Advance Pricing Agreements

Zakat, Tax and Customs Authority

First Version | February 2025

Contents

Part 2 - Advance Pricing Agreement

Part 4 - Processing the APA request

The Zakat, Tax and Customs Authority ("ZATCA", "Authority") has issued these Tax Guidelines for the purpose of clarifying certain tax treatments concerning the implementation of the statutory provisions in force as of the Guideline's issue date. The content of these Guidelines shall not be considered as an amendment to any of the provisions of the Laws and Regulations applicable in the Kingdom.

Furthermore, the Authority would like to highlight that the clarifications and indicative tax treatments prescribed in these Guidelines, where applicable, shall be implemented by the Authority in light of the relevant statutory texts. Where any clarification, interpretation or content provided in these Guidelines is modified - in relation to unchanged statutory text - the updated indicative tax treatment shall then be applicable prospectively, in respect of Transactions made after the publication date of the updated version of the Guidelines on the Authority's website.

Part 1 - Introduction

1. Definitions

1.1. "Advance Pricing Agreement" or "APA"

An advance pricing agreement between the ZATCA referred to as "the Authority" and a Taxpayer. It covers certain Transactions between the Taxpayer and Related Persons. APAs confirm appropriate Transfer Pricing Methods that will be used to determine the arm's length price, in advance, and their application to specific Controlled Transactions for specified Zakat/Tax Years, under specified terms and conditions, in accordance with the provisions of the Tax Law, the TP Bylaws, and TP Guidelines.

1.2. "APA Annual Compliance Report" or "ACR"

A report submitted to the Authority by the Taxpayer for each Zakat/Tax Year covered by an APA Period, to demonstrate the Taxpayer's compliance with the covered TPM and terms and conditions of the APA.

1.3. "APA Guideline"

The APA Guideline published by ZATCA to setting forth all information and details related to the APA, including, without limitations, the interpretation, implementation, enforcement and application thereof.

1.4. "APA Request"

The Taxpayer's formal request for an APA.

1.5. "APA Application"

The APA application form issued and authorized or approved by ZATCA submitted by the Taxpayer along with all the documents, including financial statements, schedules, analyses and any other information in support of the Taxpayer's APA Request.

1.6. "APA Period"

Zakat/Tax years covered in the APA.

1.7. "The Authority" or "ZATCA"

Zakat, Tax and Customs Authority

1.8. "Base Erosion and Profit Shifting (BEPS)"

As defined by the OECD, BEPS refers to tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity or to erode tax bases through deductible payments such as interest or royalties.

1.9. "Bilateral APA"

A taxpayer-initiated agreement between the Authority and foreign competent Authority, where the Kingdom is a party to a Tax Agreement.

1.10. "Business Cycle"

Depending on the industry, the number of years that should be included in an economic analysis to reliably value the financial performance of the Taxpayer on a go-forward basis for an APA. A cycle should include enough years to adjust for industry or market anomalies due to one-time unforeseen economic events in order to value a normalized return for APA purposes.

1.11. "Compensating Adjustments"

To comply with the terms of an APA, Compensating Adjustments are those made to Zakat /Tax Returns filed by Taxpayers for zakat/Tax years, along with the corresponding books and records. Compensating Adjustments may also be required to be made to the Zakat/Tax Returns for Zakat/Tax years of any Related Persons of the Taxpayer

1.12. "Contracting States"

The countries who are signatories to a Tax Agreement.

1.13. "Covered Transaction"

The Related Party Transactions or series of Transactions as identified and included in the APA.

1.14. "Critical Assumptions"

The underlying business conditions and assumptions relied on for purposes of the APA analysis which, if significantly changed during the APA period, would affect the substantive terms of the APA and may potentially invalidate the APA.

1.15. "Foreign Competent Authority" or "Foreign Tax Authority"

The competent Tax authority of the other Tax Jurisdictions involved in an APA.

1.16. "Multilateral APA"

A taxpayer-initiated agreement involving the Kingdom's competent authority and the competent authorities of two or more countries with which the Kingdom has concluded a Tax Agreement.

1.17. "Mutual Agreement Procedure" or "MAP"

Administrative procedure provided for in tax treaties for resolving difficulties arising out of their application. The procedure is most commonly used in cases of double taxation that are not clearly resolved by the treaty.

1.18. "Tax Agreement"

Any binding tax information agreement or any other tax agreement, including tax treaties, to which the Kingdom is a party shall be applied to residents of the Kingdom or any other Tax Jurisdiction where it is a party.

1.19. "Tax Law"

The current Tax Law under the provisions of the Kingdom of Saudi Arabia's Income Tax Law (issued by Royal Decree No. (M/1) dated 15/1/1425H and its amendments thereon or any other law that replaces it in the future.

1.20. "TP Guidelines"

The Transfer Pricing Guidelines published by ZATCA setting forth all information and details related to the TP Bylaws, including, without limitations, the interpretation, implementation, enforcement and application thereof.

1.21. "TP Bylaws"

The Transfer Pricing Bylaws issued by the Authority pursuant to Board Resolution No [6-1-19] dated 25/05/1440H corresponding to 31/01/2019 A.D and its amendments.

1.22. "Transfer Pricing" or "TP"

Setting of prices for Controlled Transactions, including but not limited to the transfer of goods, services, loans, capital and Tangible & Intangible Assets.

1.23. "Transfer Pricing Method" or "TPM"

Any of the Transfer Pricing Methods whether in the frame of the approved methods or any other applicable method as per provisions of Article 7 and Article 9 of the TP Bylaws.

1.24. "Unilateral APA"

An APA exclusively between the taxpayer and the Authority, concentrating on the Kingdom's zakat/ tax treatment of Controlled Transactions with Related Persons, and guaranteeing that these transactions adhere to the Arm's Length Principle.

1.25. "Zakat Regulations"

The Executive Regulations for Collection of Zakat issued as per the Ministerial Resolution No. 1007 dated 19/08/1445H and its amendments thereon or any other law or regulations that replaces it in the future.

All terms and phrases used in this APA Guideline without being given a specific definition above shall be construed according to the following references in the following order:

TP Bylaws;

TP Guidelines;

Income tax law;

The Implementing Regulation for Zakat collection

2. Introduction

2.1. The Authority has introduced Advance Pricing Agreement (APA) procedures in order to prevent potential future TP disputes through regular audits that are complicated, time- consuming and have a high cost for Taxpayers and the Authority. This initiative allows Taxpayers to agree on the appropriate Arm's Length method for their Transactions with Related Persons or between a head office and its Permanent Establishment ("PE") in advance, in accordance with Article 23 of the TP Bylaws. Therefore, if Taxpayers meet the conditions outlined in Section 5 , they could proceed to apply for an APA.

2.2. An APA covers a specified number of Zakat/Tax Years (period covered by the APA). It includes the appropriate method of TP that takes place between two or more Related Persons. APAs usually involve setting criteria in advance (such as methods, comparables, and necessary adjustments) to be applied to specific domestic and cross-border Controlled Transactions. This is done to ensure compliance with the Arm's Length Principle, taking into account Critical Assumptions about future events.

2.3. This agreement applies Approved Transfer Pricing methods [1] or any other method [2] deemed justifiable and is structured to align with the Arm's Length Principle.

2.4. As the APA procedures is new in the Kingdom, the Authority acknowledges that Taxpayers need time to grasp its principles before applying them. Therefore, for now, the Authority is only introducing unilateral APAs. This Guideline explains the key concepts, processes, and steps for having a finalized unilateral APA with the Authority. However, the Authority will not process Bilateral APAs and Multilateral APAs until further notice.

3. Purpose of This Guideline

3.1. The purpose of an APA is to proactively resolve TP issues and prevent disputes. It is a discretionary service provided by the Authority to gain tax certainty in the Kingdom. There is no legal obligation, entitlement, to request an APA for Taxpayers.

3.2. This Guideline offer background information and practical guidance on the procedures and steps required for Taxpayers to apply for an APA with the Authority. It also outlines how APA applications will be processed and represents the Authority's perspective on APA application procedures.

3.3. The TP Bylaws, the TP Guidelines as well as this Guideline, should be used as the only official source for APA related matters, however, Taxpayers are encouraged to refer to the OECD TP Guidelines if an issue is not addressed herein. The use of any prescribed TP Policy as mentioned in the OECD TP Guidelines may be disregarded by the Authority if deemed inappropriate.

3.4. The goal of publishing these Guidelines is to minimize any ambiguities for Taxpayers in the Kingdom on the implementation and application of the APA. In principle, cooperation between Taxpayers and the Authority is intended where both parties have a clear understanding and respect for the position and interests of the other party. Potential ambiguities could be resolved by constructive discussions between Taxpayers and the Authority on any outstanding queries.

4. Related Provisions

4.1. Pursuant to Board Resolution No. [8-2-23] dated 28/08/1444H (corresponding to 20/03/2023 A.D.), ZATCA has amended the TP Bylaws to include Article 23 , which introduces the APA provisions. Taxpayers are now eligible to apply for an APA, provided they meet the conditions outlined in Article 23 of the TP Bylaws.

5. Who Is Eligible to Submit an APA Application

5.1. As per Article 23 of the TP Bylaws Paragraph (a), a Taxpayer may be eligible to seek an APA application provided that:

5.1.1 Each [3] transaction contained in the APA minimal amount not less than one hundred million Saudi riyals (100,000,000) annually, the Governor of the Authority may exempt some complex Transactions from this requirement.

5.1.2 Complex transactions are: any intercompany transaction that involve significant challenges in determining an appropriate transfer price due to the nature of the transaction. This may include, but not limited to, factors such as:

5.1.2.1 There is substantial doubt about which transfer pricing method should be used to apply the arm's length principle;

5.1.2.2 The use of transfer pricing method can be complex and may require sophisticated calculations, such as those involved in profit split method;

5.1.2.3 Reliable comparables are difficult to find, and significant, complex adjustments may be needed to the comparables.

5.1.3 The Taxpayer must start the APA procedures at least twelve (12) months before the beginning of the first fiscal year contained in the application.

5.1.4 The Authority will not consider APA applications that include profit attribution to PE.

6. Expected Co-operation From Taxpayer(s)

6.1. Taxpayers are required to fully collaborate during the APA process; This includes but is not limited to the following:

6.1.1 Submitting a complete APA application, that fully discloses all relevant facts in each involved jurisdiction.

6.1.2 Providing the Authority with requested information within the specified timeframe.

6.1.3 Proactively furnishing the Authority with relevant and up-to-date information.

6.2 If the taxpayers fail to meets any of the typical factors outlined herein, the Authority has the right to discontinue negotiations and refuse to proceed with the APA. In such instances, the Authority will notify the Taxpayer of the rejection.

7. Persons Authorized to Sign the APA Agreement

7.1. The authorized representatives of both the applicant Taxpayer and the Authority's will officially sign the unilateral APA.

Part 2 - Advance Pricing Agreement

8. Types & Benefits of APAs

8.1. In general, there are three types of APAs: [4]

8.1.1 Unilateral APA

A unilateral APA is an arrangement between a taxpayer and a single jurisdiction. Unilateral APAs are solely domestic law instruments of jurisdictions and only provide tax certainty in relation to covered transactions(s) in a single jurisdiction. If issues arise with the counterparty's competent authority, particularly in cases of potential double taxation, ZATCA is not obliged to defend the APA before the competent authority. In such instances, the taxpayer assumes the risk of double taxation. The taxpayer shall not in any case ask to amend the APA because of any possible adjustments take place from another tax authority.

8.1.2 Bilateral APA

A bilateral APA is an APA between two jurisdictions and It is finalized under the Mutual Agreement Procedure Article of the relevant Tax Agreement, and are generally implemented domestically through an agreement between the relevant taxpayer(s) and each competent authority. Bilateral APA give tax certainty in relation to covered transaction(s) in both jurisdictions.

8.1.3 Multilateral APA

A Multilateral APA is an APA between more than two jurisdictions. It involves multiple and complementary bilateral APAs concluded under the Mutual Agreement Procedure Articles of the relevant Tax Agreement(s). A Multilateral APA offers significant tax certainty for taxpayers and competent authorities.

8.2. The Authority promotes the use of the APA procedures to offer improved tax certainty and foster a cooperative relationship between the Authority and Taxpayers. While this APA Guideline mainly focuses on the APA process, it also highlights its benefits, which are as follows:

8.2.1 Provides tax certainty for future years.

8.2.2 Reduces the need for lengthy and costly examinations of TP matters during regular tax audits, minimizing the potential for prolonged and expensive legal disputes.

8.2.3 Ensures clarity on TP issues and the suitable pricing method for Covered Transactions, providing an accurate forecast of zakat/ tax treatment for both domestic and cross-border Controlled Transactions.

8.2.4 Provides Taxpayers with objective insights to anticipate costs, expenses, and zakat/ tax liabilities, thus clarifying their rights and obligations.

8.2.5 Eases the record-keeping burden by specifying in advance the required documentation for demonstrating compliance with the agreed-upon pricing method.

9. Scope of the Agreement

9.1 The scope covered by the APA typically includes the following key elements:

9.1.1 Identification of all involved parties;

9.1.2 Specification of Covered Transactions;

9.1.3 Selection and application of Transfer Pricing Methods (TPMs) to Covered Transactions;

9.1.4 Coverage of the APA Period;

9.1.5 Critical Assumptions to be met throughout the APA Period; and

9.1.6 Any other agreed upon terms and conditions.

10. APA period

10.1. Subject to any terms and conditions stated in the APA and this Guideline, an APA is binding on both the Authority and the Taxpayer. As per Article 23(2)(c)[G1] of the TP Bylaws, the APA period is typically 3 years, contingent upon the Taxpayer submitting an ACR to demonstrate their commitment to Arm's Length Principle.

10.2. An APA covers future years Transactions and cannot be applied retrospectively, The APA can be renewed another 3 years as mutually agreed by the parties involved in the APA, please refer to Part 5 (Section 27) of this guideline.

11. Critical Assumptions

11.1. An APA predefines relevant critical assumptions that are material to the agreement. These assumptions relate to the Taxpayer, Related Persons, other industry players, or the overall economic conditions. If any of these assumptions change significantly during the APA period, it could greatly impact the validity and effectiveness of the APA.

11.2. Critical Assumptions must be customized to fit the unique circumstances of the Taxpayer, the specific business environment, the chosen methodology, and the types of Controlled Transactions involved.

11.3. Critical Assumptions may vary depending on the specific APA, the Critical Assumptions might include the following areas:

11.3.1. Assumptions concerning the Tax Law and Zakat Regulations and Tax Agreement provisions.

11.3.2. Assumptions regarding tariffs, duties, import restrictions, and government regulations.

11.3.3. Assumptions about economic conditions, market share, market conditions, end-selling price, and sales volume.

11.3.4. Assumptions related to the nature of the functions and risks of the enterprises involved in the Transactions

11.3.5. Assumptions concerning exchange rates, interest rates, credit ratings, and capital structure.

11.3.6. Assumptions regarding management or financial accounting, including the classification of income and expenses.

11.3.7. Assumptions about relevant Related Persons, including how they will operate in each jurisdiction and the form in which they will do so.

11.4. If a Taxpayer fails to meet a Critical Assumption during the APA term, or if changes occur that materially affect the suitability of the selected TPM, the Taxpayer must notify the Authority and APA may need to be revised or canceled. For further details, please refer to Part 5 (Sections 24 and 25).

Part 3 – APA request

12. Advance Pricing Agreement Procedures

12.1. Pre-file meeting:

12.1.1. Taxpayers have the option to request a pre-file meeting (on a named basis) with the APA team prior to submitting their formal application.

12.1.2. The purpose of the Pre-file meeting is to gain a comprehensive understanding of the APA process, clarify procedural steps, and address any preliminary concerns or questions.

12.2. Timeframe for Concluding APAs:

12.2.1. The estimated duration for finalizing a unilateral APA is typically around twelve (12) months.

12.2.2. However, this timeline is subject to various factors including the cases complexity, the taxpayer's cooperation, and the number of negotiation rounds needed. If the taxpayer repeatedly causes significant delays in providing necessary information to the Authority, this may result in the Authority discontinuing the APA process as outlined in Part 1 (Section 6) and Part 4 (Section 18) of this guidelines.

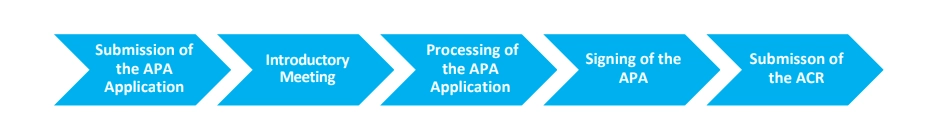

12.3. The stages of APA procedures include the following:

12.3.1 Submission of the APA Application.

12.3.2 Introductory Meeting.

12.3.3 Processing the APA Application.

12.3.4 Signing of the Agreement.

12.3.5 Submit an ACR.

The Stages of APA Procedures

13. Submission of the APA Application

13.1. Taxpayers must submit their unilateral APA applications electronically via the Electronic Registration System (ERAD) portal. However, Complex transactions that may be exempted by the governor from the minimal amount requirement as mentioned in in Part 1 (Section 5) must be submitted through the assigned relationship manager or by contacting the APA team via the Authority's official communication channels. Please refer to Appendix 1 for the Unilateral APA Application form.

13.2. The applicant must submit an application to the Authority at least twelve (12) months before the start of the first financial year specified in the Agreement. Failure to submit a complete application by this deadline will result in rejecting the APA application automatically through the e-portal and the taxpayer will be required to change the effective starting year in order to be able to complete the application.

13.3. The Taxpayer needs to supply a comprehensive application before scheduling an Introductory meeting. The application should offer details about the Covered Transactions, zakat/tax year(s), involved parties, proposed TPM for the Covered Transaction, and how an eventual APA utilizing the proposed method would impact the Taxpayer's zakat/tax filing position.

13.4. An APA application must contain detailed information supporting the application of the chosen TPM and the conclusions drawn. The Authority and the Taxpayer should discuss the proposed TPM and taxpayer is expected to offer a detailed analysis and explanation thereof in accordance with the Tax Law, Zakat Regulations, TP Bylaws and TP Guidelines, including a detailed functional analysis for all entities involved in the covered transactions. Taxpayers should justify why the proposed TPM is the most suitable method considering their specific circumstances, recognizing that adjustments may be required during the APA process. They must demonstrate the impact of the proposed TPM on the Covered Transactions by consistently applying it to historical Zakat/Tax Years or the most recent Business Cycle, if applicable, and to the desired APA Period wherever possible. The Authority requires this information for TPM testing purposes. If applying the proposed TPM results in deviations from the reported outcomes under the previous TPM, Taxpayers must clarify why the proposed TPM provides a more accurate Arm's Length result.

13.5. The Authority evaluates the suitability and applicability of a specific TPM based on factual information, including projections.

13.6. Upon receipt of a formal unilateral APA application, the Authority will acknowledge its receipt and assess the application for completeness. If the application is found to be incomplete, the Authority will notify the taxpayer, outlining the additional information required.

13.7. All documents must be in Arabic or English where appropriate.

14. Introductory Meeting

14.1. The introductory meeting which should be held within sixty (60) days of submitting the application, will only be scheduled once the application is deemed complete.

14.2. During the Introductory meeting, the Taxpayer has the chance to present the information included in the application. This presentation should cover details about business operations, structures which includes (organizational ,management and ownership) and activities, focusing on the Covered Transactions. It should also address the proposed TPM, its application, and its impact on its zakat/tax filing positions in the Kingdom. The meeting also allows the Authority to ask questions to clarify the Taxpayer's past and current zakat/ tax filing positions, as well as proposed future positions. The discussion should be open and transparent, aiming to clarify facts and resolve any misunderstandings. The objective of the Introductory meeting is to determine the appropriateness of making an application for an APA and expedite the review process.

14.3. Among other points, the following topics will be discussed during the Introductory meeting(s):

14.3.1 Summary of the Taxpayer's business operations in the past and future years.

14.3.2 The nature and scope of the covered transactions included in the agreement.

14.3.3 All relevant organizational charts and structures.

14.3.4 Description of the Related Person (s) and domestic and/or cross-border Controlled Transaction(s) to be included in the agreement, including their nature and scope.

14.3.5 Brief overview of the functional and risk profiles of the Taxpayer and Related Person(s) involved in the APA application.

14.3.6 Discussion on the benchmark study and expected periodic scope for the results.

14.3.7 Proposal for the TPM, along with a brief description of the key critical assumptions.

14.3.8 The APA Period, which is a maximum of three (3) years as specified in Article 23 of the TP Bylaws.

14.3.9 The extent of the information and additional documentation required.

14.3.10 The expected compliance required from the Taxpayer following the agreement being reached.

14.3.11 Other related topics.

14.4. While routine matters like establishing the APA terms/ conditions may be discussed, the Authority will not make commitments at this stage. The purpose of the meeting is to have initial discussions regarding the proposed Covered Transactions. To evaluate the suitability of the Taxpayer's APA Request, the Authority may request further information before, during, or after the Introductory meeting(s). Following the meeting(s), the Authority will determine the next steps, which may involve requesting additional information to address any questions that arose during the discussion.

Part 4 Processing the APA request

15. APA Request Processing

15.1. Following the submission of a complete formal unilateral APA application and the conclusion of the introductory meeting, the taxpayer will be notified of the outcome of the preliminary evaluation of accepting the APA request. The expected timeframe for concluding the unilateral APA application submission phase is ninety (90) days. Should the application be successful, the taxpayer will be required to submit additional information to the Authority within the agreed timeframe; failure to do so may result in the discontinuation of the APA process by the Authority. The taxpayer should also anticipate further meetings during the evaluation phase.

15.2. During the evaluation phase, which includes a thorough review, analysis, and evaluation, the Authority will commence processing the unilateral APA request until an agreement is reached between the parties involved.

15.3. The Authority will endeavor to conclude the evaluation phase within nine (9) months.

15.4. When handling requests for APAs, the Authority may impose limitations on the proposed scope of the agreement or may require an expansion of its coverage. Alternatively, it may decide to reject the request altogether.

16. Application Review, Analysis and Evaluation Phase

16.1. The Authority will thoroughly analyze and assess the APA application and supporting information to ensure that:

16.1.1 The proposed APA achieves Arm's Length results for the covered Controlled Transactions.

16.1.2 There is sufficient supporting information for the Authority to comprehensively evaluate the application.

16.1.3 The APA application aligns with facts and circumstances and outcomes of the introductory meetings.

16.2. During the review and analysis of the APA application, the Authority may find it necessary to conduct site visits and functional interviews to enhance understanding of the business and industry, clarify issues, and gather additional information:

16.2.1 Site visits aim to gain a deeper understanding of the Taxpayer's business operations, sector, and potential issues related to the APA. The Authority may visit the premises of the Taxpayer and Related Persons (if required) involved in the APA to comprehend the factual context. These visits allow the Authority to verify the information provided in the APA application and gather additional details. Taxpayers are expected to facilitate the identification and availability of key personnel for comprehensive data collection.

16.2.2 Stakeholder meetings involve discussions with individuals involved in the APA to agree upon suitable mechanisms. Functional interviews conducted during these meetings allow the Authority to clarify the business activities of the Taxpayer and Related Persons. Interviews may take place at the Taxpayer's and Related Persons premises or through virtual platforms.

16.3. Following the completion of site visits and functional interviews, the Authority may send written follow-up questions. The Authority will inform the Taxpayer of the subsequent steps.

16.4. The Authority may request additional information from the Taxpayer during the evaluation phase for clarification, and both parties will agree on reasonable deadlines for submitting final information. Any requested information should be provided within a mutually agreed timeframe, or the Authority may discontinue the process if it shows the lack of the Taxpayer's commitment. Refer to Section 18 for more information.

16.5. Following the review and evaluation stage, the Authority will discuss its position and findings with the Taxpayer through the negotiation process.

16.6. Negotiation of the APA:

Upon reaching a consensus, the Authority will draft the APA along with relevant documents, submitting them to the Taxpayer for approval. The APA will include:

16.6.1 Information on Related Persons, including names and addresses of the parties covered by the APA;

16.6.2 Covered Controlled Transactions and zakat/tax years;

16.6.3 Selected Comparable Transactions, TPM, calculation methods, and related financial projections.

16.6.4 Critical Assumptions.

16.6.5 Taxpayer obligations, such as annual reporting and record-keeping.

16.6.6 Legal validity and confidentiality provisions,

16.6.7 Any other terms and conditions.

16.6.8 Mutual responsibilities.

16.6.9 Effective date.

Entering into an APA does not prevent the Authority from conducting TP audits and making adjustments for controlled transactions and years not covered by the APA.

17. Conclusion of APA Request

17.1. The time required to finalize a position depends on the cooperation of the Taxpayer, the cases complexity, and the completeness and quality of provided information. The Authority will aim to finalize its position within twelve (12) months of receiving the complete application. An APA can only be completed once all parties confirm and agree on the terms and conditions. The authorized representatives from both the Authority and the Taxpayer will formally sign the unilateral APA once an agreement is reached

18. Rejection of the Application

18.1. The APA application can be rejected by the Authority at any point during the process. While each case is evaluated individually, below are typical factors leading the Authority to conclude that Taxpayers and their proposed Transactions are not suitable for the APA procedures.

18.1.1 The applicant does not adhere to the Arm's Length Principle in Transactions with Related Persons.

18.1.2 The Transaction is based on a hypothetical model or lacks sufficient consideration.

18.1.3 The Authority can not evaluate the correct application of the Arm's Length Principle.

18.1.4 The Transaction is associated with tax evasion or tax avoidance.

18.1.5 The Taxpayer causes unreasonable delays or fails to provide complete and accurate information.

18.1.6 Significant discrepancies exist between the facts provided and those gathered by the Authority.

18.1.7 The business undergoes significant transformation during the APA period.

18.1.8 If despite best efforts, the Authority and the Taxpayer cannot agree on terms for a unilateral APA, the Authority may choose to discontinue negotiations and refuse to proceed with the APA. In such instances, the Authority will notify the Taxpayer of the refusal.

18.2. If an application is declined, the Authority may -at its discretion- notify the Taxpayer of the reasons for the rejection. The Taxpayer will then have thirty (30) days from the date of receiving the rejection notice to respond. The decision made by the Authority following this process will be final.

19. Withdrawal From the APA Request

19.1. Should a taxpayer withdraw an APA request, both the taxpayer and the Authority will no longer have any obligations to each other regarding the APA request. Any prior agreements or understandings related to the APA request will no longer be in effect.

Part 5 Advance Pricing Agreement Management

20. Submit an APA Annual Compliance Report

20.1. Once an APA is established, the Taxpayer must file an APA ACR for each assessment year covered by the APA in line with the APA terms and conditions. This report should cover all required items specified in the APA, including any requests for revisions or cancellations.

20.2. These reports should be comprehensive, providing all necessary financial and analytical details for the Authority to verify the Taxpayer's compliance with the APA.

20.3. once an APA is concluded, the taxpayer needs to file the ACR within one hundred and twenty (120) days of the end of that financial year, along with the tax/zakat return.

20.4. Failure to submit APA ACR within the agreed timeframe, or failure to submit them at all, may lead to the cancellation of the APA by the Authority.

21. Annual Review of the Taxpayer's Compliance with the Agreement

21.1. The Taxpayer must keep records enabling the Authority to verify APA compliance. The Authority may conduct annual audits to ensure adherence to the terms of the APA. Audits focus on confirming compliance with terms, facts and circumstances of the APA, and not on reassessing the chosen TPM or other APA terms and conditions. They ensure:

21.1.1 Material representations in APA Requests and reports accurately depict Taxpayer and Related Persons operations.

21.1.2 The agreed TPM has been consistently applied as per APA terms and conditions.

21.1.3 Supporting data and calculations for the agreed TPM are materially accurate.

21.1.4 Critical Assumptions of the APA remain valid and relevant.

22. Compensating Adjustments

22.1. An APA may include a provision allowing the Taxpayer to make Compensating Adjustments. These adjustments align the Taxpayer's financial statements and Return of Covered Transactions with the amounts or results determined by the APA's TPM in case of deviation.

22.2. Compensating adjustments are determined based on the APA agreement specified terms on a case-by-case basis.

22.3. A compensating adjustment will occur if the actual results deviate from the arm's length prices agreed upon in the APA agreement.

22.4. The compensating adjustment(s) shall only be applicable to the covered transactions.

22.5. the taxpayer is required to make a compensating adjustment in the annual zakat/tax return if the covered transactions result is not compliant with the APA.

22.6. If the taxpayer fails to make the compensating adjustment, the Authority may propose adjustments to the amounts reported by the Taxpayer.

23. Addressing Disputes

23.1. If any audit-related matters remain unresolved or if the Taxpayer disagrees with proposed adjustments, the Authority may choose to:

23.1.1. Revise the APA with the Taxpayer; or

23.1.2. Cancel the APA; or

23.1.3. Revoke the APA

23.2. Interpreting APA terms, determining Covered Transactions, and ensuring proper record-keeping are critical aspects of addressing discrepancies. If zakat/ tax filings deviate from the Authoritys APA interpretation, the APA may be canceled or revoked.

24. Revision of the APA

24.1. During the APA term, if significant or critical changes arise that impact the APA's implementation, the Taxpayer must promptly inform the Authority. The notification should outline the reasons for the proposed revision and include supporting documentation. The parties will then discuss whether and how to revise the APA considering the changed circumstances.

24.2. A Taxpayers APA may be revised under the following circumstances:

24.2.1. Failure to meet a Critical Assumption

24.2.2. Changes in Tax law, Zakat Regulations, and Tax Agreement provisions, affecting the zakat/ tax treatment of APA-covered matters in the Kingdom.

24.2.3. Material changes in circumstances.

24.3. If all parties are not satisfied with the APA revision, the Authority may cancel it after examining the impact of potential changes in Critical Assumption, the agreement ceases to have effect as of the effective date of the cancellation.

24.4. If the Taxpayer and the Authority agree on a revised APA, its effective date will be stated.

25. Cancellation or Termination of the APA

25.1. When the Authority cancels an APA:

25.1.1 The APA will no longer be valid from the effective date of cancellation.

25.1.2 The effective date of cancellation for an APA is typically determined to be aligned with the start of the Zakat/tax year associated with the circumstances listed in paragraph 25.2.

25.1.3 Following the cancellations effective date, Transactions previously covered by the APA will be governed by bylaws.

25.1.4 The Authority will notify the taxpayer of the reasons leading to the cancellation of the APA.

25.2. The Authority may cancel an APA if any of the following conditions are met:

25.2.1 The Taxpayer or any Related Persons provided materially false information or omitted relevant details in the APA Request, APA submission, or any other related reports.

25.2.2 The Taxpayer or Related Persons failed to adhere to a significant term or condition of the APA.

25.2.3 There was a failure to meet a Critical Assumption.

25.2.4 Changes in the Tax Law, Zakat Regulations, including Tax Agreement provisions, altered the Kingdom's income zakat/ tax treatment of APA-covered matters.

25.2.5 If the Taxpayer fails to provide the information, documentation, and APA report as required by this Guideline and other relevant provisions.

25.2.6 Failure to reach an agreement.

25.2.7 If the taxpayer refuses to sign a revised unilateral APA.

25.2.8 The involved parties are no longer related.

26. Revocation of the APA

26.1 When the Authority revokes an APA:

26.1.1 The APA will no longer be effective for any part of the period specified in the APA.

26.1.2 The revocation shall be retroactive to the first day of the first zakat/tax year for which the APA was effective.

26.1.3 The Authority will notify the taxpayer of the reasons leading to the revocation of the APA.

26.2 The Authority may revoke an APA if any of the following conditions are met:

26.2.1 There has been a misrepresentation, mistake, fraud, or omission in the information submitted by the taxpayer, throughout any stage of the APA procedures;

26.2.2 The participating taxpayer failed to comply with a material terms or conditions of the APA, during any stage of the agreement;

26.2.3 The ACR was not filed within the prescribed timeframe.

27. Renewal of the APA

27.1. Renewal requests for an APA follow the same procedures as initial requests, as outlined in Part 3. The Authority will provide guidance on any potential adjustments to these procedures based on the specific circumstances of the renewal request.

27.2. Renewal requests should be submitted at least twelve (12) months before the beginning of the first fiscal year concerning the new agreement.

27.3. The Authority may consider renewing an APA under similar terms and conditions if:

27.3.1 Both the Taxpayer and the Authority are satisfied with the application of the TPM used in the ongoing APA;

27.3.2 There have been no significant changes in the circumstances or Critical Assumptions underlying the APA, ensuring that Critical Assumptions remain valid; and

27.3.3 The Taxpayer has fully complied with the ongoing APA's terms and conditions.

27.4. If the Taxpayer proposes amendments to the ongoing APA for renewal purposes, they must include the proposed changes along with updated analysis and supporting documentation. This is particularly relevant if:

27.4.1. Significant changes have occurred in the facts, circumstances, or Critical Assumptions underlying the ongoing APA; or

27.4.2. It is determined that the ongoing APA did not adequately address subsequent economic, technical, product, or industry developments.

27.5. The Authority will assess the Taxpayers renewal request, considering necessary amendments due to changed facts and circumstances.

27.6. The renewal process will involve updating Critical Assumptions and facts from the initial APA and amending related analysis as needed. The Authority will then review and evaluate the renewal APA documentation package and completing the renewal process through negotiation.

Appendix 1- Unilateral APA Application

Unilateral Advance Pricing Agreement ("APA") Application Form

The purpose of this form is to participate in the advance pricing arrangement (APA) early engagement process

NOTES:

ZATCA will only accept applications for unilateral APAs for the time being. Availability of Bilateral/Multilateral APAs will be notified in due course.

The Authority may reject the application if the following information and documents are not provided.

The APA provisions are prospective in nature and there is no option for rollback.

This is an APA application form only and does not guarantee the granting of an APA or admittance of the APA case.

For Section D of this form, please use a separate attachment. Applicant is also free to attach additional attachments for any relevant information, duly signed by the authorized representative.

Upon acceptance of the Application form, applicant will be required to submit additional information to ZATCA;

For introductory meeting, ZATCA is not obligated to the proposed dates by the applicant.

Section A:

Applicant:

| Taxpayer and/or Permanent Establishment(s), Person(s) involved in the APA (in KSA) | Address(es) |

|---|---|

Details of counterparty(s):

| Counterparty(s) involved in the APA transactions | Country of residence |

|---|---|

Details of applicant:

Applicant full name | |

Applicant TIN | |

Applicant address(es) | |

Applicant contact number | |

Applicant e-mail address | |

Full name of contact person |

Details of immediate parent company:

Name of the immediate parent company of applicant | |

Address of the immediate parent company of applicant | |

Country of residence of the immediate parent company of applicant | |

Tax identification number of the immediate parent company of applicant |

Details of the Ultimate parent company:

Name of the Ultimate parent company of applicant | |

Address of the Ultimate parent company of applicant | |

Tax identification number of the Ultimate parent company of applicant | |

Country of residence of the Ultimate parent company of applicant |

Names and designation of the authorized representatives who would be appearing before the authority for negotiations of the APA

Name of representative | |

Designation of representative | |

Contact of representative (email and phone number) |

Introductory meeting(s):

Kindly suggest three different dates and times to hold the meeting (preferably in 3 different weeks) | |

Section B:

Details of the covered transaction(s):

Details of the applicant:

Is the non-resident entity(ies) located in a jurisdiction that has a convention for elimination of double-taxation with KSA? | Yes, No |

If yes, is the proposed APA consistent with the convention for elimination of double-taxation in place? | Yes, No |

Has any of the related-parties applied for APA with the tax authority in the country of its residence? | Yes, No |

If yes, kindly attach the evidence of filing such application | |

Period for which the application for APA is made n KSA | From Day Month Year To Day Month Year |

Section C:

| I hereby, Designation | (taxpayers authorized representative full name and designation) | |

Declare, with full legal capacity, that all data, information and documents provided are complete, true and accurate. I certify to notify the Zakat, Tax and Customs Authority immediately if any of the documents submitted change. I also agree and authorize the Authority to verify these data, information or documents provided by any means it deems appropriate. And cooperate with any government agency or third parties for verification purposes. I also certify to bear full legal responsibility and any consequences resulting from the incorrectness or deficiency of any of these data, information or documents.

| Date Signature |

Section D: Disclosure Requirement (please use separate attachment)

General information

Details of the transactions proposed to be covered in the APA

Proposed Transfer Pricing Method(s) (TPMs) and policies

Proposed terms and conditions, and critical assumptions, for the APA

General description of business and products/services of the group

Multinational structure, organizational arrangement, operational set-up, including major transaction flows and shareholding percentages

Identify all other transactions of the multinational enterprise that may have an impact on the pricing of the covered transactions including counterparties, volume etc.

Functional analysis (including industry analysis)

Detailed analysis of the key functions performed, assets used, and risks assumed by each of the Persons involved in the Controlled Transaction.

Detailed description of the supply chain of the MNE group's product and services offerings related to the covered transaction.

Financial and operating information, including corporate annual reports: (Please enclose copies)

Financial statements on a consolidated and unconsolidated basis for the prior three years,

Financial statement of the related party in the covered transaction(s) for the prior three years

Segmental financial information by division/unit for the prior five years,

Copies of all relevant inter-company agreements (pricing, licensing, distributorship etc.): (Please enclose copies).

Transfer pricing background

Discussion of transfer pricing methodologies, policies, and practices used by the applicant and related person(s) for the covered transactions during the past three years:

Discussion of relevant rulings, APAs/BAPAs/MAPAs, and other similar arrangements entered into with foreign tax administrations, for transfer pricing, or other taxation matters entered into by the applicant (or its related person(s)) or foreign tax administrations.

Proposed Transfer Pricing Methodology analysis for each covered transaction in the APA

Provide all information, including detailed analyses and explanations needed to establish the appropriateness of a proposed TPM, in accordance with transfer pricing regulations as contained in the KSA Income-tax law.

Discussion and analysis of each transfer pricing method for each covered transaction. In particular provide details on accepted or rejected comparables. (Indicate assumptions, strategies and policies that may have influenced the acceptance or rejection of each TPM).