Input Tax Apportionment Value Added Tax

VATGIT1

June 2023

Contents

2. Overview of Input Tax Apportionment

3. Special Apportionment Methods

4. Applying for a special input tax apportionment method

4.2. Who may apply for a special input tax apportionment method?

4.4. Which special input tax apportionment methods to apply for?

5. Input Tax Apportionment Request Form

Appendix 1: Completing the Application Form

Introduction

Overview

Short brief

VAT is a general consumption tax on the supply of goods and services, that applies to most supplies which take place within the territorial area of the UAE.

Purpose of this document

The purpose of this Guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be used by certain types of entities where the standard input tax-based apportionment method does not yield a fair and reasonable result.

The Guide provides:

An overview of the general input tax apportionment rules and the available special methods of input tax apportionment;

An overview of the process to apply for a special method of input tax apportionment; and

The information needed to complete the form to apply for a special apportionment method.

For any additional questions regarding the process to apply for a special input tax apportionment method, please contact info@tax.gov.ae.

Who should read this document?

This document should be read by any registrant[1] who makes a mixture of taxable and exempt supplies and any other person responsible for, or involved with the apportionment calculation for such a business.

Legislative references

In this Guide, Federal Decree-Law No. 8 of 2017 on Value Added Tax and its amendments is referred to as "Decree-Law" and Cabinet Decision No. 52 of 2017 on the Executive Regulation of the Federal Decree-Law No. 8 of 2017 on Value Added Tax and its amendments is referred to as "Executive Regulation".

Status of the Guide

This guidance is not a legally binding statement, but is intended to provide assistance in understanding and applying the VAT legislation with regards to input tax apportionment and special methods for input tax apportionment.

This guide replaces the Input Tax Apportionment: Special Methods VAT Guide (VATGIT1) published in December 2019 and March 2023.

Overview of Input Tax Apportionment

Chapter summary

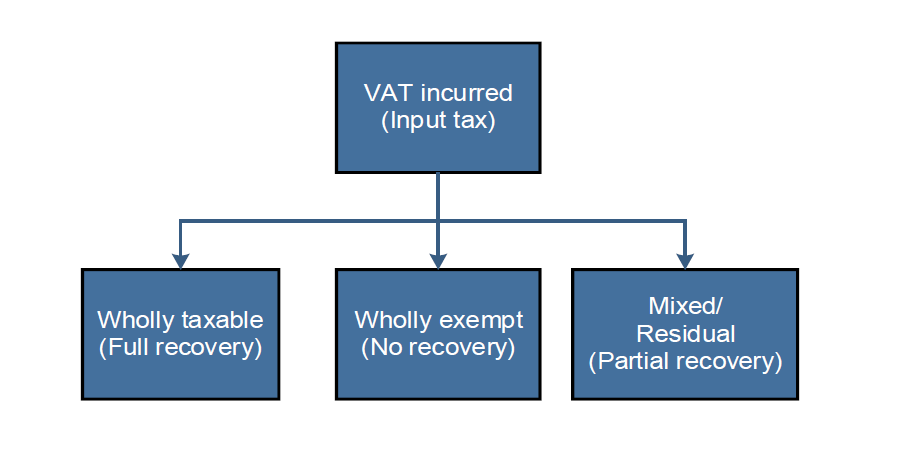

In conducting its business activities, a person may incur expenses which are subject to VAT (VAT incurred by a person is called "input tax"). This VAT can be recovered by a taxable person, subject to certain conditions being met. Consequently, VAT should, generally, not be a cost to a taxable person where such expenditure is incurred to make taxable supplies. However, where the taxable person is not able to recover the VAT incurred in respect of goods or services, the person is, in effect, treated as the end-consumer of those goods or services, and VAT becomes a cost to the business.

Entitlement to recover input tax

A taxable person is entitled to recover input tax incurred on the purchase of goods and services where certain conditions are met. Thus, the recovery of input tax will be permitted where acquired goods and services are used, or intended to be used, in making any of the following:[2]

Taxable supplies;

Supplies that are made outside the UAE which would have been considered taxable had they been made in the UAE; and

Supplies of financial services which would have been treated as exempt if made in the UAE, but which are provided to a person who is outside the UAE at the time of the supply, and the services are treated as taking place outside the UAE.

A taxable person is entitled to full input tax recovery in respect of goods and services used (or intended to be used) for any of the above purposes. In contrast, where the goods or services are used (or intended to be used) solely for non-business purposes or to make solely exempt supplies, the person will not be able to recover any of the input tax incurred.

In certain circumstances, goods or services will be used partly in the course of making supplies that allow for the recovery of input tax and partly for other purposes that do not allow input tax recovery. Where an expense is incurred for the making of such mixed business activity, the taxable person must determine the actual portion of the input tax on the expense that can be recovered.

Input tax apportionment per tax period

Input tax which is incurred in respect of goods or services which are used partly for making supplies that allow for VAT recovery and partly for other purposes for which VAT is not recoverable is referred to as 'residual input tax'. Residual input tax must be apportioned between those activities. Recovery will be restricted to the portion relating to supplies that allow for VAT recovery.

Step 1: Direct attribution

To identify the amount of the residual input tax, the input tax which is either recoverable or non-recoverable in full has to be excluded. Therefore, the first step is to perform the following calculations in respect of each tax period:[3]

Calculate the total value of input tax which is directly attributable to supplies for which VAT may be recovered under Article 54(1) of the Decree-Law. ('Fully recoverable input tax')

Calculate the total value of input tax which is directly attributable to supplies for which VAT cannot be recovered.

Note that input tax which is specifically blocked under Article 53 of the Executive Regulation shall be excluded from this calculation.

Step 2: Residual input tax

Any input tax incurred which cannot be directly attributed to the making of supplies in respect of which input tax is wholly recoverable or wholly non-recoverable constitutes the residual input tax of the taxable person.

Step 3: Apportionment percentage

The next step is to determine the extent to which input tax may be recovered in respect of the residual input tax, i.e. the apportionment rate. The standard method for apportioning the residual input tax is provided in Article 55(6) of the Executive Regulation and is calculated as follows:

a(a + b)× 1001

Where:

- a = Wholly recoverable input tax

- b = Wholly non-recoverable input tax

The percentage should be rounded to the nearest whole number.[4]

Examples of rounding:

| Recovery percentage | Rounded to Nearest Whole Number |

|---|---|

90.87 | 91% |

61.50 | 62% |

73.19 | 73% |

Step 4: Recoverable input tax

The recoverable portion of the residual input tax is calculated by multiplying the total value of residual input tax by the percentage calculated under Step 3 above.

To calculate the total recoverable input tax for the tax period, the recoverable portion of the residual input tax shall be added to the fully recoverable input tax determined under Step 1.

This calculation is required to be performed for each period in which the taxable person incurs input tax relating to the making of exempt supplies, or to activities that are not in the course of business.[5]

Input tax apportionment – Annual adjustments

Registrants are required to perform two additional calculations at the end of each tax year. The registrant's tax year is determined by the registration stagger and may be different than the calendar year and the registrant's financial year.[6] If the registrant's tax year ends on a date other that the financial year-end, the registrant may apply for an administrative exception to amend the stagger to align these two dates.[7]

The first calculation is to perform an annual washup and the second is to calculate an actual use adjustment.

Annual washup

At the end of the registrant's tax year, the person is required to perform an annual wash-up calculation as follows:

Step 1: Combine input tax recovered in returns submitted during tax year

Combine the input tax recovered during each of the tax periods forming part of that tax year by adding boxes 9 and 10 of all the relevant tax returns submitted together.

Step 2: Recalculate recoverable input tax

Recalculate recoverable input tax for the tax year as if it was a single tax period.[8] The same principles (i.e., direct attribution and residual input tax) apply as in step 1 of section 2.3. Note that the amount of the residual input tax should remain the same, but the apportionment percentage for this calculation may vary as the intention is to smoothen the percentage by removing, for example, seasonal fluctuations.

Step 3: Calculate annual washup adjustment

Deduct the total recoverable input tax calculated in step 1 from the amount calculated in step 2 to calculate the annual washup adjustment.

Example

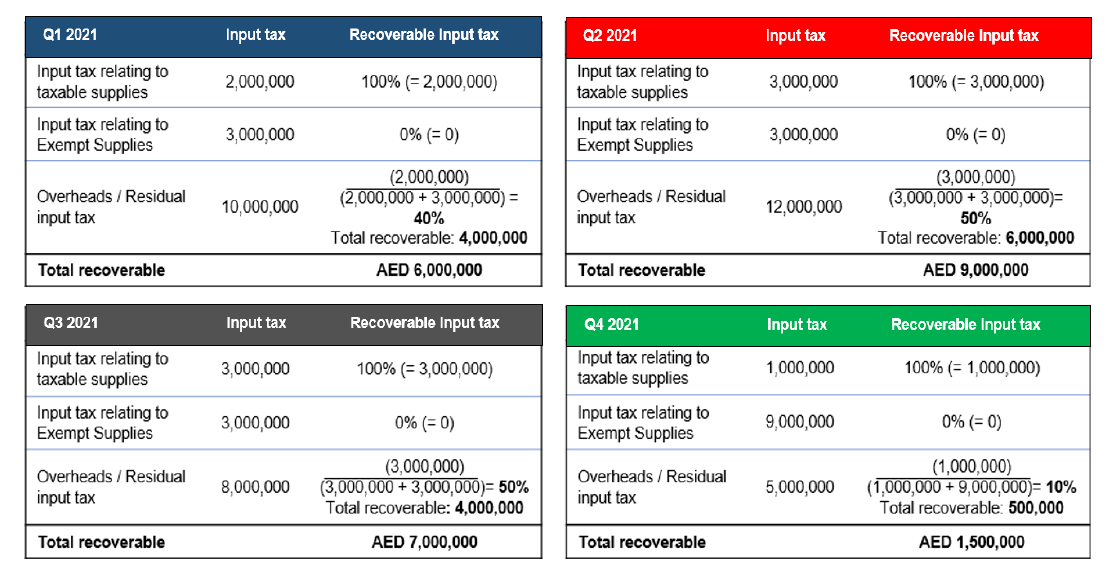

Company A, a registrant, makes both taxable and exempt supplies. Input tax was incurred to make both wholly taxable supplies and wholly exempt supplies, and for mixed purposes (residual VAT).

| Tax year | Wholly recoverable input tax | Wholly non-recoverable input tax | Residual input tax |

|---|---|---|---|

Quarter 1 | 2,000,000 | 3,000,000 | 10,000,000 |

Quarter 2 | 3,000,000 | 3,000,000 | 12,000,000 |

Quarter 3 | 3,000,000 | 3,000,000 | 8,000,000 |

Quarter 4 | 1,000,000 | 9,000,000 | 5,000,000 |

Total | 9,000,000 | 18,000,000 | 35,000,000 |

The recoverable input tax per the VAT returns is as follows:

The total residual input tax recovered per the VAT returns submitted for the calendar year is AED 14,500,000. [9]

| Full tax year | Input tax | Recoverable input tax | Total recovery |

|---|---|---|---|

Wholly recoverable input tax | 9,000,000 | 100% | 9,000,000.00 |

Wholly non-recoverable input tax | 18,000,000 | - | - |

Residual input tax | 35,000,000 | 33% | 11,550,000 |

Based on the above, the annual washup adjustment is calculated as the difference between the recoverable residual input tax per the returns submitted (AED 14,500,000) and the recoverable residual input tax per the annual calculation (AED 11,550,000), i.e., AED 2,950,000. In this case an excess amount of input tax was recovered via the VAT returns.

Actual use adjustment

After performing the annual washup calculation, the registrant is required to calculate the difference between the recoverable input tax per the annual washup calculation and the input tax which would be recoverable if an apportionment ratio which reflects the actual use of the goods and services to which the input tax relates was used.

The registrant is only required to make an actual use adjustment if the difference between these amounts is more than AED 250,000.[10] For example,

| Recoverable residual input tax | Variance | Actual use adjustment required | |

|---|---|---|---|

| Per annual washup calculation | Per actual use | ||

900,000 | 500,000 | 400,000 | Yes |

900,000 | 750,000 | 150,000 | No |

900,000 | 1,200,000 | (300,000) | Yes |

900,000 | 1,000,000 | (100,000) | No |

It should be noted, that the method to determine the "actual use" must be one of the special apportionment methods described in this Guide, taking into account the guidelines on which special methods can be used by which types of businesses.

Example – continued

Assuming Company A is a small retail bank which used the output-based method for the purposes of determining whether an actual use adjustment is required and it made the following supplies during its tax year:

Taxable supplies: AED 40,000,000

Exempt supplies: AED 360,000,000

Residual input tax per annual washup calculation: AED 35,000,000

Recoverable residual input tax per annual washup calculation: AED 11,550,000

Step 1 – Calculate recoverable residual input tax based on the alternative special method

The residual input tax recovery rate, using the outputs-based method[11] is calculated as follows:

Taxable supplies (40,000,000)Taxable supplies (40,000,000) + exempt supplies (360,000,000) × 1001 = 10%

The recoverable residual input tax under this method is AED 35,000,000 x 10% = AED 3,500,000.

Step 2 – Calculate the difference between recoverable residual input tax per the annual washup and actual use

Recoverable residual input tax per annual washup (AED 11,550,000) less recoverable residual input tax per actual use calculation (AED 3,500,000) = AED 8,050,000.

Step 3 – Determine whether an actual use adjustment is required

Since the variance calculated in step 2 is more than AED 250,000, Company A is required to make an actual use adjustment.

Step 4 – Calculate the total year-end adjustment related to recoverable residual input tax

Company A is required to reduce its input tax recovery by the following in the adjustments' column in its first VAT return of the following tax year:

Annual washup adjustment | AED 2,950,000 |

Actual use adjustment | AED 8,050,000 |

Total | AED 11,000,000 |

Alternative input tax apportionment methods

The FTA accepts that the standard method of input tax apportionment may not be appropriate for the particular situation of every registrant. Each business is different, and the standard method of apportionment may give rise to outcomes that do not reflect the actual use of goods or services by the business. In such cases, registrants may apply for an alternative method of input tax apportionment to be used.[12] If a special input tax apportionment method is approved by the FTA, the registrant shall apply the approved method from the first tax period following the tax period in which the approval was granted by the FTA.[13]

The special input tax apportionment methods which are available to registrants are:

Outputs-based method;

Transaction count method;

Floorspace method and

Sectoral method.

Not every special input tax apportionment method will be available to every business. Instead, specific special input tax apportionment methods will generally be available only to businesses from certain industry sectors.

Chapter 3 of this Guide provides guidance on each of the alternative input tax apportionment methods, and the types of businesses which may apply with FTA to use them.

Where a special method is approved, it will be applied for each tax period following the date of approval as well as for the annual wash-up adjustment in the first tax period of the following tax year. Furthermore, on the basis that the special method is based on actual use, no actual use adjustment will be required in respect of tax years following the approval as long as the FTA approval remains valid. The approval will typically be granted for 4 years in the in the case of a non-sectoral method and for 2 years in the case of the sectoral method.

Special Apportionment Methods

Outputs-based method

How does it work?

The outputs-based method determines the apportionment percentage for residual input tax on the basis of the types of supplies made by the taxable person.

To calculate the recovery ratio under this method, the registrant needs to identify the value of taxable supplies as a proportion of all supplies made by the taxable person.

Value of taxable suppliesTotal value of supplies× 1001

This method is appropriate where the VAT incurred by a business is mostly directly linked to income earned, i.e. where there is a strong correlation between income and expenses.

Who is the method available to?

The outputs-based method is available for companies engaged in the following sectors:

- Insurance companies (Islamic and non-Islamic)

- Financial institutions, such as banks that provide banking services to individuals, companies, large establishments and investment banks, and similar institutions (Islamic and non-Islamic)

- Providers of local passenger transportation services

- Educational institutions

- Establishments, such as art galleries, cultural entities, and similar establishments, that conduct non-business activities

Transaction Count method

How does it work?

The transactions count method determines the apportionment percentage based on the number of taxable transactions as a proportion of all transactions carried out by the business during the period.

Number of taxable transactionsTotal number of transactions× 1001

The transaction count method is used when the VAT on expenses incurred by the business is most directly linked to the number of transactions (i.e. supplies made) rather than the amount of income earned – that is, where the level of expense would be similar regardless of the value of the supplies being made. This method will only be appropriate if the nature of the transactions is such that each transaction is either wholly taxable or wholly exempt. Any transactions with both taxable and exempt components should be excluded from the calculation. In order to use this method, the registrant is required to accurately define the type of transactions as well as the related tax treatment in order to provide a clear audit trail to support the apportionment calculation. The registrant is, therefore, required to ensure that their accounting or management system is able to identify and track the different types of transactions.

Who is this method available to?

The transaction count method is available to financial institutions, such as banks (Islamic and non-Islamic), that provide banking services to companies, large establishments and investment banks, and similar institutions.

Floorspace method

How does it work?

The floorspace method determines the apportionment percentage for residual input tax by identifying the proportion of the floorspace used for taxable activities as a percentage of the total floorspace used by the business, excluding areas used for both taxable and non-taxable purposes.

Floorspace for making taxable suppliesTotal floorspace× 1001

The measuring unit used for the nominator and denominator should be consistent, e.g. if using m2 for nominator, m2 should also be used for denominator.

The floorspace method is used when it is possible to identify whether a specific area is used for a taxable or non-taxable / exempt activity.

Who is this method available to?

The floorspace method is available to landlords and businesses dealing with supplies (sales and rental) of commercial and residential properties, including real estate companies and other businesses selling or renting out real estate on an ongoing basis, where expenses would be similar for floorspace regardless of whether used for making non-taxable/exempt or taxable supplies.

Sectoral method

How does it work?

Large complex businesses may conduct different business activities through different divisions which are independent of each other from an operational and accounting perspective. For example, a bank may have different divisions dealing with retail customers and investment banking; or an insurance company may, in addition to its core business, have a real estate division which deals with renting out properties.

Where such business activities are conducted through distinct divisions of a single entity, and different expenses relate to activities of these divisions, none of the special apportionment methods may be suitable for apportioning input tax for the business as a whole. To ensure that the apportionment method is as tailored as possible for each of the distinct business divisions, such businesses may apply for a "sectoral" method of input tax apportionment.

In addition to being used for different divisions of the same entity, this method can also be used by different entities which are members of the same tax group – e.g. where a single type of input tax apportionment method is not appropriate for all members of the group.

Application of the sectoral method involves the following steps:

Firstly, the taxable person must identify the residual input tax in accordance with the general rules in Article 55 of the Executive Regulations as described in this Guide.

Secondly, any residual input tax which relates wholly to a particular sector (i.e. division or entity) is allocated wholly to that sector.

Thirdly, the remaining residual input tax which relates to more than one sector is divided between those sectors in accordance with an appropriate allocation method (discussed below).

Finally, each of the sectors will be assigned an own input tax apportionment method appropriate for that specific sector (e.g. either the standard input tax apportionment method, outputs-based method, transactions count method or floorspace method).

This assigned method would then be used by the sector to apportion the residual input tax relating to that sector.

Sector allocation methods

Where residual input tax of the business relates to multiple sectors of that business, it is necessary to allocate the input tax to these individual sectors. There are two methods which can be used for such an allocation:

Headcount method

Outputs method

Headcount method

The headcount method is used when overhead expenses incurred are in closest relation to the number of employees, i.e. if the expenses are linked to employees. For example, an insurance company may have different employees solely working in its (distinct) life and general insurance divisions, respectively.

The headcount method uses the full-time equivalent (FTE) of staff (usually income generating only, not back office) employed or used in each sector. In instances where employees work in more than one department/division/unit, the staff numbers shall be measured on a FTE basis.

Number of FTE members in the relevant sectorTotal number of FTE× 1001

Outputs method

The outputs method is best used where expenses are linked to income. The amount of income in the sector may therefore be reflective of the input tax on expenses.

The allocation under this method is done using the following formula:

Value of sector's suppliesTotal value of supplies× 1001

This method can be appropriate for a wide-range of entities in both private and not-for-profit sectors. It may not be appropriate, however, where the business has a mixture of well-established sectors and sectors in a start-up phase, as the expectation would be that the start-up divisions would have proportionally more expenses than income.

Who is this method available to?

It is expected that sectoral methods will be used by large, complex companies and establishments with different divisions, such as:

Banks with retail, investment and real estate divisions, and similar institutions;

Insurance companies providing both life and non-life insurance; and

Real estate companies that have separate divisions for commercial and residential properties.

Applying for a special input tax apportionment method

How does it work?

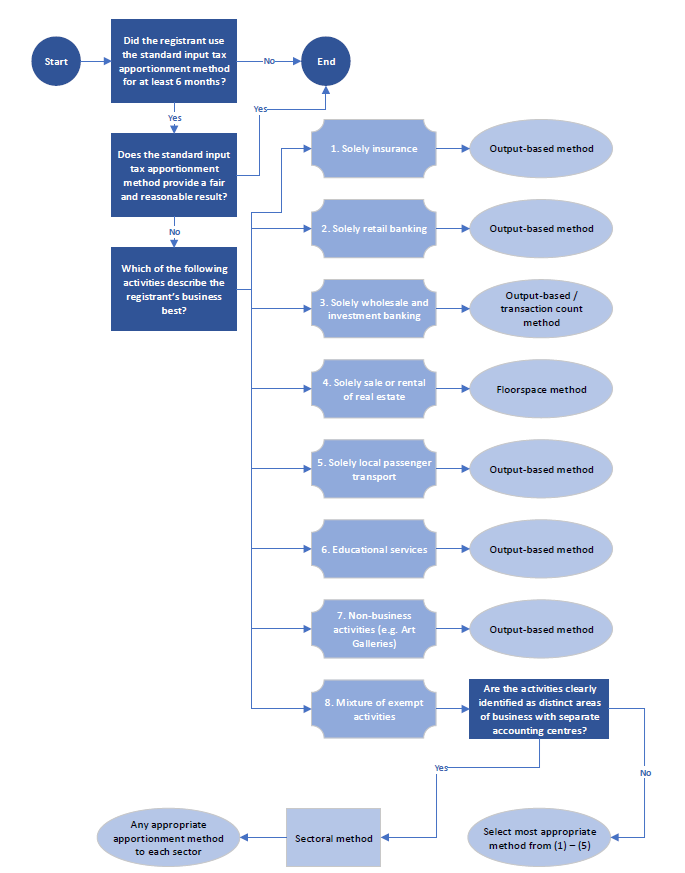

A registrant may apply to the FTA for permission to use a special method of input tax apportionment for the first time if the registrant has used the standard apportionment method for at least 6 months and this method does not yield a fair and reasonable result.

As part of the application to use a special input tax apportionment method, the registrant is required to identify which method it is applying for, and provide evidence that the special method of apportionment will be more appropriate than the standard method.

If the FTA approves the use of a special apportionment method, the taxpayer will typically be required to continue to use the approved method for at least 2 years.

Who may apply for a special input tax apportionment method?

To be eligible to apply for the special method of input tax apportionment, all of the following conditions must be met:

- The applicant has been registered for VAT for at least 6 months;

- The applicant makes both taxable supplies and exempt supplies/conducts non-taxable activities; and

- The standard method of input tax apportionment does not give a fair and reasonable result for the input tax recovery of the applicant.

Who can submit the application?

Generally, the Input Tax Apportionment Request Form should be submitted by the person seeking to use the special apportionment method (i.e. by the "applicant"). Where an application is submitted on behalf of a tax group, or for a member of a tax group, the request should be submitted by the representative member of that tax group. If the special apportionment method is approved, it shall apply to the whole tax group as the tax group is considered to be one and the same person from a VAT perspective.

The applicant must submit the Input Tax Apportionment Request Form via the concerned person’s Emaratax portal on the FTA’s website.Submissions will also be accepted where they are submitted on behalf of the applicant by either of the following:

The appointed tax agent; or

The appointed legal representative.

Please refer to the relevant Emaratax guide for more information on the process to submit the application.

Which special input tax apportionment methods to apply for?

Most applicants will be limited in respect of the types of special methods for which they can apply. Where a business is engaged in a single predominant exempt activity, depending on the type of the activity, the business is able to choose either from the outputs-based method, the transactions count method or the floorspace method for the input tax apportionment. In contrast, where a business is engaged in a number of different types of exempt activities through distinct divisions, the business is able to apply for a sectoral method of apportionment.

Please refer to the diagram on the following page to determine which apportionment methods are available to different types of businesses. The FTA will reject applications where the applicant has applied for a special input tax apportionment method which is not applicable to its specific type of business (as outlined under Chapter 3 of this Guide).

Special apportionment methods – Eligible activities

Input Tax Apportionment Request Form

What information will you need when completing the Request Form?

The applicant is required to provide the following information as part of the request for approval to use a special apportionment method for determining the recovery rate in respect of residual input tax relating to tax periods:

A detailed description of the business activities of the applicant.

The reasons for applying for a special input tax apportionment method.

Historical calculations of residual input tax apportionment in Excel format using the standard method of apportionment as provided in Article 55 of the Executive Regulations. The calculations should be for the period of 12 months preceding the application (as applicable). As an exception, if the business has not conducted business activities for at least 12 months, the calculations may be based on such shorter period.

Calculations of the residual input tax apportionment in Excel format for the same period as above but using the special method for which the applicant is applying, and an alternative method if applicable.

Where the application is made for a sectoral method, the applicant must provide the special apportionment method calculations for each of the sectors for which the application is made as well as a description of each of the sectors.

The historical and expected calculations of residual input tax apportionment must use the real figures of the business for the relevant period of 12 months (where it is applicable). These amounts should agree to the amounts reflected in the registrant's tax returns submitted during the tax year. If there are any discrepancies, reasons for the variances have to be provided to the FTA.

As part of the calculations, the applicant should provide information substantiating the figures which are used to perform apportionment calculations for both the standard method and the chosen special method(s). For example, if the calculation indicates that the applicant made a certain amount of exempt supplies in a 12-month period, the applicant should provide a list of these exempt supplies.

Please refer to Appendix 1 for details regarding the Input Tax Apportionment Request Form.

Submitting the Input Tax Apportionment Request Form

Please refer to the relevant Emaratax guide for more information on the process to submit the form.

FTA's decision in respect of the application

Once the request is accepted, the FTA may require up to 40 business days from the date the request was received, to respond to the initial input tax apportionment request if a non-sectoral method is selected, and up to 60 business days if a sectoral method is selected.

If additional information is required in respect of the lodged application, the FTA will request the additional information. It may take the FTA a further 40 or 60 business days (based on the method selected in the application) to respond to the updated request for a special input tax apportionment method.

The decision of the FTA to approve (or reject) the use a special method is based solely on the information provided by the applicant as part of the application process. The applicant will be notified of the FTA's decision in a decision delivered via an email.

Where the FTA has approved the use of a special input tax apportionment method, the approved method may be used from the first tax period following the date of approval or any other date as decided by the FTA.

The approval will typically be granted for 4 years in the in the case of a non-sectoral method and for 2 years in the case of the sectoral method. Applicants cannot apply to change the approved method for at least 2 years following the approval (subject to the notification rules described in Section 5.4 below).

Note: The FTA may withdraw the approval to use a special input tax apportionment method at any time – for example, if it considers that that the method does not provide an accurate result or where such withdrawal is necessary for the protection of public revenues. During the period of approval, the FTA may request from the taxable person such information as the FTA believes is necessary in order to make a decision regarding whether the ongoing use of the approved method is still appropriate or not.

Notifications relating to change in business

Although a business is generally not able to apply to change the approved special method for at least 2 years following the approval, it is required to notify the FTA where the result produced over the full tax year by the input tax apportionment method approved by the FTA differs by more than 10% from the result the method generated at the time of application.

The applicant may submit the notification form via the concerned person’s Emaratax portal on the FTA’s website.

Following the notification, the FTA will consider whether the approved method is still suitable for the business. Where the approved method is not considered suitable anymore, the FTA may require the business to submit a new special method application in order to be able to continue using the same, or apply an alternative special method of input tax apportionment.

When to re-apply?

As mentioned above, any method approved by the FTA is valid for 2 or 4 years, depending on the method. If the registrant wants to continue using a special method after the expiration of the period, a new application is encouraged to submit the application to the FTA at least 40 business days before the expiry of the most recent approved special method. [14] Provided the taxable person submitted a request to continue using the previously approved special method before its expiry date, the registrant may continue using the previously approved method up to the end of the tax period during which a new decision on the request is issued by the FTA.

In case of any major changes in the business, the nature of the supplies and / or expense allocation principles, between the time of the original application data and the new application, such changes should be highlighted to the FTA in the new request.

The new application shall include the same type of information and calculations as the original application, for a period of 12 months preceding the new application.

In addition to the above, the new application shall contain a comparative overview of the recovery rates and sectors (where applicable) provided in the original application and in the new apportionment calculation requested, with an explanation of any major fluctuation in the recovery rates.

Updates and Amendments

| Date of amendment | Amendments made |

|---|---|

| December 2019 |

|

| March 2023 |

|

June 2023 |

|

Appendix 1: Completing the Application Form

The form must be completed electronically via the concerned person’s Emaratax portal on the FTA’s website.

The following guidance is designed to help understanding the questions in the Input Tax Apportionment Request Form in order to complete the form accurately. Please refer to the relevant Emaratax guide for more information on the process to submit the form.

1. About the ApplicantNote that this section will be prepopulated based on the registrant's taxpayer record. | |

| Tax Registration Number (TRN) | Please review the prepopulated data. |

| Name of the Applicant (English) | Please review the prepopulated data. |

| Name of the Applicant (Arabic) | Please review the prepopulated data. |

| Tax Agent Approval Number (TAAN) (if submitted by a Tax Agent) | If the request is submitted by a tax agent on behalf of a client, the TAAN will be prepopulated based on the tax agent's profile. |

2. Business Activity Details | |

| What is the special method that you wish to apply? | Please select from the drop-down list including:

|

| Upload the calculation sheet applying the standard method for a period of 12 months preceding the application | Attach the standard method calculations in Excel format for a period of 12 months preceding the application (where it is applicable). The calculations should be done for each tax period separately and also consolidated for the entire 12-month period (where it is applicable). Furthermore, please use Excel formulae when making the calculations. |

| Specify the start and end dates to which the calculation of the standard method relates | Please select the start and end dates which correspond to the calculation sheet. |

| Please confirm what industry your business is in | This field is prepopulated based on the registrant's taxpayer record. |

| Explain why you are requesting a special input tax apportionment method | Please provide description of why you are seeking a special method. |

| Provide description of exempt supplies you make | Provide a description of each type of exempt supply that the business makes. |

| Provide description of taxable supplies you make | Provide a description of each type of taxable supply (taxed at 5% and 0%) that the business makes. |

| Provide description of non-business activities conducted by the business | Provide a description of the non-business activities. |

| Provide information on expenses wholly attributable to exempt supplies / non-business activities | Provide information on the expenses which are wholly attributable to exempt supplies / non-business activities. |

| Provide information on expenses wholly attributable to taxable supplies | Provide information on expenses which are wholly attributable to taxable supplies. |

| Provide information on residual input tax | Provide a description of the types of expenses that are incurred to make both taxable and non-taxable supplies, i.e. expenses that cannot be attributed to the making of wholly taxable, or wholly non-taxable supplies. |

3. Request Details | |

| Please identify the alternative apportionment method | Select from the drop down list the special method that applies to the applicant — the list is different based on the selection made in Step 2. |

| Complete the below section if you have selected a non-sectoral method: | |

| Please Identify the alternative apportionment method | Select from the drop-down menu |

| Provide a clear justification for the method selected. | Provide explanation using the flowchart under Section 4.4 of this Guide, to determine the appropriate special input tax apportionment method. |

| Upload the calculation sheet applying the proposed method for a period of 12 months preceding the application | Upload the calculation sheet applying the proposed method for the same period as the example of the standard method of apportionment provided above. The calculations must be provided in Excel format. |

| Provide any documentary proof to support the calculations made for the proposed and any other alternative methods | Attach the relevant supporting documents to facilitate the processing of the request. Information that is commercially sensitive can be redacted. |

| Complete the below section if you have selected a sectoral method: | |

| Identify the method for allocating expenses between sectors | Please select from the drop down list the allocation method that applies:

|

| Justification for selecting a sectoral method and the alternative methods for each sector | Provide reasons for selecting the sectoral method and the alternative methods for each sector. |

| Identify the special apportionment methods selected to be used for each sector | Select from the list the sectors and the special apportionment methods selected for each of the sectors. |

| Upload the calculation sheet applying the proposed method for a period of 12 months preceding the application | Upload the calculation sheet applying the proposed method for the same period as the example of the standard method of apportionment provided above. The calculations must be provided in an excel format. |

| Provide any documentary proof to support the calculations made for the proposed and any other alternative methods | Attach any supporting documents deemed relevant to facilitate the processing of the request. Information that is commercially sensitive can be redacted. |

4. Declaration and Authorized signatory | |

| Authorized Signatory details | Please review the prepopulated data. |

Declaration:

| |

5. Review | |

Review the whole ITA application and confirm that you have read and reviewed all details related to the application. In case all details are correct proceed with submitting the application. | |

Appendix 2: Example on input tax apportionment

Please note that below are examples only and may notbe suitable for, or may need to be adapted for specific cases.

Standard – Input based method

| Standard (Input based) method calculation | AED | |

|---|---|---|

Total input tax (Consolidated data for the whole tax year) | XX | |

Input tax attributable to making taxable supplies (Standard rated + zero-rated supplies) - Fully recoverable | XX | |

Input tax attributable to making exempt supplies - Non-recoverable | XX | |

Input tax blocked from recovery in line with the Article 53 of the Executive Regulation | XX | |

Total residual input tax - Partially recoverable | XX | |

Recovery percentage as per Standard (Inputs based) method: | X% | |

Recoverable residual input VAT | XX | |

Non-recoverable residual input tax: | XX | |

Total recoverable input VAT for the period (Fully recoverable input VAT + Residual recoverable input VAT) | - | |

Total recovered input VAT as per the submitted VAT returns | - | |

Outputs-based method

| Actual use calculation - Outputs-based method | AED |

| Total input tax (Consolidated data for the whole tax year) | XX |

| Fully recoverable input tax: | XX |

| Non-recoverable input tax | XX |

| Total residual input tax | XX |

Special Method: | |

| Total taxable supplies | XX |

| XX |

| XX |

| Total exempt supplies | XX |

| Total non-business income | XX |

| Recovery percentage as per Outputs-based method: | X% |

| Recoverable residual input tax - Outputs-based method: | XX |

| Non-recoverable residual input tax: | XX |

| Total recoverable Input VAT per the Actual use calculation (Fully recoverable input VAT + Residual recoverable input VAT): | - |

Transaction count method

| Actual use calculation - Transaction count method | AED |

|---|---|

| Total input tax (Consolidated data for the whole tax year) | XX |

| Fully recoverable input tax: | XX |

| Non-recoverable input tax | XX |

| Total residual input tax | XX |

Special Method: | |

| Number of taxable transactions | XX |

| Total number of transactions | XX |

| Recovery percentage as per Transactions count method: | X% |

| Recoverable residual input tax - Transactions count method: | XX |

| Non-recoverable residual input tax: | XX |

| Total recoverable Input VAT per the Actual use calculation (Fully recoverable input VAT + Residual recoverable input VAT): | - |

Floorspace method

| Actual use calculation - Floorspace method | AED |

|---|---|

| Total input tax (Consolidated data for the whole tax year) | XX |

| Fully recoverable input tax: | XX |

| Non-recoverable input tax | XX |

| Total residual input tax | XX |

Special Method: | |

| Total amount of floorspace (sqm) used by taxpayer | XX |

| Floorspace (sqm) used for making taxable supplies | XX |

| Floorspace (sqm) used for making exempt supplies | XX |

| Communal areas (sqm) | XX |

| Floorspace (sqm) used for making both taxable and exempt supplies | XX |

| Recovery percentage as per Floorspace method: | X% |

| Recoverable residual input tax - Floorspace method: | XX |

| Non-recoverable residual input tax: | XX |

| Total recoverable Input VAT per the Actual use calculation (Fully recoverable input VAT + Residual recoverable input VAT): | - |

Sectoral method

Original - Special method application | New application - Special method application | ||||

Tax period covered: | 1 July 2019 - 30 June 2020 | Tax period covered: | 1 July 2021 - 30 June 2022 | ||

Method selected: | Sectoral | Method selected: | Sectoral | ||

Description: | Amount (AED) | VAT (AED) | Description: | Amount (AED) | VAT (AED) |

Total value of the Input VAT for the period: | Total value of the Input VAT for the period: | ||||

a. Input tax wholly attributable to making standard rated supplies: | a. Input tax wholly attributable to making standard rated supplies: | ||||

b. Input tax wholly attributable to making zero rated supplies: | b. Input tax wholly attributable to making zero rated supplies: | ||||

Input tax wholly attributable to making taxable supplies (a. + b.): | Input tax wholly attributable to making taxable supplies (a. + b.): | ||||

Input tax wholly attributable to making exempt supplies: | Input tax wholly attributable to making exempt supplies: | ||||

Total value of the overheads / residual Input tax: | Total value of the overheads / residual Input tax: | ||||

Sector allocation – directly attributable overheads / residual Input tax: | Amount (AED) | VAT (AED) | Sector allocation – directly attributable overheads / residual Input tax: | Amount (AED) | VAT (AED) |

Sector I: | Sector I: | ||||

Sector II: | Sector II: | ||||

Sector III: | Sector III: | ||||

Sector IV: | Sector IV: | ||||

Sector V: | Sector V: | ||||

Remaining unallocated Input tax overheads / residual Input tax: | Remaining unallocated Input tax overheads / residual Input tax: | ||||

Overheads / residual input tax allocation method: | Headcount or Outputs method | Overheads / residual input tax allocation method: | Headcount or Outputs method | ||

Explanation on why certain allocation method has been selected (e.g. make sure to provide headcount overview): | Explanation on why certain allocation method has been selected (e.g. make sure to provide headcount overview): | ||||

Application of the sector allocation methodology on the overheads / residual input tax allocation to sectors: | Amount (AED) | VAT (AED) | Application of the sector allocation methodology on the overheads / residual input tax allocation to sectors: | Amount (AED) | VAT (AED) |

Sector I: | Sector I: | ||||

Sector II: | Sector II: | ||||

Sector III: | Sector III: | ||||

Sector IV: | Sector IV: | ||||

Sector V: | Sector V: | ||||

Consolidated - Sector allocation on the overheads / residual input tax: | Consolidated - Sector allocation on the overheads / residual input tax: | ||||

Sector I: | Sector I: | ||||

Sector II: | Sector II: | ||||

Sector III: | Sector III: | ||||

Sector IV: | Sector IV: | ||||

Sector V: | Sector V: | ||||

Consolidated - Sector Input tax recovery | Consolidated - Sector Input tax recovery | ||||

Sector | Input tax - recovery percentage | Recoverable Input tax for the period | Sector | Input tax - recovery percentage | Recoverable Input tax for the period |

Sector I: | Sector I: | ||||

Sector II: | Sector II: | ||||

Sector III: | Sector III: | ||||

Sector IV: | Sector IV: | ||||

Sector V: | Sector V: | ||||

Comparative overview of the special method application

| Sectors: | Recovery rate as per the previously approved special method | Recovery rate as per the new special method application | Comments on the major differences between the recovery rates |

|---|---|---|---|

| Sector I: | |||

| Sector II: | |||

| Sector III: | |||

| Sector IV: | |||

| Sector V: |

Appendix 3: Common Errors

From the Input tax apportionment special method requests received, the FTA has identified errors that are common across applications. The below checklist can assist applicants to avoid submitting incomplete or wrong application form and supporting documents:

General checks that apply to applicants for all methods:

Provide a stamped / signed letter by the authorized signatory confirming the request to apply for the special method.

Submit the standard method and the proposed method calculations in Excel format for a period of 12 months preceding the application (where it is applicable), as per Section 5.1 of the Input Tax Apportionment Guide. The calculations should be done for each Tax period separately and also consolidated for the entire 12-month period (where it is applicable). Furthermore, please use Excel formulae when making the calculations.

Ensure that the recovery rate percentages are rounded to the nearest whole number in accordance with Article 55(6) of the Executive Regulation.

Clearly state in the calculations if there are expenses that are wholly attributable to either exempt or taxable supplies or if all expenses are residual. This also applies to expenses which are subject to the reverse charge mechanism.

Make sure that there are no deviations between the calculations provided and the submitted returns. If there are deviations, these should be clearly explained.

Standard method

Exclude blocked input tax from the standard method calculations.

Outputs-based method

Exclude expenses which are subject to the reverse charge mechanism from the outputs-based method calculations. These expenses are inputs, not outputs.

Transaction count method

Exclude input transactions (including the reverse charge mechanism expenses) when performing the transaction count method calculations.

Floorspace method

Exclude communal areas such as lobbies and lifts when calculating the floorspace available for commercial or residential use.

Sectoral method

Allocations:

State the methodology used on which residual input tax has been allocated across different sectors.

If the headcount method is the chosen allocation method, provide a breakdown of your total headcount. This should show your total front and back office staff as well as any contracted personnel, even if not all of these staff are used in the headcount allocation calculations.

Sectors:

Provide detailed information on the activities performed by each sector.

Attach the calculations showing how the recoverability percentage for each sector has been derived.

Include the apportionment methods used for each sector along with the rationale for using each method.