Payment for VAT on Commercial Property Sales – Buyer - Oct 2022

User Manual

Payment for VAT on Commercial Property Sales – Buyer

Date: Oct 2022

Version 1.0.0.0

Contents

1. Document Control Information

2. Annexure - List of other user manuals that can be referred to

3. Navigating through EmaraTax

4. Introduction

Document Control Information

Document Version Control

Version No. | Date | Prepared/Reviewed by | Comments |

1.0 | 01-Oct-22 | Federal Tax Authority | User Manual for EmaraTax Portal |

Annexure - List of other user manuals that can be referred to

The below are the list of User manuals that you can refer to

S. No | User Manual Name | Description |

1 | Register as Online User | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website and create an EmaraTax account with the FTA. |

2 | Manage online user profile | This manual is prepared to provide you an understanding on Login process, user types, forgot password and modify online user profile functionalities. |

3 | User Authorisation | This manual is prepared to provide you an understanding on Account Admin, Online User, and Taxable Person account definitions and functionalities. |

4 | Taxable person dashboard | This manual is prepared to help the following ‘Taxable person‘ users to navigate through their dashboard in the Federal Tax Authority (FTA) EmaraTax Portal:

|

5 | Link TRN to email address | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website to Link TRN to New Email Address. |

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process

Button | Description |

In the Portal | |

| This is used to toggle between various personas within the user profile such as Taxable Person, Tax Agent, Tax Agency, Legal Representative etc |

| This is used to enable the Text to Speech feature of the portal |

| This is used to toggle between the English and Arabic versions of the portal |

| This is used to decrease, reset, and increase the screen resolution of the user interface of the portal |

| This is used to manage the user profile details such as the Name, Registered Email Address, Registered Mobile Number, and Password |

| This is used to log off from the portal |

In the Business Process application | |

| This is used to go the Previous section of the Input Form |

| This is used to go the Next section of the Input Form |

| This is used to save the application as draft, so that it can be completed later |

| This menu on the top gives an overview of the various sections within the form. All the sections need to be completed in order to submit the application for review. The current section is highlighted in Blue and the completed sections are highlighted in green with a check |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for taxpayers to benefit from these services in the best and simplest ways. To get more information on these services Click Here

Introduction

This manual is prepared to help a taxpayer, navigate through the EmaraTax portal, access the 'Other Services' screen and make payments for the VAT on commercial property sales as a buyer of property.

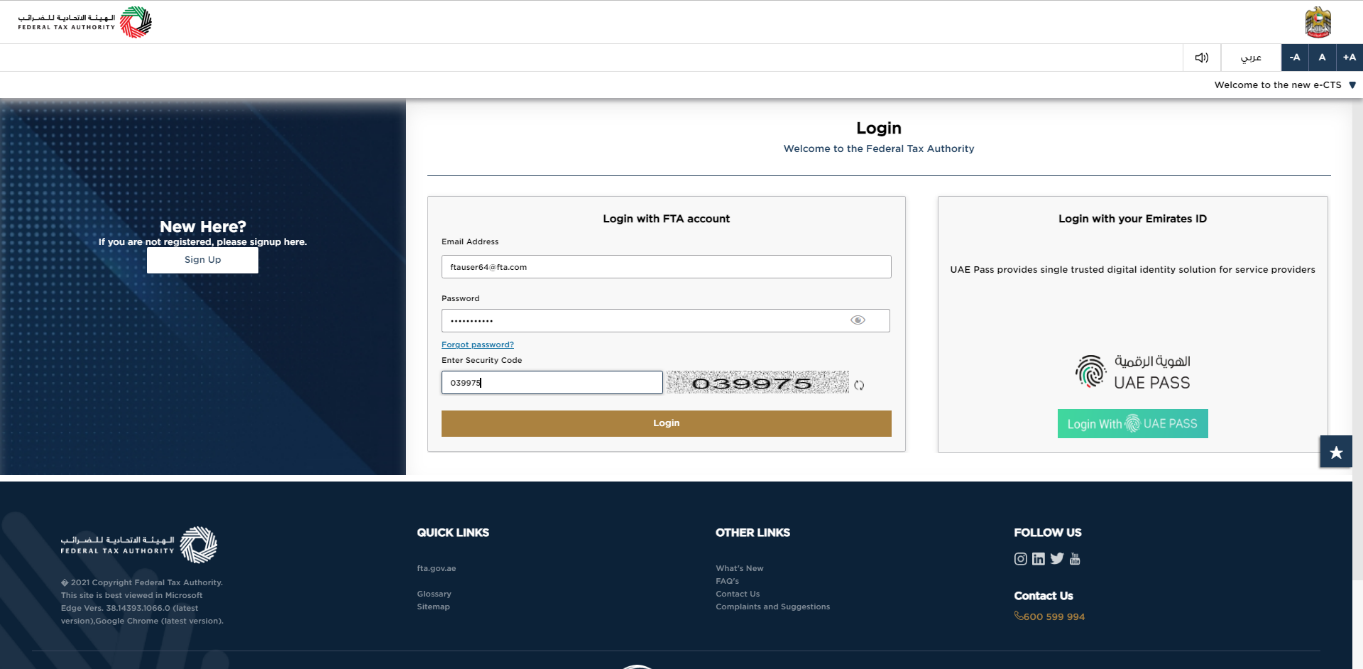

Login to EmaraTax Portal

|

|

Step | Action |

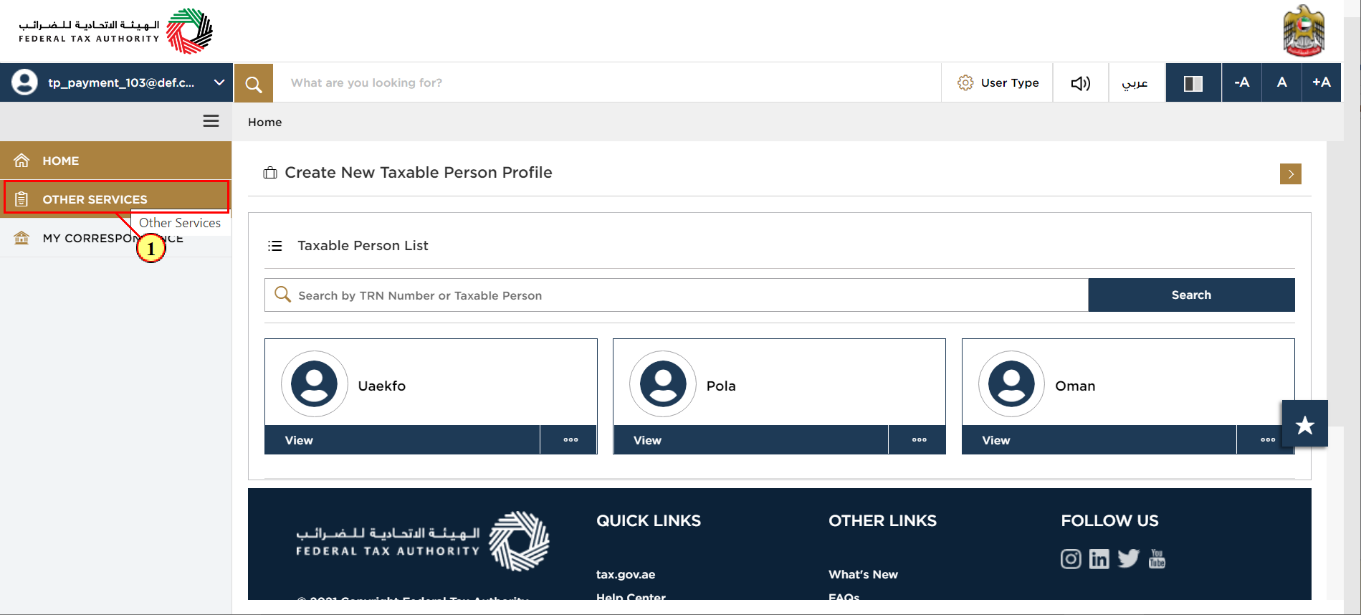

(1) | Select the “Other Services” menu option |

Step | Action |

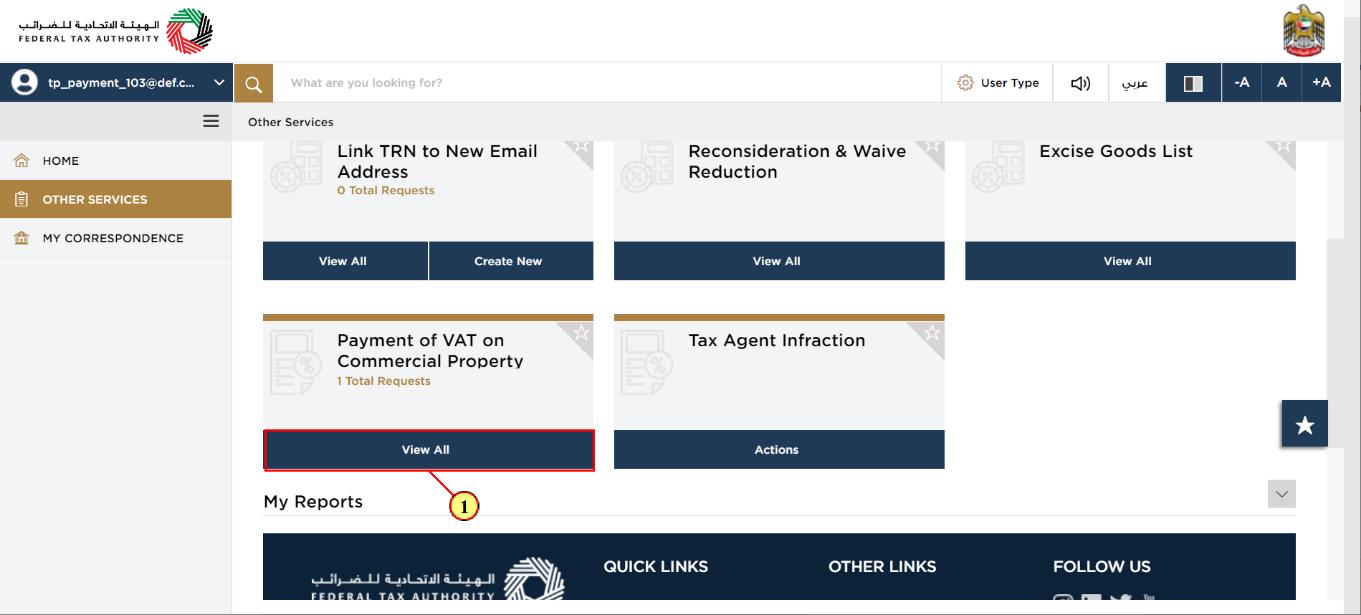

(1) | Click on “View All” under the “Payment of VAT on Commercial Property” tile. |

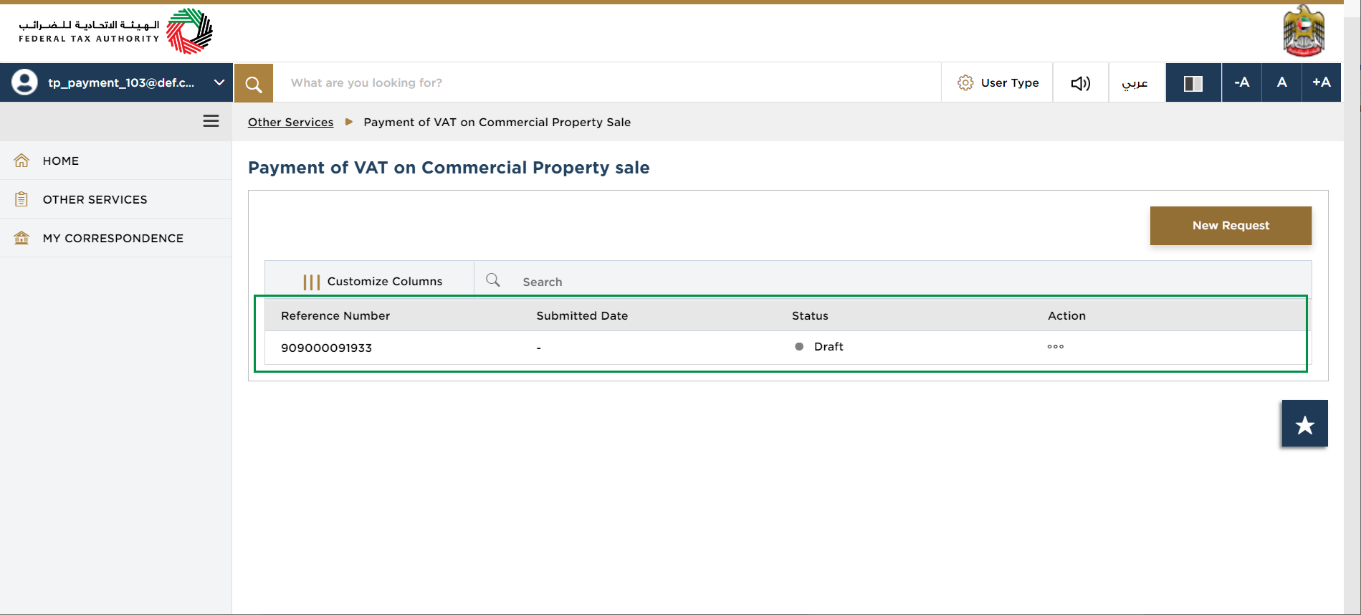

| If you have any existing requests in draft mode or have previously raised requests to make payments of VAT on commercial property sales, these will be visible as entries in the table above. |

Step | Action |

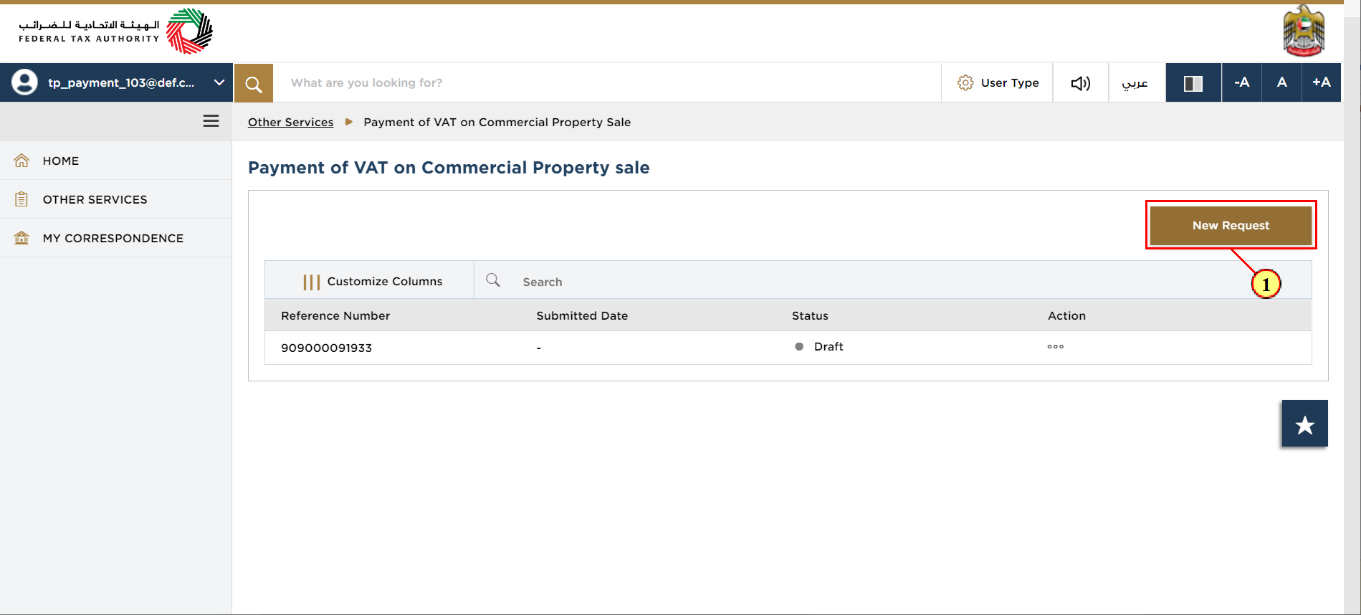

(1) | Click on the “New Request” button to make a new VAT payment for a commercial property sale. |

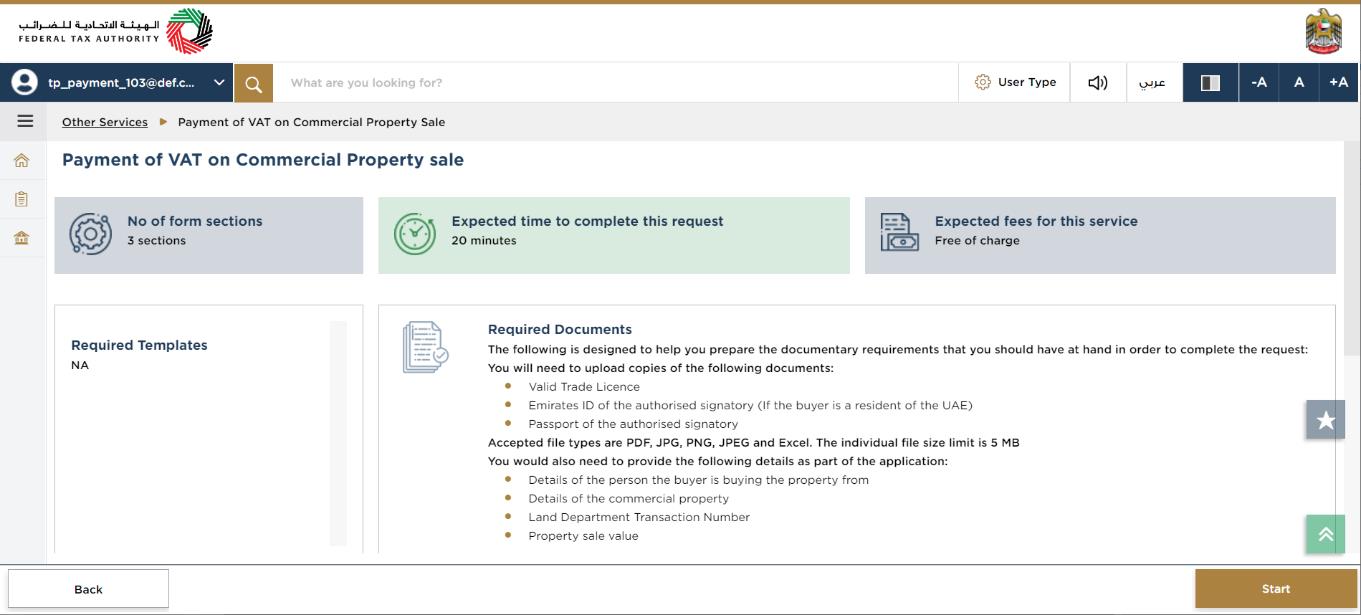

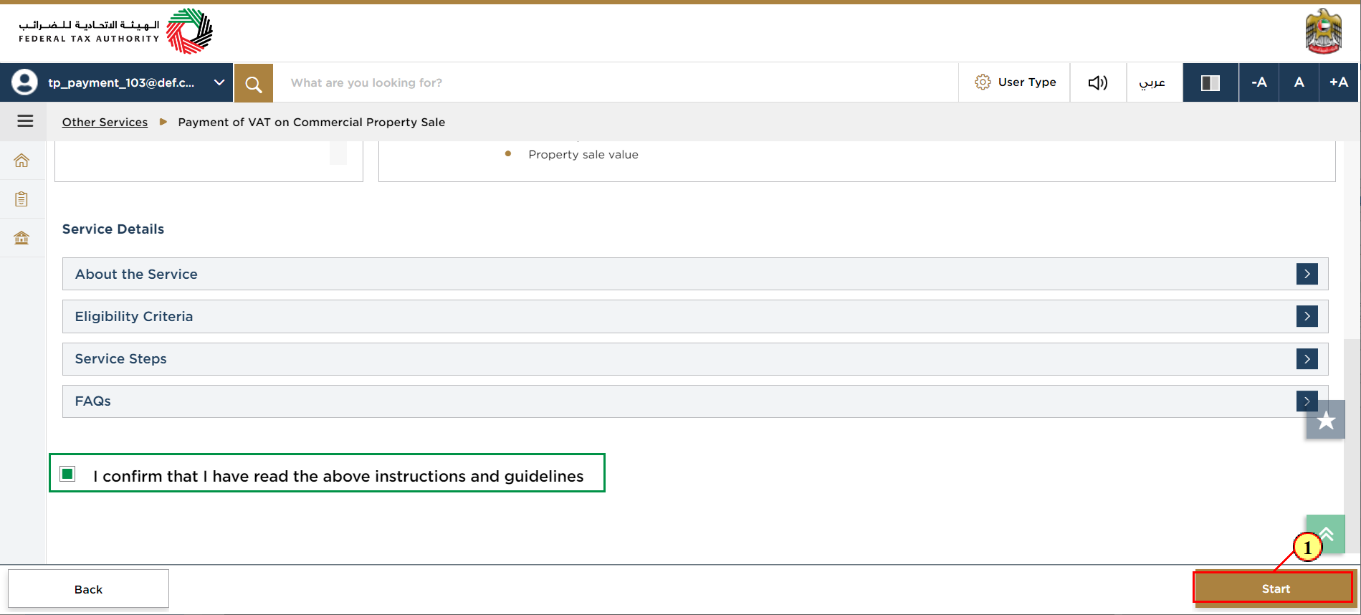

| These are the instructions and guidelines which detail key information such as required templates, supporting documentation, eligibility criteria and the expected time to complete this refund request. |

Step | Action |

(1) | After clicking and confirming that all the instructions and guidelines in the Getting Started Guide have been read, click on the “Start” button. |

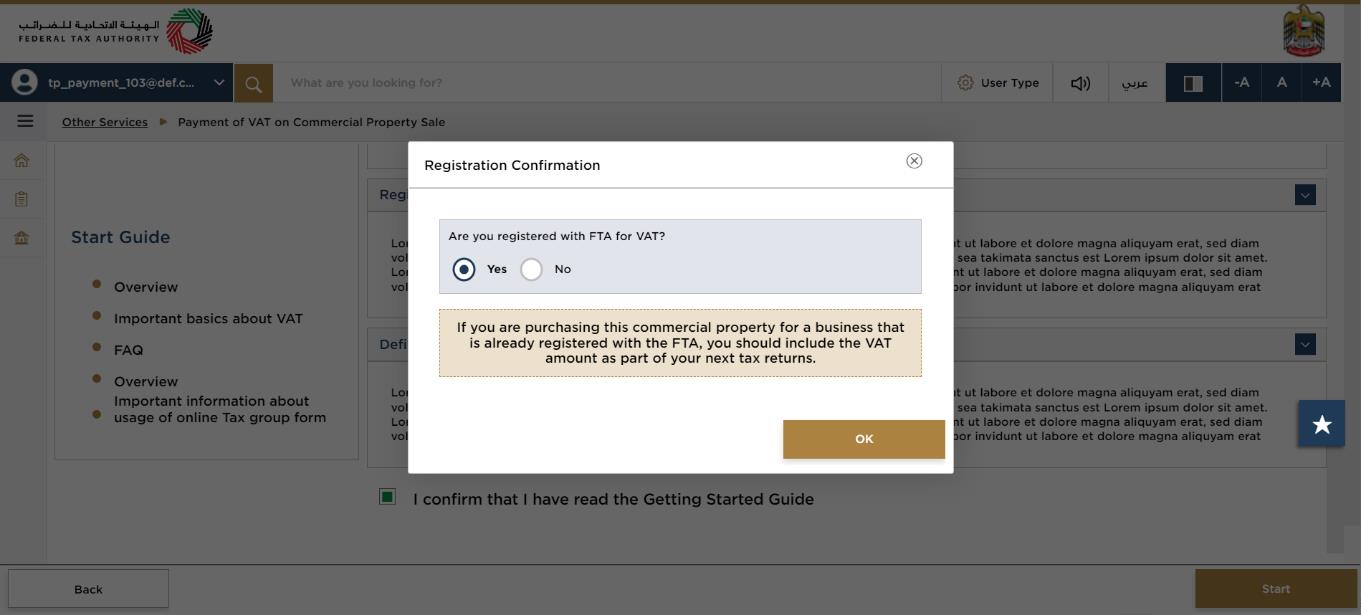

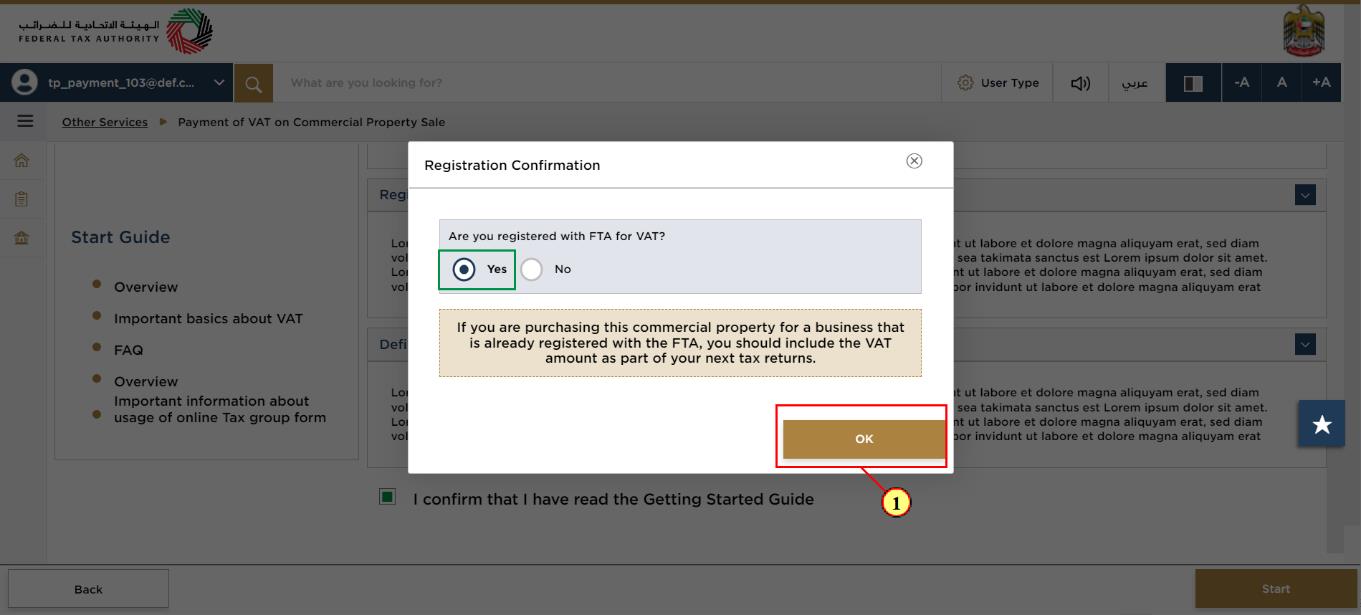

| If you are registered for VAT with the FTA, then you must report the VAT amount on any commercial property sales as part of your VAT returns. |

Step | Action |

(1) | Select “Yes” if you are registered for VAT with FTA and click on “Ok” to cancel the new request for Payment of VAT on Commercial Propert Sale. |

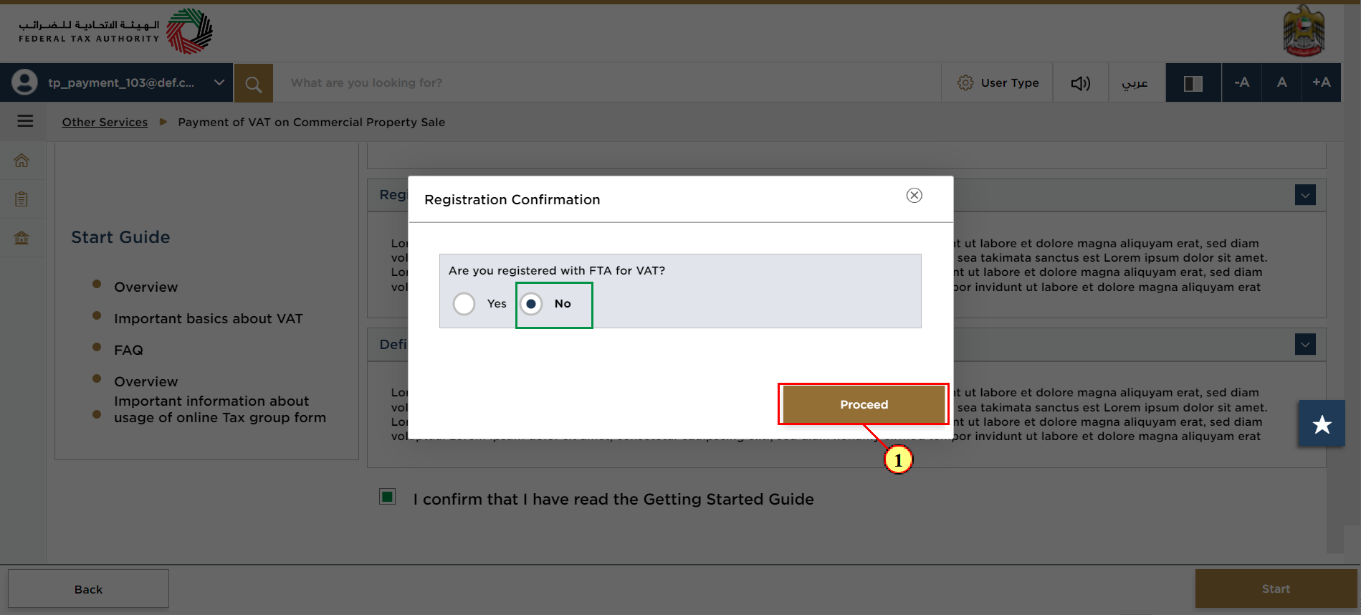

Step | Action |

(1) | Select the radio button 'No' to confirm that you are not registered with FTA for VAT and click “Proceed” which will display the request form |

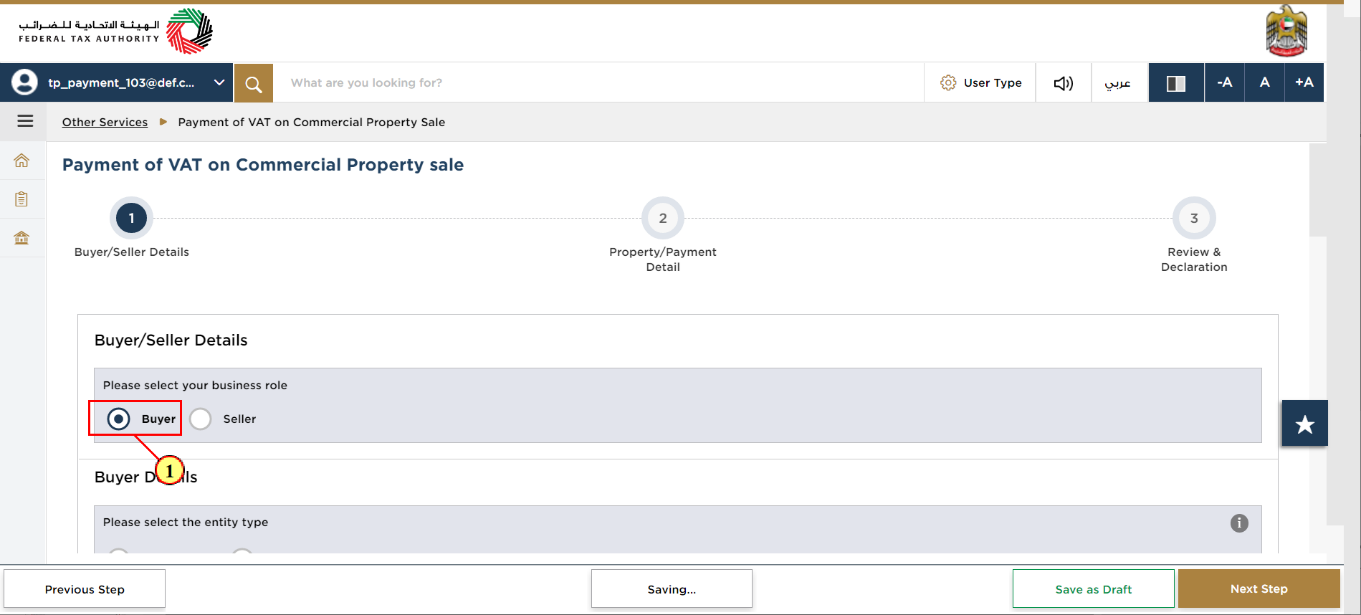

Buyer/Seller Details

Step | Action |

(1) | On the Buyer/Seller Details page, select the “Buyer” radio button if you are the buyer of the property. |

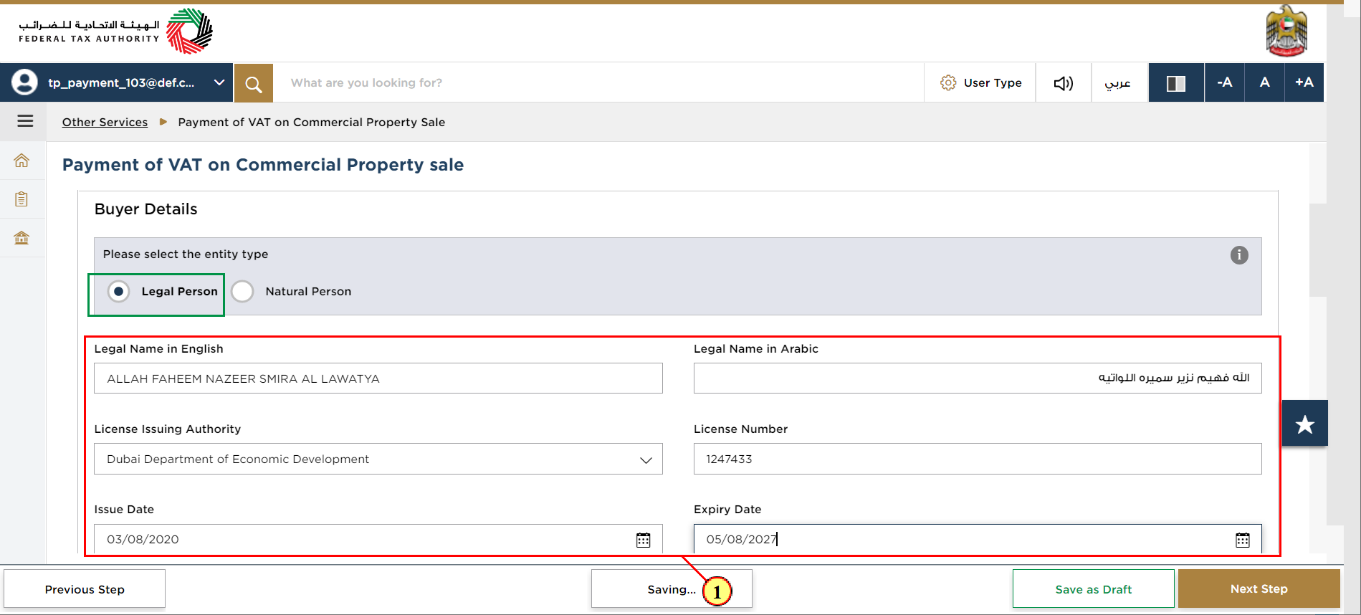

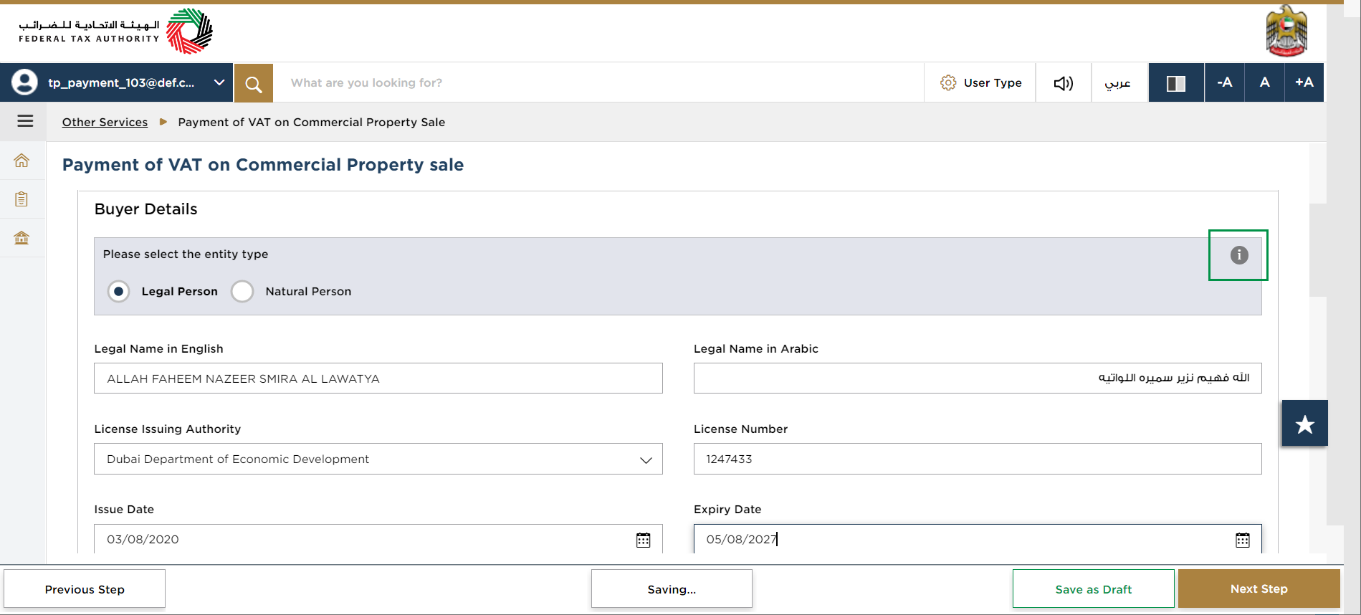

Step | Action |

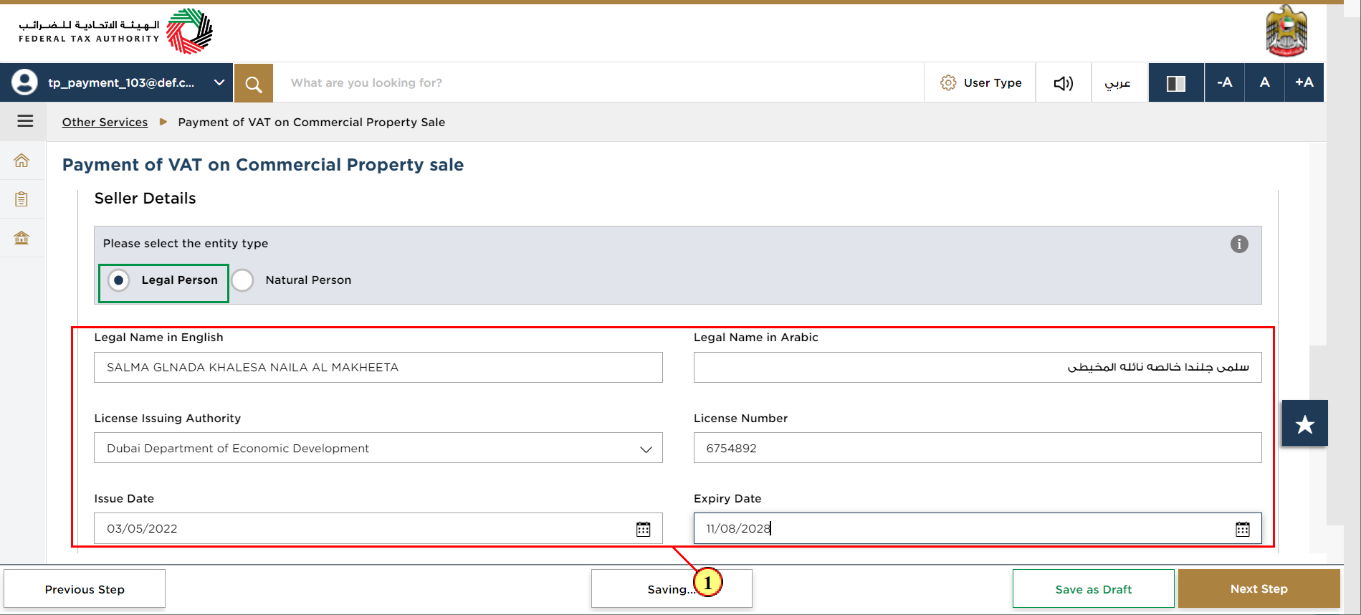

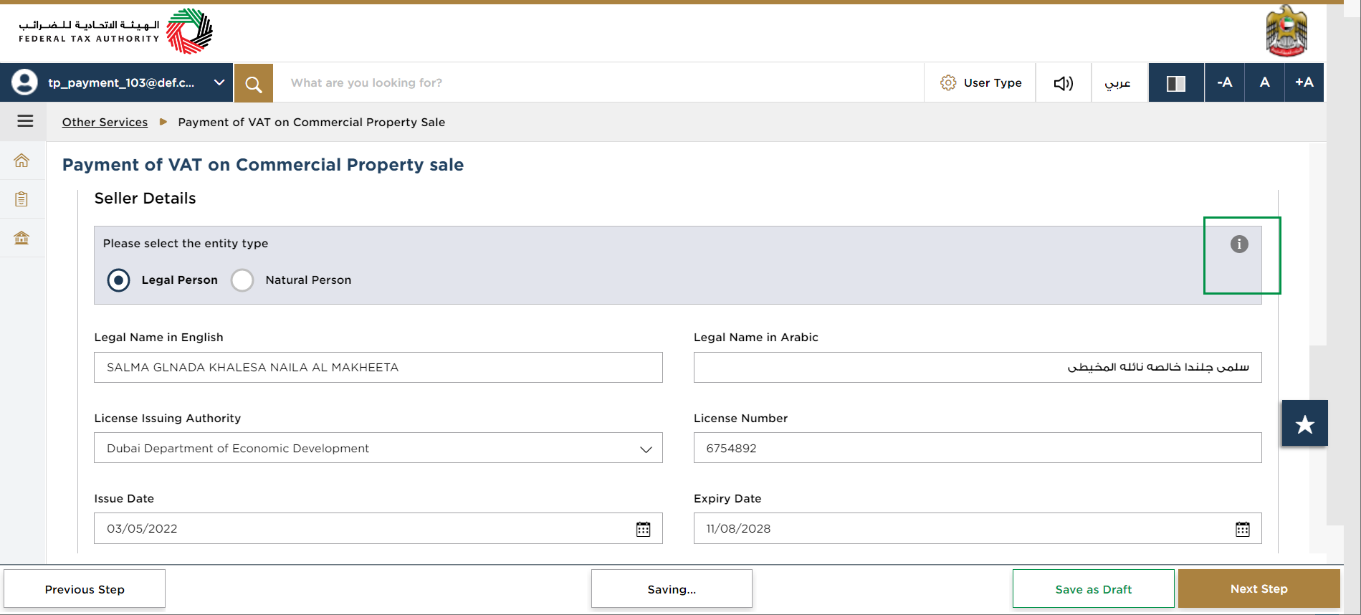

(1) | Select the Entity Type as “Legal Person” if you fall under the category of legal person and then enter all your details. |

| You can click on the “i” icon for the definitions of “Legal Person” and “Natural Person” |

Step | Action |

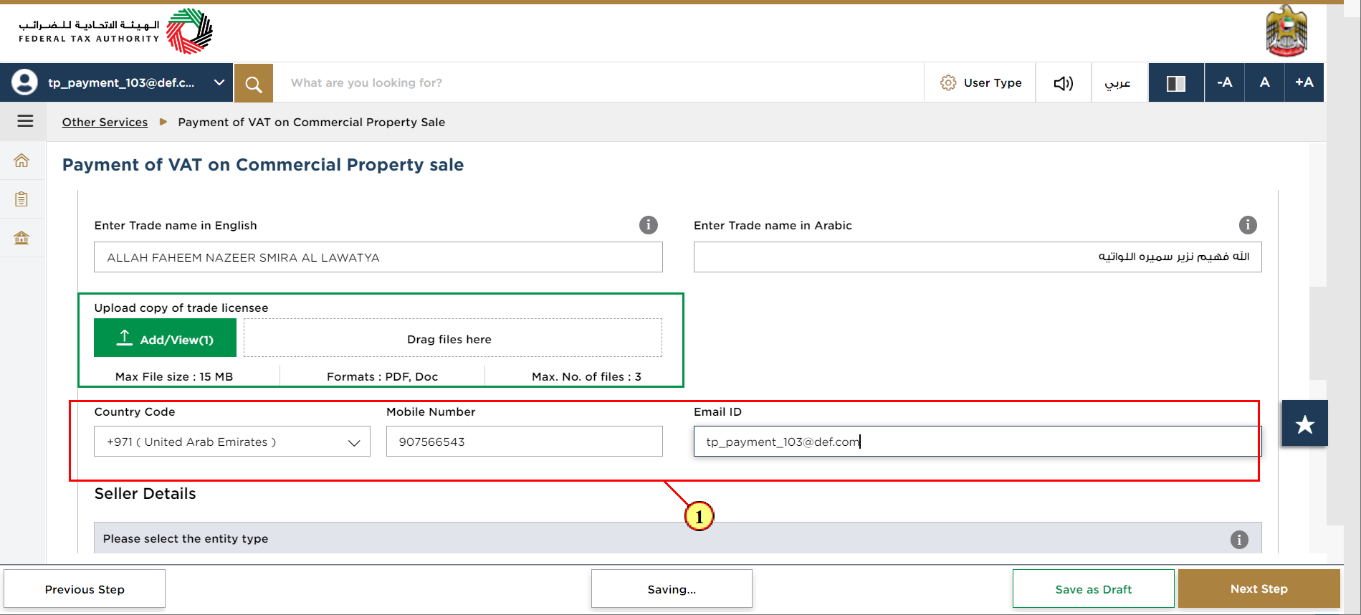

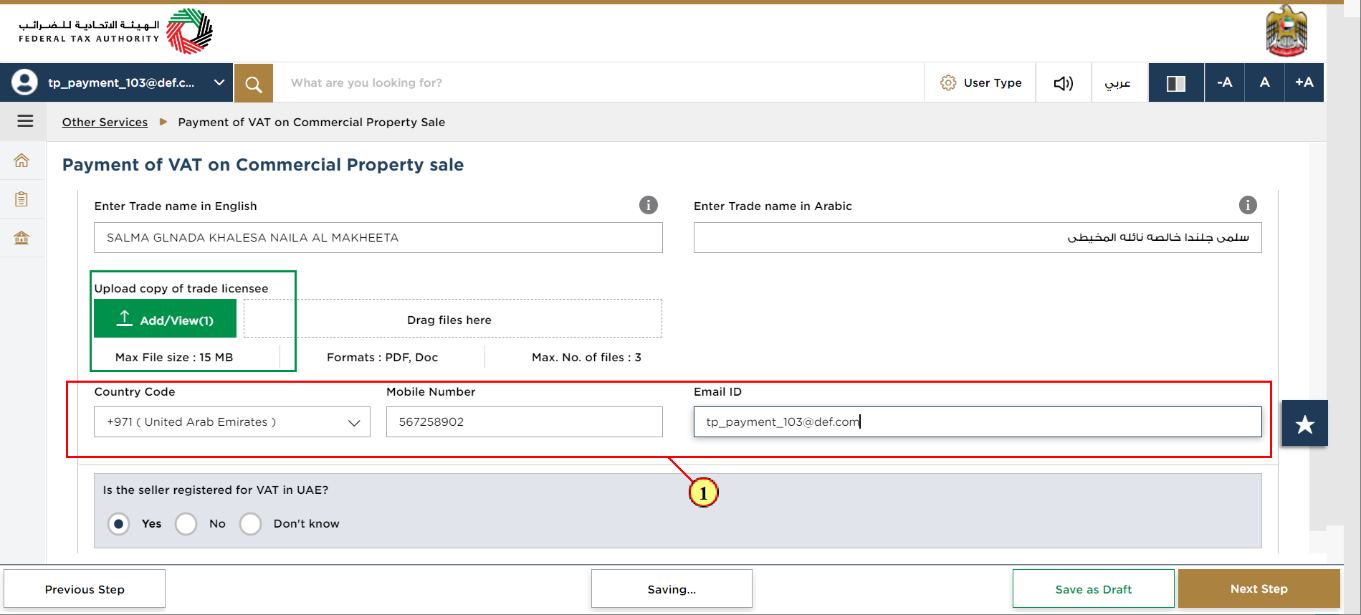

(1) | Click on Add/View button to upload a copy of the Trade Licence and then choose the applicable country code, enter your Mobile number and a valid email address. |

Step | Action |

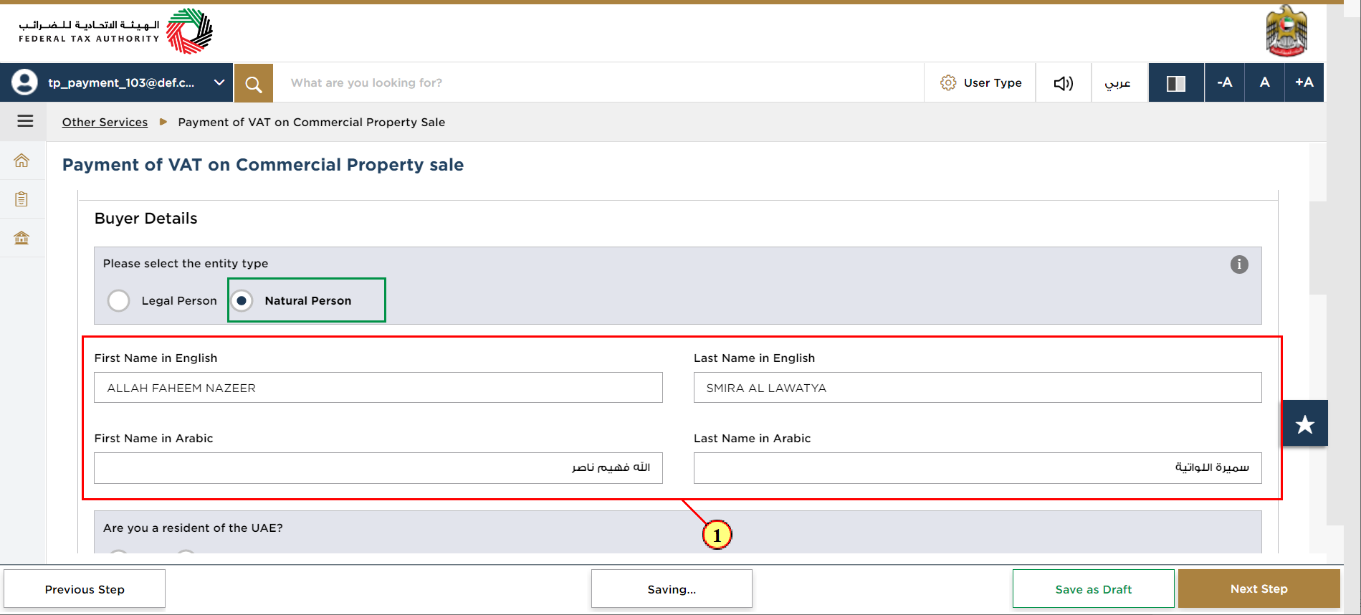

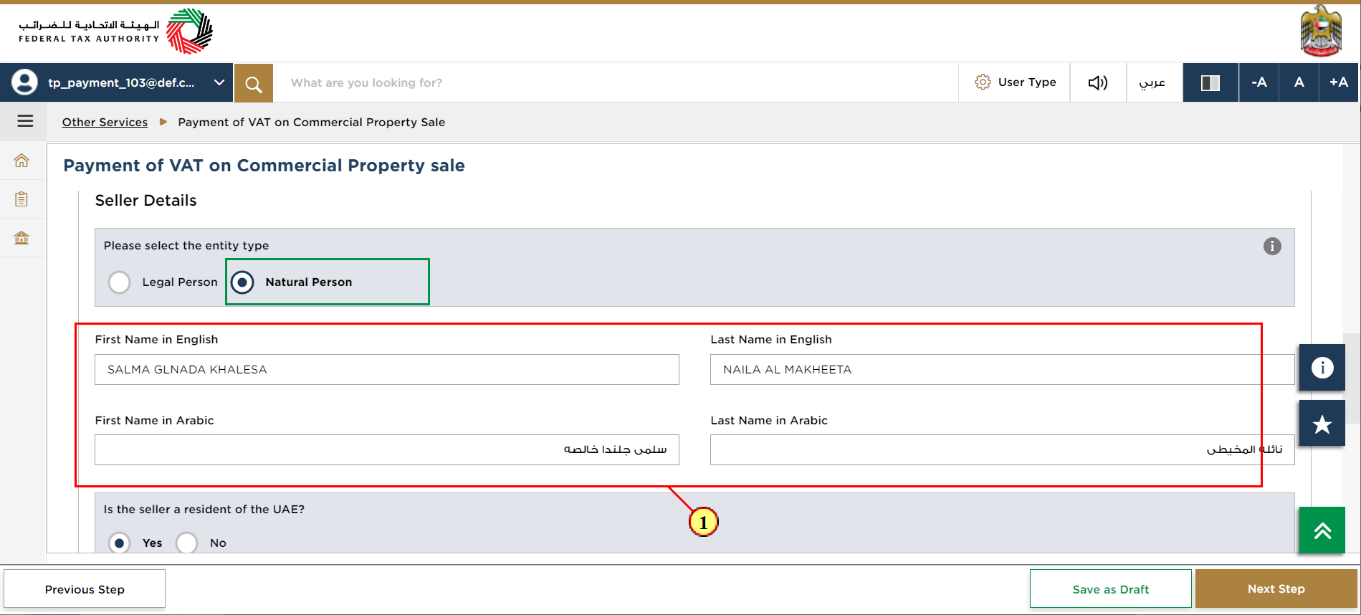

(1) | Select the “Natural Person” radio button if you fall under the category of a Natural Person and then enter all the necessary details in English and Arabic as required. |

Step | Action |

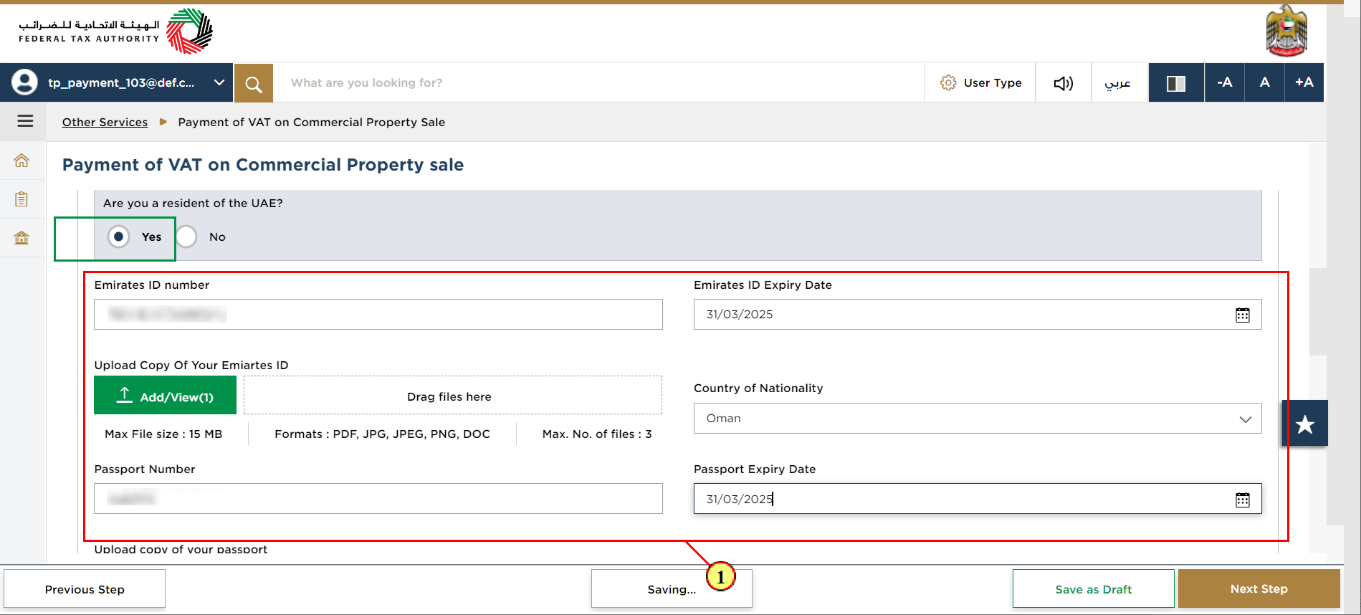

(1) | Enter the Emirates Id and Passport details if you select the radio button “Yes” to confirm that you are a resident of the UAE and click on Add/View button to upload copies of your Emirates id and passport |

Step | Action |

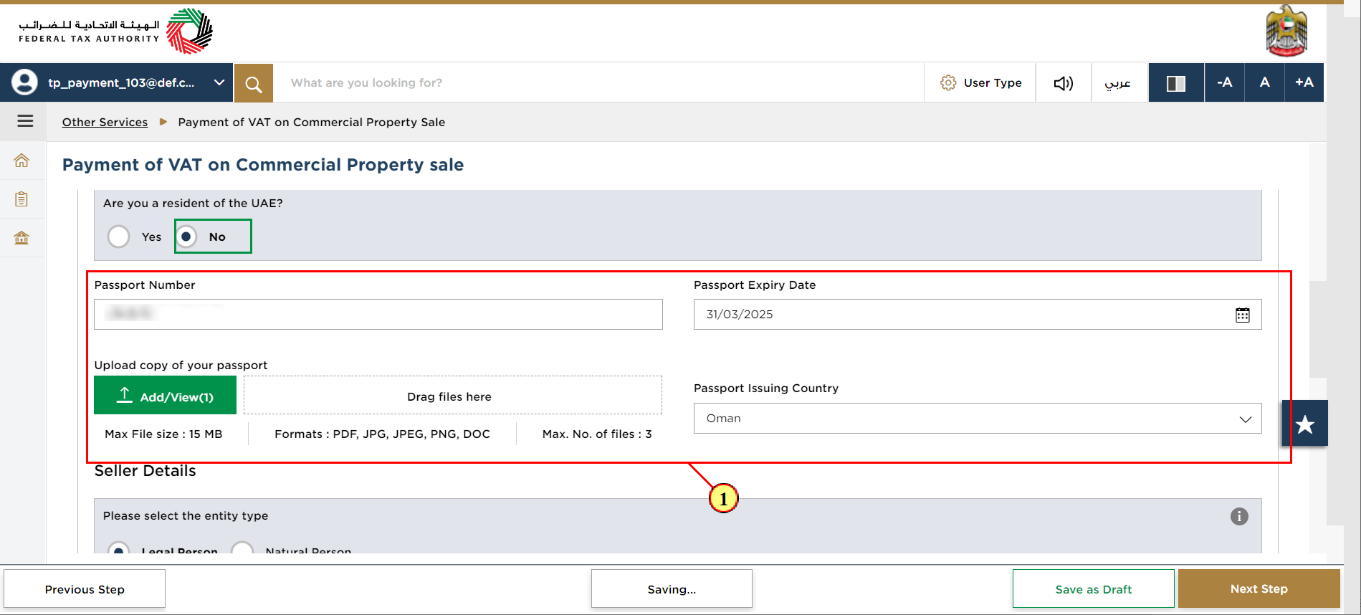

(1) | Select the radio button “No” if you are not a resident of the UAE. Enter your passport details and then click on the Add/View button to upload a copy of your passport. |

Step | Action |

(1) | Select the Entity Type as “Legal Person” if the Seller falls under the category of a Legal Person and enter all the seller‘s details. |

| You can click on the “i” icon for the definitions of “Legal Person” and “Natural Person” |

Step | Action |

(1) | Click on 'Add/View' button to upload a copy of the seller's Trade Licence and then choose the applicable country code, enter the Mobile number and a valid email address of the seller. |

Step | Action |

(1) | Select the Entity Type as “Natural Person” if the Seller falls under the category of a Natural Person and enter all the seller‘s details. |

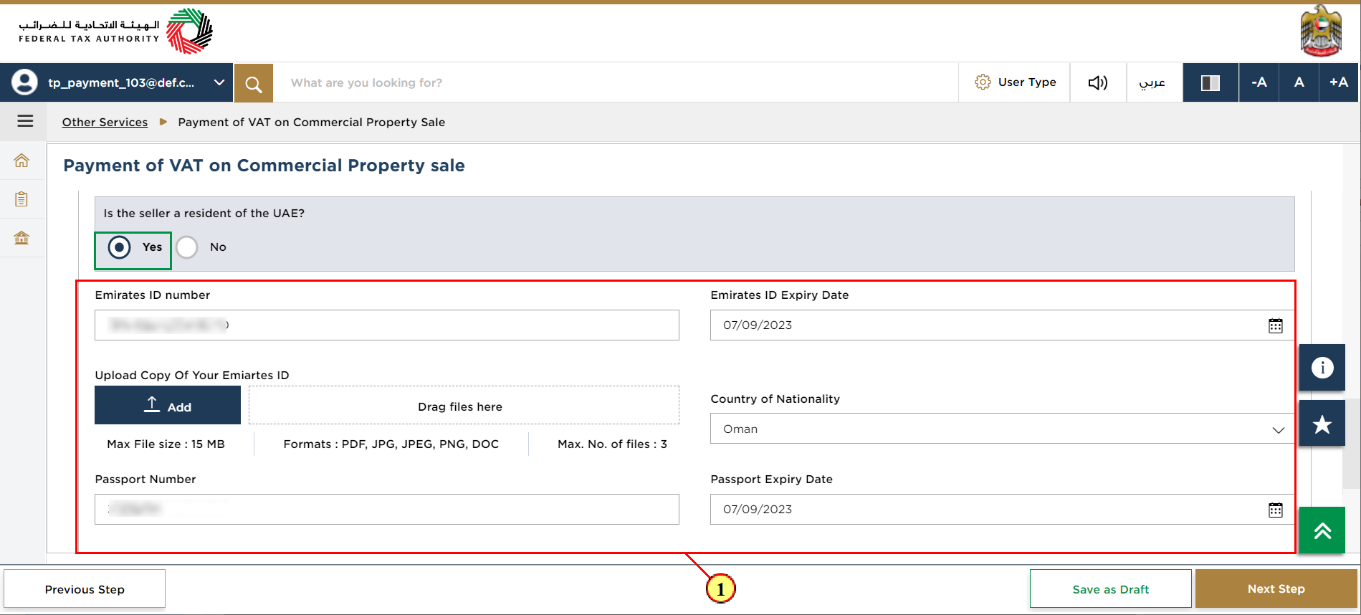

Step | Action |

(1) | Select the radio button “Yes” in case the seller is a resident of the UAE. Enter the details of the seller‘s Emirates Id and passport and then click on 'Add/View' button to upload copies of the seller‘s Emirates id and passport. |

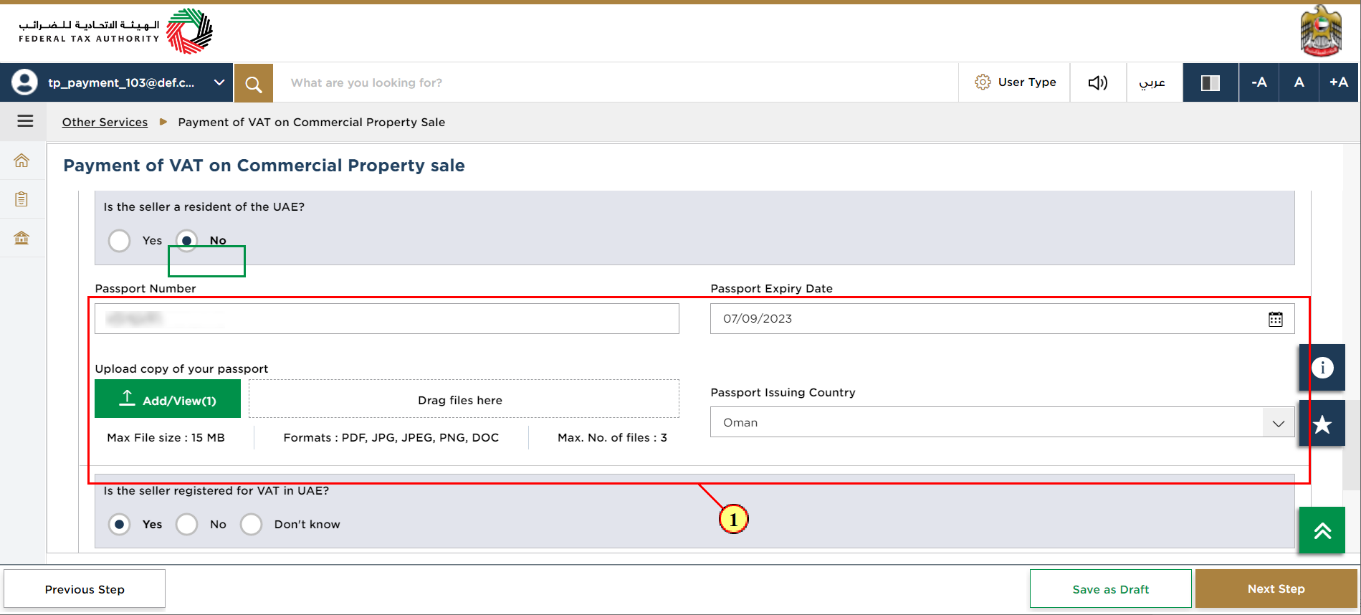

Step | Action |

(1) | Select the radio button “No” in case the seller is not a resident of the UAE. Enter the seller's passport details and click on 'Add/View' button to upload a copy of the seller‘s passport. |

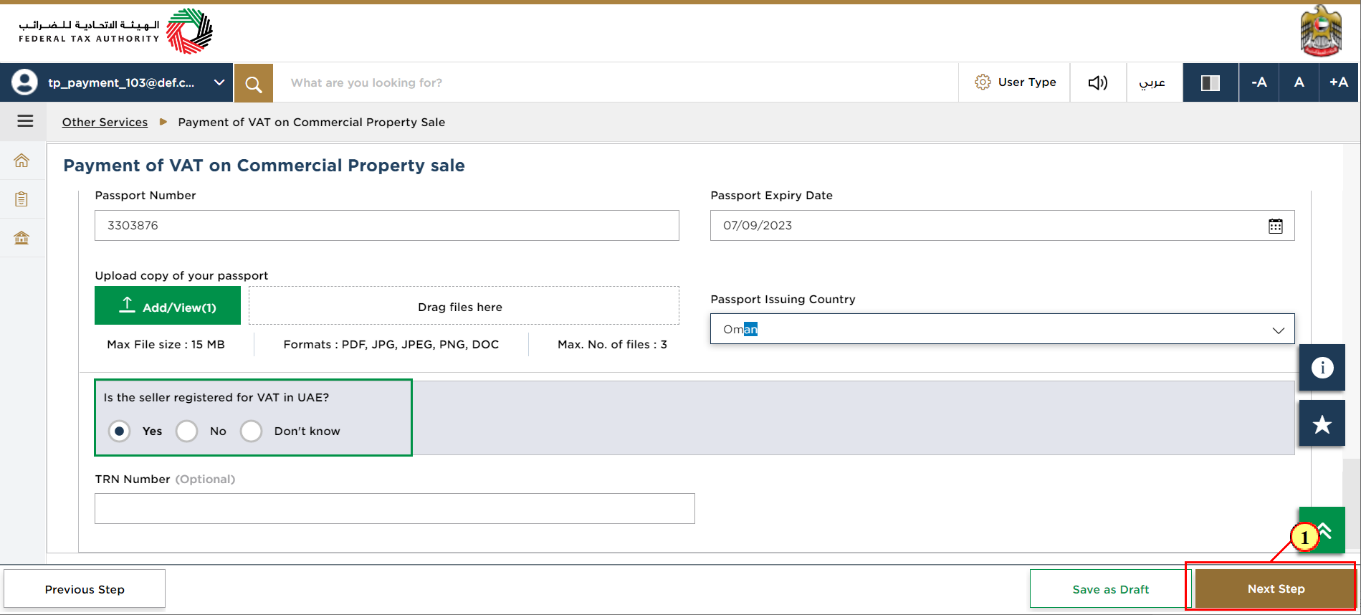

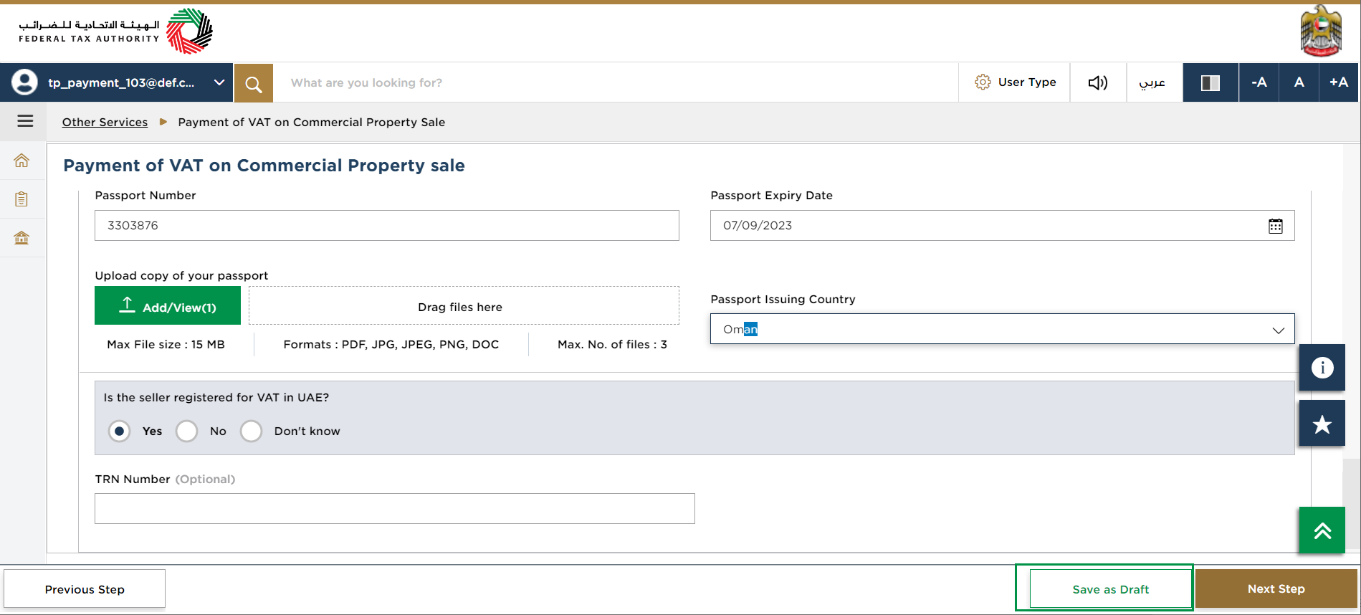

Step | Action |

(1) | Choose the radio button “Yes”, “No” or “Don‘t Know” to confirm whether the seller is registered with FTA for VAT and click on “Next Step” to proceed towards the property and payment details section of the request. |

|

|

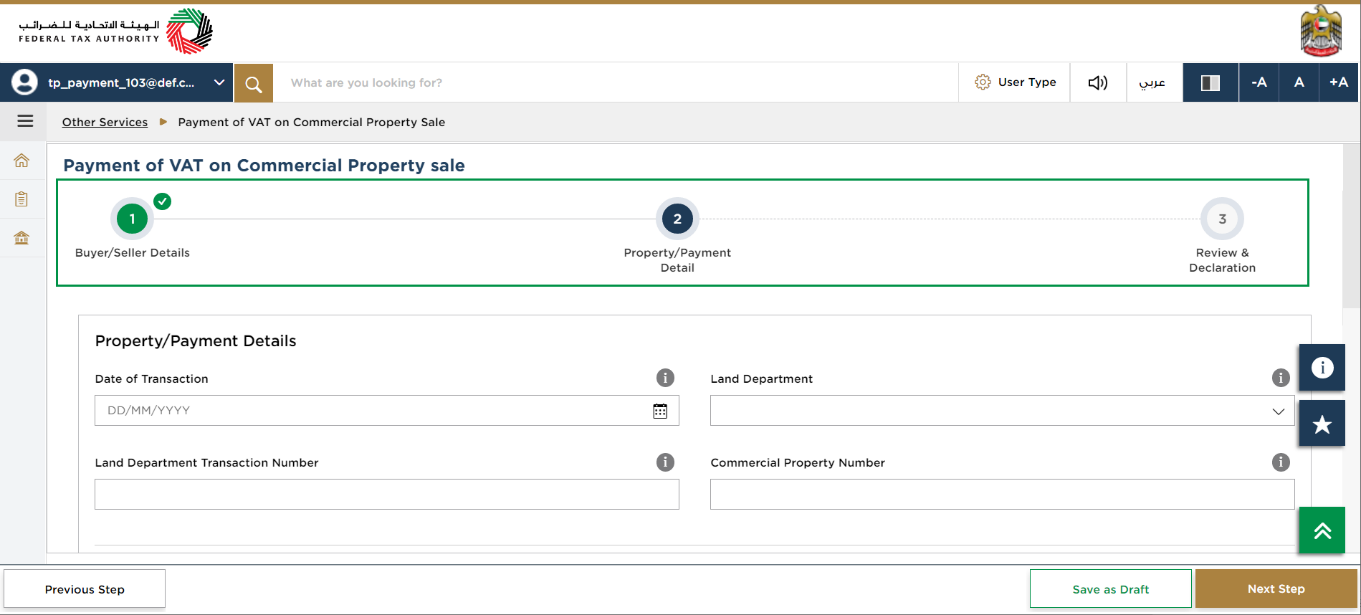

Property / Payment Details

| The progress bar displays the number of steps required to complete the application. The step you are currently in is highlighted in blue. Once you progress to the next section successfully, the previous step will be highlighted in green. |

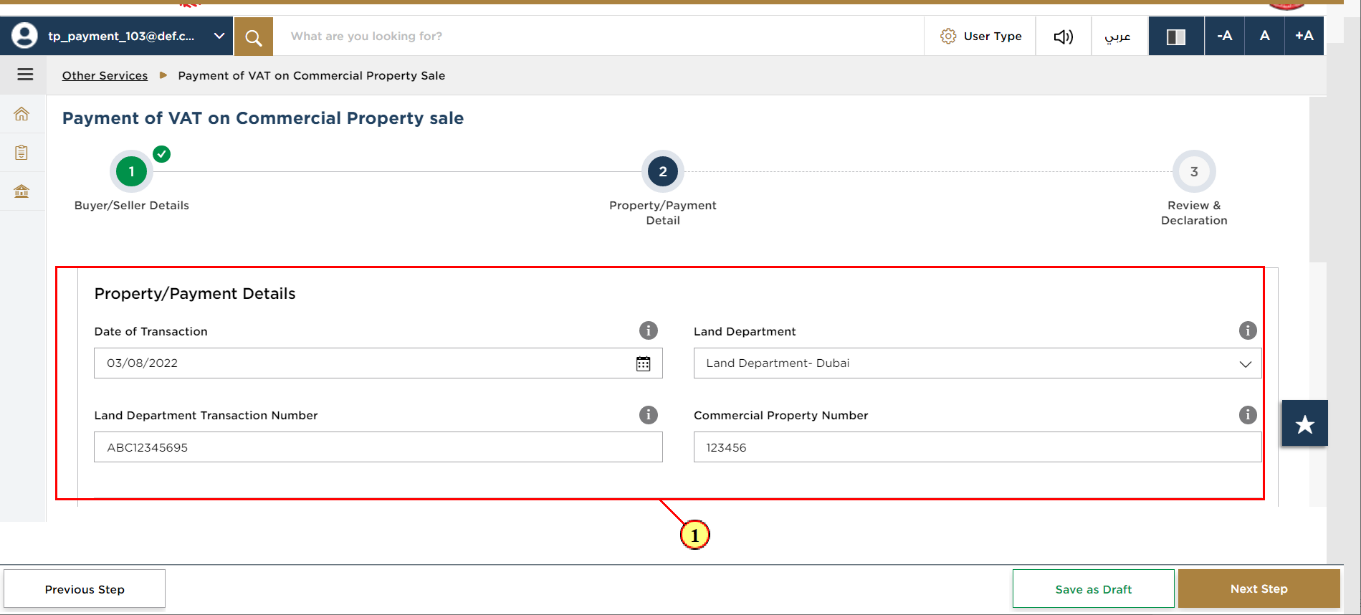

Step | Action |

(1) | Enter the details of the commercial property and the land department |

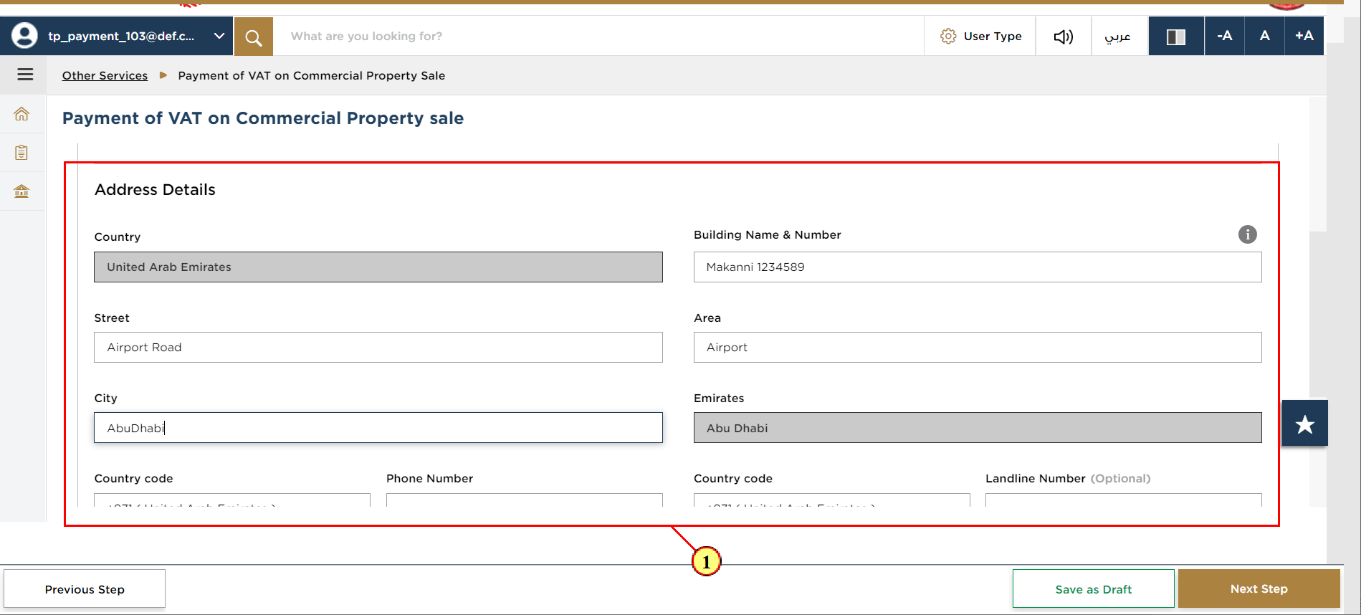

Step | Action |

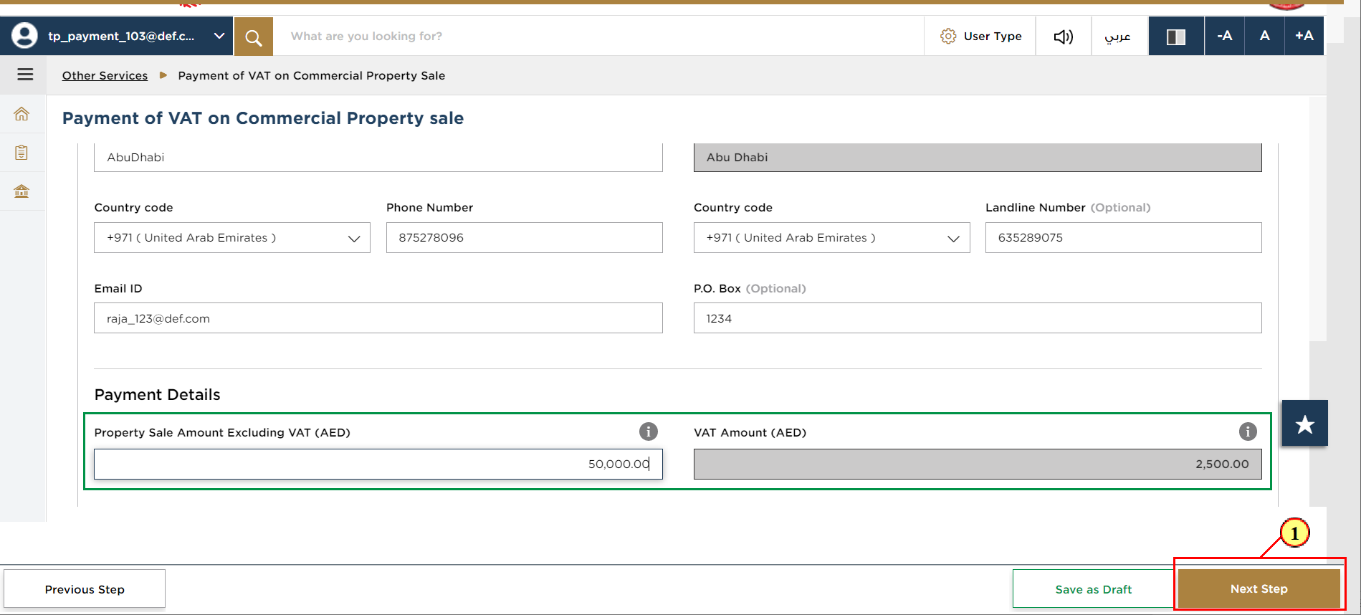

(1) | Enter the address details of the commercial property |

Step | Action |

(1) | Enter the “Property Sale Amount Excluding VAT”. The 'VAT Amount' will be automatically calculated as 5% of the value entered in the 'Property Sale Amount Excluding VAT' field. Click on “Next Step” to proceed further. |

|

|

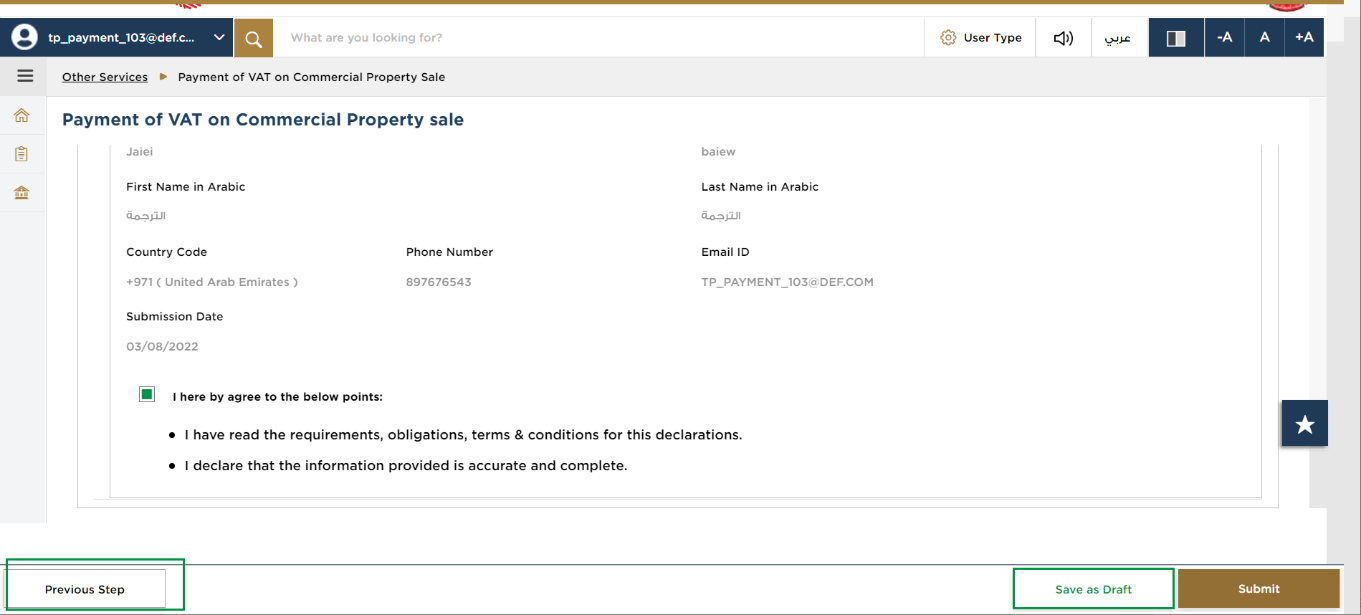

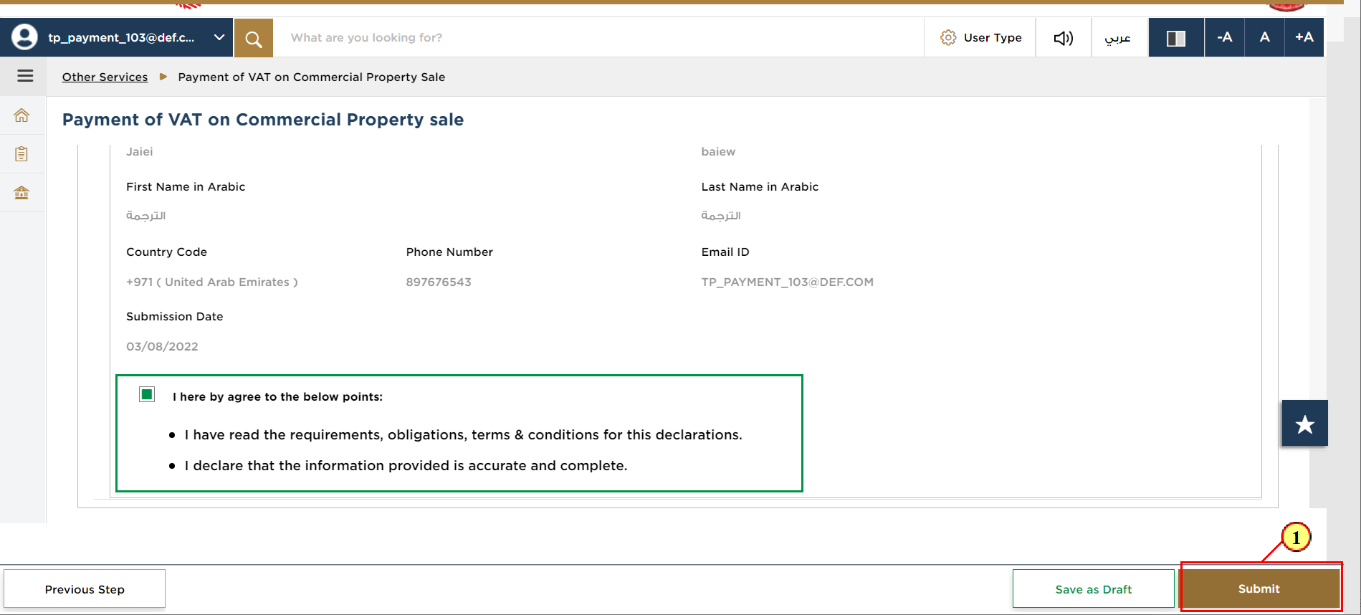

Review & Declaration

Step | Action |

(1) |

|

|

|

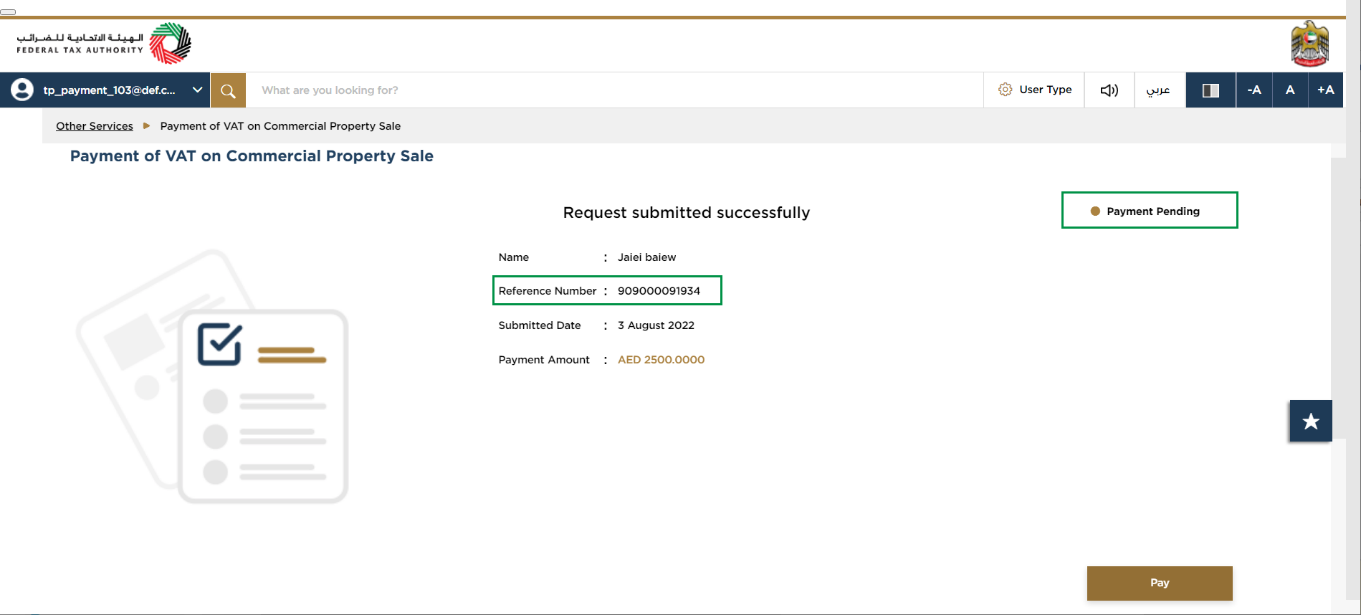

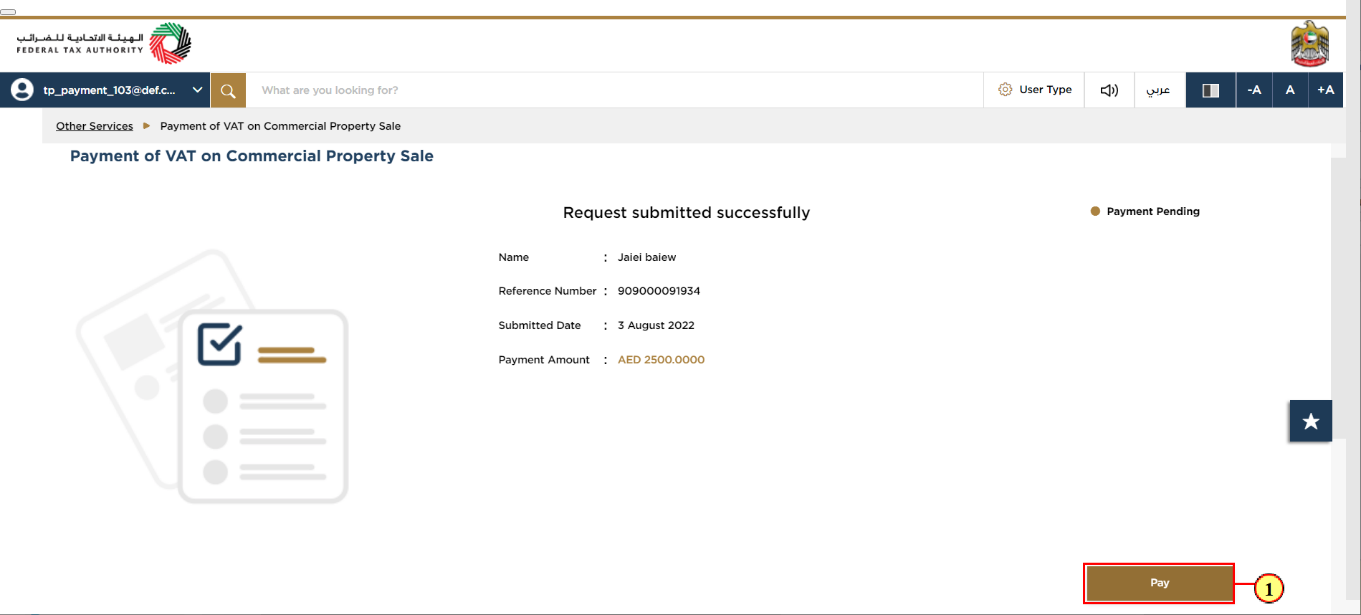

Step | Action |

(1) | Click on the “Pay” button to proceed with the payment of the VAT amount for the commercial property sale via the eDirham portal. |

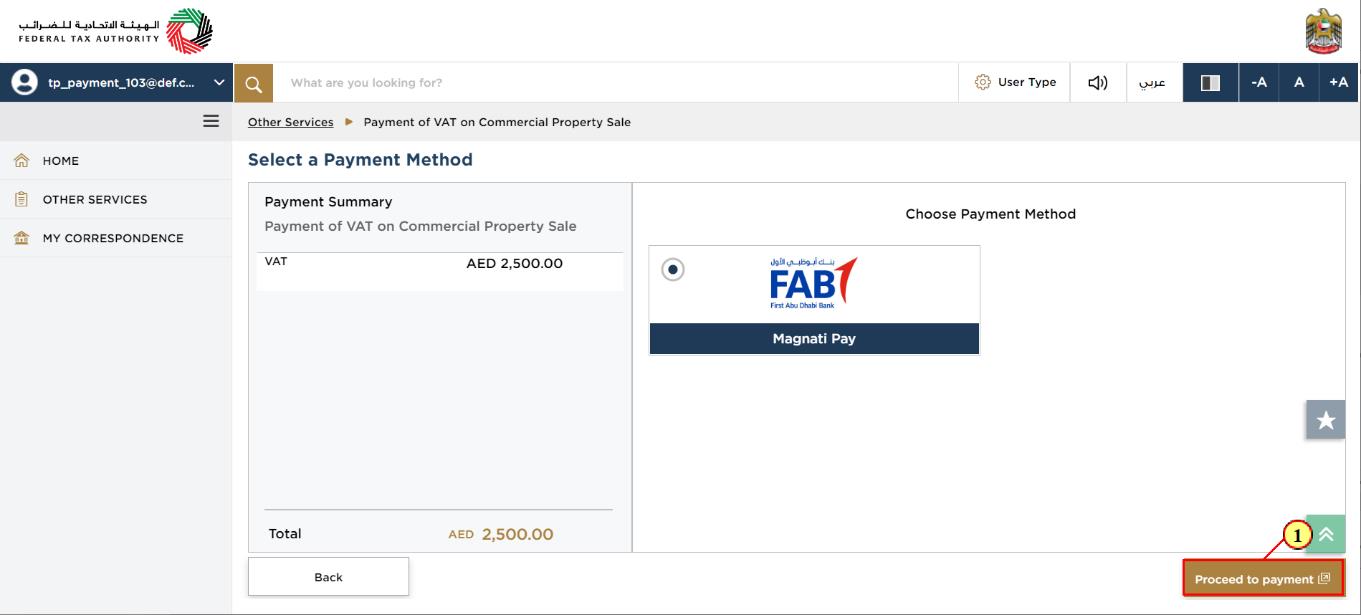

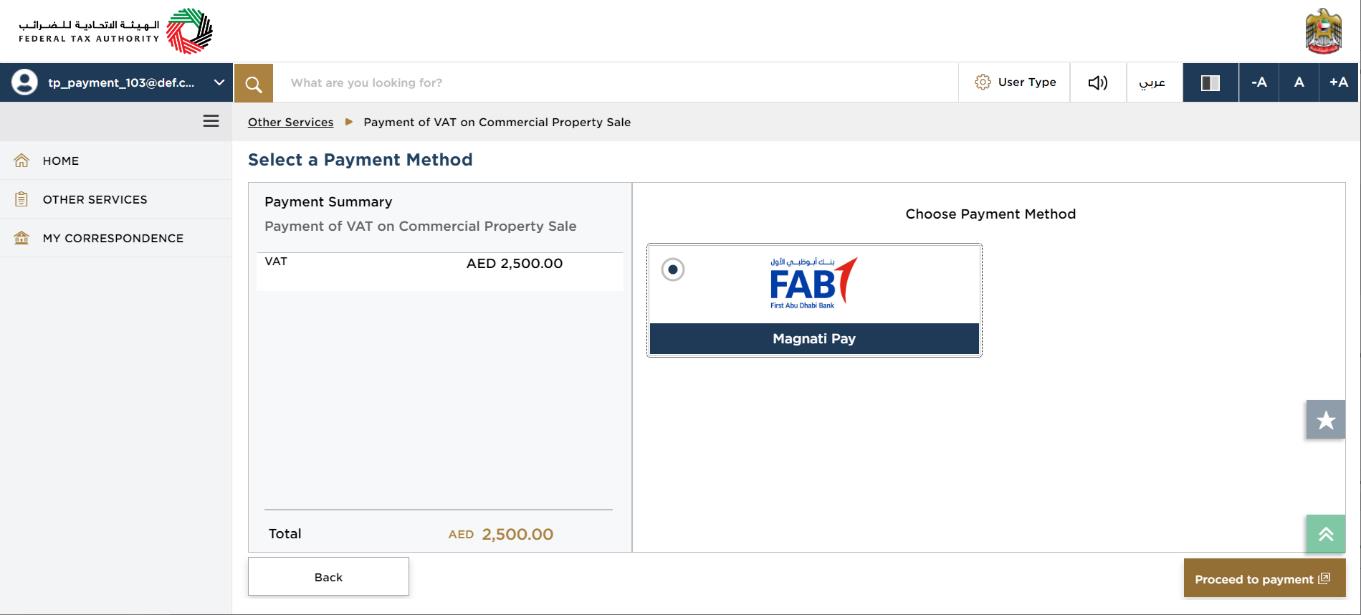

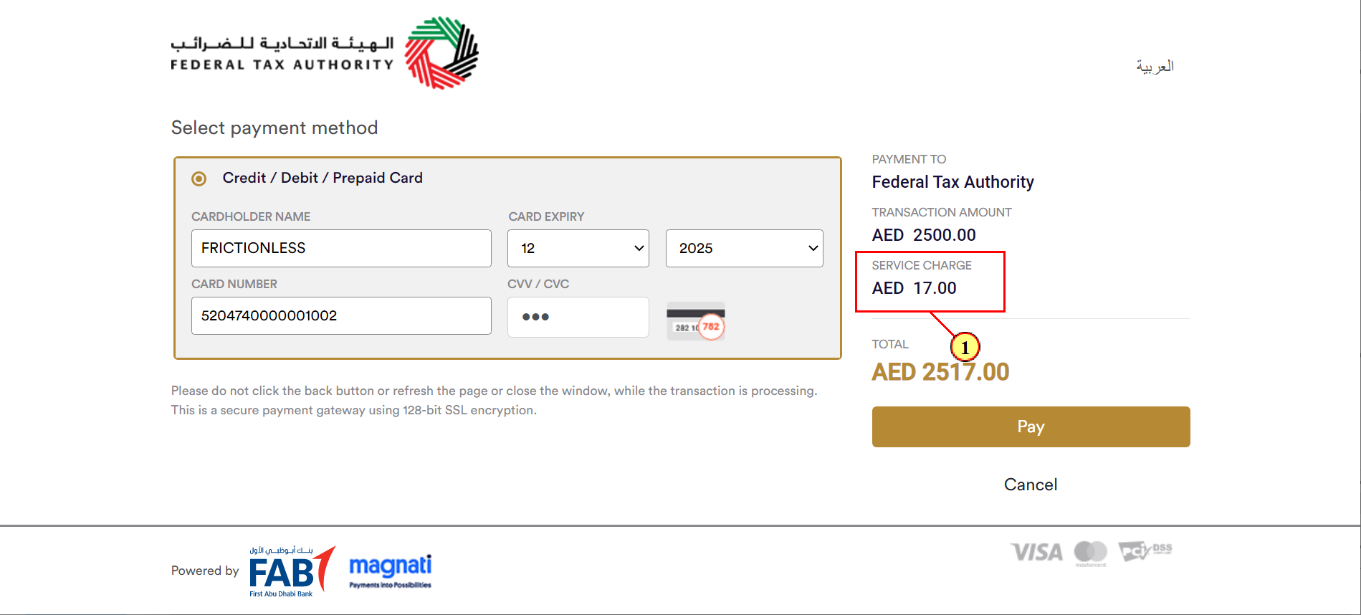

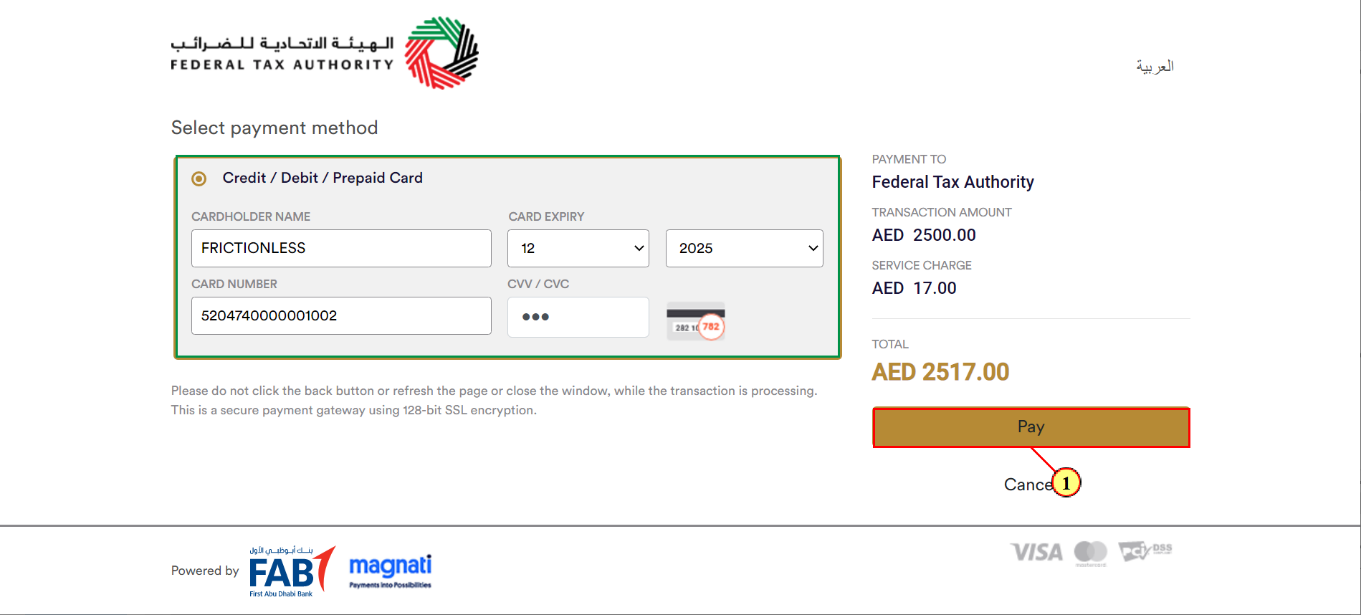

Choose Payment Method

Step | Action |

(1) | Click on the radio button “Magnati Pay” to choose the payment method and then click on “Proceed to Payment”. |

|

|

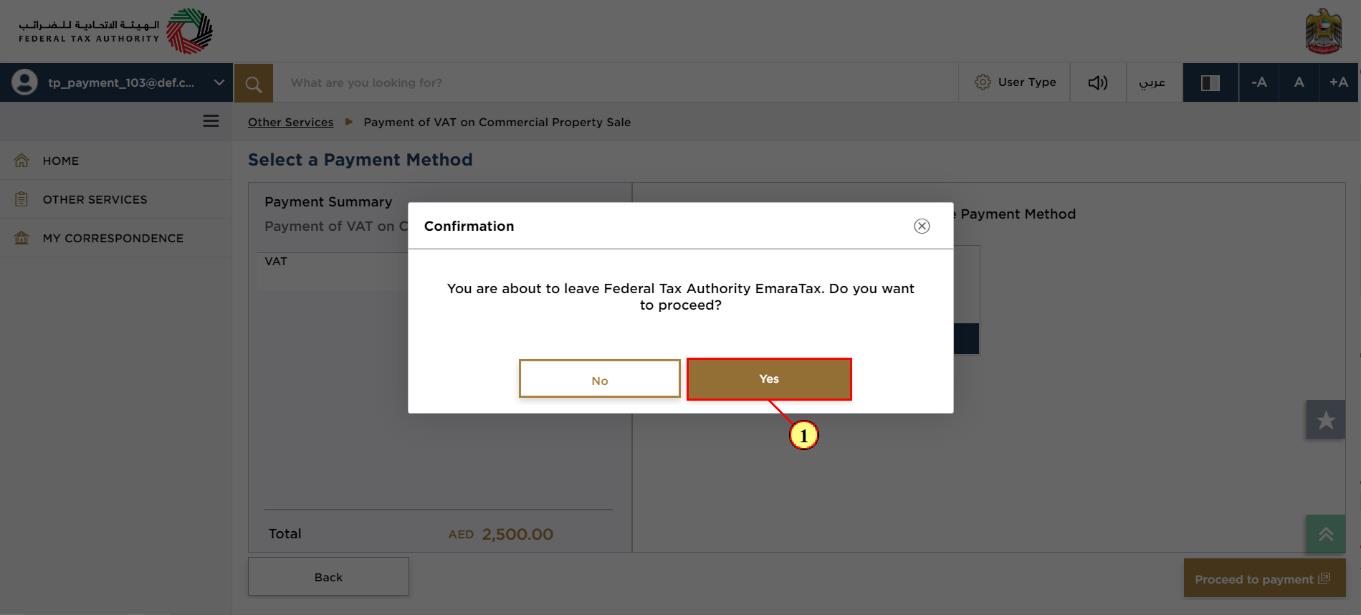

Step | Action |

(1) | Click 'Yes' to proceed to Magnati Pay portal |

|

|

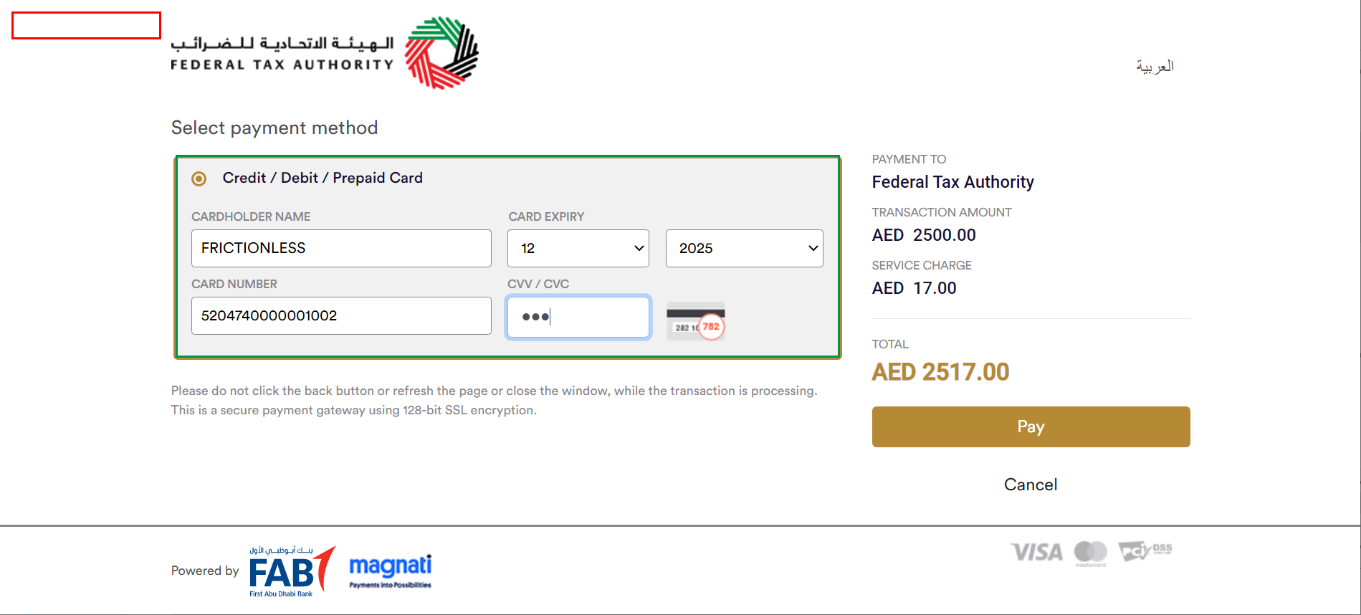

Step | Action |

(1) |

|

Step | Action |

(1) |

|

|

|

|

|

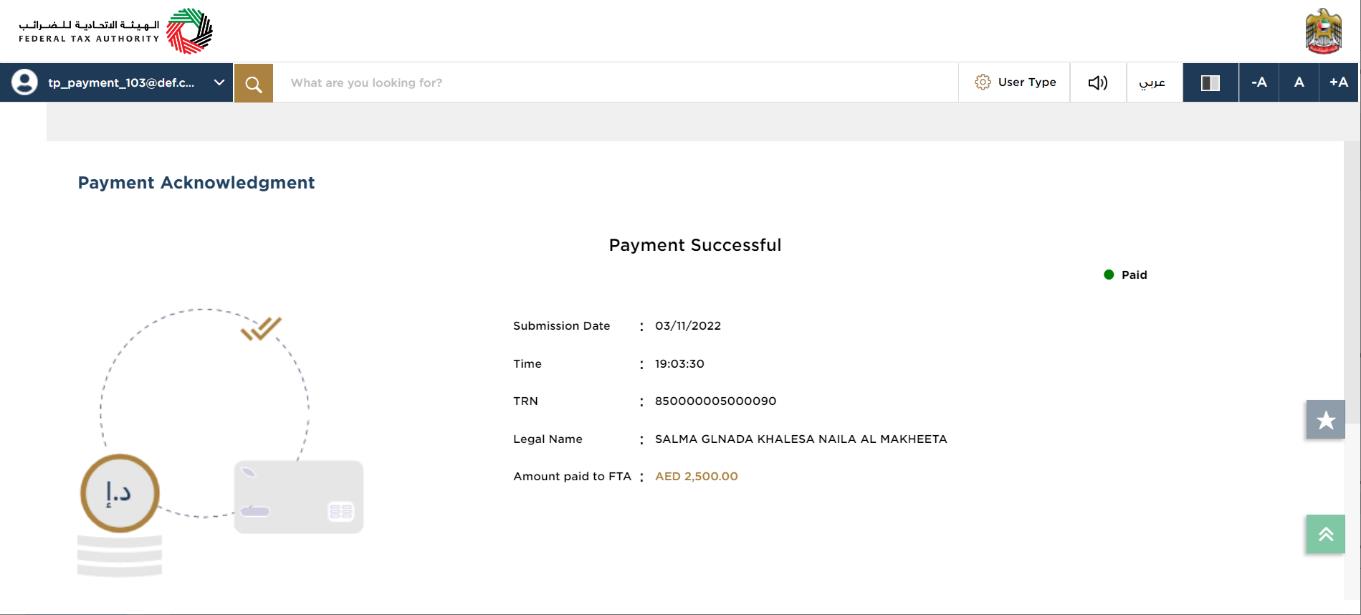

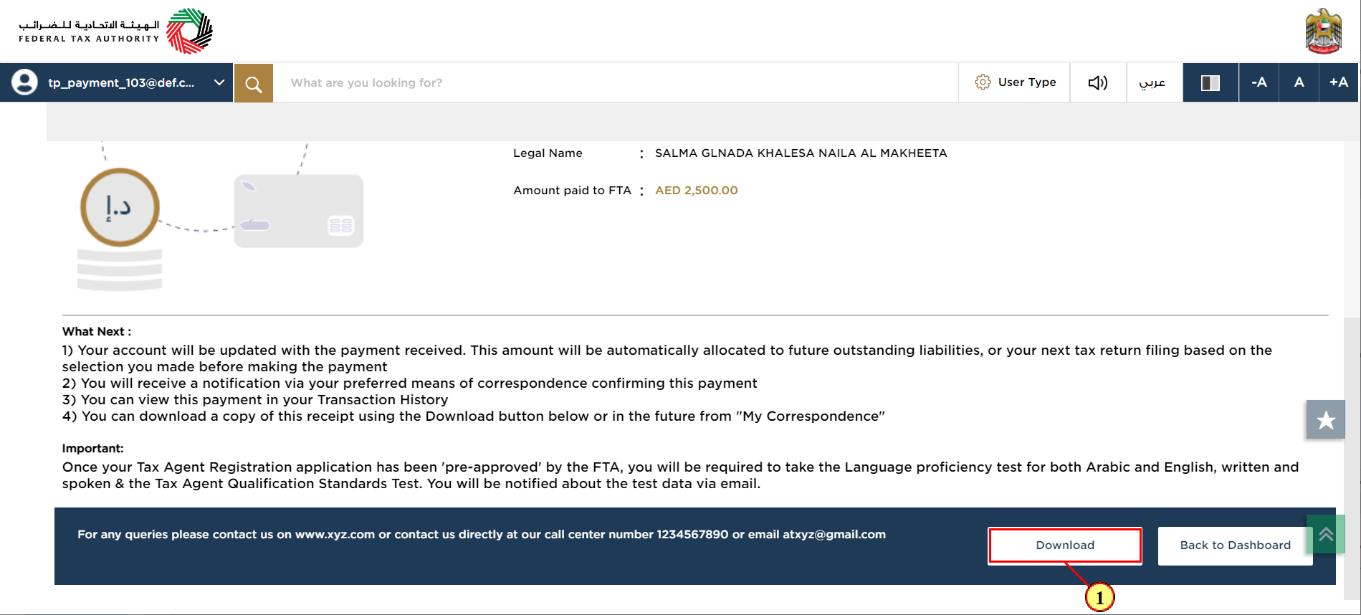

Step | Action |

(1) | Click on the “Download” button and download the Payment acknowledgment receipt. |

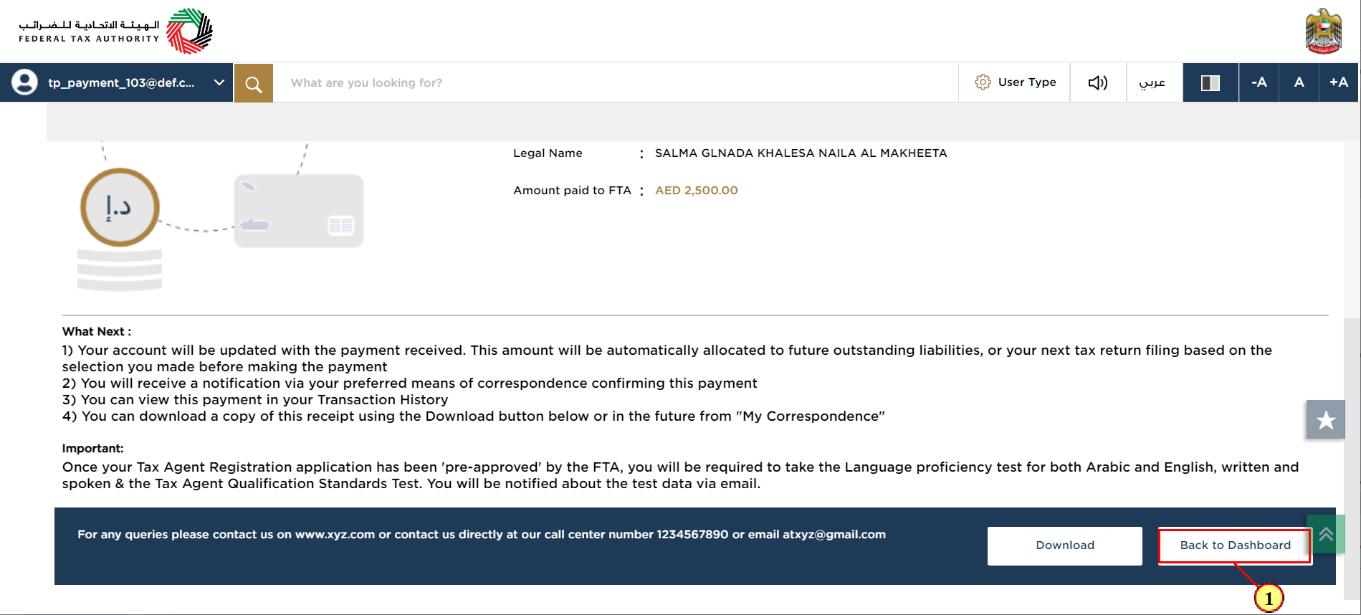

Step | Action |

(1) | Click on ‘Back to Dashboard‘ to go back to dashboard. |