Submit VAT Voluntary Disclosure by VAT Registrant - Oct 2022

User Manual

Submit VAT Voluntary Disclosure for e-commerce reporting

Date: July 2023

Version 1.0.0.0

Contents

1. Document Control Information

2. Annexure - List of other user manuals that can be referred to

3. Navigating through EmaraTax

4. Introduction

8. VAT Module

10. Instructions and Guidelines

15. Acknowledgement

17. Compare Filings

19. Previous Filings

20. VAT Return

21. Correspondences

Document Control Information

Document Version Control

Version No. | Date | Prepared/Reviewed by | Comments |

1.0 | 07-07-2023 | Federal Tax Authority | User Manual for EmaraTax Portal |

Annexure - List of other user manuals that can be referred to

The below are the list of User manuals that you can refer to

S. No | User Manual Name | Description |

1 | Register as Online User | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website and create an EmaraTax account with the FTA. |

2 | Manage online user profile | This manual is prepared to provide you an understanding on Login process, user types, forgot password and modify online user profile functionalities. |

3 | User Authorisation | This manual is prepared to provide you an understanding on Account Admin, Online User, and Taxable Person account definitions and functionalities. |

4 | Taxable person dashboard | This manual is prepared to help the following ‘Taxable person‘ users to navigate through their dashboard in the Federal Tax Authority (FTA) EmaraTax Portal:

|

5 | Link TRN to email address | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website to Link TRN to New Email Address. |

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process

Button | Description |

In the Portal | |

| This is used to toggle between various personas within the user profile such as Taxable Person, Tax Agent, Tax Agency, Legal Representative etc |

| This is used to enable the Text to Speech feature of the portal |

| This is used to toggle between the English and Arabic versions of the portal |

| This is used to decrease, reset, and increase the screen resolution of the user interface of the portal |

| This is used to manage the user profile details such as the Name, Registered Email Address, Registered Mobile Number, and Password |

| This is used to log off from the portal |

In the Business Process application | |

| This is used to go the Previous section of the Input Form |

| This is used to go the Next section of the Input Form |

| This is used to save the application as draft, so that it can be completed later |

| This menu on the top gives an overview of the various sections within the form. All the sections need to be completed in order to submit the application for review. The current section is highlighted in Blue and the completed sections are highlighted in green with a check |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for taxpayers to benefit from these services in the best and simplest ways. To get more information on these services Click Here

Introduction

This manual is prepared to help the VAT Taxpayer navigate through the EmaraTax portal to submit a VAT Voluntary Disclosure for e-commerce reporting.

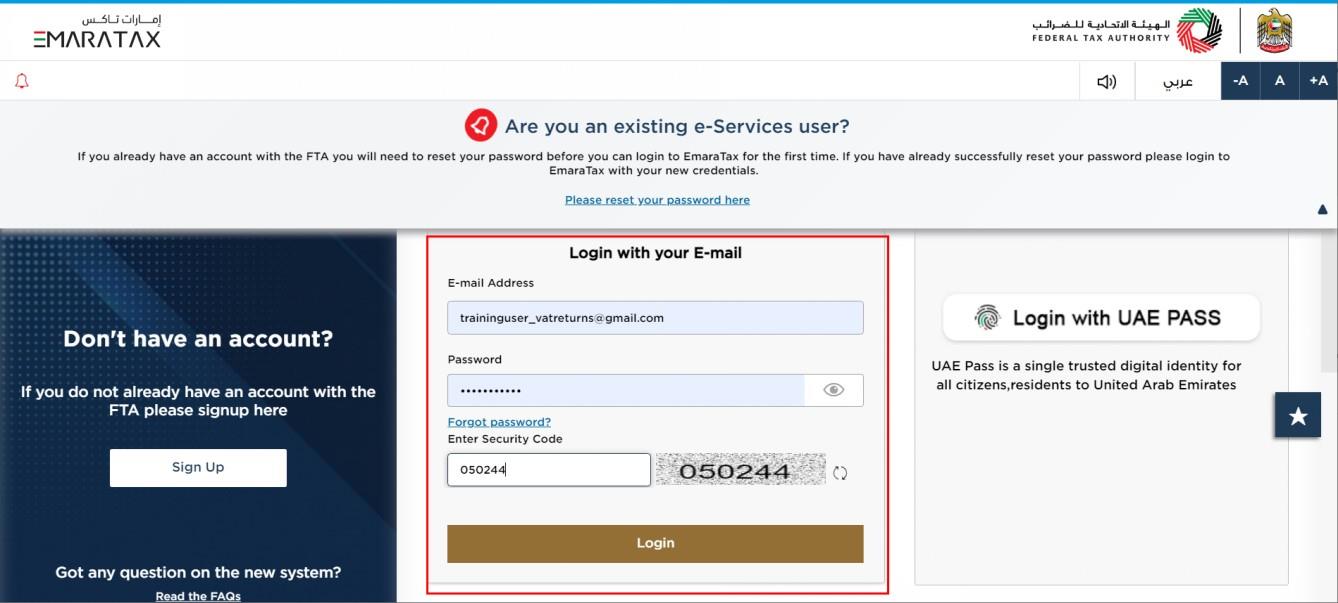

EmaraTax Login Page

|

|

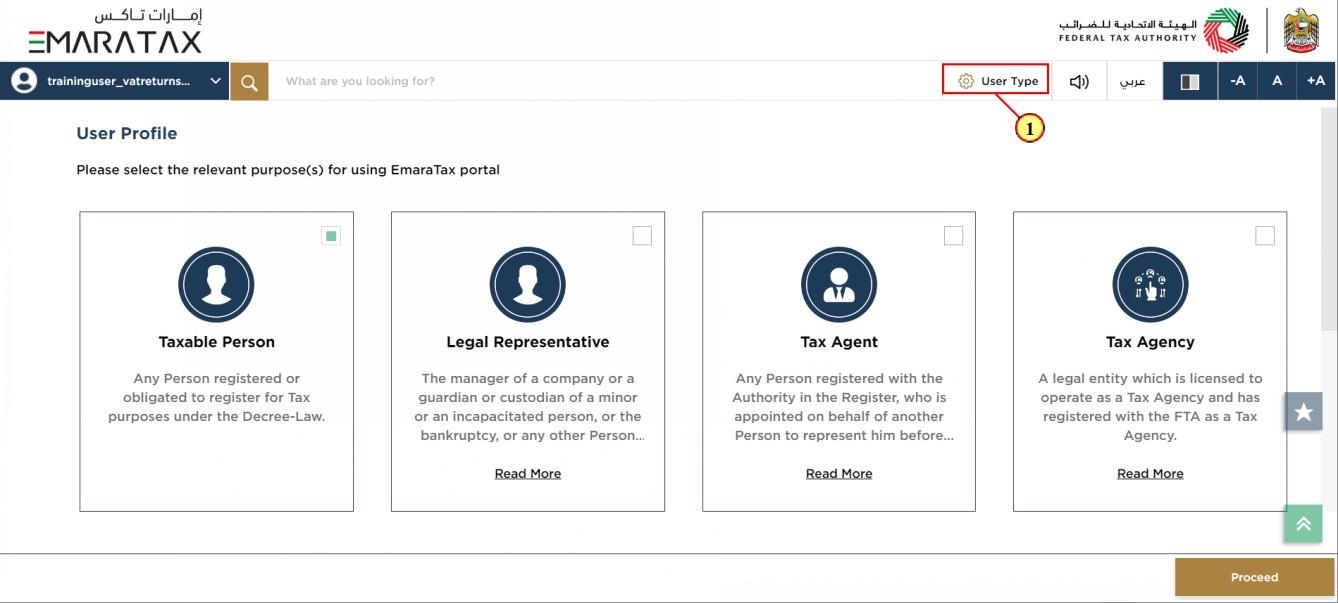

User type Selection

Step | Action |

(1) | Click here to select the user type |

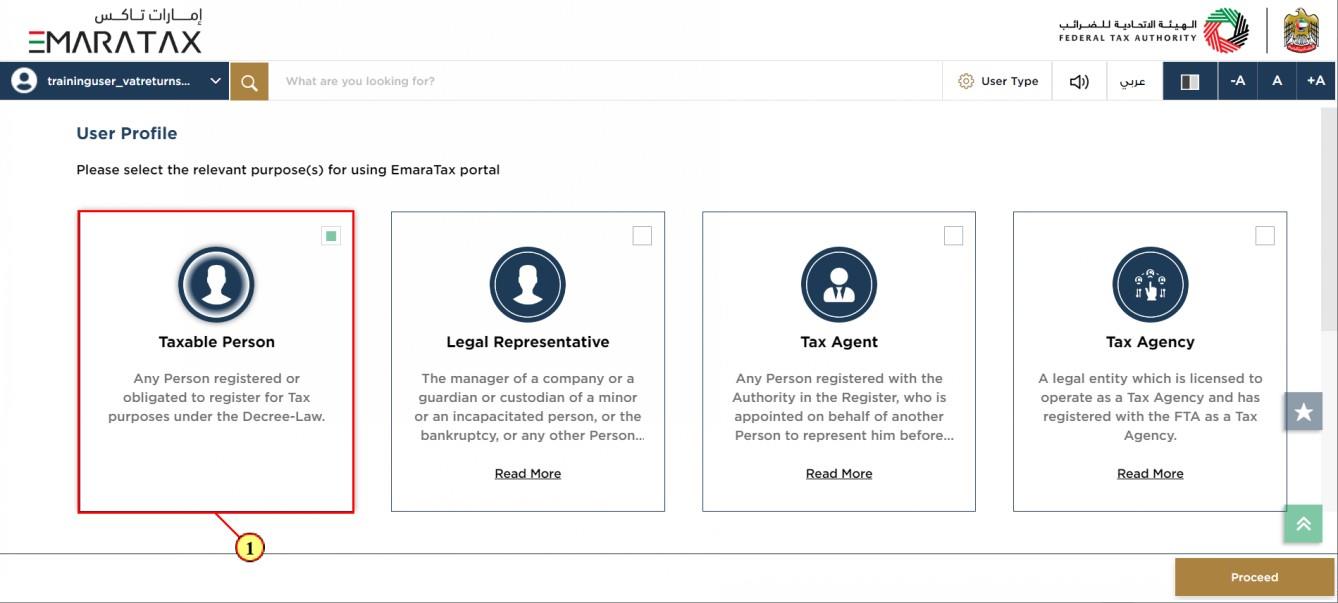

Step | Action |

(1) | Select the Taxable Person tile |

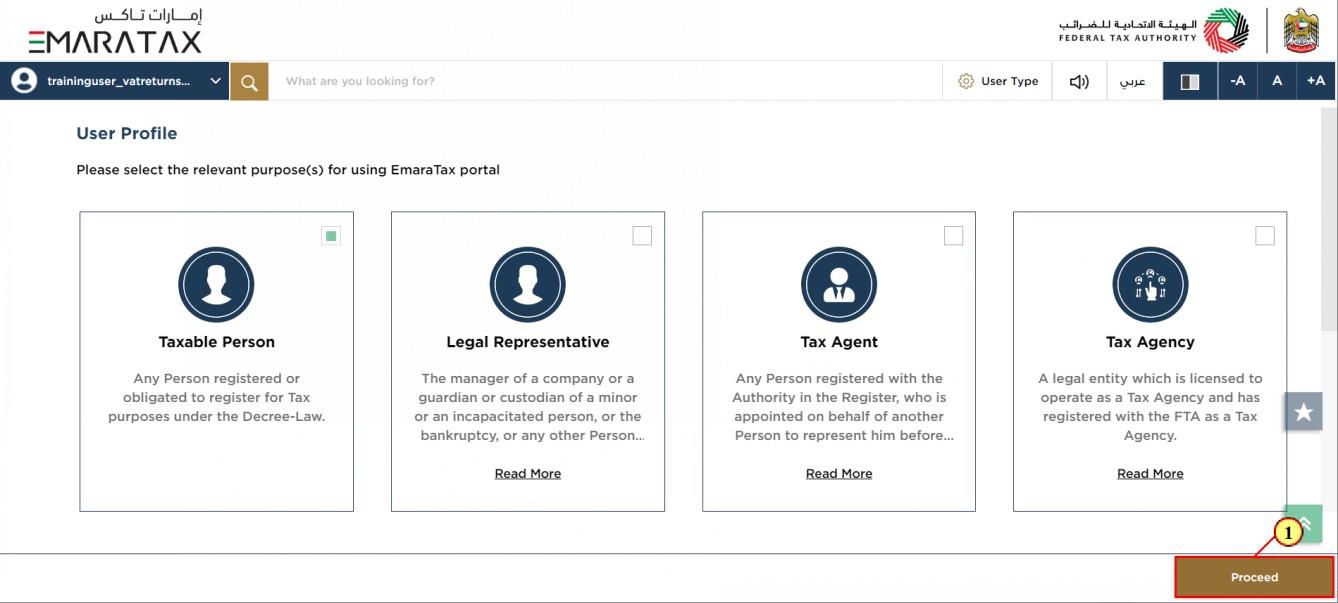

Step | Action |

(1) | Click on 'Proceed' to proceed to the Taxable Person |

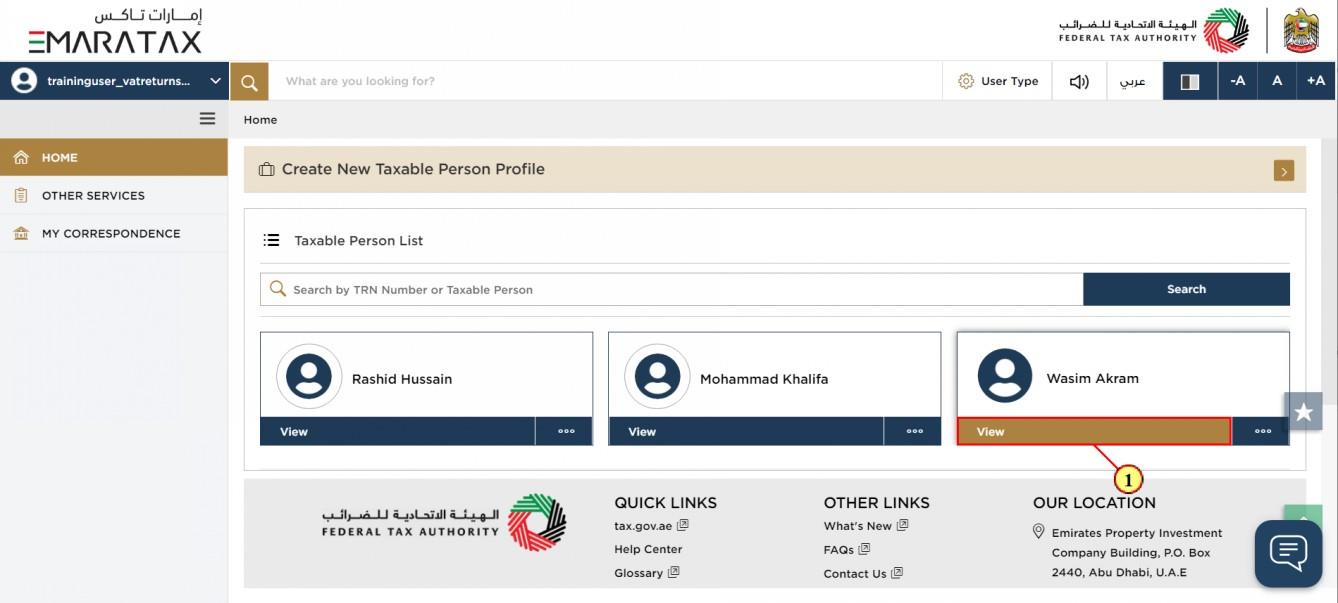

Taxable Person Home Page

Step | Action |

(1) | Click here to view the Taxable Person dashboard |

Step | Action |

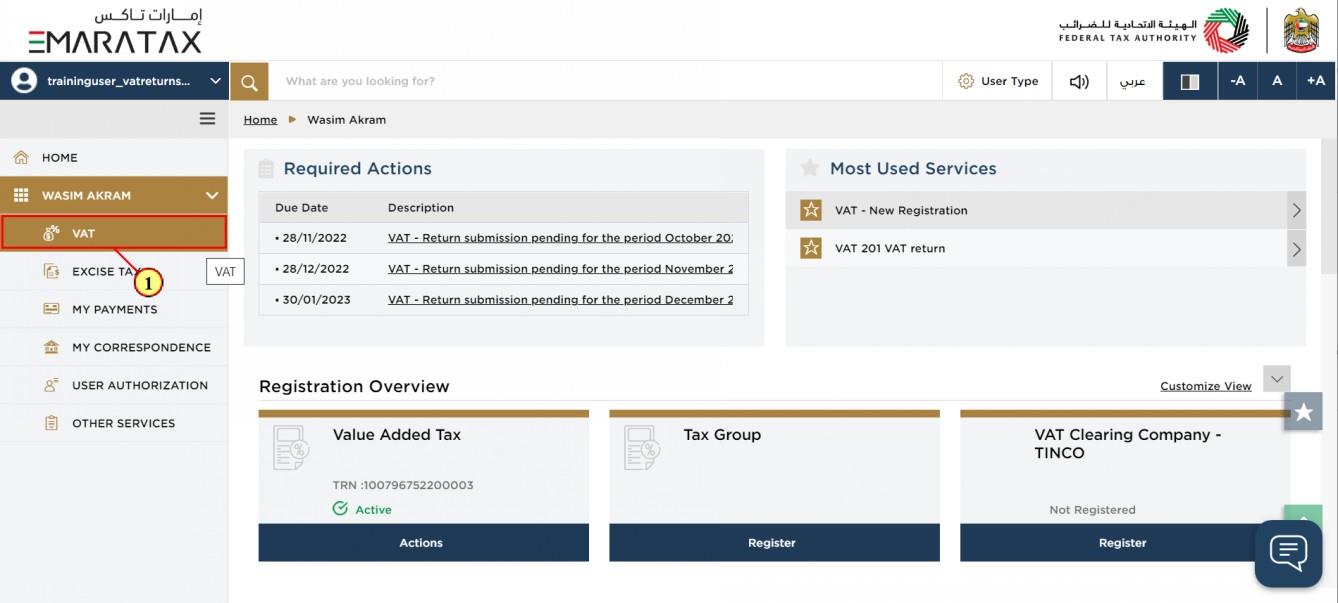

(1) | Click here to access the VAT module |

VAT Module

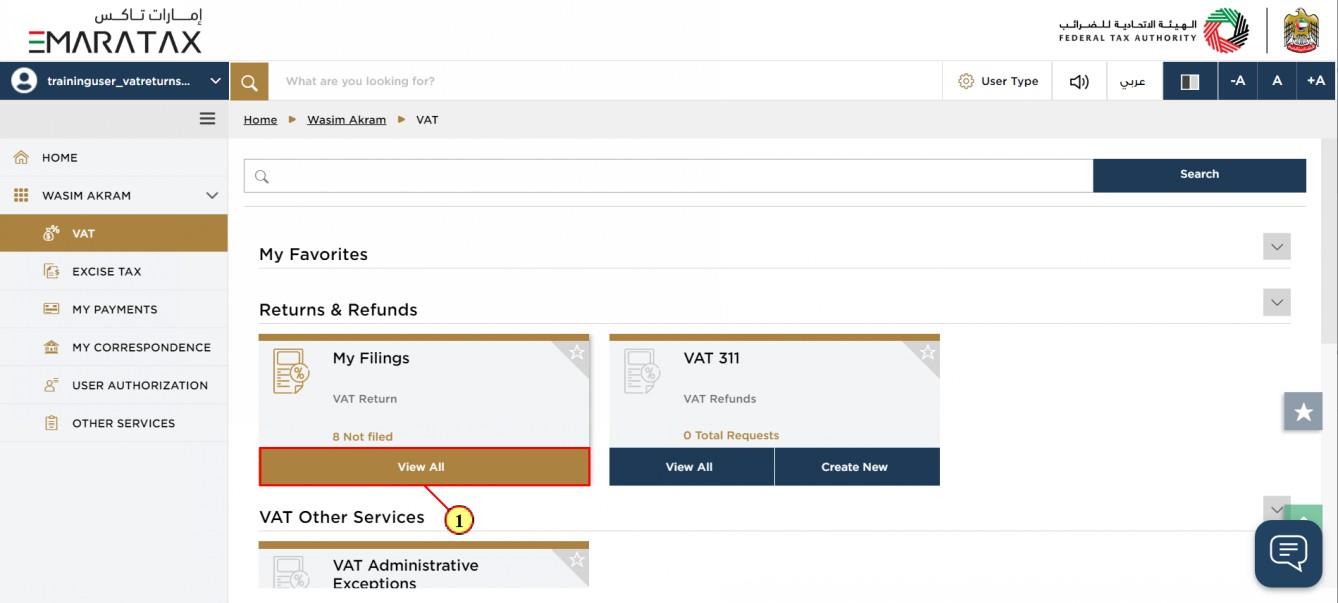

Step | Action |

(1) | Click here to view all your VAT Return filings |

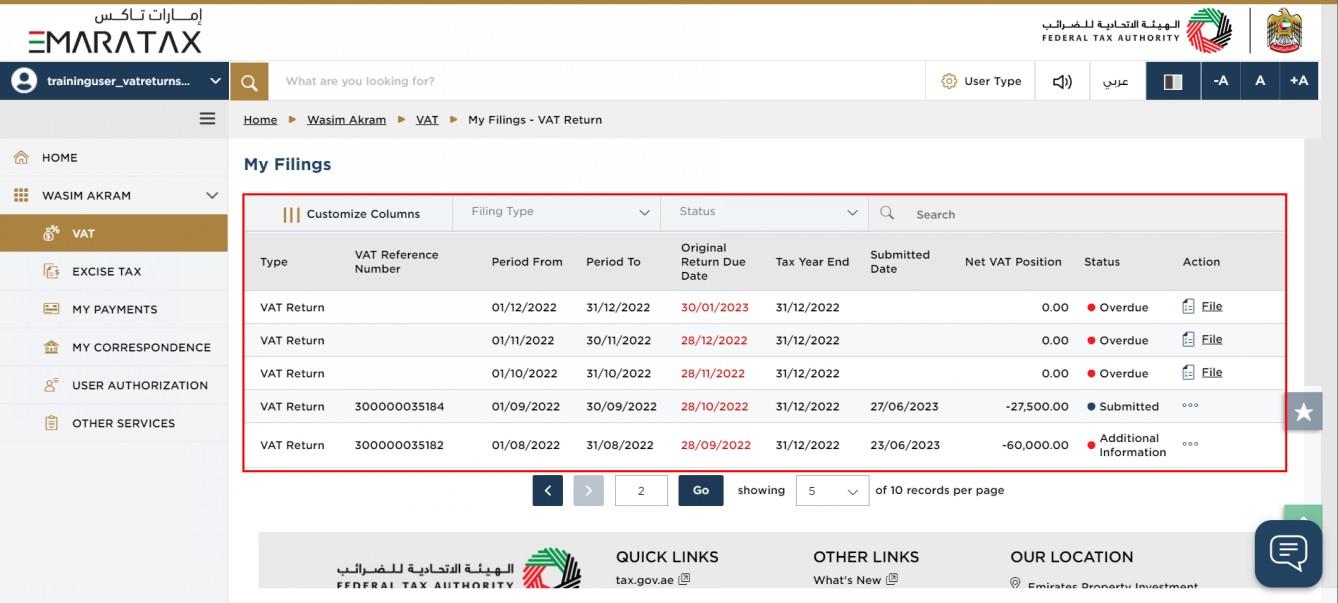

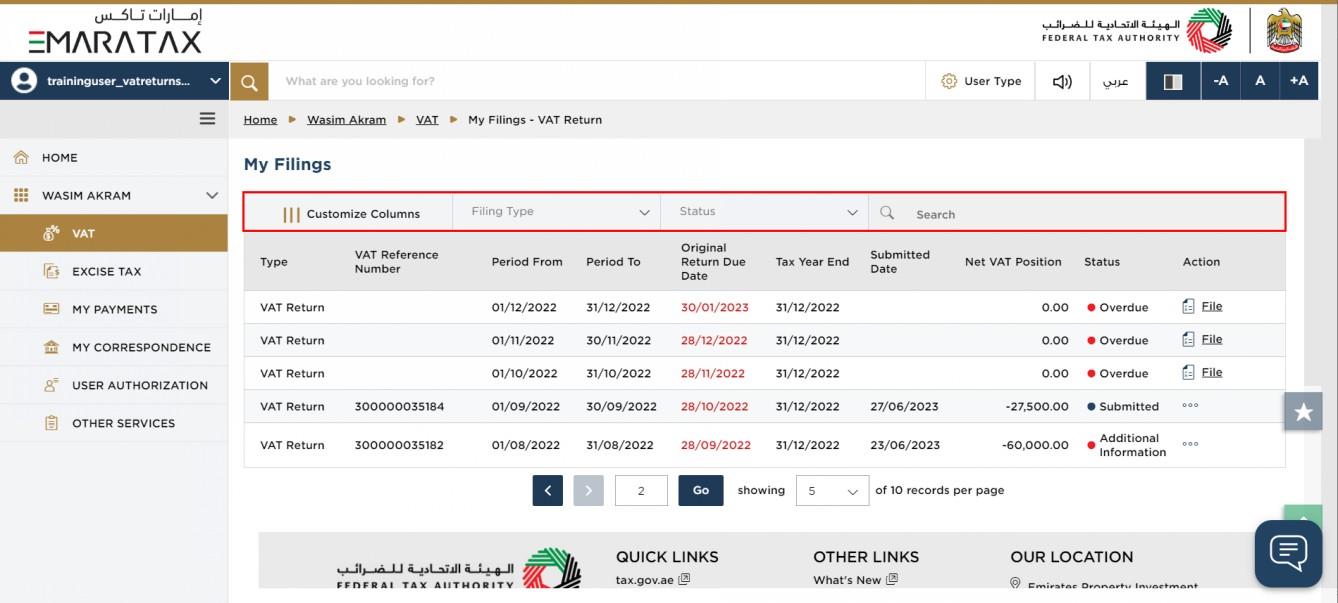

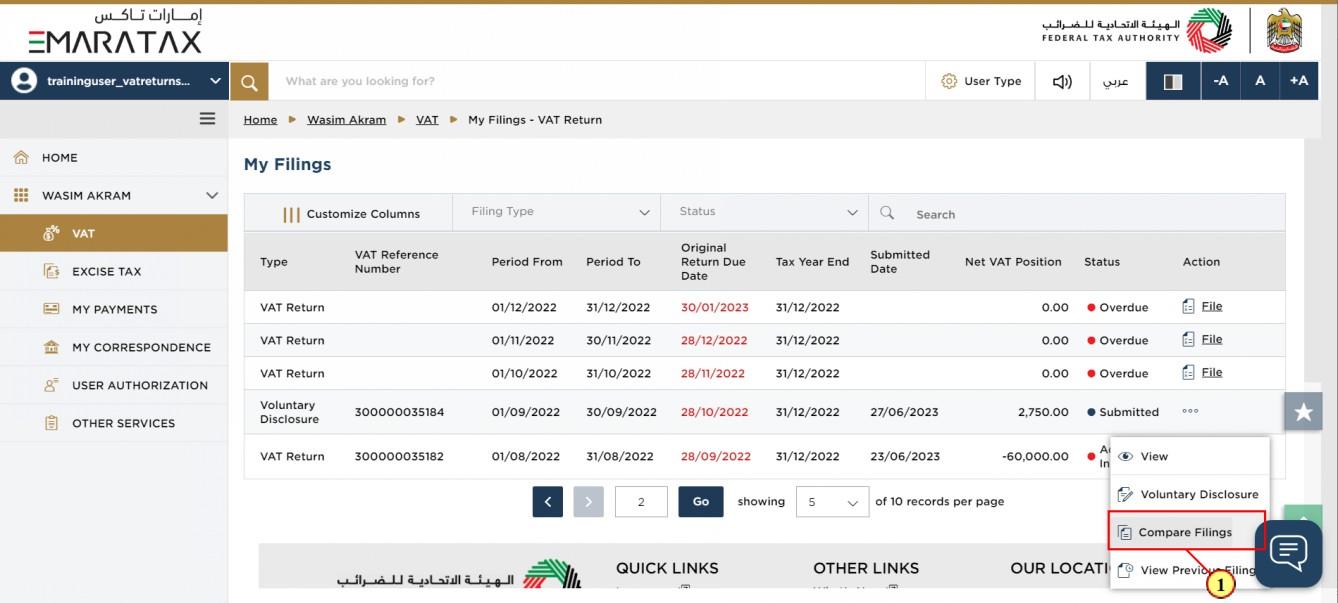

My Filings Dashboard

| This dashboard displays information related to your VAT Return(s) and VAT Voluntary disclosure(s). |

| You can add a new column to the table or filter the declarations by Return type and status. You can also search for VAT Voluntary Disclosure (VD) by reference number. |

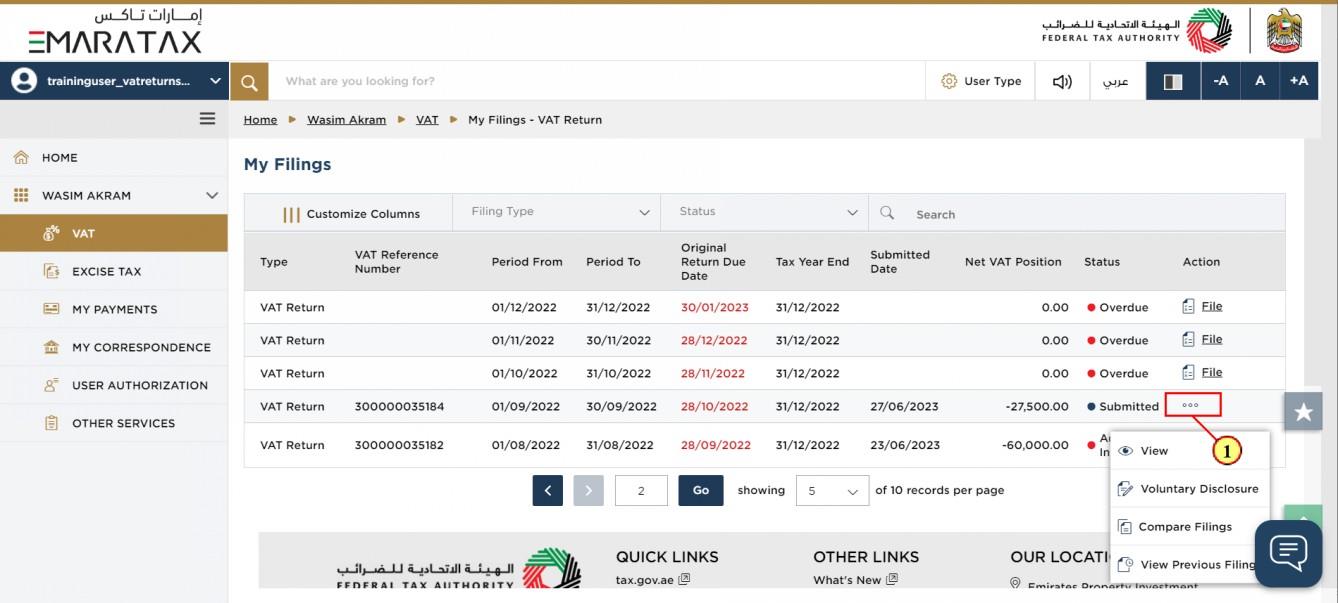

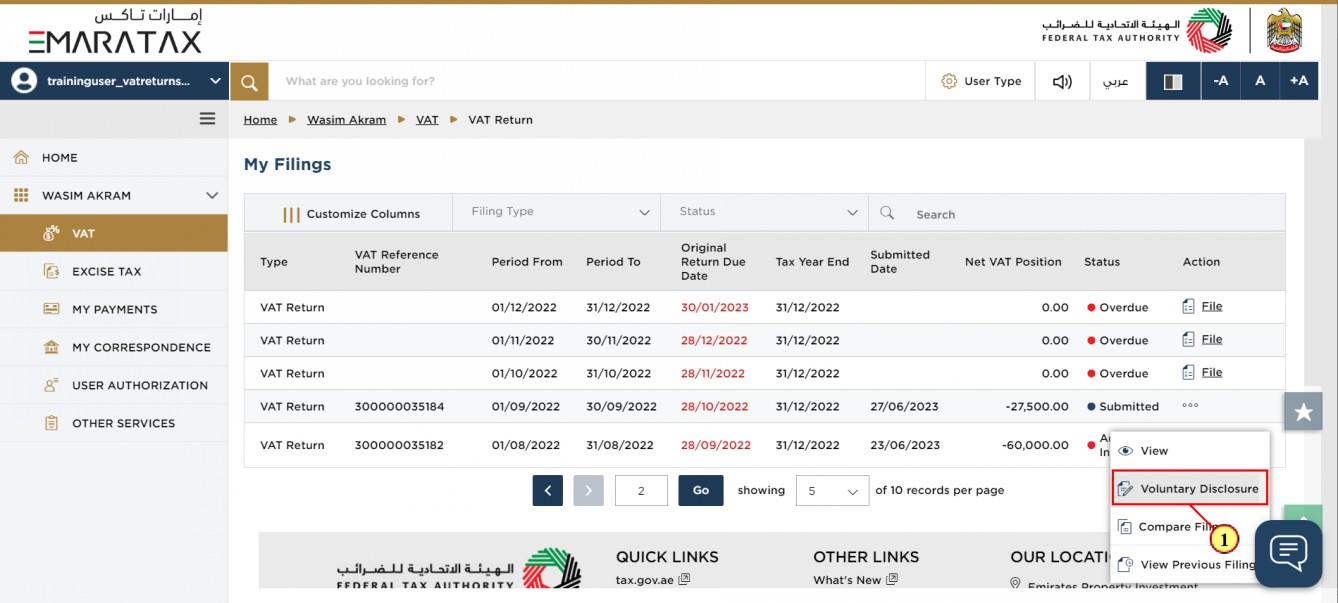

Step | Action |

(1) | Click on ellipsis to view VAT Return, Voluntary Disclosure, Compare Filings and view previous filings. |

Step | Action |

(1) | Click here to submit a VAT VD for the selected period. |

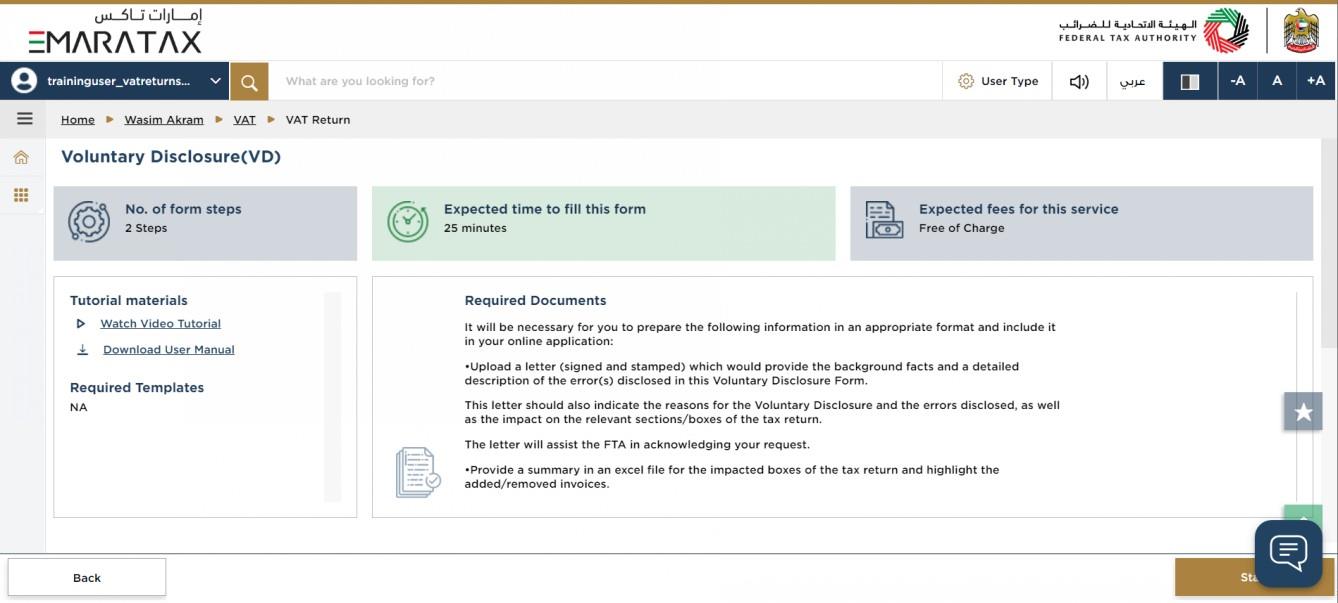

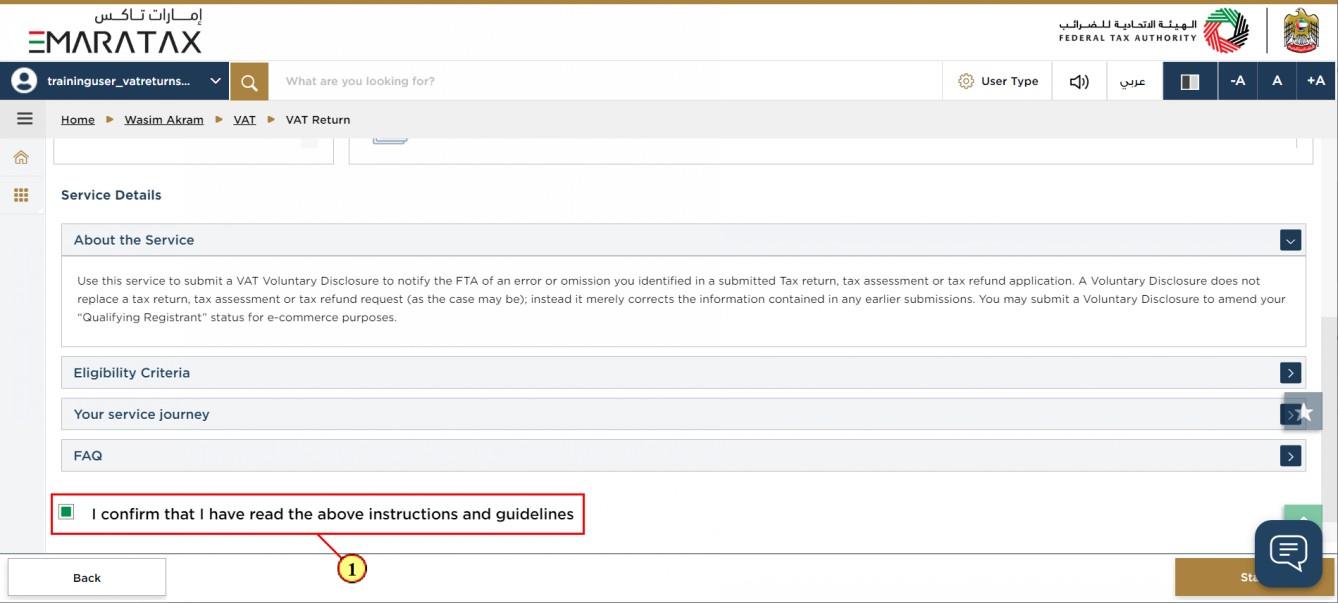

Instructions and Guidelines

| These are the instructions and guidelines which detail key information such as required templates, supporting documentation, eligibility criteria and the expected time to complete the Voluntary Disclosure. |

Step | Action |

(1) | Mark the checkbox to confirm that you have read and understood the instructions and guidelines. |

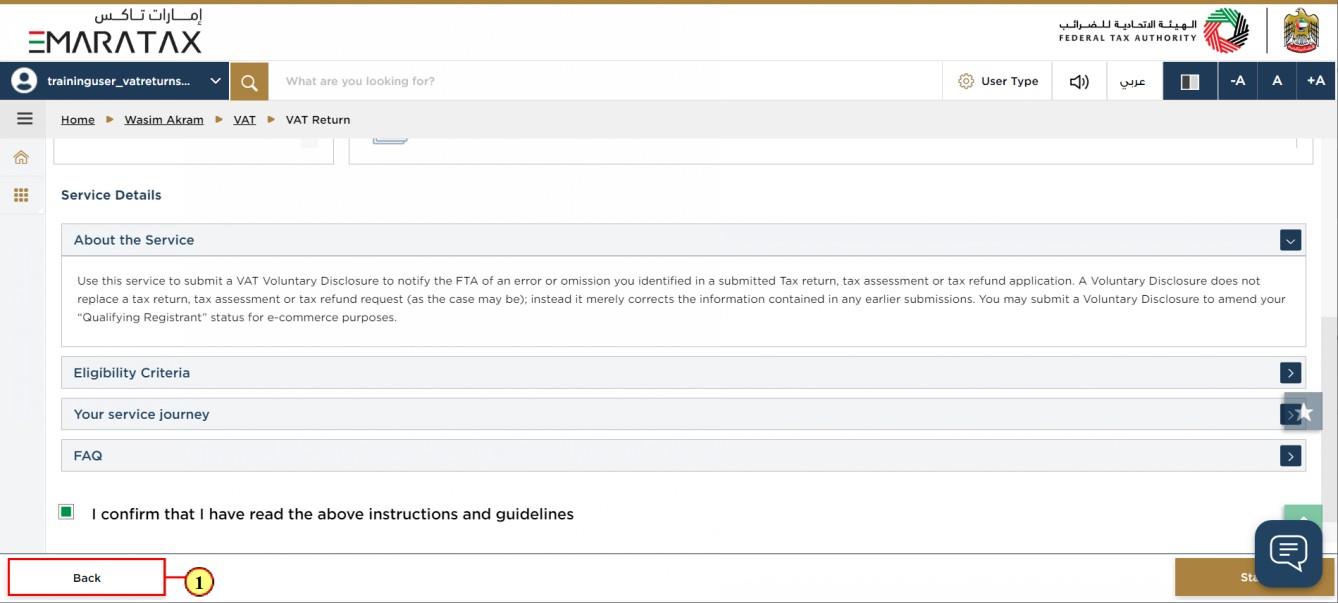

Step | Action |

(1) | Click on 'Back' to go back to the previous page |

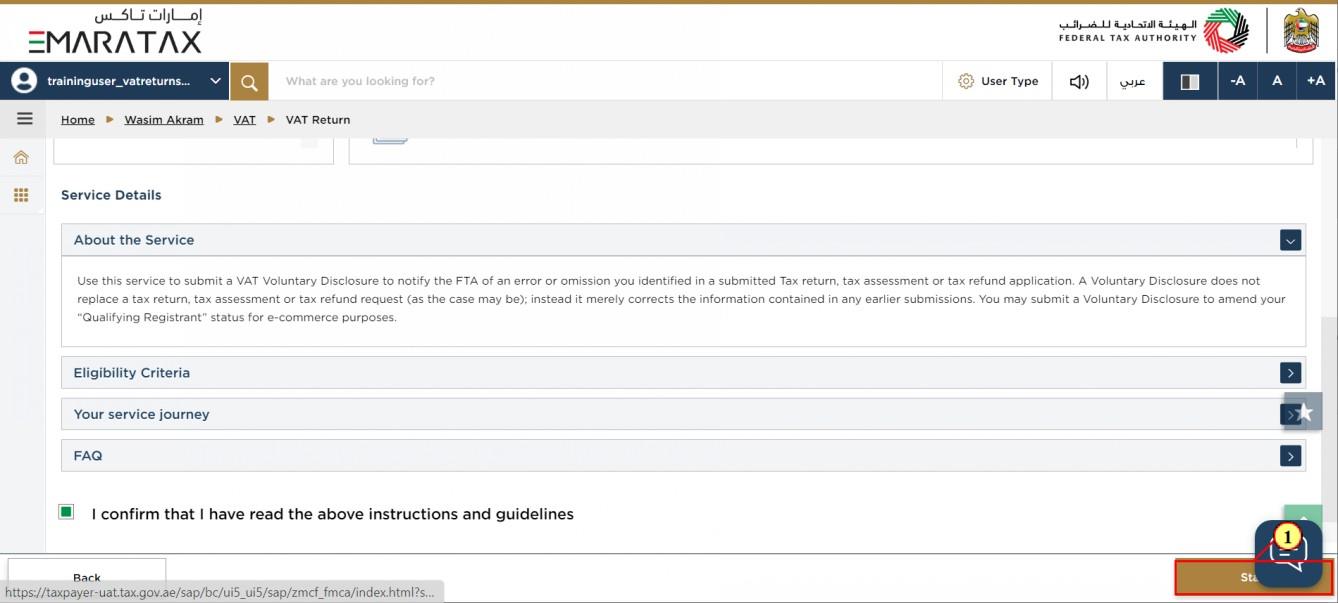

Step | Action |

(1) | Click on 'Start' to proceed to file the VAT Voluntary Disclosure. |

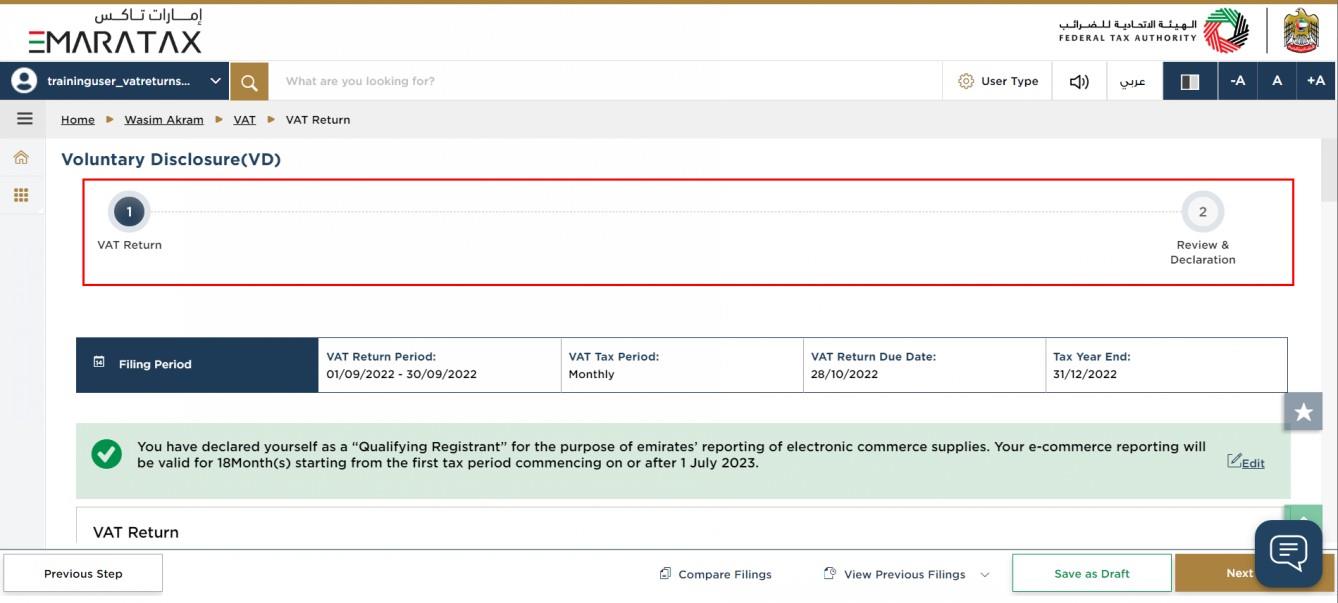

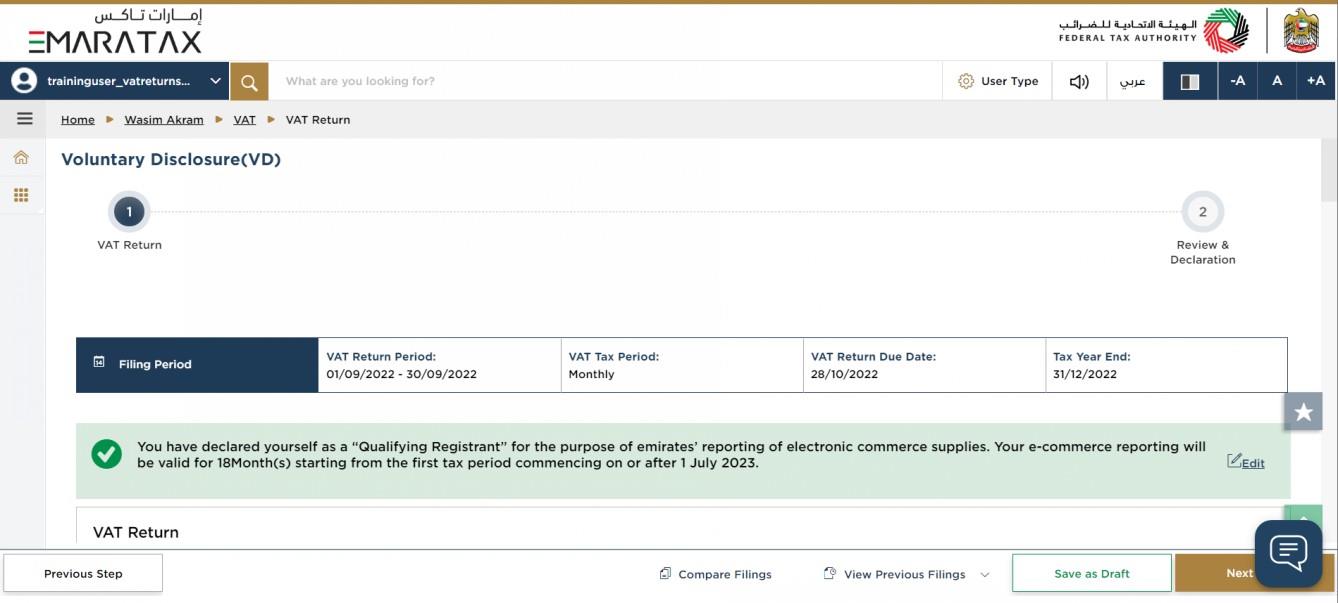

VAT Voluntary Disclosure

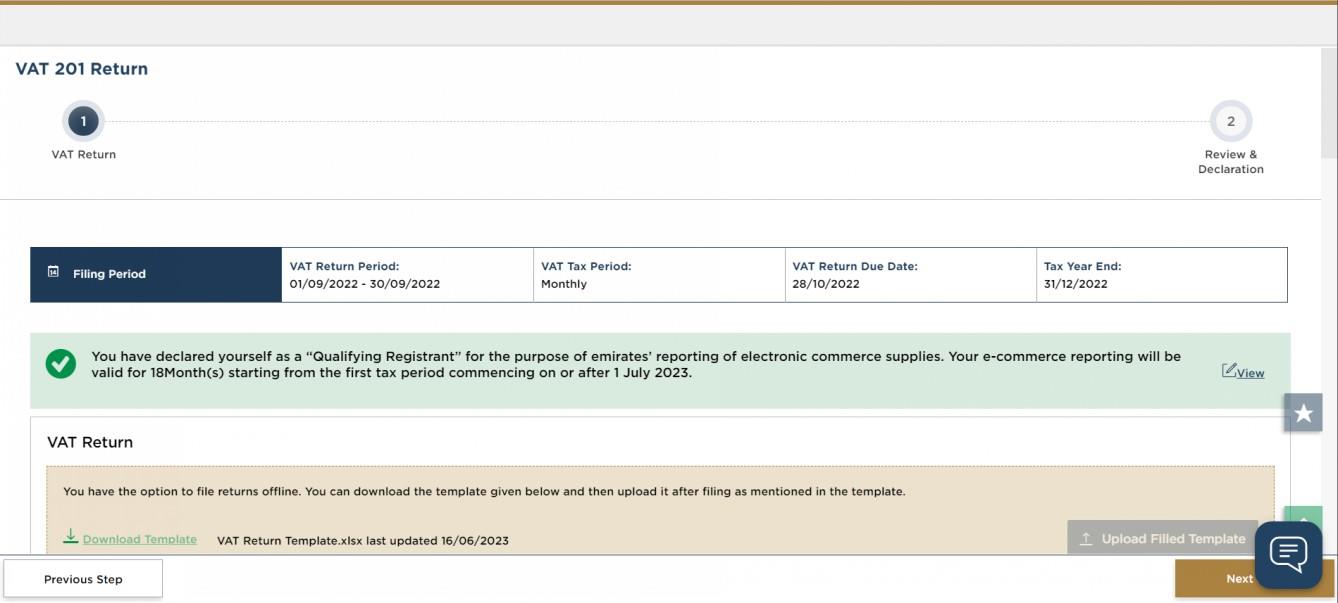

| The progress bar displays the number of steps required to complete the VAT VD. The step you are currently in is highlighted in blue. Once you progress to the next section successfully, the previous step will be highlighted in green. |

| You may be required to submit VDs in various cases including notifying the FTA of an error made in relation to your status as a “Qualifying Registrant” for e-commerce purposes or to amend errors made in your reported e-commerce supplies. |

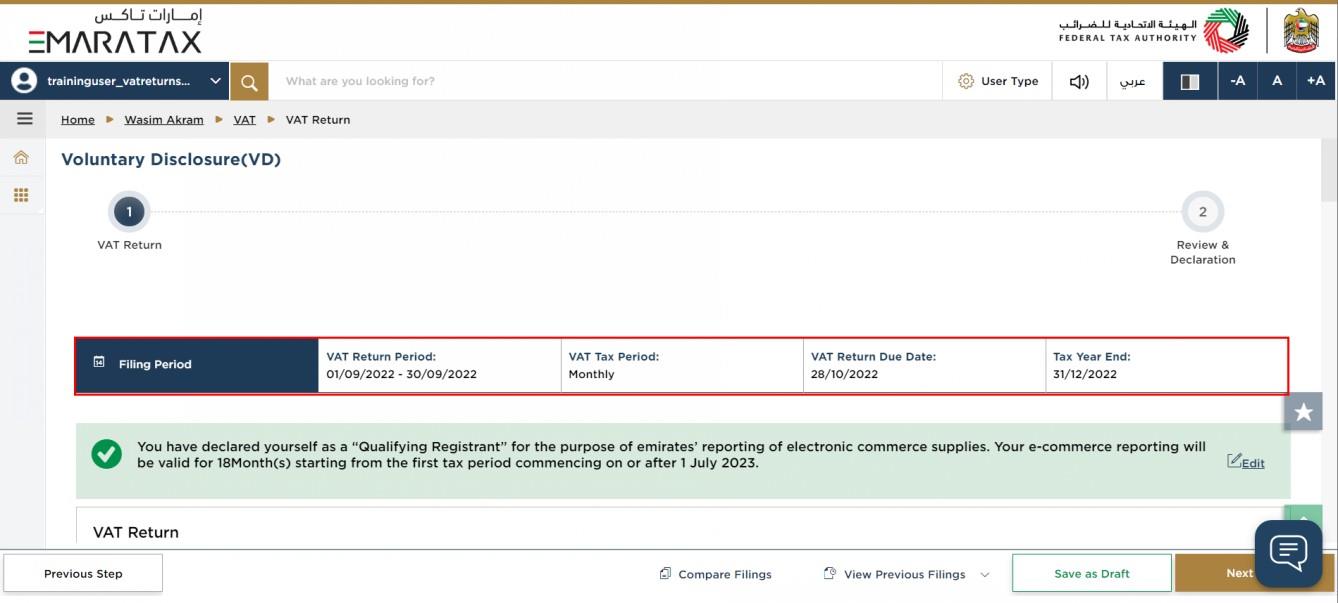

| This section displays the filing period details based on the selected VAT Return. |

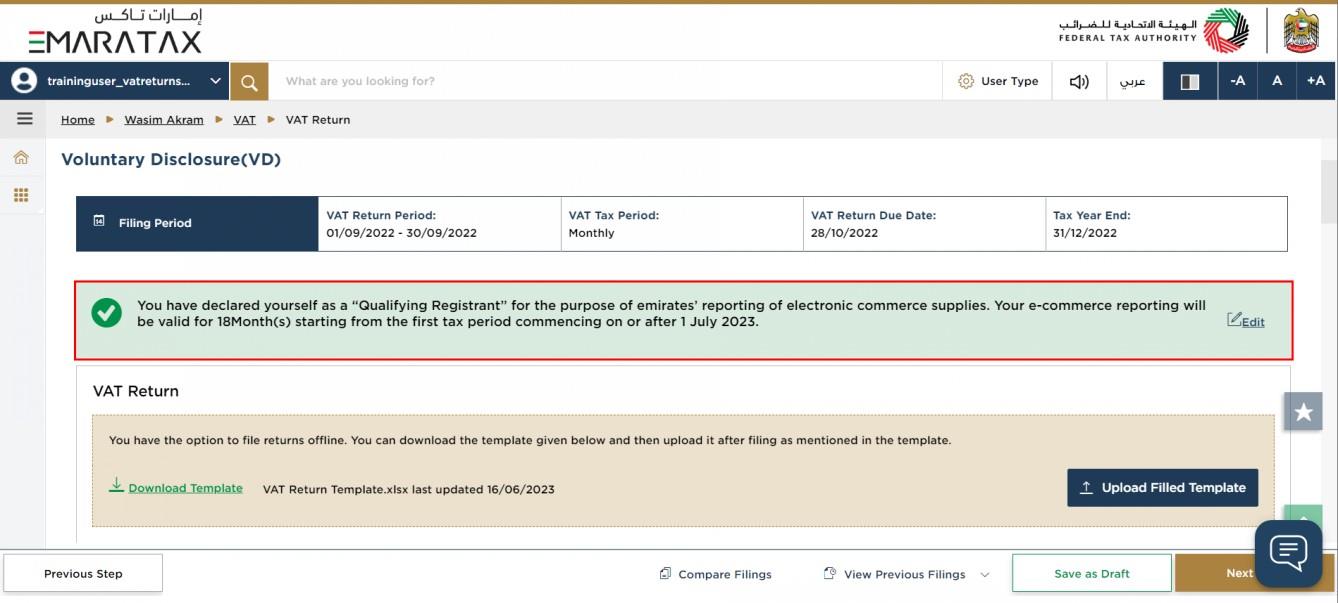

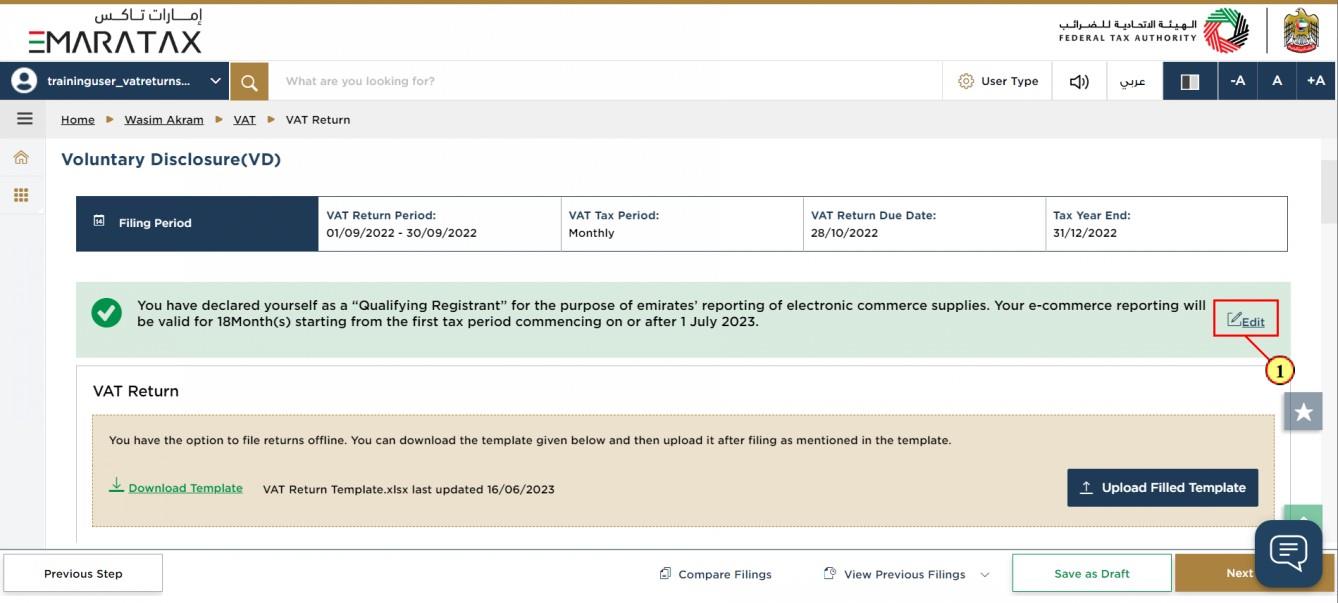

| The text highlighted in green indicates that you are a “Qualifying Registrant” and identifies your e-commerce reporting period. Based on the e-commerce reporting period which is identified specifically to you, your VAT VD will cater for e-commerce reporting if the tax period for which you are submitting your VAT VD falls within your identified e-commerce reporting period. |

Step | Action |

(1) | Click on ‘Edit‘ to respond to the e-commerce questionnaire to either notify the FTA of your “Qualifying Registrant” status for e-commerce purposes or to amend your original notification for e-commerce purposes. |

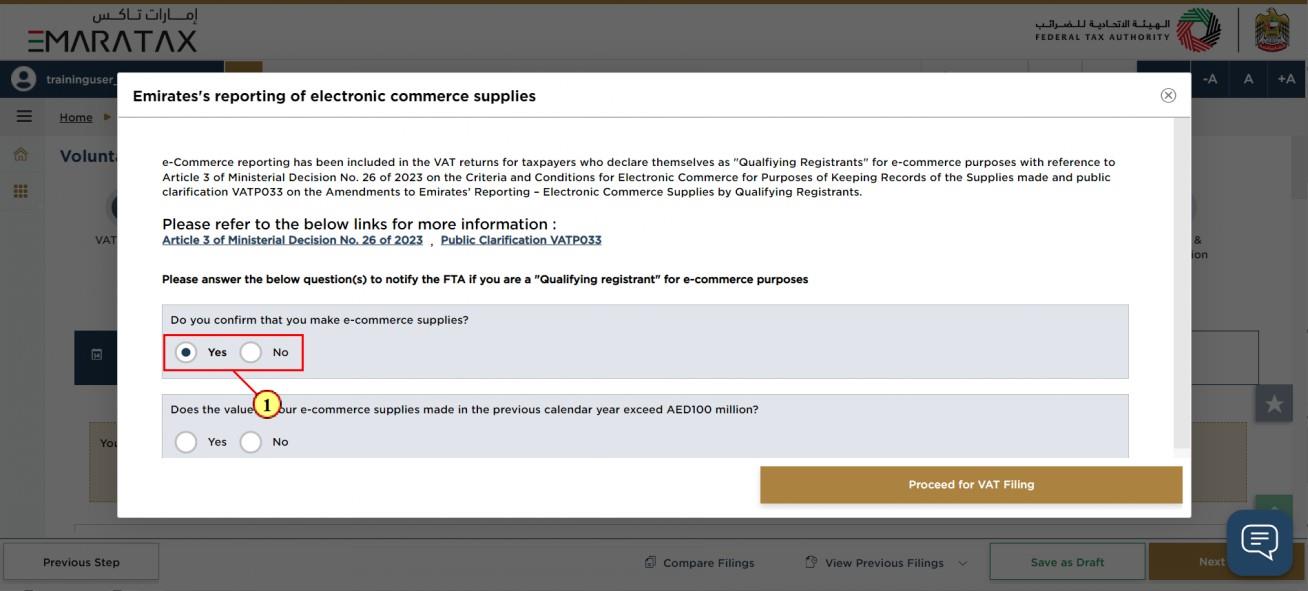

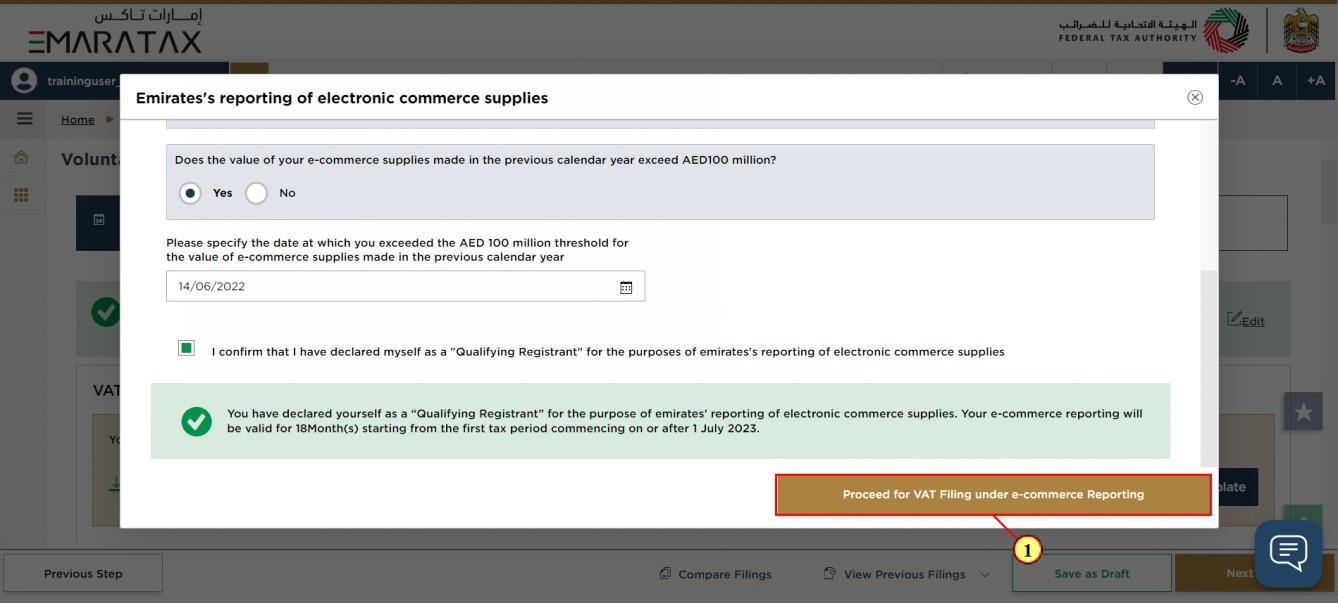

e-Commerce Questionnaire

Step | Action |

(1) | Before responding to the e-commerce questionnaire, please ensure that you read through the following:

Then select ‘Yes‘ if you make e-commerce supplies. |

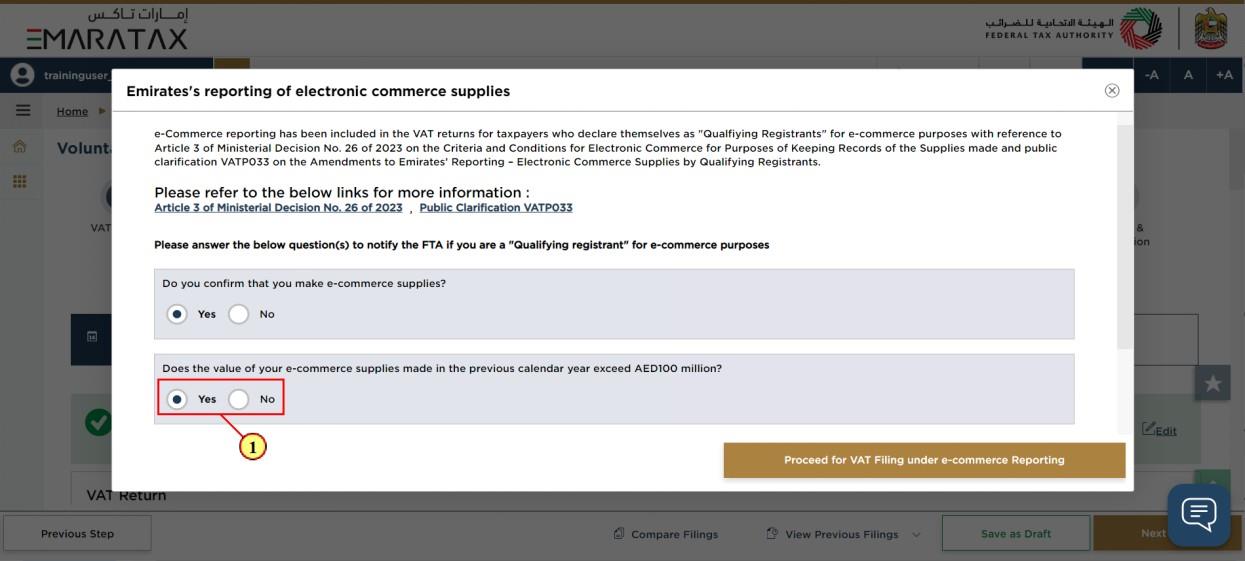

Step | Action |

(1) | If you make e-commerce supplies, you should select ‘Yes‘ if the value of your e-commerce supplies made in the previous calendar year exceeds AED 100 million. |

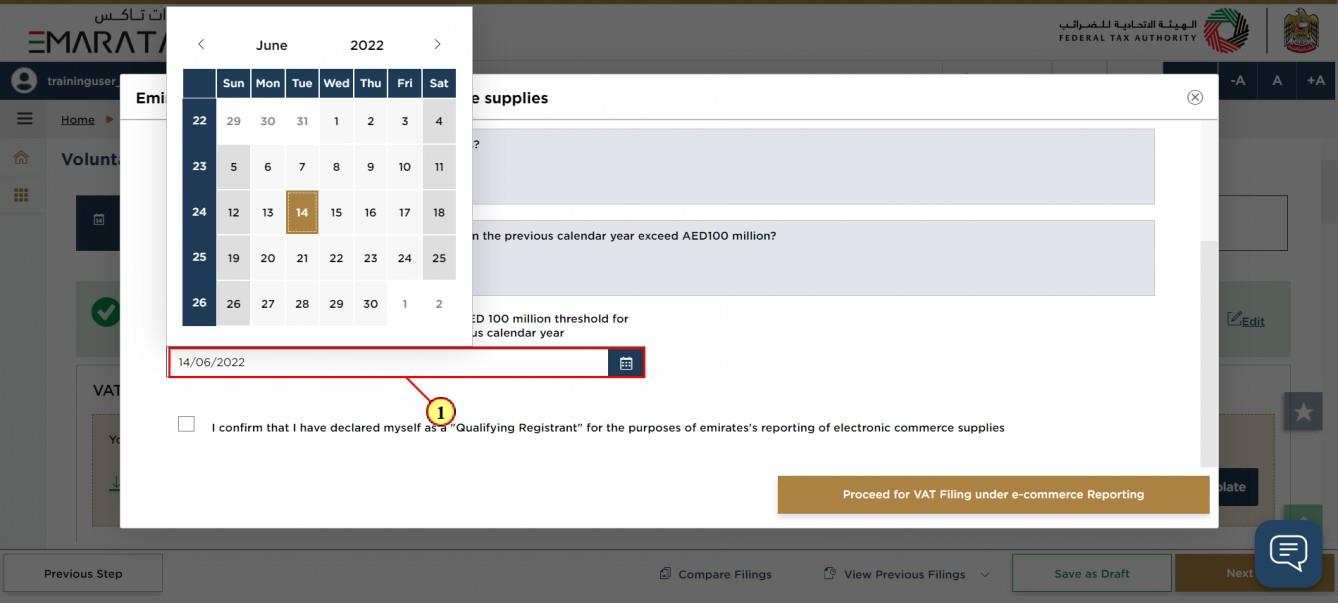

Step | Action |

(1) | If you selected ‘Yes‘ to the two previous questions, you should select the date on which you have exceeded the AED 100 million threshold for the value of e-commerce supplies made in the previous calendar year |

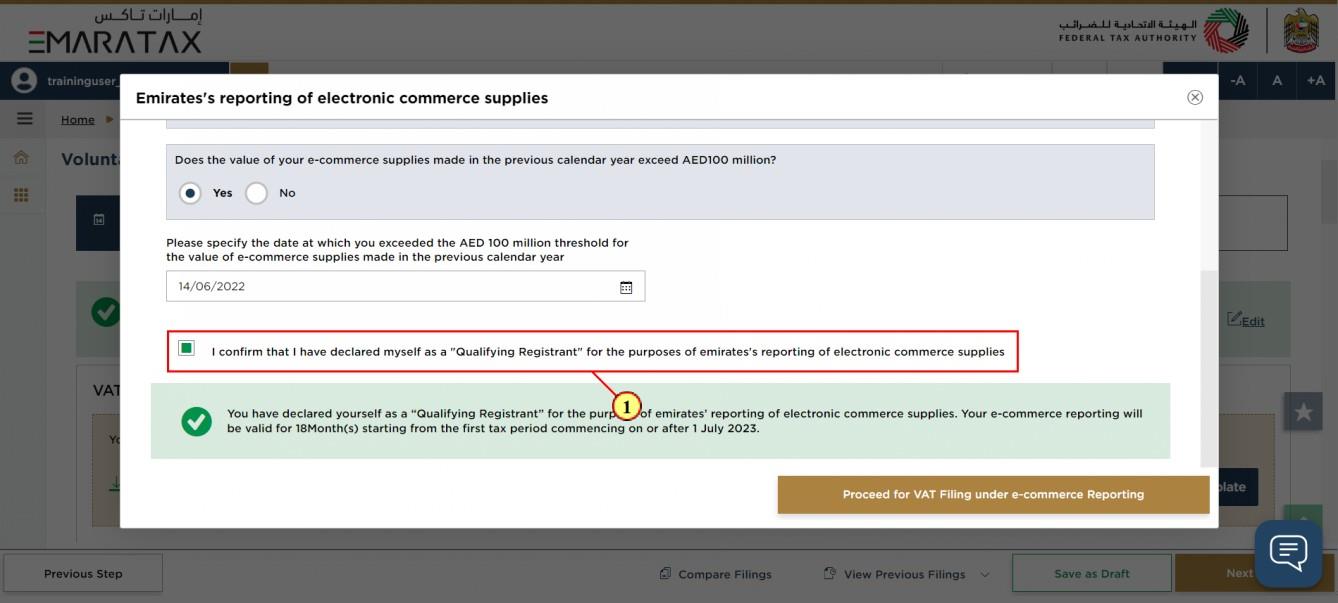

Step | Action |

(1) | Mark the checkbox to confirm that you are a “Qualifying Registrant” for the purposes of Emirates‘ reporting of e-commerce supplies. |

Step | Action |

(1) | Click on ‘Proceed for VAT Filing under e-commerce reporting‘ to file your VAT Voluntary Disclosure. |

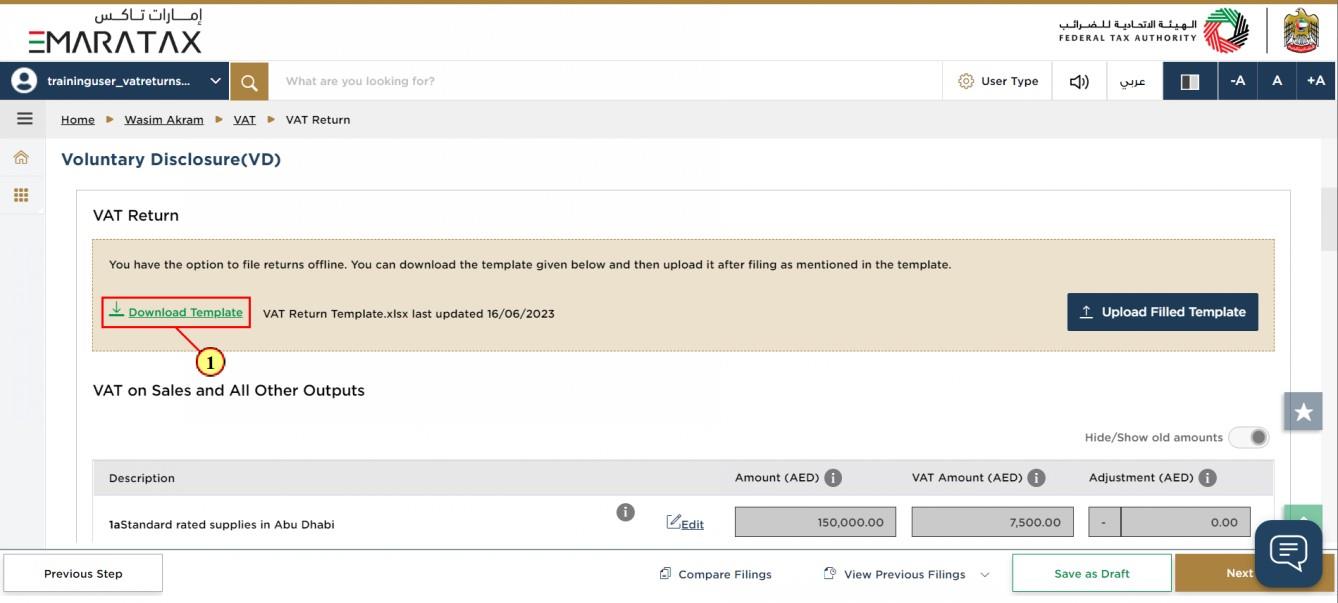

VAT Voluntary Disclosure

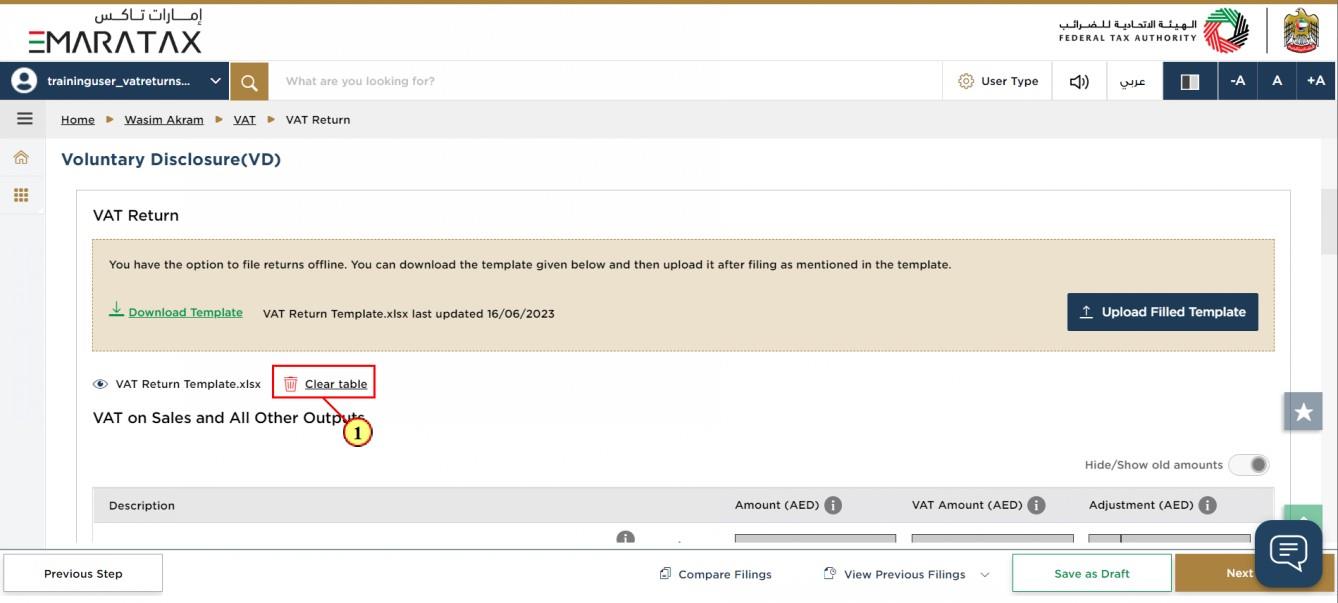

Step | Action |

(1) | Click here to download the offline template which can be used to file your returns. The downloaded template is an exact replica of the online form. The disabled or greyed out cells will be auto calculated. |

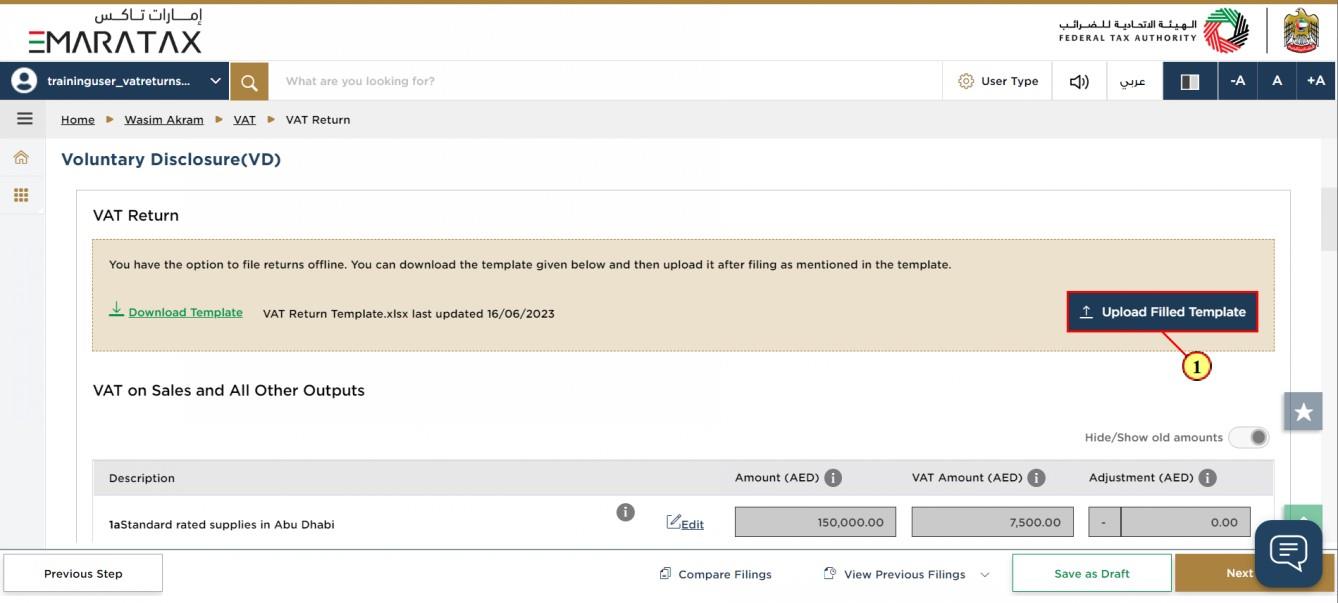

Step | Action |

(1) | Click on 'Upload Filled Template' to file your return using the offline facility. |

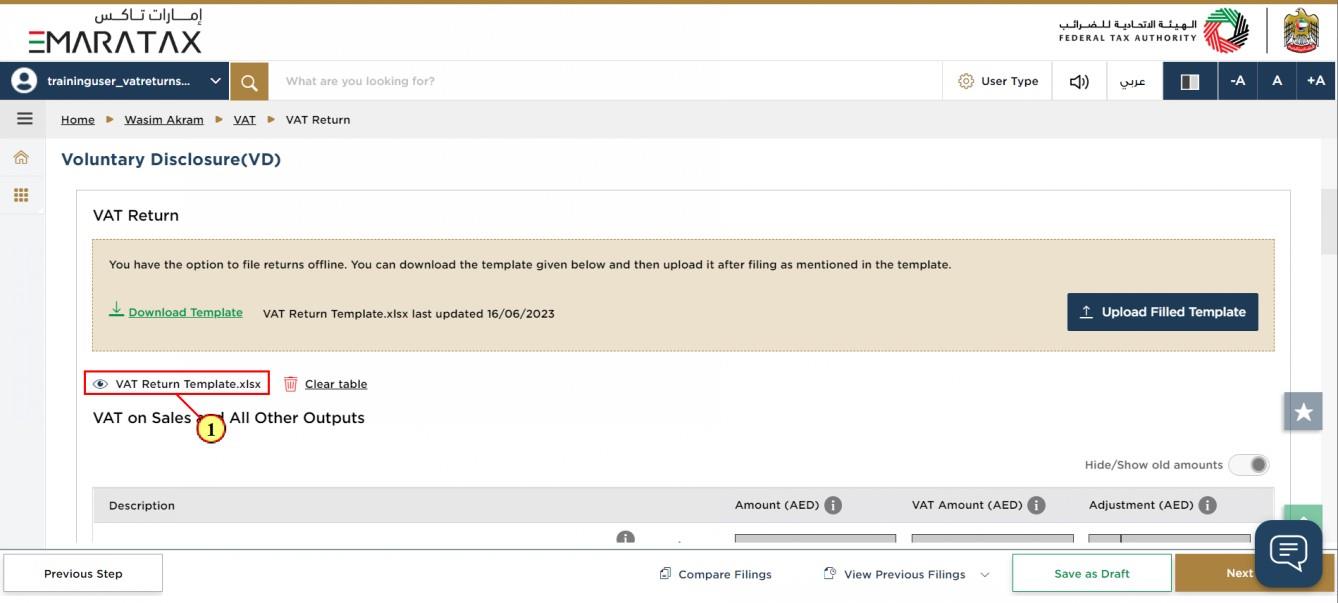

Step | Action |

(1) | Once the upload is complete, click here to download the uploaded template |

Step | Action |

(1) | Click here to clear the amounts in the table below |

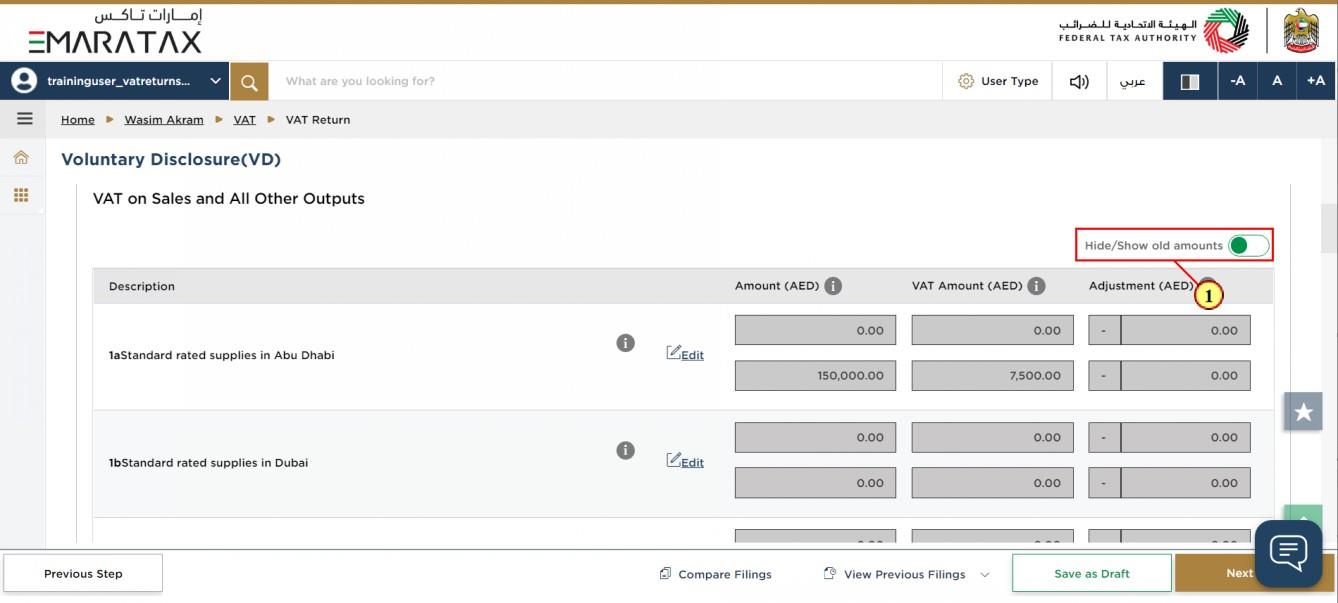

Step | Action |

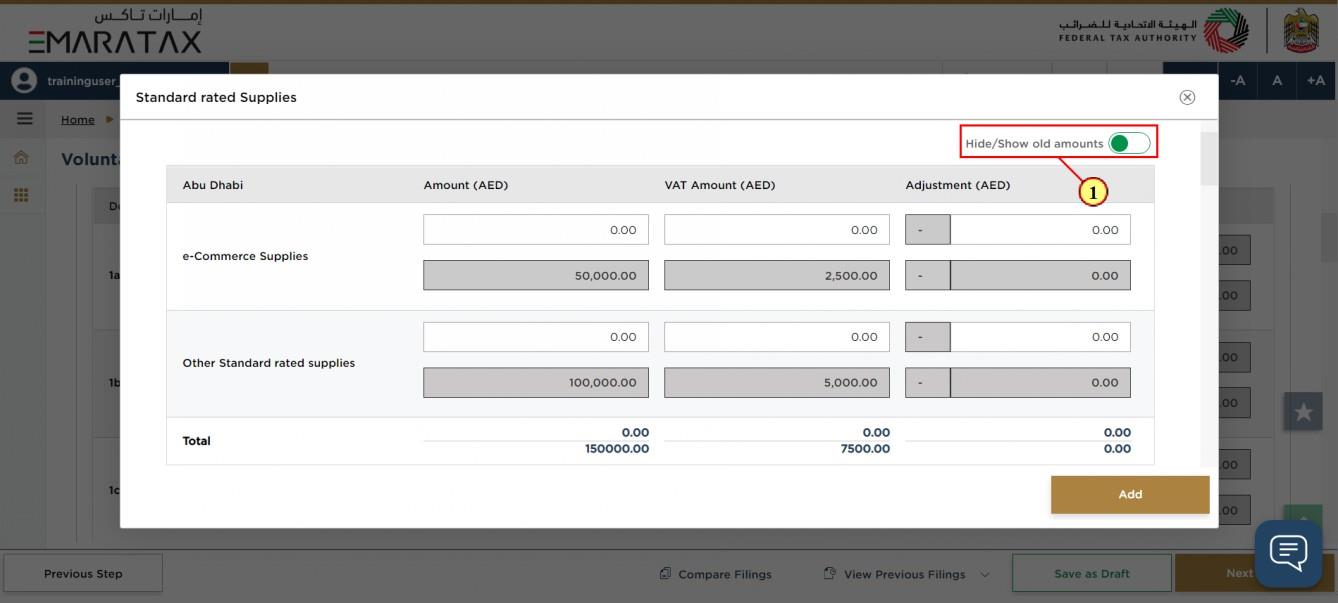

(1) | Click here to display the values that were previously declared in your VAT Return or VAT VD. |

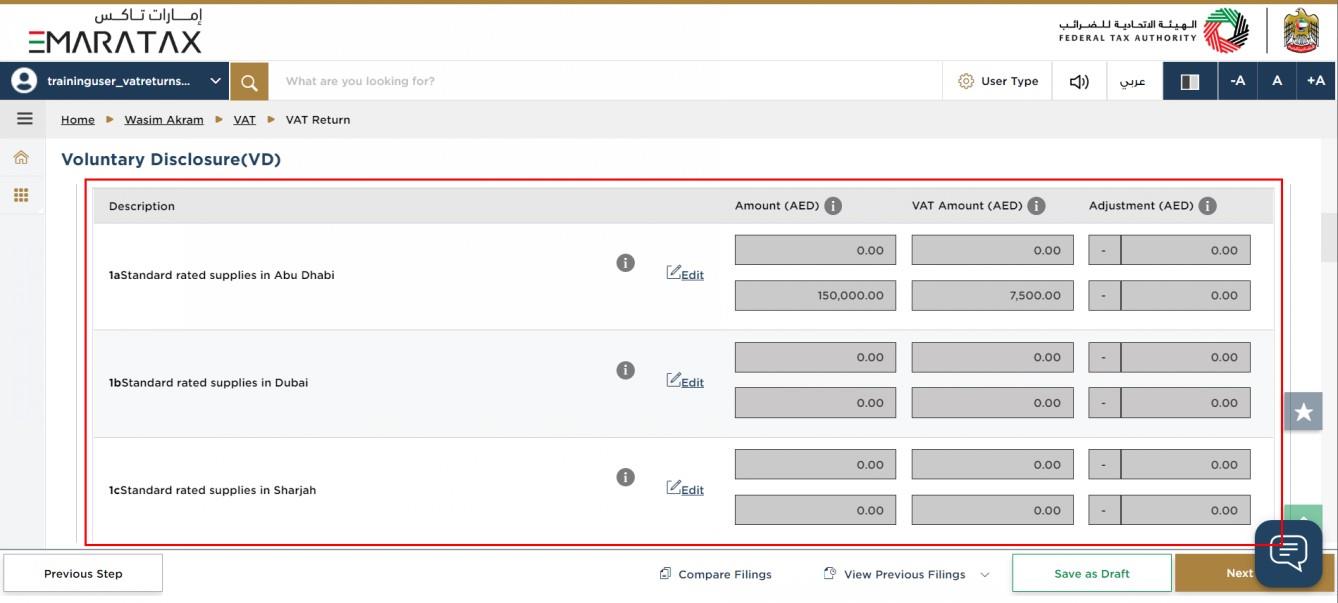

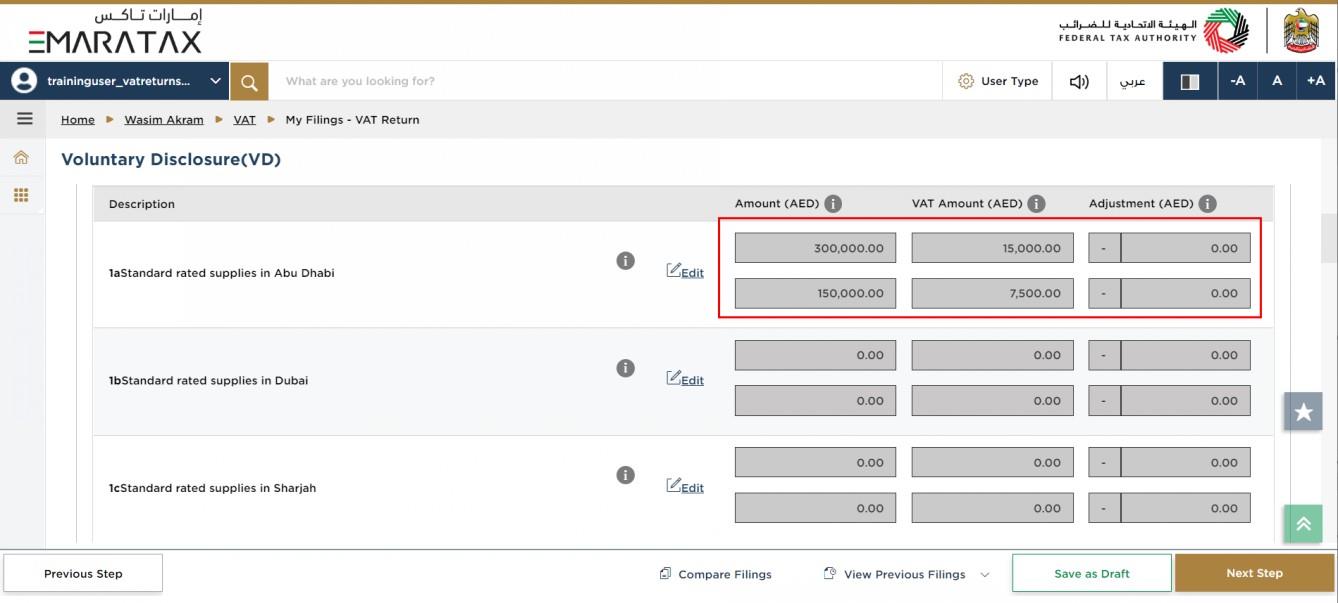

| If you declared yourself as a “Qualifying Registrant” for e-commerce purposes and the tax period for which you are submitting your VAT VD falls within your identified e-commerce reporting period, the standard rated supplies boxes 1a to 1g will be presented as read only and you will not be able to enter the amount (value of supplies), VAT amount and adjustment amount (if any) directly in these boxes. |

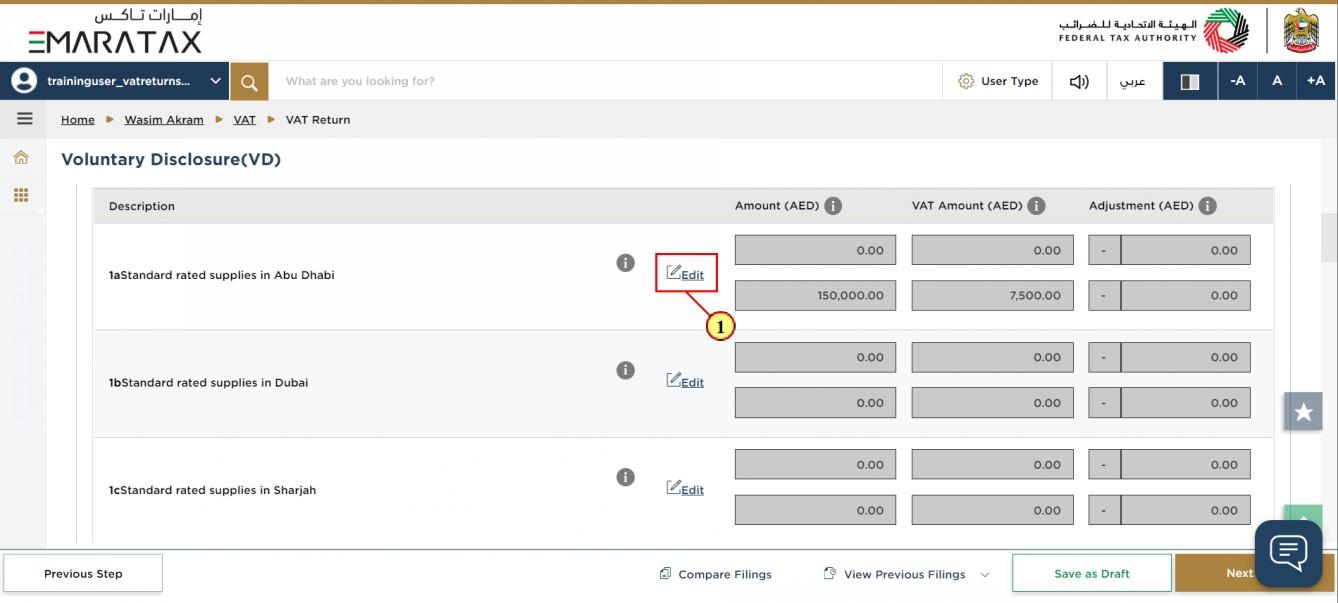

Step | Action |

(1) | Click on ‘Edit‘ to report your e-commerce and other standard rated supplies by Emirate. |

Step | Action |

(1) | Click here to display the values that were previously declared in your VAT Return or VAT VD. |

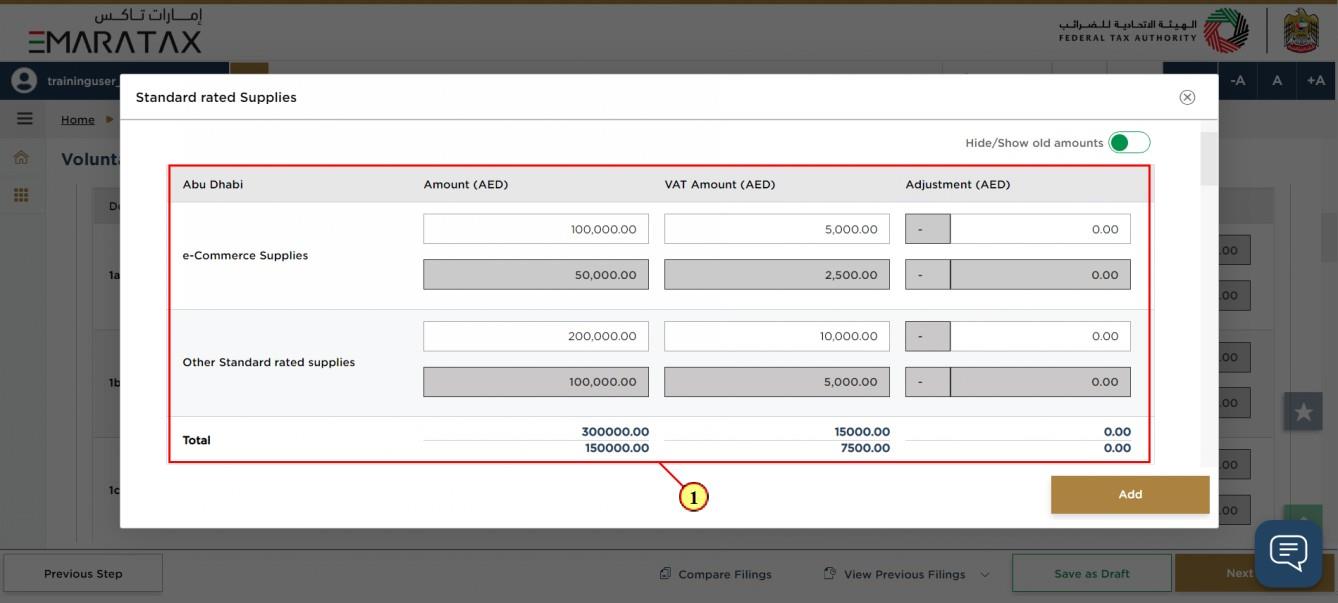

Step | Action |

(1) | The values that were previously declared in your VAT Return or VAT VD will be auto populated into the relevant boxes. Enter the amount (value of supplies), VAT amount and adjustment amount (if any) for e-commerce and other standard rated supplies by Emirate in the relevant boxes to amend any of the values that were previously declared in your VAT Return or VAT VD. |

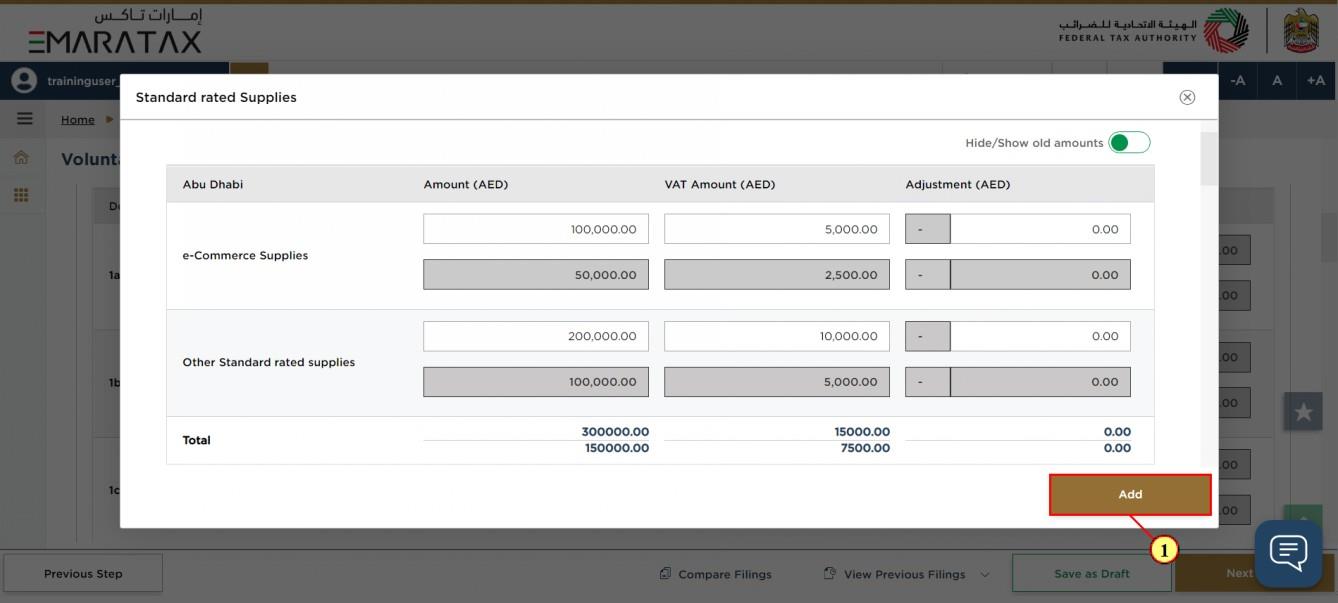

Step | Action |

(1) | Click on ‘Add‘ |

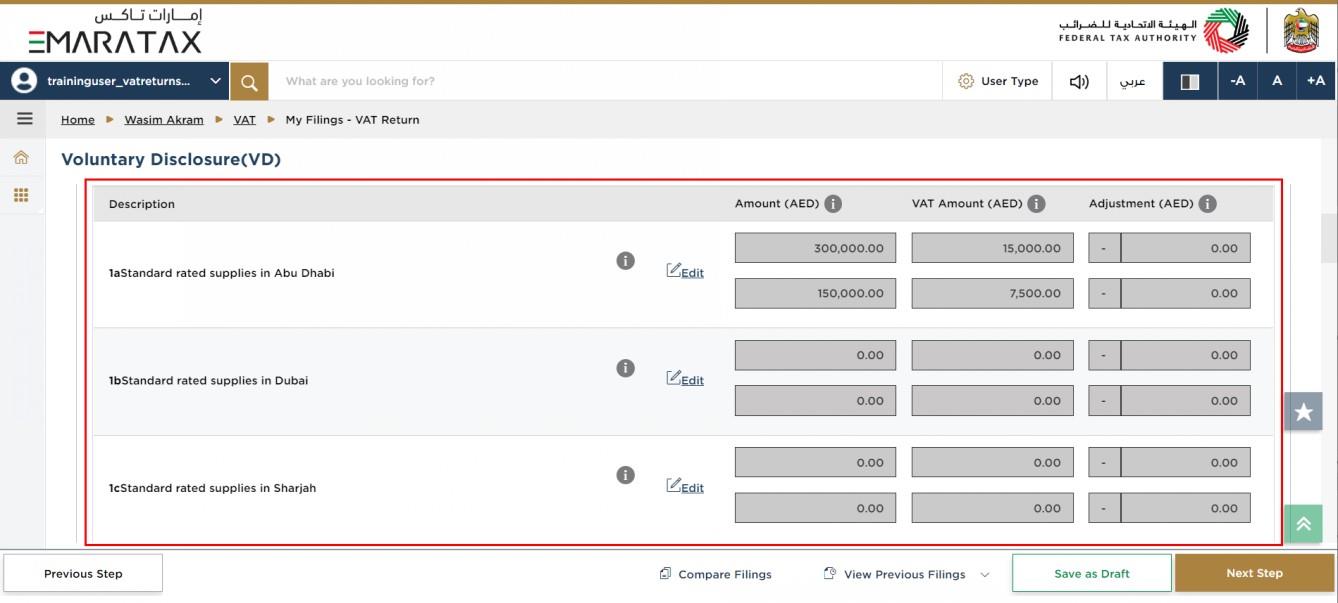

| The standard rated supplies for the corresponding Emirate are auto-calculated as the sum of the amounts entered in the boxes for e-commerce and other standard rated supplies, by Emirate. |

| The bottom boxes for each Emirate display the values that have been previously declared and the top boxes display the new figures that you want to declare for each Emirate. |

Step | Action |

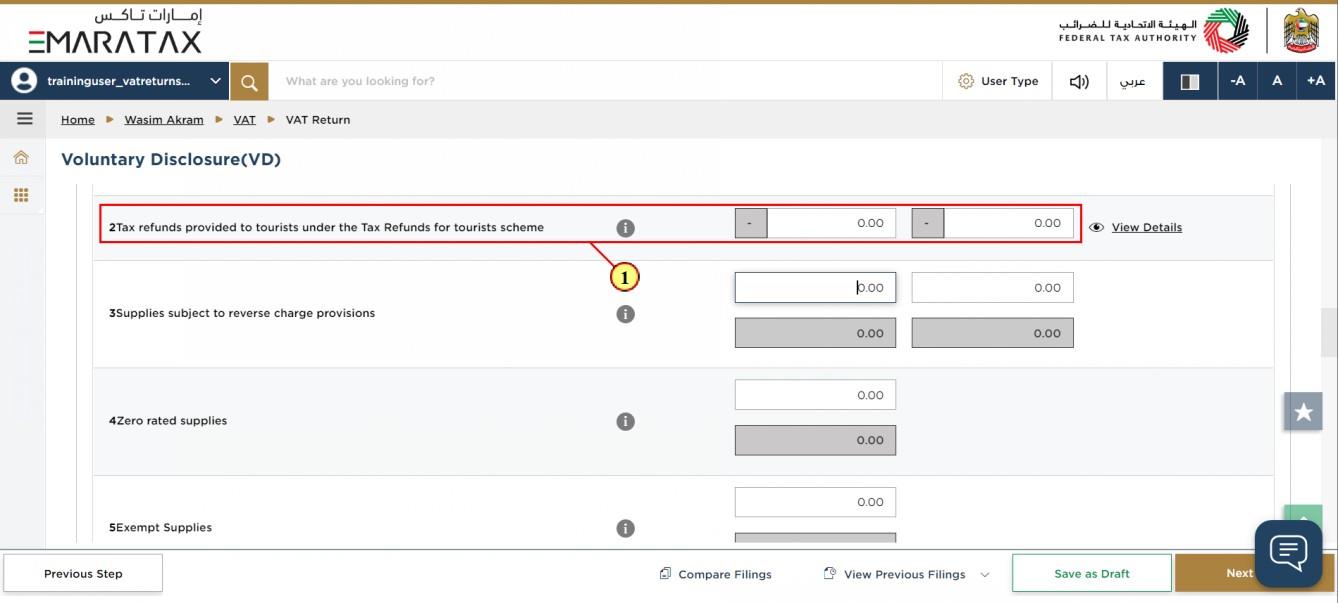

(1) | Enter amount and VAT amount in Box 2 |

Step | Action |

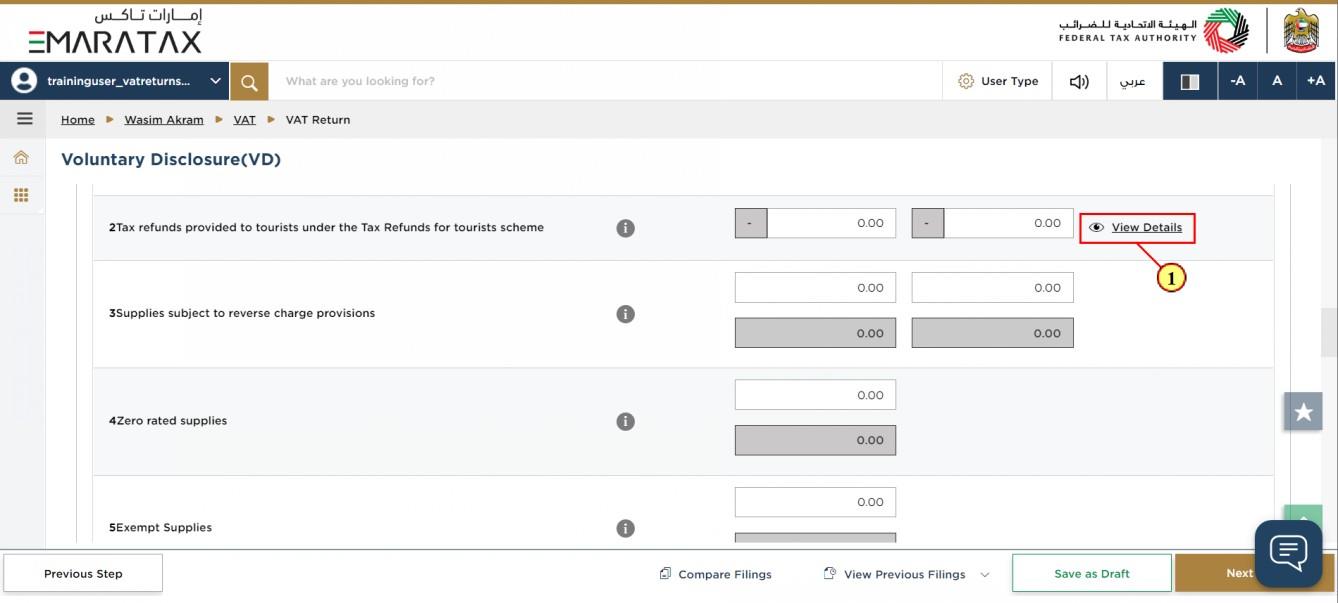

(1) | Click here to view the invoice details received from Planet Tax Free. |

Step | Action |

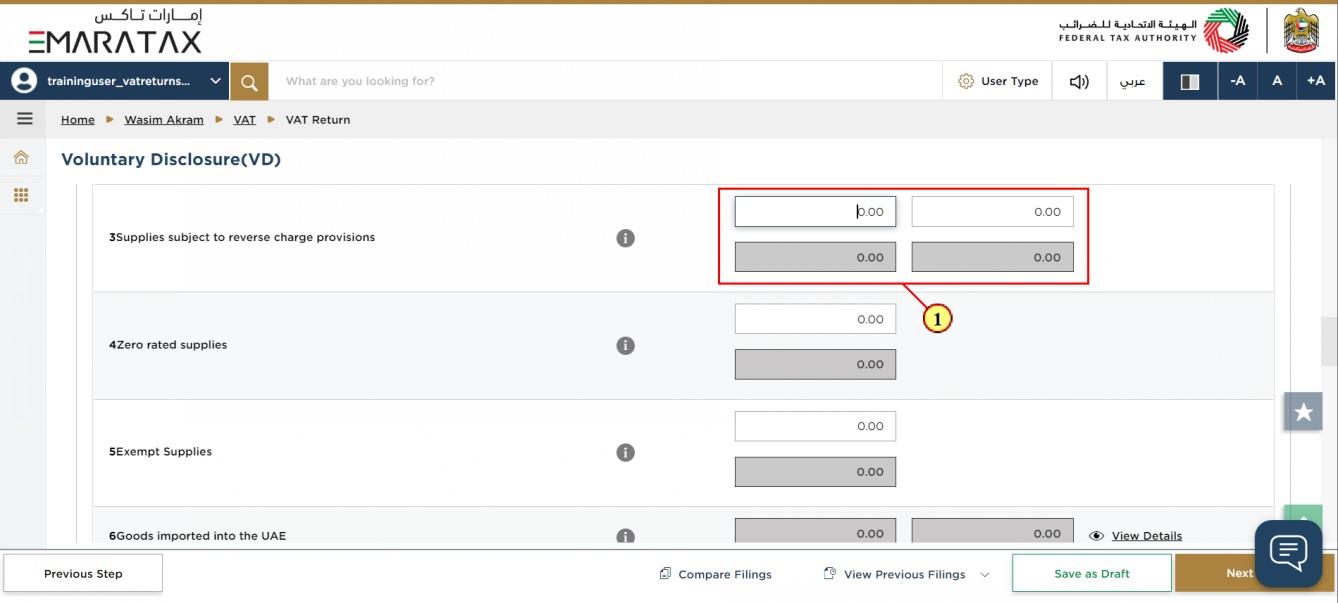

(1) | Fill box 3 with amount and VAT amount. |

Step | Action |

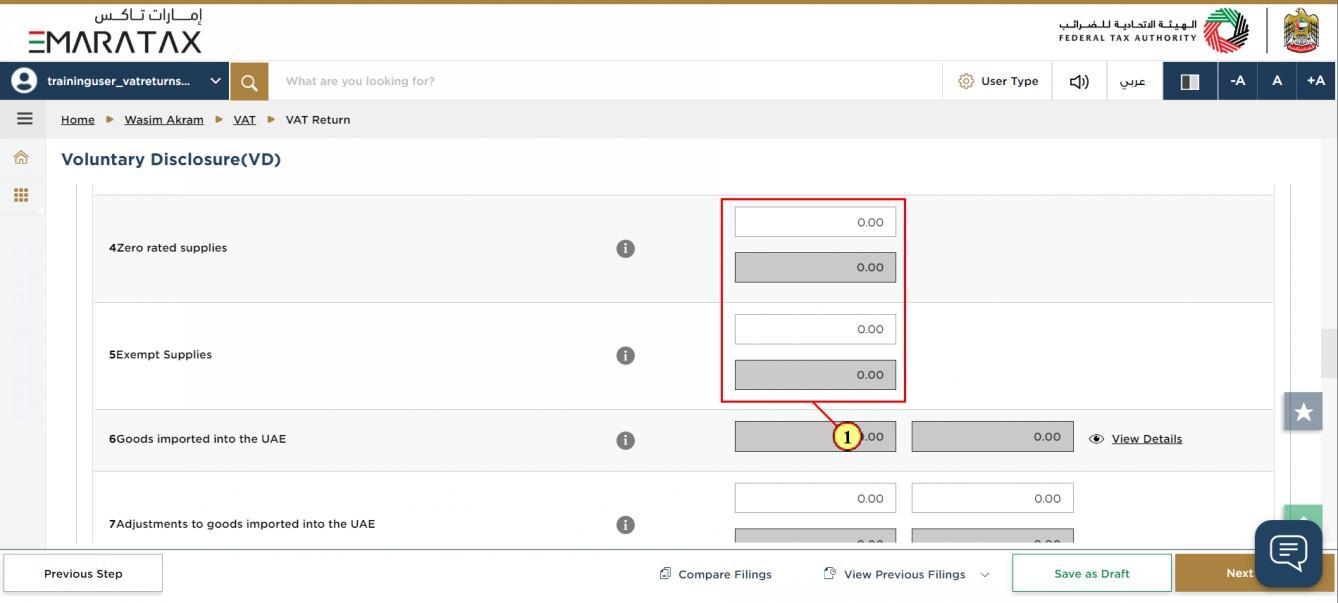

(1) | Fill box 4 and box 5 with amount |

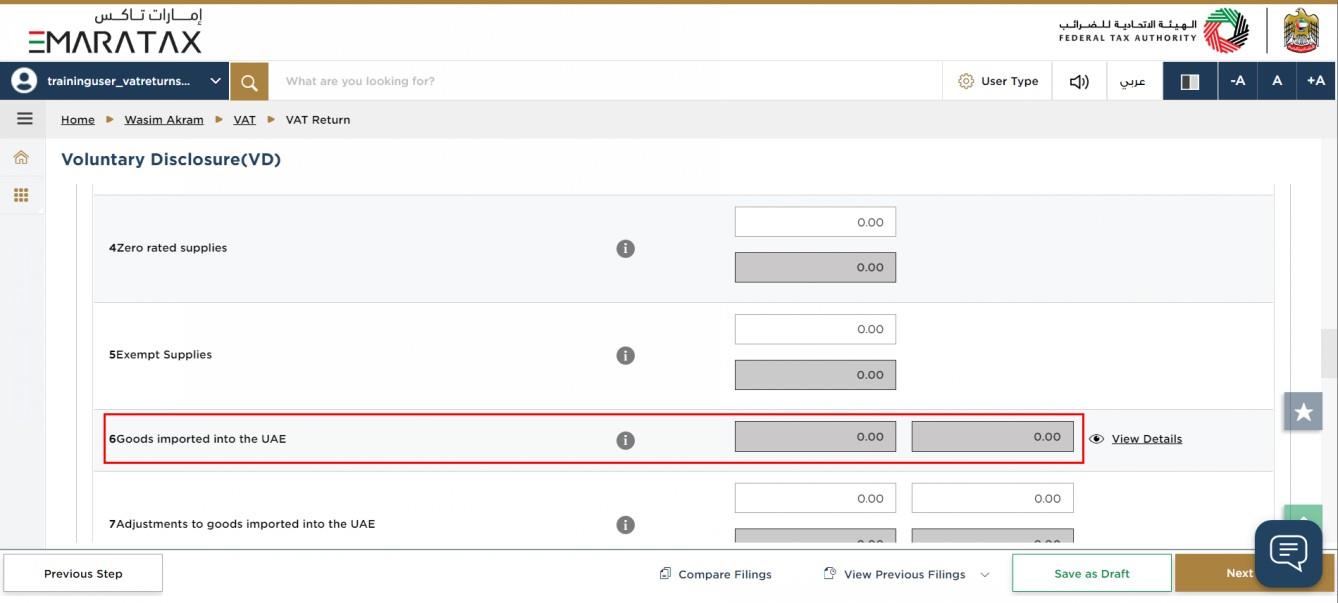

| Box 6 is pre-populated based on the data received from customs |

Step | Action |

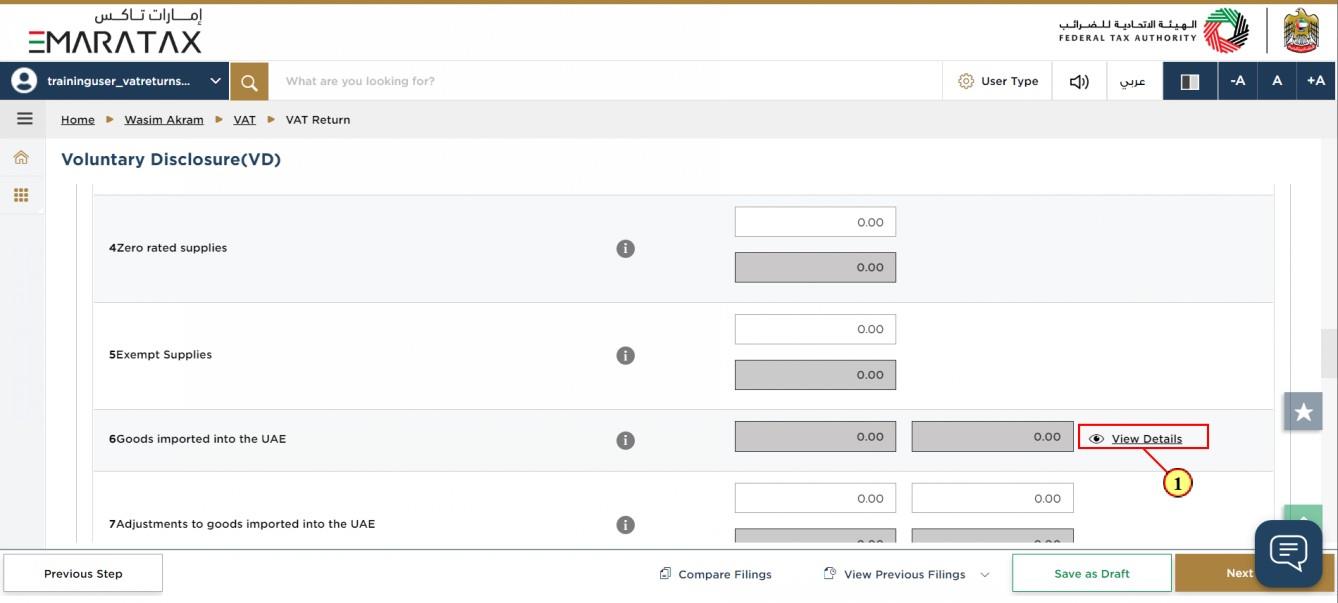

(1) | Click here to get the detailed view of Goods imported into the UAE |

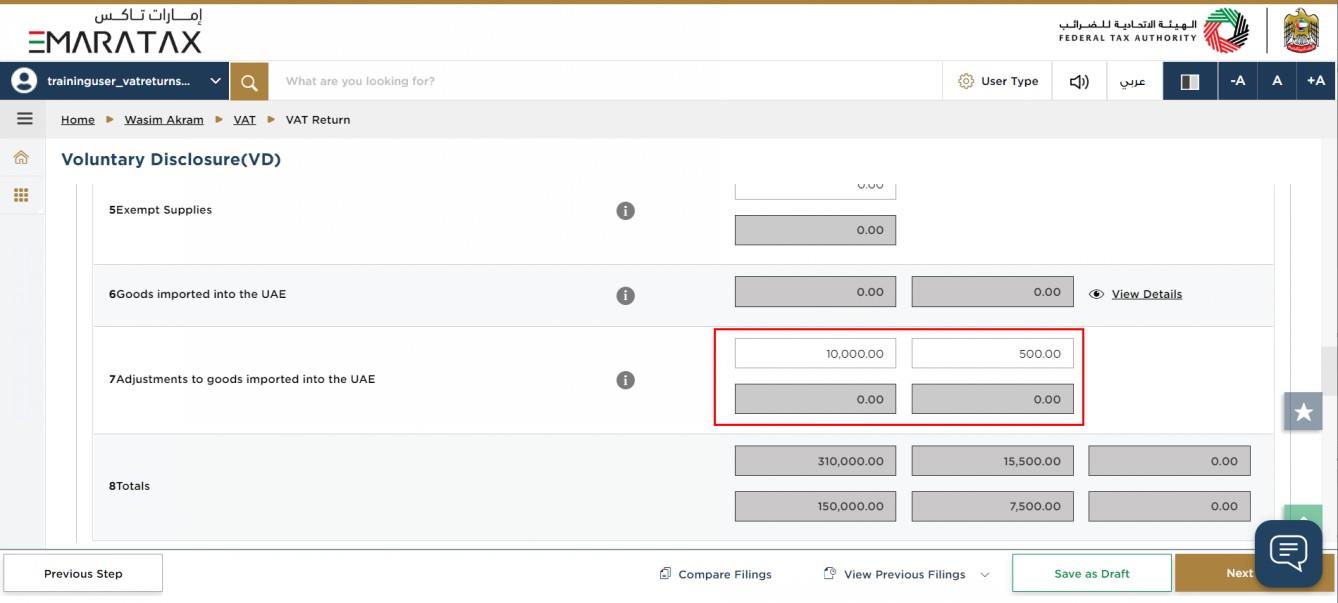

| Box 7 should be used if the information that is prepopulated in Box 6 regarding goods imported into the UAE is incomplete or incorrect. In such case, use this box to make adjustments accordingly. |

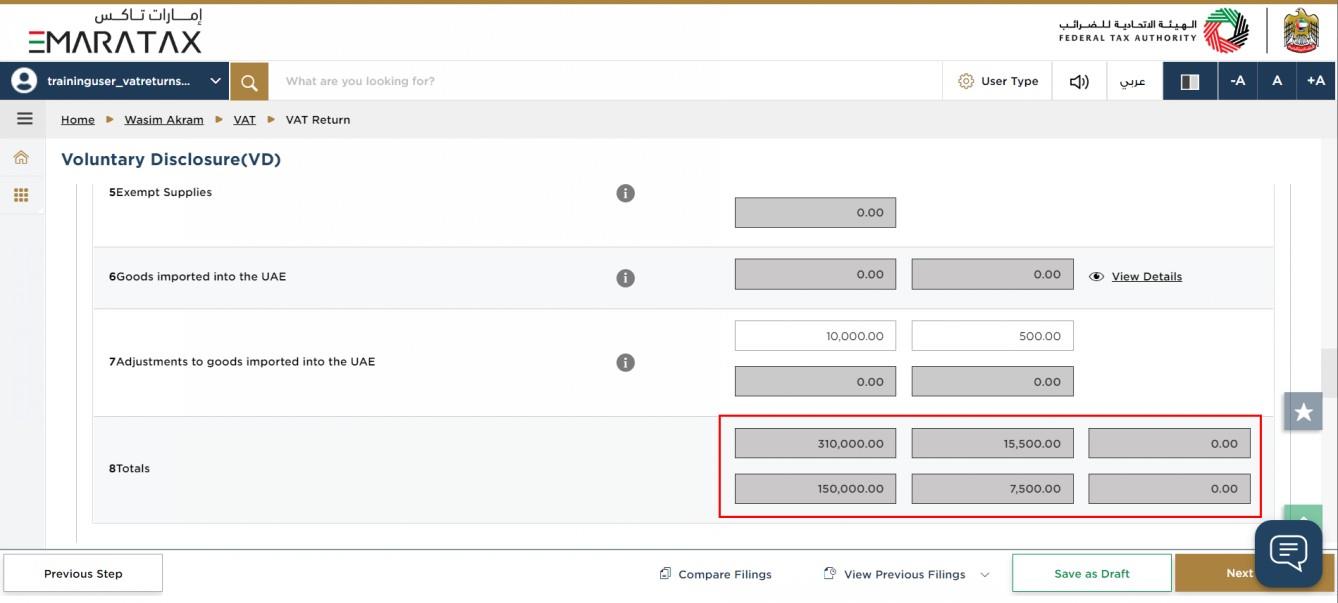

| Box 8 is the total of box 1 to box 7 which is your total output for the Tax Period |

Step | Action |

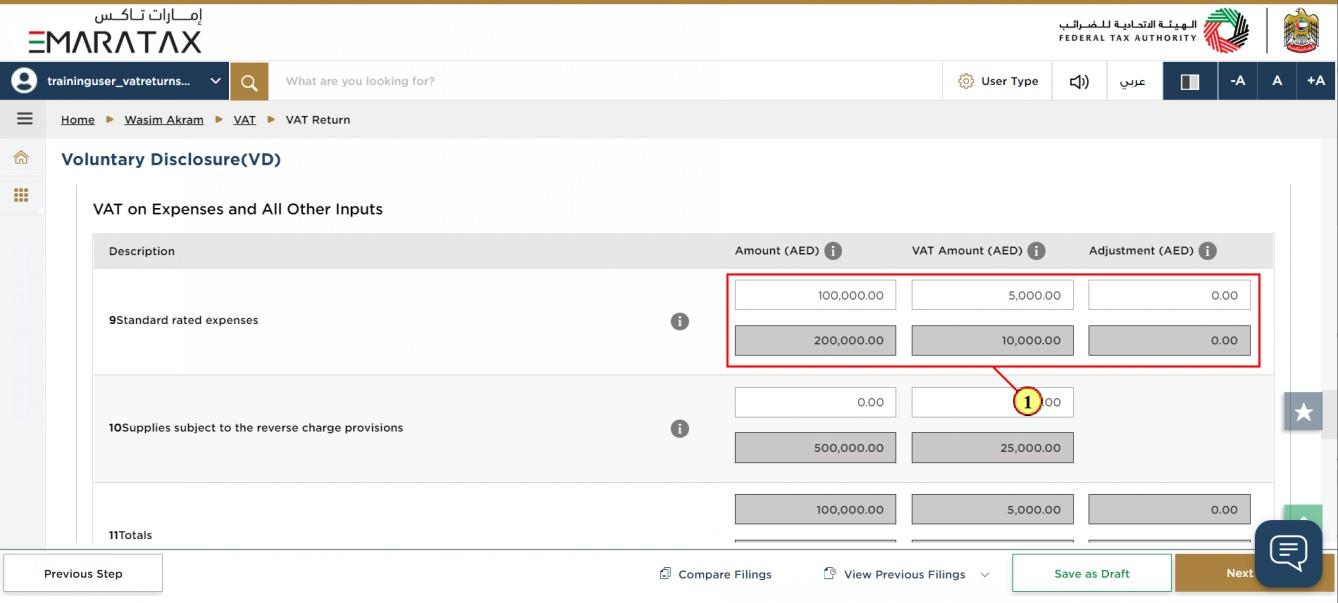

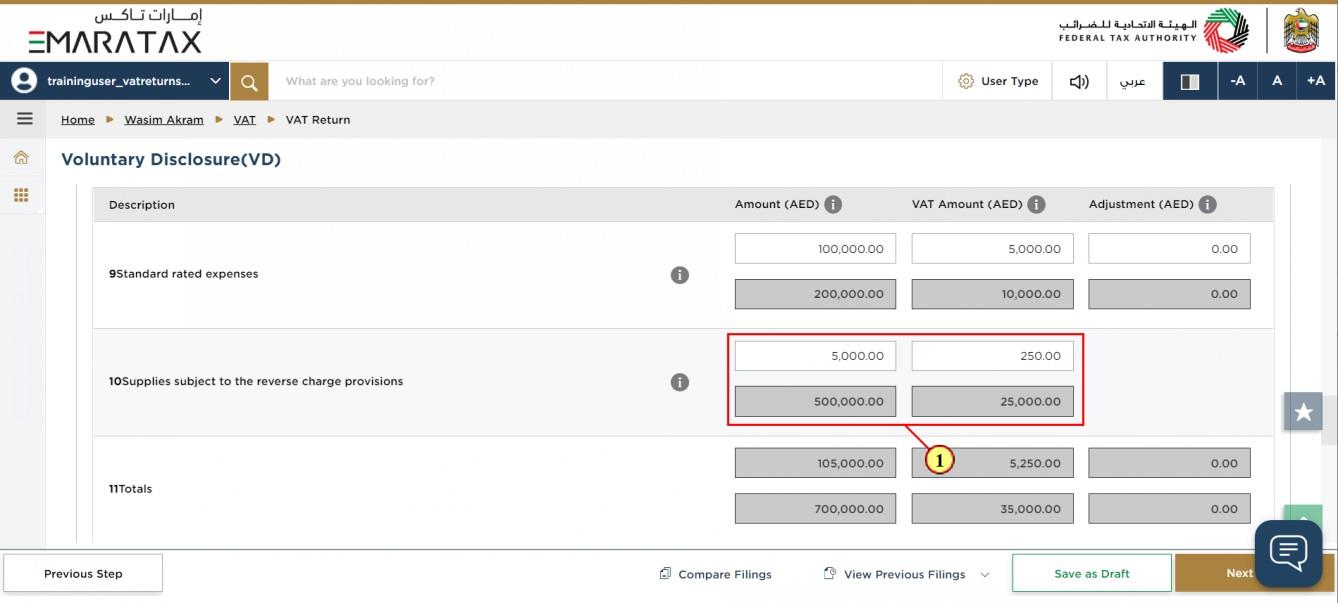

(1) | Enter the amount, corresponding VAT amount and adjustment amount for your standard rated expenses for the period. |

Step | Action |

(1) | Enter the amount and corresponding VAT amount for supplies that are subject to the reverse charge |

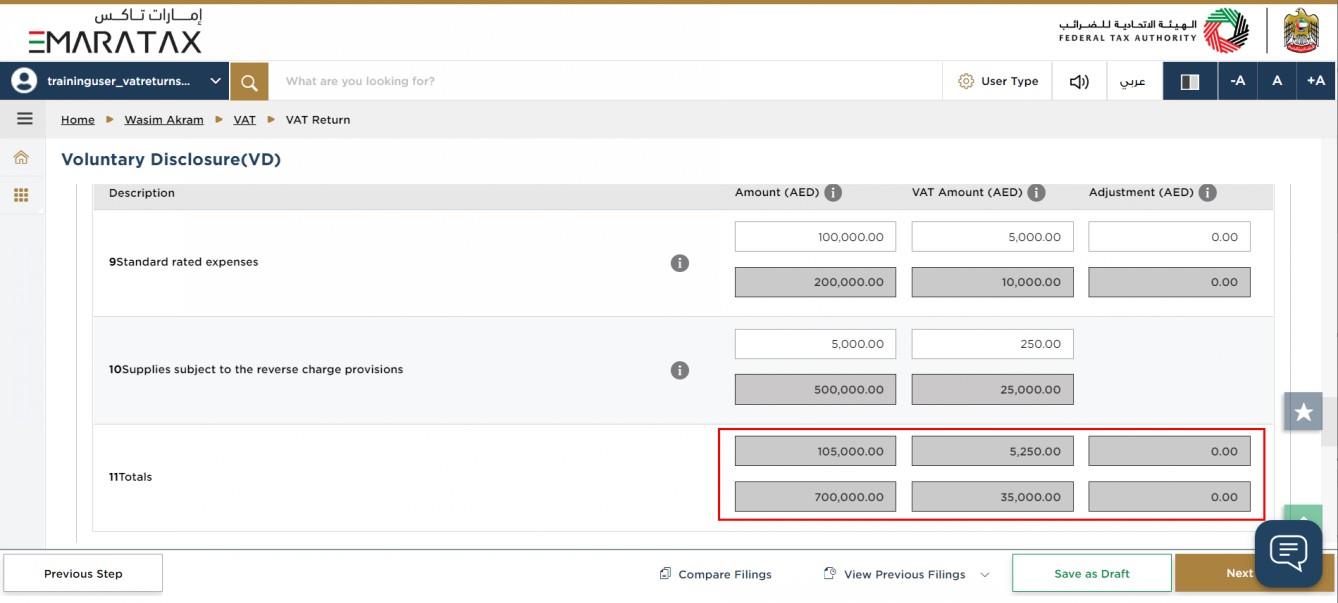

| Box 11 is auto-calculated and displays your total inputs for the Tax Period |

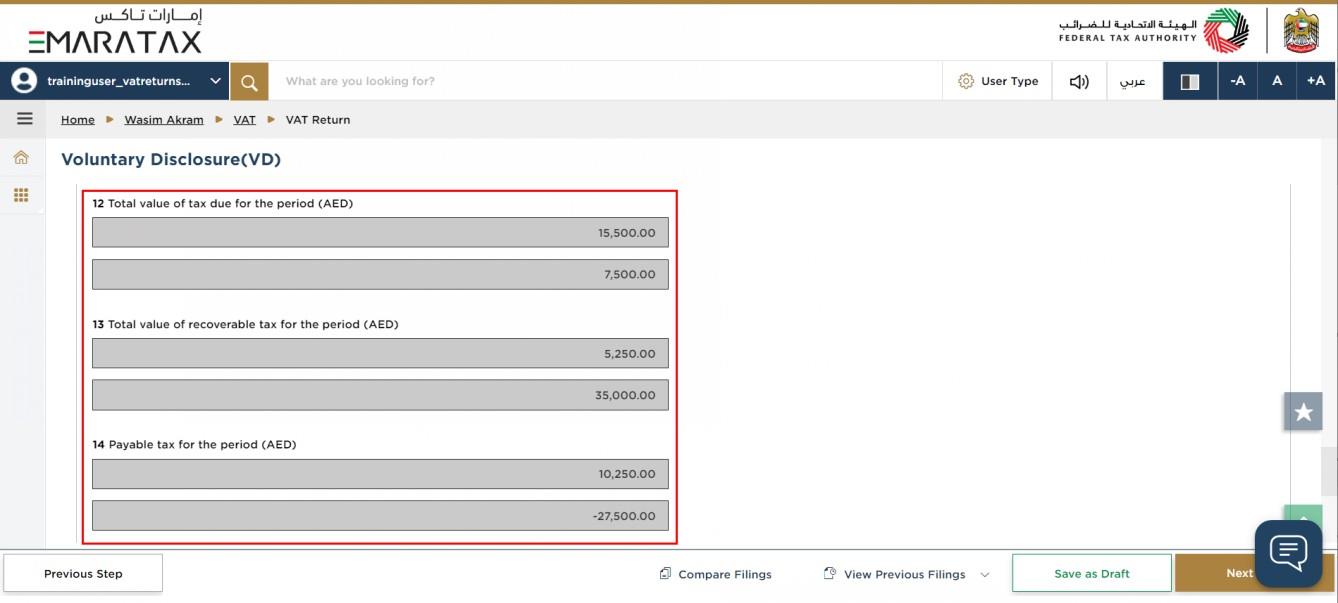

| Box 12 displays the total output tax for the period. Box 13 displays the total input tax for the period and box 14 displays the payable and (or) refundable tax for the period. |

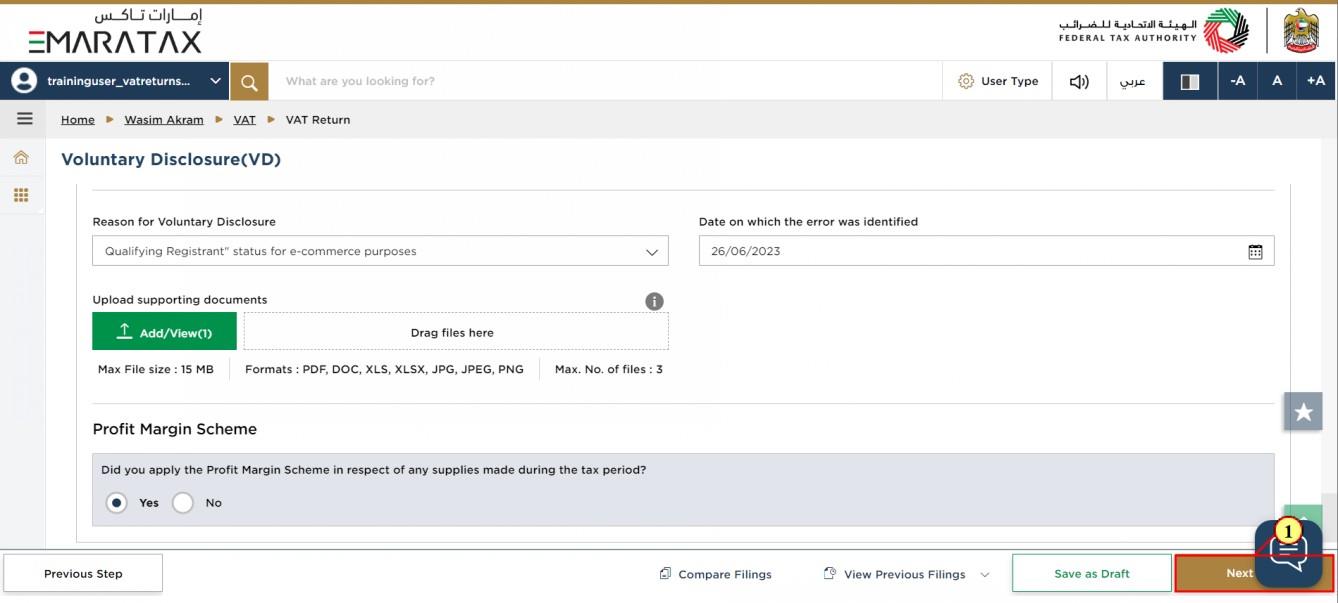

Step | Action |

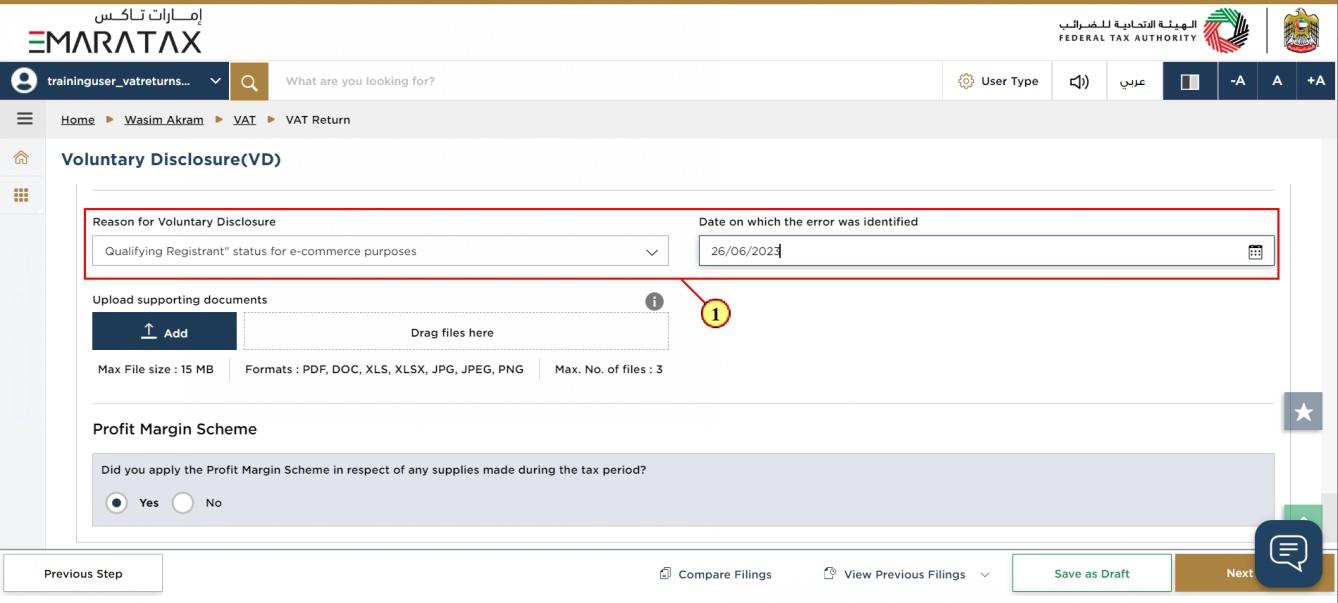

(1) | Click here to select the reason for Voluntary Disclosure and select the date on which the error was identified. You will find in the drop down menu for the reasons for submitting the VD a reason relating to your “Qualifying Registrant” status for e-commerce purposes. |

Step | Action |

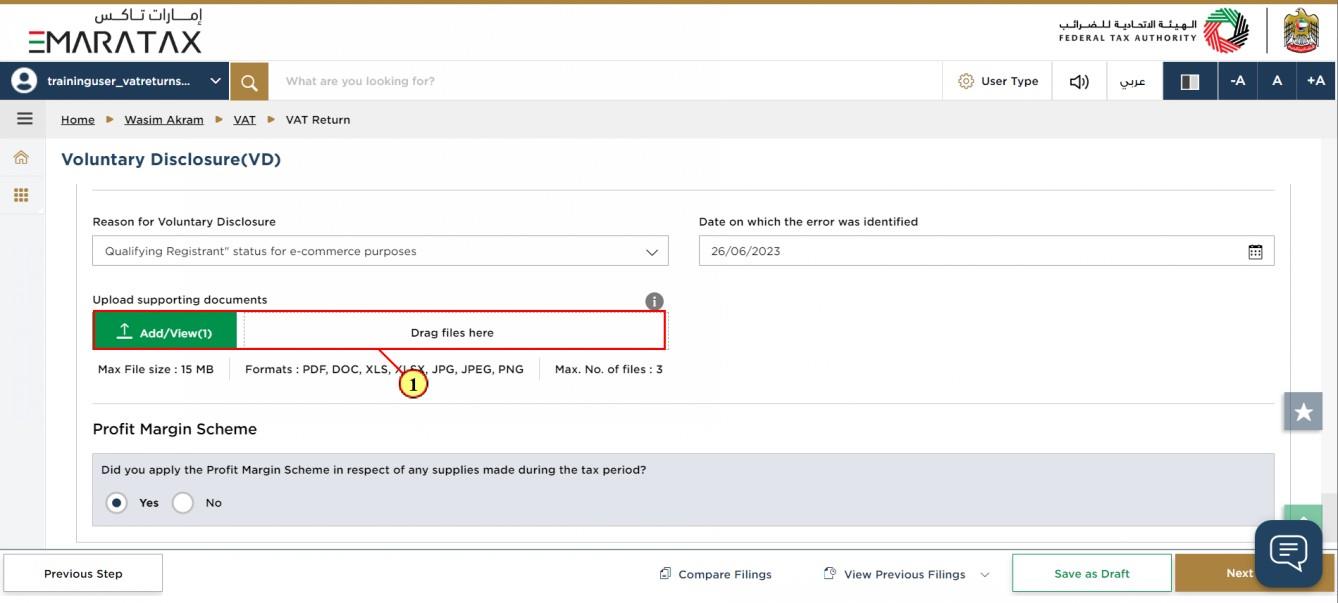

(1) | Click on 'Add' button or drag & drop your files to upload supporting documents. On successful upload of document, the Add button will be highlighted in green |

Step | Action |

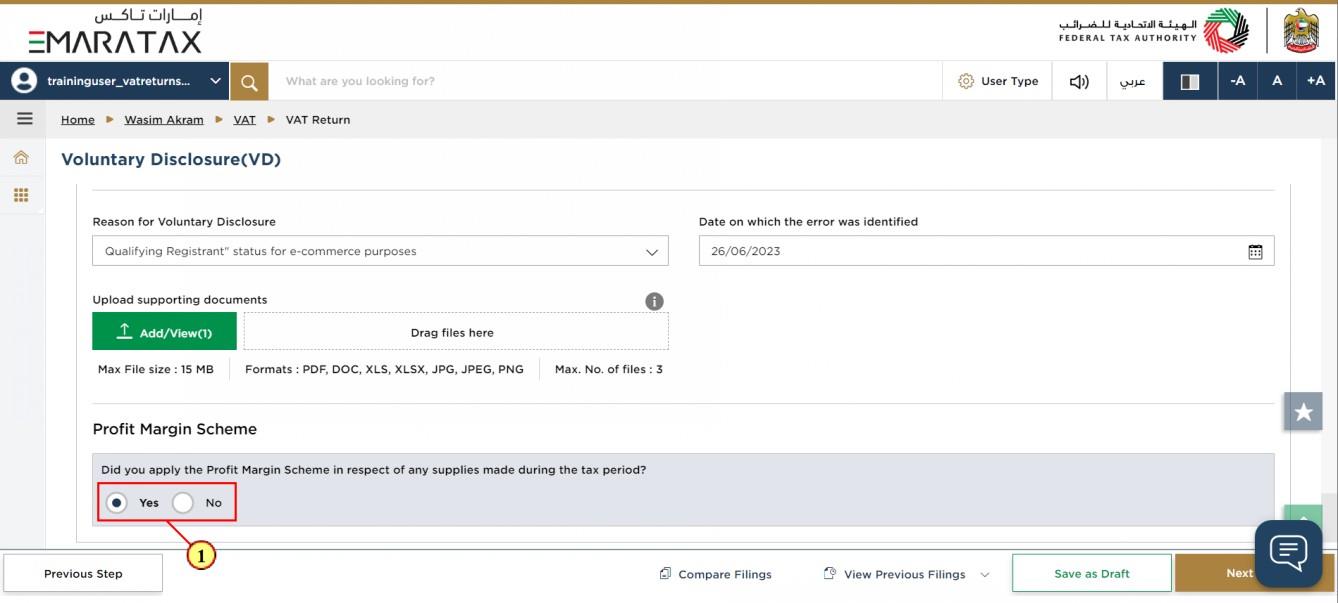

(1) | Select 'Yes' if you have reported amounts using the 'Profit Margin Scheme |

Step | Action |

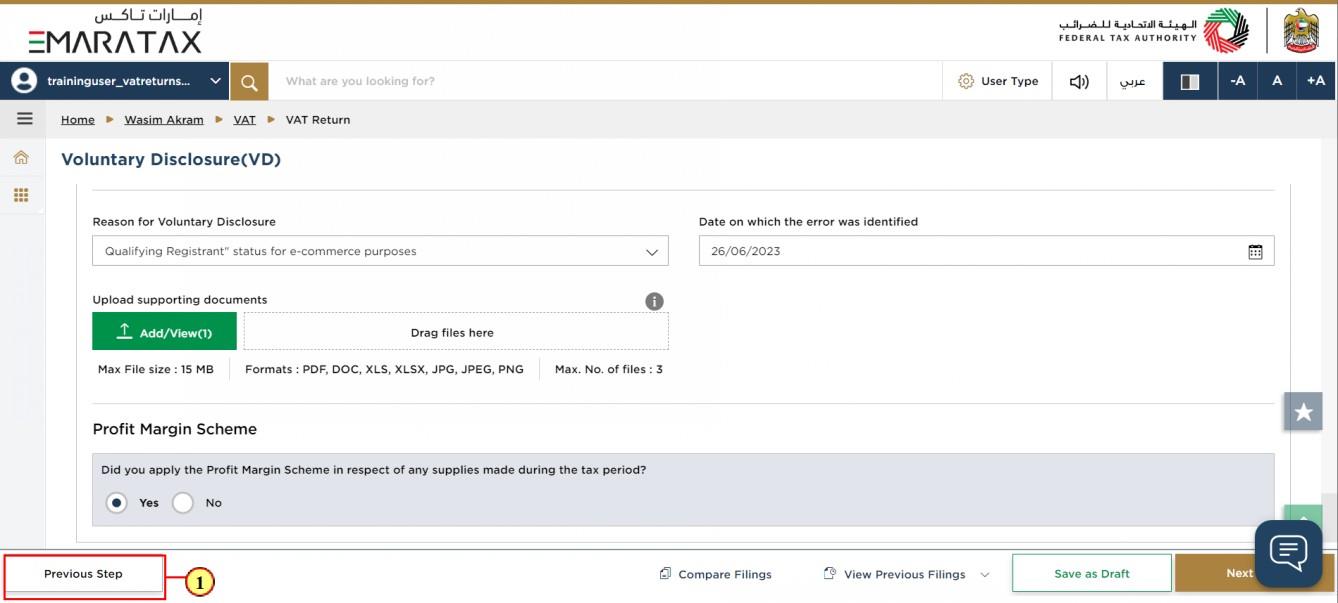

(1) | Click on 'Previous Step' to go back to the previous section |

Step | Action |

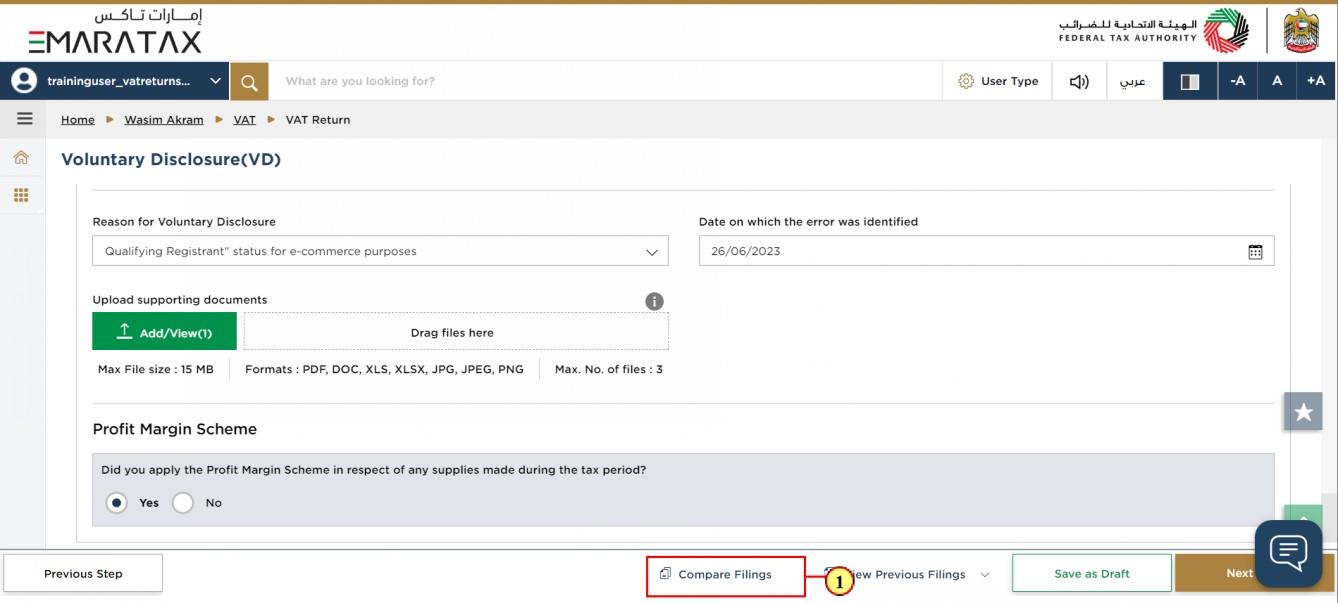

(1) | Click on 'Compare Filings' to compare the filings. |

Step | Action |

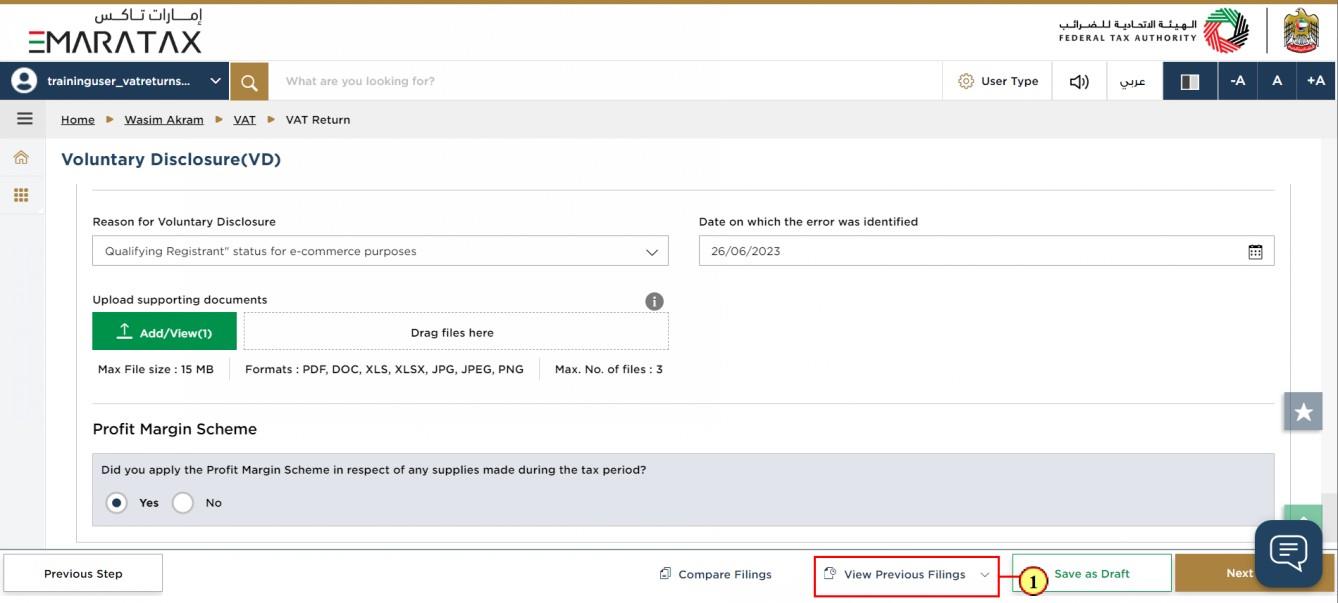

(1) | Click on 'View Previous Filings' to view the previous filings. |

Step | Action |

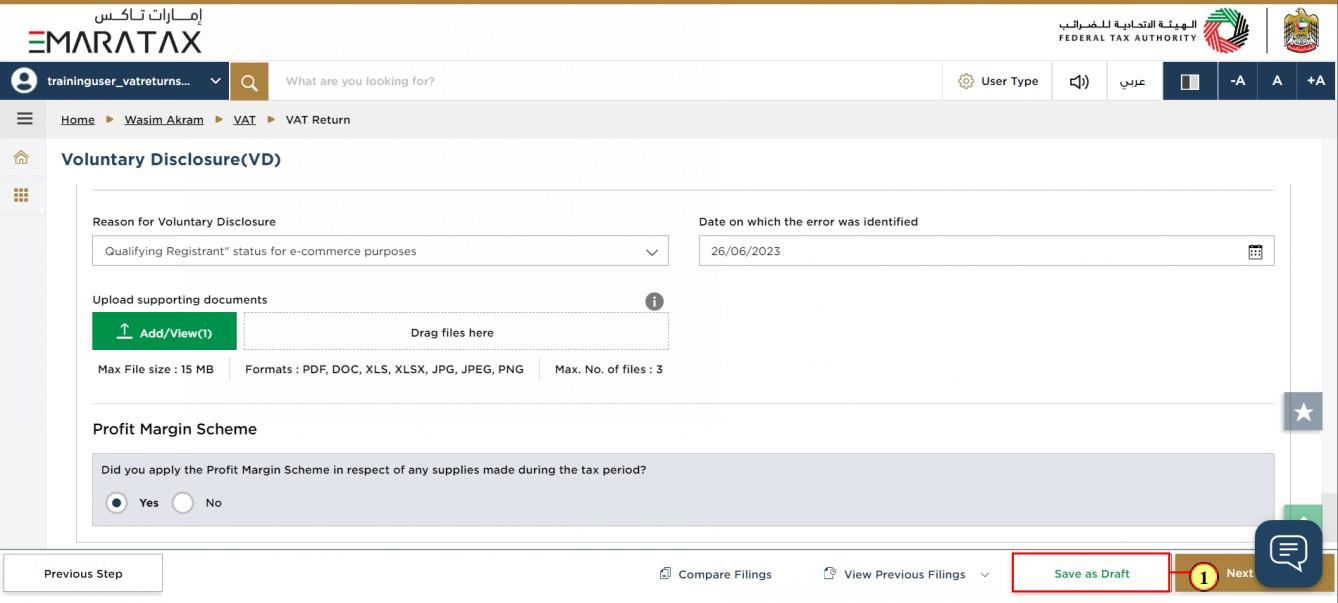

(1) | Click on 'Save as draft' to save the VAT Voluntary Disclosure as a draft. |

Step | Action |

(1) | Click on 'Next Step' to proceed to the next section |

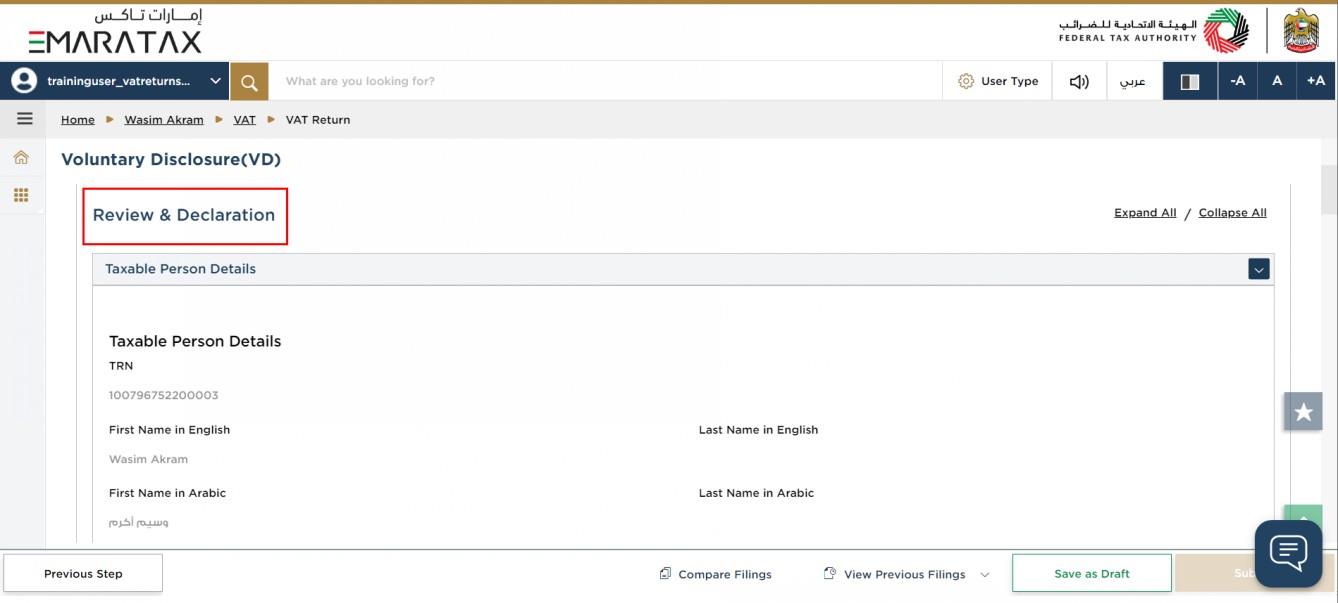

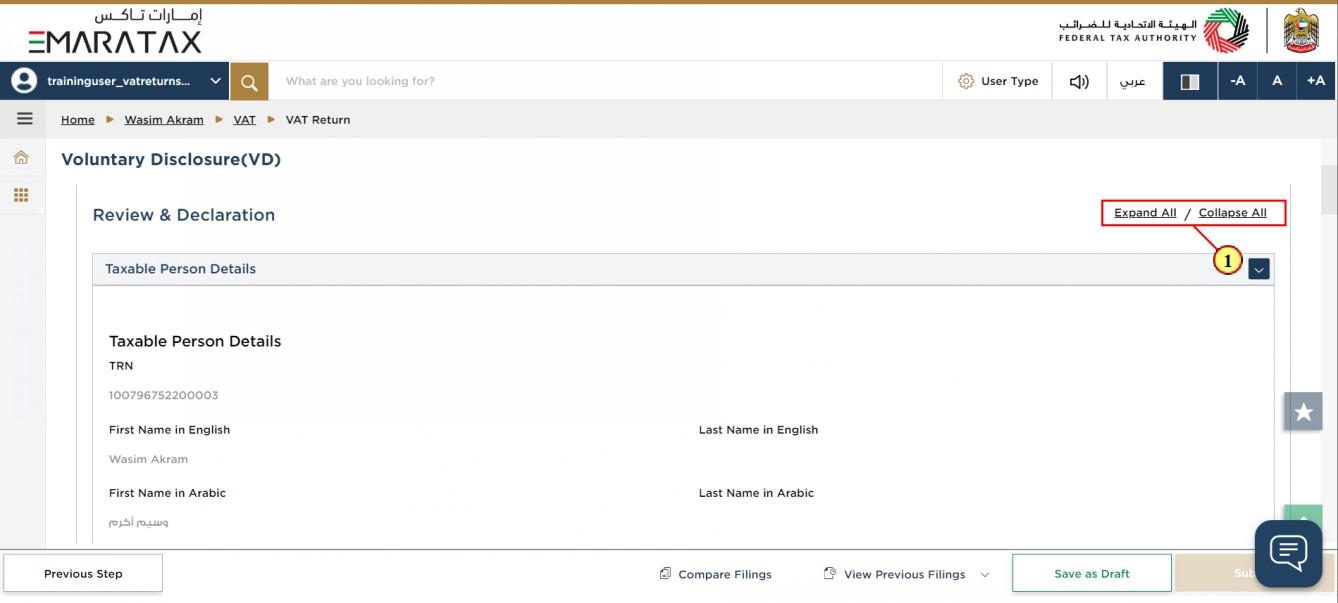

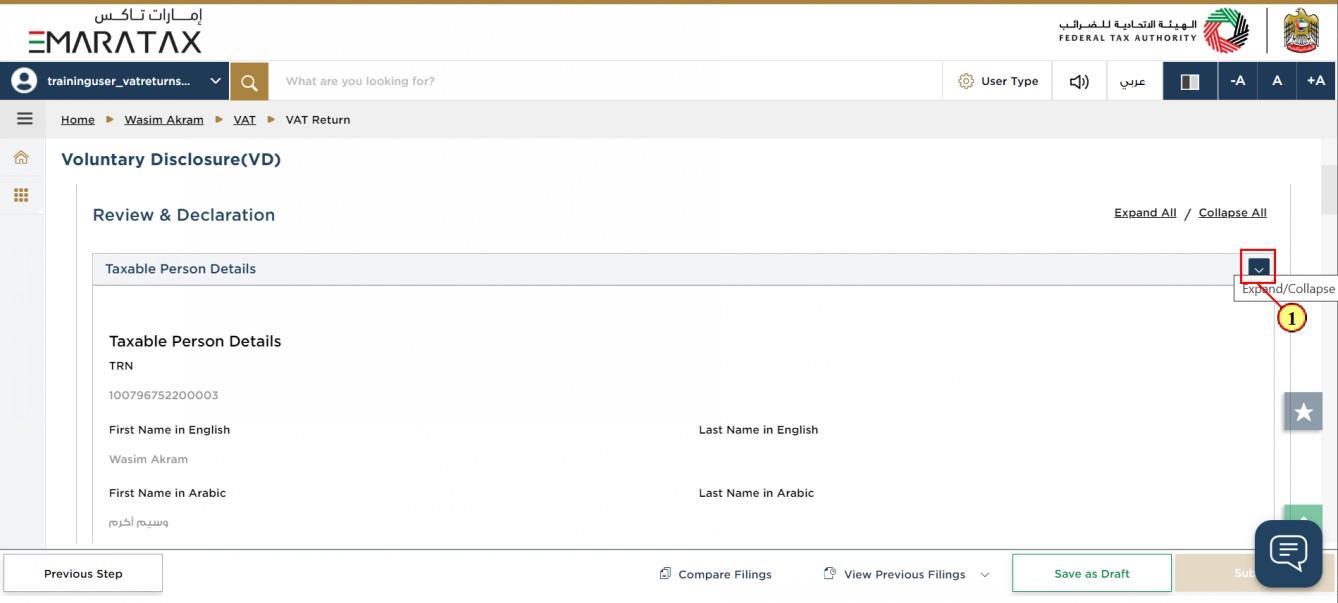

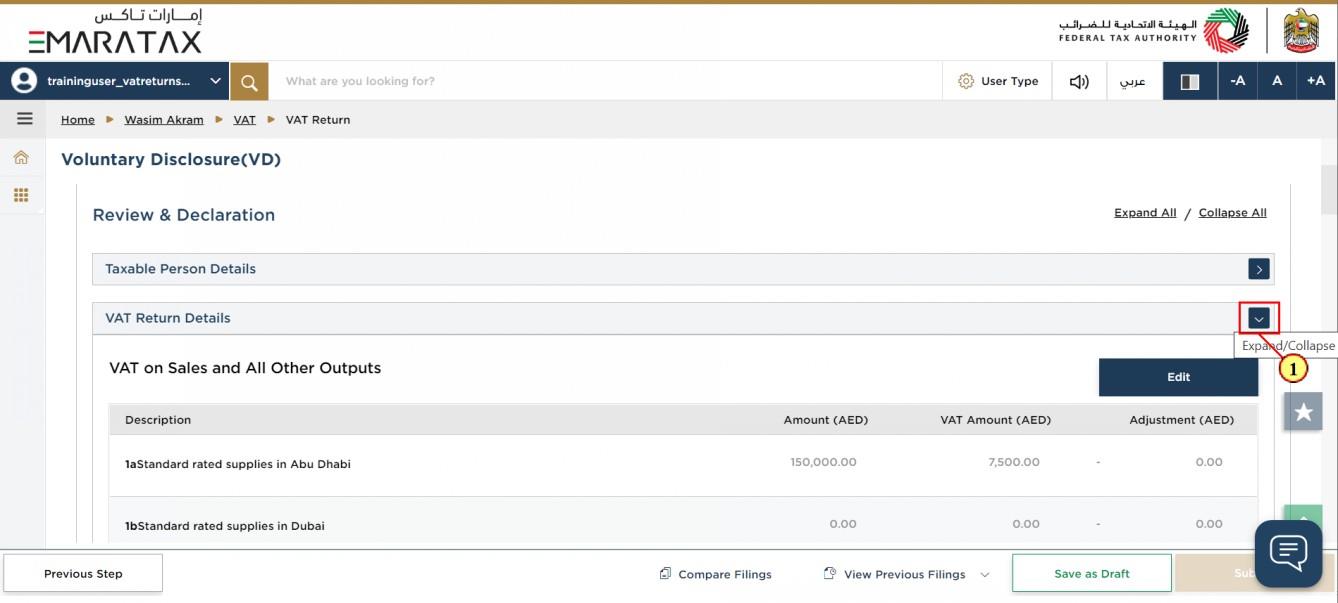

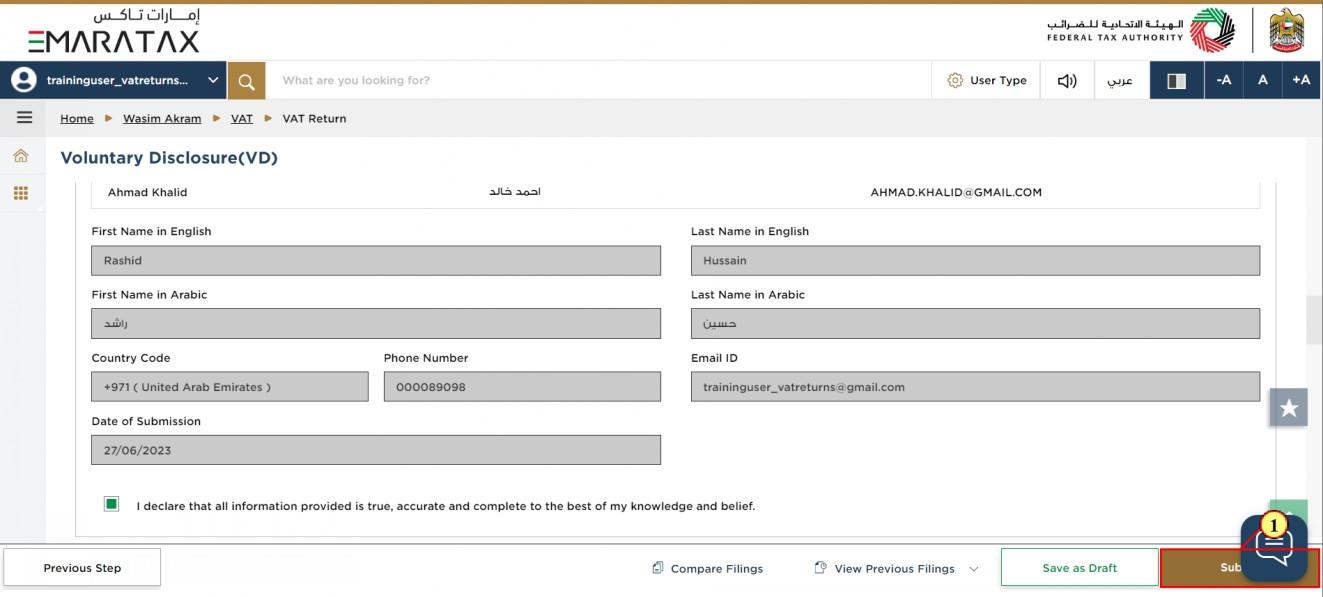

Review & Declaration

| This section displays your completed VAT VD and allows you to review it prior to submission |

Step | Action |

(1) | Click here to expand or collapse all steps at once |

Step | Action |

(1) | Click here to expand or collapse each section |

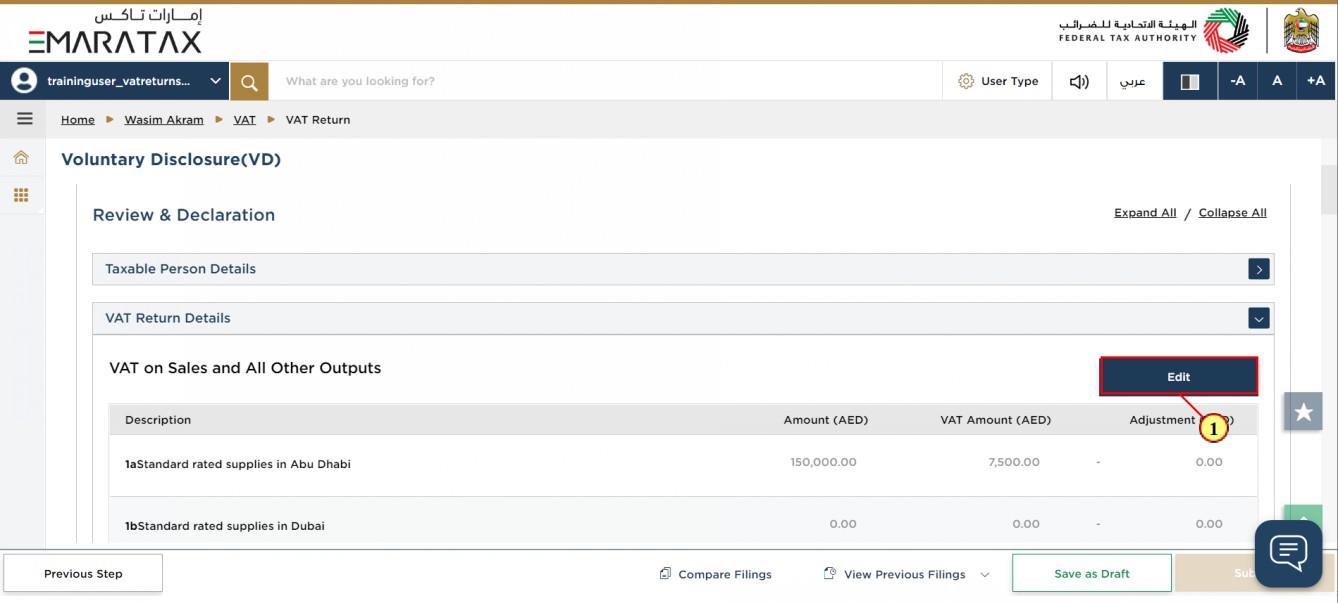

Step | Action |

(1) | Click on each step to review every section |

Step | Action |

(1) | Click here to edit the VAT VD |

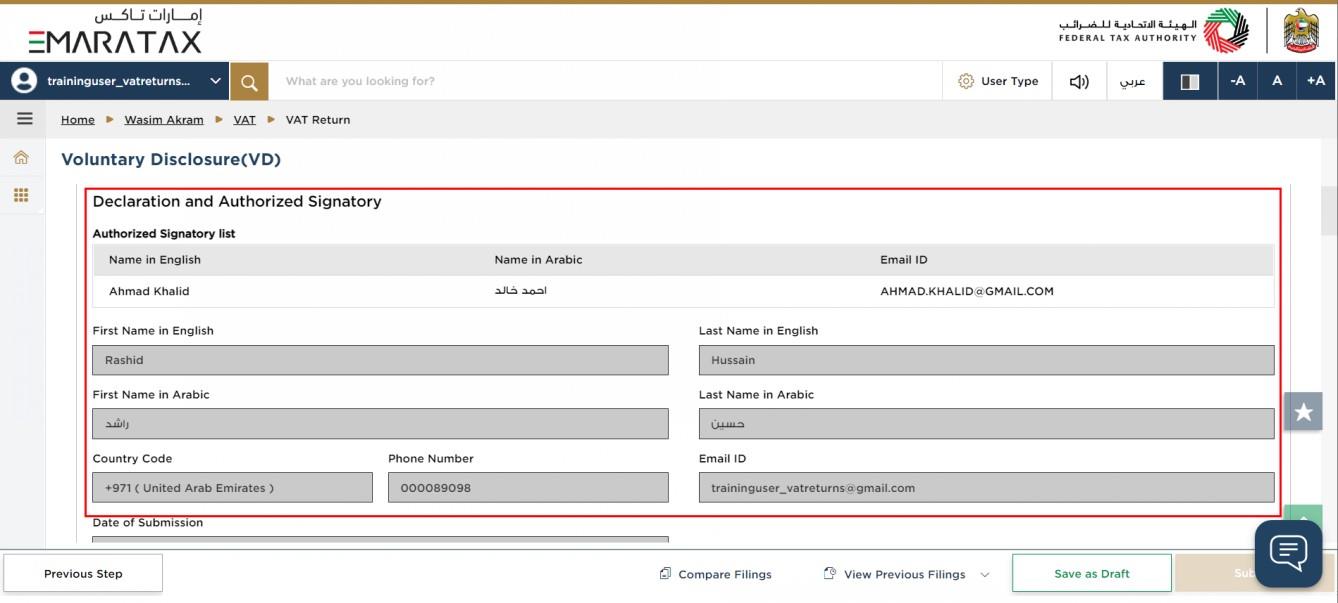

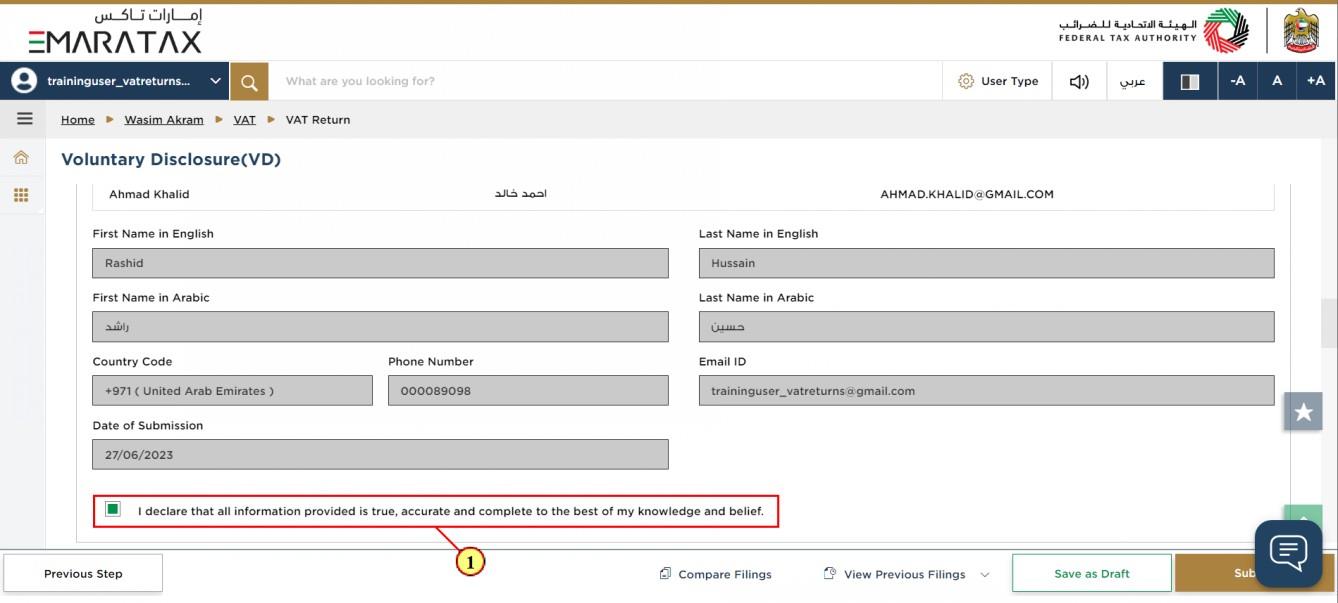

| The Declaration and Authorized Signatory details are pre-populated from your VAT Registration |

Step | Action |

(1) | Mark the checkbox to confirm that information provided is true, accurate and complete on this screen |

Step | Action |

(1) | Click on 'Submit' to submit the VAT Voluntary Disclosure |

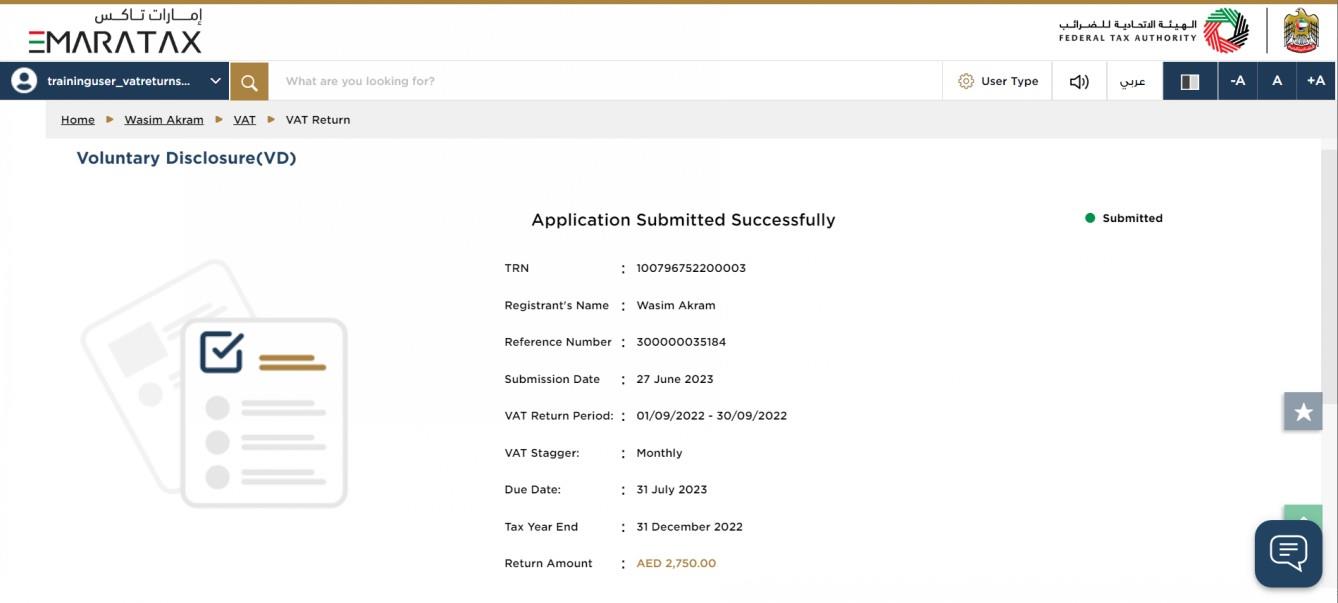

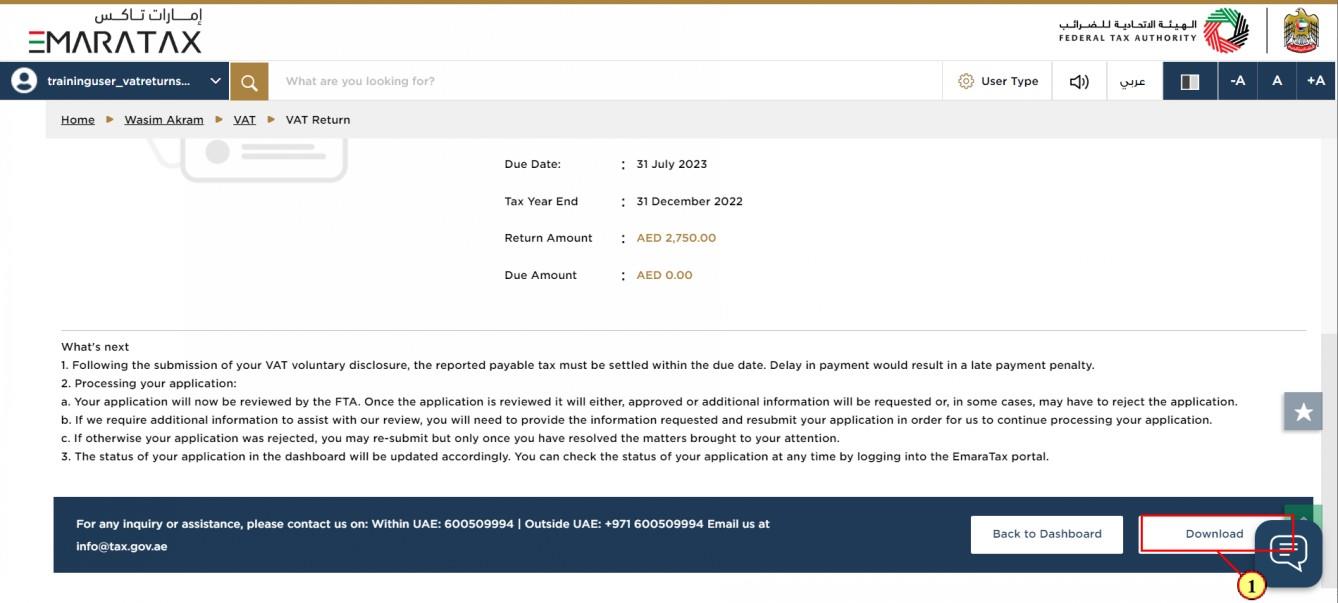

Acknowledgement

| You have successfully submitted the voluntary disclosure! Make a note of the transaction number for future references. You can also access this Voluntary Disclosure from the VAT 201 return tile, within the VAT module. |

Step | Action |

(1) | Click on ‘Download‘ to download a copy of voluntary disclosure submission acknowledgement |

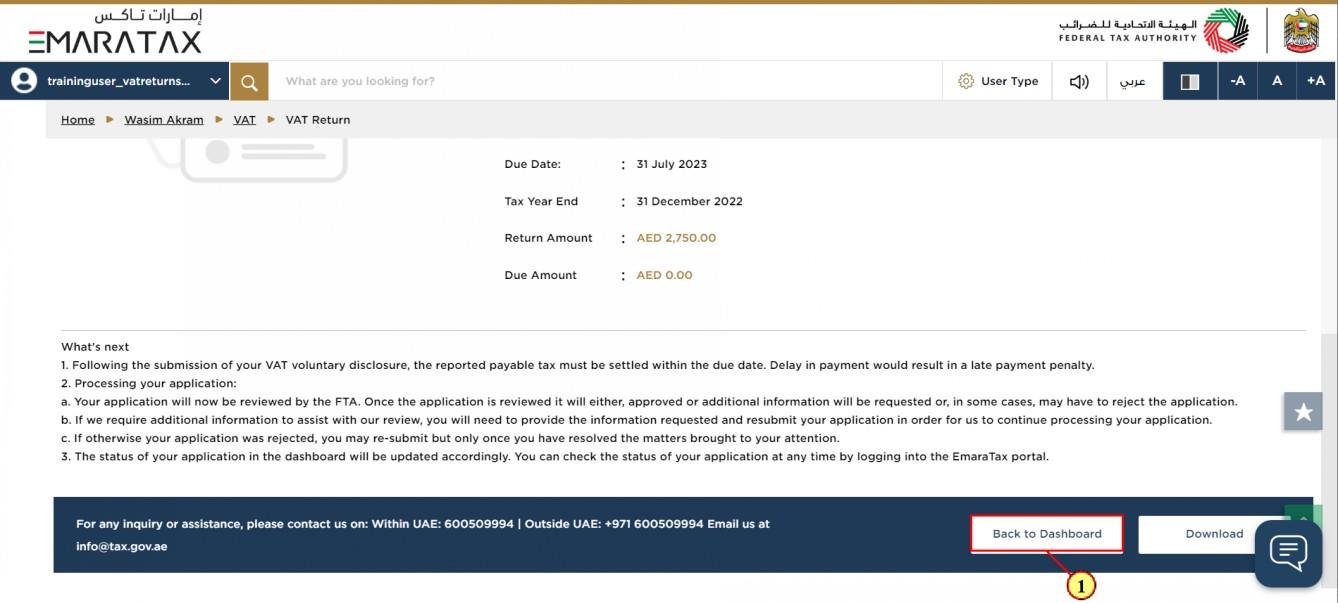

Step | Action |

(1) | Click on 'Back to Dashboard' to go back to dashboard. |

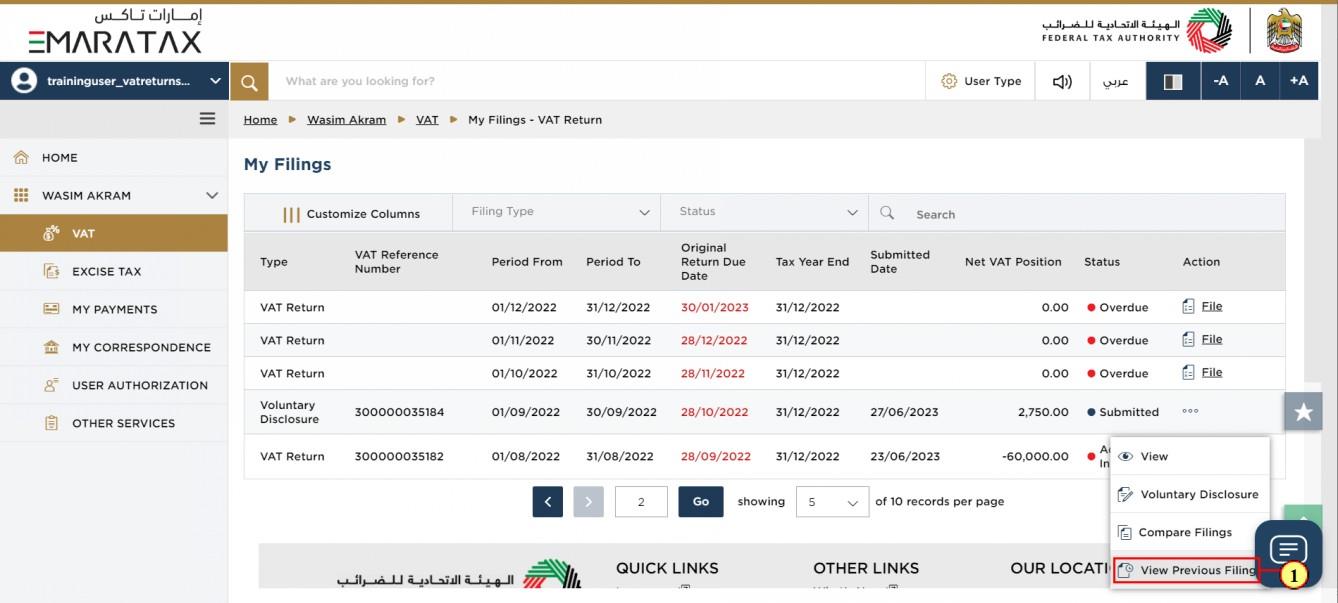

My Filings Dashboard

Step | Action |

(1) | Click here to compare your filings. |

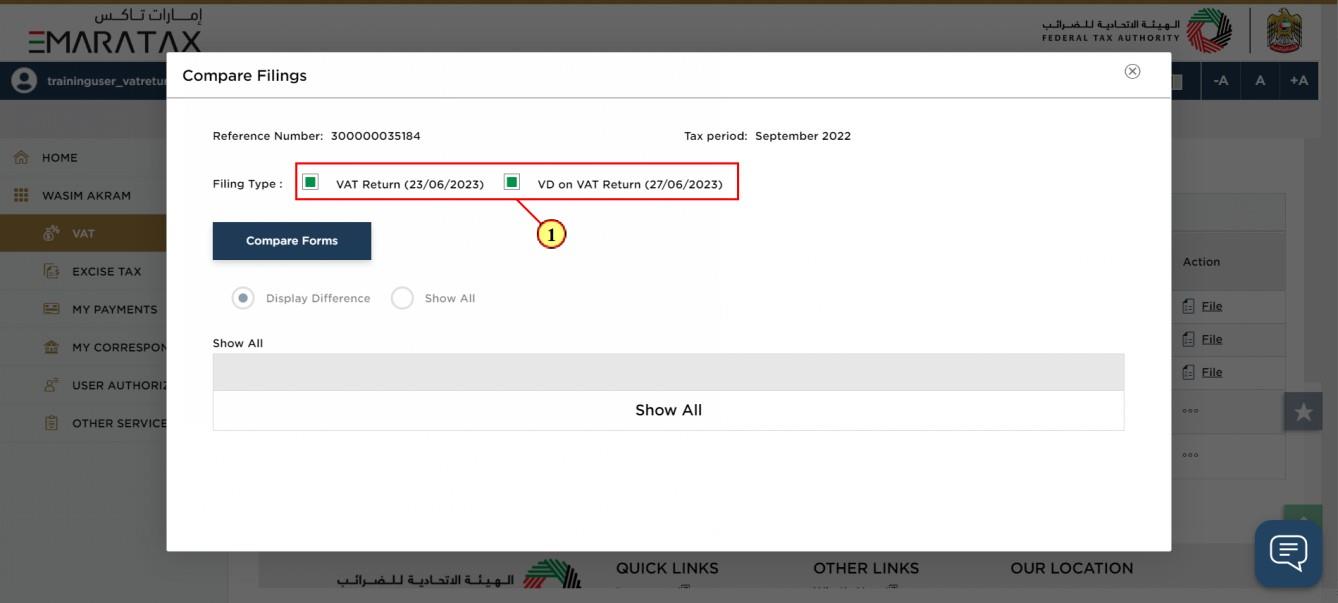

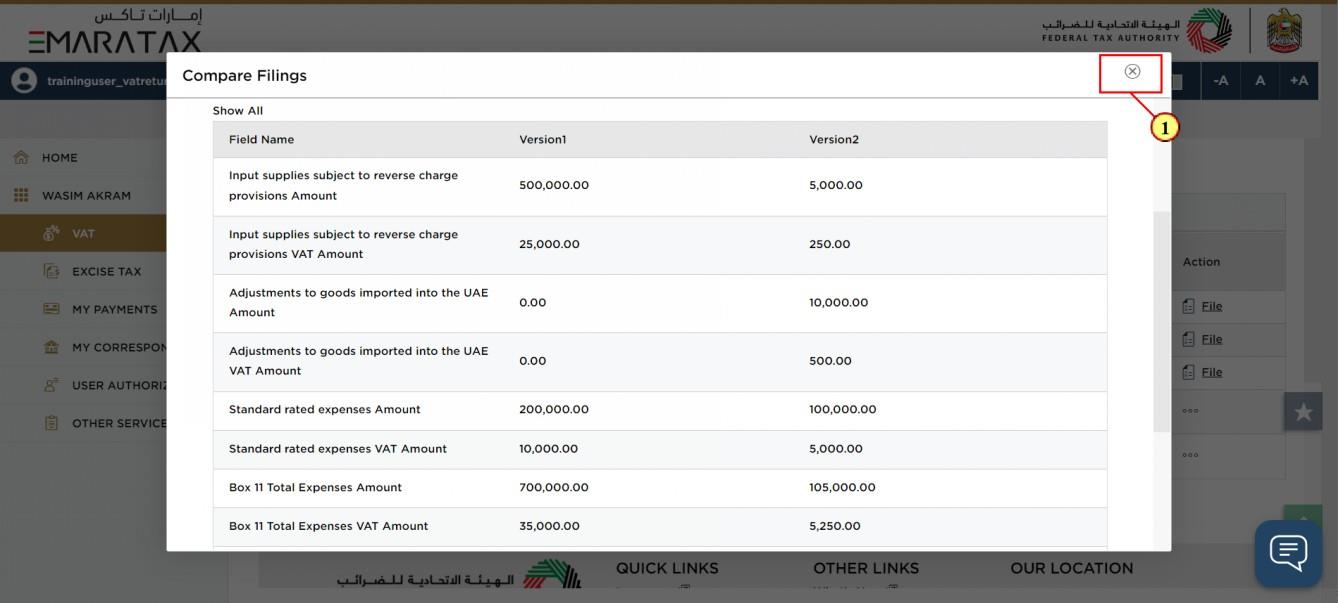

Compare Filings

Step | Action |

(1) | Mark the required checkboxes (type of filings) that you want to compare. |

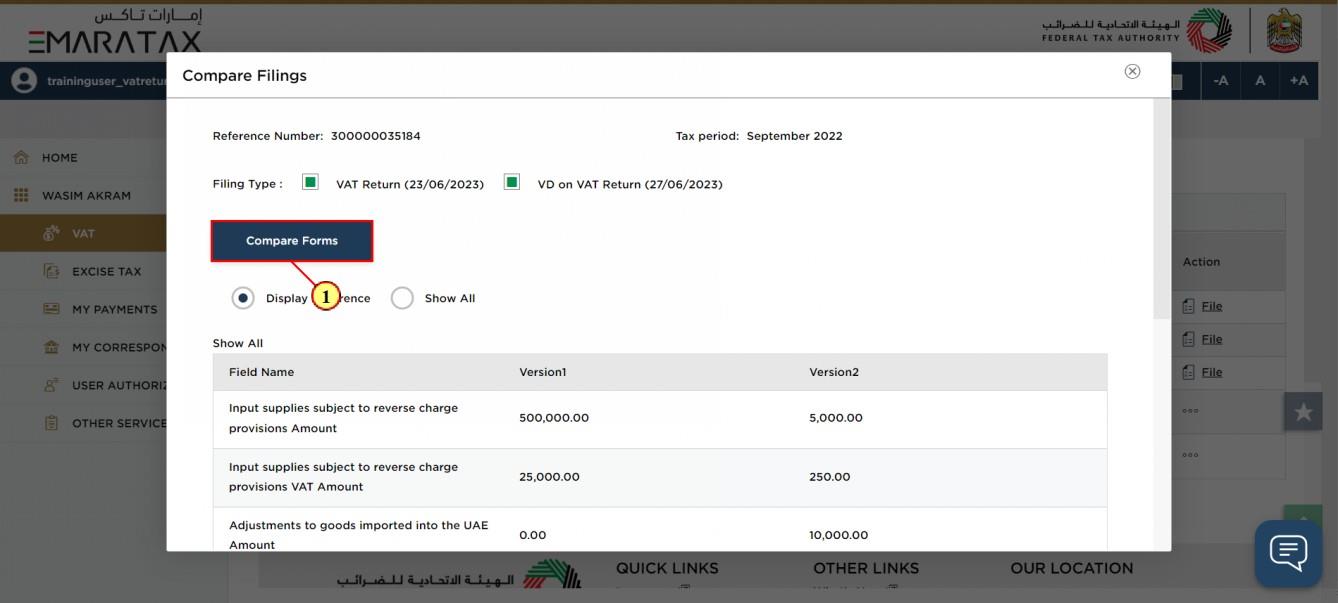

Step | Action |

(1) | Click on 'Compare Forms' to compare the selected forms. |

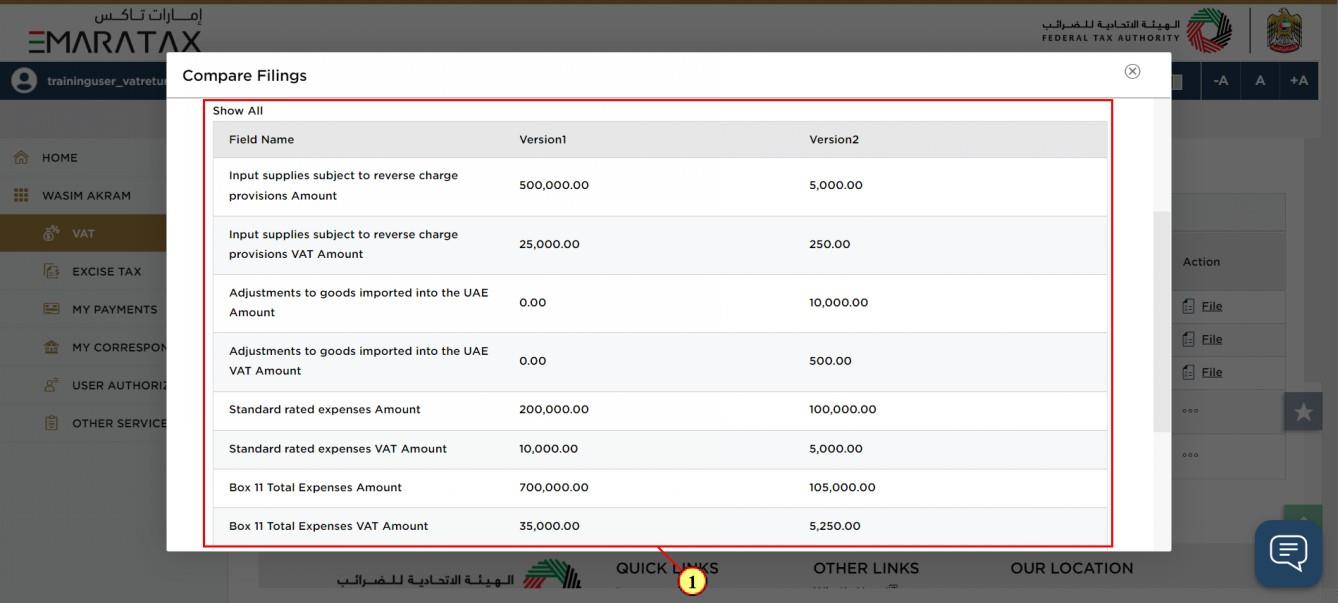

Step | Action |

(1) | The results of compared forms is displayed. |

Step | Action |

(1) | Click here to close the pop-up. |

My Filings Dashboard

Step | Action |

(1) | Click here to view your previous filings. |

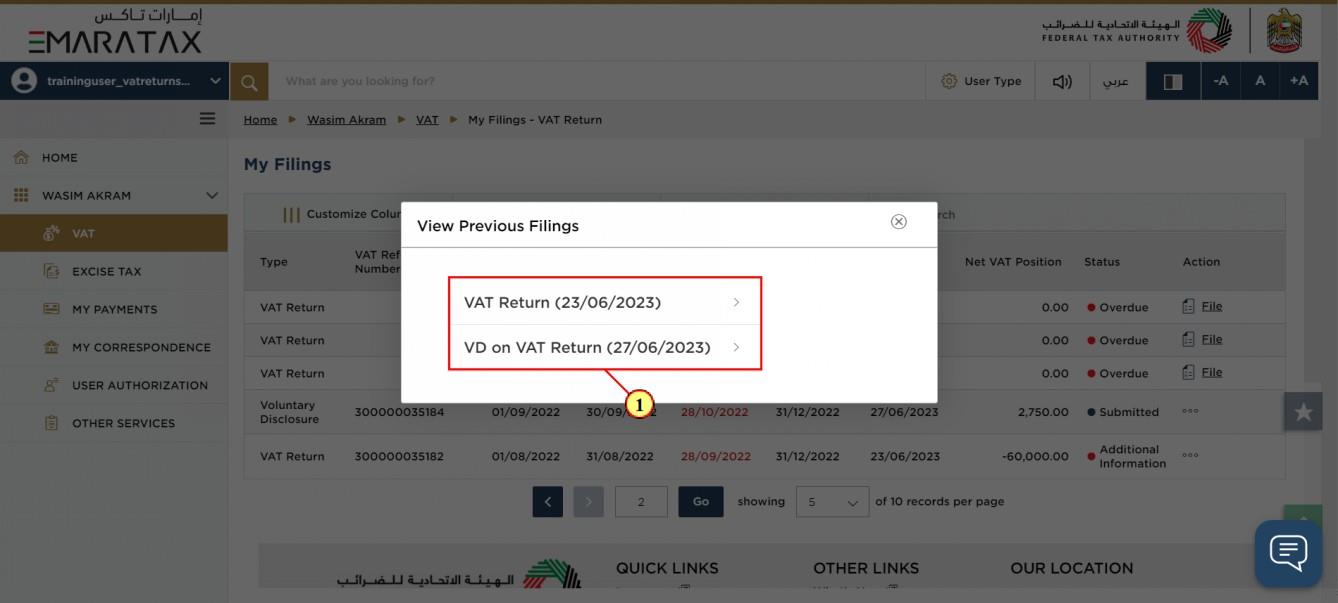

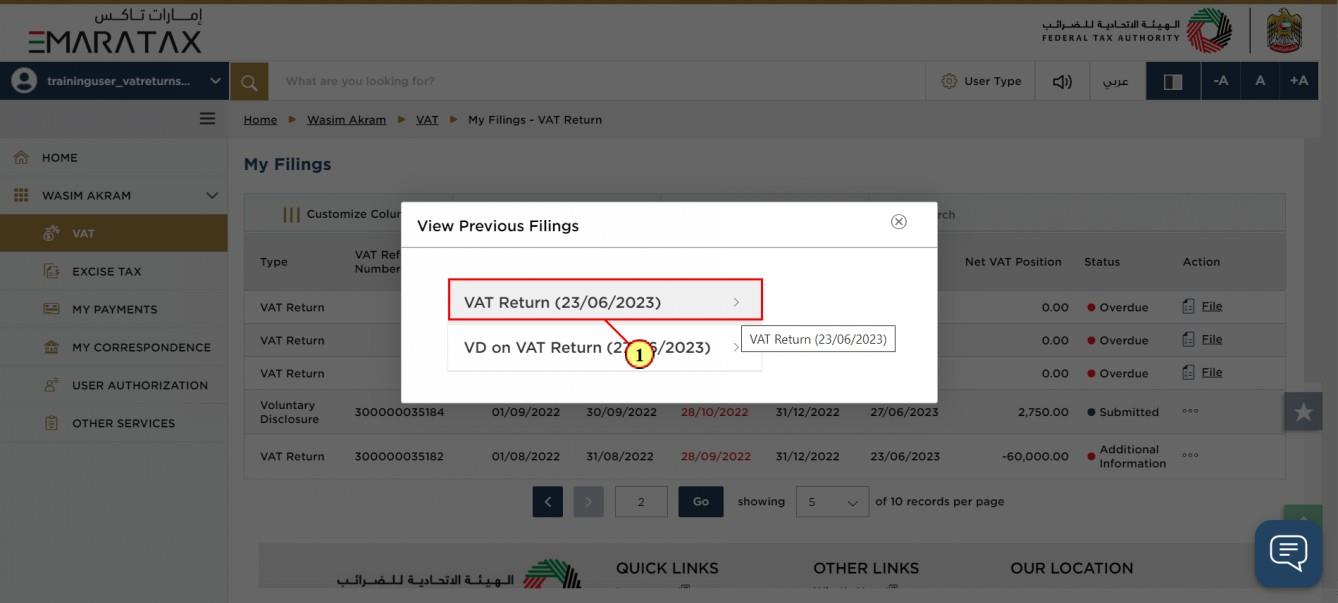

Previous Filings

Step | Action |

(1) | All your previous filings are displayed here. |

Step | Action |

(1) | Click on previous filing which you want to view in detail. |

VAT Return

| VAT Return for selected filing is displayed. |

Correspondences

After submission of the VAT Voluntary Disclosure for e-commerce reporting, taxpayer receives the following correspondences:

Voluntary Disclosure submission acknowledgment

Voluntary Disclosure acknowledged or rejected notification

Additional information notification (only if FTA requires more information to assist with their review of your VAT Voluntary Disclosure)