Tax Agent User Manual - Natural Person Tax Agent Update - 03 September 2024

Tax Agent User Manual

Natural Person Tax Agent Update Qualification

Date: 03 September, 2024

Version 1.1.0.0

Contents

1. Introduction

3. Natural Person Tax Agent Dashboard

5. Update Qualification of Natural Person Tax Agent

6. Instructions and Guidelines

7. Progress Bar

9. Review and Declaration Section

10. Post Application Submission

11. Correspondences

Introduction

This manual is prepared to help the applicant to navigate through the Federal Tax Authority EmaraTax portal to submit their Natural Person Tax Agent Update Qualification application. Note that this application will be reviewed by the FTA and will be approved only once all the preconditions are met.

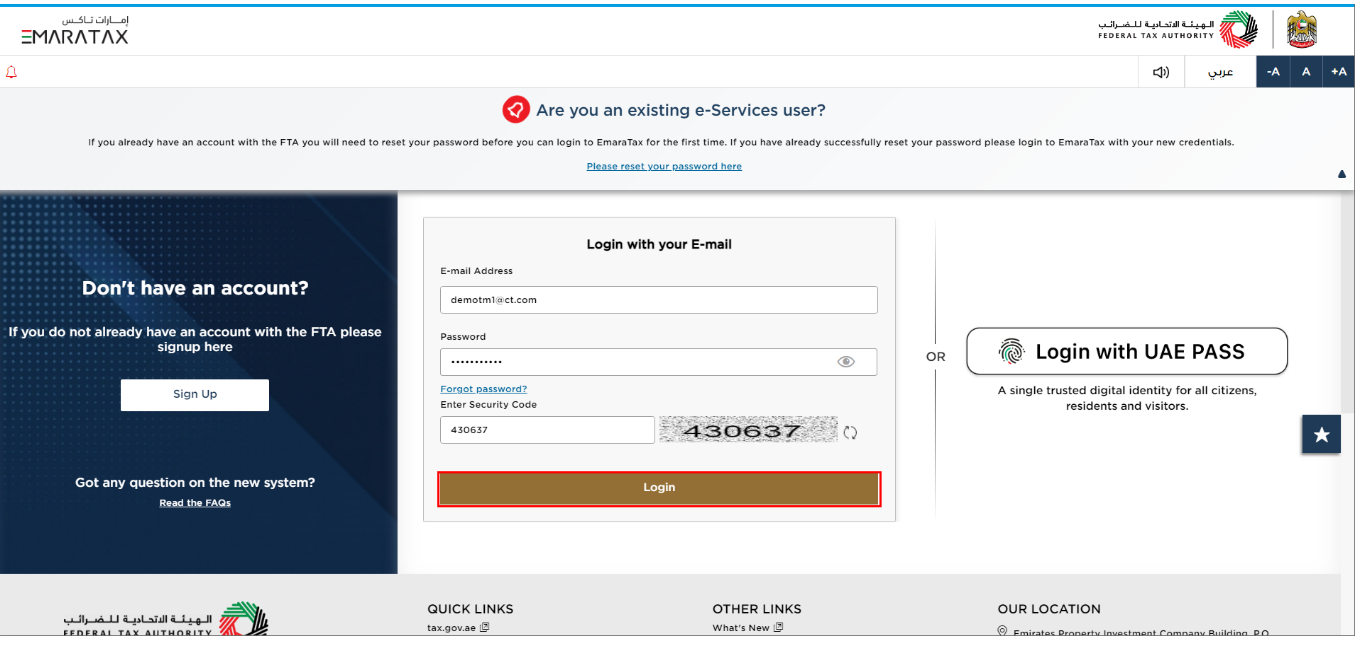

Login to EmaraTax

| You can login into the EmaraTax account using your login credentials or using UAE PASS. If you have forgotten your password, you can use the 'Forgot password?' feature to reset your password. |

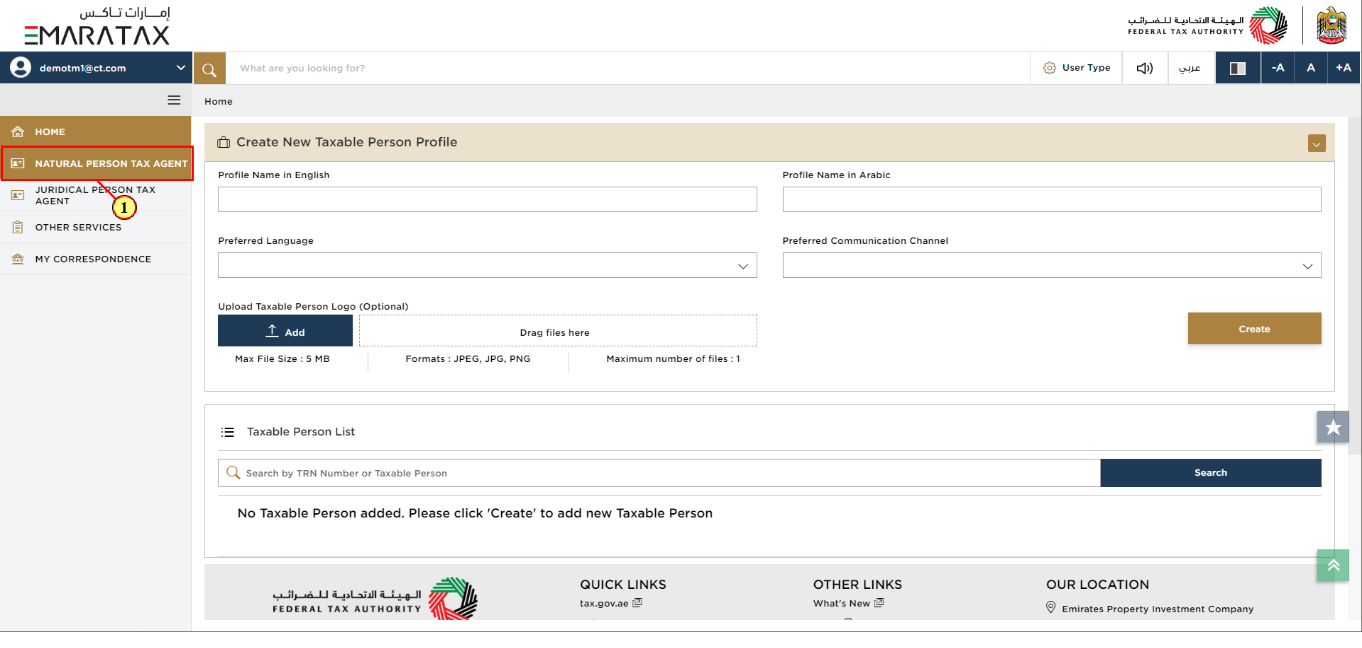

Natural Person Tax Agent Dashboard

Step | Action |

(1) | Click on the 'NATURAL PERSON TAX AGENT' |

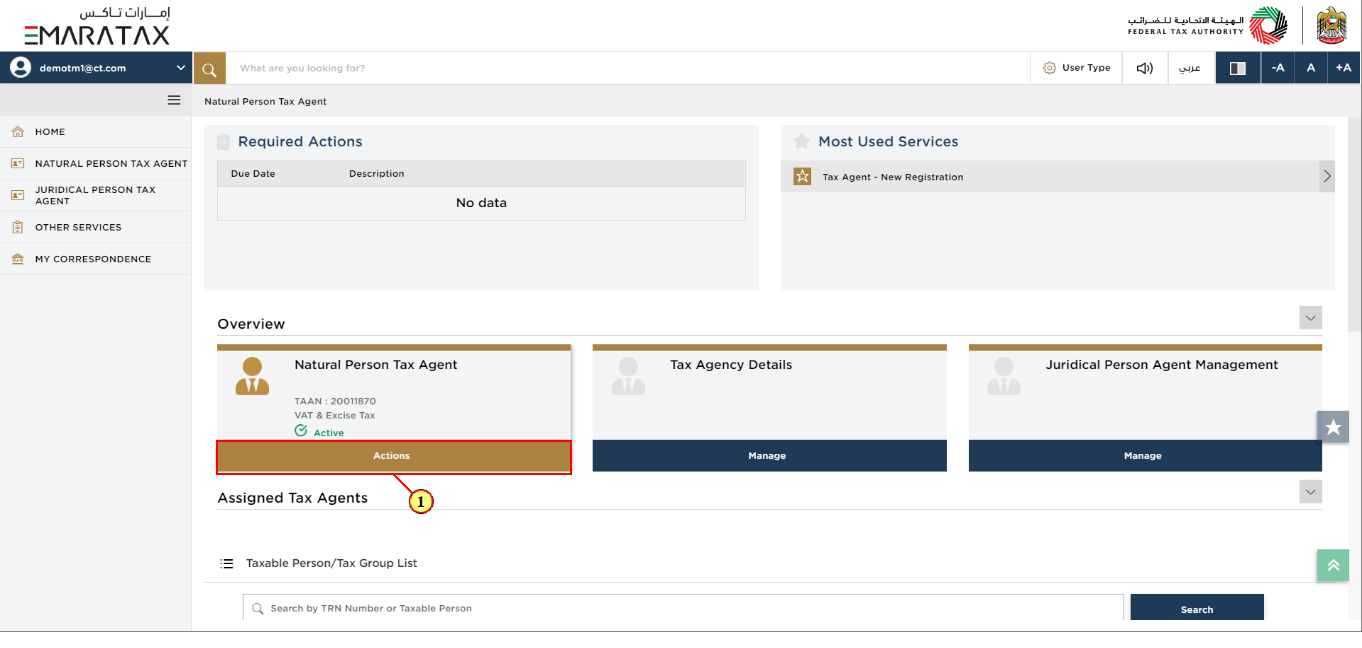

Natural Person Tax Agent

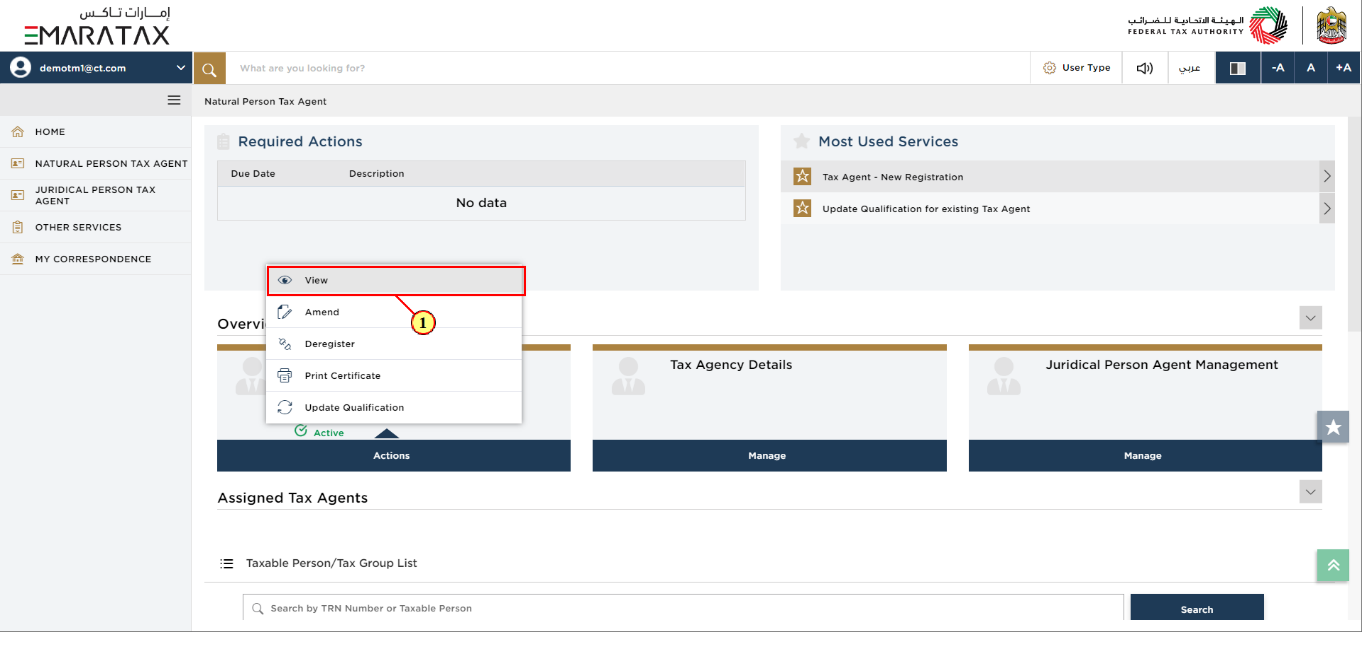

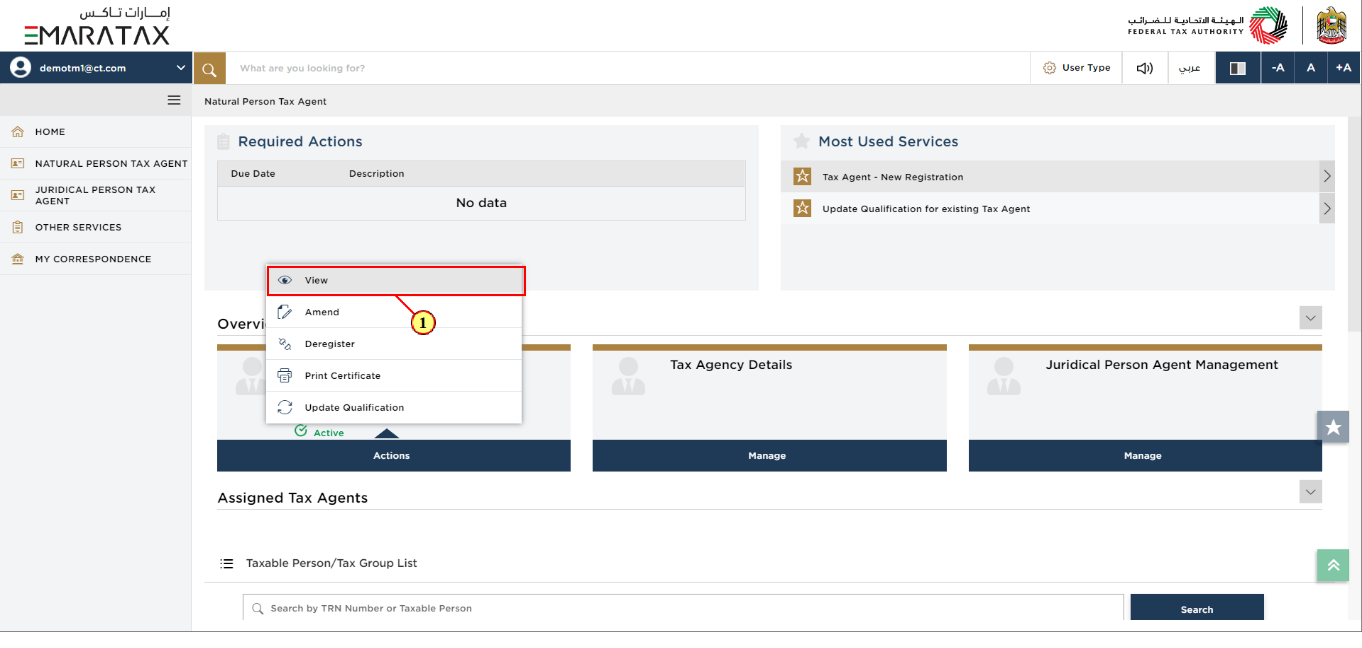

Step | Action |

(1) | Click 'Actions' on the Natural Person Tax Agent tile. |

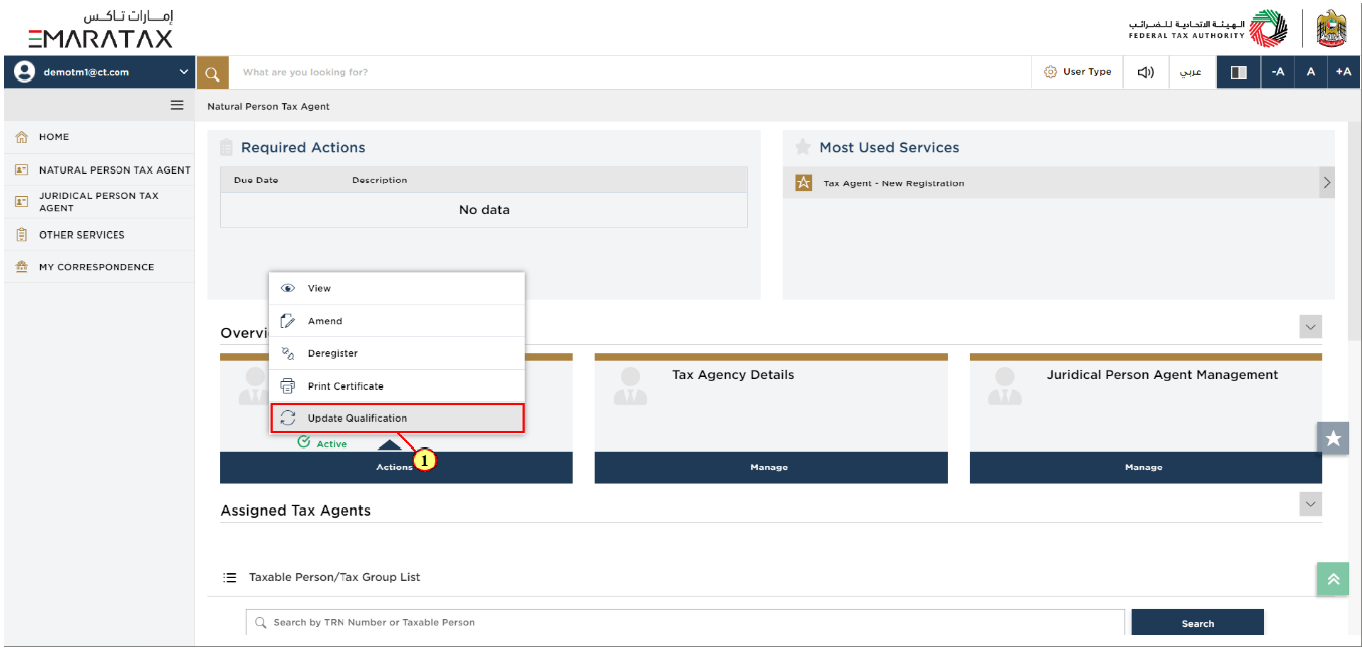

Update Qualification of Natural Person Tax Agent

Step | Action |

(1) | Click 'Update Qualification' to initiate the Natural Person Tax Agent Update Qualification application. |

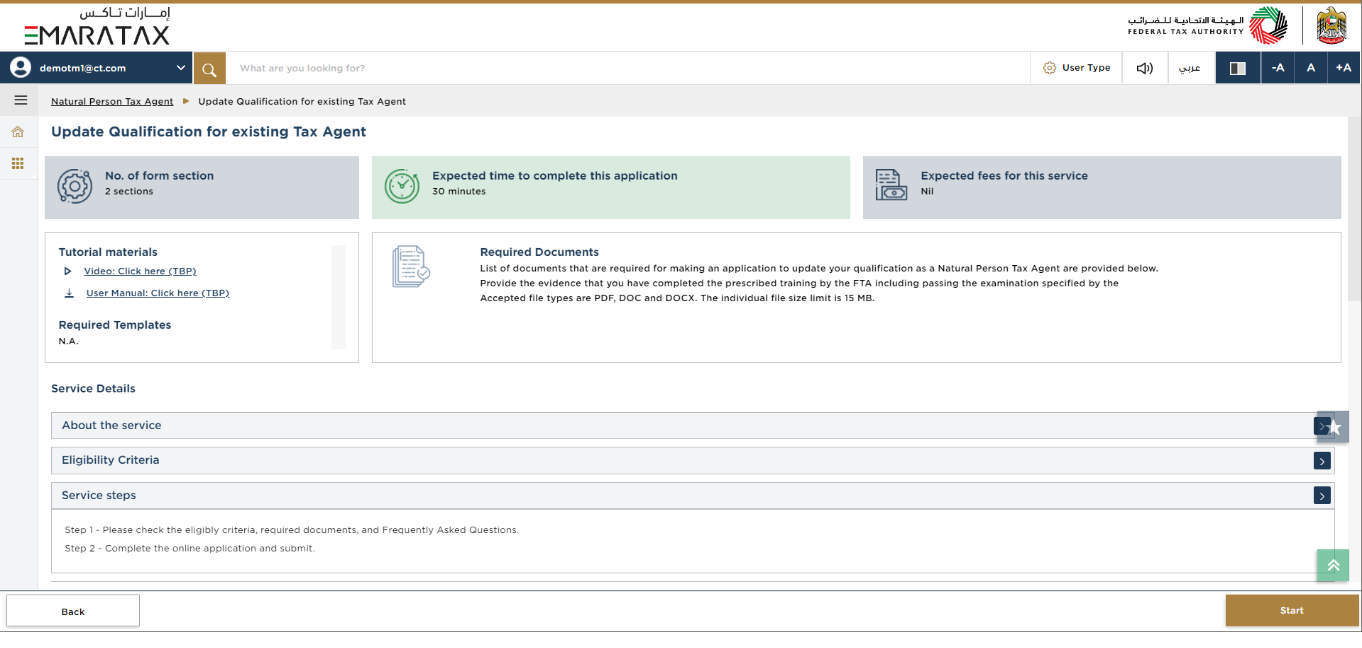

Instructions and Guidelines

| The 'instructions and guidelines' page is designed to help you understand certain important requirements relating to Update Qualification for existing Tax Agent in the UAE. It also provides guidance on what information you should have in hand when you are completing the Update Qualification for existing Tax Agent application. |

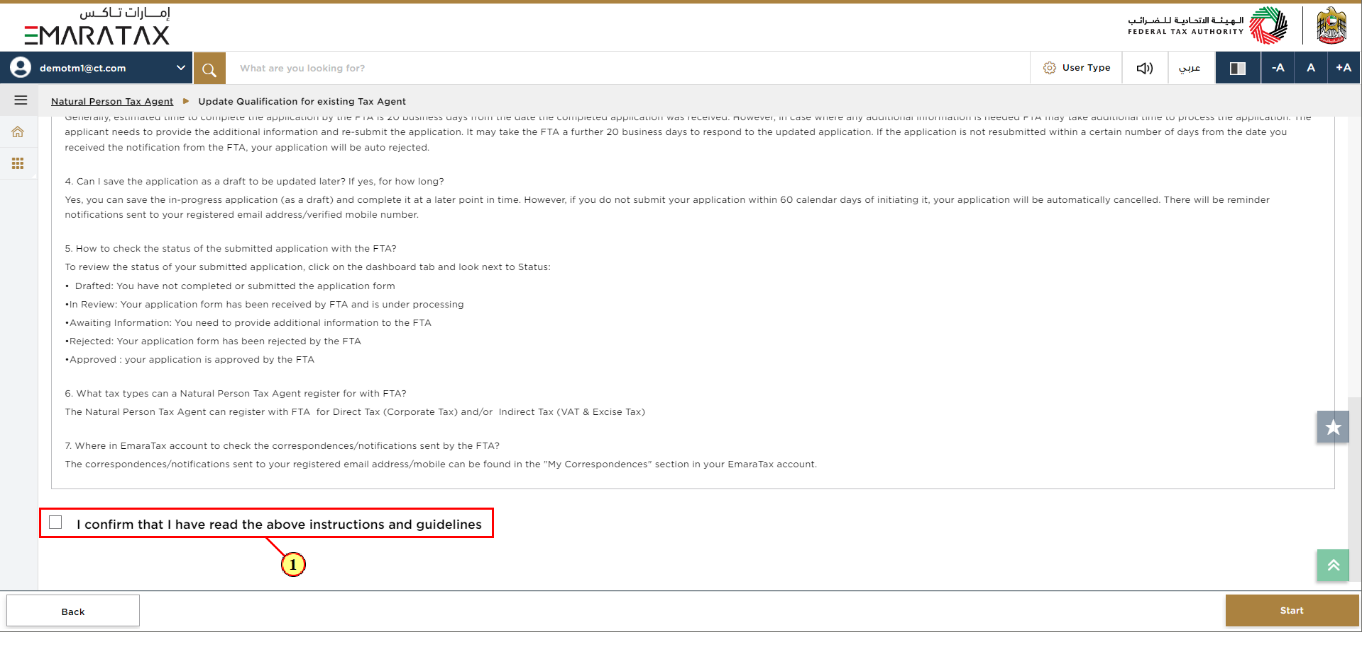

Step | Action |

(1) | Read the instructions and guidelines for Update Qualification for existing Tax Agent and mark the checkbox to confirm. |

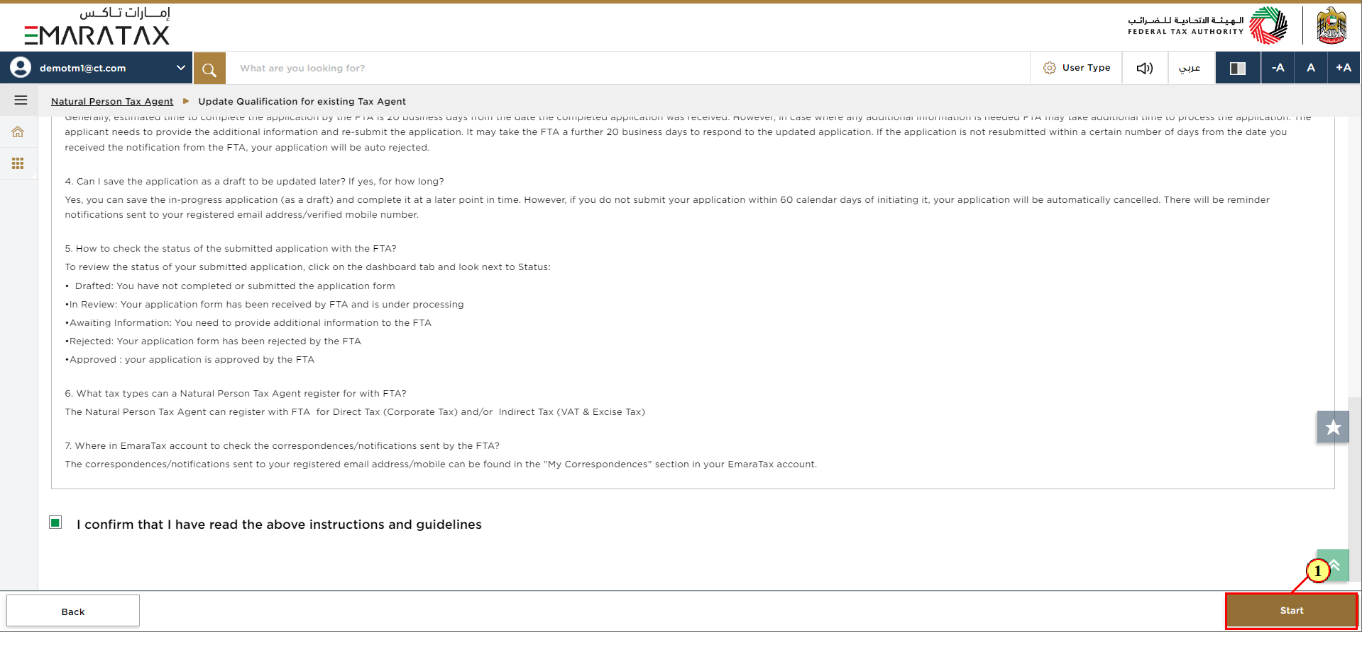

Step | Action |

(1) | Click 'Start' to initiate the Update Qualification for existing Tax Agent application. |

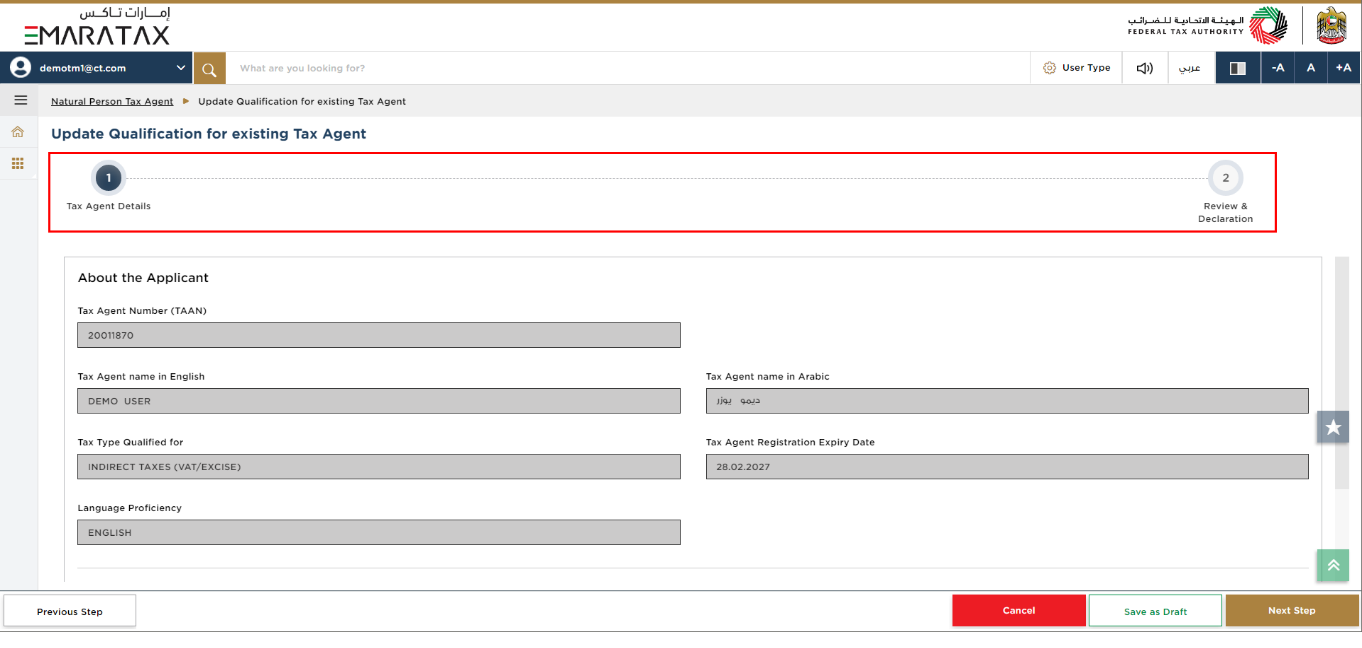

Progress Bar

|

|

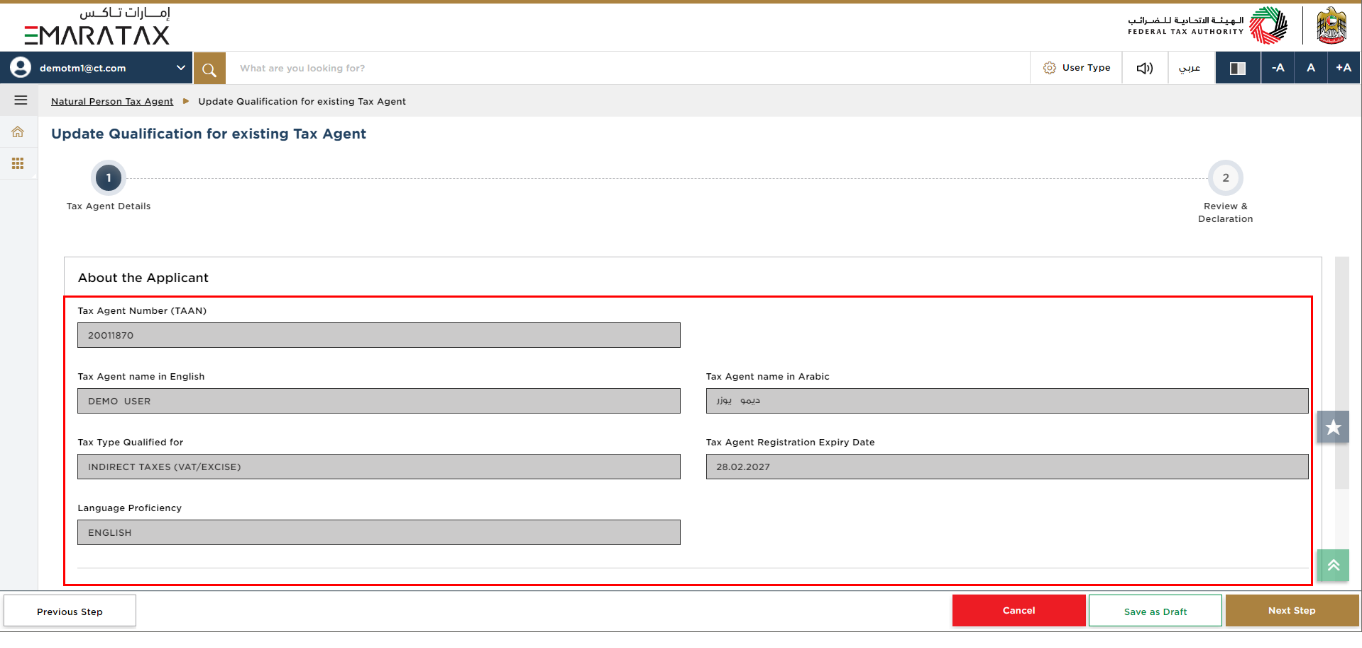

Tax Agent Details Section

| You cannot make amends to the greyed-out fields in this section. |

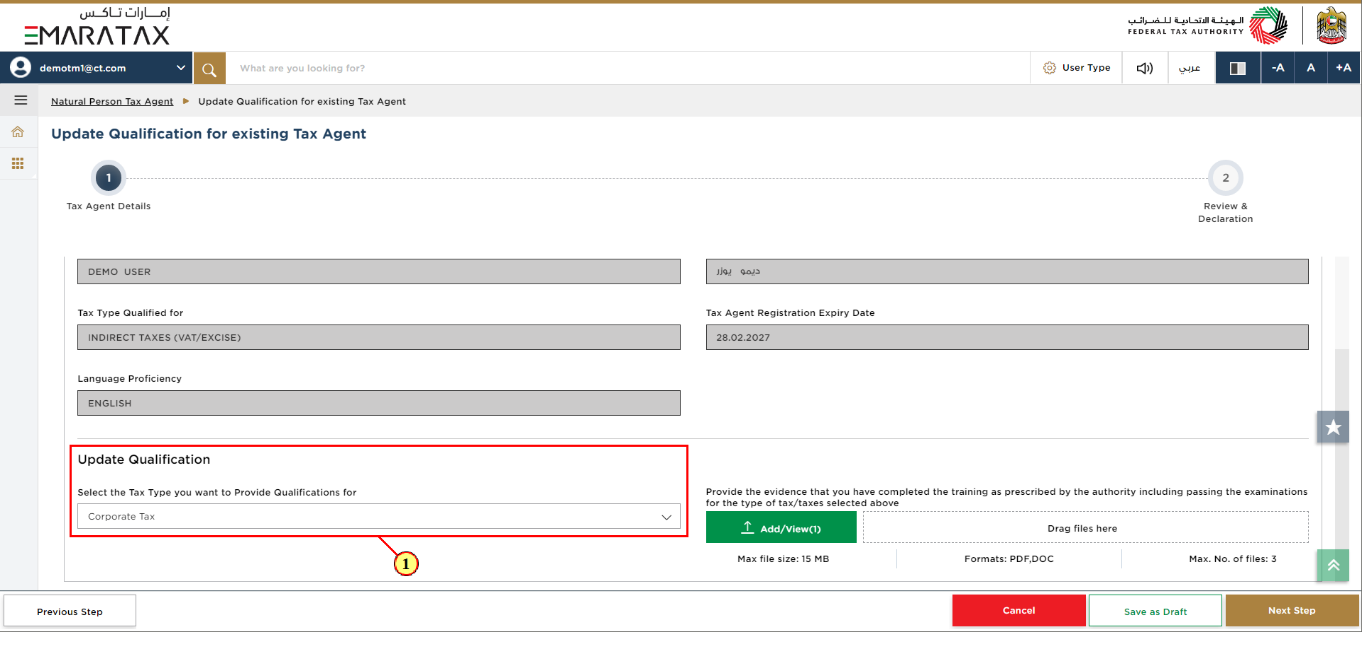

Step | Action |

(1) | Select the Tax Type from the dropdown list. |

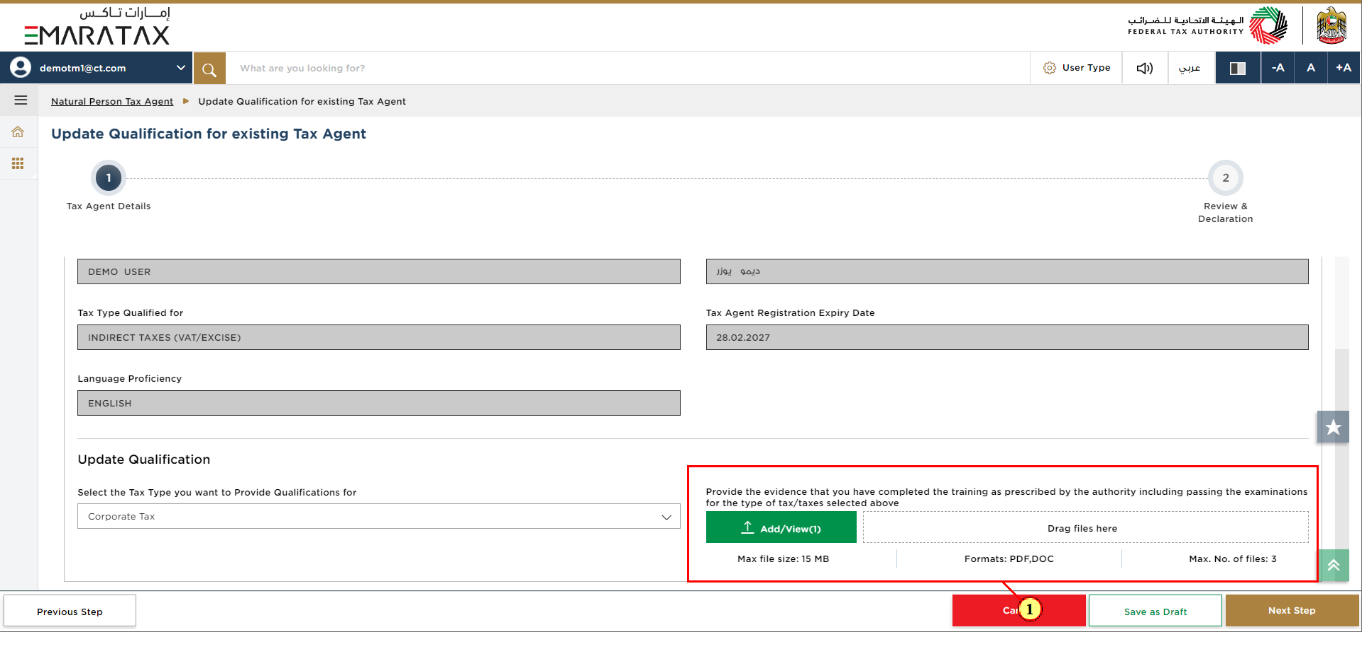

Step | Action |

(1) | Upload supporting documents. |

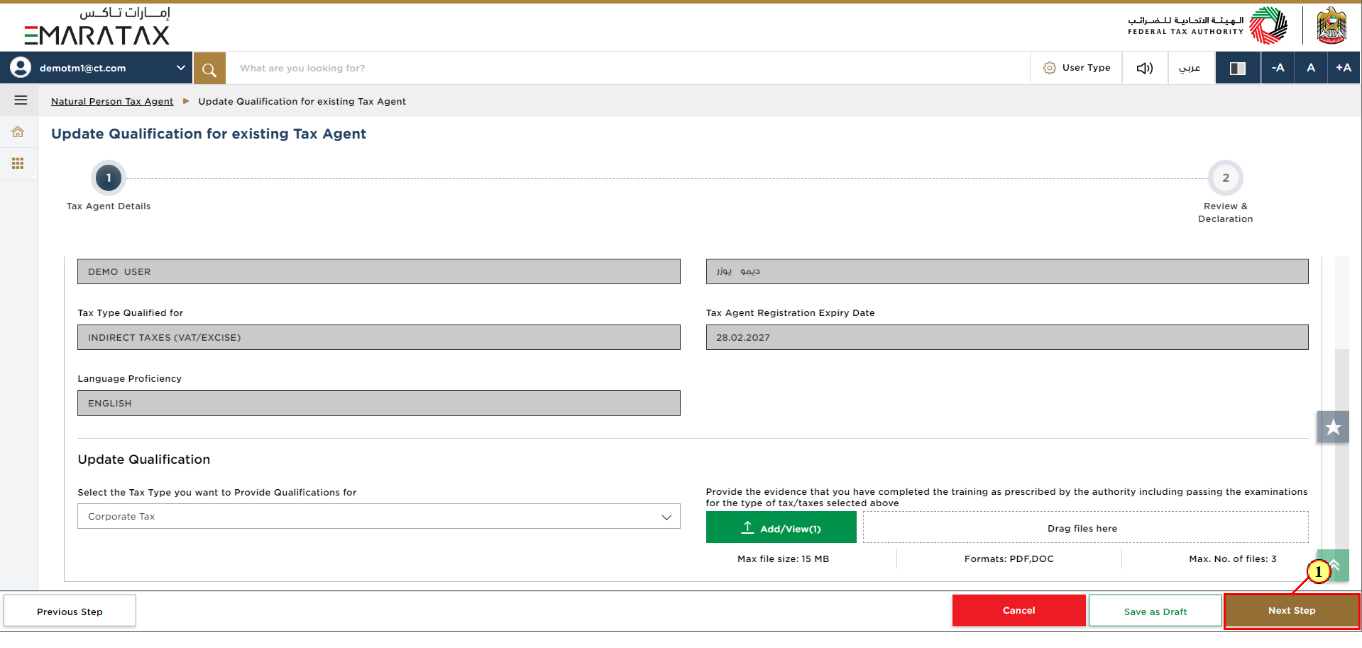

Step | Action |

(1) | After completing all mandatory fields, click the 'Next Step' button to save and proceed to the next section. |

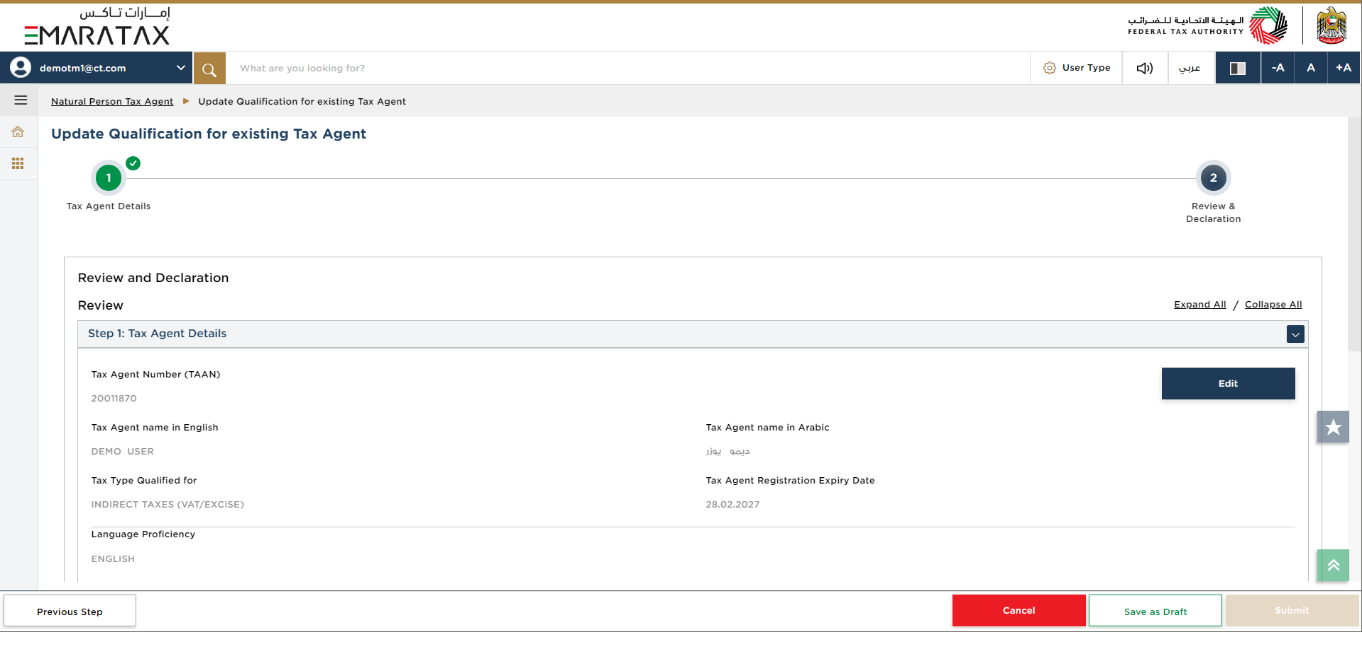

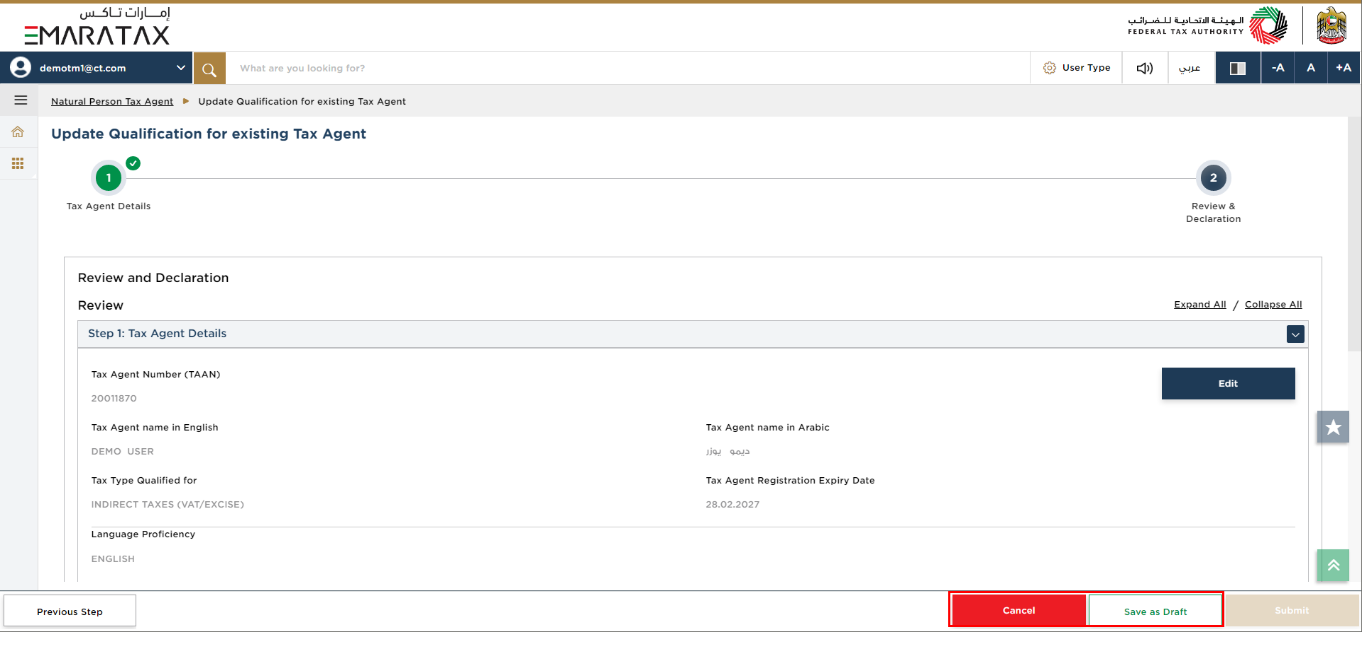

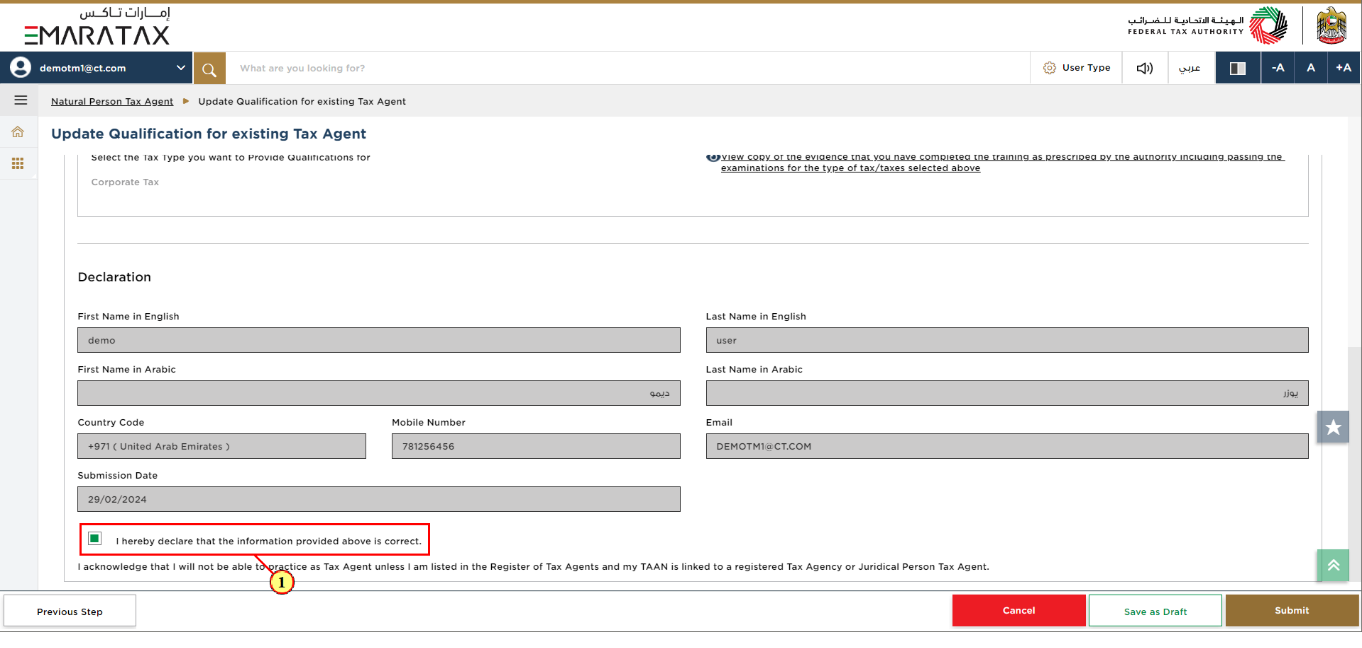

Review and Declaration Section

| This section highlights all the details entered by you across the application. You are required to review and submit the application. |

|

|

Step | Action |

(1) | After carefully reviewing all of the information entered on the application, mark the checkbox to declare the correctness of the information provided in the application. |

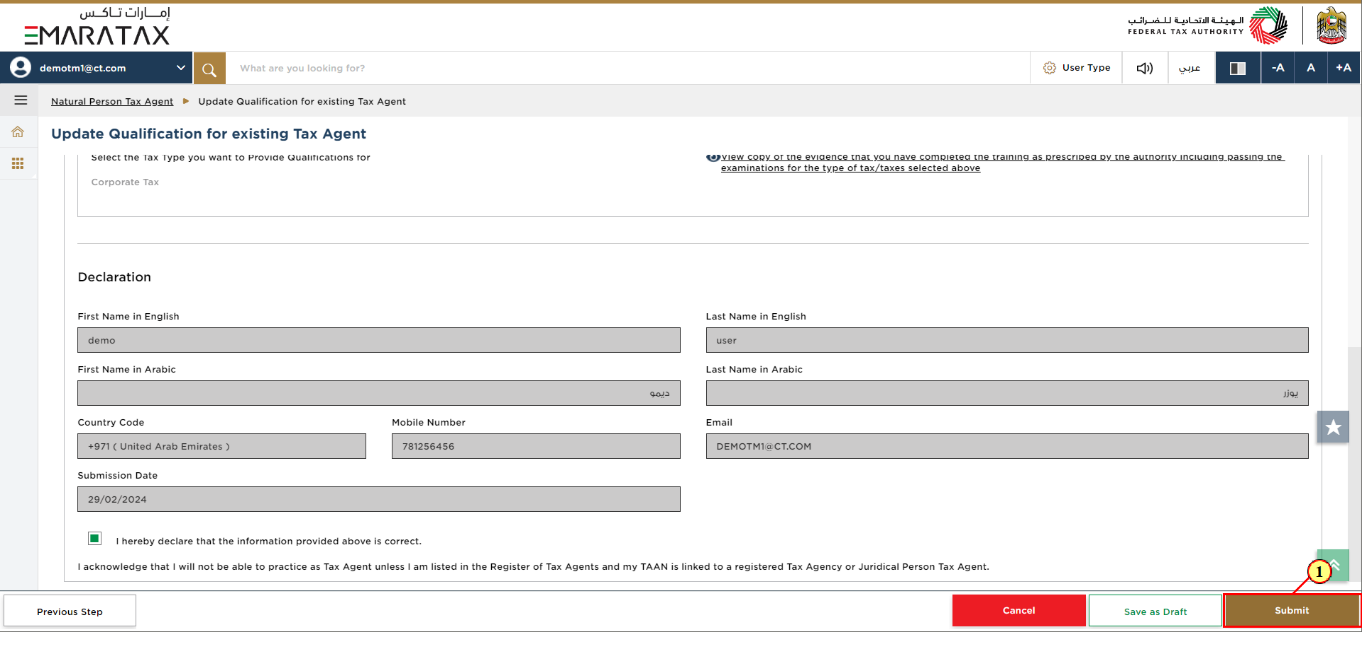

Step | Action |

(1) | Click 'Submit' to submit the Update Qualification for existing Tax Agent application. |

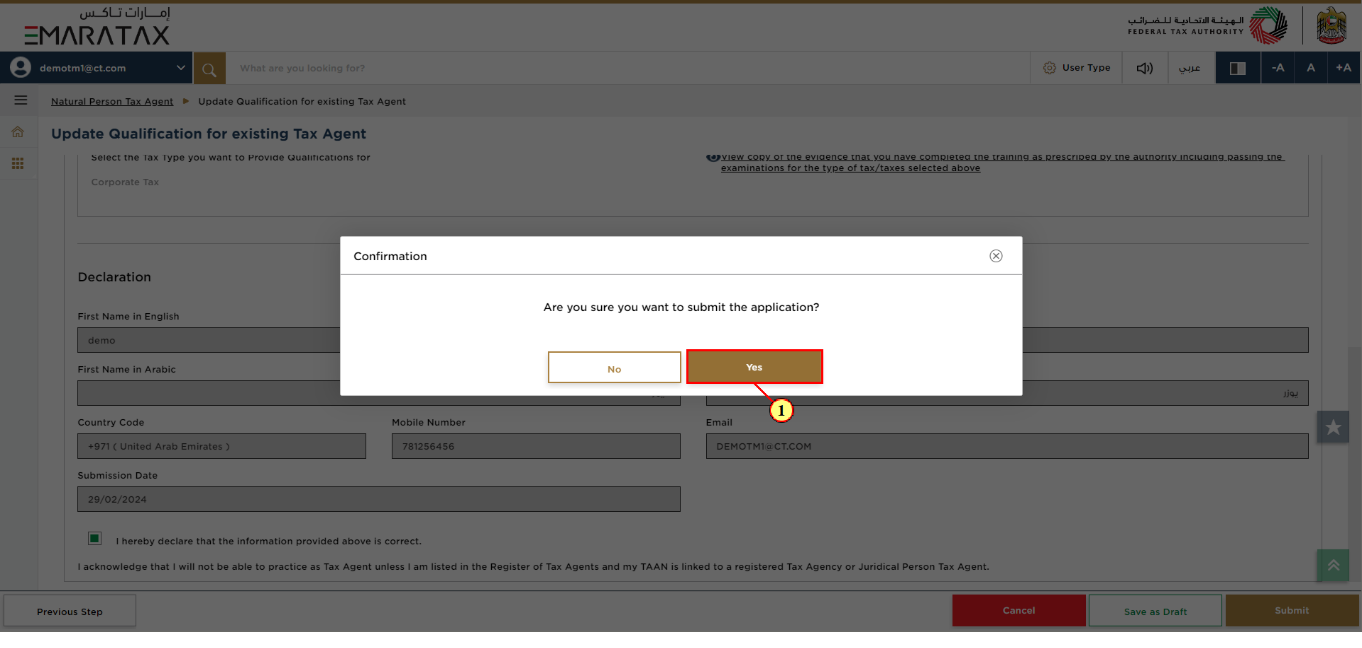

Step | Action |

(1) | Click 'Yes' to confirm. |

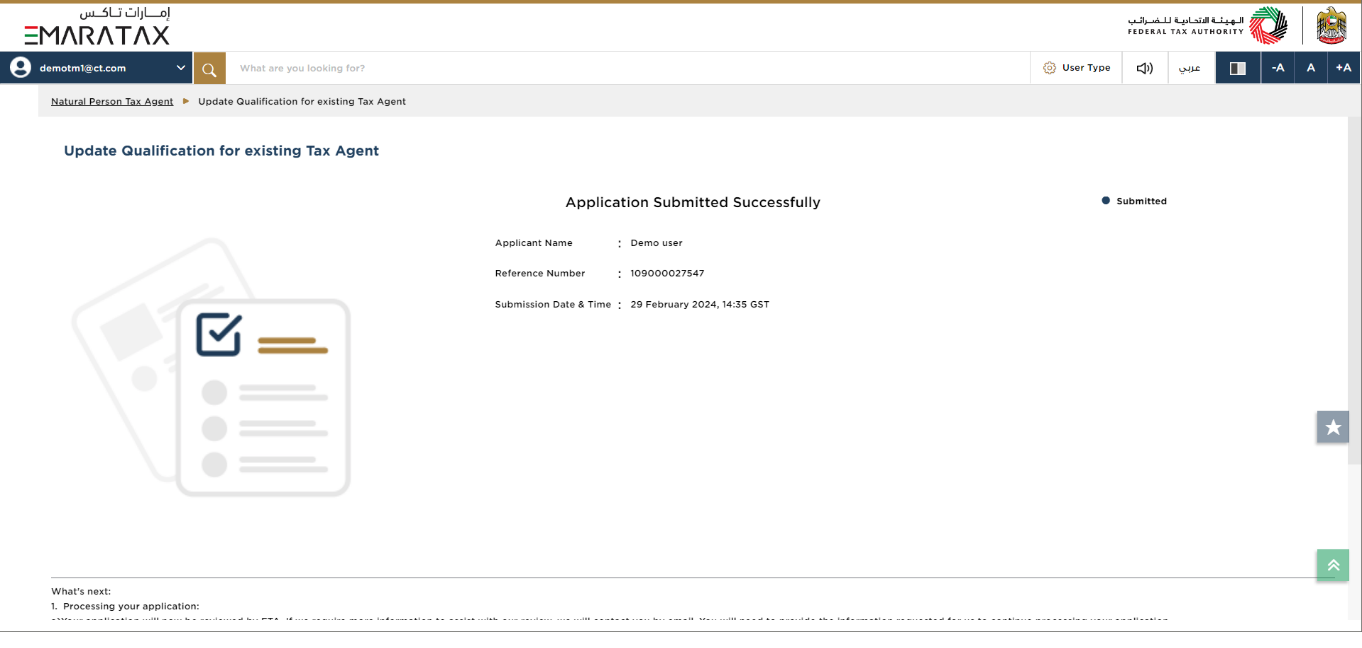

Post Application Submission

| After your application is submitted successfully, a Reference Number is generated for your submitted application. Note this reference number for future communication with the FTA. What's next?

|

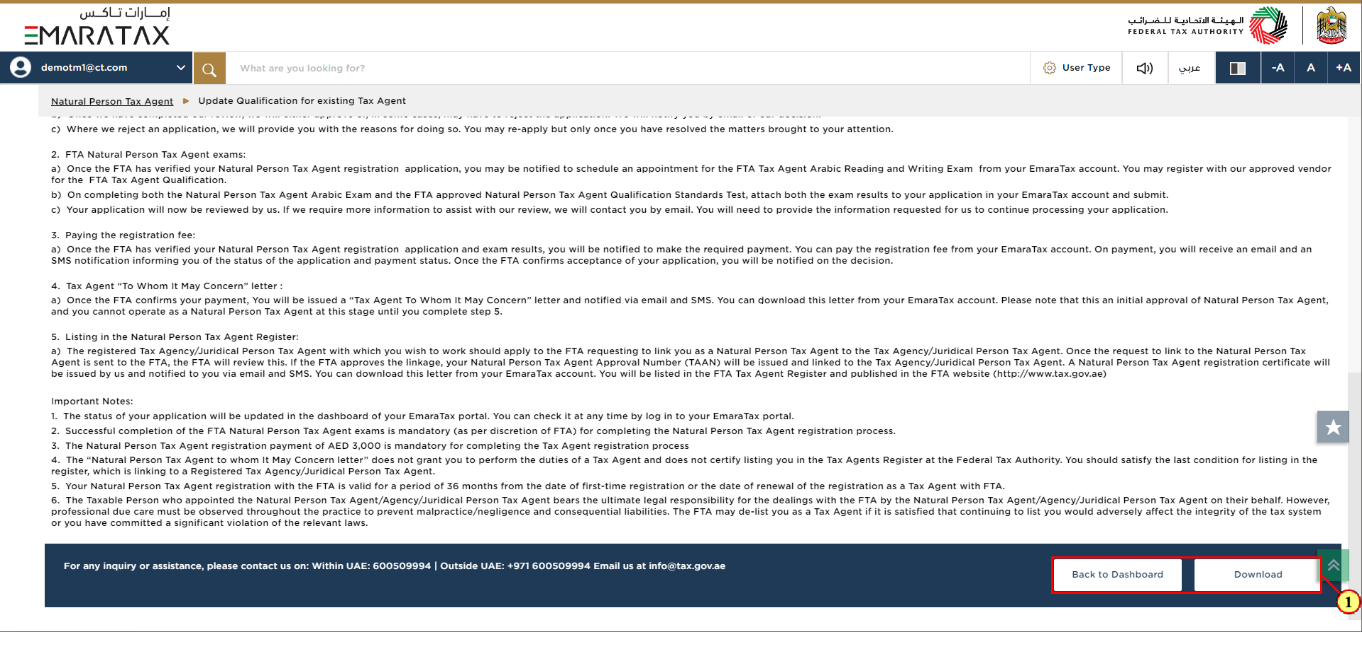

Step | Action |

(1) |

|

Correspondences

Natural Person Tax Agent receives the following correspondences:

Application submission acknowledgment.

Additional information notification (only if the FTA requires more information to assist with their review of your application).

Application approval or rejection notification.

Reminder to complete the draft application (only if the applicant fails to take action on a drafted application within the regular time period).

Draft Application auto cancellation notification (only if the applicant fails to take action on a drafted application within a Particular time period).

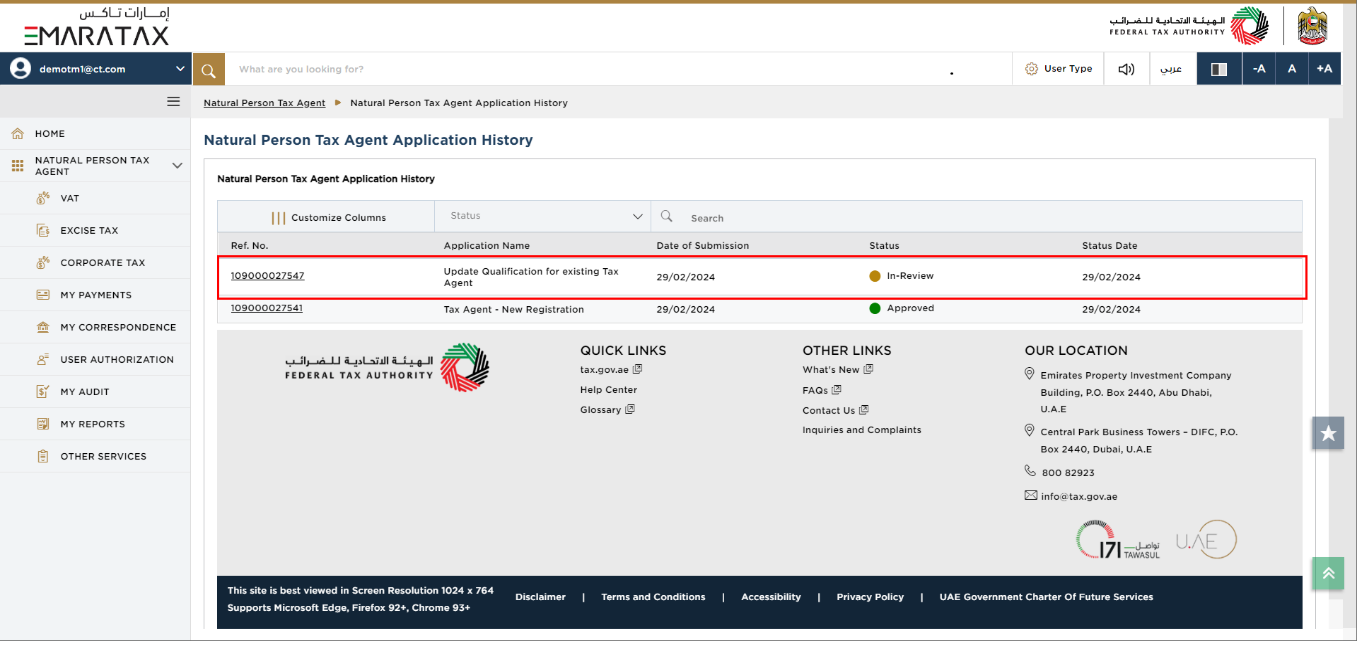

Application History - In-Review

Once the Natural Person Tax Agent submits the application for Update Qualification for existing Tax Agent, the application will be sent to the FTA for review and the status of the application will be 'In Review'.

Step | Action |

(1) |

|

| You can check the status of the application based on the application number once the application has been submitted. |

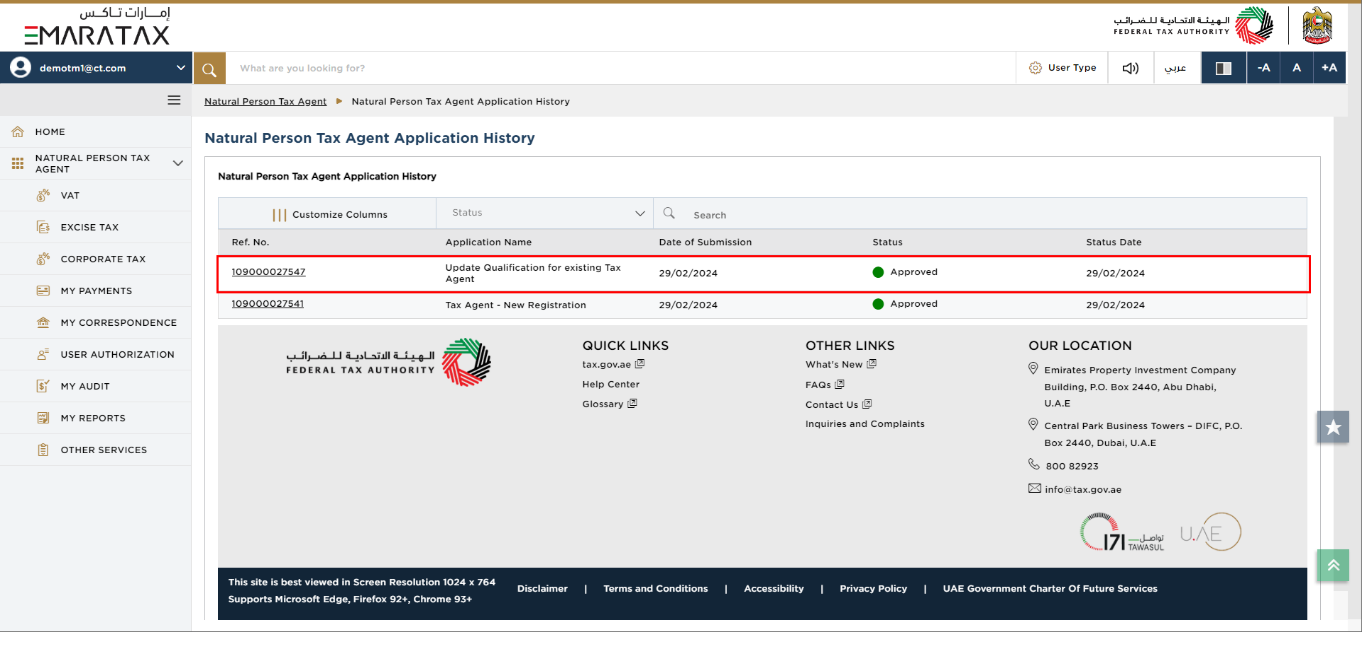

Application History - Approved

Once the FTA approves the application for Update Qualification for existing Tax Agent, the status of the application will be 'Approved'.

Step | Action |

(1) |

|

| You can check the status of the application based on the application number once the application has been approved. |