Register Natural Person Tax Agent without Exam Schedule - 25 June 2024

Tax Agent User Manual

Register Natural Person Tax Agent without Exam Schedule

Date: 25 June, 2024

Version 1.2.0.0

Contents

1. Navigating through EmaraTax

2. Introduction

5. Register Natural Person Tax Agent

6. Instructions and Guidelines

7. Basis of Registration Section

10. Review and Declaration Section

11. Post Application Submission

12. Correspondences

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process

Button | Description |

In the Portal | |

| This is used to toggle between various personas within the user profile such as Taxable Person, Tax Agent, Tax Agency, Legal Representative etc |

| This is used to enable the Text to Speech feature of the portal |

| This is used to toggle between the English and Arabic versions of the portal |

| This is used to decrease, reset, and increase the screen resolution of the user interface of the portal |

| This is used to manage the user profile details such as the Name, Registered Email Address, Registered Mobile Number, and Password |

| This is used to log off from the portal |

In the Business Process application | |

| This is used to go the Previous section of the Input Form |

| This is used to go the Next section of the Input Form |

| This is used to save the application as draft, so that it can be completed later |

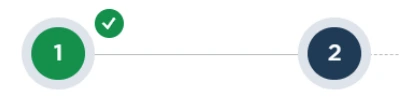

| This menu on the top gives an overview of the various sections within the form. All the sections need to be completed in order to submit the application for review. The current section is highlighted in Blue and the completed sections are highlighted in green with a check |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for taxpayers to benefit from these services in the best and simplest ways. To get more information on these services Click Here

Introduction

This training manual is prepared to help the applicant to navigate through the Federal Tax Authority EmaraTax portal to submit their Natural Person Tax Agent Registration application. You are required to be a UAE resident to perform the Natural Person Tax Agent Registration. Note that this application will be reviewed by the FTA and will be approved only once all the preconditions are met, requisite exams are cleared and Tax Registration payment is completed. This training manual explains the steps to be followed by the Natural Person Tax Agent who has already passed Arabic Exam and Qualification Standards Tests. Once the FTA approves your application, you will be informed to make the payment for your Natural Person Tax Agent Registration.

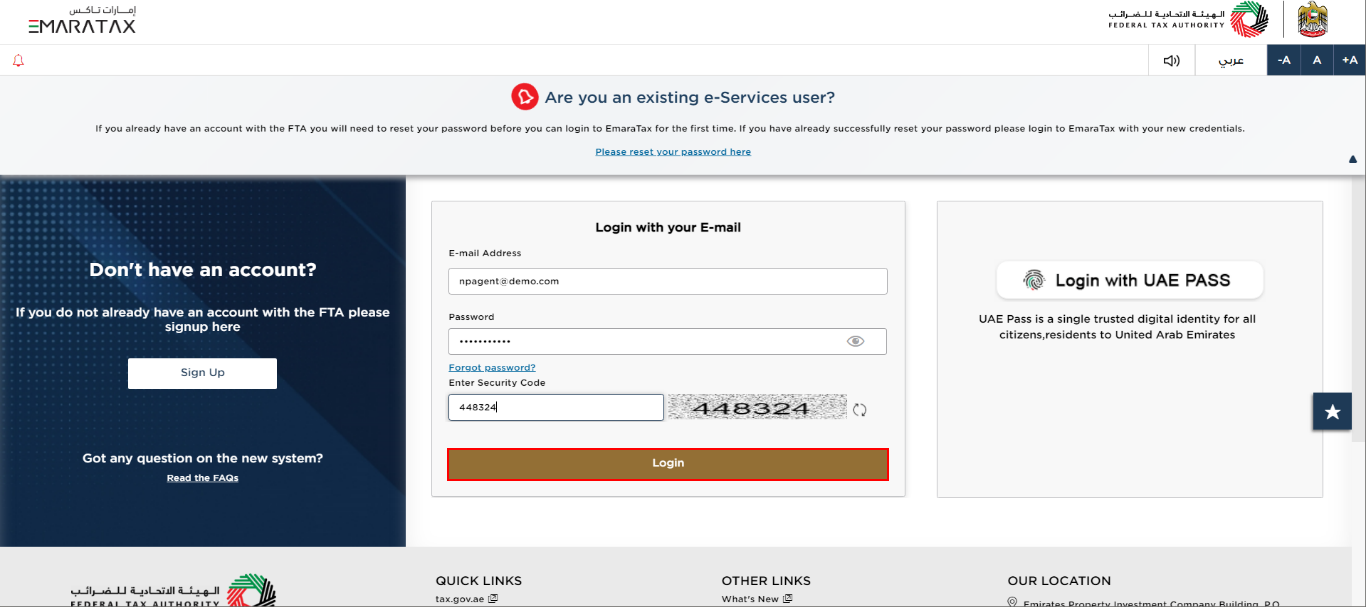

Login to EmaraTax

| You can login into the EmaraTax account using your login credentials or using UAE Pass. If you do not have an EmaraTax account, you can sign-up for an account by clicking the 'Sign Up' button. If you have forgotten your password, you can use the 'Forgot password?' feature to reset your password. |

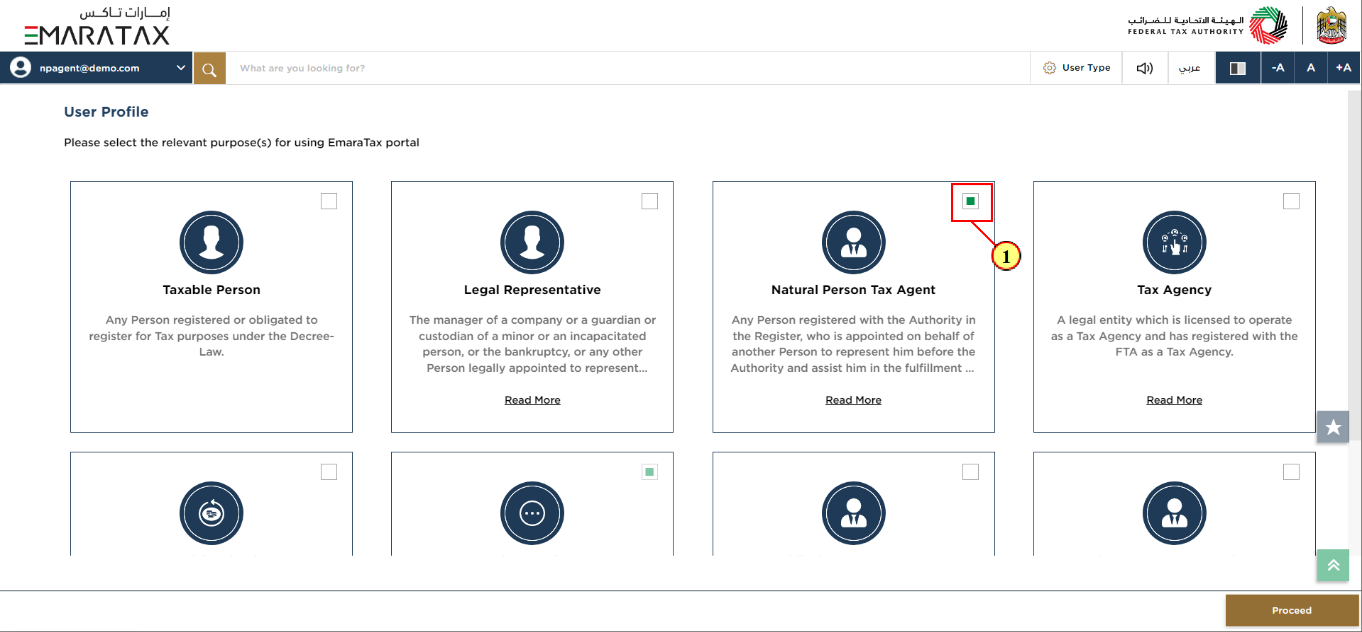

Select User Profile

Step | Action |

(1) | Select the checkbox for 'Natural Person Tax Agent' to choose the User Profile. |

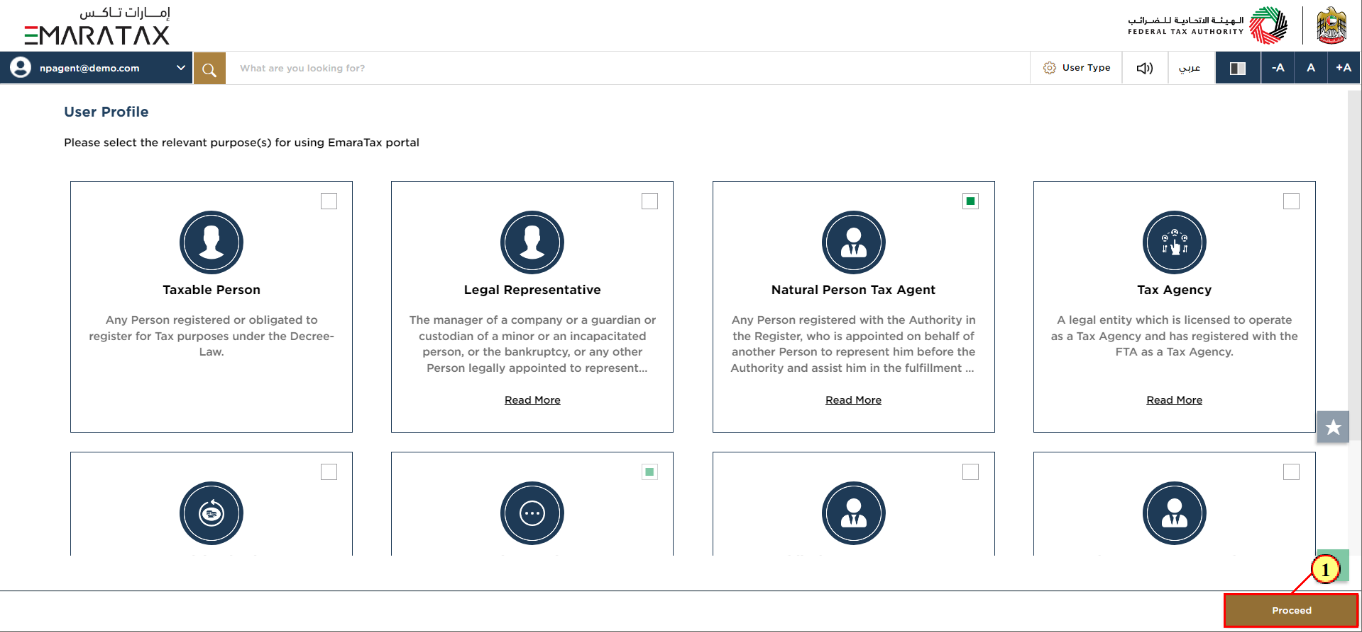

Step | Action |

(1) | Click 'Proceed' to continue to the home page. |

| The Taxable Person who appointed the Natural Person Tax Agent bears the ultimate legal responsibility for the dealings with the FTA by the Natural Person Tax Agent on their behalf. However, professional due care must be observed throughout the practice to prevent malpractice/negligence and consequential liabilities. The FTA may de-list you as a Tax Agent if it is satisfied that continuing to list you would adversely affect the integrity of the Tax System or you have committed a significant violation of the relevant laws. |

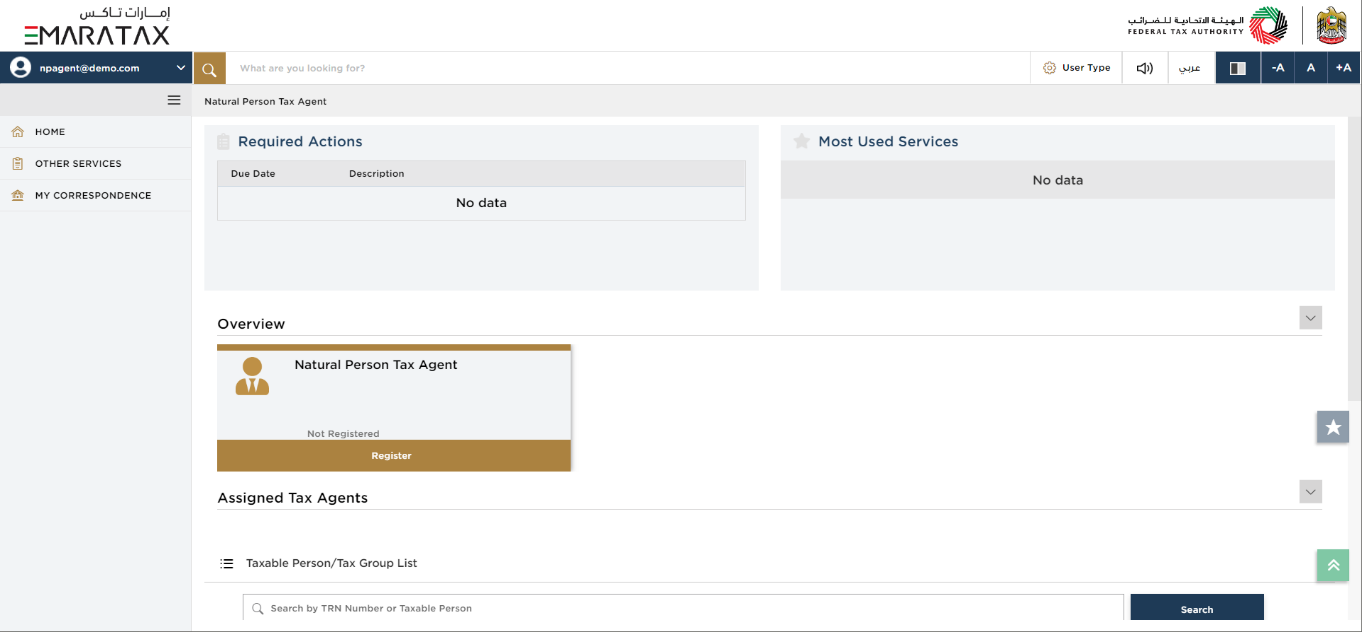

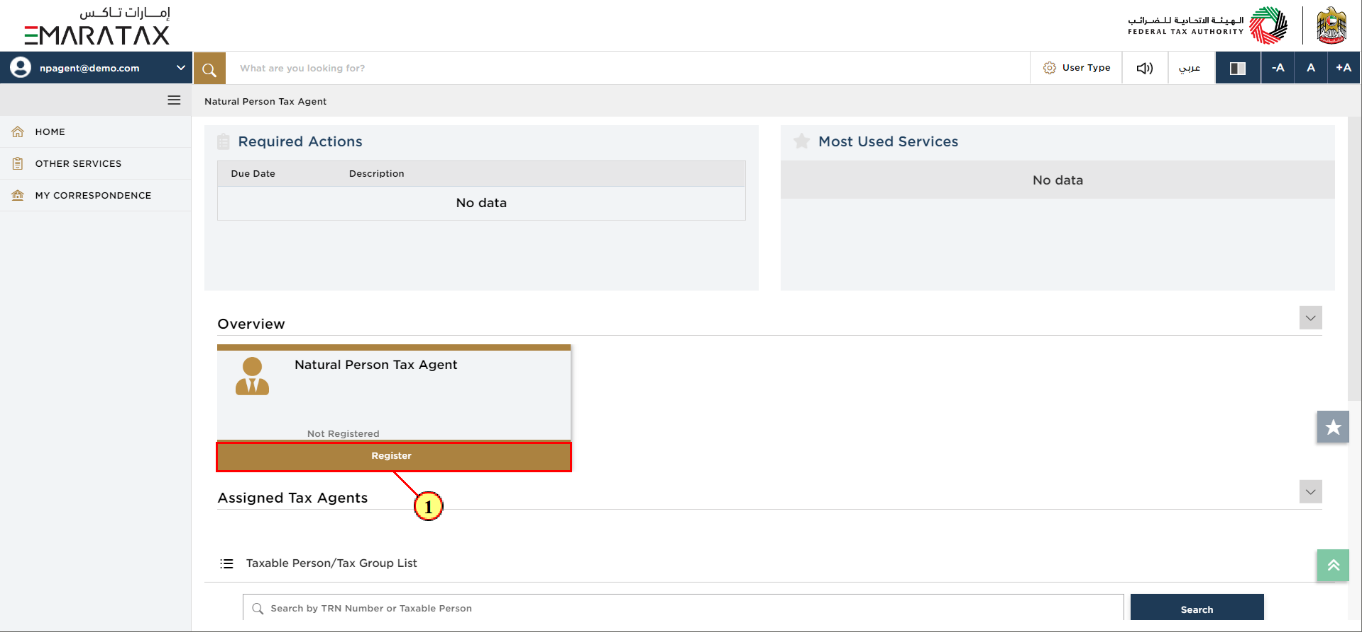

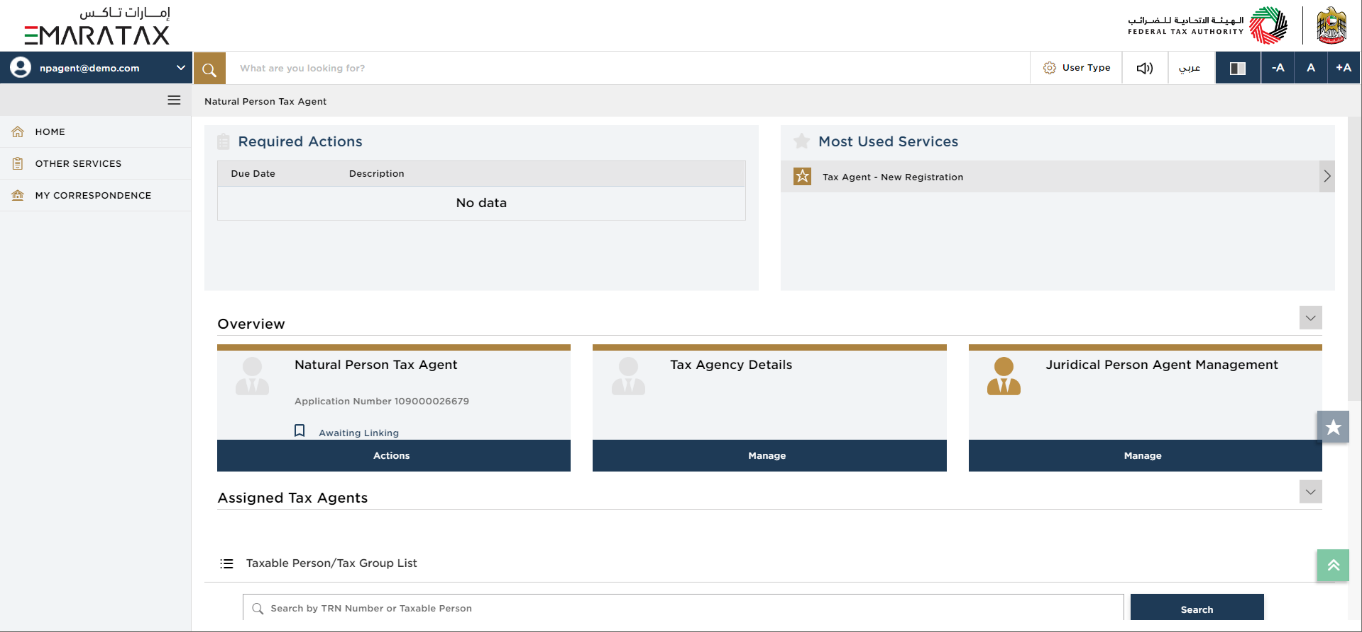

Register Natural Person Tax Agent

Step | Action |

(1) | Click 'Register' on the Natural Person Tax Agent tile to initiate the Natural Person Tax Agent Registration application. |

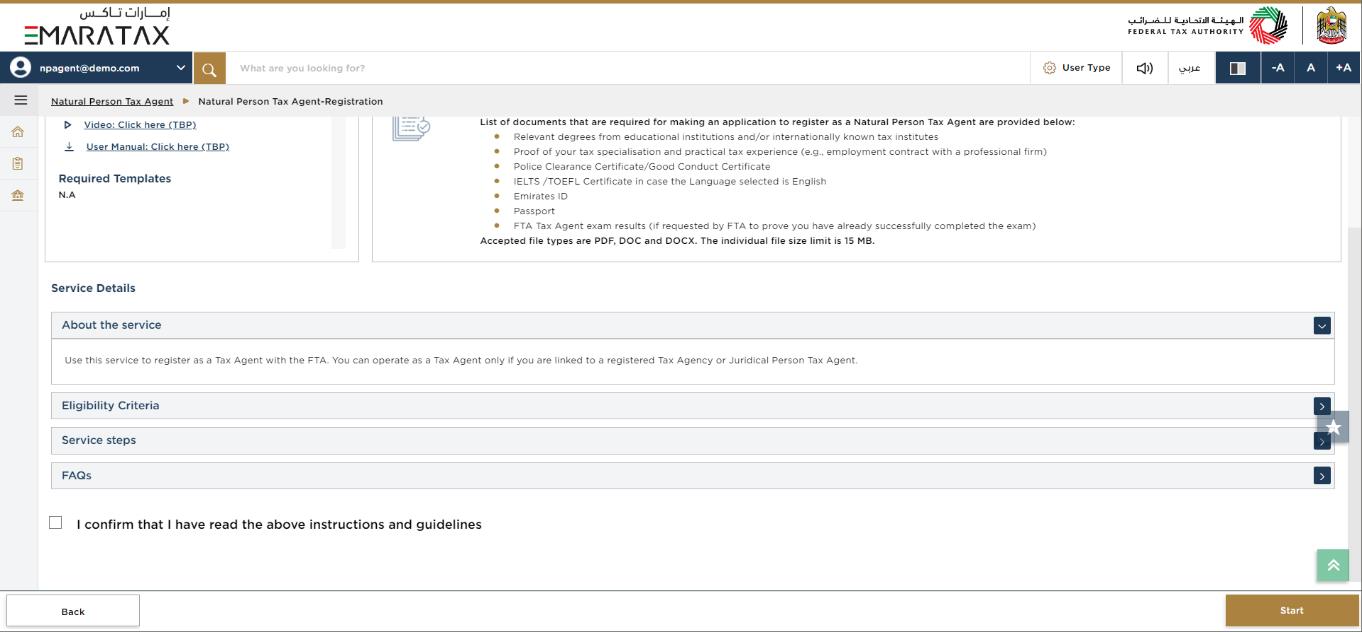

Instructions and Guidelines

| The 'instructions and guidelines' page is designed to help you understand certain important requirements relating to Natural Person Tax Agent Registration in the UAE. It also provides guidance on what information you should have in hand when you are completing the registration application. |

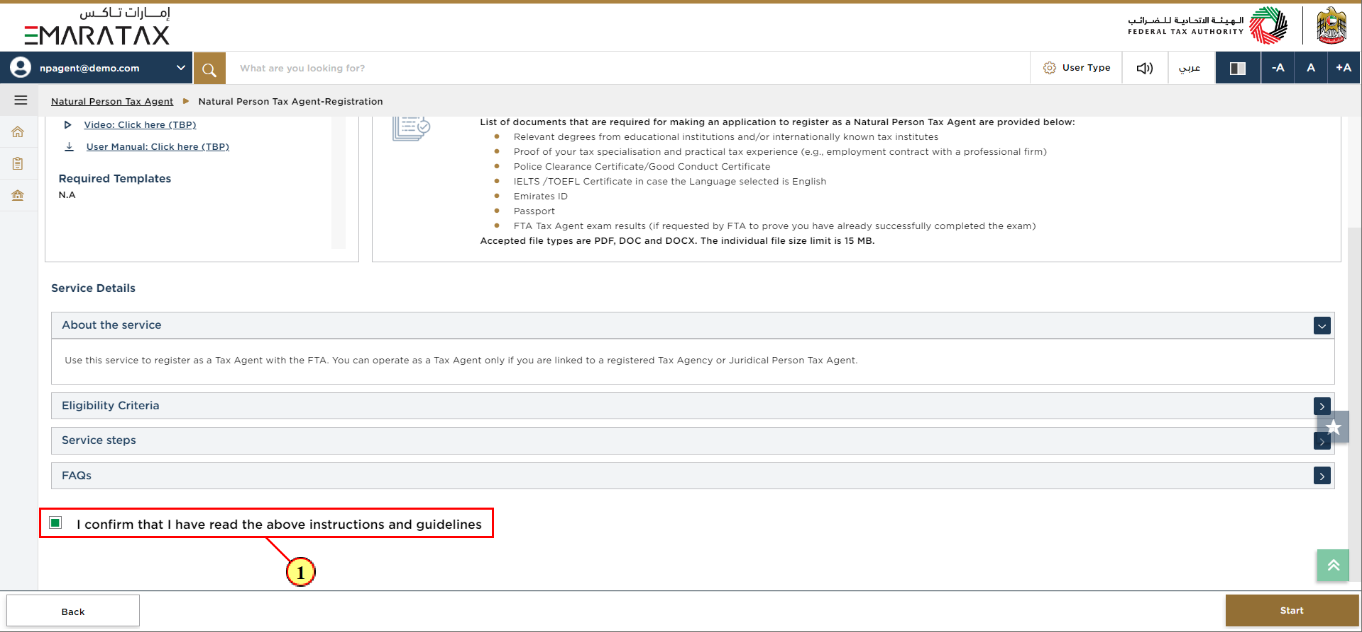

Step | Action |

(1) | Read the instructions and guidelines for Natural Person Tax Agent Registration and mark the checkbox to confirm. |

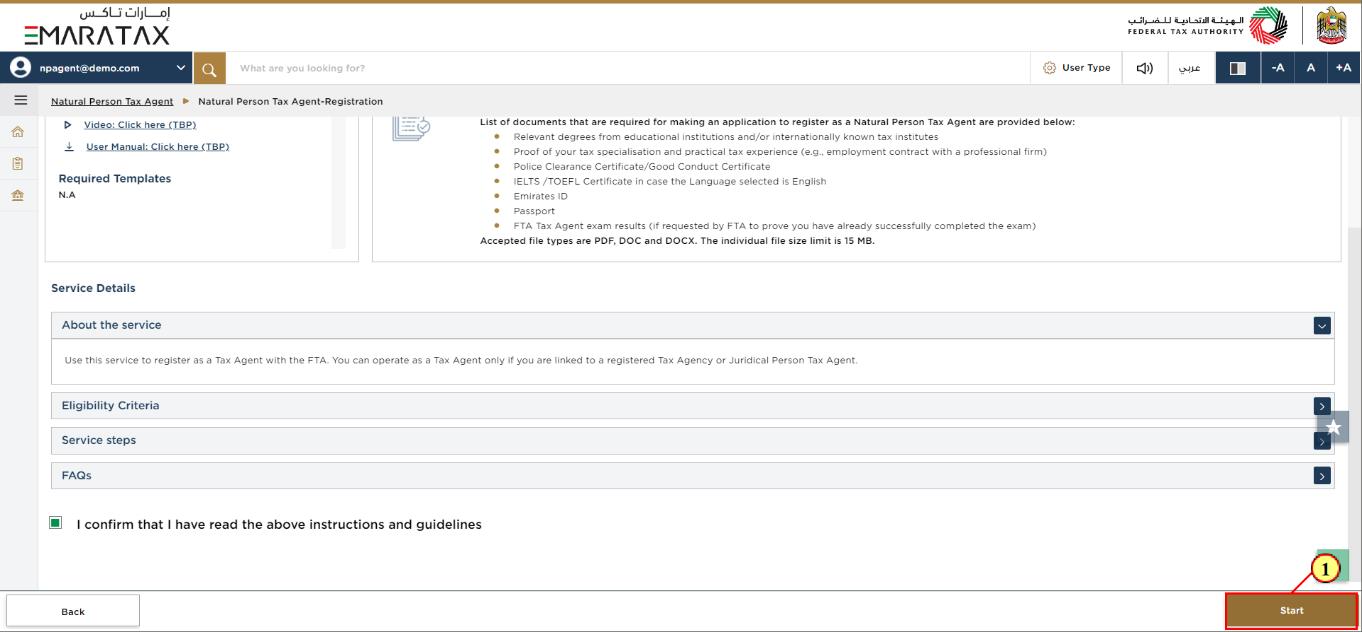

Step | Action |

(1) | Click 'Start' to initiate the Natural Person Tax Agent Registration application. |

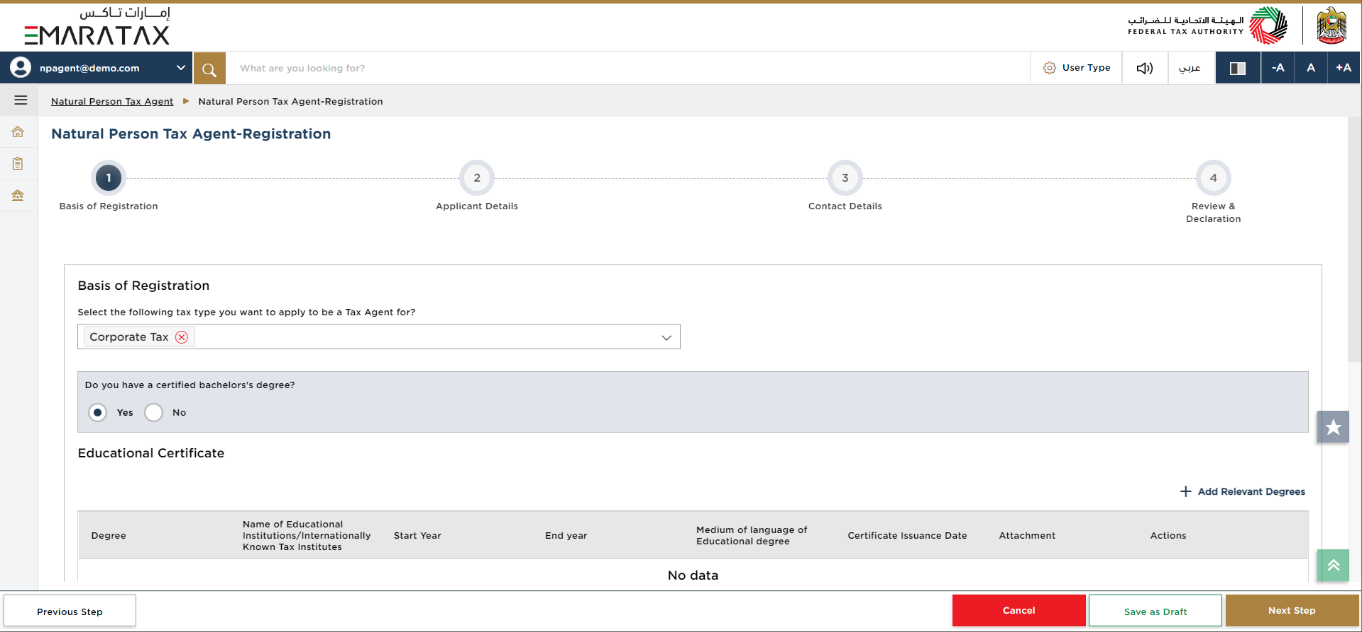

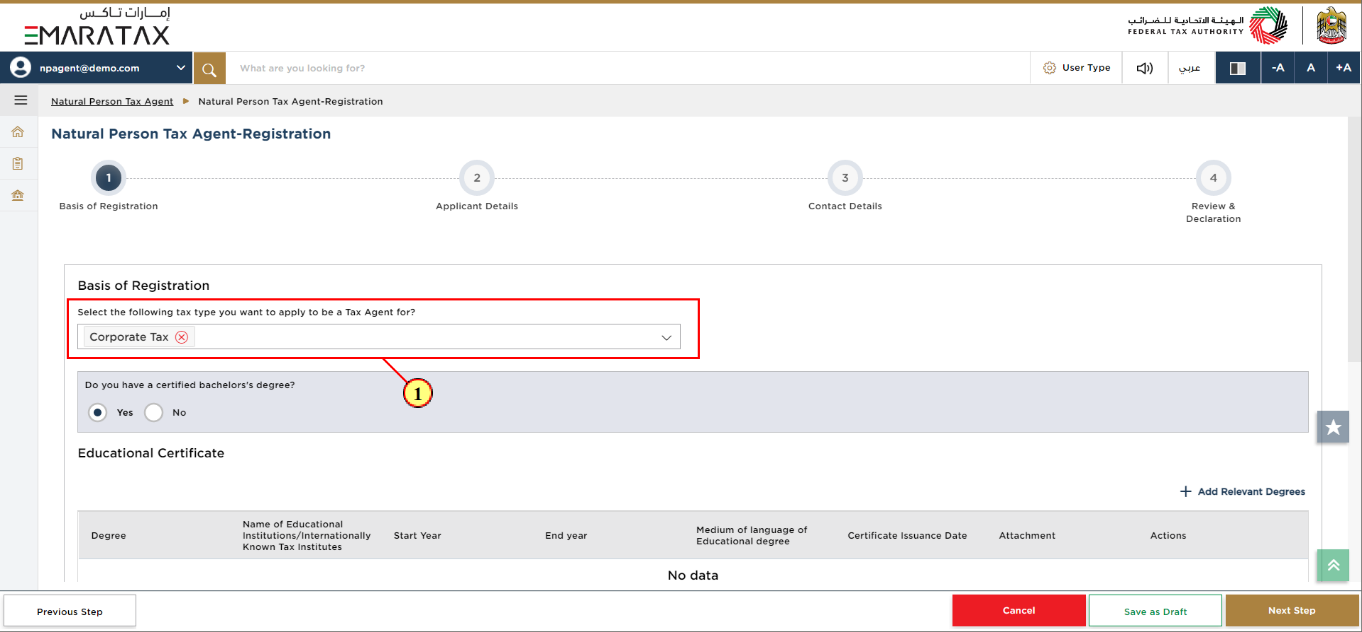

Basis of Registration Section

|

|

Step | Action |

(1) | Select the tax type from the dropdown list. |

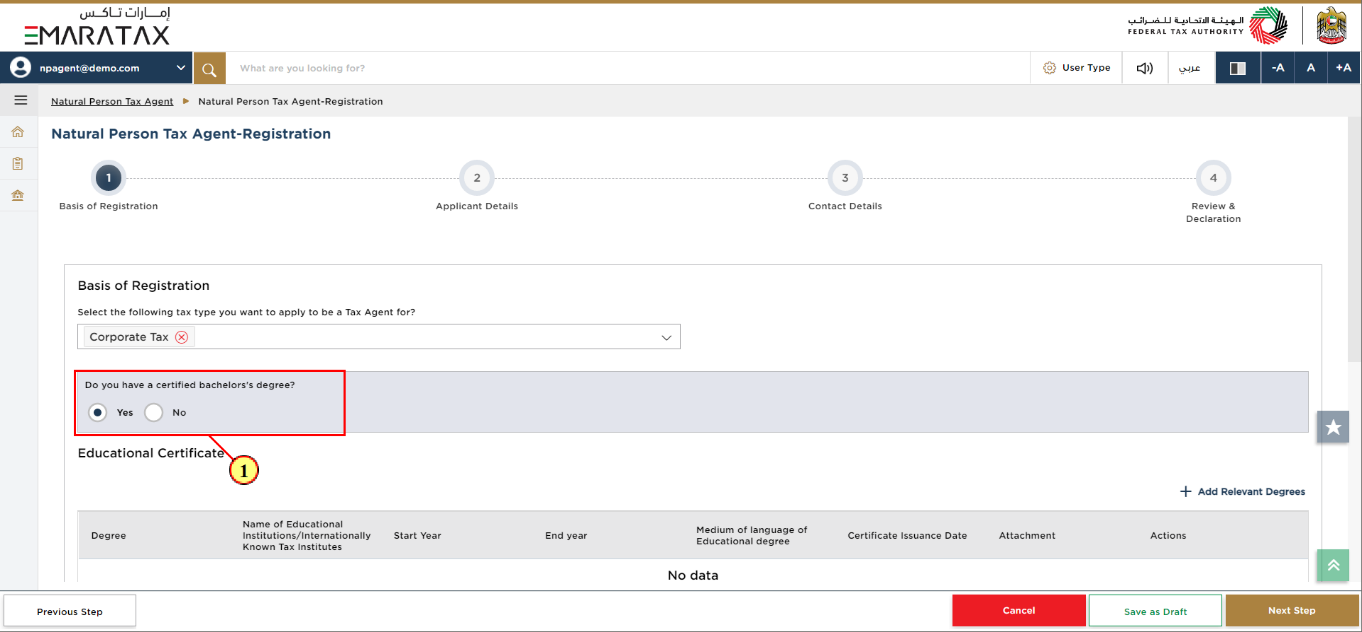

Step | Action |

(1) | Select 'Yes' to proceed with the application. |

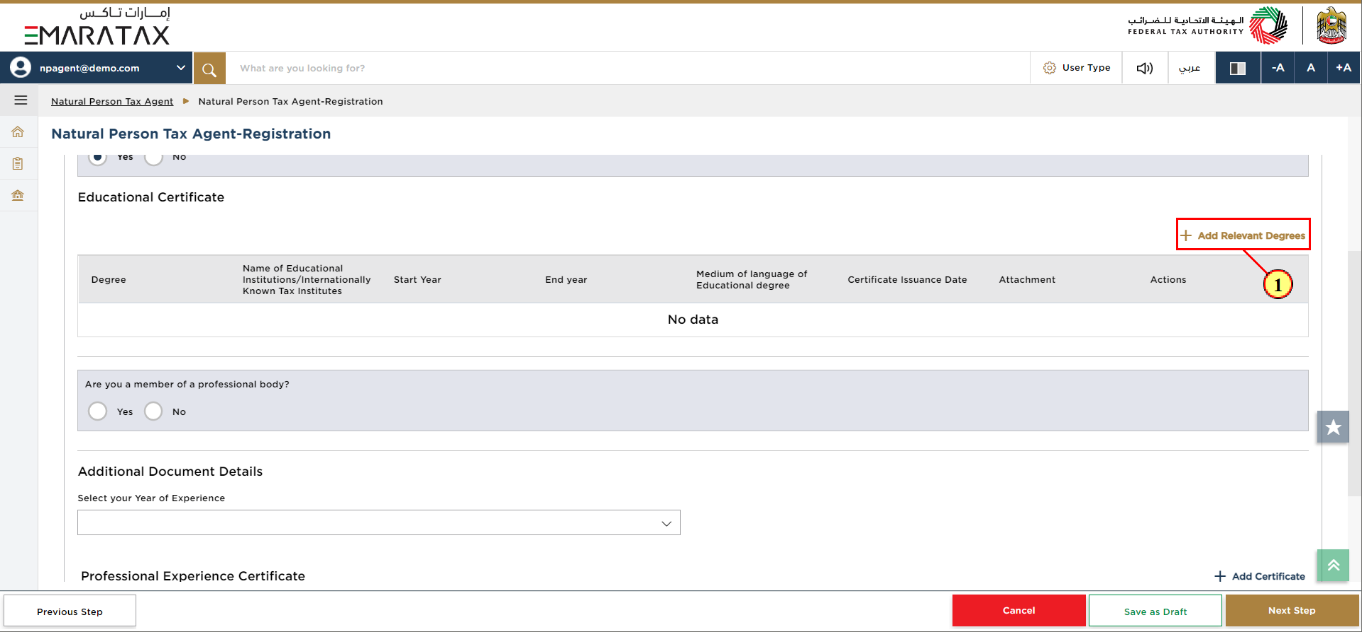

Step | Action |

(1) | Click 'Add Relevant Degrees' to upload your Educational Certificates. |

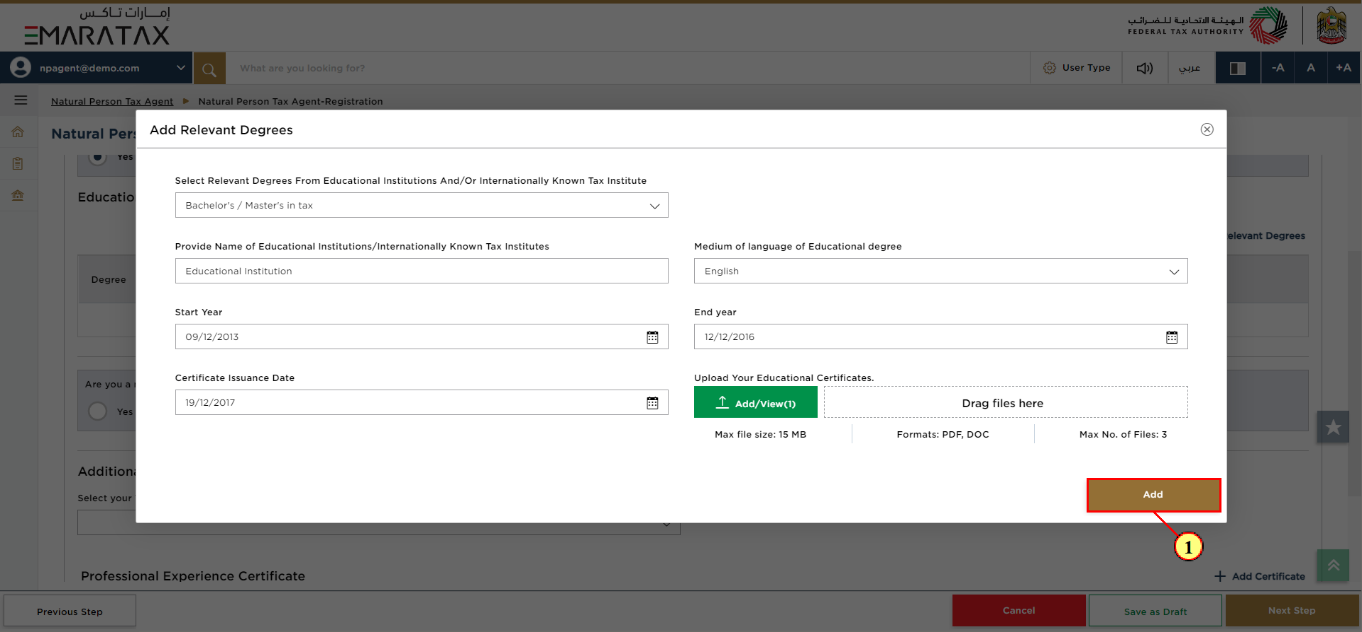

Step | Action |

(1) |

|

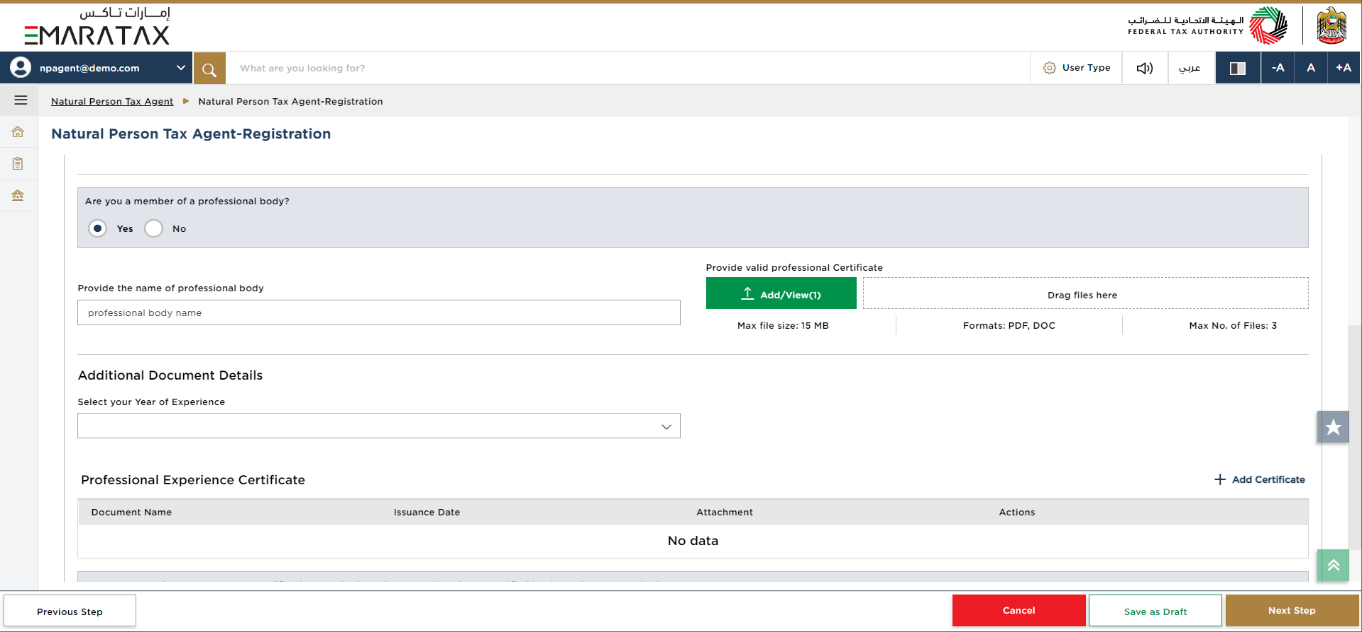

| Enter details regarding your professional body membership and upload the professional Certificate. |

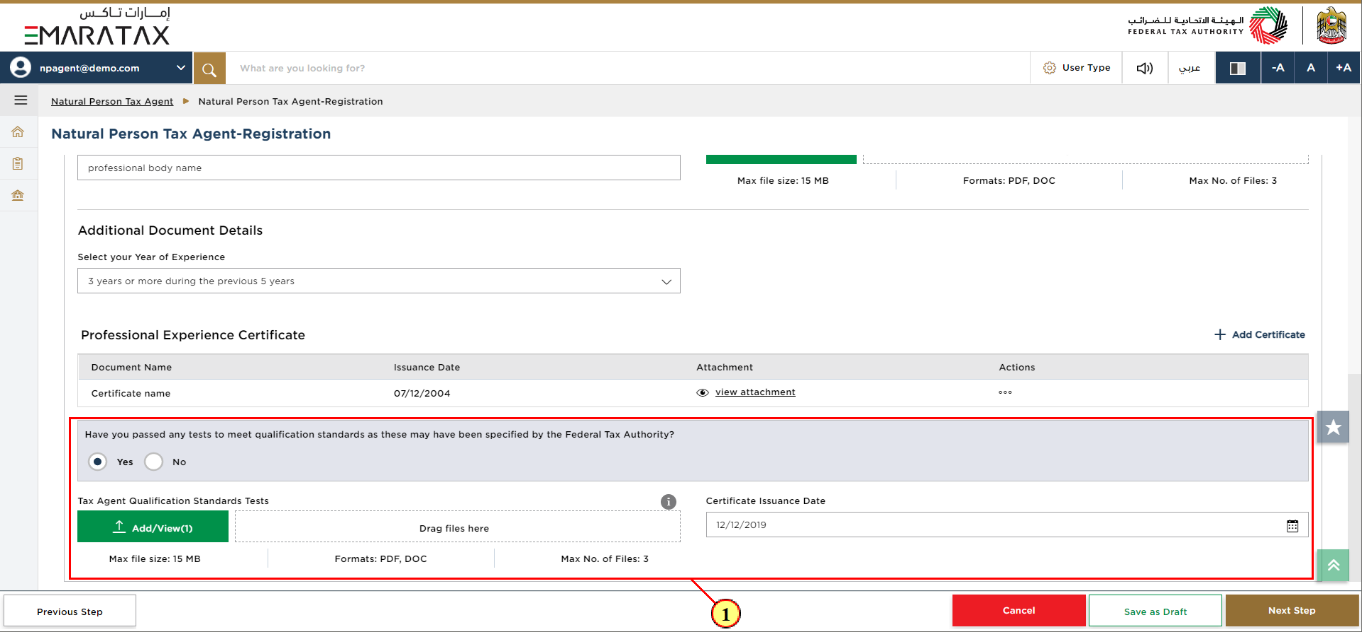

Step | Action |

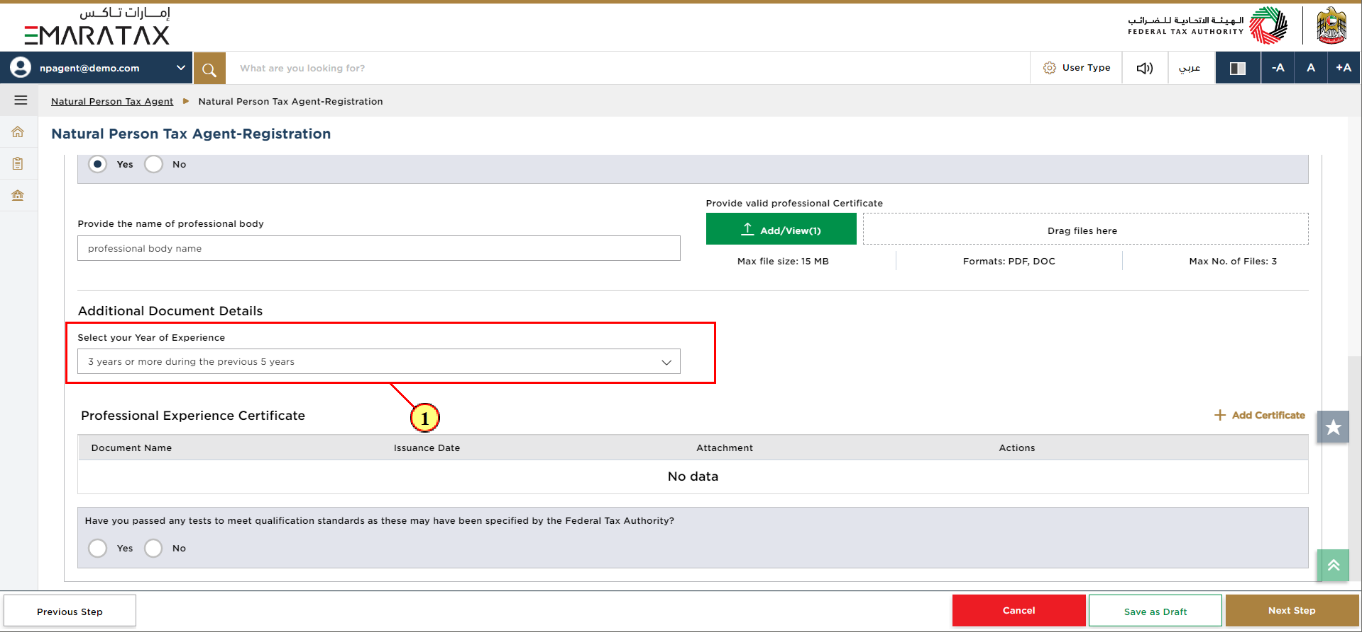

(1) | Select your 'Year of Experience' from the dropdown list. |

Step | Action |

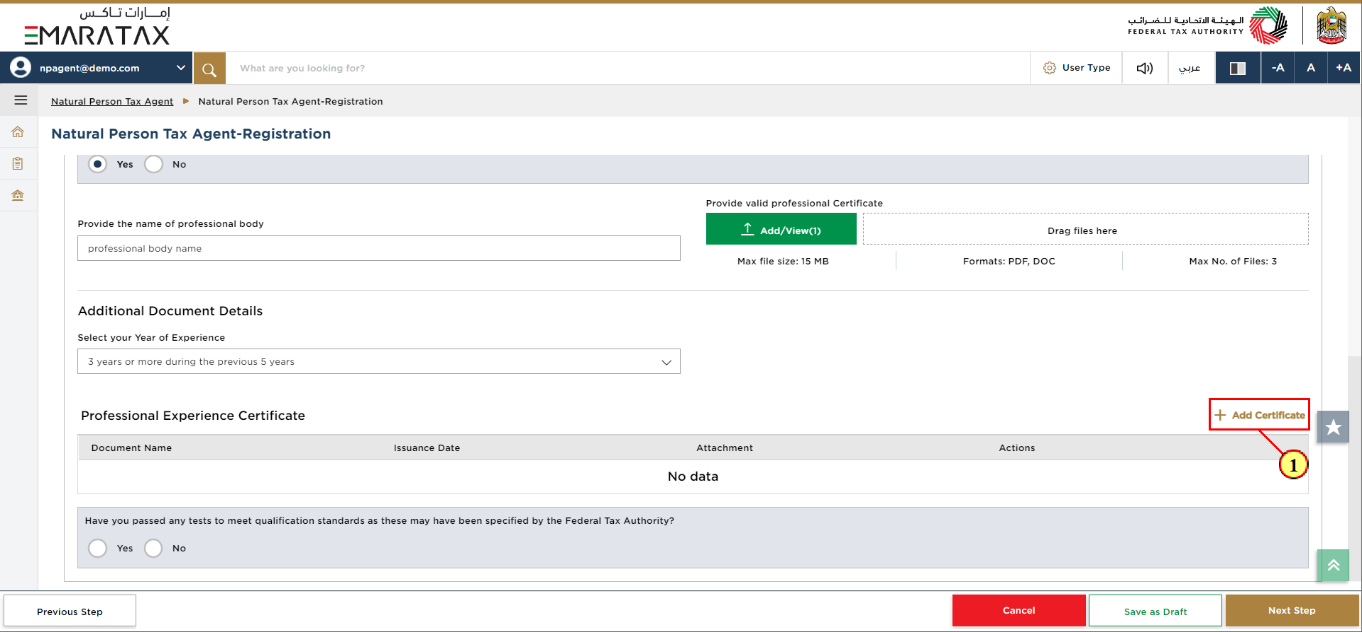

(1) | Click 'Add Certificate' to add your Professional Experience Certificate. |

Step | Action |

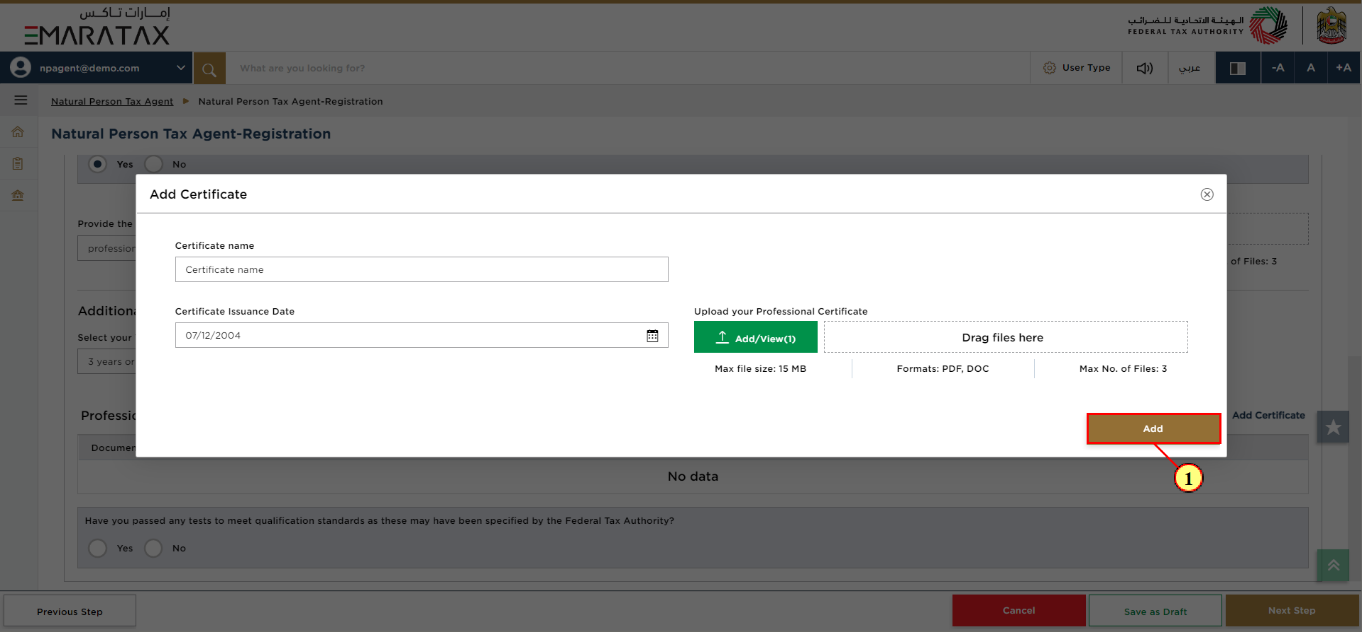

(1) |

|

Step | Action |

(1) |

|

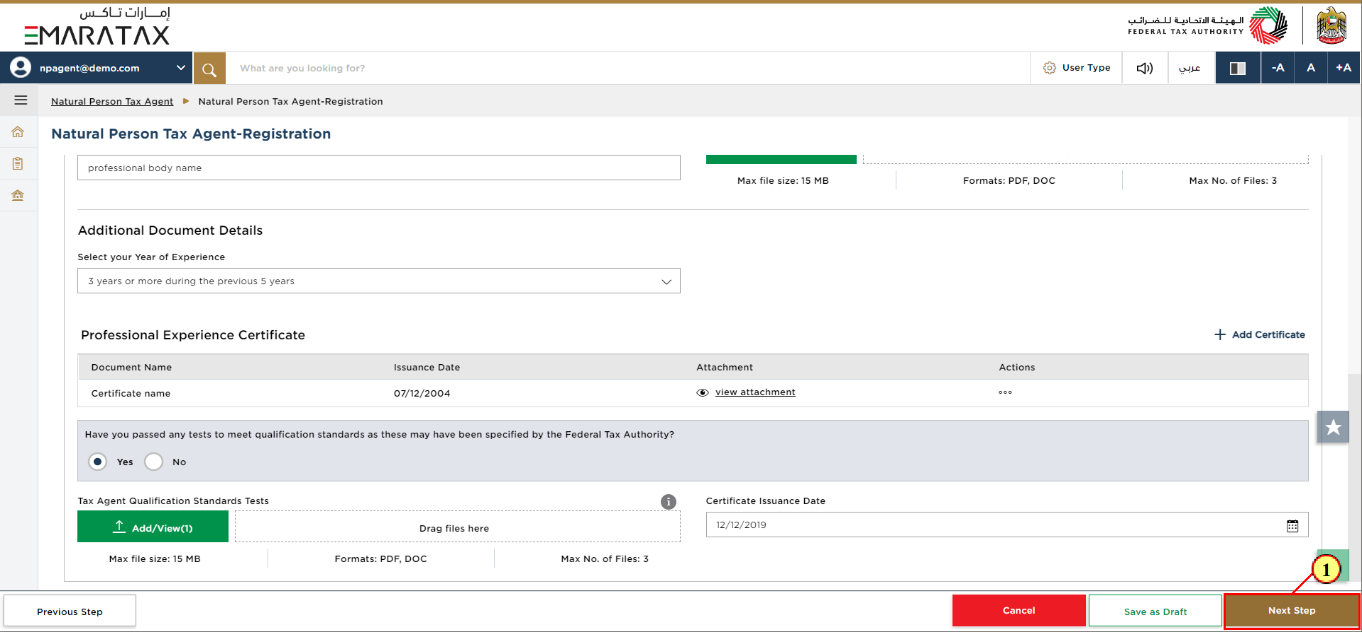

Step | Action |

(1) | After completing all mandatory fields, click the 'Next Step' button to save and proceed to the next section. |

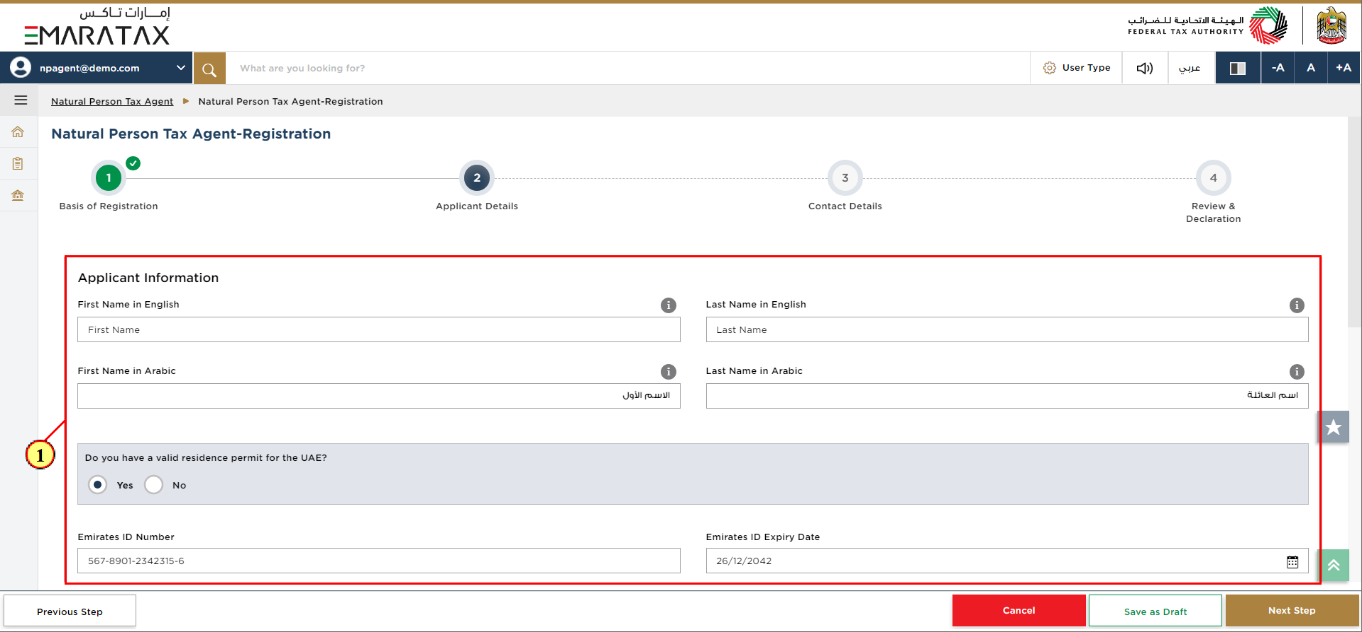

Applicant Details Section

Step | Action |

(1) | Enter the Applicant Information. |

Step | Action |

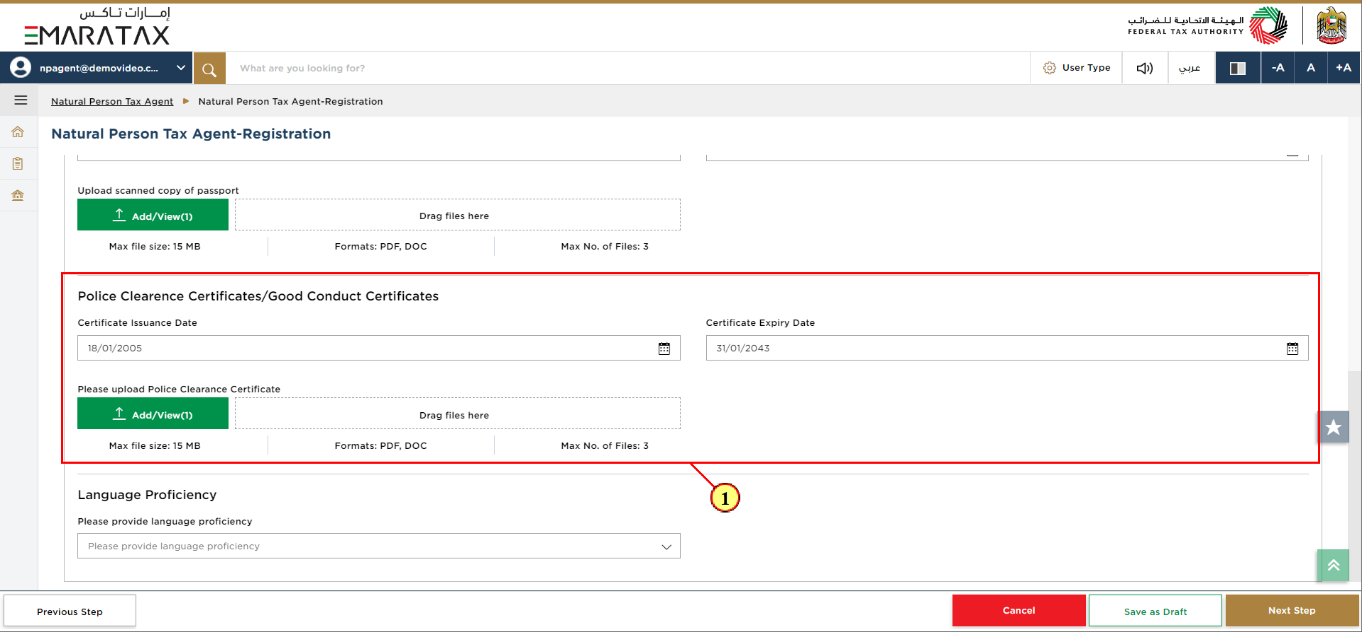

(1) |

|

Step | Action |

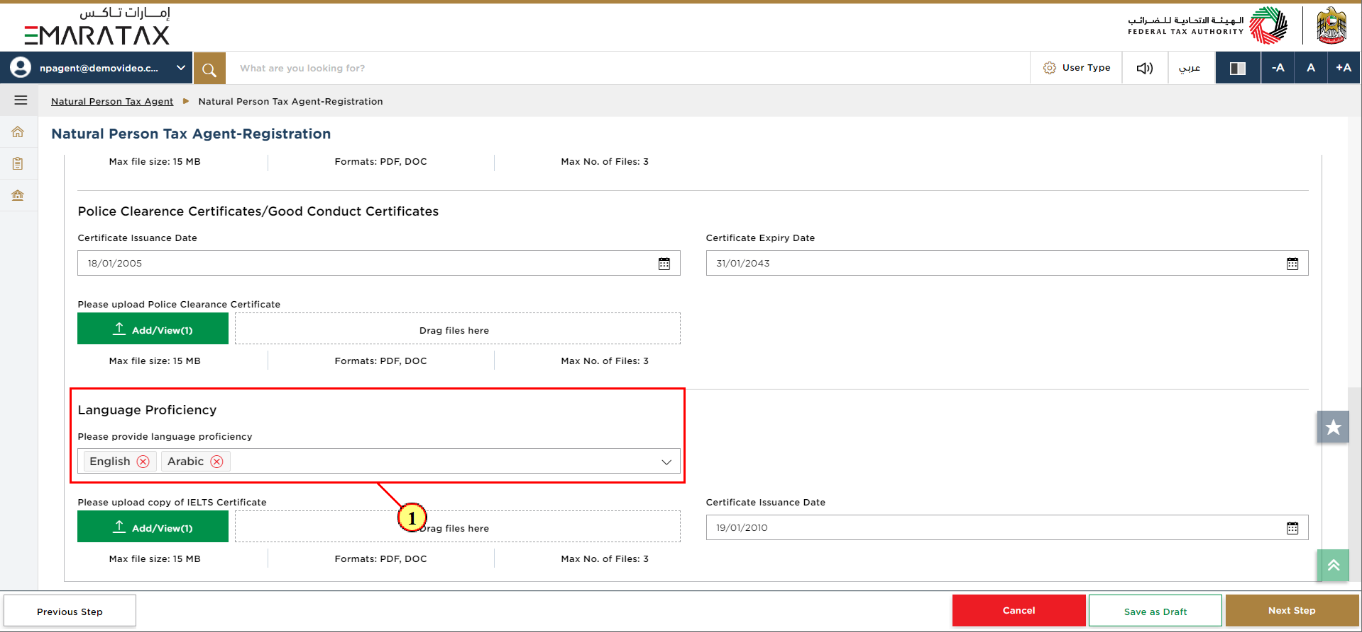

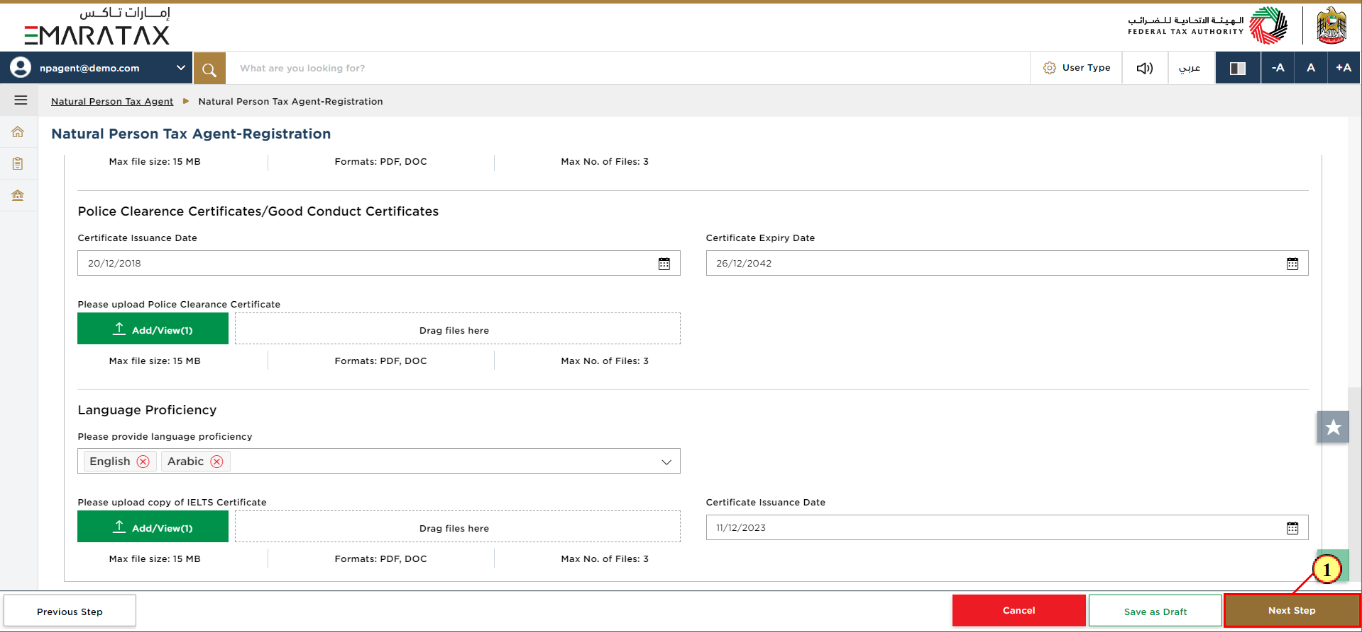

(1) | Select English and Arabic as Language Proficiency, either of these languages is acceptable. |

Step | Action |

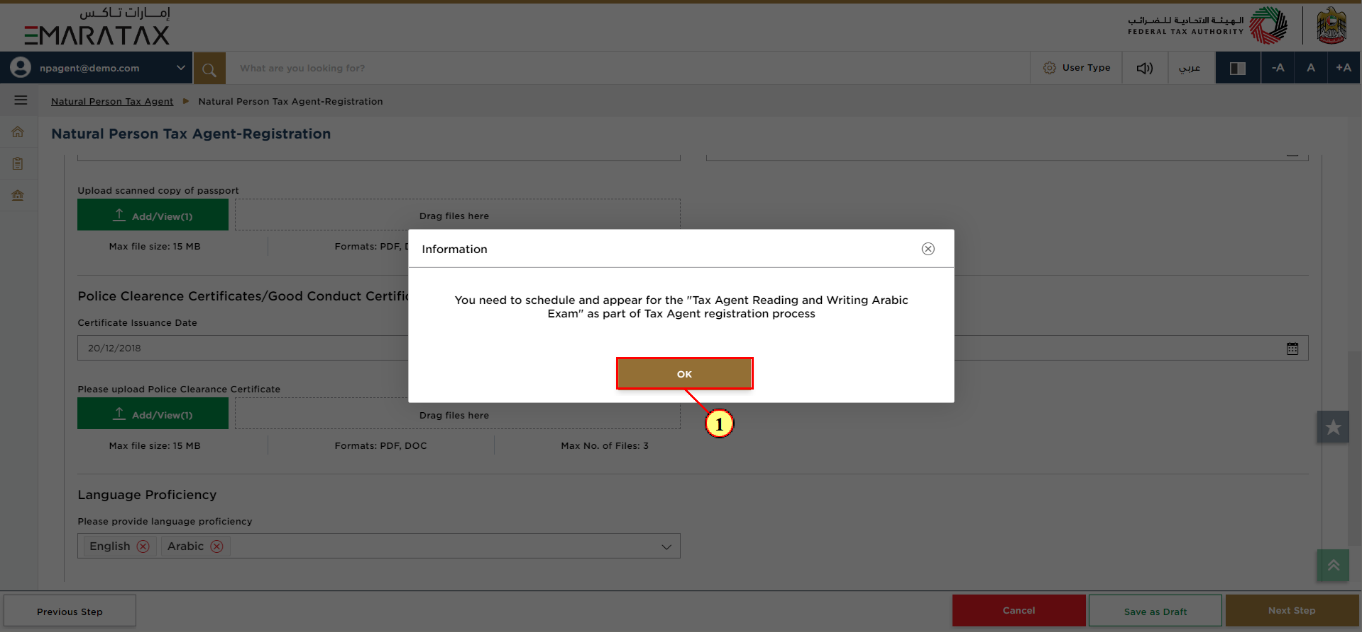

(1) | Select 'OK' to close the Information pop-up box. |

Step | Action |

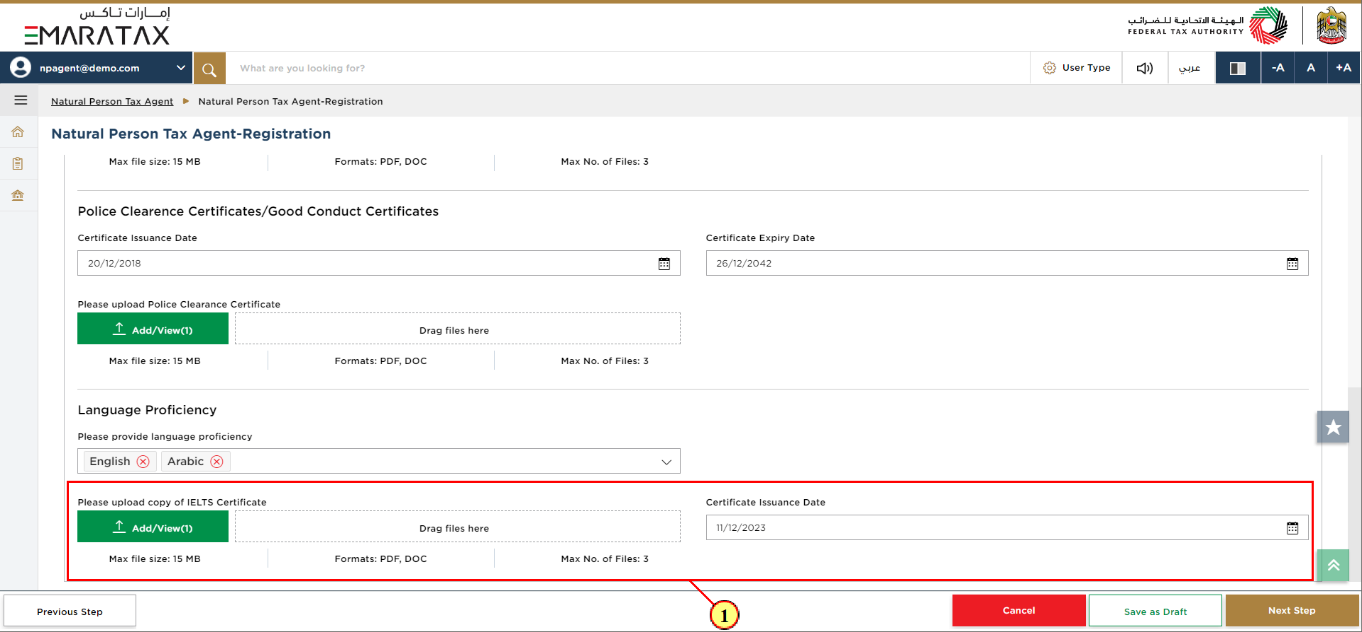

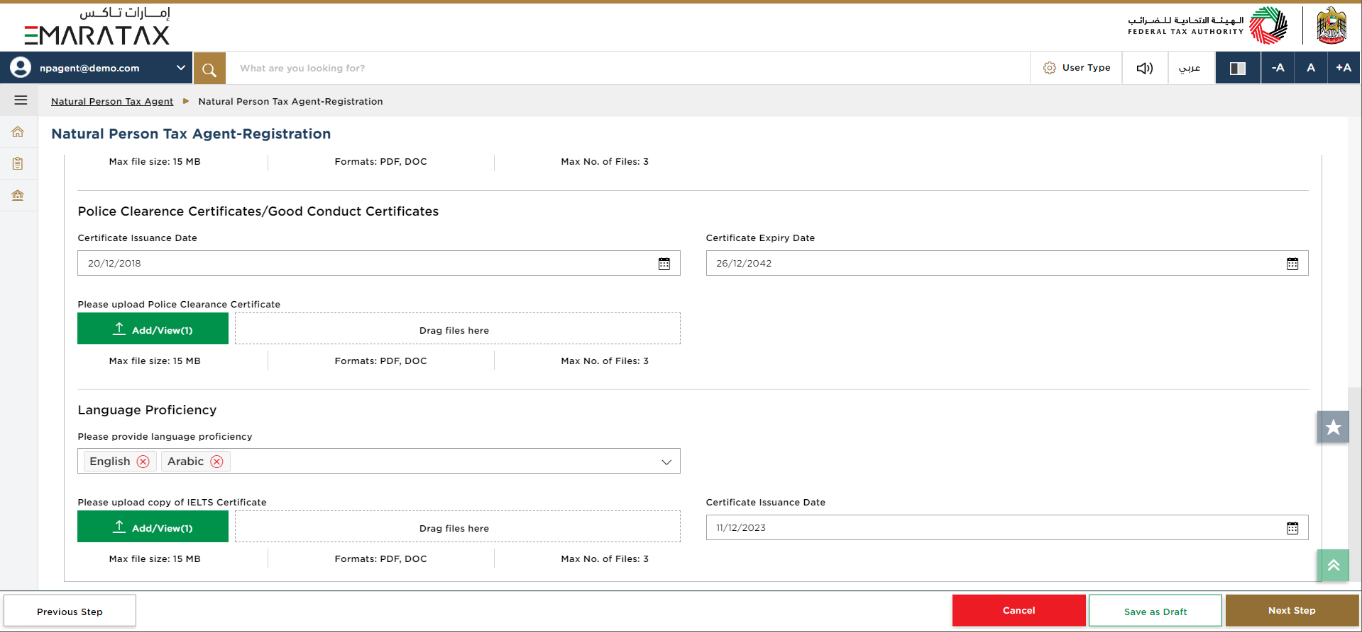

(1) | Upload copy of IELTS Certificate and enter Certificate Issuance Date. |

|

|

Step | Action |

(1) | After completing all mandatory fields, click the 'Next Step' button to save and proceed to the next section. |

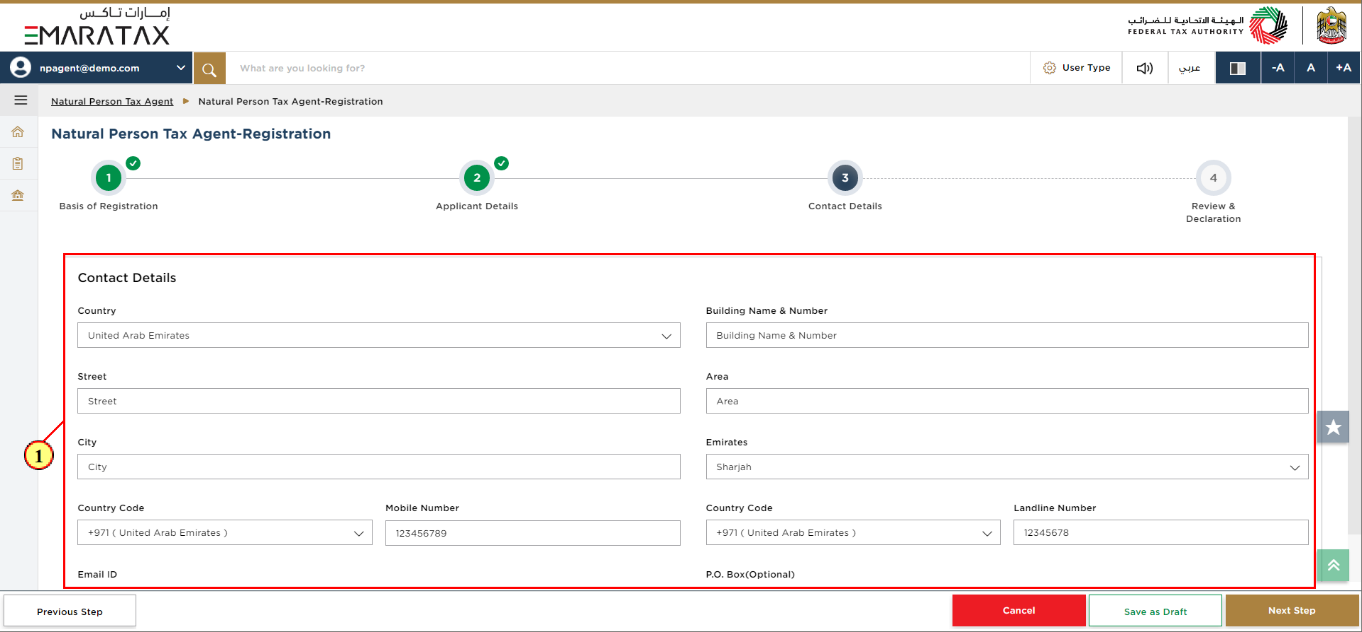

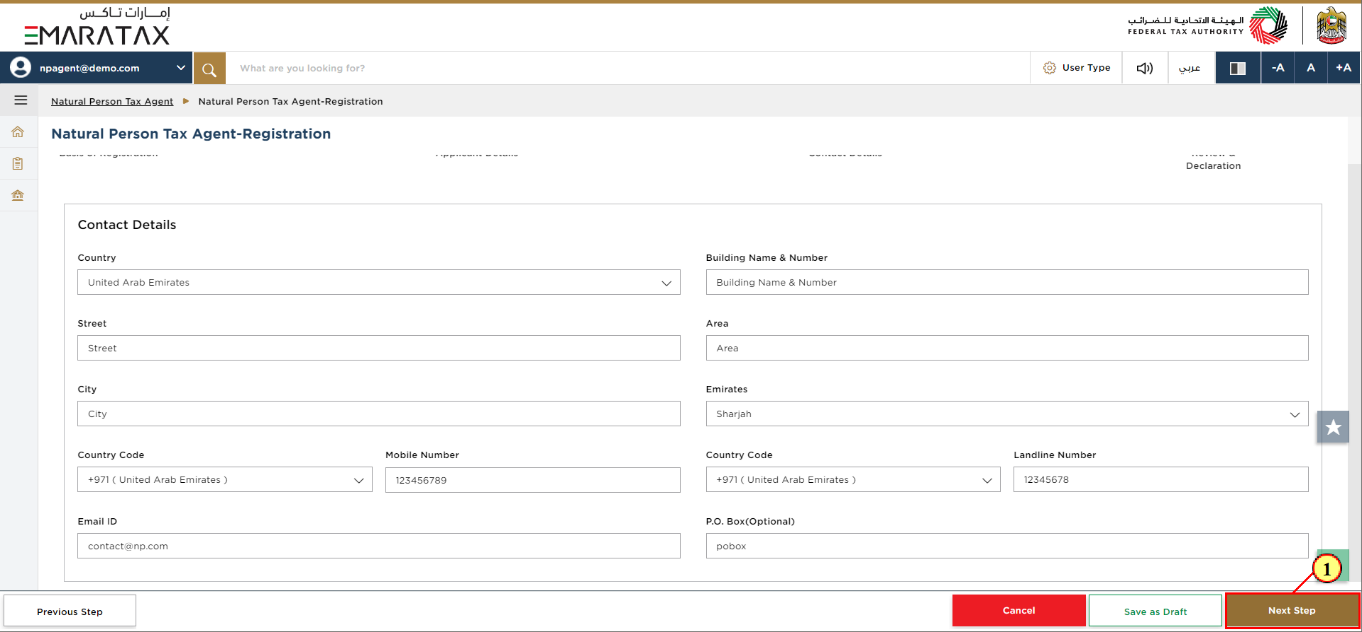

Contact Details Section

Step | Action |

(1) | Enter the Contact Details of the Natural Person Tax Agent. |

Step | Action |

(1) | After completing all mandatory fields, click the 'Next Step' button to save and proceed to the next section. |

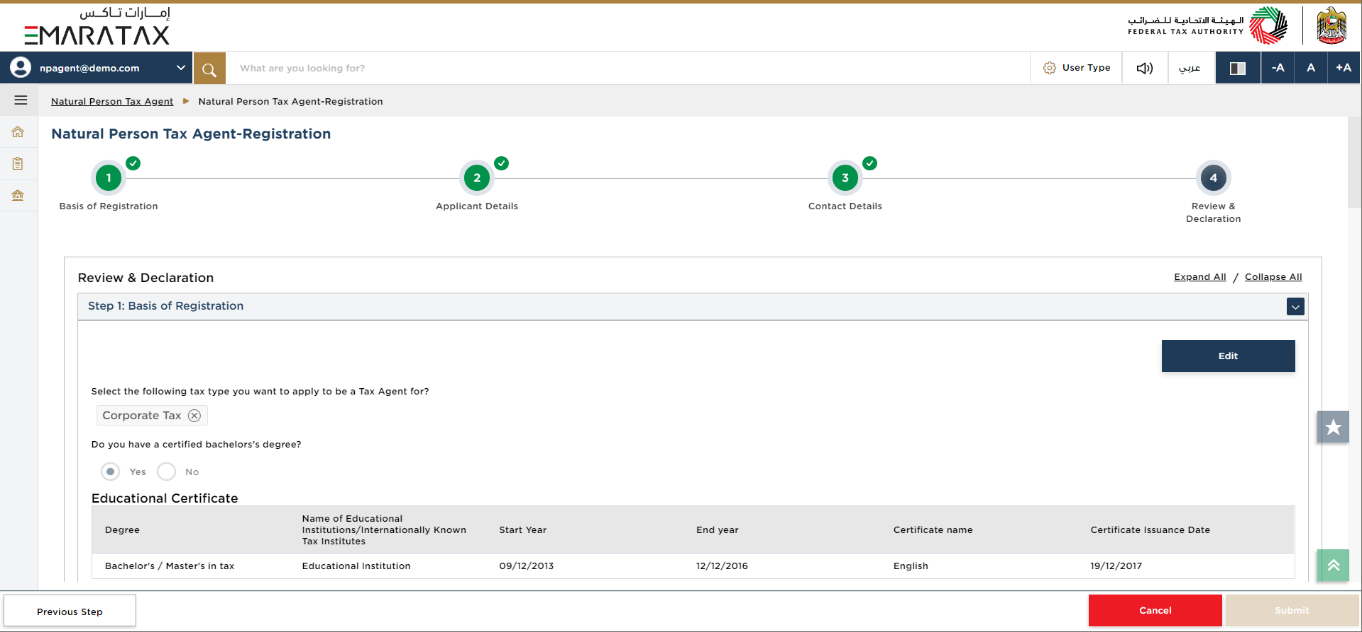

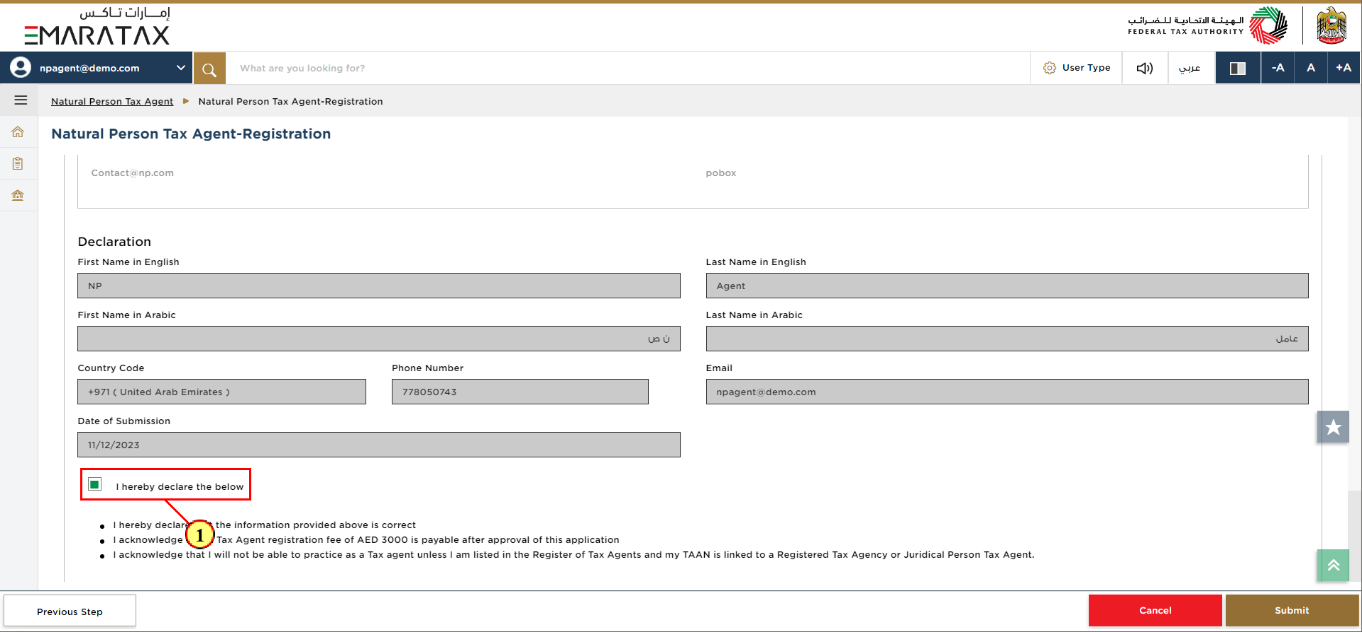

Review and Declaration Section

| This section highlights all the details entered by you across the application. You are required to review and submit the application. |

Step | Action |

(1) | After carefully reviewing all of the information entered on the application, mark the checkbox to declare the correctness of the information provided in the application. |

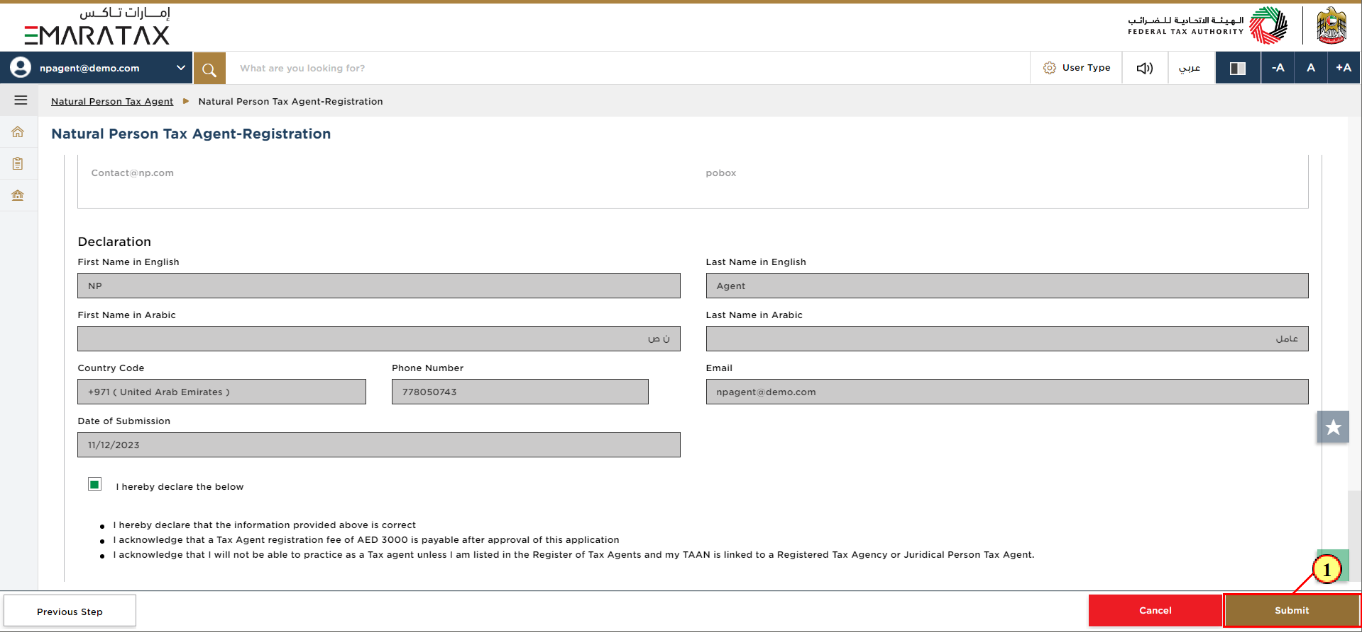

Step | Action |

(1) | Click 'Submit' to submit the Natural Person Tax Agent Registration application. |

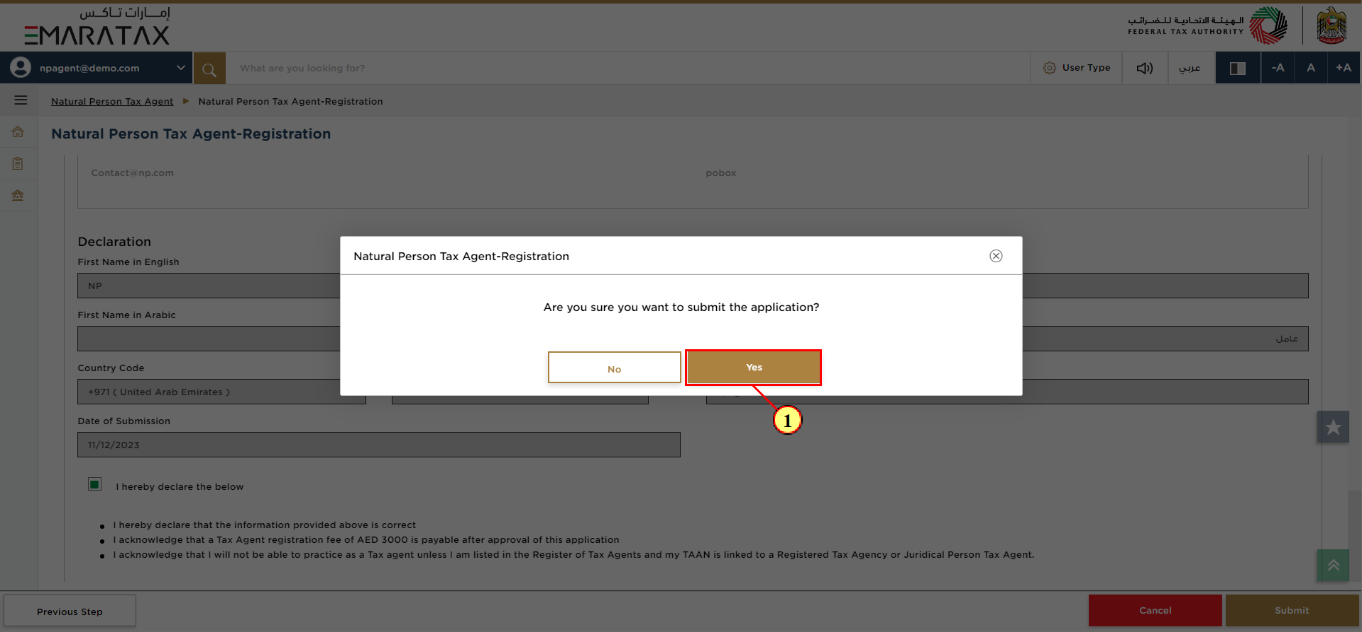

Step | Action |

(1) | Click 'Yes'. |

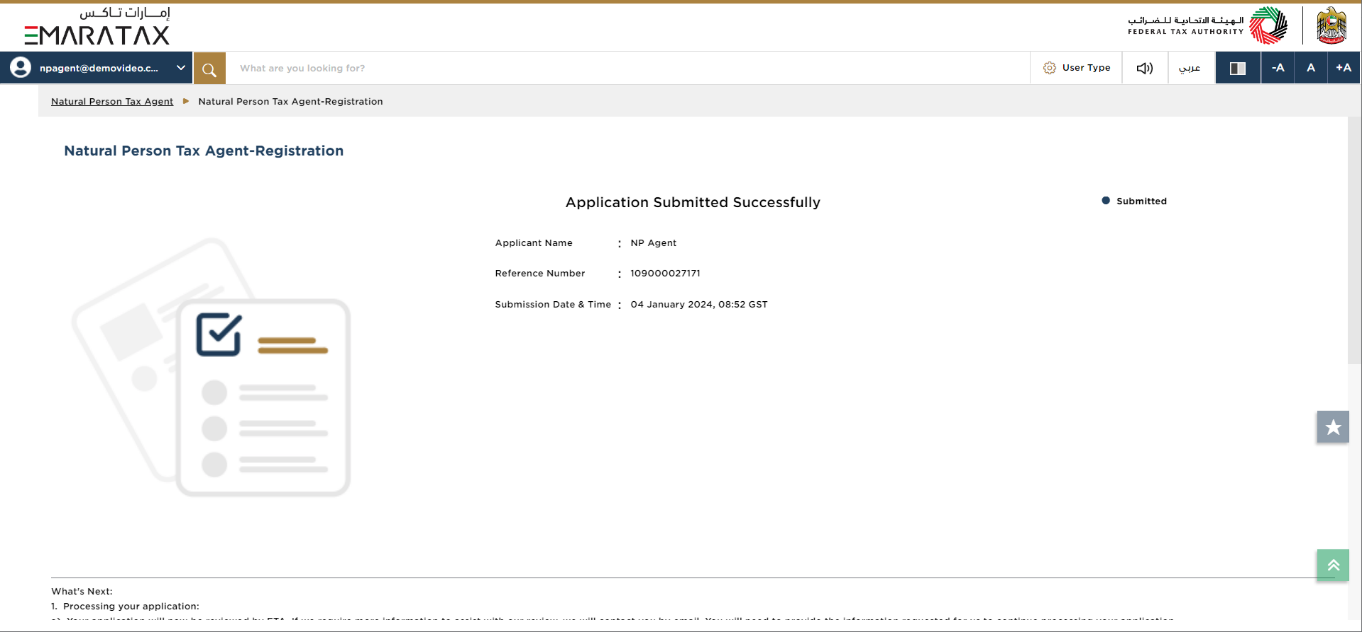

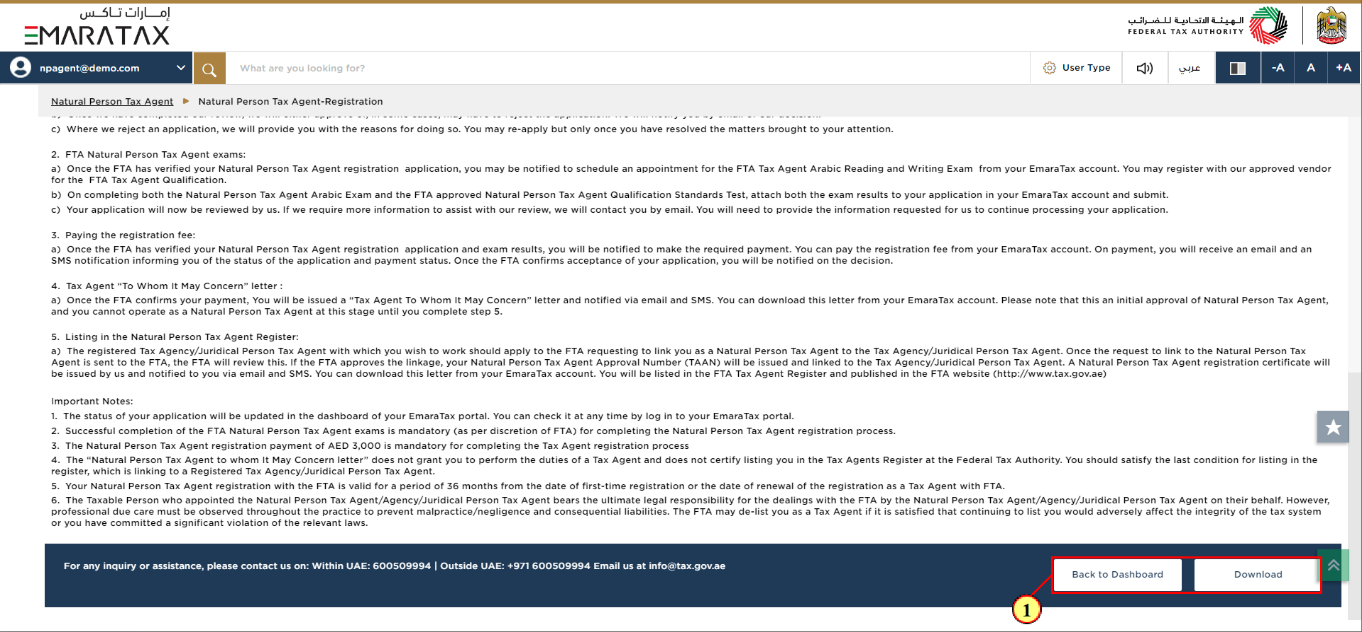

Post Application Submission

| After your application is submitted successfully, a Reference Number is generated for your submitted application. Note this reference number for future communication with the FTA. What's next?

|

Step | Action |

(1) |

|

Correspondences

Natural Person Tax Agent receives the following correspondences:

Application submission acknowledgment.

Additional information notification (only if the FTA requires more information to assist with their review of your application).

Awaiting payment.

Application approval or rejection notification.

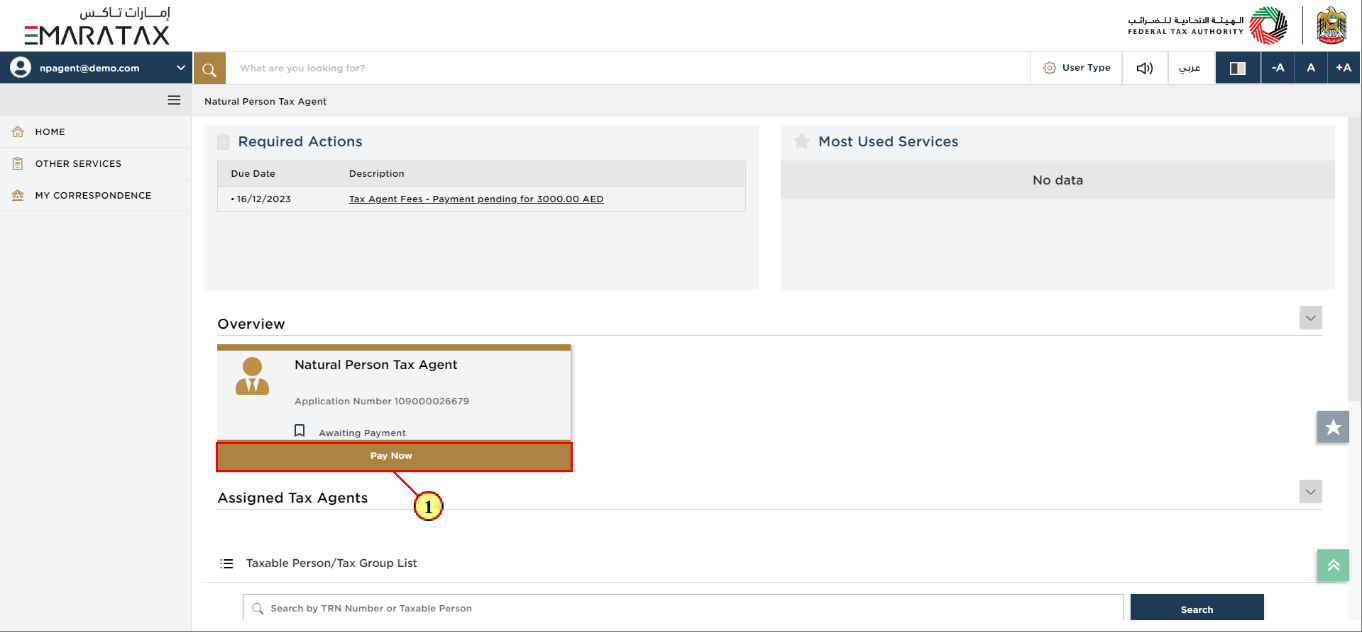

Application History - Awaiting Payment

Once the FTA approves your application, you will be informed to make the payment for your Natural Person Tax Agent Registration.

Step | Action |

(1) | Click 'Pay Now' on the Natural Person Tax Agent tile. |

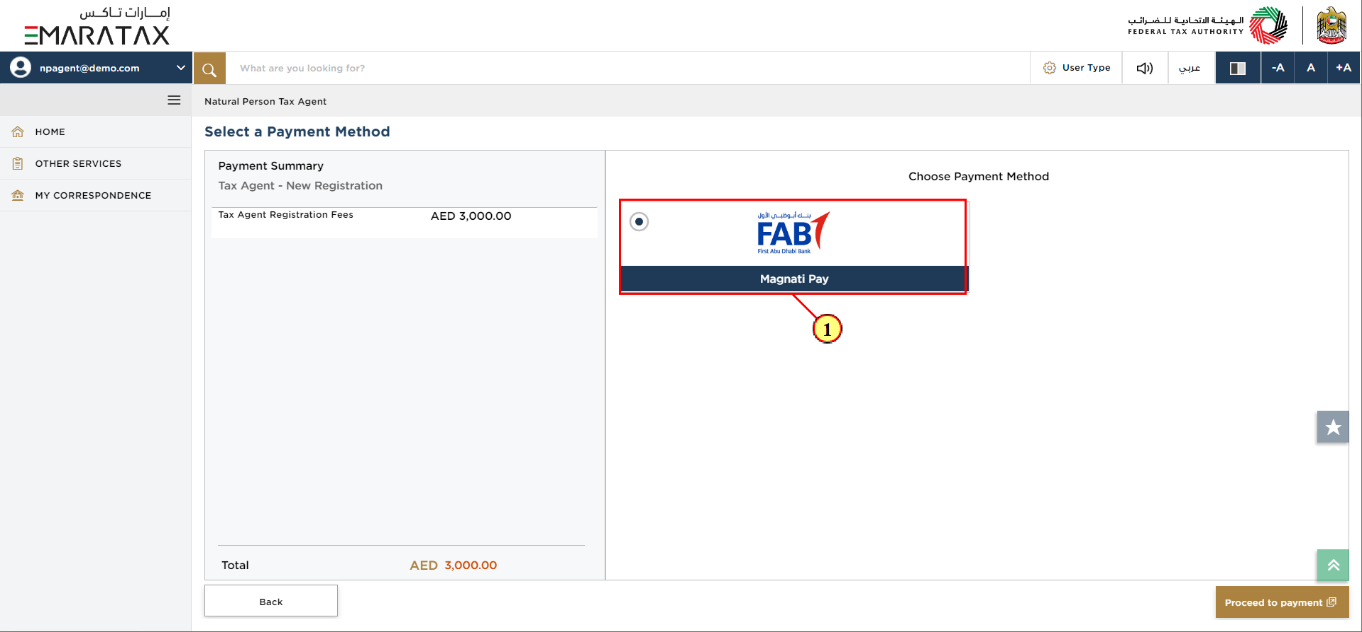

Step | Action |

(1) | Choose the preferred payment method. |

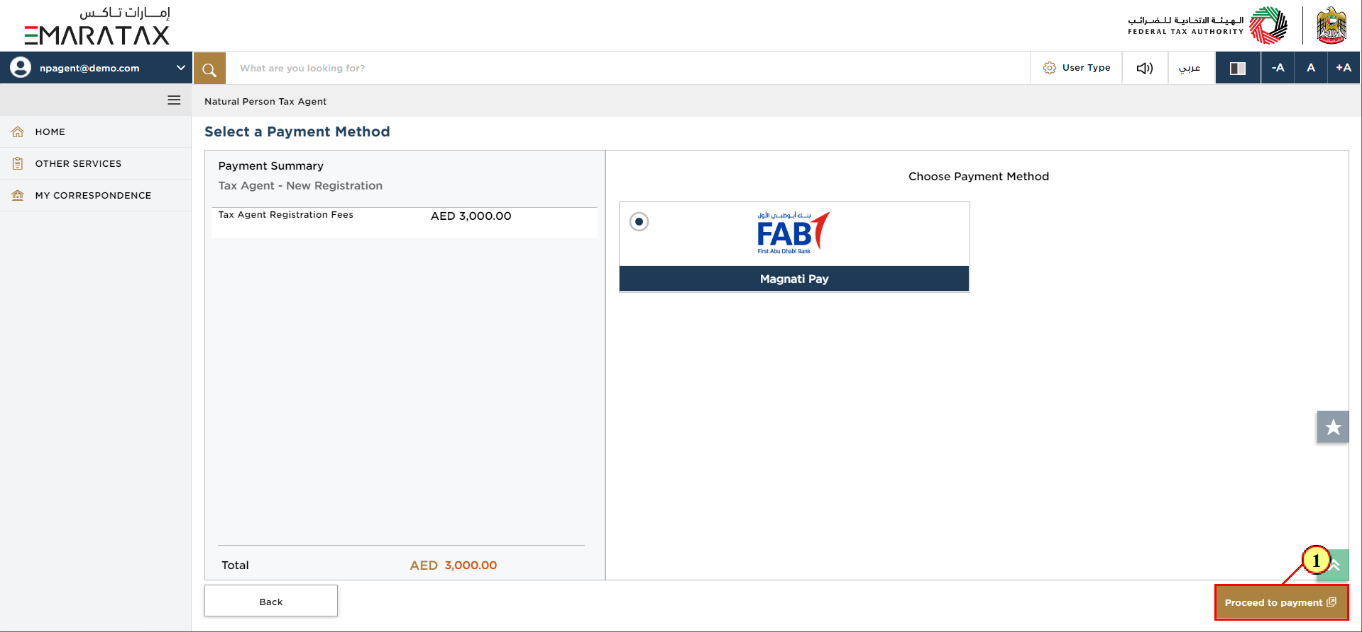

Step | Action |

(1) | Click 'Proceed to payment'. |

Step | Action |

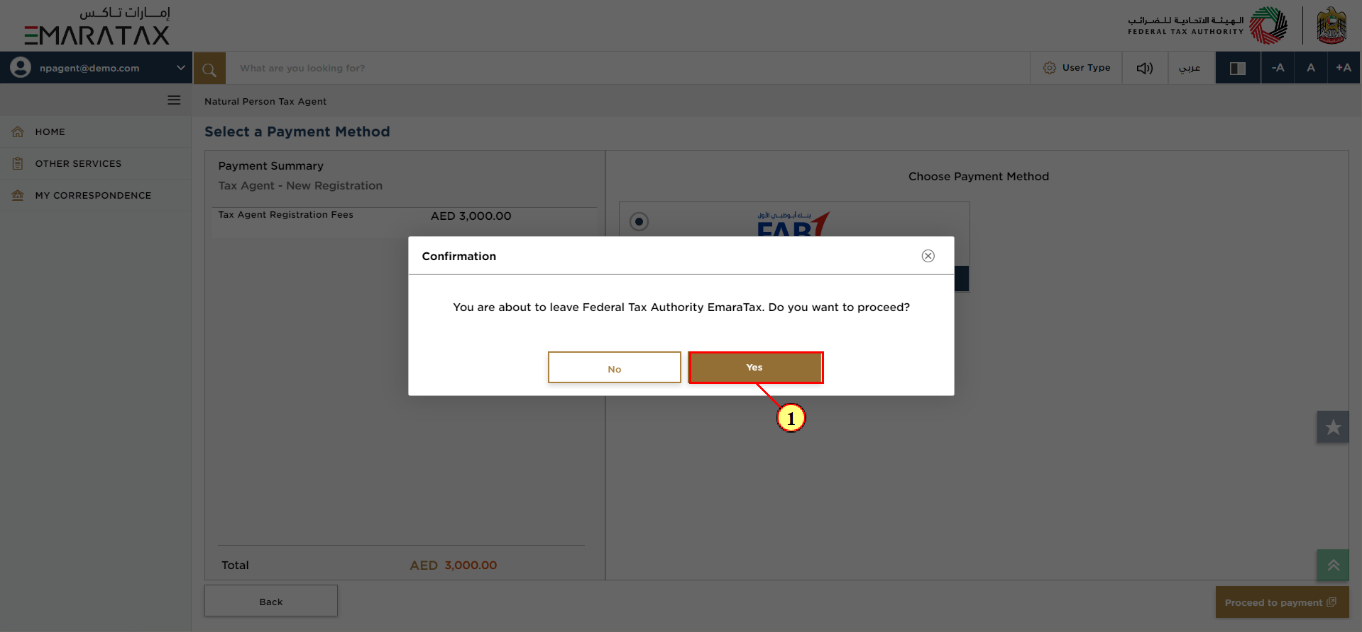

(1) | Click 'Yes' to continue. |

Step | Action |

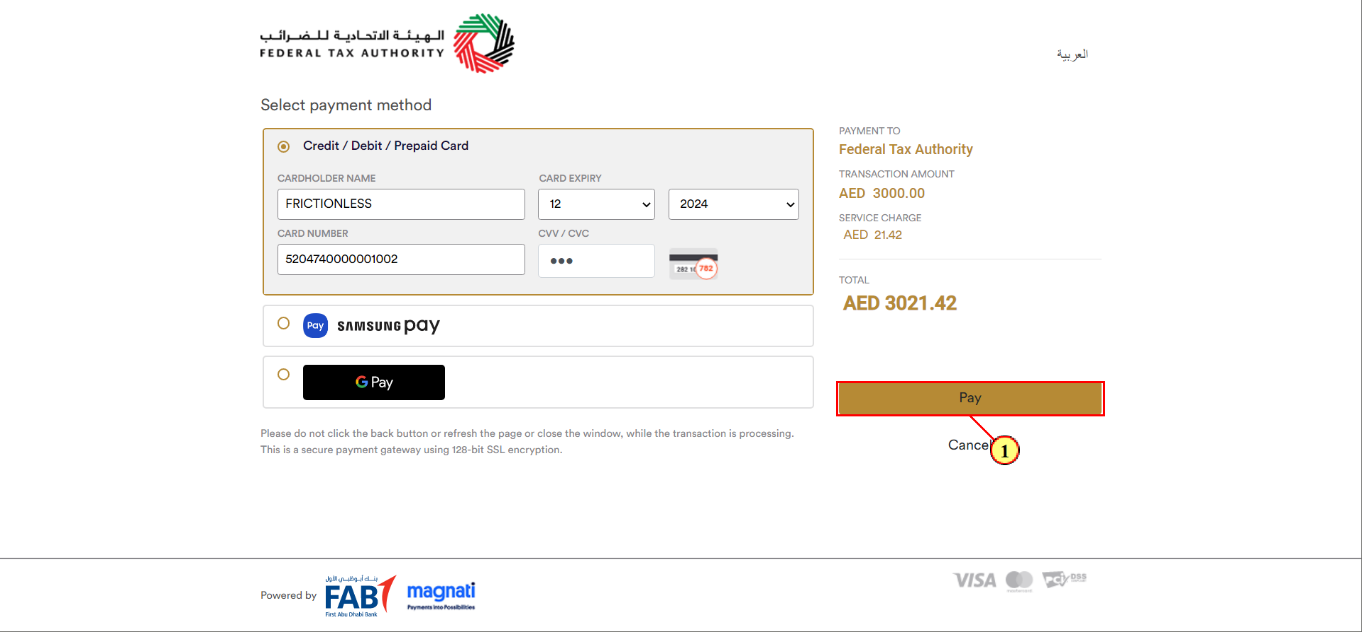

(1) | Enter the payment details and click 'Pay'. |

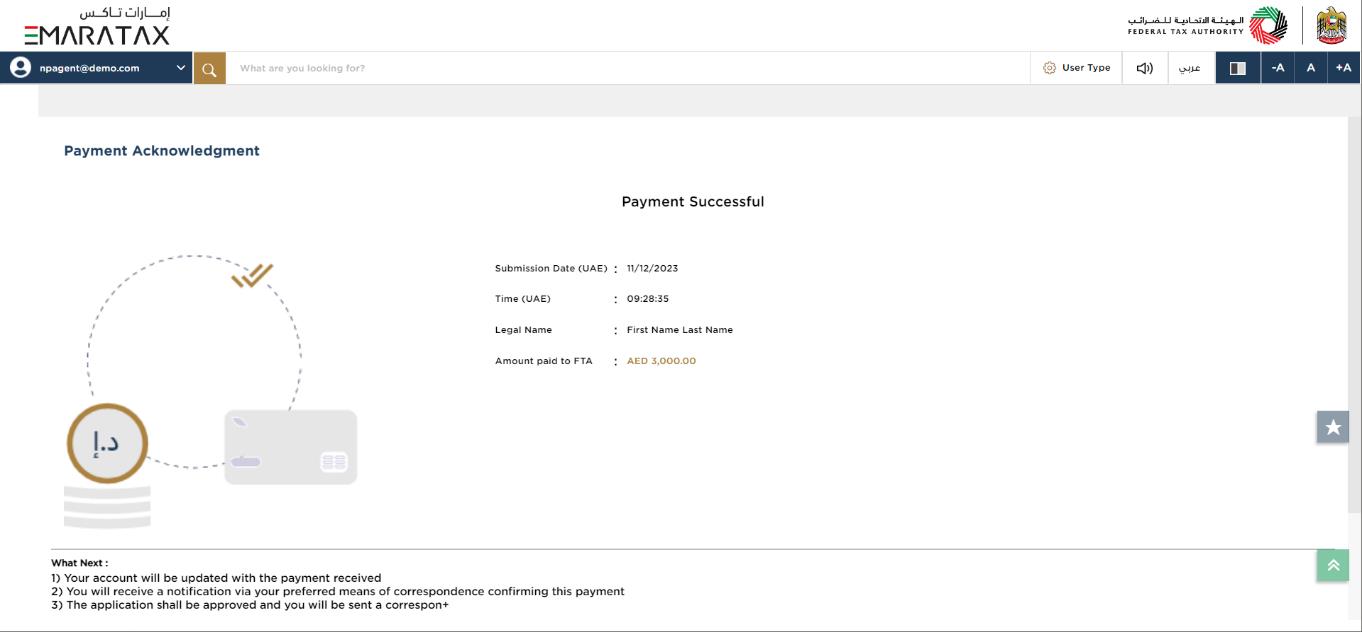

Post Successful Payment

|

|

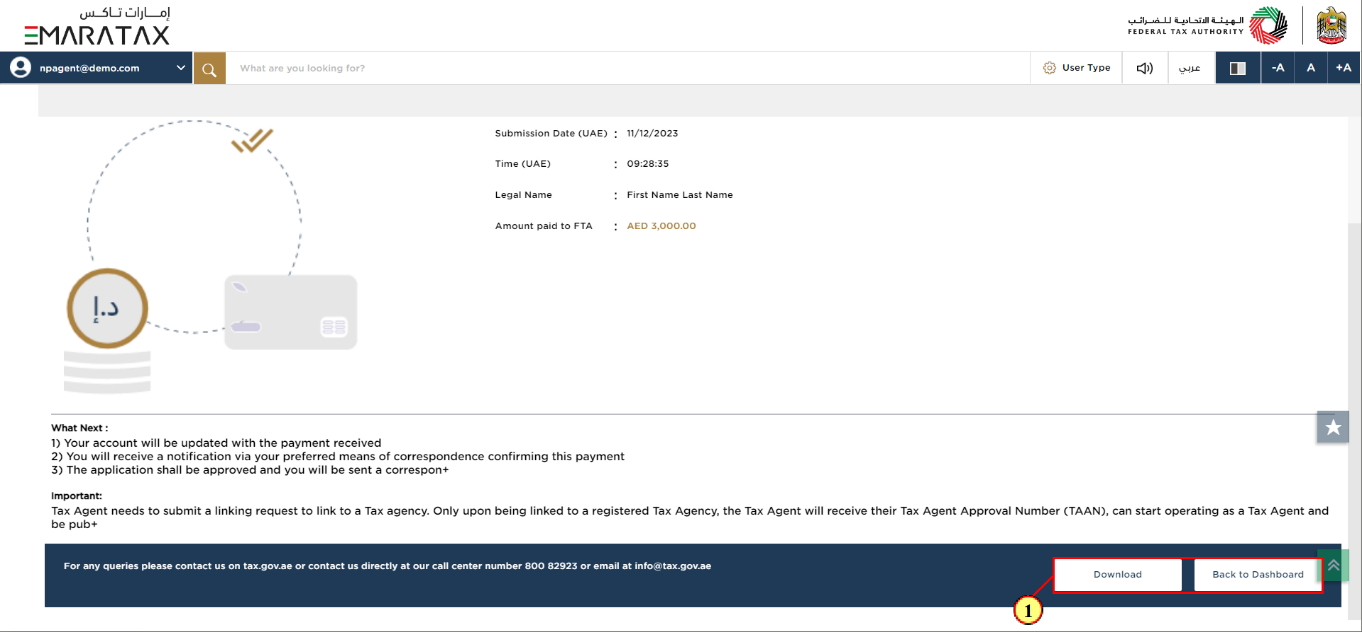

Step | Action |

(1) |

|

| You may connect with a Juridical Tax Agent to initiate an application to link you to the Juridical Tax Agent. Please note that only once you are linked to a Juridical Tax Agent which includes review and approval by the FTA, a Tax Agent Approval Number and Natural Person Tax Agent Registration Certificate will be issued by the FTA. |