Simplified Guide

The Decision to Reclassify the Value-Added Tax Field Violations

Zakat, Tax and Customs Authority

November 30, 2022

Contents

2. What Is Not Covered by the Decision?

3. Classification of Violations According to the New Decision

4. Illustrative Examples of the Decision to Reclassify VAT Violations

First: Violation of non-compliance to issue a tax invoice

Second: Violation of not issuing and keeping invoices and notes electronically

Third: Violation of not keeping invoices, records and accounting documents

Fifth: Violation of incorrectly calculating the due tax

Seventh: Violation of deleting invoices or electronic notes

Eighth: Violation of not including the QR code in the e-invoice

The Zakat, Tax and Customs Authority ("ZATCA", "Authority“) has issued this Guide for the purpose of clarifying certain tax treatments concerning the implementation of the statutory provisions in force as of the Guide's issue date. The content of this Guide shall not be considered as an amendment to any of the provisions of the Laws and Regulations applicable in the Kingdom.

Furthermore, the Authority would like to highlight that the clarifications and indicative tax treatments prescribed in this Guide, where applicable, shall be implemented by the Authority in light of the relevant statutory texts. Where any clarification, interpretation or content provided in this Guide is modified - in relation to unchanged statutory text - the updated indicative tax treatment shall then be applicable prospectively, in respect of transactions made after the publication date of the updated version of the Guide on the Authority's website.

Highlights of the Decision

Reclassification of violations and determining penalties, to begin with first alerting and educating the taxpayer before imposing a fine.

Granting the violator an appropriate time period of up to three months from the date of inflicting the penalty to correct the violation, except for the violation of preventing or impeding the Authority's employees from performing their duties and tasks, which will be inflicted consecutively in the event of a repetition by the violator.

Twelve months is the cut-off limit for a non-recurring violation by the violating taxpayer, provided that the violation is treated and not committed again within the twelve months.

This decision will take effect from January 30, 2022.

What Is Not Covered by the Decision?

This decision does not include non-field violations committed by the owner as a result of non-compliance with their duties and obligations, and this includes:

Tax evasion.

Failure to file declarations.

Delayed filing of returns.

Failure to pay tax dues.

Late payment of tax dues.

Manipulation of tax returns.

This decision does not include violations that occurred before January 30, 2022.

Classification of Violations According to the New Decision

All field violations when they are committed begin by alerting the taxpayer to the violation and making them aware of it and giving them an appropriate time period of up to three months to address it, except for the violation related to preventing or obstructing the Authority's employees from performing their duties and tasks, which will be inflicted consecutively in the event of a repetition by the violator.

| VAT Violation | Any Violation After | Violation for the First Time | Violation for the Second Time | Violation for the Third Time | Violation for the Fourth Time |

|---|---|---|---|---|---|

Failure to issue a tax invoice. | Notice | 1,000 SAR | 5,000 SAR | 10,000 SAR | 40,000 SAR |

Failure to include all elements of the tax invoice in tax invoices or credit and debit notes. | |||||

Failure to keep invoices, records and accounting documents for the duration of the preservation period specified in the regulation. | |||||

Failure to issue credit or debit notes or not to provide them to the customer. | |||||

Preventing or hindering the Authority's employees from performing their job duties and tasks. | |||||

Incorrectly calculating tax due. | |||||

Violation of any other provision of the value-added tax law or regulation. |

| E-Invoice Violations | |||||

|---|---|---|---|---|---|

Not issuing and saving invoices and notes electronically. | Notice | 1,000 SAR | 5,000 SAR | 10,000 SAR | 40,000 SAR |

Non-compliance with keeping e-invoices and electronic notes according to the format stipulated in the system. | |||||

Failure to inform the Authority of any malfunctions that hinder the process of issuing invoices and electronic notes. | |||||

Not including the QR code in the e-invoice. | |||||

Including any of the prohibited functions in the e-invoicing system used to issue and save invoices electronically. | |||||

Deleting invoices or electronic notes, or adjusting them after issuance. | |||||

Violation of any other provision of the value-added tax law or regulation. | |||||

12 months is the cut-off limit for a non-recurring violation by the violating taxpayer If the violation were repeated after 12 months of discovering it, it's considered a new violation and begins with an alert without a penalty.

Illustrative Examples of the Decision to Reclassify VAT Violations

First: Violation of non-compliance to issue a tax invoiceExample:

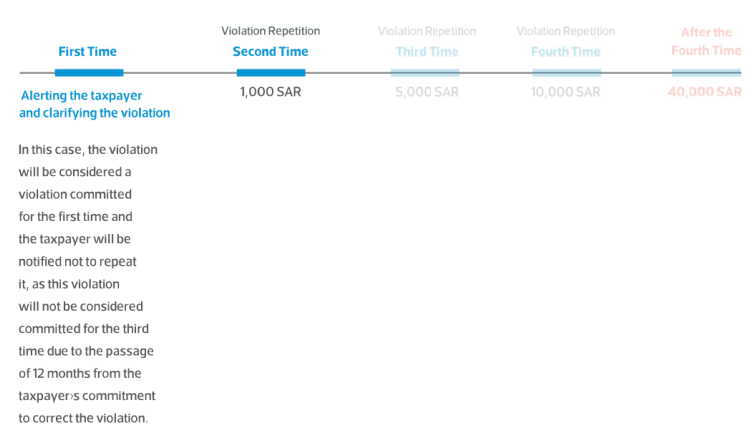

Mohammed is the owner of a facility subject to value-added tax, and when issuing invoices to consumers, he does not issue invoices according to the basic tax elements of the invoice, and upon a field visit of the Authority's inspectors, this violation was discovered, which is a violation committed for the first time.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

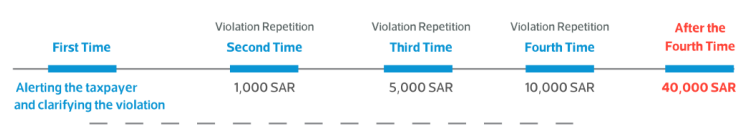

It was discovered that the owner of a laundry does not have an e-invoicing system through which invoices are issued electronically, and he was alerted the first time that he had committed this violation, and after 3 months after he was notified of this violation, he was visited in the field again and it became clear that the violation persisted and that it was not addressed by the owner of the facility.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

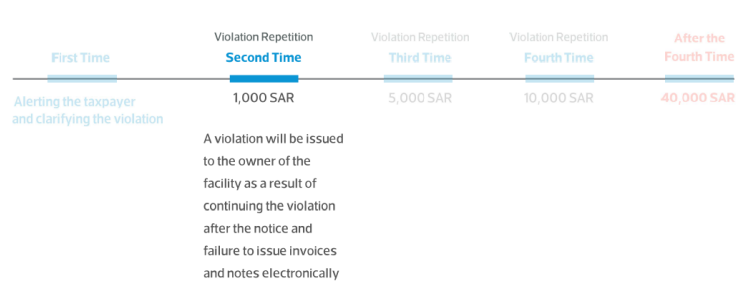

Khaled is the owner of a coffee shop, and he is committed to issuing invoices in a correct and orderly manner, but sometimes he does not save the invoices and documents that he issues, as some of those invoices have been damaged in some of their parts, and he was alerted the first time about these violations, and after 3 months, he didn't resolve the violation. A violation was issued and a fine of 1,000 riyals was imposed. On the third field visit, it was discovered that the violation had not been addressed.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

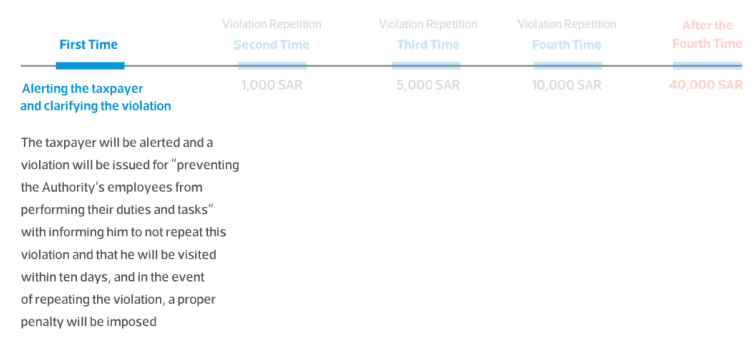

The owner of a restaurant was visited by an official employee of the Authority who presented his official card, and the owner of the restaurant was asked about his registration documents with the Authority. The owner was not collaborating and didn't provide the required documents claiming that the employee wasn't from the Authority. This is the first time he committed this violation.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

It was found that a facility owner repeatedly violated the calculation of the tax incorrectly by reducing the amount of tax due, for the fourth time and without the passage of 12 months since the previous (third) violation.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

Sarah has a clothing store and has issued her invoices electronically since December 4, 2021, but her e-invoiced system was broken and she started using handwritten invoices, and when she was visited by the Authority's employee, it became clear that she had issued invoices by hand without informing the Authority of the failure that occurred to her, knowing that this violation was committed by Sarah for the first time.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

Abdullah owns a car workshop, and mistakenly issued an e-invoice with a product value of 1,500 riyals, to a customer whose real account is 150 riyals. Then he wanted to amend that error, so he deleted the e-invoice without amending it according to the regular procedures by issuing a creditor to the customer with the difference in the incorrect value. Note that this mistake was previously repeated by Abdullah, and he was alerted during 5 field visits, and 12 months did not pass between any violation and the next violation, noting that if 12 months had passed between this violation and the last previous violation, this violation would have been considered a violation for the time The first and therefore only a notice would have been issued to the violator.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

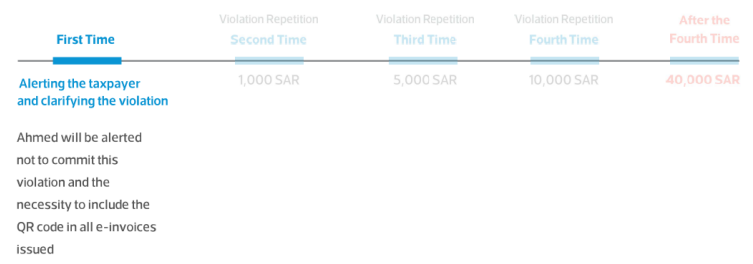

Ahmed has a restaurant, and he issues his simplified tax invoices electronically, but some of these invoices do not include a QR code, and he was visited in the field and the violation was discovered, knowing that it is the first time that this violation has been committed.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

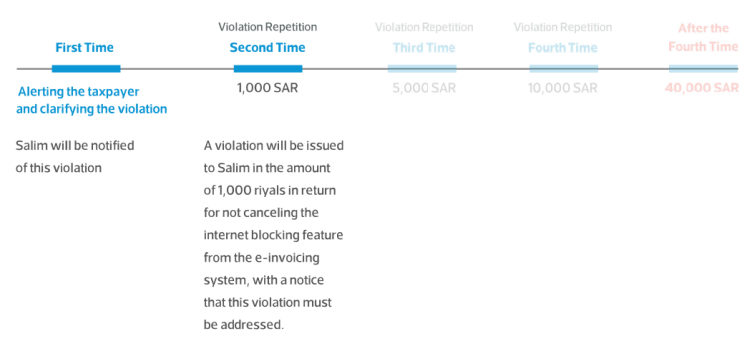

Salim is the owner of a furniture store and has an e-invoicing system, and he issues and saves his invoices electronically. In one of the field visits, the billing system used by him was reviewed and it was found that the system blocks the connection to the internet, and Salim was alerted of this violation, but he was on the second field visit after 4 months It turns out that the Internet blocking feature has not been canceled.

Illustrative Examples of the Decision to Reclassify VAT Violations

Example:

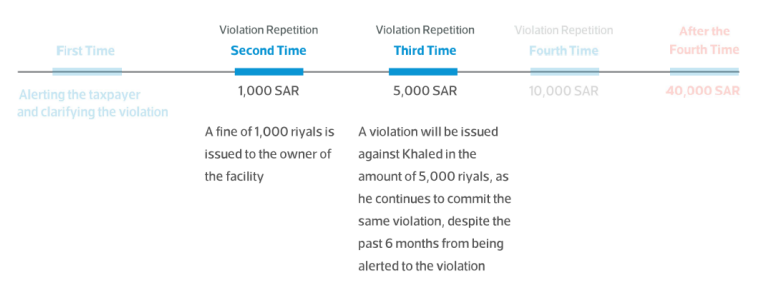

Abdullah, the owner of a restaurant, was issued a violation, and he was notified of that violation for the first time without being fined. Four months later, he was visited again and the repetition of the same violation was discovered, so he was fined one thousand riyals, and on the third visit it was found that the same violation had been addressed.