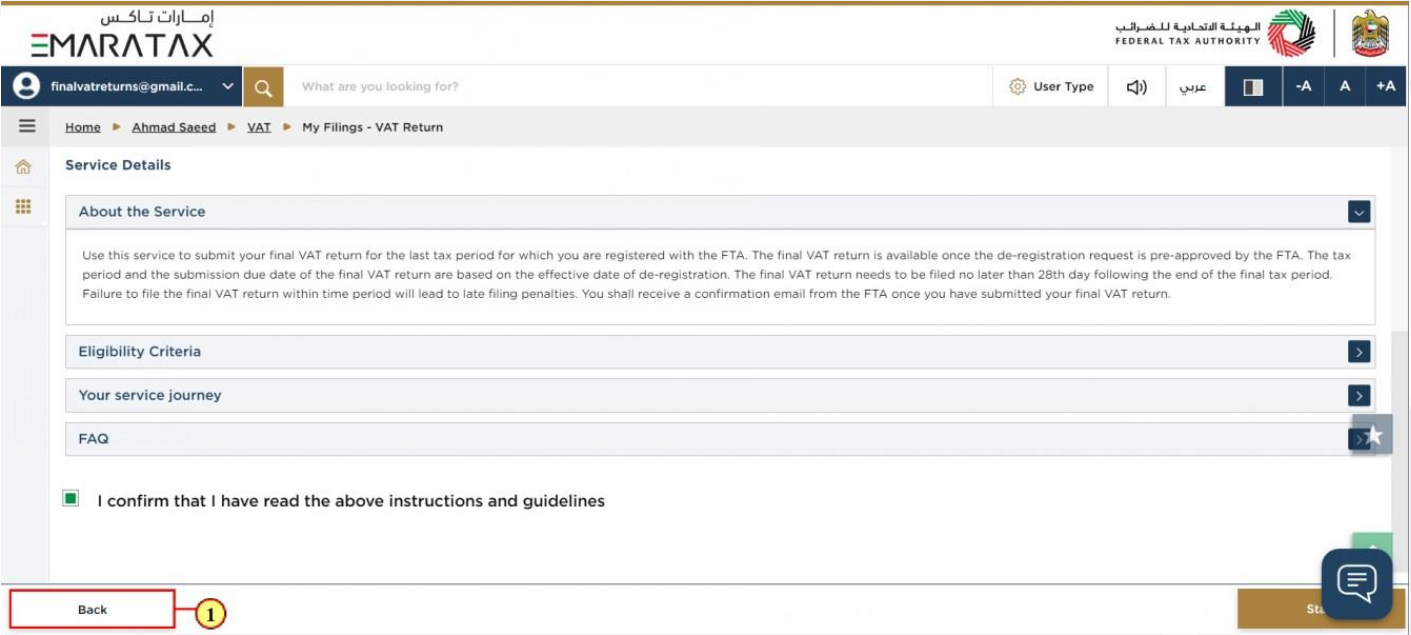

| Step | Action |

|---|---|

| (1) | Click on 'Back' to go back to the previous page |

| Step | Action |

|---|---|

| (1) | Click on 'Start' to proceed to file the VAT return |

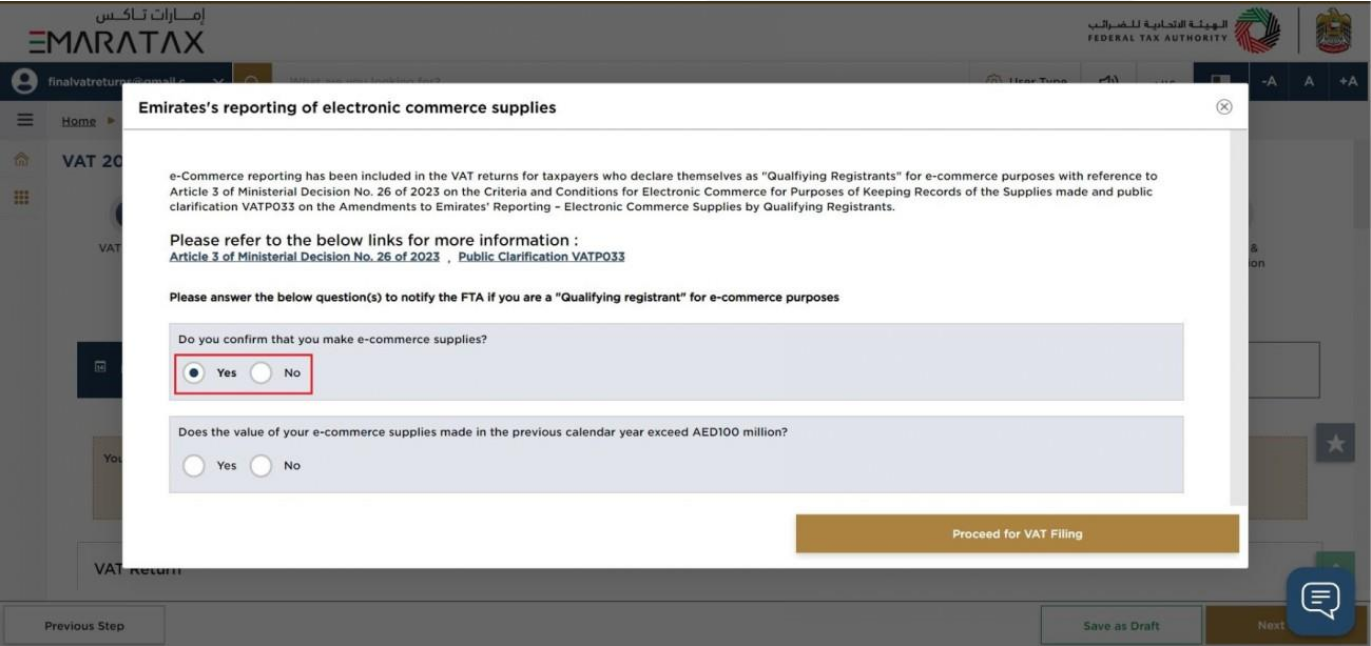

10. e-Commerce Questionnaire

| Step | Action |

|---|---|

| (1) | Before responding to the e-commerce questionnaire, please ensure that you read through the following:

Then select 'Yes' if you make e-commerce supplies. |

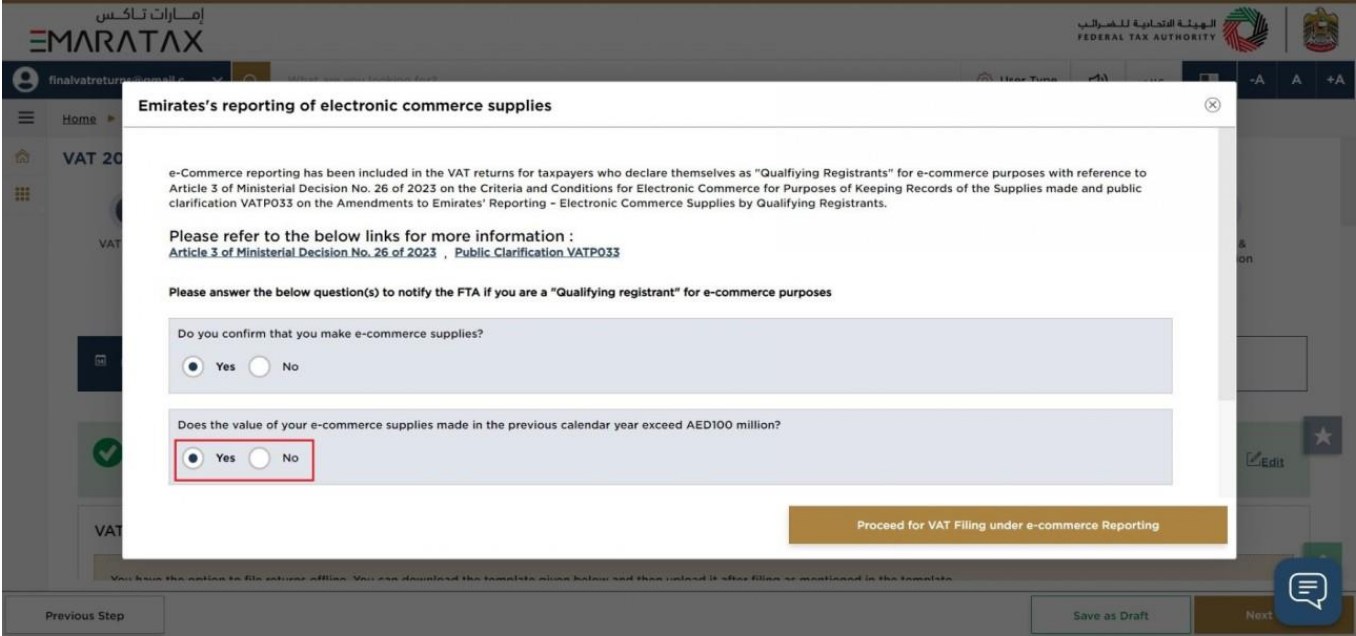

| Step | Action |

|---|---|

| (1) | If you make e-commerce supplies, you should select 'Yes' if the value of your e-commerce supplies made in the previous calendar year exceeds AED 100 million. |

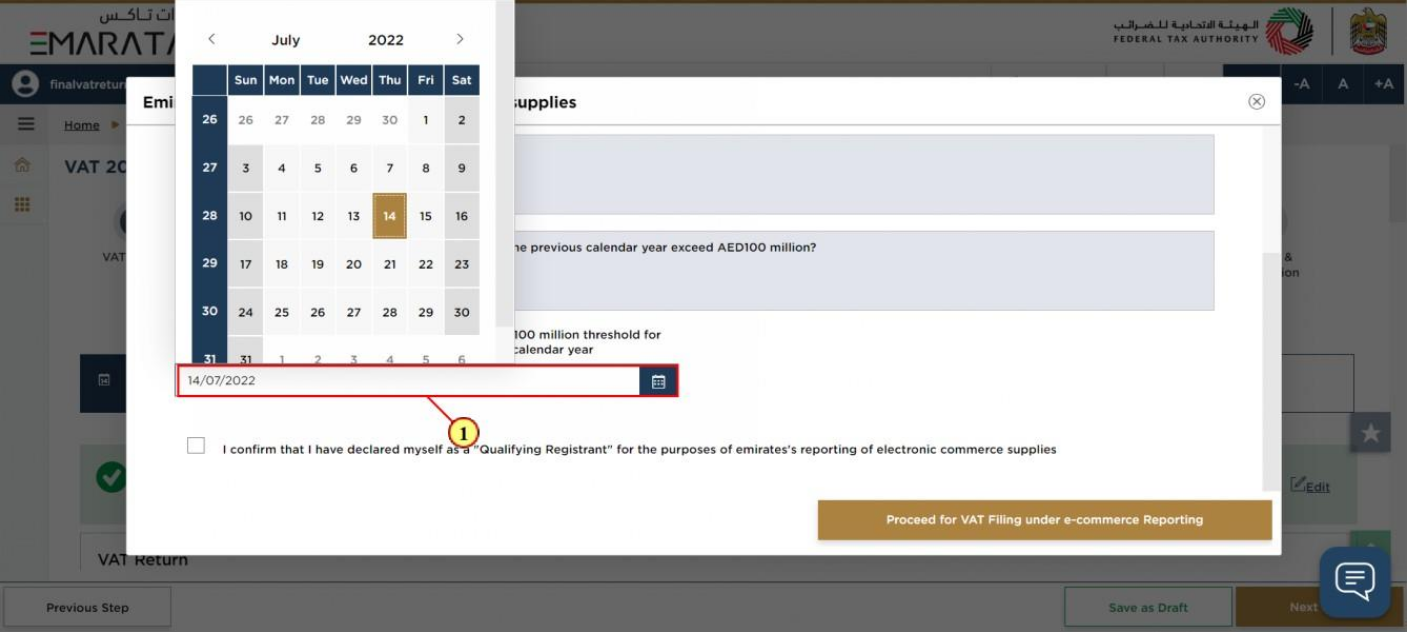

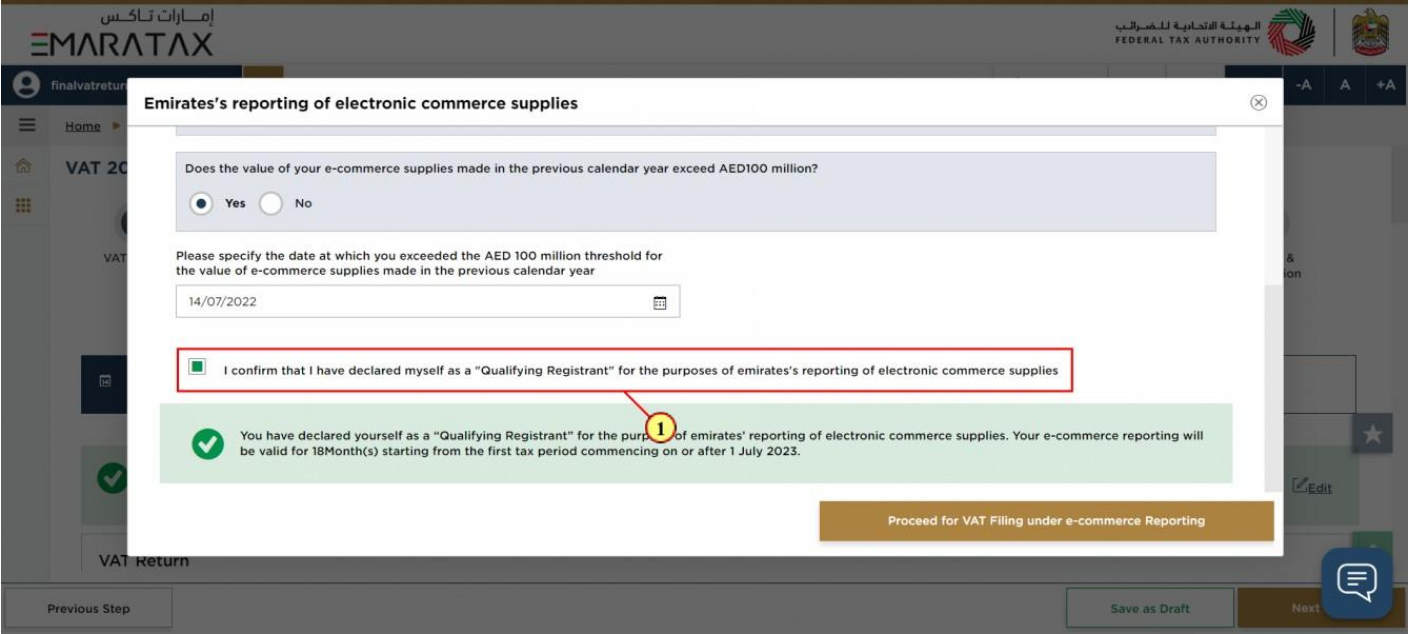

| Step | Action |

|---|---|

| (1) | If you selected 'Yes' to the two previous questions, you should select the date on which you have exceeded the AED 100 million threshold for the value of e-commerce supplies made in the previous calendar year |

| Step | Action |

|---|---|

| (1) | Mark the checkbox to confirm that you are a "Qualifying Registrant" for the purposes of Emirates' reporting of e-commerce supplies. |

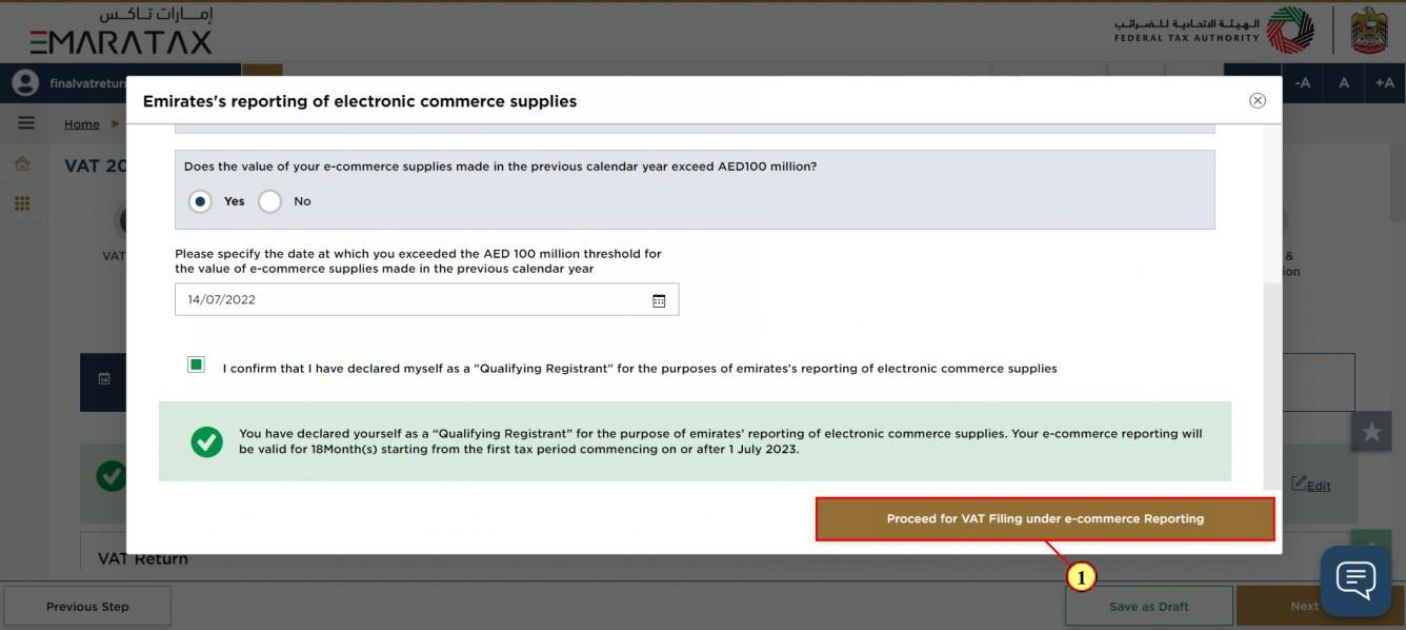

| Step | Action |

|---|---|

| (1) | Click on 'Proceed for VAT Filing under e-commerce reporting' to file your Final VAT Return |

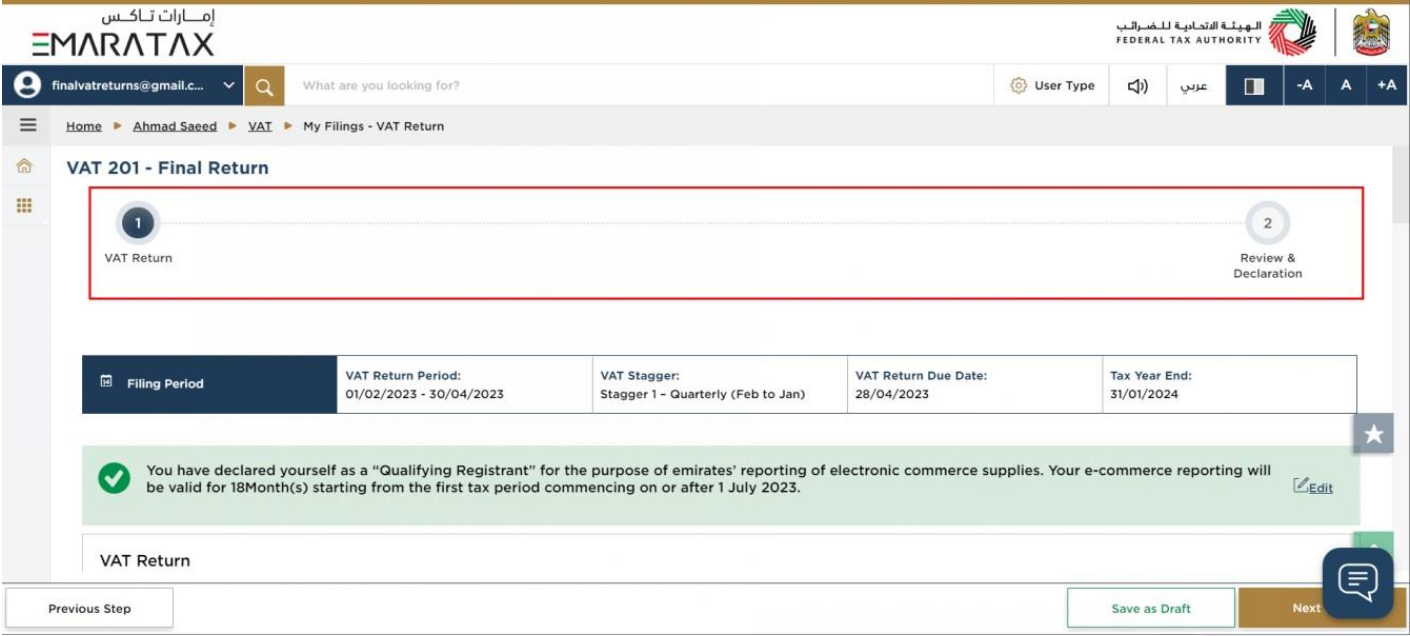

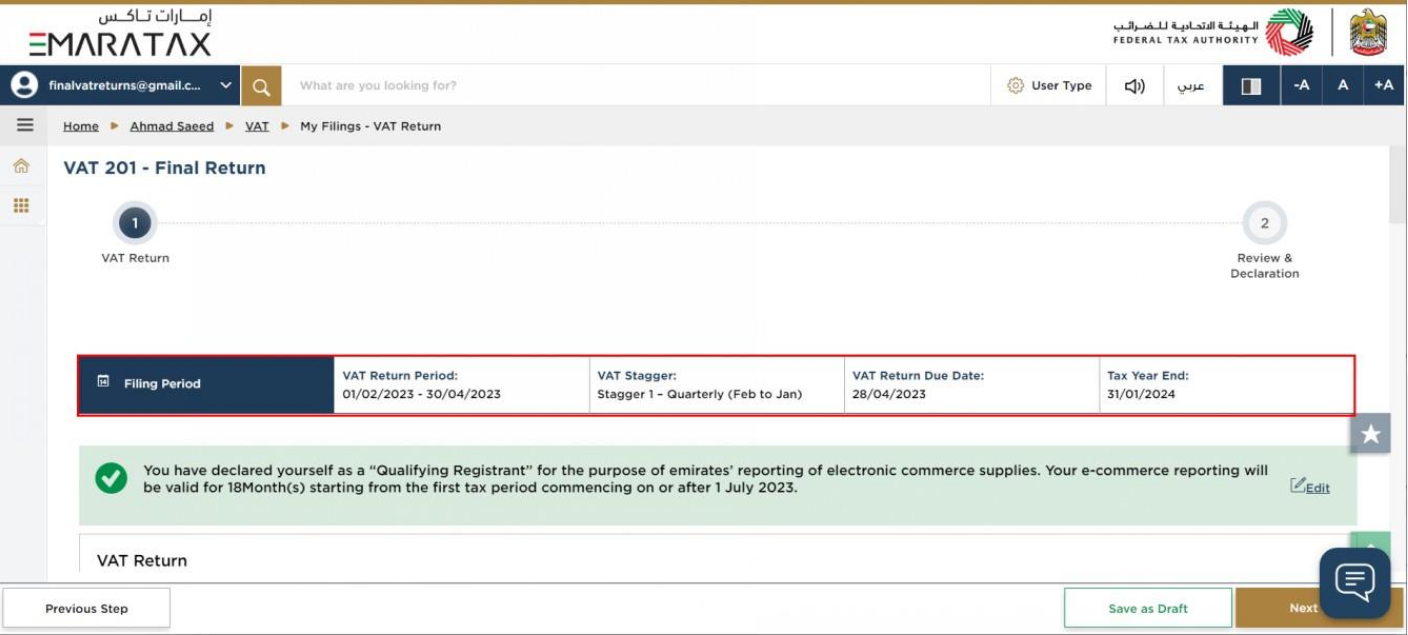

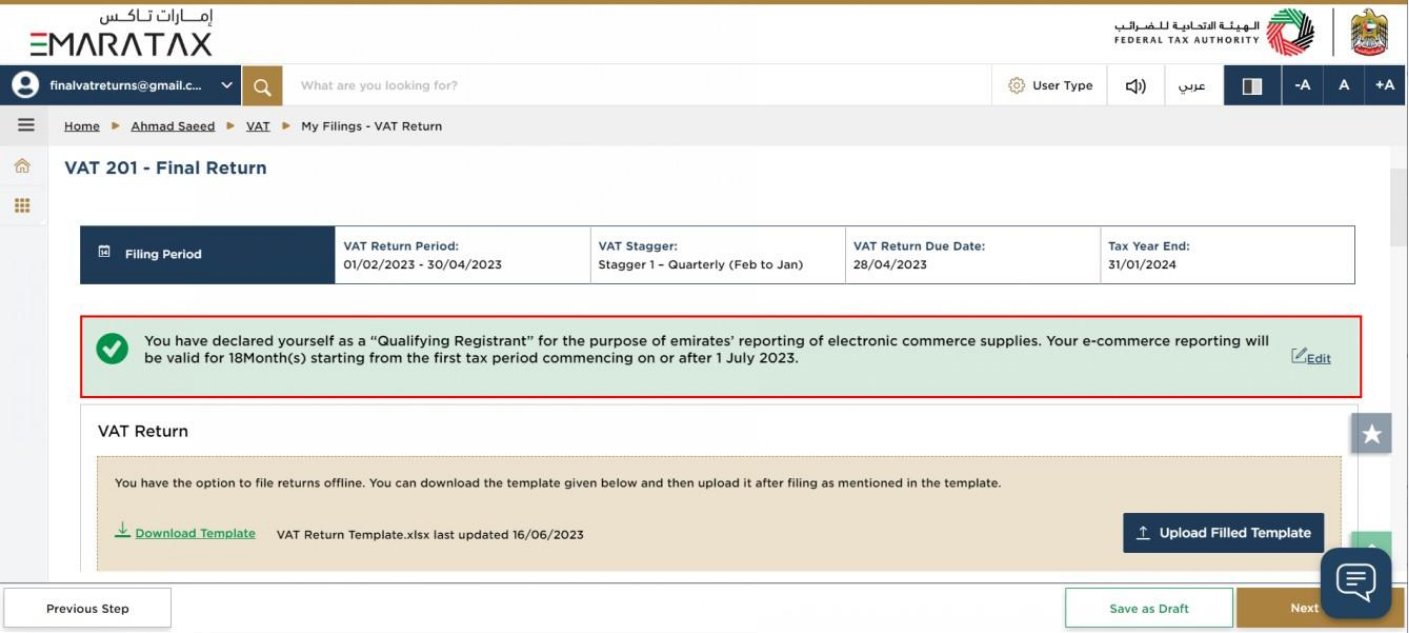

11. Final VAT Return

| The progress bar displays the number of steps required to complete the VAT Return. The step you are currently in is highlighted in blue. Once you progress to the next section successfully, the previous step will be highlighted in green |

| This section displays the filing period details based on the selected VAT Return. |

| The text highlighted in green indicates that you are a "Qualifying Registrant" and identifies your e-commerce reporting period. Note that regardless of your identified e-commerce reporting period, you may still proceed with filing your final VAT return. |

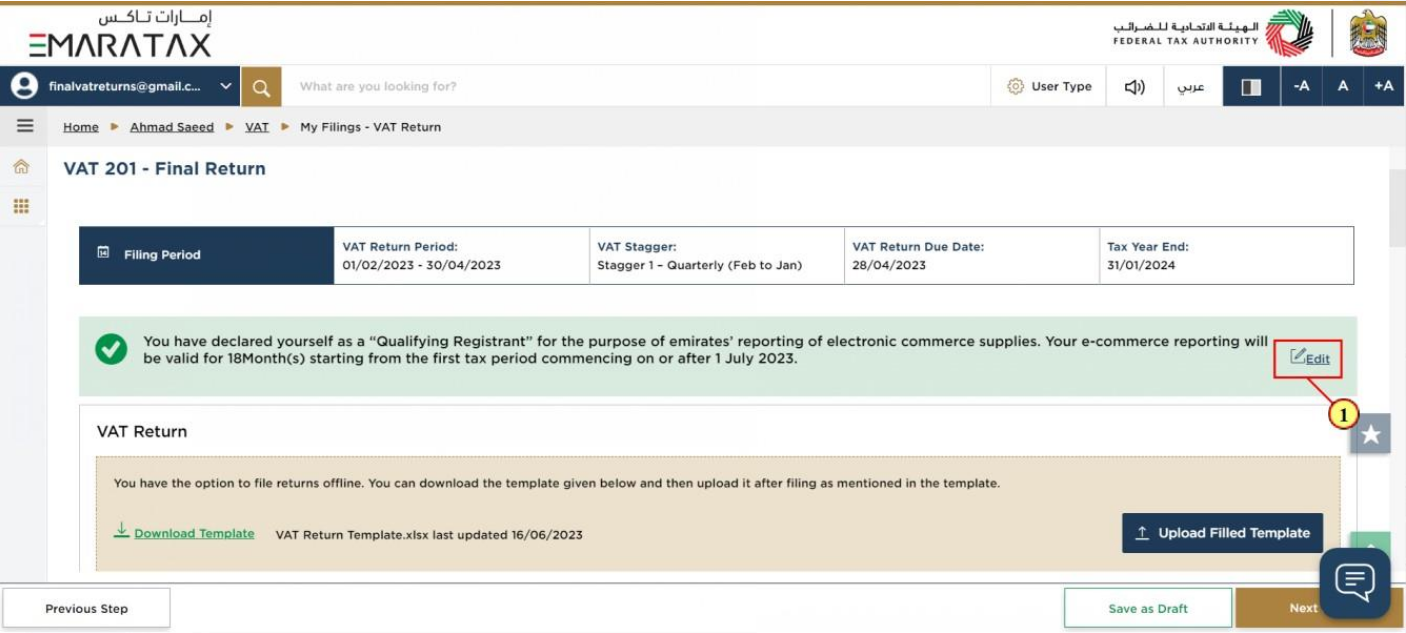

Step | Action |

(1) | Click on ‘Edit’ to respond to the e-commerce questionnaire. |

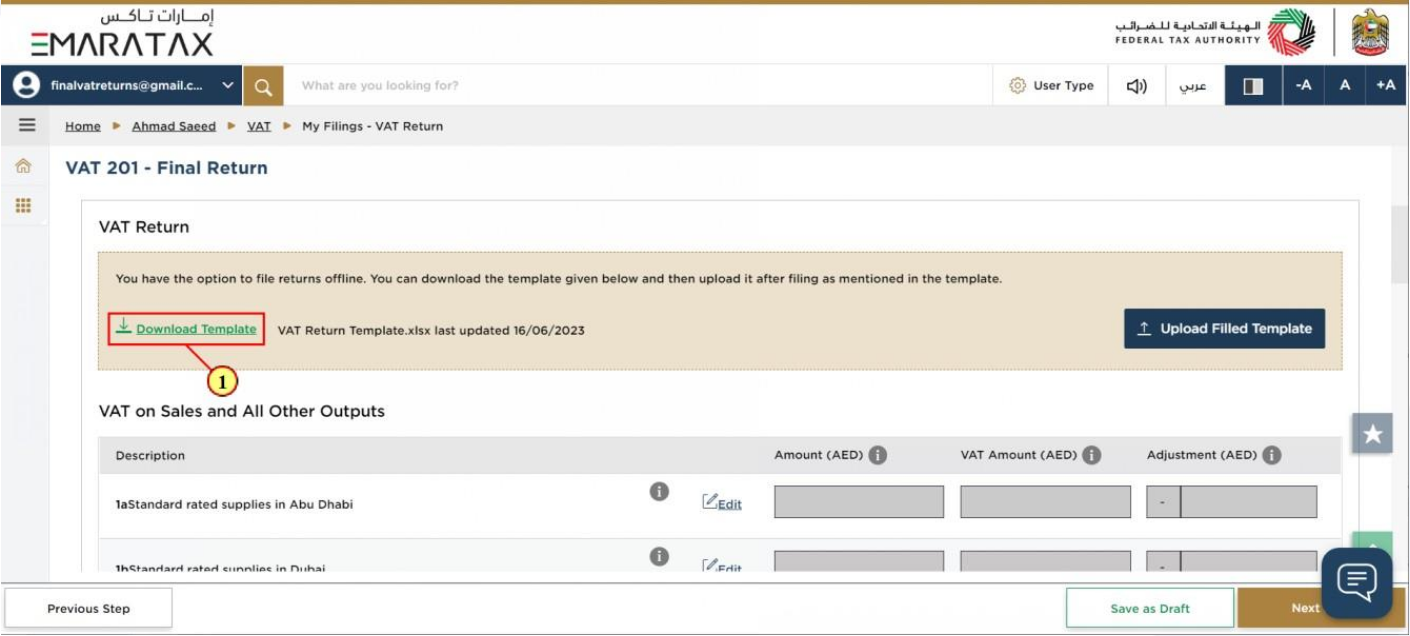

Step | Action |

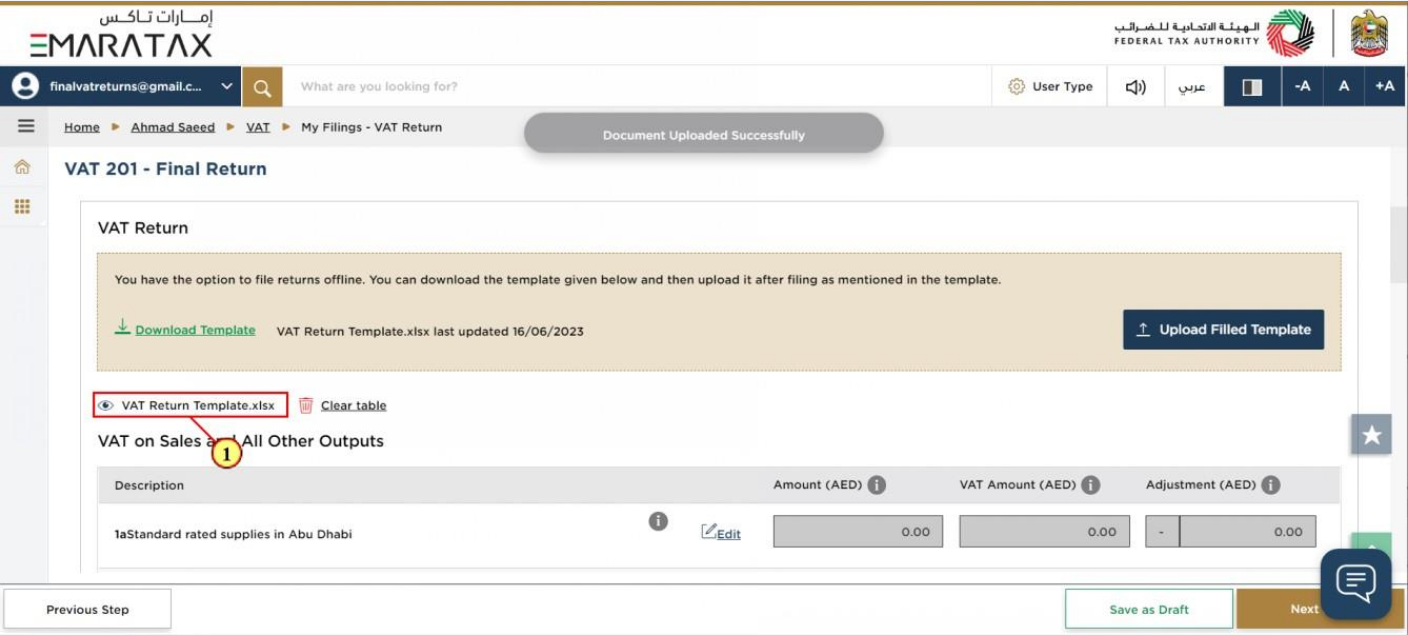

(1) | Click here to download the offline template which can be used to file your returns. |

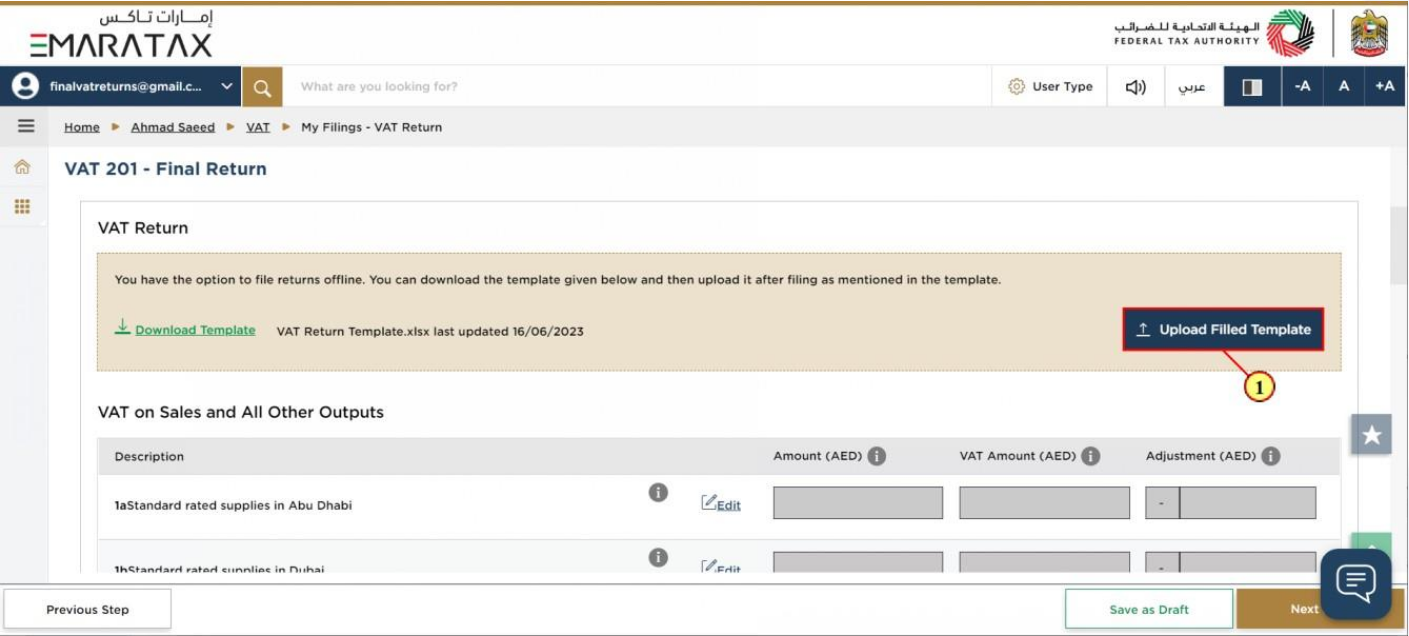

Step | Action |

(1) | Click on 'Upload Filled Template' to file your return using the offline facility. |

Step | Action |

(1) | Once the upload is complete, click here to download the uploaded template |

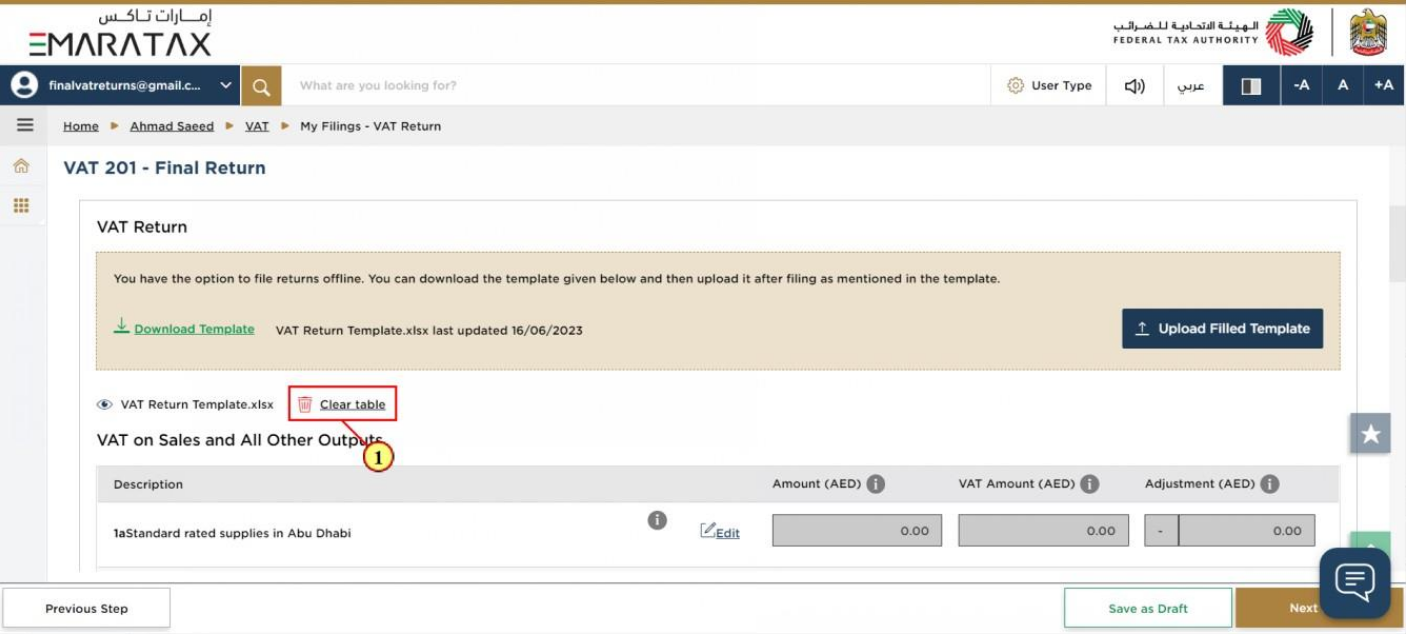

Step | Action |

(1) | Click here to clear the amounts in the table below |

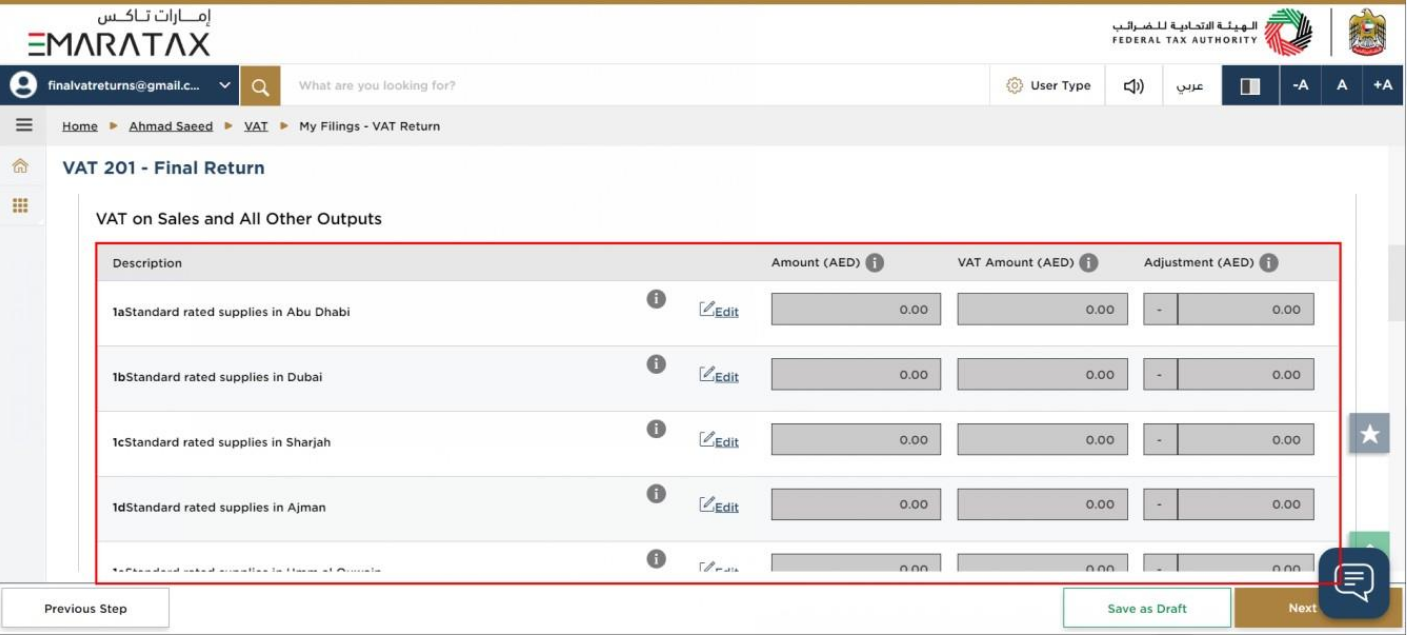

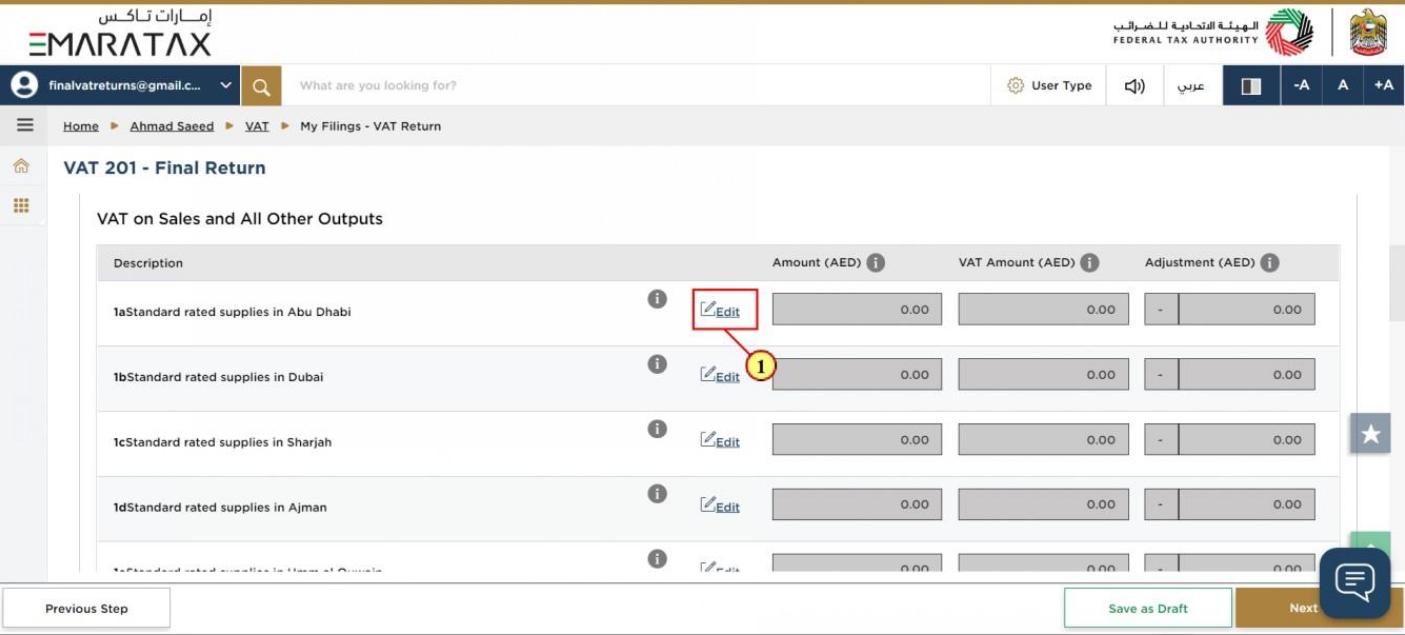

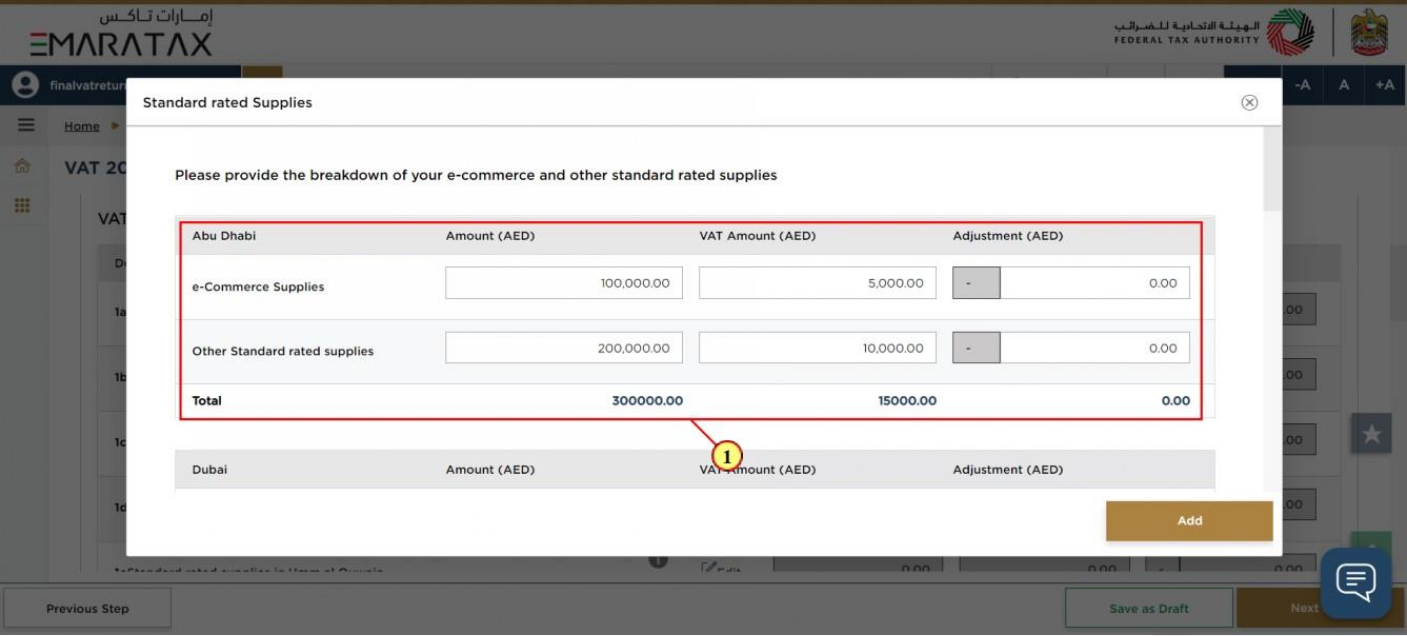

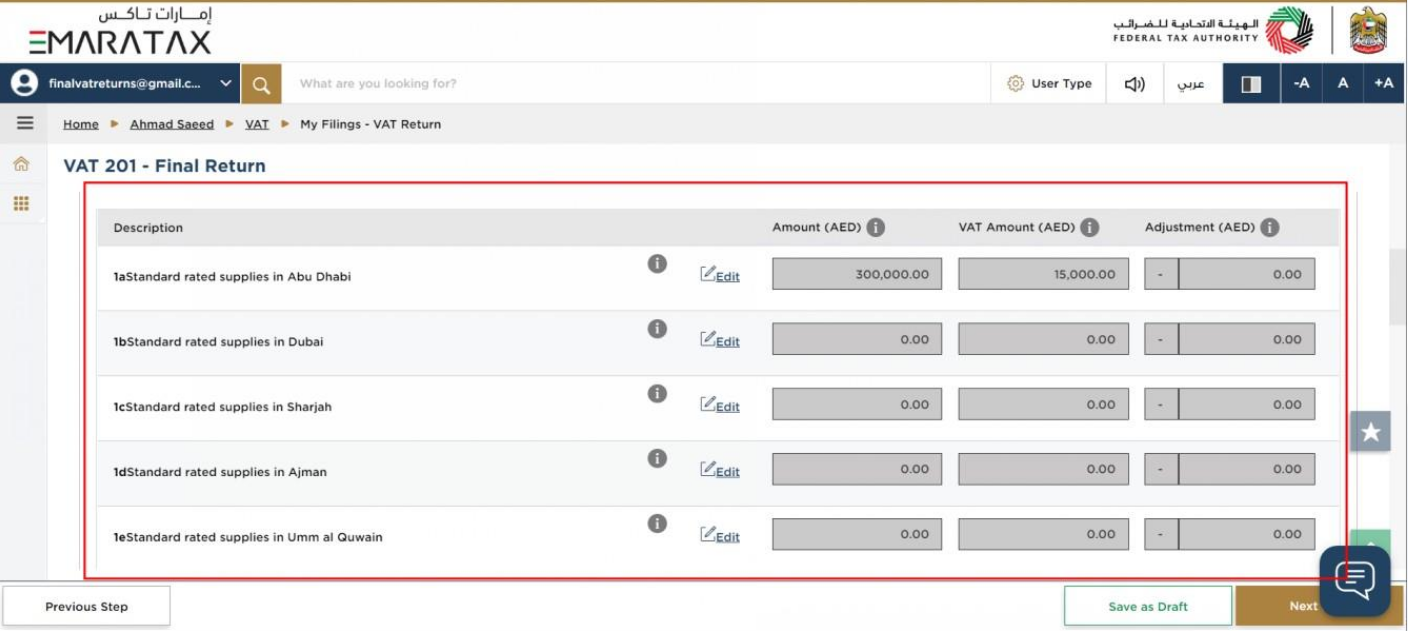

| The standard rated supplies boxes 1a to 1g are read only and you cannot enter the amount (value of supplies), VAT amount and adjustment amount (if any) directly in these boxes. |

Step | Action |

(1) | Click on ‘Edit’ to report your e-commerce and other standard rated supplies by Emirate. |

Step | Action |

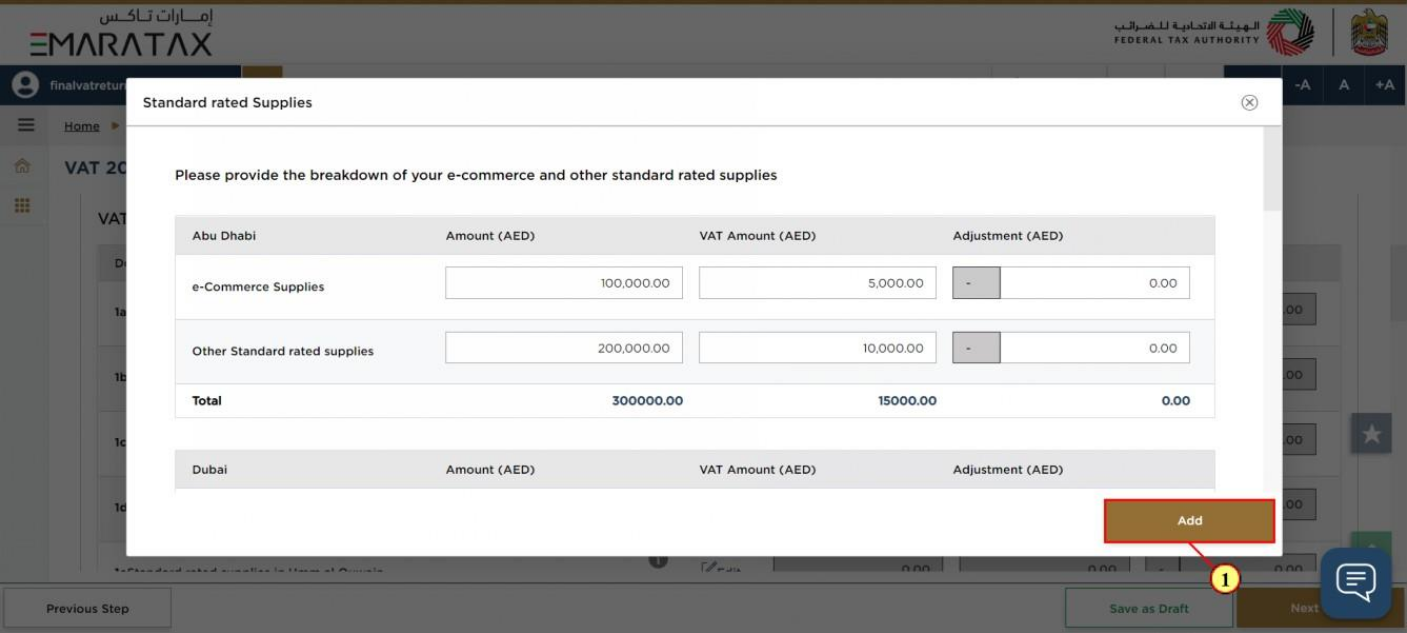

(1) | Enter the amount (value of supplies), VAT amount and adjustment amount (if any) for e- commerce and other standard rated supplies by Emirate. |

Step | Action |

(1) | Click on ‘Add’ |

| The standard rated supplies for the corresponding Emirate are auto-calculated as the sum of the amounts entered in the boxes for e-commerce supplies and other standard rated supplies, by Emirate. |

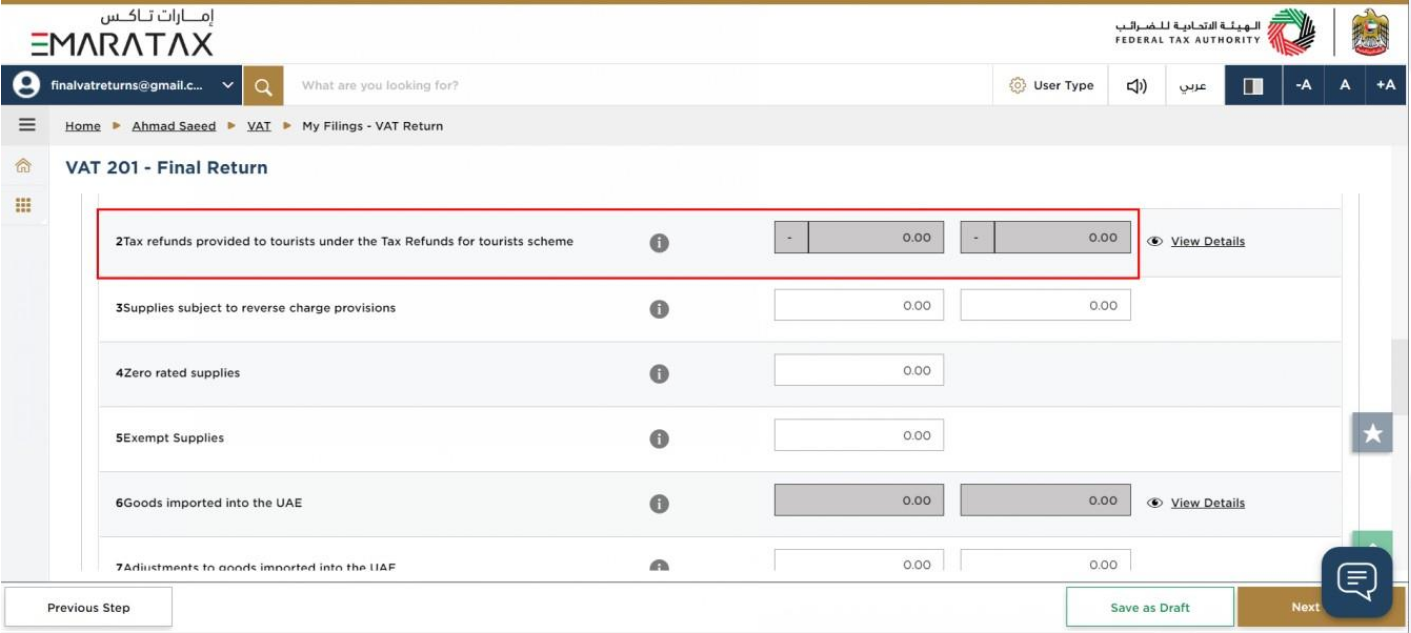

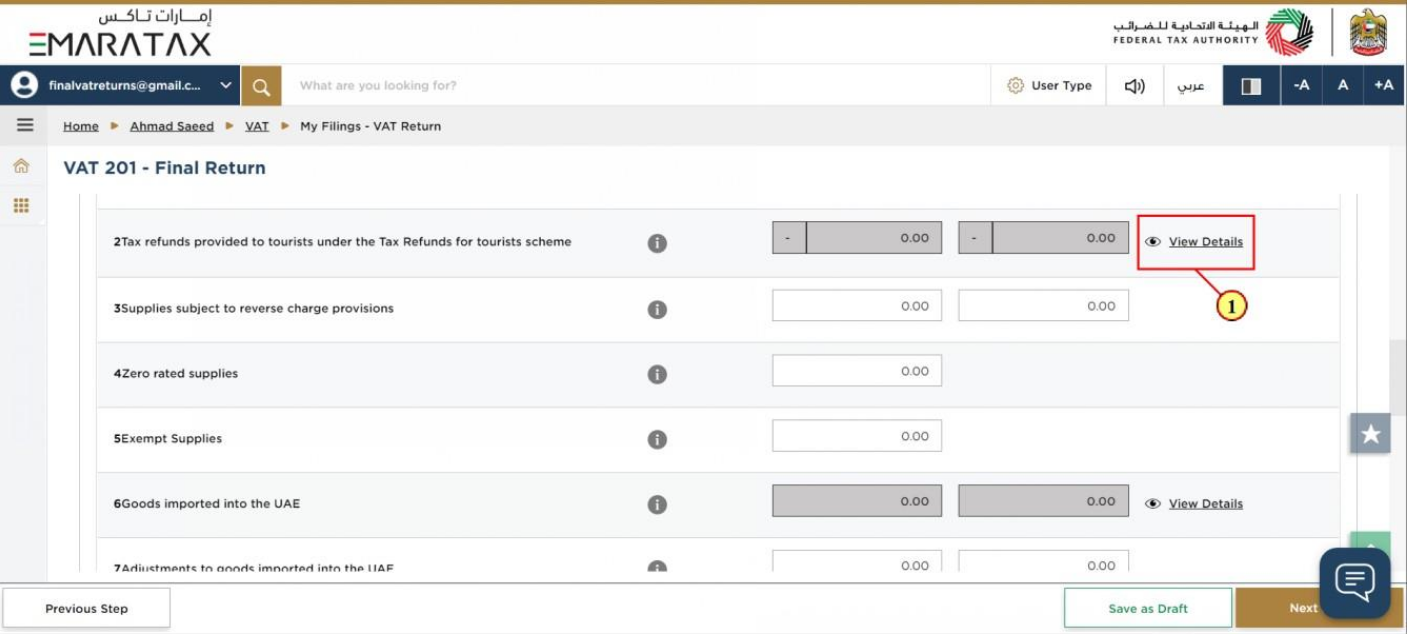

| Box 2 is pre-populated from Planet Tax Free system for Registrants that are registered for the Tourist Refund Scheme |

Step | Action |

(1) | Click here to view the invoice details received from Planet Tax Free |

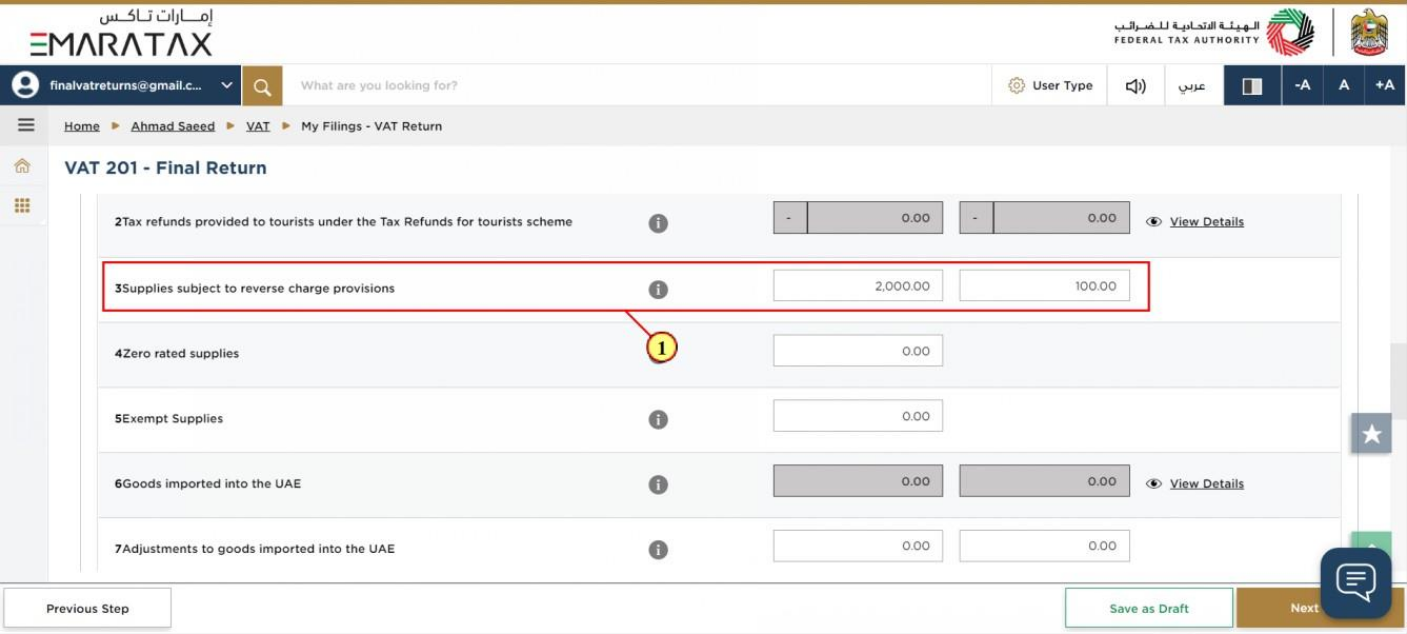

Step | Action |

(1) | Fill box 3 with amount and VAT amount. |

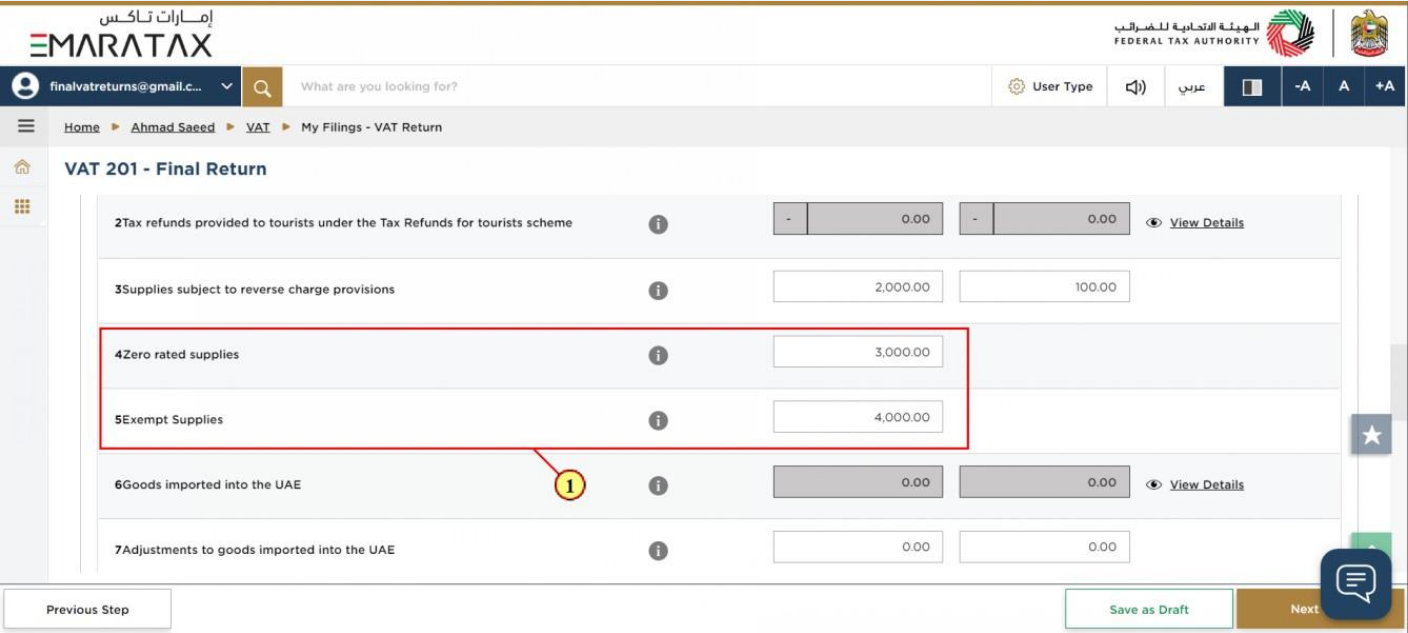

Step | Action |

(1) | Fill box 4 and box 5 with amount |

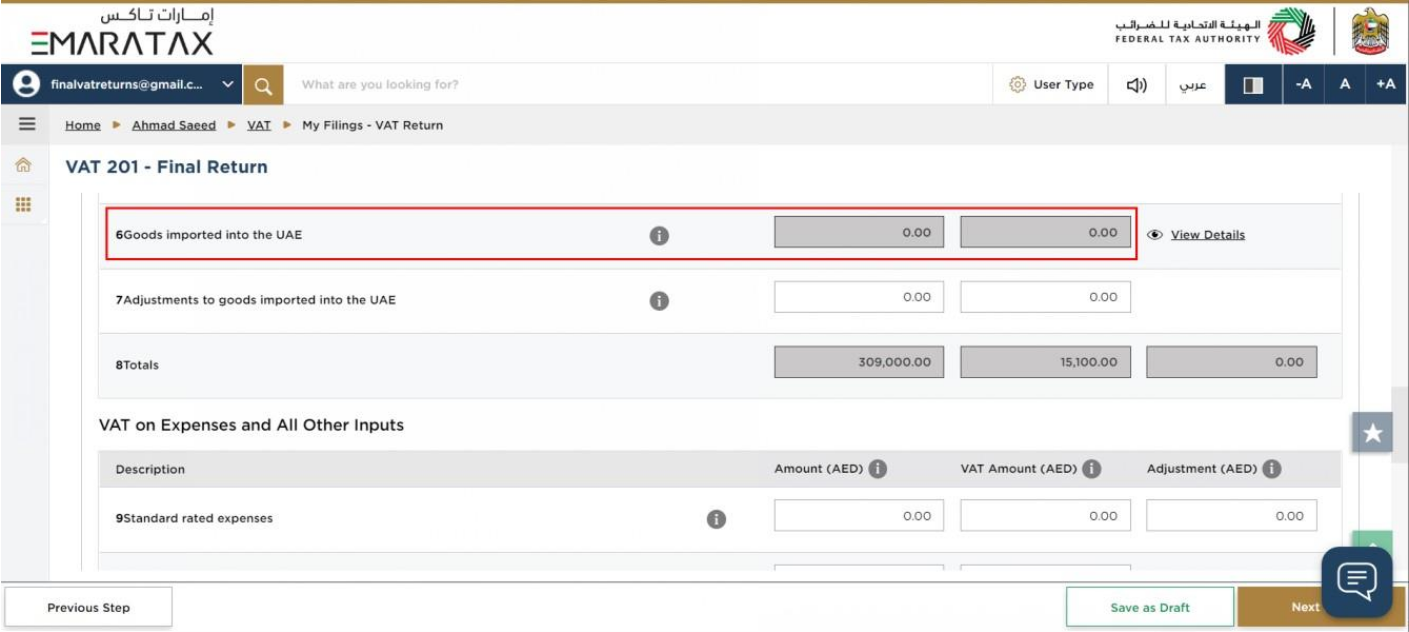

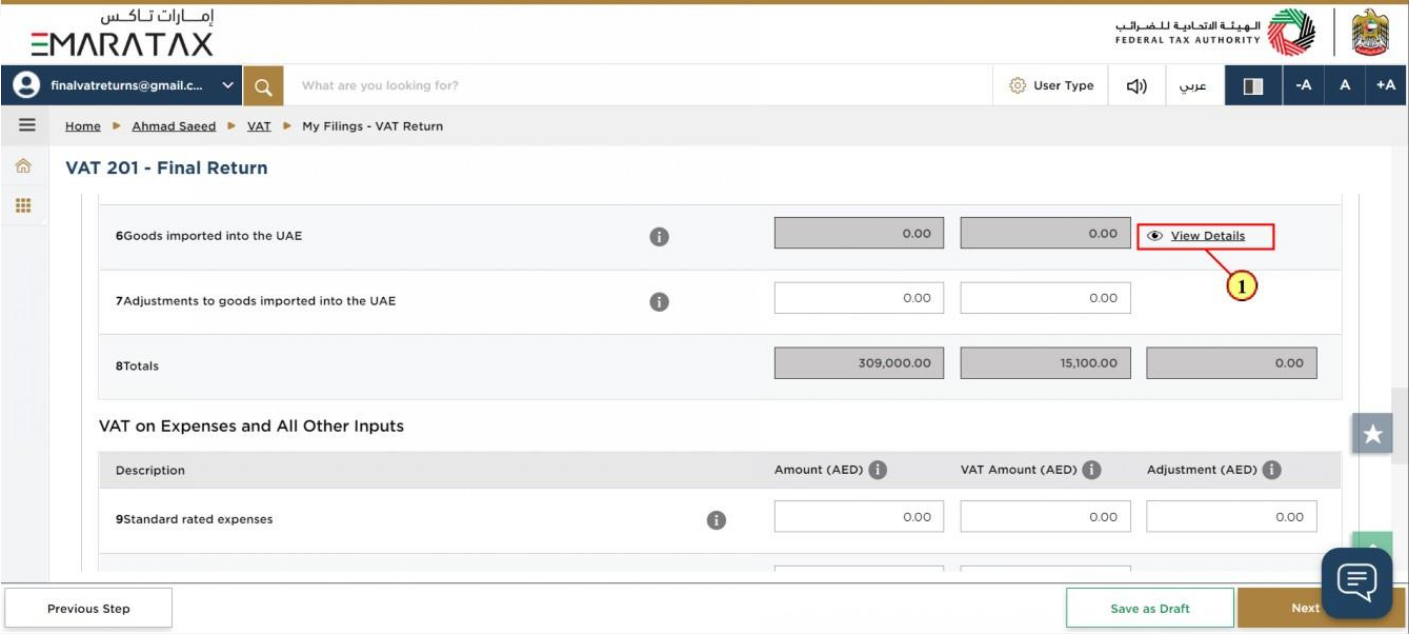

| Box 6 is pre-populated based on the data received from customs |

Step | Action |

(1) | Click here to get the detailed view of Goods imported into the UAE |

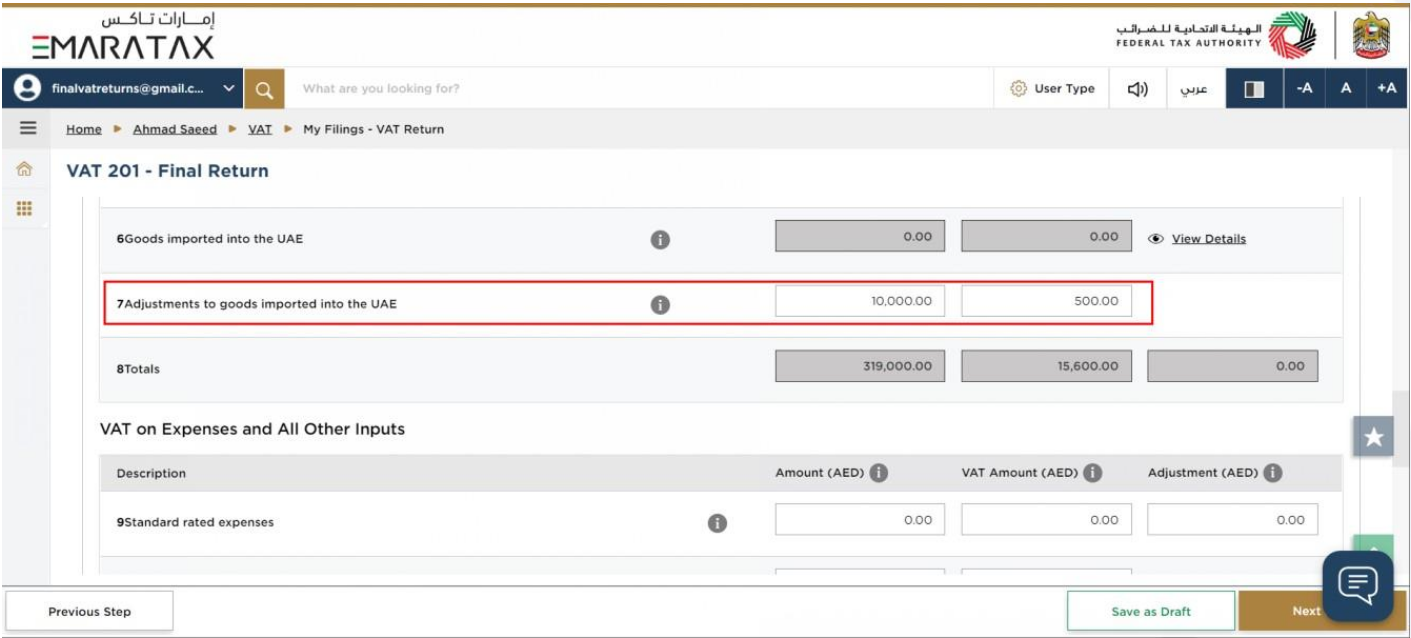

| Box 7 should be used if the information that is prepopulated in Box 6 regarding goods imported into the UAE is incomplete or incorrect. In such case, use this box to make adjustments accordingly. |

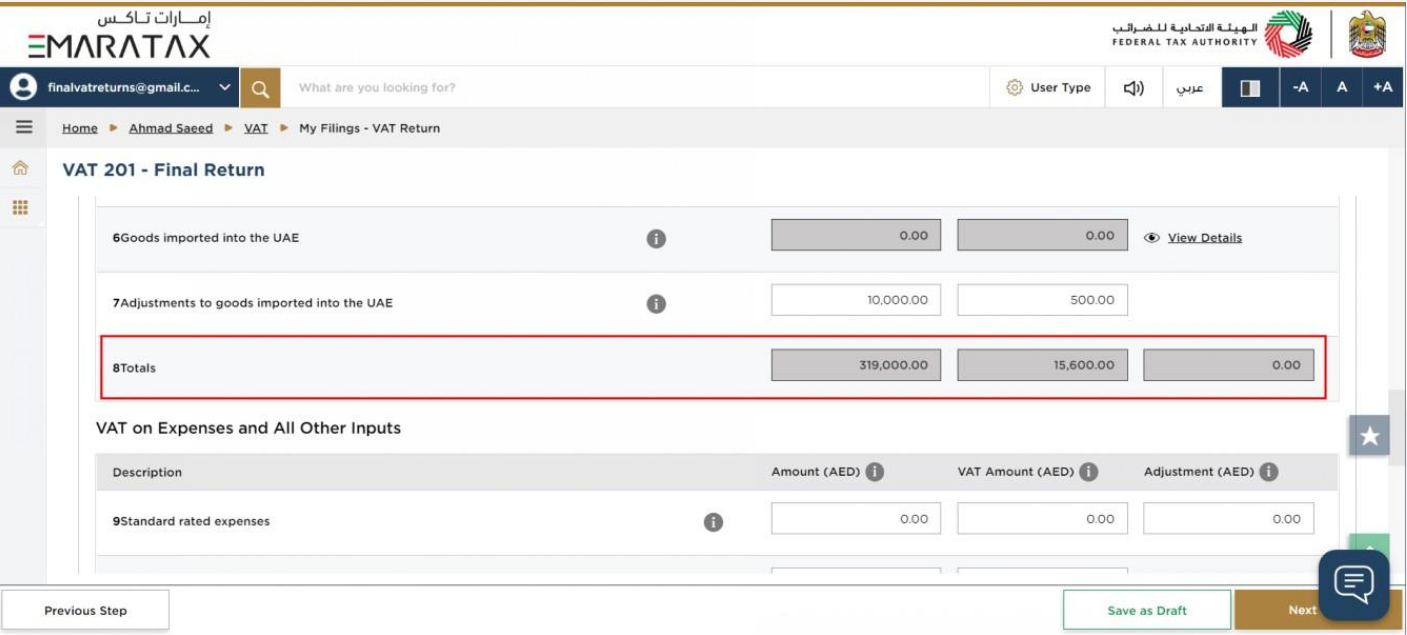

| Box 8 is the total of box 1 to box 7 which is your total output for the Tax Period |

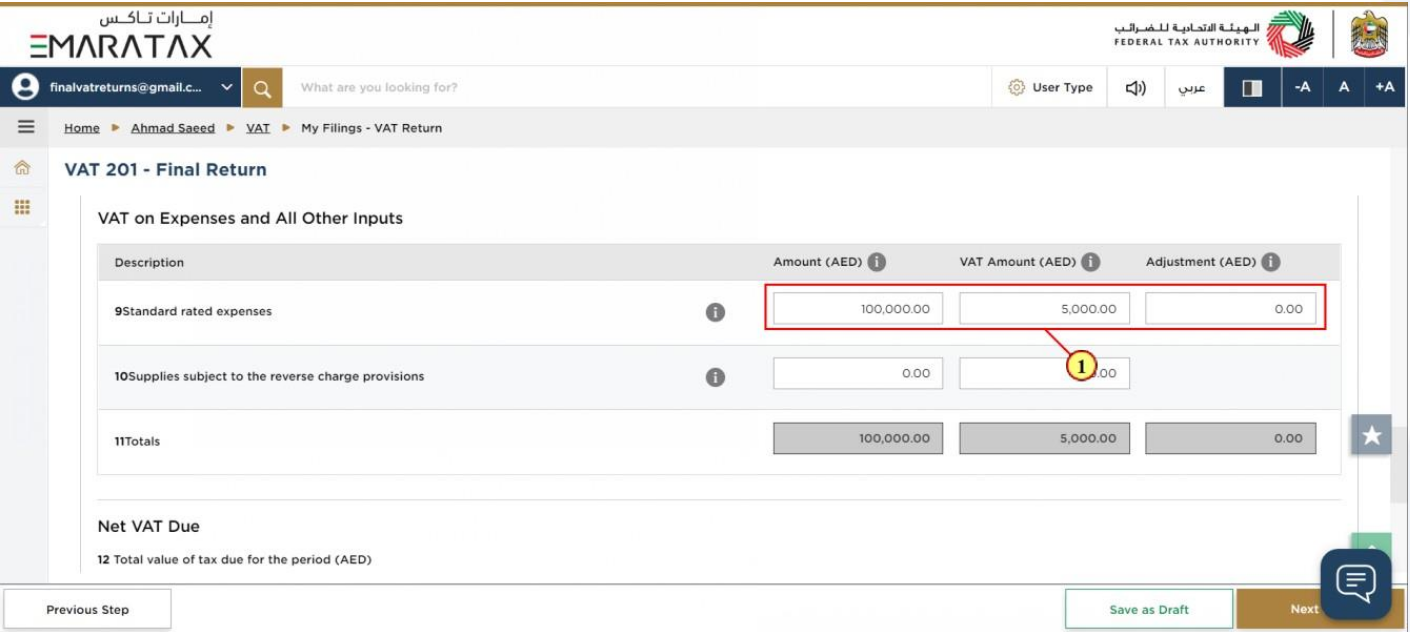

Step | Action |

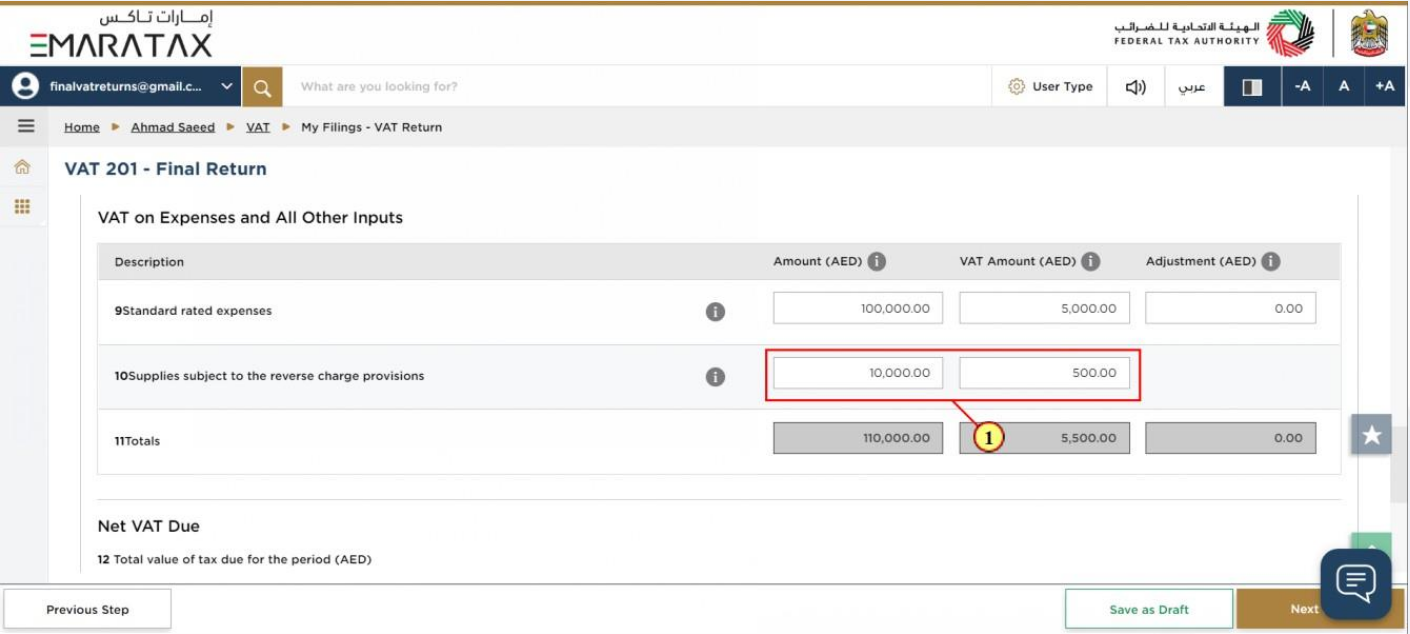

(1) | Enter the amount, corresponding VAT amount and adjustment amount for your standard rated expenses for the period. |

Step | Action |

(1) | Enter the amount and corresponding VAT amount for supplies that are subject to the reverse charge |

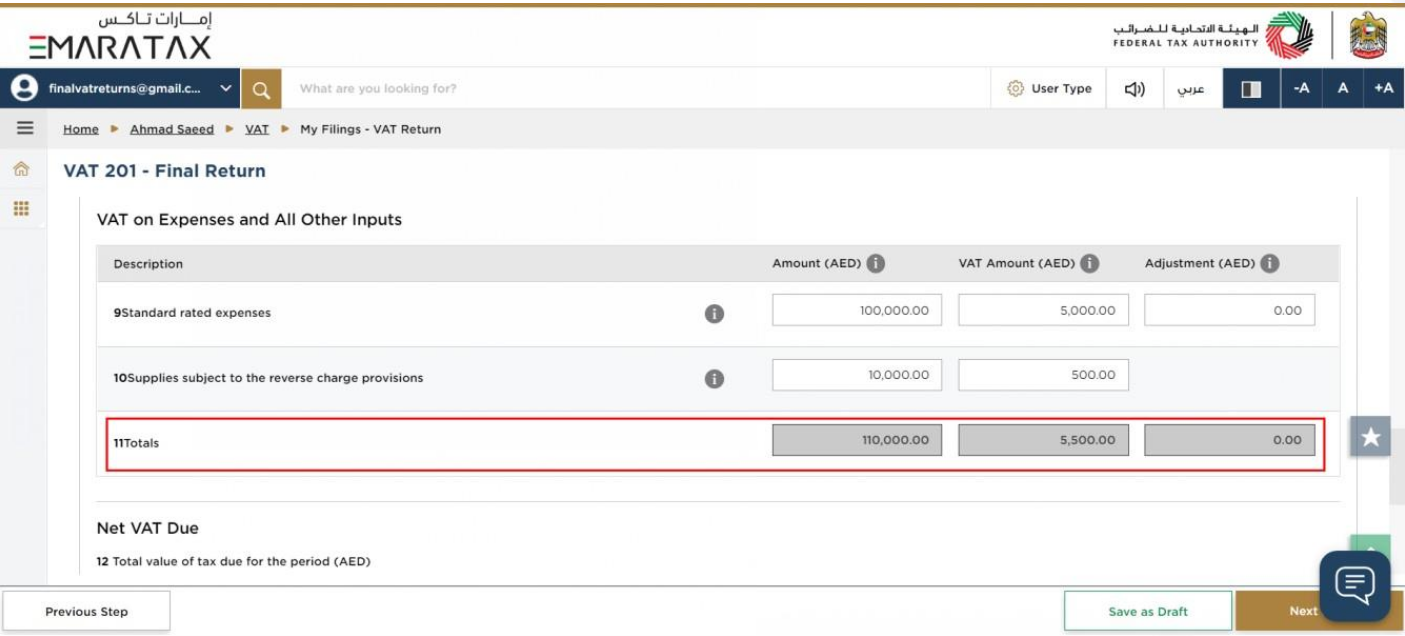

| Box 11 is auto-calculated and displays your total inputs for the Tax Period |

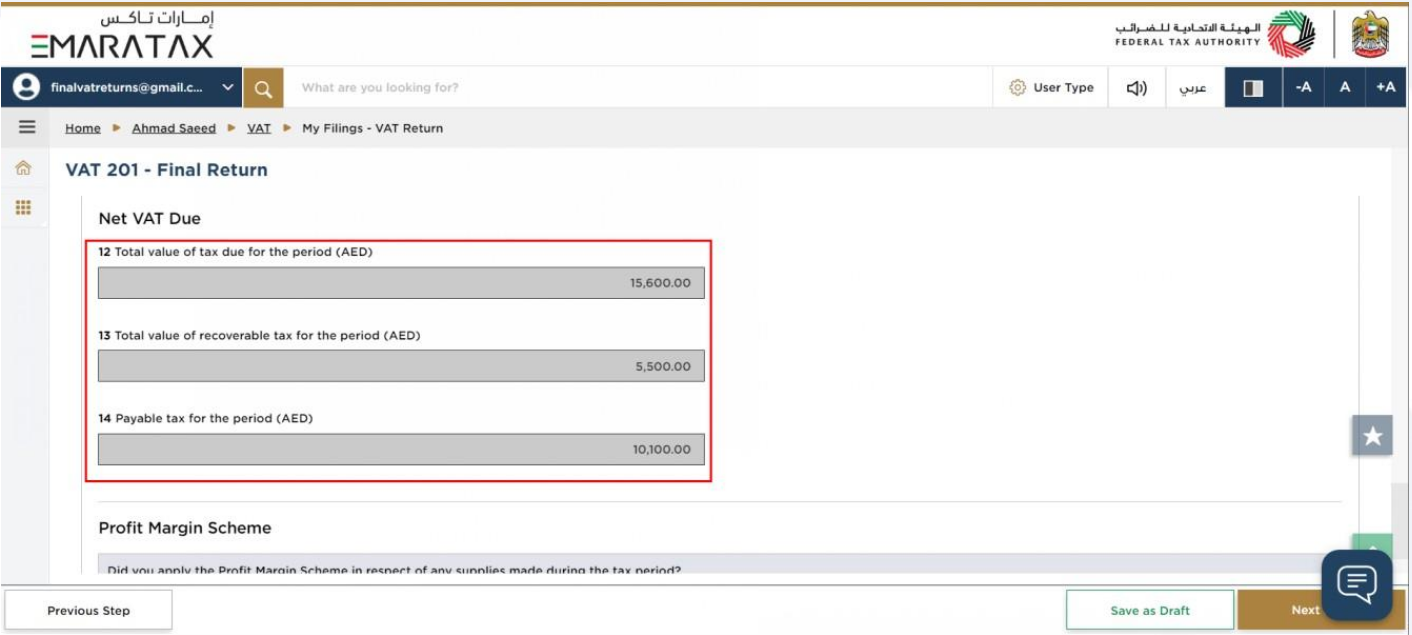

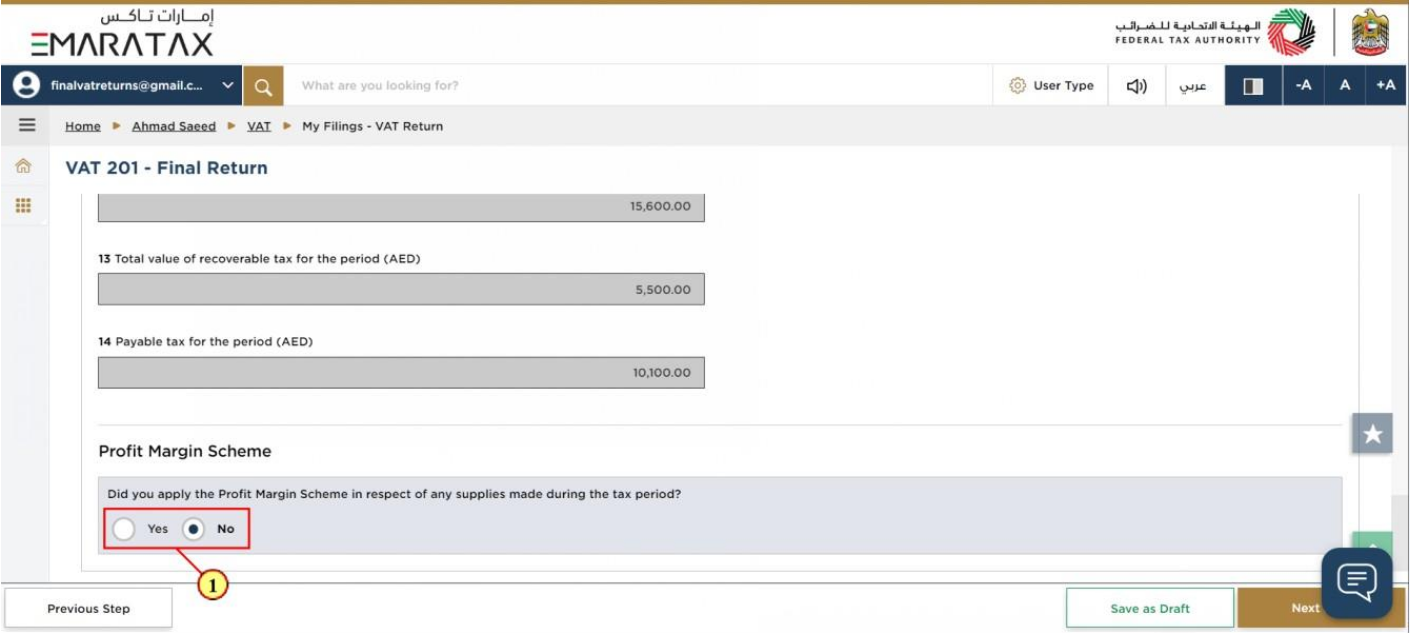

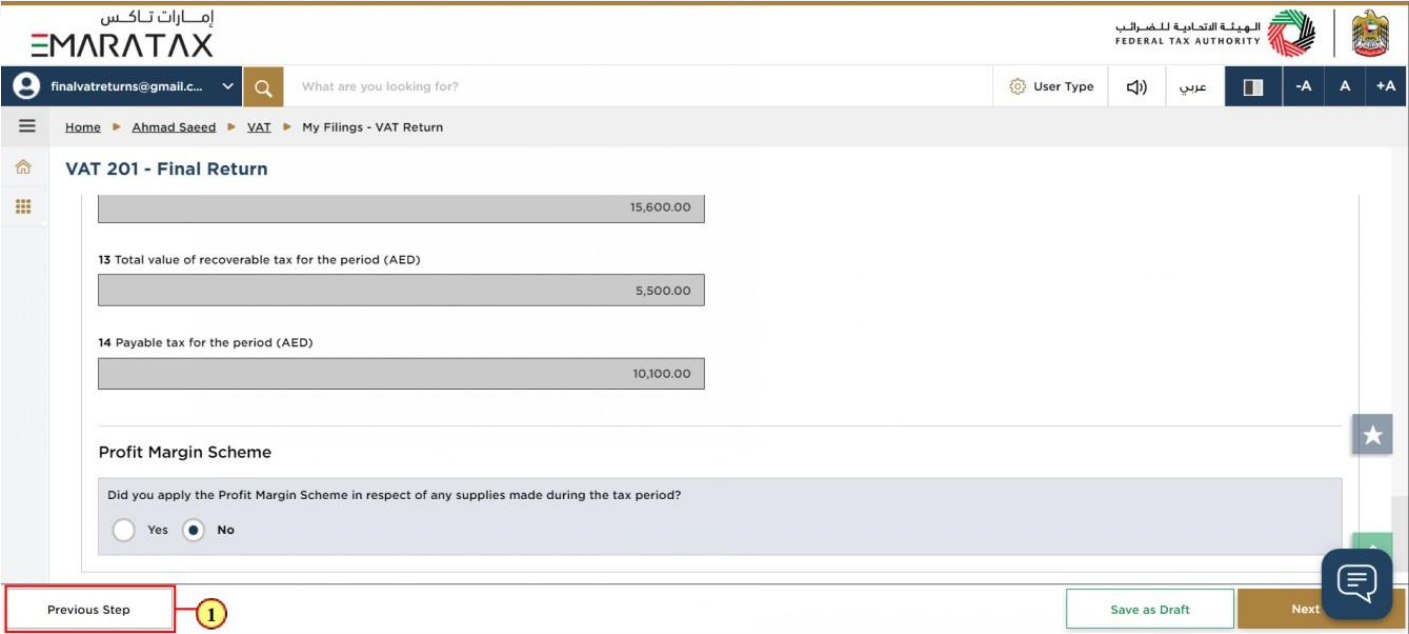

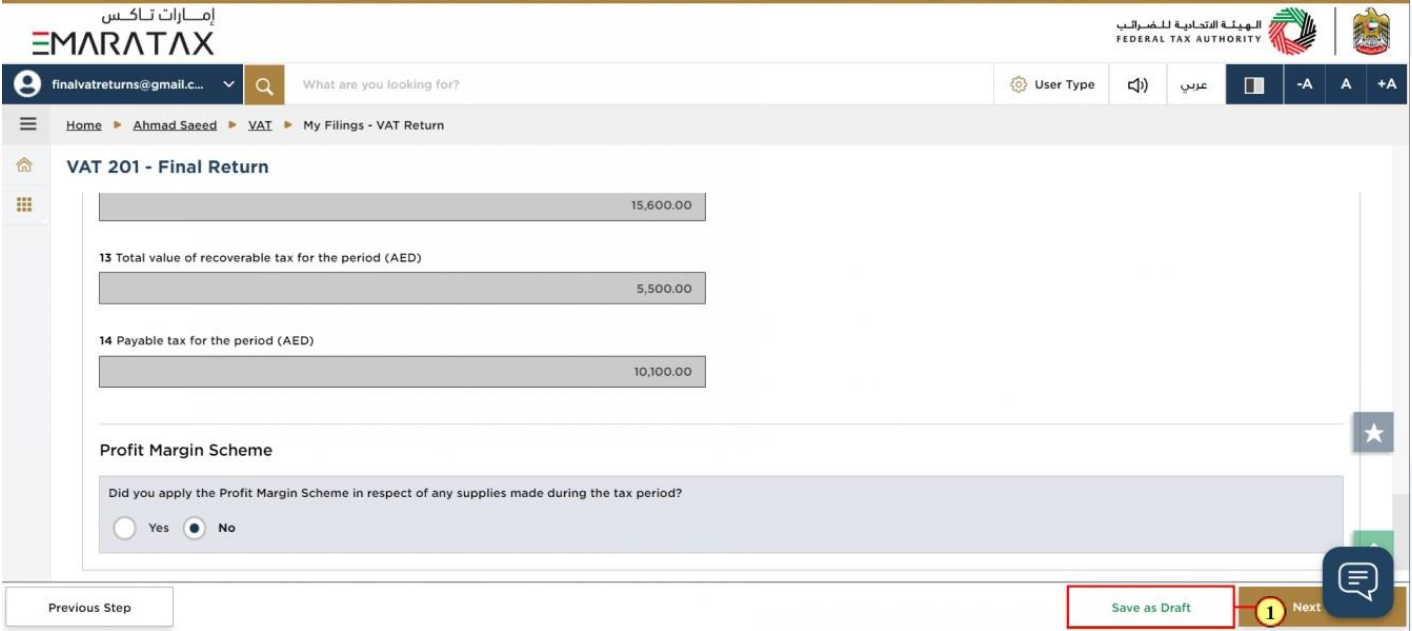

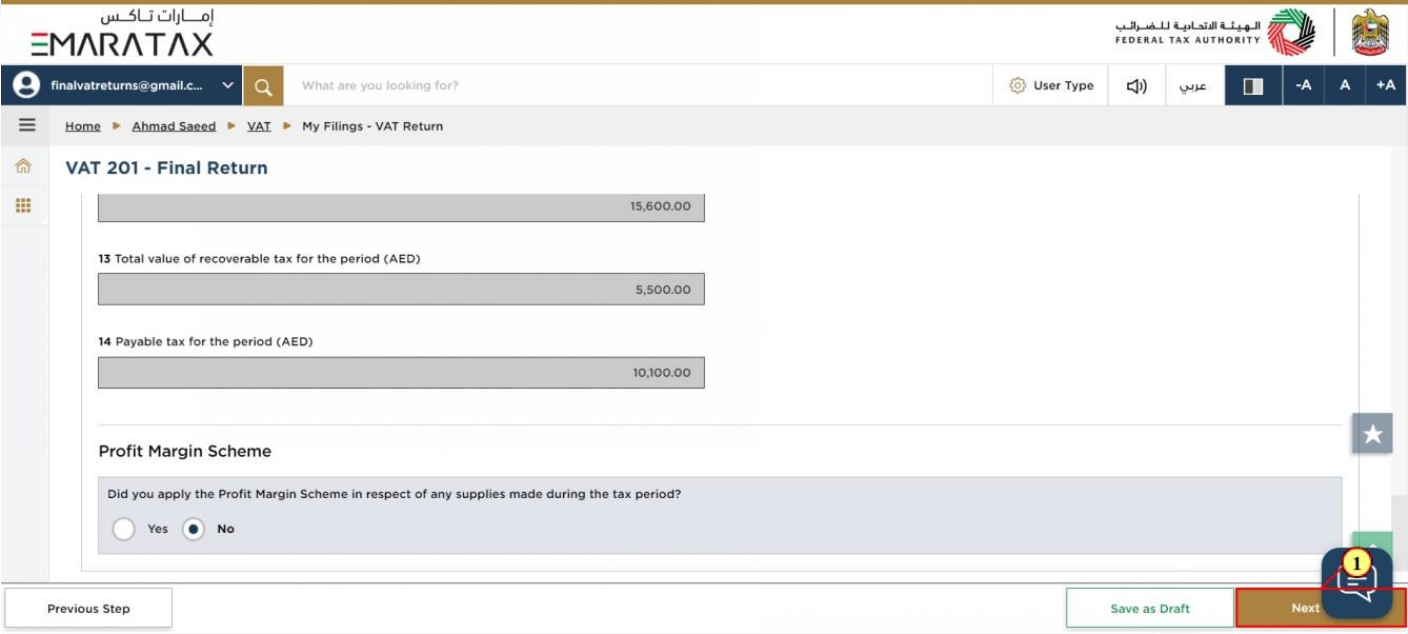

| Box 12 displays the total output tax for the period. Box 13 displays the total input tax for the period and box 14 displays the payable and (or) refundable tax for the period. |

Step | Action |

(1) | Select 'Yes' if you have reported amounts using the 'Profit Margin Scheme |

Step | Action |

(1) | Click on 'Previous Step' to go back to the previous section |

Step | Action |

(1) | Click on 'Save as draft' to save the final VAT Return as a draft |

Step | Action |

(1) | Click on 'Next Step' to proceed to the next section |

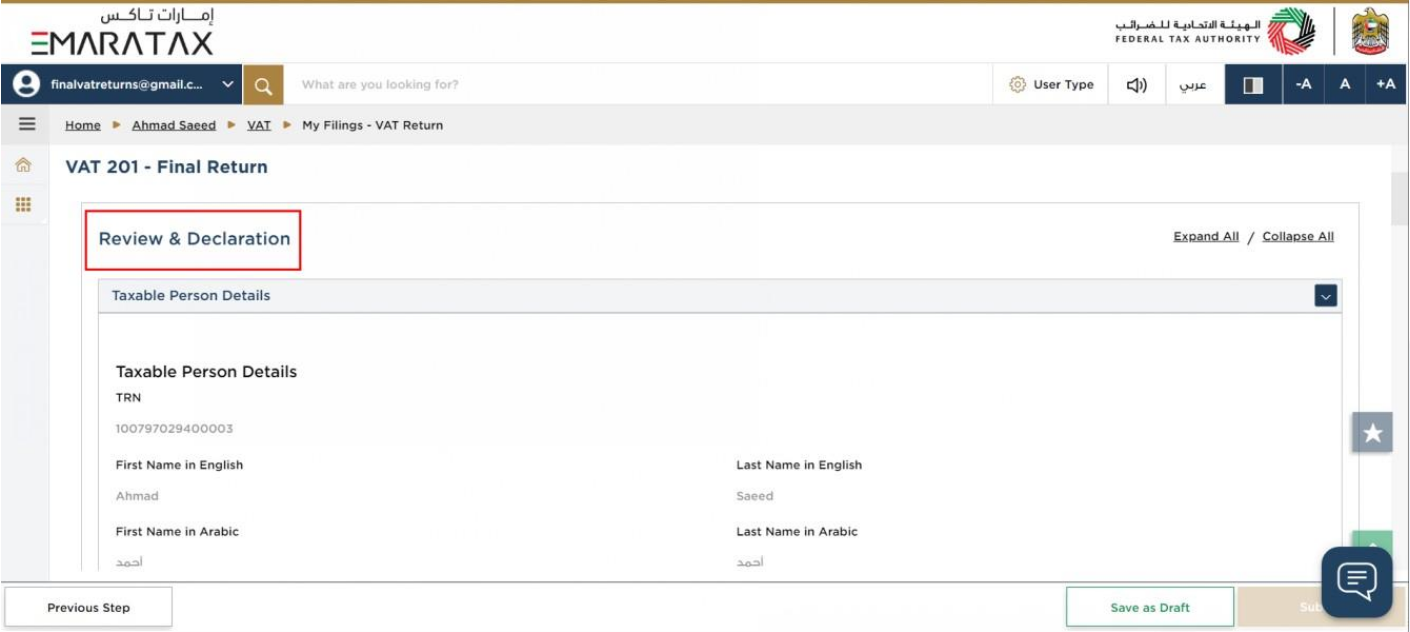

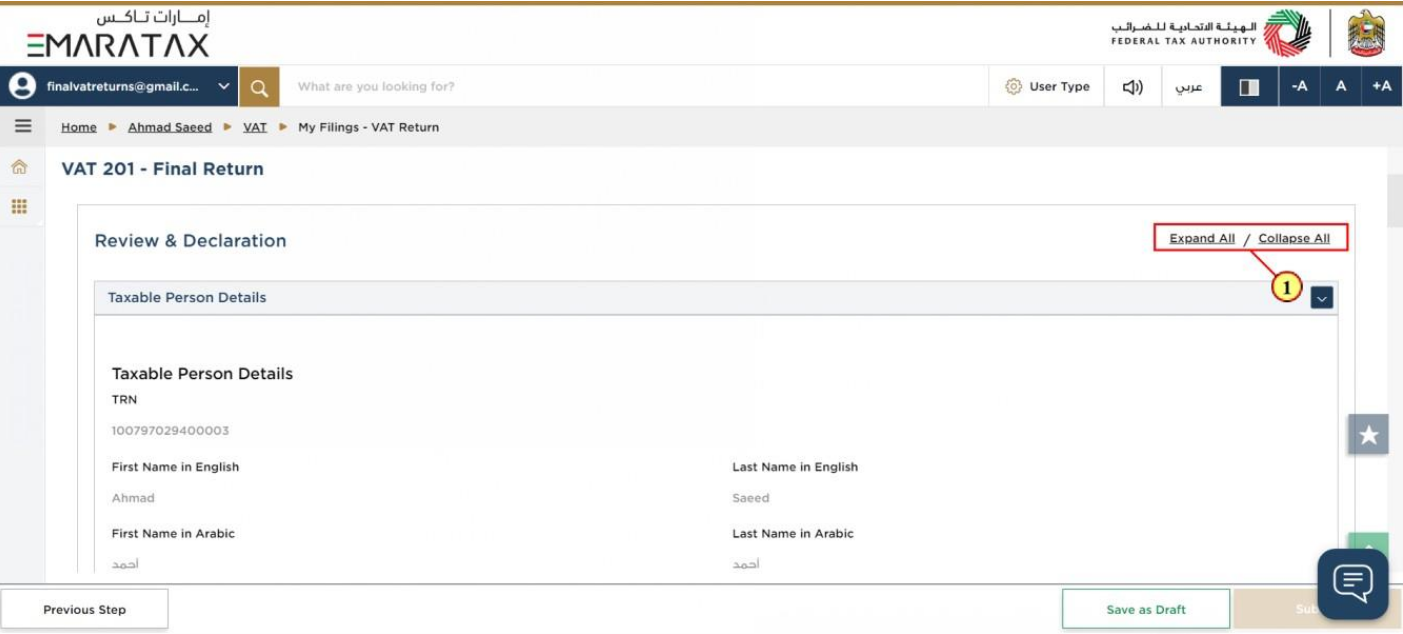

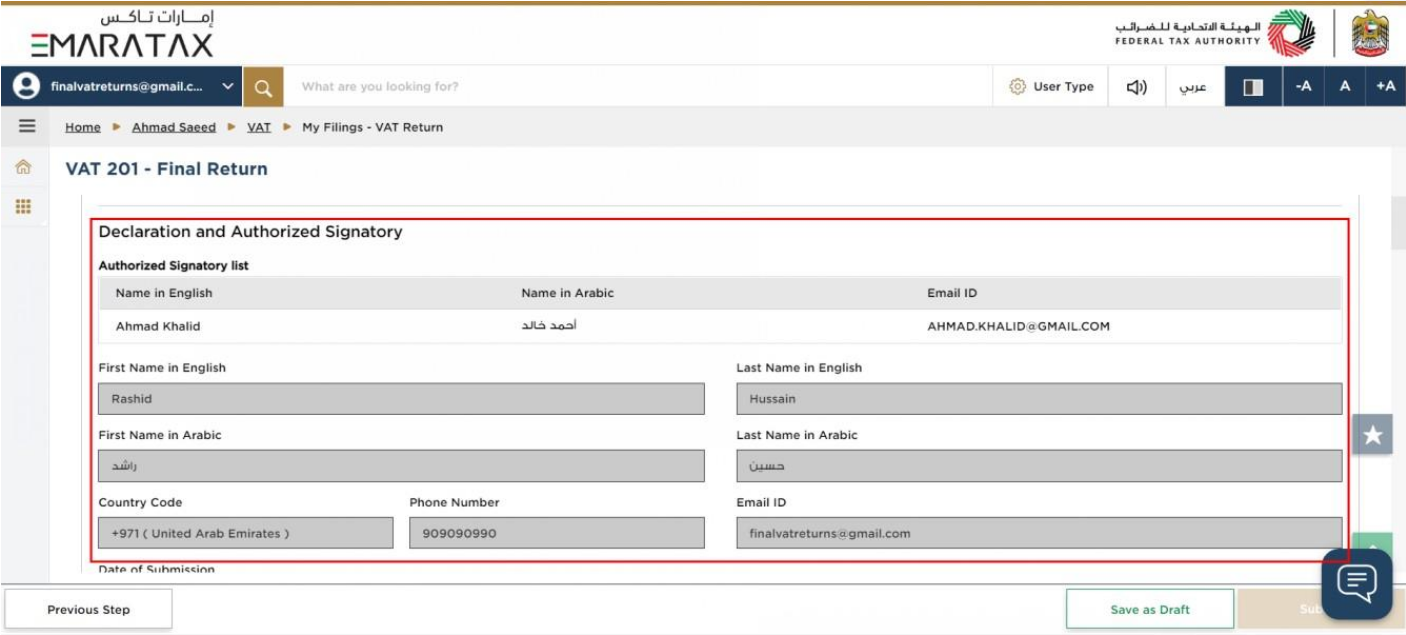

12. Review and Declaration

| This section displays your completed return and allows you to review it prior to submission |

Step | Action |

(1) | Click here to expand or collapse all steps at once |

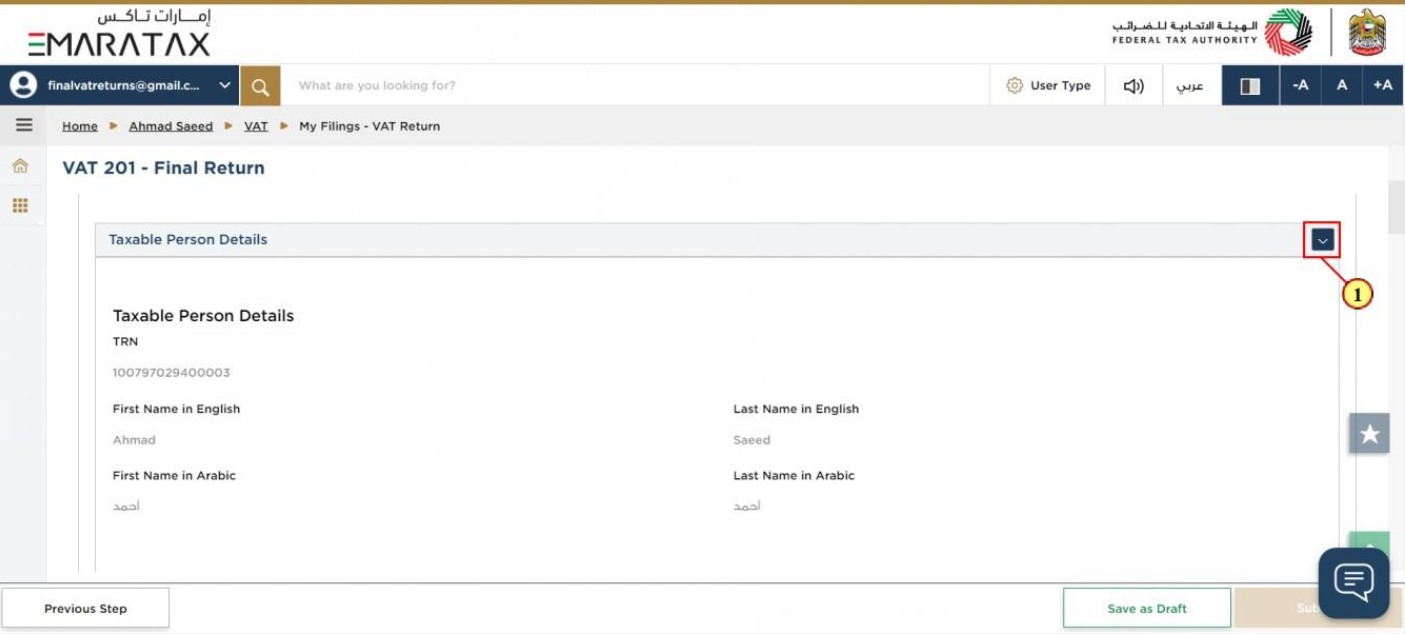

Step | Action |

(1) | Click here to expand or collapse each section |

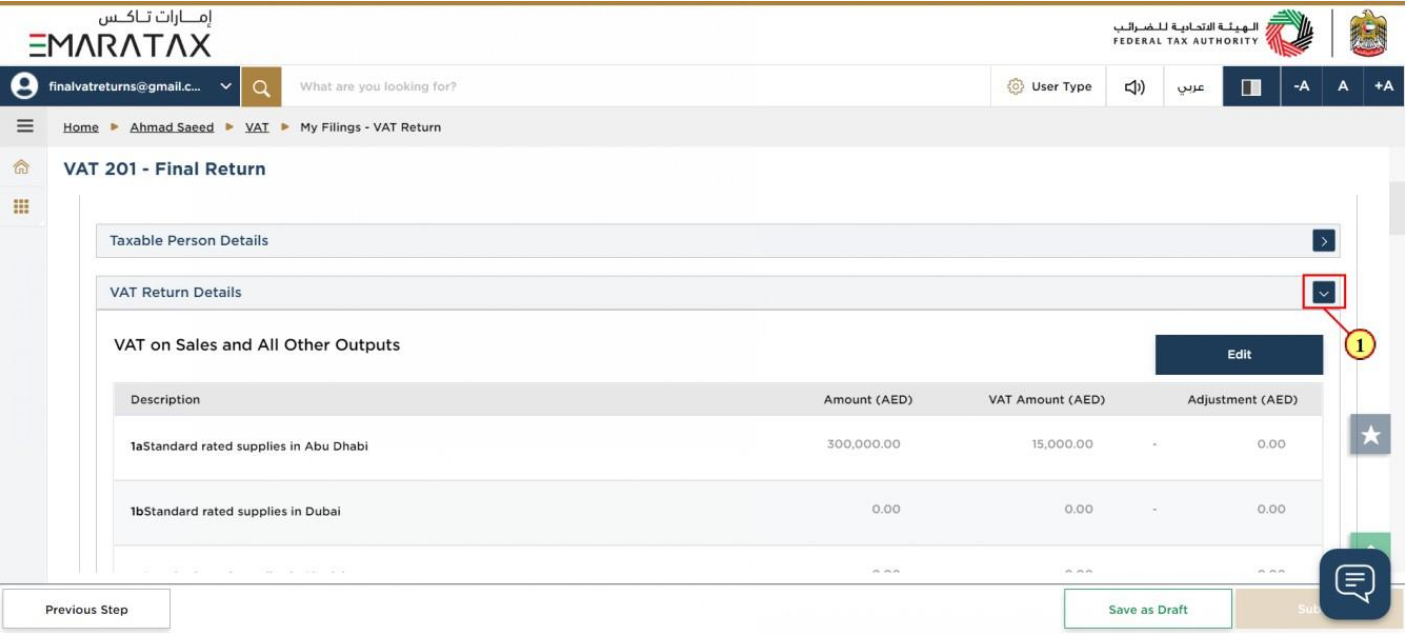

Step | Action |

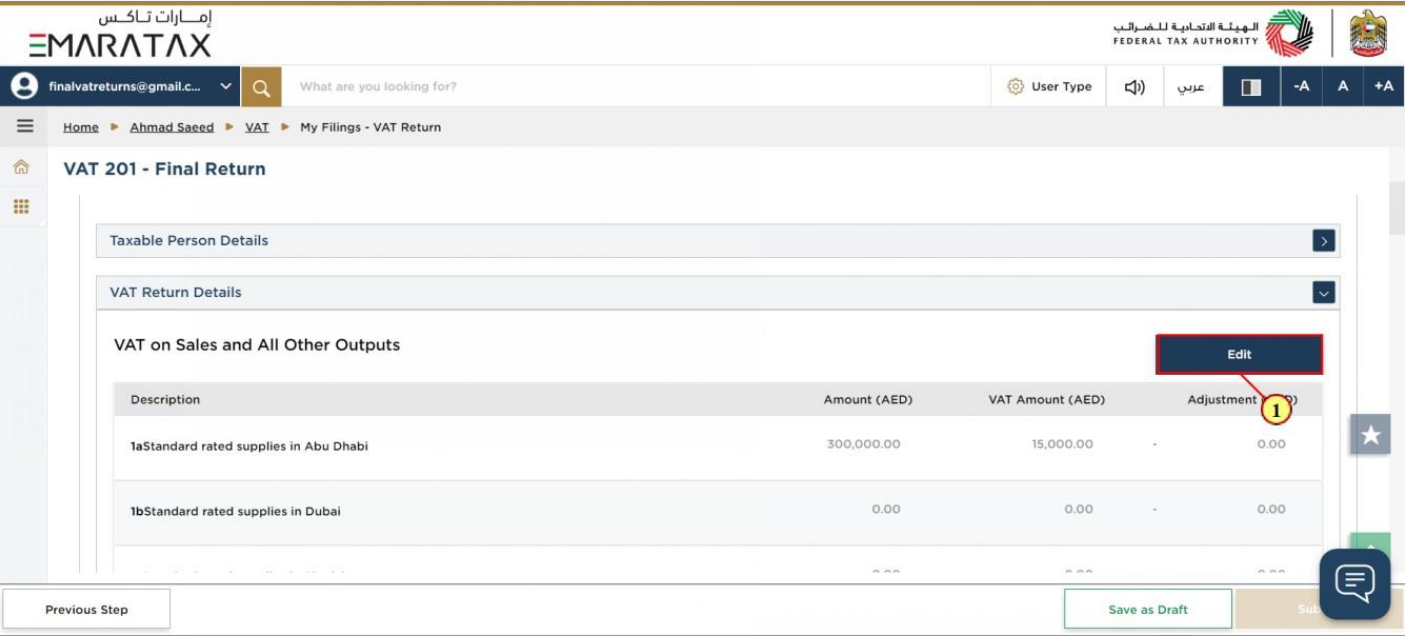

(1) | Click on each step to review every section |

Step | Action |

(1) | Click here to edit the VAT Return |

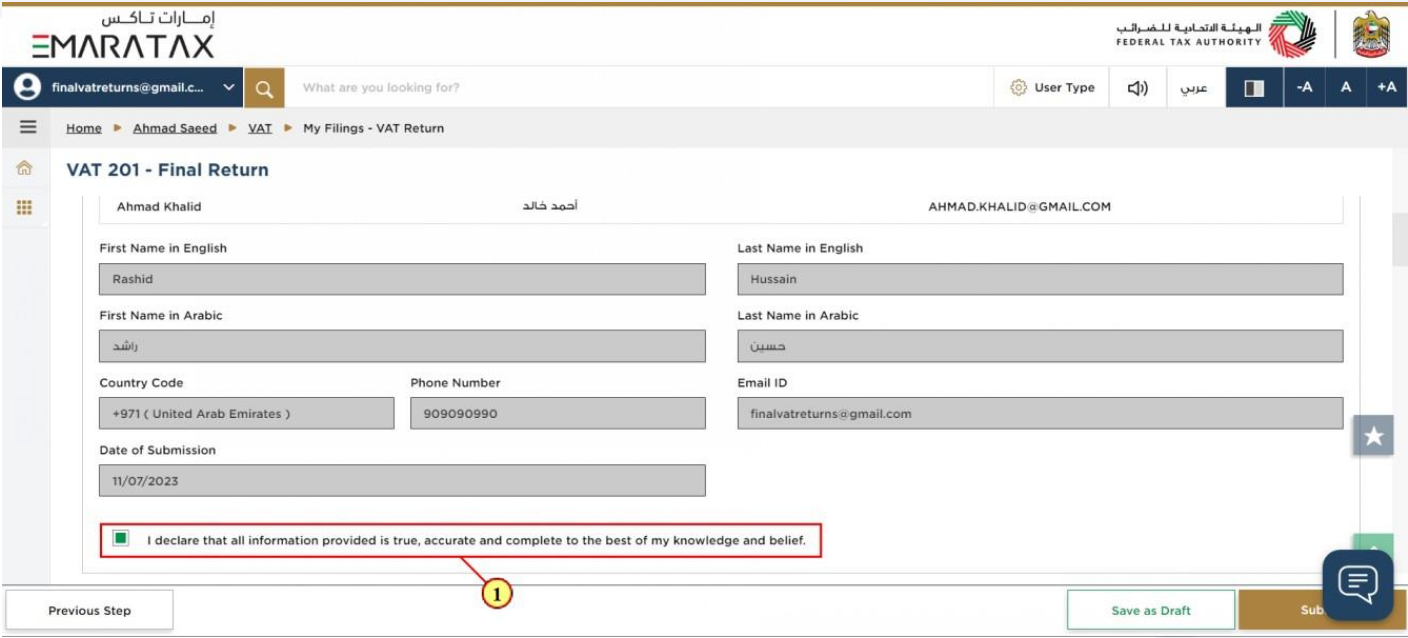

| The Declaration and Authorized Signatory details are pre-populated from your VAT Registration |

Step | Action |

(1) | Mark the checkbox to confirm that you have reviewed the final VAT Return |

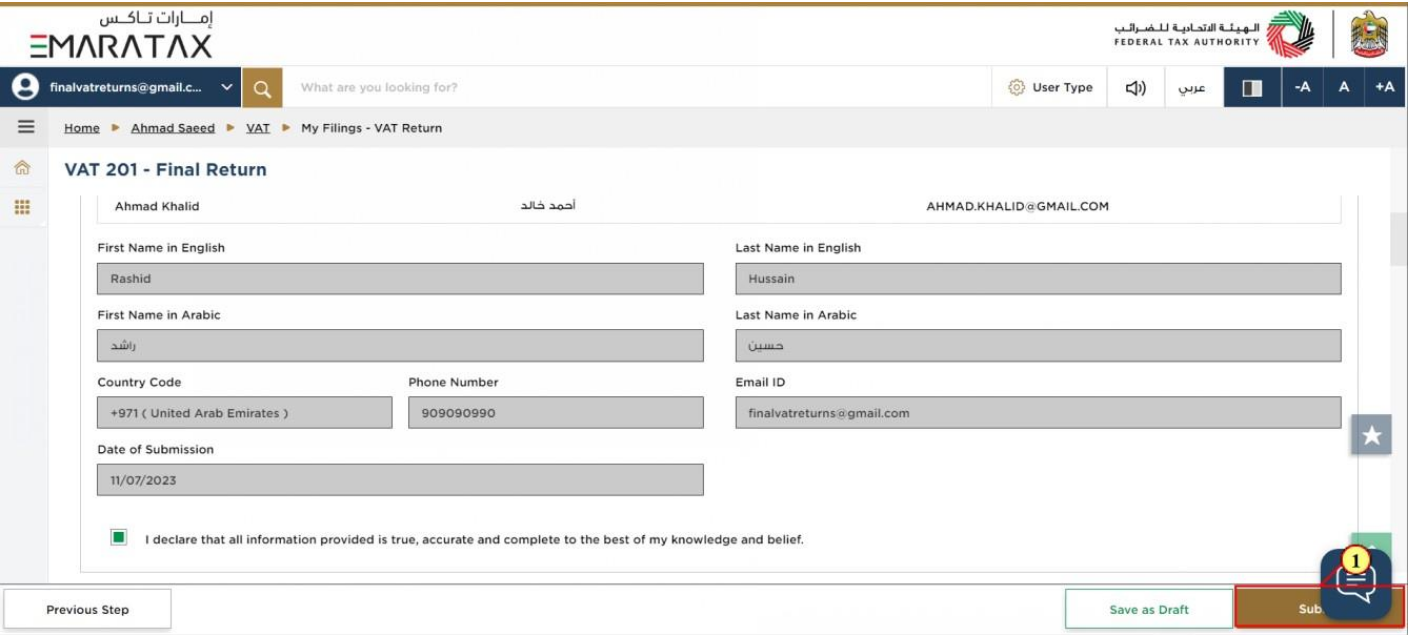

Step | Action |

(1) | Click on 'Submit' to submit the final VAT Return. |

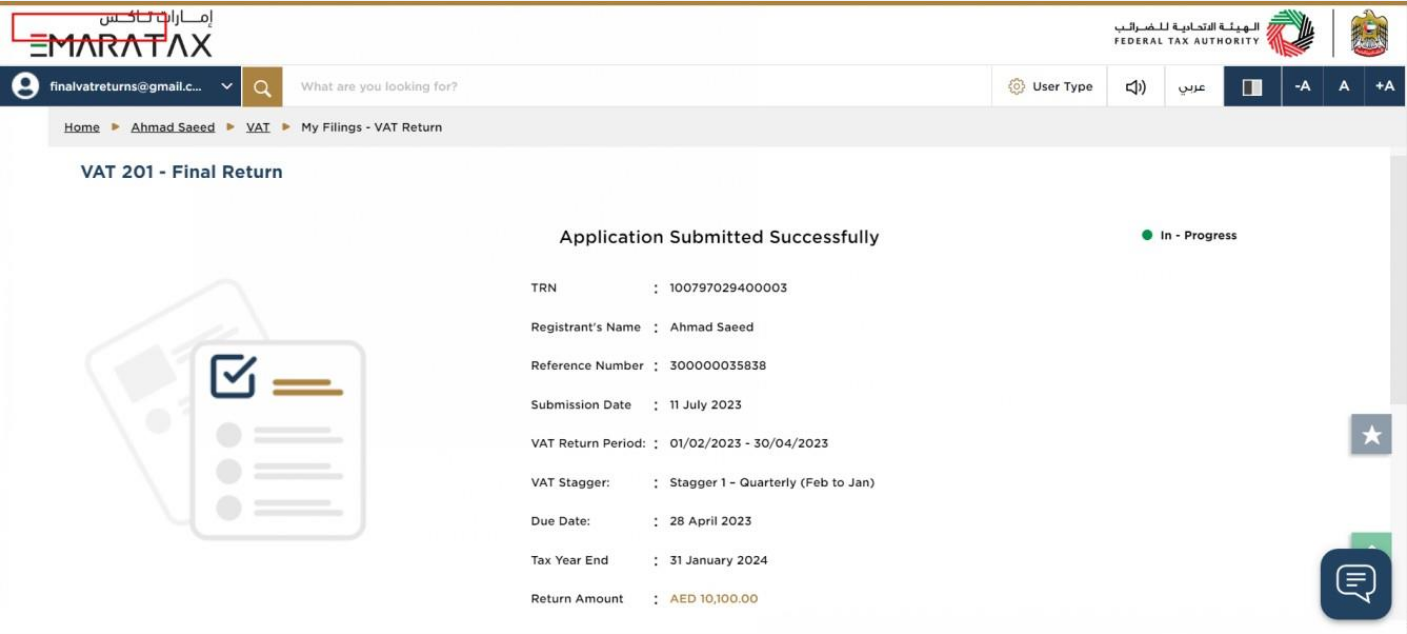

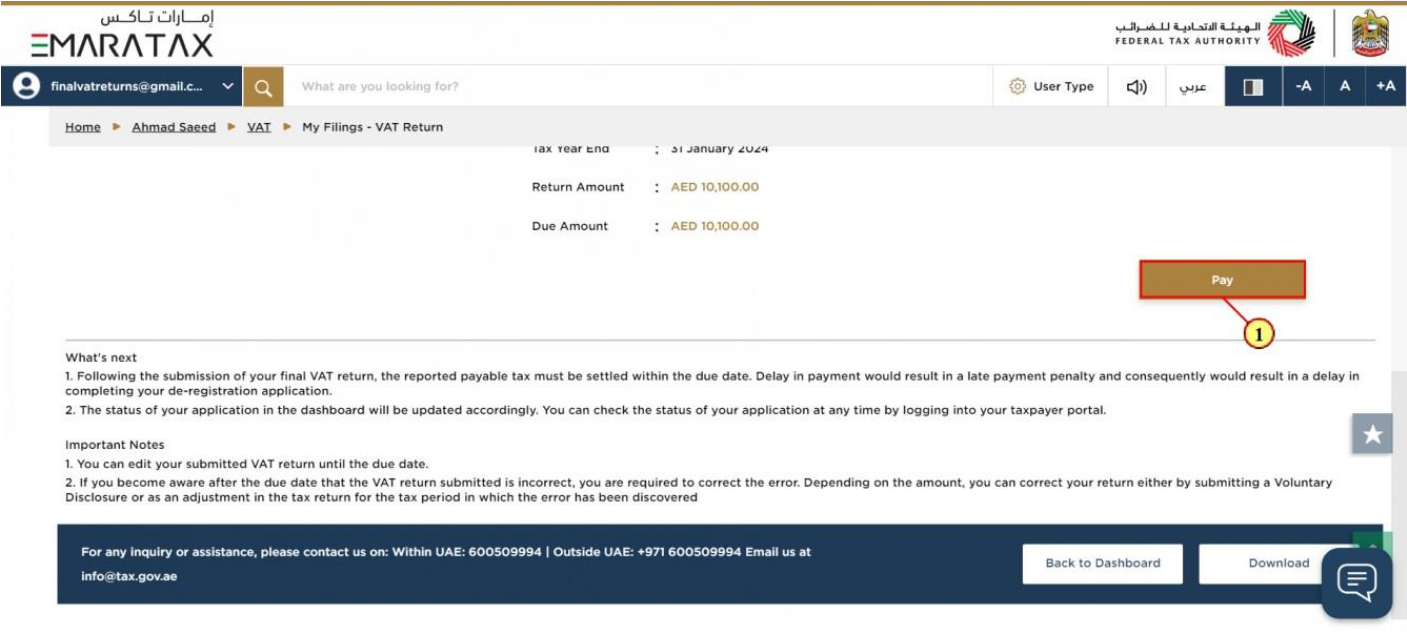

| You have successfully submitted the application! Make a note of the reference number for future references. You can also access this VAT Return from the VAT Return tile, within the VAT module. |

Step | Action |

(1) | Click on 'Pay' to pay the due amount |

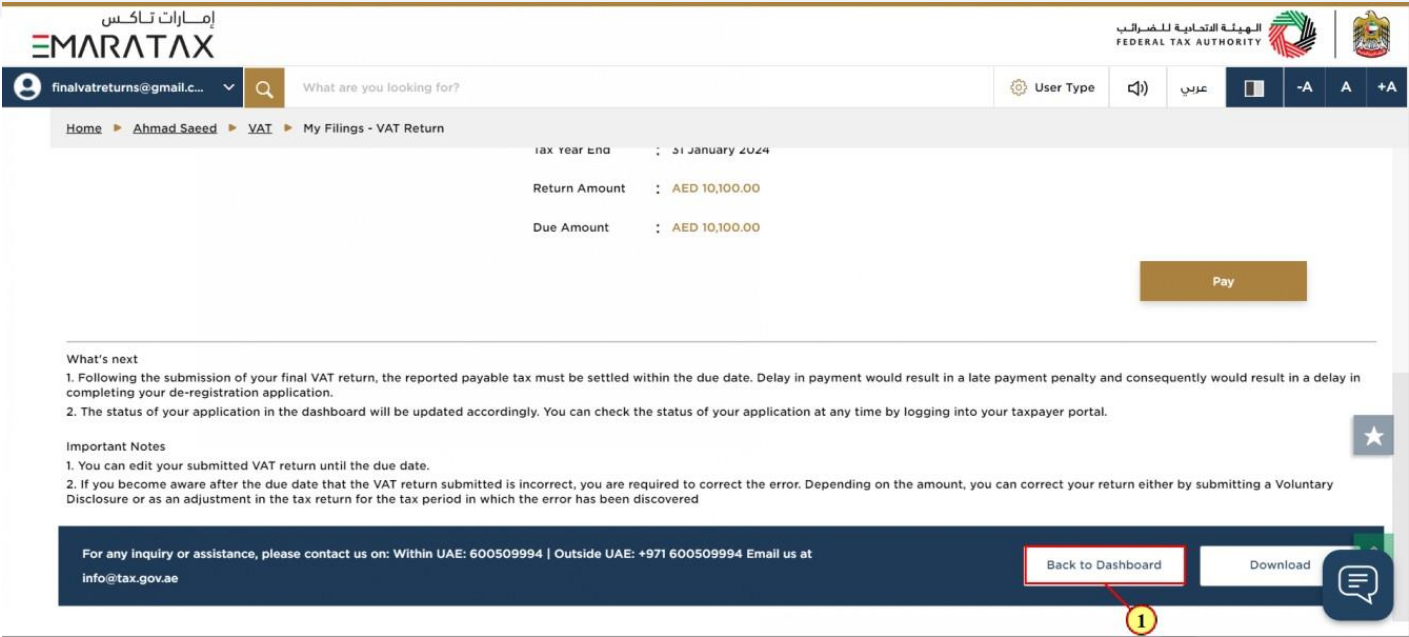

Step | Action |

(1) | Click on 'Back to Dashboard' to go back to dashboard. |

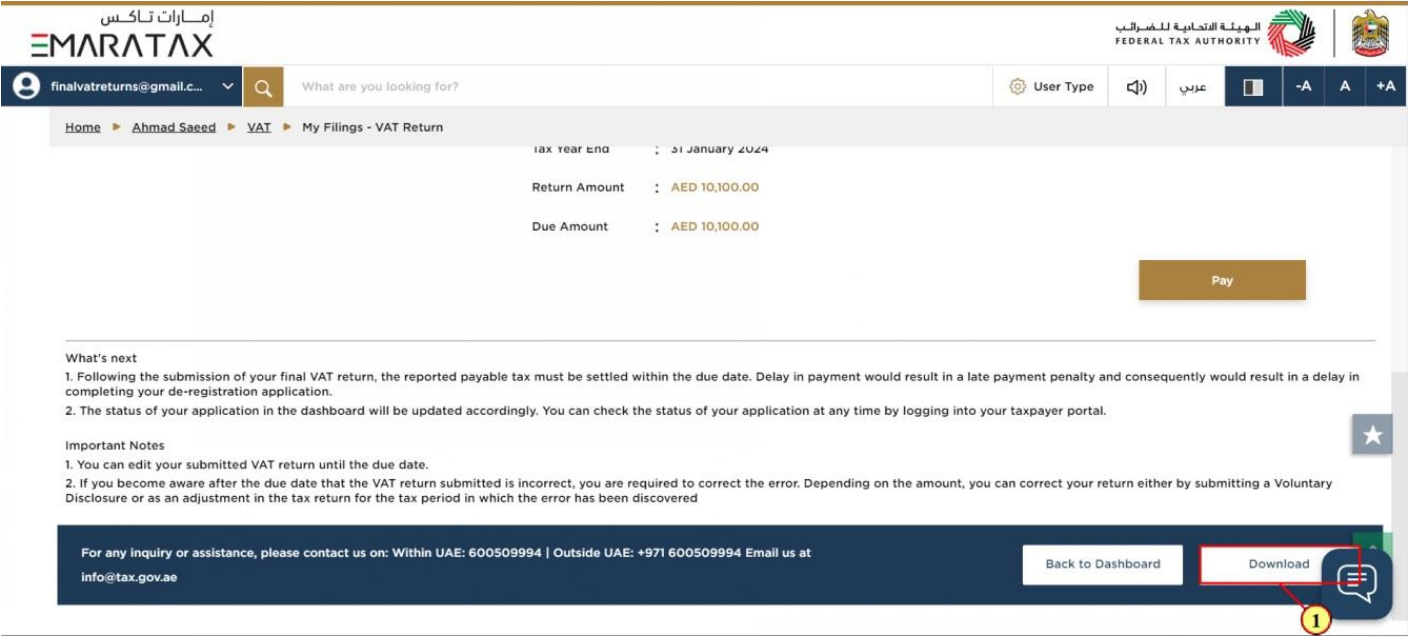

Step | Action |

(1) | Click on 'Download' to download a copy of submitted VAT Return acknowledgement. |

13. Correspondences

After submission of the Final VAT Return for e-commerce reporting, taxpayer receives the following correspondence:

- Return submission acknowledgment