Tax Agent User Manual - Link Natural Person Tax Agent with Juridical Person Tax Agent - 2024

Tax Agent User Manual

Link Natural Person Tax Agent with Juridical Person Tax Agent

Date: 25 June, 2024

Version 1.3.0.0

Contents

1. Navigating through EmaraTax

2. Introduction

3. Login to EmaraTax as Natural Person Tax Agent

4. Link Natural Person Tax Agent to Juridical Person Tax Agent

5. Juridical Tax Agent Management

6. Link request submitted to the FTA

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process:

Button | Description |

In the Portal | |

| This is used to toggle between various personas within the user profile, such as Taxable Person, Tax Agent, Tax Agency, Legal Representative, etc |

| This is used to enable the text to speech feature of the portal |

| This is used to toggle between the English and Arabic versions of the portal |

| This is used to decrease, reset, and increase the screen resolution of the user interface of the portal |

| This is used to manage the user profile details such as the Name, Registered Email Address, Registered Mobile Number, and Password |

| This is used to log off from the portal |

In the Business Process application | |

| This is used to go to the Previous section of the Input Form |

| This is used to go to the Next section of the Input Form |

| This is used to save the application as a draft, so that it can be completed later |

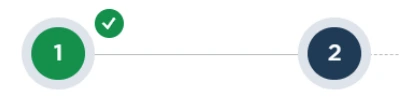

| This menu at the top gives an overview of the various sections within the application form. All the sections need to be completed in order to submit the application for review. The current section is highlighted in blue, and the completed sections are highlighted in green with a check |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for Tax Agents to benefit from these services in the best and simplest ways.

Introduction

This manual is prepared to help a registered Natural Person Tax Agent to navigate through the Federal Tax Authority EmaraTax portal to accept the linking request from Juridical Person Tax Agent. The Juridical Tax Agent needs to initiate a Natural Person Tax Agent link request application. The Natural Person Tax Agent needs to accept the request by logging into their EmaraTax account. Once the request is accepted, the application shall be sent to the FTA for review. On approval of the application by the FTA, the Natural Person Tax Agent shall be linked to the Juridical Person Tax Agent.

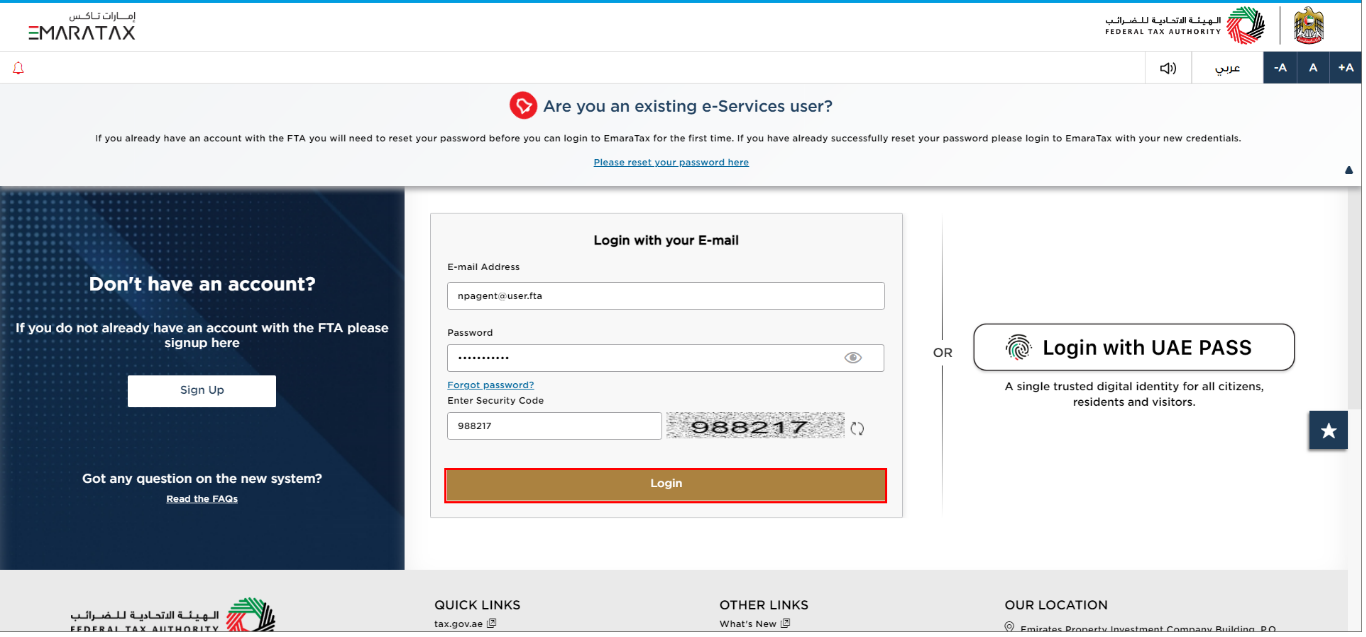

Login to EmaraTax as Natural Person Tax Agent

You can login into the EmaraTax account using your login credentials or using UAE Pass. If you do not have an EmaraTax account, you can sign-up for an account by clicking the 'Sign Up' button. If you have forgotten your password, you can use the 'Forgot password?' feature to reset your password. |

Link Natural Person Tax Agent to Juridical Person Tax Agent

Step | Action |

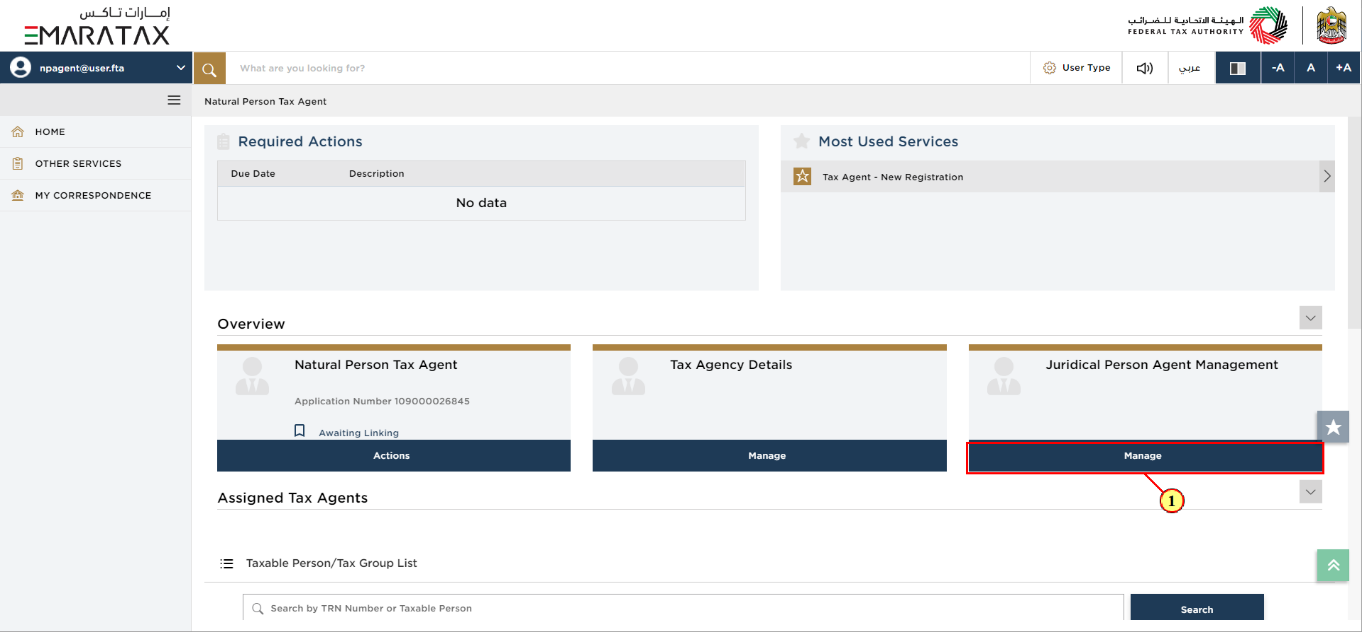

(1) | Click 'Manage' in the Juridical Person Tax Agent Management tile. |

Juridical Tax Agent Management

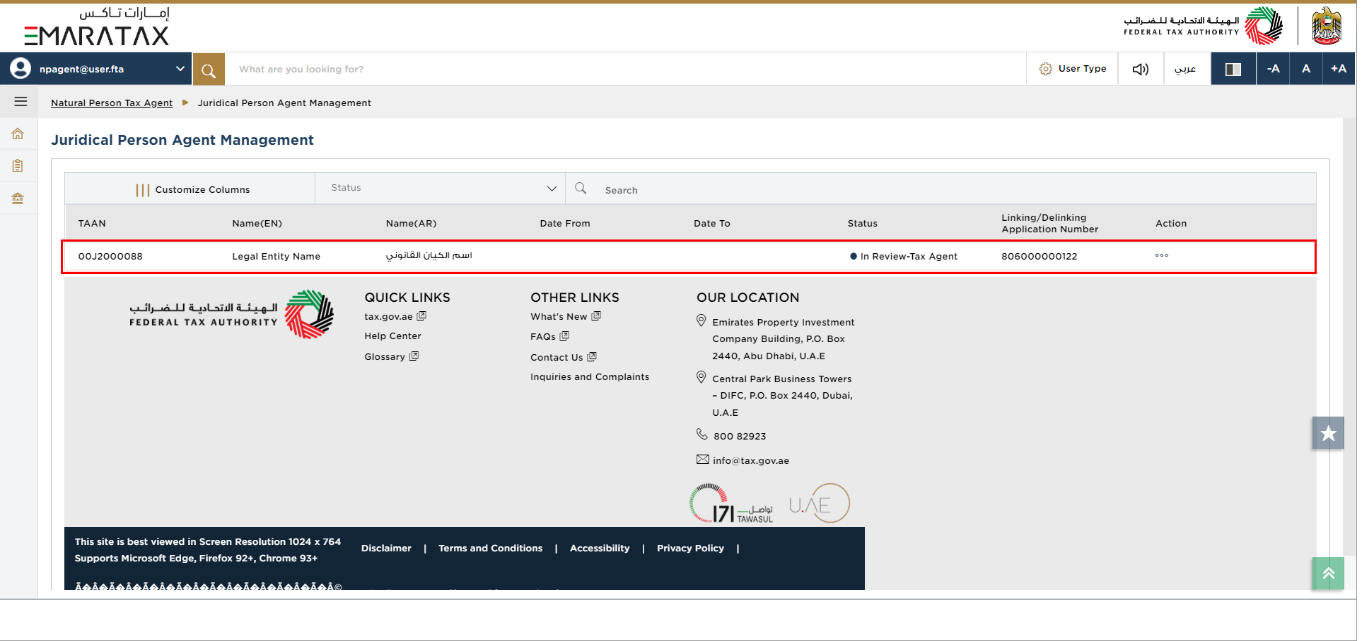

Juridical Person Tax Agent linking requests are displayed here. |

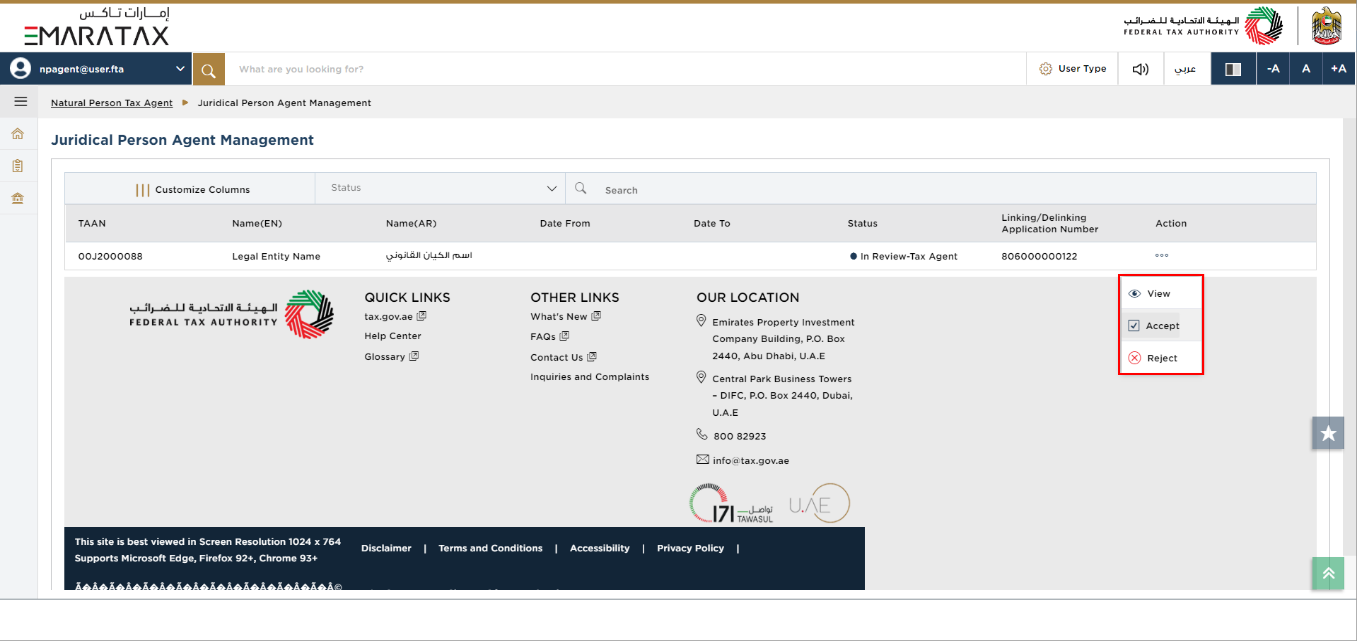

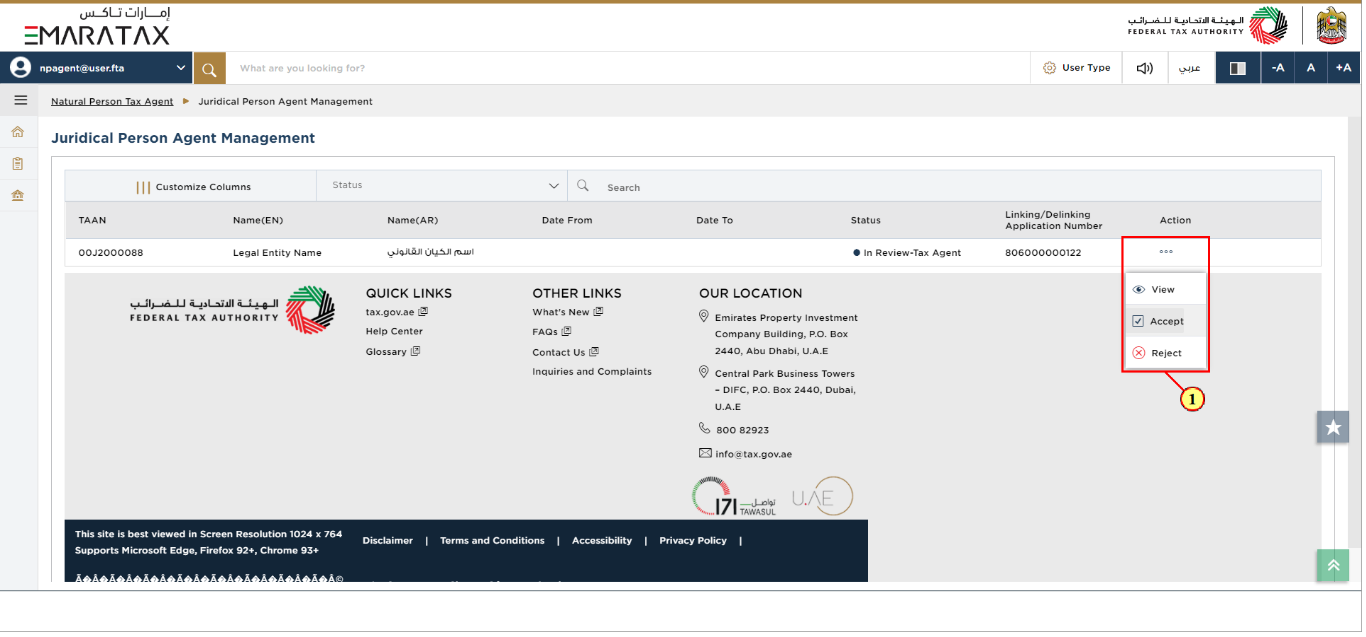

You can perform the following actions: 'View' option is to view the details of the link request. 'Accept' option is to accept the link request. On accepting the request, the link request shall be submitted to the FTA for review and approval. Both the Natural Person Tax Agent and Juridical Person Tax Agent shall receive an email correspondence. 'Reject' option is to reject the link request. On rejecting the request, both the Natural Person Tax Agent and Juridical Person Tax Agent shall receive an email correspondence. If the Natural Person Tax Agent does not take any action on the link request within 5 days of receiving the request, the request shall be auto cancelled. Reminder email notifications shall be sent to the Natural Person Tax Agent before auto cancellation. |

Step | Action |

(1) | Click on '...' and select 'Accept' to accept the Juridical Person Tax Agent linking request. |

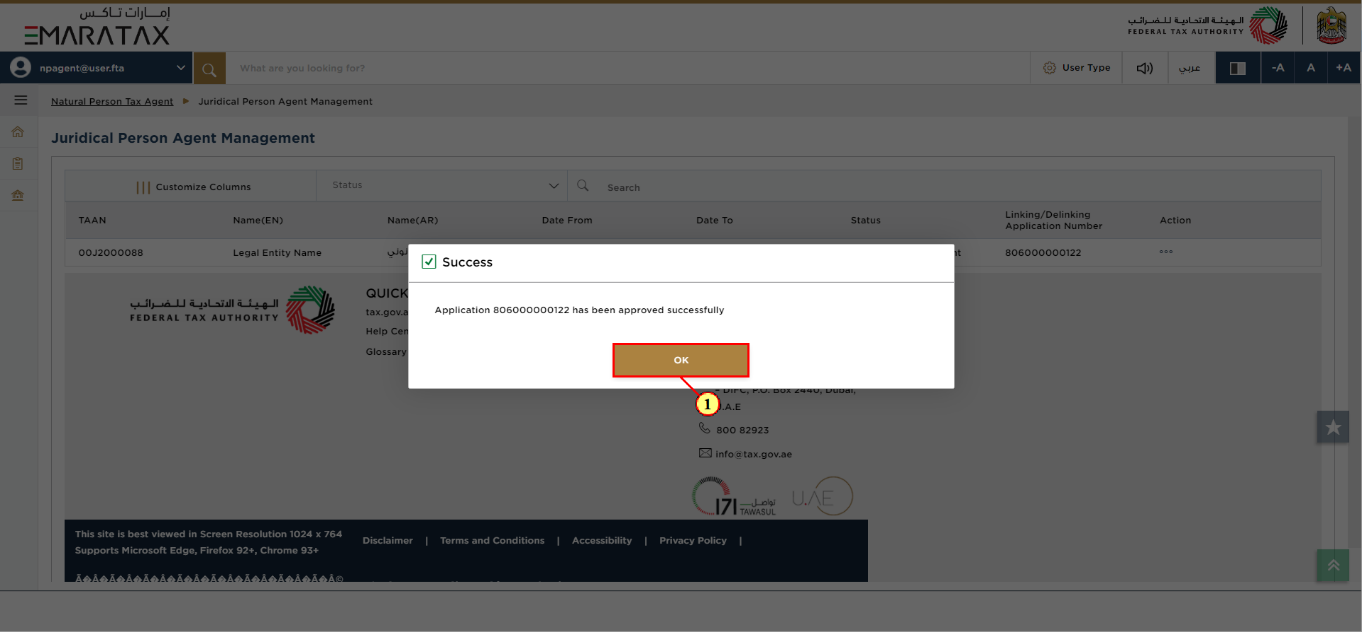

Link request submitted to the FTA

Step | Action |

(1) |

|

You can check the status of the application once the linking request is accepted by the Natural Person Tax Agent. |

Correspondences

Natural Person Tax Agent Receives the following correspondences:

- Request for acceptance of linking request.

- Application approval or rejection notification by the FTA.

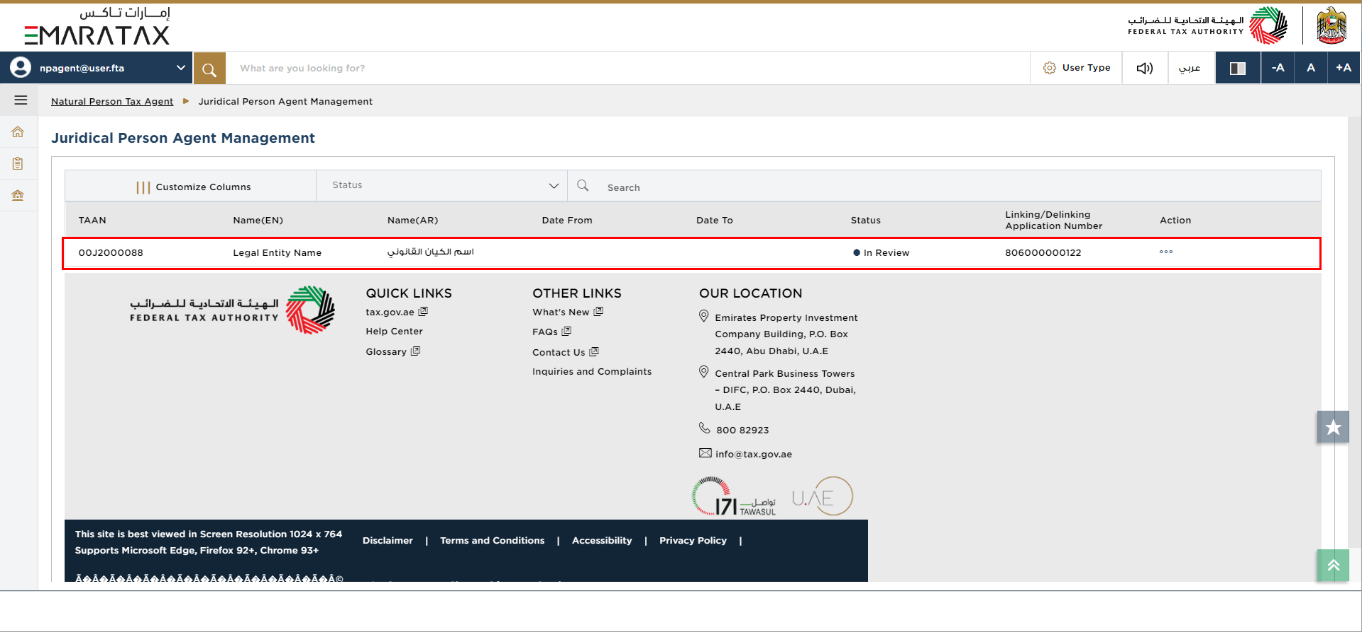

Application History – In-Review

After the Natural Person Tax Agent approves the Linking request, the application will move to the FTA for review and the status of your application will be 'In-Review'.

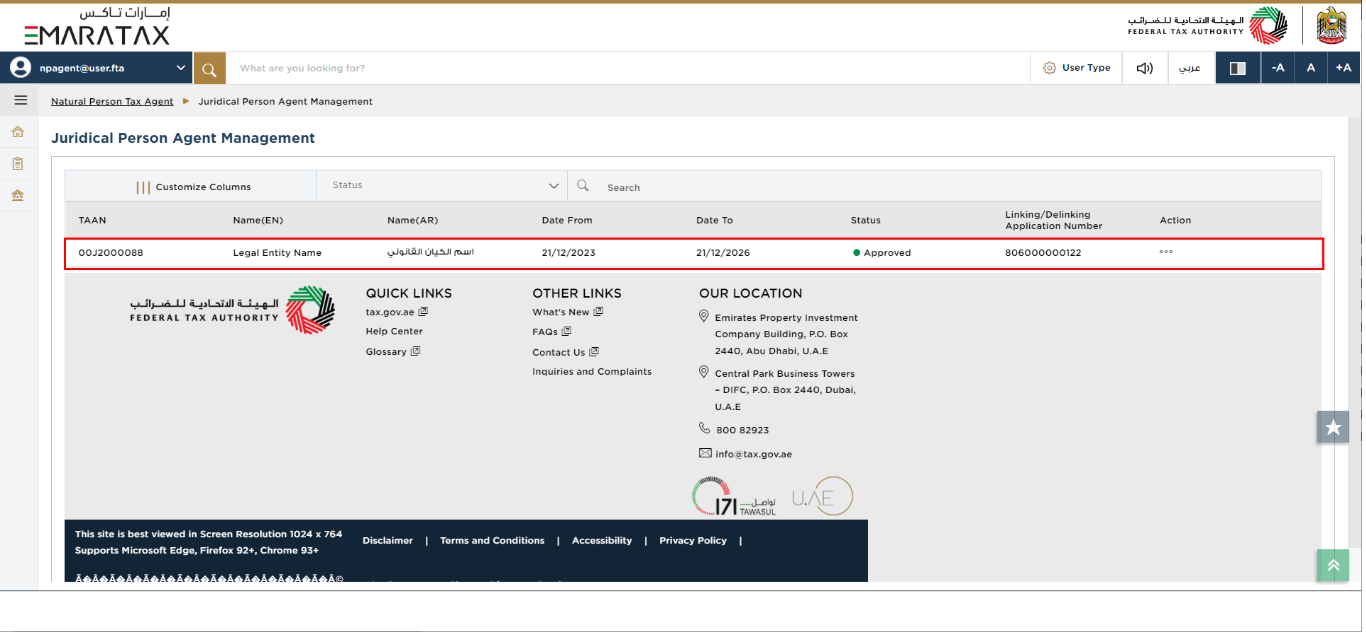

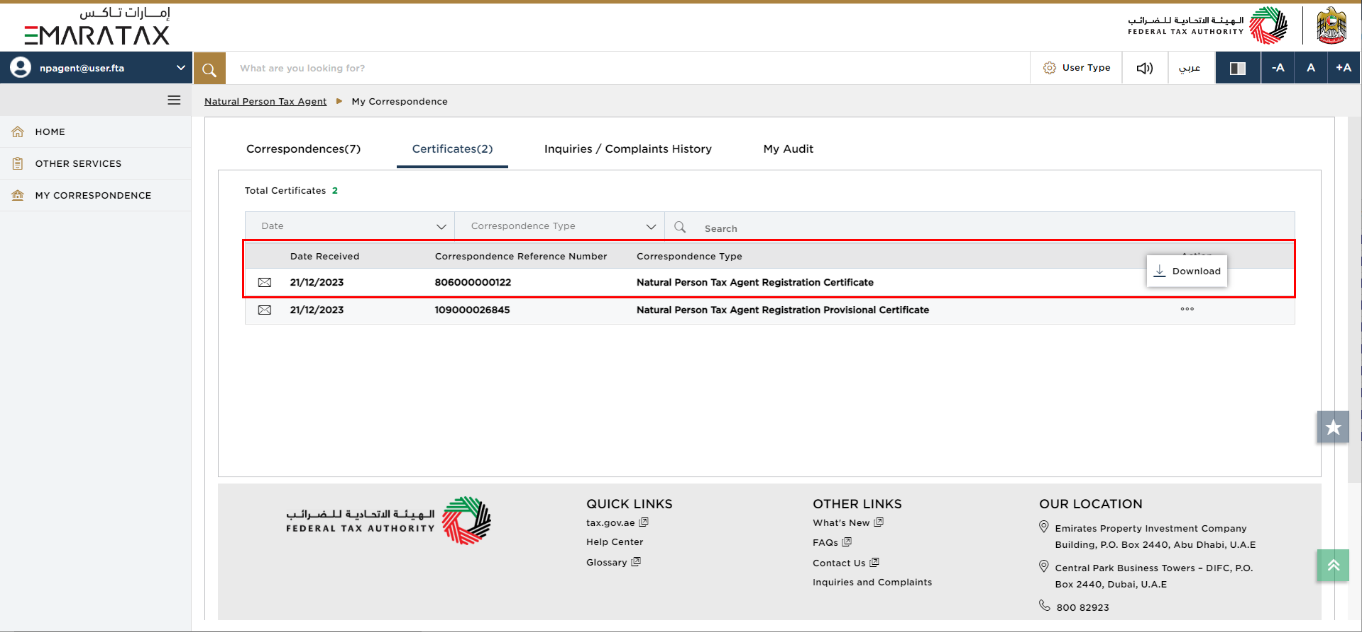

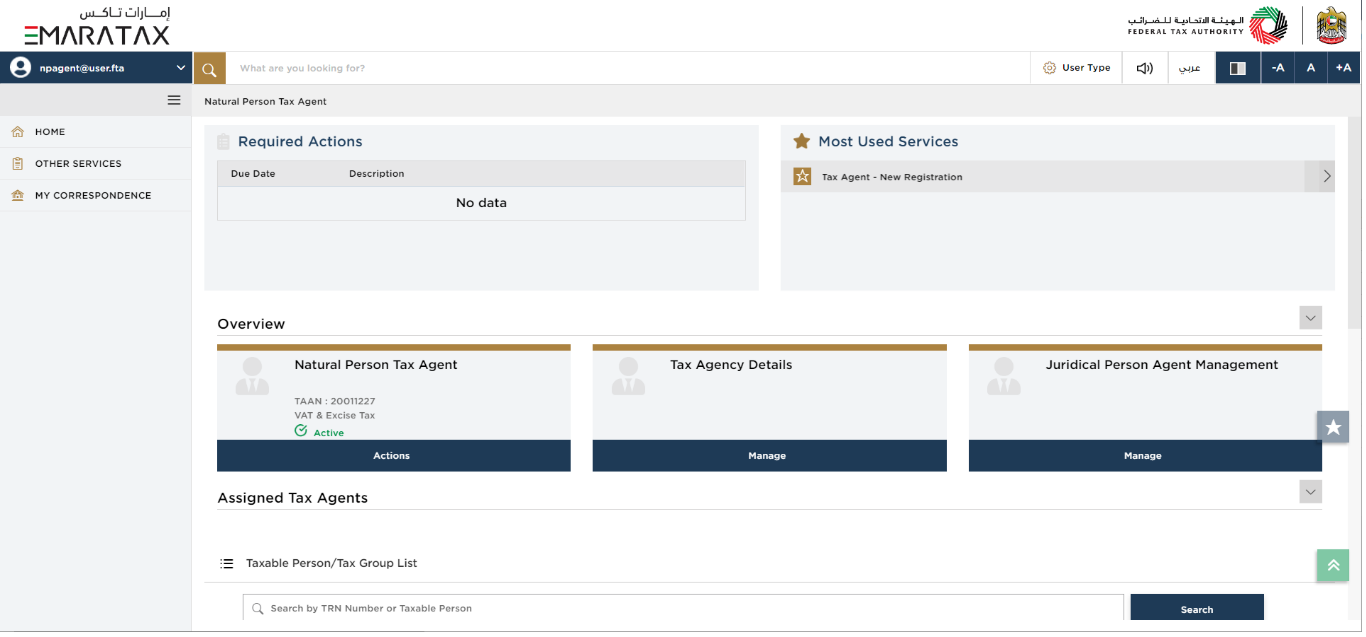

Application History – Approved

Once the FTA approves your application, the linking process is complete between the Juridical Person Tax Agent and Natural Person Tax Agent, and Registration Certificates are issued by the FTA to Juridical Person Tax Agent and Natural person Tax Agent.

You can check the status of the link request application once the link request is approved by the FTA. |

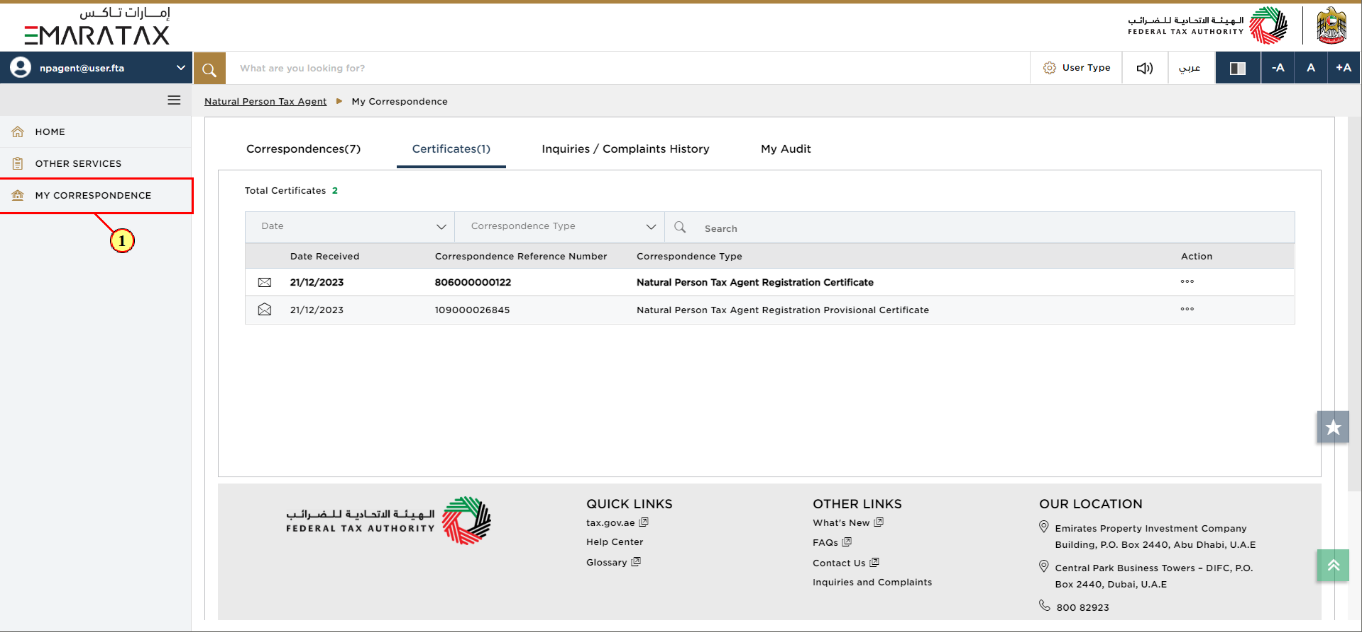

Step | Action |

(1) | Click on 'MY CORRESPONDENCE'. |

You can access and download your Natural Person Tax Agent Registration Certificate from the Certificates tab. |

After approval of the link request by the FTA, the Natural Person Tax Agent tile will have the status 'Active'. |