Business Visitor and UAE Nationals Building New Residences Dashboard - Oct 2022

User Manual

Business Visitor and UAE Nationals Building New Residences Dashboard

Date: Oct 2022

Version 1.0.0.0

Contents

1. Document Control Information

2. Annexure - List of other user manuals that can be referred to

3. Navigating through EmaraTax

4. Introduction

10. Manage Account

13. Other Services

15. Footer Section

Document Control Information

Document Version Control

Version No. | Date | Prepared/Reviewed by | Comments |

1.0 | 01-Oct-22 | Federal Tax Authority | User Manual for EmaraTax Portal |

Annexure - List of other user manuals that can be referred to

The below are the list of User manuals that you can refer to

S. No | User Manual Name | Description |

1 | Register as Online User | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website and create an EmaraTax account with the FTA. |

2 | Manage online user profile | This manual is prepared to provide you an understanding on Login process, user types, forgot password and modify online user profile functionalities. |

3 | User Authorisation | This manual is prepared to provide you an understanding on Account Admin, Online User, and Taxable Person account definitions and functionalities. |

4 | Taxable person dashboard | This manual is prepared to help the following ‘Taxable person‘ users to navigate through their dashboard in the Federal Tax Authority (FTA) EmaraTax Portal:

|

5 | Link TRN to email address | This manual is prepared to help you navigate through the Federal Tax Authority (FTA) website to Link TRN to New Email Address. |

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process

Button | Description |

In the Portal | |

| This is used to toggle between various personas within the user profile such as Taxable Person, Tax Agent, Tax Agency, Legal Representative etc |

| This is used to enable the Text to Speech feature of the portal |

| This is used to toggle between the English and Arabic versions of the portal |

| This is used to decrease, reset, and increase the screen resolution of the user interface of the portal |

| This is used to manage the user profile details such as the Name, Registered Email Address, Registered Mobile Number, and Password |

| This is used to log off from the portal |

In the Business Process application | |

| This is used to go the Previous section of the Input Form |

| This is used to go the Next section of the Input Form |

| This is used to save the application as draft, so that it can be completed later |

| This menu on the top gives an overview of the various sections within the form. All the sections need to be completed in order to submit the application for review. The current section is highlighted in Blue and the completed sections are highlighted in green with a check |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for taxpayers to benefit from these services in the best and simplest ways. To get more information on these services Click Here

Introduction

This manual is prepared to help the Business Visitor and UAE Nationals Building New Residences to navigate through the EmaraTax portal and explains the Business Visitor and UAE Nationals Building New Residences Dashboard.

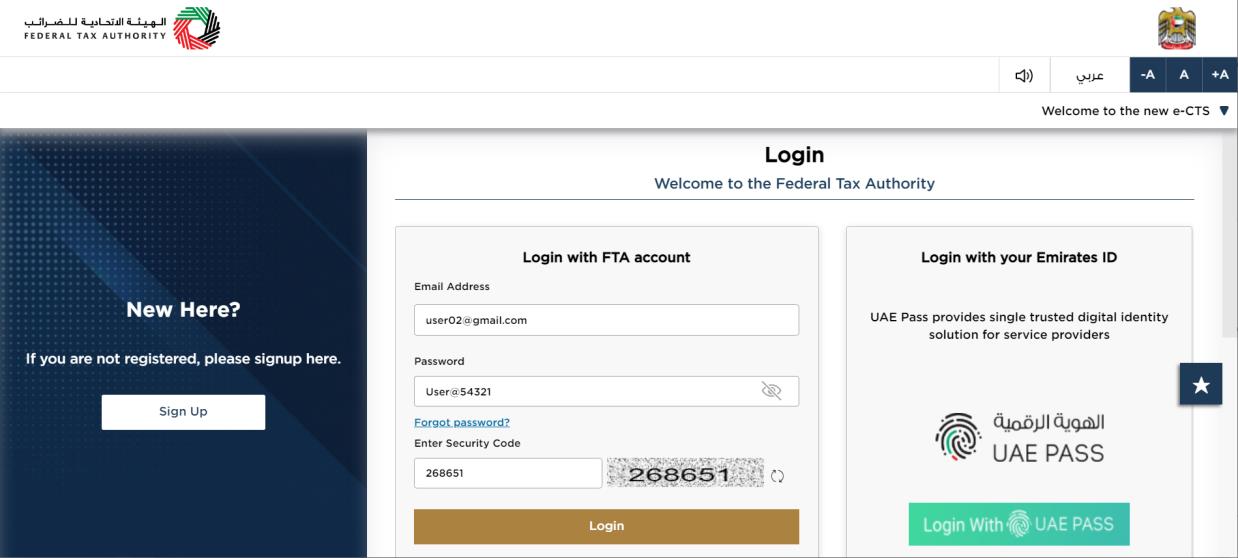

EmaraTax Login Page

|

|

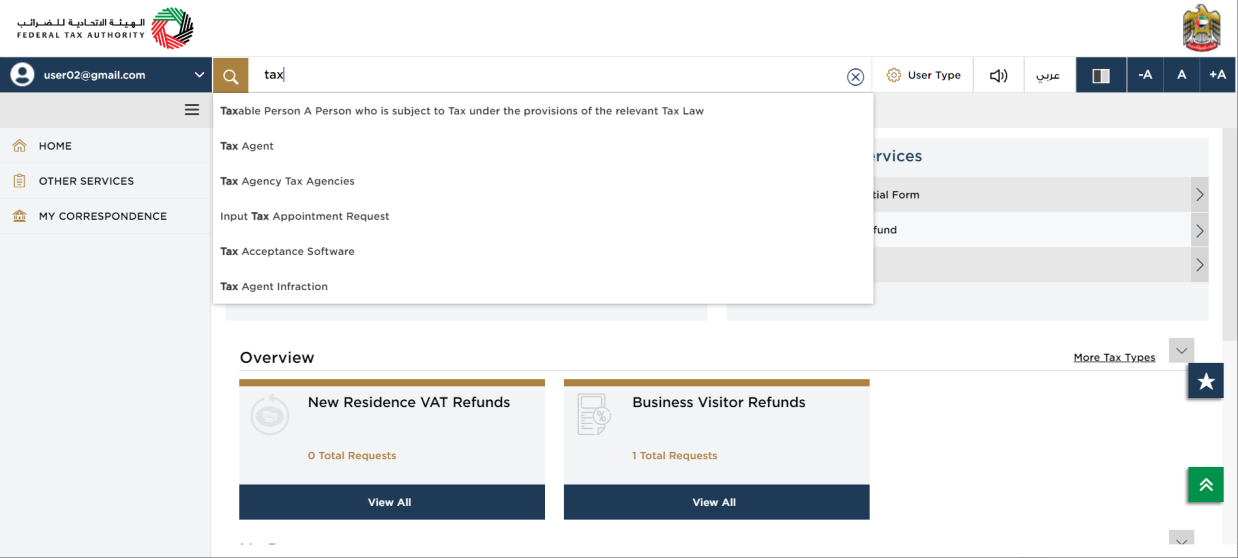

Logged in User Dashboard

| Based on the user type, the search bar lists the application forms applicable to the logged in user. The logged in user can select any option and then click on 'Search'. The user is redirected to the respective page. |

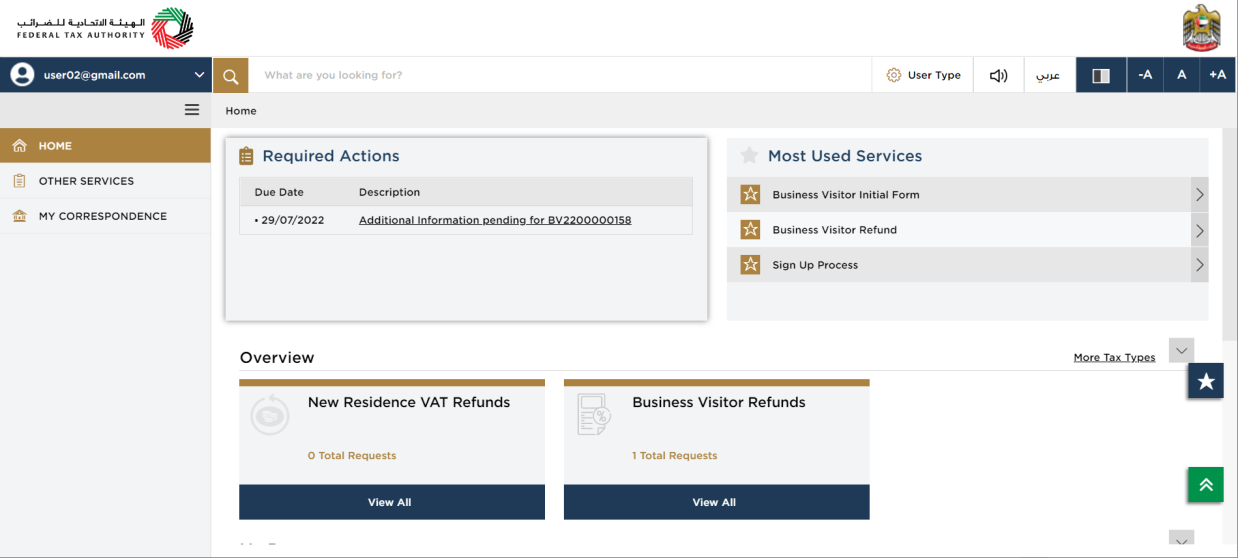

Required Actions

| The ‘Required Action Section‘ will display the three immediate actions that are due from the logged in user. If there are no actions pending from the logged in online user, this section will be empty. |

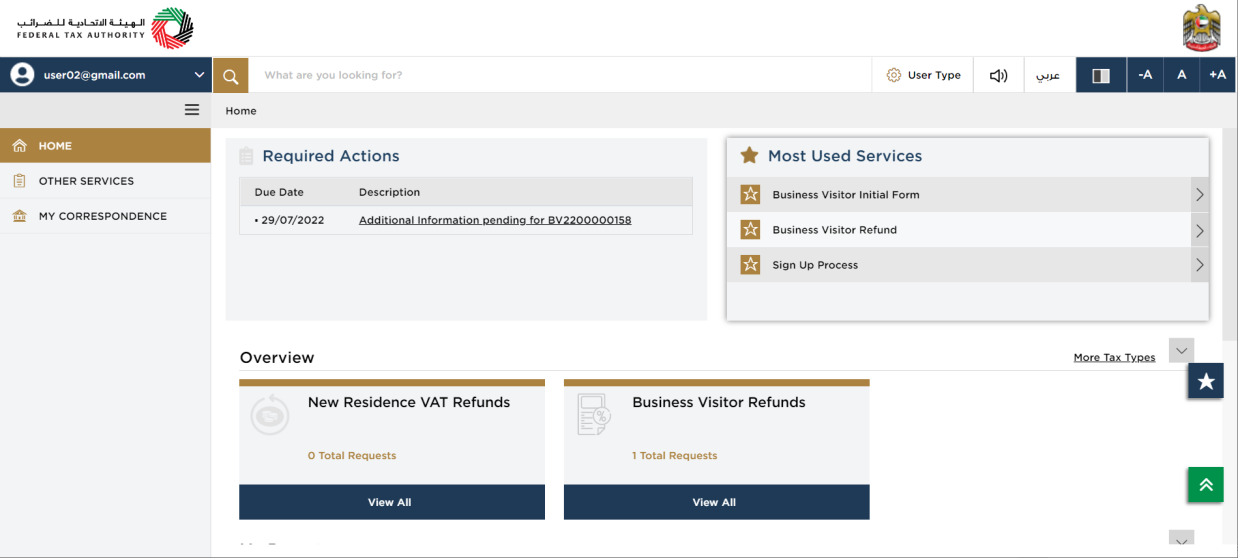

Most Used Services

| The ‘Most Used Services‘ will display the frequently availed three services by the logged in user. |

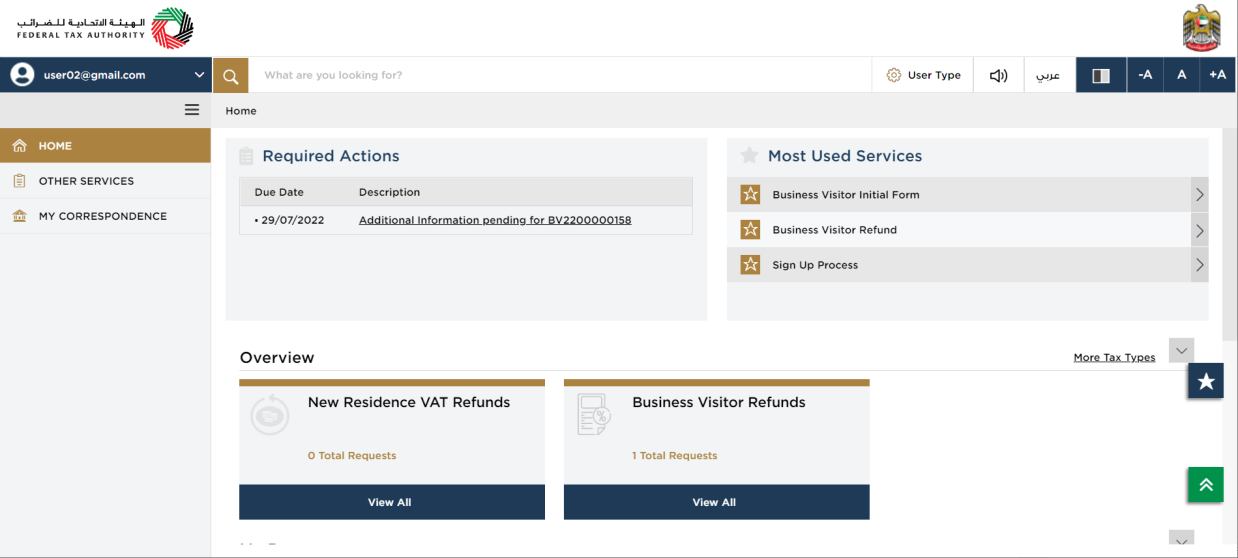

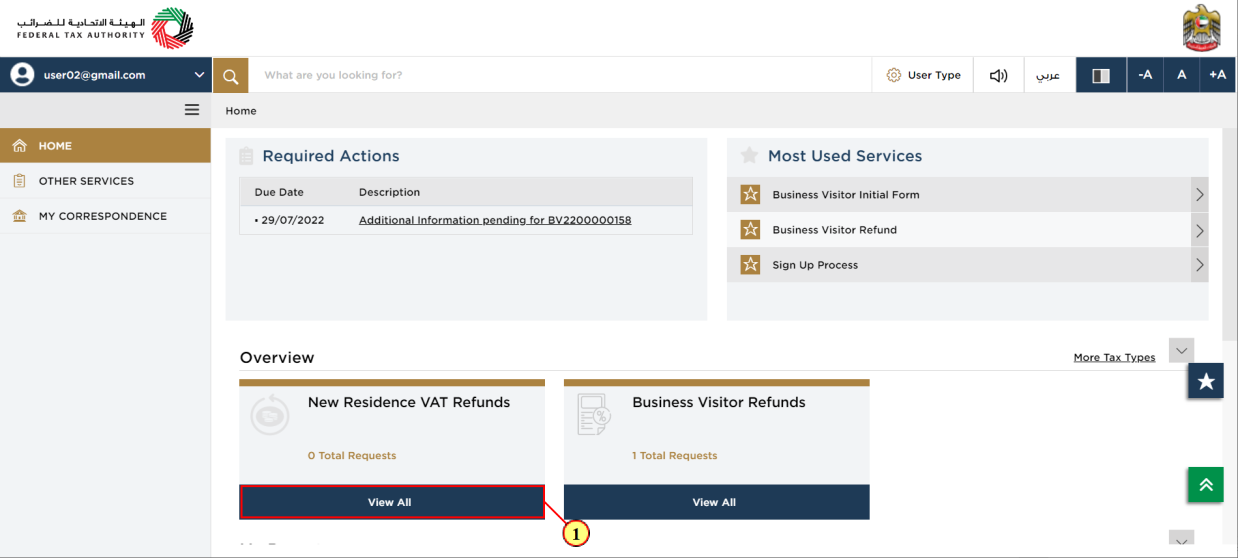

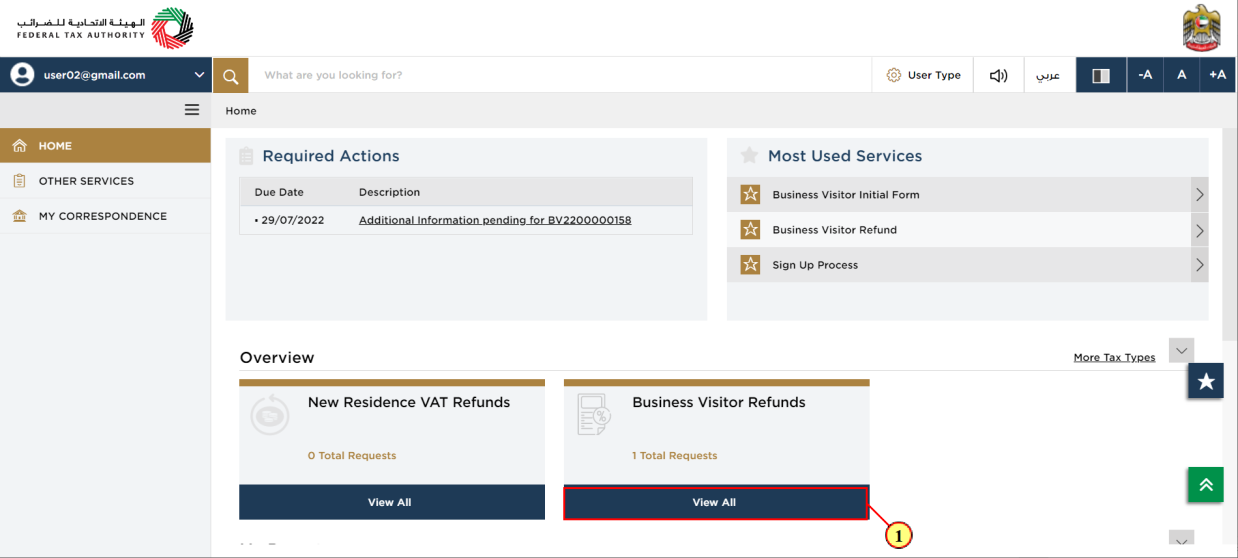

Overview Section

| The ‘Overview‘ section displays the “New Residence VAT refunds” and “Business Visitor Refunds” tile. |

Step | Action |

(1) | Click here to create a new refund request and also to view all your previous ‘New Residence VAT Refunds‘ request. |

Step | Action |

(1) | Click here to create a new refund request and also to view all your previous ‘Business Visitor Refunds‘ request. |

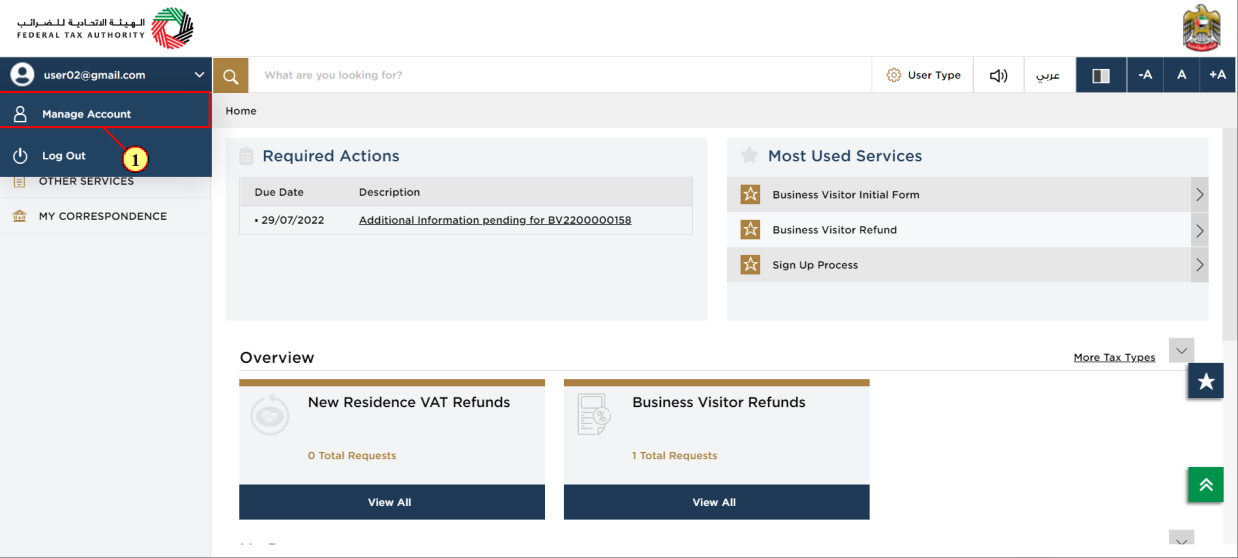

Manage Account

Step | Action |

(1) | Click on ‘Manage account‘ to manage the logged in user account. |

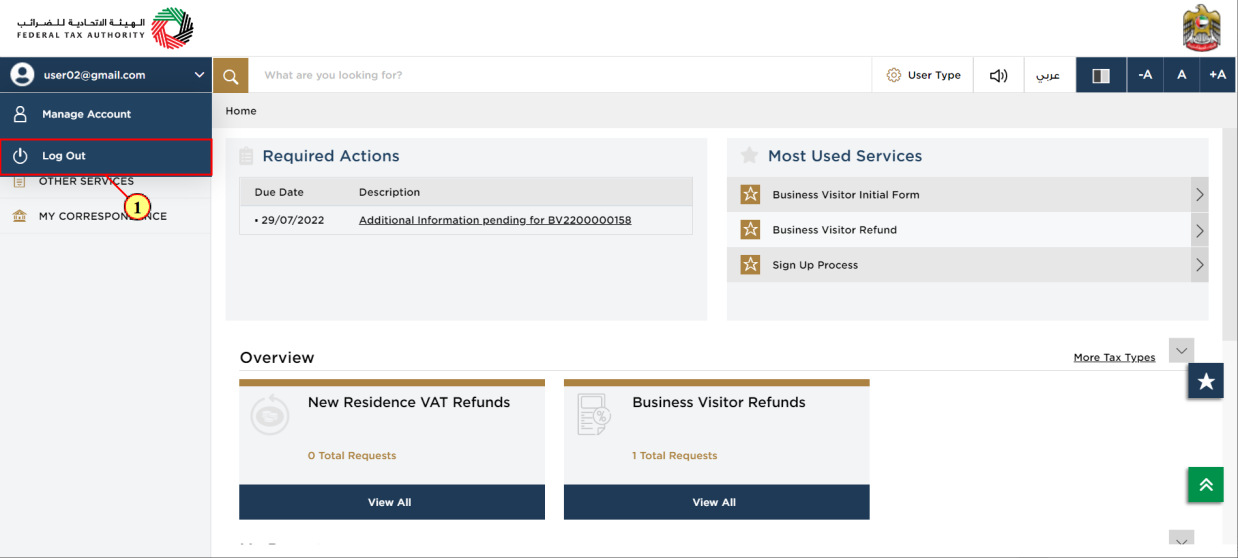

Log Out of Account

Step | Action |

(1) | Click on ‘Log out‘ to log out from the logged in user‘s EmaraTax account. |

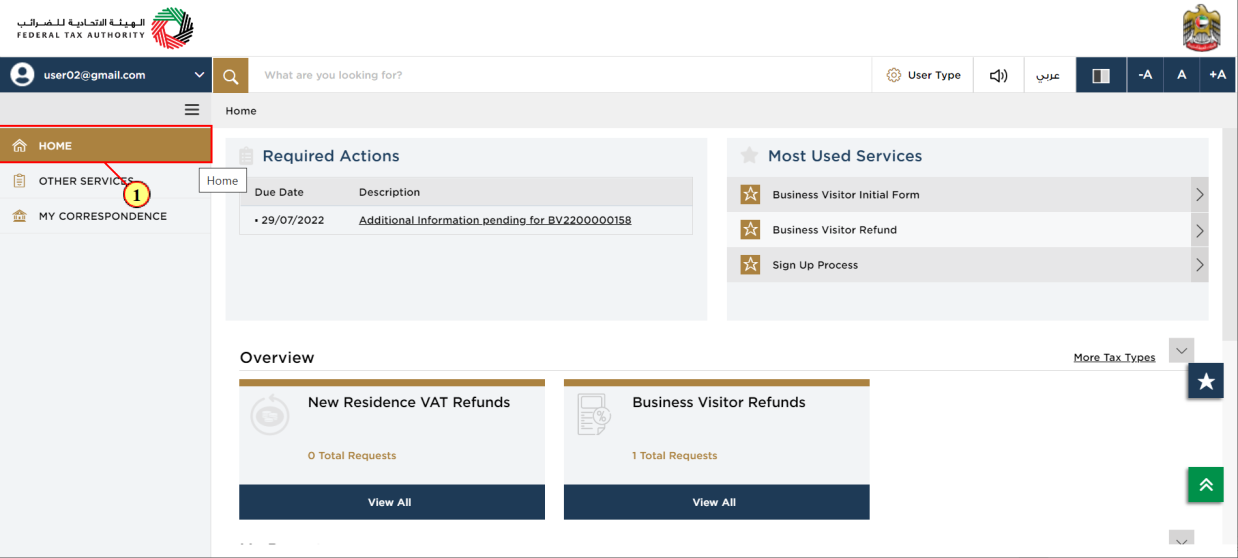

Logged in User Dashboard

Step | Action |

(1) | Click here to navigate back to the logged in user‘s dashboard screen. |

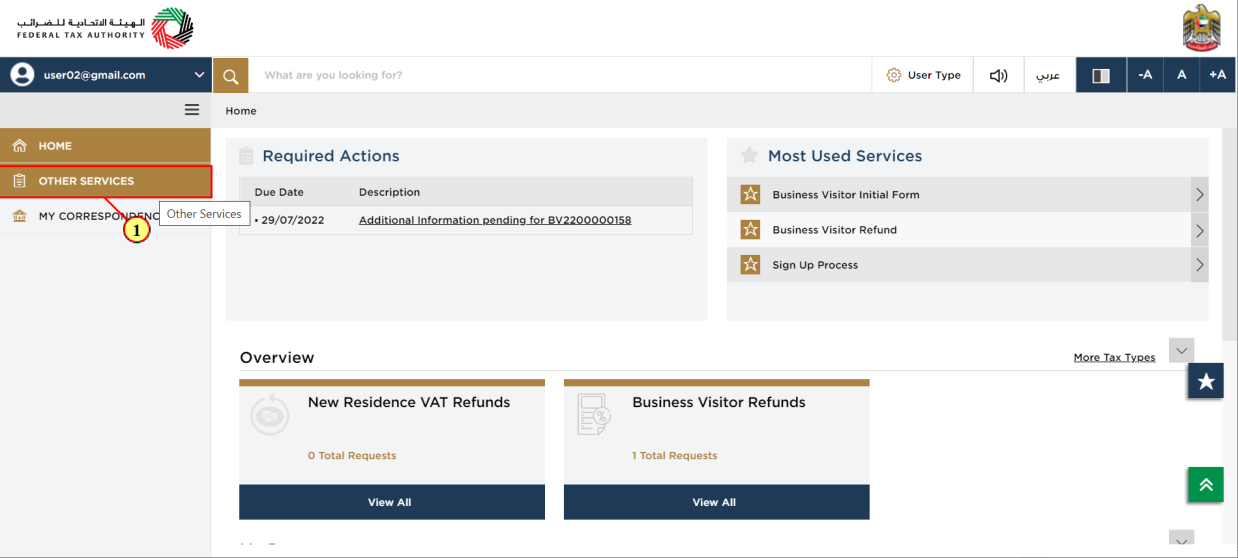

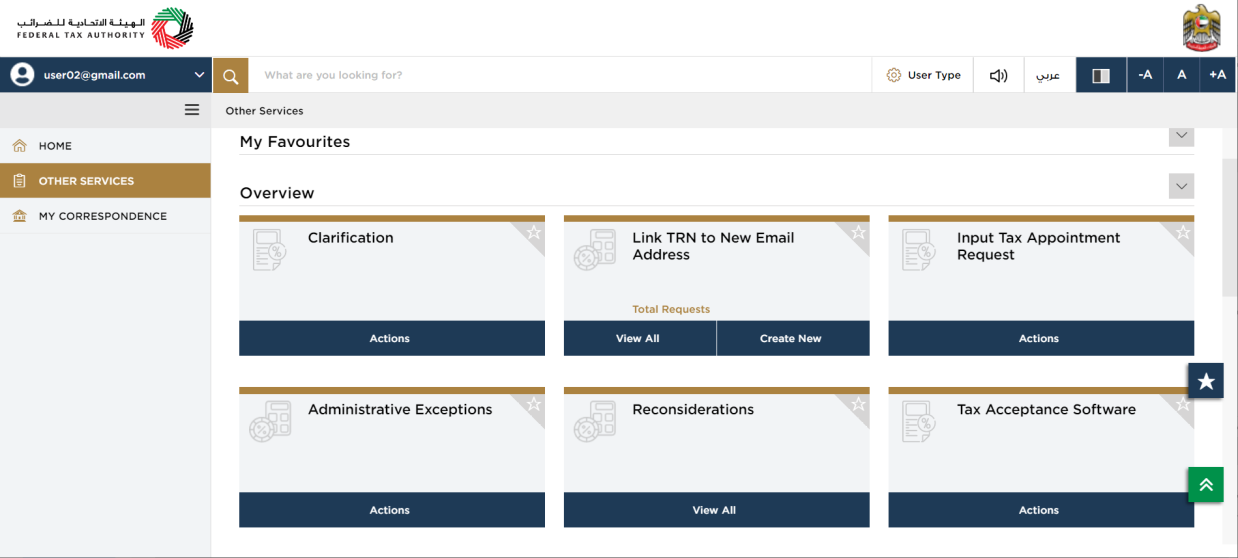

Other Services

Step | Action |

(1) | Click here to view the other services section. |

| A list of generic application forms that are accessible to the logged-in user can be found under 'Other Services'. |

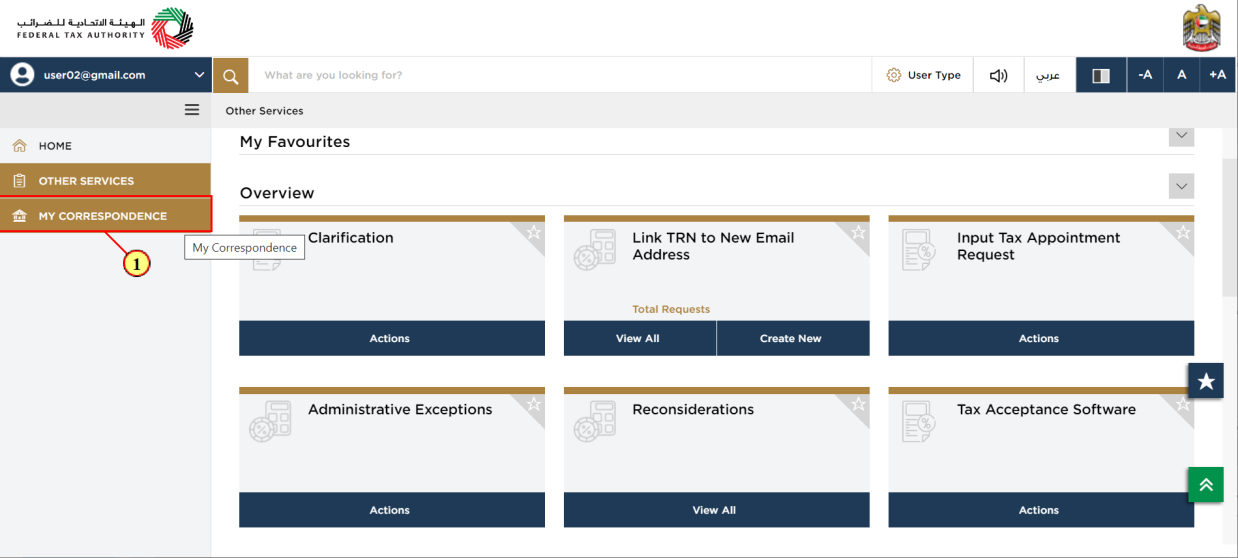

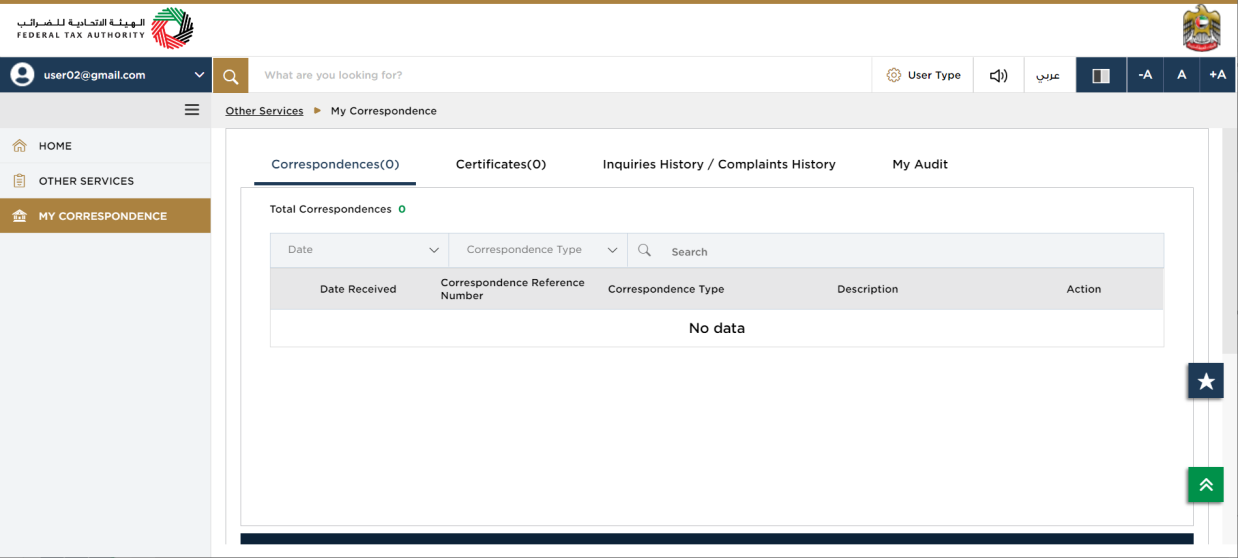

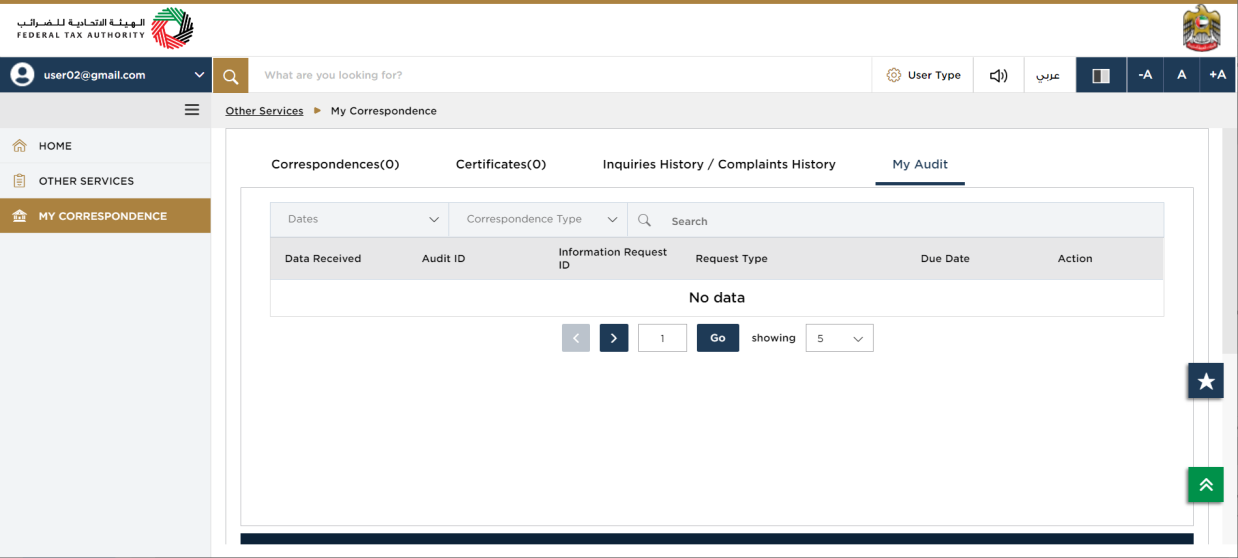

My Correspondence

Step | Action |

(1) | Click here to view the ‘My correspondence‘ section. |

| In the My Correspondence section, there are tabs titled 'Correspondences,' 'Certificates,' 'Complaints and inquiries,' and 'My Audit.' |

| The ‘Correspondence‘ tab displays the email correspondences sent to the logged in user from the EmaraTax system. |

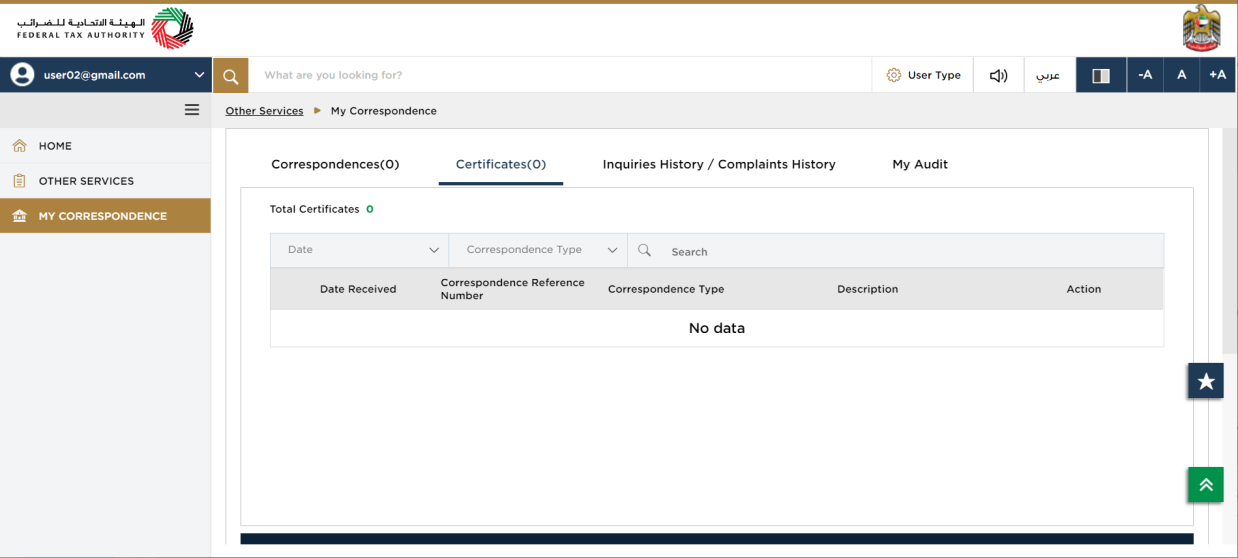

| The ‘Certificates‘ tab displays the logged in user‘s tax registration certificates issued by FTA. There are no registration certificates issued by FTA for “Business Visitor” and “UAE Nationals Home Builders”. Hence this tab is empty for the logged in user. |

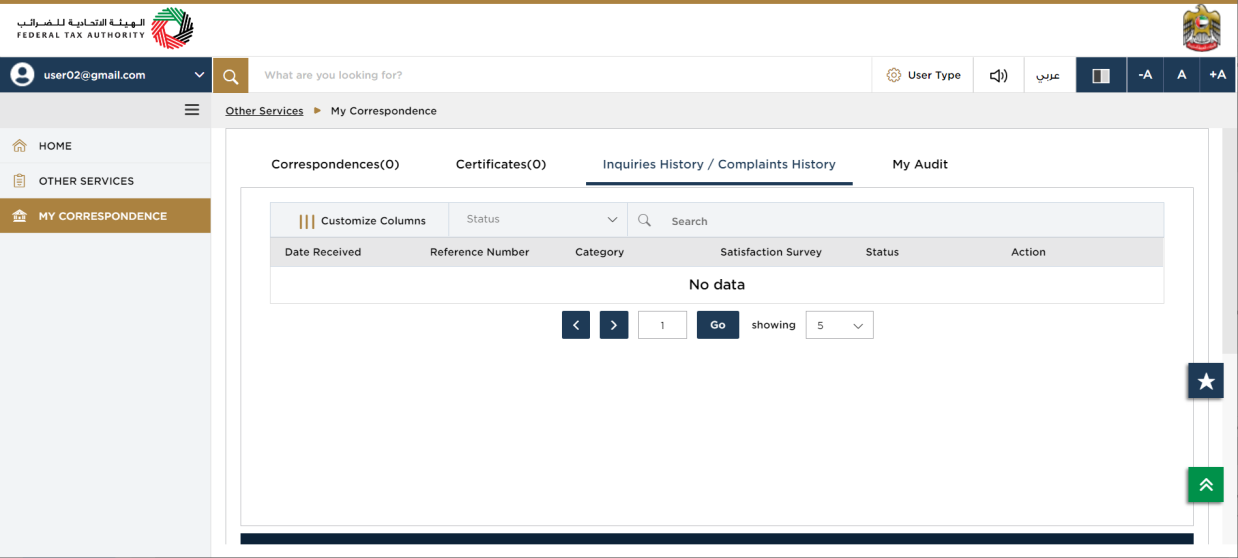

| The ‘Complaints and Inquiries‘ tab displays the complaints and inquiries submitted to FTA by the online user in EmaraTax. |

| The ‘My Audit‘ tab displays the inspections and audits raised by the FTA against the logged in user. |

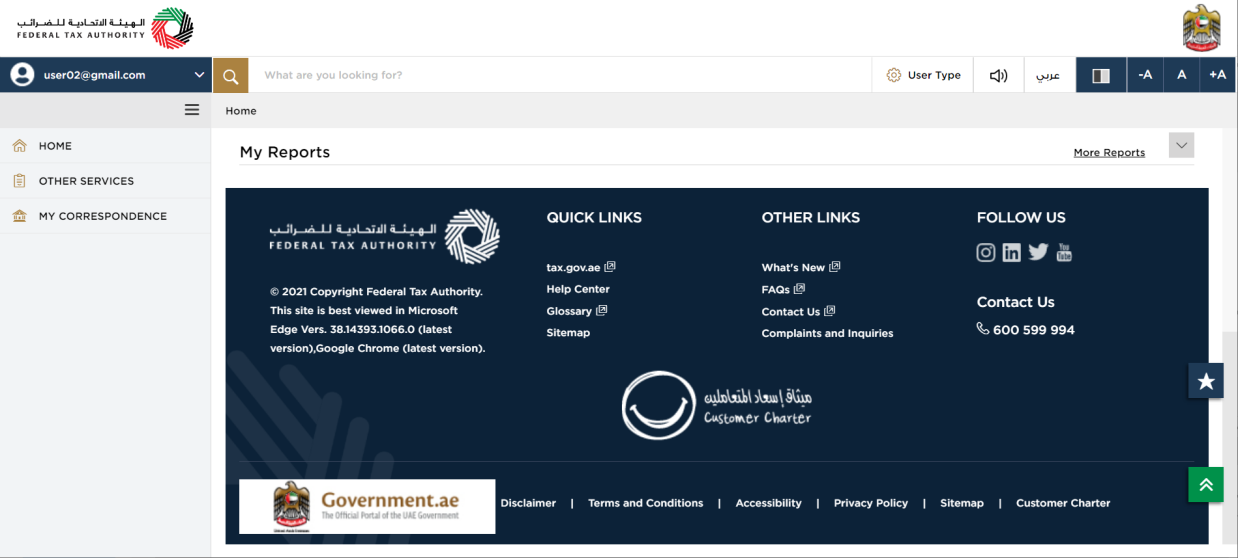

Footer Section

| The footer section contains the following information for quick and easy navigation of the logged in user Quick Links:

Other links:

|

| Follow us: The Federal Tax Authority can be followed on social media sites such as- Instagram, Facebook, Twitter and YouTube Contact us : Federal Tax Authority can be contacted at this number 600599994 Disclaimer – A detailed explanation of the disclaimer content can be found here Terms and Conditions – This page contains all terms and conditions applicable while using Federal Tax Authority Accessibility – This link provides information about accessibility policy. Privacy policy – The privacy policy can be viewed by clicking here. |