Link Juridical Person Tax Agent to Taxable Person - 25 June 2024

Tax Agent User Manual

CT - Link Juridical Person Tax Agent to Taxable Person

Date: 25 June, 2024

Version 1.2.0.0

Contents

1. Navigating through EmaraTax

2. Introduction

3. Login to EmaraTax as Juridical Person Tax Agent

5. Link Juridical Person Tax Agent to Taxable Person

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process

Button | Description |

In the Portal | |

| This is used to toggle between various personas within the user profile such as Taxable Person, Tax Agent, Tax Agency, Legal Representative etc |

| This is used to enable the Text to Speech feature of the portal |

| This is used to toggle between the English and Arabic versions of the portal |

| This is used to decrease, reset, and increase the screen resolution of the user interface of the portal |

| This is used to manage the user profile details such as the Name, Registered Email Address, Registered Mobile Number, and Password |

| This is used to log off from the portal |

In the Business Process application | |

| This is used to go the Previous section of the Input Form |

| This is used to go the Next section of the Input Form |

| This is used to save the application as draft, so that it can be completed later |

| This menu on the top gives an overview of the various sections within the form. All the sections need to be completed in order to submit the application for review. The current section is highlighted in Blue and the completed sections are highlighted in green with a check |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for taxpayers to benefit from these services in the best and simplest ways.

Introduction

This manual is prepared to help a registered or non-registered Tax Agent to navigate through the Federal Tax Authority EmaraTax portal to appoint a Juridical Person Tax Agent for managing his/her Taxpayer account. The Taxpayer can select the required access privileges to be granted to the Juridical Person Tax Agent and submit the Juridical Person Tax Agent linking request application. The Juridical Person Tax Agent can accept or reject the linking request. On accepting the Tax Agent request, the Juridical Person Tax Agent shall be linked to the Taxable Person.

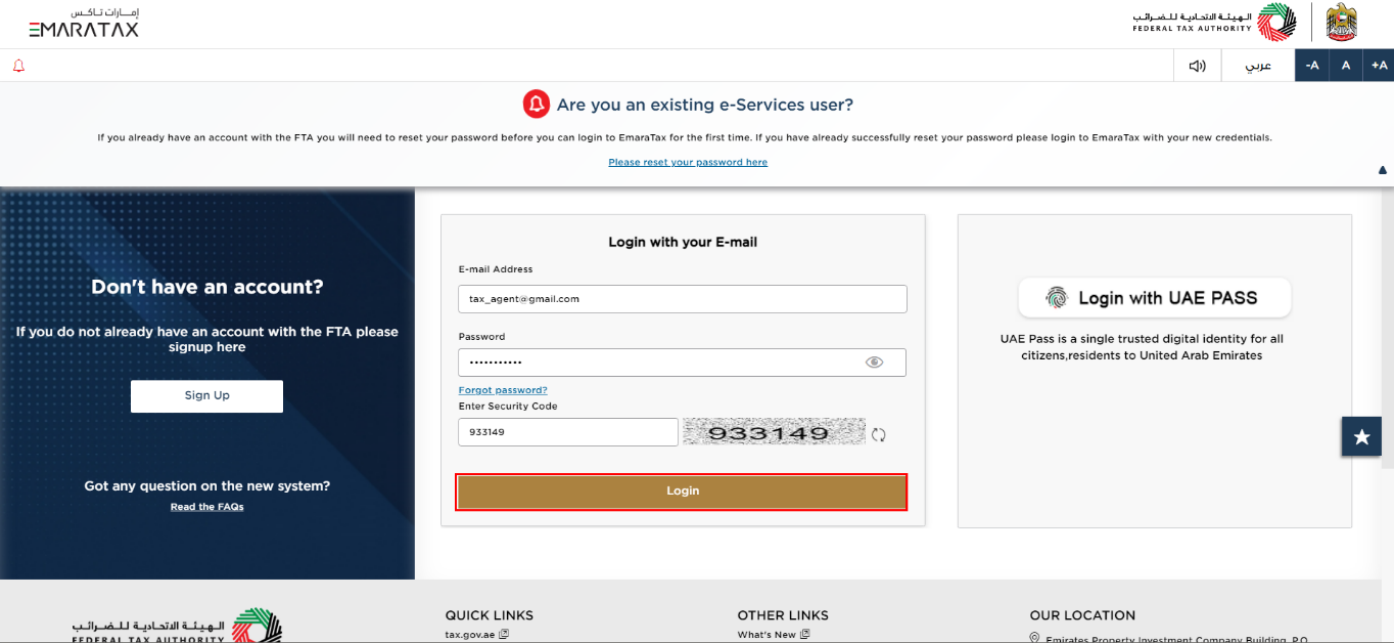

Login to EmaraTax as Juridical Person Tax Agent

| You can login into the EmaraTax account using your login credentials or using UAE Pass. If you do not have an EmaraTax account, you can sign-up for an account by clicking the ‘Sign Up’ button. If you have forgotten your password, you can use the 'Forgot password?' feature to reset your password. |

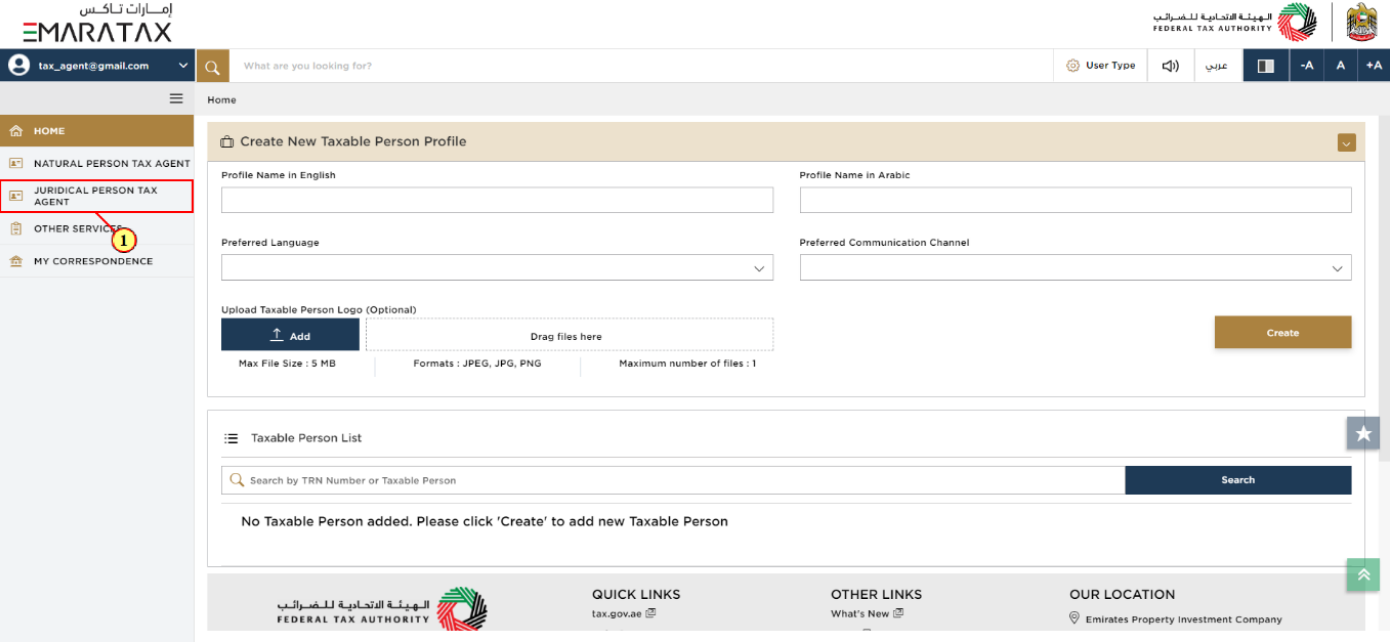

Taxable Person Dashboard

Step | Action |

(1) | Click on ‘JURIDICAL PERSON TAX AGENT’. |

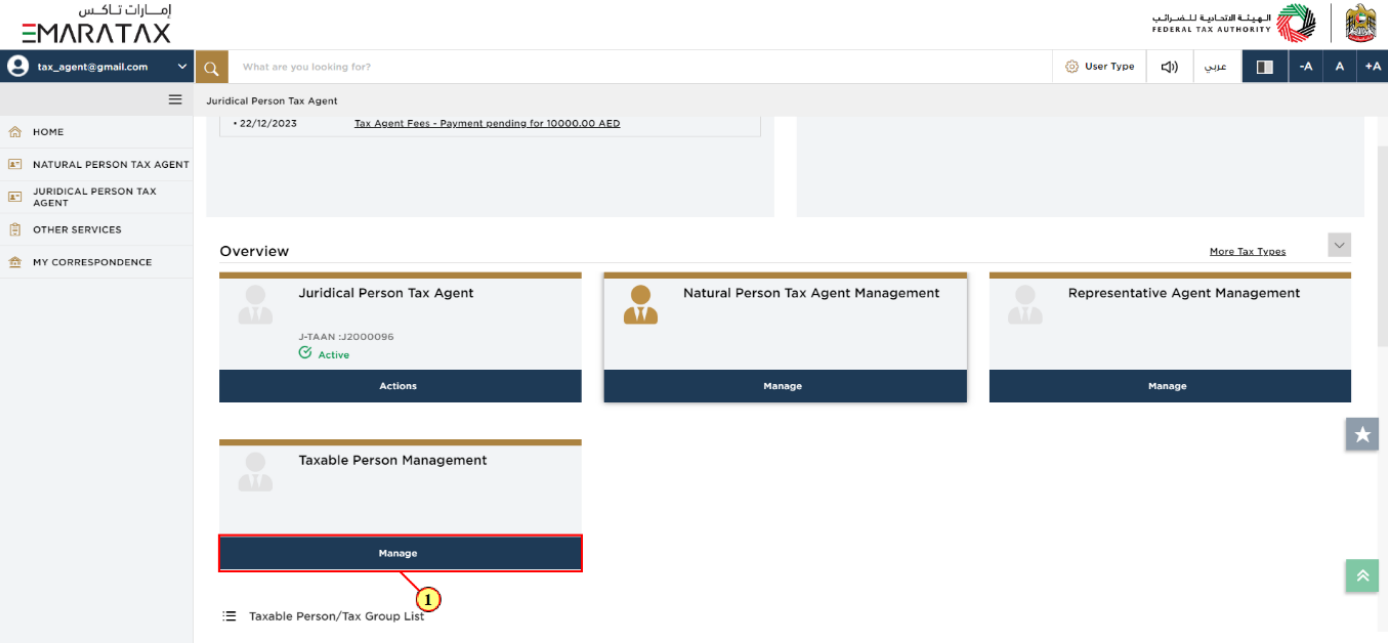

Link Juridical Person Tax Agent to Taxable Person

Step | Action |

(1) | Click ‘Manage’ on the Taxable Person Management tile. |

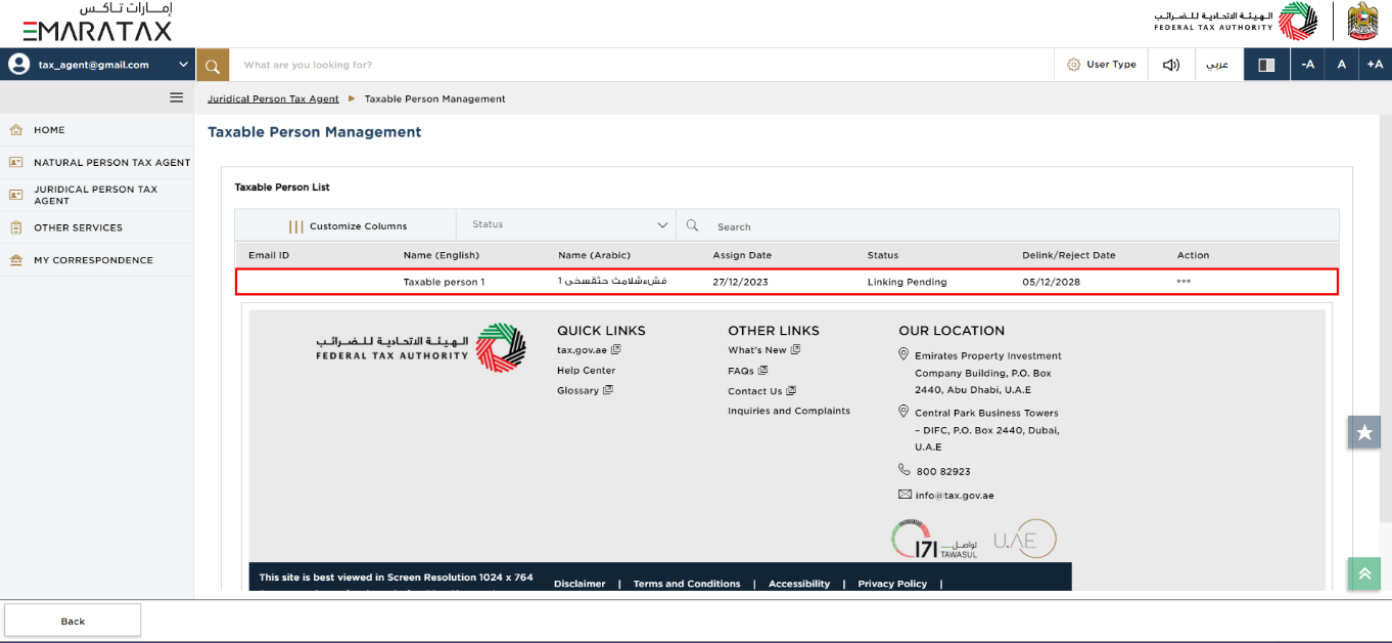

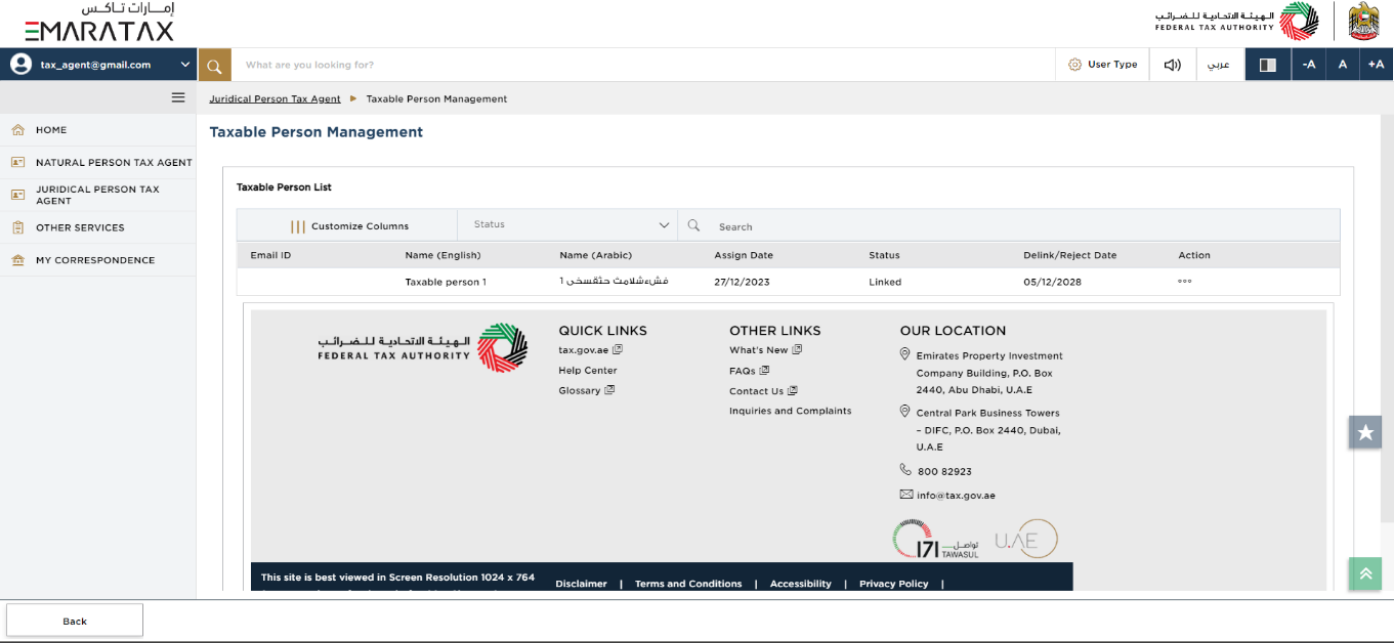

Taxable Person Management Dashboard

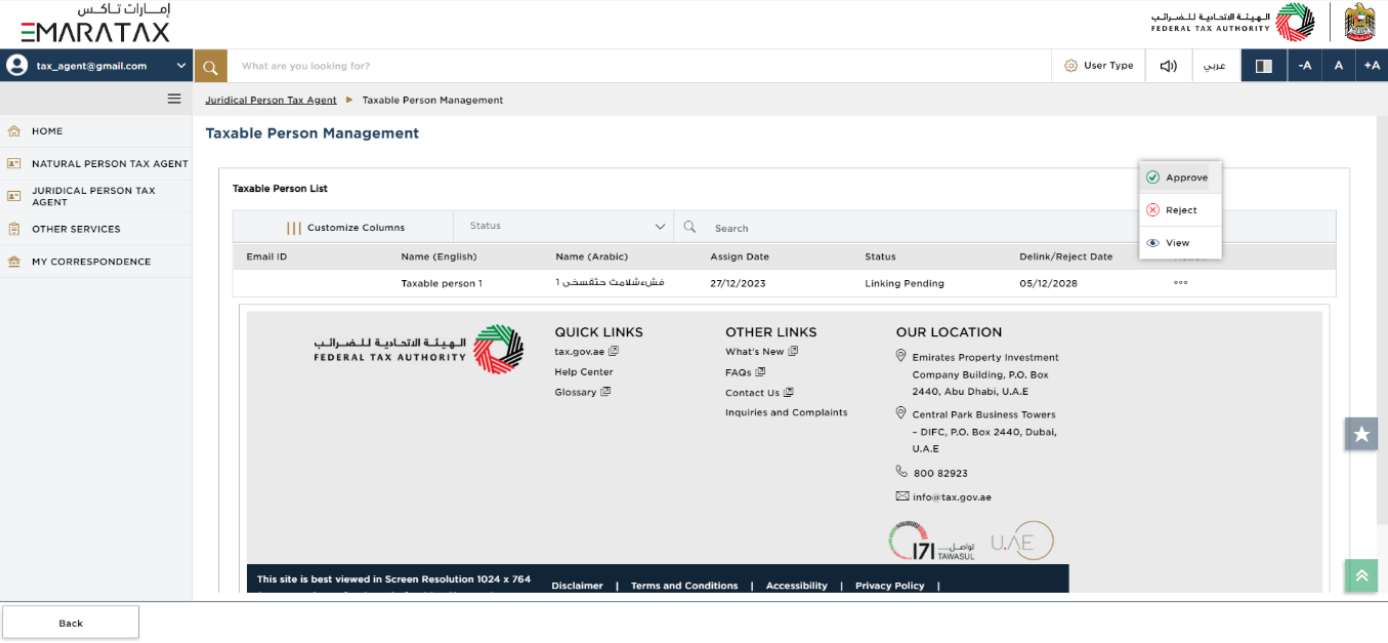

| taxable person linking requests are displayed here. |

| You can perform the following actions: ‘View’ option is to view the details of the link request. ‘Approve’ option is to approve the link request. On approving the request, the linking is complete between the Juridical Person Tax Agent and the Taxable Person. Taxable Person shall receive an email correspondence. ‘Reject’ option is to reject the link request. On rejecting the request, Taxable Person shall receive an email correspondence. |

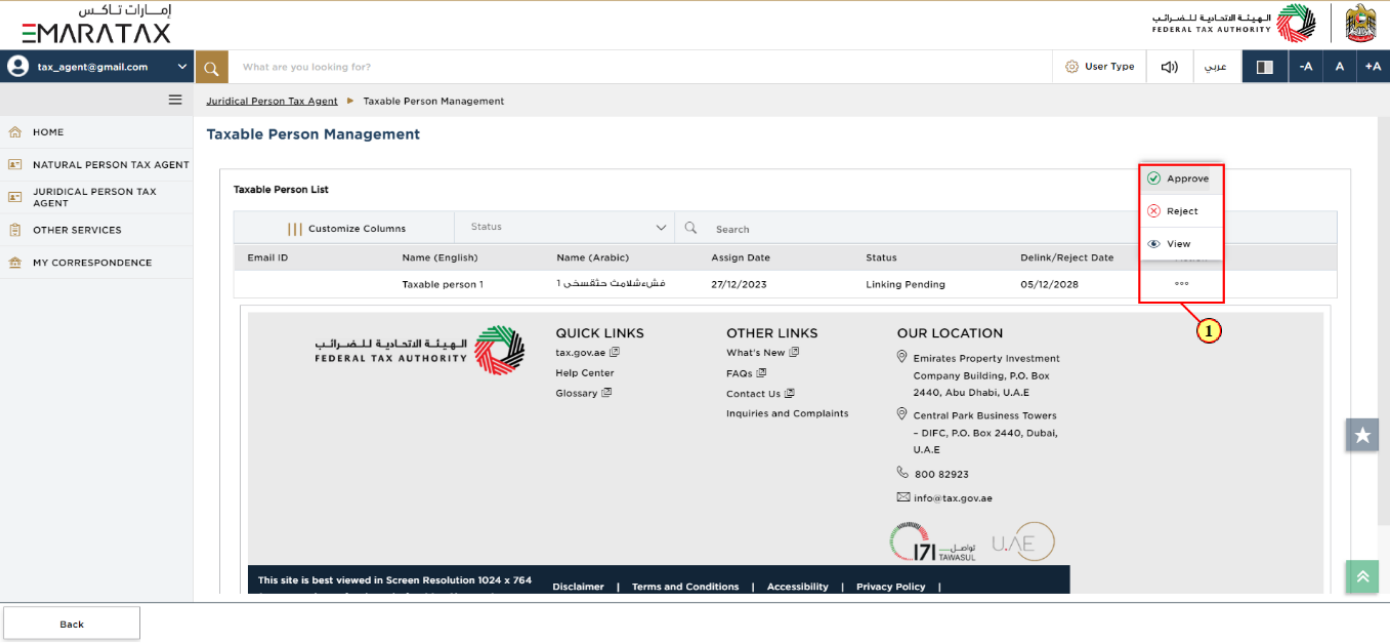

Step | Action |

(1) | Click on '...' and select ‘Approve’ to approve the linking request from the Taxable Person. |

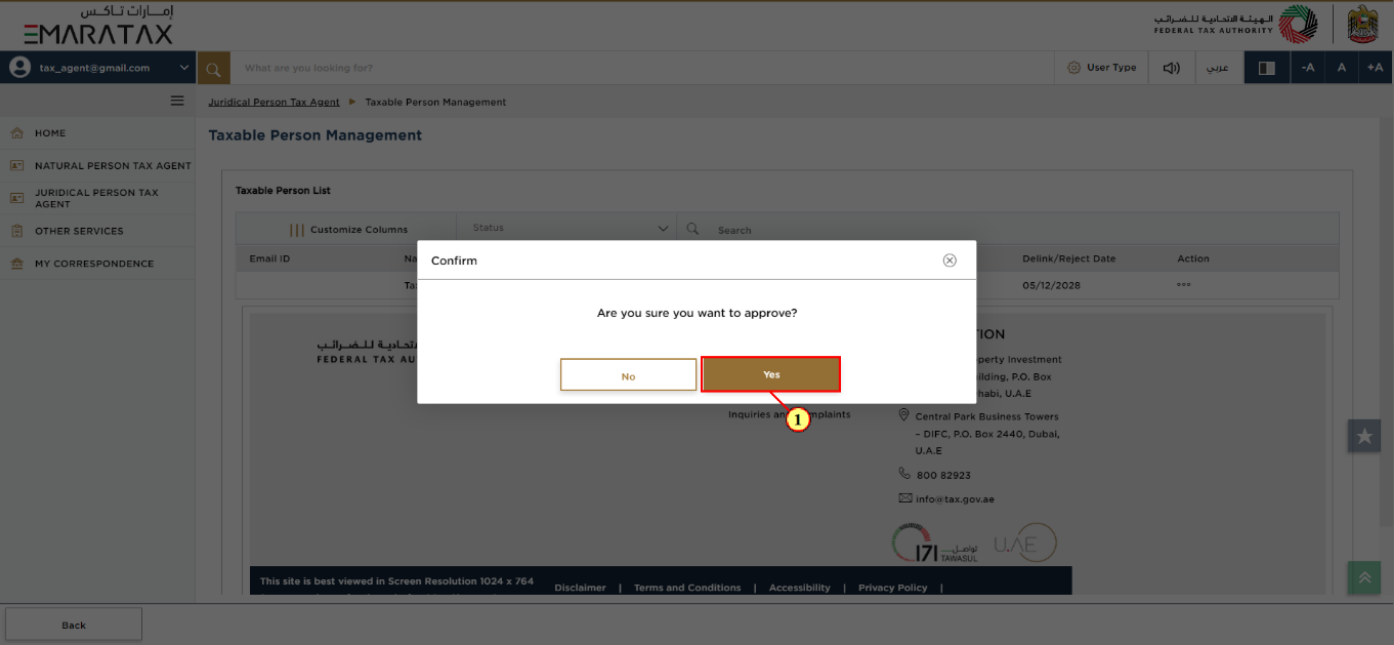

Step | Action |

(1) | Click ‘Yes’ to continue. |

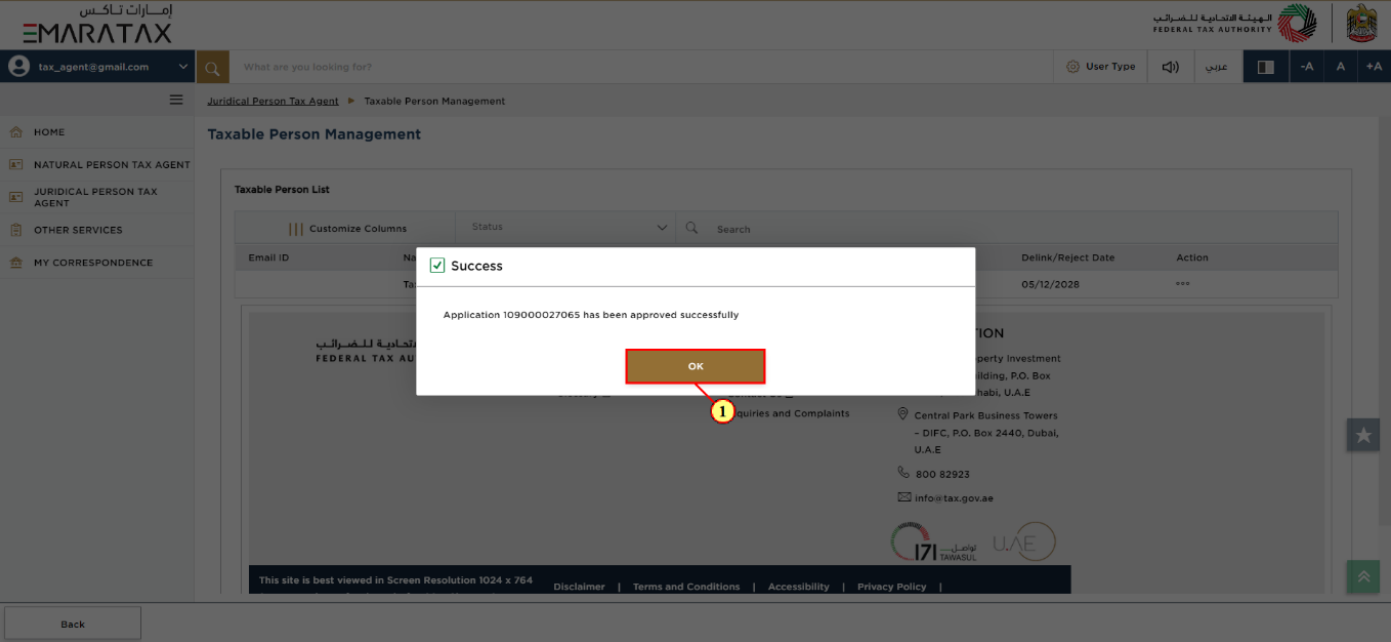

Step | Action |

(1) |

|

Correspondences

Juridical Person Tax Agent receives the following correspondences:

Linking application by Taxable Person – acknowledgement.

Reminder to take action on pending linking request.

Application Status – Linked

| You can check the status of the link request application here once the link request is approved. |