CTP002

Corporate Tax Public Clarification

The definition of 'Related Parties' where there is a common ownership and/or Control through a Government Entity

Issue

Corporate Tax in the UAE is regulated by Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments ("Corporate Tax Law").

As per Article 34 of the Corporate Tax Law[1] , in determining Taxable Income, transactions and arrangements between Related Parties must meet the arm's length standard.

Article 35 of the Corporate Tax Law provides the definition of "Related Parties"[2] . Based on this definition, two or more juridical persons can be Related Parties as a result of common ownership and/or Control, whether direct or indirect.

This Public clarification explains the application of the Related Parties definition as per Article 35 of the Corporate Tax Law to structures where common ownership and/or Control is by virtue of the UAE Federal Government or a Local Government (i.e. Emirate-level government).

Summary

Common ownership and/or Control by a Federal Government or a Local Government is not in itself a basis for being Related Parties for the purpose of Article 35 of the Corporate Tax Law.

Detailed analysis

Taxable Persons whose only common ownership of at least 50% or Control (either directly or indirectly) is through the Federal Government or Local Government, are not Related Parties for the purposes of Article 35 of the Corporate Tax Law.

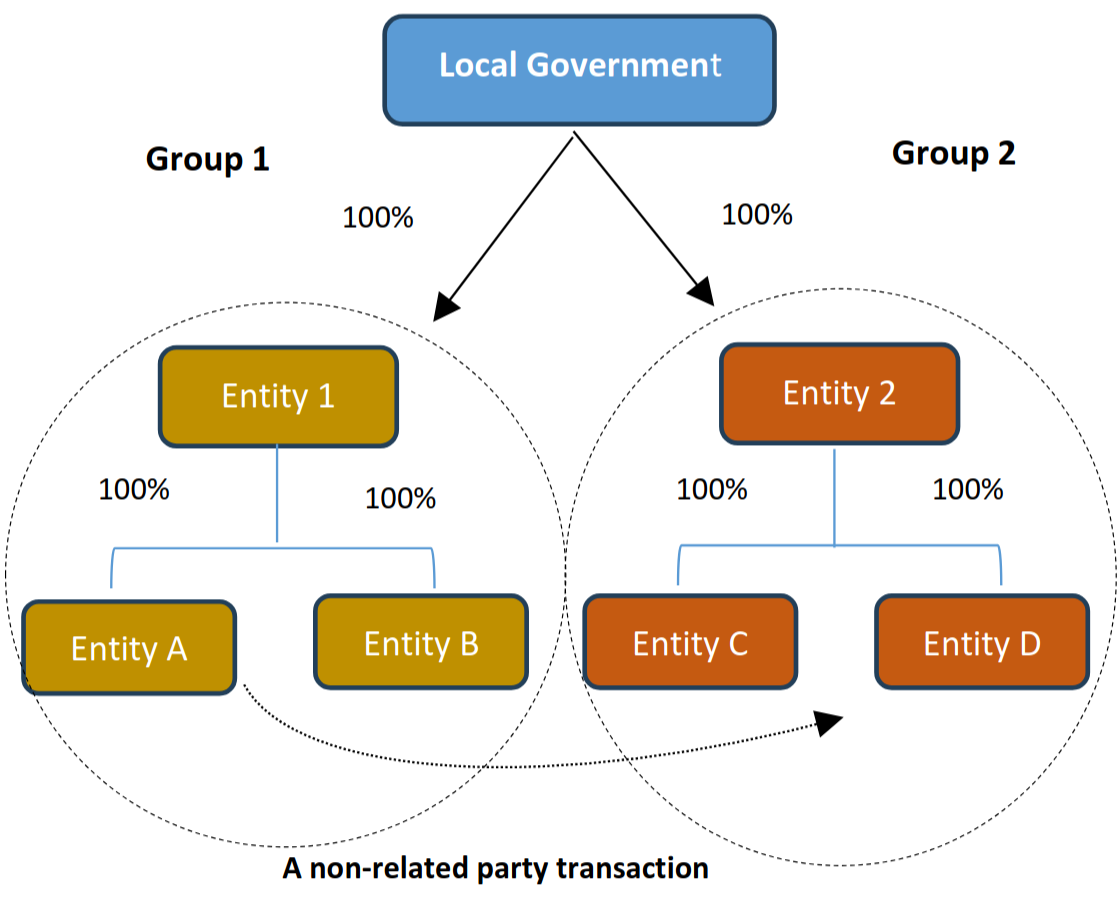

Illustrative example:

The entities in Group 1 are not considered Related Parties to entities in Group 2. Consequently, the arm's length requirement under Article 34 of the Corporate Tax Law does not apply to transactions between Group 1 and Group 2, nor are such transactions subject to transfer pricing documentation requirements.

However, the entities within each Group structure will be considered Related Parties. For example, Entity 1, Entity A and Entity B will all be considered as Related Parties to each other.

Entity 2, Entity C and Entity D will also be considered as Related Parties to each other but not to Entity 1, Entity A or Entity B.

For example, a sale by Entity A in Group 1 to Entity D in Group 2 is not considered a Related Party transaction. However, a sale by Entity A to Entity B would be a transaction between Related Parties.

This Public Clarification issued by the FTA is meant to clarify certain aspects related to the implementation of the Federal Decree Law No. 47 of 2022 on the Taxation of Corporations and Businesses, and its amendments.

This Public Clarification states the position of the FTA and neither amends nor seeks to amend any provision of the aforementioned legislation. Therefore, it is effective as of the date of implementation of the relevant legislation, unless stated otherwise.

Legislative References:

In this clarification, Federal Decree-Law No. 47 of 2022 on Taxation of Corporations and Businesses, and its amendments is referred to as "Corporate Tax Law"