Taxation of Software Payments in the context of domestic Income Tax Law

Version 1

January 2024

Contents

3. The different types of transactions which could initiate software-related payments

3.3.1 Payments for the alienation/transfer of the full ownership of the copyright on the software

3.3.9 Mixed contracts (e.g., provision of goods and sources)

4. Appendix: Overview of all transactions covered in this Guideline and their classification

The Zakat, Tax and Customs Authority ("ZATCA, "Authority) has issued this Tax Guideline for the purpose of clarifying certain tax treatments concerning the implementation of the statutory provisions in force as of the Guideline's issue date. The content of this Guideline shall not be considered as an amendment to any of the provisions of the Laws and Regulations applicable in the Kingdom.

Furthermore, the Authority would like to highlight that the clarifications and indicative tax treatments prescribed in this Guideline, where applicable, shall be implemented by the Authority in light of the relevant statutory texts. Where any clarification, interpretation or content provided in this Guideline is modified - in relation to unchanged statutory text - the updated indicative tax treatment shall then be applicable prospectively, in respect of transactions made after the publication date of the updated version of the Guideline on the Authority's website.

1. Introduction

1.1This Guideline provides information and guidance about the tax treatment of different software payments resulting from transactions taking place between non-residents and residents in the Kingdom of Saudi Arabia or between non-residents and a Permanent Establishment ('PE') in the Kingdom of Saudi Arabia ('KSA' or 'the Kingdom').

1.2This Guideline is based on the Income Tax Law in KSA (the 'Law') and its regulations (the 'Regulations') and does not address the practice applicable in the context of Double Taxation Agreements ('DTA'). The applicable tax treatment in the context of DTAs shall be assessed on a case-by-case basis based on the terms of the relevant DTA.

1.3Non-residents in the context of this Guideline refer to persons considered tax resident in a country other than the Kingdom, regardless of whether that country has in place a DTA with KSA.

1.4This Guideline is based on the Income Tax Law issued by Royal Decree No. (M/1) dated 15/1/1425 H, and amendments related this Law and its Regulations issued by the Ministerial Decision No. (1535) dated 11/6/1425 H, and amendments related to the Regulations.

2. Situational context

2.1This Guideline provides guidance in the context of cross border transactions where a resident of the Kingdom or a PE of a non-resident is making payments in relation to software products or access to database to a KSA non-resident company.

2.2The categorization of software and database related payments is widely recognized as a complex matter that requires analysis of the underlying rights transferred to the purchaser in order to determine the appropriate tax treatment. The digitalization of the economy has further exacerbated the challenges faced by taxpayers in that respect with a surge in the number of cross border transactions related to such products.

2.3The Law and its Regulations do not precisely address the circumstances in which software-related payments are taxed differently. ZATCA recognizes the importance of providing further guidance for the most common types of transactions arising in the Kingdom.

2.4This Guideline aims at defining the characteristics associated with a non-exhaustive selection of software related payment types and provide clarity on the tax treatment applicable in the Kingdom under the domestic Law.

2.4.1. General overview on software payments

2.4.1.1Software is currently not defined within the Law in KSA, and the definition included in the Commentary on Article 12 of the OECD Model Tax Convention ("MTC") [1]- largely resembles the definition under the UN Model tax Convention - is generally the definition accepted by ZATCA where software is defined as:

"a program, or series of programs, containing instructions for a computer required, either for the operational processes of the computer itself (operational software) or for the accomplishment of other tasks (application software)."

2.4.1.2The term "computer software" is commonly used to describe the program in which the intellectual property rights (copyright) subsist and the medium on which it is embodied.

2.4.1.3The term "Copyright" is defined as "a collection of moral and material interests which are vested in a person's work", It can include a Computer program which is considered a "protected work" under the copyright law applicable in the kingdom [2].

2.4.1.4In general, software can be transferred through a variety of media (in writing on a hard disk or electronically through the cloud, or via any data storage instrument or through subscriptions) and may be standardized with a wide range of applications or be tailor-made for single users. It can be transferred as an integral part of computer hardware or in an independent form available for use on a variety of hardware.

2.4.1.5Payments made for the transfer of rights in relation to computer software or database access may occur as one-off lump sum payment or through a series of payments made on a regular basis (e.g., monthly or annually).

2.4.1.6However, the categorization of payments is primarily impacted by the rights granted to the purchaser upon transfer. While the medium used and the payment method (lump sum or series of payments) is not generally a determining factor, the limitations and exclusivity associated to the rights have to be assessed carefully in order to conclude on the appropriate categorization and corresponding tax treatment.

2.4.1.7The rights transferrable under software or database access related transactions generally entail the following:

alienation of the complete rights in the copyright of a program (or in a copy of the program - i.e., a copyrighted article),

sale of a product subject to restriction on use which generally entails partial rights to the copyright or the program copy (i.e., use, customization, exploitation, distribution/resale of the copyright or a copyrighted article),

provision of support or development services attached to the software such as maintenance, training, update and up-grades.

2.4.1.8Contractually, the transfer of rights in a software often realized through but not limited to the following arrangements:

a licensing agreement where the full copyright generally remains the property of the manufacturer or developer and the purpose is generally for the end user to benefit from the software (for personal or business purposes) but not to resale to the benefit of others. Two type of licensing agreements exist:

for limited right to use, also known as 'shrink-wrap license'; or selling a ready-made computer software also known as 'off-the-shelves software' or 'commercial software'; or

for extended right to use and modify, which is opposite to the off- the-shelves software and generally referred to as 'custom-made software' or 'bespoke software' where the end-user is being granted rights to perform modifications to the software to fit its own purpose.

For the purpose of this Guideline, the term 'modify' means specifically any degree of modification or customization.

a distribution agreement where the owner of the copyright in the software grants limited exploitation/distribution rights to a distributor which in turn sells the software to end-users. Under such agreement, the distributors are only granted distribution rights with no rights to modify or use the software.

a subscription agreement whereby the developer or owner of the copyright grants access to an end-user to a database with varying content (publicly available or private and confidential studies for specific purposes);

a service agreement in situations where:

the end-user is being provided support for the development of a computer software and is granted full copyright ownership upon completion; or

the end-user is being provided technical support to understand the functions of the software or receive updates and upgrades on a regular basis. These maintenance and technical support services are either bundled in the underlying software sale/license agreement or provided separately.

2.4.1.9Based on the contractual arrangement and the nature of the underlying rights being transferred, such payments can be categorized into five different types directly impacting their tax treatment. Such categories are addressed below.

2.4.1.10The position of ZATCA in relation to the categorization of different payment types is addressed in the subsequent section of this Guideline and is generally aligned with the interpretation internationally recognized.

2.4.2. Royalties under the Law

The term "Royalties" is defined in the Law as "Payments received for the use of or the right to use intellectual rights including but not limited to, copyrights, patents, designs, industrial secrets, trademarks and trade names, know - how, trade and business secret, goodwill, and payments received against the use of information related to industrial, commercial, or scientific expertise, or against granting the right to exploit natural and mineral resources".

The method of paying royalties is not taken into account in determining its definition, as the definition is not limited to those that are paid at regular periods, but rather includes royalty payments in an irregular manner, one-time payments, or any other method.

And because royalties is considered one of the provision negotiated upon in the contract, its type and value will be determined on the basis of what is agreed upon by the relevant parties.

2.4.3. OECD and UN interpretation in respect of Royalties

This Guideline provides information and guidance about the tax treatment of different software payments under domestic law. This paragraph covers this position on software qualification under both the OECD and UN model and is included for context and is only relevant for situations where DTA's apply.

2.4.3.1 UN position

There has been a long debate within the UN Committee of Experts on "International Cooperation in Tax Matters ('UN Committee'). One side argued the position that software payments are "payments for use or right to use" and not payments for the sale of property and should therefore be regarded as royalty.

Whilst other committee members argued that payments for the acquisition of copies of software to be used for the personal or business use shall not be considered as payments "for the use or right to use" the software but, rather, as payments for the acquisition of these copies. In that respect, it is argued that these payments should not qualify under the definition of royalty.

In October 2023 the UN Committee drafted a proposal for final approval to add a new provision to Article 12 paragraph 3 of the UN model treaty to include software payment in the royalty definition:

"© received as a consideration for the use of, or the right to use, any software, or paid as a consideration for the acquisition of any copy of software for the purposes of using it."

This new position would only take effect for bilateral treaties that include this new provision.

2.4.3.2. OECD position

The OECD's interpretation in respect of royalties and their interaction with domestic law and tax treaties is clearly detailed in the OECD MTC under the relevant section on royalties (Article 12 of the MTC) and there is a general agreement of all countries member to align with such approach.

The interpretation and examples that illustrate how these principles are applied can be found in more detail in the commentary that accompanies the OECD MTC. The commentary provides in-depth explanations and practical examples to help clarify how the rules should be applied.

However, as a general clarification, the argument proposed by the OECD is principally based on the nature of the right transferred. The OECD is of the view that only payment made for the transfer of exploitation rights to reproduce, distribute, or modify a software should qualify as royalty. The OECD refers to the concept of copyright and copyrighted articles whereby payments for the simple use of copyrighted articles (personal/business use of a software with no right to the intellectual property itself) shall be regarded as business income and not royalty.

The OECD's view on the nature of software payments is as follows:

in the case of the granting of use rights without any other right to alter, modify or exploit the program in any other form (e.g., the transfer of a copyrighted article), article 7 of the OECD Model applies; and

in the case of the granting of exploitation rights (for example, rights to reproduce, distribute or modify the software) that constitute a transfer of the copyright itself, article 12 of the OECD Model is applicable.

2.4.3.3While the guidance provided by the OECD and the UN are generally widely adopted by countries members, it is important to acknowledge the fact that the DTAs model used can be modified based on bilateral agreement between the signatory countries and hence the wording and provisions in each treaty may vary. It is also important to identify the DTA model being used (OECD as opposed to UN) to assess the potential qualification on case-by-case basis.

2.4.3.4We reiterate that the present Guideline aims at clarifying the position followed by ZATCA for the categorization of software-related payments in the Kingdom and does not address the position adopted in DTAs context. Such position may therefore be affected by the relevant provisions of DTA if applicable.

3. The different types of transactions which could initiate software-related payments

3.1In all cases, in order to determine the tax treatment of a software-related payment, ZATCA will review all facts and circumstances associated with such payment. ZATCA may request the taxpayer to provide additional information to assess the qualification of software payments. However, by way of guidance, some examples of payments together with their classification are provided below.

3.2The examples addressed in this Guideline have been selected to represent the most common types of payments but shall not be considered exhaustive and some payment types may not be included.

3.3It should be noted that comments with respect to software payments are intended to cover mainly payments made by corporates as opposed to individuals/natural persons.

3.4The term 'reproduce' includes making additional copies of software in an active or passive manner, directly or indirectly, as well as making copies of software available or causing, in any way, additional copies of the software to become available

3.3.1 Payments for the alienation/transfer of the full ownership of the copyright on the software

In the context of this Guideline, an alienation or transfer of the full ownership of the copyright on a software occurs when a person resident in another jurisdiction, sells all its ownership rights of the copyright on the software to a person that is resident in the Kingdom.

3.3.1.1 Overview of the transaction

Under this transaction, a person resident in the Kingdom is granted the exclusive and full ownership of the copyright on the software in exchange for a payment

to a person resident in another jurisdiction. The buyer in the kingdom acquires the full rights, and is entitled to copy, edit, and sell the software to the public with no restrictions.

3.3.1.2 Practical Example

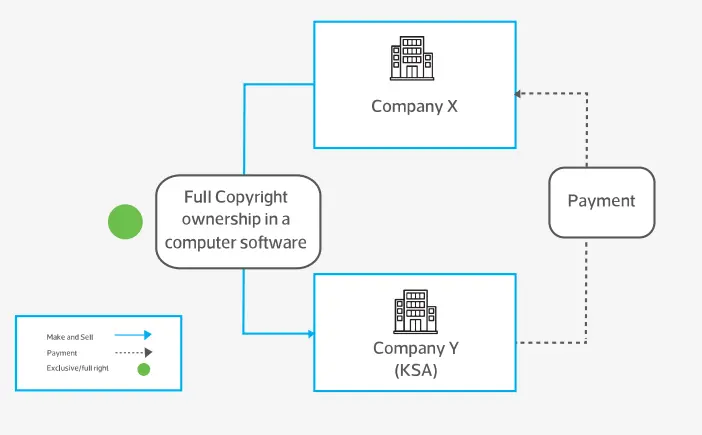

Sale of full ownership rights

Below is a practical example illustrating the tax treatment for payments made in relation to the alienation or transfer of the full ownership in a software.

Example

Transaction Scenario:

Company X, a company resident in country X, owns the copyright in computer software.

Company X sells the full ownership rights on the copyright of this software to its customer, resident in KSA.

In exchange for the right Company Y transferred, Company Y is making payment to Company X.

Upon completion of the transfer, Company Y becomes the exclusive copyright owner and is entitled to copy, edit, and sell the software to the public. The transaction scenario is depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payment shall be categorized as capital gains.

3.3.2 Payments for the alienation/transfer of part of the rights in the copyright that do not constitute a distinct and specific property

3.3.2.1 Overview of the transaction

In the context of this Guideline, an alienation or transfer of part of the rights in the copyright that do not constitute a distinct and specific property, can comprise different forms of transfers. In fact, this type of transaction involves a selective transfer of certain rights associated with the copyright, rather than the transfer of the entirety of those rights.

Under this transaction type, the non-resident of another jurisdiction develops a software and licenses it to the resident in the Kingdom, under a licensing agreement, while retaining the ownership in the copyright.

Three sub-transaction types are addressed in this Guideline, as outlined below:

2.1The non-resident transfers only the right to reproduce the software to the resident. In this case, the resident is granted non-exclusive right to reproduce the software for the purpose of selling to the public. The licensing agreement requires the resident to make monthly payments to the non-resident for such right.

2.2The non-resident transfers only the right to copy the software on a hard disk to the resident. In this case, the resident is granted a non-exclusive right to sell the disks it produces, in which the software is copied, to the public. The licensing agreement requires the resident to make payments to the non-resident for such right.

2.3The non-resident transfers only the right to modify the software to the resident. In this case, the resident is granted a non-exclusive right to modify the software according to its customers' needs and resell it through the cloud. Under the licensing agreement, the resident makes a lump sum payment to the non-resident for such right.

3.3.2.2 Practical Example

Below are some practical examples illustrating tax treatment for payments made in the context detailed above including:

2.1: Transfer of non-exclusive right to reproduce and sell the software

2.2: Transfer of non-exclusive rights to copy the software and sell the copy

2.3: Transfer of non-exclusive right to modify and resell through the cloud

Example

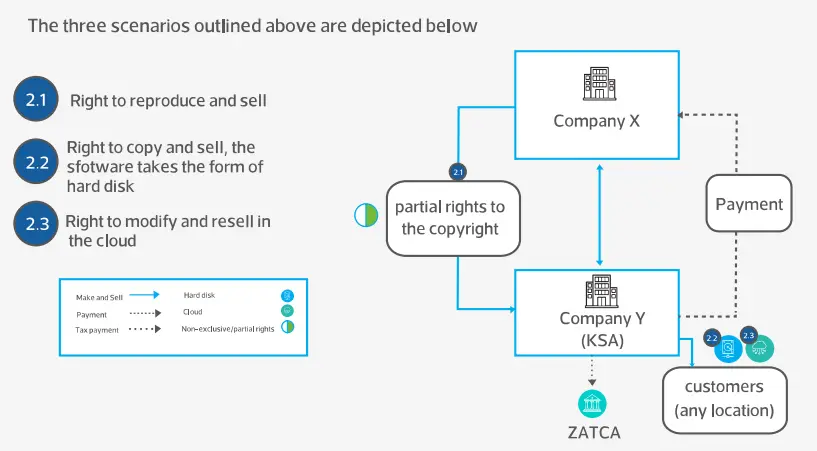

Transactions scenario:

Company X, a company resident in country X , develops the copyright in a computer software.

Company X licenses the software, under a licensing agreement, to Company Y resident in KSA. Three different scenarios are addressed as follows:

2.1: Company X transfers the right to reproduce the software to Company Y. In exchange for the right transferred, Company Y is making monthly payments to Company X. Company Y is entitled to a non-exclusive right to reproduce the software for sale to the public.

2.2: Company X transfers the right to copy the software on a hard disk to Company Y. In exchange for the right transferred, Company Y is making payments to Company X. Company Y is entitled to a non-exclusive right to sell the disks it produces, in which the software is copied, to the public.

2.3: Company X transfers the right to modify the software it develops to Company Y. In exchange for the right transferred, Company Y is making a lump sum payment to Company X. Company Y is entitled to a non-exclusive right to modify the software according to its customers' needs and resell it through the cloud to the public.

The three scenarios outlined above are depicted below

Tax treatment

Based on the facts presented, ZATCA's position is that the income derived by the non- resident from such payments shall be categorized as royalties. Such royalties would be subject to withholding tax in the Kingdom at the rate of 15%.

3.3.3 Payments for distribution arrangements in which the transferee acquires the right to make multiple copies of the program and distribute them in the market

3.3.3.1 Overview of the transaction

In the context of this Guideline, a distribution arrangement where the recipient (transferee) acquires the right to make multiple copies of the software (program) or modify the software and distribute in the market usually occurs under a licensing agreement that involves specific terms and conditions on how the software can be duplicated and sold in the market by the transferee.

Such arrangement may take different forms whereby the arrangement relates to a selective transfer of rights associated with the copyright, rather than the transfer of the entirety of those rights.

Under this transaction, the non-resident of another jurisdiction develops a software and licenses it to the resident in the Kingdom, under a licensing agreement, while retaining the ownership of the copyright.

The following sub-transaction types are addressed in this Guideline, as outlined below:

3.1The non-resident transfers the exclusive right to reproduce the software to the resident. In this case, the resident is granted an exclusive right to reproduce the software for the purpose of re-selling the software to the public. Monthly payments are made by the resident to the non-resident for such right.

3.2The non-resident transfers the exclusive right to modify the software to the resident. In this case, the resident is granted an exclusive right to modify the software according to its customers' needs and resell it through the cloud. Payments are made by the resident to the non-resident for such right.

3.3A third sub-transaction is addressed whereby the non-resident transfers to the resident, the right to load the software onto a laptop it produces. In this case, the resident is granted the right to install the software and sell it to the public, however the resident is prohibited from selling the software separately from the laptop. Under the licensing agreement the resident pays a one-time per-user fee to the non-resident for such right.

3.3.3.2 Practical Example

Below are some practical examples illustrating tax treatment for payments made in the context detailed above including:

3.1: Transfer of exclusive right to reproduce and sell software

3.2: Transfer of exclusive right to modify and resell software through the cloud

3.3: Transfer of rights to load software onto laptop and sell laptop with software

Example

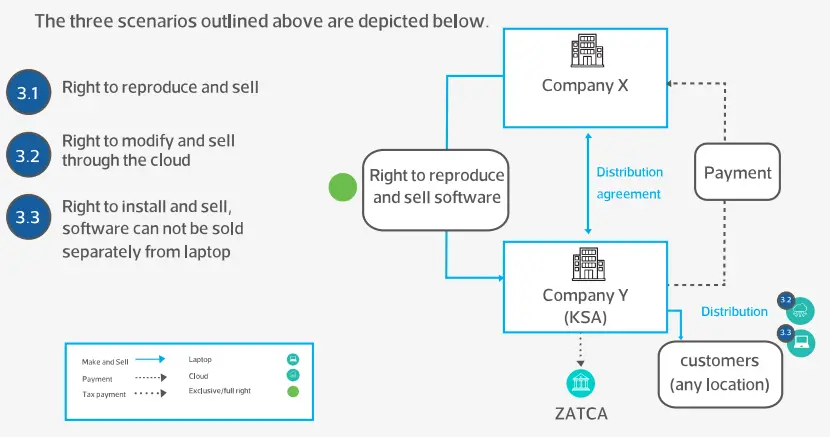

Transactions scenario

Company X, a company resident in country X, develops the copyright in a computer software. Company X licenses the software, under a licensing agreement, to Company Y resident in KSA. Three different scenarios are addressed as follows:

3.1: Company X transfers the exclusive right to reproduce the software to Company Y. In exchange for the right transferred, Company Y is making monthly payments to Company X. Company Y is entitled to an exclusive right to reproduce the software for sale to the public.

3.2: Company X transfers the exclusive right to modify the software to Company Y. In exchange for the right transferred, Company Y is making a lump sum payment to Company X. Company Y is entitled to an exclusive right to modify the software according to its customers' needs and resell it through the cloud to the public.

3.3: Company X transfers the right to install the software it develops for live translations to Company Y. In exchange for the right transferred, Company Y is paying a one-time per-user fee to Company X. Company Y is entitled to the right to load the software onto the laptops it produces and sell it to the public. Company Y is prohibited from selling the software separately from the laptop.

The three scenarios outlined above are depicted below.

Tax treatment

Based on the facts presented, ZATCA's position is that the income derived by the non- resident from such payments shall be categorized as royalties. Such royalties would be subject to withholding tax in the Kingdom at the rate of 15%.

3.3.4 Payments for information concerning industrial, commercial or scientific knowledge (e.g., access to source code)

3.3.4.1 Overview of the transaction

In the context of this Guideline, payments made in exchange for access to information in relation to industrial, commercial or scientific knowledge are usually formalized under licensing agreements with manufacturers in a relevant industry.

Under this transaction type, the non-resident of another jurisdiction develops a system software and grants limited modification rights to a resident in the Kingdom. The resident is given access to the source code and is permitted to install, modify and make future updates to the software.

The resident makes payment to the non-resident for the acquisition of such rights under the licensing agreement.

3.3.4.2 Practical Example

Provision of access to the source code with right to modify and update

Below is a practical example illustrating the tax treatment for payments made in relation to the provision of access to the source code with permission to modify and update.

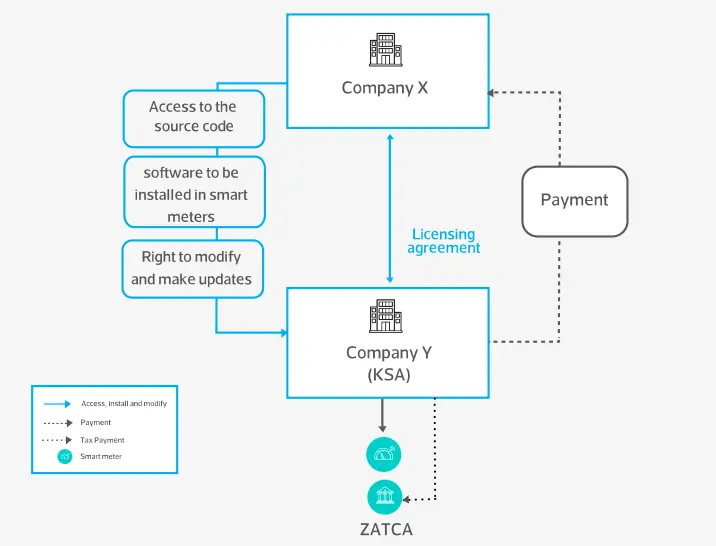

Example

Transaction Scenario:

Company X, a company resident in a country X , develops the copyright in a computer software under a contract with the manufacturers of electricity smart meters.

Company X licenses the software to Company Y resident in KSA for the purpose to have this software installed onto the smart meters.

In exchange for the rights transferred, Company Y is making payments to Company X.

Upon completion of the transaction, the manufacturers are given access to the source code but are only permitted to modify and make future updates to the software. The transaction scenario is depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payment shall be categorized as royalties on the basis that partial rights are being transferred. Such royalties would be subject to withholding tax at the rate of 15%.

3.3.5 Payments for transactions in which the transferee acquires the right to make multiple copies of the program only for operation within its own business (site, enterprise, or network license)

3.3.5.1 Overview of the transaction

In the context of this Guideline, transactions involving the transferor and transferee to agree in such a way that allows the transferee (recipient) to reproduce and install multiple copies of a software program, solely for the purpose of using the software for the recipient's own business.

Under this transaction type, the non-resident of another Jurisdiction transfers a limited right for the use of the software for business purposes to the resident in the Kingdom.

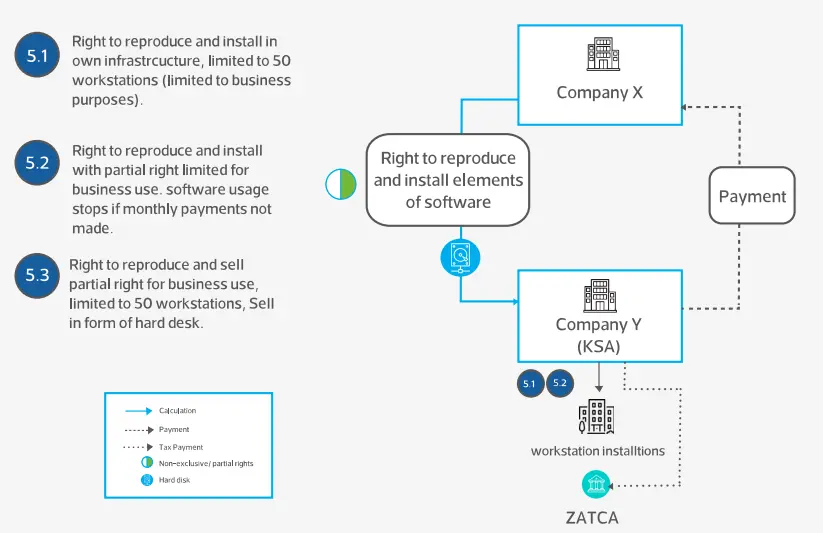

Three sub-transaction types are addressed in this Guideline, as outlined below:

5.1The non-resident transfers the right to reproduce and install elements of the software to the resident. In this case, the resident is granted with a limited right to simple use of the software for business purposes. The right to reproduce and install is also physically limited to its infrastructure on 50 workstations. The resident makes payments to the non-resident for such right.

5.2The non-resident transfers the right to reproduce and install elements of the software to the resident. In this case, the resident is granted with a limited right to simple use of the software for business purposes on its own machines. The resident makes monthly payments to the non-resident for such right and the agreement restricts the resident to continue using the software if it stops paying the fees.

5.3The non-resident transfers the right to reproduce and install elements of the software to the resident. In this case, the resident is granted with a limited right to simple use of the software for business purposes on its own infrastructure and across 50 workstations. The software is sold to the resident on CD-ROMs in this scenario. The resident makes payments to the non-resident for such right.

3.3.5.2 Practical Example

Below are some practical examples illustrating the tax treatment for payments made in the context detailed above including:

5.1: Transfer of the limited right to reproduce and install software elements for its infrastructure

5.2: Transfer of the limited right to reproduce the installed software elements for its machines

5.3: Transfer of the limited right to reproduce the installed software elements for its infrastructure accessible on CD-ROMs

Example

Transactions scenario

Company X, a company resident in country X, develops the copyright in a computer software. Company X transfers a limited right to use for internal business purposes to Company Y resident in KSA. Three different scenarios are addressed as follows:

5.1: Company X transfers the right to Company Y, to reproduce and install elements of the software on its infrastructure. Company Y is limited to install it in only 50 workstations. In exchange for the right transferred, Company Y has made a one-time Lump Sum payment.

5.2: Company X transfers the right to Company Y, to reproduce and install elements of the software to Company Y's machines. In exchange for the right transferred, Company Y is making monthly payments to Company X, and Company Y would lose the right to use the software if it stops making the payments.

5.3: Company X transfers the right to Company Y, to reproduce and install elements of a software on its infrastructure. Company X provides the software in CD-ROMs and Company Y is limited to install it in only 50 workstations. In exchange for the right transferred, Company Y is making payments to Company X against the acquisition of the software in CD-ROMs. The three scenarios outlined above are depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payment shall be categorized as royalties on the basis that partial rights of the software (with limitations) are transferred. Such royalties would be subject to withholding tax at the rate of 15%.

3.3.6 Payments for distribution arrangements in which the transferee acquires the right to distribute copies of the program without the right to reproduce the program

3.3.6.1 Overview of the transaction

In the context of this Guideline, transactions allowing the transferee to acquire the right to distribute copies of the software program without the right to reproduce or modify would occur under distribution arrangements between the transferor and the transferee.

This transaction type can take different forms and the facts can change from one transaction to another depending on the type of agreement in place.

There are four sub-transaction types that are addressed in this Guideline, as outlined below:

6.1The non-resident has a distribution agreement with the resident and a direct end-user license agreement with the customers to which the resident distributes the software. The resident is not granted with any right to reproduce or modify the software acquired but is only entitled to distribute to customers. On the other hand, the customers use the individual license key, provided by the non-resident under the end user license agreement, to download the software from a website located on a server overseas. This transaction requires the resident to make payments to the non-resident for such rights.

6.2The non-resident has a distribution agreement with the resident. In this case, the resident is not granted with any right to reproduce or modify the software acquired and can only distribute to customers under a direct end user license agreement. The customers use the individual license key provided by the non-resident to download the software from a website located on a server overseas. This transaction requires the resident to make payments to the non-resident for such rights.

6.3The non-resident has a distribution agreement with the resident. In this case, the resident is granted with a non-exclusive right to distribute the non-resident's computer games. The resident is permitted to sell packaged games at its retail outlets across the Kingdom. These packaged games contain a 'shrink-wrap' end user license agreement directly with the non-resident. This transaction requires the resident to make payments to the non-resident for such rights.

6.4A deviation to the scenario of this transaction is also being addressed whereby similar rights are being transferred, but where the resident is required to purchase at least 1,000 copies of the software program and pay a minimum fee to the non-resident for the acquisition of the rights.

3.3.6.2 Practical Example

Below are some practical examples illustrating the tax treatment for payments made in the context detailed above including:

6.1: Payment against distribution of software and then distribution to customers (direct end-user license agreements between the customer and the copyright owner)

6.2: Payment against distribution of software and then distribution to customers (direct end-user license agreements between the customer and the distributor)

6.3: Agreement to sell packaged games where end-user license is between the copyright owner and the customers

6.4: Agreement to sell packaged games where end-user license is between the copyright owner and the customers (minimum fee applicable)

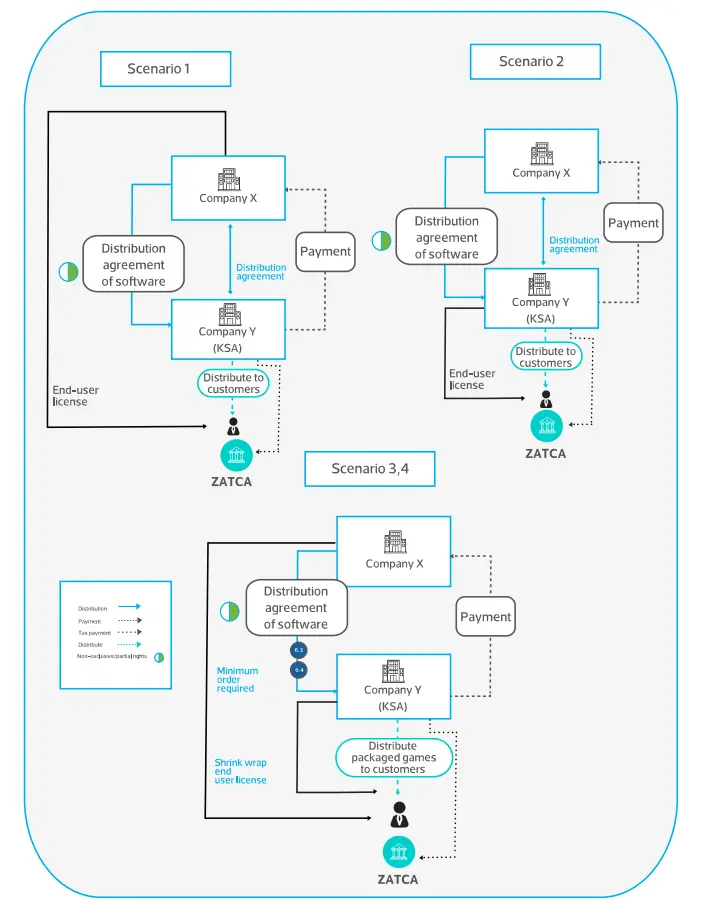

Example

Transactions scenario

a company resident in country X, concludes distribution agreements with Company Y resident in KSA, whereby Company Y can distribute the software as stipulated in the relevant agreement in exchange for payments to Company X. Four different scenarios are addressed as follows:

6.1: Company X has a distribution agreement with Company Y. Company Y can only distribute the software to customers and is not entitled to reproduce or modify the software acquired . The customers place an order through Company Y, and Company Y notifies the Company X to generate the individual license key. Company X then directly sends the Key to the customers to download the software from a website located on a server overseas. The customers enter into an end-user license agreement with Company X.

6.2: Company X has a distribution agreement with Company Y. Company Y can only distribute the software to customers and is not entitled to reproduce or modify the software acquired. The customers place an order through Company Y, and Company Y notifies the Company X to generate the individual license key. Company X then directly sends the Key to the customers to download the software from a website located on a server overseas. The customers enter into an end-user license agreement with Company Y.

6.3. Company X has a distribution agreement with Company Y. Company Y is entitled to a non-exclusive right to distribute Company's X computer games. Company Y is permitted to sell packaged games at its retail outlets across the Kingdom. The packaged games contain a 'shrink-wrap'[2] end user license agreements with the non-resident which the customers agrees to be bound to when opening the games.

6.4: Company X has a distribution agreement with Company Y. Company Y is entitled to a non-exclusive right to distribute Company's X computer games. Company Y is permitted to sell packaged games at its retail outlets across the Kingdom. Company Y is obliged to purchase a minimum of 1,000 copies of the software and pay a minimum fee in that respect. The packaged games contain a 'shrink-wrap' end user license agreements with the non-resident which the customers agrees to be bound to when opening the games.

The four scenarios outlined above are depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payment shall be categorized as commercial profits as the nature of the right transferred is only the right to distribute with no other right (i.e. adjust, modify or reproduce).

3.3.7 Development of software for a fee

3.3.7.1 Overview of the transaction

In the context of this Guideline, the development of a software is generally performed under a service contract specifying the scope of the development and the fees in exchange of this development process.

Under this transaction type, the non-resident of another jurisdiction enters into a contract with the resident whereby the non-resident develops a software for specific purposes that serve the resident and may in some instances transfer the full right in the copyright to the resident of the Kingdom. The transaction can take different forms depending on the software being developed and the rights being transferred.

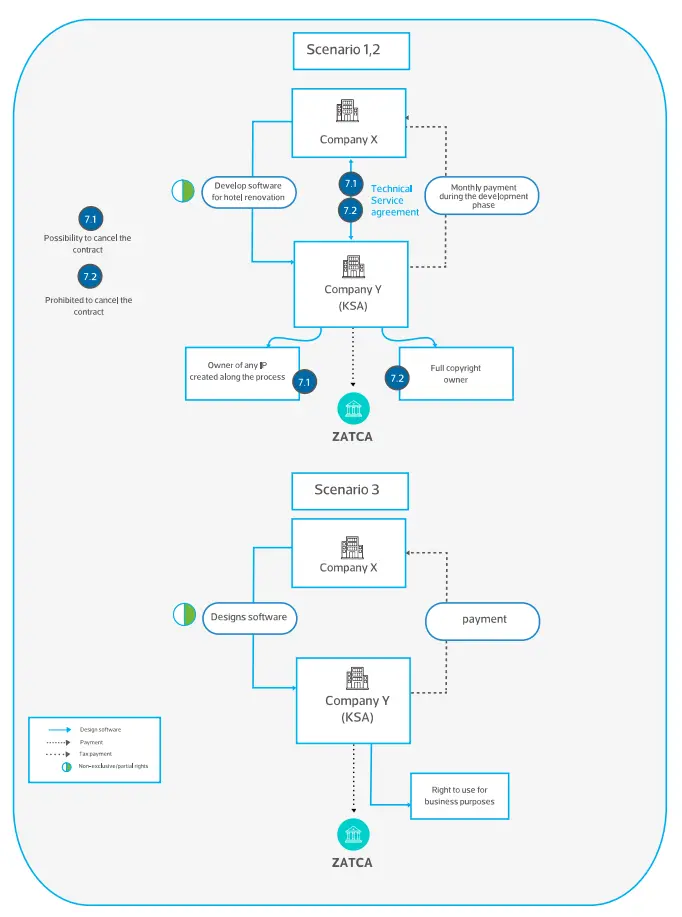

Three sub-transaction types are addressed in this Guideline, as outlined below:

7.1The non-resident develops a new software for hotel renovation under a service contract with the resident. In this case, the resident is granted the ownership of any procedures, techniques, or copyrightable interests in relation to the software being developed. The contract in place requires the resident to pay a monthly fee to the non-resident during the development phase. In case the resident is dissatisfied with the development of the program, it may cancel the contract at the end of any month; however, the non-resident will retain all previous completed payments, while the resident will maintain ownership of the procedures, techniques, or copyrightable interests in the software.

7.2The non-resident develops a new software under a service contract with the resident. In this case, the resident is granted the full copyright ownership of the software being developed upon completion of the contract. The contract in place requires the resident to make a payment to the non-resident for such rights. In case the resident is dissatisfied with the development of the program, it cannot cancel the contract at any case.

7.3The non-resident develops a new software under a service contract with the resident. In this case, the resident is granted only with the non-exclusive right to use the software for business purposes while the non-resident remains the copyright owner upon completion of the software development. Due to the non-exclusive nature of the agreement, the non-resident maintains the right to reproduce and distribute the software to other companies. The contract in place requires the resident to make a payment to the non- resident for such rights.

3.3.7.2 Practical Example

Below are some practical examples illustrating the tax treatment for payments made in the context detailed above including:

7.1: Development of software with transfer of full ownership (possibility to cancel contract)

7.2: Development of software with transfer of full ownership (no ability to cancel the contract)

7.3: Development of software with transfer of right to use for business purposes

Example

Transactions scenario

Company X, a company resident in a country X, develops a new software for different purposes for another Company Y, resident in KSA. Three different scenarios are addressed as follows:

7.1: Company X develops a new software for hotel renovation under a service contract with Company Y. Company Y is granted the ownership of any procedures, techniques, or copyrightable interests in relation to the software being developed. In exchange, Company Y makes payments to Company X on a monthly basis during the development phase. In case Company Y is dissatisfied with the development of the program, it may cancel the contract at the end of any month; however, Company X will retain all previous completed payments, while Company Y will maintain ownership of the procedures, techniques, or copyrightable interests in the software.

7.2: Company X develops a new software under a service contract with Company Y. Company Y is granted the full copyright ownership of the software being developed upon completion of the contract. In exchange, Company Y makes a lump sum payment to Company X for such rights. If Company Y is dissatisfied with the development of the program, it cannot cancel the service contract with Company X.

7.3: Company X develops a new software under a service contract with Company Y, where Company Y will make a lump sum payment to Company X. Upon completion of the software development Company Y is granted only with the non-exclusive right to use the software for business purposes, while Company X remains the copyright owner. In addition, Company X will have the right to reproduce and distribute the software to other companies.

The three scenarios outlined above are depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payment shall be categorized under two types depending on the contractual arrangement and the rights being transferred. Under scenarios 1 and 2, such income is categorized as "technical services" and subject to withholding tax at the rate of 5%, on the basis that full ownership in the copyright is granted to the resident upon completion. Whereas, under scenario 3, the income derived is categorized as "commercial profits", on the basis that the rights in the copyright remain with the non-resident and only a right to use is transferred.

3.3.8 Payments for access to an online database

3.3.8.1 Overview of the transaction

In the context of this Guideline, payments made in exchange for the provisions of access to an online database can be categorized differently. The database access can comprise access to different data and information depending on the request generated and is generally formalized under a subscription agreement.

Under this transaction type, the resident in the Kingdom makes payments to the non-resident of another Jurisdiction for a subscription to an online database.

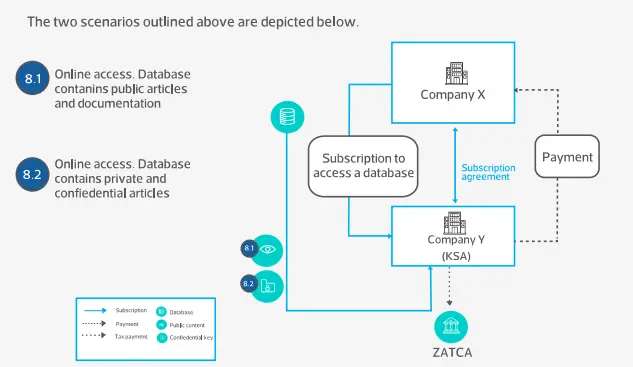

Two sub-transaction types are addressed in this Guideline, as outlined below:

8.1The resident pays subscription fees to the non-resident in order to access an online database containing public articles and documentation on international taxation. This database can be accessed using a unique password and is updated on a daily basis. The right granted is limited to access and there is no transfer of ownership in any of the content.

8.2The resident pays subscription fees to the non-resident in order to access an online database containing private and confidential data in relation to articles and documentation on international taxation. This database can be accessed using a unique password and is updated on a daily basis. The right granted is limited to access and there is no transfer of ownership in any of the content.

3.3.8.2 Practical Example

Below are some practical examples illustrating the tax treatment for payments made in the context detailed above including:

8.1: Accessing database with public content

8.2: Accessing database with private and confidential data

Example

Transactions scenario

Company X, a company resident in country X, owns a database and provides access to said database through a subscription agreement. Company X has entered into a subscription agreement with Company Y a resident in KSA. Two different scenarios are addressed as follows:

Scenario 1: Company X provides access to an online database via subscription to Company Y. Company Y is granted access to the database containing public articles and documentation on international taxation, with no transfer of ownership in the content. This database is updated on a daily basis and can be accessed by Company Y using a unique password. In exchange, Company Y pays a subscription fee to Company X for the access provided.

Scenario 2: Company X provides access to an online database via subscription to Company Y. Company Y is granted access to the database containing private and confidential data in relation to articles and documentation on international taxation, with no transfer of ownership in the content. This database is updated on a daily basis and can be accessed by Company Y using a unique password. In exchange, Company Y pays a subscription fee to Company X for the access provided.

The two scenarios outlined above are depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payment shall be categorized under two types of data for which access is being provided. Under scenario 1 where the data is public, the income derived shall be categorized as "other income". On the other hand, under scenario 2, where the data is private and confidential, the income derived shall be categorized as "royalties". In both cases, royalties or other income would be subject to withholding tax at the rate of 15%.

In the event that the database contains both "private and confidential" and "public" data, it shall be categorized as royalties.

3.3.9 Mixed contracts (e.g., provision of goods and services [G1])

3.3.9.1 Overview of the transaction

In the context of this Guideline, payments made in exchange of the provisions of a selective range of rights in relation to software systems along with secondary services provided for the support related to the software usage itself, can be categorized differently depending on the context and nature of the services being provided.

Under this transaction type, the non-resident of another jurisdiction owns a system software or owns the copyright of the system software, enters into a service agreement with the resident in the Kingdom.

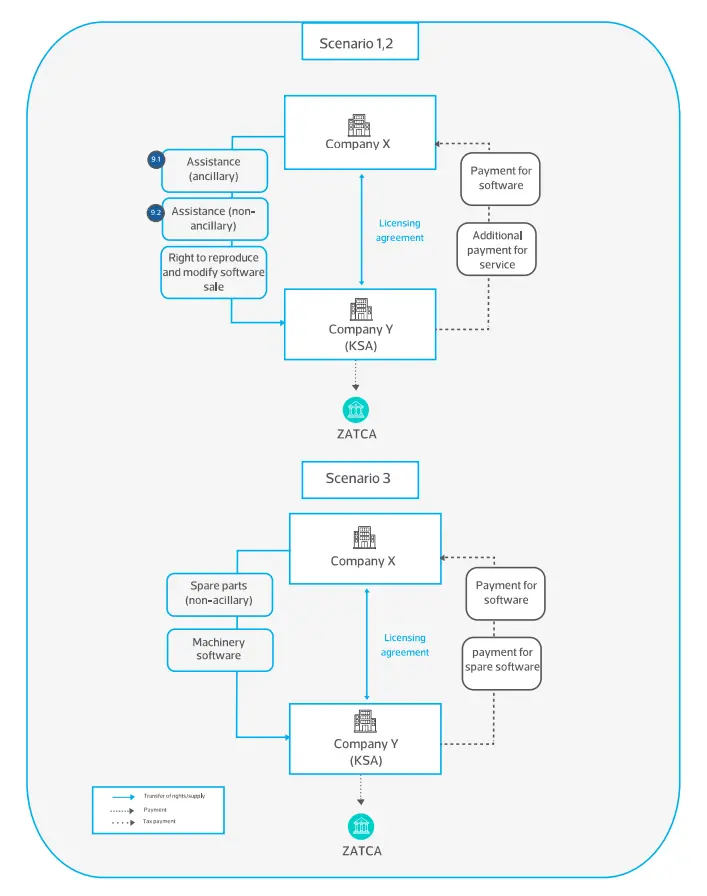

Three sub-transaction types are addressed in this Guideline, as outlined below:

9.1The non-resident owns a custom operating system software, and transfers only the right to reproduce and modify the software for sale purposes to the resident. In this case, the resident is granted the right to reproduce and modify the software for the purpose of selling to the public. Additionally, the non-resident agrees to provide the resident with an additional ancillary assistance to understand the functions of the software for an additional fee. This transaction requires the resident to make payments to the non- resident for such rights.

9.2The non-resident owns a custom operating system software, and transfers only the right to reproduce and modify the software for sale purposes to the resident. In this case, the resident is granted the right to reproduce and modify the software for the purpose of selling to the public. Additionally, the non-resident agrees to provide the resident with an additional non-ancillary assistance to understand the functions of the software for an additional fee. This transaction requires the resident to make payments to the non- resident for such rights.

9.3The non-resident owns the copyright of the software for machinery for the exploration of seabed soil. The non-resident sells spare parts and transfers only the right to reproduce and incorporate the software into the machinery to the resident. The provision of the spare parts is considered not ancillary to the software license in this case. This transaction requires the resident to make payments to the non-resident for such rights.

3.3.9.2 Practical Example

Below are some practical examples illustrating the application of withholding tax for payments made in the context detailed above including:

9.1: Transfer of rights to reproduce and modify software together with the provision of ancillary services

9.2: Transfer of rights to reproduce and modify software together with the provision of non-ancillary services

9.3: Transfer of rights to reproduce and incorporate software into machinery together with the supply of spare parts considered not ancillary to the license

Example

Transactions scenario

Company X, a company resident in a country X, owns a system software or owns the copyright of the system software, enters into a licensing and service agreement with Company Y a resident in KSA. Three different scenarios are addressed as follows:

9.1: Company X owns a custom operating system software, and transfers only the right to reproduce and modify the software for sale purposes to Company Y. Additionally, Company X agrees to provide Company Y with an additional ancillary assistance to understand the functions of the software. In exchange, Company Y makes payments to Company X for the rights and for the ancillary service.

9.2: Company X owns a custom operating system software, and transfers only the right to reproduce and modify the software for sale purposes to Company Y. Additionally, Company X agrees to provide Company Y with an additional non-ancillary assistance to understand the functions of the software. In exchange, Company Y make payments to Company X for such rights and for the non-ancillary service.

9.3: Company X owns the copyright of the software for machinery for the exploration of seabed soil. Company X sells spare parts and transfers only the right to reproduce and incorporate the software into the machinery to Company Y. The supply of the spare parts is considered non- ancillary in this case. In exchange, Company Y has to make one payment to Company X for both the rights and for the spare parts.

The three scenarios outlined above are depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payment shall be categorized under different types depending on the type of contract and services provided. Under scenario 1, the income derived from the full agreement including ancillary services shall be categorized as royalties on the basis that the contract relates to the transfer of partial rights in the copyright and that the ancillary services are required for the delivery of the whole contract and cannot be dissociated. Royalties would be subject to withholding tax at the rate of 15%

Under scenarios 2 and 3, the payments relate to the transfer of partial rights in the copyright shall be categorized as Royalties and would be subject to withholding tax at the rate of 15% the additional non-ancillary services or products shall be categorized as technical services or commercial profits (in the case of spare parts) provided that the services can be separated from the rest of the contract., the technical services would be subject to withholding tax at the rate of 5%

In case the non-ancillary services cannot be separated from the rest of the contract, the payment made for whole contract would be categorized as royalties and accordingly subject to withholding tax at the rate of 15%

3.3.10 Payments for the alienation/transfer of part of the rights in the copyright that constitute a distinct and specific property

3.3.10.1 Overview of the transaction

In the context of this Guideline, an alienation or transfer of part of the rights in the copyright that constitute a distinct and specific property, can comprise different forms of transfer. In fact, this type of transaction involves a specific range of rights being transferred in association with the copyright itself.

Under this transaction type, the non-resident of another country develops a software and licenses it to the resident in the Kingdom under a specific agreement [3].

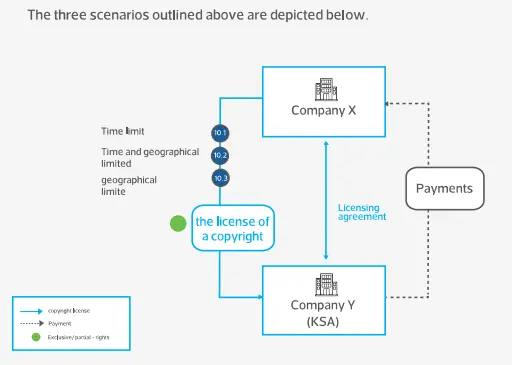

Three sub-transaction types are addressed in this Guideline, as outlined below:

10.1The non-resident transfers an exclusive and transferrable license of the copyright to the resident under a license agreement. In this case, the agreement in place is valid for five years (which exceeds the remaining life of the software) and is limited to the Arabic language. The agreement requires the resident to make annual payments to the non- resident for such right.

10.2The non-resident transfers an exclusive and transferrable license of the copyright to the resident under a license agreement. In this case, the agreement in place is valid for five years (which exceeds the remaining life of the software) and is geographically limited to the Arabic Peninsula. The agreement requires the resident to make annual payments to the non-resident for such right.

10.3The non-resident transfers an exclusive and transferrable license of the copyright to the resident under a license agreement. In this case, the agreement in place is not limited by time, but is geographically limited to the Kingdom. The agreement requires the resident to make a payment to the non-resident for such right.

3.3.10.2 Practical Example

Below are some practical examples illustrating the tax treatment for payments made in the context detailed above including:

10.1: Agreement is time-limited and limited to Arabic language only

10.2: Agreement is time-limited and geographically limited to the Arabic Peninsula

10.3: Agreement is not time-limited but geographically limited to the Kingdom

Example

Transactions scenario

Company X, a company resident in country X, develops the copyright in a computer software. Company X licenses the software, under an agreement, to Company Y a resident in KSA. Three different scenarios are addressed as follows:

10.1: Company X transfers the exclusive and transferrable license of the copyright to Company Y. In exchange for the right transferred, Company Y is making annual payments to Company X. The agreement allowing the transfer is valid for five years (which exceeds the remaining life of the software) and is limited to the Arabic language.

10.2: Company X transfers the exclusive and transferrable license of the copyright to Company Y. In exchange for the right transferred, Company Y is making annual payments to Company X. The agreement allowing the transfer is valid for five years (which exceeds the remaining life of the software) and is geographically limited to the Arabic Peninsula.

10.3: Company X transfers the exclusive and transferrable license of the copyright to Company Y. In exchange for the right transferred, Company Y is making a lump sum payment to Company X. The agreement allowing the transfer is not time-limited but is geographically limited to the Kingdom.

The three scenarios outlined above are depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payments shall be categorized as capital gains.

3.3.11 Payments for transactions where the rights acquired are limited to those necessary to enable the business user to operate the program

3.3.11.1 Overview of the transaction

In the context of this Guideline, transactions where rights acquired are limited to those necessary to enable the business user to operate the program can take different forms. In fact, this type of transaction involves a specific range of rights being transferred in association with the copyright of the software itself.

Under this transaction type, the non-resident of another Jurisdiction develops a software and licenses it to the resident in the Kingdom under a license agreement.

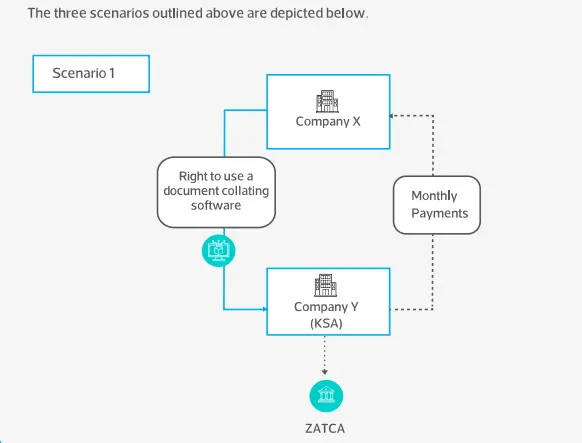

Three sub-transaction types are addressed in this Guideline, as outlined below:

11.1The non-resident transfers a non-exclusive and non-transferrable license of the copyright in a standardized software to the resident under a license agreement. In this case, the resident will be granted the right to use the software for its business-related purposes. The transaction in place requires the resident to make monthly payments to the non-resident for such right.

11.2The non-resident develops and customizes its software based on the resident's needs and transfers a non-exclusive and non-transferrable license of the copyright to the resident under a license agreement. In this case, the resident will be granted the right to use the customized software for its business-related purposes. The transaction in place requires the resident to make a payment to the non-resident for such right.

11.3The non-resident transfers a non-exclusive and non-transferrable license of the copyright to the resident under a license agreement. In this case, the resident will be granted the right to use the software for its business and may modify certain features of the software to make it suitable for its use. The transaction in place requires the resident to make a payment to the non-resident for such right.

3.3.11.2 Practical Example

Below are some practical examples illustrating the tax treatment for payments made in the context detailed above including:

11.1: Granting non-exclusive, non-transferrable license to access a standardized software for business use

11.2: Granting non-exclusive, non-transferrable license to access a customized software for business use

11.3: Granting non-exclusive, non-transferrable license to access a software for business use with right to modify certain features

Example

Transactions scenario

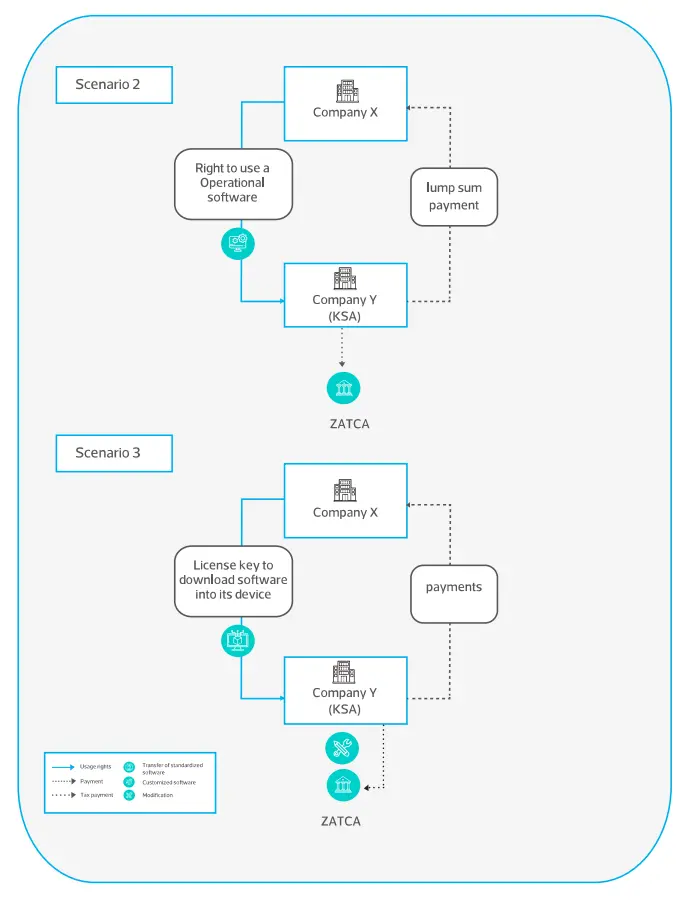

Company X, a company resident in country X, develops the copyright in a computer software. Company X licenses the software, under an agreement, to Company Y a resident in KSA. Three different scenarios are addressed as follows:

11.1: Company X transfers to Company Y the non-exclusive and non-transferrable right to use a standard software for document collating. Company Y is entitled to only access and use the standardized software for its business, in exchange for monthly payments to Company X.

11.2: Company X transfers to Company Y the non-exclusive and non-transferrable right to use a customized software based on the Company Y needs. Company Y is entitled to the right to use the customized software for its business, in exchange for a payment to Company X.

11.3: Company X transfers to Company Y the non-exclusive and non-transferrable right to use a standard software. Company Y is entitled to both use the software for its business and modify certain features of the software to make it suitable for its business use.

The three scenarios outlined above are depicted below.

Tax treatment:

Based on the facts presented, ZATCA's position is that the income derived by the non-resident from such payments shall be categorized under two types depending on the rights being transferred and the agreement in place. Under scenarios 1 and 2, the income derived shall be categorized as Commercial profits. On the other hand, under scenario 3, the income derived shall be categorized as royalties and would be subject to withholding tax at the rate of 15%.

4. Appendix: Overview of all transactions covered in this Guideline and their classification

| Transaction as covered in this Guideline | Transaction name | Rights transferred | Tax categorization |

|---|---|---|---|

3.3.1.2 Practical example Case 1: Sale of full ownership rights | Payments for the alienation/transfer of the full ownership of the copyright on the software | Full copyright ownership transfer (exclusive right) | |

3.3.2.2 Practical example Case 1: Transfer of non-exclusive right to reproduce and sell software | Payments for the alienation/transfer of part of the rights in the copyright that do not constitute a distinct and specific property | Partial transfer of rights (non-exclusive) - the right to reproduce | |

3.3.2.2 Practical example Case 2: Transfer of rights to copy software and sell copy | Partial transfer of rights (non-exclusive) - the right to copy | ||

3.3.2.2 Practical example Case 3: Transfer of non-exclusive right to modify and resell through the cloud | Partial transfer of rights (non-exclusive) - the right to modify | ||

3.3.3.2 Practical example Case 1: Transfer of exclusive right to reproduce and sell software | Payments for distribution arrangements in which the transferee acquires the right to make multiple copies of the program and distribute them in the market | Partial transfer of rights (exclusive) - the right to reproduce | |

3.3.3.2 Practical example Case 2: Transfer of exclusive right to modify and resell through the cloud | Partial transfer of rights (exclusive) - the right to modify | ||

3.3.3.2 Practical example Case 3: Transfer of right to load software onto laptop and sell laptop with software | Partial transfer of rights - the right to reproduce and install | ||

3.3.4.2 Practical example Case 1: Provision of access to the source code with right to modify and update | Payments for information concerning industrial, commercial or scientific knowledge (e.g., access to source code) | Partial transfer of rights - the right to modify | |

3.3.5.2 Practical example Case 1: Transfer of right to reproduce and install software elements for business purposes on limited 50 workstations | Payments for transactions in which the transferee acquires the right to make multiple copies of the program only for operation within its own business (site, enterprise, or network license) | Partial transfer of rights (limited to business use) - the right to reproduce and install | |

3.3.5.2 Practical example Case 2: Transfer of right to reproduce the installed software elements for business purposes with no limitation on the number of workstations | Partial transfer of rights (limited to business use) - the right to reproduce and install | ||

3.3.5.2 Practical example Case 3: Transfer of right to reproduce the installed software elements for business purposes accessible on CD-ROMs medium and limited to 50 workstations | Partial transfer of rights (limited to business use) - the right to reproduce and install | ||

3.3.6.2 Practical example Case 1: Payment against distribution of software and then distribution to customers (direct end-user license agreements between the customer and the copyright owner) | Payments for distribution arrangements in which the transferee acquires the right to distribute copies of the program without the right to reproduce the program | Partial transfer of rights - the right to distribute | |

3.3.6.2 Practical example Case 2: Payment against distribution of software and then distribution to customers (direct end-user license agreements between the customer and the distributor) | Partial transfer of rights - the right to distribute | ||

3.3.6.2 Practical example Case 3: Agreement to sell packaged games where end-user license is between copyright owner and the customers | Partial transfer of rights (non-exclusive) - the right to distribute | ||

3.3.6.2 Practical example Case 4: Agreement to sell packaged games where end-user license is between the copyright owner and the customers (minimum fee applicable) | Partial transfer of rights (non-exclusive) - the right to distribute | ||

3.3.7.2 Practical example Case 1: Development of software with partial ownership (possibility to cancel contract) | Development of software for a fee | Development of software - full ownership transferred after development completion | |

3.3.7.2 Practical example Case 2: Development of software with transfer of full ownership (no ability to cancel contract) | Development of software, full ownership transferred after development completion | ||

3.3.7.2 Practical example Case 3: Development of software with transfer of right to use for business purposes | Partial transfer of rights (non-exclusive) - the right to use | ||

3.3.8.2 Practical example Case 1: Accessing database with public content | Payments for access to an online database | Partial transfer of rights - right to access database | |

3.3.8.2 Practical example Case 2: Accessing database with private and confidential data | Partial transfer of rights - right to access database | ||

3.3.9.2 Practical example Case 1: Transfer of rights to reproduce and modify software together with the provision of ancillary services | Mixed contracts (e.g., provision of goods and sources) | Partial transfer of rights - the right to reproduce and modify | |

3.3.9.2 Practical example Case 2: Transfer of rights to reproduce and modify software together with the provision of non-ancillary services | Partial transfer of rights - the right to reproduce and modify Provision of services | ||

3.3.9.2 Practical example Case 3: Transfer of rights to reproduce and incorporate software into machinery together with the supply of spare parts considered not ancillary to the license | Partial transfer of rights - the right to reproduce and incorporate Provision of goods | ||

3.3.10.2 Practical example Case 1: Agreement is time-limited and limited to Arabic language only | Payments for the alienation/transfer of part of the rights in the copyright that constitute a distinct and specific property | Transfer of Exclusive and transferrable copyright | |

3.3.10.2 Practical example Case 2: Agreement is time-limited and geographically limited to the Arabic Peninsula | Transfer of Exclusive and transferrable copyright | ||

3.3.10.2 Practical example Case 3: Agreement is not time-limited but geographically limited to KSA | Transfer of Exclusive and transferrable copyright | ||

3.3.11.2 Practical example Case 1: Granting non-exclusive, non-transferrable license to access a standardized software for business use | Payments for transactions where the rights acquired are limited to those necessary to enable the business user to operate the program | Partial transfer of rights (non-exclusive) - the right to use | |

3.3.11.2 Practical example Case 2: Granting non-exclusive, non-transferrable license to access customized software for business use | Partial transfer of rights (non-exclusive) - the right to use | ||

3.3.11.2 Practical example Case 3: Granting non-exclusive, non-transferrable license to access a software for business use with right to modify certain features | The right to use and modify |